Filed by Lifezone Metals Limited

pursuant to Rule 425 under the Securities Act of 1933

and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934

Subject Companies: GoGreen Investments Corporation

Commission File No. 001-40941

The following is a transcript of a webcast recording that includes speakers from Lifezone Holdings Limited (“Lifezone Metals”) and GoGreen Investments Corporation (“GoGreen”) and a copy of the slide deck presentation that have been made available to the public.

SPEAKERS:

Keith Liddell

Lifezone Metals; Chairman

Chris Showalter

Lifezone Metals; CEO

John Dowd

GoGreen Investments; CEO

Mike Adams

Lifezone Metals; Chief Technology Officer

Natasha Liddell

Lifezone Metals; EVP ESG

Gerick Mouton

Lifezone Metals; Chief Operating Officer

Anthony von Christierson

Lifezone Metals; VP Commercial & Business Development

PRESENTATION:

Keith Liddell^ Welcome, everyone, and thank you for joining our webinar. I’m Keith Liddell, the Chair and Founder of Lifezone Metals.

Lifezone Metals is the most exciting company I’ve ever been involved in. And I’m delighted to introduce you to the company, and to our outstanding team. We are truly a global business, as you can see by the nature of this event. In a moment, I’ll hand over to Chris Showalter, our CEO, followed by members of the executive team to take you through the details of the company. But first, I want to look at why it’s so important to build and support a business like Lifezone Metals. And why right now is the perfect moment to do so.

I’ll begin by setting out the vision behind Lifezone Metals, and why I began this incredible journey all those years ago. Then I look at the nature of the challenge that Lifezone Metals is designed to meet and how we created the mission that’s driving the business. And then finally, I’ll explain how we set about bringing together the team, embedding the values and assets that I believe give us the best chance of success.

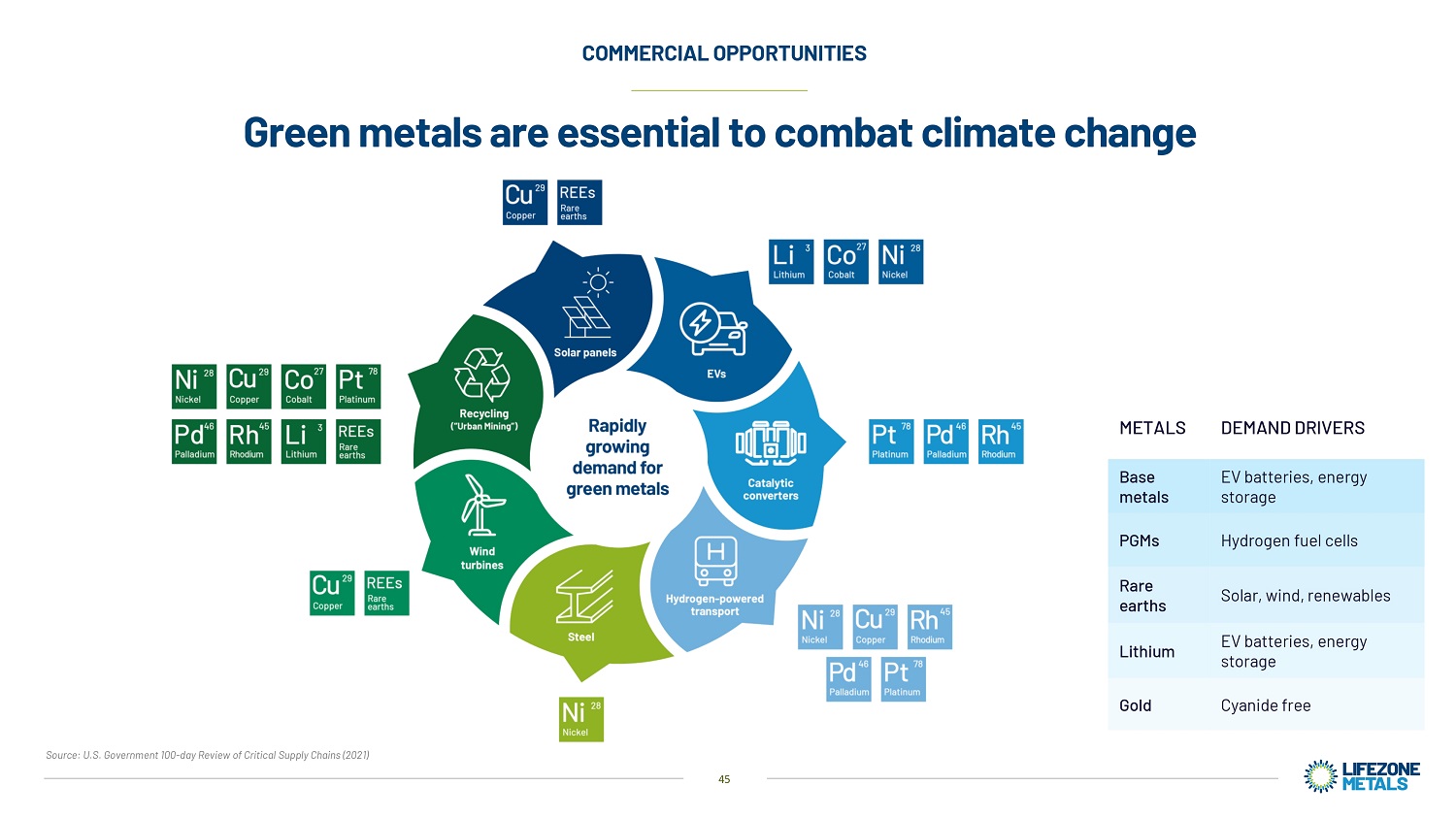

Lifezone Metals exist because we set out to build a new type of company to responsibly source the metals the world needs. The need for clean energy, this delivery and storage becomes clearer all the time, most especially in the transport sector. But as a problem, there are critical metals making up the key components in electric vehicle batteries and sourcing them is currently heavily reliant on smelting and other energy intensive processes.

Smelting is one of the biggest contributors to toxic emissions, greenhouse gases, and energy wasted in the whole energy storage value chain. It’s also expensive, especially when attempts are made to pair it with renewable electricity. And it’s a major problem that’s derailing the clean energy transition. You can’t call something clean if it’s made of dirty components. That’s just shifting pollution from one place to another, but still putting out the same pollutants on a global basis.

Throughout almost half a century working in the metals and mining sectors, as an engineer, innovator and investor, I’ve always wanted to find a way to replace smelting. And with my colleague, Mike Adams, we’ve spent around 30 years developing a hydrometallurgy process that we believe could provide a better way forward to produce cleaner energy, metals. And Lifezone Metals is a vehicle by which we want to bring this opportunity to the world.

Why the name Lifezone, you may ask? Well, we only have one planet Earth, and it’s our fragile life zone. Just look at our planet from space, the atmosphere we are destroying can hardly be seen. It’s so thin. It’s protecting humankind from oblivion. And it’s under threat from climate change and carbon emissions. So, the metals extraction and production industry has to be part of the solution. To save this fragile life zone of ours. Our business is here to make its contribution to that solution. It’s in our name. It’s in our mission, and it’s in our people.

In my career, I built nine mines and process plants as an engineer, investor, director and operator. Since the Iron Age, humanity has and will continue to need metals. But now there’s little choice. We’re out of time, these metals must be clean. But it’s appointed by an electric vehicle that has a battery mode from metals that have massive carbon footprints. It was back in 1996 that I first recognized that hydrometallurgy could be the way to replace traditional smelting.

2

For over 20 years, we have tested and improved airflow sheets thoroughly as possible to make the case. We worked with both precious and base metals to test their methods and optimize the processes. But we decided what we needed was to get the best possible project to demonstrate the suitability of our ideas.

So, when we came across Kabanga we knew we had the perfect opportunity to show how Hydromet can unlock an asset where others have spent decades and hundreds of millions of dollars without finding a viable solution. The geography and economics of smelting with a problem. With our technology we take smelting out of the picture and make a bangle work with our hydro mentality instead.

And another solution is the net zero puzzle is recycling. However, again, this uses smelting in most cases. So, we see it is another opportunity for Lifezone supplier Hydromet technology instead. This is the driving force behind Lifezone Metals. The combination of deep commercial and product execution experience, coupled with strong IP, applied to support the decarbonization of our economies. And we believe it’s a winning proposition.

Talking about people. I’ve worked with some of my colleagues in Lifezone Metals for many years now. And to build the team further, we pursued a thorough process to find the best people. And you will hear from some of them in this webcast. Our Lifezone team has decades of experience building an operating metals extraction operations, and designing process solutions, playing and winning in the industry. We have a phenomenal set of backers with vast knowledge of the Energy and Resources sectors. We have great partners, both on the industry side with BHP and in country with the government of Tanzania.

Finally, critically, we have GoGreen. More than just colleagues, John Dowd and his team have a proven track record of value creation. With them on board, I finally feel that we’re ready to take Lifezone to the next level, we’re ready for a new life as a listed company. Of course, there are no guarantees when it comes to building a business ready to deliver in this industry, I’m more excited about this one and I’ve ever been.

In conclusion, let me recap what I said at the start. Lifezone Metals is by far the most exciting venture I’ve been involved with my whole career. I believe we have the best technology, the best partners, and the best asset to deliver a globally effective solution to transform the supply chain for EV batteries, and potentially the way the world sources metals everywhere. We’re coming to market at just the right time. And as you will hear the industry is at an inflection point. At the precise moment, the world who will need much more clean nickel, we are on hand to provide it.

Finally, and importantly, we have a fantastic team to deliver on our plans. This is our future. This is our Lifezone.

3

I’ll now hand over to Chris Showalter, our CEO, who will introduce you to the rest of the team and talk you through the key elements of our presentation. Thank you for joining us today and enjoy the presentation.

Chris Showalter^ Thanks, Keith. Hello to everyone. And thank you for joining us today. My name is Chris Showalter. I’m the CEO of Lifezone Metals. It’s a pleasure to be presenting to you today.

Shortly you will hear from our executive team as they will bring you details on the key elements that make up our business model, our investment case, and the operational and strategic rationale that we believe puts us in the important position to help clean up the supply metals to the EV battery market.

As CEO, I feel generally privileged to lead this business. Not only because the role itself is so wide ranging and brings me into contact with such amazing people. But also, because it allows me to see up close how we can change the world for the better. I’m also very proud of the team we have assembled that Lifezone. Collectively, these are exceptional people with decades of experience. They’re all leaders in the fields. And we’ve built the right team with the right technology to contribute positively now. The timing aspect for me is most important. I believe this is a business that provides solutions today to a transforming sector.

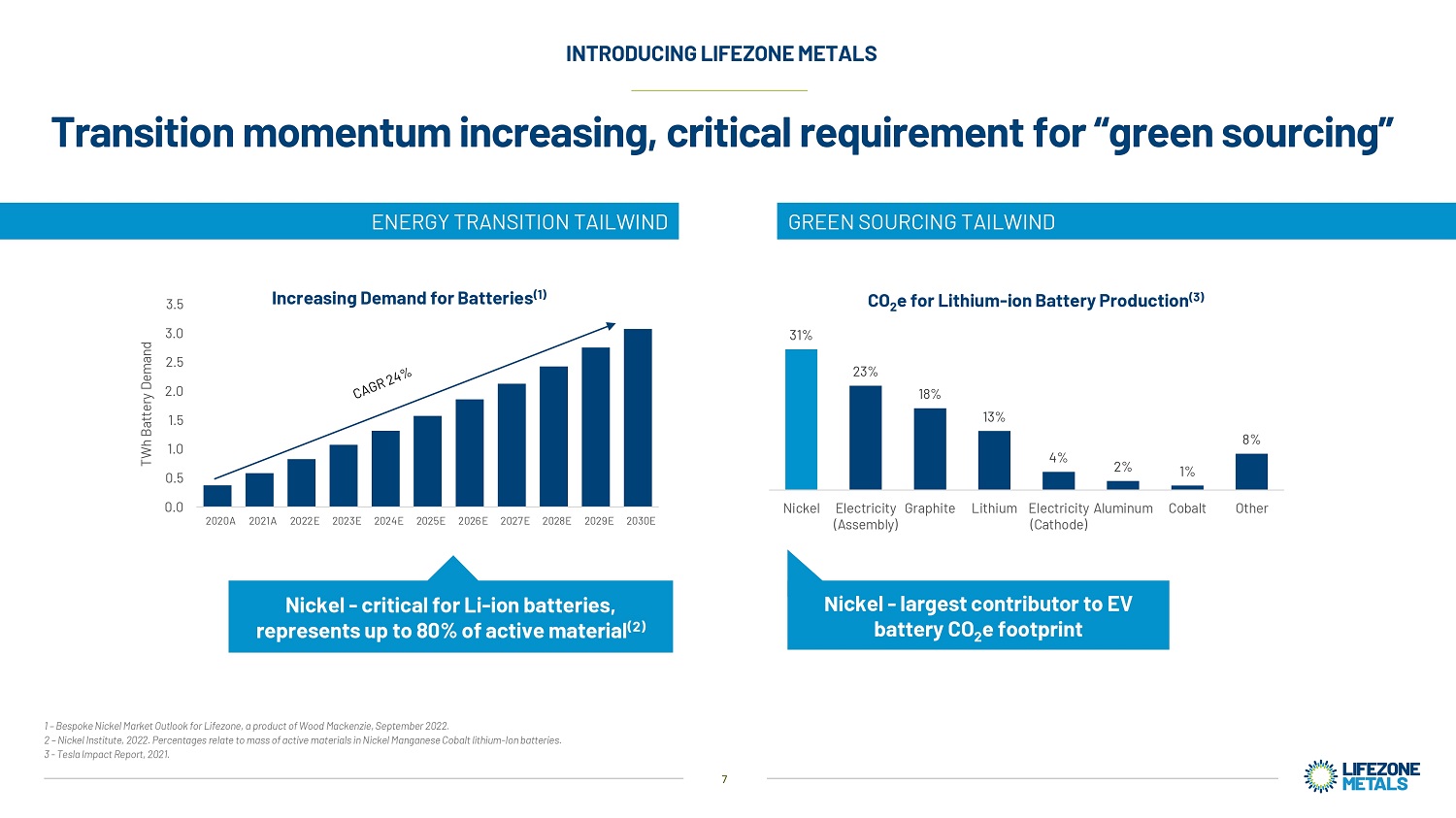

So, let’s discuss this energy revolution. The world is moving towards electric at an ever-expanding rate. The International Energy Agency recently said almost one in five cars sold worldwide in 2023 will be electric. This is almost five times the amount sold three years ago. We all know this. These are all the facts. And all those electric cars need batteries. Industry estimates -- estimates say demand for batteries could increase a fool by 2030 from just 2020.

