STRATEGIC STORAGE TRUST VI, INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED BALANCE SHEET

Note 1. Organization

Strategic Storage Trust VI, Inc., a Maryland corporation (the “Company”), was formed on October 14, 2020 under the Maryland General Corporation Law for the purpose of engaging in the business of investing in self storage facilities. Our year-end is December 31. As used herein, “we,” “us,” “our” and “Company” refer to Strategic Storage Trust VI, Inc. and each of our subsidiaries.

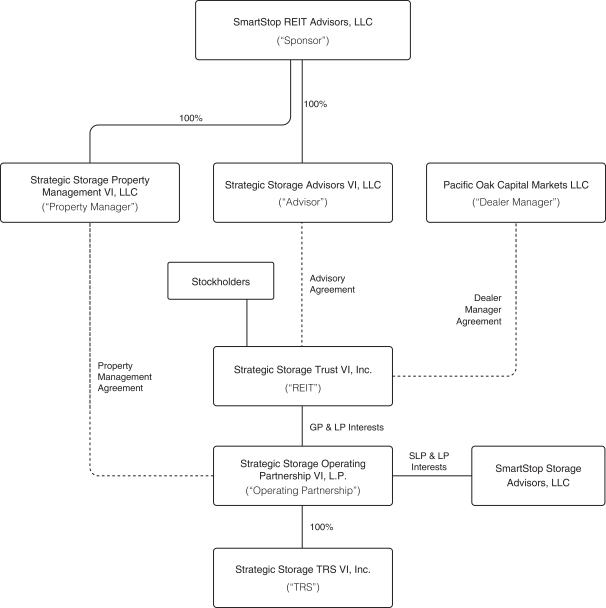

SmartStop REIT Advisors, LLC is our sponsor (our “Sponsor”). Our sponsor is an indirect subsidiary of SmartStop Self Storage REIT, Inc. (“SmartStop”). Our Sponsor is a company focused on providing self storage advisory, asset management, and property management services. Our Sponsor is the sole voting member of Strategic Storage Advisor VI, LLC (our “Advisor”) and Strategic Storage Property Management VI, LLC (our “Property Manager”).

We have no employees. Our Advisor, a Delaware limited liability company, was formed on October 7, 2020. Our Advisor is responsible for managing our affairs on a day-to-day basis and identifying and making acquisitions and investments on our behalf under the terms of an advisory agreement we entered into with our Advisor on February 26, 2021 (our “Private Offering Advisory Agreement”). A majority of our officers are also officers of our Advisor, Sponsor and SmartStop.

On January 15, 2021, our Advisor purchased approximately 110 shares of our common stock for $1,000 and became our initial stockholder. Our Articles of Incorporation (as amended and restated, our “Charter”) authorized 30,000 shares of common stock with a par value of $0.001 per share. Our Articles of Amendment and Restatement authorized 700,000,000 shares of common stock with a par value of $0.001 per share and 200,000,000 shares of preferred stock with a par value of $0.001 per share. In connection with the Public Offering, defined below, we intend to file articles of amendment to our Charter (the “Articles of Amendment”) and articles supplementary to our Charter (the “Articles Supplementary”). Following the filing of the Articles of Amendment and the Articles Supplementary, we will have authorized 300,000,000 shares of common stock designated as Class A shares, 30,000,000 shares of common stock designated as Class P shares, 300,000,000 shares of common stock designated as Class T shares, and 70,000,000 shares of common stock designated as Class W shares. We intend to file a Form S-11 Registration Statement with the Securities and Exchange Commission (“SEC”) to offer a maximum of $1,000,000,000 in shares of Class A, Class T, and Class W common stock for sale to the public (the “Primary Offering”) and $95,000,000 in shares of Class A, Class T, and Class W common stock for sale pursuant to our distribution reinvestment plan (collectively, the “Public Offering”).

On February 26, 2021, pursuant to a confidential private placement memorandum (the “private placement memorandum”), we commenced a private offering of up to $200,000,000 in shares of our common stock and $20,000,000 in shares of common stock pursuant to our distribution reinvestment plan (collectively, the “Private Offering” and together with the Public Offering, the “Offerings”). Please see Note 5—Subsequent Events, for additional information. Any outstanding common stock sold prior to the commencement of the Public Offering will be redesignated as Class P common stock upon the filing of the Articles of Amendment. As of February 28, 2021, we had engaged only in organizational and offering activities, and no shares had been sold in the Private Offering. We intend to invest the net proceeds from the Offerings primarily in self storage facilities. As of February 28, 2021, we had neither purchased nor contracted to purchase any properties.

Our operating partnership, Strategic Storage Operating Partnership VI, L.P., a Delaware limited partnership (our “Operating Partnership”), was formed on October 15, 2020. On January 15, 2021, SmartStop Storage Advisors, LLC (“SSA”), an affiliate of our Advisor, purchased a limited partnership interest in our Operating Partnership for $1,000 and we contributed the initial $1,000 capital contribution we received to our Operating Partnership in exchange for the general partner interest. On February 26, 2021, in connection with entering into

F-4