THE UNITED STATES SECURITIES AND EXCHANGE COMMISSION DOES NOT PASS UPON THE MERITS OF OR GIVE ITS APPROVAL TO ANY SECURITIES OFFERED OR THE TERMS OF THE OFFERING, NOR DOES IT PASS UPON THE ACCURACY OR COMPLETENESS OF ANY OFFERING CIRCULAR OR OTHER SOLICITATION MATERIALS. THESE SECURITIES ARE OFFERED PURSUANT TO AN EXEMPTION FROM REGISTRATION WITH THE COMMISSION; HOWEVER, THE COMMISSION HAS NOT MADE AN INDEPENDENT DETERMINATION THAT THE SECURITIES OFFERED ARE EXEMPT FROM REGISTRATION.

THE SECURITIES OFFERED HAVE NOT BEEN APPROVED OR DISAPPROVED BY ANY STATE REGULATORY AUTHORITY NOR HAS ANY STATE REGULATORY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THIS OFFERING CIRCULAR. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.

Form 1-A Offering Circular

Regulation A Tier 2 Offering

Offering Circular

For

THUMZUP MEDIA CORPORATION

A Nevada Corporation

December 16, 2022

| SECURITIES OFFERED | : | 2,000,000 Shares of Common Stock, plus up to 400,000 shares issuable a Bonus Shares (the “Bonus Shares”) |

| PRICE PER SHARE | : | $4.50 |

| MAXIMUM OFFERING AMOUNT | : | $9,000,000.00 |

| MINIMUM OFFERING AMOUNT | : | None |

| MINIMUM INVESTMENT | : | $1,000.00 |

| CONTACT INFORMATION | : | Thumzup Media Corporation |

| 11845 W Olympic Blvd, Suite 1100W #13 | ||

| Los Angeles, CA 90064 | ||

| (310) 237-2887 |

Generally, no sale may be made to you in this Offering if the aggregate purchase price you pay is more than ten (10%) percent of the greater of your annual income or net worth. Different rules apply to accredited investors and non-natural persons. Before making any representation that your investment does not exceed applicable thresholds, Investors are encouraged to review rule 251(d)(2)(i)(C) of Regulation A. For general information on investing, Investors are encouraged to refer to www.investor.gov.

Thumzup Media Corporation (the “Company” or “Thumzup®” or the “Issuer”) is a Nevada corporation, formed on October 27, 2020, by filing Articles of Incorporation with the Secretary of the State of Nevada. (see Exhibit 2 “Articles of Incorporation and Other Corporate Documents”).

The Company is offering (the “Offering”) by means of this offering circular (the “Offering Circular”) Company equity in the form of Common Stock denominated in shares (the “Shares”) on a “best-efforts” and ongoing basis to investors who meet the Investor Suitability standards as set forth herein. (See “Investor Suitability” below.) The Company will offer Shares through the Investor Portal on the Company’s website, https://www.thumzupmedia.com/invest (the “Platform”), and through Dalmore Group, LLC, a FINRA-registered broker-dealer.

The minimum investment amount per investor is $1,000.00 representing two hundred, twenty-three (223) Shares at $4.50 per Share. The Company is run by a board of directors, comprised of a total of up to 5 directors (the “Board” collectively, “Director” when referring to a single director). As of the date of this Offering Circular, the Company has two Directors sitting on the Board. The day-to-day management and investment decisions of the Company are vested in the Board and in the Officers. The Company intends to use the Proceeds from this Offering (the “Proceeds”) to expand sales to new advertisers (“Advertisers”), expand acquiring new creators (“Creators”), and improve and further develop the technology.

Sales of the Shares pursuant to the Offering will commence immediately upon qualification of the Offering by the SEC (the “Effective Date”) and will terminate at the discretion of the Board or twelve (12) months following the Effective Date, whichever is earlier. The Company has set the maximum offering amount at $9,000,000 (“Maximum Offering Amount”). The Company may increase the Maximum Offering Amount at its sole and absolute discretion, subject to qualification by the SEC of a post-qualification amendment. However, the Maximum Proceeds from this Offering shall not exceed $75,000,000.00 in any twelve (12) month period in accordance with Tier II of Regulation A as set forth under the Securities Act of 1933, as amended, (“Reg A Tier II” or “Tier II”). The Company intends to offer the Shares described herein on a continuous and ongoing basis pursuant to Rule 251(d)(3)(i)(F). Further, the acceptance of Investor subscriptions may be briefly paused at times to allow the Company to effectively and accurately process and settle subscriptions that have been received. (See “Terms of the Offering” below.)

The Company stock is presently quoted on the Over-The-Counter Venture Market exchange (OTCQB) under the symbol “TZUP”. The Offering price of the Shares offered through this Offering is arbitrary and does not bear any relationship to the value of the assets of the Company.

Investors who purchase Shares will become shareholders of the Company (“Investors” or “Shareholders” subject to the terms of the Articles of Incorporation and Bylaws of the Company (see Exhibits 2A and 2B, respectively) once the Company deposits the Investor’s investment into the Company’s main operating account. There are no selling shareholders in this Offering.

The Directors and Officers may receive compensation from the Company as Directors, and / or employees. (See “Risk Factors”, “Compensation of Directors and Officers” below.) Investing in the Shares is speculative and involves substantial risks, including risk of complete loss. Prospective Investors should purchase the Shares only if they can afford a complete loss of their investment. (See “Risk Factors” below starting on Page 5)

As of the date of this Offering Circular, the Company has engaged Pacific Stock Transfer as transfer agent for this Offering.