But there’s a challenge, forecasts suggest there’s a deficit in supply of critical materials for those batteries. And on top of that we currently have to use smelting to extract the metals we need. Smelting is a major source of emissions. And we believe automakers and original equipment manufacturers, or OEMs are increasingly going to demand cleaner metals in their supply chains. Let me show you what I mean and why we believe clean nickel should command a meaningful premium.

The big issue with nickel is that it makes up a huge percentage of the carbon contribution of battery manufacturing. So, for instance, Tesla has been public instead it’s the biggest single source critic almost one-third of the estimated CO2 emissions. And if you look at the chart here, you can see that nickel comprises 80% of the active material and the lithium-ion battery. That’s very important because we’re talking about one of the most important materials in the whole EV battery manufacturing industry being among the dirtiest. And at a time when we are at the start of a projected major growth cycle, as you can see from the estimates in this chart, imagine if there was a way to address this for automakers. A clean solution to provide cleaner metals. We believe there is, and we believe Lifezone is providing that.

4

Not only the resource in the form of Kabanga, which we believe is one of the world’s largest undeveloped nickel sulfide deposits, but also the technology to unlock it in a cleaner, more sustainable way. This is why I believe we have the right solution at the right time, a solution that can transform not just the world’s nickel supply, but potentially the way we source metals on a global scale. Throughout history, toxic smelting has been the default way to extract metals from rock. But as you can see here, it comes with multiple negative outcomes.

According to some sources, global smelting operations contribute up to 7% of the world’s greenhouse gas emissions. And that’s just staggering if you think about that. Transporting this material also cost both the mining industry, but society as a whole as materials are shipped across the world to smelters, and then on to other refineries. We believe smelting could end and that has to happen now. And we can provide that solution.

So today, we are seeing an alignment between our offering and technology, and a global demand for battery metals. We believe that this is a critical time in the green energy transition, and especially in the electric vehicle revolution. Demand for nickel, more specifically, clean nickel, as we’ve stated, is poised for a major shift. And as you can see, we have built Lifezone Metals to feature two major elements that we believe can help unlock the production and supply bottleneck in the supply chain.

We believe our business is designed to play right into the structural shift at work in the global economy. And the way our industry plays its part in that new economy. That technology has the potential to go even further. Our Chief Technology Officer, Dr. Mike Adams, will run you through how our Hydromet technology works in a few moments. So, I’ll leave that to Mike to explain in detail.

But suffice to say this technology is a result of decades of work. And so now is the time to set this in motion. And our Chief Operating Officer, Gerick Mouton is poised to talk you through the details of the Kabanga nickel mine, and the Kahama clean metals refinery in Tanzania.

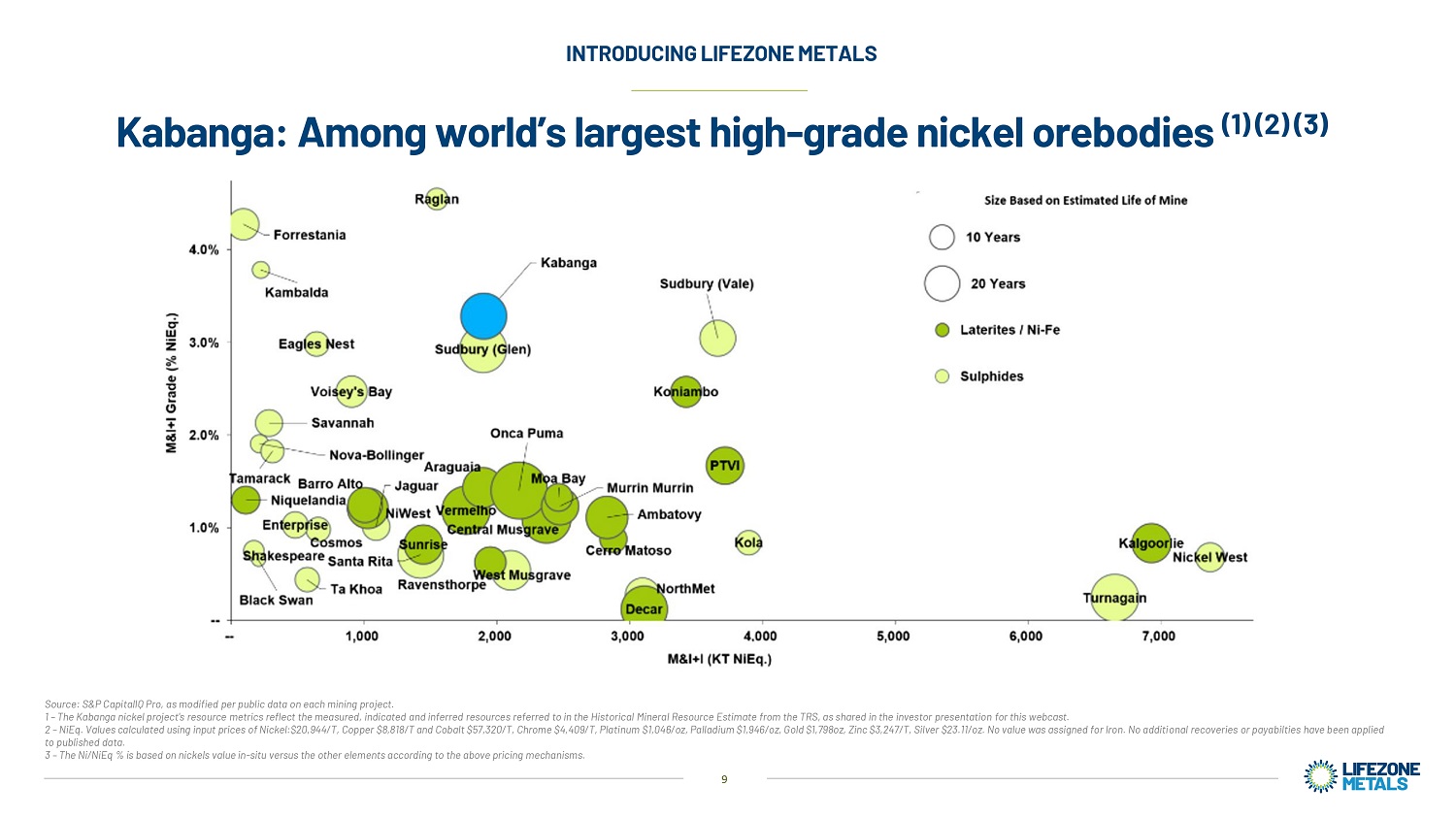

But first, I want to give you a little context around why we are so optimistic about this project. This graphic illustrates where Kabanga sits in the hierarchy of other nickel projects in terms of its grade and size.

It’s important to emphasize for those that don’t know already know this, nickel sulfide is the superior option. Laterites are more expensive to process because they’re harder to process chemically. That’s why sulfides are preferred and carry a premium. I should further highlight that some of these lower grade deposits are still very much in pre-exploration phases, compared to work Kabanga where we are well into the definitive feasibility study phase.

So, for us at Kabanga, we believe our nickels cleaner, has the higher grades suited for battery makers and we are developing ready, meaning we can deliver new sulfide supply the quickest. This is a significant new source of cleaner metals ready to help alleviate a critical shortage.

5

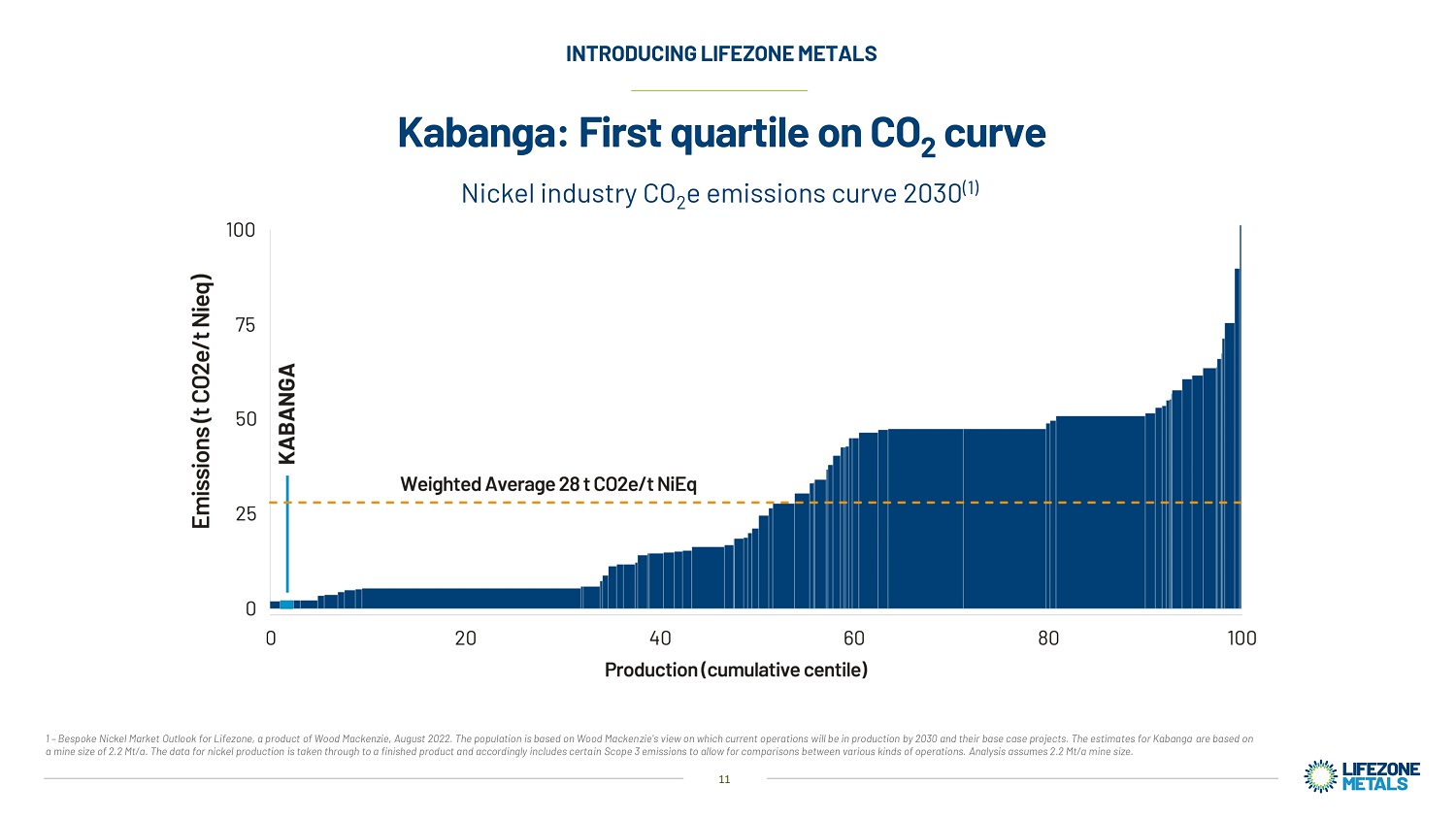

What I want to explain here supports our view that this is the right solution to unlock the right asset at the right time. These charts show you how to -- how the cost curve and the carbon curve look as we roll out towards 2030 given the current estimates. You can see the Kabanga’s positioned all the way to the left-hand side on both of these curves. This is one of the reasons why Kabanga is so attractive to a major like BHP whose portfolio was built with footholds in the lowest quartile across commodities. The point is we believe we are in one of the best economic positions to deliver cleaner nickel. And that’s what we believe the OEMs are going to need. Not only do they need it, they’re going to demand it.

We will have a short film to give you an idea of how our Hydromet technology can work, to realize this low carbon advantage. It’s not just about building the right business model. We know we need to operate to the very highest standards. We believe that no business especially in the metals and mining sector can thrive; that doesn’t take proper care of the people, the communities and the environment where it operates. That’s why partnership is one of the cornerstones of our business. We have developed a vital relationship with the government of Tanzania through our partnership in the Kabanga Nickel Project.

President Samia Suluhu Hassan has made mining a key development priority for her country. She is granted new mining licenses and is truly seated in an environment of partnership and collaboration, that she’s demonstrated that to the world. I personally spent a long time going right back to working through the challenges of the pandemic, to make sure that this Tanzania partnership model was conducive to foreign investment. So, we are a big demonstration of the future of this space in Tanzania.

This is a unique arrangement with not just shared equity, but a shared vision, one that will create skills jobs, and we believe in time a world class energy metals hub for the East African region. It is our firm belief that the world is noticing Tanzania. Key influencers of investor sentiment like Moody’s have already started to take a different view of Tanzania by recently upgrading. We also recently saw us vice president Kamala Harris, make a point of visiting President Hassan to strengthen ties and underline the White House’s commitment to the region. But the Vice President’s specifically acknowledged the vision for local beneficiation of critical metals, so that they happen in Tanzania for Tanzanians.

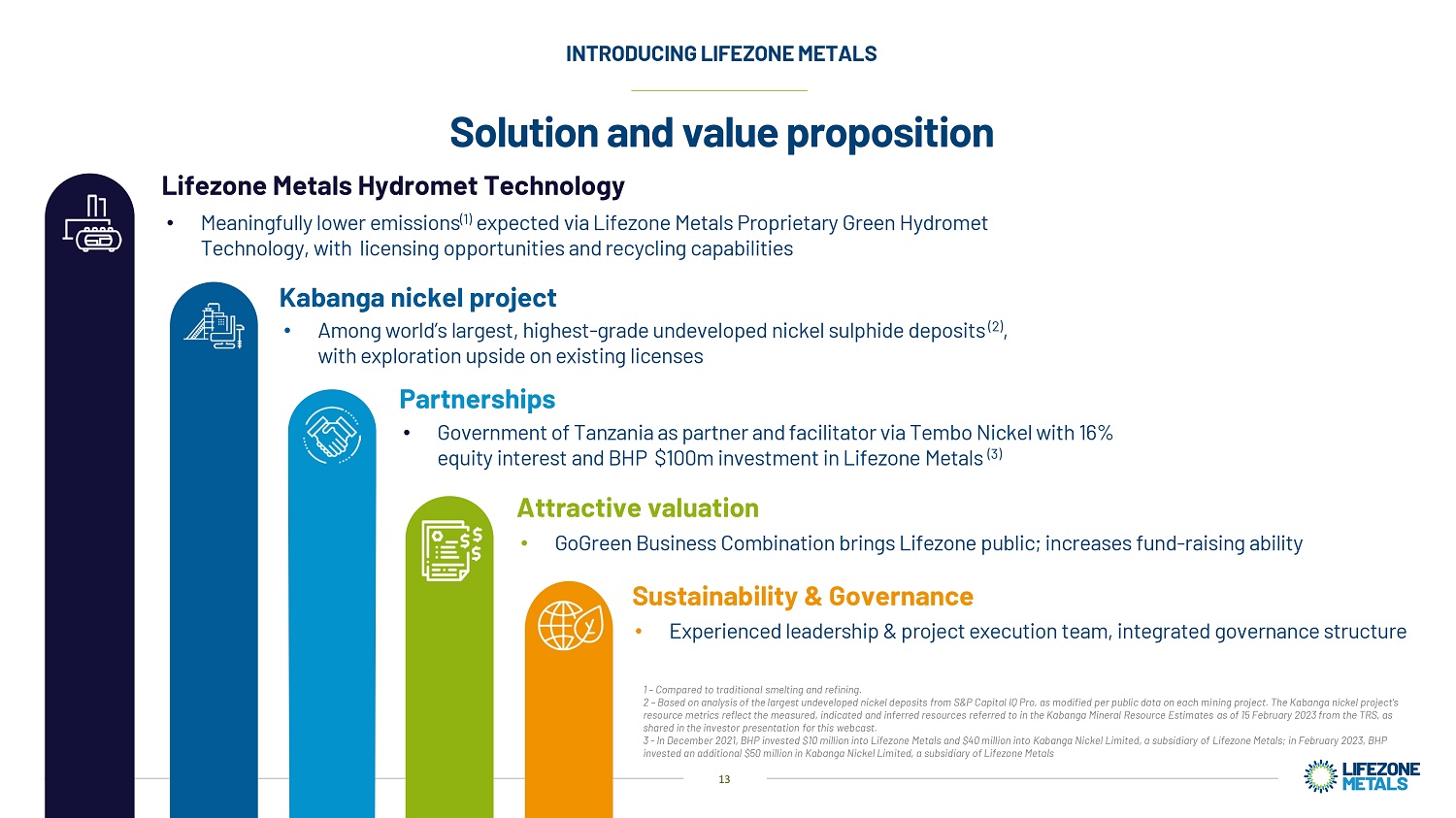

So let me summarize why believe Lifezone Metals presents an exceptional value proposition supported by excellent solutions. We have developed a proprietary technology that has the potential to reduce emissions and metal production by meaningful amounts. This technology is ready to deploy in our own projects, and we can license it for production in other metal projects around the world and for the recycling industries.

