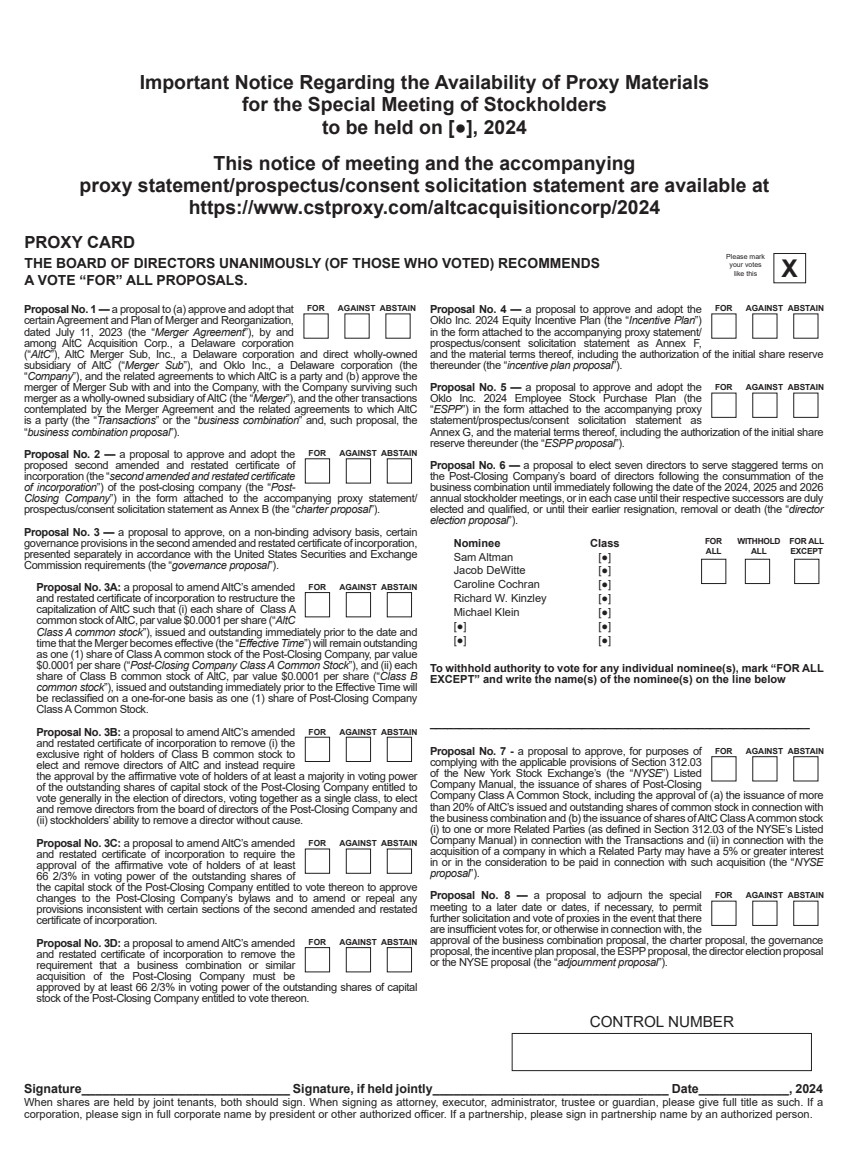

| 23157 ALTC Acq. Corp. Proxy Card_REV11 - Back Important Notice Regarding the Availability of Proxy Materials for the Special Meeting of Stockholders to be held on [●], 2024 This notice of meeting and the accompanying proxy statement/prospectus/consent solicitation statement are available at https://www.cstproxy.com/altcacquisitioncorp/2024 CONTROL NUMBER Signature______________________________ Signature, if held jointly__________________________________ Date_____________, 2024 When shares are held by joint tenants, both should sign. When signing as attorney, executor, administrator, trustee or guardian, please give full title as such. If a corporation, please sign in full corporate name by president or other authorized officer. If a partnership, please sign in partnership name by an authorized person. Proposal No. 1 — a proposal to (a) approve and adopt that certain Agreement and Plan of Merger and Reorganization, dated July 11, 2023 (the “Merger Agreement”), by and among AltC Acquisition Corp., a Delaware corporation (“AltC”), AltC Merger Sub, Inc., a Delaware corporation and direct wholly-owned subsidiary of AltC (“Merger Sub”), and Oklo Inc., a Delaware corporation (the “Company”), and the related agreements to which AltC is a party and (b) approve the merger of Merger Sub with and into the Company, with the Company surviving such merger as a wholly-owned subsidiary of AltC (the “Merger”), and the other transactions contemplated by the Merger Agreement and the related agreements to which AltC is a party (the “Transactions” or the “business combination” and, such proposal, the “business combination proposal”). Proposal No. 2 — a proposal to approve and adopt the proposed second amended and restated certificate of incorporation (the “second amended and restated certificate of incorporation”) of the post-closing company (the “Post-Closing Company”) in the form attached to the accompanying proxy statement/ prospectus/consent solicitation statement as Annex B (the “charter proposal”). Proposal No. 3 — a proposal to approve, on a non-binding advisory basis, certain governance provisions in the second amended and restated certificate of incorporation, presented separately in accordance with the United States Securities and Exchange Commission requirements (the “governance proposal”). Proposal No. 3A: a proposal to amend AltC’s amended and restated certificate of incorporation to restructure the capitalization of AltC such that (i) each share of Class A common stock of AltC, par value $0.0001 per share (“AltC Class A common stock”), issued and outstanding immediately prior to the date and time that the Merger becomes effective (the “Effective Time”) will remain outstanding as one (1) share of Class A common stock of the Post-Closing Company, par value $0.0001 per share (“Post-Closing Company Class A Common Stock”), and (ii) each share of Class B common stock of AltC, par value $0.0001 per share (“Class B common stock”), issued and outstanding immediately prior to the Effective Time will be reclassified on a one-for-one basis as one (1) share of Post-Closing Company Class A Common Stock. Proposal No. 3B: a proposal to amend AltC’s amended and restated certificate of incorporation to remove (i) the exclusive right of holders of Class B common stock to elect and remove directors of AltC and instead require the approval by the affirmative vote of holders of at least a majority in voting power of the outstanding shares of capital stock of the Post-Closing Company entitled to vote generally in the election of directors, voting together as a single class, to elect and remove directors from the board of directors of the Post-Closing Company and (ii) stockholders’ ability to remove a director without cause. Proposal No. 3C: a