Filed by Lifezone Metals Limited

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Company: GoGreen Investments Corporation

Commission File No. 001-40941

The supply chain solution for clean metals Lifezone Metals Business Combination with GoGreen Investments April 17, 2023

Disclaimer This presentation (together with oral statements made i n connection herewith, this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties i n a proposed private placement i n making their own evaluation with respect to a potential business combination between Lifezone Holdings Limited (“Lifezone”, “Lifezone Metals”, “LHL” or the “Company”) and GoGreen Investments Corporation (“GoGreen” or “GOGN”) and related transactions (the “Proposed Business Combination”) and for no other purpose . This Presentation does not constitute an offer to sell, a solicitation of an offer to buy, or a recommendation to purchase any equity, debt or other financial instruments of Lifezone or GoGreen . By accepting this Presentation, you acknowledge and agree that all of the information contained herein or disclosed orally during this Presentation is confidential, that you will not distribute, reproduce, disclose or use such information for any purpose other than for the purpose of you and your firm’s participation in the potential financing, that you will not distribute, reproduce, disclose or use such information in any way detrimental to Lifezone or GoGreen, and that you will return to Lifezone and GoGreen, delete or destroy this Presentation upon request . Further, by accepting this Presentation, the recipient agrees to maintain all such information in strict confidence, including in strict accordance with any other contractual obligations applicable to the recipient and all applicable laws, until such information becomes publicly available not as a result of any breach of such confidentiality obligation . No representations or warranties, express or implied are given in, or i n respect of, the accuracy or completeness of this Presentation or any other information (whether written or oral) that has been or will b e provided to you . You are also being advised that the United States securities laws restrict persons with material non - public information about a company obtained directly or indirectly from that company from purchasing or selling securities of such company, or from communicating such information to any other person under circumstances i n which it is reasonably foreseeable that such person is likely to purchase or sell such securities on the basis of such information . To the fullest extent permitted by law, i n no circumstances will GoGreen, Lifezone or any of their respective subsidiaries, stockholders, affiliates, representatives, control persons, members, partners, directors, officers, employees, advisers or agents b e responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated i n relation thereto or otherwise arising i n connection therewith . In addition, this Presentation does not purport to b e all - inclusive or to contain all of the information that may b e required to make a full analysis of Lifezone, the proposed private placement or the Proposed Business Combination . Viewers of this Presentation should each make their own evaluation of Lifezone, GoGreen and of the relevance and adequacy of the information provided i n this Presentation, and should make such other investigations as they deem necessary before making an investment decision . Nothing herein should be construed as legal, financial, tax or other advice . You should consult your own advisers concerning any legal, financial, tax or other considerations concerning the opportunity described herein, and, by accepting this Presentation, you confirm that you are not relying solely upon the information contained herein to make any investment decision . The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs . Lifezone Metals announced on December 13 , 2022 a business combination agreement with GoGreen . The Proposed Business Combination between Lifezone Metals and GoGreen is subject to customary closing conditions, including regulatory approvals . In connection with the Proposed Business Combination Lifezone Metals Limited intends to file with the United States Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 , which will include a preliminary prospectus and preliminary proxy statement and, after the registration statement is declared effective, GoGreen will mail a definitive proxy statement/prospectus and other relevant documents relating to the Proposed Business Combination to its shareholders . This communication is not a substitute for the registration statement, the definitive proxy statement/prospectus or any other document that GoGreen will send to its shareholders in connection with the Proposed Business Combination . INVESTORS AND SECURITY HOLDERS ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION AND THE PARTIES TO THE PROPOSED BUSINESS COMBINATION. Investors and security holders will be able to obtain copies of these documents (if and when available) and other documents filed with the SEC free of charge at www . sec . gov . The definitive proxy statement/final prospectus (if and when available) will b e mailed to shareholders of GoGreen as of a record date to b e established for voting on the Proposed Business Combination . Shareholders of GoGreen will also b e able to obtain copies of the proxy statement/prospectus without charge, once available, at the SEC’s website at www . sec . gov, or by directing a request to : GoGreen Investments Corporation, One City Centre, 1021 Main Street, Suite 1960 , Houston, TX 77002 . GoGreen, Lifezone and their respective directors and executive officers and other persons may be deemed to be participants in the solicitations of proxies from GoGreen’s stockholders in respect of the Proposed Business Combination and the other matters set forth in the proxy statement/prospectus . Information regarding GoGreen’s directors and executive officers is available under the heading “Management” in GoGreen’s final prospectus for its initial public offering filed with the SEC on March 18 , 2021 . Additional information regarding the participants in the proxy solicitation and a description of their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus relating to the Proposed Business Combination when it becomes available . NO OFFER OR SOLICITATION This Presentation relates to the potential financing of a portion of the Proposed Business Combination through a private placement of GoGreen’s Class A ordinary shares . This Presentation shall not constitute a “solicitation” as defined in Section 14 of the Securities Exchange Act of 1934 , as amended (the “Exchange Act”) . This Presentation does not constitute an offer, or a solicitation of an offer, to buy or sell any securities, investment or other specific product, or a solicitation of any proxy, vote, consent or approval i n any jurisdiction i n connection with the Proposed Business Combination, nor shall there b e any sale of securities, investment or other specific product i n any jurisdiction i n which such offer, solicitation or sale would b e unlawful prior to registration or qualification under the securities laws of any such jurisdiction . Any offering of securities (the “Securities”) will not b e registered under the Securities Act of 1933 , as amended (the “Securities Act”), and will b e offered as a private placement (A) inside the United States to a limited number of “accredited investors” as defined in Rule 501 under the Securities Act or qualified institutional buyers (as d e fined i n Rule 144 A under the Securities Act) and (B) outside the United States i n accordance with Regulation S under the Securities Act . Accordingly, the Securities must continue to b e held unless a subsequent disposition is exempt from the registration requirements of the Securities Act . Investors should consult with their counsel as to the applicable requirements for a purchaser to avail itself of any exemption under the Securities Act . The transfer of the Securities may also b e subject to conditions set forth i n an agreement under which they are to b e issued . Investors should b e aware that they might b e required to bear the financial and final risk of their investment for an indefinite period of time . Neither Lifezone nor GoGreen is making an offer of the Securities i n any state where the offer is not permitted . NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THE SECURITIES, PASSED UPON THE MERITS OF THIS OFFERING OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. 2

Disclaimer (Continued) INDUSTRY AND MARKET DATA Although certain information and opinions expressed in this Presentation, including market data and other statistical information, were obtained from sources believed to be reliable and are included in good faith, Lifezone, GoGreen and their respective affiliates, directors, officers, employees, and advisors have not independently verified the information and make no representation or warranty, express or implied, as to its accuracy or completeness . Some data is also based on the good faith estimates of Lifezone and GoGreen, which are derived from their respective reviews of internal sources as well as the independent sources described above, however, such data has not been verified by any independent source . This Presentation contains preliminary information only, is subject to change at any time and is not, and should not be assumed to be, complete or to constitute all the information necessary to adequately make an informed decision regarding your engagement with Lifezone and GoGreen . The data and information herein provided by Wood Mackenzie should not be interpreted as advice and you should not rely on it for any purpose . You may not copy or use this data and information except as expressly permitted by Wood Mackenzie in writing . To the fullest extent permitted by law, Wood Mackenzie accepts no responsibility for your use of this data and information except as specified in a written agreement you have entered into with Wood Mackenzie for the provision of such of such data and information . The EY Cova Study was conducted by EY Cova, which studied PGM metals at SRL’s platinum plant in South Africa under the then - applicable conditions in 2020 , including the original 110 ktpa design envelope . The study assumed reagents were not manufactured on site . The actual results could differ depending on the specific project . The reports were prepared in 2023 , and were prepared based on information received from Kellplant, and are wholly dependent on the accuracy and correctness of such information which was not checked by EY Cova . The reports do not contemplate the needs, purposes, or use of any person other than Kellplant and any third party use or reliance on extract contained in the report is entirely at that third - party’s own risk . FORWARD - LOOKING STATEMENTS Certain statements in this Presentation may be considered to be “forward - looking statements” within the meaning of Section 27 A of the Securities Act, Section 21 E of the Exchange Act and the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995 , as amended . Forward - looking statements may be identified by the use of words such as “may”, “should”, “will”, “predict”, “potential”, “continue”, “estimate,” “plan,” “project,” “forecast,” “intend,” “expect,” “anticipate,” “believe,” “seek,” or the negatives of these terms or variations of them or similar terminology or expressions that predict or indicate future events or trends or that are not statements of historical matters . These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of other financial and performance metrics and projections of market opportunity and market share, the Proposed Business Combination, the estimated or anticipated future results and benefits of the combined company following the Proposed Business Combination, including the likelihood and ability of the parties to successfully consummate the Proposed Business Combination, future opportunities for the combined company, including the efficacy of Lifezone Metals’ proprietary hydromet mineral processing technology (the “Hydromet Technology”) and the development of, and processing of mineral resources at, the Kabanga nickel project in Tanzania (the “Kabanga Project”), and other statements that are not historical facts . These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Lifezone’s and GoGreen’s management and are not predictions of actual performance . These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not b e relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability . Actual events and circumstances are difficult or impossible to predict and will differ from assumptions . Many actual events and circumstances are beyond the control of Lifezone and GoGreen . These forward - looking statements are subject to a number of risks and uncertainties, including changes i n domestic and foreign business, market, financial, political and legal conditions ; the inability of the parties to successfully or timely consummate the Proposed Business Combination, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the Proposed Business Combination or that the approval of the stockholders of GoGreen is not obtained ; failure to realize the anticipated benefits of the Proposed Business Combination ; risks relating to the uncertainty of the projected financial information with respect to Lifezone ; risks related to the rollout of Lifezone’s business, the efficacy of Lifezone’s proprietary technology, and the timing of expected business milestones ; the effects of competition on Lifezone’s business ; the amount of redemption requests made by GoGreen’s public stockholders ; the ability of GoGreen or the combined company to issue equity or equity - linked securities i n connection with the Proposed Business Combination or i n the future ; and those factors discussed i n GoGreen’s final prospectus filed with the SEC on March 18 , 2021 under the heading “Risk Factors” and “Cautionary Note Regarding Forward Looking Statements” and other documents of GoGreen filed, or to b e filed, with the SEC, as well as factors associated with companies such as Lifezone that are engaged i n the business of metals extraction and licensing of related intellectual property, including the risk factors highlighted elsewhere i n this Presentation . If any of these risks materialize or GoGreen’s or Lifezone’s assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements . There may b e additional risks that neither GoGreen nor Lifezone presently know or that GoGreen and Lifezone currently believe are immaterial that could also cause actual results to differ from those contained i n the forward - looking statements . In addition, forward - looking statements reflect GoGreen’s and Lifezone’s expectations, plans or forecasts of future events and views as of the date of this Presentation . GoGreen and Lifezone anticipate that subsequent events and developments may cause GoGreen’s and Lifezone’s assessments to change . However, GoGreen and Lifezone specifically disclaim any obligation or undertaking to release any updates or revisions to any forward - looking statements i n this Presentation to reflect any change i n their expectations or any change i n events, conditions or circumstances on which any such statement is based . These forward - looking statements should not b e relied upon as representing GoGreen’s and Lifezone’s assessments as of any date subsequent to the date of this Presentation . Accordingly, undue reliance should not b e placed upon the forward - looking statements . Nothing i n this Presentation should b e regarded as a representation by any person that the forward - looking statements set forth herein will b e achieved or that any of the contemplated results of such forward - looking statements will b e achieved . You should not place undue reliance on forward - looking statements i n this Presentation, which speak only as of the date they are made and are qualified i n their entirety by reference to the cautionary statements herein . Certain statements made herein include references to “clean” or “green” metals, methods of production of such metals, energy or the future in general . Such references relate to environmental benefits such as lower green - house gas (“GHG”) emissions and energy consumption involved in the production of metals using the Hydromet Technology relative to the use of traditional methods of production and the use of metals such as nickel in the batteries used in electric vehicles . While studies by third parties (commissioned by Lifezone Metals) have shown that the Hydromet Technology, under certain conditions, results in lower GHG emissions and lower consumption of electricity compared to smelting with respect to refining platinum group metals, no active refinery currently licenses Lifezone Metals’ Hydromet Technology . Accordingly, Lifezone Metals’ Hydromet Technology and the resultant metals may not achieve the environmental benefits to the extent Lifezone Metals expects or at all . Any overstatement of the environmental benefits in this regard may have adverse implications for Lifezone Metals and its stakeholders . 3