We have demonstrated how the technology has allowed us to unlock the latent potential of the Kabanga Nickel Project. This can provide a huge source of nickel at a time when nickel is a critical metal or the green energy transition. Our strategic partners bring us the complementary skills, support and best practices that we plan to embed as a core part of our business model going forward. I just outlined how closely we work with the government of Tanzania. And we expect these govern relationships will absolutely form a cornerstone of our culture going forward.

6

Now on the industry side, we benefit from our relationship with BHP who have already committed 100 million to Lifezone and Kabanga. Our focus is long term value creation. We have the backing of investment experts. And this is why I look forward to a future where we can be a public company, made possible through our business combination with GoGreen. The next you will hear from John Dowd, CEO of GoGreen Investments, who will explain the process and the rationale for our listing on the New York Stock Exchange.

Finally, and crucially, as Keith said out, we cannot build a company in its 21st century without the strongest possible values. And with all stakeholders in mind, we believe it is imperative that sustainability is not only at the heart of our technology, but at the heart of our business, and embedded as part of our governance structure and operations.

Our Chief Sustainability Officer Natasha Liddell will share more on sustainability, and our ESG frameworks in principle, and in practice. Thanks again for watching. And please remember, we added a Q&A at the end, based around the most frequently asked questions from investors.

And in conclusion, I would like to leave you with these thoughts. Lifezone Metals is closely aligned to the green energy transition by providing solutions, new sources of critical metals, combined with clean processing technology. We believe our pipeline is robust, and our outline the latest updates at the end of this presentation. We have huge depth of experience across our team, as you will see. We believe we have the right technology, the right resource, the right partners, and it is the right time to deliver as the world looks to transition to cleaner, greener energy.

Thank you. And over to you John.

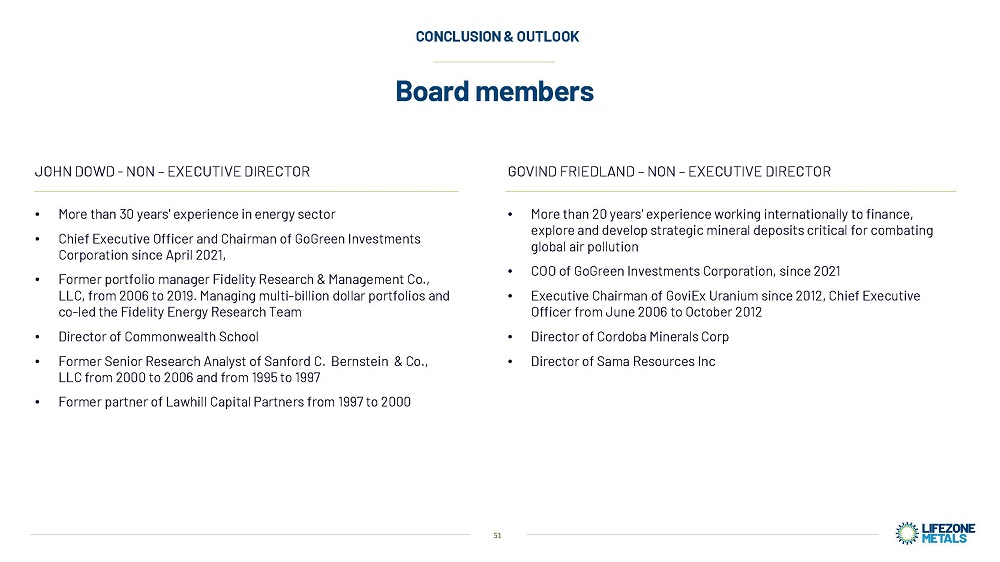

John Dowd^ Hello, my name is John Dowd and I’m the CEO of GoGreen Investments. GoGreen is the SPAC working to bring Lifezone Metals public and increase their access to funds. The SPAC itself has over $291 million of cash and trust. In addition, before announcing the transact -- transaction, we secured 70 million in pipe capital at $10 per share. GoGreen is a group of experienced professionals that we brought together from the finance, mining, oil and gas, wind, and solar businesses.

In aggregate together with our Board, were comprised of eight former CEOs, a COO, and the former assistant secretary of the U.S. Navy. The goal was to bring more than just cash to the transaction, but also the benefits of our experience and networks. Both Govind Friedland and I will join the board of Lifezone Metals upon completion of the deal. In terms of timing, we expect the deal to close by July.

7

We were attracted to Lifezone for a multitude of reasons highlighted on this page. But Lifezone was by no means the only company that we looked at. In aggregate, we evaluated over 100 companies and signed over 35 NDAs in our search for the most compelling company to bring to market. The stock market has clearly been challenged over the past two years.

However, in our view, not all SPAC are created equal. Our early research into the SPAC space led us to believe that SPAC that merge with companies that have assets or cashflow that could be used as collateral and support debt tended to work better. We also believed that endorsement in the form of a major investment by a leader in the industry was critical. BHPs partnership is important.

As we progressed our research and opportunity became clear in the mining space. I think Wall Street has raised over $100 billion for electric vehicles and batteries, but very little for the mining space. I believe the biggest misconception out there is that we can achieve the energy transition without a significant increase in mining activity.

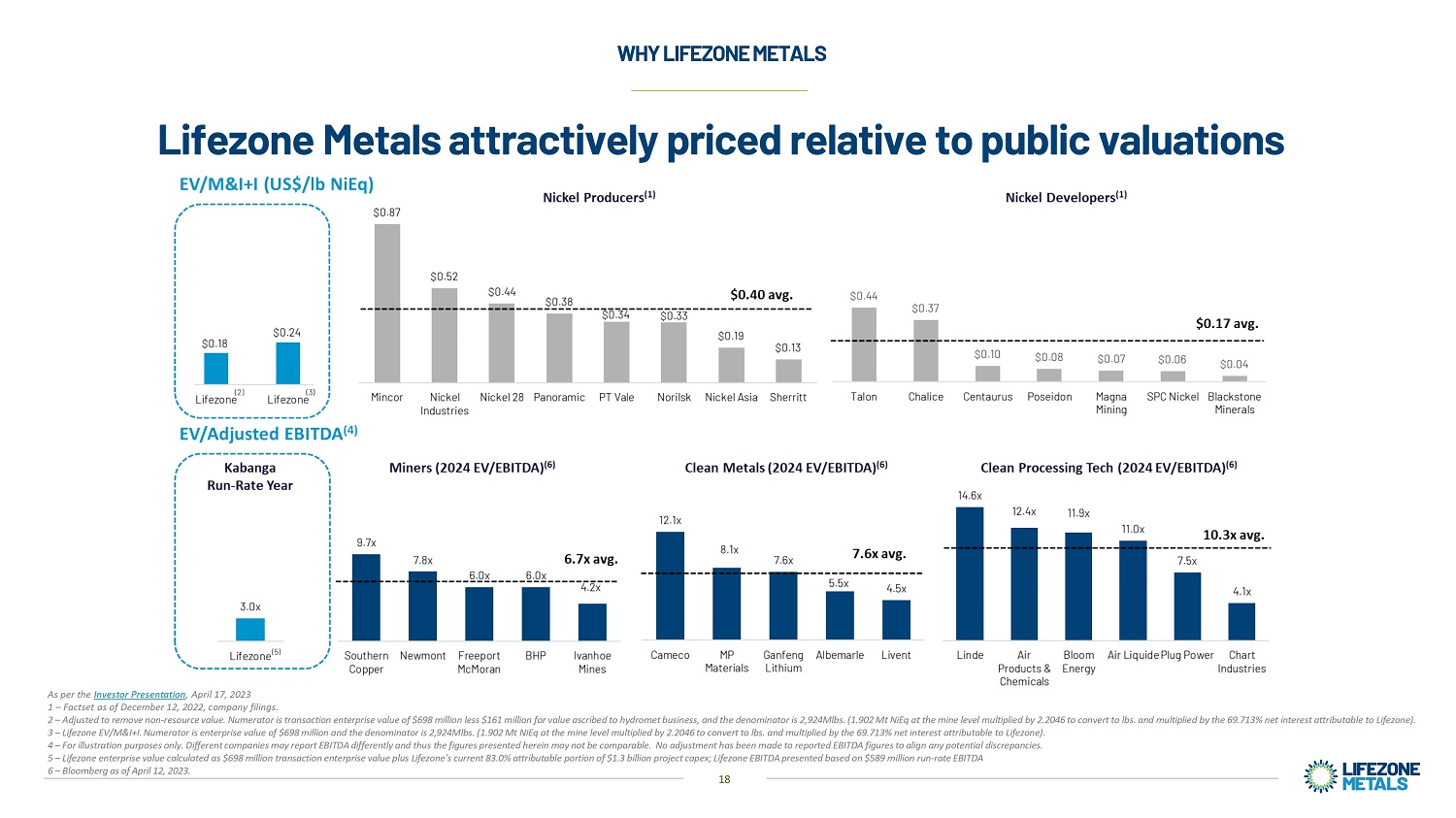

Lifezone Metals is our attempt to bring to market a company that will resonate with buyside investors. I spent 14 years at Fidelity managing money in the natural resources and energy space. Michael Sedoy, our CFO has 20 years of experience on the buyside. This is essentially a transaction designed by portfolio managers for portfolio managers. The company has a controlling interest in what we believe, is one of the largest highest grade development ready nickel sulfide projects that according to Wood Mac should sit near the low end of the cost curve.

We believe Lifezone will be one of the only pure play nickel companies listed on the NYSE providing liquidity to portfolio managers interested in investing in an emerging theme. There is a clear tailwind with visibility into demand for clean metals for the green transition -- transition. This demand for clean metals stands in stark contrast to the supply up book.

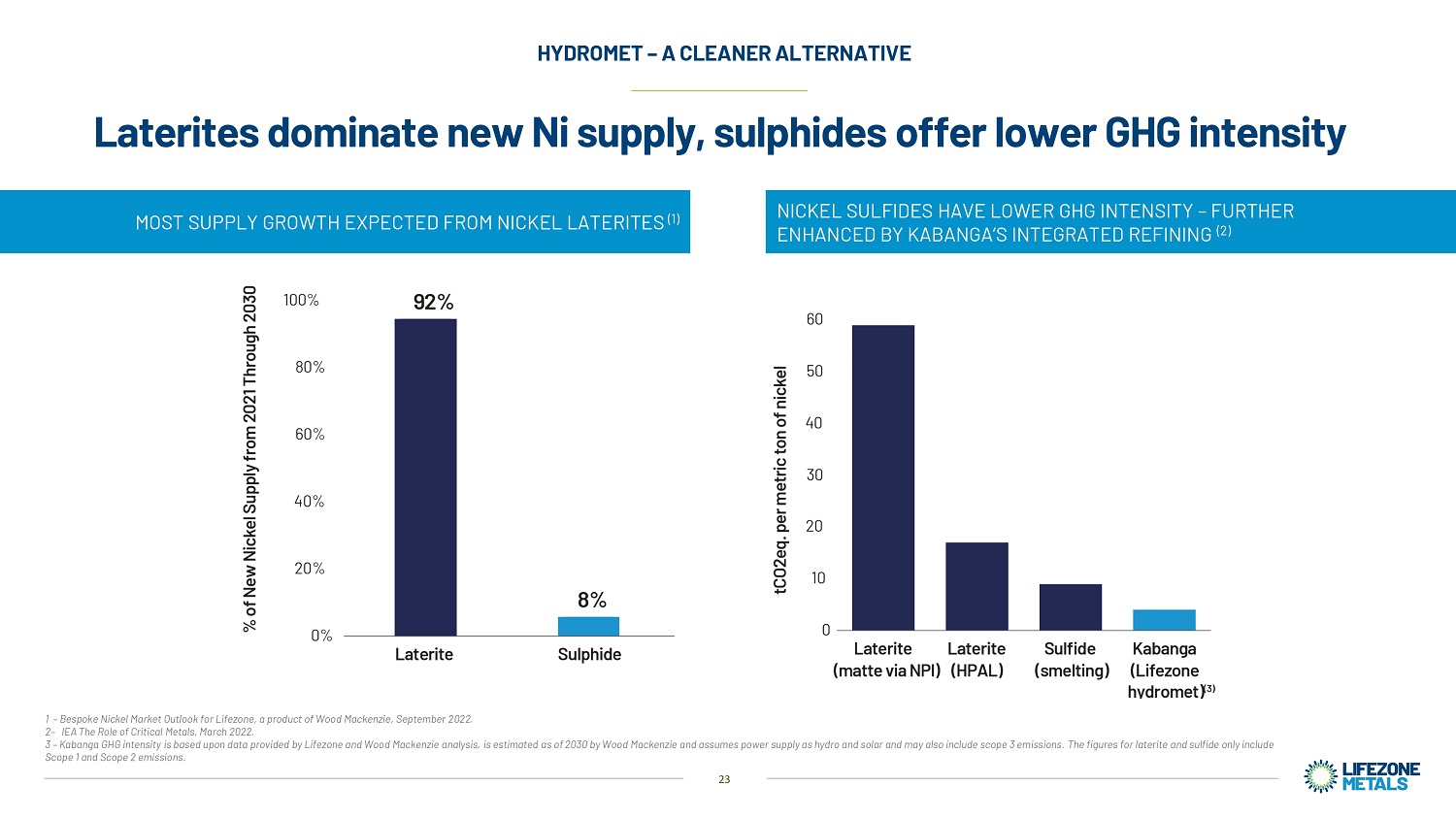

As most of the of the nickel supply growth is expected to come from laterite projects, which are typically higher polluting. There’s optionality to the upside as there are potential opportunities to either license the Hydromet technology to others or to commercialize other stranded assets. One of the most attractive characteristics of this investment to me is that we are bringing this to market at an attractive valuation. This is not an investment in my opinion that requires high or rising nickel prices in order to succeed.