RULE 251(D)(3)(I)(F) DISCLOSURE. RULE 251(D)(3)(I)(F) PERMITS REGULATION A OFFERINGS TO CONDUCT ONGOING CONTINUOUS OFFERINGS OF SECURITIES FOR MORE THAN THIRTY (30) DAYS AFTER THE QUALIFICATION DATE IF: (1) THE OFFERING WILL COMMENCE WITHIN TWO (2) DAYS AFTER THE QUALIFICATION DATE; (2) THE OFFERING WILL BE MADE ON A CONTINUOUS AND ONGOING BASIS FOR A PERIOD THAT MAY BE IN EXCESS OF THIRTY (30) DAYS OF THE INITIAL QUALIFICATION DATE; (3) THE OFFERING WILL BE IN AN AMOUNT THAT, AT THE TIME THE OFFERING CIRCULAR IS QUALIFIED, IS REASONABLY EXPECTED TO BE OFFERED AND SOLD WITHIN ONE (1) YEAR FROM THE INITIAL QUALIFICATION DATE; AND (4) THE SECURITIES MAY BE OFFERED AND SOLD ONLY IF NOT MORE THAN THREE (3) YEARS HAVE ELAPSED SINCE THE INITIAL QUALIFICATION DATE OF THE OFFERING, UNLESS A NEW OFFERING CIRCULAR IS SUBMITTED AND FILED BY THE COMPANY PURSUANT TO RULE 251(D)(3)(I)(F) WITH THE SEC COVERING THE REMAINING SECURITIES OFFERED UNDER THE PREVIOUS OFFERING; THEN THE SECURITIES MAY CONTINUE TO BE OFFERED AND SOLD UNTIL THE EARLIER OF THE QUALIFICATION DATE OF THE NEW OFFERING CIRCULAR OR THE ONE HUNDRED EIGHTY (180) CALENDAR DAYS AFTER THE THIRD ANNIVERSARY OF THE INITIAL QUALIFICATION DATE OF THE PRIOR OFFERING CIRCULAR. THE COMPANY INTENDS TO OFFER THE SHARES DESCRIBED HEREIN ON A CONTINUOUS AND ONGOING BASIS PURSUANT TO RULE 251(D)(3)(I)(F). THE COMPANY INTENDS TO COMMENCE THE OFFERING IMMEDIATELY AND NO LATER THAN TWO (2) DAYS FROM THE INITIAL QUALIFICATION DATE. THE COMPANY REASONABLY EXPECTS TO OFFER AND SELL THE SECURITIES STATED IN THIS OFFERING CIRCULAR WITHIN ONE (1) YEAR FROM THE INITIAL QUALIFICATION DATE.

The Company will commence sales of the Shares immediately upon qualification of the Offering by the SEC. The Company approximates sales will commence during Q4 of 2022.

| Price to Public* | Commissions** | Proceeds to the Issuer*** | Proceeds to Other Persons | |||||||||||

| Amount to be Raised per Share | $ | 4.50 | $ | 0.32 | $ | 4.18 | Not Applicable | |||||||

| Minimum Investment Amount | $ | 1,000.00 | $ | 70.00 | $ | 930.00 | Not Applicable | |||||||

| Minimum Offering Amount | Not Applicable | Not Applicable | Not Applicable | Not Applicable | ||||||||||

| Maximum Offering Amount | $ | 10,800,000.00 | (2) | $ | 630,000.00 | $ | 10,170,000.00 | (2) | Not Applicable | |||||

| (1) | The Company is offering up to 2,000,000 shares of Common Stock for purchase by investors in this offering, plus up to 400,000 additional shares of Common Stock, or 20% of the shares of Common Stock offered, eligible to be issued as Bonus Shares to investors based upon investment level, see “Plan of Distribution.” | |

| (2) | Total Maximum Price to Public and Proceeds to Issuer includes $9,000,000, the value of Common Stock assuming $4.50 per share, and includes $1,800,000, the value of the Bonus Shares assuming $4.50 per share; provided, however, we shall not receive such Bonus amounts because Investors are not paying the purchase price for such Bonus Shares. |

*The Offering price per Share for Investors was arbitrarily determined by the Board.

** The Company has engaged Dalmore Group, LLC, member FINRA/SIPC (“Dalmore”), to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. See “Plan of Distribution” for more details. To the extent that the Company’s officers and directors make any communications in connection with the Offering they intend to conduct such efforts in accordance with an exemption from registration contained in Rule 3a4-1 under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and, therefore, none of them is required to register as a broker-dealer.

The Company may pay up to 6% in additional commissions to registered broker-dealers.

***Net Deployable Proceeds to the Company only reflect an approximation of the Proceeds.

TABLE OF CONTENTS

The following information is only a brief summary of, and is qualified in its entirety by, the detailed information appearing elsewhere in this Offering. This Offering Circular, together with the exhibits attached including, but not limited to, the Company Articles of Incorporation and Bylaws, copies of which are attached hereto as Exhibits 2A and 2B and should be carefully read in their entirety before any investment decision is made. If there is a conflict between the terms contained in this Offering Circular and these documents, the Articles of Incorporation and Bylaws shall prevail and control, and no Investor should rely on any reference herein to the Articles of Incorporation and Bylaws without consulting the actual underlying documents.

| COMPANY INFORMATION AND BUSINESS | Thumzup Media Corporation is a Nevada corporation. The principal place of business is located at 11845 W Olympic Blvd, Suite 1100W #13, Los Angeles, CA 90064 | |

| MANAGEMENT | The Company is managed by a Board of Directors. The Board is authorized to hold up to (5) Directors. At this time the Company is operating with two (2) sitting Directors. The Company has one (1) Officer. See “Directors, Officers, and Significant Employees” below. | |

| THE OFFERING | The Company is selling equity in the form of Shares of Common Stock through this Offering of up to $9,000,000. The Company will use the Proceeds of this Offering to expand sales to new Advertisers, acquire new Creators, and improve and further develop the technology. See “Use of Proceeds” below. | |

| SECURITIES BEING OFFERED | The Shares are being offered at a purchase price of $4.50 per Share. The Minimum Investment Amount for any Investor is $1,000.00.

