UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934 (Amendment No. ______)

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

☒ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☐ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material under §240.14a-12

(Name of Registrant as Specified In Its Charter)

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (Check the appropriate box):

☒ No fee required.

☐ Fee paid previously with preliminary materials.

☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11.

MSD Investment Corp.

One Vanderbilt Avenue, 26th Floor

New York, New York 10017

[ ], 2023

Dear Shareholder:

You are cordially invited to attend the annual meeting of shareholders of MSD Investment Corp. (the “Company”) to be held on April 26, 2023 at 10:00 a.m., Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format setting only. You can participate in the Annual Meeting, vote and submit questions via live audio webcast by visiting [ ] and entering your control number on your proxy card or voting instruction form.

Your vote is very important! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting shareholder votes.

The Notice of the Annual Meeting and proxy statement accompanying this letter provide an outline of the business to be conducted at the meeting. The Annual Meeting is being held for the following purposes:

(1) to elect two members of the board of directors of the Company (the “Board”) to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified;

(2) to ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

(3) to approve and ratify the prior approval of the New Advisory Agreement; and

(4) to transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Board unanimously recommends that you vote FOR all of the proposals to be considered and voted on at the Annual Meeting.

It is important that your shares of the Company’s common stock, par value $0.001 per share, be represented at the Annual Meeting. If you are a shareholder of record and are unable to attend the virtual meeting, I urge you to vote your shares by completing, dating and signing the enclosed proxy card and promptly returning it in the envelope provided or, alternatively, by calling the toll-free telephone number or using the Internet as described on the proxy card. Your vote and participation in the governance of the Company are very important.

Sincerely yours,

Robert Platek

Chief Executive Officer, President and Chairman of the Board

MSD INVESTMENT CORP.

One Vanderbilt Avenue, 26th Floor

New York, New York 10017

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To Be Held On April 26, 2023

To the Shareholders of MSD Investment Corp.:

NOTICE IS HEREBY GIVEN THAT the annual meeting of shareholders of MSD Investment Corp., a Maryland corporation (the “Company”), will be held on April 26, 2023 at 10:00 a.m. Eastern Time (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. It is important to note that shareholders have the same rights and opportunities by participating in the virtual meeting as they would if attending an in-person meeting. You will be able to participate in the Annual Meeting, vote and submit your questions via live audio webcast by visiting [ ]. For instructions on how to attend and vote your shares at the Annual Meeting, see the information in the accompanying proxy statement under the heading “How do I attend and vote at the Annual Meeting.”

The Annual Meeting is being held for the following purposes:

1. To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified;

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

3. To approve and ratify the prior approval of the New Advisory Agreement; and

4. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

The Board unanimously recommends that you vote FOR all of the proposals to be considered and voted on at the Annual Meeting.

You have the right to receive notice of and to vote at the meeting if you were a shareholder of record at the close of business on March 22, 2023. Whether or not you expect to be attend the meeting virtually, please vote by signing the enclosed proxy card and returning it promptly in the self-addressed envelope provided or, alternatively, by calling the toll-free telephone number or using the Internet as described on the proxy card. In the event there are not sufficient votes for a quorum or to approve or ratify any of the foregoing proposals at the time of the Annual Meeting, the Annual Meeting may be adjourned in order to permit further solicitation of proxies by the Company.

By Order of the Board of Directors,

Robert Platek

Chief Executive Officer, President and Chairman of the Board

[ ], 2023

This is an important meeting. To ensure proper representation at the annual meeting, please indicate your vote as to the matters to be acted on at the meeting by following the instructions provided in the enclosed proxy card or voting instruction form. Even if you vote your shares prior to the meeting, you still may attend the meeting and vote your shares in person.

TABLE OF CONTENTS

MSD INVESTMENT CORP.

One Vanderbilt Avenue, 26th Floor

New York, New York 10017

2023 ANNUAL MEETING OF SHAREHOLDERS

To Be Held On [ ], 2023

PROXY STATEMENT

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors of MSD Investment Corp. (the “Company,” “we,” “us” or “our”) for use at our 2023 Annual Meeting of Shareholders to be held on April 26, 2023, at [ ] p.m. (Eastern Time) and at any adjournments thereof (the “Annual Meeting”). The Annual Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. The Notice of Annual Meeting, this Proxy Statement, the accompanying proxy card and our annual report for the fiscal year ended December 31, 2022 (the “Annual Report”) are first being sent to shareholders on or about [ ], 2023.

We encourage you to vote your shares, either by voting in person at the meeting (virtually) or by granting a proxy (i.e., authorizing someone else to vote your shares). If you vote by mail, Internet or telephone as described in the instructions on the proxy card, and we receive your vote in time for the meeting, the persons named as proxies will vote the shares registered directly in your name in the manner that you specified. All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if a proxy is properly executed and received by the Company (and not revoked) prior to the Annual Meeting, the Shares represented by the proxy will be: (i) voted FOR the election of two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified; (ii) voted FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and (iii) and FOR the approval and ratification the prior approval of the New Advisory Agreement. Should any matter not described above be properly presented at the Annual Meeting, the named proxies will vote in accordance with their best judgment as permitted.

YOUR VOTE IS IMPORTANT. WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING, PLEASE PROMPTLY VOTE YOUR SHARES EITHER BY MAIL, INTERNET OR TELEPHONE.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE ANNUAL SHAREHOLDER MEETING TO BE HELD ON APRIL 26, 2023:

The Notice of Annual Meeting, Proxy Statement, and our Annual Report for the fiscal year ended December 31, 2022 are available at the following Internet address:[ ].

1

QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING

What is the date of the Annual Meeting and where will it be held?

The annual meeting (the “Annual Meeting”) of shareholders of MSD Investment Corp., which is sometimes referred to in this proxy statement as “we,” “us,” “our,” or the “Company,” will be held in a virtual meeting format setting only on April 26, 2023. You will be able to participate in the Annual Meeting, vote and submit your questions via live audio webcast by visiting [ ].

What will I be voting on at the Annual Meeting?

At the Annual Meeting, holders of the Company’s common stock (each, a “Shareholder”) will be asked to: (1) elect each of Robert Platek and Louisa (Lucy) Rodriguez to the Board of Directors (the “Board”) for a three-year term, expiring at the 2026 annual meeting of shareholders and until their respective successor is duly elected and qualified; (2) ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and (3) approve and ratify the prior approval of the New Advisory Agreement.

Who can vote at the Annual Meeting?

Only Shareholders of record as of the close of business on March 22, 2023 (the “Record Date”) are entitled to notice of, and to vote at, the Annual Meeting and any postponements or adjournments thereof.

How many votes do I have?

Shareholders are entitled to one vote for each share held as of the Record Date.

How do I attend and vote at the Annual Meeting?

The Company will be hosting the Annual Meeting live via audio webcast. Any Shareholder can attend the Annual Meeting live online at [ ]. If you were a Shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

Attending the Annual Meeting Virtually. The Company will be hosting the Annual Meeting live via audio webcast. Any Shareholder can participate in the Annual Meeting live online at [ ]. If you were a Shareholder as of the Record Date, or you hold a valid proxy for the Annual Meeting, you can vote at the Annual Meeting. A summary of the information you need to attend the Annual Meeting online is provided below:

•Instructions on how to attend and participate via the Internet, including how to demonstrate proof of stock ownership, are posted at [ ].

•Assistance with questions regarding how to attend and participate via the Internet will be provided at [ ], [30 minutes before the start of the virtual Annual Meeting.]

