UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23648

PIMCO Flexible Emerging Markets Income Fund

(Exact name of registrant as specified in charter)

1633 Broadway, New York, NY 10019

(Address of principal executive offices)

Bijal Y. Parikh

Treasurer (Principal Financial & Accounting Officer)

650 Newport Center Drive, Newport Beach, CA 92660

(Name and address of agent for service)

Copies to:

David C. Sullivan

Ropes & Gray LLP

Prudential Tower

800 Boylston Street

Boston, MA 02199

Registrant’s telephone number, including area code: (844) 337-4626

Date of fiscal year end: June 30

Date of reporting period: June 30, 2024

Form N-CSR is to be used by management investment companies to file reports with the Commission not later than 10 days after the transmission to stockholders of any report that is required to be transmitted to stockholders under Rule 30e-1 under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may use the information provided on Form N-CSR in its regulatory, disclosure review, inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR, and the Commission will make this information public. A registrant is not required to respond to the collection of information contained in Form N-CSR unless the Form displays a currently valid Office of Management and Budget (“OMB”) control number. Please direct comments concerning the accuracy of the information collection burden estimate and any suggestions for reducing the burden to Secretary, Securities and Exchange Commission, 100 F Street, NE, Washington, DC 20549-1090. The OMB has reviewed this collection of information under the clearance requirements of 44 U.S.C. § 3507.

| Item 1. | Reports to Shareholders. |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

PIMCO INTERVAL FUNDS

Annual Report

June 30, 2024

PIMCO Flexible Emerging Markets Income Fund

PIMCO Flexible Credit Income Fund

Table of Contents

| | (1) | Consolidated Schedule of Investments. |

Important Information About the Funds

Information regarding each Fund’s principal investment strategies, principal risks and risk management strategies, the effects of each Fund’s leverage, and each Fund’s fundamental investment restrictions, including a summary of certain changes thereto during the most recent fiscal year, can be found within the relevant sections of this report. Please refer to the Table of Contents for further information.

We believe that bond funds have an important role to play in a well-diversified investment portfolio. It is important to note, however, that in an environment where interest rates may trend upward, rising rates would negatively impact the performance of most bond funds, and fixed-income securities and other instruments held by a Fund are likely to decrease in value. A wide variety of factors can cause interest rates or yields of U.S. Treasury securities (or yields of other types of bonds) to rise (e.g., central bank monetary policies, inflation rates, general economic conditions, etc.). In addition, changes in interest rates can be sudden and unpredictable, and there is no guarantee that Fund management will anticipate such movement accurately. A Fund may lose money as a result of movements in interest rates.

As of the date of this report, interest rates in the United States and many parts of the world, including certain European countries, remain high. In efforts to combat inflation, the U.S. Federal Reserve (the “Fed”) raised interest rates multiple times in 2022 and 2023. In the second half of 2023 and the beginning of 2024, however, the Fed paused the rate hikes, keeping interest rates steady. It is uncertain whether rates will remain steady, increase or decrease in the future. As such, the Funds may face a heightened level of risk associated with rising interest rates and/or bond yields. This could be driven by a variety of factors, including but not limited to central bank monetary policies, changing inflation or real growth rates, general economic conditions, increasing bond issuances or reduced market demand for low yielding investments. Further, while bond markets have steadily grown over the past three decades, dealer inventories of corporate bonds are near historic lows in relation to market size. As a result, there has been a significant reduction in the ability of dealers to “make markets.”

Bond funds and individual bonds with a longer duration (a measure used to determine the sensitivity of a security’s price to changes in interest rates) tend to be more sensitive to changes in interest rates, usually making them more volatile than securities or funds with shorter durations. All of the factors mentioned above, individually or collectively, could lead to increased volatility and/or lower liquidity in the fixed income markets, or negatively impact a Fund’s performance or cause a Fund to incur losses.

Classifications of the Funds’ portfolio holdings in this report are made according to financial reporting standards. The classification of a particular portfolio holding as shown in the Allocation Breakdown and Schedule of Investments or Consolidated Schedule of Investments, as applicable, and other sections of this report may differ from the classification used for the Funds’ compliance calculations, including those used in the Funds’ then-current prospectus, investment objectives, regulatory, and other investment limitations and policies, which may be based on different asset class, sector or geographical classifications. Each Fund is separately monitored for compliance with respect to investment parameters and regulatory requirements.

The geographical classification of foreign (non-U.S.) securities in this report, if any, are classified by the country of incorporation of a holding. In certain instances, a security’s country of incorporation may be different from its country of economic exposure.

In February 2022, Russia launched an invasion of Ukraine. As a result, Russia and other countries, persons and entities that provided material aid to Russia’s aggression against Ukraine have been the subject of economic sanctions and import and export controls imposed by countries throughout the world, including the United States. Such measures have had and may continue to have an adverse effect on the Russian, Belarusian and other securities and economies, which may, in turn, negatively impact a Fund. The extent, duration and impact of Russia’s military action in Ukraine, related sanctions and retaliatory actions are difficult to ascertain, but could be significant and have severe adverse effects on the region, including significant adverse effects on the regional, European and global economies and the markets for certain securities and commodities, such as oil and natural gas, as well as other sectors. Further, a Fund may have investments in securities and instruments that are economically tied to the region and may have been negatively impacted by the sanctions and counter-sanctions by Russia, including declines in value and reductions in liquidity. The sanctions may cause a Fund to sell portfolio holdings at a disadvantageous time or price or to continue to hold investments that a Fund may no longer seek to hold. PIMCO will continue to actively manage these positions in the best interests of a Fund and its shareholders.

The Funds may invest in certain instruments that rely in some fashion upon the London Interbank Offered Rate (“LIBOR”). LIBOR was traditionally an average interest rate, determined by the ICE Benchmark Administration, that banks charge one another for the use of short-term money. The United Kingdom’s Financial Conduct Authority, which regulates LIBOR, has announced plans to ultimately phase out the use of LIBOR. Although the transition process away from LIBOR for many instruments has been completed, some LIBOR use is continuing and there are potential effects related to the transition away from LIBOR or continued use of LIBOR on a Fund, or on certain instruments in which a Fund invests, which can be difficult to ascertain, and may vary depending on factors that include, but are not limited to: (i) existing fallback or termination provisions in individual contracts and (ii) whether, how, and when industry participants adopt new reference rates for affected instruments. The transition of investments from LIBOR to a replacement rate as a result of amendment, application of existing fallbacks, statutory requirements or otherwise may also result in a reduction in the value of certain instruments held by a Fund or a reduction in the effectiveness of related Fund transactions such as hedges. In addition, an instrument’s transition to a replacement rate could result in variations in the reported yields of a Fund that holds such instrument. Any such effects of the transition away from LIBOR, as well as other unforeseen effects, could result in losses to a Fund.

U.S. and global markets have experienced increased volatility, including as a result of the failures of certain U.S. and non-U.S. banks in 2023, which could be harmful to the Funds and issuers in which they invest. For example, if a bank at which a Fund or issuer has an account fails, any cash or other assets in bank or custody accounts, which may be substantial in size, could be temporarily inaccessible or permanently lost by the Fund or issuer. If a bank that provides a subscription line credit facility, asset-based facility, other credit facility and/or other services to an issuer or to a fund fails, the issuer or fund could be unable to draw funds under its credit facilities or obtain replacement credit facilities or other services from other lending institutions with similar terms.

Issuers in which a Fund may invest can be affected by volatility in the banking sector. Even if banks used by issuers in which the Funds invest remain solvent, volatility in the banking sector could contribute to, cause or intensify an economic recession, increase the costs of capital and banking services or result in the issuers being unable to obtain or refinance indebtedness at all or on as

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 3 | |

Important Information About the Funds (Cont.)

favorable terms as could otherwise have been obtained. Potential impacts to funds and issuers resulting from changes in the banking sector, market conditions and potential legislative or regulatory responses are uncertain. Such conditions and responses, as well as a changing interest rate environment, can contribute to decreased market liquidity and erode the value of certain holdings, including those of U.S. and non-U.S. banks. Continued market volatility and uncertainty and/or a downturn in market and economic and financial conditions, as a result of developments in the banking sector or otherwise (including as a result of delayed access to cash or credit facilities), could have an adverse impact on the Funds and issuers in which they invest.

The Funds may make investments in debt instruments and other securities or instruments directly or through one or more direct or indirect fully-owned subsidiaries formed by the Fund (each, a “Subsidiary”). A Subsidiary may invest, for example, in whole loans or in shares, certificates, notes or other securities representing the right to receive principal and interest payments due on fractions of whole loans or pools of whole loans, or any other security or other instrument that the Fund may hold directly.

On each Fund Summary page in this Shareholder Report, the Average Annual Total Return table measures performance assuming that any dividend and capital gain distributions were reinvested. Total return is calculated by determining the percentage change in NAV in the specific period. Returns do not reflect the deduction of taxes that a shareholder would pay on (i) Fund distributions or (ii) the sale of Fund shares. Total return for a period of more than one year represents the average annual total return. Performance shown is net of fees and expenses. Historical performance for a Fund or share class thereof may have been positively impacted by fee waivers or expense limitations in place during some or all of the periods shown, if applicable. Future performance (including total return or yield) and distributions may be negatively impacted by the expiration or reduction of any such fee waivers or expense limitations.

The dividend rate that a Fund pays on its common shares may vary as portfolio and market conditions change, and will depend on a number of factors, including without limit the amount of the Fund’s undistributed net investment income and net short- and long-term capital gains, as well as the costs of any leverage obtained by a Fund. As portfolio and market conditions change, the rate of distributions on the common shares and a Fund’s dividend policy could change. There can be no assurance that a change in market conditions or other factors will not result in a change in a Fund’s distribution rate or that the rate will be sustainable in the future.