On my last slide, let me elaborate on the valuation. This page presents the 2024 EBITDA numbers from Bloomberg for the other mining companies listed in our marketing deck. In general, mining companies with longer asset lives trade at higher EV to EBITDA multiples. This makes sense. And it’s just another way of saying that producing mining companies traded in line with NAV. We also present where Lifezone Metals would be trading, assuming the midpoint of nickel prices, operating costs, capital costs and a 2.2 million ton per year mining plan. Given that the critical permits are in hand, we believe Lifezone Metals offers an attractive valuation and a bet on the management teams and BHPs ability to execute.

8

With that, I’d like to pass the torch to Dr. Mike Adams. Thank you.

Mike Adams^ Hello, everyone. I’m Mike Adams, Lifezone Metals’ Chief Technology Officer. I’d like to talk you through how we use hydrometallurgy, the genesis of our technology and the impact it’s having on our business, as well as the huge potential for the metals extract to have and recycling industries. I’ve been working in the metallurgical engineering space for over 40 years. And for the last 10 years I’ve focused on the development and implementation, and commercialization of Lifezone technology. More specifically in the recovery of PGMs, goal, base, and rare metals. You’ve already heard that we have proprietary technology in this space. But before I get into some specifics, we felt it would be helpful to make a short film to set the scene for you.

Unidentified Speaker^ Tackling climate change is one of the greatest challenges facing planet Earth. The world is racing against time to achieve net zero carbon via the clean energy transition. As we move from the fossil fuel era to the electronic age, we need significantly larger amounts of the critical minerals that power electric vehicles and renewable energy infrastructure. Batteries need nickel, lithium, cobalt, and copper metals among other key minerals.

We believe we need to source these products quickly and responsibly. The problem is metals in this value chain are largely extracted by traditional smelting, which emits high levels of both carbon and sulfur-based pollution. Smelting involves concentrate containing the metal compounds being processed and refined at very high temperatures until the final metal products can be produced. Further emissions are released when the order is shipped from the mind to a smelter, then on to refining hubs. Traditional smelting is an ancient technique going back thousands of years; it’s time to change to a more planet friendly technology.

We believe Lifezone Metals hydrometallurgy technology is one solution that could decrease reliance upon traditional smelting and reduce emissions. We have spent decades designing and developing our proprietary processes, and we hold a portfolio of patents around the world related to the Lifezone Metals Hydromet technology. The Lifezone Metals Hydromet technology is unique in its approach to sequential unlocking of the value metals from the waste materials. Key to unlocking the value metals is our use of autoclave technology.

After the ore is processed by conventional milling and flotation, the concentrate is passed through a series of hydrometallurgical processes to separate refined metals from the waste. We are able to process the concentrate under total oxidation conditions, typically recovering over 95% of the metals to solution and converting the sulfur instead of emitting it as sulfur dioxide to the atmosphere.

9

Typically, we can extract the value metals from the raw concentrate after a period of only 60 minutes, with an overall processing time to refined metal products of around two weeks. This compares with a typical smelting timeline of months to ship concentrate tens of thousands of miles around the world, contributing to even more transport related carbon emissions. And we can refine far closer to the source. We plan to work with several partners to build Hydromet plans to produce refined products near their source, thereby reducing transportation related emissions.

We believe Lifezone Metals’ Hydromet has the potential to significantly reduce carbon and sulfur dioxide emissions in the processing of battery metals. This means we can produce metals that in comparison with traditional smelting potentially are lower cost cleaner, easily traceable, and faster to reach the market.

We are already advanced in running test work and are exploring potential partnerships all over the world. Our Hydromet process is being investigated by firms working with platinum group metals and nickel. We also own what we believe is one of the world’s largest and highest-grade sources of nickel sulfide, and plan to use Hydromet technology there to produce cleaner nickel for electric vehicle batteries.

We believe this puts Lifezone Metals right at the heart of the clean energy transition. And we won’t stop there. We believe our Hydromet process can be rolled out to other metals. In fact, it’s one of our stated aims as a business to deliver a supply chain solution that could replace traditional smelting completely over time.

In the process, we intend to produce metal ready for use by battery and vehicle manufacturers at a lower cost to customers and the planet, compared to traditional smelting. We believe the world needs us and we are ready. Lifezone Metals, cleaner metals for a greener world.

Mike Adams^ Now I trust that gave you a good indication of how our Hydromet technology works. More importantly, how it can fit into the need for cleaner processing, and why we believe it has such vast potential value. Now let me explain a little more about the work that underpins this potential. And initial point I would like to make is that as a team, Keith Liddell and I have a track record and personal partnership that spans decades, continents and multiple projects.

Now people often say someone wrote the book on a topic when they have achieved a certain level of experience. Well, when it comes to gold ore processing, I actually did write a book. Two books in fact, but it’s not just me and Keith we have strength in depth. Starting with Lisa Smith, our Senior Metallurgist. Lisa oversees all our Kabanga nickel tests work with input into the feasibility study. She’s been with Lifezone for over 10 years, and has deep experience processing all the energy storage metals will recover from Kabanga. She has also worked with precious metals and rare earths.

We’ve built a world class team of people like Lisa, they have a broad range and rich base of engineering, technical and operational expertise. And we’re always on the lookout for ways to augment this team like taking our laboratory facilities in house. I believe we’ve helped develop one of the leading facilities for Hydromet test work and flow sheet definition in the world. And this is anticipated to ramp up to be run by skilled metallurgical engineers and operators for engineers and operators, all by Lifezone. It means we can potentially do test work faster, and for more clients.

10

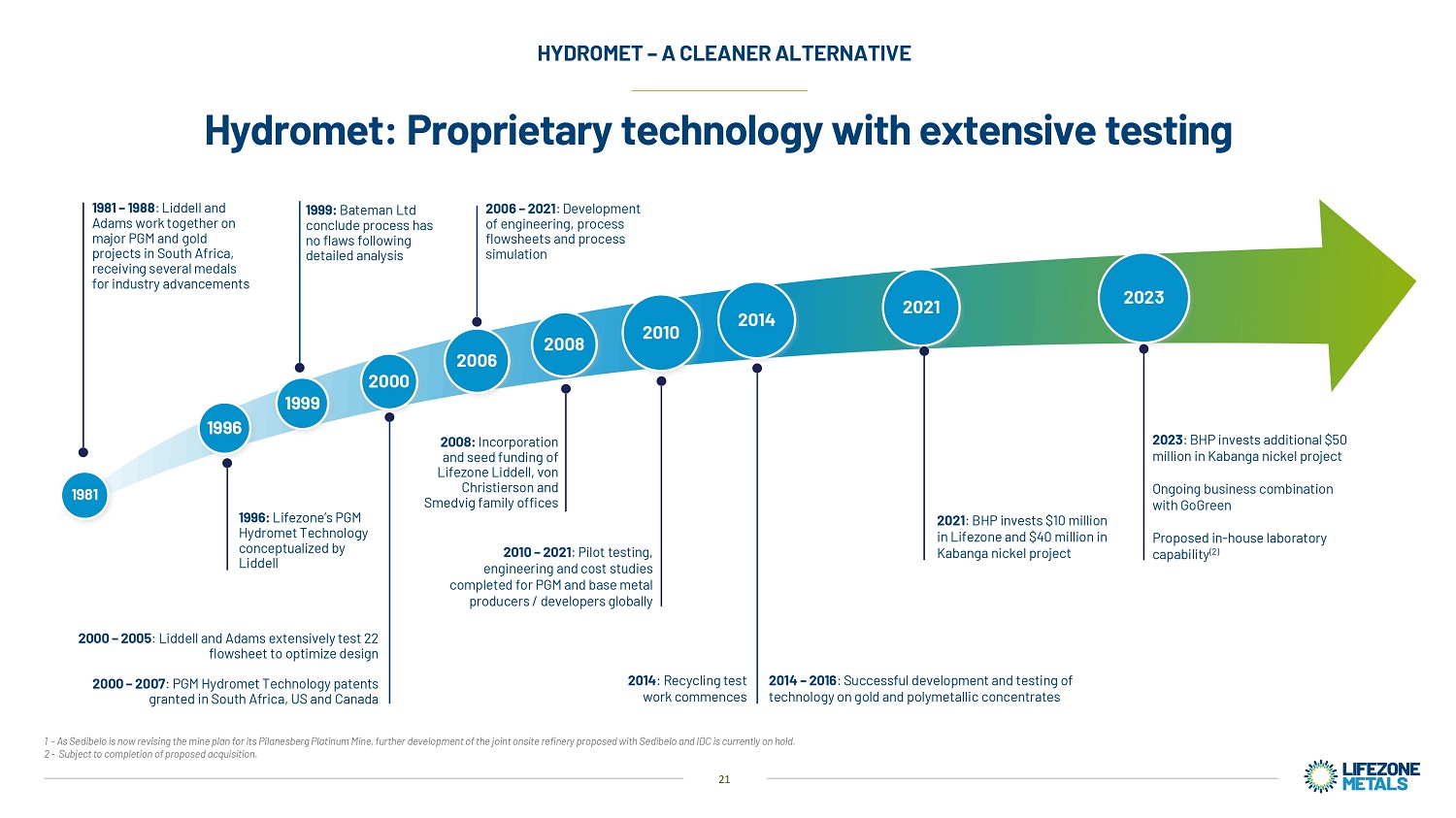

Now, we are working to circumvent the usual timelines for our work on initial scoping and bench testing. And we will work to streamline this over the rest of this year. As you can see from this slide, it’s been a long journey to get to this point. We’ve worked hard to build the case for this technology. And to get it to the advanced stage it’s out today. We’ve refined the flow sheet along the way, working across a range of metals, supported by extensive test work, demonstrating that our technology is robust and highly effective. The point is, we have been working on Hydromet as long as anyone in this industry. In most cases far longer, we have more experienced with more metals, and we are more advanced in derisking and optimizing the process.

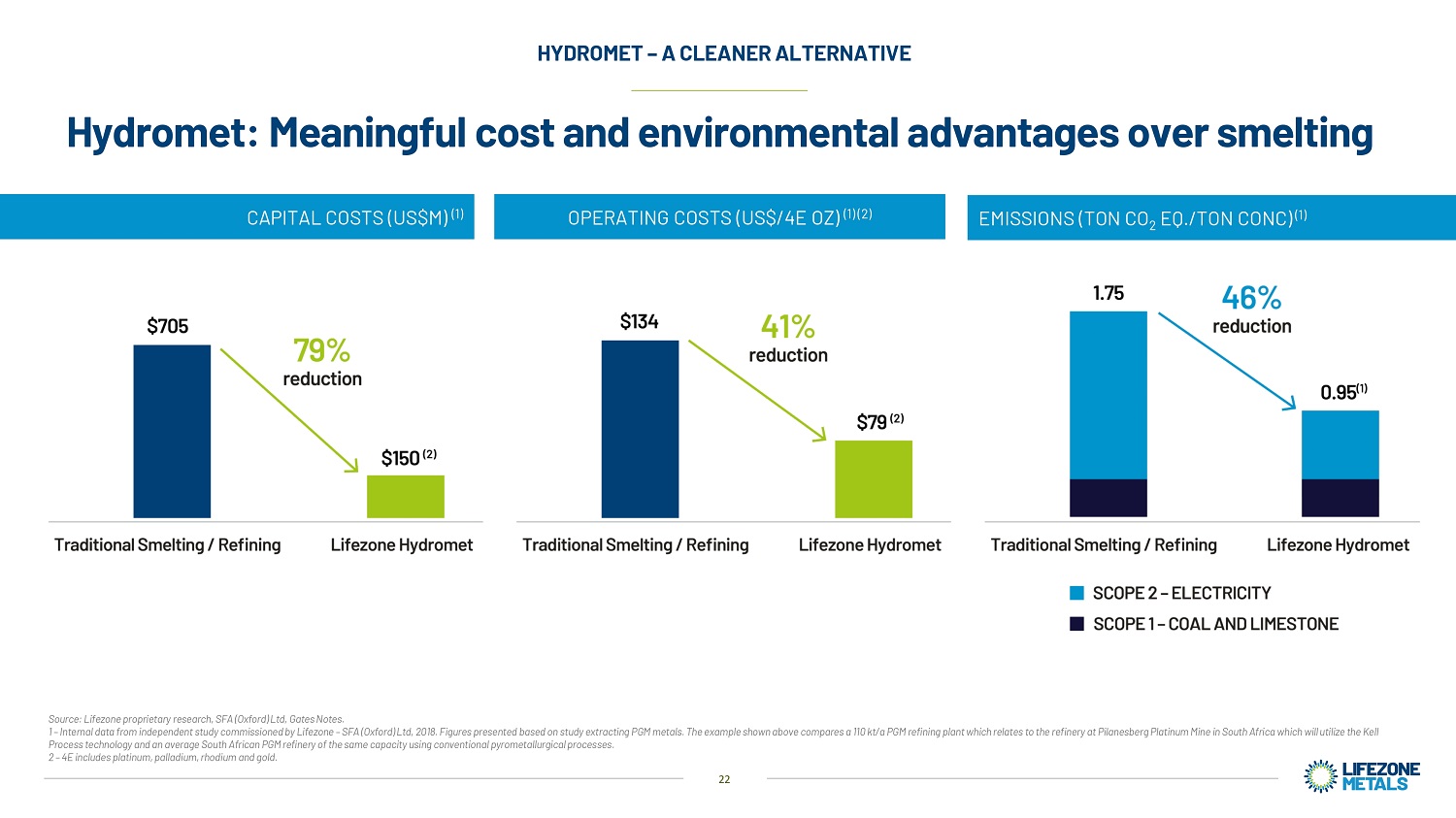

Let me show you what I mean with the example of our proposals for Kabanga nickel. You’ve seen how the technology works through the animation. And you’ve seen how we have taken the critical steps to make sure the test work and flow sheet definition is advancing. Now I can show you why we can both reduce costs and improve environmental performance. These numbers speak for themselves.

From the extensive work we’ve done on PGMs compared to smelting, CapEx has the potential to be reduced by 79% and OpEx by 41%. When it comes to emissions, compared to smelting, Hydromet has the potential to reduce CO2 by as much as 46% according to studies by EY Cova on PGMs. And Kabanga is just the start. There’s every reason to believe that we can take this model into multiple alternatives on a global scale. Whether that’s other base metals or precious and rare metals, providing us with a wealth of potential licensing opportunities.