For a complete summary of the rights granted to holders of Common Stock see “Description of the Securities” below. | |

| COMPENSATION TO DIRECTORS | The Company currently pays one of its Directors $1,000.00 per calendar quarter. The Company’s Chief Executive Officer is paid $5,000.00 per month for his service as an officer, but does not earn any additional compensation for his service as a director. For more information see “Compensation of the Directors and Officers” section below.

The Director, Officers, and employees of the Company will not be compensated through commissions for the sale of the Shares through this Offering. | |

| PRIOR EXPERIENCE OF COMPANY MANAGEMENT | The Directors and Officers have extensive experience in vital aspects of the Company’s business. See “Directors, Officers, and Significant Employees” below. |

| 1 |

| INVESTOR SUITABILITY STANDARDS | The Shares will not be sold to any person unless they are a “Qualified Purchaser”. A Qualified Purchaser includes: (1) an “Accredited Investor” as that term is defined in Rule 501(a) of Regulation D promulgated under the Securities Act of 1933 (the “Securities Act”); or (2) all other Investors who meet the investment limitations set forth in Rule 251(d)(2)(C) of Regulation A. Such persons as stated in (2) above must conform with the “Limitations on Investment Amount” as described in the next section.

Each person acquiring Shares may be required to represent that he, she, or it is purchasing the Shares for his, her, or its own account for investment purposes and not with a view to resell or distribute the securities.

Each prospective purchaser of Shares may be required to furnish such information or certification as the Company may require determining whether any person or entity purchasing Shares is an Accredited Investor if such is claimed by the Investor. | |

| LIMITATIONS ON INVESTMENT AMOUNT | For Qualified Purchasers who are Accredited Investors, there is no limitation as to the amount invested through the purchase of Shares. For non-Accredited Investors, the aggregate purchase price paid to the Company for the purchase of the Shares cannot be more than 10% of the greater of the purchaser’s (1) annual income or net worth if purchaser is a natural person; or (2) revenue or net assets for the purchaser’s most recently completed fiscal year if purchaser is a non-natural person.

Different rules apply to Accredited Investors and non-natural persons. Each Investor should review 251(d)(2)(i)(C) of Regulation A before purchasing the Shares. | |

| COMMISSIONS FOR SELLING Shares | The Shares will be offered and sold directly by the Company, the Board, the Officers, and Company’s employees. No commissions for selling the Shares will be paid to the Company, the Board, the Officers, or the Company’s employees.

7% of the offering proceeds shall be payable to broker-dealers in connection with this offering. The Company has engaged Dalmore to act as the broker-dealer of record in connection with this Offering, but not for underwriting or placement agent services. This includes the 1% commission, but it does not include the one-time set-up fee and consulting fee payable by the Company to Dalmore. 6% shall be reserved for future broker-dealers that become a part of this offering. | |

| SELLING SECURITYHOLDERS | There will be no selling Shareholders in this Offering. See “Plan of Distribution” and “Selling Shareholders” below. | |

| COMPANY EXPENSES | Except as otherwise provided herein, the Company shall bear all costs and expenses associated with the Offering, the operation of the Company, including, but not limited to, the annual tax preparation of the Company’s tax returns, any state and federal income tax due, accounting fees, filing fees, and independent audit reports. | |

| NO ASSURANCE OF LISTING ON NATIONAL EXCHANGE | As further described in the “Risk Factors” section below, the Company may never meet the listing criteria of a national exchange, and Investors could be left holding illiquid securities. |

| 2 |

FORWARD LOOKING STATEMENTS

Investors should not rely on forward-looking statements because they are inherently uncertain. Investors should not rely on forward-looking statements in this Offering Circular. This Offering Circular contains forward-looking statements that involve risks and uncertainties. The use of words such as “anticipated,” “projected,” “forecasted,” “estimated,” “prospective,” “believes,” “expects,” “plans,” “future,” “intends,” “should,” “can,” “could,” “might,” “potential,” “continue,” “may,” “will,” and similar expressions identify these forward-looking statements. Investors should not place undue reliance on these forward-looking statements, which may apply only as of the date of this Offering Circular.

INVESTOR SUITABILITY STANDARDS

All persons who purchase the Shares of the Company pursuant to the Securities Purchase Agreement, attached hereto as Exhibit 4, must comply with the Investor Suitability Standards as provided below. It is the responsibility of the purchaser of the Shares to verify compliance with the Investor Suitability Standards. The Company may request that Investor verify compliance, but the Company is under no obligation to do so. By purchasing Shares pursuant to this Offering, the Investor self-certifies compliance with the Investor Suitability Standards. If, after the Company receives Investor’s funds and transfers ownership of the Shares, the Company discovers that the Investor does not comply with the Investor Suitability Standards as provided, the transfer will be deemed null and void ab initio and the Company will return Investor’s funds to the purported purchaser. The amounts returned to the purported purchaser will be equal to the purchase price paid for the Shares less any costs incurred by the Company in the initial execution of the null purchase and any costs incurred by the Company in returning the Investor’s funds. These costs may include any transfer fees, sales fees/commissions, or other fees paid to transfer agents or brokers.

The Company’s Shares are being offered and sold only to “Qualified Purchasers” as defined in Regulation A.

Qualified Purchasers include

(i) “Accredited Investors” defined under Rule 501(a) of Regulation D (as explained below); and

(ii) All other Investors so long as their investment in the Company’s Shares does not represent more than 10% of the greater of the Investor’s, alone or together with a spouse or spousal equivalent, annual income or net worth (for natural persons), or 10% of the greater of annual revenue or net assets at fiscal year-end (for non-natural persons).

| 3 |

The Shares are offered hereby and sold to Investors that meet one of the two categories above. To qualify as an Accredited Investor, for purposes of satisfying one of the tests in the Qualified Purchaser definition, an Investor must meet one of the following conditions

1) An Accredited Investor, in the context of a natural person, includes anyone who

(i) Earned income that exceeded $200,000 (or $300,000 together with a spouse or spousal equivalent) in each of the prior two years, and reasonably expects the same for the current year or

(ii) Has a net worth over $1 million, either alone, or together with a spouse or spousal equivalent (excluding the value of the person’s primary residence), or

(iii) Holds in good standing a Series 7, 65, or 82 license.

