- AKLI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Akili (AKLI) S-1IPO registration

Filed: 23 Aug 22, 9:23pm

Delaware | 3841 | 98-1586159 | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

Daniel J. Espinoza, Esq. Arthur R. McGivern, Esq. Sarah Ashfaq, Esq. Goodwin Procter LLP 100 Northern Avenue Boston, Massachusetts (617) 570-1000 | Jacqueline Studer, Esq. Chief Legal Officer Akili, Inc. 125 Broad Street, Fifth Floor Boston, Massachusetts 02110 (617) 313-8853 |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Page | ||||

| 1 | ||||

| 2 | ||||

| 3 | ||||

| 5 | ||||

| 7 | ||||

| 13 | ||||

| 15 | ||||

| 64 | ||||

| 65 | ||||

| 66 | ||||

| 74 | ||||

| 80 | ||||

| 135 | ||||

| 137 | ||||

| 155 | ||||

| 162 | ||||

| 173 | ||||

| 176 | ||||

| 180 | ||||

| 186 | ||||

| 190 | ||||

| 191 | ||||

| 195 | ||||

| 195 | ||||

| 195 | ||||

F-1 | ||||

II-1 | ||||

| • | “2011 Plan” are to Akili Interactive Labs, Inc. Amended and Restated 2011 Stock Incentive Plan, as amended from time to time; |

| • | “2022 Incentive Plan” or “2022 Plan” are to the 2022 Stock Option and Incentive Plan for Akili, Inc.; |

| • | “2022 ESPP” are to the 2022 Employee Stock Purchase Plan for Akili Interactive Labs, Inc.; |

| • | “Akili common stock” are to common stock, par value $0.0001 per share, of Akili; |

| • | “Akili Options” are to options to purchase shares of Akili common stock; |

| • | “Akili, Inc.” are to SCS after the Domestication and its name change from Social Capital Suvretta Corp. I; |

| • | “Akili, Inc. common stock” are to common stock, par value $0.0001 per share, of Akili, Inc.; |

| • | “Akili Stockholders” are to the stockholders of Akili, holders of Akili Options and holders of warrants to acquire Akili common stock, in each case prior to the Business Combination; |

| • | “ASC” are to Accounting Standards Codification; |

| • | “Business Combination” are to the Domestication together with the Merger; |

| • | “Bylaws” are to the bylaws of Akili, Inc. |

| • | “Cayman Constitutional Documents” are to SCS’ amended and restated memorandum and articles of association, as amended from time to time prior to the Domestication; |

| • | “Certificate of Incorporation” are to the certificate of incorporation of Akili, Inc.; |

| • | “Closing” are to the closing of the Business Combination; |

| • | “Company,” “we,” “us” and “our” are to SCS prior to its domestication as a corporation in the State of Delaware and to Akili, Inc. after its domestication as a corporation incorporated in the State of Delaware, including after its change of name to Akili, Inc.; |

| • | “Continental” are to Continental Stock Transfer & Trust Company |

| • | “COVID-19” are to the novel coronavirus pandemic; |

| • | “DGCL” are to the General Corporation Law of the State of Delaware; |

| • | “Domestication” are to the domestication of Social Capital Suvretta Holdings Corp. I as a corporation incorporated in the State of Delaware; |

| • | “Exchange Act” are to the Securities Exchange Act of 1934, as amended; |

| • | “founder shares” are to the SCS Class B ordinary shares purchased by the Sponsor in a private placement prior to the initial public offering, and the SCS Class A ordinary shares that will be issued upon the conversion thereof; |

| • | “initial public offering” are to SCS’ initial public offering that was consummated on July 2, 2021; |

| • | “IPO registration statement” are to the Registration Statements on Form S-1 (333-256723 and333-257543) filed by SCS in connection with its initial public offering, which became effective on June 29, 2021 and June 30, 2021, respectively; |

| • | “IRS” are to the U.S. Internal Revenue Service; |

| • | “Merger” are to the merger of Merger Sub with and into Akili, with Akili surviving the merger as a wholly owned subsidiary of Akili, Inc.; |

| • | “Merger Sub” are to a Delaware corporation and subsidiary of SCS; |

| • | “Nasdaq” are to the Nasdaq Capital Market; |

| • | “ordinary shares” are to the SCS Class A ordinary shares and the SCS Class B ordinary shares, collectively; |

| • | “Person” are to any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, joint stock company, governmental authority or instrumentality or other entity of any kind; |

| • | “PIPE Investment” are to the purchase of shares of Akili, Inc. common stock pursuant to the Subscription Agreements; |

| • | “PIPE Investors” are to those certain investors participating in the PIPE Investment pursuant to the Subscription Agreements; |

| • | “private placement shares” are to the Class A ordinary shares issued to Sponsor in a private placement that was consummated concurrently with the closing of the initial public offering and the shares of common stock of Akili, Inc. issued as a matter of law upon the conversion thereof at the time of the Domestication; |

| • | “pro forma” are to giving pro forma effect to the Business Combination; |

| • | “public shareholders” are to holders of public shares, whether acquired in SCS’ initial public offering or acquired in the secondary market; |

| • | “public shares” are to the SCS Class A ordinary shares that were offered and sold by SCS in its initial public offering and registered pursuant to the IPO registration statement or the shares of Akili, Inc. common stock issued as a matter of law upon the conversion thereof at the time of the Domestication, as the context requires; |

| • | “redemption” are to each redemption of public shares for cash pursuant to the Cayman Constitutional Documents; |

| • | “Registration Rights Agreement” are to the Amended and Restated Registration Rights Agreement dated as of August 19, 2022, by and among Akili, Inc. (following the Domestication), the Sponsor, certain affiliates of the Sponsor, certain directors and advisors of SCS and certain former stockholders of Akili; |

| • | “Sarbanes-Oxley Act” are to the Sarbanes-Oxley Act of 2002; |

| • | “SCS” are to Social Capital Suvretta Holdings Corp. I, prior to its domestication as a corporation in the State of Delaware; |

| • | “SCS Class A ordinary shares” are to SCS’ Class A ordinary shares, par value $0.0001 per share; |

| • | “SCS Class B ordinary shares” are to SCS’ Class B ordinary shares, par value $0.0001 per share; |

| • | “SEC” are to the U.S. Securities and Exchange Commission; |

| • | “Securities Act” are to the Securities Act of 1933, as amended; |

| • | “SPE” are to special-purpose entity; |

| • | “Sponsor” are to SCS Sponsor I LLC, a Cayman Islands limited liability company, the sponsor of SCS; |

| • | “Sponsor Related PIPE Investor” are to a PIPE Investor that is an affiliate of the Sponsor (together with its permitted transferees); |

| • | “Subscription Agreements” are to the subscription agreements pursuant to which the PIPE Investment was consummated; |

| • | “Third-Party PIPE Investor” are to any PIPE Investor who is not a Sponsor Related PIPE Investor; and |

| • | “trust account” are to the trust account established at the consummation of SCS’ initial public offering and maintained by Continental, acting as trustee. |

| • | the effect of uncertainties related to the ongoing COVID-19 pandemic; |

| • | our ability to achieve and maintain profitability in the future; |

| • | our financial performance and ability to respond to general economic conditions; |

| • | our ability to manage our growth effectively and our expectations regarding the development and expansion of our business; |

| • | our ability to access sources of capital, including debt financing and other sources of capital to finance operations and growth; |

| • | our ability to achieve and maintain market acceptance and adoption of EndeavorRx and other prescription digital therapeutics by patients and physicians; |

| • | our ability to obtain or maintain adequate insurance coverage and reimbursement for EndeavorRx and its other products; |

| • | our ability to accurately forecast demand for EndeavorRx and its other products; |

| • | our ability to maintain access for EndeavorRx and our other products via the Apple Store and the Google Play Store; |

| • | our ability to achieve or maintain profitability; |

| • | our ability to maintain or obtain patent protection and/or the patent rights relating to EndeavorRx and its other product candidates and our ability to prevent third parties from competing against us; |

| • | our ability to successfully commercialize EndeavorRx and its other products; |

| • | our ability to obtain and maintain regulatory approval for EndeavorRx and our other product candidates, in the U.S. and in foreign markets, and any related restrictions or limitations of an approved product candidate; |

| • | our ability to obtain funding for our operations, including funding necessary to complete further development of EndeavorRx and further development, approval and, if approved, commercialization of our other product candidates; |

| • | our ability to identify, in-license or acquire additional technology or product candidates; |

| • | our ability to successfully protect against security breaches and other disruptions to our information technology structure; |

| • | the impact of applicable laws and regulations, whether in the U.S. or foreign jurisdictions, and any changes thereof; |

| • | our ability to successfully compete against other companies developing similar products to our current and future product offerings; |

| • | our estimates regarding expenses, future revenue, capital requirements and needs for additional financing; |

| • | our ability to establish and maintain an effective system of internal controls over financial reporting; |

