Form 1-SA

SPECIAL FINANCIAL PERIODIC REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended June 30, 2021

The Holiday Lifestyle Fund 1, LLC

A Florida limited liability company

EIN: 85-4233765

The Holiday Lifestyle Fund 1 L.L.C.

169 Griffin Boulevard, Suite 106

Panama City Beach, Florida 32413

Phone: 850-235-2090

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

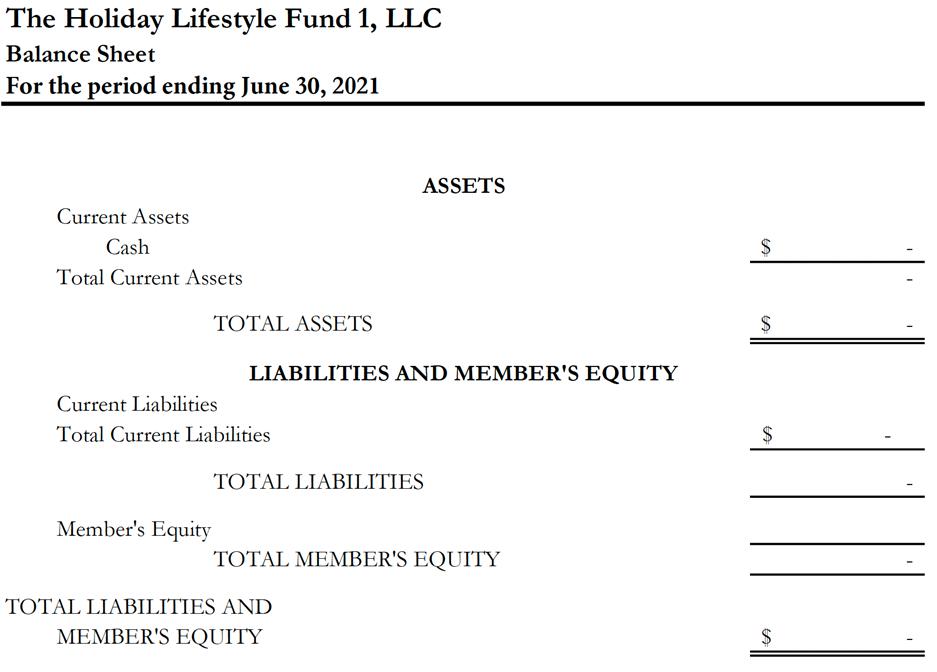

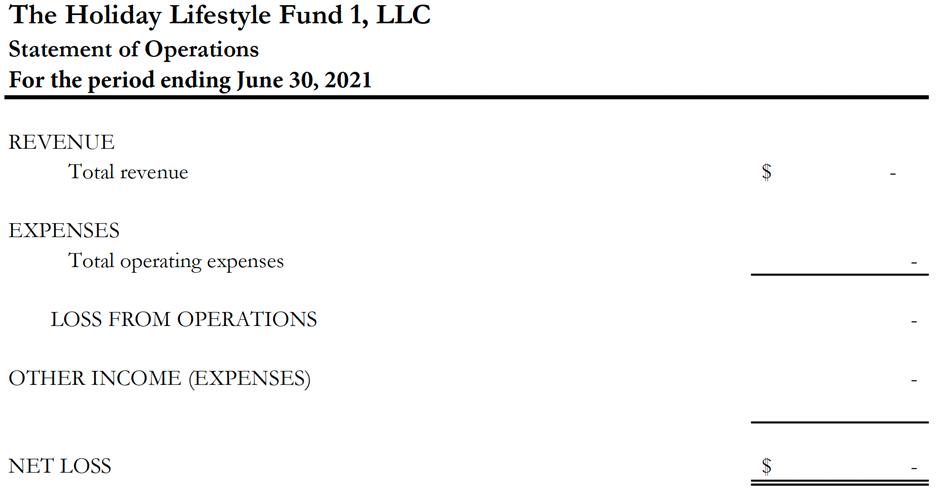

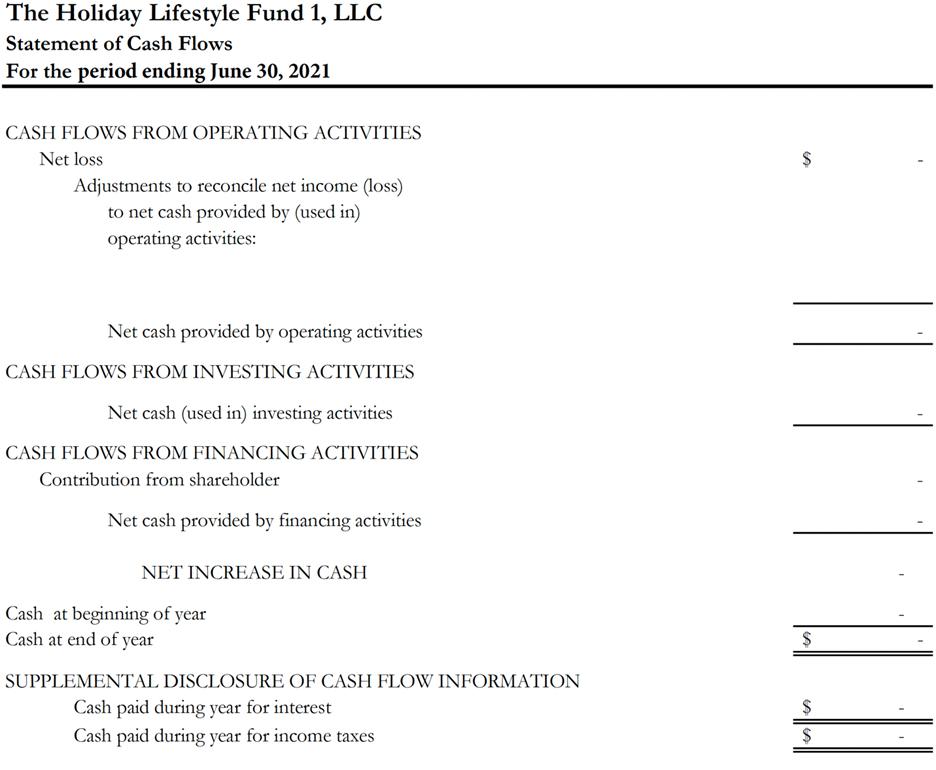

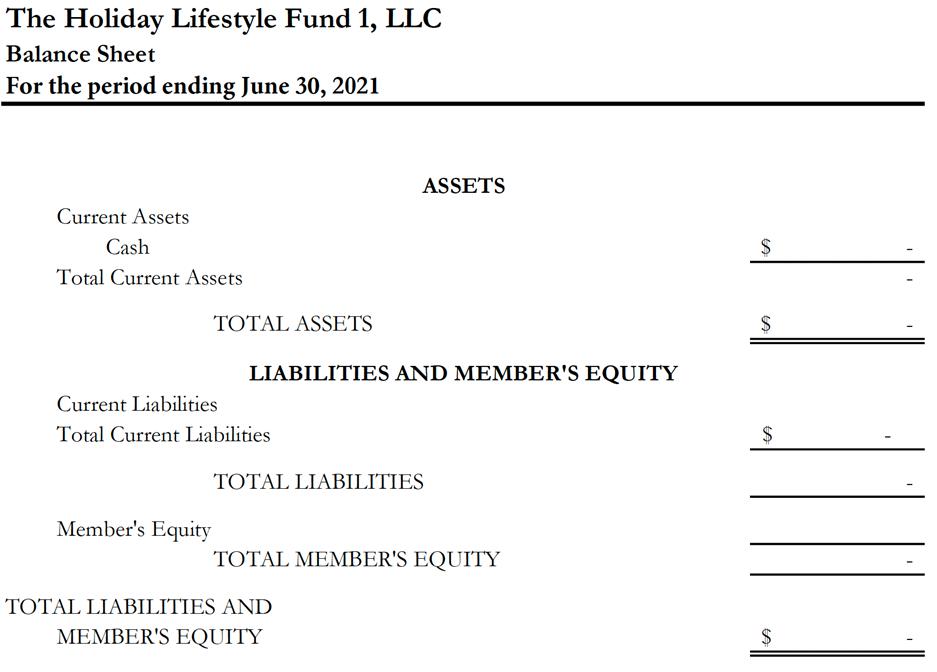

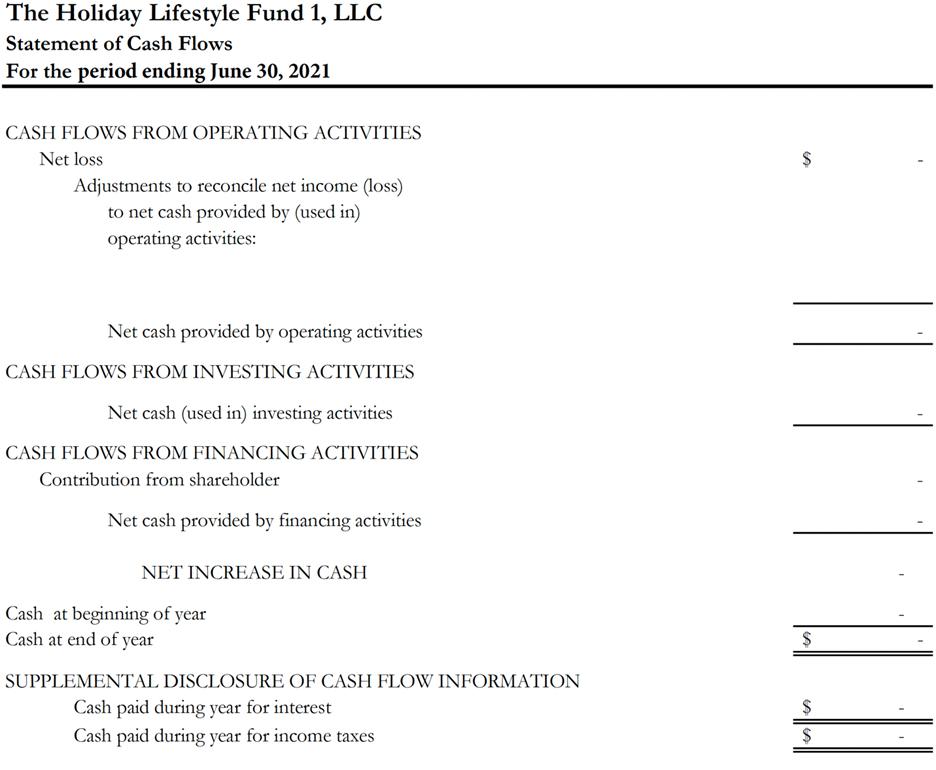

The following is a statement by the management regarding