Risks Related to the Company’s Business and Securities

The current COVID-19 pandemic could have a material adverse effect on the Company’s business, operations, financial condition and stock price.

The Company faces risks related to pandemics and epidemics, such as the outbreak of COVID-19 that surfaced in December 2019 and has spread around the world, including Canada, the United States and Brazil, which could significantly disrupt the Company’s operations and may materially and adversely affect its business and financial condition. The full extent to which COVID-19 impacts the Company’s business, including its operations and the market for its securities, will depend on future developments that are highly uncertain and will depend on numerous evolving factors that the Company may not be able to accurately predict or assess, including, but not limited to, the duration, severity, the availability of approved vaccines and remedial medications and the timing for completion of related distribution programs around the globe, and the continued governmental, business and individual actions taken in response to the pandemic. Moreover, the actual and threatened continue or spread of COVID-19, especially in Brazil, could materially and adversely impact the Company’s business, including without limitation on the regional economies in which the Company operates, employee health, workforce productivity, increased insurance premiums and medical costs, restrictions on travel by the Company’s personnel and by the personnel of the Company’s various service providers, quarantine, the availability of industry experts and personnel, and other factors that will depend on future developments beyond the Company’s control, all or some of which may have a material adverse effect on the Company’s business, financial condition and stock price.

Government efforts to curtail the spread of COVID-19 may also result in temporary or long-term suspensions or shut-downs of the Company’s operations. Given the unforeseen conditions resulting from the ongoing evolution of the COVID-19 pandemic and its global impact, there can be no assurance that the Company’s future response and business continuity plans will continue to be effective in managing the pandemic and changing conditions could result in a material adverse effect on the Company's business, financial condition and/or results of operations. Travel restrictions to and from Brazil, currently implemented by governments, as well as quarantine, isolation and physical distancing requirements during this period, may have a negative impact on workforce mobility. Further, the protective measures implemented by the Company may cause higher operating costs, combined with a decrease in workforce productivity, lower production outputs and in some cases, temporary cessation of mining development, could have a material adverse effect on the Company’s business and financial conditions.

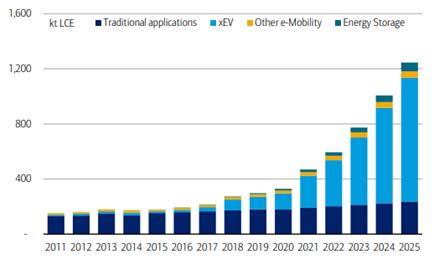

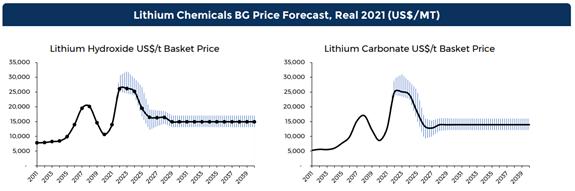

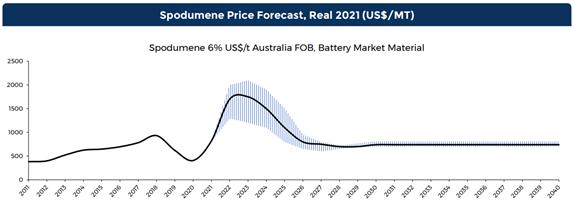

In addition, the outbreak has caused a worldwide health crisis that has adversely affected economies and financial markets resulting in a global economic downturn that has impacted lithium markets and, therefore, been negative for lithium mining companies.

The current military conflict in Ukraine and the economic or other sanctions imposed may impact global markets in such a manner as to have a material adverse effect on the Company’s business, operations, financial condition and stock price.

The military conflict in Ukraine could lead to heightened volatility in the global markets, increased inflation, and turbulence in commodities markets. More recently, in response to Russian military actions in Ukraine, several countries (including Canada, the United States and certain allies) have imposed economic sanctions and export control measures, and may impose additional sanctions or export control measures in the future, which have and could in the future result in, among other things, severe or complete restrictions on exports and other commerce and business dealings involving Russia, certain regions of Ukraine, and/or particular entities and individuals. While the Company does not have any direct exposure or connection to Russia or Ukraine, as the military conflict is a rapidly developing situation, it is uncertain as to how such events and any related economic sanctions could impact the global economy and commodities markets. Any negative developments in respect thereof could have a material adverse effect on the Company’s business, operations or financial condition.

If the Company is unable to ultimately generate sufficient revenues to become profitable and have positive cash flows, it could have a material adverse effect on its prospects, business, financial condition, results of operations or overall viability as an operating business.

The Company has a history of operating losses and it can be expected to generate continued operating losses and negative cash flows in the future while the Company carries out its current business plan to further develop and expand its business. The Company has made significant up-front investments in order to rapidly develop and expand its business. The Company is currently incurring expenditures related to its operations that have generated negative operating cash flows from operations. The successful development and commercialization of these operations will depend on a number of significant financial, logistical, technical, marketing, legal, regulatory, competitive, economic and other factors, the outcome of which cannot be predicted. There is no guarantee that such operations will