Christopher R. Bellacicco

Valerie Lithotomos, Esq.

John Lee, Esq.

U.S. Securities and Exchange Commission

Division of Investment Management

Disclosure Review and Accounting Office

100 F Street NE

Washington, DC 20549

| Re: | NEOS ETF Trust (the "Trust" or the "Registrant") File Nos. 811-23645, 333-253997 |

Dear Messrs. Bellacicco and Lee and Ms. Lithotomos:

On May 23, 2023, NEOS ETF Trust (the "Trust" or the "Registrant"), on behalf of its series, Kurv Yield Premium Goldman Sachs (GS) ETF, Kurv Yield Premium Google (GOOGL) ETF, Kurv Yield Premium Tesla (TSLA) ETF, Kurv Yield Premium UnitedHealth Group (UNH) ETF, Kurv Yield Premium Visa (V) ETF, and Kurv Yield Premium Walmart (WMT) ETF filed post-effective amendment number 33 to the Trust's registration statement. On May 23, 2023, the Registrant, on behalf of its series, Kurv Yield Premium Amazon (AMZN) ETF, Kurv Yield Premium Apple (AAPL) ETF, Kurv Yield Premium Disney (DIS) ETF, Kurv Yield Premium ExxonMobil (XOM) ETF, Kurv Yield Premium JPMorgan (JPM) ETF, and Kurv Yield Premium Microsoft (MSFT) ETF, filed post-effective amendment number 34 to the Trust's registration statement. On June 9, 2023, the Registrant, on behalf of its series, Kurv Yield Premium C3.ai (AI) ETF, Kurv Yield Premium Boeing (BA) ETF, Kurv Yield Premium Bank of America (BAC) ETF, Kurv Yield Premium Chevron (CVX) ETF, Kurv Yield Premium Ford (F) ETF, Kurv Yield Premium Coca Cola (KO) ETF, Kurv Yield Premium Meta (META) ETF, Kurv Yield Premium Netflix (NFLX) ETF, Kurv Yield Premium NVIDIA (NVDA) ETF, and Kurv Yield Premium Palantir (PLTR) ETF, filed post-effective amendment number 36 to the Trust’s registration statement. Each post-effective amendment was filed pursuant to Rule 485(a)(2) under the Securities Act of 1933, as amended, to register shares of the Funds.

On July 10, 2023, you provided comments to the Amendment by phone to Bibb Strench and Daniel Moler. Subsequently, in response to your comments provided verbally on July 10, 2023, you provided on August 22, 2023 follow-up comments, which are noted in green. You provided additional follow-up comments on September 19, 2023, which are noted in blue. John Lee and Ms. Lithotomos provided additional follow-up comments on September 29, 2023, and October 2, 2023, respectively, which are noted in yellow.

Set forth below are your follow-up comments, as we understand them, followed by responses to those comments, which the Funds have authorized Thompson Hine LLP to make on its behalf. Where applicable, revisions indicated in responses to your comments will be reflected in an amendment to the registration statement to be filed subsequently to or concurrently with this letter. All capitalized terms not defined herein have the meaning given to them in the registration statement. A marked copy of the prospectuses or relevant sections of the prospectuses are attached to, or sent separately, aid in your review.

PROSPECTUS

General

Comment 3. Given the relative novelty of these Funds, please be prepared to file Form BXT so comments can be resolved prior to effectiveness.

Response. The Registrant is prepared to file Form BXT to delay effectiveness in order to resolve the Staff’s comments.

Follow-Up Comment: #1 Please be prepared to continue to file Form BXTs so follow-up comments can be resolved prior to effectiveness.

Follow-Up Response: The Registrant is prepared to file Form BXT to delay effectiveness in order to resolve the Staff’s comments, recently filing a BXT to extend effectiveness to September 22, 2023.

Additional Follow-Up Comment: #1 Please be prepared to continue to file Form BXTs so follow-up comments can be resolved prior to effectiveness.

Additional Follow-Up Response: #1 The Registrant is prepared to file Form BXT to delay effectiveness in order to resolve the Staff’s comments, recently filing a BXT to extend effectiveness to October 11, 2023.

Additional Follow-Up Response: #1 The Registrant is prepared to file Form BXT to delay effectiveness in order to resolve the Staff’s comments, recently filing a BXT to extend effectiveness to October 17, 2023.

Comment #2: Please provide the SEC staff with updated versions of all of the statements of additional information (“SAI”).

Response: The Registrant has separately provided the SEC staff with blacklined versions of each SAI, showing changes made to the prior 485(a) filings, indicating changes made to the original filings.

Comment #3: Please provide the SEC staff with all of the Prospectuses, indicating changes made to the original filings.

Response: The Registrant has separately provided the SEC staff with blacklined versions of each Prospectuses, showing changes made to the prior 485(a) filings.

Comment 4. Please confirm that all blanks, brackets and otherwise missing information will be completed in the 485(b) filing and sufficiently in advance of effectiveness for review.

Response. The Registrant confirms that all missing information will be completed in the 485(b) filing sufficiently in advance for review prior to effectiveness.