the period of January 1, 2021 through June 30, 2021. The following balance sheets were prepared by the Company.

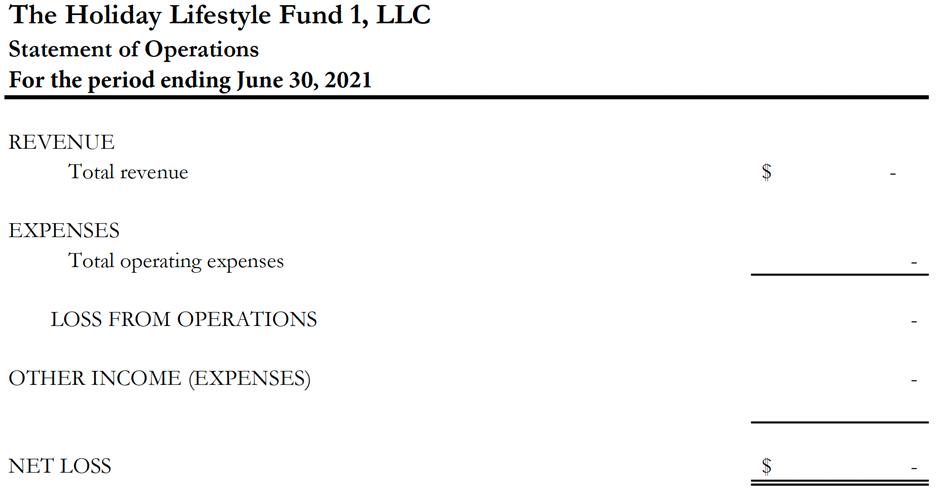

Revenue

For the period of January 1, 2021 through June 30, 2021 the Company had zero dollars ($0) in revenues because the Company had no operations during this period.