•Webcast starts at [ ] [a.m.], Eastern Time.

•You will need your control number located on your proxy card or on the instructions that accompanied your proxy materials to enter the Annual Meeting.

•Shareholders may submit questions while attending the Annual Meeting via the Internet.

To attend and participate in the Annual Meeting, you will need the control number located on your proxy card or on the instructions that accompanied your proxy materials. If you lose your control number, you may join the Annual Meeting as a “Guest,” but you will not be able to vote, ask questions or access the list of Shareholders as of the Record Date. The Company will have technicians ready to assist with any technical difficulties Shareholders may have accessing the virtual meeting website. If you encounter any difficulties accessing the virtual meeting website during the check-in or meeting time, please call the technical support number that will be posted on the Annual Meeting login page.

Voting by Proxy through the Internet. You may authorize a proxy through the Internet using the web address included in your proxy card or on the instructions that accompanied your proxy materials. Authorizing a proxy through the internet requires you to input the control number located on your proxy card or on the instructions that accompanied your proxy materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the Internet link.

Voting by Proxy by Telephone. You may authorize a proxy by telephone by using the telephone number included in your proxy card or on the instructions that accompanied your proxy materials and following the instructions provided therein. Authorizing a proxy by telephone requires you to input the control number located on

2

your proxy card or on the instructions that accompanied your proxy materials. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call.

Voting by Proxy through the Mail. You may also request from us, free of charge, hard copies of the proxy statement and proxy card for the Company by following the instructions on your proxy card or on the instructions that accompanied your proxy materials. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before 12:00 p.m., Eastern Time, on [ ], 2023.

Does the Board recommend voting for each of Proposals 1, 2 and 3?

Yes. The Board unanimously recommends that you vote “FOR” each of proposals 1, 2 and 3.

GENERAL INFORMATION ABOUT THE ANNUAL MEETING

The accompanying proxy is solicited on behalf of the Board for use at the Annual Meeting to be held on April 26, 2023 at 10:00 a.m., Eastern Time. The Annual Meeting will be held in a virtual meeting format setting only, and will be conducted via live audio webcast. Only holders of record of our common stock as of the Record Date will be entitled to vote at the Annual Meeting. As of the Record Date, we had [ ] shares of common stock, par value $0.001 per share (the “Shares”), outstanding and entitled to vote. The Notice of Annual Meeting, this proxy statement (the “Proxy Statement”), the accompanying proxy card and our annual report for the fiscal year ended December 31, 2022 (the “Annual Report”) are first being sent to shareholders on or about [ ], 2023. The Annual Report and this Proxy Statement can both be accessed online at [ ].

All proxies will be voted in accordance with the instructions contained therein. Unless contrary instructions are specified, if a proxy is properly executed and received by the Company (and not revoked) prior to the Annual Meeting, the Shares represented by the proxy will be: (1) voted FOR the election of two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified; (2) voted FOR the ratification of the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023; and (3) and FOR the approval and ratification the prior approval of the New Advisory Agreement. Should any matter not described above be properly presented at the Annual Meeting, the named proxies will vote in accordance with their best judgment as permitted.

Voting Rights

Holders of our common stock are entitled to one vote for each share held as of the Record Date.

The Annual Meeting is being held for the following purposes:

1. To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified;

2. To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023;

3. To approve and ratify the prior approval of the New Advisory Agreement; and

4. To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof.

Record Date

The Board has fixed the close of business on March 22, 2023 as the Record Date for the determination of Shareholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof. As of the Record Date, there were [ ] Shares outstanding.

3

Quorum Required

A majority of the outstanding Shares entitled to vote at the Annual Meeting must be present or represented by proxy at the Annual Meeting in order to have a quorum. If you have properly voted by proxy via Internet, telephone or mail, you will be considered part of the quorum. Abstentions and “broker non-votes” will be treated as shares present for determining whether a quorum is established.

Vote Required

| | | |

Proposal | Vote Required | Broker Discretionary Voting Allowed | Effect of Abstentions and Broker Non-Votes |

Proposal 1 – To elect two members of the Board to serve until the 2026 annual meeting of shareholders and until their respective successors are duly elected and qualified. | Affirmative vote of a plurality of the votes cast at the Annual Meeting virtually or by proxy. | No | Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, do not affect the outcome. |

Proposal 2 – To ratify the appointment of Deloitte & Touche LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2023 | Affirmative vote of a majority of the votes cast at the Annual Meeting in person (virtually) or by proxy. | Yes | Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, do not affect the outcome. |

Proposal 3 – To approve and ratify the prior approval of the New Advisory Agreement. | The lesser of (i) 67% or more of the common stock of the Company present or represented by proxy at the Annual Meeting, if the holders of more than 50% of the Company’s common stock are present or represented by proxy; or (ii) more than 50% of the outstanding common stock of the Company. | No | Abstentions and broker non-votes will have the effect of votes against the proposal. |

Proposal 4 – To transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof. | Affirmative vote of a majority of the votes cast at the Annual Meeting in person (virtually) or by proxy. | No | Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, do not affect the outcome. |

You may vote “for,” “withhold authority” or abstain from voting on Proposal 1, vote “for,” “against” or abstain from voting on Proposals 2, 3 and 4. The adoption of Proposal 1 requires the affirmative vote of the plurality of votes cast for such proposal at the Annual Meeting, meaning votes cast for such nominee’s election must exceed the votes withheld from such nominee’s election. Votes to “withhold authority” with respect to a nominee will not be voted with respect to the person indicated. The adoption of Proposal 2 and 4 require the affirmative vote of a majority of the votes cast at the Annual Meeting in person (virtually) or by proxy. The adoption of Proposal 3 requires the affirmative vote of the lesser of (i) 67% or more of the common stock of the Company present (virtually) or represented by proxy at the Annual Meeting, if the holders of more than 50% of the Company’s common stock are present (virtual) or represented by proxy; or (ii) more than 50% of the outstanding common stock of the Company. Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposals 1, 2 and 4, but will have the effect of a vote against Proposal 3.

Voting

You may vote at the Annual Meeting by using the virtual control number contained in your proxy card or on the instructions that accompanied your proxy materials or by proxy in accordance with the instructions provided

4

below. You also may authorize a proxy through the Internet or by telephone using the web address or telephone number, as applicable, included in your proxy card or on the instructions that accompanied your proxy materials. These options require you to input the control number located on your proxy card or on the instructions that accompanied your proxy materials. After inputting the control number, you will be prompted to direct your proxy to vote on the proposal. You will have an opportunity to review your voting instructions and make any necessary changes before submitting your voting instructions and terminating the telephone call or Internet link. Shareholders who vote via the Internet, in addition to confirming your voting instructions prior to submission, will also receive an e-mail confirming your instructions upon request. When voting by proxy and mailing your proxy card, you are required to:

•indicate your instructions on the proxy card;

•date and sign the proxy card;

•mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and

•allow sufficient time for the proxy card to be received on or before [ ] [p.m.], Eastern Time, on [ ], 2023.

