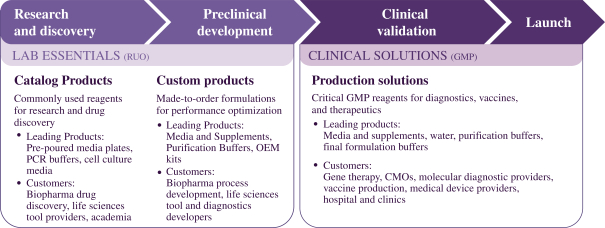

manufacture our products at our facilities in Hollister, California, which were purpose-built to address our customers’ needs for custom-made, RUO or GMP-grade input components.

For a complete description of our business, financial condition, results of operations and other important information, we refer you to our filings with the SEC that are incorporated by reference in this prospectus, including our Annual Report on Form 10-K for the year ended December 31, 2022, as amended, supplemented, or superseded from time to time by other reports we file with the SEC in the future, which are incorporated by reference into this prospectus. For instructions on how to find copies of these documents, see “Where You Can Find Additional Information”.

See the section entitled “Risk Factors” in this prospectus for a discussion of some of the risks relating to the execution of our business strategy.

Recent Developments

Concurrent Registered Direct Offering and Private Placement

On September 15, 2023, we entered into a securities purchase agreement (the “Registered Direct Purchase Agreement”) in connection with a registered direct offering (the “Registered Direct Offering”) with certain accredited investors and qualified institutional buyers. On September 15, 2023, we also entered into the Purchase Agreement and a registration rights agreement (the “Registration Rights Agreement”) in connection with a concurrent private placement (the “PIPE Private Placement”) with certain accredited investors and qualified institutional buyers.

Pursuant to the Registered Direct Purchase Agreement, we agreed to offer and sell in the Registered Direct Offering 1,086,485 shares of common stock at an offering price of $1.85.

Pursuant to the Purchase Agreement, the Company agreed to offer and sell in the PIPE Private Placement 11,299,993 shares of common stock at the same offering price of $1.85.

Our controlling stockholder, Telegraph Hill Partners Management Company LLC, through its affiliates Telegraph Hill Partners IV, L.P. and THP IV Affiliates Fund, LLC, our President and Chief Executive Officer and a member of our board of directors, Stephen Gunstream, our Chief Financial Officer, Matthew Lowell, and our General Counsel and Chief Compliance Officer, Damon Terrill, and the Mackowski Family Trust, which is affiliated with J. Matthew Mackowski, a member of our board of directors, participated in the PIPE Private Placement and purchased an aggregate of 9,054,052 shares of common stock on the same terms as the other investors.

We received aggregate gross proceeds of $22.915 million from the Registered Direct Offering and PIPE Private Placement (collectively, the “Offerings”), before deducting offering expenses payable by us.

Pursuant to the terms of the Registration Rights Agreement, we have agreed to file a registration statement with the SEC on or before October 30, 2023 to register for resale the 11,299,993 shares of common stock issued in the PIPE Private Placement. We shall use commercially reasonable efforts to cause the registration statement covering the aforementioned securities to be declared effective as promptly as possible after the filing thereof, but in any event no later than the 90th calendar day following the date of the Registration Rights Agreement (or in the event of a full review by the SEC, the 120th calendar day following the date of the Registration Rights Agreement).

The Offerings closed on September 19, 2023.

Amendments to the Amended Credit Agreement

On September 19, 2023, we entered into limited waivers and amendments (collectively “Amendment No. 4”) to (i) the May 10, 2022, Amended and Restated Credit and Security Agreement (Term Loan), as

3