Operating Expenses

For the period of January 1, 2021 through June 30, 2021 the Company had zero dollars ($0) in Operating Expenses because the Company had no operations during this period.

| | | June 30, 2021 |

| Operating Expenses | | $ | 0 | |

General and Administrative Expense

| | | June 30, 2021 |

| General and Administrative Expenses | | $ | 0 | |

General and administrative expenses remained at zero dollars ($0) for the period because the Company had no operations during this period.

Loss from Operations

Losses from operations remained at zero dollars ($0) for the period because the Company had no operations during this period.

FINANCIAL STATEMENTS (UNAUDITED)

Notes to Financial Statements June 30, 2021

Note A – Nature of Business and Organization

The Holiday Lifestyle Fund 1, LLC (“the Company”) and was organized in November 2020 in the State of Florida. Headquartered in Panama City Beach, Florida. The Company plans to provide its Members with real estate investment opportunities. The Company will purchase real estate throughout the United States and focus its investment efforts on those properties that are income producing. As of June 30, 2021 no Units have been issued.

Note B – Significant Accounting Policies

Basis of Presentation

The financial statements are prepared in accordance with accounting principles generally accepted in the United States of America.

Cash and Cash Equivalents

The Company considers all highly liquid instruments with an original maturity of less than three months to be cash and cash equivalents. The Company places its temporary cash investments with high quality financial institutions. At times, such investments may be in excess of FDIC insurance limits. The Company does not believe it is exposed to any significant credit risk on cash and cash equivalents.

Income Taxes

The Company, with the consent of its stockholder has elected to be taxed under sections of federal and state income tax law, which provide that, in lieu of partnership income taxes, the member separately accounts for its share of the Company’s items of income, deductions, losses and credits. As a result of this election, no income taxes have been recognized in the accompanying financial statements. The Company periodically assesses whether it has incurred income tax expense or related interest or penalties in accordance for uncertain income tax positions. No such amounts were recognized.

The Company adopted the income tax standard for uncertain tax positions. As a result of this implementation, the Company evaluated its tax positions and determined that it has no uncertain tax positions as of December 31, 2020.

Use of Estimates

The preparation of financial statements in conformity with accounting principles generally accepted in the United States of America requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

