“Release” shall mean any release, spill, emission, leaking, pumping, pouring, emptying, escape, injection, deposit, disposal, discharge, dispersal, dumping, leaching, or migration of Hazardous Materials into or through the indoor or outdoor environment or into or out of any property, including the movement of Hazardous Materials through or in the air, soil, surface water, or groundwater.

“Representatives” means, with respect to any Person, such Person’s Affiliates and its and their respective professional advisors, directors, officers, members, managers, equity holders, partners, employees, agents, and authorized representatives.

“Sanctioned Country” means at any time, a country or territory that is itself the subject or target of any country-wide or territory-wide Sanctions Laws (at the time of this Agreement, the Donetsk, Luhansk, and Crimea regions of Ukraine, Cuba, Iran, North Korea, Russia, and Syria).

“Sanctioned Person” means (a) any Person that is the target of any sanctions administered or enforced by: (i) the United States Department of the Treasury’s Office of Foreign Assets Control (“OFAC”), the United States Department of Commerce’s Bureau of Industry and Security, or the United States Department of State; (ii) Her Majesty’s Treasury of the United Kingdom; (iii) the United Nations Security Council; (iv) the European Union or any European Union member state; or (e) any other relevant sanctions authority, (b) any Person located, organized, or resident in, or a Governmental Authority or government instrumentality of, any Sanctioned Country, or (c) any Person directly or indirectly owned or controlled by, or acting for the benefit or on behalf of, a Person described in clause (a) or (b), either individually or in the aggregate.

“Sanctions Laws” means those trade, economic, and financial sanctions Laws administered, enacted, or enforced from time to time by (a) the United States (including OFAC, the Department of Commerce, and the Department of State), (b) the European Union or its member states, (c) the United Nations Security Council, (c) Her Majesty’s Treasury of the United Kingdom; or (e) any other relevant sanctions authority.

“Sarbanes-Oxley Act” means the Sarbanes-Oxley Act of 2002.

“SEC” means the United States Securities and Exchange Commission.

“Securities Act” means the United States Securities Act of 1933.

“Security Incident” means any material unauthorized Processing of Company Data, any material unauthorized access to the Company’s IT Systems, or any incident that requires notification to any Person, Governmental Authority, or any other entity under Privacy Requirements.

“Subsidiary” means, with respect to a Person, a corporation or other entity of which at least forty-nine percent (49%) of the voting power of the equity securities or equity interests is owned, directly or indirectly, by such Person.

“Tax Return” means any return, declaration, report, statement, information statement, or other document filed or required to be filed with any Governmental Authority with respect to Taxes, including any claims for refunds of Taxes, any information returns, and any schedules, attachments, amendments, or supplements of any of the foregoing.

“Taxes” means (i) any and all Federal, state, local, foreign, or other taxes imposed by any Governmental Authority, including all income, gross receipts, license, payroll, recapture, net worth, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, ad valorem, value added, inventory, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, registration, governmental charges, duties, levies, and other similar charges imposed by a Governmental Authority in the nature of a tax, as well as any alternative or add-on minimum or estimated taxes, and including any interest, penalty, or addition thereto; and (ii) any amounts of the type described in clause (i) of this definition as a result of being a member of an affiliated, consolidated, combined or unitary group for any period, as a result of any tax sharing or tax allocation agreement, arrangement, or understanding, or as a result of being liable for another Person’s Taxes as a transferee or successor, by contract or otherwise.

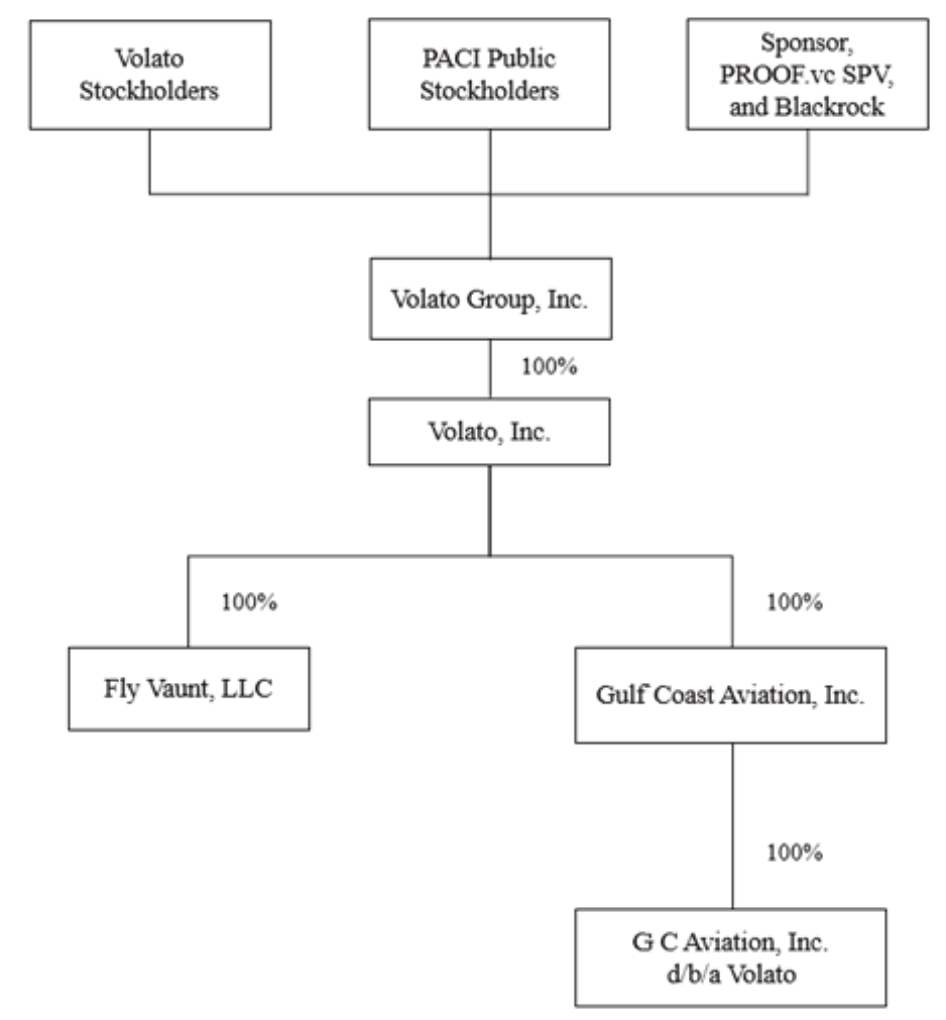

“Transactions” means, collectively, the Merger, the PIPE Investment, and the other transactions contemplated by this Agreement and the Ancillary Agreements.

“Treasury Regulations” means the regulations promulgated under the Code by the United States Department of the Treasury, whether in final, proposed, or temporary form.