Investor Presentation October 2024 OTC: CYRB Sustainably Produced Helium and CO2

Disclaimer Forward Looking Statements This presentation of Proton Green (or the “Company”) contains forward-looking statements within the meaning of the federal securities laws. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, and goals, assumption of future events or performance are not statements of historical fact and may be deemed “forward-looking statements.” Forward-looking statements can often be identified by the use of words such as “may,” “will,” “estimate,”“intend,” “continue,” “believe,” “expect,” “plan,” “propose,” “projected,” “seek,” or “anticipate,” although not all forward-looking statements contain these or other identifying words. Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Such forward-looking statements relate to, among other things: expected revenue, cash flow and earnings growth; estimates regarding natural resource reserves, future natural resource prices and present values of such reserves; strategies and timelines for growth of the Company’s business; and projected capital expenditures. These statements are qualified by important factors that could cause the Company’s actual results to differ materially from those reflected by the forward-looking statements. Such factors include, but are not limited to: the Company’s ability to locate and acquire suitable interests in natural resource properties on terms acceptable to the Company; the Company’s ability to obtain working capital as and when needed on terms acceptable to the Company; the ability to integrate, manage and operate acquired natural resource properties; the ability of the Company to build and maintain a successful operations infrastructure and to retain key personnel; possible insufficient cash flows and resulting illiquidity; government regulations; lack of diversification; political risk, international instability and the related volatility in the prices of natural resources; increased competition; stock volatility and illiquidity; the Company’s potential failure or inability to implement fully its business plans or strategies; general economic conditions; and the risks and factors described from time to time in the Company’s offerings, reports and filings with the U.S. Securities and Exchange Commission (the “SEC”). The Company cautions readers not to place undue reliance on any forward-looking statements. TheCompany does not undertake, and specifically disclaims any obligation, to update or revise such statements to reflect new circumstances or unanticipated events as they occur.The information contained in this presentation is provided by the Company for informational purposes only and does not constitute an offer to buy or an invitation to sell securities of Proton Green or other financial products. The information contained herein is not investment or financial product advice and is not intended to be used as the basis for making an investment decision. The views, opinions and advice provided in this presentation reflect those of the individual presenters and are provided for information purposes only. The presentation has been prepared without taking into account the investment objectives, financial situation or particular needs of any particular person. No representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions in this presentation. To the maximum extent permitted by law, neither the Company nor any of its respective directors, officers, employees or agents, nor any other person accepts any liability, including, without limitation, any liability arising out of fault or negligence, for any loss arising from the use of the information contained in this presentation.