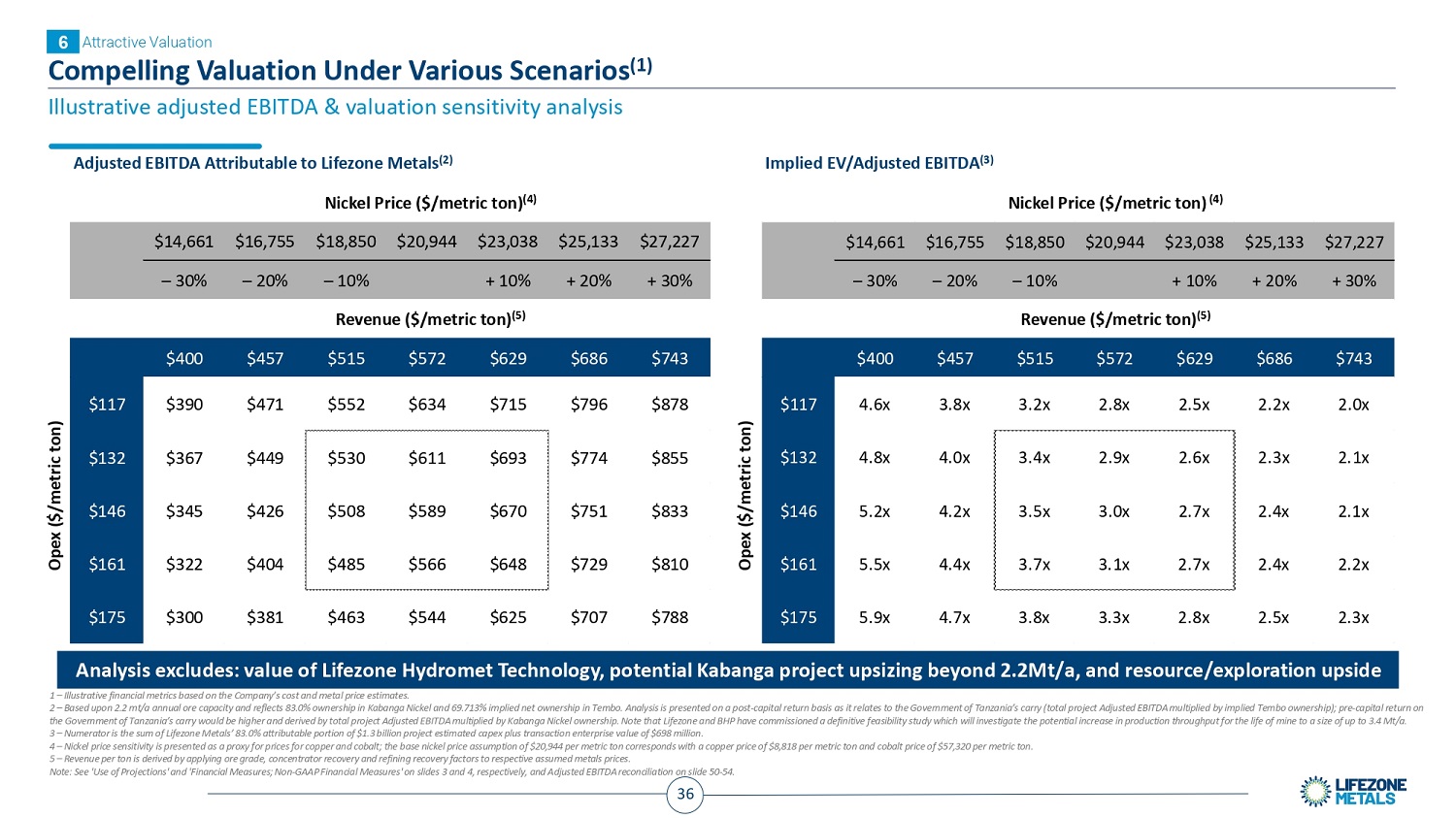

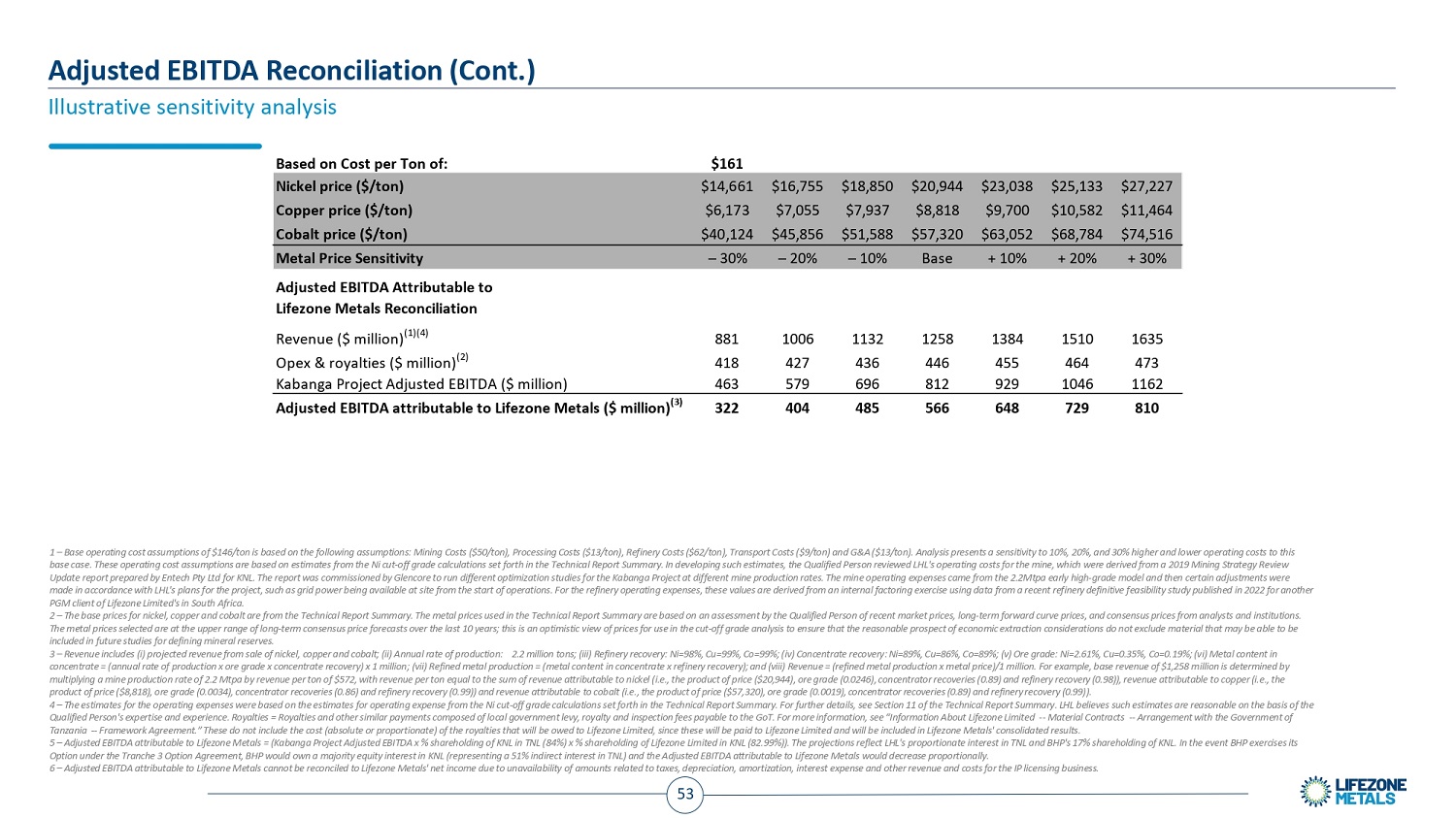

Disclaimer (Continued) USE OF PROJECTIONS This Presentation contains projected financial information with respect to Lifezone, including revenue and Adjusted EBITDA . Such projected financial information constitutes forward - looking information, is for illustrative purposes only and should not b e relied upon as necessarily being indicative of future results . The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a w i d e variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained i n the projected financial information . See “Forward - Looking Statements” section above . Further, the financial projections referred to above have been prepared based on revenue and cost estimates provided by the Company and based on certain assumptions referred to i n the “Kabanga 2023 Mineral Resource - Technical Report Summary” prepared by Raymond Kohlsmith, BSc (Hons . ) (Geol) 1980 , P . Geo ( 1044 ) PGO Canada (the “Qualified Person”) i n accordance with the U . S . Securities and Exchange Commission Regulation S - K subpart 1300 rules for Property Disclosures for Mining Registrants (“S - K 1300 ”) with an effective date of February 15 , 2023 (“TRS”) . GoGreen and Lifezone caution that their assumptions may not materialize and that current economic conditions render such assumptions, although believed reasonable at the time they were made, subject to greater uncertainty . Actual results may differ materially from the results contemplated by the projected financial information contained i n this Presentation, and the inclusion of such information i n this Presentation should not b e regarded as a representation by any person that the results reflected i n such information will be achieved . Neither GoGreen’s nor Lifezone’s independent auditors have audited, reviewed, compiled or performed any procedures with respect to the projections for the purpose of their inclusion i n this Presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation . FINANCIAL INFORMATION; NON - GAAP FINANCIAL MEASURES The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgated under the Securities Act . Accordingly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statement/prospectus to be filed by GoGreen and Lifezone Metals with the SEC . Some of the financial information and data contained in this Presentation, such as Adjusted EBITDA, and Implied EV/Adjusted EBITDA, have not been prepared in accordance with United States generally accepted accounting principles (“GAAP”) . GoGreen and Lifezone believe that the use of these non - GAAP financial measures provides an additional tool for investors to use in evaluating projected operating results and trends in and in comparing Lifezone’s financial measures with other similar companies, many of which present similar non - GAAP financial measures to investors . Management does not consider these non - GAAP measures in isolation or as an alternative to financial measures determined in accordance with GAAP . The principal limitation of these non - GAAP financial measures is that they exclude significant expenses and income that will be required by GAAP to be recorded in Lifezone Metals’ financial statements . In addition, they are subject to inherent limitations as they reflect the exercise of judgments by management about which expenses and income are excluded or included in determining these non - GAAP financial measures . Other companies may calculate these non - GAAP financial measures differently, and therefore, such financial measures may not be directly comparable to similarly titled measures of other companies . Because of the limitations of non - GAAP financial measures, you should consider the non - GAAP financial measures presented in this presentation in conjunction with GoGreen and Lifezone’s financial statements and the related notes thereto . TRADEMARKS AND TRADE NAMES Lifezone and GoGreen own or have rights to various trademarks, service marks and trade names, as applicable, that they use i n connection with the operation of their respective businesses . This Presentation also contains trademarks, service marks, copyrights and trade names of third parties, which are the property of their respective owners . The use or display of third parties’ trademarks, service marks, trade names or products i n this Presentation is not intended to, and does not imply, a relationship with Lifezone or GoGreen, or an endorsement or sponsorship by or of Lifezone or GoGreen . Solely for convenience, the trademarks, service marks and trade names referred to i n this Presentation may appear with or without the ®, TM or SM symbols, but such references are not intended to indicate, i n any way, that Lifezone or GoGreen will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names . NO RELATIONSHIP Nothing contained i n this Presentation will b e deemed or construed to create the relationship of partnership, association, principal and agent or joint venture . This Presentation does not create any obligation on the part of either GoGreen, Lifezone or the recipient to enter into any further agreement or arrangement . Unless and until a definitive agreement has been fully executed and delivered, no contract or agreement providing for a transaction will b e deemed to exist and none of GoGreen, Lifezone or the recipient will b e under any legal obligation of any kind whatsoever . Accordingly, this Presentation is not intended to create for any party a right of specific performance or a right to seek any payment or damages for failure, for any reason, to complete the proposed transactions contemplated herein . KABANGA 2023 MINERAL RESOURCE – TECHNICAL REPORT SUMMARY Certain information i n this Presentation is sourced from the “Kabanga 2023 Mineral Resource - Technical Report Summary” prepared by Raymond Kohlsmith, BSc (Hons . ) (Geol) 1980 , P . Geo ( 1044 ) PGO Canada (the “Qualified Person”) with an effective date of February 15 , 2023 (“TRS”) . The TRS has been prepared i n accordance with S - K 1300 for Lifezone on the Kabanga Nickel Project (“Project”) . The TRS is a preliminary technical and economic study of the economic potential of the Project mineralization to support the disclosure of mineral resources . The mineral resource estimates are based on mineral resources originally disclosed by the previous owners of the Project as current on December 31 , 2016 and from studies and data provided by Lifezone . 4

Risk Factors All references to “we,” “us” or “our” refer to the Company prior to the consummation of the Proposed Business Combination with GoGreen . The risks described below are a non - exhaustive list of the key risks related to the Company and the factors that could cause actual results to differ from the intentions and assumptions described i n this presentation . This list has been prepared solely for potential private placement investors i n this private placement transaction and not for any other purpose . You should carefully consider these risks and uncertainties, carry out your own due diligence, and consult with your own financial and legal advisors concerning the risks and suitability of an investment i n this private placement transaction before making an investment decision . The list below is qualified i n its entirety by disclosures contained i n future documents filed or furnished i n respect of the Proposed Business Combination with the SEC . The risks presented i n such filings will include risks associated with the post - business combination operation of the Company and the risks associated with the Proposed Business Combination, and these risks may differ significantly from, and will b e more extensive than, those risks presented below . The Company may b e subject to the following factors, many of which are outside of GoGreen’s and the Company’s control : Risks Related to Operational Factors Affecting Lifezone Metals – We will require significant additional capital to fund our business, and no assurance can be given that such capital will be available at all or available on terms acceptable to us. – Our development, growth, future profitability and ability to continue our operations may be impacted by geopolitical conditions, including in Tanzania and South Africa. – We have no operating history on which to base an evaluation of our business and prospects and an evolving business model, which raise doubts about our ability to achieve profitability. – We are subject to significant governmental regulations that affect our operations and costs of conducting our business and may not be able to obtain all required permits and licenses to place our properties into production. – Acquisitions, strategic partnerships, joint ventures and other partnerships, including offtake agreements, may not perform in accordance with expectations, may fail to receive required regulatory approvals or may disrupt our operations and adversely affect our credit ratings and profitability . – As we do not own the entire interest in our technology licensing, refinery and metals extraction businesses, other shareholders in such businesses, such as Sedibelo Resources Limited (“SRL”) and BHP Billiton (UK) DDS Limited (“BHP”), particularly if BHP makes a further investment in Kabanga Nickel Limited (“KNL”), will be able to influence the operations at the respective businesses and significant corporate actions . – The tranche 3 investment by BHP into KNL pursuant to the option agreement dated October 14 , 2022 , as amended on February 8 , 2023 entered into between BHP, Lifezone Limited and KNL (the “Tranche 3 Option Agreement”), is subject to negotiation, approval and various conditions, such as receiving favorable results of the definitive feasibility study for both the Kabanga mine and the base metals refinery to determine the development requirements of the project, including capital and operating costs (the “Definitive Feasibility Study”), and may not be consummated . Further, BHP may choose not to invest in KNL regardless of the outcome of the Definitive Feasibility Study . Failure to receive these funds or to not have BHP’s involvement could result in delays to the development of the Kabanga Project and further have an adverse effect on KNL . – The Tranche 3 Option Agreement includes certain restrictive covenants in relation to the Kabanga Project and Lifezone Limited during the period prior to the exercise of the Option under the Tranche 3 Option Agreement, which may limit our ability to explore other growth opportunities . – There can be no assurance that we will complete the acquisition of The Simulus Group Pty Limited (“SGPL” and the “Simulus Acquisition”) . Failure to complete the Simulus Acquisition, or to successfully integrate SGPL’s business into our business upon completion of the Simulus Acquisition, may adversely affect our business and operations . If the Simulus Acquisition is completed, in addition to the cash consideration, we will be required to issue Lifezone Metals’ ordinary shares to the shareholders of SGPL, which will result in dilution to Lifezone Metals’ existing shareholders . – Changes in consumer demand and preference for metals relevant to us, could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity. – If we lose senior management or are unable to hire and/or retain sufficient technically skilled employees, our business may be materially adversely affected. – We may be unable to compete successfully for employees, exploration, resources, capital funding, equipment and contract exploration, development and construction services with our competitors. – Increased labor costs could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity. – If we fail to effectively and efficiently advertise, market and license or sell our technology or products, including our Hydromet Technology or any ore that we refine, the growth of our business may be compromised. – The successful implementation of our business strategies and plans are dependent on the performance of our management and external factors. Any failure to implement our business strategies and plans may have a material adverse effect on our business and operations. – We may be involved in litigation, and unfavorable decisions may be entered against our company, subsidiaries, management, and/or controlling shareholders in legal and administrative proceedings. – Our operations may be subject to litigation or other claims in relation to tax regulations and challenges by tax authorities. – We use and expect to use third - party operators, providers and contractors, and the lack of availability, or failure to properly perform services, of one or more of these third - party operators, providers and contractors may adversely affect us. – Our operations and profits may be adversely affected by labor unrest and union activity and compliance with labor legislation. 5