2) Additional Accredited Investor categories include

(i) Any bank as defined in Section 3(a)(2) of the Act, or any savings and loan association or other institution as defined in Section 3(a)(5)(A) of the Securities Act, whether acting in its individual or fiduciary capacity; any broker or dealer registered pursuant to Section 15 of the Securities and Exchange Act of 1934 (the “Exchange Act”); any insurance company as defined in Section 2(13) of the Exchange Act; any investment company registered under the Investment Fund Act of 1940 or a business development company as defined in Section 2(a)(48) of that Act; any Small Business Investment Fund (SBIC) licensed by the U.S. Small Business Administration under Section 301(c) or (d) of the Small Business Investment Act of 1958; any plan established and maintained by a State, its political subdivisions, or any agency or instrumentality of a state or its political subdivisions, for the benefit of its employees, if such plan has total assets in excess of $5 million any employee benefit plan within the meaning of the Employee Retirement Income Security Act of 1974, if the investment decision is made by a plan fiduciary, as defined in Section 3(21) of such Act, which is either a bank, savings and loan association, insurance company, or registered investment advisor, or if the employee benefit plan has total assets in excess of $5 million or, if a self-directed plan, with investment decisions made solely by persons who are Accredited Investors;

(ii) Any private business development company as defined in Section 202(a)(22) of the Investment Advisors Act of 1940;

(iii) Any organization described in Section 501(c)(3)(d) of the Internal Revenue Code of 1986, as amended (the “Code”), corporation, Massachusetts or similar business trust, or partnership, not formed for the specific purpose of acquiring the securities offered, with total assets in excess of $5 million;

(iv) Any director or executive officer, or Fund of the issuer of the securities being sold, or any director, executive officer, or Fund of a Fund of that issuer;

(v) Any trust, with total assets in excess of $5 million, not formed for the specific purpose of acquiring the securities offered, whose purchase is directed by a sophisticated person as described in Section 506(B)(b)(2)(ii) of the Code; or

(vi) Any entity in which all of the equity owners are Accredited Investors as defined above.

| 4 |

The SEC requires the Company to identify risks that are specific to its business and its financial condition. The Company is still subject to all the same risks that all companies in its business, and all companies in the economy, are exposed to. These include risks relating to economic downturns, political and economic events and technological developments (such as hacking and the ability to prevent hacking). Additionally, early-stage companies are inherently riskier than more developed companies. prospective Investors should consider general risks as well as specific risks when deciding whether to invest.

Risks Related to the Company and Its Business

In addition to the other information in this Offering Circular, prospective Investors should carefully consider the following factors in evaluating the Company and its business. This Offering Circular contains, in addition to historical information, forward-looking statements that involve risks and uncertainties, some of which are beyond the Company’s control. Should one or more of these risks and uncertainties materialize or should underlying assumptions prove incorrect, the Company’s actual results could differ materially. Factors that could cause or contribute to such differences include, but are not limited to, those discussed below, as well as those discussed elsewhere in this Offering Circular, including the documents incorporated by reference.

There are risks associated with investing in businesses such as the Company that are primarily engaged in research and development. In addition to risks which could apply to any company or business, a prospective Investor should also consider the business the Company is in and the following:

Source and Need for Capital

The Company is a recently formed company with an unproven business plan, has not yet established profitable operations and has generated minimal revenue The Company has principally funded its operations through the sale of senior secured convertible promissory notes in the aggregate principal amount of $215,000 (all of which have been converted into either common or preferred stock), the sale of Common Stock yielding gross proceeds of approximately $1,853,500, and the sale of 19,781 shares of Series A Preferred for aggregate proceeds of approximately $890,000. As the Company moves forward in developing its technology and commercializing the Thumzup mobile application (the “Thumzup® App” or “App”), or as it responds to potential opportunities and/or adverse events, the Company’s working capital needs may change. Pending its ability to generate adequate cash flow, as to which no assurance can be given, the Company likely will continue to incur significant losses in the foreseeable future for various reasons, including unforeseen expenses, difficulties, complications, and delays, and other unknown events. As a result, the Company will require additional funding to sustain its ongoing operations and to continue its research and development activities. The Company cannot assure that its available funds will be sufficient to meet its anticipated needs for working capital and capital expenditures through any period of twelve months.

| 5 |

The Company’s ability to generate positive cash flow will be dependent upon its ability to recruit and retain Advertisers and Creators. The Company can give no assurances it will generate sufficient cash flows in the future to satisfy its liquidity requirements or sustain continuing operations, or that additional funding, if required, will be available when needed or, if available, on favorable terms.

History of Operating Losses

The Company was formed in October 2020 and has not yet established profitable operations and has generated nominal revenue. From January 1, 2021 through December 31, 2021, the Company incurred $857,255 in net losses primarily due to $716,524 in software research and development expenses, $102,698 in general and administrative expenses, and $17,486 in interest expense. From January 1, 2022 through September 30, 2022, the Company has incurred $792,445 in net losses primarily due to $412,477 in software research and development expenses, $243,979 in general and administrative expenses, and $8,886 in interest expense.

The Company expects to continue to incur losses from operations and negative cash flows, which raise substantial doubt about its ability to continue as a “going concern.”

The Company anticipates incurring additional losses until such time, if ever, it can obtain adequate Advertiser support and acceptance by Creators. Substantial additional financing will be needed to fund the Company’s development, marketing and sales activities and generally to commercialize its technology and develop brand support and Creator acceptance. These factors raise substantial doubt about the Company’s ability to continue as a going concern.