proposal to amend AltC’s amended and restated certificate of incorporation to require the approval of the affirmative vote of holders of at least 66 2/3% in voting power of the outstanding shares of the capital stock of the Post-Closing Company entitled to vote thereon to approve changes to the Post-Closing Company’s bylaws and to amend or repeal any provisions inconsistent with certain sections of the second amended and restated certificate of incorporation. Proposal No. 3D: a proposal to amend AltC’s amended and restated certificate of incorporation to remove the requirement that a business combination or similar acquisition of the Post-Closing Company must be approved by at least 66 2/3% in voting power of the outstanding shares of capital stock of the Post-Closing Company entitled to vote thereon. Proposal No. 4 — a proposal to approve and adopt the Oklo Inc. 2024 Equity Incentive Plan (the “Incentive Plan”) in the form attached to the accompanying proxy statement/ prospectus/consent solicitation statement as Annex F, and the material terms thereof, including the authorization of the initial share reserve thereunder (the “incentive plan proposal”). Proposal No. 5 — a proposal to approve and adopt the Oklo Inc. 2024 Employee Stock Purchase Plan (the “ESPP”) in the form attached to the accompanying proxy statement/prospectus/consent solicitation statement as Annex G, and the material terms thereof, including the authorization of the initial share reserve thereunder (the “ESPP proposal”). Proposal No. 6 — a proposal to elect seven directors to serve staggered terms on the Post-Closing Company’s board of directors following the consummation of the business combination until immediately following the date of the 2024, 2025 and 2026 annual stockholder meetings, or in each case until their respective successors are duly elected and qualified, or until their earlier resignation, removal or death (the “director election proposal”). Nominee Class Sam Altman [●] Jacob DeWitte [●] Caroline Cochran [●] Richard W. Kinzley [●] Michael Klein [●] [●] [●] [●] [●] To withhold authority to vote for any individual nominee(s), mark “FOR ALL EXCEPT” and write the name(s) of the nominee(s) on the line below _________________________________________________________________ Proposal No. 7 - a proposal to approve, for purposes of complying with the applicable provisions of Section 312.03 of the New York Stock Exchange’s (the “NYSE”) Listed Company Manual, the issuance of shares of Post-Closing Company Class A Common Stock, including the approval of (a) the issuance of more than 20% of AltC’s issued and outstanding shares of common stock in connection with the business combination and (b) the issuance of shares of AltC Class A common stock (i) to one or more Related Parties (as defined in Section 312.03 of the NYSE’s Listed Company Manual) in connection with the Transactions and (ii) in connection with the acquisition of a company in which a Related Party may have a 5% or greater interest in or in the consideration to be paid in connection with such acquisition (the “NYSE proposal”). Proposal No. 8 — a proposal to adjourn the special meeting to a later date or dates, if necessary, to permit further solicitation and vote of proxies in the event that there are insufficient votes for, or otherwise in connection with, the approval of the business combination proposal, the charter proposal, the governance proposal, the incentive plan proposal, the ESPP proposal, the director election proposal or the NYSE proposal (the “adjournment proposal”). PROXY CARD THE BOARD OF DIRECTORS UNANIMOUSLY (OF THOSE WHO VOTED) RECOMMENDS A VOTE “FOR” ALL PROPOSALS. Please mark your votes like this X FOR ALL WITHHOLD ALL FOR ALL EXCEPT FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN FOR AGAINST ABSTAIN |