If your Shares are held in street name, these proxy materials are being forwarded to you by your account holder, along with voting instructions. As the beneficial owner, you have the right to direct your account holder how to vote your Shares, and the account holder is required to vote your Shares in accordance with your instructions. Your broker cannot vote your Shares on your behalf without your instructions. A “broker non-vote” with respect to a matter occurs when a broker, bank or other nominee holding Shares on behalf of a beneficial owner votes on some matters on the proxy card, but not on other matters, because the broker has not received voting instructions from the beneficial owner on a particular proposal and does not have discretionary authority (or declines to exercise discretionary authority) to vote the Shares on such proposal. Brokers, banks and other nominees will not have discretionary authority to vote on the proposals with respect to the election of directors (Proposal 1), the approval of the New Advisory Agreement (Proposal 3) or the approval to transact such other business as may properly come before the Annual Meeting or any postponement or adjournment thereof (Proposal 4). In addition, as the beneficial owner of our Shares, you are entitled to participate in the Annual Meeting. If you are a beneficial owner, however, you may not vote your Shares at the Annual Meeting unless you obtain a legal proxy executed in your favor from the account holder of your Shares.

You may receive more than one proxy statement and proxy card or voting instructions form if your Shares are held through more than one account (e.g., through different account holders). Each proxy card or voting instructions form only covers those Shares held in the applicable account. If you hold Shares in more than one account, you must provide voting instructions as to all your accounts to vote all your Shares.

If you plan to attend the Annual Meeting and vote your Shares virtually, you will need your control number located on your proxy card or on the instructions that accompanied your proxy materials in order to be admitted to the Annual Meeting.

Quorum and Adjournment

A quorum must be present at the Annual Meeting for any business to be conducted. The presence at the Annual Meeting, virtually or by proxy, of the holders of a majority of the Shares outstanding on the Record Date will constitute a quorum.

If a quorum is not present at the Annual Meeting, the Chairman will have the authority to adjourn the Annual Meeting, from time-to-time without notice and without the vote or approval of the Shareholders, until a quorum is present.

Proxies for the Annual Meeting

The named proxies for the Annual Meeting are Saritha Reddy and Brian Williams (or their duly authorized designees), who will follow submitted proxy voting instructions. They will vote as the Board recommends herein as to any submitted proxies that do not direct how to vote on any item, and will vote on any other matters properly presented at the Annual Meeting in their judgment.

Expenses of Soliciting Proxies

The Company will pay the expenses of soliciting proxies to be voted at the Annual Meeting, including the cost of preparing and posting this Proxy Statement and the Annual Report to the Internet and the cost of mailing the proxy card or on the instructions that accompanied your proxy materials and any requested proxy materials to the Shareholders. The Company has engaged Broadridge Financial Solutions, Inc., an independent proxy solicitation firm, to assist in the distribution of the proxy materials and tabulation of proxies. The cost of Broadridge’s services with

5

respect to the solicitation of proxies for the Annual Meeting is estimated to be approximately $[ ], plus reasonable out-of-pocket expenses.

Revocability of Proxies

A Shareholder may revoke any proxy that is not irrevocable by attending the Annual Meeting and voting virtually or by delivering a proxy in accordance with applicable law bearing a later date to the Secretary of the Company. Shareholders have no appraisal or dissenters’ rights in connection with the proposal described herein.

Contact Information for Proxy Solicitation

You can contact us by mail sent to the attention of the [ ] of the Company, [ ], at our principal executive offices located at One Vanderbilt Avenue, 26th Floor, New York, New York 10017. You can call us by dialing (212) 303-4728. You can access our proxy materials online at [ ].

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth certain information with respect to the beneficial ownership of our Shares, according to information furnished to us by such persons or publicly available filings, as of the Record Date by: (1) each director and director nominee of the Company; (2) the Company’s executive officers; (3) the executive officers and directors as a group; and (4) each person known to us to beneficially own 5% or more of our outstanding Shares. Ownership information for those persons who beneficially own 5% or more of the outstanding Shares is based upon filings by such persons with the SEC and other information obtained from such persons. Beneficial ownership is determined in accordance with the rules and regulations of the SEC. These rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct the voting thereof, or to dispose or direct the disposition thereof or has the right to acquire such powers within 60 days. The percentage ownership is based on [ ] Shares outstanding as of the Record Date. The number of Shares held by beneficial owners of 5% or more of our outstanding common stock is as of the date of the applicable SEC filing made by those owners (unless otherwise noted). To our knowledge, except as indicated in the footnotes to the table, each of the Shareholders listed below has sole voting and/or investment power with respect to our Shares beneficially owned by such Shareholder.

| | | | | | |

Name and Address | | Number of

Shares Owned | | | Percentage of Class Outstanding |

Interested Directors | | | | | |

Robert Platek | | | 227,337 | | | * |

Independent Directors | | | | | |

James Chapman | | | - | | | * |

Joseph Branch | | | - | | | * |

Louisa (Lucy) Rodriguez | | | 11,947 | | | * |

Executive Officers Who Are Not Directors | | | | | |

Saritha Reddy | | | - | | | * |

Brian Williams | | | 3,524 | | | * |

All Directors and Executive Officers as a Group (6 persons) | | | 242,807 | | | * |

5% Owners | | | | | |

Noble Environmental Investments, LLC | | | 12,951,726 | | | 52.38% |

Susan L. Dell Separate Property Trust | | | 3,532,289 | | | 14.28% |

MSD Portfolio L.P. - MSD Personal Income | | | 2,354,859 | | | 9.52% |

* Less than 1%

PROPOSAL 1: ELECTION OF DIRECTOR NOMINEES

At the Annual Meeting, Shareholders are being asked to consider the election of two directors of the Company. Pursuant to the Company’s bylaws, the number of directors on the Board may not be less than one or more than nine. Under the Company’s Articles of Amendment and Restatement (the “Charter”), the directors are divided into three classes. Each class of directors holds office for a three-year term. However, the initial members of the three classes have initial terms of one, two, and three years, respectively. The Board currently consists of four directors who serve in the following classes: Class I (terms ending at the Annual Meeting) — Robert Platek and Louisa (Lucy) Rodriguez; Class II (term ending at the 2024 annual meeting of shareholders) — James Chapman; and Class III (term ending at the 2025 annual meeting of shareholders) — Joseph Branch.

Each of Robert Platek and Louisa (Lucy) Rodriguez has been nominated for election by the Board to serve a three-year term until the 2026 annual meeting of shareholders and until their respective successor is duly elected and qualified. Each director nominee has agreed to serve as a director if re-elected at the Annual Meeting and has consented to being named as a nominee in this Proxy Statement.

A Shareholder can vote “for,” “withhold authority” or abstain from voting his, her or its vote from the nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to

6

vote such proxy FOR the election of each of the director nominees named below in accordance with the recommendation of the Board. If any of the director nominees should decline or be unable to serve as a director, the persons named as proxies will vote for such other nominee as may be proposed by the Nominating and Corporate Governance Committee (the “Nominating Committee”). The Board has no reason to believe that any of the persons named as director nominees will be unable or unwilling to serve.

Required Vote

Each director nominee will be elected to the Board if the votes cast for such nominee's election exceed the votes withheld from such nominee’s election. If a Shareholder votes to “withhold authority” with respect to a nominee, the shares will not be voted with respect to the person indicated. Abstentions and “broker non-votes” will not be included in determining the number of votes cast and, as a result, will have no effect on this Proposal 1. There will be no cumulative voting with respect to Proposal 1.

Information about the Director Nominees and Directors

Set forth below is information regarding Robert Platek and Louisa (Lucy) Rodriguez, who are being nominated for election as directors of the Company by the Shareholders at the Annual Meeting, as well as information about the Company’s other current directors whose terms of office will continue after the Annual Meeting. Neither Mr. Platek nor Ms. Rodriguez is being proposed for election pursuant to any agreement or understanding between either Mr. Platek or Ms. Rodriguez, on the one hand, and the Company or any other person or entity, on the other hand.