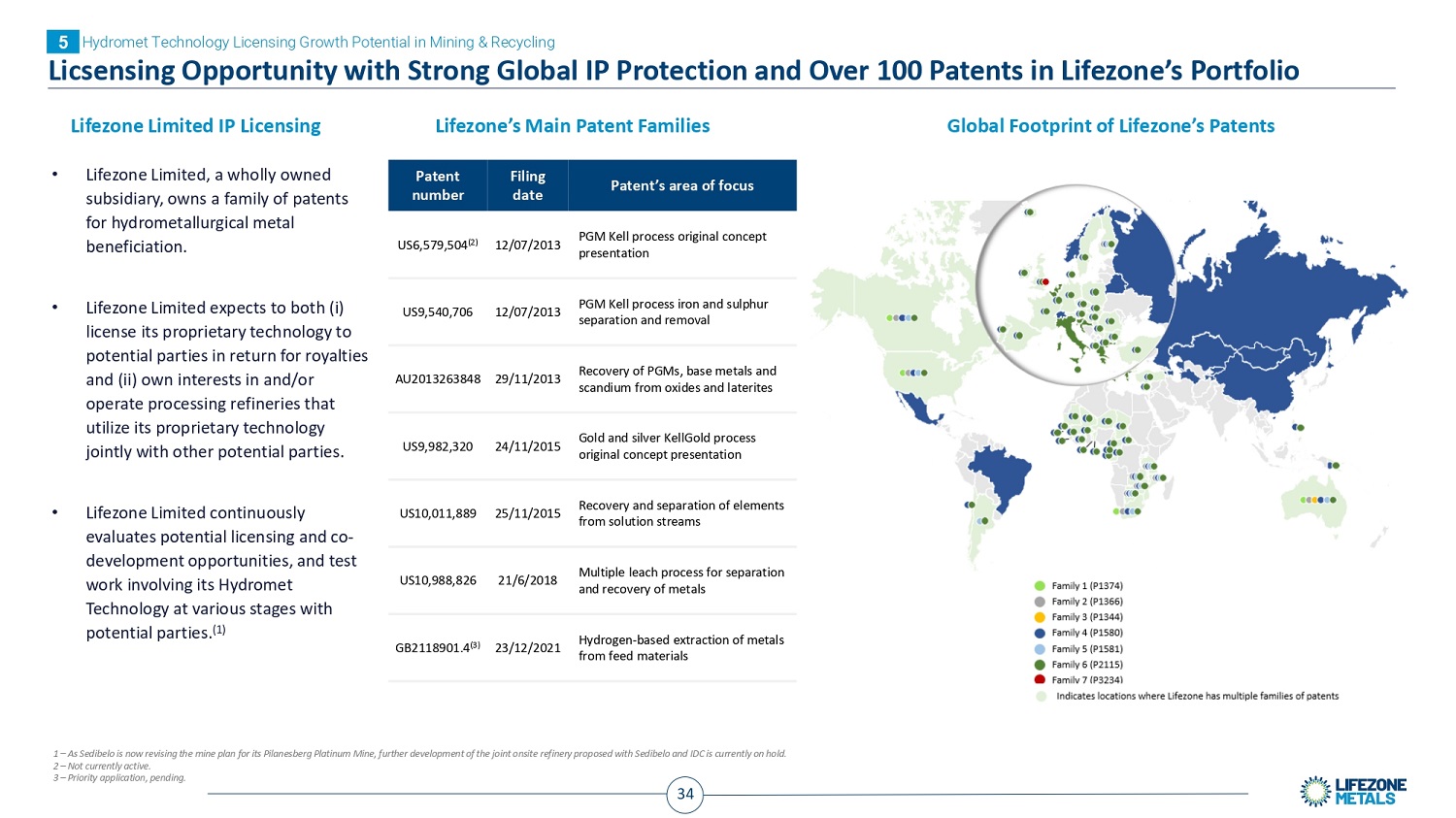

Risk Factors (Continued) – If our operations do not perform in line with expectations, we may be required to write down the carrying value of our investments, which could affect any future profitability and our ability to pay dividends. – Once the Kabanga Project is commissioned, we expect to recognize revenue from the offtake from the Kabanga Project on a provisional price basis, which may result in significant revisions in later periods. – We are subject to exchange rate and interest rate fluctuations, which may be harmful to our business. Further, our business, results of operations, and financial condition may be adversely affected by inflation. – Our holding company structure makes us dependent on the operations of our subsidiaries. – Due to an inadvertent administrative error during incorporation, the articles of association and share capital of each of TNL’s Tanzanian subsidiaries, Tembo Nickel Mining Company Limited and Tembo Nickel Refining Company Limited, provide the GoT with a 16% non - dilutable free - carried interest in such JVC Subsidiary in addition to the 16% non - dilutable free - carried interest in TNL. – Our failure to comply with applicable anti - corruption, anti - bribery, anti - money laundering, economic and trade sanctions, and other similar laws and regulations could negatively impact our reputation and results of operations. – We are subject to global resource nationalism trends which encompass a range of measures, such as seeking the greater participation of historically disadvantaged or indigenous people, expropriation or taxation, whereby governments seek to increase the economic benefits derived by their countries from their natural resources. – Unexpected operational accidents and natural disasters, public health or political crises or other catastrophic events may adversely affect our operations. – Our insurance coverage may not adequately satisfy all potential claims in the future. – We use information, communication, and technology systems, which record personal data. Failure of or damage to these systems, cyber threats, disruption or the failure to protect personal data, could significantly impact our business and operations. – If we fail to comply with our obligations under any shareholder, license or technology agreements with third parties, we may be required to pay damages and we could lose license rights that are critical to our business. – The current global COVID - 19 pandemic has significantly impacted the global economy and markets and is likely to continue to do so, which could adversely affect our business, financial condition, results of operations and prospects. – The ongoing military action between Russia and Ukraine and the sanctions imposed in relation to such action could have a material adverse effect on the global mining industry and our business, financial condition, results of operations, prospects or liquidity. – Adverse developments affecting the financial services industry, such as actual events or concerns involving liquidity, defaults or non - performance by financial institutions or transactional counterparties, could adversely affect the Company’s current and projected business operations and its financial condition and results of operations. – Our operating and financial results, forecasts and projections rely in large part upon assumptions and analyses developed by us. If the assumptions or analyses that we made in connection with our projections and forecasts prove to be incorrect, our actual results of operations may be materially different from our forecasted results. Risks Related to the Hydromet Technology and Intellectual Property – We may not be able to adequately obtain, maintain, protect, or enforce our intellectual property rights in our technology, which could result in a loss in our competitive position and/or the value of our intangible assets, and substantially harm our business . – Our proprietary Hydromet Technology licensed to Kelltech Limited has not been deployed at a commercial scale and we may encounter operational difficulties at that scale, and the Hydromet Technology proposed to b e applied i n the Kabanga Project is yet to b e developed and may not b e commercially viable, each of which may i n turn have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity . – Our partners may change their interests, plans and strategies, and we may lose the support of any or all of our partners, which may have a material adverse effect on our ability to successfully develop and deploy the Hydromet Technology on a commercial scale, which i n turn may have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity . – We may not b e able to successfully develop and implement new technology initiatives and other strategic investments relating to our Hydromet Technology i n a timely manner . We may not b e able to obtain patent protection for such new technologies or be able to do so i n a timely manner . Specifically, while we anticipate that none of our patent applications will apply to the Hydromet Technology proposed to b e applied i n the Kabanga Project, we may file additional patent applications based on our ongoing development and testing, and any delay or failure to obtain patent protection for the Hydromet Technology proposed to b e applied i n the Kabanga Project or other initiatives may negatively impact our business, financial condition, results of operations, prospects or liquidity . – Our licensing revenues, growth and future profitability may be impacted by third parties not licensing the Hydromet Technology, or continuing to receive professional services from Lifezone Limited in accordance with our business plan and/or using substitute technology . 6

Risk Factors (Continued) Risks Related to Potential Refineries which may license our Hydromet Technology — The construction of the potential refinery at SRL’s Pilanesberg Platinum Mine in South Africa that would process PGMs, and gold, nickel, copper and cobalt, applying the Hydromet Technology licensed to Kelltech Limited (the ‘Kell - Sedibelo - Lifezone Refinery’) is uncertain and its operation may involve risks, including continued operating losses, the inability to fund its operations and future impairments of its assets, that could negatively impact our business, results of operations, cash flows and asset values . — The regulatory approval, permitting, development, startup and/or operation of sustainable power generation facilities at SRL and its use at the potential Kell - Sedibelo - Lifezone Refinery may involve unanticipated events resulting in delays that could negatively impact our business and our results of operations and cash flows . — Capital costs for development of a precious and base metals refinery and other mineral processing projects have increased substantially i n recent years, and further increases could negatively impact our business, financial condition, results of operations, prospects or liquidity . — The potential Kell - Sedibelo - Lifezone Refinery may be subject to compliance with certain Broad - Based Black Economic Empowerment (“B - BBEE”) requirements which could impose significant costs and burdens and which impose certain ownership requirements . — Because the potential Kell - Sedibelo - Lifezone Refinery would be concentrated in the Bushveld Complex, disruptions in this and neighboring regions could have a material adverse impact on our operations. — Social unrest, sickness or natural or man - made disaster at informal settlements in the vicinity of the potential Kell - Sedibelo - Lifezone Refinery may disrupt our business or may lead to greater social or regulatory impositions on us. — The potential Kell - Sedibelo - Lifezone Refinery is subject to costs and liabilities related to stringent environmental and health and safety standards. — A majority of the environmental and health and safety licenses and approvals are currently not held by Kellplant (Pty) Limited (“Kellplant”) directly. — The development and operation of the potential Kell - Sedibelo - Lifezone Refinery would rely substantially on the Pilanesberg Platinum Mine’s existing infrastructure. — Kellplant, as the owner of the potential Kell - Sedibelo - Lifezone Refinery, would not have any formal rights of access in respect of the land upon which the potential Kell - Sedibelo - Lifezone Refinery would be developed. — Economic, political or social instability in South Africa may have a material adverse effect on Kellplant’s and, in turn, our operations and profits. — There are certain risks associated with the funding arrangement for the potential Kell - Sedibelo - Lifezone Refinery. — The development and operation of the Kell - Sedibelo - Lifezone Refinery will rely substantially on the Pilanesberg Platinum Mine’s existing infrastructure. — Kellplant, as the owner of the Kell - Sedibelo - Lifezone Refinery, will not have any formal rights of access in respect of the land upon which the Kell - Sedibelo - Lifezone Refinery is to be developed. — Economic, political or social instability in South Africa may have a material adverse effect on Kellplant’s and, in turn, our operations and profits. Risks Related to the Metals Extraction Operations – Changes in the market price of nickel, cobalt and copper, which in the past have fluctuated widely, may negatively affect the profitability of our metals extraction operations and the cash flows generated by those operations. – We may be unable to replace the mineral resource base on the area covered by the special mining license (“SML”) as it becomes depleted. – Because our only metals extraction development project, the Kabanga Project, is concentrated in Tanzania, disruptions in Tanzania and its neighboring regions could have a material adverse impact on our operations. – Concentration of our operations in one location may increase our risk of production loss and could have a material adverse impact on our operations. – Our mineral resources estimates may be materially different from mineral reserves and final quantities we may ultimately recover, our estimates of life - of - mine may prove inaccurate and market price fluctuations and changes in operating and capital costs may render all or part of our mineral resources uneconomic to extract. – Extraction of minerals from identified nickel deposits may not be economically viable and the development of our mineral project into a commercially viable operation cannot be assured. – Our exploration activities on our properties are highly speculative in nature and may not be commercially successful, which could lead us to abandon our plans to develop our properties and our investments in further exploration. – Mineral operations are subject to applicable law and government regulation. Such laws and regulations could restrict or prohibit the exploitation of the mineral resource we have or might find in the future. If we cannot exploit any mineral resource that we discover on our properties, our business may fail. – Our operations are subject to environmental, health and safety regulations, which could impose additional costs and compliance requirements, and we may face claims and liability for breaches, or alleged breaches, of such regulations and other applicable laws. 7

Risk Factors (Continued) – Our mining rights and licenses, including our SML and the framework agreement entered into with the Government of Tanzania in relation to the Kabanga Project, could be altered, suspended or cancelled for a variety of reasons, including breaches in our obligations in respect of such mining rights. – Title to our properties may be subject to other claims that could affect our property rights and claims. – Metals extraction and related activities are inherently hazardous and the related risks of events that cause disruptions to such of our operations may adversely impact cash flows and overall profitability. – Metals extraction operations and projects are vulnerable to supply chain disruption such that operations and development projects could be adversely affected by shortages of, as well as the lead times to deliver, strategic spares, critical consumables, mining equipment or metallurgical plant. – Power stoppages, fluctuations and usage constraints may force us to halt or curtail operations or increase costs. – Our business will be subject to high fixed costs in the future, which may impact our profitability. – Our actual costs of reclamation and mine closure may exceed current estimates, which may, along with an inability to safely close redundant operations, adversely affect our business. – Theft of the mineral concentrate, final metals and production inputs may occur. These activities are difficult to control, can disrupt our business and can expose us to liability. – Any failure in the operation of maintenance of a tailings storage facility could negatively impact our business, reputation, operating results and financial condition. – We face intense competition in the metals extraction and mining industry. Risks Related to Lifezone Metals Operating as a Public Company – Prior to the Proposed Business Combination, there will have been no public market for Lifezone Metals’ ordinary shares, and there is no guarantee that an active and liquid market will develop. – The market price of Lifezone Metals’ ordinary shares could fluctuate significantly, which could result in substantial losses for purchasers of Lifezone Metals’ ordinary shares. – KNL has identified a material weakness in its internal control over financial reporting and Lifezone Metals may be unable to remediate this material weakness or may identify additional material weaknesses in the future and, for these reasons, may fail to maintain effective internal control over financial reporting, which in turn may result in material misstatements of the consolidated financial statements and a loss of investor confidence in Lifezone Metals. – A significant portion of Lifezone Metals’ total outstanding shares following the closing of the Proposed Business Combination may not be immediately resold but may be sold into the market soon after closing. This could cause the market price of the Lifezone Metals’ ordinary shares to drop significantly, even if Lifezone Metals’ business is doing well. – If securities or industry analysts do not publish research or publish inaccurate or unfavorable research about Lifezone Metals’ business, the market price for Lifezone Metals’ ordinary shares and trading volume could decline. – Lifezone Metals will incur increased costs as a result of operating as a public company, and its management will be required to devote substantial time to new compliance initiatives and corporate governance practices. – We do not anticipate paying dividends before we achieve significant profitability and, as a result, your ability to achieve a return on capital of your investment may depend on appreciation in the price of Lifezone Metals’ ordinary shares. – We have broad discretion over the use of our cash balances we receive as a result of the Proposed Business Combination and may not apply such balances in ways that increase the value of your investment. – Lifezone Metals’ management team has limited experience managing a public company, which may result in difficulty adequately operating and growing Lifezone Metals’ business. – Lifezone Metals is an “emerging growth company”, and the reduced disclosure requirements applicable to emerging growth companies may make Lifezone Metals’ ordinary shares less attractive to investors. – As a foreign private issuer, Lifezone Metals will not be subject to U.S. proxy rules and will be subject to Exchange Act reporting obligations that, to some extent, are more lenient and less frequent than those of a U.S. domestic public company, which may make Lifezone Metals’ ordinary shares less attractive to investors. – As a company incorporated in the Isle of Man, Lifezone Metals is permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from the New York Stock Exchange (the “NYSE”) corporate governance listing standards; these practices may afford less protection to shareholders than they would enjoy if Lifezone Metals complied fully with the NYSE corporate governance listing standards. – We may lose our foreign private issuer status which would then require us to comply with the Exchange Act’s domestic reporting regime and cause us to incur significant additional legal, accounting and other expenses. – As the rights of shareholders under Isle of Man law differ from those under U.S. law, you may have fewer protections as a shareholder. – The Lifezone Metals Public Company Articles and the Lifezone Metals Shareholders Agreement contain certain provisions, including anti - takeover provisions, that limit the ability of shareholders to take certain actions and could delay or discourage takeover attempts that shareholders may consider favorable. 8