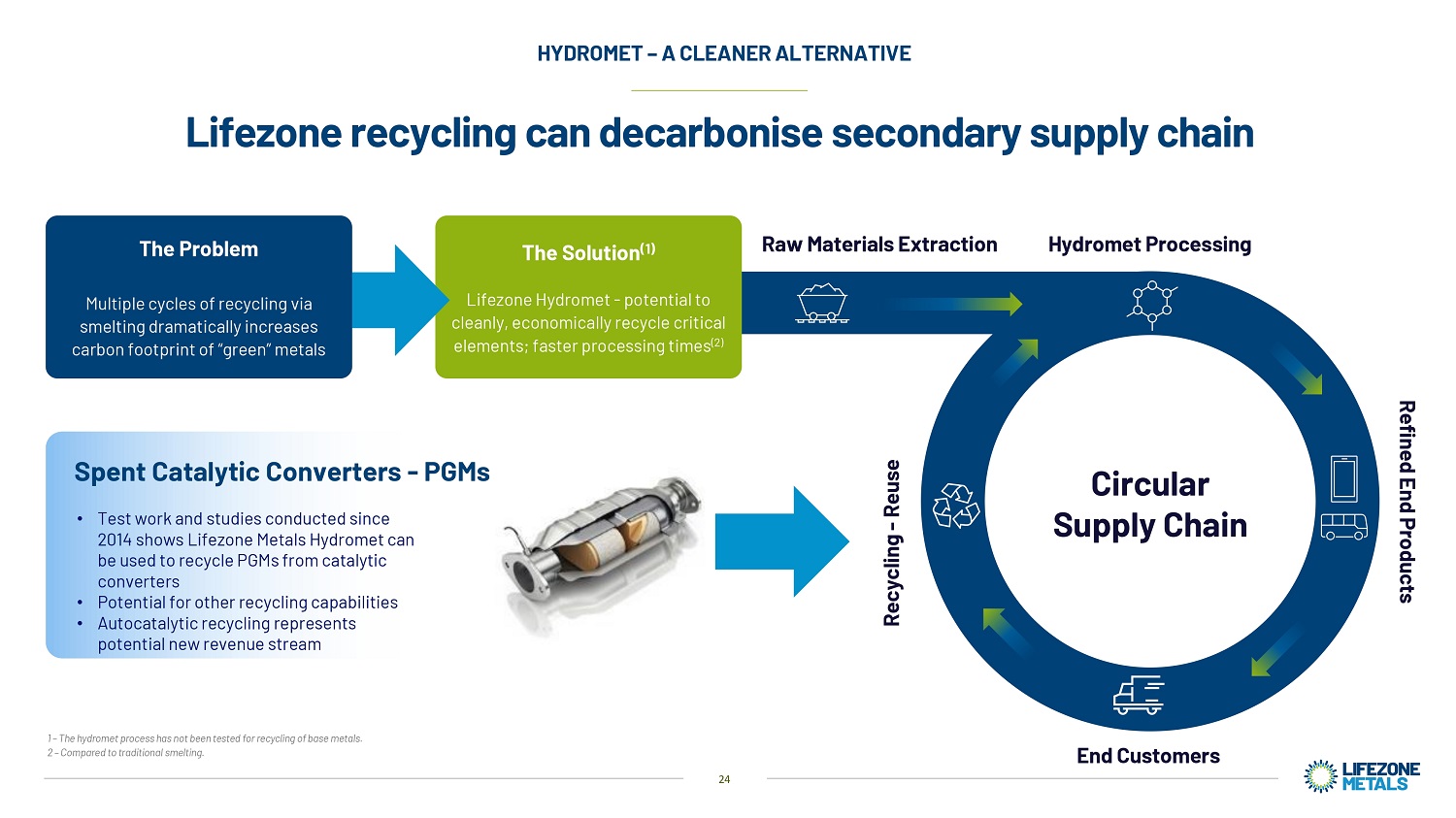

Kabanga nickel shows how we can unlock the intrinsic value in assets that others cannot. There’ll be more to come on the commercial opportunities when Anthony von Christierson gives his presentation later. We believe that this momentum is beginning to build until it reaches a critical mass, and that inflection point is coming near in our view. It’s not just the primary supply chain that benefits from Lifezone Hydromet, our technology can also unlock a more efficient and sustainable recycling model.

The issue is the recycling through smelting increases the carbon footprints of recycled metals due to the high energy demand and the duration of the process. That’s double smelting metals and almost doubling its emissions footprint over lifecycle. Hydromet can handle these critical elements in a cleaner more economical way, processing them faster and using less energy. Our test work from 2014 onwards indicates that Lifezone Hydromet can be used to recycle PGMs from catalytic converters.

To summarize why we are so excited about the potential of our solution. Strategically, as a scalable concept, there are huge advantages with our Hydromet technology. Our unique IP and strong expertise are a key feature of across our technical team. All of us have decades of processing experience. Our model is really driven by the test work from a resource point of view. Our results indicate the Kabanga nickel concentrate is very amenable to processing using our Hydromet technology. Metallurgical test work continues for concentrated confirmation and developments of the refinery flow sheet.

11

But it’s not just what we tell you that matters. Look at what others are saying and doing. Future metals announced that their initial assessments of the Lifezone Hydromet technology suggests that this will be a lower capital flow sheet addition with significant operating and economic benefits depends on PGM projects in Western Australia. Additionally, the opportunities to license and scale our technology are significant and could span sectors.

I’m proud to say I believe that we could not have timed the advance of our Hydromet any better. At a critical time for the mining industry and the planet, we have a solution that will help save and support both into a cleaner, greener future.

Thank you.

Natasha Liddell^ Hello, everyone. I’m Natasha Liddell, Lifezone Metals Chief Sustainability Officer. My role is to ensure Lifezone Metals acts, works, and truly delivers sustainably. My team covers both ESG and communications. How does ESG and communications fit together you may ask? When actions count for more than words.

Today, I’m going to tell you about sustainability in principle and in practice at Lifezone Metals. Let’s take a step back for a second. Sustainability is the driver, the ethics, ESG is the framework and the mechanism. And I think that’s where we’ve changed. Businesses are becoming more conscious. In the last decade, mining companies have stood up and taken safety seriously.

And today, sustainability is driving conscious behaviors to think about how our smallest actions have an impact across a business. I’ve spent all of my career in mining across different disciplines. But throughout each and every one of these disciplines, there has been at least one if not most of the key issues, always considering sustainability. Evidencing that the mining industry has, in the most part, already drawn attention to sustainability and the need to communicate these issues to stakeholders.

Today, the standards and frameworks along with governments are starting to drive further attention to sustainability and the impact of not only our direct operations, but those that form part of our supply chain. Just as mining companies cannot be siloed into one part of the supply chain. Sustainability cannot be an add on to one department or team. I believe sustainability has to be integrated across all teams. Sustainability has to be a cultural value.

We know that the world is going to need more resources. We cannot live day to day without energy, metals, commodities, and it would be short sighted to think so. But we need to be smarter, we need to be more sustainable. And that is the opportunity. I believe sustainability and ESG have one goal, shorter, greener supply chains that result in greater shared value. Supply chains need to become value chains.

12

You’ve heard from Keith that years of brain power development and IP have gone into Hydromet technology. And Mike has taken you through the specifics regarding the technology itself, so you should have a good understanding that the foundation of our business is built on a technology that can potentially replace harmful smelting and advanced the metals industry in a new cleaner direction. Our Lifezone technology is unlocking intrinsic value, and what I value most is that it is a supporting cog in what sustainability and ESG frameworks aim to achieve in the mining sector.

This is one of my favorite graphics. This is the Nexus. This is the heart of Lifezone technology. By replacing just one part of the metal supply chain, smelting, it has the potential to unlock benefits, such as all the ones listed here. Every Hydromet refinery or license could be one positive step in reducing the impact of smelting globally as we move towards a green to transition pathway. It is not just our technology that makes us sustainable.

You can see on the slide here how we’re talking about some of the biggest challenges the world is facing right now. Climate change on a whole, decarbonizing supply chains, social impact, governance and regulatory change, and all importantly critical environmental effects. These demands and macro changes are ever evolving, and so is the scrutiny that surrounds them. That’s why we need to be incremental in our strategy, and not only meet the requirements and expectations of our business, but keep up with the changes in the macro demands as our business also changes.

We’re about to become a publicly listed company, and that brings with it its own compliance responsibilities. While we are working towards meeting global standard reporting requirements, we need to remember that we are still in the early stages of our business’ incorporation. We are building a long-term strategy while taking thoughtful steps to guide our future in the right direction.

We are taking a holistic view and assessing our sustainability impact and ESG strategy across a growing portfolio with an integrated governance structure being at the forefront. For example, we are continuously looping into the engineering scoping studies, the test work undertaken by our labs, and any new work taken on as Lifezone Metals. All this starts on the ground, Gerick will explain the detail behind the mining operations and our early works at Kabanga, but I want to explain what Kabanga means from an ESG lens.

A lot is well underway, and while most call Kabanga a mining project it’s actually a social project. At Kabanga, we have inherited years of history and the legacy. We have worked to understand that legacy bring it forward and share the same vision, but in a new light for a more responsible future.

13

What we do, and the changes we will make will impact our communities, the Tanzanian economy and our business now and year -- many years following the closure of the mine. That is why this work is so important to us. It is imperative that we continue to evolve the social value of the project, and that we continually address the needs of the environment and all our stakeholders.

For example, Kabanga is in a very remote location in Tanzania, where local communities do not have access to power or water alongside many more challenges. We know that their needs will change over the years as a result of the mine. So, we need to adapt how we support, grow, and nurture our relationship with them for this generation and for the next.

We are lucky to be fostering a partnership with BHP and collaborating with their team on the approach to social value, given their existing high standards and commitments. Where our team and the skills we are building are critical to a strong foundation and have been a priority from day one.

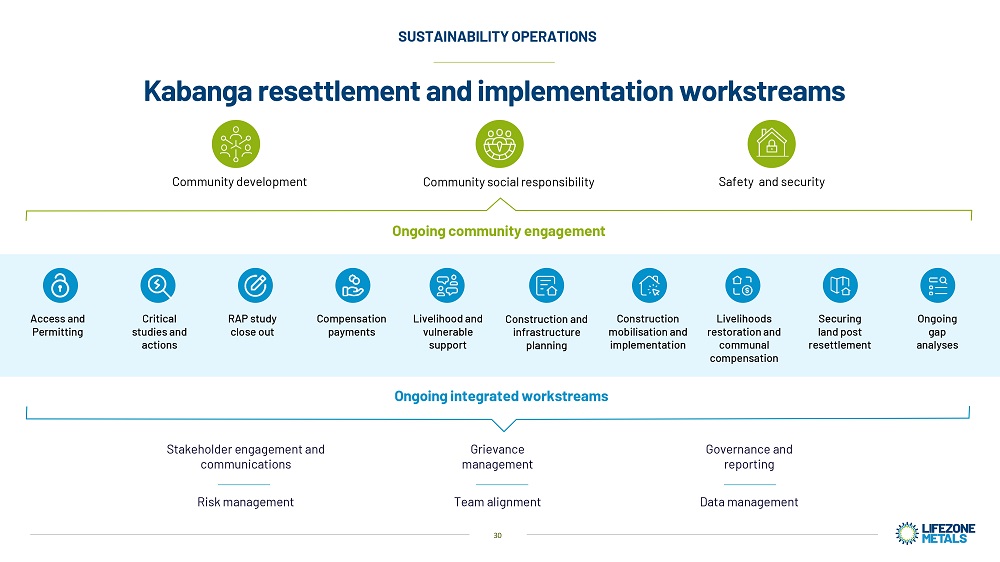

One of the very first people on the ground was that ESG General Manager and that quickly grew with our community relations team and resettlement project team coming together early last year. They have been mobilized to deliver the Resettlement Action Plan or the RAP as we call it. That includes many parts, and a lot of work has already been done; so much that I can’t talk all about it in great detail and to every aspect today.

We will shortly shift into the next phase: relocation implementation. At the start of May, the chief valuer of Tanzania signed off the compensation schedules for the project affected persons a huge milestone. You’ll see on our timeline other program elements as we take the plan into implementation, with each work stream carefully being managed. This links into broader capabilities and skills and ongoing work the team has been busy on and that will continue to drive once resettlement is complete. The team has been busy. This is evident.

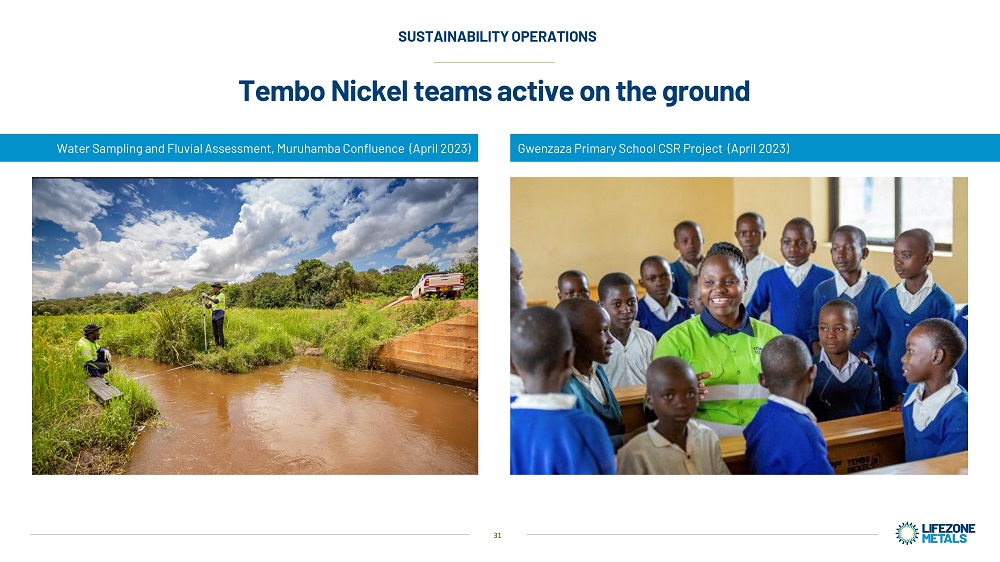

While Kabanga isn’t yet generating revenue, we have already contributed CSR and last year we committed over $80,000 to local schools and health projects. This is a small increment but an important contribution. Just the other week Tembo Nickel, our operating entity in Tanzania, signed a community security and safety MOU with a Tanzanian police to ensure, enhance safety and security to the community surrounding the Kabanga Nickel Project.

So now, when it comes to our work with the environment, this is another area where we have built out a team and expertise on the ground at Kabanga. Soon also for the refinery at Kahama, establishing monitoring and understanding of our baselines for the environmental impact assessments starts as the foundation and will guide and underpin further permitting.