| • | our ability to maintain the listing of our securities on Nasdaq; |

| • | the risk that the Business Combination disrupts our plans and operations; |

| • | our inability to realize the anticipated benefits of the Business Combination; |

| • | the outcome of any legal or governmental proceedings that may be instituted against us; and |

| • | other factors detailed under the section titled “ Risk Factors |

| • | Targeted treatments that are personalized to patients’ needs |

| • | Clinically validated therapeutics like drugs and medical devices. |

| • | Therapeutics that are experienced as entertainment |

| • | Patient focused and adaptive |

| (1) | Timeframes are estimates and are subject to change—see Disclaimer and Risk Factors. |

| (2) | AKL-T01 is marketed as EndeavorRx in the U.S. for children ages8-12 old with primarily inattentive or combined-type ADHD, who have a demonstrated attention issue. |

| (3) | Shionogi is responsible for the clinical development and commercialization of SDT-001 (a version ofAKL-T01 localized for Japanese language and culture), as well as any future development and commercialization ofAKL-T02, another version of our SSME engine that has been used for our ASD program, each in Japan and Taiwan. |

| (4) | AKL-M01 is designed to use SSME algorithms to monitor and assess certain aspects of cognition, as opposed to providing cognitive therapy. |

| (5) | To the extent we are unable to access additional sources of funding following the completion of the Business Combination, our current estimated timeframe for initiating a pivotal study in this development program could be delayed. |

| * | Estimated timeframes in figure above correspond to applicable milestone start times, and are subject to change. Please refer to the section entitled “ Risk Factors Risks Related to Our Business and Industry—Enrollment and retention of patients in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside of our control. If we experience delays or difficulties in the enrollment or retention of patients in clinical trials, our ability to obtain necessary marketing authorizations for our product candidates could be delayed or preventedRisks Related to Our Products—Our current product candidates are in various stages of development. Our product candidates may fail in development or suffer delays that adversely affect their commercial viability. If we fail to maintain clearance, de novo classification or approval to market our product candidates, including AKL-T01 for expanded indications, or if we are delayed in obtaining such marketing authorizations, our business, prospects, results of operations and financial condition could be materially and adversely affected |

| • | Establishing a commercial foothold in pediatric ADHD. |

| • | Leveraging our initial success to expand into other ADHD populations. |

| • | Applying our clinically-validated technology to other mental health and neurology conditions. |

| • | Simultaneously pursuing new technologies designed to address other cognitive impairments. |

| • | Further evolving the treatment paradigm by creating new methods of cognitive assessment. |

| • | We have a history of significant losses, anticipate losses increasing expenses in the future, and may not be able to achieve or maintain profitability. |

| • | The failure of our prescription digital therapeutics to achieve and maintain market acceptance and adoption by patients and physicians could have a material adverse effect on our business, prospects, results of operation and financial condition. |

| • | The market for prescription digital therapeutics is new, rapidly evolving, and increasingly competitive, as the healthcare industry in the U.S. is undergoing significant structural change, which makes it difficult to forecast demand for our products. As a result, all prospective financial information included herein are subject to change. |

| • | Our development programs represent novel and innovative potential therapeutic areas, and negative perception of any product or product candidate that we develop could adversely affect our ability to conduct our business, obtain marketing authorizations or identify alternate regulatory pathways to market for such product candidate. |

| • | We face competition, and new products may emerge that provide different or better alternatives for treatment of the conditions that EndeavorRx or our future products, if granted marketing authorization, are authorized to treat. |

| • | If we fail to achieve and maintain clearance, de novo classification or approval to market our product candidates, including AKL-T01 for expanded indications, or if we are delayed in obtaining such marketing authorizations, our business, prospects, results of operations and financial condition could be materially and adversely affected. |

| • | Clinical trials of any of our products or product candidates may fail to produce results necessary to support marketing authorization. |

| • | EndeavorRx is made available via the Apple App Store® and on Google PlayTM, and supported by third-party infrastructure. If our ability to access these markets or access necessary third-party infrastructure was stopped or otherwise restricted or limited, it could have a material adverse effect on our business, prospects, results of operations and financial condition. |

| • | If we are not able to develop and release new products, or successful enhancements, new features and modifications to EndeavorRx or any future products, our business, prospects, results of operations and financial condition could be materially and adversely affected. |

| • | We rely on a single third party digital pharmacy for the fulfillment of prescriptions. This reliance on a single third party increases the risk that we could have disruption in the fulfillment of prescriptions, which could have a material and adverse effect on our reputation, business, results of operations and financial condition. |

| • | If we are unable to adequately protect and enforce our intellectual property and proprietary technology, obtain and maintain patent protection for our technology and products where appropriate or if the scope of the patent protection obtained is not sufficiently broad, or if we are unable to protect the confidentiality of our trade secrets and know-how, our competitors could develop and commercialize technology and products similar or identical to our products, and our ability to successfully commercialize our technology and products may be impaired. |

| • | If we fail to comply with obligations in the agreements under which we collaborate with or license intellectual property rights from third parties, or otherwise experience disruptions to our business relationships with collaborators or licensors, we could lose rights that are important to its business. |

| • | We will need substantial additional funding, and if it is unable to raise capital when needed or on terms favorable to us, our business, financial condition and results of operation could be materially and adversely affected. |

| • | The amount of our future losses is uncertain and our quarterly and annual operating results may fluctuate significantly or fall below the expectations of investors or securities analysists, each of which may cause our stock price to fluctuate or decline. |

| • | exemption from the requirement to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting; |

| • | exemption from compliance with the requirement of the Public Company Accounting Oversight Board, or PCAOB, regarding the communication of critical audit matters in the auditor’s report on the financial statements; |

| • | reduced disclosure about our executive compensation arrangements; and |

| • | exemption from the requirement to hold non-binding advisory votes on executive compensation or golden parachute arrangements. |

Issuer | Akili, Inc. |

Shares of common stock to be issued by us | 2,096,106 shares of common stock reserved for issuance upon the exercise of stock options to purchase common stock. |

Shares of common stock outstanding prior to the exercise of stock options and settlement of restricted stock units | 85,395,207 shares |

Use of proceeds | We will receive up to an aggregate of approximately $6,440,833 from the exercise of stock options to which this registration statement relates (assuming the exercise in full of all of the outstanding stock options for cash). There is no assurance that stock options will be in the money prior to their expiration or that the holders of such stock options will elect to exercise any or all of such stock options. We believe the likelihood that these holders will exercise such stock options, and therefore any cash proceeds that we may receive in relation to the exercise of such stock options being offered for sale in this prospectus, will be dependent on the trading price of our common stock. If the market price for our common stock is less than the exercise price of stock options, we believe the holders of such stock options will be unlikely to exercise such securities. We expect to use any net proceeds from the exercise of stock options for general corporate purposes. See “ Use of Proceeds |

Shares of common stock offered by the Selling Securityholders | 43,414,721 shares consisting of: |

| • | 16,200,000 shares of common stock issued in the PIPE Investment by certain of the selling securityholders; |

| • | 6,250,000 shares of common stock issued upon consummation of the Business Combination, in exchange for Class B ordinary shares of SCS originally issued to the Sponsor; |

| • | 640,000 shares of common stock issued upon consummation of the Business Combination, in exchange for Class A ordinary shares of SCS originally issued to the Sponsor; |

| • | 2,494,549 shares of common stock held by certain of our current and former directors; |

| • | 15,684,066 shares of common stock issued to certain former equity holders of Akili pursuant to the Business Combination; |

| • | 2,096,106 shares of common stock reserved for issuance upon the exercise of options to purchase common stock held by persons who previously ended their relationship with Akili prior to or concurrently with the Closing to the Business Combination; and |

| • | 50,000 shares of common stock reserved for issuance upon the settlement of restricted stock units. |

Terms of the offering | The Selling Securityholders will determine when and how they will dispose of the securities registered under this prospectus for resale. See “Plan of Distribution”. |

Use of proceeds | We will not receive any proceeds from the sale of the securities registered under this prospectus by the Selling Securityholders. |

Risk factors | See “Risk Factors” and the other information included in this prospectus for a discussion of factors you should consider before investing in our securities. |

