Exhibit 99.1

| | Nova Minerals Ltd | Annual Report  | 2 |

Contents

| | Nova Minerals Ltd | Annual Report  | 3 |

Message from the CEO, Christopher Gerteisen |  |

Dear Fellow Shareholders,

It is with great pleasure that I present to you Nova Minerals Ltd’s 2024 Annual Report, which details the exciting progress we have made both corporately and in our development of the Estelle Gold and Critical Minerals District.

We are excited with how the Estelle project is unfolding with optionality available in terms of the initial project size and scale. This allows us development flexibility to align with current market conditions, whereby future growth can be achieved through cash flow and/or strategic partnerships to meet our objective of ultimately growing the Estelle Project into a tier 1 producer. In addition, a near-term cash flow opportunity in advancing the stand-alone antimony project is being pursued with ongoing discussion and support of the DoD that will run in parallel to our gold project within the wider Estelle Gold and Critical Elements District.

With the RPM deposit having some of the best drill intercepts in the last 10 years globally, coupled with the positive technical parameters we have seen in our test work, we are laser focussed on completing the PFS on the lower capex, high margin, RPM start up production scenario. Upon completion of the PFS we are positioned to begin the permitting process to put RPM into production and achieve cash flow, enabling us to organically develop the larger Estelle Gold Project at the RPM and Korbel deposits. We are also maintaining communications with potential strategic partners that would see project expansion on a much faster timeline.

Antimony is currently in the spotlight with global supply shortages and historic high prices. At Estelle we have identified two highly prospective antimony-gold zones at Stibium and Styx with surface samples returning results up to 60.5% Sb. While the potential scale of this discovery continues to be assessed by our technical team, these discoveries represent a significant opportunity for the company, and Nova is in advanced discussions with various agencies within the US Dept. of Defense and has submitted applications for US federal grants to develop these resources with an aim towards fully securing the US domestic supply chain. Given the additional value that antimony production could add to the project, antimony will now also be considered in future project studies. The speed of this work and potential production is subject to DoD grant funding.

Subsequent to the end of year after many countless hours of dedication, the company also completed a major milestone with the dual listing on the NASDAQ, under ticker code NVA.

As of the date of this report we are well-funded with fantastic near-term gold and antimony development opportunities across the Estelle Project that offer us great optionality and flexibility along the way. We have a clear strategy and focus to move towards production for early cash flow and are confident in the value proposition we are creating via our current strategy. There are many catalysts for share price appreciation over the next year to create a high-grade, high margin project at RPM, and grow organically into the much larger Korbel deposit and wider Estelle district, while continuing to expand the RPM resource with the added gratuity of establishing a standalone antimony project with DoD support. Concurrently, we have only scratched the surface and our ongoing exploration programs continue to advance the over 20 other known prospects containing gold, antimony, silver, copper, and other critical elements across the Estelle Project. I encourage you to review our activities in greater detail as described in this annual report and on our website to truly understand the magnitude, opportunity, and value Estelle presents to the investor.

I, together with the rest of the Nova team, thank you for your continued support as we continue to push forward rapidly on our path towards production

Christopher Gerteisen

CEO and Executive Director

| | Nova Minerals Ltd | Annual Report  | 4 |

| | Nova Minerals Ltd | Annual Report  | 5 |

Review of Operations

Strategic Review

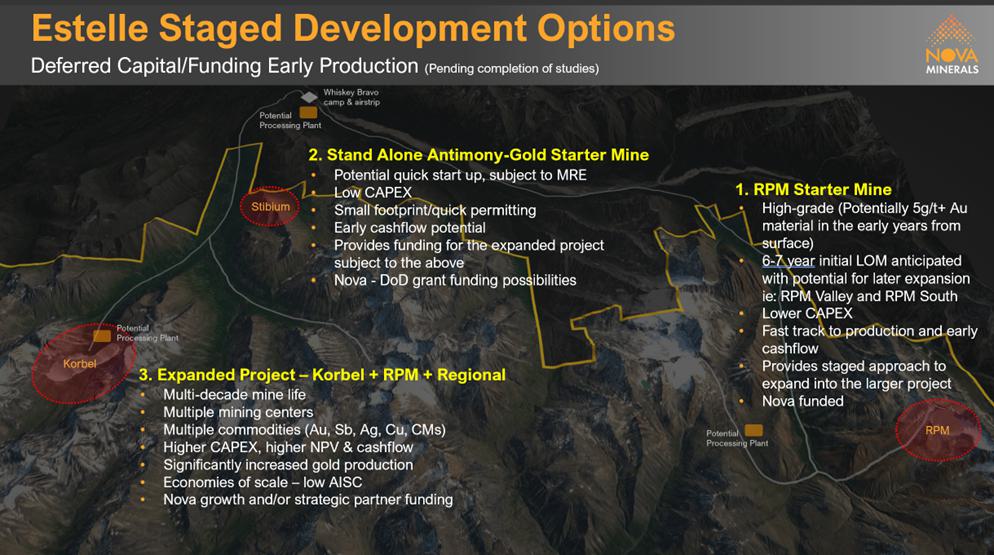

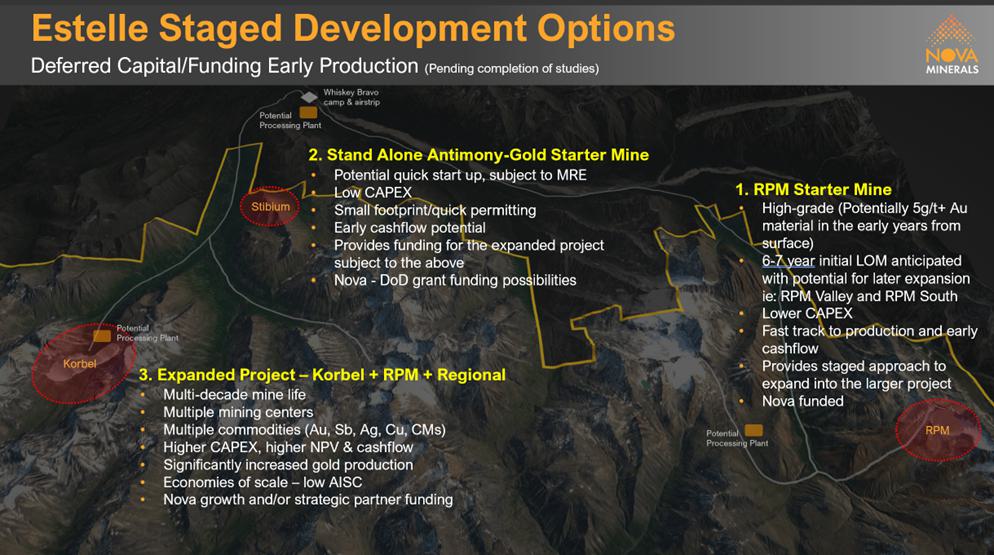

During the year Nova conducted a strategic review on its Estelle Gold Project to investigate opportunities to improve the proposed flowsheet (Figure 2) which could potentially increase gold production, whilst reducing the capital and operating costs of the project, and to look at ways to get Estelle into production sooner (Figure 1). The review identified a number of material opportunities which are now being tested as part of the PFS level studies currently underway, and which have been identified as being important to potential partners and funders in early discussions. Items identified include:

Development Optionality

| 1. | High-Grade RPM Starter Mine |

Establishing an initial lower capex smaller scale operation at the high-grade RPM deposit for potential near term cashflow at high margins to self-fund expansion plans; and/or

| 2. | Expanded Project – Korbel + RPM + Regional |

Scalability – Large project for both gold and critical minerals with a pipeline spanning decades of potential production from over 20 known prospects. Higher capex larger mining operation with increased gold production, cash flow, and mine life, which is of interest to potential future large gold company strategic partners.

| 3. | Stand Alone Antimony-Gold Starter Mine: |

With China announcing export restrictions on antimony, the Company is now also investigating the possibility to fast track the Stibium gold-antimony prospect development option with potential US Dept. of Defense (DoD) support.

Figure 1. Estelle staged development options

| | Nova Minerals Ltd | Annual Report  | 6 |

Heap Leaching Lower Grade Ore

| ● | Evaluating heap leaching, a well-proven low cost gold recovery method which could potentially recover gold from the 100’s of millions of tons of lower grade material and the reject material from the ore sorters, which in the current flowsheet is waste, to provide a lift to the annual gold production profile. METS Engineering (METS) has commenced test work on bulk samples sent to Perth late last year using a finer crush size, with early stage indications looking positive. |

| | |

| ● | Investigating various heap leaching options, including agglomeration, and alternative leach reagents, with results expected in the 2nd half of 2024. |

Critical Minerals Extraction

| ● | Assessing extraction options of the highly elevated concentrations of Silver, Copper, Antimony and other CM identified across the project which could potentially provide valuable bi-product credits and which the US government is currently trying to sure up a domestic supply. |

Ore Sorting Options

| ● | Reviewing various selective ore sorting options on material from both RPM and Korbel with Steinart ore sorting to test a combination of different sensors including, XRT density, colour, laser, and induction, to potentially improve the ore sorting results further. |

| | |

| ● | Early-stage discussions with potential partners and funders has shown the need to demonstrate the capabilities of ore sorting on a larger scale. A bulk, up to 200 kt, pilot scale ore sort test program is currently being planned in consultation with Rough Stock, METS and Steinert. |

Alternative Technologies

| ● | Investigating alternative technology options, such as SAG (Semi Autogenous Grinding) mills, coarse flotation using Hydrofloat technology, and gravity recovery using a Reflux Classifier to further improve and optimize the process flowsheet. |

| | |

| ● | The review also identified numerous power options that would meet the startup requirements (10-20MW) for the Estelle Project with the ability to scale up in the future. |

Resource Drilling

| ● | The review also identified that additional drilling was required at RPM this year, with a focus on increasing the resource to the higher measured and indicted categories to prove up a larger ore reserve for the PFS. |

| | |

| ● | Maiden drill testing at the Stibium, Train, Trumpet, Muddy Creek and Stoney prospects, to follow up on the high-grade surface samples of gold, antimony and other CM discovered in those areas last year, was also identified as being a necessity to increase gold resources and to support the proposed CM bi-product extraction. |

Road Access

| ● | While the review recognised the importance of the West Susitna Access Road (WSAR), which is due to break ground in 2025, it also identified that Nova could potentially utilize the road at an early stage and commence mine construction using the initial frontier trail along the proposed WSAR alignment prior to the road being fully completed, along with the winter snow road to transport equipment to site. |

| | Nova Minerals Ltd | Annual Report  | 7 |

Figure 2. Current and proposed conceptual flowsheet, which is being tested as part of the PFS level studies underway