The Company will seek to obtain additional capital through the issuance of debt or equity financings or other arrangements to fund operations; however, there can be no assurance it will be able to raise needed capital under acceptable terms, if at all. The sale of additional equity may dilute existing shareholders and newly issued shares may contain senior rights and preferences compared to currently outstanding shares of Common Stock. Issued debt securities may contain covenants and limit the Company’s ability to pay dividends or make other distributions to Shareholders. If the Company is unable to obtain such additional financing, future operations would need to be scaled back or discontinued. Due to the uncertainty in the Company’s ability to raise capital, the Company believes that there is substantial doubt as to its ability to continue as a going concern.

The Company’s independent registered public accounting firm’s reports have raised substantial doubt as to its ability to continue as a “going concern.”

The Company’s independent registered public accounting firm indicated in its reports on the audited financial statements as of and for the periods October 27, 2020 through December 31, 2020, and January 1, 2021 through December 31, 2021, that there is substantial doubt about the Company’s ability to continue as a going concern. A “going concern” opinion indicates that the financial statements have been prepared assuming the business will continue as a going concern and do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets, or the amounts and classification of liabilities that may result if the Company does not continue as a going concern. Therefore, prospective Investors should not rely on the Company balance sheet as an indication of the amount of proceeds that would be available to satisfy claims of creditors, and potentially be available for distribution to shareholders, in the event of liquidation. The presence of the going concern note to the Company’s financial statements may have an adverse impact on the relationships the Company is developing and plan to develop with third parties as it continues the commercialization of its products and could make it challenging and difficult for the Company to raise additional financing, all of which could have a material adverse impact on the business and prospects and result in a significant or complete loss of an investment.

| 6 |

There is no assurance that the Company will ever be profitable or that debt or equity financing will be available to it in the amounts, on terms, and at times deemed acceptable to the Company, if at all. The issuance of additional equity securities by the Company would result in a significant dilution in the equity interests of its Shareholders. Obtaining commercial loans, assuming those loans would be available, would increase the Company’s liabilities and future cash commitments. If the Company is unable to obtain financing in the amounts and on terms deemed acceptable to it, the Company may be unable to continue the business, as planned, and as a result may be required to scale back or cease operations, the results of which would be that Shareholders would lose some or all of their investment. The financial statements do not include any adjustments to reflect the possible future effects on the recoverability and classification of assets or the amounts and classifications of liabilities that may result should the Company be unable to continue as a going concern.

The continuing COVID-19 pandemic may have a significant negative impact on the Company’s business, sales, results of operations and financial condition.

The COVID-19 pandemic continues to adversely affect the United States of America and the world, including in the primary regions in which the Company plans to operate. Additionally, the Company’s liquidity could be negatively impacted if these conditions continue for a significant period of time. Capital and credit markets have been disrupted by the crisis and the Company’s ability to obtain any required financing is not guaranteed and largely dependent upon evolving market conditions and other factors. Depending on the continued impact of the crisis, further actions may be required to improve the Company’s cash position and capital structure.

The extent to which the COVID-19 outbreak could ultimately impact the Company’s business, sales, results of operations and financial condition, will depend on future developments, which are highly uncertain and cannot be predicted, including, but not limited to, the duration and spread of the outbreak, its severity, the actions to contain the virus or treat its impact, and how quickly and to what extent normal economic and operating conditions can resume. Even after the COVID-19 outbreak has fully subsided, the Company may continue to experience significant impacts to its business as a result of its global economic impact, including any economic downturn or recession that has occurred or may occur in the future.

The Company may not generate sufficient cash flows to cover its operating expenses.

As noted previously, the Company has incurred operating losses since inception and expects to continue to incur losses as a result of expenses related to research and continued development of its technology, marketing expense, corporate general and administrative expenses and interest on the senior secured convertible promissory notes. The Company’s limited capital resources and operations to date have been substantially funded through issuance of $215,000 in senior secured convertible promissory notes (in November 2020) and the Company’s subsequent issuances during 2021 of 1,007,836 shares of Common Stock at $1.00 per share and 30,000 shares at $0.001 par value for gross proceeds of $1,149,500, and during 2022 of 275,834 shares of Common Stock at $1.50 and $3.00 per share and 2,000 shares at $0.001 for gross proceeds of $704,000.

| 7 |

As of December 31, 2021, the Company had accumulated deficit of $862,942, cash and cash equivalents of approximately $424,445, and Shareholders’ equity of $179,845. As of September 30, 2022, the Company had total Shareholders’ equity of $1,194,436, accumulated deficit of $1,655,388, cash and cash equivalents of approximately $1,099,761. Although the Company has, as of September 30, 2022, cash on hand of $1,099,761 there is no assurance that these funds will prove adequate beyond twelve months.

In the event that the Company is unable to generate sufficient cash from its operating activities or raise additional funds, it may be required to delay, reduce or severely curtail its operations or otherwise impede the Company’s on-going business efforts, which could have a material adverse effect on its business, operating results, financial condition and long-term prospects.

Security breaches and other disruptions could compromise the Company’s information and expose it to liability, which would cause its business and reputation to suffer.

In the ordinary course of the Company’s business, it may collect and store sensitive data, including intellectual property, proprietary business information, proprietary business information of its customers, including, credit card and payment information, and personally identifiable information of customers and employees. The secure processing, maintenance, and transmission of this information is critical to the Company’s operations and business strategy. As such, the Company is subject to federal, state, provincial and foreign laws regarding privacy and protection of data. Some jurisdictions have enacted laws requiring companies to notify individuals of data security breaches involving certain types of personal data and the Company’s agreements with certain customers require it to notify them in the event of a security incident. Evolving regulations regarding personal data and personal information, in the European Union and elsewhere, including, but not limited to, the General Data Protection Regulation (GDPR), and the California Consumer Privacy Act of 2018, especially relating to classification of IP addresses, machine identification, location data and other information, may limit or inhibit the Company’s ability to operate or expand its business. Such laws and regulations require or may require the Company or its customers to implement privacy and security policies, permit consumers to access, correct or delete personal information stored or maintained by the Company or its customers, inform individuals of security incidents that affect their personal information, and, in some cases, obtain consent to use personal information for specified purposes.