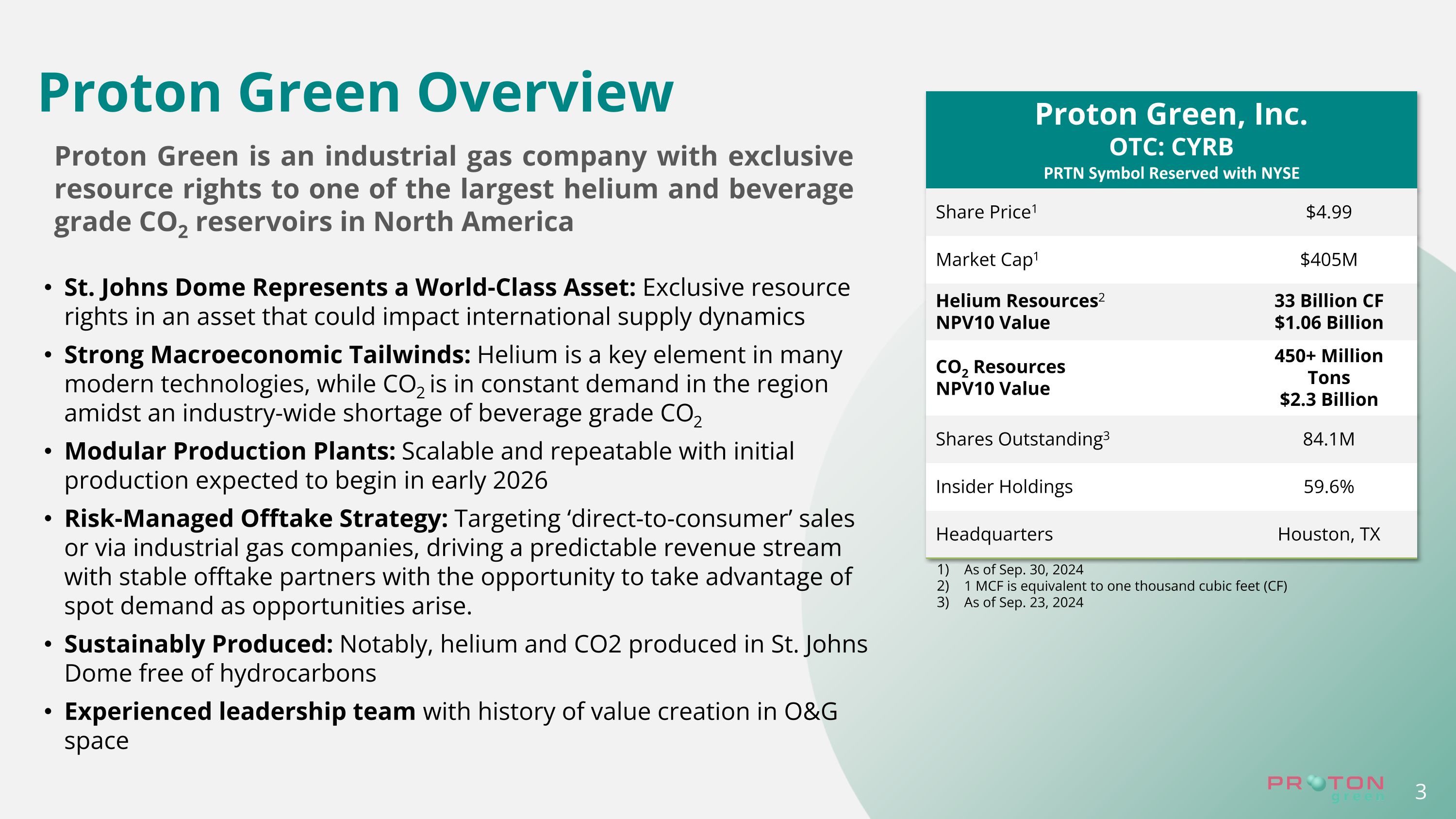

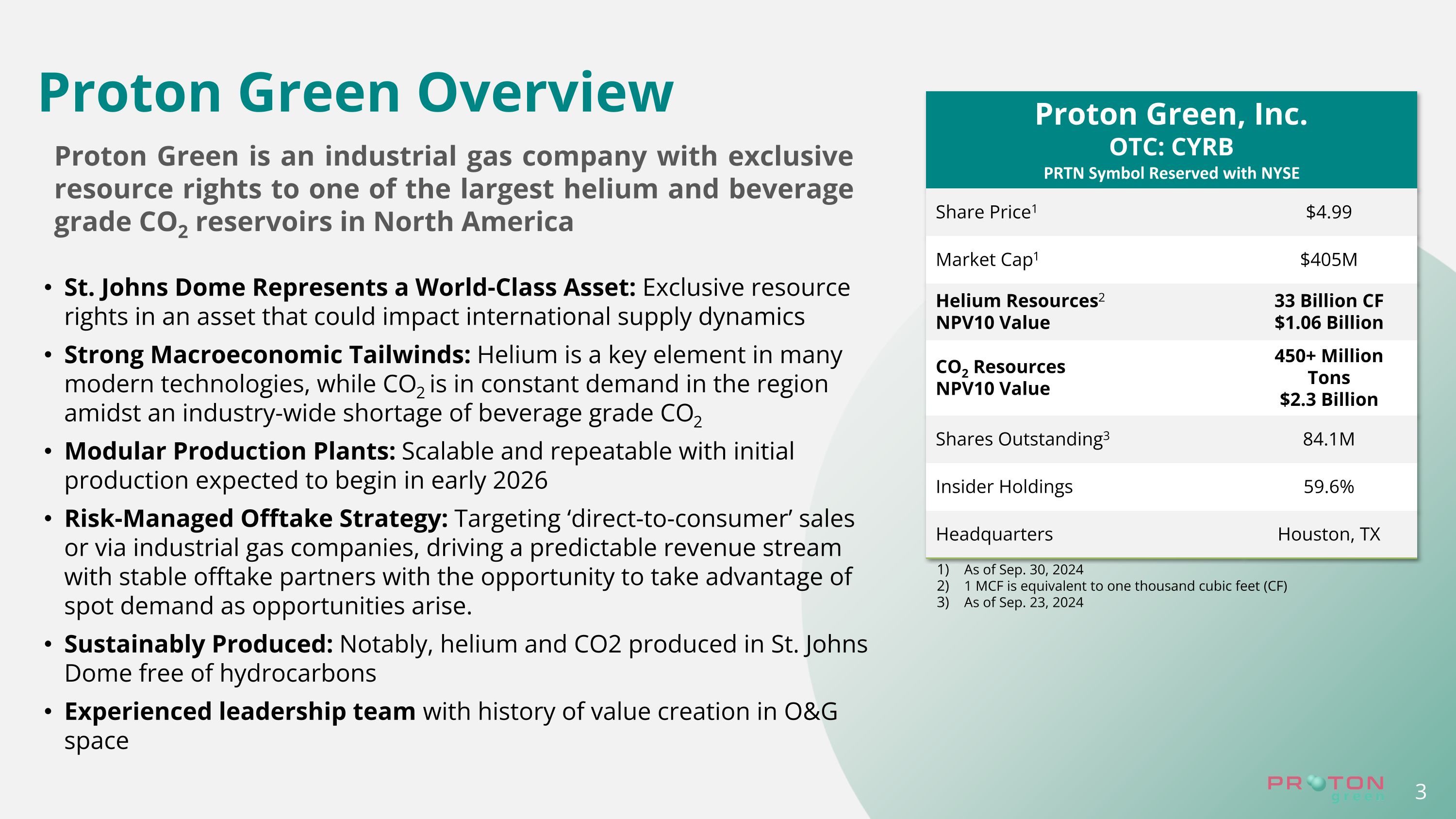

Proton Green Overview Proton Green is an industrial gas company with exclusive resource rights to one of the largest helium and beverage grade CO2 reservoirs in North America 3 St. Johns Dome Represents a World-Class Asset: Exclusive resource rights in an asset that could impact international supply dynamics Strong Macroeconomic Tailwinds: Helium is a key element in many modern technologies, while CO2 is in constant demand in the region amidst an industry-wide shortage of beverage grade CO2 Modular Production Plants: Scalable and repeatable with initial production expected to begin in early 2026 Risk-Managed Offtake Strategy: Targeting ‘direct-to-consumer’ sales or via industrial gas companies, driving a predictable revenue stream with stable offtake partners with the opportunity to take advantage of spot demand as opportunities arise. Sustainably Produced: Notably, helium and CO2 produced in St. Johns Dome free of hydrocarbons Experienced leadership team with history of value creation in O&G space Proton Green, Inc. OTC: CYRB PRTN Symbol Reserved with NYSE Share Price1 $4.99 Market Cap1 $405M Helium Resources2�NPV10 Value 33 Billion CF�$1.06 Billion CO2 Resources �NPV10 Value 450+ Million Tons�$2.3 Billion Shares Outstanding3 84.1M Insider Holdings 59.6% Headquarters Houston, TX As of Sep. 30, 2024 1 MCF is equivalent to one thousand cubic feet (CF) As of Sep. 23, 2024