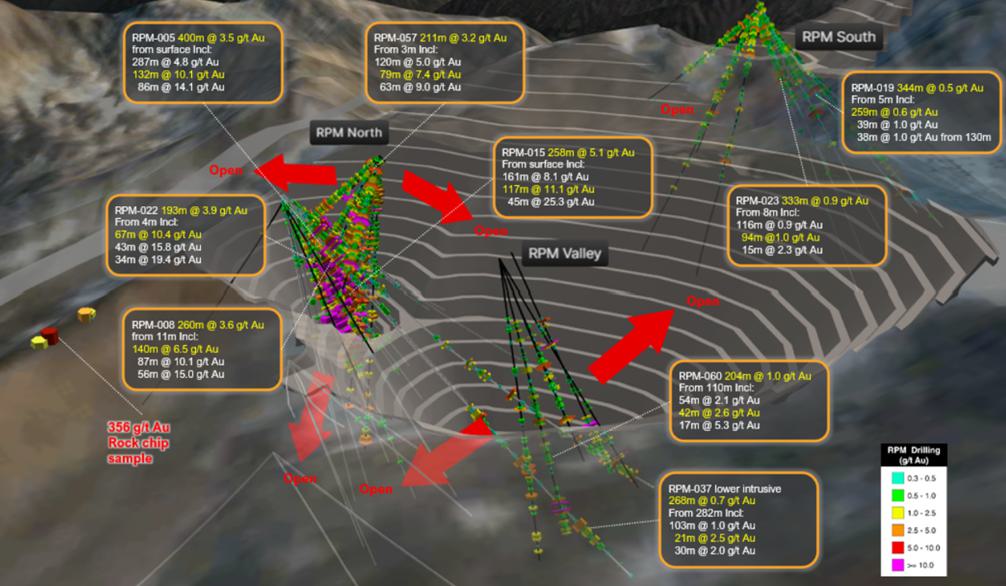

Drill Program Results

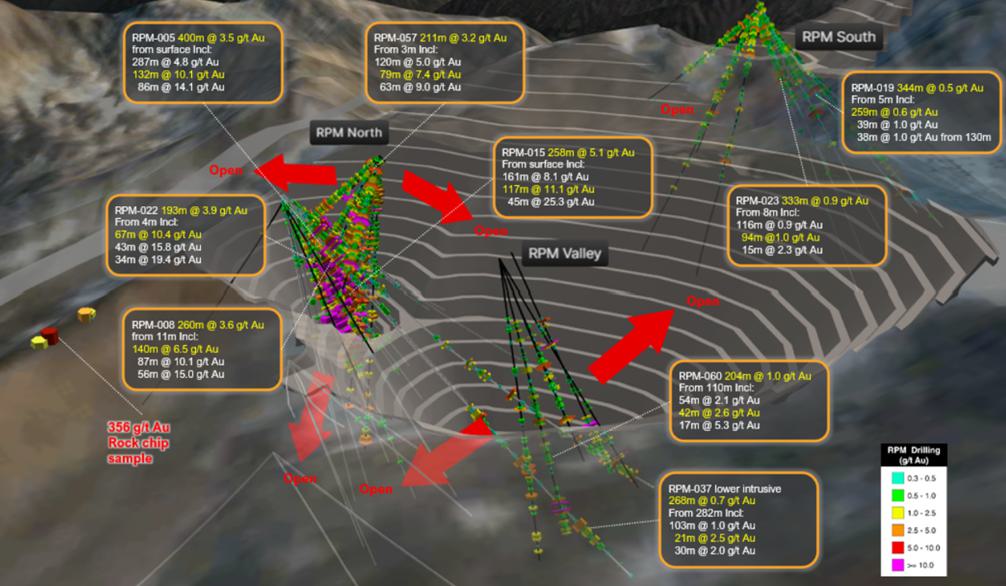

During the 1st half of the 2024 financial year, Nova undertook a highly targeted ~6,600m diamond drill program at RPM. The primary aim of this program was to increase both the size and confidence of the resource at RPM.

At RPM North, the high-grade infill and step-out drilling confirmed the consistency of mineralization and resource extension potential at RPM North to the South, East and at depth, with over 10 broad intersections grading > 5 g/t Au. Highlight results included:

| ● | RPM-056: 152m @ 2.3 g/t Au from 3m, including 98m @ 3.4 g/t Au from 48m and 38m @7.5 g/t Au from 99m |

| | |

| ● | RPM-057: 211m @ 3.2 g/t Au from 3m, including 120m @ 5.0 g/t Au from 93m and 79m @ 7.4 g/t Au from 128m |

| | |

| ● | RPM-065: 314m @ 1.9 g/t Au from 2m, including 231m 2.4 g/t Au from 39m and 118m 3.9 g/t Au from 152m |

At RPM Valley, drilling confirmed an additional zone of broad high-grade gold with mineralization remaining wide open and the potential exists for RPM Valley to connect with RPM North. Highlight results included:

| ● | RPM-048: 54m @ 1.2 g/t Au from 244m including 22m @ 1.8 g/t Au from 255m and 16m @ 2.4 g/t Au from 255m |

| | |

| ● | RPM-060: 54m @ 2.1 g/t Au from 260m including 42m @ 2.6 g/t Au from 270m and 17m @ 5.3 g/t Au from 273m |

At RPM South, infill and extensional drilling continued to show large intervals of near surface gold. Importantly, 6 of the 7 holes drilled had average grades above the current MRE grade for RPM South of 0.4 g/t Au and a number of the significantly intercepts were also greater than the 0.73 g/t Au mill feed grade used in the 2023 scoping study. Highlight results included:

| ● | RPM-039: 30m @ 1.2 g/t Au from 30m, 7m @ 2.1 g/t Au from 48m including 1m @ 7.7 g/t Au from 48m |

| | Nova Minerals Ltd | Annual Report  | 8 |

The drill results from the overall 2023 drilling program at RPM clearly demonstrate that RPM is a large system that continues to grow with the deposit remaining wide open in several directions where the potential remains for continuity linking the mineralized zones and to discover further very high-grade pods similar to RPM North. The planned 2024 resource drilling program will prioritize RPM to increase and prove up resources for inclusion in the upcoming Pre-Feasibility Study (PFS).

