- RKLYQ Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

S-1 Filing

Rockley Photonics (RKLYQ) S-1IPO registration

Filed: 29 Nov 21, 5:20pm

Cayman Islands | 3674 | Not Applicable | ||

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code No.) | (I.R.S. Employer Identification No.) |

| Large accelerated filer | ☐ | Accelerated filer | ☐ | |||

Non-accelerated filer | ☒ | Smaller reporting company | ☒ | |||

| Emerging growth company | ☒ | |||||

Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Offering Price Per Share (2) | Proposed Maximum Aggregate Offering Price | Amount of Registration Fee | ||||

Ordinary Shares, nominal value $.000004026575398 per share | 7,785,560 | $6.29 | $48,971,173 | $4,540 | ||||

| (1) | Represents 69,512 ordinary shares previously issued to the selling shareholder named herein and 7,716,048 ordinary shares that are issuable pursuant to a purchase agreement with the selling shareholder named herein. Pursuant to Rule 416(a) under the Securities Act of 1933, as amended (the “Securities Act”), the registrant is also registering hereunder an indeterminate number of shares that may be issued and resold resulting from stock splits, stock dividends or similar transactions. |

| (2) | Estimated pursuant to Rule 457(c) under the Securities Act solely for the purpose of calculating the registration fee, based upon the average of the high and low prices for the registrant’s ordinary shares as reported on the New York Stock Exchange on November 23, 2021. |

| i | ||||

| i | ||||

| iii | ||||

| 1 | ||||

| 3 | ||||

| 6 | ||||

| 10 | ||||

| 50 | ||||

| 56 | ||||

| 57 | ||||

| 58 | ||||

| 60 | ||||

| 60 | ||||

| 61 | ||||

| 67 | ||||

| 71 | ||||

| 93 | ||||

| 114 | ||||

| 124 | ||||

| 133 | ||||

| 138 | ||||

| 140 | ||||

| 148 | ||||

| 150 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| 154 | ||||

| F-1 |

| • | Rockley’s ability to recognize the anticipated benefits of the Business Combination, which may be affected by, among other things, competition and the ability of the combined business to grow and manage growth profitably; |

| • | Rockley’s financial and business performance following the Business Combination, including its expectations regarding expenses and other financial measures and business metrics; |

| • | Rockley’s strategy, future operations, financial position, prospects and plans; |

| • | the implementation, market acceptance, and success of Rockley’s business model; |

| • | developments and expectations relating to Rockley’s competitors, target markets, and industry; |

| • | Rockley’s future capital requirements and sources and uses of cash; |

| • | Rockley’s ability to obtain funding for its product development plans, execution of its business strategy, and its operations; |

| • | Rockley’s business, product development plans, and opportunities; |

| • | the outcome of any known and unknown litigation and regulatory proceedings; |

| • | Rockley’s anticipated growth and market opportunities; |

| • | Rockley’s plans to commercialize its products and services, and anticipated timing thereof; |

| • | Rockley’s expectations as to when it may generate sufficient revenue from the sale of its products and services to cover expansion plans, operating expenses, working capital, and capital expenditures; |

| • | the development status and anticipated timeline for commercial production of Rockley’s products; |

| • | Rockley’s plans for products under development and future products and anticipated features and benefits thereof; |

| • | the status and expectations regarding Rockley’s customer and strategic partner, and potential customer and strategic partner relationships; |

| • | the total addressable markets for Rockley’s products and technology; |

| • | the ability of Rockley to increase market share in its existing markets or any new markets it may enter; |

| • | Rockley’s ability to obtain any required regulatory approvals, including any required U.S. Food and Drug Administration (“FDA”) approvals, in connection with its anticipated products and technology; |

| • | Rockley’s ability to maintain an effective system of internal control over financial reporting; |

| • | Rockley’s ability to maintain and protect its intellectual property; |

| • | Rockley’s success in retaining or recruiting, or changes required in, officers, key employees, or directors; the ability of Rockley to manage its growth effectively; |

| • | the ability of Rockley to achieve and maintain profitability in the future; |

| • | Rockley’s sale of ordinary shares to Lincoln Park pursuant to the terms of the Purchase Agreement (as defined below) and its ability to register and maintain the registration of the shares issued and issuable thereunder; |

| • | Rockley’s anticipated use of the net proceeds from the potential sale of ordinary shares to Lincoln Park; and |

| • | the impact of the COVID-19 pandemic. |

| • | not being required to comply with the auditor attestation requirements for the assessment of our internal control over financial reporting provided by Section 404 of the Sarbanes-Oxley Act of 2002; |

| • | reduced disclosure obligations regarding executive compensation; and |

| • | not being required to hold a nonbinding advisory vote on executive compensation or seek shareholder approval of any golden parachute payments not previously approved. |

| • | If Rockley does not fully develop or commercialize its products and services, or if such products and services experience significant delays, Rockley’s business, financial condition, and results of operation will be materially and adversely affected. |

| • | Rockley has a history of recurring losses and a significant accumulated deficit, which raises substantial doubt about its ability to continue as a “going concern.” Rockley expects to incur significant research and development expenses and devote substantial resources to commercializing new products, which could increase its losses and negatively impact its ability to achieve or maintain profitability. |

| • | If the end products into which Rockley’s products are incorporated are not fully developed and commercialized or do not achieve widespread market acceptance, or if such products experience |

delays, cancellations, or reductions, or if Rockley’s products are not selected for inclusion in its customers’ end products, are not adopted in other industry verticals or use cases, or are not adopted by leading consumer and medical device companies, Rockley’s business will be materially and adversely affected. |

| • | Rockley’s estimates and expectations as to its financial performance are based upon assumptions, analyses, and internal estimates developed by Rockley’s management. If these assumptions, analyses, or estimates prove to be incorrect or inaccurate, Rockley’s actual operating results may differ materially from any such estimates and expectations. |

| • | Rockley expects its results of operations to fluctuate on a quarterly and annual basis, which could cause Rockley’s stock price to fluctuate or decline. |

| • | If Rockley is unable to manage its growth or scale its operations, its business and operating results could be materially and adversely affected. |

| • | Market opportunity estimates and growth forecasts are subject to significant uncertainty and are based on assumptions and estimates that may not prove to be accurate. |

| • | Rockley’s international operations expose it to operational, financial, and regulatory risks, which could harm Rockley’s business. |

| • | Rockley is susceptible to supply shortages, long lead times for components, and supply changes, any of which could disrupt its supply chain and could delay deliveries of its products to customers, which in turn could adversely affect Rockley’s business, results of operations, and financial condition. |

| • | If Rockley is unable to sell its products to its target customers, including large corporations with substantial negotiating power, or is unable to enter into agreements with customers and suppliers on satisfactory terms, its prospects and results of operations will be adversely affected. |

| • | Rockley currently depends on a few large customers for a substantial portion of its revenue. The loss of, or a significant reduction in, orders from Rockley’s customers, or Rockley’s failure to diversify its customer base, could significantly reduce its revenue and adversely impact Rockley’s operating results. |

| • | Because Rockley does not anticipate long-term purchase commitments with its customers, orders may be cancelled, reduced, or rescheduled with little or no notice, which in turn exposes Rockley to inventory risk, and may cause its business and results of operations to suffer. |

| • | Rockley’s business depends substantially on the efforts of its executive officers, including its Chief Executive Officer and founder, Dr. Andrew Rickman. |

| • | Rockley’s failure to comply with applicable governmental export and import control laws and regulations, including those related to the use, distribution, and sale of its products, FDA clearance or approval requirements, or privacy, data protection, and information security requirements in the jurisdictions in which Rockley operates could materially harm its business and operating results. |

| • | Rockley may not be able to adequately protect or enforce its intellectual property rights or prevent unauthorized parties from copying or reverse engineering its products or technology. Further, Rockley’s intellectual property applications, including patent applications, may not be approved or granted. |

| • | A network or data security incident or disruption or performance issues with Rockley’s network infrastructure could harm its brand, reputation, and business, as well as its operating results. |

| • | Rockley’s failure to raise additional capital or generate the significant capital necessary to expand its operations could reduce its ability to compete and could harm its business. |

| • | In preparing Rockley’s consolidated financial statements, Rockley makes good faith estimates and judgments that may change or turn out to be erroneous, which could adversely affect Rockley’s operating results. |

| • | Rockley’s ordinary shares may not remain eligible for listing on the NYSE. |

| • | If the Business Combination’s benefits do not meet the expectations of investors or securities analysts, the market price of Rockley’s securities, may decline. |

| • | Rockley may be required to take write downs or write offs, or may be subject to restructuring, impairment or other charges that could have a significant negative effect on Rockley’s financial condition, results of operations and the market price of Rockley’s ordinary shares. |

| • | The unaudited pro forma financial information included herein may not be indicative of actual results of Rockley after the Business Combination. |

| • | If analysts do not publish or cease publishing research or reports about Rockley or if they change their recommendations regarding Rockley’s securities, the price and trading volume of Rockley’s securities could decline. |

| • | The requirements of being a public company may strain Rockley’s resources, divert management’s attention, and affect its ability to attract and retain qualified board members. |

| • | The global COVID-19 pandemic could harm Rockley’s business, financial condition, results of operations, and prospects. |

| • | The sale or issuance of our ordinary shares to Lincoln Park may cause dilution, and the sale of the ordinary shares acquired by Lincoln Park, or the perception that such sales may occur, could cause the price of our ordinary shares to fall. |

| • | We may not have access to the full amount available under the Purchase Agreement with Lincoln Park. |