The Company intends to take reasonable steps to protect the security, integrity and confidentiality of the information it collects, uses, stores, and discloses, and it takes steps to strengthen its security protocols and infrastructure, however, the Company’s information technology and infrastructure may be vulnerable to attacks by hackers or breached due to employee error, malfeasance, or other disruptions. The Company also could be negatively impacted by software bugs or other technical malfunctions, as well as employee error or malfeasance. Advanced cyber-attacks can be multi-staged, unfold over time, and utilize a range of attack vectors with military-grade cyber weapons and proven techniques, such as spear phishing and social engineering, leaving organizations and users at high risk of being compromised. Any such access, disclosure, or other loss of information could result in legal claims or proceedings, liability under laws that protect the privacy of personal information, regulatory penalties, a disruption of the Company’s operations, damage to its reputation, a loss of confidence in the Company’s business, early termination of its contracts and other business losses, indemnification of its customers, liability for stolen assets or information, increased cybersecurity protection and insurance costs, financial penalties, litigation, regulatory investigations and other significant liabilities, any of which could materially harm and adversely affect the Company’s business, revenues, and competitive position.

| 8 |

The Company is dependent on third parties to, among other things, maintain its servers, provide the bandwidth necessary to transmit content, and utilize the content derived therefrom for the potential generation of revenues.

The Company depends on third-party service providers, suppliers, and licensors to supply some of the services, hardware, software, and operational support necessary to provide some of its products and services. Some of these third parties do not have a long operating history or may not be able to continue to supply the equipment and services the Company desires in the future. If demand exceeds these vendors’ capacity, or if these vendors experience operating or financial difficulties or are otherwise unable to provide the equipment or services the Company needs in a timely manner, at its specifications and at reasonable prices, the Company’s ability to provide some products and services might be materially adversely affected, or the need to procure or develop alternative sources of the affected materials or services might delay its ability to serve its users. These events could materially and adversely affect the Company’s ability to retain and attract users, and have a material negative impact on its operations, business, financial results, and financial condition.

Because the Company does not intend to pay any cash dividends on its Shares of Common Stock in the near future, Shareholders will not be able to receive a return on their Shares unless and until they sell them.

The Company intends to retain a significant portion of any future earnings to finance the development, operation and expansion of its business. The Company does not anticipate paying any cash dividends on its Common Stock in the near future. The declaration, payment, and amount of any future dividends will be made at the discretion of the Company Board of Directors, and will depend upon, among other things, the results of operations, cash flows, and financial condition, operating and capital requirements, and other factors as its Board of Directors considers relevant. There is no assurance that future dividends will be paid, and, if dividends are paid, there is no assurance with respect to the amount of any such dividend. Unless the Board of Directors determines to pay dividends, Shareholders will be required to look to appreciation of the Company’s Common Stock to realize a gain on their investment. There can be no assurance that this appreciation will occur.

The Company is dependent on key personnel.

The Company’s continued success will depend, to a significant extent, on the services of its Directors, executive management team, and key personnel. If one or more of these individuals were to leave, there is no guarantee the Company could replace them with qualified individuals in a timely or economically satisfactory manner or at all. The loss or unavailability of any or all of these individuals could harm the Company’s ability to execute its business plan, maintain important business relationships and complete certain product development initiatives, which would have a material adverse effect on its business, results of operations and financial conditions.

| 9 |

The Company may not be able to successfully execute the business plan.

The Company is raising significant amounts of capital in order to scale its operations. This will allow the Company to expand its operations and continue to build out its business model. There is no guarantee that the Company will be able to achieve or sustain the foregoing within the anticipated timeframe, or at all – even though the Company’s Directors and Officers are industry professionals. The Company may exceed the budget, encounter obstacles in development activities, or be hindered or delayed in implementing the Company’s plans, any of which could imperil the Company’s ability to execute its business plan.

The Company is a new company with a brief operating history, no revenue and an untested business plan which may not be accepted in the markets in which it intends to operate.

The Company was formed in Nevada in October 2020 and will encounter difficulties, including unforeseen difficulties as an early-stage, pre-revenue company in establishing the credibility of its brand and service.

The Company will incur net losses in the foreseeable future if it is unable to anticipate market trends and match its service offerings to market patterns. The Company’s business strategy is unproven, and it may not be successful in addressing early-stage challenges, such as establishing the Company’s position in the market and developing effective marketing of its Thumzup® App. To implement its business plan, the Company will be required to obtain additional financing but cannot guaranty that such additional financing will be available.