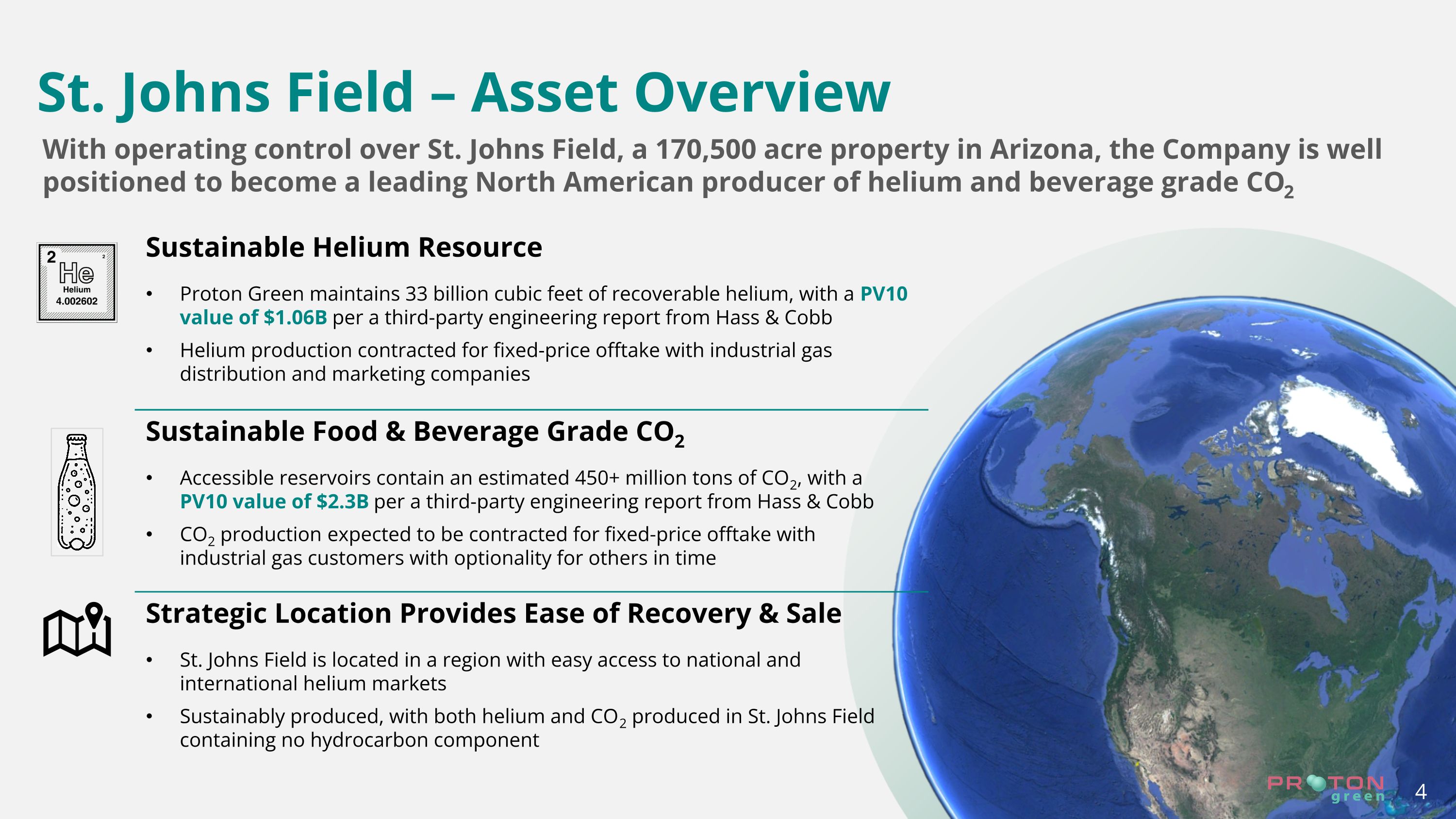

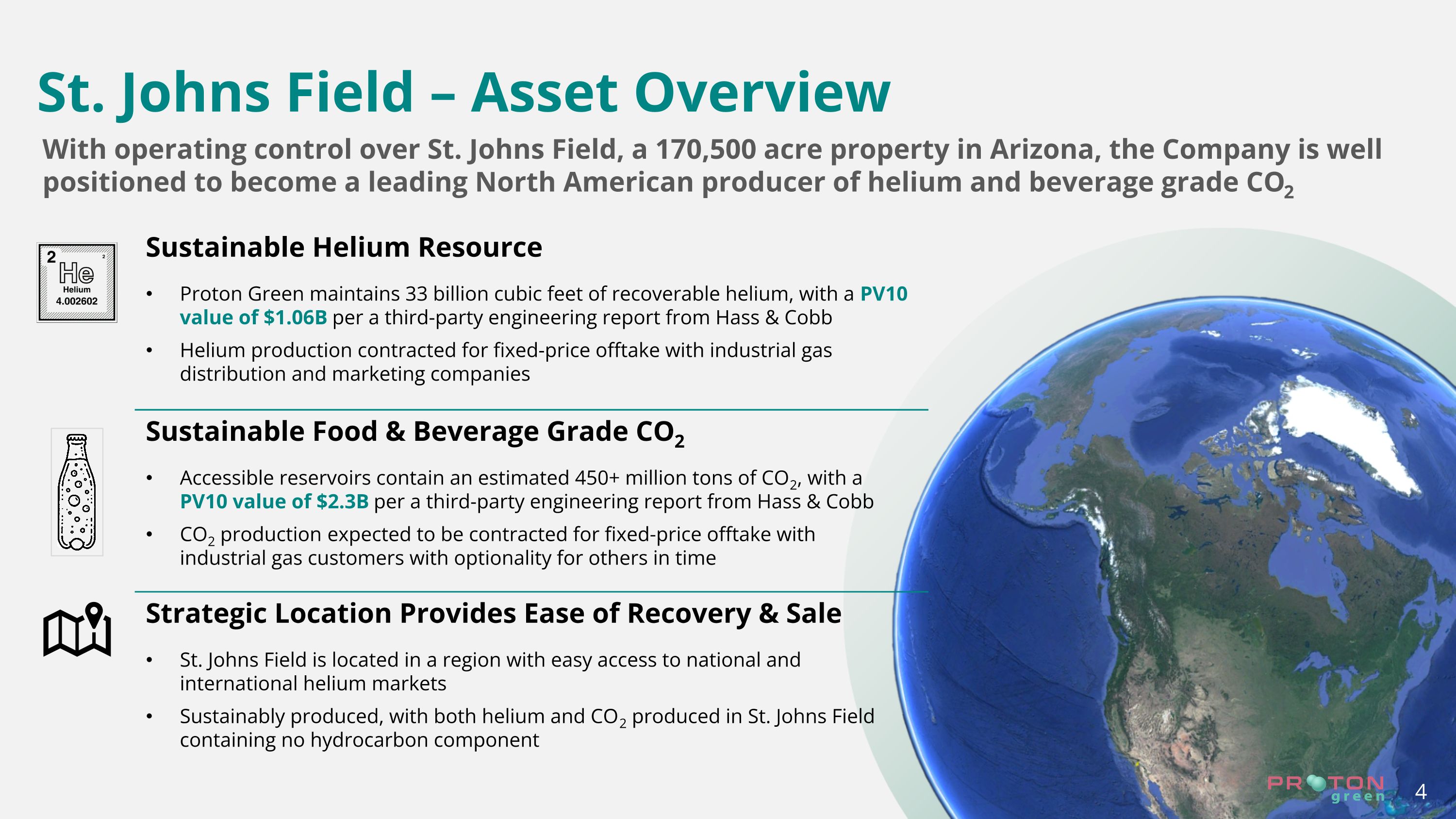

4 St. Johns Field – Asset Overview With operating control over St. Johns Field, a 170,500 acre property in Arizona, the Company is well positioned to become a leading North American producer of helium and beverage grade CO2 Sustainable Helium Resource Proton Green maintains 33 billion cubic feet of recoverable helium, with a PV10 value of $1.06B per a third-party engineering report from Hass & Cobb Helium production contracted for fixed-price offtake with industrial gas distribution and marketing companies Sustainable Food & Beverage Grade CO2 Accessible reservoirs contain an estimated 450+ million tons of CO2, with a �PV10 value of $2.3B per a third-party engineering report from Hass & Cobb CO2 production expected to be contracted for fixed-price offtake with �industrial gas customers with optionality for others in time Strategic Location Provides Ease of Recovery & Sale St. Johns Field is located in a region with easy access to national and international helium markets Sustainably produced, with both helium and CO2 produced in St. Johns Field containing no hydrocarbon component