Ordinary shares to be offered by the selling shareholder | 69,512 Commitment Shares issued to Lincoln Park upon execution of the Purchase Agreement. We will not receive any cash proceeds from the issuance of these Commitment Shares. |

| Up to 7,716,048 shares we may sell to Lincoln Park under the Purchase Agreement from time to time after the date of this prospectus (subject to the limitations under the Purchase Agreement, including the $50,000,000 total commitment available thereunder). |

Ordinary shares outstanding prior to this offering | 126,675,098 ordinary shares |

Ordinary shares to be outstanding after this offering | 134,460,658 shares, assuming the sale of a total of 7,716,048 ordinary shares to Lincoln Park and the 69,512 Commitment Shares issued to Lincoln Park. The actual number of shares issued will vary depending upon the actual sales prices under this offering. |

Use of proceeds | We will receive no proceeds from the sale of ordinary shares by Lincoln Park in this offering. We may receive up to $50,000,000 aggregate gross proceeds under the Purchase Agreement from any sales we make to Lincoln Park pursuant to the Purchase Agreement after the date of this prospectus. |

| Any proceeds that we receive from sales to Lincoln Park under the Purchase Agreement will be used for working capital and general corporate purposes. See “Use of Proceeds.” |

Dividend policy | We have not paid any cash dividends on our ordinary shares to date and have no current plans to pay cash dividends on our ordinary shares. See “Market Information for Ordinary Shares and Dividend Policy — Dividend Policy.” |

Risk factors | This investment involves a high degree of risk. See “Risk Factors” for a discussion of factors you should consider carefully before making an investment decision. |

NYSE Symbol | “RKLY” |

| • | 17,520,135 ordinary shares issuable upon exercise of outstanding stock options as of September 30, 2021 at a weighted-average exercise price of $2.72 per share; |

| • | 14,355,705 ordinary shares reserved for future issuance under our 2021 Stock Incentive Plan (the “2021 Plan”) and 1,526,239 ordinary shares reserved for future issuance under our 2021 Employee Stock Purchase Plan (the “ESPP”) as of September 30, 2021, plus any future increases in the number of ordinary shares reserved for issuance pursuant to evergreen provisions; |

| • | 14,074,986 shares issuable upon exercise of warrants outstanding as of September 30, 2021 at a weighted-average exercise price of $11.50 per share; and |

| • | any additional shares that we may issue to Lincoln Park pursuant to the Purchase Agreement dated November 15, 2021, should we elect to sell shares to Lincoln Park. |

| • | continues to invest in its technology and its silicon photonics chipsets and modules, as well as its cloud-based analytics subscription service; |

| • | continues to develop innovative solutions and applications for its technology; |

| • | commercializes its silicon photonics solutions; |

| • | continues to invest in its sales and marketing activities and distribution channels; |

| • | invests and improves its operational, financial, and management information systems; |

| • | increases its headcount; |

| • | expands its intellectual property portfolio; and |

| • | enhances internal functions, systems, and infrastructure to support its anticipated transition to a public company. |

| • | successfully commercialize its products and services, including its silicon photonics chipsets, module applications, and analytics subscription service; |

| • | develop innovative applications for its silicon photonics and sensing technology; |

| • | expand its sales and marketing activities and distribution channels; |

| • | improve its operational, financial, and management information systems; |

| • | attract, hire, integrate, and retain qualified talent to support the growth of its business. This includes increasing headcount to appropriately staff to projected growth; |

| • | protect its intellectual property portfolio; |

| • | enhance internal, systems, functions, and infrastructure to support its anticipated transition to a public company; |

| • | comply with existing and new or modified laws and regulations applicable to its business; |

| • | manage capital expenditures for its current and future products, as well as its supply chain and supplier relationships; |

| • | anticipate and respond to macroeconomic changes and changes in the markets in which it operates; |

| • | effectively manage its growth and business operations, including the impacts of the COVID-19 pandemic on its business; and |

| • | hire, integrate, and retain qualified talent to support the growth of its business. |

| • | Revenue-related assumptions: |

| • | customer contracts and design wins: Rockley’s existing memoranda of understanding (“MOUs”) and development contracts may not ultimately convert into production contracts. In addition, Rockley may be unable to secure design wins from additional customers in a timely manner; |

| • | form of customer arrangement: It is possible that instead of entering into agreements with customers for the purchase of a significant amount of Rockley’s products, Rockley may be required to enter into license arrangements with certain customers, any of which would have a significant impact on the revenue Rockley has currently forecasted to achieve; |

| • | timing of launch and delivery: Rockley or Rockley’s customers may encounter delays in the launch or delivery of Rockley’s product or the customer’s end product incorporating Rockley’s product, including due to a customer’s decision to delay the launch of a product, Rockley’s ability to deliver its product in a timely manner to a customer, which in turn may result in the customer canceling a contract, technical challenges, or customer-related delays in its development program; |

| • | pricing and volume fluctuation: Rockley may experience pricing and volume fluctuations due to price negotiations, lower than anticipated unit volumes, delays in volume ramp, decreases in average selling prices due to competition or market dynamics, or other factors; |

| • | timing and execution of customer agreements: Rockley may face difficulties in meeting customer milestones in a timely manner or achieving required technical specifications. In addition, Rockley |

may experience execution delays under its NRE programs, including with its largest customer, due to resource constraints or customer delay. Further, to the extent Rockley were to enter into licensing arrangements in lieu of a product sale with a customer, including its largest customer, it could have a significant negative impact on Rockley’s anticipated revenue; and |

| • | commercialization of products and services: Rockley must successfully commercialize its products and services, including its silicon photonics chipsets, module applications, and analytics subscription service. |

| • | Production cost-related assumptions: |

| • | production volume and ramp: Rockley has in the past, and may in the future experience delays in contract execution, lower than expected manufacturing yields, manufacturing delays, and technical challenges, including if and when Rockley commences commercial production of its products, any of which could negatively impact forecasted production volume and ramp; |

| • | production cost: Rockley may be unable to secure the volume pricing or yield cost levels underlying its assumptions and indirect materials and production overhead costs may exceed forecasted amounts; and |

| • | inventory and obsolescence: Rockley’s quality, warranty, return merchandise authorization, and inventory obsolescence may exceed forecasted amounts. Rockley may also experience product recalls which are not included in Rockley’s assumptions. Further, Rockley may incur greater than expected costs in connection with its NRE programs. |

| • | Operating expenses and cash utilization-related assumptions: Rockley’s cash utilization may exceed currently anticipated rates due to a variety of factors, including lower than expected revenue, revenue delays, higher than anticipated production and manufacturing costs, operating expenses, and capital expenditures, lower than anticipated average selling prices, greater than anticipated cash needs for internal resources and organic growth, and potential strategic investments and acquisitions not currently anticipated. |

| • | partnering with customers and potential customers to develop and commercialize Rockley’s products; |

| • | investing in research and development; |

| • | investing in its workforce, including its engineering talent; |

| • | expanding its sales, marketing, and distribution efforts; |

| • | investing in new applications and markets for its products; |

| • | partnering with third parties to develop manufacturing processes; and |

| • | investing in legal, accounting, and other administrative and internal functions necessary to support its operations as a public company. |