The information below includes specific information about each director’s experience, qualifications, attributes or skills that led the Board to the conclusion that the individual is qualified to serve on the Board, in light of the Company’s business and structure. There were no legal proceedings of the type described in Item 401(f)(7) and (8) of Regulation S-K in the past 10 years against any of our directors, director nominees or officers, and none are currently pending.

Nominees for Class I Directors — Term Expiring 2023

| | | | | | | | | | |

Name, Address and Age | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director | | Other Directorships Held by Director or Nominee for Director |

Interested Director | | | | | | | | | |

Robert Platek, 58 | | Chief Executive Officer, President, Director and Chairman | | Partner & Global Head of Credit at BDT & MSD Partners, LLC and Portfolio Manager of the MSD Credit Opportunity Funds, Private Credit Opportunity Funds, Real Estate Credit Opportunity Funds, and Special Investments Funds | Class I Director since 2021, Term expires in 2023 | | 1 | | None |

The Board has determined that Ms. Rodriguez is not an “interested person” of the Company as defined in the 1940 Act.

| | | | | | | | | | |

Name, Address and Age | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director | | Other Directorships Held by Director or Nominee for Director |

Independent Director | | | | | | | | | |

Louisa (Lucy) Rodriguez, 64 | | Director | | Executive Vice President of Investor Relations, Corporate Communications and Public Affairs at CEMEX, S.A.B. de C.V. | Class I Director since 2022, Term expires in 2023 | | 1 | | Orion Biotech Opportunities Corp., Trinidad Cement Ltd. |

7

Robert Platek serves as Chief Executive Officer, President and Chairman of the Board. Mr. Platek is a Partner & the Global Head of Credit at BDT & MSD Partners, LLC (“BDT & MSD Partners”) and Portfolio Manager of the MSD Credit Opportunity Funds, Private Credit Opportunity Funds, Real Estate Credit Opportunity Funds, and Special Investments Funds. He joined MSD Partners, L.P. (the “Adviser” or “MSD”) in January 2002 as Co-Manager of the Special Opportunities Portfolio and became a Partner of MSD in January 2006. From 1995 through 2001, Mr. Platek founded Griffin Partners, L.P. and Plymouth Partners, L.P., and he was also the Hedge Fund Portfolio Manager for the Proprietary Group of Paine Webber, in each case focusing primarily on distressed and high yield bonds as well as restructured equities. From 1991 through 1994, he was a member of the High Yield Trading Group at Citicorp Securities, Chase Securities, and The Printon Kane Group. From 1986 through 1990, Mr. Platek was a financial analyst of Chase Manhattan Bank’s Debt Restructuring Group and Financial Audit Group. Mr. Platek received a B.S. degree from Rutgers University in 1986.

We believe Mr. Platek’s numerous management positions, as well as his depth of experience with corporate finance and middle market investments, give the Board valuable industry-specific knowledge and expertise on these and other matters, and his history with MSD provides an important skillset and knowledge base to the Board.

Louisa (Lucy) Rodriguez has served as a director of the Company, a member of the Nominating Committee, a member of the Audit Committee and a member of the Pricing Committee since March 2022. Ms. Rodriguez is Executive Vice President of Investor Relations, Corporate Communications and Public Affairs at CEMEX, S.A.B. de C.V. (“CEMEX”) (NYSE: CX). She has over 25 years of experience in international finance and capital markets. She joined CEMEX in 2006 in the Investor Relations Department where she has been involved in more than $15 billion of equity and fixed income fundraising efforts. She also represents the company in the international financial community. Prior to CEMEX, Ms. Rodriguez spent 15 years at Citibank where she worked in capital markets origination, debt syndicate and securitization financing for Emerging Market issuers. In her early career, she worked for KPMG in their Audit Department. She previously served on the board of Trinidad Cement Ltd. and TCL Group and currently serves on the Board of Orion Biotech. Ms. Rodriguez holds a B.A. in Economics from Trinity College, an MBA from New York University and a Masters from Columbia University School of International and Public Affairs. She has been a Certified Public Accountant (lapsed).

We believe Ms. Rodriguez’s broad experiences in the financial services and capital markets sector along with her depth of knowledge of financial issues and investor relations-related matters provide her with skills and valuable insight in serving on the board of an investment company, which make her well-qualified to serve on the Board.

Incumbent Class II Director — Term Expiring 2024:

The Board has determined that Mr. Chapman is not an “interested person” of the Company as defined in the 1940 Act.

| | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

Independent Director | | | | | | | | | |

James Chapman, 60 | | Director | | Director | Class II Director since 2021, term expires in 2024 | | 1 | | Arch Resources, Inc., Denbury, Inc., California Resources Corp., AerCap Holdings NV, Tower International, Inc. |

James Chapman

James Chapman has served as a director of the Company, a member of the Nominating Committee, a member of the Audit Committee and a member of the Pricing Committee since December of 2021. Mr. Chapman also serves as a non-executive Advisory Director of SkyWorks Capital, LLC, an aviation and aerospace management consulting services company based in Greenwich, Connecticut, which he joined in December 2004. Prior to SkyWorks, he was associated with Regiment Capital Advisors, LP, an investment advisor based in Boston specializing in high yield

8

investments, which he joined in January 2003. Prior to Regiment, Mr. Chapman acted as a capital markets and strategic planning consultant with private and public companies, as well as investment advisers and hedge funds (including Regiment), across a range of industries. Prior to establishing an independent consulting practice, Mr. Chapman worked for The Renco Group, Inc. (a multi-billion dollar private corporation with diverse investment holdings located throughout the world) from December 1996 to December 2001. Prior to Renco, he was a founding principal of Fieldstone Private Capital Group in August 1990 where he headed the Corporate Finance and High Yield Finance Groups. Prior to joining Fieldstone, Mr. Chapman worked for Bankers Trust Company from July 1985 to August 1990, most recently in the BT Securities capital markets area.

Mr. Chapman has over 38 years of investment banking experience in a wide range of industries including aviation/airlines, metals/mining, natural resources/energy, automotive/general manufacturing, financial services, real estate and healthcare. Presently, he serves as a member of the Board of Directors of Arch Resources, Inc. (NYSE: ARCH), California Resources Corporation (NYSE: CRC) and Denbury, Inc. (NYSE: DEN) along with several private companies.

In prior years, Mr. Chapman has served as director of numerous other companies dating back to 1986. Mr. Chapman has served on numerous committees for the various boards including audit committee, compensation committee, pricing committee, portfolio management committee, treasury committee and corporate governance and human resource/nomination committee responsibilities. He has also served on special committees related to “going-private” transactions and other strategic initiatives, including mergers, acquisitions, restructurings, bankruptcies and litigation.

Mr. Chapman received an M.B.A. degree with distinction from Dartmouth College in 1985 and was elected an Edward Tuck Scholar. He received his B.A. degree, with distinction, magna cum laude, at Dartmouth College in 1984 and was elected to Phi Beta Kappa, in addition to being a Rufus Choate Scholar.

We believe Mr. Chapman’s numerous management positions and broad experiences in the financial services sector provide him with skills and valuable insight in handling complex financial transactions and issues, all of which make him well qualified to serve on the Board.

