| | |

| | Stevanato Group S.p.A. Report on remuneration policy and practices |

Stevanato Group Remuneration Practices

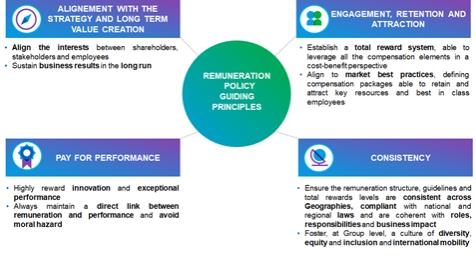

The remuneration structure envisages an appropriate combination and balance of all the incentive levers and components (base salary, short term incentive plan, long term incentive plan, benefits), to design compensation packages consistent with different clusters of the population, roles and complexity of the positions.

Total remuneration packages are subject to periodical review to ensure internal consistency, as well as adequacy and competitiveness compared to the markets for positions of similar levels of responsibility and complexity.

Base Salary (Fixed Remuneration)

Base Salary is determined and allocated based on pre-defined criteria.

It reflects the role and the responsibilities assigned, taking into consideration skills, contribution and experience required for the position.

The overall amount and weight of Base Salary must be sufficient and appropriate to remunerate the role and is periodically reviewed with respect to a predefined reference market.

Variable Remuneration

The variable component of Stevanato’s remuneration framework consists of:

| | ● | | Short Term Incentive Plan |

| | ● | | Long Term Incentive Plan |

Short Term Incentive Plan is a cash-based plan that aims at motivating and rewarding the achievement of annual financial and non-financial objectives, within the framework of long-term sustainable performance.

Key performance indicators, foreseen in the annual bonus scheme, vary depending on organizational layer and responsibilities of the participants. There is a mix of financial metrics at Group level (such as revenues, ebitda or ebitda margin, net working capital, free cash flow) and non-financial metrics (such as strategic objectives linked to business plan priorities, ESG performance areas, and operating metrics in the areas of safety, quality, production, sales, customer satisfaction). It is expected that the heaviest weighting for senior executives will be on financial metrics.

Short Term Incentive Plan envisages a cap to the maximum award and pre-defined performance and payout curves.

Target bonus opportunity for eligible positions is defined according to the level of accountabilities, contribution to company results and consistent with practices of the reference market.

Long Term Incentive Plan aims at strengthening the link between variable compensation, company performance and shareholder return over a multi-year period. The current Plan is a Stock Grant Plan, subject to claw-back clause.

Stock Grant Plan provides for the right of the beneficiaries to be granted a pre-defined number of shares of the Company, free of any charges, that will be awarded at the end of the vesting period, subject to the achievement of specific financial performance objectives at Group level. Furthermore, at the end of the vesting period, the Plan provides for a lock-up period, during which beneficiaries shall maintain the shares awarded.

| | |

| | 4 |