| • | the timing and magnitude of NRE services revenue in any quarter; |

| • | the timing and magnitude of operating expenses incurred, including research and development expenses; |

| • | Rockley’s ability to meet product development roadmaps and timelines, which in turn may be impacted by resource constraints and must meet certain technical standards; |

| • | the timing and degree of success of commercialization of Rockley’s products; |

| • | Rockley’s ability to attract and retain customers and successfully transition customers with which it is engaged in discussions to contracted customers with whom it has MOUs or development and supply agreements and to attract new customers; |

| • | changes in terms of customer agreements; |

| • | the ability of Rockley’s customers to commercialize and achieve widespread market adoption of products incorporating Rockley’s products; |

| • | the timing and magnitude of orders and shipments of Rockley’s products in any quarter; |

| • | the mix of product sales and licensing arrangements in lieu of product sales; |

| • | the actual timing and magnitude of sales returns and warranty claims of Rockley’s products in any quarter may differ from estimate; |

| • | Rockley’s ability to develop, introduce, commercialize, manufacture, and ship in a timely manner products that meet customer requirements; |

| • | disruptions in Rockley’s sales channels or termination of its relationships with key channel partners; |

| • | customer demand and product life cycles; |

| • | the receipt, reduction, or cancellation of, or changes in the forecasts or timing of, orders by customers; |

| • | fluctuations in the levels of inventories held by distributors or end customers; |

| • | the gain or loss of significant customers, including Rockley’s largest customer; |

| • | fluctuations in sales by customers who incorporate Rockley’s products into their products; |

| • | cyclicality, seasonality, and the competitive landscape in Rockley’s target markets; |

| • | fluctuations in manufacturing yields; |

| • | changes in pricing, product cost, product volume, and product mix; |

| • | sales of subscriptions to Rockley’s cloud-based analytics subscription service, if and when commercially launched, and in the future, the rate of renewal of subscriptions by existing customers, the extent the use of subscription offerings and related services is expanded under such subscriptions, and timing and magnitude of any such subscriptions which are not renewed; |

| • | the mix of customers licensing the service on a subscription basis as compared to a perpetual license; |

| • | the size, timing, and terms of its subscription agreements with new customers; |

| • | supply chain disruptions, delays, shortages, and capacity limitations as a result of the COVID-19 pandemic or other reasons; |

| • | the impact and duration of the global COVID-19 pandemic; |

| • | the timing and rate of broader market adoption of consumer and medical devices utilizing Rockley’s products or technology across the consumer wearables, mobile device, and medical device sectors; |

| • | changes in the competitive landscape in Rockley’s target markets, including industry consolidation, regulatory developments, and new market entrants; |

| • | Rockley’s ability to effectively manage its third-party suppliers and manufacturing partners; |

| • | changes in the source, cost, and availability of materials and components incorporated in Rockley’s products; |

| • | adverse litigation, judgments, settlements or other litigation-related costs, or claims that may give rise to such costs; |

| • | general economic, industry, and market conditions, including trade disputes; and |

| • | Rockley’s estimates of potential or future market growth in this prospectus may not be accurate. |

| • | define, design, and regularly introduce new products that anticipate the functionality and integration needs of Rockley’s customers’ next-generation products and applications; |

| • | build strong and long-lasting relationships with Rockley’s customers and other industry participants; |

| • | cost-effectively develop and commercialize products which compete favorably with competitors’ products; |

| • | achieve design wins; |

| • | accurately estimate the effectiveness and success of Rockley’s customers’ end products incorporating Rockley’s products in their competitive end markets; |

| • | expand its research and development capabilities to provide innovative solutions and maintain Rockley’s product roadmap; |

| • | strengthen its sales and marketing efforts, brand awareness and reputation; |

| • | deliver products in volume on a timely basis at competitive prices; |

| • | withstand or respond to significant price competition; |

| • | build and expand international operations in a cost-effective manner; |

| • | obtain, maintain, protect, and enforce Rockley’s intellectual property rights; |

| • | defend potential patent infringement claims arising from third parties; |

| • | promote and support Rockley’s customers’ incorporation of Rockley’s products into their products; and |

| • | retain high-level talent, including Rockley’s management team and engineers. |

| • | foreign currency fluctuations, which could result in increased operating expenses and reduced revenue; |

| • | political and economic instability, international terrorism, and anti-American or British sentiment, particularly in emerging markets; |

| • | disadvantages of competing against companies from countries that are not subject to U.S. and U.K. laws and regulations, including the Foreign Corrupt Practices Act, Office of Foreign Assets Control regulations, and U.S. anti-money laundering regulations, as well as exposure of Rockley’s foreign operations to liability under these regulatory regimes; |

| • | preference for locally branded products, and laws and business practices favoring local competition; |

| • | potential consequences of, and uncertainty related to, the “Brexit” process in the United Kingdom, which could lead to additional expense and complexity in doing business there; |

| • | less effective protection of intellectual property; |

| • | stringent regulation of the end products incorporating Rockley’s products and stringent consumer protection and product compliance regulations, including but not limited to General Data Protection Regulation in the European Union, European competition law, the Restriction of Hazardous Substances Directive, the Waste Electrical and Electronic Equipment Directive, and the European Ecodesign Directive that are costly to comply with and may vary from country to country; |

| • | difficulties and costs of staffing and managing foreign operations; |

| • | foreign taxes, including withholding of payroll taxes; and |

| • | the U.S. government’s and U.K. government’s restrictions on certain technology transfer to certain countries of concern. |

| • | product design, development, and manufacture; |

| • | laboratory, pre-clinical and clinical testing, labeling, packaging, storage, and distribution; |

| • | premarketing clearance or approval; |

| • | record-keeping; |

| • | product marketing, promotion and advertising, sales, and distribution; and |

| • | post-marketing surveillance, including reporting of deaths or serious injuries and recalls and correction and removals. |

| • | actual or anticipated fluctuations in operating results; |

| • | failure to meet or exceed financial estimates and projections of the investment community or that we may provide to the public; |

| • | issuance of new or updated research or reports by securities analysts or changed recommendations for our ordinary shares or the semiconductor industry in general; |

| • | announcements by us or our competitors of significant acquisitions, strategic partnerships, joint ventures, collaborations or capital commitments; |

| • | operating and share price performance of other companies that investors deem comparable to us; |

| • | our focus on long-term goals over short-term results; |

| • | the timing and magnitude of our investments in the growth of our business; |

| • | actual or anticipated changes in laws and regulations affecting our business; |

| • | additions or departures of key management or other personnel; |

| • | disputes or other developments related to our intellectual property or other proprietary rights, including litigation; |

| • | our ability to market new and enhanced products and technologies on a timely basis; |

| • | sales of substantial amounts of the ordinary shares by the Board, executive officers or significant shareholders or the perception that such sales could occur; |

| • | changes in our capital structure, including future issuances of securities or the incurrence of debt; and |

| • | general economic, political, and market conditions. |

| • | the lowest sale price for our ordinary shares on the purchase date of such shares; or |

| • | the arithmetic average of the three lowest closing sale prices for our ordinary shares during the 10 consecutive business days ending on the business day immediately preceding the purchase date of such shares. |

| • | 300% of the applicable Regular Purchase Share Limit for the corresponding Regular Purchase; and |

| • | 20% of the total volume of ordinary shares traded on the NYSE during the Accelerated Purchase Period or the Additional Accelerated Purchase Period. |

| • | the volume weighted average price of our ordinary shares for the period beginning at the Accelerated Purchase Commencement Time and ending at the Accelerated Purchase Termination Time; and |

| • | the closing sale price of our ordinary shares on the applicable Accelerated Purchase date. |

| • | 300% of the number of purchase shares directed by us to be purchased by Lincoln Park pursuant to the corresponding Regular Purchase Notice for the corresponding Regular Purchase (subject to the purchase share limitations contained in the Purchase Agreement); and |

| • | an amount equal to (A) the Additional Accelerated Purchase Share Percentage multiplied by (B) the total number (or volume) of ordinary shares traded on the NYSE during the period on the applicable Additional Accelerated Purchase Date beginning at the Additional Accelerated Purchase Commencement Time for such Additional Accelerated Purchase and ending at the Additional Accelerated Purchase Termination Time for such Additional Accelerated Purchase. |

| • | the volume weighted average price of our ordinary shares for the period beginning at the Additional Accelerated Purchase Commencement Time and ending at the Additional Accelerated Purchase Termination Time; and |