Incumbent Class III Director — Term Expiring 2025:

The Board has determined that Mr. Branch is not an “interested person” of the Company as defined in the 1940 Act.

| | | | | | | | | | |

Name, Address and Age(1) | | Position(s) held within the Company | | Principal Occupation(s) During the Past 5 years | | Term of Office and Length of Time Served | | Number of Companies in Fund Complex Overseen by Director or Nominee for Director(2) | | Other Directorships Held by Director or Nominee for Director |

Independent Director | | | | | | | | | |

Joseph Branch, 46 | | Director | | Head of Strategy WME Sports, Assistant General Manager of the Minnesota Timberwolves | Class III Director since 2021, term expires in 2025 | | 2 | | None |

Mr. Branch has served as a director of the Company, a member of the Nominating Committee, a member of the Audit Committee and a member of the Pricing Committee since December of 2021. Mr. Branch recently started as Head of Basketball Strategy & Business Development for WME Sports bringing nearly two decades of experience to the firm. In this role, Mr. Branch leads recruiting and retention strategy efforts, oversees the agency's basketball analytics department and pre-draft / player development initiatives. Mr. Branch also holds a leadership role within the WME Sports Division. Previously, beginning in 2019 Mr. Brach served three season with the Minnesota Timberwolves as Assistant General Manager. In this role, Mr. Branch led pro personnel efforts and oversaw the team's integrated player development initiatives. We believe Mr. Branch’s executive and management experience makes him qualified to serve as a member of our Board.

9

Dollar Range of Equity Securities Beneficially Owned by Directors and Executive Officers

The table below shows the dollar range of equity securities of the Company and the aggregate dollar range of equity securities of the Company that were beneficially owned by each director and executive officer as of the Record Date stated as one of the following dollar ranges: None; $1 – $10,000; $10,001 – $50,000; $50,001 – $100,000; or Over $100,000.

| | |

Name | | Dollar Range of Equity Securities Beneficially Owned(1)(2) |

Interested Directors | | |

Robert Platek | | Over $100,000 |

Independent Directors | | |

James Chapman | | None |

Joseph Branch | | None |

Louisa (Lucy) Rodriguez | | Over $100,000 |

Executive Officers Who Are Not Directors | | |

Saritha Reddy | | None |

Brian Williams | | $50,001 - $100,000 |

(1) Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

(2) Dollar ranges were determined using the number of Shares that are beneficially owned as of the Record Date, multiplied by the Company’s net asset value per share as of December 31, 2022, which was $[ ].

Information about Executive Officers Who Are Not Directors

The following sets forth certain information regarding the executive officers of the Company who are not directors of the Company.

| | | | | | |

Name | | Age | | Position | | Officer Since |

Brian Williams | | 40 | | Chief Financial Officer and Treasurer | | 2021 |

Saritha Reddy | | 41 | | Chief Compliance Officer and Secretary | | 2021 |

The address for each of the Company’s executive officers is c/o MSD Investment Corp., One Vanderbilt Avenue, 26th Floor, New York, NY 10017.

Brian Williams Chief Financial Officer and Treasurer

Brian Williams serves as Chief Financial Officer and Treasurer of the Company, as well as Managing Director at BDT & MSD Partners. Mr. Williams is responsible for the oversight of finance, accounting and fund administration for the business development companies. He joined MSD in July 2021. From May of 2020 to June of 2021 Mr. Williams worked at Wells Fargo Asset Management (“WFAM”) as a Senior Vice President and Controller overseeing Private Credit. From September 2017 through May of 2020 Mr. Williams worked at Guggenheim Investments as a Director and Controller and served as the Chief Financial Officer of their BDCs. Prior to September 2017, Mr. Williams served as First Vice President and BDC Chief Accounting Officer for W. P. Carey Inc., where he was responsible for accounting, finance and financial reporting for business development companies. Mr. Williams previously served as Vice President at W. P. Carey Inc. Mr. Williams holds a B.S. in Accountancy from Villanova University and an MBA from the New York University Stern School of Business. He has earned the right to use the Chartered Financial Analyst® designation and is a member of the CFA Institute.

Saritha Reddy Chief Compliance Officer and Secretary

Saritha Reddy is a Managing Director, Assistant General Counsel & Deputy Chief Compliance Officer for BDT & MSD Partners. She joined MSD in November 2021. Prior to joining MSD, Saritha worked at Apollo Global Management Inc. since 2015 with her most recent position being Managing Director and Senior Compliance Officer. Prior to Apollo, she worked as a senior associate in the Litigation and Investment Management groups at Pryor Cashman LLP from 2010 to 2015 and an associate in the Litigation group at Reed Smith LLP from 2007 to 2010. Ms. Reddy earned a B.A. in International Relations & Economics from Tufts University and a J.D. from Fordham University School of Law.

CORPORATE GOVERNANCE

The Board

The Board consists of four members. The Board is divided into three classes, with the members of each class serving staggered, three-year terms; however, the initial members of the three classes have initial terms of one, two

10

and three years, respectively. The terms of the Company’s Class I directors will expire at the Annual Meeting; the terms of the Company’s Class II directors will expire at the 2024 annual meeting of shareholders; and the terms of the Company’s Class III directors will expire at the 2025 annual meeting of shareholders.

Mr. Platek and Ms. Rodriguez serve as Class I directors (with terms expiring at the Annual Meeting). Mr. Chapman serves as a Class II director (with a term expiring in 2024). Mr. Branch serves as a Class III director (with a term expiring in 2025).

Pursuant to the 1940 Act, a majority of the Board will consist of directors who are not “interested persons” (as defined in Section 2(a)(19) of the 1940 Act) of the Company and the Adviser, or of any of their respective affiliates (the “Independent Directors”). On an annual basis, each member of the Board is required to complete a questionnaire eliciting information to assist the Board in determining whether the Independent Directors continue to be independent under the Exchange Act and the 1940 Act. The Board limits membership on the Audit Committee, and the Nominating Committee to Independent Directors.

Based on these independence standards and the recommendation of the Nominating Committee, after reviewing all relevant transactions and relationships between each director, or any of his or her family members, and the Company, the Adviser, or of any of their respective affiliates, the Board has determined that Rodriguez and Messrs. Chapman and Branch qualify as Independent Directors. Each director who serves on the Audit Committee is an independent director for purposes of Rule 10A-3 under the Exchange Act.

Mr. Platek is considered an “interested person” (as defined in Section 2(a)(19) of the 1940 Act) of the Company because he is an officer of the Company and the Adviser.

During the fiscal year ended December 31, 2022, the Board met 7 times and took action by unanimous written consent 16 times on various matters. Each of the incumbent directors attended at least 75% of the aggregate of the Board meetings and meetings of the committee(s) on which he or she served during the last fiscal year and while he or she served as a director.

Board Attendance at the Annual Meeting

The Company’s practice is to encourage its directors to attend each annual meeting of shareholders; however, such attendance is not required at this time.

Board Leadership Structure

The Board monitors and performs an oversight role with respect to the Company’s business and affairs, including with respect to the Company’s operations, investment practices and performance, compliance with regulatory requirements and the services, expenses and performance of the Company’s service providers. Among other things, the Board approves the appointment of the Adviser and officers, reviews and monitors the services and activities performed by the Adviser and executive officers, and approves the engagement and reviews the performance of the Company’s independent registered public accounting firm.

Under the Company’s bylaws, the Board may designate a Chairman to preside over the meetings of the Board and meetings of the Shareholders and to perform such other duties as may be assigned to him by the Board. The Company does not have a fixed policy as to whether the Chairman of the Board should be an Independent Director and believes that the Company should maintain the flexibility to select the Chairman and reorganize the leadership structure, from time to time, based on criteria that are in the best interests of the Company and its Shareholders at such times.