The following table discloses the inception dates and diversification status of the Funds:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Fund Name | | | | | Fund

Inception | | | Institutional

Class | | | Class A-1 | | | Class A-2 | | | Class A-3 | | | Class A-4 | | | Diversification

Status |

| | | | | | | | |

| PIMCO Flexible Emerging Markets Income Fund | | | | | | | 03/15/22 | | | | 03/15/22 | | | | — | | | | — | | | | — | | | | — | | | Non-Diversified |

| | | | | | | | |

| PIMCO Flexible Credit Income Fund | | | | | | | 02/22/17 | | | | 02/22/17 | | | | 01/29/21 | | | | 10/28/19 | | | | 11/09/20 | | | | 11/30/18 | | | Diversified |

An investment in a Fund is not a bank deposit and is not guaranteed or insured by the Federal Deposit Insurance Corporation or any other government agency. It is possible to lose money on investments in a Fund.

The Trustees are responsible generally for overseeing the management of the Funds. The Trustees authorize the Funds to enter into service agreements with Pacific Investment Management Company LLC (“PIMCO”) and other service providers in order to provide, and in some cases authorize service

providers to procure through other parties, necessary or desirable services on behalf of the Funds. Shareholders are not parties to or third-party beneficiaries of such service agreements. Neither a Fund’s prospectus or Statement of Additional Information (“SAI”), any press release or shareholder report, any contracts filed as exhibits to the Funds’ registration statement, nor any other communications, disclosure documents or regulatory filings (including this report) from or on behalf of the Funds creates a contract between or among any shareholders of a Fund, on the one hand, and the Funds, a service provider to a Fund, and/or the Trustees or officers of the Funds, on the other hand.

The Trustees (or the Funds and its officers, service providers or other delegates acting under authority of the Trustees) may amend its most recent prospectus or use a new prospectus or SAI with respect to the Funds, adopt and disclose new or amended policies and other changes in press releases and shareholder reports and/or amend, file and/or issue any other communications, disclosure documents or regulatory filings, and may amend or enter into any contracts to which a Fund is a party, and interpret the investment objective(s), policies, restrictions and contractual provisions applicable to a Fund, without shareholder input or approval, except in circumstances in which shareholder approval is specifically required by law (such as changes to fundamental investment policies) or where a shareholder approval requirement is specifically disclosed in the Funds’ then-current prospectus, SAI or shareholder report and is otherwise still in effect.

PIMCO has adopted written proxy voting policies and procedures (“Proxy Policy”) as required by Rule 206(4)-6 under the Investment Advisers Act of 1940, as amended. The Proxy Policy has been adopted by the Funds as the policies and procedures that PIMCO will use when voting proxies on behalf of the Funds.

A description of the policies and procedures that PIMCO uses to vote proxies relating to portfolio securities of each Fund, and information about how each Fund voted proxies relating to portfolio securities held during the most recent twelve-month period ended June 30, are available without charge, upon request, by calling the Funds at (844) 312-2113, on the Funds’ website at www.pimco.com, and on the Securities and Exchange Commission’s (“SEC”) website at www.sec.gov.

The Funds file their complete schedules of portfolio holdings with the SEC for the first and third quarters of each fiscal year as an exhibit to their reports on Form N-PORT. The Funds’ Form N-PORT reports are available to the public on the SEC’s website at www.sec.gov and on PIMCO’s website at www.pimco.com, and upon request by calling PIMCO at (844) 312-2113.

SEC rules allow the Funds to fulfill their obligation to deliver shareholder reports to investors by providing access to such reports online free of charge and by mailing a notice that the report is electronically available. Investors may elect to receive all future reports in paper free of charge by contacting their financial intermediary or, if invested directly with a Fund, investors can inform the Fund by calling (844) 312-2113. Any election to receive reports in paper will apply to all funds held with a fund complex if invested directly with a Fund or to all funds held in the investor’s account if invested through a financial intermediary,

In October 2022, the SEC adopted changes to the mutual fund and exchange-traded fund (“ETF”) shareholder report and registration statement disclosure requirements and the registered fund advertising rules, which impact the disclosures provided to shareholders. The rule amendments addressing fee and expense information in advertisements that might be materially misleading, which impact the Funds, were effective January 24, 2023.

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 5 | |

Important Information About the Funds (Cont.)

In September 2023, the SEC adopted amendments to a current rule governing fund naming conventions. In general, the current rule requires funds with certain types of names to adopt a policy to invest at least 80% of their assets in the type of investment suggested by the name. The amendments expand the scope of the current rule in a number of ways that are expected to result in an increase in the types of fund names that would require the fund to adopt an 80% investment policy under the rule. Additionally, the amendments address deviations from a fund’s 80% investment policy and the use and valuation of derivatives instruments for purposes of the rule. The amendments are effective as of December 11, 2023, but the SEC is providing a 24-month compliance period following the effective date for fund groups with net assets of $1 billion or more (and a 30-month compliance period for fund groups with net assets of less than $1 billion).

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 7 | |

| | |

| PIMCO Flexible Emerging Markets Income Fund | | |

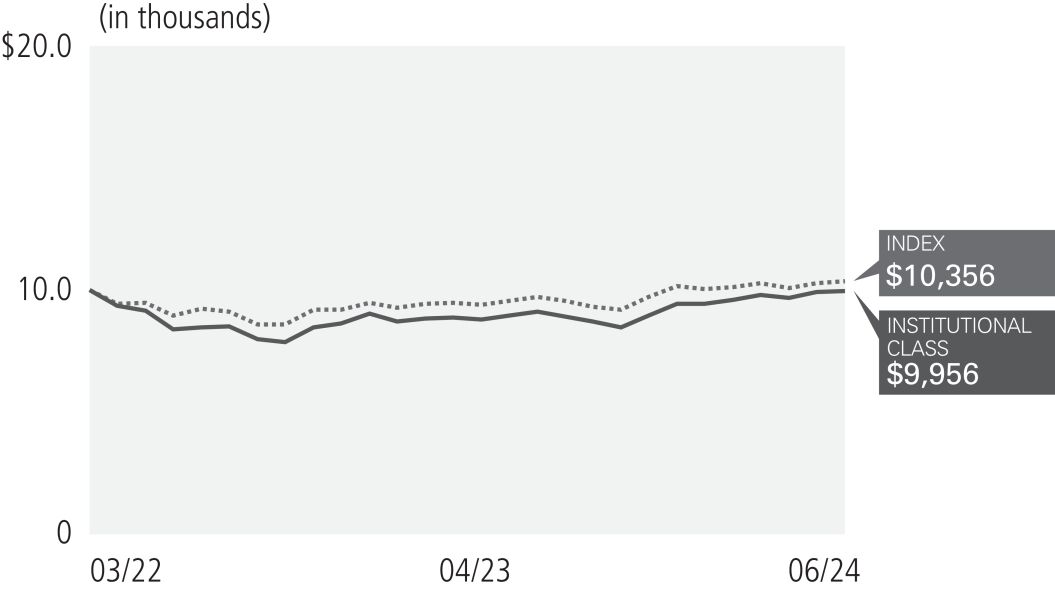

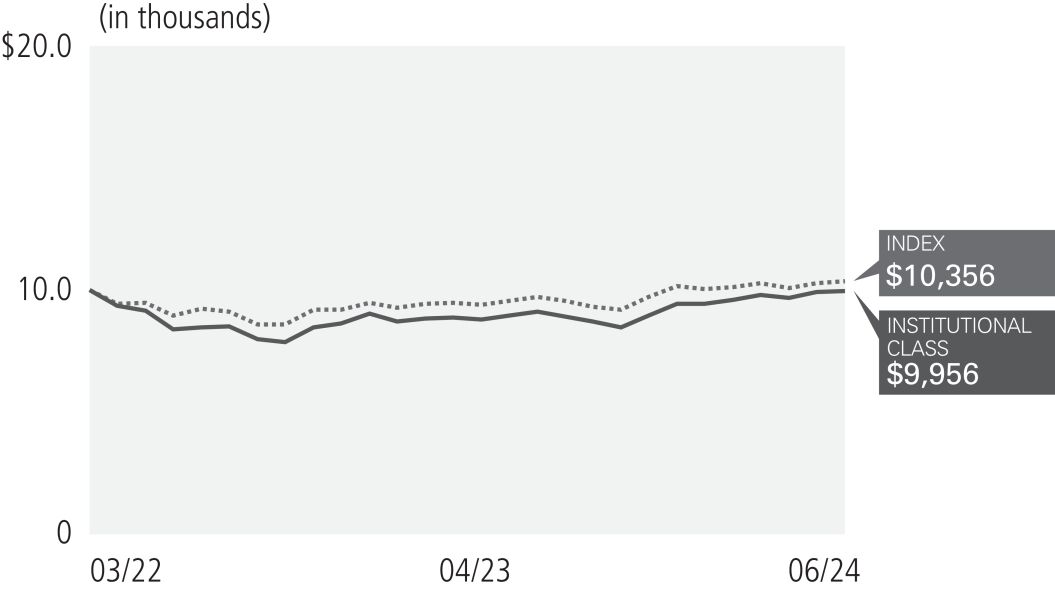

Cumulative Returns Through June 30, 2024

$10,000 invested at the end of the month when the Fund’s Institutional Class commenced operations.