Risk Factors (Continued) – Mail sent to Lifezone Metals may be delayed. – In the event BHP completes the tranche 3 investment pursuant to the Tranche 3 Option Agreement and gains majority ownership of KNL, LHL and Lifezone Limited may be classified as inadvertent investment companies for the purposes of the Investment Company Act of 1940 (“ICA”), which may have a material adverse effect on us. Risks Related to ESG – We are increasingly expected to operate in a responsible and sustainable manner and to provide benefits and mitigate adverse impacts to affected communities. Failure, or perceived failure, to do so may result in legal suits, additional costs to address social or environmental impacts of operations, investor divestment, adverse reputational impacts and loss of “social license to operate,” and could adversely impact our financial condition. – A failure to understand, manage and provide greater transparency of our exposure to environmental, social and governance (“ESG”) related risks or an overstatement of the potential ESG benefits of our products or technology may have adverse implications for us and stakeholders. – Regulations and pending legislation governing issues involving climate change could result in increased operating costs, which could have a material adverse effect on our business, financial condition, results of operations, prospects or liquidity. Risks Related to Doing Business in Tanzania and South Africa – Investor perceptions of risks in developing countries or emerging markets, including in Tanzania and South Africa, could reduce investor appetite for investments in these countries or for the securities of issuers operating in these countries, such as Lifezone Metals. – Our operations are subject to water use regulation, which could impose significant costs and burdens. – Our business and operations may be negatively impacted by laws and regulations applicable to foreign owned companies and barriers to foreign investment in Tanzania. – The potential impact of the control of currency conversion, restrictions on dividends or the ability to transfer funds out of Tanzania and/or South Africa may negatively impact our business. – Any downgrading of Tanzania’s debt rating by an international rating agency, or an increase in interest rates in Tanzania, could adversely affect our ability to generate or use letters of credit. Risks Related to the Business Combination – GoGreen’s board of directors did not obtain a fairness opinion in determining whether or not to proceed with the Proposed Business Combination and, as a result, the terms may not be fair from a financial point of view to the GoGreen public shareholders. – Because LHL is not conducting an underwritten public offering of its securities, no underwriter has conducted due diligence of LHL’s business, operations or financial condition or reviewed the disclosure in this proxy statement/prospectus. – If we fail to implement and maintain an effective system of internal control to remediate our material weakness over financial reporting, we may be unable to accurately report our results of operations, meet our reporting obligations as a public company or prevent fraud, and investor confidence and the trading prices of our securities may be materially and adversely affected. – Each of GoGreen and Lifezone Metals will incur significant transaction costs in connection with the Proposed Business Combination. – The consummation of the Proposed Business Combination will be subject to a number of conditions, and if those conditions are not satisfied or waived, the business combination agreement may be terminated in accordance with its terms and the Proposed Business Combination may not be completed. – GoGreen may waive one or more of the conditions to the Proposed Business Combination, resulting in the consummation of the Proposed Business Combination notwithstanding the divergence from assumptions on which the Proposed Business Combination was evaluated and approved. – Upon consummation of the Proposed Business Combination, the rights of the holders of Lifezone Metals’ ordinary shares arising under the Isle of Man Companies Act as well as the Lifezone Metals’ Public Company Articles of association will differ from and may be less favorable to the rights of holders of GoGreen Class A ordinary shares arising under Cayman Islands law as well as the GoGreen Articles. – The ability to successfully effect the Proposed Business Combination and the combined company’s ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel. The loss of such key personnel could negatively impact the operations and financial results of the combined business. – There can be no assurance that the combined company’s securities will be approved for listing on the NYSE or that the combined company will be able to comply with the continued listing standards of NYSE. – Legal proceedings in connection with the Proposed Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Proposed Business Combination. 9

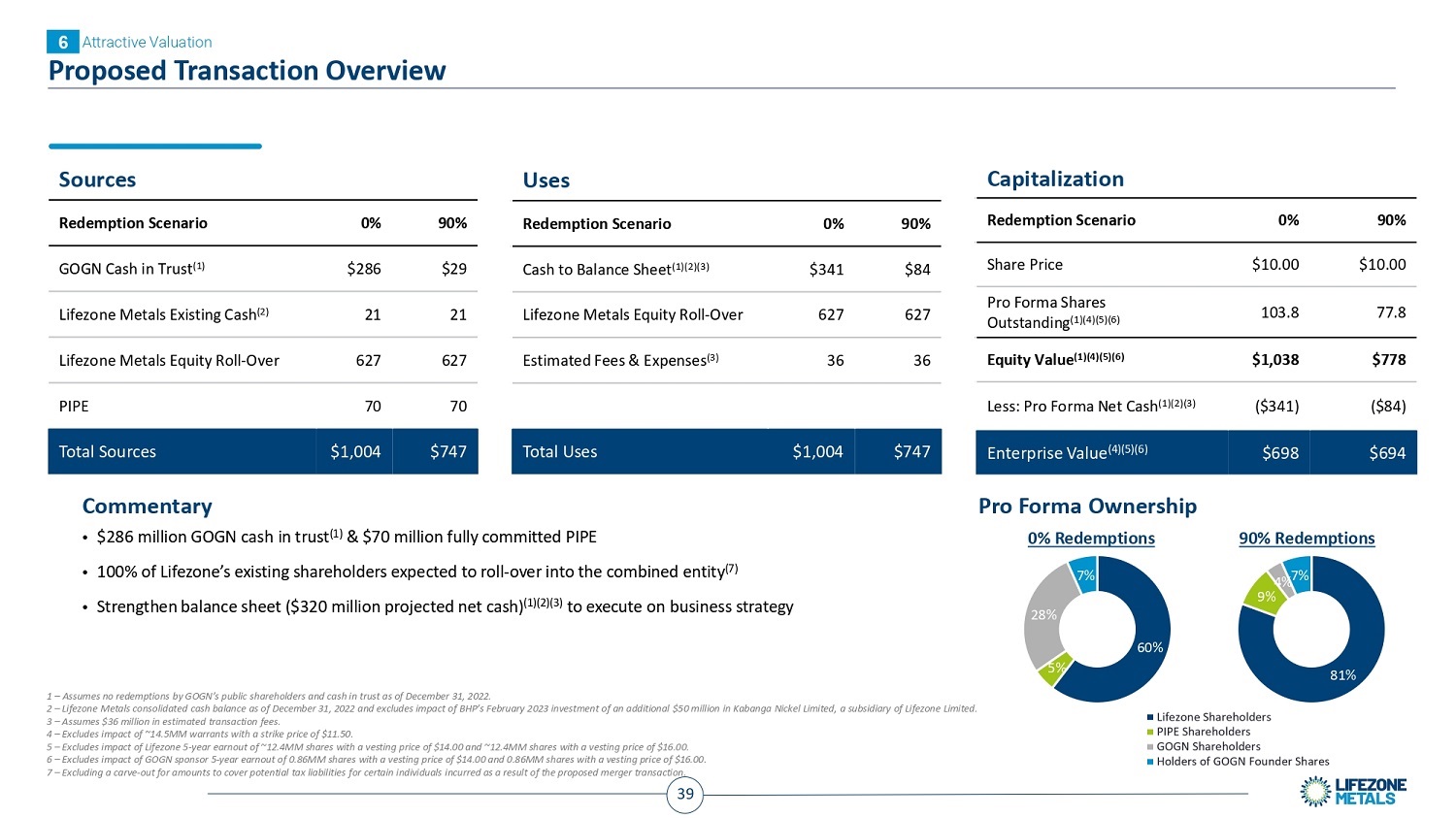

Transaction Overview Proposed Transaction Summary Overview • Lifezone owns a controlling interest in one of the world’s largest, highest - grade, undeveloped nickel sulphide deposits (1) (the “Kabanga Project”). BHP is Lifezone’s partner and has an option to acquire a controlling stake in the Kabanga Project; if the option is exercised, BHP would run the development and production of the resource utilizing Lifezone’s proprietary hydromet refining technology that we believe reduces costs and emissions compared to traditional smelting, which we believe has the potential to make Kabanga one of the “greenest” nickel projects in the world. (2) • Lifezone has entered into a business combination agreement with GoGreen Investments Corporation (NYSE:GOGN). GoGreen is a Special Purpose Acquisition Company focused on energy transition with approximately $286 million of cash currently held in trust. • The post - closing company is expected to trade on NYSE under the ticker symbol LZM. Capital Structure (3)(4) • Fully committed PIPE of approximately $70 million. • 100% of Lifezone’s existing shareholders are expected to roll - over into the combined entity. (5) • The proposed transaction is expected to provide Lifezone with approximately $320 million of cash, (3) in addition to Lifezone’s $21 million net consolidated cash contribution as of December 31, 2022. • Pro forma equity ownership percentage for the transaction: – 60% existing Lifezone shareholders; – 33% existing GoGreen public shareholders and holders of founder shares; and – 7% PIPE investors. Valuation • Transaction implies a post - transaction enterprise value of $681 million and equity value of $1.0 billion. (3) • Attractive on resource basis versus peers with rollover equity in line with BHP’s $100 million investment in Kabanga and Lifezone. (4)(5) 1 – Based on analysis of the largest undeveloped nickel deposits from S&P Capital IQ Pro, as modified per public data on each mining project. The Kabanga Project's resource metrics reflect the measured, indicated and inferred resources referred to in the Kabanga Mineral Resource Estimates as of 15 February 2023 from the TRS, as set out on slide 24. 2 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. 3 – Assumes no redemptions by GOGN’s public shareholders and $36 million in estimated transaction fees; excludes impact of GOGN sponsor 5 - year earnout of 0.86MM shares with a vesting price of $14.00 and 0.86MM shares with a vesting price of $16.00. 4 – Excludes impact of Lifezone 5 - year earnout of ~12.4MM shares with a vesting price of $14.00 and ~12.4MM shares with a vesting price of $16.00. 5 – Excluding a carve - out for amounts to cover potential tax liabilities for certain individuals incurred as a result of the proposed merger transaction. 6 – In December 2021, BHP invested $10 million into Lifezone and $40 million into Kabanga Nickel Limited, a subsidiary of Lifezone; in February 2023, BHP invested an additional $50 million in Kabanga Nickel Limited, a subsidiary of Lifezone. 10

GoGreen Investments Corporation Overview (GOGN) Chief Executive Officer 30+ years energy investing experience Managed multi - billion - dollar portfolios for Fidelity Investments for 14 years focused on energy and natural resources; co - led the Fidelity Energy Research Team Awarded 6 Lipper awards for the best risk - adjusted performance in the natural resources sector John Dowd Lifezone Metals is Perfectly Aligned with GoGreen’s Vision and Construction GoGreen’s team was assembled with 3 core disciplines and Lifezone exceeds and leverages each: Clean technology and commercialization. We believe GoGreen management’s executive experience building, growing and operating clean tech businesses provide critical insights into Lifezone mining project execution and technology growth potential Upstream metals and mining. Govind Friedland, a geological engineer from Colorado School of Mines, seasoned investor with 20+ years experience, multi generational mining & metals family office focused on developing critical metals required for energy transition Investment and capital allocation . John Dowd’s experience in successfully investing within secular trends was critical in identifying “materials” as the key energy transition bottleneck GoGreen Overview GOGN completed its IPO in October 2021 With significant team experience in green transition, GOGN focused their search on targets in the clean energy ecosystem, with the following investment thesis: Diverse and intersecting skills sets and experiences Unprecedented and enduring market opportunities Companies with access to capital will lead Long - term value creation through leading expertise Chief Operating Officer 20+ years energy metals, mineral exploration, development, specializing in assembling management teams, raising capital via private - public equity and unconventional sources of capital Deep experience pioneering geophysical exploration programs Mutigenerational mining family — Ivanhoe Group of Companies Geology & Geological Engineering — Colorado School of Mines Govind Friedland Chief Development Officer 22 years of management leadership roles across Energy & other diverse businesses at GE including CEO of GE Renewable Energy – Onshore Wind Americas Extensive experience in business transformations, capital allocation, strategy, operations and talent development Under his leadership, GE Onshore Wind business restored to #1 position in the U.S., grew market share from 29% to 53% Vikas Anand 11