| • | the closing sale price of our ordinary shares on the applicable Additional Accelerated Purchase date. |

| • | the effectiveness of the registration statement of which this prospectus forms a part lapses for any reason (including, without limitation, the issuance of a stop order or similar order), or any required prospectus supplement and accompanying prospectus are unavailable for the resale by Lincoln Park of our ordinary shares offered hereby, and such lapse or unavailability continues for a period of 10 consecutive business days or for more than an aggregate of 30 business days in any 365-day period; |

| • | suspension by our principal market of our ordinary shares from trading for a period of one business day; |

| • | the de-listing of our ordinary shares from the NYSE, our principal market, provided our ordinary shares are not immediately thereafter trading on The Nasdaq Global Select Market, the Nasdaq Capital Market, the NYSE Arca, the NYSE American, the OTC Bulletin Board, or the OTCQB or the OTCQX operated by the OTC Markets Group, Inc. (or any nationally recognized successor to any of the foregoing); |

| • | if at any time the Exchange Cap is reached unless and until shareholder approval is obtained, to the extent applicable; |

| • | the failure of our transfer agent to issue to Lincoln Park ordinary shares within two business days after the applicable date on which Lincoln Park is entitled to receive such shares; |

| • | any breach of the representations, warranties, or covenants contained in the Purchase Agreement or Registration Rights Agreement that has or would reasonably be expected to have a material adverse effect on us and, in the case of a breach of a covenant that is reasonably curable, that is not cured within five business days; |

| • | any voluntary or involuntary participation or threatened participation in insolvency or bankruptcy proceedings by or against us; or |

| • | if at any time we are not eligible to transfer our ordinary shares electronically as DWAC shares. |

Assumed Average Purchase Price Per Share | Maximum Number of Shares Issuable Under the Purchase Agreement (1) | Number of Registered Shares to be Issued if Full Purchase (1) (2 ) | Percentage of Outstanding Shares After Giving Effect to the Issuance to Lincoln Park (3) | Gross Proceeds from the Sale of Shares to Lincoln Park Under the Purchase Agreement | ||||||||||||||||

| $ | 5.00 | 7,716,048 | 7,716,048 | 5.8 | % | $ | 38,580,240 | |||||||||||||

| $ | 6.00 | 7,716,048 | 7,716,048 | 5.8 | % | $ | 46,296,288 | |||||||||||||

| $ | 6.68 | (4) | 7,485,029 | 7,554,541 | 5.6 | % | $ | 49,999,993 | ||||||||||||

| $ | 7.00 | 7,142,857 | 7,212,369 | 5.4 | % | $ | 49,999,999 | |||||||||||||

| $ | 8.00 | 6,250,000 | 6,319,512 | 4.7 | % | $ | 50,000,000 | |||||||||||||

| (1) | Based on the $50,000,000 total commitment available under the Purchase Agreement and the corresponding assumed average purchase price per share in the first column. The registration statement of which this prospectus forms a part registers 7,716,048 ordinary shares for resale, excluding the 69,512 Commitment |

| Shares. However, as we may not sell ordinary shares in excess of the $50,000,000 total commitment available to us under the Purchase Agreement, the actual number of shares we may sell may be more or less than the number of shares covered by this prospectus, depending on the price per share at which we sell our ordinary shares to Lincoln Park pursuant to the Purchase Agreement. |

| (2) | Represents: (i) 69,512 Commitment Shares that we already issued to Lincoln Park as commitment fee for making the commitment under the Purchase Agreement; and (ii) the maximum number of shares set forth in the second column which represents the maximum number of shares which may be issued and sold to Lincoln Park in the future under the Purchase Agreement at the corresponding average purchase price per share set forth in the first column, if and when we sell shares to Lincoln Park under the Purchase Agreement, and which may or may not cover all the shares we ultimately sell to Lincoln Park under the Purchase Agreement, depending on the purchase price per share. See footnote 1. If we seek to issue ordinary shares, including shares from other transactions that may be aggregated with the transactions contemplated by the Purchase Agreement under the applicable rules of the NYSE, in excess of 25,431,161 shares, or 19.99% of the total ordinary shares outstanding immediately prior to the execution of the Purchase Agreement, we may be required to seek shareholder approval in order to be in compliance with the rules of the NYSE. |

| (3) | The denominator is based on 127,219,418 shares outstanding as of November 12, 2021, adjusted to include (i) the 69,512 Commitment Shares issued to Lincoln Park upon execution of the Purchase Agreement and (ii) the number of shares set forth in the second column, which represents the maximum number of shares which may be issued and sold to Lincoln Park in the future under the Purchase Agreement at the corresponding average purchase price per share set forth in the first column. The numerator is based on the 69,512 Commitment Shares issued to Lincoln Park upon execution of the Purchase Agreement plus the maximum number of shares set forth in the second column which may be issued to Lincoln Park under the Purchase Agreement at the corresponding assumed purchase price set forth in the first column. See footnote 1. |

| (4) | The closing sale price of our ordinary shares on November 12, 2021, the last trading date immediately preceding the execution of the Purchase Agreement. |

| • | 17,520,135 ordinary shares issuable upon exercise of outstanding stock options as of September 30, 2021 at a weighted-average exercise price of $2.72 per share; |

| • | 14,355,705 ordinary shares reserved for future issuance under the 2021 Plan and 1,526,239 ordinary shares reserved for future issuance under the ESPP as of September 30, 2021, plus any future increases in the number of ordinary shares reserved for issuance pursuant to evergreen provisions; |

| • | 14,074,986 shares issuable upon exercise of warrants outstanding as of September 30, 2021 at a weighted-average exercise price of $11.50 per share; and |

| • | any additional shares that we may issue to Lincoln Park pursuant to the Purchase Agreement dated November 15, 2021, should we elect to sell shares to Lincoln Park. |

Selling Shareholder | Shares Beneficially Owned Before this Offering | Percentage of Outstanding Shares Beneficially Owned Before this Offering | Shares to be Sold in this Offering Assuming the Company issues the Maximum Number of Shares Under the Purchase Agreement | Percentage of Outstanding Shares Beneficially Owned After this Offering | ||||||||||||

Lincoln Park Capital Fund, LLC (1) | 69,512 | (2) | * | (3) | 7,785,560 | (4) | * | |||||||||

| * | Represents less than 1% of the outstanding shares and/or assumes all ordinary shares registered hereunder have been resold by Lincoln Park. |

| (1) | Josh Scheinfeld and Jonathan Cope, the Managing Members of Lincoln Park Capital, LLC, are deemed to be beneficial owners of all of the ordinary shares owned by Lincoln Park Capital Fund, LLC. Messrs. Cope and Scheinfeld have shared voting and investment power over the shares being offered under the prospectus in connection with the transactions contemplated under the Purchase Agreement. Lincoln Park Capital, LLC is not a licensed broker dealer or an affiliate of a licensed broker dealer. |

| (2) | Represents 69,512 Commitment Shares issued to Lincoln Park upon our execution of the Purchase Agreement as a fee for its commitment to purchase ordinary shares under the Purchase Agreement, all of which are covered by the registration statement that includes this prospectus. We have excluded from the number of shares beneficially owned by Lincoln Park prior to the offering all of the ordinary shares that Lincoln Park may be required to purchase on or after the date of this prospectus pursuant to the Purchase Agreement, because the issuance of such shares is solely at our discretion and is subject to certain conditions, the satisfaction of all of which are outside of Lincoln Park’s control, including the registration statement of which this prospectus is a part becoming and remaining effective. Furthermore, under the terms of the Purchase Agreement, issuances and sales of ordinary shares to Lincoln Park are subject to certain limitations on the amounts we may sell to Lincoln Park at any time, including the Exchange Cap and the Beneficial Ownership Cap. See the description under the heading “The Lincoln Park Transaction” for more information about the Purchase Agreement. |

| (3) | Based on 127,219,418 outstanding ordinary shares as of November 12, 2021, adjusted to include the 69,512 Commitment Shares we have already issued to Lincoln Park pursuant to the Purchase Agreement. |

| (4) | Represents: (i) 69,512 Commitment Shares issued to Lincoln Park upon our execution of the Purchase Agreement as a fee for its commitment to purchase ordinary shares under the Purchase Agreement; and |

