QUESTIONS AND ANSWERS ABOUT THE EXTRAORDINARY GENERAL MEETING

These Questions and Answers are only summaries of the matters they discuss. They do not contain all of the information that may be important to you. You should read carefully the entire proxy statement, including the annex to this proxy statement.

Why am I receiving this proxy statement?

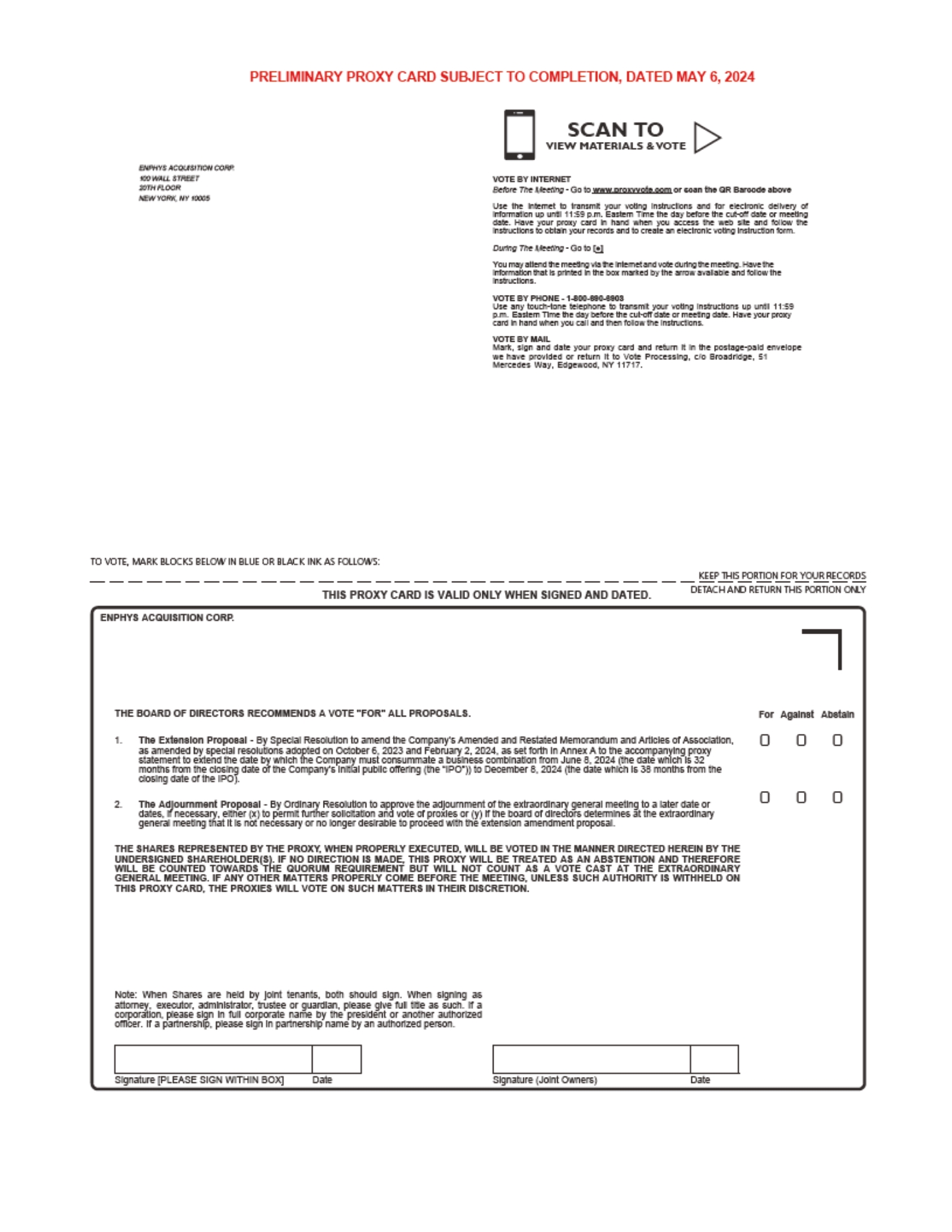

This proxy statement and the enclosed proxy card are being sent to you in connection with the solicitation of proxies by our Board for use at the Extraordinary General Meeting, or at any adjournments or postponements thereof. This proxy statement summarizes the information that you need to make an informed decision on the proposals to be considered at the Extraordinary General Meeting.