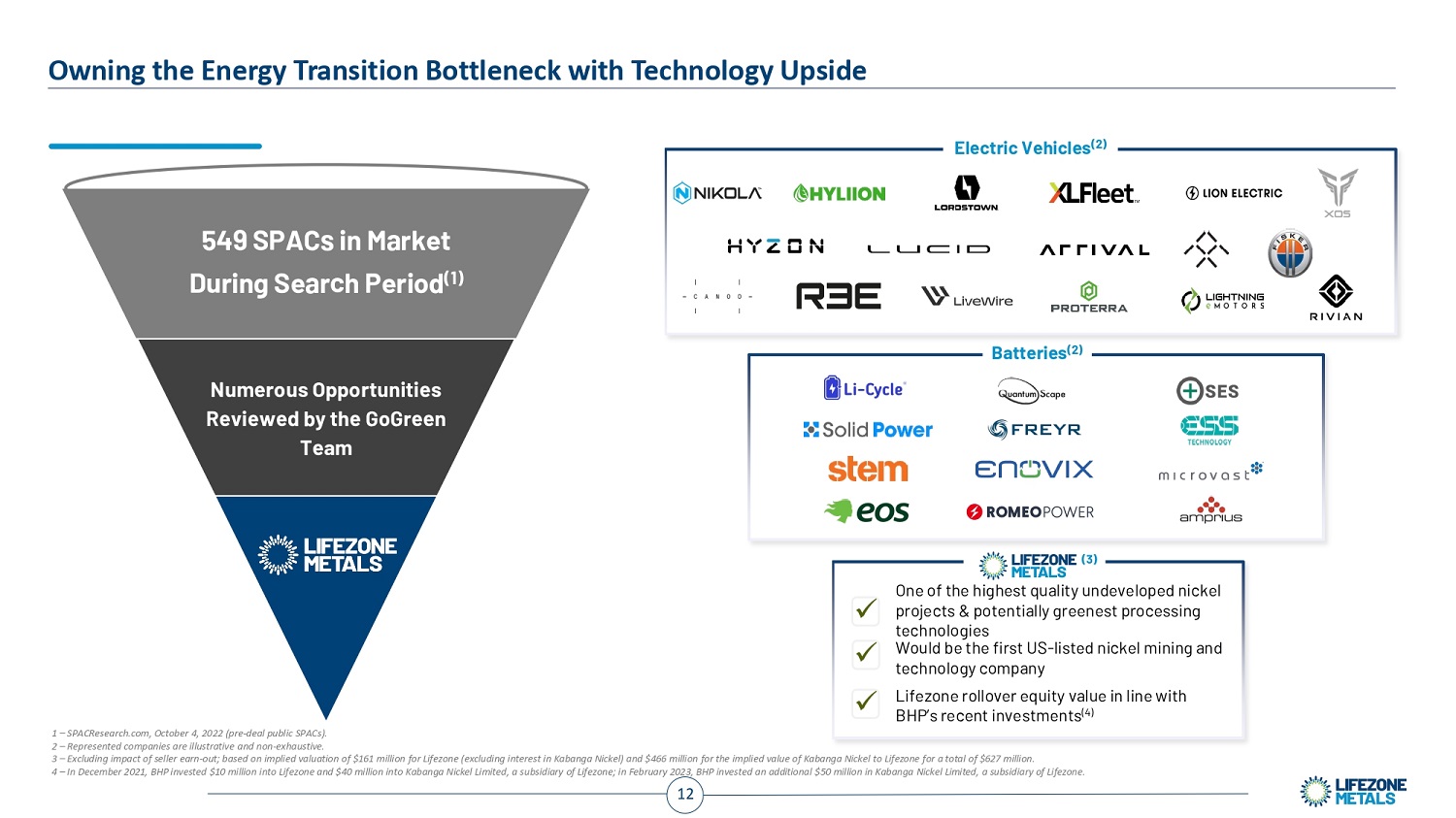

Owning the Energy Transition Bottleneck with Technology Upside 549 SPACs in Market During Search Period (1) Numerous Opportunities Reviewed by the GoGreen Team Batteries (2) Electric Vehicles (2) Lifezone rollover equity value in line with BHP’s recent investments (4) x x x One of the highest quality undeveloped nickel projects & potentially greenest processing technologies Would be the first US - listed nickel mining and technology company 1 – SPACResearch.com, October 4, 2022 (pre - deal public SPACs). 2 – Represented companies are illustrative and non - exhaustive. 3 – Excluding impact of seller earn - out; based on implied valuation of $161 million for Lifezone (excluding interest in Kabanga Nickel) and $466 million for the implied value of Kabanga Nickel to Lifezone for a total of $627 million. 4 – In December 2021, BHP invested $10 million into Lifezone and $40 million into Kabanga Nickel Limited, a subsidiary of Lifezone; in February 2023, BHP invested an additional $50 million in Kabanga Nickel Limited, a subsidiary of Lifezone. (3) 12

One Mission: To Help Towards Decarbonizing and Sourcing Green Metals to Accelerate Energy Transition Two business segments: one world class nickel asset, one compelling technology Lifezone Metals Hydromet Technology Proprietary technology with minority interest and royalty in a Hydromet refinery under construction in South Africa 13 Up to 73% lower CO 2 eq. emissions compared to traditional smelting and refining (1)(2) Licensing growth opportunities in mining and recycling industries Kabanga Nickel Mine One of the largest and highest quality undeveloped nickel sulphide deposits globally (3) Underpinned by BHP with $100 million of investments in Kabanga and Lifezone (4) Exploration upside and commercial opportunities on Lifezone’s existing licenses Significant Resource of Responsibly Sourced Potentially “Greener" Nickel 1 – Nickel Class 1 downstream processing CO2 eq. emissions baseline from 2020 Nickel Institute LCA. Estimated Kabanga refinery expected emissions from internal Company analysis. 2 – Expected reductions are lower for PGMs, as they utilize a more complicated flowsheet and are more energy intensive. For example, a study from EY Cova (an independent South African National Accreditation System accredited energy Measurement and Verification inspection body) found 46% lower emissions utilizing our Hydromet Technology compared to traditional smelting and refining (EY Cova studied PGM metals at the originally proposed 110 ktpa concentrate feed rate refinery at the Sedibelo plant site in South Africa under the then - applicable conditions in 2020 and assuming reagents not manufactured on - site; actual results could differ). Results will vary for specific PGM projects. 3 – Based on analysis of the largest undeveloped nickel deposits from S&P Capital IQ Pro, as modified per public data on each mining project. The Kabanga Project's resource metrics reflect the measured, indicated and inferred resources referred to in the Kabanga Mineral Resource Estimates as of 15 February 2023 from the TRS, as set out on slide 24. 4 – In December 2021, BHP invested $10 million into Lifezone and $40 million into Kabanga Nickel Limited, a subsidiary of Lifezone; in February 2023, BHP agreed to invest an additional $50 million in Kabanga Nickel Limited, a subsidiary of Lifezone.

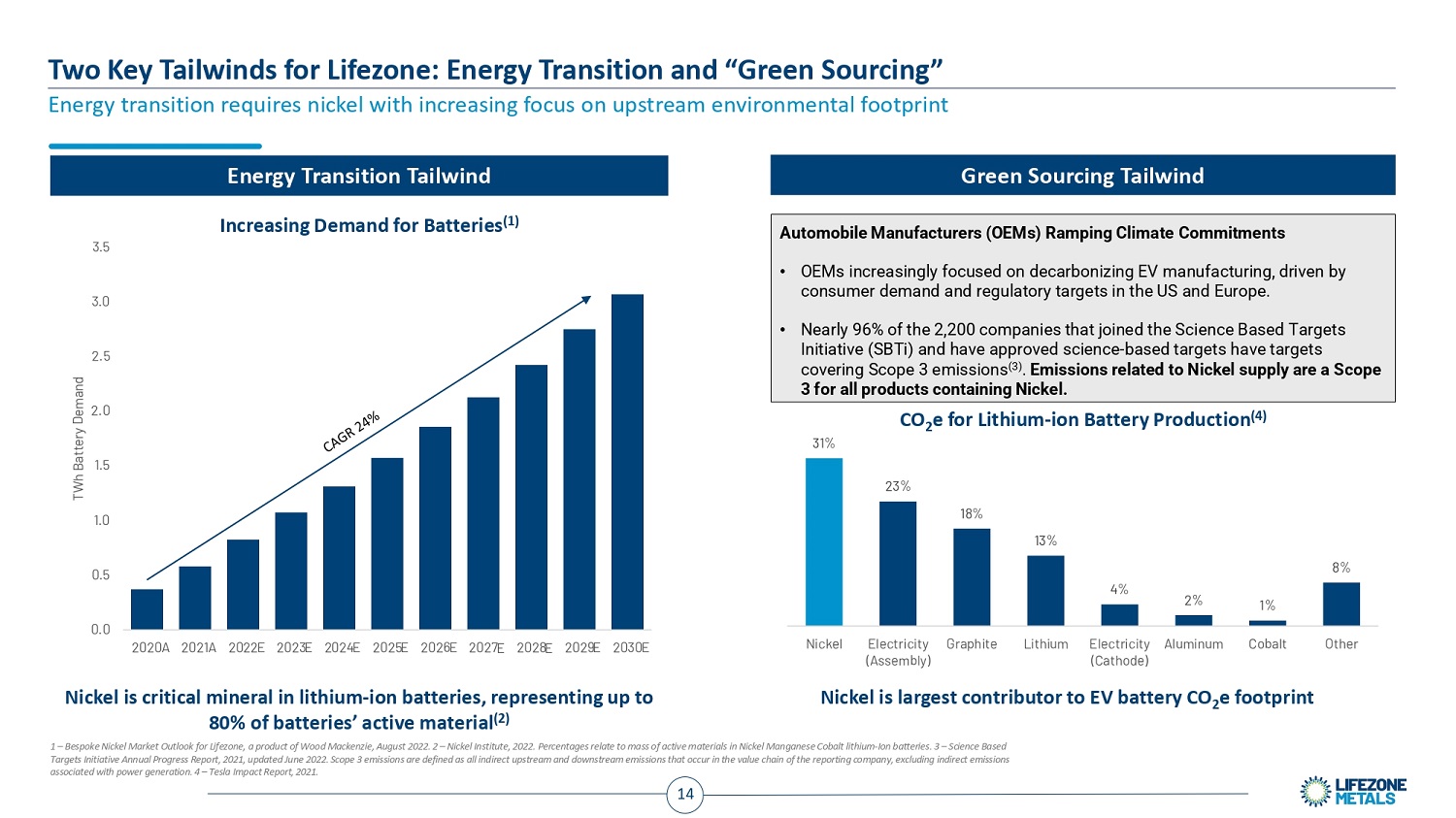

Two Key Tailwinds for Lifezone: Energy Transition and “Green Sourcing” Energy transition requires nickel with increasing focus on upstream environmental footprint Automobile Manufacturers (OEMs) Ramping Climate Commitments • OEMs increasingly focused on decarbonizing EV manufacturing, driven by consumer demand and regulatory targets in the US and Europe. • Nearly 96% of the 2,200 companies that joined the Science Based Targets Initiative (SBTi) and have approved science - based targets have targets covering Scope 3 emissions (3) . Emissions related to Nickel supply are a Scope 3 for all products containing Nickel. Nickel is critical mineral in lithium - ion batteries, representing up to Nickel is largest contributor to EV battery CO 2 e footprint 80% of batteries’ active material (2) 1 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, August 2022 . 2 – Nickel Institute, 2022 . Percentages relate to mass of active materials in Nickel Manganese Cobalt lithium - Ion batteries . 3 – Science Based Targets Initiative Annual Progress Report, 2021 , updated June 2022 . Scope 3 emissions are defined as all indirect upstream and downstream emissions that occur in the value chain of the reporting company, excluding indirect emissions associated with power generation . 4 – Tesla Impact Report, 2021 . Energy Transition Tailwind Green Sourcing Tailwind 31% 23% 18% 13% 4% 2% 1% 8% Nickel Electricity Graphite (Assembly) Lithium Electricity Aluminum (Cathode) Cobalt Other 2 CO e for Lithium - ion Battery Production (4) 0.0 14 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2020A 2021 A 2022E 2023E 2024 E 2025E 2026 E 2027 E 2028 E 2029E 2030E TWh Battery Demand Increasing Demand for Batteries (1)

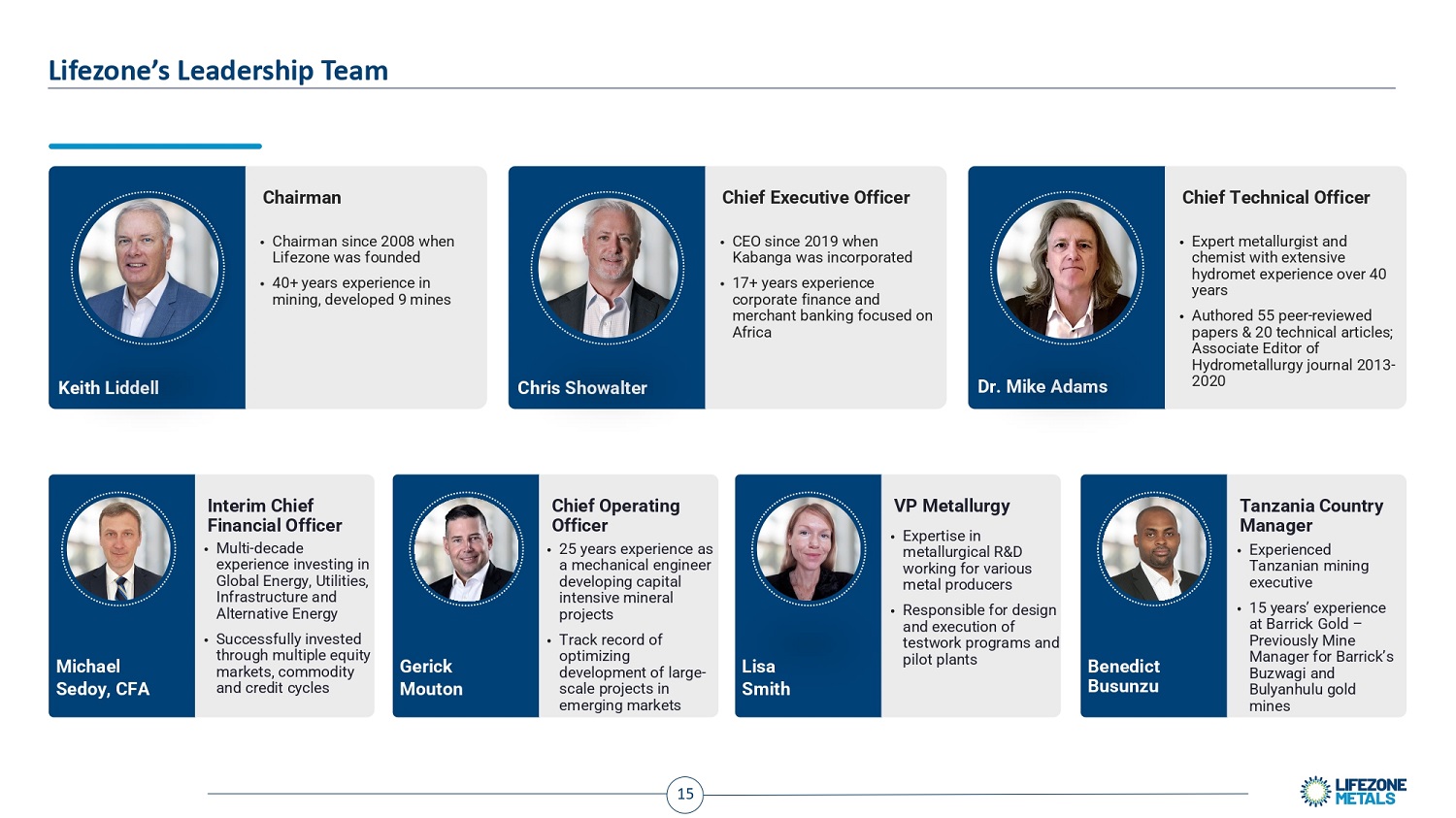

Lifezone’s Leadership Team Chairman • Chairman since 2008 when Lifezone was founded • 40+ years experience in mining, developed 9 mines Keith Liddell Chief Executive Officer • CEO since 2019 when Kabanga was incorporated • 17+ years experience corporate finance and merchant banking focused on Africa Chris Showalter Chief Technical Officer • Expert metallurgist and chemist with extensive hydromet experience over 40 years • Authored 55 peer - reviewed papers & 20 technical articles; Associate Editor of Hydrometallurgy journal 2013 - 2020 Dr. Mike Adams Gerick Mouton Chief Operating Officer • 25 years experience as a mechanical engineer developing capital intensive mineral projects • Track record of optimizing development of large - scale projects in emerging markets Tanzania Country Manager • Experienced Tanzanian mining executive • 15 years’ experience at Barrick Gold – Previously Mine Manager for Barrick’s Buzwagi and Bulyanhulu gold mines Benedict Busunzu Michael Sedoy, CFA Interim Chief Financial Officer • Multi - decade experience investing in Global Energy, Utilities, Infrastructure and Alternative Energy • Successfully invested through multiple equity markets, commodity and credit cycles Lisa Smith VP Metallurgy • Expertise in metallurgical R&D working for various metal producers • Responsible for design and execution of testwork programs and pilot plants 15