Further focus is on how the project complies both with Tanzania and standards and uplift to international standards. We are working on closing those gaps, which also builds and establishes capabilities in country. Our focus is not only on social value, and environment, but also embraces a broader value system. I am personally very proud of the team on the ground at Kabanga which I’ve seen grow from the first few to now over 100 just in the last year, and I can truly say we have a world class team committed to social responsibility, environmental management, and true sustainability.

14

I trust you can now see how thoroughly we address sustainability and ESG at Lifezone Metals. I know however, that it can be hard to reconcile all that theory with the real world.

So, I’d like to finish on a personal note so that you can see how this translates into our everyday world. People sometimes ask me whether I drive an electric vehicle or EV, I don’t. And they’re often surprised. But as Keith has said at the start, when you know how dirty the materials in the batteries of EVs are, as I do, it’s hard to justify that these are really bring up vehicles.

So, when I know that I’ll be able to open up the hood of my electric vehicle and see where the battery has come from, and I can understand the whole supply chain, the value chain of that battery. That’s when I’ll be ready to buy an EV. And that’s the future we must all aspire to.

I believe some of that responsibly sourced nickel will come from Kabanga, and I know that because it will say so on the battery. We believe that you’ll be able to buy cars like this as soon as we’re delivering metal. And I believe we’re development ready.

The point is, policy regulations and standards are evolving fast. ESG is no longer a separate silo. It’s a standard by which business operates and is evaluated. We know this is a journey, one that will involve obstacles and challenges. But we also know that by seeding best practice today, we can make a significant impact on the world of tomorrow within this company, and the many others we wish to partner with and serve.

Lifezone Metals is a company with all stakeholders in mind. And when our actions count for more than words, that will be our sustainable legacy.

Thank you.

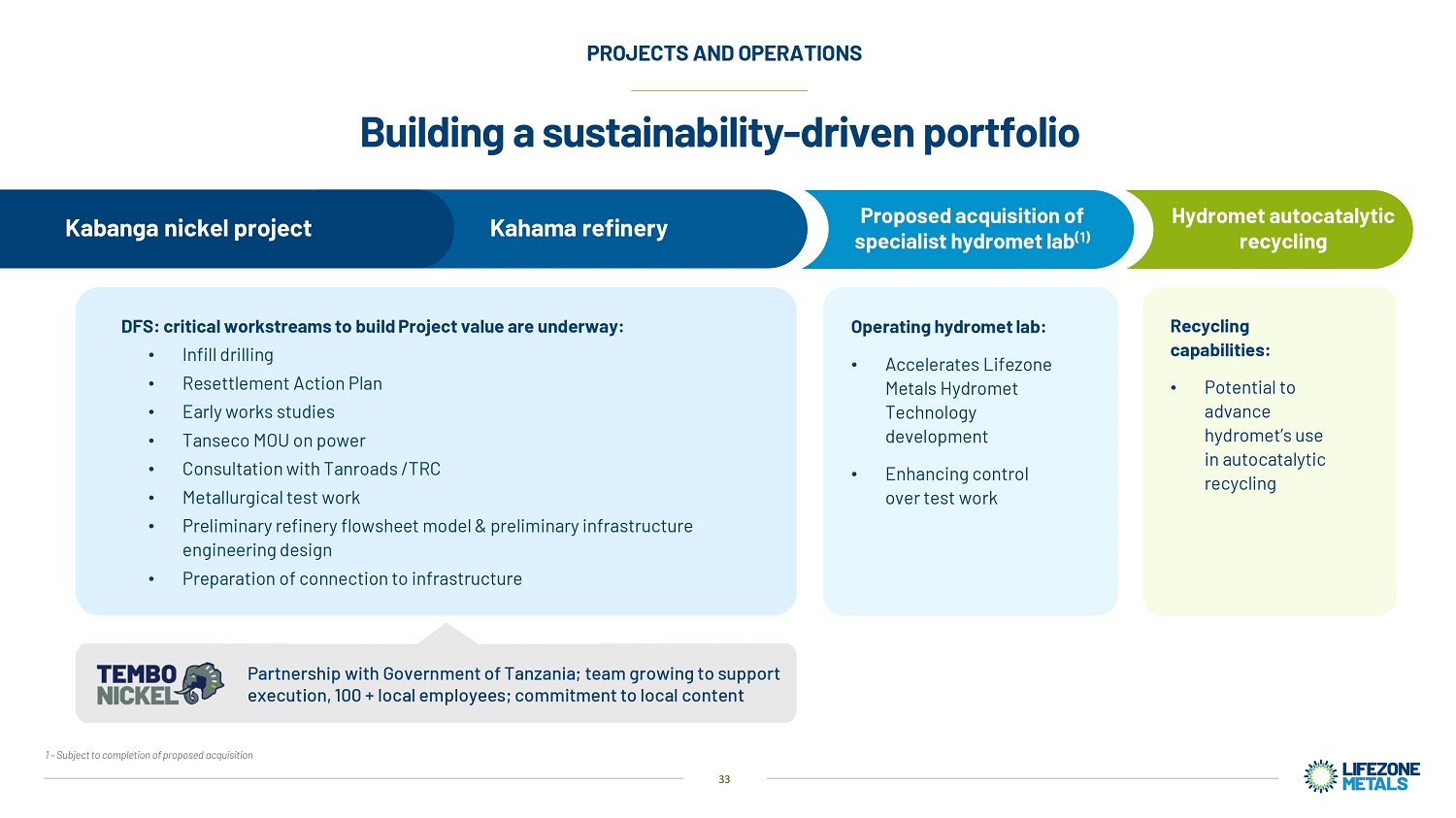

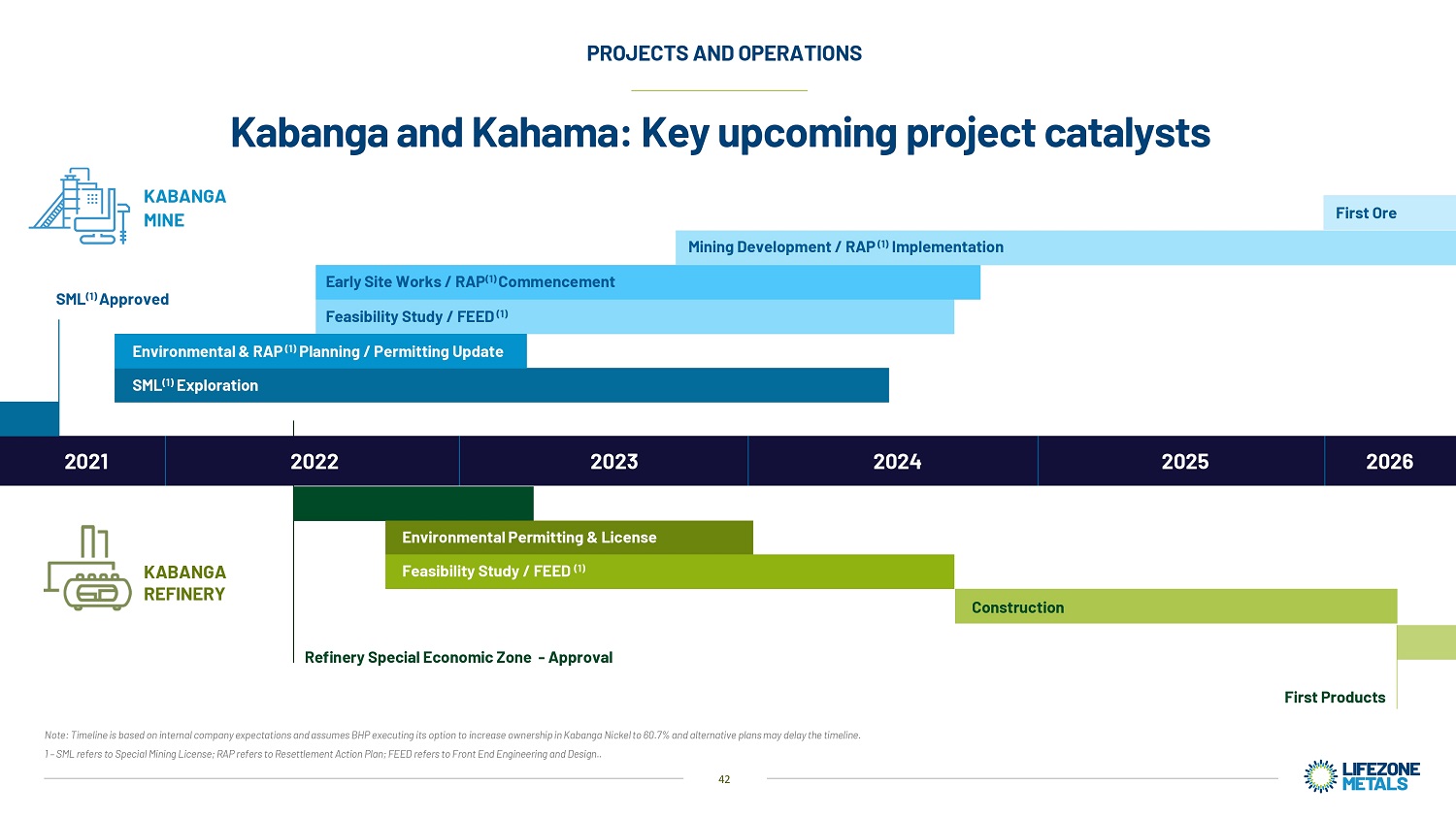

Gerick Mouton^ Hi, I’m Gerick Mouton, the Chief Operating Officer of Lifezone Metals. We are building a safe, sustainably driven, quality asset portfolio. And to be honest, we’ve only just begun. To give you a bit of context. The Kabanga Nickel Project is considered a project of national importance for Tanzania. Plus, it is equally a social and economic project. We have a number of critical operational workstreams underway for the Kabanga mine and the Kahama refinery including the DFS, which I will explain in greater detail.

At Tembo Nickel, a partnership entity with the government of Tanzania, we are committed to local employment and content. We are focused on growing the Tembo team from the ground up, and I’ve expanded to over 100 employees, 96% of whom are Tanzanian. Additionally, we’ve had over 600 people in casual labor this quarter alone. I will touch on our graduate program in a few moments. A portfolio reach expands cross geography and application. Recent developments complement our strategy and support the momentum that we are building a more sustainable metal supply chain solution.

15

We will soon have a fully functional in-house specialists Hydromet lab, this will improve our ability to expedite the Hydromet technology and test work programs across different all types. And I’m also very proud to be running operations to use our Hydromet technology to advance the recycling of precious metals.

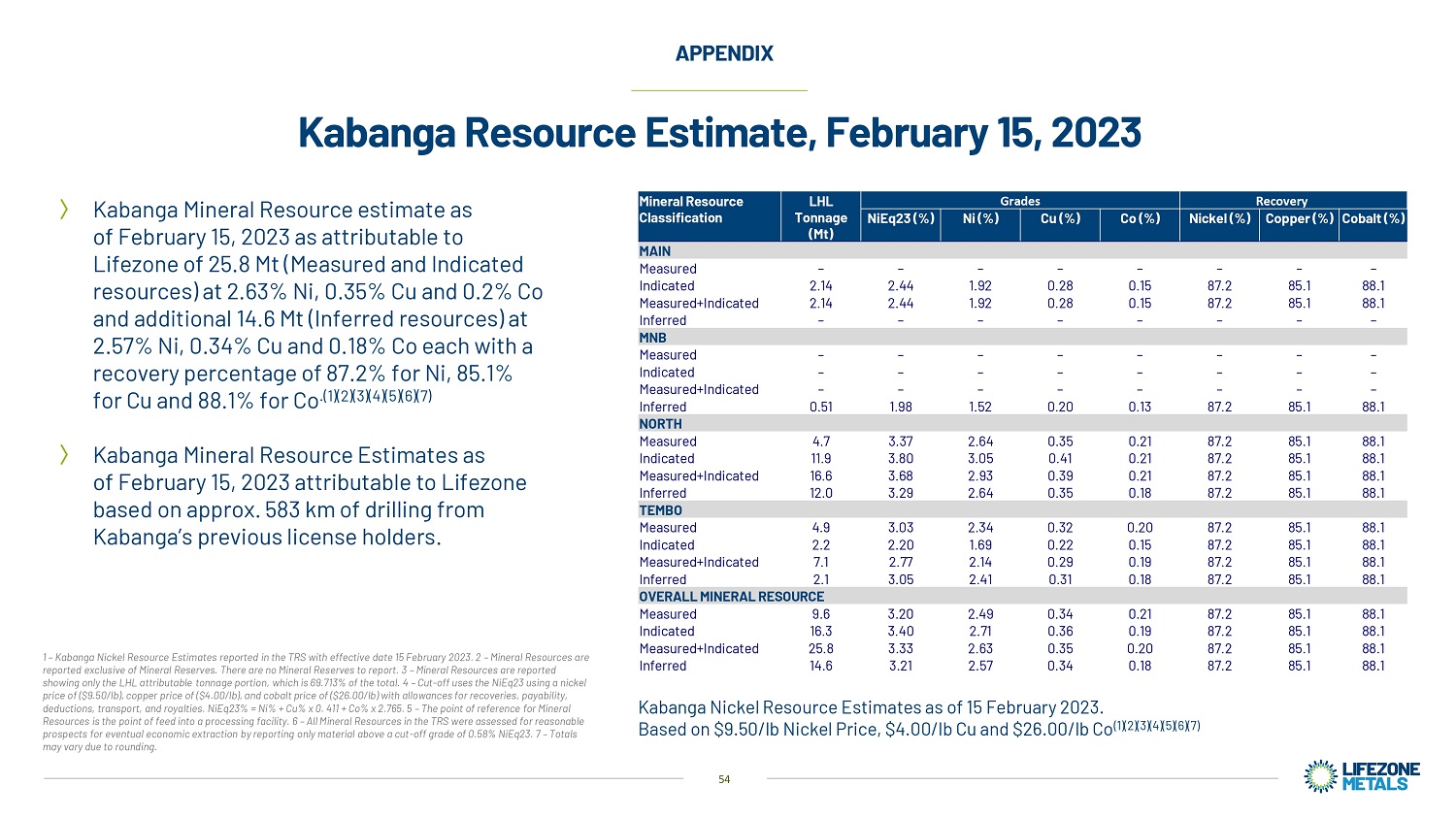

As Chris said earlier, Kabanga is one of the largest and highest-grade undeveloped nickel sulfide deposits globally, and we are working with a resource that has favorable characteristics. Kabanga is in a class of its own. One, it’s shallow, which means we can access the ore body faster, speeding up both production and cash flow. Two, it averages at 20-to-25-meter thickness. And three, it has a current struggling of more than six kilometers with potential further expansion. The long and significant history of Kabanga means we are already working with years of previous studies, data, and over 560 kilometers of resource drilling.