Figure 3. High-light drill results at RPM. Black drill traces show 2023 drilling

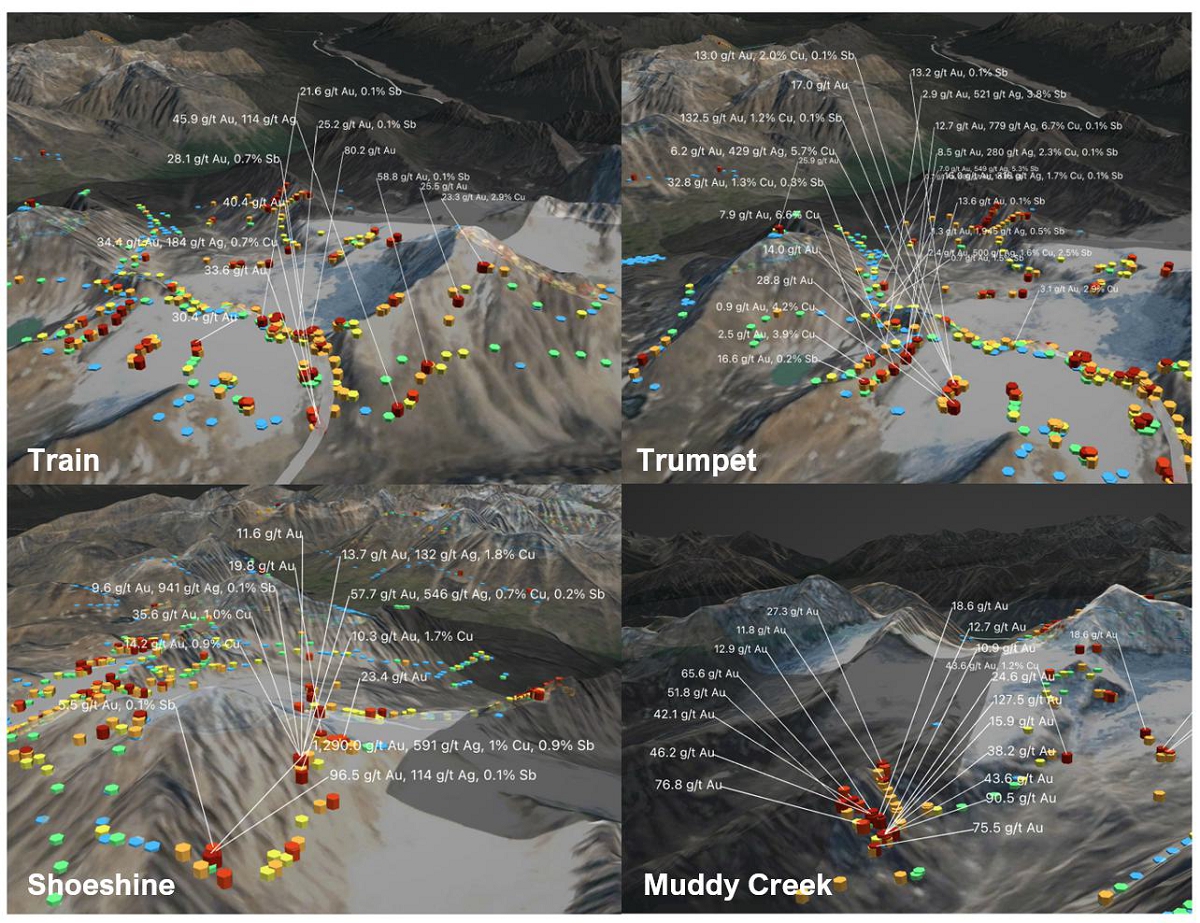

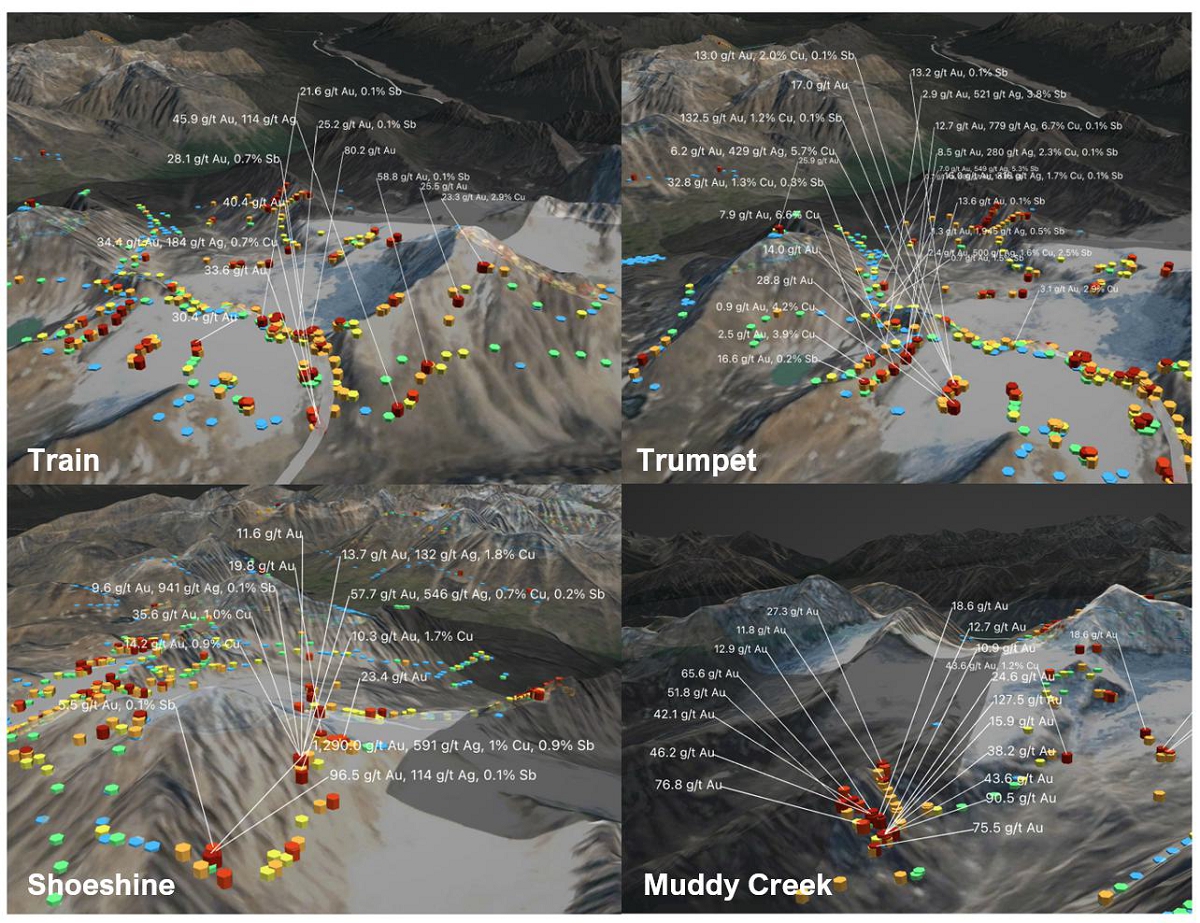

New Discoveries from an Extensive Surface Exploration Program

During the 2023 field season Nova’s Head of Exploration, Mr Hans Hoffman, undertook an extensive surface exploration mapping and sampling program across the entire Estelle Gold Project comprising of over 45 traverses covering 100-line kilometers, 674 soil samples, 446 rock samples and 21 stream sediment samples. The program resulted in a number of significant new discoveries including:

| ● | A record 1,290 g/t Au rock chip sample, along with many other samples returning high-grades for gold, antimony, copper and silver at the Shoeshine and Shadow prospects (Figure 4). |

| | |

| ● | The discovery of one of the most continuous high-grade zones of mineralization on the property at the new Discovery and Muddy Creek prospects, with a 1.5km long surface gold anomaly including 18 rock samples grading > 10 g/t Au, with a high of 127.5 g/t Au and 15 multi-gram soil samples > 2/g/t Au, with a high of 6.1 g/t Au (Figure 4). |

| | |

| ● | The identification of two new gold-antimony prospect areas, Stibium and Styx with surface samples returning highs of 12.7g/t Au, 2.1% Sb, 1600g/t Ag and 1.5g/t Au, 60.5% Sb. |

| | |

| ● | Further numerous high-grade gold, silver, copper and antimony at the Train and Trumpet prospects with a high of 132.5 g/t Au, 1.2% Cu and 0.1% Sb and one sample returning a very high 16.8% Sb (Figure 4). |

| | |

| ● | The identification of the thickest gold-bearing veins to date with over a 1km strike length and grades up to 24.2 g/t Au at the new Wombat Prospect. |

| | Nova Minerals Ltd | Annual Report  | 9 |

Figure 4. High-grade rock and soil samples discovered in 2023 in the Train, Trumpet, Shoeshine and Muddy Creek prospects

Figure 5. The Estelle Gold Project, a 513km2 district scale project on State Alaska mining claims with over 20 prospects advancing at varying stages. And not just gold, with future targets including antimony, silver, copper and other critical minerals to expand the exploration pipeline for longer term opportunity.

| | Nova Minerals Ltd | Annual Report  | 10 |

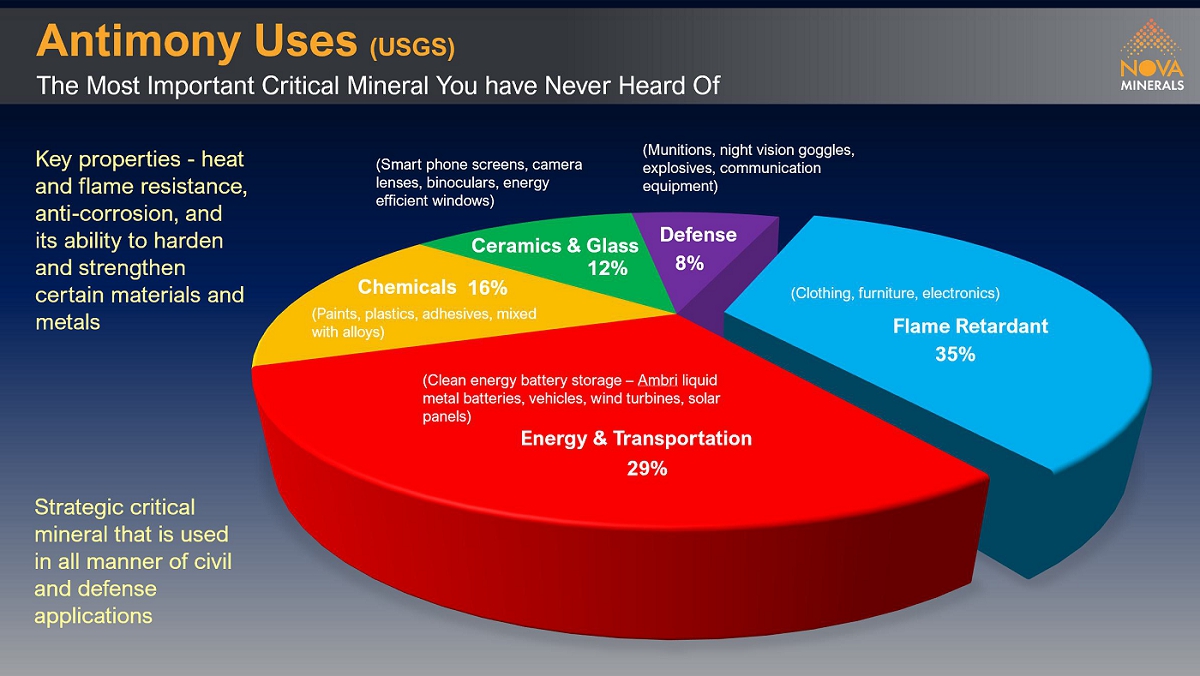

New Gold-Antimony Targets Discovered

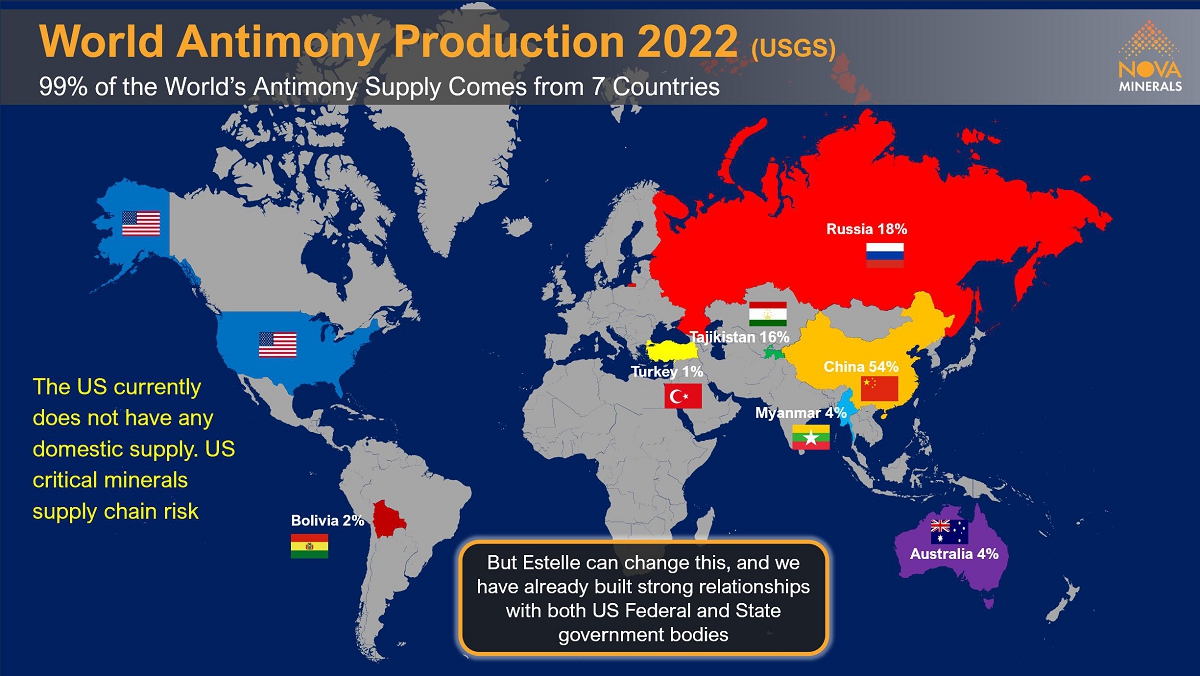

The discovery of high grade stibnite a primary ore source for the critical mineral antimony (Figures 6 and 7), associated with the gold systems at several prospects across the project site, represented a significant development for the Company as antimony is listed as a critical and strategic mineral to US economic and national security interests with no current US domestic supply.