| | | | |

| |

| Allocation Breakdown as of June 30, 2024†§ | | | |

| |

| Corporate Bonds & Notes | | | 52.1 | % |

| Sovereign Issues | | | 31.3 | % |

| Loan Participations and Assignments | | | 10.2 | % |

| Short-Term Instruments‡ | | | 6.1 | % |

| Other | | | 0.3 | % |

| † | | % of Investments, at value. |

| § | | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| ‡ | | Includes Central Funds Used for Cash Management Purposes. |

| | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2024 | |

| | | |

| | | | | 1 Year | | | Commencement

of Operations

(03/15/22) | |

| | PIMCO Flexible Emerging Markets Income Fund Institutional Class | | | 11.23% | | | | 1.07% | |

| | J.P. Morgan Emerging Markets Bond Index (EMBI) Global | | | 8.35% | | | | 2.22% | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when repurchased by the fund. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the repurchase of fund shares. Performance current to the most recent month-end is available at www.pimco.com or via (844) 312-2113. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect brokerage commissions in connection with the purchase or sale of Fund shares.

| | | | | | |

| Institutional Class - EMFLX | | | | | | |

| | | | | | |

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

It is not possible to invest directly in an unmanaged index.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report), was 1.98% for Institutional Class. As of June 30, 2024, the Fund’s Total Effective Leverage(1) was 26.31%. See Financial Highlights for actual expense ratios as of the end of the period covered by this report.

| (1) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO Flexible Emerging Markets Income Fund’s investment objective is to seek to provide attractive risk-adjusted returns and current income by investing, under normal circumstances, across a wide array of instruments, including from sovereign, quasi-sovereign and corporate borrowers, that are economically tied to “emerging market” countries. The Fund utilizes a flexible asset allocation strategy among multiple public and private credit sectors in the emerging market credit markets, including corporate debt (including, among other things, fixed-, variable- and floating-rate bonds, loans, convertible and contingent convertible securities and stressed, distressed and defaulted debt securities issued by corporations or other business entities), mortgage-related and other consumer-related instruments, collateralized debt obligations, including, without limitation, collateralized loan obligations, government, sovereign and quasi-sovereign debt and other fixed-, variable- and floating-rate income-producing securities. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights

The following affected performance (on a gross basis) during the reporting period:

| » | | Long exposure to Mexican quasi-sovereign and corporate external debt contributed to absolute returns, as the sectors posted positive performance. |

| » | | Long exposure to Ecuadorian sovereign external debt contributed to absolute returns, as the sector posted positive performance. |

| » | | Select Ukrainian sovereign external debt securities detracted from absolute returns, as select securities underperformed. |

| » | | Exposure to Argentinian sovereign external debt detracted from absolute returns, as select securities underperformed. |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 9 | |

PIMCO Flexible Credit Income Fund

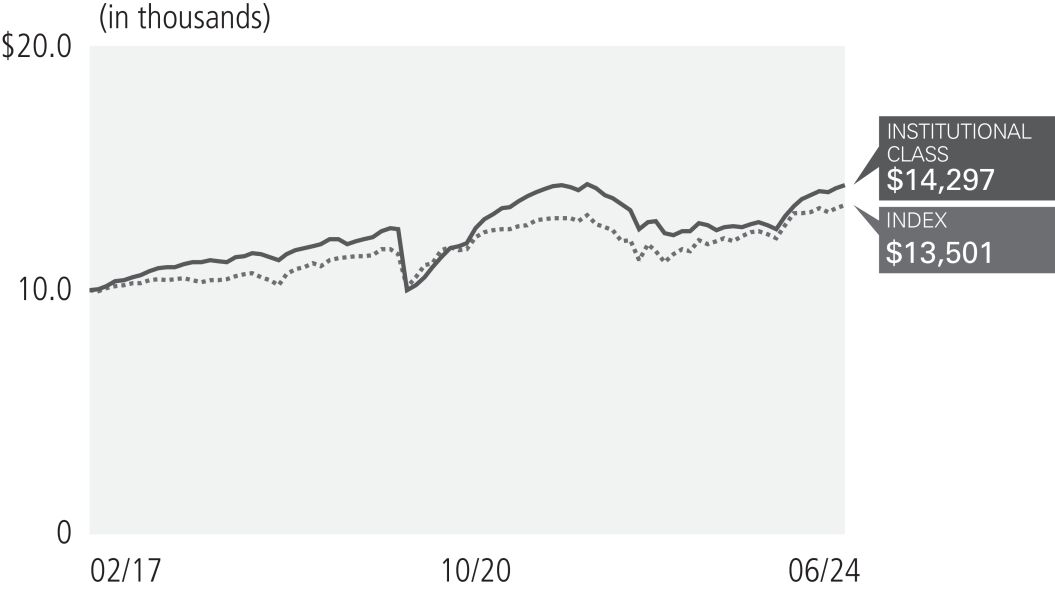

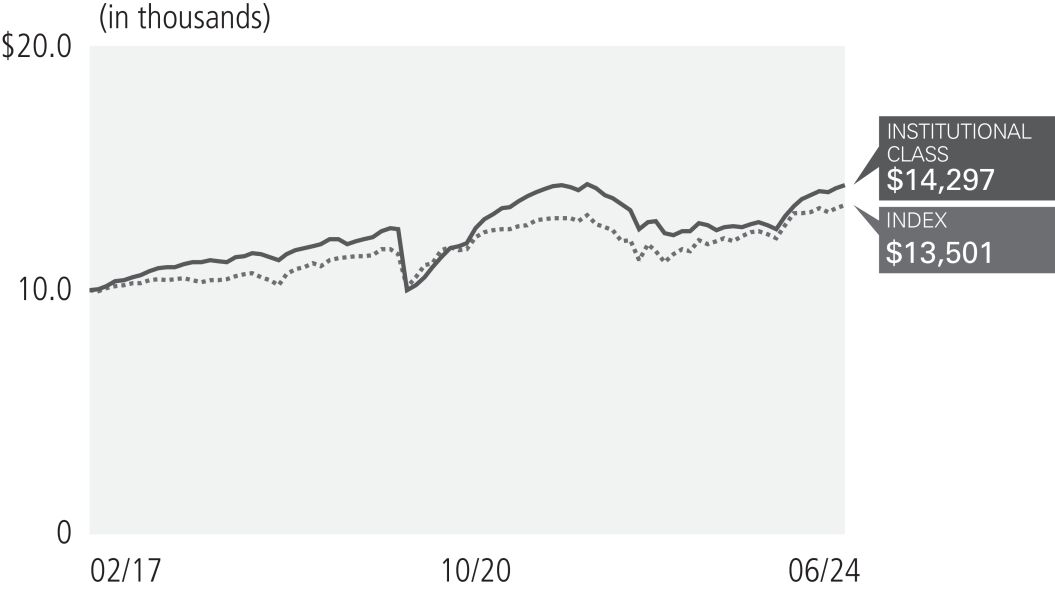

Cumulative Returns Through June 30, 2024

$10,000 invested at the end of the month when the Fund’s Institutional Class commenced operations.

| | | | |

| |

| Allocation Breakdown as of June 30, 2024†§ | | | |

| |

| Non-Agency Mortgage-Backed Securities | | | 27.2 | % |

| Loan Participations and Assignments | | | 20.0 | % |

| Asset-Backed Securities | | | 17.5 | % |

| Corporate Bonds & Notes | | | 17.1 | % |

| Short-Term Instruments‡ | | | 8.2 | % |

| Common Stocks | | | 7.3 | % |

| Municipal Bonds & Notes | | | 1.4 | % |

| Other | | | 1.3 | % |

| † | | % of Investments, at value. |

| § | | Allocation Breakdown and % of investments exclude securities sold short and financial derivative instruments, if any. |

| ‡ | | Includes Central Funds Used for Cash Management Purposes. |

| | | | | | | | | | | | | | |

|

| Average Annual Total Return for the period ended June 30, 2024 | |

| | | | |

| | | | | 1 Year | | | 5 Years | | | Commencement

of Operations

(2/22/17)* | |

| | PIMCO Flexible Credit Income Fund Institutional Class | | | 13.68% | | | | 3.44% | | | | 5.04% | |

| | PIMCO Flexible Credit Income Fund A-1 | | | 13.12% | | | | 3.00% | | | | 4.47% | |

| | PIMCO Flexible Credit Income Fund A-2 | | | 13.12% | | | | 2.78% | | | | 4.35% | |

| | PIMCO Flexible Credit Income Fund A-2 (adjusted) | | | 10.85% | | | | 2.36% | | | | 4.07% | |

| | PIMCO Flexible Credit Income Fund A-3 | | | 12.84% | | | | 2.63% | | | | 4.13% | |

| | PIMCO Flexible Credit Income Fund A-4 | | | 12.84% | | | | 2.65% | | | | 4.24% | |

| | PIMCO Flexible Credit Income Fund A-4 (adjusted) | | | 10.57% | | | | 2.03% | | | | 3.81% | |

| | ICE BofA US High Yield Index | | | 10.44% | | | | 3.73% | | | | 4.22% | |

| | | | | | |

| Institutional Class - PFLEX | | Class A-1 - PFAIX | | Class A-2 - PFALX | | |

| Class A-3 - PFASX | | Class A-4 - PFFLX | | | | |

All Fund returns are net of fees and expenses and include applicable fee waivers and/or expense limitations. Absent any applicable fee waivers and/or expense limitations, performance would have been lower and there can be no assurance that any such waivers or limitations will continue in the future.

* For class inception dates, please refer to the Important Information.

Performance quoted represents past performance. Past performance is not a guarantee or a reliable indicator of future results. Current performance may be lower or higher than performance shown. Investment return and the principal value of an investment will fluctuate. Shares may be worth more or less than original cost when repurchased by the fund. Returns shown do not reflect the deduction of taxes that a shareholder would pay on fund distributions or the repurchase of fund shares. The adjusted returns take into account the maximum sales charge of 3.00% on Class A-2 and Class A-4 shares. Performance current to the most recent month-end is available at www.pimco.com or via (844) 312-2113. Performance is calculated assuming all dividends and distributions are reinvested at prices obtained under the Fund’s dividend reinvestment plan. Performance does not reflect brokerage commissions in connection with the purchase or sale of Fund shares.