Nasdaq symbols | Our common stock is listed on Nasdaq under the symbol “AKLI”. |

| • | the failure of EndeavorRx to achieve wide acceptance among patients, self-insured employers, commercial and government payers, health plans, physicians and other government entities, and key opinion leaders in the treatment community; |

| • | lack of additional evidence of peer-reviewed publication of clinical or real world evidence supporting the effectiveness, safety, cost-savings or other advantages of our products over competitive products or other currently available methodologies; |

| • | perceived risks associated with the use of our product or similar products or technologies generally; |

| • | our ability to maintain U.S. Food and Drug Administration, or FDA, marketing authorization and other marketing authorizations for EndeavorRx; |

| • | our ability to secure and maintain other regulatory clearance, authorization or approval for AKL-T01 for expanded indications and our other product candidates; |

| • | the introduction of competitive products and the rate of acceptance of those products as compared to our products; and |

| • | results of clinical, real world and health economics and outcomes research studies relating to chronic condition products or similar competitive products. |

| • | lack of availability of adequate third-party payer coverage or reimbursement; |

| • | lack of experience with our products; |

| • | our inability to convince key opinion leaders to recommend our products; |

| • | perceived inadequacy of evidence supporting clinical benefits, safety or cost-effectiveness of our products; |

| • | liability risks generally associated with the use of new products; and |

| • | the training required to use new products. |

| • | restrictions on the marketing or manufacturing of the product, withdrawal of the product from the market, or voluntary or mandatory product recalls; |

| • | clinical trial holds; |

| • | fines, warning letters or other regulatory enforcement action; |

| • | refusal by the FDA or comparable foreign regulatory authorities to clear or approve pending submissions filed by us; |

| • | product seizure or detention, or refusal to permit the import or export of products; and |

| • | injunctions or the imposition of civil or criminal penalties. |

| • | We may not be able to demonstrate to the FDA’s satisfaction that our product candidates meet the applicable regulatory standards for clearance, de novo classification, or approval, as applicable; |

| • | The FDA may disagree that our clinical data supports the label and use that we are seeking; and |

| • | The FDA may disagree that the data from our preclinical or pilot studies and clinical trials is sufficient to support marketing authorization. |

| • | the possible breach of the manufacturing agreement by the third party; and |

| • | the possible termination or nonrenewal of the agreement by the third party at a time that is costly or inconvenient for us. |

| • | we may lose marketing authorization of such product; |

| • | regulatory authorities may require additional warnings on the product’s label; |

| • | we may be required to issue safety communications to patients or healthcare providers that outline the risks of such side effects; |

| • | we could be sued and held liable for harm caused to patients; and |

| • | our reputation may suffer. |

| • | multiple, conflicting and changing laws and regulations such as tax laws, privacy and data protection laws and regulations, export and import restrictions, employment laws, regulatory requirements and other governmental approvals, permits and licenses; |

| • | requirements to maintain data and the processing of that data on servers located within the United States or in such countries; |

| • | protecting and enforcing our intellectual property rights; |

| • | converting our products as well as the accompanying instructional and marketing materials to conform to the language and customs of different countries; |

| • | complexities associated with managing multiple payer reimbursement regimes, and government payers; |

| • | competition from companies with significant market share in our market and with a better understanding of user preferences; |

| • | financial risks, such as longer payment cycles, difficulty collecting accounts receivable, the effect of local and regional financial pressures on demand and payment for our products and services and exposure to foreign currency exchange rate fluctuations; |

| • | natural disasters, political and economic instability, including wars, terrorism, political unrest, outbreak of disease (including the recent coronavirus outbreak), boycotts, curtailment of trade, and other market restrictions; and |

| • | regulatory and compliance risks that relate to maintaining accurate information and control over activities subject to regulation under the U.S. Foreign Corrupt Practices Act (the “FCPA”), and comparable laws and regulations in other countries. |

| • | a covered benefit under its health plan; |

| • | safe, effective and medically necessary; |

| • | supported by robust clinical data from well-controlled clinical research; |

| • | appropriate for the specific patient; |

| • | cost-effective; and |

| • | neither experimental nor investigational. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | the extent to which our technology and processing infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | the sublicensing of patent and other rights under our collaborative development relationships; |

| • | our diligence obligations under the license agreement and what activities satisfy those diligence obligations; |

| • | the inventorship and ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our partners; and |

| • | the priority of invention of patented technology. |

| • | the scope of rights granted under the license agreement and other interpretation-related issues; |

| • | amount of royalty payments under the license agreement; |

| • | whether and to what extent our technology and processes infringe on intellectual property of the licensor that is not subject to the licensing agreement; |

| • | our right to sublicense patent and other rights to collaborators and other third parties; |

| • | our diligence obligations with respect to the use of the licensed technology in relation to our development and commercialization of our products, and what activities satisfy those diligence obligations; and |

| • | the ownership of inventions and know-how resulting from the joint creation or use of intellectual property by our licensors and us and our collaborators. |

| • | the scope, progress, results and costs of researching and developing our current product candidates, as well as other additional product candidates we may develop and pursue in the future; |

| • | the timing of, and the costs involved in, obtaining marketing authorization for our product candidates and any other additional product candidates we may develop and pursue in the future; |

| • | the number of future product candidates that we may pursue and their development requirements; |

| • | the costs of commercialization activities for our product candidates, including the costs and timing of establishing product sales, marketing, and distribution capabilities; |

| • | revenue received from commercial sales of our current products and, subject to receipt of authorization, revenue, if any, received from commercial sales of our product candidates; |

| • | the extent to which we in-license or acquires rights to other products, product candidates or technologies; |

| • | our investment in our human capital required to grow the business and the associated costs as we expand our research and development and establishes a commercial infrastructure; |

| • | the costs of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual property rights, including enforcing and defending intellectual property-related claims; and |

| • | the cost of operating a public company. |

| • | the timing and success or failure of clinical trials for our product candidates or competing product candidates, or any other change in the competitive landscape of our industry, including consolidation among our competitors or partners or as a result of COVID-19; |

| • | our ability to successfully recruit and retain subjects for clinical trials, and any delays caused by difficulties in such efforts, including as a result of COVID-19; |

| • | our ability to obtain marketing authorization for our product candidates and the timing and scope of any such marketing authorizations we may receive; |

| • | the timing and cost of, and level of investment in, research and development activities relating to our product candidates, which may change from time to time; |

| • | our ability to attract, hire and retain qualified personnel; |

| • | expenditures that we will or may incur to develop additional product candidates; |

| • | the level of demand for EndeavorRx and our other product candidates should such product candidates receive marketing authorizations, which may vary significantly; |

| • | the risk/benefit profile, cost and reimbursement policies with respect to EndeavorRx and our other product candidates, if granted marketing authorization, and existing and potential future therapeutics that compete with our product candidates; |

| • | the changing and volatile U.S. and global economic environments including global inflationary pressures; and |

| • | future accounting pronouncements or changes in our accounting policies. |

| • | changes in the industries in which we and our customers operate; |

| • | developments involving our competitors; |

| • | changes in laws and regulations affecting our business; |

| • | variations in our operating performance and the performance of our competitors in general; |

| • | actual or anticipated fluctuations in our quarterly or annual operating results; |

| • | publication of research reports by securities analysts about our or our competitors or our industry; |

| • | the public’s reaction to our press releases, our other public announcements and our filings with the SEC; |

| • | actions by stockholders, including the sale by the Third-Party PIPE Investors of any of their shares of our common stock; |

| • | additions and departures of key personnel; |

| • | commencement of, or involvement in, litigation involving us; |

| • | changes in our capital structure, such as future issuances of securities or the incurrence of additional debt; |

| • | the volume of shares of our common stock available for public sale; and |

| • | general economic and political conditions, such as the effects of the ongoing COVID-19 pandemic, recessions, interest rates, local and national elections, fuel prices, international currency fluctuations, corruption, political instability and acts of war or terrorism. |

| • | the accompanying notes to the unaudited pro forma condensed combined financial statements; |

| • | the historical unaudited condensed financial statements of SCS as of June 30, 2022 and for the six months ended June 30, 2022 and the related notes included in the prospectus; |

| • | the historical audited financial statements of SCS as of December 31, 2021 and for the period from February 25, 2021 (inception) through December 31, 2021 and the related notes included in this prospectus; |

| • | the historical unaudited condensed consolidated financial statements of Akili as of June 30, 2022 and for the six months ended June 30, 2022 and the related notes included elsewhere in this prospectus; |

| • | the historical audited consolidated financial statements of Akili as of December 31, 2021 and for the year ended December 31, 2021 and the related notes included elsewhere in this prospectus; and |

| • | the section entitled “ SCS’s Management’s Discussion and Analysis of Financial Condition and Results of Operations Akili’s Management’s Discussion and Analysis of Financial Condition and Results of Operations |

Akili Interactive Labs, Inc. Stock Outstanding at June 30, 2022 | Additional Akili Interactive Labs, Inc. Stock Issued and Options Exercised/Expired After June 30, 2022 (1) | Conversion of Akili Interactive Labs, Inc. Preferred Stock and automatically exercised Warrants into Akili Interactive Labs, Inc. Common Stock | Akili Interactive Labs, Inc. Stock Prior to Closing | Akili, Inc. Stock Held by Akili Stockholders Post Closing (2) | ||||||||||||||||

COMMON STOCK | ||||||||||||||||||||

Common Stock (3) | 1,482,520 | 22,750 | 45,872,861 | (5) | 47,378,131 | 54,541,224 | ||||||||||||||

PREFERRED STOCK | ||||||||||||||||||||

Series A-1 Convertible Preferred Stock | 4,000,000 | — | (4,000,000 | ) | — | — | ||||||||||||||

Series A-2 Convertible Preferred Stock | 4,427,072 | — | (4,427,072 | ) | — | — | ||||||||||||||