| (ii) an aggregate of 7,716,048 shares that may be sold by us to Lincoln Park at our discretion from time to time over a 24-month period commencing after the satisfaction of certain conditions set forth in the Purchase Agreement, including that the SEC has declared effective the registration statement that includes this prospectus. Depending on the price per share at which we sell our ordinary shares to Lincoln Park pursuant to the Purchase Agreement, we may need to sell to Lincoln Park under the Purchase Agreement more or less ordinary shares than are offered under this prospectus in order to receive aggregate gross proceeds equal to the $50,000,000 total commitment available to us under the Purchase Agreement. If we choose to sell more shares than are offered under this prospectus, we must first register for resale under the Securities Act such additional shares. The number of shares ultimately offered for resale by Lincoln Park is dependent upon the number of shares we sell to Lincoln Park under the Purchase Agreement. |

| • | The additional expense related to the private and public warrants and other additional costs as a result of the Business Combination as and for the six months ended June 30, 2021 and as of and for the fiscal year ended December 31, 2020; and |

| • | The historical unaudited consolidated financial statements of Rockley as of and for the six months ended June 30, 2021 and the historical audited consolidated financial statements of Rockley as of and for the fiscal year ended December 31, 2020. |

| • | The board of directors of HoldCo approved and implemented a director compensation program for HoldCo’s non-employee directors (the “Director Compensation Program”). Under the Director Compensation Program, and following the filing of a registration statement on FormS-8 with respect to the 2021 Plan, HoldCo expects to grant (i) an “Initial RSU Award” to eachnon-employee director in connection with the closing of the Business Combination and (ii) an “Annual RSU Award” following the conclusion of each regular annual meeting of HoldCo’s shareholders commencing with the 2022 annual meeting, to eachnon-employee director who continues serving as a member of HoldCo’s board of directors. In addition, each eligiblenon-employee director will receive an annual cash retainer in connection with their service on HoldCo’s board of directors and respective committees. For additional information, including size of any cash retainers, and the size and vesting terms of the Initial RSU Award and Annual RSU Award, see “Management —Non-Employee Director Compensation Policy.” |

| • | Following the filing of a registration statement on Form S-8 with respect to the 2021 Plan, the board of directors of HoldCo is also expected to approve grants of stock options and RSU awards to select members of the management team. For additional information, including the size and vesting terms application to these awards, see “Executive Compensation — Equity Compensation.” |

| • | In addition, HoldCo entered into new employment agreements with its executive officers, including its named executive officers. Accordingly, the effect of the new employment arrangements with HoldCo’s executive officers has been included in the unaudited pro forma condensed combined financial information. For additional information, see “Executive Compensation — Employment Agreements.” |

| • | All of the Rockley issued and outstanding convertible loan notes (other than certain convertible notes issued in connection with Rockley’s term facility with Argentum Securities Ireland plc), inclusive of interest accrued thereon, converted into ordinary shares of HoldCo at a conversion price of $10.00 per |

share, and outstanding options exercisable for Rockley ordinary shares converted into options exercisable for HoldCo ordinary shares (“Rockley UK Options”). On May 25, 2021, Rockley entered into an agreement in principle to amend the payment and maturity terms of the Argentum term facility such that 30% of the outstanding principal balance was converted to ordinary shares of HoldCo at the time of the Business Combination and 70% which would otherwise be redeemable after the closing of the Business Combination is expected to mature on August 31, 2022. For additional information, see “Management’s Discussion and Analysis of Financial Condition and Results of Operations — Business Combination and Public Company Costs” and Note 16 to the notes to the condensed consolidated financial statements of Rockley Photonics Limited. |

Capital Infusion | Rockley | Transaction Accounting Adjustments | Ref | Pro Forma Combined | ||||||||||||||||

Assets | ||||||||||||||||||||

Current assets | ||||||||||||||||||||

Cash and cash equivalents | — | $ | 35,395 | $ | 126,565 | A | $ | 161,960 | ||||||||||||

Accounts receivable | — | 2,411 | — | 2,411 | ||||||||||||||||

Other receivable | — | 23,037 | — | 23,037 | ||||||||||||||||

Prepaid expenses | — | 7,724 | — | 7,724 | ||||||||||||||||

Other current assets | — | 258 | — | 258 | ||||||||||||||||

Total current assets | — | 68,825 | 126,565 | 195,390 | ||||||||||||||||

Property, equipment and finance lease right-of-use | — | 8,170 | — | 8,170 | ||||||||||||||||

Equity method investments | — | 4,711 | — | 4,711 | ||||||||||||||||

Intangible assets | — | 3,048 | — | 3,048 | ||||||||||||||||

Cash and marketable securities held in trust account | 93,839 | — | (93,839 | ) | C | — | ||||||||||||||

Other non-current assets | — | 11,715 | (8,427 | ) | D | 3,288 | ||||||||||||||

Total assets | 93,839 | $ | 96,469 | $ | 24,299 | $ | 214,607 | |||||||||||||

Liabilities | ||||||||||||||||||||

Accounts payable and accrued expenses | 922 | $ | 20,796 | $ | (4,875 | ) | E | $ | 16,843 | |||||||||||

Long-term debt, current portion | — | — | 12,500 | I | 12,500 | |||||||||||||||

Other current liabilities | 1,035 | 1,020 | (1,035 | ) | J | 1,020 | ||||||||||||||

Total current liabilities | 1,957 | 21,816 | 6,590 | 30,363 | ||||||||||||||||

Long-term debt, net of current portion | — | 194,328 | (183,064 | ) | K | 11,264 | ||||||||||||||

Deferred underwriting fee payable | 6,038 | — | (6,038 | ) | E | — | ||||||||||||||

Warrant liabilities | 32,502 | — | — | 32,502 | ||||||||||||||||

Other long-term liabilities | — | 2,719 | — | 2,719 | ||||||||||||||||

Total liabilities | 40,497 | 218,863 | (182,512 | ) | 76,848 | |||||||||||||||

Class A Ordinary Shares subject to redemption | 48,342 | — | (48,342 | ) | L | — | ||||||||||||||

Shareholders’ Equity | ||||||||||||||||||||

Ordinary Shares | — | — | — | M | — | |||||||||||||||

Class A Ordinary Shares | — | — | — | M | — | |||||||||||||||

Class B Ordinary Shares | — | — | — | M | — | |||||||||||||||

Additional paid-in capital | 30,382 | 205,823 | 229,771 | M | 465,976 | |||||||||||||||

Accumulated deficit | (25,382 | ) | (328,217 | ) | 25,382 | N | (328,217 | ) | ||||||||||||

Total shareholders’ equity | 5,000 | $ | (122,394 | ) | $ | 255,153 | $ | 137,759 | ||||||||||||

Total liabilities and shareholders’ equity | 93,839 | $ | 96,469 | $ | 24,299 | $ | 214,607 | |||||||||||||

Expenses Related to Capital Infusion | Rockley | Transaction Accounting Adjustments | Ref | Pro Forma Combined | Ref | |||||||||||||||||||

Revenue | $ | — | $ | 3,966 | $ | — | 3,966 | |||||||||||||||||

Cost of revenue | — | 8,283 | — | 8,283 | ||||||||||||||||||||

Gross profit | — | (4,317 | ) | — | (4,317 | ) | ||||||||||||||||||

Selling, general and administrative expenses | — | 14,020 | 198 | a | ||||||||||||||||||||

| 1,256 | b | |||||||||||||||||||||||

| 754 | c | 16,228 | ||||||||||||||||||||||

Research and development | — | 33,531 | 331 | b | 33,862 | |||||||||||||||||||

Operating loss | — | (51,868 | ) | (2,539 | ) | (54,407 | ) | |||||||||||||||||

Interest income (expense), net | — | (326 | ) | — | (326 | ) | ||||||||||||||||||

Other income | — | 2,860 | — | 2,860 | ||||||||||||||||||||

Equity method investment loss | — | (760 | ) | — | (760 | ) | ||||||||||||||||||

Change in fair value of debt instruments | — | (45,661 | ) | 45,661 | f | — | ||||||||||||||||||

Realized and unrealized gain (loss) on foreign currency | — | 631 | — | 631 | ||||||||||||||||||||

Change in fair value of warrant liabilities | (13,447 | ) | — | — | (13,447 | ) | ||||||||||||||||||

Loss before income taxes | (13,447 | ) | (95,124 | ) | 40,162 | (65,449 | ) | |||||||||||||||||

Income tax expense | — | 210 | — | 210 | ||||||||||||||||||||

Net loss | $ | (13,447 | ) | $ | (95,334 | ) | $ | 40,162 | $ | (65,659 | ) | |||||||||||||