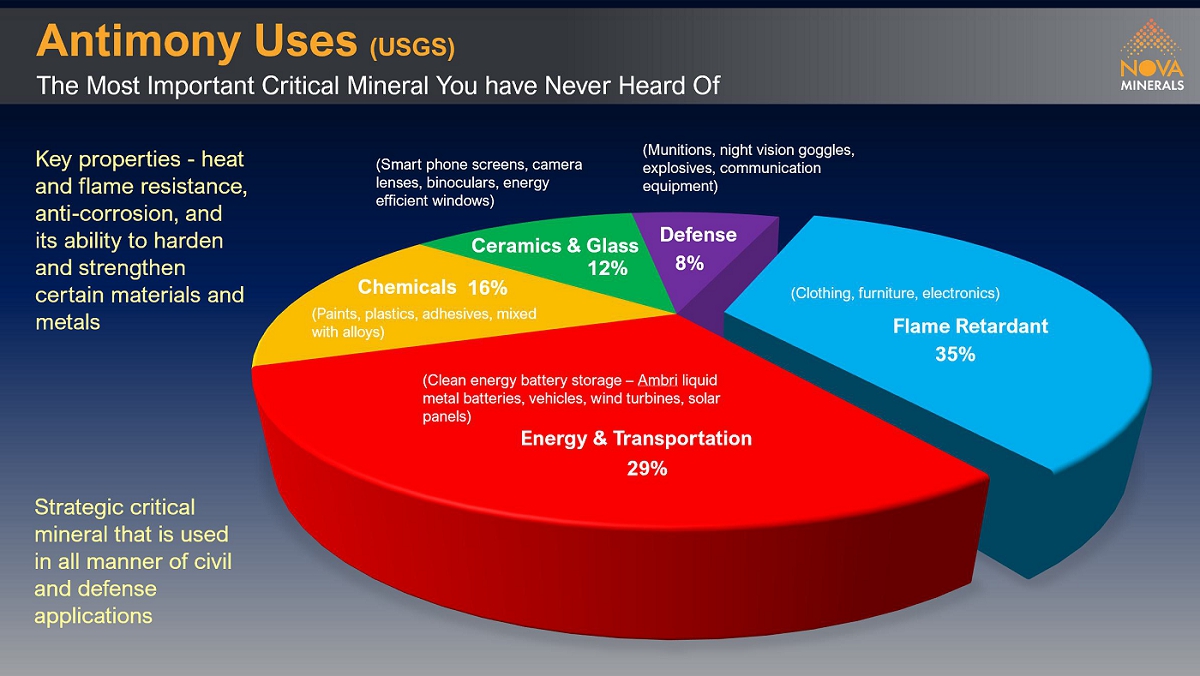

Figure 6. Antimony uses (Source USGS)

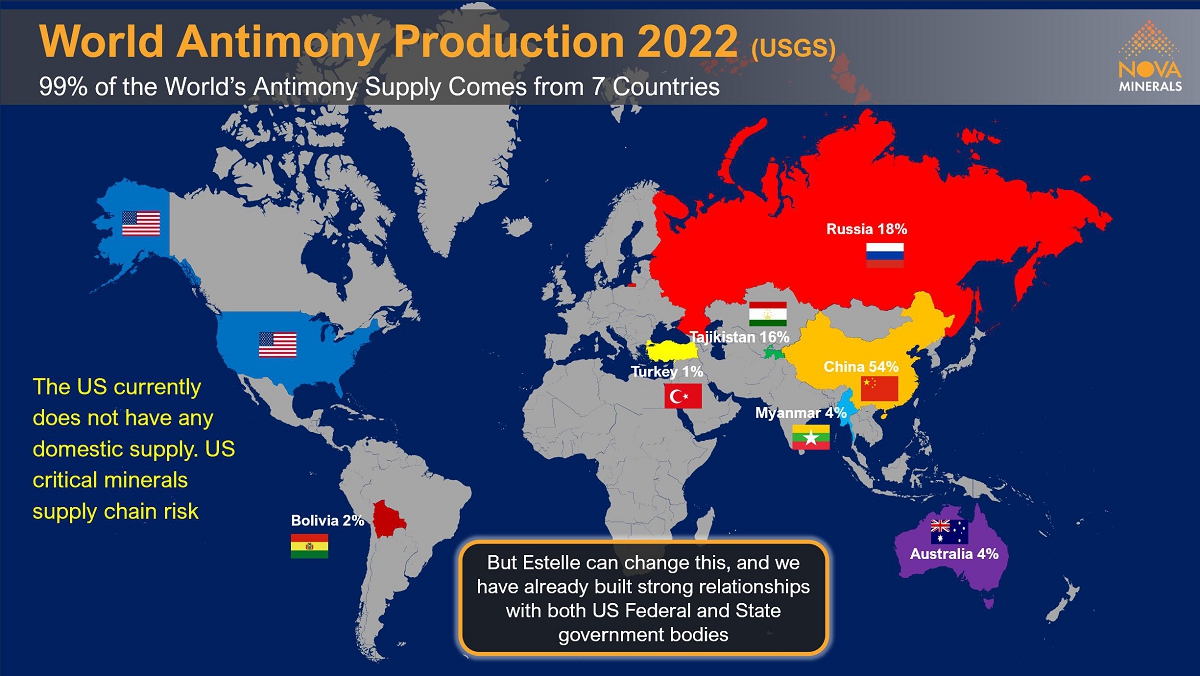

Figure 5. Antimony supply (Source USGS) – No US domestic supply currently While the potential scale of this discovery continues to be assessed by our technical team, Nova has now appointed a highly reputable national consulting group and assembled a highly influential internal team, to assist the company with accessing any potential US federal grants and funding to further investigate and progress the discovery across the entire supply chain. Given the additional value that antimony could add to the project, via the potential to provide substantial bi-product credits amongst other benefits, antimony will now also be included in any future studies.

| | Nova Minerals Ltd | Annual Report  | 11 |

Significant Subsequent Events

US NASDAQ Listing

On 24 July 2024 Nova announced that it had successfully completed its US listing on the NASDAQ under the symbol NVA, along with an associated US$3.3m (AUD$4.9m) capital raising, before deducting underwriting discounts and offering expenses. The public offering comprised of 475,000 units, with each unit consisting of one American Depositary Share representing ordinary shares (“ADS”) and one warrant, with an ADS-to-ordinary-share ratio of 1 to 60, at a price to the public of US$6.92 per unit, Each whole warrant is exercisable for one ADS at an exercise price of US$7.266 per ADS, and will be immediately exercisable upon issuance for a period of five years following the date of issuance. In addition, Nova granted the underwriters an option to purchase up to an additional 47,500 ADSs and/or an additional 47,500 warrants to cover over-allotments, if any until August 29, 2024.

2025 Financial Year Next Steps

| ● | RPM resource drilling and results |

| | |

| ● | Updated Mineral Resource Estimate (MRE) for 2023 and 2024 drilling results, and higher gold price |

| | |

| ● | Lidar survey results across the property to enable detailed infrastructure design, mineral reserve classification, exploration, etc. |

| | |

| ● | Material PFS test work results and trade-off studies as they become available |

| | |

| ● | Results and potential new discoveries from the ongoing surface exploration mapping and sampling program |

| | |

| ● | Metallurgical test work ongoing |

| | |

| ● | Environmental test work ongoing |

| | |

| ● | West Susitna access road update |

| | Nova Minerals Ltd | Annual Report  | 12 |

| | Nova Minerals Ltd | Annual Report  | 13 |

Financial Report

| | Nova Minerals Ltd | Annual Report  | 14 |

Directors’ Report

The directors present their report, together with the financial statements, on the consolidated entity (referred to hereafter as the ‘consolidated entity’) consisting of Nova Minerals Limited (referred to hereafter as the ‘company’ or ‘parent entity’) and the entities it controlled at the end of, or during, the year ended 30 June 2024.

Directors

The following persons were directors of Nova Minerals Limited during the whole of the financial year and up to the date of this report, unless otherwise stated:

Richard Beazley (Appointed 24 July 2024)

Christopher Gerteisen

Louie Simens

Craig Bentley

Rodrigo Capel Pasqua

Avi Geller

Principal Activities

During the financial year the principal contributing activities of the consolidated entity consisted of mining exploration.

Dividends

There were no dividends paid, recommended, or declared during the current or previous financial year.

Review of Operations

Statement of Profit or Loss and Other Comprehensive Income

As an exploration company, Nova does not have an ongoing source of revenue. Its revenue stream is normally from interest received on cash at bank. Administration expenses increased from $2,721,273 in 2023 to $3,536,622 in 2024 primarily due to increase legal costs, USA listing fees, and marketing fees. Share-based expense was $780,235 in 2023 compared to $335,669 in 2024. Snow Lake Resources impairment was nil 2023 compared to $8,824,187 in 2024. Share of losses of associate was $6,254,759 in 2023 compared to $839,153 in 2024. As a result the loss for the consolidated entity after providing for income tax amounted to $16,389,292 (2023: $11,571,240).

Statement of Financial Position

At 30 June 2024, the Company had cash at bank of $3,149,909 (2023: $19,240,707). During the year, trade and other receivables decreased from $495,186 to $328,794, and capitalised exploration expenditure increased from $81,070,075 to $92,117,750 as a result of expenditure incurred on the Estelle Gold project. At 30 June 2024, the Company had total liabilities of $8,862,289 (2023: $8,946,817). As a result, the Company had net assets of $98,383,732 as at 30 June 2024 (2023: $113,389,965).

Cashflow

During the year, the Company paid $3,666,768 (2023: $3,083,677) for operating activities; paid $13,321,921 (2023: $24,139,677) for investing activities; and received $986,892 (2023: $25,158,615) from financing activities.

Significant Changes in the State of Affairs

There were no significant changes in the state of affairs of the consolidated entity during the financial year.

| | Nova Minerals Ltd | Annual Report  | 15 |

Matters Subsequent to the End of the Financial Year

The following events have occurred subsequent to 30 June 2024:

| ● | The Company announced on 24 July 2024 the NASDAQ IPO and an underwritten public offering of 475,000 units, with each unit consisting of one American Depositary Share representing ordinary shares (“ADS”) and one warrant, with an ADS-to-ordinary-share ratio of 1 to 60, at a price to the public of US$6.92 per unit, for gross proceeds of approximately US$3.3m (AUD$4.9m), before deducting underwriting discounts and offering expenses. Each whole warrant is exercisable for one ADS at an exercise price of US$7.266 per ADS and will be immediately exercisable upon issuance for a period of five years following the date of issuance. In addition, Nova has granted the underwriters an option to purchase up to an additional 47,500 ADSs and/or an additional 47,500 warrants to cover over-allotments, if any until August 29, 2024. |

| | |

| ● | The Company announced on 24 July 2024 the appointment of Mr. Richard Beazley to the Board of Directors as Independent Non-Executive Chairman. Mr. Louie Simens reverted to Executive Director from his Interim Chairman position at that time. |

| | |

| ● | The Company announced on 31 July 2024 the commencement of resource definition drilling at RPM and exploration field programs on its Estelle Gold Project. |

| | |

| ● | The Company announced on 21 August 2024 an update on the progress of its 2024 resource definition drilling and exploration field programs. |

| | |

| ● | The Company announced on 5 September 2024 an update on its Antimony-Gold prospects at Stibium and Styx where bulk samples of stibnite (antimony) have been collected for metallurgical testing. |

| | |

| ● | The Company announced on 20 September 2024 that has filed a registration statement on Form F-1 with the U.S. Securities and Exchange Commission (“SEC”) relating to a secondary public offering of its American Depositary Shares (“ADSs”), each of which will represent 60 of the Company’s ordinary shares of no par value each (“Ordinary Shares”) in the United States (the “Offering”). |

| | |

| ● | The Company announced on 20 September 2024 that it had executed a variation agreement with its largest institutional shareholder and convertible note holder, Nebari Gold Fund 1, LP (“Nebari”), to reduce the month-end cash covenant required under the previously announced loan agreement dated 21 November 2022 from US$2m to A$1m, with the option to extend the convertible facility for a further 12 months to 29 November 2026. In return for Nebari’s support, Nova has agreed to amend the conversion price from A$0.53 to A$0.25, subject to shareholder approval. |

| | |

| ● | Further to the announcement on 20 September 2024, the Company announced the ability to accelerate the RPM early start up option to a Pre-Feasibility Study (PFS) for delivery in 2025 by undertaking internal optimization studies aimed to investigate how it can potentially generate as much early cashflow as possible to organically fund our expansion plans across the Estelle project. It also gives the Company the ability to continue our advanced discussions with the US Dept. of Defense (“DoD”) in relation to potentially establishing a starter antimony operation at Stibium in parallel. |

| | |

| ● | The Company announced on 24 September 2024 a secondary NASDAQ public offering of 430,000 units, with each unit consisting of one American Depositary Share representing ordinary shares (“ADS”), with an ADS-to-ordinary-share ratio of 1 to 60, at a price to the public of US$5.00 per unit, for gross proceeds of approximately US$2.15m (AUD$3.14m), before deducting underwriting discounts and offering expenses. In addition, Nova has granted the underwriters an option to purchase up to an additional 43,000 ADSs to cover over-allotments, if any, for 45 days. |

No other matters or circumstance has arisen since 30 June 2024 that has significantly affected, or may significantly affect the consolidated entity’s operations, the results of those operations, or the consolidated entity’s state of affairs in future financial years.