The Company intends to re-examine its corporate governance policies on an ongoing basis to ensure that they continue to meet the Company’s needs.

Robert Platek currently serves as the chairman of our Board. Mr. Platek is an ‘‘interested person’’ of the Company as defined in Section 2(a)(19) of the 1940 Act because he is an officer of the Company and the Adviser. We believe that Mr. Platek’s history with MSD, familiarity with our investment objectives and investment strategy, and extensive knowledge of the financial services industry and the investment valuation process in particular qualify him to serve as the chairman of our Board. We believe that, at present, we are best served through this leadership structure, as Mr. Platek’s relationship with MSD provides an effective bridge and encourages an open dialogue between our management and our Board, ensuring that all groups act with a common purpose. We are aware of the potential conflicts that may arise when a non-Independent Director is chairman of the Board, but believe these potential conflicts are offset by our strong corporate governance policies. Our corporate governance policies include regular meetings of

11

the Independent Directors in executive session without the presence of the interested directors; the establishment of the Audit Committee and the Nominating Committee, which are comprised solely of Independent Directors; and the appointment of a Chief Compliance Officer, with whom the Independent Directors meet regularly without the presence of the interested directors and other members of management, and who is responsible for administering our compliance policies and procedures. The Board also believes that its leadership structure is appropriate in light of the Company’s characteristics and circumstances because the structure allocates areas of responsibility among the individual directors and the committees in a manner that encourages effective oversight. The Board also believes that its size creates a highly efficient governance structure that provides ample opportunity for direct communication and interaction between the Adviser and the Board. We recognize that different board leadership structures are appropriate for companies in different situations. We intend to continue to re-examine our corporate governance policies on an ongoing basis to ensure that they continue to meet our needs.

The Board currently does not have a designated lead Independent Director. However, Mr. Chapman, the chairman of the Audit Committee, is an independent director and acts as a liaison between the Independent Directors and management between meetings of the Board. The Company believes the role of the Board in risk oversight is effective and appropriate given the extensive regulation to which it is already subject as a BDC. Specifically, as a BDC, the Company must comply with certain regulatory requirements that control the levels of risk in its business and operations. For example, the Company’s ability to incur indebtedness is limited such that its asset coverage must equal at least 150% immediately after the Company incurs such indebtedness, and the Company generally has to invest at least 70% of its total assets in “qualifying assets.” In addition, the Company has elected, and intends to qualify annually, to be treated as a regulated investment company (“RIC”) under Subchapter M of the Internal Revenue Code of 1986, as amended. As a RIC, the Company must, among other things, meet certain income source, income distribution, and asset diversification requirements.

The Board believes its existing role in risk oversight is appropriate. However, the Board re-examines the manner in which it administers its oversight function on an ongoing basis to ensure that it continues to meet the Company’s needs.

Board’s Role in Risk Oversight

The Board performs its risk oversight function primarily through (a) its standing Audit Committee, which reports to the entire Board and is comprised solely of Independent Directors, and (b) active monitoring by the Company’s Chief Compliance Officer of the Company’s compliance policies and procedures.

As described below in more detail under “Committees of the Board of Directors,” the Audit Committee assists the Board in fulfilling its risk oversight responsibilities. The Audit Committee’s risk oversight responsibilities include overseeing the internal audit staff (sourced through the Administrator), if any, accounting and financial reporting processes, the Company’s valuation process, the Company’s systems of internal controls regarding finance and accounting and audits of the Company’s financial statements.

The Board also performs its risk oversight responsibilities with the assistance of the Chief Compliance Officer. The Board will annually review a written report from the Chief Compliance Officer discussing the adequacy and effectiveness of the Company’s compliance policies and procedures and the Company’s service providers. The Chief Compliance Officer’s annual report will address, at a minimum, (a) the operation of the Company’s compliance policies and procedures and the Company’s service providers’ compliance policies and procedures since the last report; (b) any material changes to such policies and procedures since the last report; (c) any recommendations for material changes to such policies and procedures as a result of the Chief Compliance Officer’s annual review; and (d) any compliance matter that has occurred since the date of the last report about which the Board would reasonably need to know to oversee the Company’s compliance activities and risks. In addition, the Chief Compliance Officer will meet separately in executive session with the Independent Directors at least once each year.

The Company believes that the Board’s role in risk oversight is effective, and appropriate given the extensive regulation to which the Company is already subject as a BDC. As a BDC, the Company is required to comply with certain regulatory requirements that control the levels of risk in its business and operations. For example, the Company’s ability to incur indebtedness is limited such that its asset coverage generally must equal at least 150% immediately after each time the Company incur indebtedness, the Company generally has to invest at least 70% of its total assets in “qualifying assets,” and the Company is not generally permitted to invest in any portfolio company in which one of its affiliates currently has an investment.

Communications with Directors

Shareholders and other interested parties may contact any member (or all members) of the Board by mail. To communicate with the Board, any individual directors or any group or committee of directors, correspondence should be addressed to the Board or any such individual directors or group or committee of directors by either name or title.

12

All such correspondence should be sent MSD Investment Corp., One Vanderbilt Avenue, 26th Floor, New York, NY 10017, Attention: Chief Compliance Officer.

Committees of the Board of Directors

The Board has established an Audit Committee, a Pricing Committee and a Nominating and Corporate Governance Committee, and may establish additional committees in the future. All directors are expected to attend at least 75% of the aggregate number of meetings of the Board and of the respective committees on which they serve. The Company requires each director to make a diligent effort to attend all Board and committee meetings as well as each annual meeting of Shareholders.

The Audit Committee had 4 formal meetings during the fiscal year ended December 31, 2022 and did not taken any actions by unanimous written consent.

The Audit Committee is composed of James Chapman, Joseph Branch and Louisa (Lucy) Rodriguez, each of whom is an Independent Director. Mr. Chapman serves as chair of the Audit Committee. The Board has determined that Mr. Chapman is an “audit committee financial expert” as that term is defined under Item 407 of Regulation S-K, as promulgated under the Exchange Act. Our Audit Committee members also meet the current independence and experience requirements of Rule 10A-3 of the Exchange Act.

The Audit Committee operates pursuant to a charter approved by our Board, which sets forth the responsibilities of the Audit Committee. The Audit Committee (a) assists the Board’s oversight of the integrity of our financial statements, the independent registered public accounting firm’s independence, qualifications and performance and our compliance with legal and regulatory requirements; (b) reviews and approves the Audit Committee report, as required by the SEC, to be included in our annual proxy statement; (c) oversees the scope of the annual audit of our financial statements, the quality and objectivity of our financial statements, accounting and policies and internal controls over financial reporting; (d) establishes guidelines and makes recommendations to the Board regarding the valuation of our investments, and is responsible for aiding the Board in determining the fair value of portfolio securities for which current market values are not readily available; (e) determines the selection, appointment, retention and termination of our independent registered public accounting firm, as well as approving the compensation thereof; (f) reviews reports regarding compliance with the Company’s Code of Business Conduct; (g) pre-approves all audit and non-audit services provided to us by such independent registered public accounting firm; and (h) acts as a liaison between our independent registered public accounting firm and the Board.

Nominating and Corporate Governance Committee

The Nominating Committee had 2 formal meeting during the fiscal year ended December 31, 2022 and did not take any actions by unanimous written consent.