Investment Highlights 1 Compelling Outlook for Nickel Supply/Demand and Responsibly Sourced “Green” Metals 2 One of the World's Largest & Highest - Grade Undeveloped Nickel Sulphide Deposits (1) 3 Leading Strategic Partner BHP Supports Economics & Enhances Project Execution Meaningfully Lower Emissions (2) Expected via Lifezone’s Proprietary Green Hydromet Technology 4 6 Attractive Valuation 5 Hydromet Technology Licensing Growth Potential in Mining & Recycling 7 Experienced Leadership & Project Execution Team 1 – Based on analysis of the largest undeveloped nickel deposits from S&P Capital IQ Pro, as modified per public data on each mining project. The Kabanga Project's resource metrics reflect the measured, indicated and inferred resources referred to in the Kabanga Mineral Resource Estimates as of 15 February 2023 from the TRS, as set out on slide 24. 2 – Compared to traditional smelting and refining. 16

Supply Chains Increasingly Focused on Future Nickel Supply Nov. 14, 2022 Dec. 2, 2021 May 6, 2022 Compelling Outlook for Nickel Supply/Demand and Responsibly Sourced “Green” Metals 1 17

18 0.0 0.5 1.0 1.5 2.0 2.5 3.0 3.5 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 TWh Battery Demand 0 10 20 30 40 50 60 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 EV Car Sales (million units) Compelling Outlook for Nickel Supply/Demand and Responsibly Sourced “Green” Metals 1 Energy Transition Battery Demand Driving Nickel Sulphide Demand Electric Vehicle Sales Accelerating (1) Increasing Demand for Batteries (2) Gigafactory Expansions Underway (3) 2 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. Based on electric vehicle and energy storage demand. 3 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. 4 – Signatories to the Glasgow Declaration on Zero Emission Cars and Vans in 2021. 5 – Alliance Bernstein Research, February 2022. 6 – Nickel Institute, 2022. Percentages relate to mass of active materials in Nickel Manganese Cobalt lithium - Ion batteries. • Global EV market share is now well into the early adopters S - curve stage • Ford, GM, Mercedes - Benz, and Volvo among OEMs committed to selling only zero - emission cars and vans by 2035 - 2040 (4) • Lithium - ion batteries are the single largest cost component in EVs 1 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. 0 100 200 300 400 500 600 700 800 900 GWh Capacity 2021 Capacity 2025 Capacity Pipeline Capacity • Global lithium - ion battery capacity projected to rise at least 5x by 2030 compared to 2021 (3) • Tesla opened the first Gigafactory in 2017, today over 300 are under construction or planned • Outside of China, North America has seen the fastest growth of any region, adding 11 gigafactories to its pipeline since mid - 2021 • Growth in EV volumes will drive demand for expanded lithium - ion battery volumes • Nickel - based lithium - ion batteries represent 70% of the market – producers are increasing nickel content to raise energy density (5) • Nickel is critical mineral in lithium - ion batteries, representing up to 80% of active material (6)

0.0 0.2 0.4 0.6 0.8 1.0 1.2 1.4 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 Nickel Precursors for EV / ESS Battery Demand (million tons) Nickel Sulphide – Supply Shortage of Greener Nickel 1 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. Based on battery demand from electric vehicles and energy storage applications. 2 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, September 2022. 3 – IEA The Role of Critical Metals, March 2022. 4 – Kabanga GHG intensity is based upon data provided by Lifezone and Wood Mackenzie analysis, is estimated as of 2030 by Wood Mackenzie and assumes power supply as hydro and solar and may also include scope 3 emissions. The figures for laterite and sulfide only include Scope 1 and Scope 2 emissions. Compelling Outlook for Nickel Supply/Demand and Responsibly Sourced “Green” Metals 1 Most Supply Growth Expected From Nickel Laterites (2) Nickel Sulfides Have Lower GHG Intensity – Further Enhanced by Kabanga’s Integrated Refining (3) 70 0 10 20 30 40 50 60 Laterite (matte via NPI) Laterite (HPAL) Sulfide (smelting) Kabanga (Lifezone hydromet) (4) tCO 2 eq. per metric ton of nickel 92% 19 8% 0% 20% 40% 60% 80% 100% Laterite Sulphide % of New Nickel Supply from 2021 Through 2030 Battery Demand for Nickel to Catalyze Nickel Supply Growth (1)