The Company is a blank check company incorporated on March 3, 2021 as a Cayman Islands exempted company, for the purpose of entering into a merger, share exchange, asset acquisition, share purchase, recapitalization, reorganization or other similar business combination with one or more businesses.

During the period from March 3, 2021 through March 4, 2021, the Sponsor received 7,187,500 Class B ordinary shares for a per share purchase price of approximately $0.003. Prior to the IPO, the Company effected a share capitalization issuing 0.2 of a share for each ordinary share in issue, resulting in the Sponsor holding an aggregate of 8,625,000 Class B ordinary shares. Prior to the IPO, our Sponsor also transferred 20,000 of its Class B ordinary shares to each of Jose Antonio Aguilar Bueno, Federico Carrillo-Zurcher, Helio L. Magalhães and Eva Redhe (the “independent directors” and, together with the Sponsor, the “initial shareholders”). Upon transfer of these 80,000 shares, the Company recorded $557,600 of share-based compensation for services provided by the independent directors. As of the date of this proxy statement, the Sponsor continues to own 4,994,800 Class A ordinary shares of the Company which are non-redeemable and 1,500,000 Class B ordinary shares and the Company’s independent directors hold in aggregate 80,000 Class A ordinary shares which are non-redeemable (such 6,574,800 shares, the “founder shares”). Prior to the close of the IPO, certain anchor investors (the “anchor investors”) received 2,050,200 Class B ordinary shares with the Company cancelling an equivalent number of shares. The anchor investors continue to hold, in the aggregate, 1,737,700 Class A ordinary shares which are non-redeemable and 312,500 Class B ordinary shares (the “anchor shares”). The founder shares and anchor shares are subject to certain lock-up restrictions. As of the date of this proxy statement, there are no agreements between the Company and the anchor investors regarding their continued ownership or the redemption of any public shares they may continue to hold or acquire, or regarding the voting of any such public shares or the anchor shares.

On October 8, 2021, the Company consummated its IPO of 34,500,000 units (the “units”), including 4,500,000 Units issued pursuant to the full exercise of the underwriters’ over-allotment option. Each unit consisted of one Class A ordinary share (the “public shares”) and one-half of one redeemable warrant (the “public warrants”), with each whole warrant entitling the holder thereof to purchase one public share for $11.50 per share. The units were sold at a price of $10.00 per unit, generating gross proceeds of $345,000,000.

Simultaneously with the closing of the IPO, the Company consummated the sale of an aggregate of 8,900,000 private placement warrants (the “private placement warrants”), at a price of $1.00 per private placement warrant in a private placement to our Sponsor, generating gross proceeds to the Company of $8,900,000. The private placement warrants are identical to the warrants sold as part of the units in the IPO, except as otherwise disclosed in the Registration Statement. As of the date of this proxy statement, the Sponsor owns an aggregate of 8,900,000 private placement warrants.

Following the closing of the IPO on October 8, 2021, an amount of approximately $345 million from the net proceeds of the sale of the units in the IPO and $6.9 million from the sale of the private placement warrants was placed in the trust account, which was invested in U.S. government securities, within the meaning set forth in Section 2(a)(16) of the Investment Company Act of 1940, as amended (“Investment Company Act”), with a maturity of 185 days or less or in money market funds meeting certain conditions under Rule 2a-7 promulgated under the Investment Company Act which invest only in direct U.S. government treasury obligations, until the earlier of: (a) the completion of our initial business combination, (b) the redemption of any public shares properly submitted in connection with a shareholder vote to approve certain amendments to our Governing Documents, including a vote to approve an extension to the Current Outside Date, and (c) the redemption of our public shares if we are unable to complete the initial business combination within the period provided in our Governing Documents. On October 10, 2023, to mitigate the risk of us being deemed to be an unregistered investment company (including under the subjective test of Section 3(a)(1)(A) of the Investment Company Act) and thus subject to regulation under the