Likely Developments and Expected Results of Operations

Information on likely developments in the operations of the consolidated entity and the expected results of operations have not been included in this report because the directors believe it would be likely to result in unreasonable prejudice to the consolidated entity.

| | Nova Minerals Ltd | Annual Report  | 16 |

Environmental Regulation

The exploration activities of the Company are conducted in accordance with and controlled principally by government legislation in Alaska, United States of America.

The Company has exploration land holdings in Alaska (USA) and Manitoba (Canada). The Company employs a system for reporting environmental incidents, establishing and communicating accountability, and rating environmental performance. During the year, data on environmental performance was reported as part of the monthly exploration reporting regime. In addition, as required under various state and territory legislation, procedures are in place to ensure that the relevant authorities are notified prior to the commencement of ground disturbing exploration activities.

The Company is committed to minimising the impact of its activities on the surrounding environment, while at the same time aiming to maximise the social, environmental and economic returns for the local community. To this end, the environment is a key consideration in our exploration activities and during the rehabilitation of disturbed areas. Generally, rehabilitation occurs immediately following the completion of a particular phase of exploration. In addition, the Company continues to develop and maintain mutually beneficial relationships with the local communities affected by its activities.

Material Business Risks

The key risk factors affecting the Company are set out below. The occurrence of any of the risk below could adversely impact the Company’s operating or financial performance.

There are specific risks which relate directly to the Company’s business. In addition, there are other general risks, many of which are largely beyond the control of the Company and the Directors. The risks identified in this section, or other risk factors, may have a material impact on the financial performance of the Company and the market price of the Shares.

The following is not intended to be an exhaustive list of the risk factors to which the Company is exposed.

| (a) | General risks associated with operating overseas |

The Company conducts and has interests in operations in the USA and Canada. Consequently, the Company will be subject to the risks associated with operating in such countries. Such risks can include economic, social or political instability or change, hyperinflation, currency non-convertibility or instability and changes of law affecting foreign ownership, government participation, taxation, working conditions, rates of exchange, exchange control, exploration licensing, export duties, repatriation of income or return of capital, environmental protection, mine safety, labour relations as well as government control over mineral properties or government regulations.

Changes to mining or investment policies and legislation or a shift in political attitude may adversely affect the Company’s operations and profitability.

| (b) | Future capital requirements |

The Company believes its available cash should be adequate to fund its exploration and corporate activities and other Company objectives in the short-to medium-term.

However, in order to successfully develop its lithium projects and for production to commence, the Company may require additional financing in the future. Any additional equity financing may be dilutive to Shareholders, may be undertaken at lower prices than the then market price or may involve restrictive covenants which limit the Company’s operations and business strategy. Debt financing, if available, may involve restrictions on financing and operating activities.

Although the Directors believe that additional capital can be obtained as and when required, no assurances can be made that appropriate capital or funding, if and when needed, will be available on terms favourable to the Company or at all. If the Company is unable to obtain additional financing as needed, it may be required to reduce the scope of its activities and this could have a material adverse effect on the Company.

| | Nova Minerals Ltd | Annual Report  | 17 |

The mineral claims in which the Company will, or may, acquire an interest in the future are subject to the applicable local laws and regulations.

Mineral claims in which the Company has an interest are subject to the relevant conditions applying in each jurisdiction. Failure to comply with these conditions may render the mineral claims liable for forfeiture.

The mineral claims will be subject to application for renewal from time to time. Renewal of the term of each mineral claim is subject to applicable legislation. If the mineral claim is not renewed for any reason, the Company may suffer significant damage through loss of the opportunity to develop and discover any mineral resources on that mineral claim.

Overseas jurisdictions are subject to differing legal and political systems, when compared with the systems in place in Australia.

Possible risks include, without limitation, changes in the terms of mining legislation, changes to royalty arrangements, changes to taxation rates and concessions and changes in the ability to enforce legal rights. Any of these factors may, in the future, adversely affect the financial performance of the Company and the market price of its Shares.

In relation to the Company’s projects in Canada, there may be areas over which First Nations land claims exist at present or in the future. The impact of any such claim on the Company’s Canadian projects cannot be foreseen with any degree of certainty and no assurance can be given that a broad recognition of First Nations rights in the areas in which the Canadian Projects are located would not have an adverse effect on the Company’s activities. Even in the absence of such recognition, the Company may at some point be required to negotiate with and seek the approval of holders of First Nations interests in order to facilitate exploration and development work on the Company’s mineral properties. It cannot be assured that the Company will be able to establish practical working relationships with the First Nations in the area which would allow it to ultimately develop the Company’s Canadian projects.

The Company is required to pay royalties on some or all minerals derived from its projects.

There is a risk that the royalties will have an impact on the economics of progressing any proposed mining operations. However, the Company has no control over the incurrence of these costs and is unable to predict the magnitude of such costs.

| (g) | Exploration and operating costs |

The proposed exploration expenditure of the Company is based on certain assumptions with respect to the method and timing of exploration and feasibility work. By their nature, these estimates and assumptions are subject to significant uncertainties and, accordingly, the actual costs may materially differ from these estimates and assumptions. Accordingly, no assurance can be given that the cost estimates and the underlying assumptions will be realised in practice.

The Company is not aware of any expenses that may need to be incurred that have not been taken into account. However, if such unforeseen expenses were subsequently incurred, the expenditure proposals of the Company may be adversely affected.

The Company may need to seek various Federal, state or local permits and approvals to undertake exploration or mining activities on the Mineral Claims. This could result in unforeseen delay in the undertaking of such activities.

The Company is of the view however that the exploration activities as outlined in this Prospectus can be undertaken in the timeframes contemplated.

| | Nova Minerals Ltd | Annual Report  | 18 |

| (j) | Potential acquisitions |

As part of its business strategy, the Company may make acquisitions of, or significant investments in, other resource projects. Any such future transactions would be accompanied by the risks commonly encountered in making acquisitions of resource projects.

The ability of the Company to achieve its objectives will depend on the performance by the counterparties to any agreements that the Company may enter into. If any counterparty defaults in the performance of their obligations, it may be necessary for the Company to approach a court to seek a legal remedy. Legal action can be costly.

Furthermore, certain contracts to which the Company is a party are governed by laws of jurisdictions outside Australia - namely the United States and Canada. There is a risk that the Company may not be able to seek the legal redress that it could expect under Australian law and generally there can be no guarantee that a legal remedy will ultimately be granted on the appropriate terms.

| (l) | Health, safety and the environment |

The conduct of business in the resources sector involves a variety of risks to the health and safety of personnel and to the environment. If it is conceivable that an incident may occur which might negatively impact on the Company’s business.

| (m) | International operations |

International sales and operations are subject to a number of risks, including:

| i. | Potential difficulties in enforcing agreements (including joint venture agreements) and collecting receivables through foreign local systems; |

| ii. | Potential difficulties in protecting intellectual property; |

| iii. | Increases in costs for transportation and shipping; and |

| iv. | Restrictive governmental actions, such as imposition of trade quotas, tariffs and other taxes. |

These factors (or others) could materially and adversely affect the Company’s business, results of operations and financial condition.

Increases in commodity prices may encourage increases in exploration, development and construction activities, which can result in increased demand for, and cost of, exploration, development and construction services and equipment. Increased demand for services and equipment could cause exploration and project costs to increase materially, resulting in delays if services cannot be obtained in a timely manner due to inadequate availability, and could increase potential scheduling difficulties and costs due to the need to co-ordinate the availability of services or equipment, any of which could materially increase project exploration, development or construction costs or result in project delays or both. Any such material increase in costs would adversely affect the Company’s financial condition.

A decrease in commodity prices may render mineral properties uneconomic or may result in material reductions in the value of exploration, development or developed mineral properties.

| (o) | Risk of adverse publicity |

The projects which the Company aims to develop involves exploration and ore processing within the relevant local communities. Any failure to adequately manage community expectations with respect to compensation for land access, artisanal mining activity, employment opportunities, impact on local business and any other expectations may lead to local dissatisfaction. The political and social pressures resulting from local dissatisfaction and adverse publicity could lead to delays in approval of, and increased expenses in the Company’s proposed exploration programme.

| | Nova Minerals Ltd | Annual Report  | 19 |

| (a) | Exploration and evaluation risks |

The Company’s mineral claims are at various stages of exploration, and potential investors should understand that mineral exploration and development are high-risk undertakings. There can be no assurance that exploration of these mineral claims, or any other mineral claims that may be acquired in the future, will result in the development of an economic ore deposit. Even if an apparently viable deposit is identified, there is no guarantee that it can be economically exploited.

The future exploration activities of the Company may be affected by a range of factors including geological conditions, limitations on activities due to permitting conditions, seasonal weather patterns, unanticipated operational and technical difficulties, industrial and environmental accidents, changing government regulations and many other factors beyond the control of the Company.

The success of the Company will also depend upon the Company having access to sufficient development capital, being able to maintain title to its mineral claims and obtaining all required approvals for its activities and so doing in a timely manner considering constraints associated with the presence of special management areas, the absence of existing or suitable physical access or seasonal road closures. In the event that exploration programs prove to be unsuccessful this could lead to a diminution in the value of the mineral claims and possible relinquishment or sale of the mineral claims.

The exploration costs of the Company are based on certain assumptions with respect to the method and timing of exploration. By their nature, these estimates and assumptions are subject to significant uncertainties and, accordingly, the actual costs may materially differ from these estimates and assumptions. Accordingly, no assurance can be given that the cost estimates and the underlying assumptions will be realised in practice, which may materially and adversely affect the Company’s viability.