The Nominating Committee is comprised of James Chapman, Joseph Branch and Louisa (Lucy) Rodriguez, each of whom is an Independent Director. Mr. Branch serves as chair of the Nominating Committee.

The Nominating Committee operates pursuant to a charter approved by our Board, which sets forth the responsibilities of the Nominating Committee. The Nominating Committee recommends to the Board persons to be nominated by the Board for election on an annual basis and in the event any vacancy on the Board may arise. The Nominating Committee will consider for nomination to the Board candidates submitted by the Shareholders or from other sources it deems appropriate. In considering whether to recommend any particular candidate for inclusion in the Board’s slate of recommended director nominees, the Nominating Committee applies the criteria included in its charter. These criteria include the candidate’s standards of character and integrity, knowledge of the Company’s business and industry, conflicts of interest, willingness to devote time to the Company and ability to act in the interests of all Shareholders. The Nominating Committee does not assign specific weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. The Board does not have a specific diversity policy, but considers diversity of race, religion, national origin, gender, sexual orientation, disability, cultural background and professional experiences in evaluating candidates for board membership. The Board believes diversity is important because a variety of viewpoints contribute to an effective decision-making process.

The Nominating Committee also makes recommendations with regard to the tenure of the directors and is responsible for overseeing an annual evaluation of the Board and its committee structure to determine whether the structure is operating effectively.

Pricing Committee

The Pricing Committee is comprised of Robert Platek, James Chapman, Joseph Branch, and Louisa (Lucy) Rodriguez, with Robert Platek serving as the Chairman of the Pricing Committee. The Board established a Pricing Committee to determine the offering price of shares in in connection with the initial private offering and any

13

subsequent offerings. The purpose of the Pricing Committee is to ensure that the price of shares in any offering is determined in accordance with the Company’s pricing and valuation policies, as well as compliance with Section 23(b) of the 1940 Act, which requires that shares not be sold below NAV exclusive of any distributing commissions or discounts.

Code of Business Conduct

The Company has adopted a Code of Business Conduct that applies to the Company’s principal executive officer, principal financial officer, principal account officer or controller, any person performing similar functions and all employees of the Adviser that perform services on behalf of the Company. There have been no material changes to the Company’s Code of Business Conduct or material waivers of the Code of Business Conduct that apply to the Company’s Chief Executive Officer or Chief Financial Officer. If the Company makes any substantive amendment to, or grants a waiver from, a provision of its Code of Business Conduct and Ethics, the Company will promptly file a Form 8-K with the SEC. The Company will provide any person, without charge, upon request, a copy of the Code of Business Conduct. To receive a copy, please provide a written request to: MSD Investment Corp., One Vanderbilt Avenue, 26th Floor, New York, NY 10017, Attention: Chief Compliance Officer and Secretary, Saritha Reddy.

Election of Executive Officers

Executive officers hold their office until their respective successor has been duly elected and qualified, or until the earlier of their respective resignation or removal.

Compensation Discussion and Analysis

We do not currently have any employees and do not expect to have any employees. Services necessary for our business are provided by individuals who are employees of the Advisers, the Administrator or their respective affiliates, pursuant to the terms of the Investment Advisory Agreement and the Administration Agreement (each as defined below), as applicable. Our day-to-day administrative operations are managed by the Administrator. Most of the services necessary for the origination and administration of our investment portfolio will be provided by investment professionals employed by the Adviser or its affiliates.

Each of our executive officers is an employee of an affiliate of the Administrator. We reimburse the Administrator for our allocable portion of expenses incurred by the Administrator in performing its obligations under the Administration Agreement, including our allocable portion of the cost of our Chief Financial Officer, our Chief Compliance Officer and their respective staffs, and we reimburse the Adviser for certain expenses under the Investment Advisory Agreement.

Director Compensation

No compensation will be paid to our interested directors. The Company pays each Independent Director: (i) $100,000 per year (prorated for any partial year) and (ii) an additional fee of $10,000 per year for the chairman of the Audit Committee. The Company is also authorized to pay the reasonable out-of-pocket expenses of each Independent Director incurred by such director in connection with the fulfillment of his or her duties as an Independent Director. The table below sets forth the compensation received by each independent director from the Company for service during the fiscal year ended December 31, 2022: James Chapman, Joseph Branch, and Louisa (Lucy) Rodriguez

| | | | | | | | |

| | Fees Earned and Paid in Cash | | | Total Compensation | |

James Chapman | | $ | 110,000 | | | $ | 110,000 | |

Joseph Branch | | | 100,000 | | | | 100,000 | |

Louisa (Lucy) Rodriguez (1) | | | 80,000 | | | | 80,000 | |

Total | | $ | 290,000 | | | $ | 290,000 | |

(1) Ms. Rodriguez was appointed to the Board on .March 14, 2022

Compensation of the Adviser

The Adviser is responsible for the overall management of the Company’s activities pursuant to an investment advisory agreement between the Company and the Adviser (the “Investment Advisory Agreement”).

Management Fee. Pursuant to the Advisory Agreement, the Company will pay to the Adviser an annual management fee (the “Management Fee”), payable quarterly in arrears. Management Fees for any partial month or quarter will be appropriately prorated and adjusted for any share issuances or repurchases during the relevant month or quarter. The Management Fee shall be calculated as follows:

i)Prior to an initial public offering of the Company’s common stock and/or listing on a nationally recognized stock exchange (an “Exchange Listing”), the Management Fee shall be calculated at a rate of 0.1875% per quarter (0.75% per annum) of the Company’s average gross asset value at the end of the two most recently completed calendar quarters (or for the first quarter which the Company has operations, the

14

average gross assets at the date of the initial drawdown from investors and the end of such calendar quarter), including assets purchased with borrowed funds or other forms of leverage (each, a “Credit Facility”) but excluding (i) cash and cash equivalents (as defined below) and (ii) undrawn commitments (commitments that are not yet property of the Company and therefore are not included in the calculation). “Cash equivalents” means U.S. government securities, money market fund investments, commercial paper instruments, and other similar cash equivalent investments maturing within one year of purchase.

ii)Following an Exchange Listing, the Management Fee will be calculated at a rate 0.3125% per quarter (1.25% per annum) of the Company’s average gross asset value including assets purchased with borrowed amounts under any credit facility but excluding cash and cash equivalents at the end of the two most recently completed calendar quarters (or for the first quarter following an Exchange Listing, the average gross assets as of the date of the Exchange Listing and the end of such calendar quarter).

Incentive Fee. Pursuant to the Advisory Agreement, the Company will pay to the Adviser an incentive fee (the “Incentive Fee”).

The Incentive Fee consists of two components that are independent of each other with the result that one component may be payable even if the other is not. A portion of the Incentive fee is based on the Company’s income (the “Income-Based Fee”) and a portion is based on the Company’s capital gains (the “Capital Gains Fee”), each is described below.

i)The Income-Based Fee will be determined and paid quarterly in arrears based on the amount by which the aggregate “Pre-Incentive Fee Net Investment Income” (as defined below) in any calendar quarter exceeds the “Hurdle Amount” (as defined below). The Hurdle Amount will be determined on a quarterly basis and will be calculated by multiplying 1.5% (6% annualized) by the Company’s net asset value at the beginning of each applicable calendar quarter.