Helium & CO2 �Market Overview 5

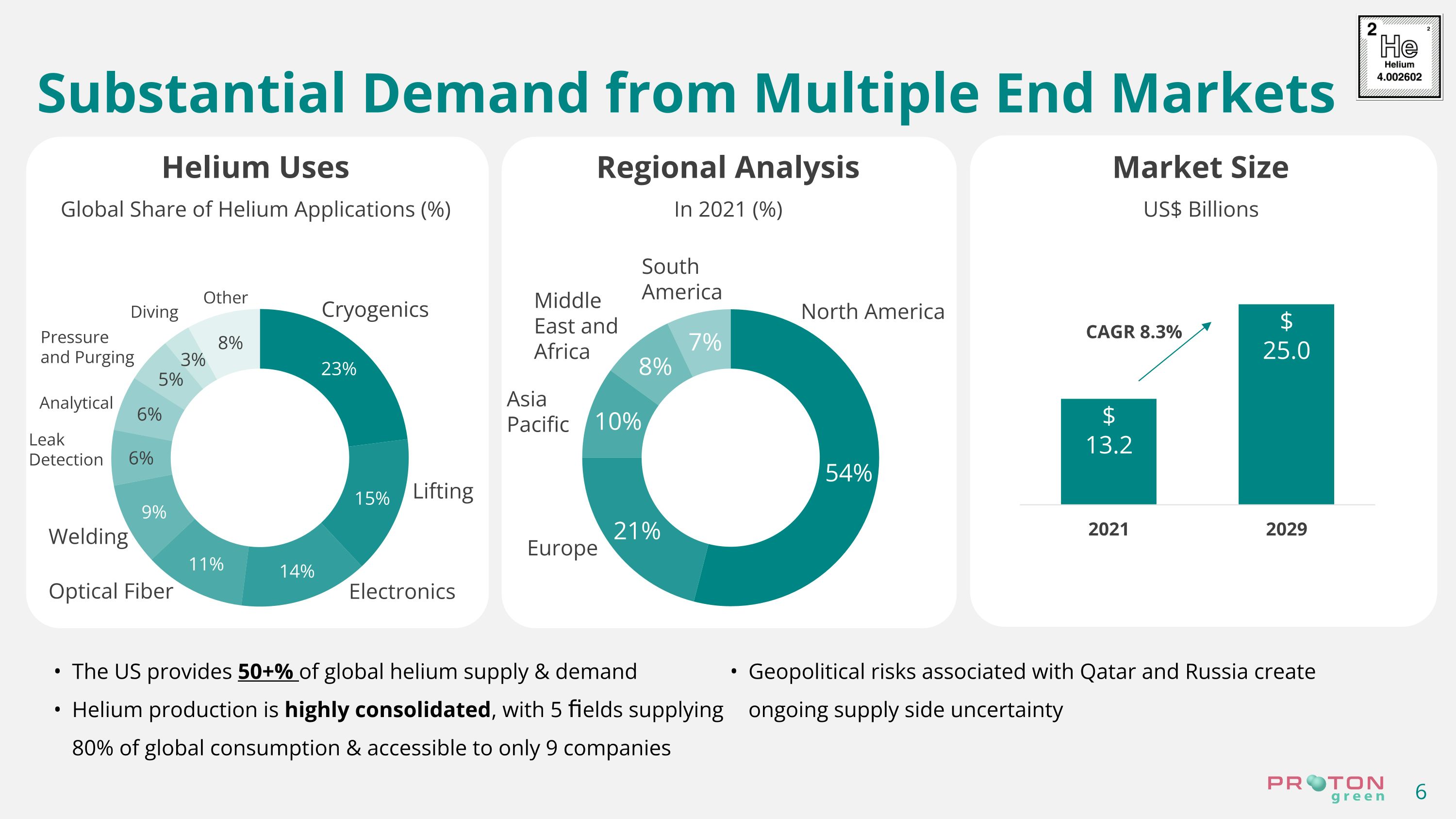

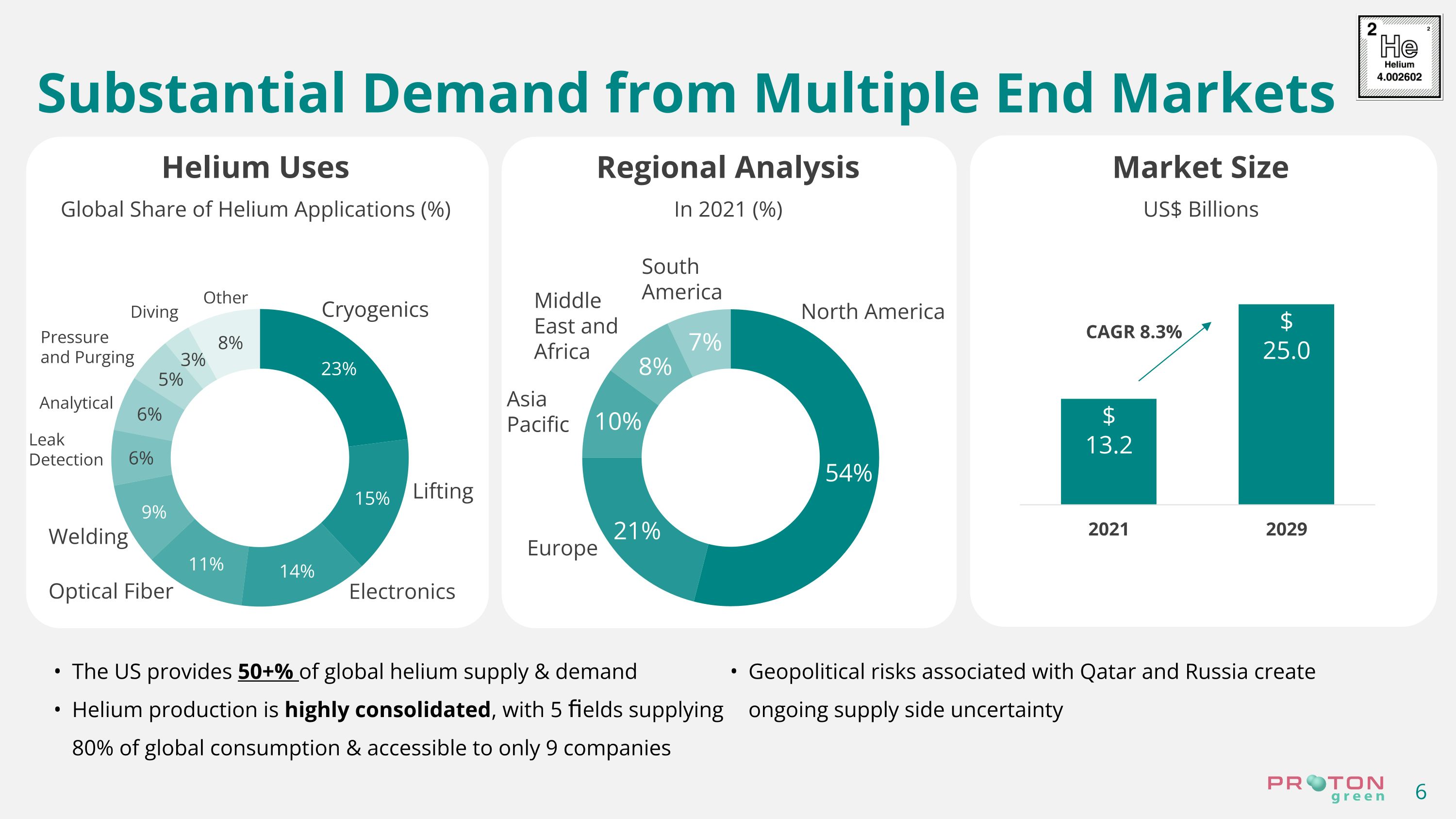

Substantial Demand from Multiple End Markets The US provides 50+% of global helium supply & demand Helium production is highly consolidated, with 5 fields supplying 80% of global consumption & accessible to only 9 companies Geopolitical risks associated with Qatar and Russia create ongoing supply side uncertainty CAGR 8.3% Helium Uses Regional Analysis Market Size Global Share of Helium Applications (%) In 2021 (%) US$ Billions North America Europe Asia Pacific Middle East and Africa South America Cryogenics Lifting Electronics Optical Fiber Welding Leak Detection Analytical Pressure and Purging Diving Other

State of F&B Grade CO2 Supply in the United States CO2 Supply Disruptions Expected Association News Aug 5, 2024 Supermarket shelves depleted of soft drink amid low supply of CO2 By Sue Daniel Feb 29, 2024 There’s a Carbon Dioxide Shortage, and Food and Drink Makers are Scrambling By Jesse Newman Aug. 26, 2022 CO2 Shortages: How did we get here? Molly Burgess Jul 31, 2024 What’s Causing the CO2 Shortage and How to Remedy It By John Bell Jan 17, 2023 U.S. CO2 Shortages due to gas contamination and supply chain disruptions have left an in-demand market ripe for new suppliers Jackson Dome, a major source of natural CO2, began producing contaminated gas in 2022 and additional infrastructure is required to bring the gas back to food and beverage grade