Net loss per share | ||||||||||||||||||||||||

Basic and diluted | $ | (0.52 | ) | d | ||||||||||||||||||||

Weighted average shares outstanding | ||||||||||||||||||||||||

Basic and diluted | 126,575,257 | e | ||||||||||||||||||||||

Expenses related to Capital Infusion | Rockley | Transaction Accounting Adjustments | Ref | Pro Forma Combined | Ref | |||||||||||||||||||

Revenue | $ | — | $ | 22,343 | $ | — | 22,343 | |||||||||||||||||

Cost of revenue | — | 24,240 | — | 24,240 | ||||||||||||||||||||

Gross profit | — | (1,897 | ) | — | (1,897 | ) | ||||||||||||||||||

Selling, general and administrative expenses | — | 20,260 | 198 | a | ||||||||||||||||||||

| 389 | b | |||||||||||||||||||||||

| 754 | c | 21,601 | ||||||||||||||||||||||

Research and development | — | 35,900 | 542 | b | 36,442 | |||||||||||||||||||

Operating loss | — | (58,057 | ) | (1,883 | ) | (59,940 | ) | |||||||||||||||||

Interest income (expense), net | (189 | ) | (189 | ) | ||||||||||||||||||||

Equity method investment loss | — | (1,274 | ) | — | (1,274 | ) | ||||||||||||||||||

Change in fair value of debt instruments | — | (20,163 | ) | 20,163 | f | — | ||||||||||||||||||

Realized and unrealized gain (loss) on foreign currency | — | (25 | ) | — | (25 | ) | ||||||||||||||||||

Change in fair value of warrant liabilities | (5,489 | ) | — | — | (5,489 | ) | ||||||||||||||||||

Loss before income taxes | (5,489 | ) | (79,708 | ) | 19,277 | (66,917 | ) | |||||||||||||||||

Income tax expense | — | 569 | — | 569 | ||||||||||||||||||||

Net loss | $ | (5,489 | ) | $ | (80,277 | ) | $ | 19,277 | $ | (67,486 | ) | |||||||||||||

Net loss per share | ||||||||||||||||||||||||

Basic and diluted | $ | (0.53 | ) | d | ||||||||||||||||||||

Weighted average shares outstanding | ||||||||||||||||||||||||

Basic and diluted | 126,575,257 | e | ||||||||||||||||||||||

Amount | Ref | |||||

(In thousands) | ||||||

Cash inflow from PIPE financing | $ | 150,000 | B | |||

Cash inflow from trust account | 17,966 | C | ||||

Payment from deferred IPO fees and accrued transaction-related liabilities | (4,392 | ) | E | |||

Payments of estimated financing fees | (25,820 | ) | F | |||

Payments of estimated transaction fees incurred by Rockley | (5,185 | ) | G | |||

Payments of estimated transaction fees incurred by acquiree | (5,569 | ) | H | |||

Settlement of acquiree promissory note | (435 | ) | I | |||

Net Pro Forma adjustment to cash | 126,565 | A | ||||

Deferred IPO underwriting commissions | $ | 6,038 | ||

Less: IPO underwriting discount | (1,510 | ) | ||

Deferred IPO underwriting commission paid | 4,528 | |||

Acquiree’s deferred transaction fees | 1,005 | |||

Rockley’s deferred transaction fees | 5,201 | |||

Total deferred costs and accrued expenses paid at or after Business Combination close | $ | 10,734 | ||

HoldCo Par Value | Acquiree Par Value | Rockley Par Value | ||||||||||||||||||

Ordinary Shares | Class A Ordinary Shares | Class B Ordinary Shares | Ordinary Shares | Additional Paid-in Capital | ||||||||||||||||

Redemption of acquiree shares to Class A Ordinary Shares | — | — | — | — | (27,532 | ) | ||||||||||||||

Conversion of acquiree Class B to Class A Ordinary Shares | — | — | — | — | — | |||||||||||||||

PIPE financing | — | — | — | — | 150,000 | |||||||||||||||

Conversion of Rockley’s convertible loan notes to Ordinary Shares | — | — | — | — | 170,564 | |||||||||||||||

Adjustment for share issuance and conversion transaction | — | — | — | — | 293,032 | |||||||||||||||

Estimated acquiree transaction costs | — | — | — | — | (4,298 | ) | ||||||||||||||

Estimated Rockley’s transaction costs | — | — | — | — | (9,741 | ) | ||||||||||||||

Estimated financing transaction costs | — | — | — | — | (25,820 | ) | ||||||||||||||

Elimination of acquiree’s historical retained Earnings | — | — | — | — | (23,402 | ) | ||||||||||||||

Total adjustments to par value and additional paid-in capital | — | — | — | — | 229,771 | |||||||||||||||

Six Months Ended June 30, 2021 | Year Ended December 31, 2020 | |||||||

Numerator | ||||||||

Pro forma net loss | $ | (65,659 | ) | $ | (67,486 | ) | ||

Denominator | ||||||||

Current Rockley Shareholders | 103,916,607 | 103,916,607 | ||||||

Acquiree Shareholders | 1,777,150 | 1,777,150 | ||||||

Sponsor Shareholders | 10,562,500 | 10,562,500 | ||||||

PIPE Investors | 10,000,000 | 10,000,000 | ||||||

Other Shareholders (1) | 319,000 | 319,000 | ||||||

Total | $ | 126,575,257 | $ | 126,575,257 | ||||

Net loss per share | ||||||||

Basic and diluted | $ | (0.52 | ) | $ | (0.53 | ) | ||

| (1) | On September 27, 2021, the Company entered into an agreement with Cowen and Company LLC (“Cowen”) and BCW Securities LLC (“BCW”) to issue 319,000 ordinary shares at a value of $10.00 per share pursuant to a private placement exemption under Section 4(a)(2) of the Securities Act in lieu of cash payment for a portion ($3.194 million) of the fees payable to Cowen as part of the transaction costs. |

| • | continue to invest in our technology and our silicon photonics solutions; |

| • | continue to develop innovative solutions and applications for our technology; |

| • | commercialize our silicon photonics solutions; |

| • | continue to invest in our sales and marketing activities and distribution channels; |

| • | invest and improve our operational, financial, and management information systems; |

| • | increase our headcount; |

| • | obtain, maintain and expand our intellectual property portfolio; and |

| • | enhance internal functions to support our operations as a public company. |

| • | Total non-recurring transaction costs estimated at approximately $44.1 million, of which the Company expects approximately $1.0 million to be expensed; and |

| ��� | The payment of deferred legal fees, underwriting commission, and other costs in connection with the initial public offering. |

| • | Rockley’s existing shareholders will hold a majority ownership interest in HoldCo, irrespective of whether or not existing shareholders of SC Health exercise their right to redeem their ordinary shares of SC Health; |

| • | Rockley’s existing senior management team will comprise senior management of HoldCo; |

| • | Rockley’s is the larger of the companies based on historical operating activity and employee base; and |

| • | Rockley’s operations will comprise the ongoing operations of HoldCo. |

Three Months Ended September 30, | Nine Months Ended September 30, | |||||||||||||||

2021 | 2020 | 2021 | 2020 | |||||||||||||

Revenue | $ | 1,839 | $ | 4,517 | $ | 5,805 | $ | 19,061 | ||||||||

Cost of revenue | 3,459 | 5,015 | 11,742 | 18,100 | ||||||||||||

Gross profit | (1,620 | ) | (498 | ) | (5,937 | ) | 961 | |||||||||

Operating expenses: | ||||||||||||||||

Selling, general, and administrative expenses | 13,568 | 5,354 | 27,588 | 12,603 | ||||||||||||

Research and development expenses | 26,418 | 10,790 | 59,949 | 27,007 | ||||||||||||

Total operating expenses | 39,986 | 16,144 | 87,537 | 39,610 | ||||||||||||

Loss from operations | (41,606 | ) | (16,642 | ) | (93,474 | ) | (38,649 | ) | ||||||||

Other income (expense): | ||||||||||||||||

Forgiveness of PPP loan | — | — | 2,860 | — | ||||||||||||

Interest expense, net | (1,587 | ) | 1 | (1,913 | ) | (73 | ) | |||||||||

Equity method investment loss | 40 | (689 | ) | (720 | ) | (941 | ) | |||||||||

Change in fair value of debt instruments | (14,255 | ) | (3,325 | ) | (59,916 | ) | (5,547 | ) | ||||||||