Follow-Up Comment: #2 Please confirm that all blanks, brackets and otherwise missing information will be completed in the 485(b) filing and sufficiently in advance of effectiveness for review. Also note that “Palantir” is misspelled in the chart in the Prospectus.

Follow-Up Response: The Registrant has supplied the missing information noted in the comment and has correct the spelling of “Palantir” in the chart in the Prospectus.

Additional Follow-Up Comment: #2 and #2 Please confirm the Registrant will provide the Staff with a completed fee and expenses table for each fund prior to going effective.

Additional Follow-Up Comment: #3 Please address the discrepancies regarding the length of the applicable fee waivers.

Additional Follow-Up Response: The Registrant has completed the fee and expense tables for one of the Funds of each 485(a) filing and provided those prospectuses with the completed tables to the Staff via e-mail.

Additional Follow-Up Response: The Registrant has revised, where necessary, each fee table and the narrative in the FUND MANAGEMENT – Adviser sections to state in relevant part:

The Fund’s adviser has contractually agreed to waive its fees and reimburse expenses of the Fund until July 29, 2024.

Strategy

Comment 8. Please consider adding suitability related disclosure, explaining what the product is, what it is designed to do, why it was designed and the purposes for which investors should use it.

Response. The Registrant has added the following disclosure:

The Fund is a unique investment product that may not be suitable for all investors. An investor should consider investing in the Fund if it, among other reasons, fully understands the risks inherent in an investment in the Fund’s Shares. There is no guarantee that the Fund, in the future will provide the opportunity for upside participation to the price exposure of underlying. There may be limits on upside participation to the price exposure of underlying under certain market conditions.

The Fund employs an investment strategy that includes the sale of call option contracts, which limits the degree to which the Fund will participate in increases in value experienced by the underlying stock over the call period. This means that if the underlying stock experiences an increase in value above the strike price of the sold call options during a Call Period, the Fund will likely not experience that increase to the same extent and may significantly underperform the underlying stock over the call period.

Comment 9. The first sentence of Principal Investment Strategies states that “the strategy limits potential investment gains related to share price appreciation.” This implies that there may be a cap or limit as to the potential gains. Please include additional disclosure explaining the expected limits as to the potential gains.

Response. The Registrant has added the following disclosure to the Prospectus in response to the above comment:

The performance of the Fund’s shares may exceed, substantially track or trail the performance of the underlying stock because the options transactions that the Fund enters may outperform or underperform the underlying stock’s performance.

Follow-Up Comments to Comments 8 and 9:

Follow-Up Comment A: #3 Please add disclosure to the strategy highlighting that the Fund may underperform the underlying stock if the underlying stock appreciates beyond the options premiums earned by the Fund due to the fact that the options the Fund wrote have hit their strike price.

Follow-Up Response A: The Registrant has added the following disclosure to each Fund’s Investment Strategy section:

“The Fund employs an investment strategy that includes the sale of call option contracts, which limits the degree to which the Fund will participate in increases in value experienced by the underlying stock over the call period. This means that if the underlying stock experiences an increase in value above the strike price of the sold call options during a Call Period, the Fund will likely not experience that increase to the same extent and may significantly underperform the underlying stock over the call period.”

Follow-Up Comment B: #4 Please copy and paste the following risk disclosure noted in your response to Comment #8 to the Investment Strategy Section of each Prospectus:

“The Fund is a unique investment product that may not be suitable for all investors. An investor should consider investing in the Fund if it, among other reasons, fully understands the risks inherent in an investment in the Fund’s Shares. There is no guarantee that the Fund, in the future will provide the opportunity for upside participation to the price exposure of underlying. There may be limits on upside participation to the price exposure of [underlying] under certain market conditions.”

Follow-Up Response B: The Registrant has copied and pasted the disclosure noted above in the manner requested.

Additional Follow-Up Comment: #3 Please remove the language discussed in follow up comment #4, and use the language sent in the response sent to the Staff to comment #8.

Additional Follow-Up Response: The Registrant has made the requested changes.

Follow-Up Comment C: #5 Please include a discussion that when an investor purchases and sells shares of a Fund, such purchases and sales may affect the investor’s performance in light of the Fund’s trailing, tracking or outperforming the underlying stock.

Follow-Up Response C: The Registrant has added the following disclosure to each Fund’s Investment Strategy section:

“When an investor purchases and sells shares of a Fund, such purchases and sales may affect the investor’s performance in light of the Fund’s share price trailing, tracking or outperforming the underlying stock.”

Additional Follow-Up Comment: #4 and #4 Please provide disclosure clarifying that depending when an investor purchases shares in the Fund, they may not have the protection of the covered-call strategy which may affect the investor’s performance.

Additional Follow-Up Response: The Prospectus has been revised to add the following:

“For example, if an investor purchases shares or sells shares of a Fund immediately [prior to/after/or during] the period the Sub-Adviser is entering in covered call transactions for the Fund may heighten the difference between the share price of that investor’s shares and the performance the underlying stock over the period the investor owns Fund shares.”

Additional Follow-Up Comment: #5 If appropriate, please remove the brackets before and after “[prior to/after/or during]” or otherwise edit this sentence.