Series B Convertible Preferred Stock | 7,341,485 | — | (7,341,485 | ) | — | — | ||||||||||||||

Series C Convertible Preferred Stock | 8,016,645 | — | (8,016,645 | ) | — | — | ||||||||||||||

Series D Convertible Preferred Stock | 13,843,858 | 8,236,127 | (22,079,985 | ) | — | — | ||||||||||||||

Total Common and Preferred Stock (3) | 39,111,580 | 8,258,877 | 7,674 | 47,378,131 | 54,541,224 | |||||||||||||||

Akili Interactive Labs, Inc. Warrants (4) | 134,729 | — | (7,674 | ) | 127,055 | 137,628 | ||||||||||||||

Akili Interactive Labs, Inc. Options (4) | 4,124,718 | (56,389 | ) | — | 4,068,330 | 5,321,115 | ||||||||||||||

Total Stock, Warrants and Options | 43,371,027 | 8,202,488 | — | 51,573,516 | 59,999,967 | |||||||||||||||

| (1) | Reflects the capitalization activity of Akili subsequent to the latest balance sheet date through August 19, 2022, in connection with the Merger Agreement. The amount includes cumulative dividends that accrue on each share of Series D at an annual rate of 10%, which are issued in additional shares. Upon conversion, Series D shares are multiplied by 150% when calculating the number of shares of common stock. |

| (2) | Per the terms of the Merger Agreement, no fractional Akili, Inc. common stock were issued. Each holder of Akili stock entitled to a fraction of a Akili, Inc. common stock had its fractional share rounded down to the nearest whole share. Each holder of an Akili option and warrant underlying a fraction of a share of Akili, Inc. common stock had its fractional option rounded down to the nearest whole share. |

| (3) | Amount excludes the issuance of 7,536,461 Earnout Shares, to certain eligible Akili equity holders as a result of Akili, Inc. satisfying certain performance conditions described below with the Earnout Period. |

| (4) | Stock options and warrants to purchase common stock were converted using the treasury stock method at each date. |

| (5) | Includes 7,674 shares representing the cashless exercise of certain outstanding Akili Interactive Labs, Inc. warrants prior to Closing. |

| Shares | % | |||||||

SCS Public Stockholders (a) | 227,522 | 0.3 | % | |||||

SCS Sponsor and Independent Director | 6,890,000 | 8.8 | % | |||||

Total SCS | 7,117,522 | 9.1 | % | |||||

Akili Stockholders (b) | 54,541,224 | 70.1 | % | |||||

PIPE Investors | 16,200,000 | 20.8 | % | |||||

Total Shares at Closing (excluding certain Akili shares) | 77,858,746 | 100 | % | |||||

Akili—Remaining Consideration Shares (b)(c) | 5,458,743 | |||||||

Total Shares at Closing (including certain Akili shares) | 83,317,489 | |||||||

| (a) | Reflects redemptions of 24,772,478 public shares of SCS Class A common stock in connection with the Transactions at a redemption price of $10.03 per share based on funds held in the trust account as of August 17, 2022, two business days prior to closing. |

| (b) | Total consideration issued to Akili is $600.0 million or 60,000,000 shares ($10 per share price with no fractional shares). The total shares issued includes those in respect of Akili common and preferred stock and stock options and warrants to purchase common stock, converted using the treasury stock method. The Akili—Remaining Consideration Shares reflect a Conversion Ratio of approximately 1.15. |

| (c) | Amount excludes the issuance of 7,536,461 Earnout Shares, to certain eligible Akili equity holders as a result of Akili, Inc. satisfying certain performance conditions described above with the Earnout Period. |

Historical | ||||||||||||||||||||

SCS | Akili | Transaction Accounting Adjustments | Pro Forma Balance Sheet | |||||||||||||||||

ASSETS | ||||||||||||||||||||

Current assets: | ||||||||||||||||||||

Cash and cash equivalents | $ | 145 | $ | 40,638 | $ | 250,814 | 3 | (a) | $ | 175,684 | ||||||||||

| (2,226 | ) | 3 | (d) | |||||||||||||||||

| (9,045 | ) | 3 | (f) | |||||||||||||||||

| 162,000 | 3 | (i) | ||||||||||||||||||

| (2,700 | ) | 3 | (k) | |||||||||||||||||

| (7,752 | ) | 3 | (l) | |||||||||||||||||

| (5,520 | ) | 3 | (e) | |||||||||||||||||

| (248,531 | ) | 3 | (j) | |||||||||||||||||

| (2,139 | ) | 3 | (n) | |||||||||||||||||

Restricted cash | — | 305 | — | 305 | ||||||||||||||||

Short-term investments | — | 4,987 | — | 4,987 | ||||||||||||||||

Account receivable, net | — | 17 | — | 17 | ||||||||||||||||

Prepaid expenses and other current assets | 524 | 5,328 | (2,338 | ) | 3 | (f) | 3,514 | |||||||||||||

Total current assets | 669 | 51,275 | 132,563 | 184,507 | ||||||||||||||||

Property and equipment, net | — | 1,054 | — | 1,054 | ||||||||||||||||

Operating lease right-of-use | — | 2,686 | — | 2,686 | ||||||||||||||||

Marketable securities held in Trust Account | 250,371 | — | (250,371 | ) | 3 | (a) | — | |||||||||||||

Total assets | $ | 251,040 | $ | 55,015 | $ | (117,808 | ) | $ | 188,247 | |||||||||||

LIABILITIES, REDEEMABLE CONVERTIBLE PREFERRED STOCK AND STOCKHOLDERS’ DEFICIT | ||||||||||||||||||||

Current liabilities: | ||||||||||||||||||||

Accounts payable | $ | 17 | $ | 4,309 | $ | (17 | ) | 3 | (l) | $ | 4,309 | |||||||||

Accrued expenses and other current liabilities | 7,405 | 5,044 | (7,405 | ) | 3 | (l) | 5,044 | |||||||||||||

Promissory note—related party | 250 | — | (250 | ) | 3 | (l) | — | |||||||||||||

Due to related party | 80 | — | (80 | ) | 3 | (l) | — | |||||||||||||

Deferred revenue | — | 109 | — | 109 | ||||||||||||||||

Deferred rent, short term | — | 9 | — | 9 | ||||||||||||||||

Operating lease liability | — | 625 | — | 625 | ||||||||||||||||

Note payable, short term | — | 625 | — | 625 | ||||||||||||||||

Total current liabilities | 7,752 | 10,721 | (7,752 | ) | 10,721 | |||||||||||||||

Deferred underwriting fee payable | 7,700 | — | (7,700 | ) | 3 | (e) | — | |||||||||||||

Note payable, long term | — | 14,213 | — | 14,213 | ||||||||||||||||

Operating lease liability, net of current portion | — | 2,832 | — | 2,832 | ||||||||||||||||

Corporate bond, net of bond discount | — | 1,735 | — | 1,735 | ||||||||||||||||

Earnout liability | — | — | 57,197 | 3 | (m) | 57,197 | ||||||||||||||

Total liabilities | $ | 15,452 | $ | 29,501 | $ | 41,745 | $ | 86,698 | ||||||||||||

Historical | ||||||||||||||||||||

SCS | Akili | Transaction Accounting Adjustments | Pro Forma Balance Sheet | |||||||||||||||||

Commitments and contingencies | ||||||||||||||||||||

Class A ordinary shares | 250,371 | — | (250,371 | ) | 3 | (b) | — | |||||||||||||

Class A common stock | — | — | 250,371 | 3 | (b) | — | ||||||||||||||

| (250,371 | ) | 3 | (j) | |||||||||||||||||

REDEEMABLE CONVERTIBLE PREFERRED STOCK: | ||||||||||||||||||||

Akili Series A-1 redeemable convertible preferred stock | — | — | — | — | ||||||||||||||||

Akili Series A-2 redeemable convertible preferred stock | — | 7,128 | (7,128 | ) | 3 | (g) | — | |||||||||||||

Akili Series B redeemable convertible preferred stock | — | 41,854 | (41,854 | ) | 3 | (g) | — | |||||||||||||

Akili Series C redeemable convertible preferred stock | — | 67,904 | (67,904 | ) | 3 | (g) | — | |||||||||||||

Akili Series D redeemable convertible preferred stock | — | 183,668 | (183,668 | ) | 3 | (g) | — | |||||||||||||