Resource estimates are expressions of judgement based on knowledge, experience and industry practice. Estimates which were valid when originally calculated may alter significantly when new information or techniques become available. In addition, by their very nature, resource estimates are imprecise and depend to some extent on interpretations, which may prove to be inaccurate. As further information becomes available through additional fieldwork and analysis, the estimates are likely to change. This may result in alterations to development and mining plans which may, in turn, adversely affect the Company’s operations.

| (c) | Ability to exploit successful discoveries |

It may not always be possible for the Company to exploit successful discoveries which may be made in areas in which the Company has an interest. Such exploration would involve obtaining the necessary licences or clearances from the relevant authorities that may require conditions to be satisfied and/or the exercise of discretions by such authorities. It may or may not be possible for such conditions to be satisfied. Further, the decision to proceed to further exploration may require participation of other companies whose interests and objectives may not be the same as the Company’s.

| (d) | Development risks and costs |

Possible future development of mining operations at any of the Company’s projects is dependent on a number of factors and avoiding various risks including, but not limited to, failure to acquire and/or delineate economically recoverable ore bodies, unfavourable geological conditions, failing to receive the necessary approvals from all relevant authorities and parties, failure to withstand legal challenges to Federal and state agency permit approvals, unseasonal weather patterns, excessive seasonal weather patterns, fire, flooding, unanticipated challenges related to background conditions or area soil or water quality, access and utilities, unanticipated technical and operational difficulties encountered in extraction and production activities, mechanical failure of operating plant and equipment, unexpected shortages or increases in the price of consumables, spare parts and plant and equipment, cost overruns, risk of access to the required level of funding and contracting risk from third parties providing essential services.

| | Nova Minerals Ltd | Annual Report  | 20 |

In addition, the exploration and pre-development Federal and state approvals prior to construction of any proposed development may exceed the expected timeframe or cost for a variety of reasons out of the Company’s control, including but not limited to Federal and state agency approvals being subject to administrative and judicial appeals. Any delays to project development could adversely affect the Company’s operations and financial results and may require the Company to raise further funds to complete resource delineation, project development and commence operations.

There can be no assurance that the Company’s intended goals will lead to successful exploration, mining and/or production operations. Further, no assurance can be given that the Company will be able to initiate or sustain minerals production, or that future operations will achieve commercial viability.

When additional exploration is undertaken and if a JORC compliant resource or reserve is not defined, then it may have a negative impact on the Company.

Future operations of the Company may be affected by various factors including:

| i. | Geological and hydrogeological conditions; |

| ii. | Limitations on activities due to seasonal weather patterns and monsoon activity; |

| iii. | Delays associated with the obtaining of permits and approvals to undertake exploration activity including allowing ground disturbing activity associated with operations in Canada and the United States; |

| iv. | Unanticipated operational and technical difficulties encountered in survey, drilling and production activities; |

| v. | Electrical and/or mechanical failure of operating plant and equipment, industrial and environmental accidents, industrial disputes and other force majeure events; |

| vi. | Equipment failure, fires, spills or industrial and environmental accidents; |

| vii. | Unavailability of aircraft or equipment to undertake airborne surveys and other geological and geophysical investigations; |

| viii. | Risk that exploration, appraisal, development, plant or operating costs prove to be greater than expected or that the proposed timing of exploration, development or production may not be achieved; |

| ix. | Failure to achieve exploration success; |

| x. | The supply and cost of skilled labour; |

| xi. | Unexpected shortages or increases in the costs of consumables, diesel fuel, spare parts, plant and equipment; and |

| xii. | Prevention and restriction of access by reason of political unrest, outbreak of hostilities and inability to obtain consents or approvals. |

No assurances can be given that the Company’s operations will achieve commercial viability through successful exploration and/or mining.

The proposed activities of the Company are subject to the laws and regulations of Australia, USA and Canada concerning the environment. As with most exploration projects, the Company’s activities are expected to have an impact on the environment, particularly during advanced exploration and future mining activities. It is the Company’s intention to conduct its activities to the highest standard of environmental obligation, including compliance with all environmental laws.

Mining operations have inherent risks and liabilities associated with safety and damage to the environment and the disposal of waste products occurring as a result of mineral exploration, development and production. The occurrence of any such safety or environmental incident could delay production or increase costs. Events such as unpredictable rainfall or bushfires may impact on the Company’s ongoing compliance with environmental laws, regulations and licenses. Significant liabilities could be imposed on the Company for damages, clean-up costs or penalties in the event of certain discharges into the environment, environmental damage caused by previous operations or non-compliance with environmental laws or regulations.

| | Nova Minerals Ltd | Annual Report  | 21 |

The disposal of mining and process waste and mine water discharge and air emissions discharge are under constant legislative scrutiny and regulation. There is a risk that environmental laws and regulations become more onerous, which could delay the Company’s activities and make its operations more expensive.

| (g) | Occupational Health and Safety |

The exploration and mining industry is subject to increasing occupational health and safety responsibility and liability. The Company may become liable for past and current conduct which violates such laws and regulations, which may be amended by the relevant authorities. Penalties for breaching health and safety laws can be significant and victims of workplace accidents may also commence civil proceedings against the Company. These events may not be insured, or may be uninsurable.

Changes to health and safety laws and regulations may also increase compliance costs for the Company, which would negatively impact the financial results of the Company.

The mining, processing, development and mineral exploration activities of the Company are subject to various Federal and state laws governing prospecting, development, production, taxes, labour standards and occupational health, mine safety, toxic substances, land use authorisations, water use protection of water quality, sensitive, threatened and endangered species and cultural resources and other matters. Although the Company’s activities are and will be currently carried out in accordance with all applicable rules and regulations, no assurance can be given that new statutes, regulations, executive orders, agency directives or policies or judicial decisions will not be adopted or that existing statutes, regulations or policies will not be applied in a manner which could limit exploration efforts or preclude or curtail future development or production. Amendments to current laws and regulations governing exploration and operations or more stringent implementation thereof could have a substantial adverse impact on the Company’s ability to further delineate and develop the resource.

The Company’s business operations are subject to risks and hazards inherent in the mining industry. The exploration for and the development of mineral deposits involves significant risks, including environmental hazards; industrial accidents; metallurgical and other processing problems; unusual or unexpected rock formations; structure cave-in or slides; flooding; fires and interruption due to inclement or hazardous weather conditions. These risks could result in damage to, or destruction of, mineral properties, production facilities or other properties, personal injury or death, environmental damage, delays in mining, increased production costs, monetary losses and possible legal liability.

Whether income will result from projects undergoing exploration and development programs depends on the successful establishment of mining operations. Factors including costs, actual mineralisation, consistency and reliability of ore grades and commodity prices affect successful project development.

The Company operates in multiple currencies and exchanges rates are constantly fluctuating. International prices of various commodities as well as the exploration expenditure of the Company are denominated in United States or Canadian dollars, whereas the Company will rely principally on funds raised and accounted for in Australian currency, exposing the Company to the fluctuations and volatility of the rate of exchange between the United States or Canadian dollar and the Australian dollar as determined in international markets.

There are a number of climate-related factors that may affect the operations and proposed activities of the Company. The climate change risks particularly attributable to the Company include:

| i. | The emergence of new or expanded regulations associated with the transitioning to a lower-carbon economy and market changes related to climate change mitigation. The Company may be impacted by changes to local or international compliance regulations related to air quality emissions and/or climate change mitigation efforts, or by specific taxation or penalties for carbon emissions or environmental damage. These examples sit amongst an array of possible restraints on industry that may further impact the Company and its profitability. While the Company will endeavor to manage these risks and limit any consequential impacts, there can be no guarantee that the Company will not be impacted by these occurrences; and |

| | Nova Minerals Ltd | Annual Report  | 22 |

| ii. | Climate change may cause certain physical and environmental risks that cannot be predicted by the Company, including events such as increased severity of weather patterns and incidence of extreme weather events and longer term physical risks such as shifting climate patterns. All these risks associated with climate change may significantly change the industry in which the Company operates. |

| 3. | General Investment Risks |

General economic conditions, introduction of tax reform, new legislation, movements in interest rates, inflation and currency exchange rates may have an adverse effect on the Company’s exploration, development and production activities, as well as on its ability to fund those activities.

| (b) | Reliance on key management personnel |

The responsibility of overseeing the day-to-day operations and the strategic management of the Company and its controlled entities depends substantially on its senior management and its key personnel. There can be no assurance given that there will be no detrimental impact on the Company if one or more of these senior management, key personnel or employees cease their involvement or employment with the Company or its controlled entities.

| (c) | Market risk and interest rate volatility |

From time to time, the Company may borrow money and accordingly will be subject to interest rates which may be fixed or floating. A change in interest rates would be expected to result in a change in the interest rate to the Company and, hence, may affect its profit.

The industry in which the Company will be involved is subject to global competition. While the Company will undertake all reasonable due diligence in its business decisions and operations, the Company will have no influence or control over the activities or actions of its competitors, whose activities or actions may, positively or negatively, affect the operating and financial performance of the Company’s Projects and business. The potential also exists for the nature and extent of the competition to change rapidly, which may cause loss to the Company.

There are general risks associated with an investment and the share market. The price of the Company’s securities on ASX may rise and fall depending on a range of factors beyond the Company’s control and which are unrelated to the Company’s financial performance. These factors may include movements on international stock markets, interest rates and exchange rates, together with domestic and international economic conditions, inflation rates, investor perceptions, changes in government policy, commodity supply and demand, government taxation and royalties, war, global hostilities and acts of terrorism.

Neither the Company nor the Directors warrant the future performance of the Company or any return on an investment in the Company.

There is no guarantee that there will be an ongoing liquid market for the Company’s securities. Accordingly, there is a risk that, should the market for the securities become illiquid, Shareholders will be unable to realise their investment in the Company.

| (g) | Insurance and uninsured risks |

The Company, where economically feasible, may insure its operations in accordance with industry practice. However, even if insurance is taken out, in certain circumstances the Company’s insurance may not be of a nature or level to provide adequate insurance cover. The occurrence of an event that is not covered, or fully covered, by insurance could have a material adverse effect on the business, financial condition and results of the Company. Insurance of all risks associated with mineral exploration and production is not always available and, where available, the costs can be prohibitive.

| | Nova Minerals Ltd | Annual Report  | 23 |

| (h) | Infectious disease pandemics |

Infectious disease pandemics such as the coronavirus, whilst opening up various new opportunities for the deployment of the Company’s technology, have the potential to interrupt the Company’s operations, impair deployment of its products to customers and prevent suppliers or distributors from honouring their contractual obligations. Such pandemics could also cause hospitalisation or death of the Company’s existing and potential customers and staff.

The Company’s projects now or in the future may be adversely affected by risks outside the control of the Company including labour unrest, civil disorder, war, subversive activities or sabotage, fires, floods, explosions or other catastrophes, epidemics, pandemics or quarantine restrictions.

| (j) | Investment speculative |

The above list of risk factors ought not to be taken as exhaustive of the risks faced by the Company or by investors in the Company. The above factors, and others not specifically referred to above may, in the future, materially affect the financial performance of the Company and the value of the new Shares offered under this Prospectus.

