DESCRIPTION OF SHARE CAPITAL

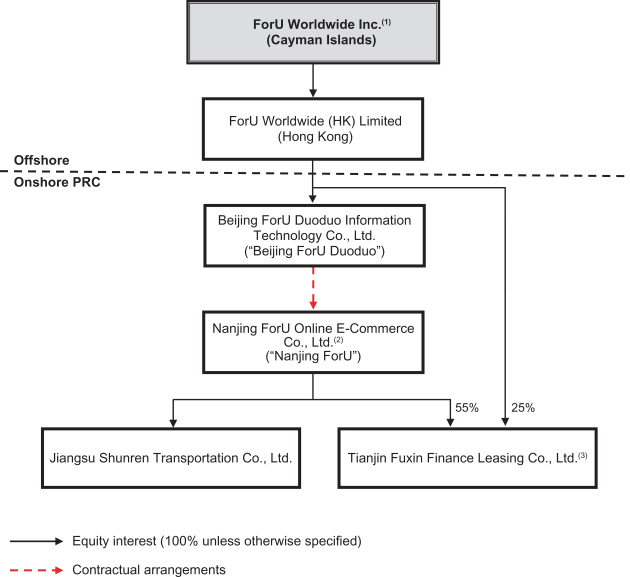

We are a Cayman Islands exempted company incorporated with limited liability and our affairs are governed by our memorandum and articles of association, the Companies Act (As Revised) of the Cayman Islands, which we refer to as the Companies Act below, and the common law of the Cayman Islands.

As of the date of this prospectus, our authorized share capital is US$100,000 divided into 2,000,000,000 shares, par value of US$0.00005 each, comprising of 964,315,753 class A ordinary shares, 130,250,000 class B ordinary shares, 40,000,000 Series Angel preferred shares, 47,500,000 Series A preferred shares, 75,000,000 Series A+ preferred shares, 137,500,000 Series B preferred shares, 132,537,879 Series C preferred shares, 58,831,334 Series C+ preferred shares, 69,094,422 Series C++ preferred shares, 161,992,603 Series D preferred shares, and 182,978,009 Series E preferred shares.

As of the date of this prospectus, 33,750,000 class A ordinary shares, 130,250,000 class B ordinary shares, 40,000,000 Series Angel preferred shares, 47,500,000 Series A preferred shares, 75,000,000 Series A+ preferred share, 137,500,000 Series B preferred shares, 132,537,879 Series C preferred shares, 58,831,334 Series C+ preferred shares, 69,094,422 Series C++ preferred shares, 161,992,603 Series D preferred shares, and 169,254,658 Series E preferred shares are issued and outstanding. All of our issued and outstanding ordinary and preferred shares are fully paid.

Immediately prior to the completion of this offering, our authorized share capital will be changed into US$200,000 divided into 4,000,000,000 shares comprising of (i) 3,400,000,000 class A ordinary shares of a par value of US$0.00005 each, (ii) 200,000,000 class B ordinary shares of a par value of US$0.00005 each, and (iii) 400,000,000 shares of a par value of US$0.00005 each of such class or classes (however designated) as the board of directors may determine in accordance with our post-offering memorandum and articles of association. Immediately prior to the completion of this offering, all of our issued and outstanding ordinary shares will be converted into, and/or re-designated and re-classified, as class A ordinary shares on a one-for-one basis, save and except that the 130,250,000 class B ordinary shares held by Miracle Dream Investment Inc. will continue to be classified as class B ordinary shares. Following such conversion and/or re-designation, we will have class A ordinary shares issued and outstanding and class B ordinary shares issued and outstanding, assuming the underwriters do not exercise their option to purchase additional ADSs. All of our shares issued and outstanding prior to the completion of the offering are and will be fully paid, and all of our shares to be issued in the offering will be issued as fully paid.

Our Post-Offering Memorandum and Articles of Association

Our shareholders have conditionally adopted a sixth amended and restated memorandum and articles of association, which will become effective and replace our current amended and restated memorandum and articles of association in its entirety immediately prior to the completion of this offering. The following are summaries of material provisions of the post-offering memorandum and articles of association and of the Companies Act, insofar as they relate to the material terms of our ordinary shares.

Objects of Our Company. Under our post-offering memorandum and articles of association, the objects of our company are unrestricted, and we have the full power and authority to carry out any object not prohibited by the laws of the Cayman Islands.

Ordinary Shares. Our ordinary shares are divided into class A ordinary shares and class B ordinary shares. Holders of our class A ordinary shares and class B ordinary shares will have the same

158