Stockholders equity (deficit): | ||||||||||||||||||||

SCS Preference shares | — | — | — | — | ||||||||||||||||

Class A ordinary shares | — | — | — | 3 | (b) | — | ||||||||||||||

Class A common stock | — | — | — | 3 | (b) | 11 | ||||||||||||||

| 1 | 3 | (c) | ||||||||||||||||||

| 3 | 3 | (j) | ||||||||||||||||||

| 5 | 3 | (h) | ||||||||||||||||||

| 2 | 3 | (i) | ||||||||||||||||||

Class B ordinary shares | 1 | — | (1 | ) | 3 | (b) | — | |||||||||||||

Class B common stock | — | — | 1 | 3 | (b) | — | ||||||||||||||

| (1 | ) | 3 | (c) | |||||||||||||||||

Akili Common stock | — | — | 5 | 3 | (g) | — | ||||||||||||||

| (5 | ) | 3 | (h) | |||||||||||||||||

Additional paid-in capital | — | — | 2,280 | 3 | (j) | 383,783 | ||||||||||||||

| 161,998 | 3 | (i) | ||||||||||||||||||

| (2,700 | ) | 3 | (k) | |||||||||||||||||

| (14,784 | ) | 3 | (h) | |||||||||||||||||

| 300,549 | 3 | (g) | ||||||||||||||||||

| (2,226 | ) | 3 | (d) | |||||||||||||||||

| (11,383 | ) | 3 | (f) | |||||||||||||||||

| (57,197 | ) | 3 | (m) | |||||||||||||||||

| 2,180 | 3 | (e) | ||||||||||||||||||

| 5,066 | 3 | (o) | ||||||||||||||||||

Accumulated deficit | (14,784 | ) | (275,033 | ) | 14,784 | 3 | (h) | (282,238 | ) | |||||||||||

| (2,139 | ) | 3 | (n) | |||||||||||||||||

| (5,066 | ) | 3 | (o) | |||||||||||||||||

| 443 | 3 | (a) | ||||||||||||||||||

| (443 | ) | 3 | (j) | |||||||||||||||||

Accumulated other comprehensive loss | — | (7 | ) | — | (7 | ) | ||||||||||||||

Total stockholders’ equity (deficit) | $ | (14,783 | ) | $ | (275,040 | ) | $ | 391,372 | $ | 101,549 | ||||||||||

Total liabilities, redeemable convertible preferred stock and stockholders’ deficit | $ | 251,040 | $ | 55,015 | $ | (117,808 | ) | $ | 188,247 | |||||||||||

Historical | ||||||||||||||||||||

SCS | Akili Interactive Labs, Inc. | Transaction Accounting Adjustments | Pro Forma Statement of Operations | |||||||||||||||||

Revenue | $ | — | $ | 130 | $ | — | $ | 130 | ||||||||||||

Operating expenses: | ||||||||||||||||||||

Cost of revenue | — | 193 | — | 193 | ||||||||||||||||

Research and development | — | 13,662 | 49 | 4 | (c) | 13,711 | ||||||||||||||

Selling, general and administrative | — | 30,339 | 59 | 4 | (c) | 36,671 | ||||||||||||||

| 6,273 | 4 | (b) | ||||||||||||||||||

Operating and formation costs | 6,273 | — | (6,273 | ) | 4 | (b) | — | |||||||||||||

Total operating expenses | 6,273 | 44,194 | 108 | 50,575 | ||||||||||||||||

Loss from operations | (6,273 | ) | (44,064 | ) | (108 | ) | (50,445 | ) | ||||||||||||

Interest earned on marketable securities held in Trust Account | 363 | — | (363 | ) | 4 | (a) | — | |||||||||||||

Loss on extinguishment of debt | — | — | — | — | ||||||||||||||||

Interest expense | — | (370 | ) | — | (370 | ) | ||||||||||||||

Other income | — | 49 | — | 49 | ||||||||||||||||

Loss before provision for income taxes | (5,910 | ) | (44,385 | ) | (471 | ) | (50,766 | ) | ||||||||||||

Provision for income taxes | — | — | — | — | ||||||||||||||||

Net loss | $ | (5,910 | ) | $ | (44,385 | ) | $ | (471 | ) | $ | (50,766 | ) | ||||||||

Unrealized loss on short-term investments | $ | — | $ | (7 | ) | $ | — | $ | — | |||||||||||

Comprehensive loss | $ | (5,910 | ) | $ | (44,392 | ) | $ | (471 | ) | $ | (50,766 | ) | ||||||||

Net loss | $ | (5,910 | ) | $ | (44,385 | ) | $ | (471 | ) | $ | (50,766 | ) | ||||||||

Dividends on Series D convertible preferred stock | — | (5,785 | ) | — | (5,785 | ) | ||||||||||||||

Accretion of Series D convertible preferred stock | — | (2,893 | ) | — | (2,893 | ) | ||||||||||||||

Net loss attributable to common stockholders, basic and diluted | $ | (5,910 | ) | $ | (53,063 | ) | $ | (471 | ) | $ | (59,444 | ) | ||||||||

Net loss per share, basic and diluted | $ | (0.19 | ) | $ | (36.18 | ) | $ | (0.76 | ) | |||||||||||

Weighted-average common shares outstanding: Basic and diluted | 31,890,000 | 1,466,462 | 77,858,746 | |||||||||||||||||

Historical | ||||||||||||||||||||

SCS | Akili Interactive Labs, Inc. | Transaction Accounting Adjustments | Pro Forma Statement of Operations | |||||||||||||||||

Revenue | $ | — | $ | 538 | $ | — | $ | 538 | ||||||||||||

Operating expenses: | ||||||||||||||||||||

Cost of revenue | — | 355 | — | 355 | ||||||||||||||||

Research and development | — | 18,234 | 2,733 | 5 | (c) | 20,967 | ||||||||||||||

Selling, general and administrative | — | 42,668 | 5,879 | 5 | (c) | 53,133 | ||||||||||||||

| 2,447 | 5 | (b) | ||||||||||||||||||

| 2,139 | 5 | (d) | ||||||||||||||||||

Operating and formation costs | 2,447 | — | (2,447 | ) | 5 | (b) | — | |||||||||||||

Total operating expenses | 2,447 | 61,257 | 10,751 | 74,455 | ||||||||||||||||

Loss from operations | (2,447 | ) | (60,719 | ) | (10,751 | ) | (73,917 | ) | ||||||||||||

Interest earned on marketable securities held in Trust Account | 8 | — | (8 | ) | 5 | (a) | — | |||||||||||||

Loss on extinguishment of debt | — | (181 | ) | — | (181 | ) | ||||||||||||||

Interest expense | — | (465 | ) | — | (465 | ) | ||||||||||||||

Other income | — | 17 | — | 17 | ||||||||||||||||

Loss before provision for income taxes | (2,439 | ) | (61,348 | ) | (10,759 | ) | (74,546 | ) | ||||||||||||

Provision for income taxes | — | — | — | — | ||||||||||||||||

Net loss | (2,439 | ) | (61,348 | ) | (10,759 | ) | (74,546 | ) | ||||||||||||

Dividends on Series D convertible preferred stock | — | (6,660 | ) | — | (6,660 | ) | ||||||||||||||

Accretion of Series D convertible preferred stock | — | (58,649 | ) | — | (58,649 | ) | ||||||||||||||

Net loss attributable to common stockholders, basic and diluted | $ | (2,439 | ) | $ | (126,657 | ) | $ | (10,759 | ) | $ | (139,855 | ) | ||||||||

Net loss per share, basic and diluted | $ | (0.12 | ) | $ | (105.77 | ) | $ | (1.80 | ) | |||||||||||

Weighted-average common shares outstanding: Basic and diluted | 20,954,628 | 1,197,489 | 77,858,746 | |||||||||||||||||

| (1) | For the period from February 25, 2021 (date of inception) to December 31, 2021. |

| • | Triggering Event I is $15.00 |

| • | Triggering Event II is $20.00 |

| • | Triggering Event III is $30.00 |

Combined Pro Forma | ||||||||

Year Ended December 31, 2021 | Six Months Ended June 30, 2022 | |||||||

Pro forma net loss | $ | (139,855 | ) | $ | (59,444 | ) | ||

Pro forma weighted average shares outstanding—basic and diluted | 77,858,746 | 77,858,746 | ||||||

Pro forma net loss per share-basic and diluted | $ | (1.80 | ) | $ | (0.76 | ) | ||

Pro Forma weighted average shares calculation—basic and diluted | ||||||||

SCS Sponsors | 6,890,000 | 6,890,000 | ||||||

SCS common stock subject to redemption | 227,522 | 227,522 | ||||||

Total SCS | 7,117,522 | 7,117,522 | ||||||

Issuance of SCS common stock in connection with closing of the PIPE Transaction | 16,200,000 | 16,200,000 | ||||||

Issuance of SCS common stock to Akili shareholders in connection with Business Combination (a)(b) | 54,541,224 | 54,541,224 | ||||||