Additional Follow-Up Response: The brackets referenced above have been deleted.

Comment 13. The second sentence of the Principal Investment Strategies states that the Fund does not seek to employ temporary defensive positions during periods of adverse conditions. Supplementally, explain why no temporary defensive positions may be in place.

Response. The Registrant has removed the clause stating that the Fund does not seek to employ temporary defensive positions during periods of adverse conditions. Each Fund through options transactions and long positions in the underlying stock seeks to track the performance of the underlying stock and therefore will not engage in transactions for temporary defensive purposes. Each Fund may invest its assets in cash or cash equivalents or a higher percentage of its assets directly in the underlying stock. The Registrant believes it is prudent to have ability to invest in the underlying stock for a number of reasons including to defensively protect the Fund’s ability to gain long exposure to the underlying stock during stressed market environments. From time to time, there may be disruptions in the options markets, making it difficult or imprudent to engage in options on behalf of the Funds for temporary periods of time. In these scenarios, the Fund can gain long exposure simply by purchasing the stock of the underlying company. This is the traditional covered call strategy. We have updated the language to Prospectus in response to this comment.

Follow-Up Comment: #6 Please clarify whether the Fund’s investing in cash or cash equivalents as described in the response above or the Fund investing a higher percentage of its assets directly in the underlying stock are intended to serve as temporary defensive measures.

Follow-Up Response: The Registrant has revised the disclosure in each Prospectus with respect to cash and cash equivalents and direct underlying stock investments as follows:

“The Fund may hold cash and cash equivalents and/or the underlying stock from time to time when there are disruptions in the options markets making it difficult or impractical to employ a covered call strategy to synthetically track the underlying stock. Under such temporary situations, the Fund may better track the performance of the underlying stock by holding it directly.”

Additional Follow-Up Comment: #5 Please clarify the updated language related to the possibility of the Fund holding cash and cash-equivalents. Additionally, please clarify what “temporary situations” is referring to in the added disclosure language.

Additional Follow-Up Response: The Fund will not engage in temporary defensive investments as timing the market or the performance of the underlying stock is not part of its investment strategy. Rather, the Fund attempts to track the performance of the underlying stock primarily by employing a covered call strategy. As noted in the language above, due to conditions in the options market, the Fund may for temporary periods be unable to engage in call and put option transactions and during those times the Fund may invest directly in the underlying stock and/or cash. So to avoid confusion, this language has been revised to remove the word “temporary” and it now reads:

“The Fund may hold cash and cash equivalents and/or the underlying stock from time to time when there are disruptions in the options markets making it difficult or impractical to employ a covered call strategy to synthetically track the underlying stock. In such situations, the Fund may better track the performance of the underlying stock by holding it directly until disruptions in the options markets cease.”

Comment 16. Supplementally, please elaborate on what active management would entail and provide examples of when the Fund will deviate from the strategy.

Response. Each day the markets are open, the Sub-Adviser actively manages each Fund’s synthetic and actual long positions. In addition, the Sub-Adviser decides the pricing and expiry and related costs of the call and put options used. Each Fund may invest its assets in cash or cash equivalents or directly in the underlying stock. Therefore, the Sub-Adviser will actively manage the assets of each Fund in an attempt to replicate the returns of the underlying stock and generate income in the process, utilizing options transactions, direct investments in the underlying stock, cash positions and combination of these transactions.

Follow-Up Comment: #7 Please further elaborate on what the Registrant means by “active management” and what “active management” entails. Consider adding illustrative expiries. For example, the Fund typically purchases call option that range from 1 to 3 months that is from 10% to 15% out of the money of the current price of the stock.

Follow-Up Response: The Registrant has added the following disclosure to the Investment Strategy section of each Prospectus:

“To replicate the returns of the underlying stock, the Sub-Adviser will purchase call options and sell put options with the same expiration date and the same strike price that may range from 1 to 3 months out and be close to the current price of the stock.”

Additional Follow-Up Comment: #6 Please clarify what the length of the option contracts will be and update and disclosures accordingly. Additionally, please provide the Staff with marked versions compared to each original 485A filing.

Additional Follow-Up Response: The following disclosure has been added:

“The Fund will purchase call options and sell put options generally with [1-]month to [3-]month terms.”

Additional Follow-Up Comment: #6 If appropriate, please remove the brackets before and after “[1-]” and “[3-]” or otherwise edit this sentence.

Additional Follow-Up Response: The brackets referenced above have been deleted.

Additional Follow-Up Comment: #7 Sentences elsewhere in the Prospectus indicate that the Fund will purchase call options and sell put options generally with 1 month to longer terms than 3 months (e.g., 6-months or 12-months). Please disclose in the Prospectus when the Sub-Adviser will enter into options transactions with these longer terms.

Additional Follow-Up Response: The Prospectus has been revised to state that the Fund will purchase call options and sell put options generally with 1-month to 12-month terms and no longer references longer terms such as 6-months or 12-months.