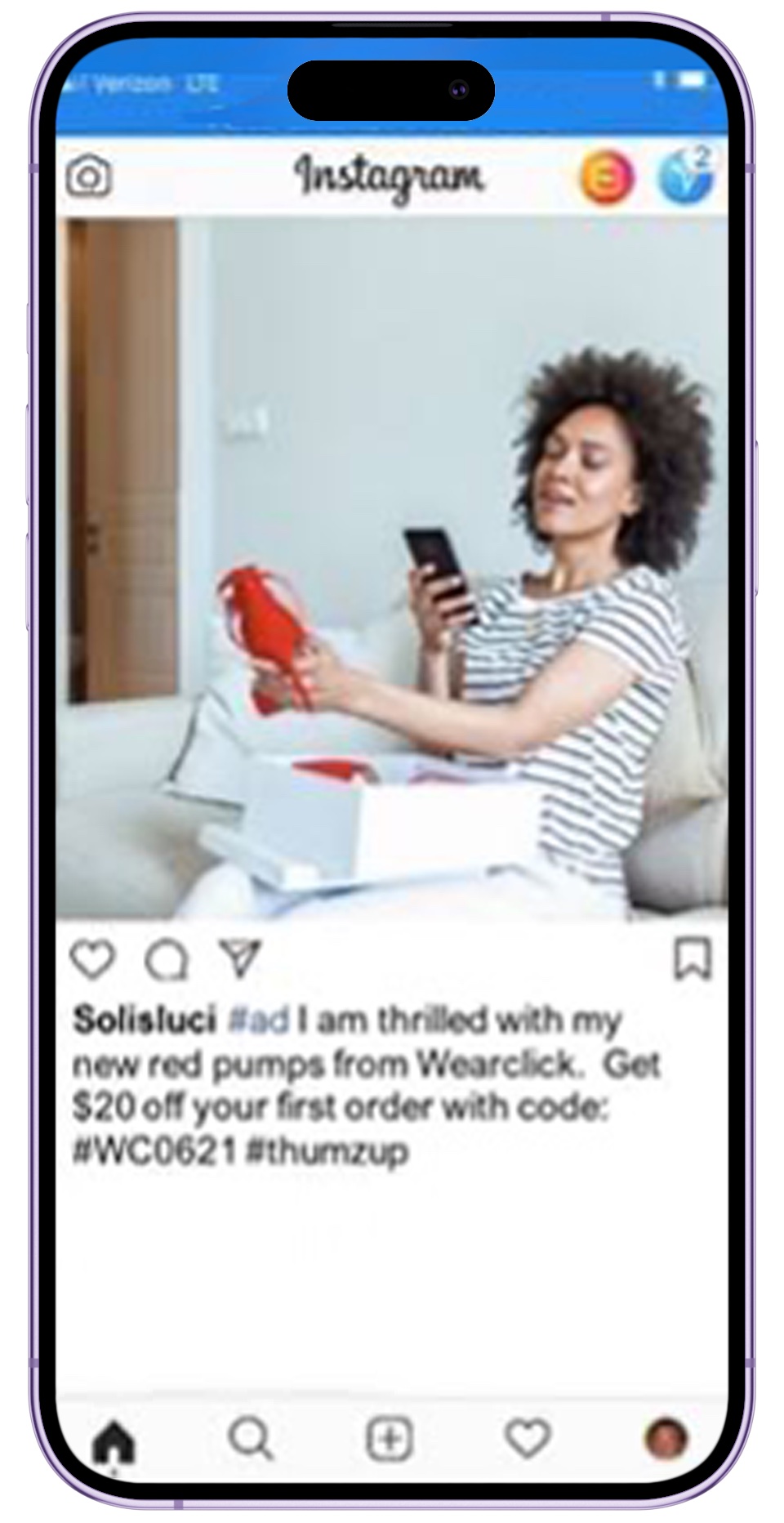

The Company’s prospects must be considered highly speculative, considering the risks, expenses, and difficulties frequently encountered in the establishment of a new business with an unproven business plan, specifically the risks inherent in developmental stage companies seeking to have mobile app users with limited number social media followers endorse products or services at a level that Advertisers will seek to fund and support. The Company expects to continue to incur significant operating and capital expenditures and, as a result, it expects significant net losses in the future. The Company cannot assure that it will be able to achieve positive cash flow operations or, if achieved, that positive cash can be maintained for any significant period, or at all.

Although the Company believes that its business strategy addresses an underserved but significant niche of market segment utilizing important Creators or consumers whom it defines as “micro-influencers,” the Company may not be successful in the implementation of its business strategy or its business strategy may not be successful, either of which will impede the Company’s development and growth. The Company’s business strategy involves attracting a large number of Creators who are active in social media and who are willing to make recommendations over the Thumzup® App with Advertisers who find the Company’s service cost effective in generating sales and market support. The Company’s ability to implement this business strategy is dependent on its ability to:

| ● | predict concerns of Advertisers; | |

| ● | identify and engage Advertisers; | |

| ● | convince a large number of end users to adopt the Thumzup® App; | |

| ● | establish brand recognition and customer loyalty; and | |

| ● | manage growth in administrative overhead costs during the initiation of the Company’s business efforts. |

| 10 |

The Company does not know whether it will be able to successfully implement its business strategy or whether the Company’s business strategy will ultimately be successful. In assessing the Company’s ability to meet these challenges, a potential Investor should consider the Company’s lack of operating history and brand recognition, its focus on nano-influencer Creators, management’s relative inexperience, the competitive conditions existing in its industry and general economic conditions and consumer discretionary spending habits. The Company’s growth is largely dependent on its ability to successfully implement its business strategy. The Company’s revenue may be adversely affected if it fails to implement its business strategy or if the Company diverts resources to a business strategy that ultimately proves unsuccessful.

The Company has not yet established brand identity and customer loyalty.

The Company believes that establishing and maintaining brand identity and brand loyalty is critical to attracting and retaining active users to the Thumzup® App program. In order to attract Thumzup® App Creators to the Company’s program quarter over quarter, the Company may need to spend substantial funds to create and maintain brand recognition among Thumzup® App users. If the Company’s branding efforts are not successful, its ability to earn revenues and sustain its operations will be materially impaired.

Promotion and enhancement of the Thumzup® App will also depend on the Company’s success in consistently providing high-quality, ease-of-use, fun-to-share products or recommended services to the Company’s App users. Since the Company relies on technology partners to provide portions of the service to its customers, if the Company’s suppliers do not send accurate and timely data, or if its customers do not perceive the products it offers as attractive or superior, the value of the Thumzup® brand could be harmed. Any brand impairment or dilution could decrease the attractiveness of Thumzup® to one or more of these groups, which could harm the Company’s business, results of operations and financial condition.

The Company cannot assure prospective Investors that the Thumzup® App will be accepted.