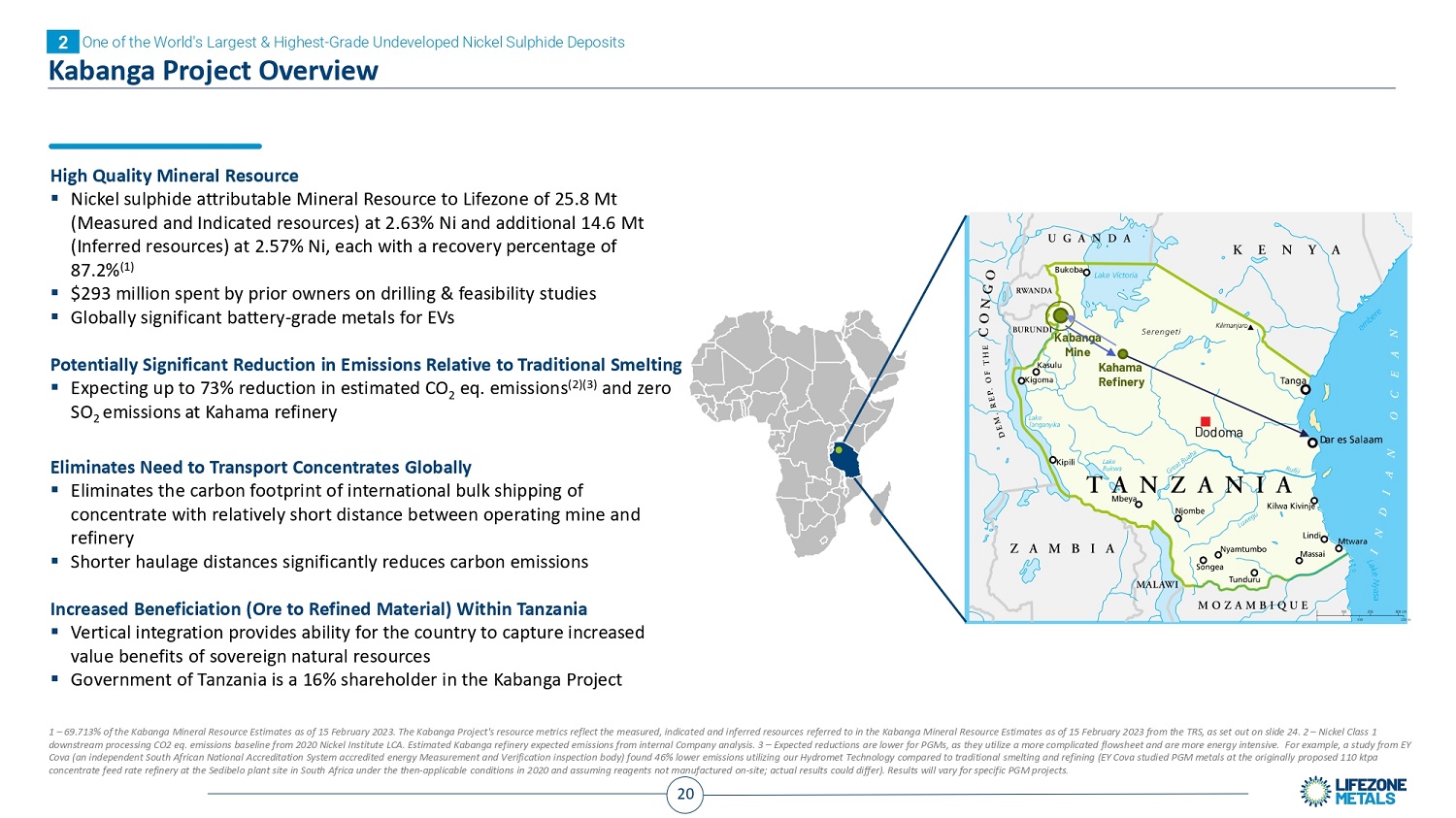

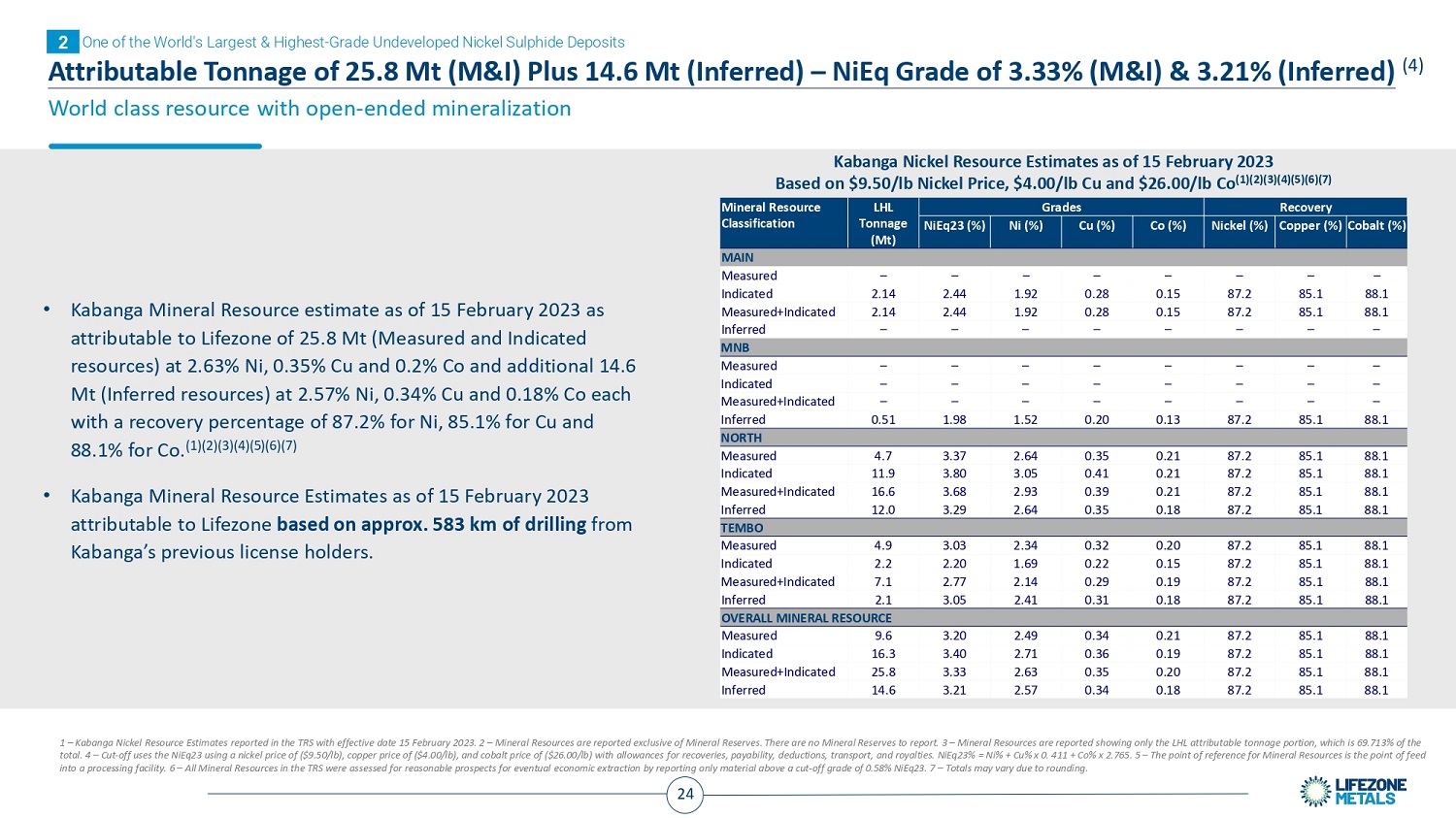

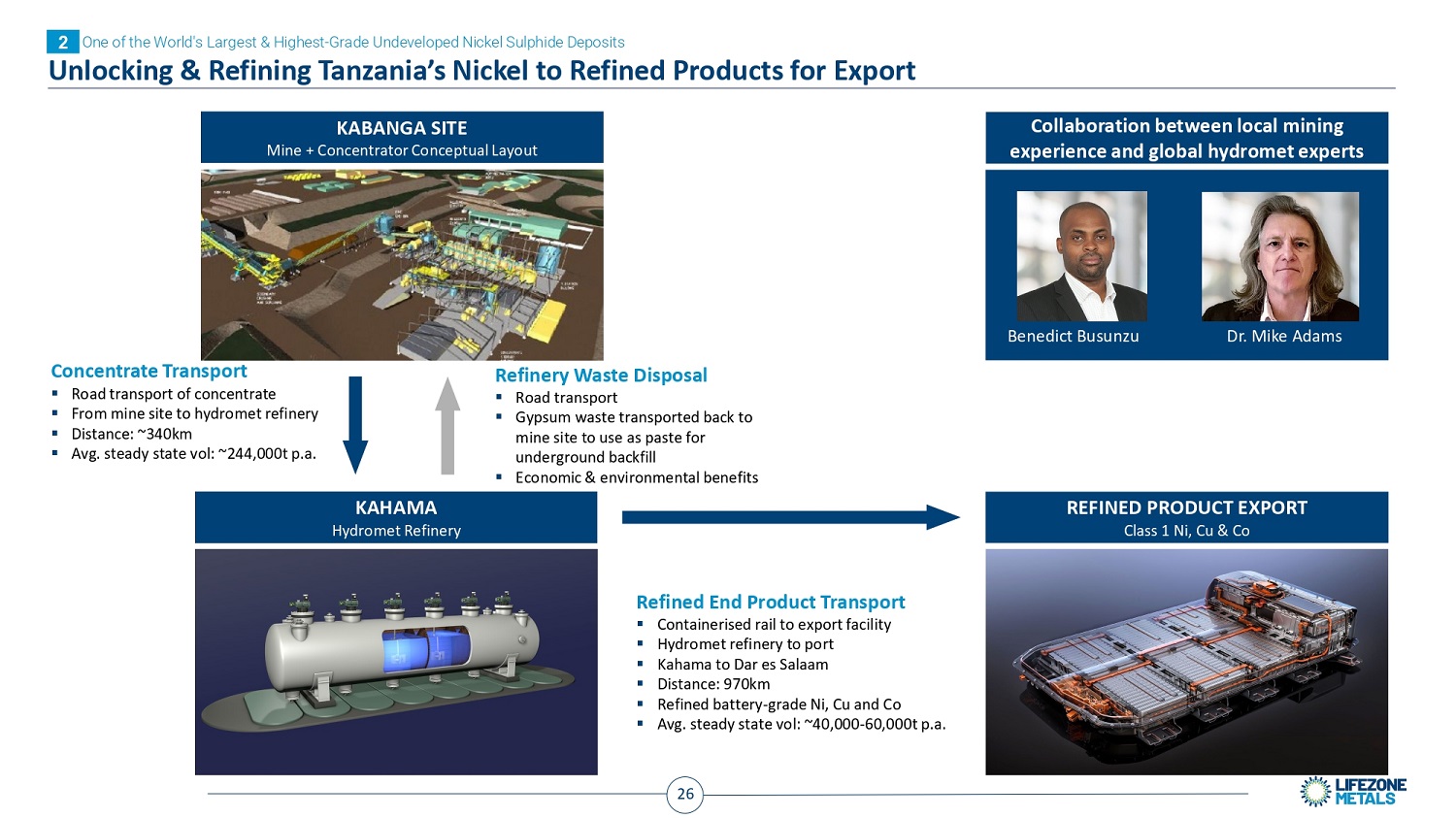

Kabanga Project Overview One of the World's Largest & Highest - Grade Undeveloped Nickel Sulphide Deposits 2 High Quality Mineral Resource ▪ Nickel sulphide attributable Mineral Resource to Lifezone of 25.8 Mt (Measured and Indicated resources) at 2.63% Ni and additional 14.6 Mt (Inferred resources) at 2.57% Ni, each with a recovery percentage of 87.2% (1) ▪ $293 million spent by prior owners on drilling & feasibility studies ▪ Globally significant battery - grade metals for EVs Potentially Significant Reduction in Emissions Relative to Traditional Smelting 2 ▪ Expecting up to 73% reduction in estimated CO eq. emissions (2)(3) and zero SO 2 emissions at Kahama refinery Eliminates Need to Transport Concentrates Globally ▪ Eliminates the carbon footprint of international bulk shipping of concentrate with relatively short distance between operating mine and refinery ▪ Shorter haulage distances significantly reduces carbon emissions Increased Beneficiation (Ore to Refined Material) Within Tanzania ▪ Vertical integration provides ability for the country to capture increased value benefits of sovereign natural resources ▪ Government of Tanzania is a 16% shareholder in the Kabanga Project Dodoma Kabanga Mine Kahama Refinery 1 – 69.713% of the Kabanga Mineral Resource Estimates as of 15 February 2023. The Kabanga Project's resource metrics reflect the measured, indicated and inferred resources referred to in the Kabanga Mineral Resource Estimates as of 15 February 2023 from the TRS, as set out on slide 24. 2 – Nickel Class 1 downstream processing CO2 eq. emissions baseline from 2020 Nickel Institute LCA. Estimated Kabanga refinery expected emissions from internal Company analysis. 3 – Expected reductions are lower for PGMs, as they utilize a more complicated flowsheet and are more energy intensive. For example, a study from EY Cova (an independent South African National Accreditation System accredited energy Measurement and Verification inspection body) found 46% lower emissions utilizing our Hydromet Technology compared to traditional smelting and refining (EY Cova studied PGM metals at the originally proposed 110 ktpa concentrate feed rate refinery at the Sedibelo plant site in South Africa under the then - applicable conditions in 2020 and assuming reagents not manufactured on - site; actual results could differ). Results will vary for specific PGM projects. 20

One of the World's Largest & Highest - Grade Undeveloped Nickel Sulphide Deposits 2 Kabanga is One of the World’s Largest and Highest Quality Nickel Deposits (1)(2) Source: S&P Capital IQ Pro, as modified per public data on each mining project. 1 – NiEq. Values calculated using input prices of Nickel:$20,944/T, Copper $8,818/T and Cobalt $57,320/T, Chrome $4,409/T, Platinum $1,046/oz, Palladium $1,946/oz, Gold $1,798oz, Zinc $3,247/T, Silver $23.11/oz. No value was assigned for Iron. No additional recoveries or payabilties have been applied to published data. 2 – The Ni/NiEq % is based on nickels value in - situ versus the other elements according to the above pricing mechanisms. 21

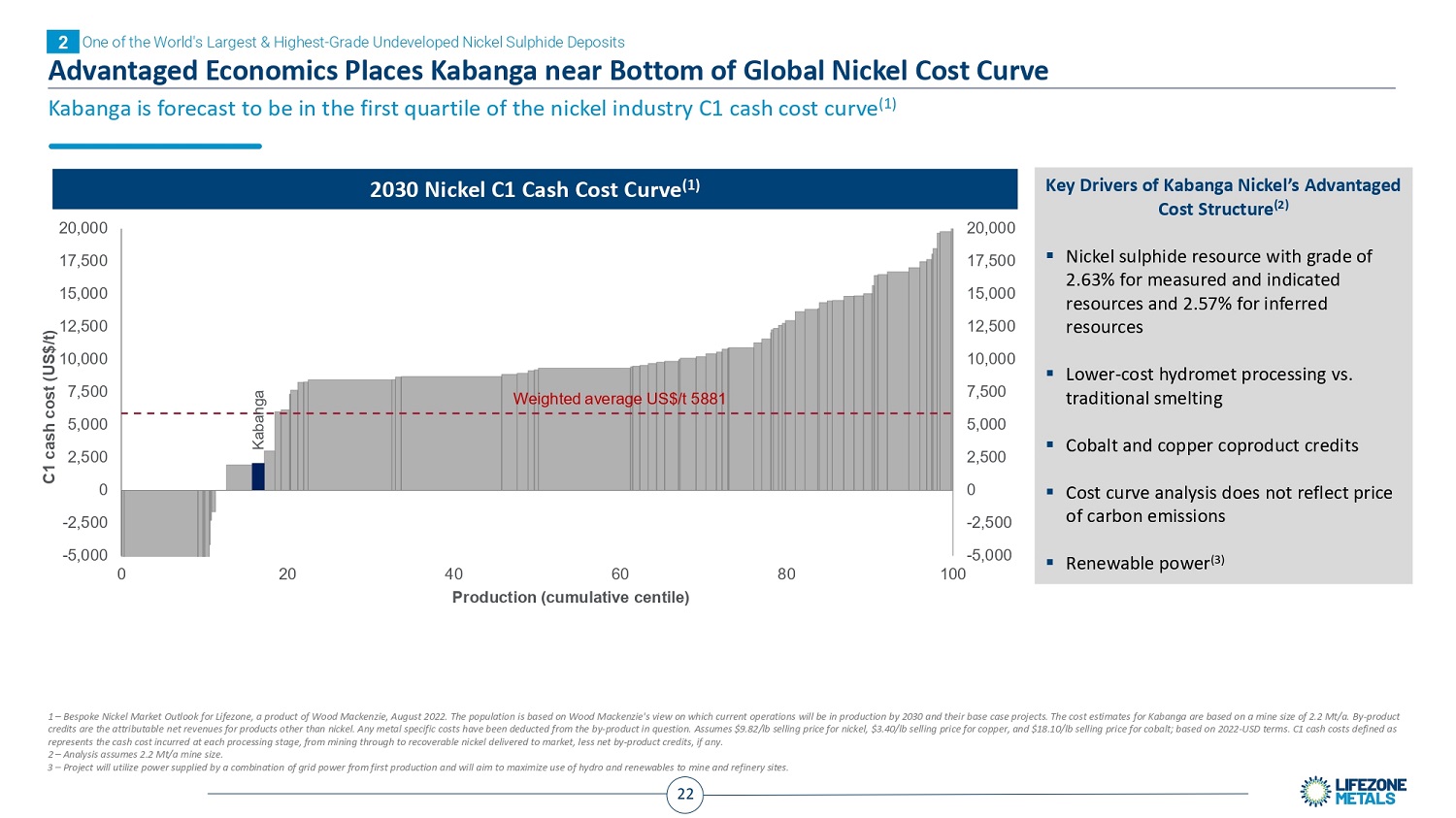

One of the World's Largest & Highest - Grade Undeveloped Nickel Sulphide Deposits 2 Advantaged Economics Places Kabanga near Bottom of Global Nickel Cost Curve Kabanga is forecast to be in the first quartile of the nickel industry C1 cash cost curve (1) Key Drivers of Kabanga Nickel’s Advantaged Cost Structure (2) ▪ Nickel sulphide resource with grade of 2.63% for measured and indicated resources and 2.57% for inferred resources ▪ Lower - cost hydromet processing vs. traditional smelting ▪ Cobalt and copper coproduct credits ▪ Cost curve analysis does not reflect price of carbon emissions ▪ Renewable power (3) Kabanga 22 Weighted average US$/t 5881 - 5,000 0 20 40 60 Production (cumulative centile) 80 - 5,000 100 20,000 17,500 15,000 12,500 10,000 7,500 5,000 2,500 0 - 2,500 12,500 10,000 7,500 5,000 2,500 0 - 2,500 20,000 17,500 15,000 C1 cash cost (US$/t) 2030 Nickel C1 Cash Cost Curve (1) 1 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, August 2022. The population is based on Wood Mackenzie's view on which current operations will be in production by 2030 and their base case projects. The cost estimates for Kabanga are based on a mine size of 2.2 Mt/a. By - product credits are the attributable net revenues for products other than nickel. Any metal specific costs have been deducted from the by - product in question. Assumes $9.82/lb selling price for nickel, $3.40/lb selling price for copper, and $18.10/lb selling price for cobalt; based on 2022 - USD terms. C1 cash costs defined as represents the cash cost incurred at each processing stage, from mining through to recoverable nickel delivered to market, less net by - product credits, if any. 2 – Analysis assumes 2.2 Mt/a mine size. 3 – Project will utilize power supplied by a combination of grid power from first production and will aim to maximize use of hydro and renewables to mine and refinery sites.