Additional Follow-Up Comment: #7 Please clarify what is meant by “be close to the current price of the stock” as the Fund refers to “at the money” later in the Prospectus. Are these phrases synonymous?

Additional Follow-Up Response: The sentence referred to in the response has been revised to read:

“To replicate the returns of the underlying stock, the Sub-Adviser will purchase call options and sell put options with the same expiration date and the same strike price that may range from 1 to 12 months out at the money.”

Additional Follow-Up Comment: #8 Please clarify what is meant by “be close to the current price of the stock”?

Additional Follow-Up Response: The Prospectus has been revised to use the phrase “at the money” in lieu of “be close to the current price of the stock”.

Comment 19. Under Synthetic Long Exposure in the subsection entitled “Synthetic Covered Call Strategy” the disclosure states that “[t]he combination of the long call options and sold put options seek to provide the Fund with investment exposure equal to approximately 100% of UNH for the duration of the applicable options exposure.” Please disclose the maximum and minimum investment exposure as a percentage of net assets to which the Fund will adhere.

Response. We respectfully respond that there is no feasible way to calculate the minimum/maximum exposure. Each Fund’s strategy is to maintain a full 100% exposure at time the options are put on. It is possible for deviation to occur between rolling the synthetic long option. The exposure would be calculated daily and would be fully dependent on market price and stock price fluctuation. The synthetic long exposure would be generally rebalanced quarterly.

Follow-Up Comment: #9 The Staff notes that the word “synthetic” has appeared to have been removed from the “synthetic call strategy” discussion in the investment strategy section of the Prospectus. Unless the Fund plans to fully cover its calls with direct investments in the underlying stock, please re-insert the term “synthetic” when discussing the cover call strategy.

Follow-Up Response: The requested re-insertions of “synthetic” have been made. Please note that call option positions when seeking to track the performance of the underlying stock synthetically will always be covered with written call options. See response to Comment #7. A long position would be taken temporarily where it is not possible to implement the synthetic positions. A long position in that scenario would not be covered because the objective of the Fund is to track the performance of the underlying stock.

Additional Follow-Up Response:

New Comment: #12 At the end of the second paragraph under “Covered Call Writing” on page 5 of the Prospectus, please insert “short” after the word “strategy” in the last sentence in that section.

Follow-Up Response: The language has been updated to be more accurate.

Covered Call Writing

As part of its strategy, the Fund writes (sells) call option contracts on GOOGL to generate income. If the fund gains long exposure synthetically, since the Fund does not directly own GOOGL, these written call options will be sold short (i.e., selling a position it does not currently own). If the fund holds cash equity of GOOGL, these written call options will be not be sold short.

It is important to note that the sale of the GOOGL call option contracts will limit the Fund’s participation in the appreciation in GOOGL’s stock price. If the stock price of GOOGL increases, the above-referenced synthetic and/or cash long exposure would allow the Fund to experience similar percentage gains. However, if GOOGL’s stock price appreciates beyond the strike price of one or more of the sold (short) call option contracts, the Fund will lose money on those short call positions, and the losses will, in turn, limit the upside return of the Fund’s synthetic and cash long exposure. As a result, the Fund’s overall strategy (i.e., the combination of the synthetic and/or cash long exposure to GOOGL and the sold (short) GOOGL call positions) will limit the Fund’s participation in gains in the GOOGL stock price beyond a certain point.

Additional Follow-Up Comment: #8 Please clarify the disclosure added in response to comment 12, specifically the sentence that states, “If the fund holds cash equity of GOOGL, these written call options will be not be sold short.” Additionally, please confirm that the disclosure will be tailored in each prospectus to the applicable underlying security.

Additional Follow-Up Response: The Registrant has removed the sentence referred to in the comment. The Registrant confirms that this edit will or has been made to each prospectus.

Additional Follow-Up Comment: #9 Certain Prospectuses continue to contain the term “cash equity.” Please clarify what “cash equity” means.

Additional Follow-Up Response: The Registrant has removed all references to “cash equity” in the Prospectus.

Additional Follow-Up Comment: #9 In this sentence: “As a result, the Fund’s overall strategy (i.e., the combination of the synthetic and/or cash long exposure to GOOGL and the sold (short) GOOGL call positions) will limit the Fund’s participation in gains in the GOOGL stock price beyond a certain point.” , should the phrase “and the sold (short) GOOGL call positions)” be instead: and the sold (short) GOOGL put positions)”?

Additional Follow-Up Response: The Registrant confirms that “call positions” is correct and thus did not edit this sentence.

