The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any state or other jurisdiction where the offer or sale is not permitted.

Subject to completion, dated February 1, 2023

Prospectus

23,255,814 Shares

Class A common stock

This is an initial public offering of shares of Class A common stock of Nextracker Inc. We are offering 23,255,814 shares of our Class A common stock. Prior to this offering, there has been no public market for our Class A common stock. We currently expect the initial public offering price of the Class A common stock being offered to be between $20.00 and $23.00 per share. We have applied to list the Class A common stock on the Nasdaq Global Select Market (“Nasdaq”) under the symbol “NXT.”

We will use all of the net proceeds from this offering to purchase 23,255,814 LLC Common Units (as defined herein) from a subsidiary of Flex Ltd. (or 26,744,186 LLC Common Units if the underwriters exercise in full their option to purchase additional shares of Class A common stock) at a price per unit equal to the initial public offering price per share of Class A common stock in this offering less the underwriting discount. We will not retain any of the net proceeds of this offering.

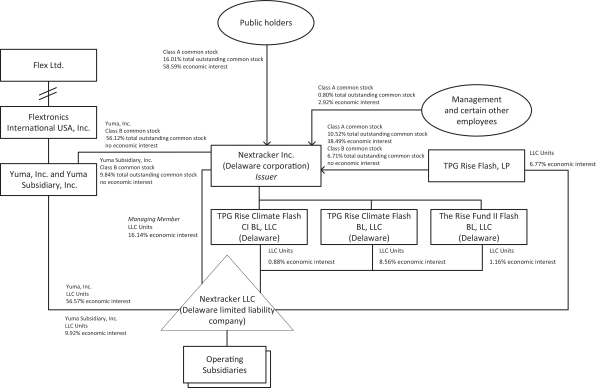

Following the completion of this offering, we will have two classes of authorized and outstanding common stock. Each share of our Class A common stock and Class B common stock entitles its holder to one vote on all matters presented to our stockholders generally. We are offering 23,255,814 shares of our Class A common stock, which immediately after this offering will represent in the aggregate 16.01% of our total outstanding shares of common stock (or 18.41% of our total outstanding shares of common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock).

Immediately after this offering, Flex Ltd., our parent company, will own, indirectly through one or more subsidiaries, 90.76% of the outstanding shares of our Class B common stock, representing 65.96% of our total outstanding shares of common stock (or 63.56% of our total outstanding shares of common stock if the underwriters exercise in full their option to purchase additional shares of Class A common stock) and, so long as it owns a controlling interest in our common stock, it will be able to control any action requiring the general approval of our stockholders, including the election and removal of directors, any amendments to our certificate of incorporation and the approval of any merger or sale of all or substantially all of our assets. Accordingly, we will be a “controlled company” within the meaning of the corporate governance rules of Nasdaq. See “Risk factors—Risks related to the Transactions and our relationship with Flex,” “Management—controlled company exemption” and “Principal stockholders.”

We will be a holding company and, upon the completion of this offering, our principal asset will consist of LLC Common Units that we acquire from a subsidiary of Flex Ltd. with the proceeds from this offering and common units issued to us in connection with the merger of certain blocker corporations, representing 26.75% of the total economic interest in the LLC (as defined herein) (or 29.17% if the underwriters exercise in full their option to purchase additional shares of Class A common stock). The remaining economic interest in the LLC will be owned by subsidiaries of Flex Ltd. and TPG Rise Flash, L.P. through their ownership of LLC Common Units.

Upon the completion of this offering, we will be the managing member of the LLC. We will operate and control all of the business and affairs of the LLC and its direct and indirect subsidiaries and will conduct our business through the LLC and its direct and indirect subsidiaries.

Certain funds and accounts managed by subsidiaries of BlackRock, Inc. and by Norges Bank Investment Management, a division of Norges Bank, have, severally and not jointly, indicated an interest in purchasing up to an aggregate of $100 million collectively in shares of our Class A common stock in this offering at the initial public offering price and on the same terms and conditions as the other purchasers in this offering. Because these indications of interest are not binding agreements or commitments to purchase, such purchasers could determine to purchase more, fewer or no shares in this offering or the underwriters could determine to sell more, fewer or no shares to such purchasers. The underwriters will receive the same discount on any of our shares of Class A common stock purchased by certain funds and accounts managed by subsidiaries of BlackRock, Inc. and by Norges Bank Investment Management, a division of Norges Bank, as they will from any other shares of Class A common stock sold to the public in this offering.

| | | | | | | | |

| | | |

| | | Per Share | | | Total | |

| | |

Initial public offering price | | $ | | | | $ | | |

| | |

Underwriting discount(1) | | $ | | | | $ | | |

| | |

Proceeds to Nextracker Inc., before expenses | | $ | | | | $ | | |

| (1) | | See “Underwriting” for a description of the compensation payable to the underwriters. |

We have granted the underwriters an option for a period of 30 days to purchase up to an additional 3,488,372 shares of Class A common stock.

Investing in our Class A common stock involves a high degree of risk. See “Risk factors” beginning on page 33.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares to purchasers on or about , 2023.

| | |

| J.P. Morgan | | BofA Securities |

| |

| Citigroup | | Barclays |

| | | | |

| Truist Securities | | HSBC | | BNP PARIBAS |

| Mizuho | | Scotiabank | | KeyBanc Capital Markets |

| | | | | | | | |

| SMBC Nikko | | BTIG | | UniCredit | | Roth Capital Partners | | Craig-Hallum |

, 2023