Therefore, the new Shares to be issued pursuant to this Prospectus carry no guarantee with respect to the payment of dividends, returns of capital or the market value of those new Shares.

Potential investors should consider that an investment in the Company is highly speculative and should consult their professional advisers before deciding whether to apply for new Shares pursuant to this Prospectus.

| (k) | Cyber risks and security breaches |

The Company stores data in its own systems and networks and also with a variety of third-party service providers. A malicious attack on the Company’s systems, processes or people, from external or internal sources, could put the integrity and privacy of customers’ data and business systems at risk. It could prevent customers from using the products for a period of time, put its users’ premises at risk and could also lead to unauthorised disclosure of data.

Other risk factors include those normally found in conducting business, including litigation through breach of agreements or in relation to employees (through personal injuries, industrial matters or otherwise) or any other cause, strikes, lockouts, loss of service of key management or operational personnel and other matters that may interfere with the Company’s business or trade.

| | Nova Minerals Ltd | Annual Report  | 24 |

Information on Directors

| Name: | | Richard Beazley (Appointed 24 July 2024) |

| Title: | | Non-Executive Chairman |

| Age: | | 60 |

Experience and expertise:

| | Mr. Beazley is an internationally experienced mining professional and director with over 35 years of experience in senior corporate, operational and project development roles. He is a qualified Mining Engineer and has worked in a range of projects throughout Australia, Africa, North and South America, in both underground and open cut operations, producing gold, base metals and critical minerals. Mr Beazley holds a Bachelor of Engineering (Honours) (Mining) from the University of New South Wales. He holds a MBA from APESMA (Association of Professional Engineers, Scientists and Managers, Australia) and Deakin University. He is a Member of the Australian Institute of Company Directors (MAICD) and a Member and Competent Person of the Australasian Institute of Mining and Metallurgy (MAusIMM (CP)) |

| Other current directorships: | | MetalsGrove Mining Limited (Non-executive Chair), Catalina Resources Ltd (Non-executive Director) |

| Former directorships (last 3 yr): | | None |

| Special responsibilities | | Audit and Risk Committee and Remuneration and Nomination Committee |

| Interests in shares: | | - |

| Interests in options: | | - |

| Interests in rights: | | - |

| Name: | | Christopher Gerstein |

| Title: | | Executive Director & CEO |

| Age: | | 51 |

Experience and expertise:

| | Mr. Christopher Gerteisen as CEO controls all aspects of the Estelle Gold project while implementing efficiencies and savings to keep cost per discovery ounce well below industry average. Mr. Gerteisen has over 20 years of experience as a professional geologist with an extensive record of managing and advancing complex and challenging resource projects across North America, Australia, and Asia. His work experience spans greenfields from discovery through to production stage and other projects with a focus on commodities including gold and copper. He worked as a geologist on the Carlin Trend in Nevada and on exploration in Alaska with Newmont. He has held senior positions within several projects throughout the goldfields of Western Australia. As a research geologist with Newmont he worked on the Batu Hijau Porhryry Cu-Au deposit in Indonesia. Most recently, through his technical contributions and management skills, Mr. Gerteisen played a significant role in the successful start-up, operations, and exploration which resulted in further mine-life extending discoveries at several prominent projects in the Australasian region, including Oxiana’s Sepon and PanAust’s Phu Bia in Laos. Mr. Gerteisen holds a Bachelor of Geology from the University of Idaho and a Master’s Degree in Economic Geology from the Western Australia School of Mines. He is a dual USA and Australia Citizen based in Alaska and a member of the Australian Institute of Geoscientists. |

| Other current directorships: | | Viridis Mining and Minerals Limited (ASX: VMM) |

| Former directorships (last 3 yr): None |

| Interests in shares: | | 1,833,614 |

| Interests in options: | | 2,050,000 |

| Interests in rights: | | 800,000 |

| | Nova Minerals Ltd | Annual Report  | 25 |

| Name: | | Louie Simens |

| Title: | | Executive Director |

| Age: | | 42 |

Experience and expertise:

| | Louie Simens served on our Board since December 2017, from Estelle greenfields to its current 10Moz global resources under JORC code and as our interim executive Chairman from April 2023 to July 23, 2024. Mr. Simens is responsible for managing our core business operations, which requires oversight of company-wide operational efficiencies and working with management and the board to review and implement strategic plans to facilitate growth. Mr. Simens has served as manager of our AK Custom Mining LLC subsidiary since 2017, our Alaska Range Resources LLC subsidiary since 2022 and our AK Operations LLC subsidiary since 2018. In addition, Mr. Simens has served as a director of our AKCM (AUST) Pty Ltd subsidiary since 2017. He has extensive experience in capital markets and running businesses, as well as in corporate restructuring, due diligence and mergers & acquisitions, where he utilizes his knowledge of corporate governance and project management. Mr. Simens has a successful track record spanning more than a decade, owning and operating contracting businesses in the fields of both civil and building construction. Mr. Simens has been a director of Benison Contractors Pty Ltd, his family construction group since inception on 5 July 2007. He also undertakes property development and investment. Mr. Simens was a Director of Snow Lake Resources Ltd (Nasdaq: LITM), an entity in which we have a 29.6% interest, since November 2018 to May 2022 and was appointed Snow Lake’s Non-Executive Chairman in December 2020 after the company’s Nasdaq listing. He has also served as Non-Executive Chairman of Torian Resources Ltd. (now Asra Minerals (ASX: ASR)). Since February 2024, Mr. Simens serves as a Director of CryptAi Pty Ltd, an artificial intelligence investment company. |

| Other current directorships: | | None |

| Former directorships (last 3 yr): | | Asra Minerals Limited (ASX: ASR), Snow Lake Resources Ltd (NASDAQ: LITM) |

| Interests in shares: | | 9,033,199 |

| Interests in options: | | 2,214,286 |

| Interests in rights: | | 800,000 |

| Name: | | Craig Bentley |

| Title: | | Director of Finance and Compliance |

| Age: | | 55 |

Experience and expertise:

| | Mr Craig Bentley holds a Bachelor of Commerce and Administration degree, majoring in accountancy and commercial law. Mr Bentley held positions at Ernst and Young and worked internationally, including on the audit of the Bank of America and a special audit for an insurance company prior to IPO listing in the USA amongst others. In addition, he has over 30 years commercial and finance experience working in senior roles in multinational private enterprises. As part of his role with Nova, Mr Bentley will also be tasked with compliance and risk management, as well as assisting with the company’s strategy during Nova’s forecasted rapid growth period. |

| Other current directorships: | | None |

| Former directorships (last 3 yr): | | None |

| Interests in shares: | | 3,616,669 |

| Interests in options: | | 821,429 |

| Interests in rights: | | - |

| | Nova Minerals Ltd | Annual Report  | 26 |

| Name: | | Rodrigo Capel Pasqua |

| Title: | | Non-Executive Director |

| Age: | | 35 |

Experience and expertise:

| | Mr Rodrigo Capel Pasqua is a Member of the AusIMM, holds a BEng in Mining Engineering from the University of São Paulo, a Western Australia First Class Mine Managers Certificate and specialisations in Corporate Leadership (University of Oxford), Corporate Strategy (London University) and Finance (University of Illinois and Harvard University). Technically, Mr Capel Pasqua skills encompass most aspects of underground and open pit engineering, going from mining studies, financial valuations and project execution to systems and new technology implementation, operations management, and technical teams’ supervision. He has vast experience in unlocking the value of mining projects across the world, including specific expertise in large tonnage bulk mining operations and at his tenure at Evolution Mining Limited, as Group Head of Mining and Transformation, amongst many other projects and sites Mr Capel Pasqua was involved with the Cowal Open Pit project and was also instrumental in the Red Lake mine turnaround At Nova Mr Capel Pasqua will provide technical and corporate advice as the Company progresses the development of its flagship Estelle Gold Project in Alaska |

| Other current directorships: | | None |

| Former directorships (last 3 yr): | | None |

| Special responsibilities: | | Audit and Risk Committee and Remuneration and Nomination Committee |

| Interests in shares: | | 28,500 |

| Interests in options: | | 264,250 |

| Interests in rights: | | - |

| Name: | | Avi Geller |

| Title: | | Non-Executive Director |

| Age: | | 36 |

Experience and expertise:

| | Mr. Geller has served as a member of our board of directors since November 2018. Mr. Geller has extensive investment experience and a deep knowledge of corporate finance, including capital markets, venture capital, hybrid, debt and private equity. He has been serving as the Chief Investment Officer of Leonite Capital LLC, a family office he co-founded focusing on real estate and capital markets, since January 2017. Mr. Geller has also served as a director at DealFlow Financial Products, Inc. since January 2017. Since May 2018, he has also served as a Director of Parkit Enterprise Inc., a publicly traded real estate company (TSX-V:PKT; OTCQX:PKTEF). In the past he served as an Interim Chief Executive Officer. From November 2020 through June 2022, He served as a Director at Australis Capital Inc., (AUSA.CN; OTCQB:AUSAF) a publicly traded company that is implementing a capital light growth strategy towards establishing a highly competitive and profitable MSO in the U.S. and global cannabis markets. |

| Other current directorships: | | Parkit Enterprise Inc (TSX-V: PKT | OTCQX: PKTEF) |

| Former directorships (last 3 yr): | | None |

| Special responsibilities: | | Audit and Risk Committee and Remuneration and Nomination Committee |

| Interests in shares: | | 2,290,177 |

| Interests in options: | | 550,000 |

| Interests in rights: | | - |

| | Nova Minerals Ltd | Annual Report  | 27 |

‘Other current directorships’ quoted above are current directorships for listed entities only and excludes directorships of all other types of entities, unless otherwise stated.

‘Former directorships (last 3 years)’ quoted above are directorships held in the last 3 years for listed entities only and excludes directorships of all other types of entities, unless otherwise stated.

Company Secretary

| Name: | | Ian Pamensky |

| Title: | | Company Secretary |

| Age: | | 56 |

Experience and expertise:

| | Mr. Ian Pamensky has been our Secretary since September 18, 2019. Mr. Pamensky is a Chartered Accountant, Fellow of Governance Institute of Australia and fellow of FinSIA. He has over 30 years of experience working across a wide range of industries, from audit and funds management to mining and AgTech. Mr. Pamensky has significant experience as Company Secretary of ASX listed companies. |

Meetings of Directors

The number of meetings of the company’s Board of Directors (‘the Board’) held during the year ended 30 June 2024, and the number of meetings attended by each director were:

| | | Full Board | | | Nomination and Remuneration Committee* | | | Audit and Risk Committee* | |

| | | Attended | | | Held | | | Attended | | | Held | | | Attended | | | Held | |

| C Bentley | | | 6 | | | | 6 | | | | - | | | | - | | | | - | | | | - | |

| R Pasqua | | | 6 | | | | 6 | | | | - | | | | - | | | | - | | | | - | |

| A Geller | | | 5 | | | | 6 | | | | - | | | | - | | | | - | | | | - | |

| L Simens | | | 6 | | | | 6 | | | | - | | | | - | | | | - | | | | - | |

| C Gerteisen | | | 6 | | | | 6 | | | | - | | | | - | | | | - | | | | - | |

‘Held’ represents the number of meetings held during the time the director held office.