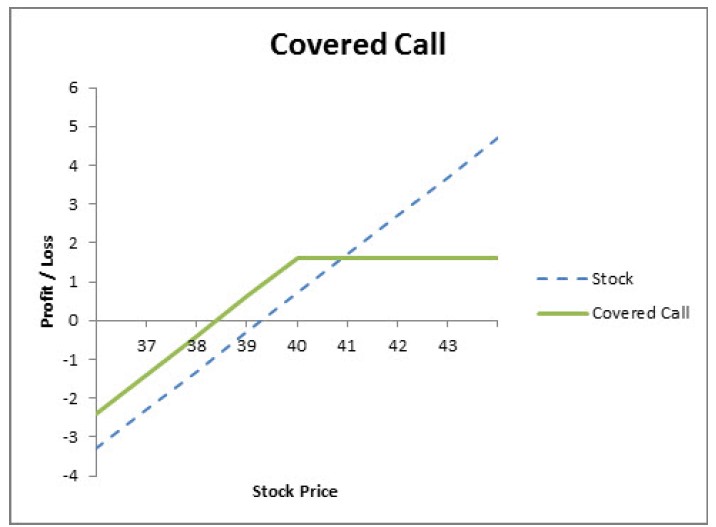

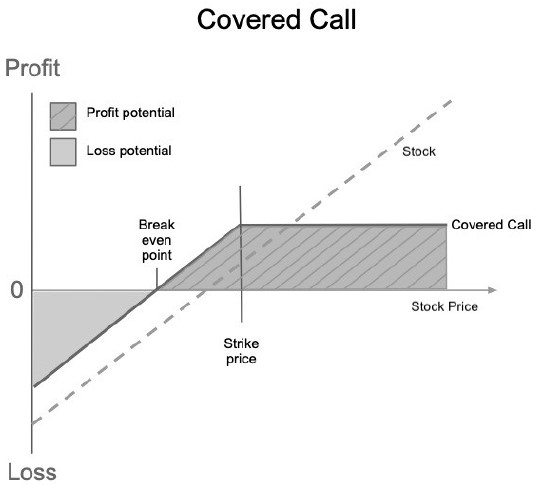

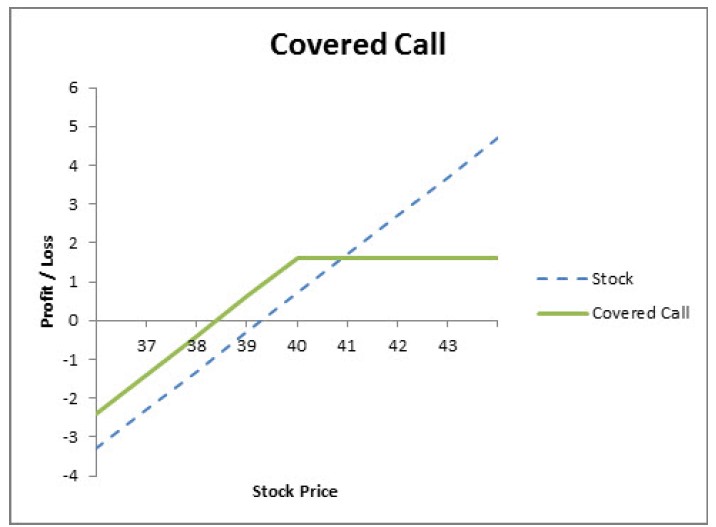

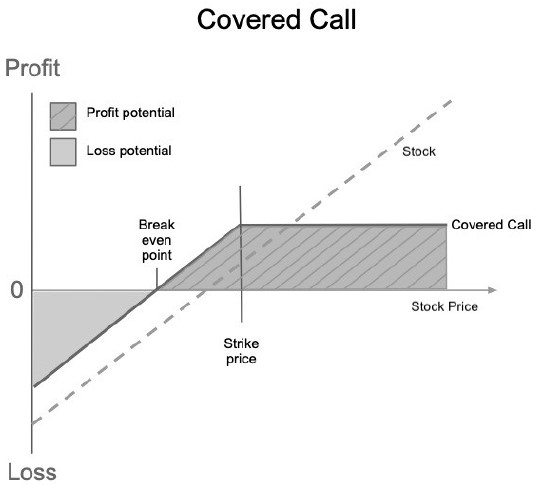

Comment 29. Please plot expected return profile on a graph (x and y-axis) to aid an investor’s understanding.

Response. The Registrant has added the following graph to the Prospectus.

Follow-Up Comment B: #14 Please explain what “Profit/Loss” means, which is the label of the Y axis.

Additional Follow-Up Response: The above graph has replaced with the following graph:

The above payoff graph illustrates the option position’s total profit or loss (y-axis) depending on the price of the underlying stock (x-axis).

The strike price of an option is the price at which a put or call option can be exercised.

“Breakeven point” is the stock purchase price minus the premium received from call option sale.

The maximum profit potential of a covered call is achieved if the stock price is at or above the strike price of the call at expiration. Maximum profit is equal to the premium received from the call option sale plus the difference between the strike price and the stock purchase price. Profit potential is capped and remains constant when the stock price is greater than the strike price.

Below the strike price, the line slopes downward as the payoff falls in proportion with the stock price. If the underlying stock price is below the breakeven price at expiration, the covered call strategy will result in a loss. The loss will be equal to the ending stock price minus the stock purchase price plus the call option premium received.

Additional Follow-Up Comment: #10 Please add an explanation as to what the included graph illustrates. Specifically, please include what each axis represents, what Profit/Loss means, what the strike price is, and the significance of the breakeven point. Please omit the numbers: “37 ….43”.

Additional Follow-Up Response: The requested edits have been added.