For periods prior to the inception date of a share class launched subsequent to the Fund’s inception date, the performance information shown is adjusted for the performance of the Fund’s Institutional Class shares. The prior Institutional Class performance has been adjusted to reflect the distribution and/or service fees and other expenses paid by each respective share class.

Performance of an index is shown in light of a requirement by the Securities and Exchange Commission that the performance of an appropriate broad-based securities market index be disclosed. However, the Fund is not managed to an index nor should the index be viewed as a “benchmark” for the Fund’s performance. The index is not intended to be indicative of the Fund’s investment strategies, portfolio components or past or future performance.

It is not possible to invest directly in an unmanaged index.

The Fund’s total annual operating expense ratio, as stated in the Fund’s currently-effective prospectus (as of the date of this report), were 5.36% for Institutional Class, 5.86% for Class A-1 shares, 5.86% for Class A-2 shares, 6.11% for Class A-3 shares and 6.11% for Class A-4 shares. As of June 30, 2024, the Fund’s Total Effective Leverage(1) was 39.34%. See Financial Highlights for actual expense ratios as of the end of the period covered by this report.

| (1) | Represents total effective leverage outstanding, as a percentage of total managed assets. Total effective leverage consists of preferred shares, reverse repurchase agreements and other borrowings, credit default swap notional and floating rate notes issued in tender option bond transactions, as applicable (collectively “Total Effective Leverage”). The Fund may engage in other transactions not included in Total Effective Leverage disclosed above that may give rise to a form of leverage, including certain derivative transactions. For the purpose of calculating Total Effective Leverage outstanding as a percentage of total managed assets, total managed assets refer to total assets (including assets attributable to Total Effective Leverage that may be outstanding) minus accrued liabilities (other than liabilities representing Total Effective Leverage). |

Investment Objective and Strategy Overview

PIMCO Flexible Credit Income Fund seeks to provide attractive risk-adjusted returns and current income by investing, under normal circumstances across a wide array of global credit sectors, including corporate, mortgage, consumer, emerging market and municipal credit markets and utilizing a flexible asset allocation strategy among multiple public and private credit sectors in the global credit markets, including corporate debt (including, among other things, fixed-, variable- and floating-rate bonds, loans, convertible and contingent convertible securities and stressed, distressed and defaulted debt securities issued by U.S. or foreign (non-U.S.) corporations or other business entities, including emerging market issuers), mortgage-related and other consumer-related instruments, collateralized debt obligations, including, without limitation, collateralized loan obligations, government and sovereign debt, municipal bonds and other fixed-, variable- and floating-rate income-producing securities of U.S. and foreign issuers, including emerging market issuers. The Fund may invest without limit in investment grade debt securities and may invest without limit in below investment grade debt securities (commonly referred to as “high yield” securities or “junk bonds”), including securities of stressed and distressed issuers. Fund strategies may change from time to time. Please refer to the Fund’s current prospectus for more information regarding the Fund’s strategy.

Fund Insights

The following affected performance (on a gross basis) during the reporting period:

| » | | Exposure to select corporate special situation positions contributed to absolute performance, as select issuers posted positive returns. |

| » | | Exposure to corporate credit contributed to absolute performance, as the sector posted positive returns. |

| » | | Exposure to mortgage credit contributed to absolute performance, as select securities posted positive returns. |

| » | | The costs associated with one or more forms of leverage detracted from performance. The costs of leverage generally will reduce returns to the extent they exceed the rate of return on the additional investments purchased with such leverage. |

| » | | Interest rate positioning detracted from performance, primarily driven by the Fund’s long exposure at the intermediate portion of the curve, as rate volatility persisted. |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 11 | |

Index Descriptions

| | |

| Index* | | Index Description |

| |

| ICE BofA US High Yield Index | | ICE BofA US High Yield Index tracks the performance of below investment grade U.S. dollar-denominated corporate bonds publicly issued in the U.S. domestic market. Qualifying bonds must have at least one year remaining term to maturity, a fixed coupon schedule and a minimum amount outstanding of USD 100 million. Bonds must be rated below investment grade based on a composite of Moody’s and S&P. |

| |

| J.P. Morgan Emerging Markets Bond Index (EMBI) Global | | J.P. Morgan Emerging Markets Bond Index (EMBI) Global tracks total returns for United States Dollar denominated debt instruments issued by emerging market sovereign and quasi-sovereign entities: Brady bonds, loans, and Eurobonds. |

| * | | It is not possible to invest directly in an unmanaged index. |

(THIS PAGE INTENTIONALLY LEFT BLANK)

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 13 | |

Financial Highlights

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Investment Operations | | | | Less Distributions(c) |

| | | | | | | | | | | | | | | | | |

Selected Per Share Data for the

Year or Period Ended^: | | Net Asset

Value

Beginning

of Year or

Period(a) | | Net

Investment

Income

(Loss)(b) | | Net

Realized/

Unrealized

Gain (Loss) | | Total | | | | From Net

Investment

Income | | From Net

Realized

Capital Gains | | Total |

| | | | | | | | |

PIMCO Flexible Emerging

Markets Income Fund | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | $ | 8.19 | | | | $ | 0.68 | | | | $ | 0.20 | | | | $ | 0.88 | | | | | | | | | $ | (0.66 | ) | | | $ | 0.00 | | | | $ | (0.66 | ) |

| | | | | | | | |

06/30/2023 | | | | 8.39 | | | | | 0.60 | | | | | (0.03 | ) | | | | 0.57 | | | | | | | | | | (0.77 | ) | | | | 0.00 | | | | | (0.77 | ) |

| | | | | | | | |

03/15/2022 - 06/30/2022 | | | | 10.00 | | | | | 0.22 | | | | | (1.62 | ) | | | | (1.40 | ) | | | | | | | | | (0.21 | ) | | | | 0.00 | | | | | (0.21 | ) |

| | | | | | | | |

PIMCO Flexible Credit Income Fund (Consolidated) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Institutional Class | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | $ | 6.81 | | | | $ | 0.73 | | | | $ | 0.16 | | | | $ | 0.89 | | | | | | | | | $ | (0.76 | ) | | | $ | 0.00 | | | | $ | (0.76 | ) |

| | | | | | | | |

06/30/2023 | | | | 7.89 | | | | | 0.88 | | | | | (0.85 | ) | | | | 0.03 | | | | | | | | | | (1.11 | ) | | | | 0.00 | | | | | (1.11 | ) |

| | | | | | | | |

06/30/2022 | | | | 9.68 | | | | | 0.89 | | | | | (1.88 | ) | | | | (0.99 | ) | | | | | | | | | (0.80 | ) | | | | 0.00 | | | | | (0.80 | ) |

| | | | | | | | |

06/30/2021 | | | | 8.21 | | | | | 0.84 | | | | | 1.40 | | | | | 2.24 | | | | | | | | | | (0.77 | ) | | | | 0.00 | | | | | (0.77 | ) |

| | | | | | | | |

06/30/2020 | | | | 10.09 | | | | | 0.73 | | | | | (1.61 | ) | | | | (0.88 | ) | | | | | | | | | (1.00 | ) | | | | 0.00 | | | | | (1.00 | ) |

| | | | | | | | |

Class A-1 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | | 6.81 | | | | | 0.69 | | | | | 0.17 | | | | | 0.86 | | | | | | | | | | (0.73 | ) | | | | 0.00 | | | | | (0.73 | ) |

| | | | | | | | |

06/30/2023 | | | | 7.89 | | | | | 0.84 | | | | | (0.85 | ) | | | | (0.01 | ) | | | | | | | | | (1.07 | ) | | | | 0.00 | | | | | (1.07 | ) |

| | | | | | | | |

06/30/2022 | | | | 9.68 | | | | | 0.90 | | | | | (1.94 | ) | | | | (1.04 | ) | | | | | | | | | (0.75 | ) | | | | 0.00 | | | | | (0.75 | ) |

| | | | | | | | |

01/29/2021 - 06/30/2021 | | | | 9.34 | | | | | 0.32 | | | | | 0.36 | | | | | 0.68 | | | | | | | | | | (0.34 | ) | | | | 0.00 | | | | | (0.34 | ) |

| | | | | | | | |

Class A-2 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | | 6.81 | | | | | 0.69 | | | | | 0.17 | | | | | 0.86 | | | | | | | | | | (0.73 | ) | | | | 0.00 | | | | | (0.73 | ) |

| | | | | | | | |

06/30/2023 | | | | 7.89 | | | | | 0.85 | | | | | (0.86 | ) | | | | (0.01 | ) | | | | | | | | | (1.07 | ) | | | | 0.00 | | | | | (1.07 | ) |

| | | | | | | | |

06/30/2022 | | | | 9.68 | | | | | 0.85 | | | | | (1.89 | ) | | | | (1.04 | ) | | | | | | | | | (0.75 | ) | | | | 0.00 | | | | | (0.75 | ) |

| | | | | | | | |

06/30/2021 | | | | 8.21 | | | | | 0.78 | | | | | 1.38 | | | | | 2.16 | | | | | | | | | | (0.69 | ) | | | | 0.00 | | | | | (0.69 | ) |

| | | | | | | | |

10/28/2019 - 06/30/2020 | | | | 9.82 | | | | | 0.40 | | | | | (1.33 | ) | | | | (0.93 | ) | | | | | | | | | (0.68 | ) | | | | 0.00 | | | | | (0.68 | ) |

| | | | | | | | |

Class A-3 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | | 6.81 | | | | | 0.68 | | | | | 0.16 | | | | | 0.84 | | | | | | | | | | (0.71 | ) | | | | 0.00 | | | | | (0.71 | ) |

| | | | | | | | |

06/30/2023 | | | | 7.89 | | | | | 0.84 | | | | | (0.87 | ) | | | | (0.03 | ) | | | | | | | | | (1.05 | ) | | | | 0.00 | | | | | (1.05 | ) |

| | | | | | | | |

06/30/2022 | | | | 9.68 | | | | | 0.83 | | | | | (1.89 | ) | | | | (1.06 | ) | | | | | | | | | (0.73 | ) | | | | 0.00 | | | | | (0.73 | ) |

| | | | | | | | |

11/09/2020 - 06/30/2021 | | | | 8.89 | | | | | 0.48 | | | | | 0.75 | | | | | 1.23 | | | | | | | | | | (0.44 | ) | | | | 0.00 | | | | | (0.44 | ) |

| | | | |

| 14 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratios/Supplemental Data |

| | | | | | | Ratios to Average Net Assets | | |

Net Asset

Value End

of Year

or Period(a) | | Total

Return(d) | | Net Assets

End of Year

or Period

(000s) | | Expenses(e) | | Expenses

Excluding

Waivers(e) | | Expenses

Excluding

Interest

Expense | | Expenses

Excluding

Interest

Expense and

Waivers | | Net

Investment

Income (Loss) | | Portfolio

Turnover

Rate |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | $ | 8.41 | | | | | 11.23 | % | | | $ | 32,297 | | | | | 1.48 | % | | | | 2.17 | % | | | | 0.85 | % | | | | 1.54 | % | | | | 8.40 | % | | | | 70 | % |

| | | | | | | | |

| | | 8.19 | | | | | 7.20 | | | | | 24,876 | | | | | 0.94 | | | | | 2.15 | | | | | 0.51 | | | | | 1.72 | | | | | 7.31 | | | | | 76 | |

| | | | | | | | |

| | | 8.39 | | | | | (14.05 | ) | | | | 23,101 | | | | | 0.84 | * | | | | 2.31 | * | | | | 0.53 | * | | | | 2.00 | * | | | | 7.84 | * | | | | 33 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | $ | 6.94 | | | | | 13.85 | % | | | $ | 2,245,017 | | | | | 6.61 | % | | | | 6.61 | % | | | | 2.19 | % | | | | 2.19 | % | | | | 10.64 | % | | | | 16 | % |

| | | | | | | | |

| | | 6.81 | | | | | 0.53 | | | | | 2,290,340 | | | | | 5.35 | | | | | 5.35 | | | | | 2.22 | | | | | 2.22 | | | | | 11.91 | | | | | 26 | |

| | | | | | | | |

| | | 7.89 | | | | | (10.97 | ) | | | | 2,488,404 | | | | | 2.54 | | | | | 2.54 | | | | | 2.10 | | | | | 2.10 | | | | | 9.73 | | | | | 35 | |

| | | | | | | | |

| | | 9.68 | | | | | 28.02 | | | | | 1,971,964 | | | | | 3.06 | | | | | 3.06 | | | | | 2.30 | | | | | 2.30 | | | | | 9.19 | | | | | 34 | |

| | | | | | | | |

| | | 8.21 | | | | | (9.21 | ) | | | | 1,301,140 | | | | | 3.77 | | | | | 3.78 | | | | | 2.23 | | | | | 2.24 | | | | | 8.00 | | | | | 17 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | 6.94 | | | | | 13.29 | | | | | 9,506 | | | | | 7.11 | | | | | 7.11 | | | | | 2.69 | | | | | 2.69 | | | | | 10.13 | | | | | 16 | |

| | | | | | | | |

| | | 6.81 | | | | | 0.03 | | | | | 9,321 | | | | | 5.85 | | | | | 5.85 | | | | | 2.72 | | | | | 2.72 | | | | | 11.39 | | | | | 26 | |

| | | | | | | | |

| | | 7.89 | | | | | (11.43 | ) | | | | 9,658 | | | | | 3.04 | | | | | 3.04 | | | | | 2.60 | | | | | 2.60 | | | | | 10.30 | | | | | 35 | |

| | | | | | | | |

| | | 9.68 | | | | | 7.39 | | | | | 11 | | | | | 3.56 | * | | | | 3.56 | * | | | | 2.80 | * | | | | 2.80 | * | | | | 8.10 | * | | | | 34 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | 6.94 | | | | | 13.29 | | | | | 114,412 | | | | | 7.11 | | | | | 7.11 | | | | | 2.69 | | | | | 2.69 | | | | | 10.15 | | | | | 16 | |

| | | | | | | | |

| | | 6.81 | | | | | 0.03 | | | | | 95,806 | | | | | 5.91 | (f) | | | | 5.91 | (f) | | | | 2.72 | (f) | | | | 2.72 | (f) | | | | 11.49 | | | | | 26 | |

| | | | | | | | |

| | | 7.89 | | | | | (11.45 | ) | | | | 87,001 | | | | | 3.04 | | | | | 3.04 | | | | | 2.60 | | | | | 2.60 | | | | | 9.37 | | | | | 35 | |

| | | | | | | | |

| | | 9.68 | | | | | 27.00 | | | | | 39,835 | | | | | 3.56 | | | | | 3.56 | | | | | 2.80 | | | | | 2.80 | | | | | 8.44 | | | | | 34 | |

| | | | | | | | |

| | | 8.21 | | | | | (9.77 | ) | | | | 5,476 | | | | | 4.27 | * | | | | 4.28 | * | | | | 2.73 | * | | | | 2.74 | * | | | | 7.32 | * | | | | 17 | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | 6.94 | | | | | 13.00 | | | | | 490,934 | | | | | 7.36 | | | | | 7.36 | | | | | 2.94 | | | | | 2.94 | | | | | 9.90 | | | | | 16 | |

| | | | | | | | |

| | | 6.81 | | | | | (0.22 | ) | | | | 444,222 | | | | | 6.31 | (f) | | | | 6.31 | (f) | | | | 2.97 | (f) | | | | 2.97 | (f) | | | | 11.46 | | | | | 26 | |

| | | | | | | | |

| | | 7.89 | | | | | (11.66 | ) | | | | 255,741 | | | | | 3.29 | | | | | 3.29 | | | | | 2.85 | | | | | 2.85 | | | | | 9.15 | | | | | 35 | |

| | | | | | | | |

| | | 9.68 | | | | | 14.01 | | | | | 88,868 | | | | | 3.81 | * | | | | 3.81 | * | | | | 3.05 | * | | | | 3.05 | * | | | | 7.81 | * | | | | 34 | |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 15 | |

Financial Highlights (Cont.)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Investment Operations | | | | Less Distributions(c) |

| | | | | | | | | | | | | | | | | |

Selected Per Share Data for the

Year or Period Ended^: | | Net Asset

Value

Beginning

of Year or

Period(a) | | Net

Investment

Income

(Loss)(b) | | Net

Realized/

Unrealized

Gain (Loss) | | Total | | | | From Net

Investment

Income | | From Net

Realized

Capital Gains | | Total |

| | | | | | | | |

PIMCO Flexible Credit Income Fund (Consolidated) | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Class A-4 | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

06/30/2024 | | | $ | 6.81 | | | | $ | 0.68 | | | | $ | 0.16 | | | | $ | 0.84 | | | | | | | | | $ | (0.71 | ) | | | $ | 0.00 | | | | $ | (0.71 | ) |

| | | | | | | | |

06/30/2023 | | | | 7.89 | | | | | 0.78 | | | | | (0.81 | ) | | | | (0.03 | ) | | | | | | | | | (1.05 | ) | | | | 0.00 | | | | | (1.05 | ) |

| | | | | | | | |

06/30/2022 | | | | 9.68 | | | | | 0.82 | | | | | (1.88 | ) | | | | (1.06 | ) | | | | | | | | | (0.73 | ) | | | | 0.00 | | | | | (0.73 | ) |

| | | | | | | | |

06/30/2021 | | | | 8.21 | | | | | 0.77 | | | | | 1.39 | | | | | 2.16 | | | | | | | | | | (0.69 | ) | | | | 0.00 | | | | | (0.69 | ) |

| | | | | | | | |

06/30/2020 | | | | 10.09 | | | | | 0.64 | | | | | (1.60 | ) | | | | (0.96 | ) | | | | | | | | | (0.92 | ) | | | | 0.00 | | | | | (0.92 | ) |

| | | | | | | | |

11/30/2018 - 06/30/2019 | | | | 10.17 | | | | | 0.52 | | | | | 0.06 | | | | | 0.58 | | | | | | | | | | (0.66 | ) | | | | 0.00 | | | | | (0.66 | ) |

| ^ | A zero balance may reflect actual amounts rounding to less than $0.01 or 0.01%. |

| * | Annualized, except for organizational expense, if any. |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Funds. |

| (b) | Per share amounts based on average number of shares outstanding during the year or period. |

| (c) | The tax characterization of distributions is determined in accordance with Federal income tax regulations. See Note 2, Distributions — Common Shares, in the Notes to Financial Statements for more information. |

| (d) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Funds. Additionally, excludes initial sales charges and contingent deferred sales charges. |

| (e) | Ratio includes interest expense which primarily relates to participation in borrowing and financing transactions. See Note 5, Borrowings and Other Financing Transactions, in the Notes to Financial Statements for more information. |

| (f) | Expense ratio as presented is calculated based on average net assets for the period presented. Due to significant fluctuations in total net assets during the period, the expense ratio to average net assets differs from the total operating expense ratio in effect for each class. See Note 9, Fees and Expenses in the Notes to Financial Statements for additional information on how the Fund’s expenses are calculated. |

| | | | |

| 16 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | Ratios/Supplemental Data |

| | | | | | | Ratios to Average Net Assets | | |

Net Asset

Value End

of Year

or Period(a) | | Total

Return(d) | | Net Assets

End of Year

or Period

(000s) | | Expenses(e) | | Expenses

Excluding

Waivers(e) | | Expenses

Excluding

Interest

Expense | | Expenses

Excluding

Interest

Expense and

Waivers | | Net

Investment

Income (Loss) | | Portfolio

Turnover

Rate |

| | | | | | | | |

| |

|

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | $ | 6.94 | | | | | 13.00 | % | | | $ | 29,128 | | | | | 7.36 | % | | | | 7.36 | % | | | | 2.94 | % | | | | 2.94 | % | | | | 9.93 | % | | | | 16 | % |

| | | | | | | | |

| | | 6.81 | | | | | (0.22 | ) | | | | 26,774 | | | | | 5.41 | (f) | | | | 5.41 | (f) | | | | 2.97 | (f) | | | | 2.97 | (f) | | | | 10.11 | | | | | 26 | |

| | | | | | | | |

| | | 7.89 | | | | | (11.66 | ) | | | | 150,498 | | | | | 3.29 | | | | | 3.29 | | | | | 2.85 | | | | | 2.85 | | | | | 8.99 | | | | | 35 | |

| | | | | | | | |

| | | 9.68 | | | | | 27.05 | | | | | 116,482 | | | | | 3.81 | | | | | 3.81 | | | | | 3.05 | | | | | 3.05 | | | | | 8.42 | | | | | 34 | |

| | | | | | | | |

| | | 8.21 | | | | | (9.95 | ) | | | | 71,662 | | | | | 4.52 | | | | | 4.53 | | | | | 2.98 | | | | | 2.99 | | | | | 7.07 | | | | | 17 | |

| | | | | | | | |

| | | 10.09 | | | | | 5.99 | | | | | 25,482 | | | | | 4.66 | * | | | | 4.67 | * | | | | 2.93 | * | | | | 2.94 | * | | | | 9.06 | * | | | | 14 | |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 17 | |

Statement of Assets and Liabilities PIMCO Flexible Emerging Markets Income Fund

| | | | |

| (Amounts in thousands†, except per share amounts) | | | |

| |

Assets: | | | | |

| |

Investments, at value | | | | |

Investments in securities* | | $ | 34,304 | |

Investments in Affiliates | | | 919 | |

| |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | | 7 | |

Over the counter | | | 177 | |

Deposits with counterparty | | | 928 | |

Foreign currency, at value | | | 39 | |

Receivable for investments sold | | | 362 | |

Receivable for Fund shares sold | | | 185 | |

Interest and/or dividends receivable | | | 800 | |

Dividends receivable from Affiliates | | | 3 | |

Reimbursement receivable from PIMCO | | | 11 | |

| |

Total Assets | | | 37,735 | |

| |

Liabilities: | | | | |

| |

Borrowings & Other Financing Transactions | | | | |

Payable for reverse repurchase agreements | | $ | 3,799 | |

| |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | | 32 | |

Over the counter | | | 358 | |

Payable for investments purchased | | | 582 | |

Payable for investments in Affiliates purchased | | | 3 | |

Payable for unfunded loan commitments | | | 582 | |

Distributions payable to common shareholders | | | 43 | |

Accrued management fees | | | 36 | |

Foreign capital gains tax payable | | | 3 | |

| |

Total Liabilities | | | 5,438 | |

| |

Commitments and Contingent Liabilities^ | | | | |

| |

Net Assets | | $ | 32,297 | |

| |

Net Assets Consist of: | | | | |

| |

Par value^^ | | $ | 0 | |

| |

Paid in capital in excess of par | | | 36,336 | |

| |

Distributable earnings (accumulated loss) | | | (4,039 | ) |

| |

Net Assets | | $ | 32,297 | |

| |

Net Assets: | | | | |

| |

Institutional Class | | $ | 32,297 | |

| |

Common Shares Outstanding: | | | | |

| |

Institutional Class | | | 3,841 | |

| |

Net Asset Value Per Common Share(a): | | | | |

| |

Institutional Class | | $ | 8.41 | |

| |

Cost of investments in securities | | $ | 34,986 | |

| |

Cost of investments in Affiliates | | $ | 919 | |

| |

Cost of foreign currency held | | $ | 41 | |

| |

Cost or premiums of financial derivative instruments, net | | $ | (293 | ) |

| |

* Includes repurchase agreements of: | | $ | 414 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ^ | See Note 9, Fees and Expenses, in the Notes to Financial Statements for more information. |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| | | | |

| 18 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Consolidated Statement of Assets and Liabilities PIMCO Flexible Credit Income Fund

| | | | |

| (Amounts in thousands†, except per share amounts) | | | |

| |

Assets: | | | | |

| |

Investments, at value | | | | |

Investments in securities | | $ | 4,233,604 | |

Investments in Affiliates | | | 566,981 | |

| |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | | 4,641 | |

Over the counter | | | 13,995 | |

Cash | | | 3,402 | |

Deposits with counterparty | | | 46,326 | |

Foreign currency, at value | | | 27,264 | |

Receivable for investments sold | | | 71,152 | |

Receivable for Fund shares sold | | | 7,692 | |

Interest and/or dividends receivable | | | 49,508 | |

Dividends receivable from Affiliates | | | 1,128 | |

Other assets | | | 2 | |

| |

Total Assets | | | 5,025,695 | |

| |

Liabilities: | | | | |

| |

Borrowings & Other Financing Transactions | | | | |

Payable for reverse repurchase agreements | | $ | 1,873,256 | |

| |

Financial Derivative Instruments | | | | |

Exchange-traded or centrally cleared | | | 2,444 | |

Over the counter | | | 6,258 | |

Payable for investments purchased | | | 160,167 | |

Payable for investments in Affiliates purchased | | | 1,283 | |

Payable for unfunded loan commitments | | | 45,291 | |

Deposits from counterparty | | | 30,890 | |

Distributions payable to common shareholders | | | 12,007 | |

Accrued management fees | | | 4,652 | |

Accrued servicing fees | | | 340 | |

Foreign capital gains tax payable | | | 31 | |

Other liabilities | | | 79 | |

| |

Total Liabilities | | | 2,136,698 | |

| |

Commitments and Contingent Liabilities^ | | | | |

| |

Net Assets | | $ | 2,888,997 | |

| |

Net Assets Consist of: | | | | |

| |

Par value^^ | | $ | 4 | |

Paid in capital in excess of par | | | 3,868,790 | |

Distributable earnings (accumulated loss) | |

| (979,797

| )

|

| |

Net Assets | | $ | 2,888,997 | |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 19 | |

Consolidated Statement of Assets and Liabilities PIMCO Flexible Credit Income Fund (Cont.)

| | | | |

Net Assets: | | | | |

| |

Institutional Class | | $ | 2,245,017 | |

Class A-1 | | | 9,506 | |

Class A-2 | | | 114,412 | |

Class A-3 | | | 490,934 | |

Class A-4 | | | 29,128 | |

| |

Common Shares Outstanding: | | | | |

| |

Institutional Class | | | 323,675 | |

Class A-1 | | | 1,370 | |

Class A-2 | | | 16,495 | |

Class A-3 | | | 70,786 | |

Class A-4 | | | 4,200 | |

| |

Net Asset Value Per Common Share(a): | | | | |

| |

Institutional Class | | $ | 6.94 | |

Class A-1 | | | 6.94 | |

Class A-2 | | | 6.94 | |

Class A-3 | | | 6.94 | |

Class A-4 | | | 6.94 | |

| |

Cost of investments in securities | | $ | 4,893,075 | |

Cost of investments in Affiliates | | $ | 548,333 | |

Cost of foreign currency held | | $ | 27,441 | |

| |

Cost or premiums of financial derivative instruments, net | | $ | 30,969 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| ^ | See Note 9, Fees and Expenses, in the Notes to Financial Statements for more information. |

| (a) | Includes adjustments required by U.S. GAAP and may differ from net asset values and performance reported elsewhere by the Fund. |

| | | | |

| 20 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Statement of Operations PIMCO Flexible Emerging Markets Income Fund

| | | | |

| Year Ended June 30, 2024 | | | |

| (Amounts in thousands†) | | | |

| |

Investment Income: | | | | |

| |

Interest, net of foreign taxes* | | $ | 2,652 | |

Dividends from Investments in Affiliates | | | 17 | |

Miscellaneous income | | | 24 | |

Total Income | | | 2,693 | |

| |

Expenses: | | | | |

| |

Management fees | | | 390 | |

Trustee fees and related expenses | | | 12 | |

Interest expense | | | 172 | |

Expense reimbursements recouped | | | 19 | |

Total Expenses | | | 593 | |

Waiver and/or Reimbursement by PIMCO | | | (189 | ) |

Net Expenses | | | 404 | |

| |

Net Investment Income (Loss) | | | 2,289 | |

| |

Net Realized Gain (Loss): | | | | |

| |

Investments in securities | | | (348 | ) |

Exchange-traded or centrally cleared financial derivative instruments | | | 56 | |

Over the counter financial derivative instruments | | | 213 | |

Foreign currency | | | (57 | ) |

| |

Net Realized Gain (Loss) | | | (136 | ) |

| |

Net Change in Unrealized Appreciation (Depreciation): | | | | |

| |

Investments in securities | | | 951 | |

Exchange-traded or centrally cleared financial derivative instruments | | | (84 | ) |

Over the counter financial derivative instruments | | | 47 | |

Foreign currency assets and liabilities | | | (8 | ) |

| |

Net Change in Unrealized Appreciation (Depreciation) | | | 906 | |

| |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 3,059 | |

| |

* Foreign tax withholdings | | $ | 16 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 21 | |

Consolidated Statement of Operations PIMCO Flexible Credit Income Fund

| | | | |

| Year Ended June 30, 2024 | | | |

| (Amounts in thousands†) | | | |

| |

Investment Income: | | | | |

| |

Interest, net of foreign taxes* | | $ | 449,904 | |

Dividends, net of foreign taxes** | | | 9,177 | |

Dividends from Investments in Affiliates | | | 10,139 | |

Miscellaneous income | | | 13,859 | |

Total Income | | | 483,079 | |

| |

Expenses: | | | | |

| |

Management fees | | | 60,852 | |

Distribution and/or servicing fees - Class A-1 | | | 47 | |

Distribution and/or servicing fees - Class A-2 | | | 520 | |

Distribution and/or servicing fees - Class A-3 | | | 3,395 | |

Distribution and/or servicing fees - Class A-4 | | | 185 | |

Trustee fees and related expenses | | | 241 | |

Interest expense | | | 123,340 | |

Miscellaneous expense | | | 117 | |

Total Expenses | | | 188,697 | |

| |

Net Investment Income (Loss) | | | 294,382 | |

| |

Net Realized Gain (Loss): | | | | |

| |

Investments in securities | | | (85,254 | ) |

Investments in Affiliates | | | 86 | |

Exchange-traded or centrally cleared financial derivative instruments | | | (115,739 | ) |

Over the counter financial derivative instruments | | | 24,526 | |

Foreign currency | | | (3,292 | ) |

| |

Net Realized Gain (Loss) | | | (179,673 | ) |

| |

Net Change in Unrealized Appreciation (Depreciation): | | | | |

| |

Investments in securities | | | 98,301 | |

Investments in Affiliates | | | 18,647 | |

Exchange-traded or centrally cleared financial derivative instruments | | | 107,422 | |

Over the counter financial derivative instruments | | | 14,341 | |

Foreign currency assets and liabilities | | | 2,938 | |

| |

Net Change in Unrealized Appreciation (Depreciation) | | | 241,649 | |

| |

Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 356,358 | |

| |

* Foreign tax withholdings - Interest | | $ | 249 | |

| |

** Foreign tax withholdings - Dividends | | $ | 146 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| | | | |

| 22 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Statements of Changes in Net Assets PIMCO Flexible Emerging Markets Income Fund

| | | | | | | | |

| (Amounts in thousands†) | | Year Ended

June 30, 2024 | | | Year Ended

June 30, 2023 | |

| | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

| | |

Net investment income (loss) | | $ | 2,289 | | | $ | 1,732 | |

Net realized gain (loss) | | | (136 | ) | | | (2,475 | ) |

Net change in unrealized appreciation (depreciation) | | | 906 | | | | 2,408 | |

| | |

Net Increase (Decrease) in Net Assets Applicable to Common

Shareholders Resulting from Operations | | | 3,059 | | | | 1,665 | |

| | |

Distributions to Common Shareholders: | | | | | | | | |

| | |

From net investment income and/or net realized capital gains | | | | | | | | |

Institutional Class | | | (2,227 | ) | | | (2,195 | ) |

| | |

Total Distributions to Common Shareholders(a) | | | (2,227 | ) | | | (2,195 | ) |

| | |

Common Share Transactions*: | | | | | | | | |

| | |

Receipts for shares sold | | | 5,315 | | | | 262 | |

Issued as reinvestment of distributions | | | 1,926 | | | | 2,044 | |

Cost of shares repurchased | | | (652 | ) | | | (1 | ) |

Net increase (decrease) resulting from common shares transactions | | | 6,589 | | | | 2,305 | |

| | |

Total increase (decrease) in net assets | | | 7,421 | | | | 1,775 | |

| | |

Net Assets : | | | | | | | | |

| | |

Beginning of year | | | 24,876 | | | | 23,101 | |

End of year | | $ | 32,297 | | | $ | 24,876 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| * | See Note 13, Common Shares Offering, in the Notes to Financial Statements. |

| (a) | The tax characterization of distribution is determined in accordance with Federal income tax regulations. See Note 2, Distributions — Common Shares, in the Notes to Financial statements for more information. |

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 23 | |

Consolidated Statements of Changes in Net Assets PIMCO Flexible Credit Income Fund

| | | | | | | | |

| (Amounts in thousands†) | | Year Ended

June 30, 2024 | | | Year Ended

June 30, 2023 | |

| | |

Increase (Decrease) in Net Assets from: | | | | | | | | |

| | |

Operations: | | | | | | | | |

| | |

Net investment income (loss) | | $ | 294,382 | | | $ | 341,036 | |

Net realized gain (loss) | | | (179,673 | ) | | | (225,765 | ) |

Net change in unrealized appreciation (depreciation) | | | 241,649 | | | | (102,138 | ) |

| | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 356,358 | | | | 13,133 | |

| | |

Distributions to Common Shareholders: | | | | | | | | |

| | |

From net investment income and/or net realized capital gains | | | | | | | | |

Institutional Class | | | (246,274 | ) | | | (347,804 | ) |

Class A-1 | | | (998 | ) | | | (1,326 | ) |

Class A-2 | | | (11,141 | ) | | | (12,454 | ) |

Class A-3 | | | (47,233 | ) | | | (53,620 | ) |

Class A-4 | | | (2,522 | ) | | | (6,920 | ) |

| | |

Total Distributions to Common Shareholders(a) | | | (308,168 | ) | | | (422,124 | ) |

| | |

Common Share Transactions*: | | | | | | | | |

| | |

Receipts for shares sold | | | 539,688 | | | | 1,013,844 | |

Issued as reinvestment of distributions | | | 122,529 | | | | 134,096 | |

Cost of shares repurchased | | | (687,873 | ) | | | (863,788 | ) |

Net increase (decrease) resulting from common share transactions | | | (25,656 | ) | | | 284,152 | |

| | |

Total Increase (Decrease) in Net Assets | | | 22,534 | | | | (124,839 | ) |

| | |

Net Assets: | | | | | | | | |

| | |

Beginning of year | | | 2,866,463 | | | | 2,991,302 | |

End of year | | $ | 2,888,997 | | | $ | 2,866,463 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

| * | See Note 13, Common Shares Offering, in the Notes to Financial Statements. |

| (a) | The tax characterization of distributions is determined in accordance with Federal income tax regulation. The actual tax characterization of distributions paid is determined at the end of the fiscal year. See Note 2, Distributions — Common Shares, in the Notes to Financial Statements for more information. |

| | | | |

| 24 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

Consolidated Statement of Cash Flows PIMCO Flexible Credit Income Fund

| | | | |

Year Ended June 30, 2024 (Amounts in thousands†) | |

| |

Cash Flows Provided by (Used for) Operating Activities: | | | | |

| |

Net increase (decrease) in net assets resulting from operations | | $ | 356,358 | |

| |

Adjustments to Reconcile Net Increase (Decrease) in Net Assets from Operations to Net Cash Provided by (Used for) Operating Activities: | | | | |

| |

Purchases of long-term securities | | | (863,643 | ) |

Proceeds from sales of long-term securities | | | 1,073,327 | |

(Purchases) Proceeds from sales of short-term portfolio investments, net | | | (82,188 | ) |

(Increase) decrease in deposits with counterparty | | | 65,591 | |

(Increase) decrease in receivable for investments sold | | | 71,763 | |

(Increase) decrease in interest and/or dividends receivable | | | 20,918 | |

(Increase) decrease in dividends receivable from Affiliates | | | (1,128 | ) |

Proceeds from (Payments on) exchange-traded or centrally cleared financial derivative instruments | | | (13,745 | ) |

Proceeds from (Payments on) over the counter financial derivative instruments | | | 25,875 | |

(Increase) decrease in other assets | | | (2 | ) |

Increase (decrease) in payable for investments purchased | | | (40,449 | ) |

Increase (decrease) in payable for unfunded loan commitments | | | 21,145 | |

Increase (decrease) in deposits from counterparty | | | 19,326 | |

Increase (decrease) in accrued management fees | | | (786 | ) |

Increase (decrease) in accrued servicing fees | | | (11 | ) |

Proceeds from (Payments on) foreign currency transactions | | | (1,836 | ) |

Increase (decrease) in foreign capital gains tax payable | | | (68 | ) |

Increase (decrease) in other liabilities | | | (3 | ) |

Net Realized (Gain) Loss | | | | |

Investments in securities | | | 85,254 | |

Investments in Affiliates | | | (86 | ) |

Exchange-traded or centrally cleared financial derivative instruments | | | 115,739 | |

Over the counter financial derivative instruments | | | (24,526 | ) |

Foreign currency | | | 3,292 | |

Net Change in Unrealized (Appreciation) Depreciation | | | | |

Investments in securities | | | (98,301 | ) |

Investments in Affiliates | | | (18,647 | ) |

Exchange-traded or centrally cleared financial derivative instruments | | | (107,422 | ) |

Over the counter financial derivative instruments | | | (14,341 | ) |

Foreign currency assets and liabilities | | | (2,938 | ) |

Net amortization (accretion) on investments | | | (76,791 | ) |

Net Cash Provided by (Used for) Operating Activities | | | 511,677 | |

| |

Cash Flows Received from (Used for) Financing Activities: | | | | |

| |

Proceeds from shares sold | | | 557,364 | |

Payments on shares repurchased | | | (687,873 | ) |

Increase (decrease) in overdraft due to custodian | | | (2,990 | ) |

Cash distributions paid* | | | (187,883 | ) |

Proceeds from reverse repurchase agreements | | | 11,207,223 | |

Payments on reverse repurchase agreements | | | (11,369,737 | ) |

Net Cash Received from (Used for) Financing Activities | | | (483,896 | ) |

| |

Net Increase (Decrease) in Cash and Foreign Currency | | | 27,781 | |

| |

Cash and Foreign Currency: | | | | |

| |

Beginning of year | | | 2,885 | |

End of year | | $ | 30,666 | |

* Reinvestment of distributions | | $ | 122,529 | |

| |

Supplemental Disclosure of Cash Flow Information: | | | | |

Interest expense paid during the year | | $ | 125,255 | |

Non-Cash Payment In-Kind | | $ | 30,114 | |

| † | A zero balance may reflect actual amounts rounding to less than one thousand. |