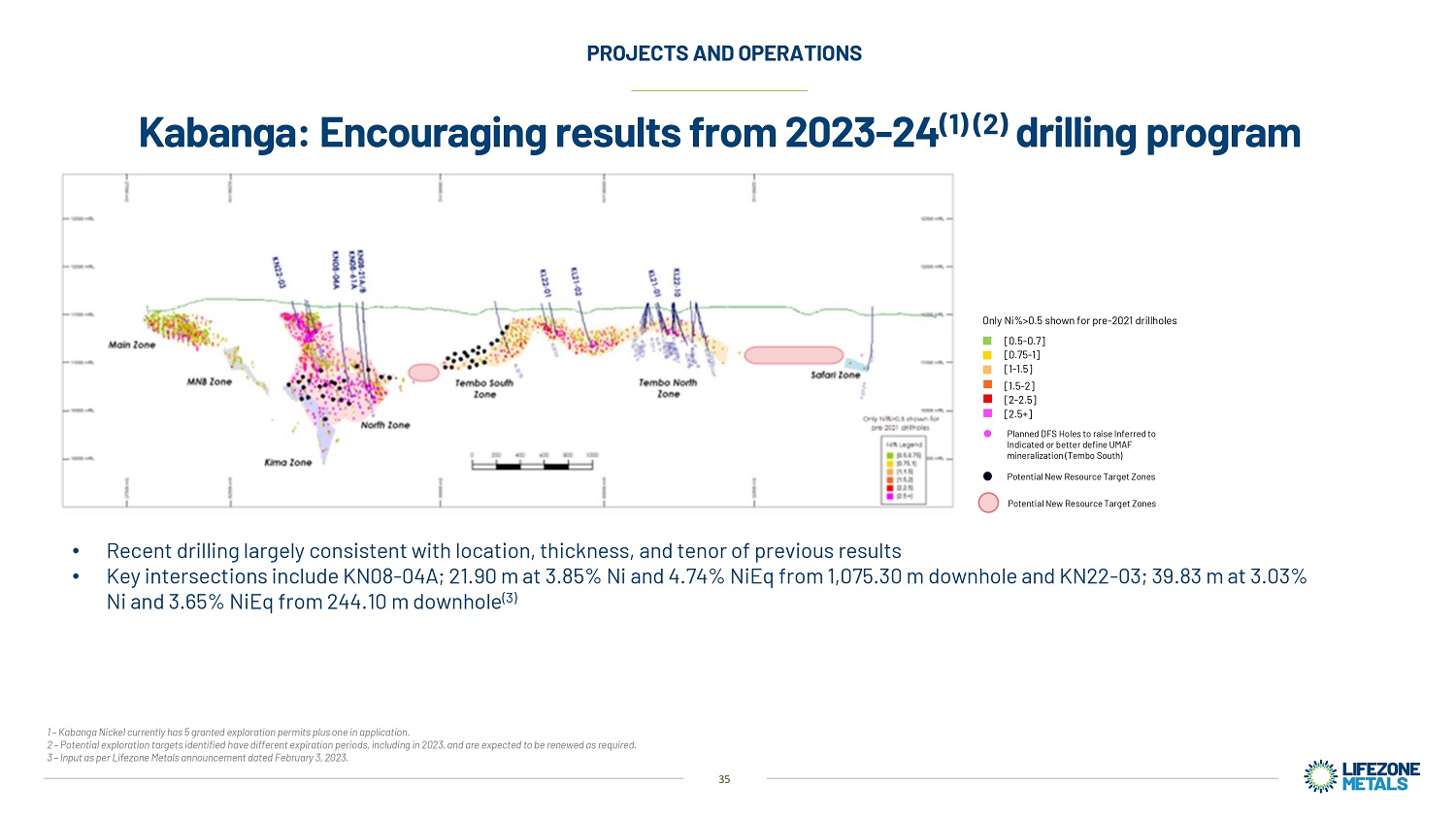

Now we’re building on an extensive resource definition studies already done and adding value to this important asset as we work towards the clearing and oil reserve. As you can see, our recent intersections and grades have been promising indicating further value to be unlocked at Kabanga. We currently have five rigs focusing on resource definition drilling to support the DFS mining plan.

Early works planning is progressing and the DFS is well underway. This is part of a fast-track process where we are developing the mines critical path activities in conjunction with key studies to date on mine planning is focused on verifying and progressing the quality of existing geotechnical and geochemical data, as well as developing mining infrastructure engineering detail on the ventilation and mind backfill scenarios.

Critical path activities as part of our early work included road construction and airstrip and preparing tender packages to the mining commission’s approved shortlisted tenderers. We are also working on upgrading and expanding the existing gap, which will be reflected in the permitting approval program.

Our lead engineers - DRA Global - advancing the DFS for the Kabanga concentrator, site and mining infrastructure. A preliminary concentrated flow sheet estimate has been prepared and a revised site plan has been -- layout has been delivered. Following the extensive drilling I described earlier, Metallurgical tests work continues in Perth to support the process design and the development of a capital and operating costs for the concentrator and refinery.

At Kahama, the preliminary refinery flow sheet model has been delivered and preliminary infrastructure engineering designs has already commenced. We are preparing the layout plan and requirements for connecting to the existing bulk infrastructure. As I said in the outset, Kabanga is a social project, and it will always be a social project. It is all about our communities, how we work with them at present and also in the future.

16

Our aim is upskilling generations to come, creating jobs, local businesses, enterprises and addressing their needs as we work with the Tanzanian government to widen Kabanga’s economic benefit to everybody. This means building the pipeline of local talent for the long-term development of Kabanga.

Recently, we have created the Tembo young talent program, with 10 graduate inducts this year alone. While we need to plan for the future, we also need to acknowledge the long and significant history of Kabanga and its existing connection to local communities, which is an important part of our social value and responsibility. Natasha has already shared on how we are focused on developing social and sustainability-based practices at Kabanga to support this in future.

Our current most critical work stream is the Resettlement Action Plan, or as we call it, the RAP. And the implementation execution of this plan. As part of the RAP, we are working towards livelihood restoration and the construction of new homes for resettled community members. We have already recently appointed a dedicated project director for the resettlement implementation phase.

With regards to licensing and permitting, we are progressing with the Kabanga Environmental Management Plan update, the Kahama refinery environmental impact assessment and various other permitting approvals. Kabanga is a pioneering project in terms of our focus on the value chain lifecycle and assessment of our impact.

This all works to reduce the carbon footprint of metals produced. We have set up an audit in order to leverage of the work already done at Kabanga, and initiate work at Kahama, our refinery site with this special economic zone permit pending. Once the special economic zone at Kahama becomes official, the plant, multi metals refining facility will be key to unlocking our potential. This will create opportunities for the community, cost savings for the business and economic benefits for Tanzania and East Africa as a region, as it becomes a clean metals processing and industrial hub. This will underpin our commitment to sharing value between the company and the country.

Our mine-to-metal approach, expertise conscious supply and chain integration and technology will come together to create the solution for OEMs. As they need greener final battery metal grade ready to use, which we will deliver. Kabanga and Kahama are supported by the extensive investments being made in Tanzania’s bulk infrastructure, including roads, rail and power. With a central railway system and the 80 megawatts consumer force hydropower project both under construction, we are poised to take advantage of the potential for efficient transportation and clean power.

Our MOU with TANESCO and consultations with Tanroads and the Tanzanian Railway Corporation have allowed us to pull the power and logistics picture together to support our development and operations.

17

Kabanga is just one part of Lifezone Metals. We have made tremendous strides in the last few years, we are working on an accelerated timeline, and our own wider project portfolio, which will support our intent of becoming a cleaner metal supply chain solution, and applications included directly to unlock world class projects and recycling. We are on track to at Kabanga supporting the initiation of operations at Kahama.

As I’ve mentioned previously, our projects and operational teams have grown significantly across the business as we work to deliver a major new source of battery metals cleanly and with enhanced on social benefits. In everything we do, my critical integration factor is that we do so with wider safety, social and sustainability considerations in mind.

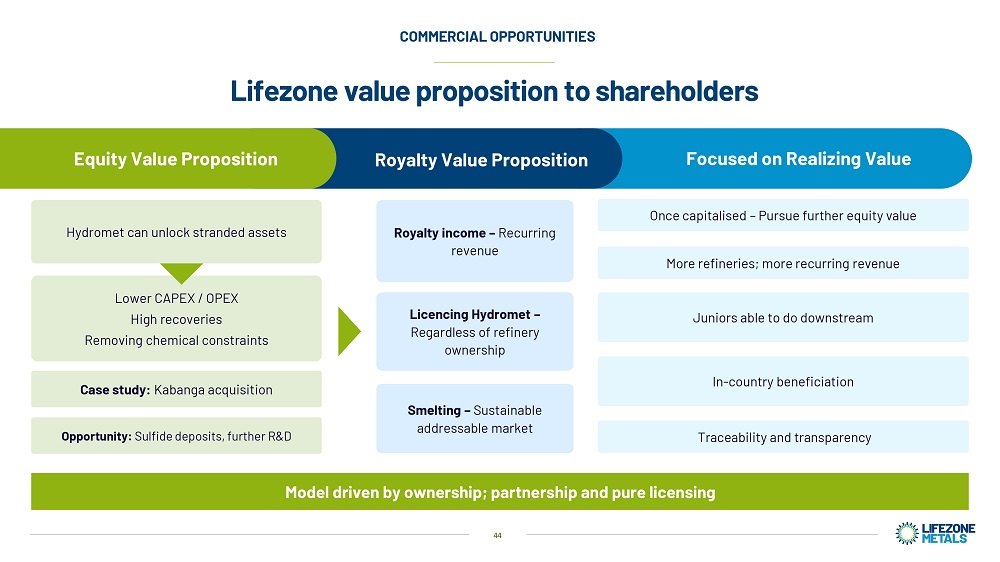

Anthony von Christierson^ Hi, I’m Anthony von Christierson, and I’m the Executive Vice President Commercial and Business Development at Lifezone Metals. First, I would like to explain more about Lifezone Metals value proposition and business model. We believe that the model we have developed offers equity value to shareholders with potential for royalty value that is scalable across the industry. Lifezone Metals has been founded on IP and years of development and experience, as you have heard so far, that has included many studies, a huge amount of test work and now a clear direction.

I have worked at Lifezone for the last six years, and it’s been incredible to witness the progress Lifezone has made towards providing an impactful supply chain solution to the industry. We believe equity value can be unlocked by our technology driven by lower CapEx and OpEx when compared to traditional smelting and refining, a technology that has been around for millennia. Take the Kabanga Nickel Project as a case study. Although considered one of the world’s largest and highest quality nickel sulfide deposits, it has been a stranded asset, passing hands between major mining companies for the past three decades.

Why now? Why Kabanga? By unlocking the asset with Lifezone’s technology, that’s why and that’s how. We acquired the asset from Barrick and Glencore in 2021. And we are now on the road to developing this significant project, one that I’m very excited about. As a result of our technology, Kabanga is now expected to sit in the lowest cost quartile of the nickel industry, according to Wood Mac estimates. You’ve heard a lot about Kabanga so far and understandably, as we believe it underpins our current valuation.

But let me take a step back and explain our wider MO. The Lifezone Metals business model has three key approaches, ownership, partnership and licensing. Regarding ownership, once we are capitalized, we will be on the hunt to unlock other stranded assets constrained by lack of infrastructure, viable economics, export limitations or chemical impurities. With partnership, this can be evidenced on a number of levels, such as engagement with junior mining companies to empower them to go downstream and recognize further value while decarbonizing the supply chain with strategic methods.

18

In parallel, we will be engaging with local stakeholders to deliver in country benefits by offering host nations the ability to recognize full value of their sovereign resources through in country beneficiation that will allow nations to benefit economically and socially that may not have been possible previously. The government of Tanzania being our partner in our Kabanga Project is a model we will look to replicate in the future.

Through our hard work, we are also privileged to work alongside the likes of BHP in the Kabanga Project with licensing for mining companies that have the balance sheet to fund and operate a life so refinery themselves. We would license our technology in return for a royalty. Our mission is to decarbonize the supply chain of strategic metals to support the green energy transition. Therefore, industry endorsement and adoption is the fastest route to scale.

Every project that involves a Lifezone refinery, we will earn a royalty in return for licensing our Hydromet technology. For our Kabanga Project, a royalty rate has been agreed with BHP. The current smelting and refining industry for Lifezone’s suite of applicable metals is a substantial addressable market, particularly with additional metal supply coming online. Licensing provides Lifezone with a recurring revenue model at each project despite ownership.

Over the past decade, our technical team have built a large portfolio of global patterns across multiple metal groups. Our Hydromet technology is applicable to base metals, nickel, copper and cobalt essential for the EV market, platinum group metals needed for the hydrogen economy. Gold, we offer a cyanide free processing solution from refractory ore bodies, and, as part of our research and development, we are also looking at processing rare earth and other metals considered as critical minerals.

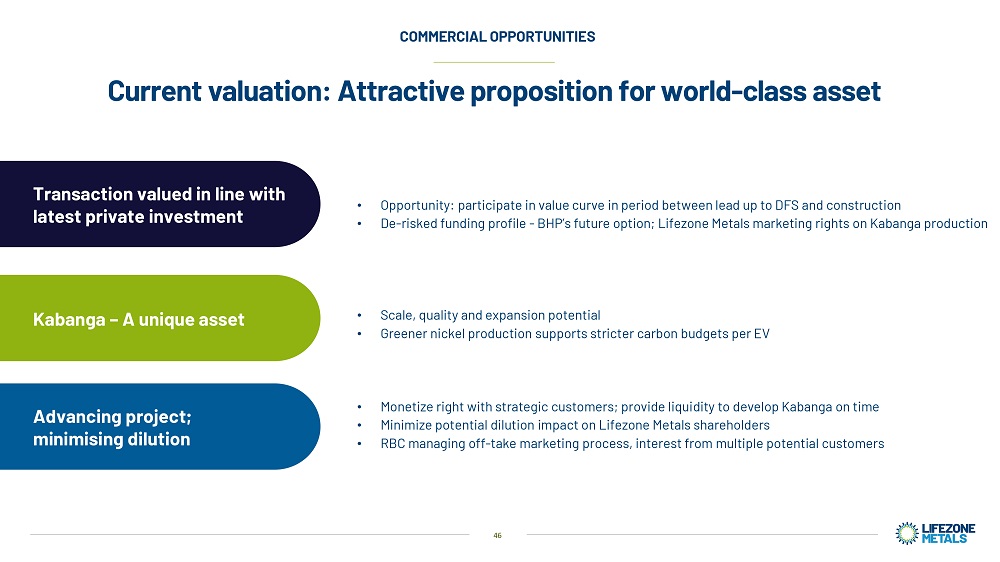

As I touched on, our current value proposition is driven primarily by Kabanga where we believe our technology will unlock a major new source of clean the nickel. Our transaction coming to market is based on BHPs latest private investments into Lifezone technology, and the Kabanga Nickel Project.