Pro forma weighted average shares outstanding—basic and diluted (c) | 77,858,746 | 77,858,746 | ||||||

| a. | Excludes 5,458,743 Akili consideration shares that will be issued upon the occurrence of future events (i.e., exercise of stock options and warrants). Total consideration to be issued to Akili is $600.0 million or 60,000,000 shares ($10 per share price with no fractional shares issued). The total shares to be issued includes those in respect of all issued and outstanding Akili common and preferred stock and shares underlying stock options and warrants. Accordingly, the weighted average pro forma shares outstanding at Closing has been adjusted to exclude the portion of consideration shares that were unissued at Closing. |

| b. | Amount excludes the issuance of approximately 7,536,461 Earnout Shares to certain eligible Akili equity holders as a result of Akili, Inc. satisfying certain conditions described above within the Earnout Period. |

| c. | For the purposes of applying the if converted method for calculating diluted earnings per share, it was assumed that all Akili common stock options are exchanged for common stock. However, since this results in anti-dilution, the effect of such exchange was not included in the calculation of diluted loss per share. Shares underlying these instruments include 5,458,743 Akili consideration shares for unexercised stock options and warrants. |

| • | Targeted treatments that are personalized to patients’ needs de-identified, aggregate level view of each patient’s activity, informing our product development. The therapeutics’ mechanics, algorithms and designs are protected by patents, trade secrets and copyrights, combining protections typically seen in both the medicine and technology industries to create a robust intellectual property portfolio. |

| • | Clinically validated therapeutics like drugs and medical devices The American Journal of Psychiatry, The Lancet Digital Health and Nature: Digital Medicine |

| • | Therapeutics that are experienced as entertainment |

unique user experiences also allows us to adapt the experience to appeal to different patient populations by developing and testing product candidates in clinical trials. We believe we have the potential to offer the first treatments that both rival the experience of consumer entertainment products and can be utilized as part of a treatment plan. |

| • | Patient focused and adaptive |

| • | pivotal study in adolescents with ADHD |

| • | pivotal study in adults with ADHD |

| • | Weill Cornell Medicine/NewYork-Presbyterian Hospital in acute cognitive dysfunction in COVID-19 survivors |

| • | Vanderbilt University Medical Center in acute cognitive dysfunction in COVID-19 survivors |

| • | pivotal study in pediatric ADHD in Japan by Shionogi & Co., Ltd (“Shionogi”) |

| • | proof of concept study in early childhood (3-8 year olds) ADHD by TALi Digital Limited (“TALi”) |

| • | post-operative cognitive dysfunction by Vanderbilt University Medical Center |

| • | chemotherapy-related cognitive impairment by the University of California San Francisco (“UCSF”) |

| • | cognitive monitoring in a healthy aging population |

| • | proof of concept and/or pivotal study in inattention in ASD |

| • | pivotal study in cognitive dysfunction in MS |

| • | pivotal study in cognitive dysfunction in MDD |

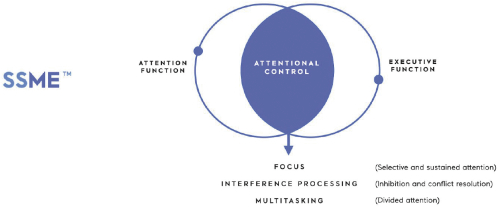

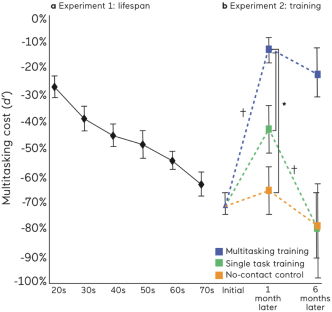

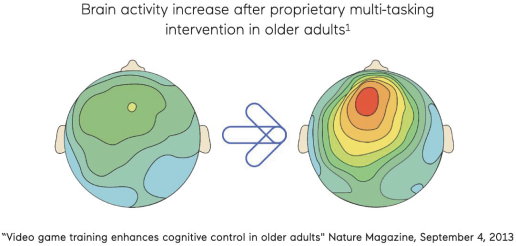

Core Mechanic | Description | Targeted Physiology | ||

SSME Stimulus Management Engine | Targets attentional control |  | ||

SNAV Navigation Engine | Targets spatial navigation and episodic memory |  | ||

BBT Trainer | Targets attentional control, goal management and working memory |  |

| • | Navigation: Steering over gates and/or avoiding obstacles |

| • | Targeting: Tap for targets and ignore non-targets |

| • | Multitasking: Simultaneous navigation and targeting |

Disease Area | Total U.S. Population with Disease Diagnosis | Initial Target Population Subset with applicable cognitive impairment, as noted | ||

Attention-deficit/hyperactivity disorder (“ADHD”), all ages | 10.8M (ADHD + inattention) | 8.1M | ||

Autism spectrum disorder (“ASD”) | 1.3M | 410k (ASD + inattention) | ||

Multiple sclerosis (“MS”) | 900K | 180K | ||

| (MS + cognitive dysfunction) | ||||

Major depressive disorder (“MDD”) | 19M | 2.1M | ||

| (MDD + cognitive dysfunction) | ||||

Acute cognitive dysfunction | 81M | 3.3M | ||

(COVID fog, ICU-related, TBI, cancer-related) |

| * | Figures in table above are based on our management’s good faith estimates based on various publications, public health data and national health statistics including from the NIH and CDC. |

| (1) | Timeframes are estimates and are subject to change—see Disclaimer and Risk Factors. |

| (2) | AKL-T01 is marketed as EndeavorRx in the U.S. for children ages8-12 old with primarily inattentive or combined-type ADHD, who have a demonstrated attention issue. |

| (3) | Shionogi is responsible for the clinical development and commercialization of SDT-001 (a version ofAKL-T01 localized for Japanese language and culture), as well as any future development and commercialization ofAKL-T02, another version of our SSME engine that has been used for our ASD program, each in Japan and Taiwan. |

| (4) | AKL-M01 is designed to use SSME algorithms to monitor and assess certain aspects of cognition, as opposed to providing cognitive therapy. |

| (5) | To the extent we are unable to access additional sources of funding, our current estimated timeframe for initiating a pivotal study in this development program could be delayed. |

| * | Estimated timeframes in figure above correspond to applicable milestone start times, and are subject to change. Please refer to the section entitled “ Risk Factors Risks Related to Our Business and Industry—Enrollment and retention of patients in clinical trials is an expensive and time-consuming process and could be made more difficult or rendered impossible by multiple factors outside of our control. If we experience delays or difficulties in the enrollment or retention of patients in clinical trials, our ability to obtain necessary marketing authorizations for our product candidates could be delayed or prevented Risks Related to Our Products—Our current product candidates are in various stages of development. Our product candidates may fail in development or suffer delays that adversely affect their commercial viability. If we fail to maintain clearance, de novo classification or approval to market our product candidates, including AKL-T01 for expanded indications, or if we are delayed in obtaining such marketing authorizations, our business, prospects, results of operations and financial condition could be materially and adversely affected |

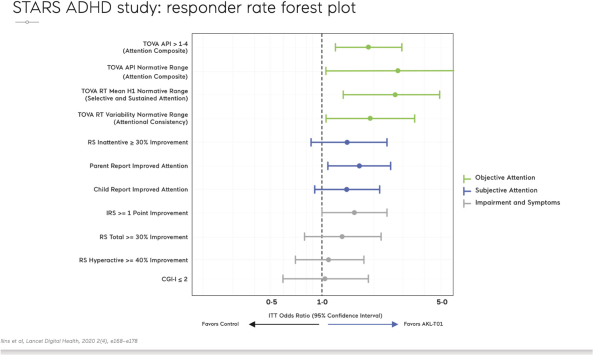

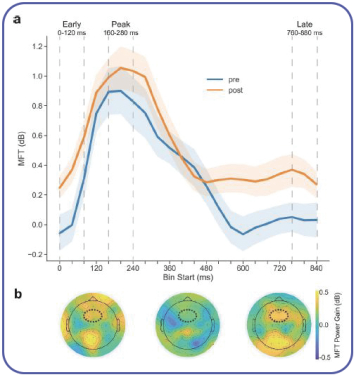

| STARS-ADHD pivotal study | ||

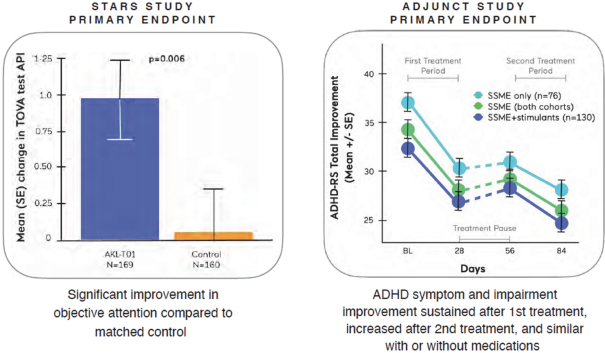

| The pivotal STARS-ADHD study was a 4-week multi-center, randomized, blinded, controlled trial conducted between July 2016 and November 2017 in 348 children aged8-12 years and diagnosed with ADHD. Children enrolled into the study were instructed to useAKL-T01 or an educational-style video game control for approximately 25 minutes a day for 28 days. |  | |