* Committees were formed on 24 July 2024.

| | Nova Minerals Ltd | Annual Report  | 28 |

Remuneration Report (Audited)

The remuneration report details the key management personnel remuneration arrangements for the consolidated entity, in accordance with the requirements of the Corporations Act 2001 and its Regulations.

Key management personnel are those persons having authority and responsibility for planning, directing and controlling the activities of the entity, directly or indirectly, including all directors.

The remuneration report is set out under the following main headings:

| ● | Principles used to determine the nature and amount of remuneration |

| ● | Details of remuneration |

| ● | Service agreements |

| ● | Share-based compensation |

| ● | Additional information |

| ● | Additional disclosures relating to key management personnel |

Principles Used to Determine the Nature and Amount of Remuneration

The objective of the consolidated entity’s executive reward framework is to ensure reward for performance is competitive and appropriate for the results delivered. The framework aligns executive reward with the achievement of strategic objectives and the creation of value for shareholders, and it is considered to conform to the market best practice for the delivery of reward. The Board of Directors (‘the Board’) ensures that executive reward satisfies the following key criteria for good reward governance practices:

| ● | Competitiveness and reasonableness |

| ● | Acceptability to shareholders |

| ● | Performance linkage / alignment of executive compensation |

| ● | Transparency |

At 30 June 2024, the consolidated entity did not have a formal Nomination and Remuneration Committee, having regard to the size of the consolidated entity and its operations. The Board acknowledges that when the size and nature of the Company warrants the necessity of a formal remuneration committee, such a committee will operate under a remuneration committee charter to be approved by the Board. Until 30 June 2024, the Board as a whole, excluding any relevant affected director, serves as a nomination committee to the Company. On 24 July 2024, the Board approved the formation of a formal committee in conjunction with the NASDAQ IPO.

The reward framework is designed to align executive reward to shareholders’ interests. The Board have considered that it should seek to enhance shareholders’ interests by:

| ● | Having economic profit as a core component of plan design |

| ● | Focusing on sustained growth in shareholder wealth, consisting of dividends and growth in share price, and delivering constant or increasing return on assets as well as focusing the executive on key non-financial drivers of value |

| ● | Attracting and retaining high calibre executives |

Additionally, the reward framework should seek to enhance executives’ interests by:

| ● | Rewarding capability and experience |

| ● | Reflecting competitive reward for contribution to growth in shareholder wealth |

| ● | Providing a clear structure for earning rewards |

In accordance with best practice corporate governance, the structure of non-executive director and executive director remuneration is separate.

| | Nova Minerals Ltd | Annual Report  | 29 |

Non-Executive Directors Remuneration

Fees and payments to non-executive directors reflect the demands and responsibilities of their role. Non-executive directors’ fees and payments are reviewed annually by the Nomination and Remuneration Committee. The Nomination and Remuneration Committee may, from time to time, receive advice from independent remuneration consultants to ensure non-executive directors’ fees and payments are appropriate and in line with the market. The chairman’s fees are determined independently to the fees of other non-executive directors based on comparative roles in the external market. The chairman is not present at any discussions relating to the determination of his own remuneration. Non-executive directors do receive share options or other incentives

ASX listing rules require the aggregate non-executive directors’ remuneration be determined periodically by a general meeting. The most recent determination was at the Annual General Meeting held on 29 November 2022, where the shareholders approved a maximum annual aggregate remuneration for non-executive directors of $500,000.

Executive Remuneration

The consolidated entity aims to reward executives based on their position and responsibility, with a level and mix of remuneration which has both fixed and variable components.

The executive remuneration and reward framework has four components:

| ● | Base pay and non-monetary benefits |

| ● | Short-term performance incentives |

| ● | Share-based payments |

| ● | Other remuneration such as superannuation and long service leave |

The combination of these comprises the executive’s total remuneration.

Voting and comments made at the company’s 2023 Annual General Meeting (‘AGM’)

At the 29 November 2023 AGM, 96.83% of the votes received supported the adoption of the remuneration report for the year ended 30 June 2023. The company did not receive any specific feedback at the AGM regarding its remuneration practices.

Details of Remuneration

Amounts of remuneration

Details of the remuneration of key management personnel of the consolidated entity are set out in the following tables.

| | | Short-Term Benefits | | | Post-

Employ-

ment | | | Long-

Term Benefits | | | Share-

Based Payments | | | | |

| | | Cash Salary | | | Cash | | | Non- | | | Super- | | | Long Service | | | Equity- | | | | |

| | | and Fees | | | Bonus | | | monetary | | | annuation | | | Leave | | | Settled | | | Total | |

| 30 June 2024 | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Executive Directors: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| R Capel Pasqua | | | 84,900 | | | | - | | | | - | | | | - | | | | - | | | | 24,962 | | | | 109,862 | |

| A Geller | | | 60,000 | | | | - | | | | - | | | | - | | | | - | | | | 49,925 | | | | 109,925 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Directors: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L Simens | | | 276,000 | | | | - | | | | - | | | | - | | | | - | | | | 45,323 | | | | 321,323 | |

| C Gerteisen | | | 384,369 | | | | - | | | | - | | | | - | | | | - | | | | 45,323 | | | | 429,692 | |

| C Bentley | | | 120,000 | | | | - | | | | - | | | | - | | | | - | | | | 74,887 | | | | 194,887 | |

| | | | 925,269 | | | | - | | | | - | | | | - | | | | - | | | | 240,420 | | | | 1,165,689 | |

| | Nova Minerals Ltd | Annual Report  | 30 |

| | | Short-Term Benefits | | | Post-

Employ-

ment | | | Long-

Term Benefits | | | Share-

Based Payments | | | | |

| | | Cash Salary | | | Cash | | | Non- | | | Super- | | | Long Service | | | Equity- | | | | |

| | | and Fees | | | Bonus | | | monetary | | | annuation | | | Leave | | | Settled | | | Total | |

| 30 June 2023 | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | | | $ | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Non-Executive Directors: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| R Capel Pasqua | | | 59,545 | | | | - | | | | - | | | | - | | | | - | | | | 16,195 | | | | 75,740 | |

| A Geller | | | 60,000 | | | | - | | | | - | | | | - | | | | - | | | | 28,918 | | | | 88,918 | |

| A Ladd-Kruger | | | 50,684 | | | | - | | | | - | | | | - | | | | - | | | | - | | | | 50,684 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Executive Directors: | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| L Simens | | | 268,000 | | | | - | | | | - | | | | - | | | | - | | | | 215,698 | | | | 483,698 | |

| C Gerteisen | | | 374,208 | | | | - | | | | - | | | | - | | | | - | | | | 215,698 | | | | 589,906 | |

| C Bentley | | | 112,000 | | | | - | | | | - | | | | - | | | | - | | | | 44,650 | | | | 156,650 | |

| | | | 924,437 | | | | - | | | | - | | | | - | | | | - | | | | 521,159 | | | | 1,445,596 | |

The proportion of remuneration linked to performance and the fixed proportion are as follows:

| | | Percentage Fixed Remuneration | | | Percentage Share-Based Payments | |

| Name | | 30 June 2024 | | | 30 June 2023 | | | 30 June 2024 | | | 30 June 2023 | |

| | | | | | | | | | | | | |

| Non-Executive Directors: | | | | | | | | | | | | | | | | |

| R Capel Pasqua | | | 77 | % | | | 78 | % | | | 23 | % | | | 22 | % |

| A Geller | | | 55 | % | | | 67 | % | | | 45 | % | | | 33 | % |

| A Ladd-Kruger | | | - | | | | 100 | % | | | - | | | | - | |

| | | | | | | | | | | | | | | | | |

| Executive Directors | | | | | | | | | | | | | | | | |

| L Simens | | | 86 | % | | | 55 | % | | | 14 | % | | | 45 | % |

| C Gerteisen | | | 89 | % | | | 63 | % | | | 11 | % | | | 37 | % |

| C Bentley | | | 62 | % | | | 71 | % | | | 38 | % | | | 29 | % |

Service Agreements

Remuneration and other terms of employment for key management personnel are formalised in service agreements. Details of these agreements are as follows:

| Name: | | Richard Beazley |

| Title: | | Non-Executive Chairman |

| Agreement commenced: | | Appointed 24 July 2024 |

| Term of agreement: | | The Company has entered into a Non-Executive Director letter agreement with Mr Beazley on 04 June 2024 (Mr Beazley’s appointment being concurrent with the effectiveness of the Company’s F-1 registration statement located with the American Securities Exchange Commission on 24 July 2024). The Company has agreed to pay Mr Beazley an annual fee of AUD$120,000 (inclusive of superannuation contributions, if applicable) for up to 20 hours per month. Any excess hours will be charged at AUD$300 per hour. |

| | Nova Minerals Ltd | Annual Report  | 31 |

| Name: | | Rodrigo Capel Pasqua |

| Title: | | Non-Executive Director |

| Agreement commenced: | | 1 May 2022 |

| Term of agreement: | | The Company has entered into a Non-Executive Director letter agreement with Mr Pasqua on 2 May 2022. The Company has agreed to pay Mr Pasqua an annual fee of A$60,000 (inclusive of superannuation contributions, if applicable) for up to 20 hours per month. Any excess hours will be charged at AUD$300 per hour. |

| Name: | | Craig Bentley |

| Title: | | Director of Finance and Compliance |

| Agreement commenced: | | 19 February 2022 (Updated on 9 September 2022) |

| Term of agreement: | | On 9 September 2022 the Company entered into an updated agreement to pay Mr Bentley $120,000 (inclusive of superannuation contributions, if applicable, effective 1 September 2022. Termination by Company: The Company must either give Mr Bentley twelve months’ written notice and, at the end of that notice period, make a payment to Mr Bentley equal to his salary over a twelve month period; or otherwise may terminate Mr Bentley’s employment with immediate effect by paying him the equivalent of his salary over a twelve month period. Termination by Mr Bentley Mr Bentley may terminate his employment if the Company commits a serious breach of the agreement and does not remedy that breach; or, otherwise, by providing twelve months written notice to the Company. |

| Name: | | Avi Gellar |

| Title: | | Non-Executive Director |

| Agreement commenced: | | 23 July 2020 |

| Term of agreement: | | The Company has entered into a Non-Executive Director letter agreement with Mr Gellar on 23 July 2020. The Company has agreed to pay Mr Gellar an annual fee of A$60,000 (inclusive of superannuation contributions, if applicable). |

| Name: | | Chris Gerteisen |

| Title: | | Executive Director and CEO |

| Agreement commenced: | | 20 April 2022 (Updated on 22 June 2023) |