We believe a Kabanga Project has been de-risked as a result of BHPs $90 million already invested to date, their option to increase their stake to a 51% look through interest at the asset level. And three the marketing rights of refined nickel, copper and cobalt, 40% of which have been retained by Lifezone methods. RBC have been appointed by us to market and manage the offtake process of our 40% allocation.

We are already seeing encouraging interest from OEM and battery manufacturers who are attracted by not only Kabanga scale, but also by what we believe is greener nickel and cobalt that will be produced from our refinery in Tanzania. Our commercial design with BHP for the Kabanga Project has been to de-risk the execution of the project while minimizing the potential for equity dilution. So, shareholders can participate in the value curve towards first production and beyond.

19

We believe Kabanga has material equity value. However, it is just one project. We are also excited about our technology’s future potential across a considerable addressable market alongside making strategic equity investments or partnerships.

So, as we leave behind the era of capital and energy intensive smelting, we are ready as Lifestyle Metals to one, deliver cleaner metals into the supply chain and circular economy without smelting, two, unlock stranded assets with latent value, and three, scale the technology through a licensing model.

Thank you. I’ll now hand back to Chris for concluding remarks and Q&A.

Chris Showalter^ Hello again. So, it’s been an incredibly fast paced journey over the past few years, and that momentum both strategically and operationally is only set to increase. This concludes the presentations and I trust you will now have a clearer understanding of who we are and what Lifezone Metals is setting out to achieve.

We will present to you a Q&A session, which will follow after my concluding remarks. To recap on the key takeaways, we believe that we have developed a proprietary technology that has the potential to reduce emissions in metal production by meaningful amounts. This technology is ready to be deployed as part of our own projects, licensed unlock royalty income, and be utilized for the recycling industries. We have demonstrated how Hydromet unlocks the potential of the Kabanga Nickel Project. This can provide a major source of nickel at a time when nickel is a critical metal for the green energy transition, and EV battery supply chain.

Partnerships are the cornerstone of our business. Our partners bring complementary skills, support, and best practice that we plan to embed as a core part of our business model going forward. Our focus as ever is long term value creation. We have the backing of investment experts, and a significant investment through our business combination with GoGreen investments.

We see governance and sustainability as the heart of our technology, and our business. It’s embedded alongside a culture of safety as part of our operations. This is why we have spent time ensuring we are ready for the next step with the right team. We have bolstered our executive team to shortly be able to announce the appointment of our chief financial officer. So, stay tuned for an update in the coming weeks.

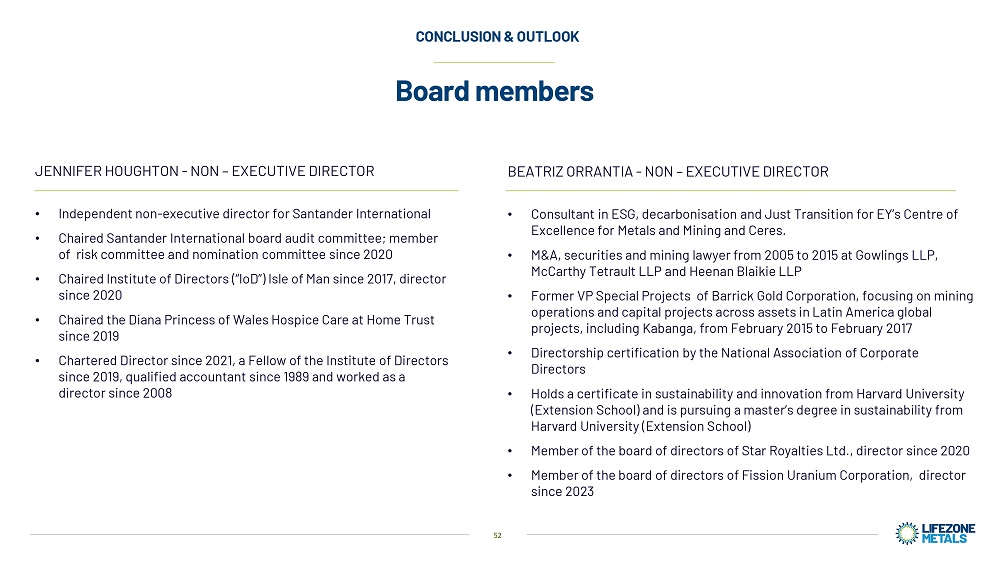

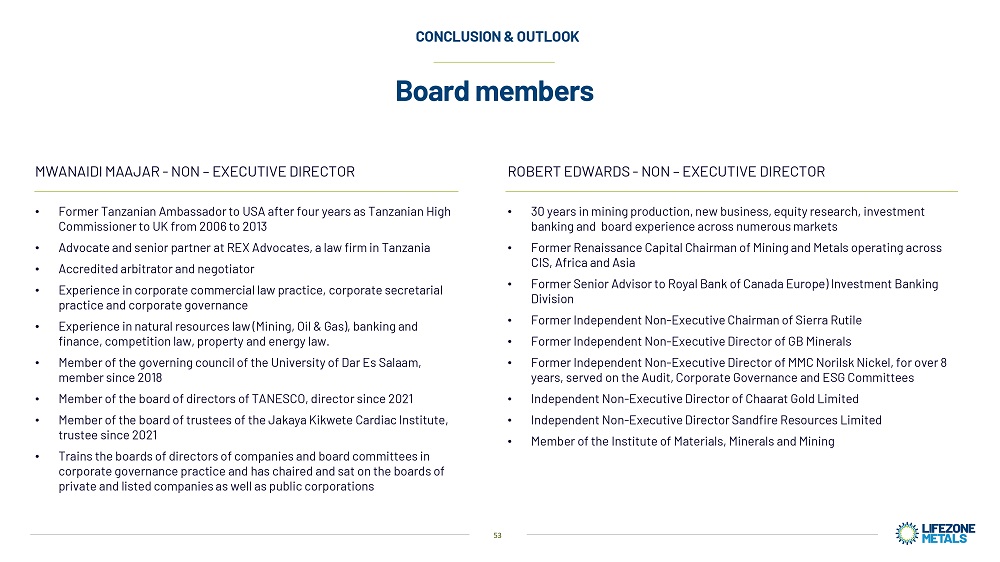

And I’m proud to announce that we have formalized our Board of Directors with the right diverse set of skills to help us deliver on our strategy. And this puts the right governance structure in place. This makes the final piece of the puzzle as we work to transition into life as a public company. Lifezone Metals is closely aligned to the green energy transition by providing potential solutions, new sources of critical metals, combined with clean processing technology.

I believe we’ve shown our pipelines robust and growing. Our strategy and the operational plans that bring it to life will draw revenues from different work streams -- work streams, and opportunities. We have huge depth of experience across our team. And we have the right technology, at the right resource, with the right partners. As the world watches and looks to transition to cleaner, greener energy, Lifezone Metals is poised to be a partner of choice. And we believe a pioneer of change, to create a safer, more sustainable world.

Thanks again for watching. And please remember, we added a Q&A at the end, based around the most frequently asked questions from investors. Thank you.

20

QUESTIONS & ANSWERS:

Keith Liddell^ So Mike Adams, and I’ve been working in hydrometallurgy since the early 1980s, 40 years or more. And a lot of those years, we’ve worked together on projects all over the world for many different metals. And we’ve come up with solutions for the industry throughout our careers. So, we’re just taking what we’ve -- what we’ve done our whole careers in applying it into Lifezone to generate a hydrometallurgy that’s effective, it’s cost effective, it works.

We know it works, because it’s based on fundamental chemistry, and then we apply value engineering to it. So that creates cost effective solutions, lower capital costs, lower operating cost. And as it turns out, much lower emissions, hydrometallurgy generates way lower emissions than smelting does, and it’s much more energy efficient as well. When electricity becomes a valuable commodity, particularly green electricity, then you don’t want to waste electricity like smelting does in the efficient process of hydrometallurgy.

And that’s how it all links together. And then we put together the knowledge that we’ve gained over 40 years together to design particular bespoke solutions for each concentrate that we look to extract energy metals out of, and it’s really that simple.

Mike Adams^ Well, the term hydrometallurgy is quite broad and spans multiple metals multiple ore types and multiple chemistries. What we’re doing specifically is utilizing all three of those things, and while the term hydrometallurgy has been around for probably 100 years or so, what we do is very specific in terms of selectively taking the slurry through multiple processes that actually sequentially enhance, purify and end up with pure array of products. And I believe that that is really the differentiator between us and other so called Hydromet technologies.

And probably the other, just thinking about it, the other differentiator is, with our process, we transform waste materials into commodities that are useful. For example, the gypsum that we make is used underground. Other Hydromet techniques do not do this, they end up with polluting wastes that have to be stored and cause problems environmentally.

John Dowd^ I think there are two reasons to list on the NYSE. First, the U.S. represents the largest and most liquid capital markets in the world. Second, at its roots, Lifezone Metals is springing an environmental solution to the market. This is not just a mining company. I think if it were just a mine, it would make sense to list it in Australia or Canada or in London. But really for environmental solution to clean battery metals, the New York Stock Exchange is the right place.

Chris Showalter^ I think when you look at the complimentary aspect of GoGreen and the relationships they have on Wall Street. This makes a natural fit for us to list on the NYSE.

John Dowd^ There have been no significant delays in the SPAC timeline. We are still on scheduled to go public by the July 25 deadline of the SPAC.

Gerick Mouton^ Yes, increasing the mine size at Kabanga is definitely on our radar, as the previous studies suggested, which were based on the 2.2 million tons per annum throughput. We’ve taken that as the base case. And we’re currently running optimizations to see if we can increase that to obviously improve the overall economics of the project. And also, to generate more metal at the end of the day.

21

Natasha Liddell^ The RAP and resettlement and relocation in general for us is a social project. It’s a project in itself. And I think, given that level of importance, we are applying that level of rigor to deliver a project. So right now, we’re at a critical inflection point with the RAP itself. So, we move from the resettlement action plan. So, the RAP which is almost complete, that’s a physical document and a plan. And then we move into the execution phase, which is actually building and constructing the physical relocation sites themselves.

So, we’re in this critical phase, which we’ve now mapped into workstreams and get really clear about the detail required to deliver that both to Tanzanian standards and then uplift to international standards at a point in time when we can do. We also have BHP as partners on this and they bring their expertise and advice as well to assist as to where we are. So, I think we’re in a good place right now.

Anthony von Christierson^ Lifezone’s business model comprises two main pillars. First equity value from strategic investments. Our strategy is to unlock latent value through our technology driven by greenness, but also lower CapEx and OpEx with Kabanga being our primary case study. At the same time, we are flexible, and we may look to bring in World Class partners like BHP or co-fund with junior mining companies to empower them to realize further value downstream.

And the second pillar is royalty value. As I said despite ownership every Lifezone refinery built will earn royalty that will go to Lifezone and that we are looking to scale across a large addressable market.

Natasha Liddell^ I believe Lifezone has evolved to where it is today with just being able to attract and retain the right talent but also build those skills in house. We’ve now come to a point where it’s a consolidation of being able to present a whole new board. And that will lead us into that next phase. But also make sure that we can build the right team at every level as well. At one level is obviously a Tembo Nickel where that team has grown from 20 this time last year to 100. Right about now and many more due to come on board.

So, I think we’ve shown that we can attract the right talent and retain it so far, but I think we have the right cultural values to also attract that talent and skills.

Chris Showalter^ Something we’re specifically proud of right now is the fact that we have over 96% of Tanzanian nationals employed by Tembo Nickel on the ground in Tanzania, and that complements the Lifezone team. But as we look to adhere to very high standards of employing local Tanzanians, this is going to be a metric that we’re going to continue to focus on. So that we’re contributing not only to the economy of Tanzania, but also employing and also bringing up the overall quality of skills transfers, to Tanzanians.

So, as we’ve articulated, as I’ve said, in this presentation, partnerships are really a key ingredient of how we’re going to progress as a company going forward and the BHP relationship, and how we’ve been able to work with them has been critical. So, we benefit from their expertise from the contribution of their team, integrating with the Lifezone team. And I think that’s something that’s going to enhance going forward.

And I think importantly, when you look at the, the agreement we have with BHP, and they work very hard to ensure that they have the proper minority rights to have confidence in their contribution going forward in the early stage. And conversely, once BHP in the assumption that they trigger their next investment, option, Lifezone will benefit from those minority rights that were enshrined in the agreement that protect BHP right now. And then we’ll be protecting Lifezone as a shareholder going forward.

22

So Lifezone, we’re in a very fortuitous position, because we have a partner like BHP who’s not only committed to coming in as a co-investor and partner in the mine development, but also the refinery. So, when we look at our capital structure going forward, we’re really focused on the capital raise right now with GoGreen, and the equity we raised there will be complementary to BHPs investment. But we also have a number of other financing solutions at our fingertips, having the offtake as we present in Lifezone’s hands, we have the ability to monetize that, to raise capital, specifically, we have the ability to provide streams.

So, there’s a lot of creative solutions to financing that last part of the capital structure. But clearly having a party like BHP puts us at a preferential position to ensure that the mine will be fully funded at a very early stage.

Anthony von Christierson^ So we recently launched a process run by RBC, whereby for the 40% of our marketing rights from the Kabanga Project, which involves the refined nickel, copper and cobalt from the project will be marketing to end customers, primarily OEMs and battery manufacturers. So far, the reception has been very positive from the market. This has been driven not only by Kabanga scale, but also by the potential greenness of the nickel and cobalt coming from the project. As the world looks to decarbonize, greenness is becoming ever more important for the end customers of these battery and car manufacturers.

We have some very interesting developments on the recycling front. We first started testing our technology on spent auto catalytic converters that contain platinum, palladium and rhodium, back in 2014, 20% of the world’s global supply of PGMs comes from recycling. We are looking to do this in the U.S., particularly because PGMs are now part of the U.S. critical minerals list. Our mission is to break the circuit of smelting not only in mining but also recycling where the vast majority of PGMs from the secondary market are re-smelted. So, we’re looking to clean up that circular economy from smelting.

Chris Showalter^ So what we’ve seen evolving in Tanzania is really this the strengthening of relationships between our group and the government of Tanzania but that’s really more credit to President Hassan and the policy she’s been implementing. And I think a demonstration of that, if you look at the recent summit between the United States and Tanzania where Vice President Harris came over for a state visit, that’s really a demonstration of the importance that’s really enhancing between the two countries.

I think, Lifezone Metals, were right there at the forefront. And I think being a U.S. NYSE listed company, and having the support of the U.S. government, enhancing the relationships to Tanzania, it’s really going to strengthen the whole policy initiative, supporting battery supply chains emerging in new regions around the world. And I think that that relationship is going to continue to go forward, and I think it’s going to be a massive benefit to us as a group.

23

Investor Presen t ation May 24, 2023