Our Approach to Production

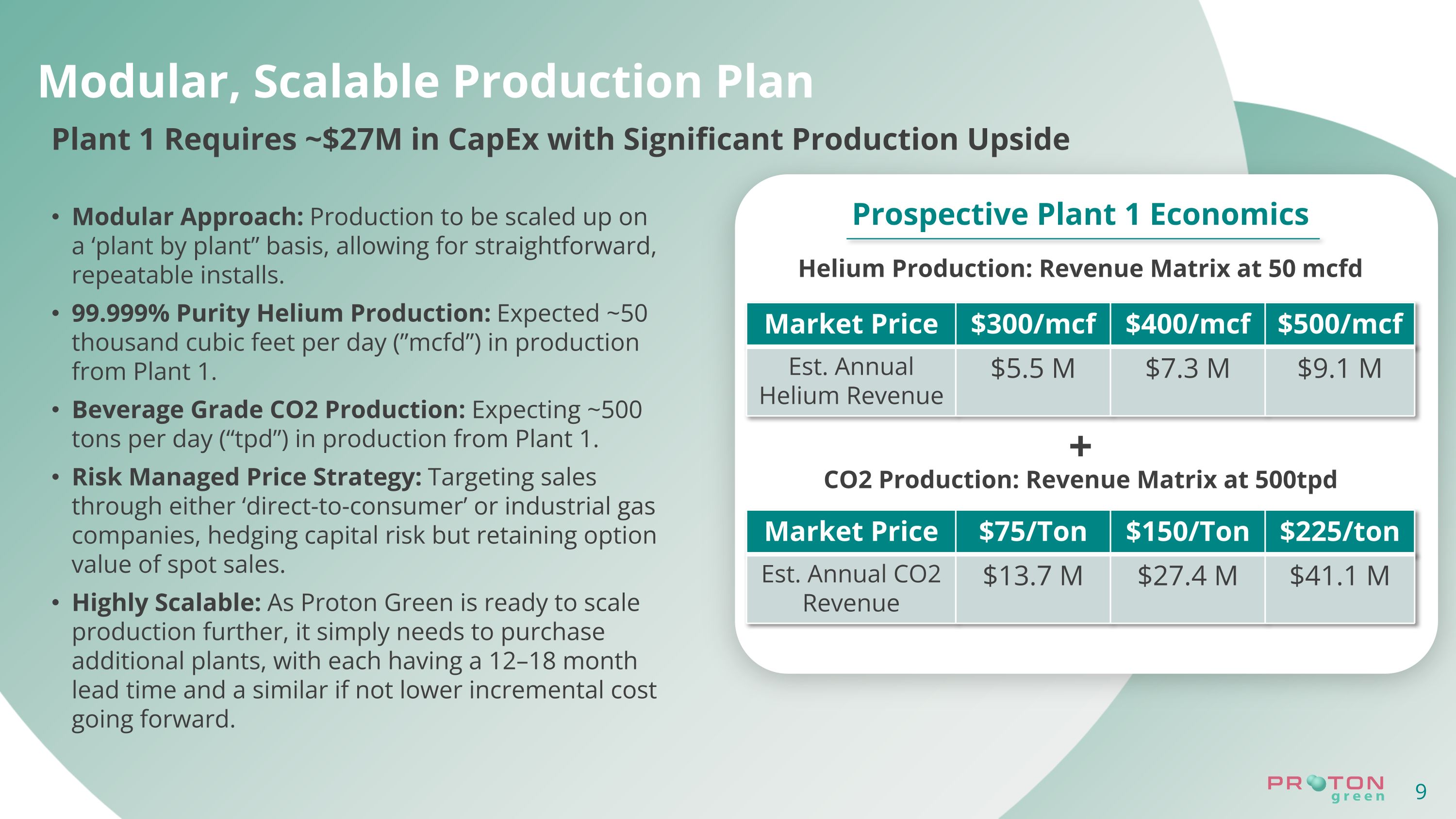

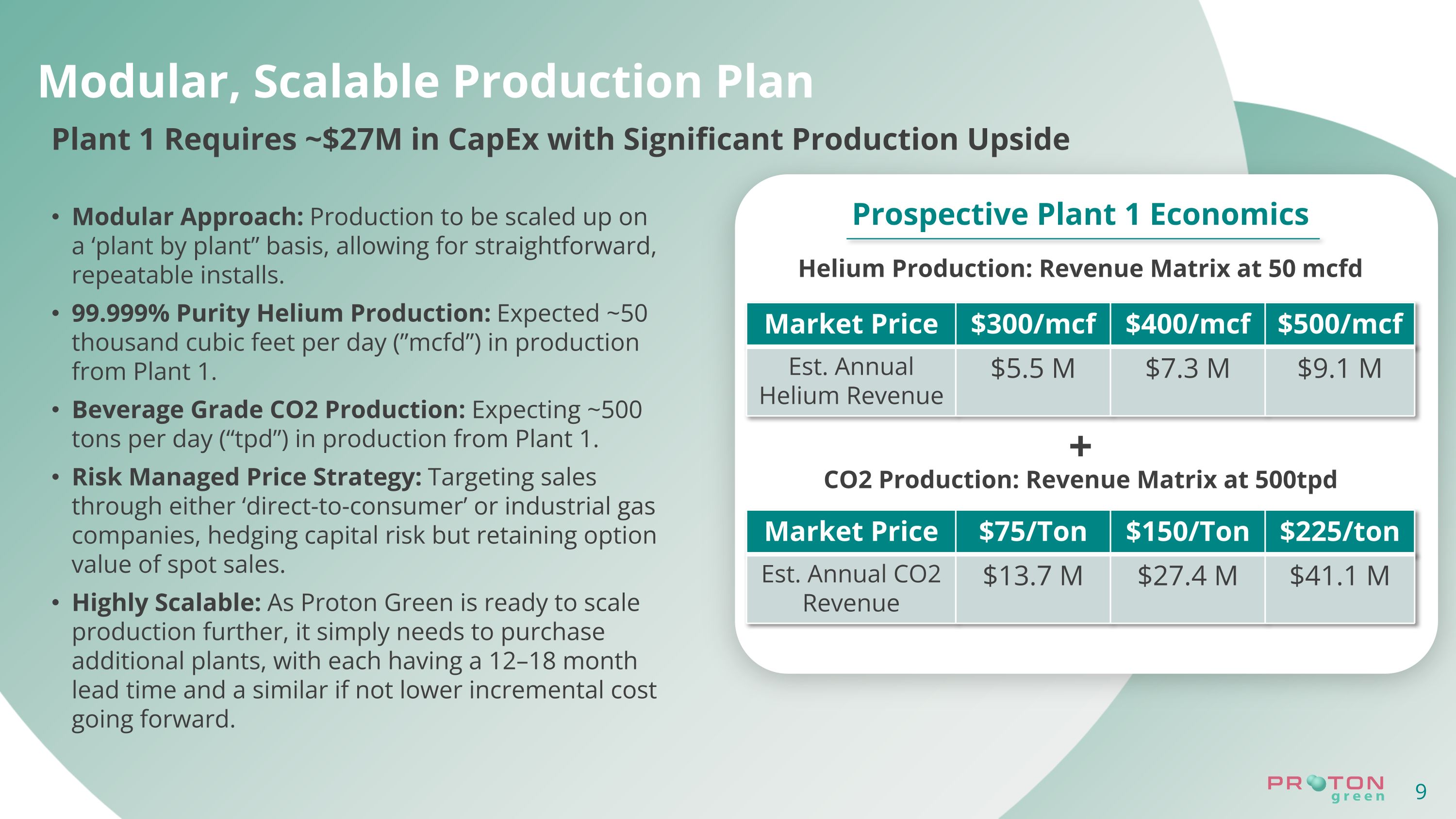

Modular, Scalable Production Plan Plant 1 Requires ~$27M in CapEx with Significant Production Upside Modular Approach: Production to be scaled up on a ‘plant by plant” basis, allowing for straightforward, repeatable installs. 99.999% Purity Helium Production: Expected ~50 thousand cubic feet per day (”mcfd”) in production from Plant 1. Beverage Grade CO2 Production: Expecting ~500 tons per day (“tpd”) in production from Plant 1. Risk Managed Price Strategy: Targeting sales through either ‘direct-to-consumer’ or industrial gas companies, hedging capital risk but retaining option value of spot sales. Highly Scalable: As Proton Green is ready to scale production further, it simply needs to purchase additional plants, with each having a 12–18 month lead time and a similar if not lower incremental cost going forward. Market Price $300/mcf $400/mcf $500/mcf Est. Annual Helium Revenue $5.5 M $7.3 M $9.1 M Market Price $75/Ton $150/Ton $225/ton Est. Annual CO2 Revenue $13.7 M $27.4 M $41.1 M Helium Production: Revenue Matrix at 50 mcfd CO2 Production: Revenue Matrix at 500tpd + Prospective Plant 1 Economics

Experienced Leadership Team David Hobbs Steven Looper John Mark Coates Kenneth Winters Executive Chairman Chief Executive Officer Chief Technology Officer Chief Financial Officer Mr. Hobbs is an expert in energy industry structure and strategies with nearly 40 years of experience. Executive Chairman of Pantheon Resources Plc Former Head of Research at KAPSARC where he established a world leading think tank in Saudi Arabia. Chief Energy Strategist at IHS (Now S&P Global) and Co-Chair of CERAWEEK providing insights to governments and energy companies around the world Former Head of Business Development with Monument Oil & Gas as well as managed North American and Asian businesses of Hardy Oil & Gas. Mr. Looper has been an independent oil and gas producer since 1982. Experience drilling and operating wells in Colorado, Kentucky, Louisiana, New Mexico, Oklahoma, Texas and Wyoming. Project management in Botswana, Canada, South Africa and Zimbabwe. Since 