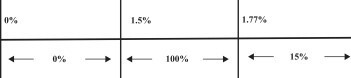

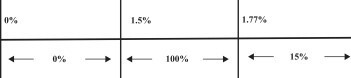

The calculation of the Income-Based Fee for each quarter is as follows:

A.No Income-Based Fee shall be payable to the Adviser in any calendar quarter in which the Company’s aggregate Pre-Incentive Fee Net Investment Income does not exceed the Hurdle Amount;

B.100% of the Company’s aggregate Pre-Incentive Fee Net Investment Income, if any, that exceeds the Hurdle Amount but is less than or equal to an amount (the “Catch-Up Amount”) determined on a quarterly basis by multiplying 1.77% (7.06% annualized) by the Company’s net asset value at the beginning of each applicable calendar quarter. The Catch-Up Amount is intended to provide the Adviser with an incentive fee of 15% on all of the Company’s Pre-Incentive Fee Net Investment Income when the Company’s Pre-Incentive Fee Net Investment Income reaches the Catch-Up Amount for any calendar quarter; and;

C.For any quarter in which the Company’s aggregate Pre-Incentive Fee Net Investment Income exceeds the Catch-Up Amount, the Income-Based Fee shall equal 15% of the amount of the Company’s Pre-Incentive Fee Net Investment Income for such quarter, as the Hurdle Amount and Catch-Up Amount will have been achieved.

ii)The Capital Gains Fee will be determined and payable in arrears as of the end of each calendar year (or upon termination of the Advisory Agreement), commencing with the first calendar year ended after the Company elects to be treated as a BDC, and is calculated at the end of each applicable year by subtracting (a) the sum of the Company’s cumulative aggregate realized capital losses and aggregate unrealized capital depreciation from (b) the Company’s cumulative aggregate realized capital gains. If such amount is positive at the end of such year, then the Capital Gains Fee payable for such year is equal to 15% of such amount, less the cumulative aggregate amount of Capital Gains Fees paid in all prior years commencing with the first calendar year ended after the Company elects to be treated as a BDC. If such amount is negative, then there is no Capital Gains Fee payable for such year. If the Advisory Agreement is terminated as of a date that is not a calendar year end, the termination date shall be treated as though it were a calendar year end for purposes of calculating and paying a Capital Gains Fee. The Company will accrue, but will not pay, a Capital Gains Incentive Fee with respect to unrealized appreciation, in accordance with generally accepted account principals in the United States (“U.S. GAAP”), because a capital gains incentive fee would be owed to the Adviser if the Company were to sell the relevant investment and realize a capital gain. In no event will the Capital Gains Incentive Fee calculated on unrealized appreciation be payable until such gains are realized, if at all.

“Pre-Incentive Fee Net Investment Income” shall mean interest income, dividend income and any other income (including any other fees such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies but excluding fees for providing managerial assistance)

15

accrued during the calendar quarter, minus operating expenses for the quarter (including the Management Fee, any expenses payable under the Administration Agreement, and any interest expense and dividends paid on any outstanding preferred stock, but excluding the Incentive Fee). In addition, “Pre-Incentive Fee Net Investment Income” shall include, in the case of investments with a deferred interest feature such as market discount, original issue discount (“OID”), debt instruments with payment-in-kind (“PIK”) interest, preferred stock with PIK dividends and zero-coupon securities, accrued income that the Company has not yet received in cash. For avoidance of doubt, Pre-Incentive Fee Net Investment Income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

Examples of the quarterly incentive fee calculation are annexed to the Advisory Agreement. Such examples are included for illustrative purposes only and are not considered part of the Advisory Agreement. The fees payable under the Advisory Agreement for any partial period will be appropriately prorated.

Both the calculation of the Management Fee and the Income-Based Fee will be appropriately adjusted for any capital calls done by the Company during the quarter (based on the actual number of days elapsed relative to the total number of days in such calendar quarter).

For purposes of computing the Income-Based Fee and the Capital Gains Fee, the calculation methodology will look through derivative financial instruments or swaps as if the Company owned the reference assets directly, in the manner described above. With respect to the calculation of quarterly Pre-Incentive Fee Net Investment Income for purposes of calculating the Income-Based Fee, net interest, if any, associated with a derivative or swap (which is defined as the difference between (i) the interest income and transaction fees received in respect of the reference assets of the derivative or swap and (ii) all interest and other expenses paid by us to the derivative or swap counterparty) will be included in calculating the Income-Based Fee. The notional value of any such derivatives or swaps is not used for these purposes. With respect to the calculation of the Capital Gains Fee, realized gains and realized losses on the disposition of any reference assets, as well as unrealized depreciation on reference assets retained in the derivative or swap, will be included on a cumulative basis in calculating the Capital Gains Fee.

The following is a graphical representation of the quarterly calculation of the Incentive Fee:

Examples of Incentive Fee Calculation

Example 1: Income Based Fee

General Assumptions:

Hurdle rate = 1.5%

Catchup rate = 1.7647%

Base management fee = 0.1875%

Other expenses (legal, accounting, custodian, transfer agent, etc.) = 0.2%

Scenario 1

Additional Assumptions

•Investment income (including interest, dividends, fees, etc.) = 1.25%

Calculations

•Pre-incentive fee net investment income = (investment income – (base management fee + other expenses))

•Pre-incentive fee net investment income = (1.25% - (0.1875% + 0.2%)

•Pre-incentive fee net investment income = 0.8625%

Pre-incentive net investment income does not exceed hurdle rate, therefore there is no Income Based Fee.

Scenario 2

Additional Assumptions

•Investment income (including interest, dividends, fees, etc.) = 2.0%

Calculations

16

•Pre-incentive fee net investment income = (investment income – (base management fee + other expenses))

•Pre-incentive fee net investment income = (2.00% - (0.1875% + 0.2%)

•Pre-incentive fee net investment income = 1.6125%

Pre-incentive fee net investment income of 1.6125% exceeds the hurdle rate but is less than the catchup rate

•Incentive fee = 100% × (Pre-incentive fee net investment income – hurdle rate)

•Incentive fee = 100% × (1.6125% – 1.5000%)

Income Based Fee = 0.1125%

Scenario 3

Additional Assumptions

•Investment income (including interest, dividends, fees, etc.) = 2.5%

Calculations

•Pre-incentive fee net investment income = (investment income – (base management fee + other expenses))

•Pre-incentive fee net investment income = (2.50% - (0.1875% + 0.2%)

•Pre-incentive fee net investment income = 2.1125%

•Pre-incentive fee net investment income of 2.1125% exceeds the catchup rate

•Incentive fee = 100% × (catchup rate – hurdle rate) + (15.0% × (Pre-incentive fee net investment income – catchup rate)

•Incentive fee = 100% × (1.7647% – 1.5000%) + (15.0% × (2.1125% – 1.7647%)

Income Based Fee = 0.3169%

Example 2: Capital Gains Fee:

Scenario 1 – Assumptions:

•Year 1: $20 million investment made in Company A (“Investment A”), and $30 million investment made in Company B (“Investment B”).

•Year 2: Investment A sold for $50 million and fair market value (“FMV”) of Investment B determined to be $32 million.

•Year 3: FMV of Investment B determined to be $25 million.

•Year 4: Investment B sold for $31 million.

The Capital Gains Fee, if any, would be:

•Year 2: $4.5 million Capital Gains Fee, calculated as follows:

o$30 million realized capital gains on sale of Investment A, multiplied by 15.0%

•Year 3: None, calculated as follows:

o$3.75 million cumulative fee (15.0% multiplied by $25 million ($30 million cumulative capital gains less $5 million cumulative capital depreciation)) less $4.5 million (previous capital gains fee paid in Year 2).

•Year 4: $150,000 Capital Gains Fee, calculated as follows: