UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-K

(Mark One)

☒ ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended: December 31, 2023

☐ TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the transition period from ____________ to _____________

Commission File No. 001-41290

| SMART FOR LIFE, INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada | | 81-5360128 |

(State or other jurisdiction of

incorporation or organization) | | (I.R.S. Employer

Identification No.) |

| | | |

| 990 Biscayne Blvd, Suite 505, Miami, FL | | 33132 |

| (Address of principal executive offices) | | (Zip Code) |

| (786) 749-1221 |

| (Registrant’s telephone number, including area code) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | SMFL | | The Nasdaq Stock Market LLC |

Securities registered pursuant to Section 12(g) of the Act: None

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | Large accelerated filer | ☐ | Accelerated filer | ☐ |

| | Non-accelerated filer | ☒ | Smaller reporting company | ☒ |

| | | | Emerging growth company | ☒ |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark whether registrant is a shell company (as defined in Rule 12b-2 of the Act). Yes ☐ No ☒

As of June 30, 2023 (the last business day of the registrant’s most recently completed second fiscal quarter), the aggregate market value of the registrant’s common stock held by non-affiliates (based upon the closing price of such shares as reported on the Nasdaq Capital Market) was approximately $6.37 million. Shares held by each executive officer and director and by each person who owns 10% or more of the outstanding common shares have been excluded from the calculation in that such persons may be deemed to be affiliates of the registrant. This determination of affiliate status is not necessarily a conclusive determination for other purposes.

As of September 20, 2024, there were a total of 7,090,728 shares of the registrant’s common stock issued and outstanding.

DOCUMENTS INCORPORATED BY REFERENCE

None.

Smart for Life, Inc.

Annual Report on Form 10-K

Year Ended December 31, 2023

TABLE OF CONTENTS

INTRODUCTORY NOTES

Use of Terms

Except as otherwise indicated by the context and for the purposes of this report only, references in this report to “we,” “us,” “our” and “our company” are to Smart for Life, Inc., a Nevada corporation, and its consolidated subsidiaries.

Special Note Regarding Forward-Looking Statements

This report contains forward-looking statements that are based on our management’s beliefs and assumptions and on information currently available to us. All statements other than statements of historical facts are forward-looking statements. These statements relate to future events or to our future financial performance and involve known and unknown risks, uncertainties and other factors that may cause our actual results, levels of activity, performance or achievements to be materially different from any future results, levels of activity, performance or achievements expressed or implied by these forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| ● | our goals and strategies; |

| ● | our future business development, financial condition and results of operations; |

| ● | expected changes in our revenue, costs or expenditures; |

| ● | growth of and competition trends in our industry; |

| ● | our expectations regarding demand for, and market acceptance of, our products; |

| ● | our expectations regarding our relationships with investors, institutional funding partners and other parties with which we collaborate; |

| ● | fluctuations in general economic and business conditions in the markets in which we operate; and |

| ● | relevant government policies and regulations relating to our industry. |

In some cases, you can identify forward-looking statements by terms such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. These statements are only predictions. You should not place undue reliance on forward-looking statements because they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond our control and which could materially affect results. Factors that may cause actual results to differ materially from current expectations include, among other things, those listed under Item 1A “Risk Factors” and elsewhere in this report. If one or more of these risks or uncertainties occur, or if our underlying assumptions prove to be incorrect, actual events or results may vary significantly from those implied or projected by the forward-looking statements. No forward-looking statement is a guarantee of future performance.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this report, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all potentially available relevant information. These statements are inherently uncertain and investors are cautioned not to unduly rely upon these statements.

The forward-looking statements made in this report relate only to events or information as of the date on which the statements are made in this report. Except as expressly required by the federal securities laws, there is no undertaking to publicly update or revise any forward-looking statements, whether as a result of new information, future events, changed circumstances or any other reason.

PART I

ITEM 1. BUSINESS.

Overview

We are engaged in the development, marketing, manufacturing, acquisition, operation and sale of a broad spectrum of nutritional and related products with an emphasis on health and wellness. Structured as a global holding company, we are executing a buy-and-build strategy with serial accretive acquisitions creating a vertically integrated company. To drive growth and earnings, we are developing proprietary products as well as acquiring other profitable companies, encompassing brands, manufacturing, and distribution channels.

We also operate a network platform in the affiliate marketing space. Affiliate marketing is an advertising model in which a product vendor compensates third-party digital marketers to generate traffic or leads for the product vendor’s products and services. The third-party digital marketers are referred to as affiliates, and the commission fee incentivizes them to find ways to promote the products being sold by the product vendor.

Business Model

We are engaged in a comprehensive program to develop a robust pipeline of prospective acquisitions in addition to the companies currently operated by us. Our management has significant experience in locating and evaluating prospective target operating companies. We have also entered into buy-side agreements with certain advisers and consultants to assist management in identifying and evaluating prospective target operating companies. The nutritional products industry is highly fragmented, and we believe that there is a large pool of companies generating less than $20 million in revenues representing significant opportunity for industry consolidation.

We plan to acquire target companies utilizing a combination of cash, promissory notes, earnouts and public company stock, generally at 4x to 6x trailing adjusted EBITDA (earnings before interest, taxes, depreciation, and amortization). Aside from our first acquisition described below, we intend on paying no more than 60% cash on any acquisition that we execute with a target of 50%. The remainder is allocated between stock and a note and/or earnout with a heavier weighting toward the former. Although the acquisition consideration is structured, we believe that our acquisitions will provide three distinct benefits to the principals of an acquisition - first, a significant liquidity event; second, the creation of a significant equity position in an emerging growth public company; and third, ongoing employment at customary industry compensation.

We plan to acquire multiple companies creating a vertically integrated company. We do not currently have sufficient capital to complete these acquisitions. We intend to raise capital for additional acquisitions primarily through debt financing at our operating company level, additional equity offerings by our company, or by undertaking a combination of any of the above. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all.

There is no guarantee that we will be able to acquire additional businesses under the terms outlined above or that we will be able to find additional acquisition candidates should we terminate our plans for any of our current acquisition targets.

Corporate History and Structure

Our company was incorporated in the State of Delaware on February 2, 2017 under the name Bonne Santé Group, Inc. On August 4, 2021, we changed our name to Smart for Life, Inc. in connection with the acquisition of DSO described below. On April 10, 2023, we redomiciled as a Nevada company.

On March 8, 2018, we acquired 51% of Millenium Natural Manufacturing Corp. and Millenium Natural Health Products Inc. for a purchase price of $2,140,272. On October 8, 2019, we entered into an agreement to acquire the remaining 49% of these companies, which was completed on October 8, 2019. On September 30, 2020, we changed the name of Millenium Natural Manufacturing Corp. to Bonne Sante Natural Manufacturing, Inc., or BSNM, and on November 24, 2020, we merged Millenium Natural Health Products Inc. into BSNM to better reflect our vertical integration. On March 6, 2024, we entered into a sale and leaseback agreement relating to BSNM as more fully described under Item 7 “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Recent Developments—Sale and Leaseback Agreement.” As a result of this transaction, BSNM is no longer a subsidiary of our company.

On February 11, 2020, we entered into securities purchase agreement, which was amended on July 7, 2020 and June 4, 2021, to acquire all of the issued and outstanding equity interests of Doctors Scientific Organica, LLC d/b/a Smart for Life, Oyster Management Services, Ltd., Lawee Enterprises, L.L.C. and U.S. Medical Care Holdings, L.L.C. On July 1, 2021, the acquisition was completed. On August 27, 2021, we transferred all of the equity interests of Oyster Management Services, Ltd., Lawee Enterprises, L.L.C. and U.S. Medical Care Holdings, L.L.C. to Doctors Scientific Organica, LLC. On December 13, 2022, we converted Oyster Management Services, Ltd. to a limited liability company known as Oyster Management Services, L.L.C. On May 19, 2022, we acquired Lavi Enterprises, LLC. On the same date, we transferred all of the equity interests of Lavi Enterprises, LLC to Doctors Scientific Organica, LLC. As a result, these entities are now wholly owned subsidiaries of Doctors Scientific Organica, LLC. In this report, we collectively refer to Doctors Scientific Organica, LLC and its consolidated subsidiaries as DSO.

On August 24, 2021, we established Smart for Life Canada Inc. as a wholly owned subsidiary of Doctors Scientific Organica, LLC in Canada. This subsidiary sells retail products through a retail store location in Montreal Canada and the same location also acts as distribution center for our international direct to consumer and big box customers. We maintain inventory and employees at this location.

On July 21, 2021, we entered into a securities purchase agreement, which was amended on November 8, 2021, to acquire all of the issued and outstanding capital stock of Nexus Offers, Inc., or Nexus. On November 8, 2021, the acquisition was completed.

On November 29, 2021, we entered into a contribution and exchange agreement to acquire all of the issued and outstanding capital stock of GSP Nutrition Inc., or GSP. On December 6, 2021, the acquisition was completed.

On March 14, 2022, we entered into securities purchase agreement, which was amended on July 29, 2022, to acquire all of the issued and outstanding equity interests of Ceautamed Worldwide LLC and its wholly-owned subsidiaries Wellness Watchers Global, LLC and Greens First Female LLC, which we collectively refer to in this report as Ceautamed. On July 29, 2022, the acquisition was completed. On January 29, 2024, we contributed nearly all of the assets of Ceautamed into a limited liability company, First Health FL LLC, or First Health, of which we own 49%. Pursuant to the limited liability company operating agreement, we do not exert operational control of First Health. The aggregate value of the contributed assets was $3,486,223.

On August 15, 2022, we organized Smart Acquisition Group, LLC in the State of Florida. This subsidiary is 50% owned by our company and 50% owned by Stuart Benson, the former owner and principal of Ceautamed. This special purpose subsidiary is dedicated exclusively to the identification, negotiation, financing, and acquisition of companies synergistic to our buy-and-build business model. On September 22, 2023, we dissolved this subsidiary.

Corporate Structure

The following charts depict our organization structure.

Our Industry

The markets in which we operate are characterized by rapid technological changes, frequent new product introductions, established and emerging competition, extensive intellectual property disputes and litigation, price competition, aggressive marketing practices, evolving industry standards and changing customer preferences. Accordingly, our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies operating in rapidly changing and competitive markets.

Nutraceutical Industry

The nutraceutical industry focuses on nutritional supplements intended to improve longevity, sports fitness and provide health benefits in addition to the basic nutritional value present in food. Most people are familiar with various nutraceutical products—and have likely used them—even if they are unfamiliar with the industry name. Nutraceuticals comprise such commonly used items as herbal products, specific diet products, vitamins, processed foods and beverages, functional foods, isolated nutrients and other dietary products. Functional foods are foods that have a potentially positive effect on health beyond basic nutrition. A familiar example of a functional food is oatmeal because it contains soluble fiber that can help lower cholesterol levels. Some foods are also modified to have health benefits. An example is orange juice that has been fortified with calcium for bone health.

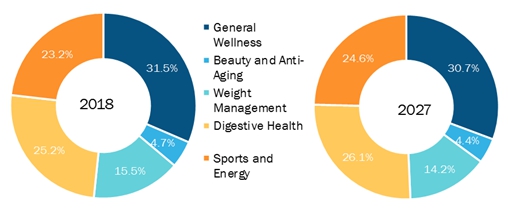

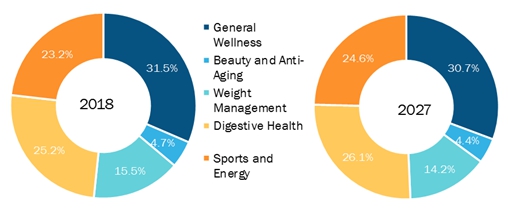

The following table prepared by the Council for Responsible Nutrition (www.crnusa.org), or CRN, depicts the types of supplements taken by the population in the different indicated categories beginning in 2018 and estimated through 2027. We sell products across all of these product categories, and we believe that our market share in each of these categories is currently less than 1%.

SOURCE: Council for Responsible Nutrition

Nutraceuticals are garnering immense attention in recent years due to various trends including changing lifestyles, burgeoning middle-class segment across emerging economies, transforming dietary habits, aging population, and increased life expectancy. In addition, the focus of R&D based pharmaceutical sector on expensive specialty drugs is increasing the burden on the healthcare system as well as resulting in higher out-of-pocket costs for drugs driving the focus on prevention than intervention. The self-care trend across the world is driving strong demand for nutraceuticals including superfoods, food and dietary supplements, sports nutrition, and functional foods and beverages. Given the hectic lifestyles and the lack of time for consumption of the required nutrients through regular diet, the need for replenishing such essential nutrients is increasing. In this context, nutraceuticals are emerging to be the solution for meeting this requirement. Nutraceuticals are considered to be the vital link between health and food.

The market is also experiencing strong demand for personalized approaches to wellness that is driving product innovation in the areas of weight management, sports nutrition, and healthy snacking. Other noteworthy trends benefiting market prospects in the near term include emergence of clean labeling as a new norm owing to increasing focus of consumers on ingredient list on the product; innovative delivery technologies such as microencapsulation, which protects the product from adverse conditions such as light and air.

As the overall population continues to turn to healthier living in hopes of offsetting rising healthcare expenditures and preventing general subpar health conditions, we believe that the demand for nutraceutical industry products will resemble a similar trend.

Digital Marketing

As a result of our acquisition of Nexus, we have entered the digital marketing industry as a way to promote the products and brands that we sell. Digital marketing is a component of marketing that uses internet and online based digital technologies such as desktop computers, mobile phones and other digital media and platforms to promote products and services.

The COVID-19 pandemic resulted in people staying at home and/or working remotely from home, resulting in huge increase in online traffic. Clicks and display ads are among the most prominent forms of digital marketing initiatives. Clicks are expensive compared to display ads, as clicks ensure the customer is directed to the advertiser’s website. However, clicks provide a better return on investment.

Our Operating Subsidiaries

DSO

DSO manufactures, sells and owns the Smart for Life brand of natural health and wellness meal replacement products. The brand includes proprietary hunger suppressing functional foods that are designed to work with the body’s natural ability to lose weight. The program uses an exact protein-to-sugar ratio, a low glycemic index and glycemic load as well as multiple small meals throughout the day to deliver specific amounts of protein, super fibers and complex carbs to suppress hunger, keep sugar and insulin low and trigger the body’s release of the fat releasing hormone glucagon.

Our Smart for Life products deliver:

| ● | Hunger controlling protein mix |

| ● | No toxins or preservatives |

| ● | The right amount of protein per calorie ratio |

| ● | No insulin spike, lets glucagon do its job |

| ● | A small amount of essential good fats |

| ● | Right amount of complex carbs |

DSO also develops premium supplements and commodities that will promote optimal health and wellness. This natural product line uses simple quality ingredients to help create a more sustainable lifestyle. DSO has over 15 years of experience providing high-quality products to premium retail locations and companies. DSO branded vitamins and supplements are also being sold through Amazon, and this sales channel is becoming a major contributor to the growth of the brand online. All products are packaged in eco-friendly and bio-degradable packaging.

GSP

GSP is a sports nutrition company. It offers nutritional supplements for athletes and active lifestyle consumers through a variety of wellness solutions and delivery methods, including powders, tablets and soft gels that are formulated to support energy and performance; nutrition and wellness; and focus and clarity.

In conjunction with the sale of BSNM, we entered into a lease agreement with the buyer to operate the facility owned by the buyer. Following the surrendering of the facility in Doral, Florida, GSP moved the equipment and operation to the manufacturing facility in Riviera Beach, Florida. This subsidiary primarily focuses on the contract manufacturing of vitamins and supplements, with a particular emphasis on the production of tablets, capsules and powders, along with turn-key solutions for packaging these health and wellness products in a wide variety of bottles, jars, sachets and stick packs. GSP’s initial line of nutritional products was marketed under the Sports Illustrated Nutrition brand. The product line consisted of whey protein isolate powder, tablet supplements for joint health, nitric oxide, post workout blends, Omega-3 supplements, and pre-workout supplements, among others. Due to the high cost of the license associated with Sports Illustrated Nutrition, the license agreement was surrendered, and future products will be marketed under the GSP brand.

First Health

First Health is primarily engaged in the development and distribution of a wide variety of nutritional products, including antioxidant rich supplements, plant-based protein, alkalizing nutrients and products designed for weight management.

First Health shares the Greens First line of branded products which have been specifically marketed to the healthcare provider sector. These vitamins and supplements have been sold on a business-to-business basis, direct-to-consumer, as well as sold utilizing an international medical distribution company.

The mission is to create a healthier world with nutritious wellness products made from the highest quality ingredients for superior benefits.

Nexus

Nexus operates a cost per action/cost per acquisition network. This network consists of hundreds of digital marketers who stand ready to market products introduced to the Nexus network. The cost per action/cost per acquisition model is where digital marketers are paid for an action (e.g., a product sale or lead generation) that is taken as a direct result of their marketing efforts. Through the digital marketer’s method of marketing, the digital marketer sends traffic to one of the product vendor’s offers listed on the network.

Nexus has relationships with both product vendors and digital marketers. A product vendor is a Nexus customer that has products, whether digital or physical, for sale and is looking for increased sales through digital marketing avenues from digital marketers. Digital marketers are Nexus contractors that engage in digital marketing. An example of a digital marketer is someone who has a strong Facebook following, or a strong knowledge of Facebook ad marketing. Other examples include google ad marketing or email marketers who send marketing messages to an opted in list of subscribers. Historically, Nexus’ customers consisted exclusively of owners of digital products that were also delivered digitally. Following our acquisition of Nexus, BSNM, DSO, GSP and Ceautamed, as well as any additional nutraceutical companies that we acquire in the future, will also become customers of Nexus. Nexus will use its online marketplace to market our nutraceutical products through its network of digital marketers. Our nutraceutical product companies will then sell and physically deliver the nutraceutical products to the end users identified through the efforts of the digital marketers. Nexus has the ability to “plug and play” with any of the products sold by companies that we may acquire in the future as we can take the consumer facing products being sold by those companies and seamlessly add them to the Nexus network to generate sales.

Product vendors come to Nexus to increase sales of their products and digital marketers come to Nexus to receive a commission in exchange for their marketing efforts, which are designed to generate sales for the product vendors. When a digital marketer’s marketing efforts results in a sale of a product by a product vendor, the digital marketer is then credited with a commission. The product vendor is billed weekly for the sales that the product vendor makes during the week as the result of such digital marketers’ marketing efforts. The product vendor pays Nexus and Nexus pays the digital marketer. This is an anonymous transaction as digital marketers and product vendors are only defined inside the marketplace by an offer name (product vendor) and an affiliate number (digital marketer).

Manufacturing, Distribution and Quality Control

DSO operates a 30,000 square foot manufacturing facility in Riviera Beach, Florida. This facility is primarily focused on the production of natural health and wellness meal replacement products, including nutrition bars, cookies, soups and shakes, as well as some vitamin and supplement capabilities such as powders. In addition to our own products, DSO manufactures products on behalf of third parties

GSP operated an 18,000 square foot manufacturing facility in Doral, Florida. This facility primarily focused on the contract manufacturing of vitamins and supplements, with a particular emphasis on the production of tablets, capsules and powders, along with turn-key solutions for packaging these health and wellness products in a wide variety of bottles, jars, sachets and stick packs. During 2024, the equipment and inventory located at the Doral facility was transferred to the facility in Riviera Beach, Florida.

First Health relies on third-party contract manufacturers to manufacture its products.

All our manufacturing operations are subject to good manufacturing practices, or GMPs, promulgated by the U.S. Food and Drug Administration, or the FDA, and other applicable regulatory standards. We believe our manufacturing processes comply with the GMPs for dietary supplements or foods, and our manufacturing and distribution facilities generally have sufficient capacity to meet our current business requirements and our currently anticipated sales. We place special emphasis on quality control. We assign lot numbers to all raw materials and initially hold them in quarantine while our quality department evaluates them for compliance with established specifications. Once released, we retain samples and process the material according to approved formulas by blending, mixing and technically processing as necessary. We manufacture products in final delivery form as a capsule, tablet, powder, or nutrition bar. After a product is manufactured, our laboratory analysts test its weight, purity, potency, disintegration and dissolution, if applicable, utilizing both internal equipment and third-party labs. We hold the product in quarantine until we complete the quality evaluation and determine that the product meets all applicable specifications before packaging. When the manufactured product meets all specifications, our automated packaging equipment packages the product with at least one tamper-evident safety seal and affixes a label, an indelible lot number and, in most cases, the expiration or “best by” date.

Our manufacturing operations are designed to allow low-cost production of a wide variety of products of different quantities, physical sizes and packaging formats, while maintaining a high level of customer service and quality. Flexible production line changeover capabilities and reduced cycle times allow us to respond quickly to changes in manufacturing schedules and customer demands.

We have inventory control systems at our facilities that track each manufacturing and packaging component as we receive it from our supply sources through manufacturing and shipment of each product to customers. To facilitate this tracking, most products we sell are bar coded. We believe our distribution capabilities increase our flexibility in responding to our customers’ delivery requirements.

Raw Materials and Suppliers

In fiscal 2023 and 2022, we spent approximately $1,988,000 and $9,335,000, respectively, on raw materials, excluding shipping packaging and similar product materials. The principal raw materials required in our operations are food ingredients, vitamins, minerals, herbs, gelatin, labels, and bottles. We believe that there are adequate sources of supply for all our principal raw materials, and in general we maintain two to three suppliers for many of our raw materials. From time to time, weather or unpredictable fluctuations in the supply and demand may affect price, quantity, availability, or selection of raw materials. We believe that our strong relationships with our suppliers yield high quality, competitive pricing, and overall good service to our customers. Although we cannot be sure that our sources of supply for our principal raw materials will be adequate in all circumstances, we believe that we can develop alternate sources in a timely and cost-effective manner if our current sources become inadequate. During fiscal 2023, we had one significant raw material supplier accounted for 22% of our raw material purchases. Due to availability of numerous alternative raw material suppliers, we do not believe that the loss of any single raw material supplier would have a material adverse effect on our consolidated financial condition or results of operations. See Item 1A “Risk Factors—Risks Related to Our Business and Industry—An increase in the price and shortage of supply of key raw materials could adversely affect our business.”

Sales and Marketing

We employ many different techniques and strategies within our marketing initiatives. These include direct to consumer outreach, use of influencers through social media, Facebook targeting, focused e-mail campaigns, and traditional media. Our marketing goal is always to increase visibility and relevance of our brands in the minds of our customers and potential customers. We hope to expand our programs to include experimental marketing techniques in the future.

We recently shifted the marketing focus of Nexus to target the nutraceutical industry away from all other efforts, which we believe will become a value-added component of our marketing strategies.

Customers

DSO, GSP and First Health primarily sell products to customers under individual purchase orders placed by them under their standard terms and conditions of sale. These terms and conditions generally include insurance requirements, representations by us with respect to the quality of our products and our manufacturing process, our obligations to comply with law, and indemnifications by us if we breach our representations or obligations. There is no commitment from any customer to purchase from us, or from us to sell to them, any minimum amount of product. During fiscal 2023, Amazon and Boxout, accounted for 31% and 31%, respectively, of our total revenues.

First Health has distribution agreements with Boxout whereby it acts as an exclusive distributor for certain of First Health’s products to professional health and wellness providers and service locations, along with distributors selling to such providers and locations, within the U.S. and Canada, as well as through e-commerce websites Amazon, Ebay and Walmart.

As described above, Nexus’ customers are product vendors. Although the number of customers that Nexus has fluctuates from year to year, it has established long-term relationships with its significant product vendors, but it does not have long-term contracts with any of its customers. The relationship with customers can be terminated at any time by either party; however, as a result of Nexus’ extensive network of digital marketers, which drive sales for product vendors, the average length of Nexus’ relationships with its significant customers is 3 years. Most of Nexus’ customers are acquired through existing customer referrals. Nexus also attends Internet marketing conferences to promote is service.

The loss of any major customer would have a material adverse effect on us if we were unable to replace that customer. See Item 1A “Risk Factors—Risks Related to Our Business and Industry—Our major customers account for a significant portion of our consolidated net sales and the loss of any major customer could have a material adverse effect on our results of operations.”

Competition

The nutraceutical industry is highly competitive. Our competitors include a number of large, nationally known brands such as Nature Made (Pharmavite), Nature’s Bounty, GNC, Spectrum (Hain Celestial), Country Life, Garden of Life and Jarrow Formulas, and many smaller brands, manufacturers and distributors. The sales of products through online marketplace platforms such as Amazon and firms’ websites continue to expand. Private label products also provide competition to our products. Whole Foods Market, Walmart, CVS, Walgreens and many health stores also sell a portion of their nutritional supplement offerings under their own private labels. Private label products are often sold at a discount to branded products. We also compete with distributors that sell products to health stores as well as mass market retailers such as United Natural Foods and KeHE Distributors. In addition, several major pharmaceutical companies continue to offer nutritional supplement lines in the mass market, including Centrum (Pfizer and GSK) and One-A-Day (Bayer). Pharmaceutical companies also offer prescription and over-the-counter products that are or may be competitive with nutritional supplements, particularly with regard to certain categories of products. Finally, as the nutraceutical market generally has low barriers to entry, additional competitors enter the market regularly.

Nexus’ competitors would be any digital marketing agency in the cost per acquisition space looking to acquire exclusive advertiser offers and high end publishers who can send high amounts of traffic through digital marketing media. Examples include Ca$hNetwork, OfferBlueprint and MaxBounty.

Competitive Strengths

Based on management’s belief and experience in the industry, we believe that the following competitive strengths enable us to compete effectively.

| ● | Proprietary manufacturing facilities. GSP and DSO own and operate proprietary manufacturing facilities, which allow for a high level of managerial control over all aspects of production, including sourcing, logistics and maintaining the highest levels of quality during the manufacturing process. Through direct ownership, we are able to optimize our sales and marketing practices and provide a completely integrated approach, all solidified by a single manufacturing platform for capsules, tablets, powders and various other delivery methods for all vitamins and supplements. In addition, as a private label contract manufacturer for third parties, we can provide a turnkey solution for brands and retailers who want to minimize their supply chain disruption and maximize their control over product flow to end customers. In addition, as a middle market-sized contract manufacturer, we are not encumbered by the often overly complex processes that our larger competitors may have. We can be nimble and highly adaptable, “flexing” with our customers’ needs as they change over time, which allows us to better service our ever-expanding international client base. We are able to maintain a competitive advantage due to our vertically integrated operational control. This vertical integration also allows us to minimize intellectual property and data security risks, while also eliminating costs, improving focus, optimizing quality and launching with a faster time-to-market for new products. We retain control over every step of the manufacturing processes, allowing us to establish our own institutional advantages and maximize efficiencies. |

| ● | Established and trusted brands. Smart for Life, Doctors Scientific Organica, and Greens First are well-established brands in the in the health and wellness industry. In particular, Smart for Life products are currently sold in many of the largest big-box retailers in the United States and Canada, including Costco, Walmart, Sam’s Club, BJ’s and Publix, as well as through online channels such as Amazon. DSO has established a dedicated following of consumers that are strong believers in the high-quality vitamins and supplements it sells to its customers, along with the eco-friendly and bio-degradable packaging, with Amazon sales numbers continuing to increase as a result. |

| ● | Client focused innovative research and development. We believe that our research and development team adds significant value to our company and our customers and is a differentiating factor for our company. We strive to be technology driven leveraging technology, science, and innovation in our research and development efforts. We work closely with our clients to create and develop new and exciting products. We frequently work directly with our customers in our research and development labs to create innovative solutions that create value for our customers in a timely manner. Our team works closely with physicians to create novel wholesome products that add nutritional and functional value. |

| ● | Ability to market through captive marketing subsidiary. We believe that our subsidiary, Nexus, allows us access to a broad spectrum of marketing tools to be utilized across the entire spectrum of our products. We believe that having an experienced management team and existing customer base accessible to all of our other brands in our portfolio will allow us to drive sales and revenue of existing products as well as test new product offerings generated through our research and development. |

| ● | Referral only network based on long term relationships. Nexus operates a referral only network, meaning that all of its digital marketers are referred. There is no way to get a Nexus account other than being directly referred by a known good account holder. This allows Nexus to stem any fraudulent traffic, which we believe is a substantial competitive advantage for product vendors. We believe that these factors set Nexus apart from its competition. |

Growth Strategies

We will strive to grow our business by pursuing the following growth strategies.

| ● | Acquisition of additional businesses. The nutritional products industry is highly fragmented, and we believe that there is a large pool of companies generating less than $20 million in revenues representing significant opportunity for industry consolidation. We plan to acquire multiple companies creating a vertically integrated company. As noted above, we do not currently have sufficient capital to complete these acquisitions. We intend to raise capital for additional acquisitions primarily through debt financing at our operating company level, additional equity offerings by our company, or by undertaking a combination of any of the above. The sale of additional equity securities could result in dilution to our stockholders. The incurrence of indebtedness would result in increased debt service obligations and could require us to agree to operating and financial covenants that would restrict our operations. Financing may not be available in amounts or on terms acceptable to us, if at all. There is no guarantee that we will be able to acquire additional businesses under the terms outlined above or that we will be able to find additional acquisition candidates should we terminate our plans for any of our current acquisition targets. |

| ● | Increase sales from existing and new customers. We expect to continue to drive growth for our consumer products branded business through our increased focus on our top brands and continued expansion in various health and wellness categories, which we expect to result in incremental shelf space with existing customers and new customer additions. We expect that our focus on delivering tangible benefits to consumers through product innovation will not only benefit us but also benefit our customers. Our ability to supply both branded and private label products broadens and deepens our partnerships with key retail customers, providing us more opportunities for category leadership and growth. We view the private label business as an important and valuable service that we provide to key accounts. |

| ● | Further penetrate international markets. Our products are currently marketed and sold in approximately two countries. In fiscal 2023, approximately 4% of our sales were to customers outside the United States. We plan to capitalize on our marketing and distribution capabilities to drive incremental international sales of our consumer product brands in emerging markets, which are characterized by a rising middle class and a strong demand for high quality nutritional and wellness products from U.S.-based manufacturers. |

| ● | Drive productivity through operational efficiencies. We expect to continue to focus on improving efficiency across our operations to allow us to reduce costs in our manufacturing facilities as well as across our overhead cost areas. Our acquisition of DSO significantly increased our production capacity. In addition, we have launched an initiative to optimize our product portfolio, which we expect will enable further efficiencies across our manufacturing network. We are also introducing new initiatives that leverage automation, standardization and simplification and are expected to increase productivity across our operations. |

Intellectual Property

We believe trademark protection is particularly important to the maintenance of the recognized brand names under which we market our products. We own or have rights to material trademarks or trade names that we use in conjunction with the sale of our products, including the Smart for Life, Doctors Scientific Organica, and Greens First, and brand names. We also own website domain names and have proprietary methodologies that we use in our manufacturing businesses. We also rely upon trade secrets, know-how, continuing technological innovations and licensing opportunities to develop and maintain our competitive position.

We protect our intellectual property rights through a variety of methods, including trademark, patent and trade secret laws, as well as confidentiality agreements and proprietary information agreements with vendors, employees, consultants and others who have access to our proprietary information. Protection of our intellectual property often affords us the opportunity to enhance our position in the marketplace by precluding our competitors from using or otherwise exploiting our technology and brands. We are also a party to several intellectual property license agreements relating to certain of our products. The duration of our trademark registrations is generally 10, 15 or 20 years, depending on the country in which the marks are registered, and we can renew the registrations. The scope and duration of our intellectual property protection varies throughout the world by jurisdiction and by individual product. Our global trademark portfolio, with the aforementioned registration durations, consists of our core marks for our business and our proprietary product brands which drive significant brand awareness for all of our businesses. Our proprietary product formulas and recipes, maintained as trade secrets, are significant to our growth and success as they form the foundation for our production and sales of effective, high quality products.

Employees

As of December 31, 2023, we had approximately 12 employees with approximately 7 of such employees being engaged in our manufacturing operations and the balance being engaged in management or middle management. None of our employees are represented by labor unions, and we believe that we have an excellent relationship with our employees.

Regulation

Our business is subject to varying degrees of regulation by a number of government authorities in the United States, including the FDA, the Federal Trade Commission, or the FTC, the Consumer Product Safety Commission, or the CPSC, the U.S. Department of Agriculture, or the USDA, and U.S. Environmental Protection Agency, or the EPA. Various agencies of the state and localities in which we operate and in which our products are sold also regulate our business.

The areas of our business that these and other authorities regulate include, among others:

| ● | product claims and advertising; |

| ● | product ingredients; and |

| ● | how we manufacture, package, distribute, import, export, sell and store our products. |

In addition, our products sold in foreign countries are also subject to regulation under various national, local and international laws that include provisions governing, among other things, the formulation, manufacturing, packaging, labeling, advertising and distribution of dietary supplements and over-the-counter drugs.

As a result of the acquisition of Nexus, we are also subject to laws and regulations generally applicable to providers of digital marketing services, including federal and state laws and regulations governing data security and privacy, unfair and deceptive acts and practices, advertising and content regulation.

We are also subject to a variety of other regulations in the United States, including those relating to taxes, employment, import and export, and intellectual property.

Food and Drug Administration

The Dietary Supplement Health and Education Act of 1994, or DSHEA, amended the Federal Food, Drug, and Cosmetic Act, or the FDC Act, to establish a new framework governing the composition, safety, labeling, manufacturing and marketing of dietary supplements. Generally, under the FDC Act, dietary ingredients (i.e., vitamins; minerals; herb or other botanical; amino acids; or dietary substances for use by humans to supplement diet by increasing total dietary intake; or any concentrate, metabolite, constituent, extract or combination of any of the above) that were marketed in the United States prior to October 15, 1994 may be used in dietary supplements without notifying the FDA. New dietary ingredients (i.e., dietary ingredients that were not marketed in the United States before October 15, 1994) must be the subject of a new dietary ingredient notification submitted to the FDA unless the ingredient has been “present in the food supply as an article used for food” without being “chemically altered.” A new dietary ingredient notification must provide the FDA evidence of a “history of use or other evidence of safety” establishing that use of the dietary ingredient “will reasonably be expected to be safe.” A new dietary ingredient notification must be submitted to the FDA at least 75 days before the initial marketing of the new dietary ingredient. The FDA may determine that a new dietary ingredient notification does not provide an adequate basis to conclude that a dietary ingredient is reasonably expected to be safe. Such a determination could prevent the marketing of such dietary ingredient.

In 2011 and 2016, the FDA issued draft guidance setting forth recommendations for complying with the new dietary ingredient notification requirement. Although FDA guidance is non-binding and does not establish legally enforceable responsibilities, and companies are free to use an alternative approach if the approach satisfies the requirements of applicable laws and regulations, FDA guidance is a strong indication of the FDA’s current thinking on the topic discussed in the guidance, including its position on enforcement. At this time, it is difficult to determine whether the 2016 draft guidance (which replaced the 2011 draft guidance), if finalized, would have a material impact on our operations. However, if the FDA were to enforce the applicable statutes and regulations in accordance with the draft guidance as written, such enforcement could require us to incur additional expenses, which could be significant, and negatively impact our business in several ways, including, but not limited to, enjoining the manufacturing of our products until the FDA determines that we are in compliance and can resume manufacturing, increasing our liability and reducing our growth prospects.

The FDA or other agencies could take actions against products or product ingredients that, in their determination, present an unreasonable health risk to consumers that would make it illegal for us to sell such products. In addition, the FDA could issue consumer warnings with respect to the products or ingredients in such products that are sold in our stores. Such actions or warnings could be based on information received through FDC Act-mandated reporting of serious adverse events.

We take a number of actions to ensure the products we sell comply with the FDC Act. Some of these actions include maintaining and continuously updating a list of restricted ingredients that will be prohibited from inclusion in any products that we sell. In addition, we have developed and maintain a list of ingredients that we believe comply with the applicable provisions of the FDC Act. As is common in our industry, we rely on some third-party vendors to ensure that the products they manufacture and sell to us comply with all applicable regulatory and legislative requirements. In general, we seek representations and warranties, indemnification and/or insurance from our vendors. However, even with adequate insurance and indemnification, any claims of non-compliance could significantly damage our reputation and consumer confidence in our products. In addition, the failure of such products to comply with applicable regulatory and legislative requirements could prevent us from marketing the products or require us to recall or remove such products from the market, which in certain cases could materially and adversely affect our business, financial condition and results of operations. A removal or recall could also result in negative publicity and damage to our reputation that could reduce future demand for our products. In the past, we have attempted to offset any losses related to recalls and removals with reformulated or alternative products; however, there can be no assurance that we would be able to offset all or any portion of losses related to any future removal or recall.

The FDC Act permits structure/function claims to be included in labels and labeling for dietary supplements without FDA pre-market approval. However, companies must have substantiation that the claims are “truthful and not misleading”, and must submit a notification with the text of the claims to the FDA no later than 30 days after marketing the dietary supplement with the claims. Permissible structure/function claims may describe how a particular nutrient or dietary ingredient affects the structure, function or general well-being of the body, or characterize the documented mechanism of action by which a nutrient or dietary ingredient acts to maintain such structure or function. The label or labeling of a product marketed as a dietary supplement may not expressly or implicitly represent that a dietary supplement will diagnose, cure, mitigate, treat or prevent a disease (i.e. a disease claim). If the FDA determines that a particular structure/function claim is an unacceptable disease claim that causes the product to be regulated as a drug, a conventional food claim or an unauthorized version of a “health claim,” or, if the FDA determines that a particular claim is not adequately supported by existing scientific data or is false or misleading in any particular, we would be prevented from using the claim and would have to update our product labels and labeling accordingly.

In addition, DSHEA provides that so-called “third-party literature,” e.g., “a publication, including an article, a chapter in a book, or an official abstract of a peer-reviewed scientific publication that appears in an article and was prepared by the author or the editors of the publication” supplements, when reprinted in its entirety, may be used “in connection with the sale of a dietary supplement to consumers” without the literature being subject to regulation as labeling. Such literature: (1) must not be false or misleading; (2) may not “promote” a particular manufacturer or brand of dietary supplement; (3) must present a balanced view or is displayed or presented with other such items on the same subject matter so as to present a balanced view of the available scientific information; (4) if displayed in an establishment, must be physically separate from the dietary supplements; and (5) should not have appended to it any information by sticker or any other method. If the literature fails to satisfy each of these requirements, we may be prevented from disseminating such literature with our products, and any continued dissemination could subject our product to regulatory action as an illegal drug.

In June 2007, pursuant to the authority granted by the FDC Act as amended by DSHEA, the FDA published detailed GMP regulations that govern the manufacturing, packaging, labeling and holding operations of dietary supplement manufacturers. The GMP regulations, among other things, impose significant recordkeeping requirements on manufacturers. The GMP requirements are in effect for all dietary supplement manufacturers, and the FDA conducts inspections of dietary supplement manufacturers pursuant to these requirements. There remains considerable uncertainty with respect to the FDA’s interpretation of the regulations and their actual implementation in manufacturing facilities.

In addition, the FDA’s interpretation of the regulations governing dietary supplements will likely change over time as the agency becomes more familiar with the industry and the regulations. The failure of a manufacturing facility to comply with the GMP regulations renders products manufactured in such facility “adulterated,” and subjects such products and the manufacturer to a variety of potential FDA enforcement actions. In addition, under the Food Safety Modernization Act, or FSMA, which was enacted in January 2011, the manufacturing of dietary ingredients contained in dietary supplements will be subject to similar or even more burdensome manufacturing requirements, which will likely increase the costs of dietary ingredients and will subject suppliers of such ingredients to more rigorous inspections and enforcement. The FSMA will also require importers of food, including dietary supplements and dietary ingredients, to conduct verification activities to ensure that the food they might import meets applicable domestic requirements.

The FDA has broad authority to enforce the provisions of federal law applicable to dietary supplements, including powers to issue a public warning or notice of violation letter to a company, publicize information about illegal products, detain products intended for import, require the reporting of serious adverse events, require a recall of illegal or unsafe products from the market, and request the Department of Justice to initiate a seizure action, an injunction action or a criminal prosecution in the United States courts.

The FSMA expands the reach and regulatory powers of the FDA with respect to the production and importation of food, including dietary supplements. The expanded reach and regulatory powers include the FDA’s ability to order mandatory recalls, administratively detain domestic products, and require certification of compliance with domestic requirements for imported foods associated with safety issues. FMSA also gave FDA the authority to administratively revoke manufacturing facility registrations, effectively enjoining manufacturing of dietary ingredients and dietary supplements without judicial process. The regulation of dietary supplements may increase or become more restrictive in the future.

Federal Trade Commission

The FTC exercises jurisdiction over the advertising of dietary supplements and other health-related products and requires that all advertising to consumers be truthful and non-misleading. The FTC actively monitors the dietary supplement space and has instituted numerous enforcement actions against dietary supplement companies for failure to have adequate substantiation for claims made in advertising or for the use of false or misleading advertising claims. FTC enforcement actions may result in consent decrees, cease and desist orders, judicial injunctions and the payment of fines with respect to advertising claims that are found to be unsubstantiated.

Environmental Regulation

Our facilities and operations, in common with those of similar industries making similar products, are subject to many federal, state, provincial and local requirements, rules and regulations relating to the protection of the environment and of human health and safety, including those regulating the discharge of materials into the environment. We continually examine ways to reduce our emissions, minimize waste and limit our exposure to any liabilities, as well as decrease costs related to environmental compliance. Costs to comply with current and anticipated environmental requirements, rules and regulations and any estimated capital expenditures for environmental control facilities are not anticipated to be material when compared with overall costs and capital expenditures. Accordingly, we do not anticipate that such costs will have a material effect on our financial position, results of operations, cash flows or competitive position.

New Legislation or Regulation

Legislation may be introduced which, if passed, would impose substantial new regulatory requirements on dietary supplements and other health products. We cannot determine what effect additional domestic or international governmental legislation, regulations, or administrative orders, when and if promulgated, would have on our business in the future. New legislation or regulations may require the reformulation of certain products to meet new standards, require the recall or discontinuance of certain products not capable of reformulation, impose additional record keeping or require expanded documentation of the properties of certain products, expanded or different labeling or scientific substantiation.

ITEM 1A. RISK FACTORS.

An investment in our securities involves a high degree of risk. You should carefully read and consider all of the risks described below, together with all of the other information contained or referred to in this report, before making an investment decision with respect to our securities. If any of the following events occur, our financial condition, business and results of operations (including cash flows) may be materially adversely affected. In that event, the market price of our stock could decline, and you could lose all or part of your investment.

Risks Related to Our Business and Industry

We are an early-stage company with a limited operating history.

We were organized as a Delaware corporation in February 2017, and in April 2023 redomiciled in Nevada. We have a limited history upon which you can evaluate our business and prospects. Our prospects must be considered in light of the risks encountered by companies in the early stages of development in highly competitive markets, particularly the markets for nutraceuticals and related products. You should consider the frequency with which early-stage businesses encounter unforeseen expenses, difficulties, complications, delays and other adverse factors. These risks are described in more detail below.

We have incurred losses since our inception, and we may not be able to manage our businesses on a profitable basis.

We have generated losses since inception and have relied on cash on hand, sales of securities, external bank lines of credit, and issuance of third-party and related party debt to support our operations. For the year ended December 31, 2023, we generated an operating loss of $17,155,992 and a net loss of $22,675,741. We cannot assure you that we will achieve profitably or that we will have adequate working capital to meet our obligations as they become due. Management believes that our success will depend on our ability to successfully complete additional acquisitions of profitable nutraceutical companies and related products as well as develop our own brands. We cannot guarantee that we will be successful in completing acquisitions or any other companies or products, that we will successfully integrate acquired companies, or that we will be able to successfully develop our own brands. We cannot assure you that even if we are successful in completing the acquisitions or in developing our own branded products, we will be successful in profitably managing such companies, acquired assets and brands. We cannot assure you that we will maintain profitability for any period of time or that investors will not lose their entire investment.

Our auditors have issued a going concern opinion on our audited financial statements.

The report of our independent registered public accounting firm that accompanies our financial statements for the year ended December 31, 2023 contains a going concern qualification in which such firm expressed substantial doubt about our ability to continue as a going concern, based on the financial statements at that time. We have suffered recurring losses from operations and have a working capital deficiency of approximately $19.7 million and an accumulated deficit of $67.7 million as of December 31, 2023. Additionally, we had a net loss of $22.7 million, and cash used in operations of $5.8 million for the year ended December 31, 2023. These conditions raise substantial doubt about our ability to continue as a going concern.

Management believes that current available resources will not be sufficient to fund our planned expenditures over the next 12 months. Management has implemented restructuring activities, including staff reductions, a subsequent event sale of BSNM, and a subsequent event sale of Ceautamed’s assets. Accordingly, we will be dependent upon the raising of additional capital through placement of common stock and/or debt financing in order to implement our business plan. If we raise additional capital through the issuance of equity securities or securities convertible into equity, stockholders will experience dilution, and such securities may have rights, preferences, or privileges senior to those of the holders of common stock or convertible senior notes. If we raise additional funds by issuing debt, we may be subject to limitation on its operations, through debt covenants or other restrictions. There is no assurance that we will be successful with future financing ventures, and the inability to secure such financing may have a material adverse effect on our financial condition. The accompanying consolidated financial statements do not include any adjustments to the amounts and classifications of assets and liabilities that might be necessary should we be unable to continue as a going concern. If we cannot continue as a going concern, our stockholders would likely lose most or all of their investment in us.

If we fail to implement our business plan and complete acquisitions as planned, our mission will fail and our business will suffer accordingly.

Our mission is the creation of a world-class nutraceutical company engaged in the development, manufacture and sales of quality nutraceutical and related health and lifestyle products for distribution to an expanding global marketplace. We expect that our holding company strategy through which we plan to acquire profitable but undervalued target companies and products will enable us to accelerate the development and expansion of our product portfolio, manufacturing capacity and distribution channels. If we are unable to execute our strategy of completing acquisitions as planned, we will not be able to fulfill our mission or grow our business.

Our acquisitions may result in significant transaction expenses, integration and consolidation risks, and we may be unable to profitably operate our consolidated company.

We are structured as a holding company and we have executed a buy and hold strategy. We are engaged in the business of acquisition, operation and management of nutraceutical and related products. Our acquisitions may result in significant transaction expenses and present new risks associated with entering additional markets or offering new products and services and integrating the acquired companies. We may not have sufficient management, financial and other resources to integrate the companies we acquire or to successfully operate new businesses and we may be unable to profitably operate our expanded company. Moreover, any new businesses that we may acquire, once integrated with our existing operations, may not produce expected or intended results.

We may not be able to manage future growth effectively.

We expect to continue to experience significant growth. Should we keep growing rapidly, our financial, management and operating resources may not expand sufficiently to adequately manage our growth. If we are unable to manage our growth, our costs may increase disproportionately, our future revenues may not grow or may decline, and we may face dissatisfied customers. Our failure to manage our growth may adversely impact our business and the value of your investment.

Our ability to obtain continued financing is critical to the growth of our business. We will need additional financing to fund operations, which additional financing may not be available on reasonable terms or at all.

Our future growth, including the potential for future market expansion will require additional capital. We will consider raising additional funds through various financing sources, including the procurement of commercial debt financing. However, there can be no assurance that such funds will be available on commercially reasonable terms, if at all. If such financing is not available on satisfactory terms, we may be unable to execute our growth strategy, and operating results may be adversely affected. Any additional debt financing will increase expenses and must be repaid regardless of operating results and may involve restrictions limiting our operating flexibility.

Our ability to obtain financing may be impaired by such factors as the capital markets, both generally and specifically in our industry, which could impact the availability or cost of future financings. If the amount of capital we are able to raise from financing activities, together with our revenues from operations, are not sufficient to satisfy our capital needs, we may be required to decrease the pace of, or eliminate, our future product offerings and market expansion opportunities and potentially curtail operations.

Unfavorable publicity or consumer perception of our products and any similar products distributed by other companies could have a material adverse effect on our business.

We believe the nutritional supplement market is highly dependent upon consumer perception regarding the safety, efficacy and quality of nutritional supplements generally, as well as of products distributed specifically by us. Consumer perception of our products can be significantly influenced by scientific research or findings, regulatory investigations, litigation, national media attention and other publicity regarding the consumption of nutritional supplements. There can be no assurance that future scientific research, findings, regulatory proceedings, litigation, media attention or other research findings or publicity will be favorable to the nutritional supplement market or any particular product, or consistent with earlier publicity. Future research reports, findings, regulatory proceedings, litigation, media attention or other publicity that are perceived as less favorable than, or that question, earlier research reports, findings or publicity could have a material adverse effect on the demand for our products and our business, results of operations, financial condition and cash flows. Our dependence upon consumer perceptions means that adverse scientific research reports, findings, regulatory proceedings, litigation, media attention or other publicity, whether or not accurate or with merit, could have a material adverse effect on us, the demand for our products, and our business, results of operations, financial condition and cash flows. Further, adverse publicity reports or other media attention regarding the safety, efficacy and quality of nutritional supplements in general, or our products specifically, or associating the consumption of nutritional supplements with illness, could have such a material adverse effect. Such adverse publicity reports or other media attention could arise even if the adverse effects associated with such products resulted from consumers’ failure to consume such products appropriately or as directed.

Our success is linked to the size and growth rate of the vitamin, mineral and supplement market and an adverse change in the size or growth rate of that market could have a material adverse effect on us.

An adverse change in size or growth rate of the vitamin, mineral and supplement market could have a material adverse effect on us. Underlying market conditions are subject to change based on economic conditions, consumer preferences, and other factors that are beyond our control, including media attention and scientific research, which may be positive or negative.

General economic conditions, including a prolonged macroeconomic downturn, may negatively affect consumer purchases, which could adversely affect our sales, as well as our ability to access credit on terms previously obtained.

Our results are dependent on a number of factors impacting consumer spending, including general economic and business conditions; consumer confidence; wages and employment levels; the housing market; consumer debt levels; availability of consumer credit; credit and interest rates; fuel and energy costs; energy shortages; taxes; and general political conditions, both domestic and abroad. Consumer product purchases, including purchases of our products, may decline during recessionary periods. A prolonged downturn or an uncertain outlook in the economy may materially adversely affect our business, revenues and profits and the market price of our common stock, and we cannot be certain that funding for our capital needs will be available from our existing financial institutions and the credit markets if needed, and if available, to the extent required and on acceptable terms. If we cannot obtain funding when needed, in each case on acceptable terms, we may be unable to adequately fund our operating expenses and fund required capital expenditures, which may have an adverse effect on our revenues and results of operations.

We operate in highly competitive and fast-evolving industries, and our failure to compete effectively could affect our market share, financial condition, and growth prospects adversely.

The markets in which we operate are characterized by rapid technological changes, frequent new product introductions, established and emerging competition, extensive intellectual property disputes and litigation, price competition, aggressive marketing practices, evolving industry standards and changing customer preferences. Accordingly, our prospects must be considered in light of the uncertainties, risks, expenses, and difficulties frequently encountered by companies operating in rapidly changing and competitive markets.

The nutritional supplement industry is a large and growing industry and is highly fragmented in terms of both geographical market coverage and product categories. The market for nutritional supplements is highly competitive in all our channels of distribution. We compete with companies that may have broader product lines or larger sales volumes, or both, than we do, and our products compete with nationally advertised brand name products. These national brand companies have resources greater than ours. Numerous companies compete with us in the development, manufacture, and marketing of nutritional supplements worldwide. The market is highly sensitive to the introduction of new products, which may rapidly capture a significant share of the market. We also may face competition from low-cost entrants to the industry, including from international markets. Increased competition from companies that distribute through the wholesale channel, especially the private label market, could have a material adverse effect on our business, results of operations, financial condition and cash flows as these competitors may have greater financial and other resources available to them and possess extensive manufacturing, distribution, and marketing capabilities far greater than ours. We are also subject to competition in the attraction and retention of employees. Many of our competitors have greater financial resources and can offer employees compensation packages with which it is difficult for us to compete.

There has been an increase in the access and popularity of weight management medications which may negatively impact the consumer demand for nutritional supplements and weight management foods. As individuals migrate towards such prescription medications, and health insurance companies make such medications more affordable, there may be a decline in the demand for our products and services.

With our acquisition of Nexus in 2021, we entered the digital marketing industry as a way to promote the products and brands that we sell. We compete with other advertising service providers that may reach our target audience by means that are more effective than our services. Further, if such other providers of advertising have a long operating history, large product and service suites, more capital resources and broad international or local recognition, our operating results may be adversely affected if we cannot successfully compete.

The digital advertising market is rapidly developing. Accordingly, the development of the markets in which we operate makes it difficult to evaluate the viability and sustainability of our business and its acceptance by advertisers and clients. We cannot assure you that we will be profitable every year. We expect that our operating expenses will increase as we expand. Any significant failure to realize anticipated revenue growth could result in operating losses.

We may not be able to compete effectively in some or all our markets, and our attempt to do so may require us to reduce our prices, which may result in lower margins. Failure to compete effectively could have a material adverse effect on our market share, business, results of operations, financial condition, cash flows and growth prospects.

Our major customers account for a significant portion of our consolidated net sales and the loss of any major customer could have a material adverse effect on our results of operations.

During fiscal 2023, Amazon and Boxout accounted for 31% and 31%, respectively, of our total revenues. We do not have a long-term contract with these major customers, and the loss of any major customer could have a material adverse effect on our results of operations. In addition, our results of operations and ability to service our debt obligations would be impacted negatively to the extent that any major customer is unable to make payments to us or does not make timely payments on outstanding accounts receivables.

Failure to develop new products and production technologies or to implement productivity and cost reduction initiatives successfully may harm our competitive position.