1993, Mr. Looper has been focused on the development of large resource plays in West Texas at Riata Energy, Inc. and most recently in the Barnett Shale trend where his capital providers achieved >100% rates of return. Mr. Coates is an experienced oil and gas professional with a career emphasis on large scale unconventional resource development. Joined MCN Corp (now DTE Energy) in a senior management role to successfully develop a multi-TCF natural gas reserve base in the US. Cofounded Patrick Energy, an E&P company, with funding from a family office that led to a series of privately funded companies being built and sold over the past twenty years. Mr. Winters has over 16 years of public company accounting experience, with a heavy focus in the oil and gas and renewable energy industry. Previously served as the Corporate Controller of Rosehill Operating Company, VP of Accounting for Alert Logic, Corporate Controller and Financial Reporting Manager for KiOR, Inc., and worked in the audit practice for Deloitte and Touche. Holds a Master of Professional Accountancy and a Bachelor of Business Administration from Stephen F. Austin State University.

Key Takeaways St. Johns Dome Represents a World-Class Asset: Exclusive resource rights in an asset that could impact international supply dynamics Strong Macroeconomic Tailwinds: Helium is a key element in many modern technologies, while CO2 is in constant demand in the region amidst an industry-wide shortage of beverage grade CO2 Modular Production Plants: Scalable and repeatable with initial production expected to begin in early 2026 Risk-Managed Offtake Strategy: Targeting ‘direct-to-consumer’ �sales or via industrial gas companies, driving a predictable �revenue stream with stable offtake partners with the opportunity �to take advantage of spot demand as opportunities arise. Sustainably Produced: Notably, helium and CO2 produced�in St. Johns Dome are free of hydrocarbons Experienced leadership team with history of value �creation in O&G space

Investor Relations�Lucas A. Zimmerman�Managing Director MZ Group – MZ North America 949-259-4987 PRTN@mzgroup.us Contact www.protongreen.com Sustainably Produced Helium and CO2