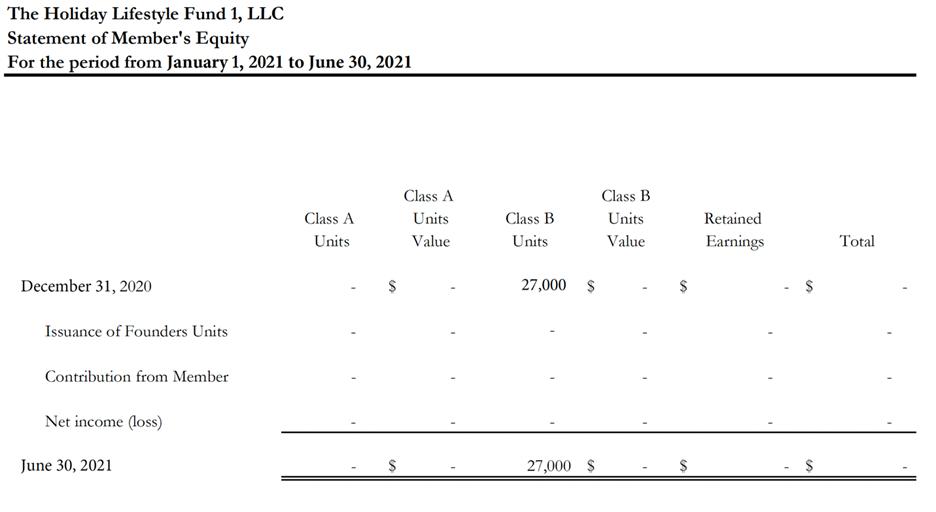

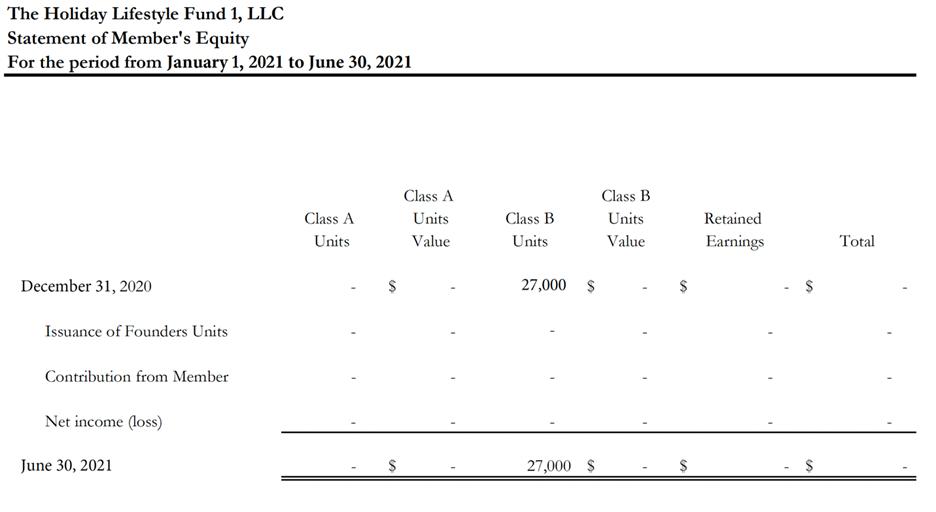

Note C – Member’s Equity

The Holiday Lifestyle Fund 1, LLC has authorized two classes of units. As of June 30, 2021, authorized and issued units were as follows:

Authorized Class A Units 50,000 Class B Units (founders shares) 27,000

Issued 27,000

Class A Units represent 65% and Class B Units represents 35% of the total interests in the Company. During the period from January 01, 2021 to June 30, 2021 the Company issued 0 units.

Note D – Commitments and Contingencies

Contingencies

Certain conditions may exist as of the date the financial statements are issued, which may result in a loss to the Company but which will only be resolved when one or more future events occur or fail to occur. The Company’s management and its legal counsel assess such contingent liabilities, and such assessment inherently involves an exercise of judgment. In assessing loss contingencies related to legal proceedings that are pending against the Company or unasserted claims that may result in such proceedings, the Company’s legal counsel evaluates the perceived merits of any legal proceedings or unasserted claims as well as the perceived merits of the amount of relief sought or expected to be sought therein.

If the assessment of a contingency indicates that it is probable that a material loss has been incurred and the amount of the liability can be estimated, then the estimated liability would be accrued in the Company’s financial statements. If the assessment indicates that a potentially material loss contingency is not probable, but is reasonably possible, or is probable but cannot be estimated, then the nature of the contingent liability, together with an estimate of the range of possible loss if determinable and material, would be disclosed.

COVID-19

Management has concluded that the ongoing COVID-19 outbreak in 2021 may have a significant impact on business in general, but the potential impact on the Company is not currently measurable. Due to the level of risk this virus has had on the global economy, it is at least reasonably possible that it could have an impact on the operations of the Company in the near term that could materially impact the Company’s financials. Management has not been able to measure the potential financial impact on the Company but will review commercial and federal financing options should the need arise.

Note E – Subsequent Events

Management has assessed subsequent events through June 30, 2021, the date on which the financial statements were available to be issued.

EXHIBITS

2.1 Articles of Organization

3.1 Operating Agreement

4.1 Subscription Agreement

15.1 Affiliates Diagram

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A and has duly caused this Offering Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the in the City of Panama City Beach, Florida on November 24, 2021.

ISSUER COMPANY LEGAL NAME AND ADDRESS:

Holiday Lifestyle Fund 1, L.L.C.

169 Griffin Boulevard, Suite 106

Panama City Beach, Florida 32413

This Offering Statement has been signed by the following persons in the capacities and on the dates indicated:

s/Robert Easter, Jr.

Robert Easter, Jr., Chief Executive Officer of the Company

(Date): November 24, 2021

Location Signed: City of Panama City Beach, Florida

This Offering Statement has been signed by the following Directors in the capacities and on the dates indicated.

s/Robert Easter, Jr.

Robert Easter, Jr., Chief Executive Officer of the Manager

(Date): November 24, 2021

Location Signed: City of Panama City Beach, Florida