Additional Follow-Up Comment: #10 Immediately prior to the graph, please explain what is meant by “cash long exposure”? Is it directly equity?

Additional Follow-Up Response: The Registrant has revised the disclosure to replace “cash long exposure” with “holding the underlying stock directly.”

Additional Follow-Up Comment: #11 Please add disclosure indicate that the graph is for illustration purposes only and that an investor may have profit and loss outcomes that differ from the graph.

Additional Follow-Up Response: See response to Comment #19 (John Lee Comment #5).

Comment 32. In the row “Sold (short) call option contracts” under the column “Investment Terms” supplementally explain whether this scenario may generate losses to the Fund. If not, please explain the result of this scenario.

Response. Selling Short call option will generate a loss for a Fund if the underlying stock moves higher through the strike price of the call option contract.

Follow-Up Comment: #16 Please add disclosure discussing when selling short call options may generate losses for the Fund.

Follow-Up Response: The following disclosure has been added:

“Short-selling activity could generate losses for the Fund when the underlying stock is heavily shorted, causing such stock to unexpectedly rises in value, which in turn might trigger a cascade of further price increases as more and more short-sellers are forced to buy the stock to close out their positions. The losses to the Fund under certain circumstances could be limited or eliminated because of the Fund’s covered call strategy whereby the options written on the underlying stock would rise in value, offsetting the losses generated by the short positions.”

Additional Follow-Up Comment: #11 The Staff notes that the disclosure was changed as a result of follow-up comment #16. Please revise the disclosure back to the language provided in the response to original comment #32.

Additional Follow-Up Response: The Registrant has reverted the language to the language included in the previous disclosure. Specifically, edits have been made to include the following sentence in lieu of the longer explanation above:

”Selling short call option will generate a loss for a Fund if the underlying stock moves higher through the strike price of the call option contract.”

APPENDIX

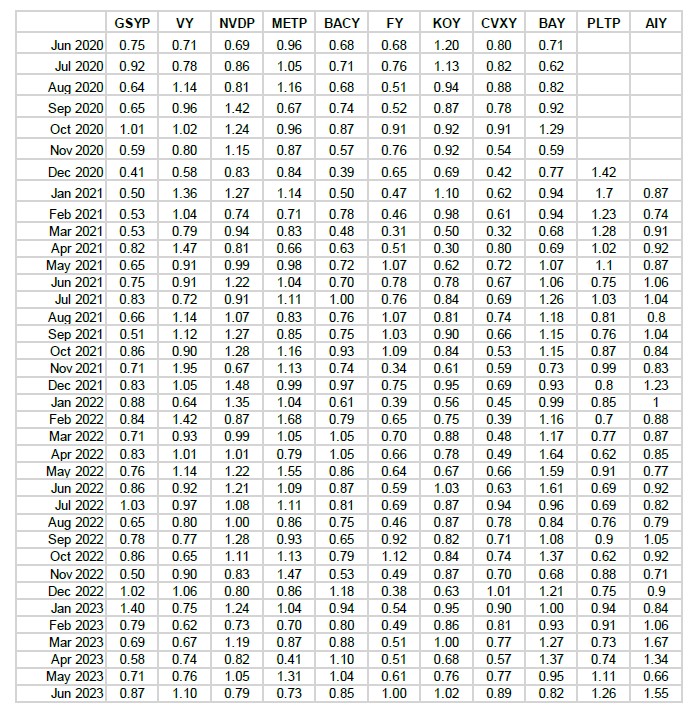

Comment #12.

| A. | Please provide the Staff with the calculations used in the VaR for each Fund. The Staff notes that the VaR calculations are still missing for certain Funds. |

| B. | Please confirm there will be a rolling 20-day VaR period. |

| C. | Please include designated reference portfolios for each of the issuers. The Staff notes, a number of issuers have not been provided yet. |

Response.

| B. | The Registrant confirms that there will be a rolling 20-day VaR period. |

Additional Follow-Up Comment: #12

Please make sure Appendix the calculations used in the VaR for all the Funds.

Additional Follow-Up Response: All missing VaR calculations and designated reference portfolios have been added for the eleven Funds that will initially be launched.

Additional Follow-Up Comment: #13 Please confirm that a 20-day rolling period was used and delete the word “Yes”.

Additional Follow-Up Response: The Registrant confirms that a 20-day rolling period was used and the word “Yes” in the response has been deleted.

Additional Follow-Up Comment: #14

Please ensure that each Fund is listed in the Designated Reference Portfolio table.

Additional Follow-Up Response: The Registrant has revised the table to include each Fund that will initially be launched.

Comment #15 (John Lee Comment 1). The following statement under Principal Investment Strategies is confusing: “To replicate the returns of the underlying stock, the Sub-Adviser will purchase call options and sell put options with the same expiration date and the same strike price that may range from 1 to 12 months out at the money.” Please replace the sentence with “To replicate the returns of the underlying stock, the Sub-Adviser will purchase at the money call options and sell put options with the same expiration date and the same strike price that may range from 1-12 months from expiry.”

Response: The requested edit has been made.