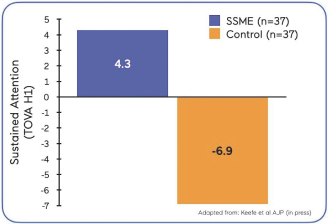

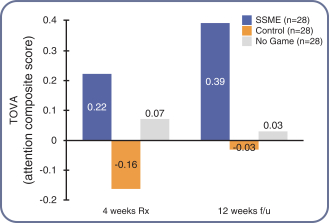

| The predefined primary endpoint of the study was the change from baseline in the TOVA Attention Performance Index (TOVA API), a measure of objective attention for which the study was statistically powered. TOVA is a computerized test cleared by the FDA to assess attention deficits and evaluate the effects of interventions in ADHD; the API is a composite measure of attention functioning. This objective attention endpoint was the primary endpoint for which the study was statistically powered. The control condition used in this study was specifically designed to enable the assessment of changes in the primary endpoint of objective attention. The control was in the form of an educational style word search digital game matched to AKL-T01 for expectation of benefit and time on task.AKL-T01 showed a statistically significant improvement on the TOVA API compared to the control (p=0.006). | ||

| The study demonstrated statistically significant improvement in the IRS from baseline after one month as well as to the end of the three- month trial in both the children on-stimulants andoff-stimulants (both cohorts: p<0.001). The second period ofAKL-T01 treatment resulted in further increases in efficacy on this primary outcome measure, beyond the effects already seen after the first period of treatment. The magnitude of improvement in IRS throughout the study was similar for children independent of their ADHD medication use. Responder rates for IRS (improvement of greater than 1 point or more on the IRS scale) were 41% and 56% at the end of the first period of treatment withAKL-T01 in theoff-stimulant andon-stimulant groups respectively (50% across both groups). This increased to 69% and 68% respectively by the end of the second period of treatment. Further, across both groups, responder rates forADHD-RS Total (% children with ≥30% improvement) after the first period of treatment was 27% and increased to 45% after the second period of treatment. Additionally, after the second period of treatment, 60% of parents said the intervention helped their child’s attention in real life, and 75% of children reported feeling an improvement in their attention when asked via an exit survey. |  |

| • | Australia, in which the technology does not require a medical prescription; and |

| • | India, in which the technology does not require a medical prescription. |

| • | U.S. commercial launch of EndeavorRx in 8-12 year-old patients with primarily inattentive or combined-type ADHD, who have a demonstrated attention issue: Expected H2 2022 |

| • | Shionogi pivotal trial data in Japan: Expected H2 2023 |

| • | Initiation of TALi technology study in 3-8 year-old children with ADHD: Expected H1 2023 |

| • | Pivotal trial data in adolescent ADHD patients: Expected H2 2023 |

| • | Pivotal trial data in adult ADHD patients: Expected H2 2023 |

The study was conducted at the Children’s Hospital of Philadelphia Center for Autism Research, which enrolled 19 children with autism, aged 9-13 years old and with an average age of 10 years old. Patients received either our investigational treatment(AKL-T02) or a control educational style video game based on a word challenge game. Patients were asked to play the game for 30 minutes a day, five days a week, for four weeks.This pilot study found that not only did the child participants like and engage with our investigational treatment, their attention on the TOVA test of attention improved similar to what was seen in our studies of children with only an ADHD diagnosis. The control video game did not demonstrate improvement in the mean TOVA score. There was one adverse event (decreased frustration tolerance) in the AKL-T02 group; no serious adverse events were reported. |  |

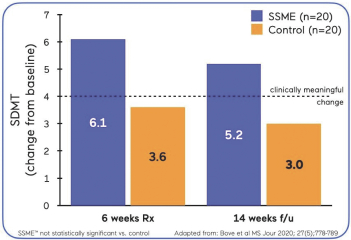

| Our proof of concept study in MDD was a multi-center, randomized, controlled trial of our SSME technology engine, utilizing the AKL-T03 variation of our treatment software, in 74 adult patients diagnosed withmild-to-moderate mild-to-moderate AKL-T03 or a control game. Both groups used the treatment/control at home, five days per week for 25 minutes per day, on a tablet device for six weeks. Following the treatment period, anin-clinic assessment was conducted to assess key outcomes. The primary outcome of the study assessed sustained attention as measured by TOVA, anFDA-cleared objective measure of attention. |  |

| • | SDMT: No difference between group, p=0.21. Both the AKL-T03 and control groups showed statistically significant improvements, p<0.001 and p=0.024, respectively. |

| • | At 8 weeks follow up, responders analysis (clinically meaningful +4 point increase in SDMT relative to baseline SDMT score) was statistically significant favoring AKL-T03, p=0.038. |

| • | PASAT: No difference between group, p=0.93. Both the AKL-T03 and control groups showed statistically significant improvements, p=0.002 and p=0.07 (marginally significant), respectively. |

Clinical evidence in acute cognitive function Evaluating the ability of our SSME technology to improve impairments related to acute cognitive dysfunction, we conducted a pilot study between September 2015 and April 2019 of 84 patients with TBI, including 60– 85-year-old HVLT-R learning, delayed recall and recognition. |  |

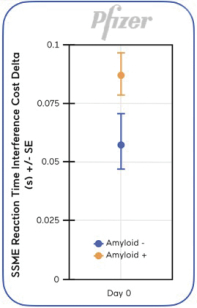

We also conducted a pilot study in 54 healthy older adults in collaboration with Pfizer. The study showed the potential for SSME assessment to detect cognitive differences between amyloid positive and amyloid negative status, where amyloid is a protein biomarker associated with a higher risk of progression to dementia, in otherwise healthy individuals (graph on right). |  |

| • | Consumer-driven model: |

| • | Active participation by a physician: |

| • | Delivered as a comprehensive care program: |

| • | Coverage by formulary decision-makers: self-pay/reimbursement model to enable growth in the short term with potential to track toward expanded access via insurance coverage over time. |

| • | Power of data to inform and adapt: |

PHASE | PRE-LAUNCH | PRE-LAUNCH | PRE-LAUNCH | |||||||||||

METRIC | FY 2021 | Q 1’22 | GROWTH VS. Q1’21 | |||||||||||

DEMAND | Total Rx Written | 1,713 | 668 | 229 | % | |||||||||

| New Rx | 1,422 | 503 | 166 | % | ||||||||||

| Refill Rx | 291 | 165 | 1079 | % | ||||||||||

ENGAGEMENT | Total Prescribers | 877 | 437 | 191 | % | |||||||||

| New Prescribers | 832 | 239 | 96 | % | ||||||||||

| Conversion (Enrolled To Dispense) | 57 | % | 53 | % | (14 | %) | ||||||||

REIMBURSEMENT | % of TRx Self Paid | 86 | % | 89 | % | N/A | ||||||||

| % of TRx Reimbursed | 10 | % | 4.3 | % | N/A | |||||||||

| Total Covered Lives | 2.8 | M | 2.6 | M | N/A | |||||||||

| • | families with children not well-managed on ADHD drugs due to side effects or lack of efficacy, |

| • | families choosing to not put their children on ADHD drugs, and |

| • | families with children actively taking ADHD drugs but looking for additional options to add to their treatment. |

| * | Estimated timeframes in figure above correspond to applicable milestone start times, and are subject to change—please refer to the section entitled “ Risk Factors Risks Related to Our Business and Industry—Enrollment and retention of patients in clinical trials is an expensive and time- consuming process and could be made more difficult or rendered impossible by multiple factors outside of our control. If we experience delays or difficulties in the enrollment or retention of patients in clinical trials, our ability to obtain necessary marketing authorizations for our product candidates could be delayed or |

prevented Risks Related to Our Products—Our current product candidates are in various stages of development. Our product candidates may fail in development or suffer delays that adversely affect their commercial viability. If we fail to maintain clearance, de novo classification or approval to market our product candidates, including AKL-T01 for expanded indications, or if we are delayed in obtaining such marketing authorizations, our business, prospects, results of operations and financial condition could be materially and adversely affected |

| ** | Population data in table above are estimates based on our management’s good faith estimates based on various publications, public health data, national health statistics including from the NIH and CDC and partner research data. |

| • | An exclusive license from UCSF to a patent family directed to software and methods for enhancing cognition via a task performed in the presence of interferences (distractions and/or interrupters) (see “Agreements/Third Parties—UCSF Neuroracer Agreement” below for a description of this exclusive license agreement). Two U.S. patents, five Japanese patents and one Canadian patent have been allowed in this family, the patents expiring as early as 2031 (Japan and Canada) and 2032 (U.S.). Additional applications are pending in this family in Australia, Canada, and Europe. |

| • | An exclusive license from UCSF to a patent family directed to software and methods for enhancing cognition via a task with both a physical and cognitive component. One Japanese patent has been allowed in this family, expiring as early as 2035. Additional applications are pending in this family in the U.S., Australia, Canada, Europe, Hong Kong and Japan. |

| • | A patent family directed to a personalized cognitive training regimen through difficulty progression. One U.S. patent, one Japanese patent and one South Korean patent have been allowed in this family and will expire as early as 2035. Additional applications are pending in this family in Australia, Canada, Europe and Hong Kong. |