A Statement of Cash Flows is presented when the Fund has a significant amount of borrowing during the year, based on the average total borrowing outstanding in relation to total assets or when substantially all of the Fund’s investments are not classified as Level 1 or 2 in the fair value hierarchy.

| | | | | | | | | | |

| | | ANNUAL REPORT | | | | JUNE 30, 2024 | | | 25 | |

Schedule of Investments PIMCO Flexible Emerging Markets Income Fund

(Amounts in thousands*, except number of shares, contracts, units and ounces, if any)

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

| INVESTMENTS IN SECURITIES 106.2% | |

| |

| LOAN PARTICIPATIONS AND ASSIGNMENTS 11.1% | |

|

Ecopetrol SA | |

TBD% due 08/16/2024 «µ | | $ | | | 600 | | | $ | | | 597 | |

|

NMC Healthcare LLC | |

11.585% (LIBOR03M + 6.000%) due 03/25/2027 «~ | | AED | | | 1,543 | | | | | | 424 | |

|

Oi SA | |

1.750% (LIBOR03M + 1.750%) due 02/26/2035 «~ | | $ | | | 390 | | | | | | 4 | |

|

Republic of Cote d’lvoire | |

6.852% (EURO03M + 3.050%) due 03/07/2025 «~ | | EUR | | | 300 | | | | | | 321 | |

|

Republic of Kenya | |

11.726% due 06/29/2025 « | | $ | | | 300 | | | | | | 299 | |

|

Republic of Senegal | |

9.489% (EURO06M + 5.800%) due 12/22/2028 «~ | | EUR | | | 600 | | | | | | 639 | |

|

Republic of Turkey | |

TBD% due 04/27/2031 « | | | | | 300 | | | | | | 364 | |

|

SOCAR Turkey Enerji AS | |

7.348% (EURO06M + 3.450%) due 08/11/2026 ~ | | | | | 300 | | | | | | 320 | |

|

State Oil Co. of the Azerbaijan Republic | |

8.229% due 11/26/2024 « | | $ | | | 181 | | | | | | 180 | |

|

Telemar Norte Leste SA | |

1.750% due 02/26/2035 « | | | | | 20 | | | | | | 0 | |

1.750% (LIBOR06M + 1.750%) due 02/26/2035 «~ | | | | | 302 | | | | | | 3 | |

|

The Ministry of Finance and Planning, Government of the United Republic of Tanzania | |

11.222% due 04/26/2028 « | | | | | 444 | | | | | | 447 | |

| | | | | | | | | | | | |

Total Loan Participations and Assignments

(Cost $3,872) | | | 3,598 | |

| | | | |

| |

| CORPORATE BONDS & NOTES 56.9% | |

| |

| BANKING & FINANCE 16.5% | |

|

Abu Dhabi Developmental Holding Co. PJSC | |

5.375% due 05/08/2029 | | | | | 200 | | | | | | 203 | |

5.500% due 05/08/2034 | | | | | 200 | | | | | | 206 | |

|

Africa Finance Corp. | |

2.875% due 04/28/2028 | | | | | 200 | | | | | | 177 | |

|

Asian Infrastructure Investment Bank | |

42.250% due 12/30/2024 | | TRY | | | 26,700 | | | | | | 779 | |

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

|

Banco del Estado de Chile | |

7.950% due 05/02/2029 •(g) | | $ | | | 200 | | | $ | | | 207 | |

|

Banco do Brasil SA | |

8.500% due 07/29/2026 | | MXN | | | 3,000 | | | | | | 155 | |

|

BOI Finance BV | |

7.500% due 02/16/2027 | | EUR | | | 350 | | | | | | 354 | |

|

Gabon Blue Bond Master Trust | |

6.097% due 08/01/2038 | | $ | | | 600 | | | | | | 599 | |

|

Interoceanica Finance Ltd. | |

0.000% due 05/15/2030 (f) | | | | | 253 | | | | | | 207 | |

|

Ipoteka-Bank ATIB | |

5.500% due 11/19/2025 | | | | | 300 | | | | | | 291 | |

|

Kuwait Projects Co. SPC Ltd. | |

4.500% due 02/23/2027 | | | | | 600 | | | | | | 540 | |

|

Panama Infrastructure Receivable Purchaser PLC | |

0.000% due 04/05/2032 (f) | | | | | 800 | | | | | | 523 | |

|

Peru Payroll Deduction Finance Ltd. | |

0.000% due 11/01/2029 «(f) | | | | | 496 | | | | | | 408 | |

|

Trust Fibra Uno | |

6.390% due 01/15/2050 | | | | | 500 | | | | | | 395 | |

6.950% due 01/30/2044 | | | | | 300 | | | | | | 263 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 5,307 | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| |

| INDUSTRIALS 28.6% | |

|

Aeropuerto Internacional de Tocumen SA | |

5.125% due 08/11/2061 | | | | | 200 | | | | | | 148 | |

|

Alfa Desarrollo SpA | |

4.550% due 09/27/2051 | | | | | 199 | | | | | | 149 | |

|

AngloGold Ashanti Holdings PLC | |

3.750% due 10/01/2030 | | | | | 300 | | | | | | 262 | |

|

Antofagasta PLC | |

6.250% due 05/02/2034 | | | | | 200 | | | | | | 207 | |

|

Bioceanico Sovereign Certificate Ltd. | |

0.000% due 06/05/2034 (f) | | | | | 127 | | | | | | 95 | |

|

Charter Communications Operating LLC | |

3.850% due 04/01/2061 | | | | | 300 | | | | | | 175 | |

|

CSN Resources SA | |

4.625% due 06/10/2031 | | | | | 200 | | | | | | 157 | |

|

Ecopetrol SA | |

5.875% due 05/28/2045 | | | | | 400 | | | | | | 287 | |

|

Empresa de los Ferrocarriles del Estado | |

3.068% due 08/18/2050 (i) | | | | | 900 | | | | | | 547 | |

|

Fideicomiso PA Pacifico Tres | |

8.250% due 01/15/2035 | | | | | 602 | | | | | | 593 | |

|

Fortune Star BVI Ltd. | |

3.950% due 10/02/2026 | | EUR | | | 400 | | | | | | 390 | |

|

Guara Norte SARL | |

5.198% due 06/15/2034 (i) | | $ | | | 745 | | | | | | 688 | |

|

IRB Infrastructure Developers, Inc. | |

7.110% due 03/11/2032 | | | | | 200 | | | | | | 200 | |

| | | | |

| 26 | | PIMCO INTERVAL FUNDS | | See Accompanying Notes |

June 30, 2024

| | | | | | | | | | | | |

| | | | | PRINCIPAL

AMOUNT

(000S) | | | | | MARKET

VALUE

(000S) | |

|

JSW Steel Ltd. | |

5.050% due 04/05/2032 | | $ | | | 300 | | | $ | | | 264 | |

|

KazMunayGas National Co. JSC | |

5.750% due 04/19/2047 | | | | | 300 | | | | | | 262 | |

|

Metalsa SA de CV | |

3.750% due 05/04/2031 | | | | | 300 | | | | | | 240 | |

|

OCP SA | |

5.125% due 06/23/2051 | | | | | 500 | | | | | | 377 | |

7.500% due 05/02/2054 | | | | | 200 | | | | | | 204 | |

|

Petroleos de Venezuela SA | |

9.750% due 05/17/2035 | | | | | 600 | | | | | | 86 | |

|

Petroleos del Peru SA | |

5.625% due 06/19/2047 | | | | | 400 | | | | | | 256 | |

|

Petroleos Mexicanos | |

6.375% due 01/23/2045 | | | | | 600 | | | | | | 389 | |

6.950% due 01/28/2060 (i) | | | | | 1,400 | | | | | | 927 | |

|

Saderea DAC | |

12.500% due 11/30/2026 ^(c) | | | | | 558 | | | | | | 277 | |

|

Stillwater Mining Co. | |

4.000% due 11/16/2026 | | | | | 200 | | | | | | 183 | |

4.500% due 11/16/2029 | | | | | 200 | | | | | | 163 | |

|

TransJamaican Highway Ltd. | |

5.750% due 10/10/2036 | | | | | 180 | | | | | | 159 | |

|

Turkish Airlines Pass-Through Trust | |

4.200% due 09/15/2028 | | | | | 477 | | | | | | 453 | |

|

Vale SA | |

0.000% due 12/29/2049 ~(g) | | BRL | | | 14,500 | | | | | | 896 | |

|

Yinson Boronia Production BV | |

8.947% due 07/31/2042 | | $ | | | 200 | | | | | | 202 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 9,236 | |

| | | | | | | | | | | | |

| |

| UTILITIES 11.8% | |

|

Chile Electricity Lux MPC SARL | |

6.010% due 01/20/2033 | | | | | 600 | | | | | | 608 | |

|

Engie Energia Chile SA | |

3.400% due 01/28/2030 | | | | | 200 | | | | | | 174 | |

6.375% due 04/17/2034 | | | | | 200 | | | | | | 203 | |

|

EP Infrastructure AS | |

1.816% due 03/02/2031 | | EUR | | | 150 | | | | | | 130 | |

|

LLPL Capital Pte. Ltd. | |

6.875% due 02/04/2039 (i) | | $ | | | 697 | | | | | | 703 | |

|

Mong Duong Finance Holdings BV | |

5.125% due 05/07/2029 | | | | | 506 | | | | | | 481 | |

|

Peru LNG SRL | |

5.375% due 03/22/2030 | | | | | 200 | | | | | | 173 | |

|

Poinsettia Finance Ltd. | |

6.625% due 06/17/2031 | | | | | 738 | | | | | | 636 | |