Comment #16 (John Lee Comment 2). Please add a sentence in the Principal Investment Strategy Section that explains that the Fund is not using the synthetic positioning to leverage higher than 100%. Please include something to like the following: “The combined exposure to BA shares created by synthetic long positions achieved through options and any direct investment in shares will not exceed 100% of the net assets of the Fund.”

Response: The requested edit has been made.

Comment #17 (John Lee Comment 3). Please add to the first paragraph under Principal Investment Strategies the following: “In addition to achieving a long position in BA stock, either synthetically or through purchasing shares, the fund will hold positions in BA options contracts as described below.”

Response: The requested edit has been made.

Comment #18 (John Lee Comment 4). On Page 5 under the Short Dated Fixed Income Instruments section, please add the following sentence: “The notional principal amount of written call options will not exceed the principal amount of the synthetic or cash long position in BA.”

Response: The requested edit has been made.

Comment #19 (John Lee Comment 5). On Page 6 under the Covered Call return profile chart, please add: “Because the fund may sell call options with a variety of expiration dates and strikes, the actual profile of that strategy may vary from that depicted in the charts. For example, the income earned from the sale of options can vary relative to a comparative stock position where calls have not been sold and the reduced upside potential could begin at a higher, or lower stock position level than depicted above.”

Response: The requested edit has been made. Prior to that sentence, the Registrant has added: “The graph is only an illustration of a covered call strategy."

* * * *

If you have any additional comments or questions, please contact the undersigned at (202) 973-2727.