| • | A patent family directed to processor-implemented systems and methods for measuring cognitive abilities. One U.S. patent has been allowed in this family and will expire as early as 2036. Additional applications are pending in this family in Australia, Canada, Europe, Japan and South Korea. |

| • | A patent family directed to signal detection metrics in adaptive response-deadline procedures. One Chinese patent has been allowed in this family and will expire as early as 2037. Additional applications are pending in this family in the U.S., Australia, Canada, Europe, Japan and South Korea. |

| • | A patent family directed to audio-only interference training for cognitive disorder screening and treatment. One U.S. patent has been allowed in this family and will expire as early as 2039. Additional applications are pending in this family in China, Hong Kong, South Korea, Canada, Europe, Australia and Japan. |

| • | A patent family directed to facial expression detection for screening and treatment of affective disorders. One U.S. patent has been allowed in this family and will expire as early as 2039. Additional applications are pending in this family in China, Hong Kong, South Korea, Canada, Europe, Australia and Japan. |

| • | A patent family directed to a platform configured to render computerized emotional/affective elements for use as stimuli in computerized tasks. One South Korean patent and one Chinese patent have been allowed in this family and will expire as early as 2037. Additional applications are pending in this family in Australia, Canada, Europe, Japan, the U.S, and Hong Kong. |

| • | A patent family directed to a cognitive platform coupled with a physiological component. One U.S. patent, one Japanese patent, and one South Korean patent have been allowed in this family and will expire as early as 2037. Additional applications are pending in this family in Australia, Canada, China, Europe, and Hong Kong. |

| • | A pending patent family directed to a cognitive platform for deriving effort metric for optimizing cognitive treatment, with applications pending in the U.S., Canada, Europe, Australia, Japan, South Korea, China and Hong Kong. If any patents are allowed in this family, they could expire as early as 2039. |

| • | A pending patent family directed to a distributed network for the secured collection, analysis, and sharing of data across platforms, with applications pending in the U.S., Canada, Europe, Australia, Japan and China. If any patents are allowed in this family, they could expire as early as 2038. |

| • | A pending patent family directed to systems and methods for scientific evaluation of program code outputs, with applications pending in the U.S. and pursuant to the international Patent Cooperation Treaty. If any patents are allowed in this family, they could expire as early as 2040. |

| • | A pending patent family directed to systems and methods for software design control and quality assurance, with applications pending in the U.S., Taiwan, and pursuant to the international Patent Cooperation Treaty. If any patents are allowed in this family, they could expire as early as 2040. |

| • | A pending patent family directed to a system and method for adaptive configuration of computerized cognitive training programs, with an application pending in the U.S. If any patents are allowed in this family, they could expire as early as 2041. |

| • | A pending patent family directed to a method for algorithmic rendering of graphical user interface elements, with a provisional application pending in the U.S. If any patents are allowed in this family, they could expire as early as 2041. |

| • | A pending patent family directed to a method and system for determining equitable benefit in digital products and services, with a provisional application pending in the U.S. If any patents are allowed in this family, they could expire as early as 2042. |

| • | A pending patent family directed to a cognitive platform including computerized evocative elements in modes, with applications pending in the U.S., Australia, Canada, China, Europe, Hong Kong, Japan, and South Korea. If any patents are allowed in this family, they could expire as early as 2037. |

| • | A pending patent family directed to a cognitive platform including computerized elements, with applications pending in the U.S., Canada, Europe, Japan, Australia, China, and Hong Kong. If any patents are allowed in this family, they could expire as early as 2038. |

| • | A pending patent family directed to a cognitive platform for identification of biomarkers and other types of markers, with applications pending in the U.S., Europe, Canada, Australia, and Japan. If any patents are allowed in this family, they could expire as early as 2037. |

| • | A pending patent family directed to a platform for identification of biomarkers using navigation tasks and treatments using navigation tasks, with applications pending in the U.S., Australia, Canada, China, Europe, Japan, and South Korea. If any patents are allowed in this family, they could expire as early as 2037. |

| • | A pending patent family directed to cognitive screens, monitor and cognitive treatments targeting immune-mediated and neuro-degenerative disorders, with applications pending in the U.S., Taiwan, Canada, Europe, Australia, Japan, China, Hong Kong, and South Korea. If any patents are allowed in this family, they could expire as early as 2039. |

| • | the federal Anti-Kickback Statute, which prohibits, among other things, persons from knowingly and willfully soliciting, receiving, offering or paying any remuneration (including any kickback, bribe, or rebate), directly or indirectly, overtly or covertly, in cash or in kind, to induce, or in return for, either the referral of an individual, or the purchase, lease, order or recommendation of any good, facility, item or |

service for which payment may be made, in whole or in part, under a federal healthcare program, such as the Medicare and Medicaid programs. A person or entity does not need to have actual knowledge of the statute or specific intent to violate it in order to have committed a violation; |

| • | federal civil and criminal false claims laws, including the False Claims Act (“FCA”), which can be enforced through civil “qui tam” or “whistleblower” actions and civil monetary penalty laws, impose criminal and civil penalties against individuals or entities for, among other things, knowingly presenting, or causing to be presented, claims for payment or approval from Medicare, Medicaid or other federal health care programs that are false or fraudulent; knowingly making or causing a false statement material to a false or fraudulent claim or an obligation to pay money to the federal government; or knowingly concealing or knowingly and improperly avoiding or decreasing such an obligation. Manufacturers can be held liable under the FCA even when they do not submit claims directly to government payers if they are deemed to “cause” the submission of false or fraudulent claims. In addition, the government may assert that a claim including items or services resulting from a violation of the federal Anti-Kickback Statute constitutes a false or fraudulent claim for purposes of the FCA. The FCA also permits a private individual acting as a “whistleblower” to bring actions on behalf of the federal government alleging violations of the FCA and to share in the proceeds of any monetary recovery; |

| • | the federal Health Insurance Portability and Accountability Act of 1996 (“HIPAA”), which created new federal criminal statutes that prohibit knowingly and willfully executing, or attempting to execute, a scheme to defraud any healthcare benefit program or obtain, by means of false or fraudulent pretenses, representations or promises, any of the money or property owned by, or under the custody or control of, any healthcare benefit program, regardless of the payer (e.g., public or private) and knowingly and willfully falsifying, concealing or covering up by any trick or device a material fact or making any materially false statements in connection with the delivery of, or payment for, healthcare benefits, items or services relating to healthcare matters. Similar to the federal Anti-Kickback Statute, a person or entity can be found guilty of violating these statutes without actual knowledge of the statutes or specific intent to violate them in order to have committed a violation; |

| • | the federal Physician Payment Sunshine Act, created under the ACA and its implementing regulations, which require manufacturers of drugs, devices, biologicals and medical supplies for which payment is available under Medicare, Medicaid or the Children’s Health Insurance Program (with certain exceptions) to report annually to the US Department of Health and |

| • | Human Services (“HHS”) information related to payments or other transfers of value made to physicians (defined to include doctors, dentists, optometrists, podiatrists and chiropractors) and teaching hospitals, as well as ownership and investment interests held by physicians and their immediate family members. Effective January 1, 2022, these reporting obligations will extend to include payments and transfers of value made to physician assistants, nurse practitioners, clinical nurse specialists, anesthesiologist assistants, certified registered nurse anesthetists and certified nurse midwives during the previous year; |

| • | federal government price reporting laws, which require us to calculate and report complex pricing metrics in an accurate and timely manner to government programs; |

| • | federal consumer protection and unfair competition laws, which broadly regulate marketplace activities and activities that potentially harm consumers; and |

| • | analogous state and foreign laws and regulations, such as state and foreign anti-kickback, false claims, consumer protection and unfair competition laws which may apply to pharmaceutical business practices, including but not limited to, research, distribution, sales and marketing arrangements as well as submitting claims involving healthcare items or services reimbursed by any third-party payer, including commercial insurers; state laws that require pharmaceutical companies to comply with the pharmaceutical industry’s voluntary compliance guidelines and the relevant compliance guidance promulgated by the federal government that otherwise restricts payments that may be made to healthcare providers and other potential referral sources; state laws that require drug manufacturers to file reports with states regarding pricing and |

marketing information, such as the tracking and reporting of gifts, compensations and other remuneration and items of value provided to healthcare professionals and entities; and state and local laws requiring the registration of pharmaceutical sales representatives. |

| • | increased the minimum level of Medicaid rebates payable by manufacturers of brand name drugs from 15.1% to 23.1% of the average manufacturer price; |

| • | required collection of rebates for drugs paid by Medicaid managed care organizations; |

| • | required manufacturers to participate in a coverage gap discount program, under which they must agree to offer 70 percent point-of-sale |

| • | imposed a non-deductible annual fee on pharmaceutical manufacturers or importers who sell “branded prescription drugs” to specified federal government programs. |

| • | On January 2, 2013, the U.S. American Taxpayer Relief Act of 2012 was signed into law, which, among other things, further reduced Medicare payments to several types of providers. |