Change in fair value of warrant liabilities | 515 | — | 515 | — | ||||||||||||

Gain (loss) on foreign currency | (481 | ) | 285 | 150 | (1,369 | ) | ||||||||||

Total other income (expense) | (15,768 | ) | (3,728 | ) | (59,024 | ) | (7,930 | ) | ||||||||

Loss before income taxes | (57,374 | ) | (20,370 | ) | (152,498 | ) | (46,579 | ) | ||||||||

Provision for income tax | 598 | 154 | 808 | 374 | ||||||||||||

Net loss and comprehensive loss | $ | (57,972 | ) | $ | (20,524 | ) | $ | (153,306 | ) | $ | (46,953 | ) | ||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Revenue | $ | 1,839 | $ | 4,517 | $ | (2,678 | ) | (59 | )% | $ | 5,805 | $ | 19,061 | $ | (13,256 | ) | (70 | )% | ||||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Cost of revenue | $ | 3,459 | $ | 5,015 | $ | (1,556 | ) | (31 | )% | $ | 11,742 | $ | 18,100 | $ | (6,358 | ) | (35 | )% | ||||||||||||||

Gross Profit | (1,620 | ) | (498 | ) | (1,122 | ) | 225 | % | (5,937 | ) | 961 | (6,898 | ) | (718 | )% | |||||||||||||||||

Gross Margin | (88 | )% | (11 | )% | NM | NM | (102 | )% | 5 | % | NM | NM | ||||||||||||||||||||

| NM | – Not meaningful |

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Selling, general, and administrative expenses | $ | 13,568 | $ | 5,354 | $ | 8,214 | 153 | % | $ | 27,588 | $ | 12,603 | $ | 14,985 | 119 | % | ||||||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Research and development expenses | $ | 26,418 | $ | 10,790 | $ | 15,628 | 145 | % | $ | 59,949 | $ | 27,007 | $ | 32,942 | 122 | % | ||||||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Other income, net | — | — | $ | — | 100 | % | $ | 2,860 | $ | — | $ | 2,860 | 100 | % | ||||||||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Interest expense, net | $ | (1,587 | ) | $ | 1 | $ | (1,588 | ) | (158,800 | )% | $ | (1,913 | ) | $ | (73 | ) | $ | (1,840 | ) | 2,521 | % | |||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Equity method investment loss | $ | 40 | $ | (689 | ) | $ | 729 | (106 | )% | $ | (720 | ) | $ | (941 | ) | $ | 221 | (23 | )% | |||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Change in fair value of debt instruments | $ | (14,255 | ) | $ | (3,325 | ) | $ | (10,930 | ) | 329 | % | $ | (59,916 | ) | $ | (5,547 | ) | $ | (54,369 | ) | 980 | % | ||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Change in fair value of warrants | $ | 515 | $ | — | $ | 515 | 100 | % | $ | 515 | $ | — | $ | 515 | 100 | % | ||||||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Gain (loss) on foreign currency | $ | (481 | ) | $ | 285 | $ | (766 | ) | (269 | )% | $ | 150 | $ | (1,369 | ) | $ | 1,519 | (111 | )% | |||||||||||||

Three Months Ended September 30, | Change | Nine Months Ended September 30, | Change | |||||||||||||||||||||||||||||

2021 | 2020 | $ | % | 2021 | 2020 | $ | % | |||||||||||||||||||||||||

Provision for income tax | $ | 598 | $ | 154 | $ | 444 | 288 | % | $ | 808 | $ | 374 | $ | 434 | 116 | % | ||||||||||||||||

Years Ended December 31, | ||||||||

2020 | 2019 | |||||||

Consolidated Statements of Operations and Loss Data: | ||||||||

Revenue | $ | 22,343 | $ | 20,492 | ||||

Cost of revenue | 24,240 | 30,705 | ||||||

Gross Profit | (1,897 | ) | (10,213 | ) | ||||

Operating expenses: | ||||||||

Selling, general and administrative expenses | 20,260 | 13,306 | ||||||

Research and development expenses | 35,900 | 22,303 | ||||||

Operating loss | (58,057 | ) | (45,822 | ) | ||||

Other income (expense): | ||||||||

Interest income (expense), net | (189 | ) | (747 | ) | ||||

Equity method investment loss | (1,274 | ) | (1,281 | ) | ||||

Change in fair value of debt instruments | (20,163 | ) | 2,969 | ) | ||||

Gain (loss) on foreign currency | (25 | ) | 280 | |||||

Loss before provision for income tax | (79,708 | ) | (50,539 | ) | ||||

Provision for income tax | 569 | 311 | ||||||

Net loss and comprehensive loss | $ | (80,277 | ) | $ | (50,850 | ) | ||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Revenue | $ | 22,343 | $ | 20,492 | $ | 1,851 | 9 | % | ||||||||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Cost of Revenue | $ | 24,240 | $ | 30,705 | $ | (6,465 | ) | (21 | )% | |||||||

Gross Profit | $ | (1,897 | ) | $ | (10,213 | ) | $ | 8,316 | 81 | % | ||||||

Gross Margin | (8 | )% | (50 | )% | NM | NM | ||||||||||

| NM | – Not meaningful |

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Selling, general and administrative expenses | $ | 20,260 | $ | 13,306 | $ | 6,954 | 52 | % | ||||||||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Research and development expenses | $ | 35,900 | $ | 22,303 | $ | 13,597 | 61 | % | ||||||||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Interest income | $ | 30 | $ | 281 | $ | (251 | ) | (89 | )% | |||||||

Interest expense | $ | (219 | ) | $ | (1,028 | ) | $ | 809 | (79 | )% | ||||||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Change in fair value of debt instruments | $ | 20,163 | $ | 2,969 | $ | 17,194 | 579 | % | ||||||||

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Gain (loss) on foreign currency | $ | 25 | $ | (280 | ) | $ | 305 | NM | ||||||||

| NM | – Not meaningful |

Years Ended December 31, | Change | |||||||||||||||

2020 | 2019 | $ | % | |||||||||||||

Provision for income tax | $ | 569 | $ | 311 | $ | 258 | 83 | % | ||||||||

| • | timing and the costs involved in bringing our products to market; |

| • | anticipated customer contracts and design wins may not materialize; |

| • | delay in launching our products due to technical challenges from our customers or our product development team; |

| • | pricing and the volume of sales of our products may be different from our estimates; |

| • | execution delays due to resources constraints; |

| • | assisting our fab partners with expansion of production capacity; |

| • | the cost of maintaining, expanding and protecting our intellectual property portfolio, including litigation costs and liabilities; |

| • | the cost of additional general and administrative talent, including accounting and finance, legal and human resources, as a result of becoming a public company; |

| • | Rockley’s additional investment requirement needed for HRT to be self-sufficient; and |

| • | other risks discussed in the section entitled “Risk Factors.” |

Nine Months Ended September 30, | ||||||||

2021 | 2020 | |||||||

(in thousands) | ||||||||

Net cash used in operating activities | $ | (91,902 | ) | $ | (28,738 | ) | ||

Net cash used in investing activities | (55,968 | ) | (3,590 | ) | ||||

Net cash provided by financing activities | 203,833 | 30,352 | ||||||

Net increase (decrease) in cash and cash equivalents | $ | 55,963 | $ | (1,976 | ) | |||