Sincerely,

/s/ Bibb Strench

Bibb Strench

Kurv Investment Management LLC

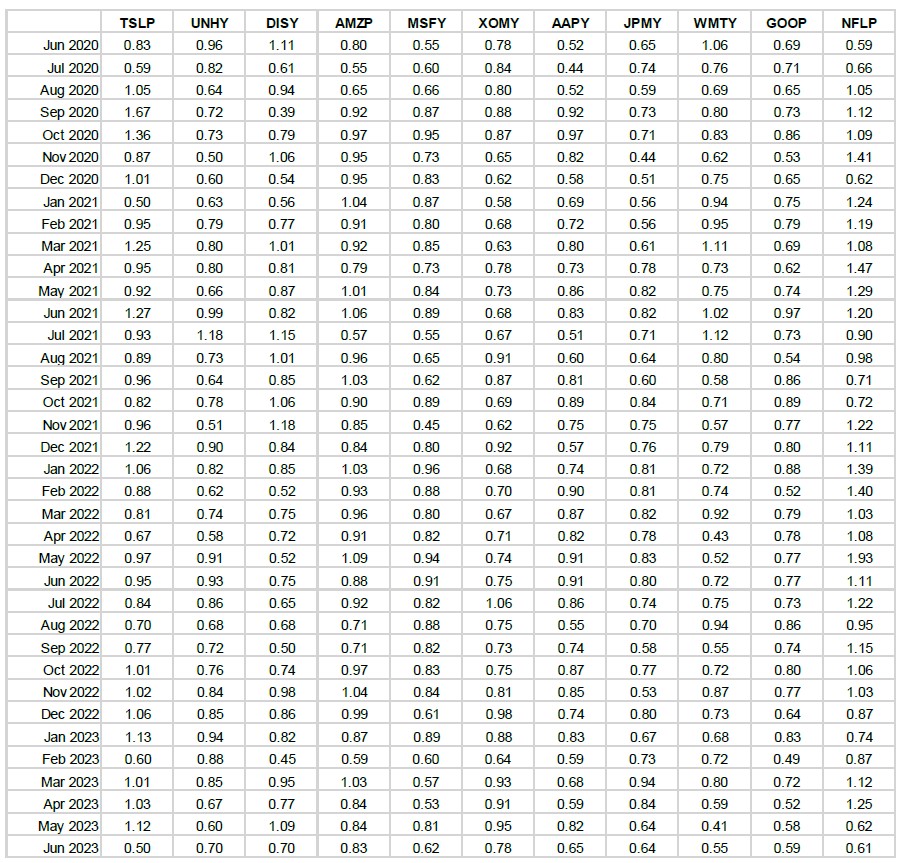

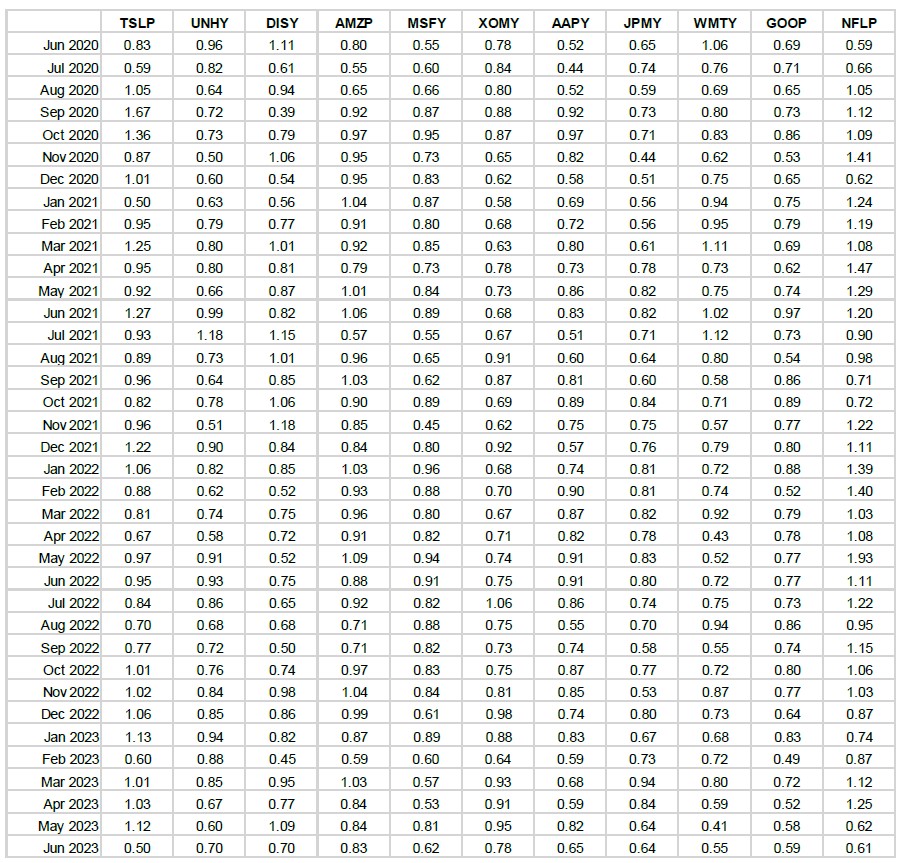

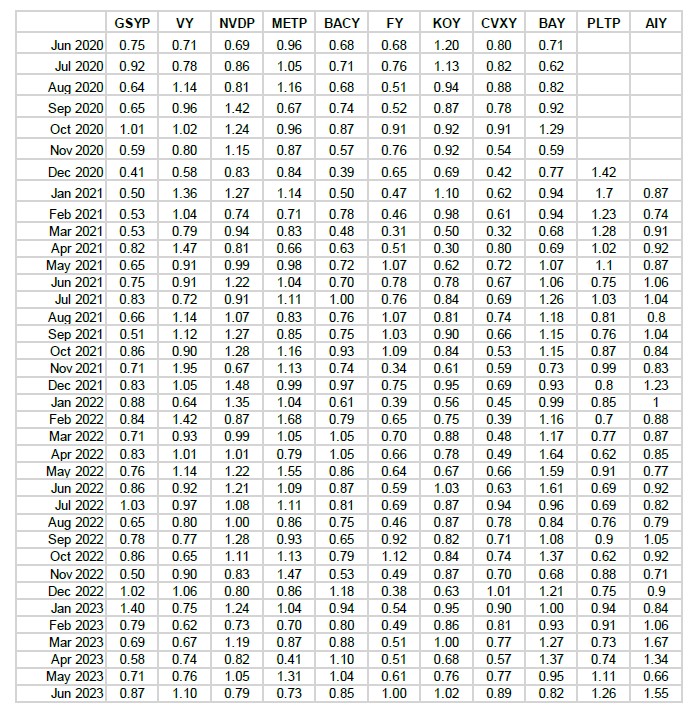

APPENDIX

Hypothetical VAR Calculations

Date range: June 2020 - June 2023 (20-day rolling period was used)

Designated reference portfolio:

| Fund Ticker | Index |

| TSLP | DJ Autos & Parts |

| UNHY | S&P 500 Managed Health Care (Sub Ind) (TR) |

| DISY | S&P 500 Movies & Entertainment (Sub Ind) (TR) |

| AMZP | DJ Broadline DOM |

| MSFY | S&P 500 Systems Software (Sub Ind) (TR) |

| XOMY | S&P 500 Integrated Oil & Gas (Sub Ind) (TR) |

| AAPY | S&P 500 Technology Hardware, Storage & Peripherals (Sub Ind)(TR) |

| JPMY | S&P 500 Diversified Banks (Sub Ind) (TR) |

| WMTY | S&P 500 Consumer Staples Merchandise Retail (Sub Ind) (TR) |

| GOOP | S&P 500 Interactive Media & Services (Industry) (TR) |

| NFLP | S&P 500 Movies & Entertainment (Sub Ind) (TR) |

| GSYP | S&P 500 Investment Banking & Brokerage (Sub Ind) (TR) |

| VY | DJ Financial Services |

| NVDP | S&P 500 Semiconductors (Sub Ind) (TR) |

| METP | S&P 500 Interactive Media & Services (Industry) (TR) |

| BACY | S&P 500 Diversified Banks (Sub Ind) (TR) |

| FY | S&P 500 Automobile Manufacturers (Sub Ind) (TR) |

| KOY | DJ Soft Drinks |

| CVXY | S&P 500 Integrated Oil & Gas (Sub Ind) (TR) |

| BAY | DJ Aerospace |

| PLTP | Daily 50/50 weighted PLTR/SQ index |

| AIY | Daily 50/50 weighted PLTR/AI index |