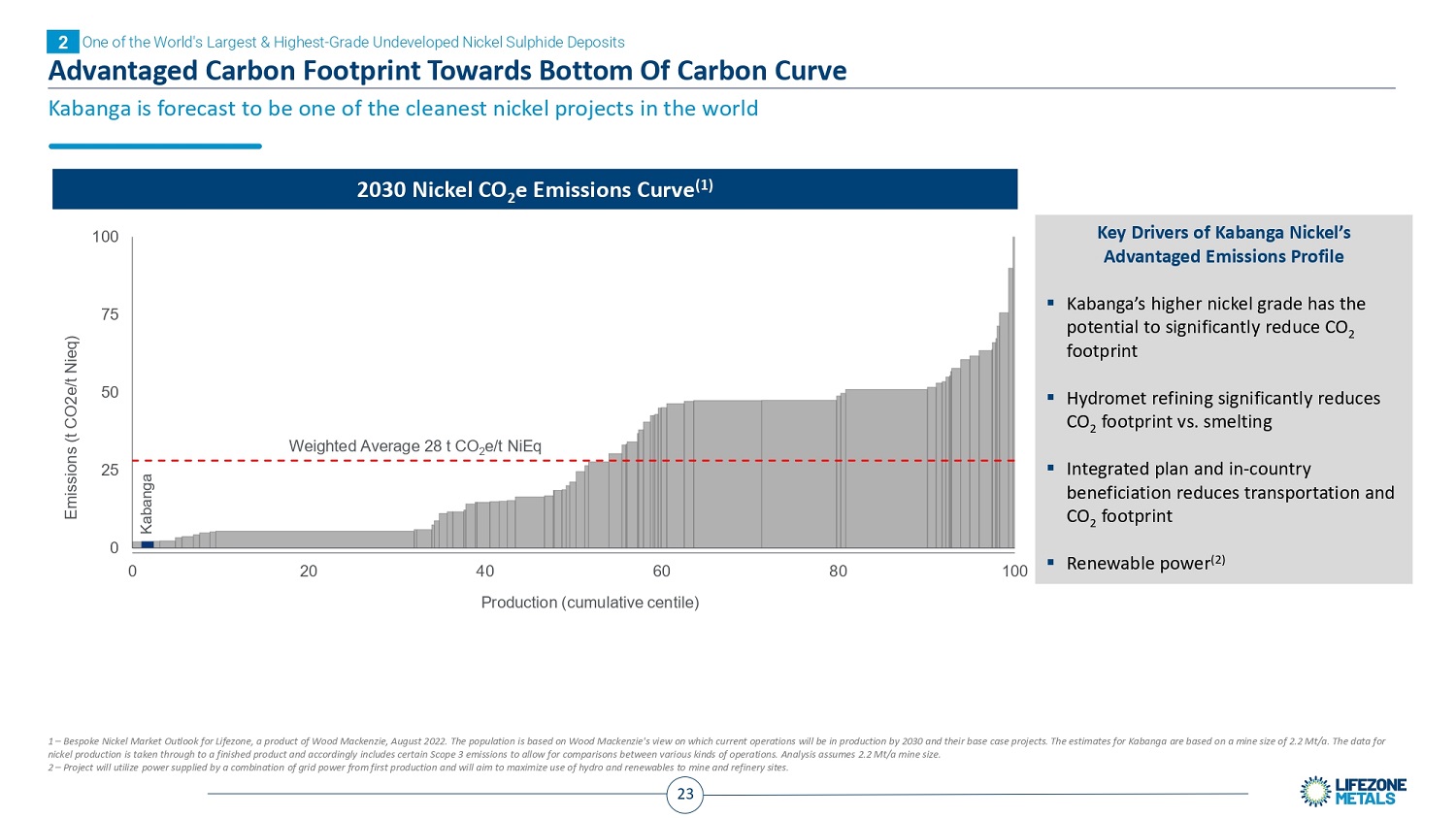

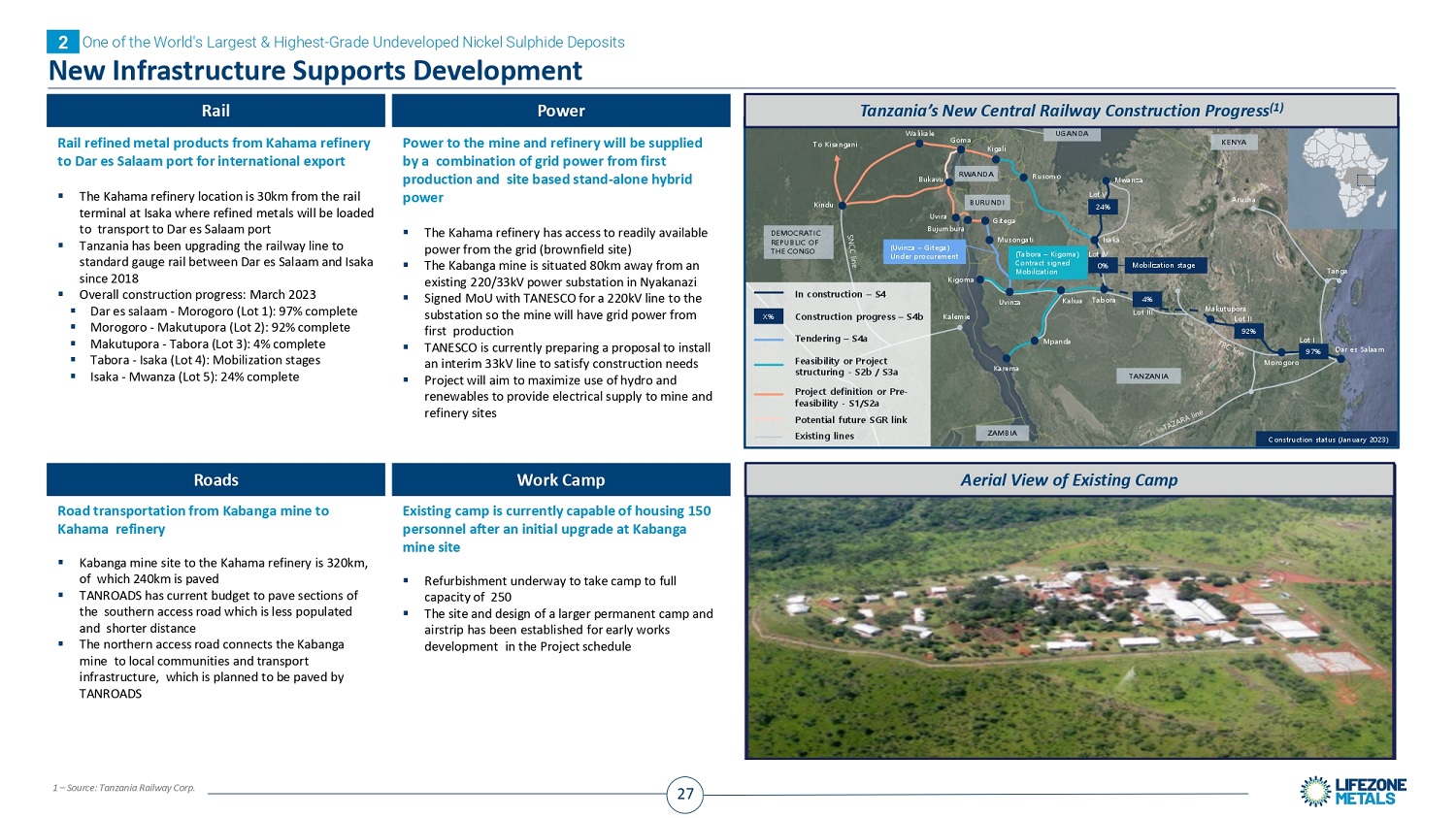

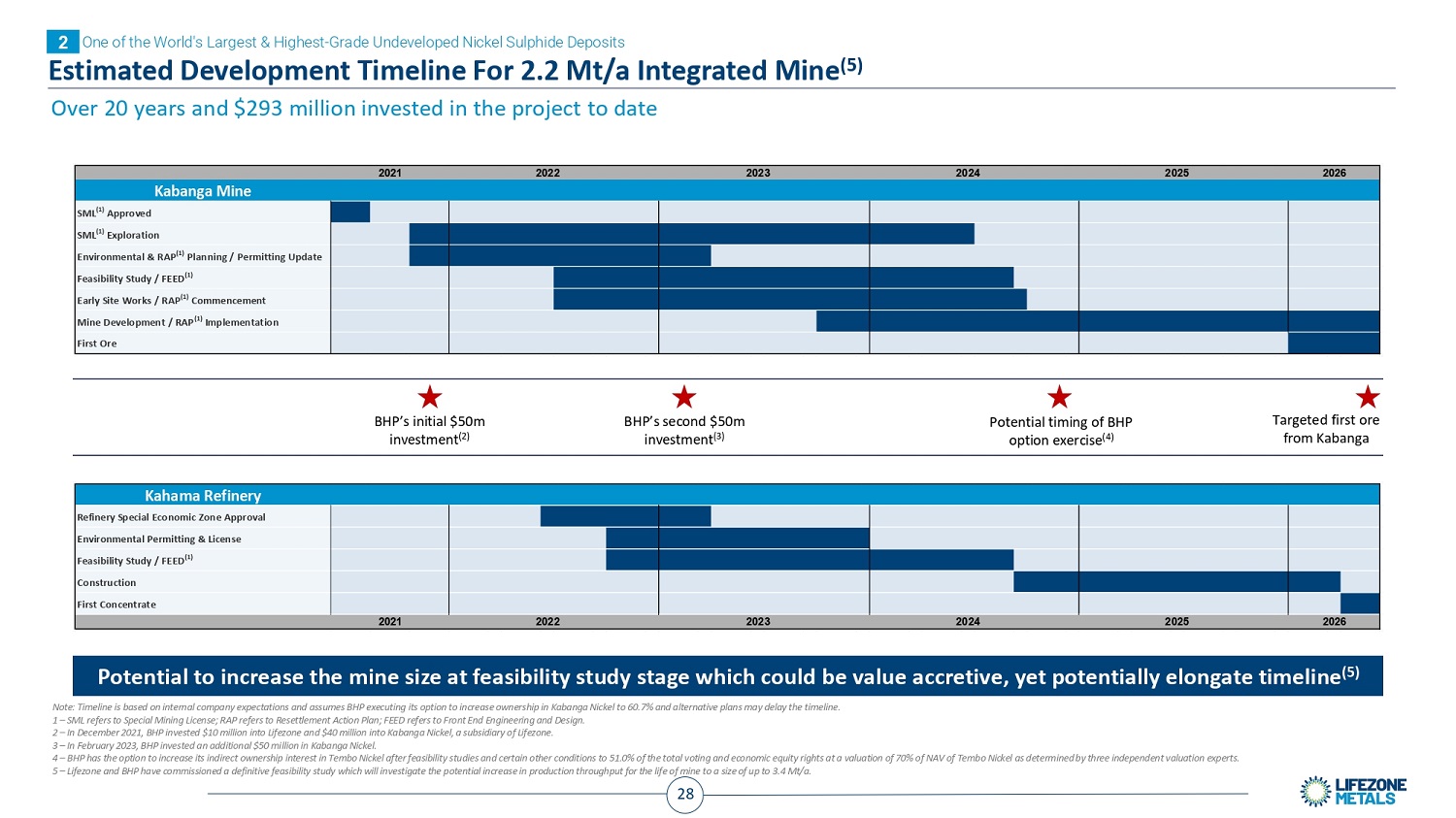

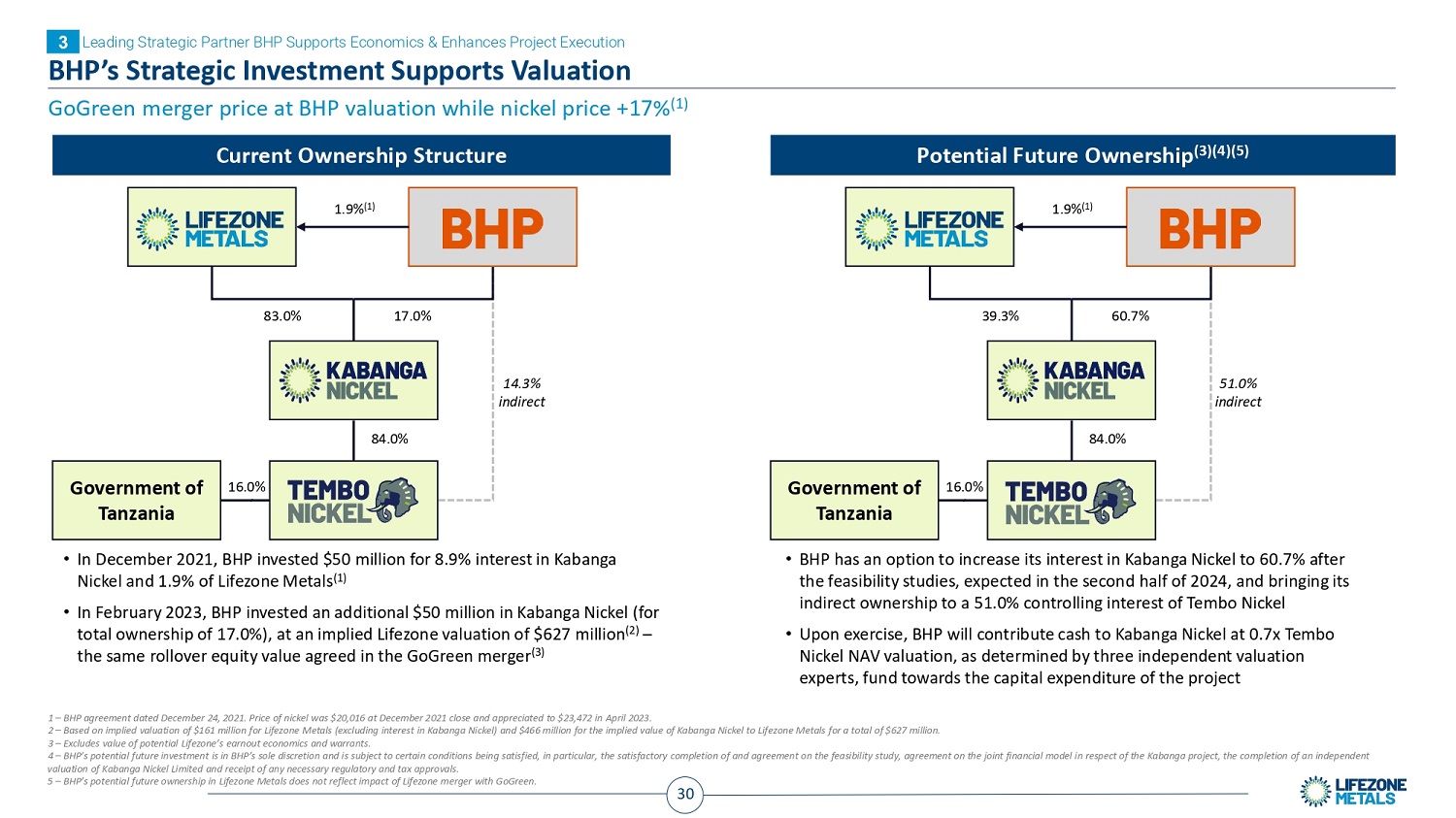

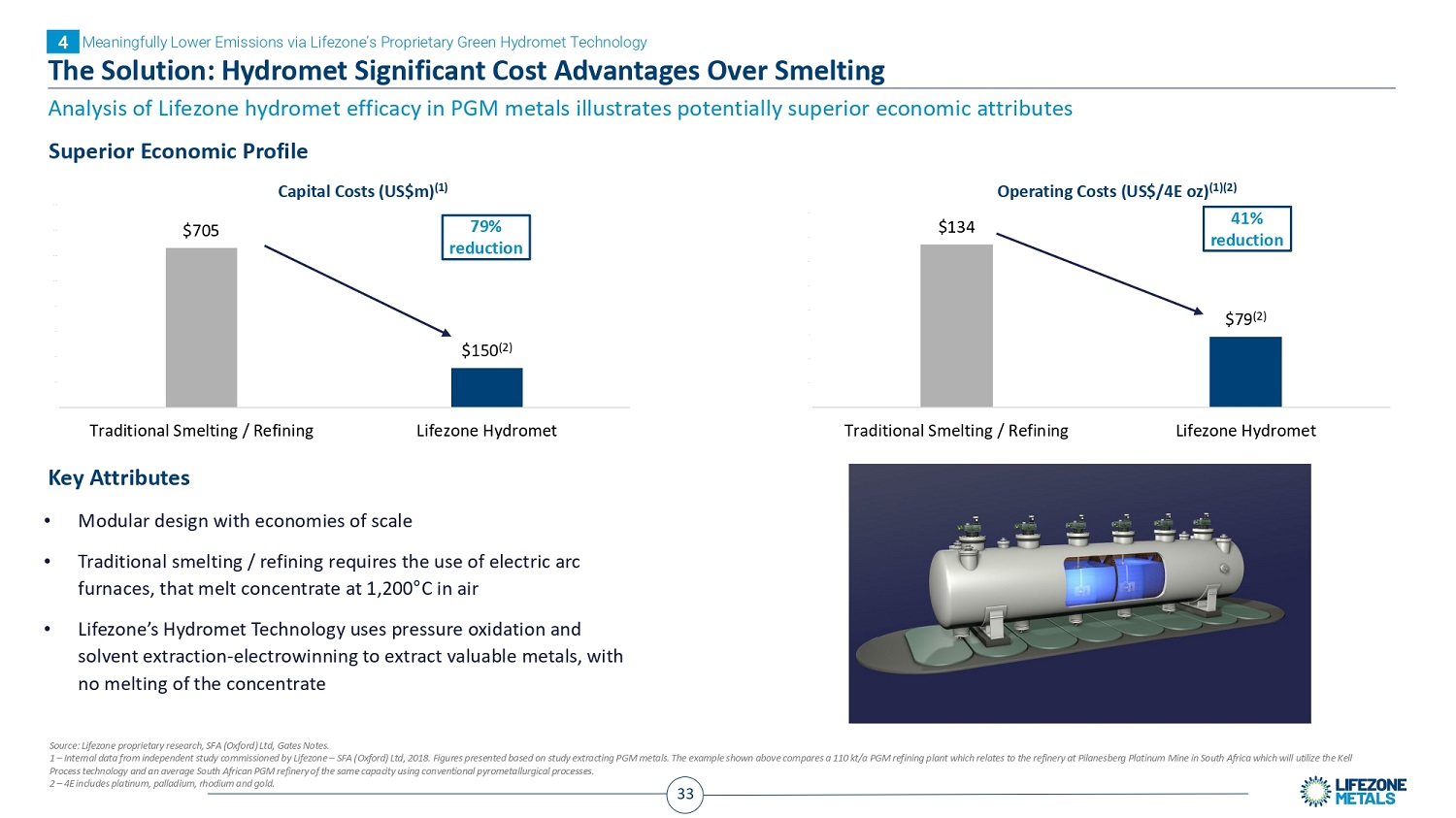

1 – Bespoke Nickel Market Outlook for Lifezone, a product of Wood Mackenzie, August 2022. The population is based on Wood Mackenzie's view on which current operations will be in production by 2030 and their base case projects. The estimates for Kabanga are based on a mine size of 2.2 Mt/a. The data for nickel production is taken through to a finished product and accordingly includes certain Scope 3 emissions to allow for comparisons between various kinds of operations. Analysis assumes 2.2 Mt/a mine size. 2 – Project will utilize power supplied by a combination of grid power from first production and will aim to maximize use of hydro and renewables to mine and refinery sites. Kabanga Weighted Average 28 t CO 2 e/t NiEq 0 0 20 40 60 Production (cumulative centile) 80 100 25 50 75 100 Emissions (t CO2e/t Nieq) One of the World's Largest & Highest - Grade Undeveloped Nickel Sulphide Deposits 2 Advantaged Carbon Footprint Towards Bottom Of Carbon Curve Kabanga is forecast to be one of the cleanest nickel projects in the world Key Drivers of Kabanga Nickel’s Advantaged Emissions Profile ▪ Kabanga’s higher nickel grade has the potential to significantly reduce CO 2 footprint ▪ Hydromet refining significantly reduces CO 2 footprint vs. smelting ▪ Integrated plan and in - country beneficiation reduces transportation and CO 2 footprint ▪ Renewable power (2) 2030 Nickel CO 2 e Emissions Curve (1) 23