Years Ended December 31, | ||||||||

2020 | 2019 | |||||||

Consolidated Statements of Cash Flow Data: | ||||||||

Net cash (used in) provided by: | ||||||||

Operating activities | $ | (48,354 | ) | $ | (36,556 | ) | ||

Investing activities | (6,656 | ) | (2,831 | ) | ||||

Financing activities | 53,334 | 48,933 | ||||||

Net (decrease) increase in cash and cash equivalents | $ | (1,676 | ) | $ | 9,546 | |||

| • | Revenue recognition; |

| • | equity valuations; |

| • | fair value of financial instruments and fair value measurements; and |

| • | income taxes. |

| • | Fair value of ordinary shares—see “Ordinary Shares Valuations” discussion below; |

| • | Expected Term—This is the period that the options or warrants that have been granted are expected to remain unexercised. The Company employs the average period the stock options and warrants are expected to remain outstanding; |

| • | Volatility—This is a measure of the amount by which a financial variable, such as a share price, has fluctuated (historical volatility) or is expected to fluctuate (expected volatility) during a period. As the Company does not yet have sufficient history of its own volatility, management has identified several guideline comparable companies and estimates volatility based on the volatility of those companies; |

| • | Risk-Free Interest Rate—This is the U.S. Treasury rate, having a term that most closely resembles the expected life of the stock option or warrant; and |

| • | Dividend Yield—The Company has not and does not expect to pay dividends on its ordinary shares in the foreseeable future. |

| • | Rockley’s historical financial results and future financial projections; |

| • | the lack of marketability of Rockley’s ordinary shares; |

| • | the likelihood of achieving a liquidity event, such as an initial public offering or business combination, given prevailing market conditions; |

| • | industry outlook; and |

| • | general economic outlook, including economic growth, inflation and unemployment, interest rate environment and global economic trends. |

| 1 | Specifically, we believe our TAM for the wearables, mobile, and medical device markets will be approximately $48 billion by 2025, taking into account our anticipated timeline for commercial availability of our products and the market for the end products into which our products are designed to be incorporated. Our products are being designed for utilization in: (a) medical devices, including blood pressure, body temperature, blood glucose, and alcohol monitoring devices, pulse oximetry, and near infra-red (“NIR”) spectrometers, with an aggregate forecasted TAM of $15.1 billion by 2025, according to the Yole Report, and mobile cardiac telemetry/general patient monitoring patch devices, with an aggregate forecasted TAM of $2.7 billion by 2025, according to the IDtechEx Report; and (b) consumer wearables and mobile devices, including smartwatches, smart earbuds, fitness bands, and mobile phones, which, based on our internal estimates, are expected to have a TAM of $2.7 billion, $3.0 billion, $1.5 billion, and $23.5 billion, respectively, or an aggregate TAM of $30.7 billion, by 2025. We estimated our TAM in the consumer wearables and mobile device sectors by multiplying third-party forecasted total volumes in 2025 for the devices for which our products are being designed, by our currently anticipated and estimated average selling prices for these products. The volume estimate for smartwatches was based on the benchmarked figure forecasted by annual volume for smartwatches for 2022 according to the TrendForce Report. The volume estimate for smart earbuds was based a 20% volume CAGR between 2020-2025, with 2020 annual shipments estimated at 230 million units, according to the TrendForce Report. According to the Yole Report, fitness bands were forecasted to reach 89 million units by 2025. The volume estimates for smartphones were based on multiple third-party forecasted volumes for mobile phones, multiplied by the average selling price. |

| • | Consumer health and wellbeing awareness. COVID-19 has had a profound impact on the way consumers perceive their need for“at-home” monitoring solutions. |

| • | Chronic conditions and disease care. non-invasive monitoring solutions for chronic conditions have historically been costly and available only in a medical facility. With our potential for individual noninvasive wearable monitoring solutions, we believe we have a great opportunity to impact patients’ compliance with healthcare guidance, that will lead to better quality of life and drastic overall healthcare cost reductions.Non-invasive monitoring could also allow detection and prevention of potential chronic conditions and disease at a much earlier stage, resulting in reduced overall healthcare cost. |

| • | Superior sensing performance. LED-based solutions based on product analysis undertaken by Rockley comparing the Rockley silicon photonics-based spectrometer chip to existingLED-based solutions. We believe our unique silicon photonics technology and the entire product ecosystem we are developing will make ourend-to-end |

| 2 | We believe the TAM for medical devices into which our products may be incorporated will be approximately $18 billion by 2025 based on: (a) an aggregate forecasted addressable market of $15.1 billion for healthcare monitoring devices and NIR spectrometers by 2025, according to the Yole Report; and (b) mobile cardiac telemetry/general patient monitoring patch devices with an aggregate forecasted addressable market of $2.7 billion by 2025, according to the IDtechEx Report. |

offerings in the health and wellness domain difficult to replicate. Current optical-based sensing solutions rely on LED-based sensing (PPG signals for SpO2, heart rate, heart rate variability, breath rate, and blood pressure). However, there are many biomarkers present in the body (such as in blood or interstitial fluid) that are not detectable in visible LED range. We believe the wide wavelength span ininfra-red and capability of our silicon photonics solutions to integrate many wavelengths within that range in a compact chip at high volume and low cost opens the door to addressing those biomarkers. |

| • | Flexible platform architecture. |

| • | Deep understanding of market opportunity and customer priorities. are developing many applications and systems with our silicon photonics solutions that are driven by industry leaders in the consumer sensors, healthcare, and data communications markets. Through our established relationships with industry leaders, we have consistently demonstrated our ability to address their technological challenges. As a result, we have signed MOUs and have contracted with several industry leaders in wearable consumer technology to establish product specifications and desirable features. We believe we are well-positioned to develop high-volume optical sensing modules and algorithms for their emerging architectures. We have ongoing, collaborative discussions with consumer wearables, healthcare, and communication companies and original equipment manufacturers (“OEM”) and module and component vendors to address their next generation product offering to end users. |

| • | Fabless, scalable business model with manufacturing process expertise and ownership. |

| • | Highly differentiated process. III-V actives, Integration) are unique and well suited to meeting our customers’ economic and performance needs for their applications. In particular, we believe our silicon PIC process on multi-micron thickSilicon-On-Insulator |

| • | Strong intellectual property portfolio. know-how is based on over 30 years of leadership in the development and commercialization of silicon photonics and we have established strong and deep technical foundations and expertise for high-volume product delivery that would be difficult for a competitor to replicate. |

| • | Established and committed foundry partner network. |

| • | Extend our silicon photonics leadership. |

| • | Identify and promote new and emerging applications for our technologies. end-product roadmaps and to demonstrate how our technologies can help them to devise and enable innovative solutions. |

| • | Develop our product portfolio. |

| • | Forming strategic partnerships in products and applications: |

| • | Continue to attract and acquire new customers. |

| • | Sustain margin through expansion of our products into higher-end markets. |

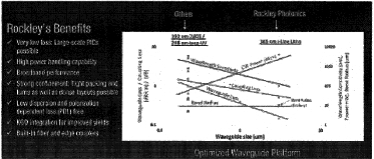

| • | A unique and proprietary silicon photonics platform technology to address a broad set of requirements in the healthcare and wellness industries. |

| • | Our custom multi-micron-waveguide photonics-optimized process with integrated III-V semiconductor actives brings multiple competitive advantages in terms of performance and manufacturability, offering lower waveguide losses, higher waveguide power handling, polarization independence, ubiquitous integration ofIII-V actives in their nativeknown-good-die form, ultra-broad-band performance, and lower sensitivity to manufacturing variations while enabling compact circuitry with high integration densities. |

| • | Optical loss per unit distance is much lower than for others, enabling lower power solutions and/or larger-scale PICs. |

| • | The platform provides broadband performance and is suitable for the visible, short-wave and mid-infrared bands. This is a key enabler for sensing applications that other platforms cannot serve. |

| • | A larger waveguide is much less sensitive to manufacturing variations that can affect its shape and hence its refractive index, thus achieving much better center wavelength registration than small waveguides enabling accurate wavelength filters. |

| • | Strong optical confinement enables tight packing of waveguides and sharp waveguide bends, hence dense layout capability and compact PICs. |

| • | Our waveguides exhibit low dispersion (low signal distortion) and low polarization dependent loss (simplifying receiver architectures in particular). |

| • | The platform incorporates features that enable low-loss, passively aligned fiber coupling (integrated mode size converters andv-grooves). |

| • | The platform is well suited to power-efficient integration of III-V waveguide devices such as lasers and modulators that also have a multi-micron mode size. Processed, known good,III-V devices can be flip-chip bonded into recesses etched in the silicon waveguide layer to achieve edge coupling. This has the advantages of compact coupling without tapers orspot-size converters, active device processing in existingIII-V foundries,back-end integration of known good and reliableIII-V devices, and more favorable thermals. |

| • | The large waveguides also offer a much higher optical power handling capability than small waveguides. |

| • | Broadband optical performance enables sensing a large optical spectrum to cover a wide range of measurands. |

| • | Accurate wavelength targeting enables using many finely spaced wavelengths for accurate detection. |

| • | Low optical loss enables a high signal-to-noise |

| • | Low-loss coupling fromIII-V to Si waveguide drives down power consumption for long battery life. |

| • | Compact PIC layouts result in small chip sizes to fit within consumer device form factors and reduce product cost. |