Anticipation of demand and market acceptance of service offerings are subject to a high level of uncertainty and challenges to implementation. The success of the Company’s service offerings primarily depends on the interest of Creators joining its service, as to which it cannot assure to prospective Investors. In general, achieving market acceptance for the Company’s services will require substantial marketing efforts and the expenditure of significant funds, the availability of which the Company cannot be assured, to create awareness and demand among customers. The Company has limited financial, personnel and other resources to undertake extensive marketing activities. Accordingly, no assurance can be given as to the acceptance of the Thumzup® App services or the Company’s ability to generate the revenues necessary to remain in business.

| 11 |

A better financed competitor may enter the marketplace, cause the Company’s market share or acceptance rates to plummet and adversely affect its ability to sustain viable operations.

While platforms are in operation for professional or large-scale influencers, to the Company’s knowledge no other company is currently offering Advertisers a scalable platform to activate everyday end-user micro-influencers who do not possess a large legion of followers. The success of the Company’s service offerings primarily depends on the interest of Creators and Advertisers joining its service, as opposed to a similar service offered by a competitor catering to celebrities or other large-scale influencers. If a direct competitor having greater human and cash resources enters the market targeting micro-influencers, the Company’s achieving market acceptance for the Thumzup® App may require additional marketing efforts and the expenditure of significant funds to create awareness and demand among customers. The Company has limited financial, personnel and other resources to undertake additional marketing activities. Accordingly, the Company may be unable to compete, its operations may suffer, and it may suffer greater losses.

Although the Company may own various intellectual property rights, these rights may not provide it with any competitive advantage.

The Company uses “Thumzup®” as a brand name, however it cannot assure prospective Investors that the services it sells, or that its brand name will not infringe on the intellectual property rights of others, or that the Company’s assertions of intellectual property rights will be enforceable or provide protection against competitive products or otherwise be commercially valuable. Moreover, enforcement of intellectual property rights typically requires time-consuming and costly litigation, and the Company cannot assure that others will not independently develop substantially similar products.

The Company’s future financial results are uncertain and its operating results may fluctuate, due to, among other things, consumer trends, the impact of COVID on advertising budgets and App user activity, competition, and changing social media behaviors.

As a result of the Company’s lack of operating history, it is unable to forecast market penetration or anticipated revenue and it has little historical financial data upon which to base planned operating expenses. The Company bases its current and future expense levels on its operating plans and estimates of future expenses. The Company’s expenses are dependent in large part upon expenses associated with its proposed marketing expenditures and related overhead expenses, and the costs of hiring and maintaining qualified personnel to carry out its respective services. Sales and operating results are difficult to forecast because they will depend on the growth of the Company’s customer base, changes in customer demands based on consumer trends, the degree of utilization of its advertising services as well as the mix of products and services sold by its Advertisers.

As a result, the Company may be unable to make accurate financial forecasts and adjust its spending in a timely manner to compensate for any unexpected revenue shortfall. This inability could cause the Company’s net losses in a given quarter to be greater than expected and could further cause continuing greater losses quarter over quarter.

| 12 |

The Company’s ability to succeed will depend on the ability of its management to control costs.

The Company has used reasonable commercial efforts to assess and predict costs and expenses based on the and restricted cash experience of its management. However, the Company has a limited operating history upon which to base predictions. Implementing its business plan may require more employees, equipment, supplies or other expenditure items than the Company has predicted. Similarly, the cost of compensating additional management, employees and consultants or other operating costs may be more than its estimates, which could result in sustained losses.

The Company’s Officers and Directors do not devote full time to the affairs of the Company and could allocate their time and attention to other business ventures which may not benefit the Company.

The Company’s Officers and Directors may engage in other activities. Although there are none known to the Company, the potential for conflicts of interest exists among the Officers, Directors, and affiliated persons for future business opportunities that may not be presented to the Company. The Company’s Officers and Directors may have conflicts of interests in allocating time, services, and functions between the other business ventures in which those persons may be or become involved. The Company’s Officers and Directors however believe that the business will have sufficient staff, consultants, employees, agents, contractors, and managers to adequately conduct its business.

The Company’s Officers, Directors, and employees are entitled to receive compensation, payments and reimbursements, regardless of whether it operates at a profit or a loss.

While the Company’s Officers and founders currently receive no salaries, consulting fees, loans or payment of any kind, they may in the future. Any compensation received by the Officers, management personnel, and Directors, and for the Company’s founders will be determined from time to time by the Board of Directors. The Company’s Officers, Directors and management personnel will be reimbursed for any out-of-pocket expenses incurred on their behalf.

Combination or “layering” of multiple risk factors may significantly increase the risk of loss on the Shares.

Although the various risks discussed in this Offering Circular are generally described separately, prospective Investors should consider the potential effects of the interplay of multiple risk factors. Where more than one significant risk factor is present, the risk of loss to an Investor may be significantly increased. In considering the potential effects of layered risks, an Investor should carefully review the descriptions of the Offering and the Shares.

| 13 |

Our business is sensitive to consumer spending, inflation and economic conditions.

Consumer purchases of discretionary retail items and restaurants may be adversely affected by national and regional economic, market and other conditions such as employment levels, salary and wage levels, the availability of consumer credit, inflation, high interest rates, high tax rates, high fuel prices, the threat of a pandemic or other health crisis (such as COVID-19) and consumer confidence with respect to current and future economic, market and other conditions. Consumer purchases may decline during recessionary periods or at other times when unemployment is higher or disposable income is lower. These risks may be exacerbated for retailers such as our Advertisers. Consumer willingness to make discretionary purchases may decline, may stall or may be slow to increase due to national and regional economic conditions. Our financial performance is particularly susceptible to economic and other conditions in regions or states where we have a significant presence. There remains considerable uncertainty and volatility in the national and global economy. Further or future slowdowns or disruptions in the economy, market and other conditions could adversely affect mall traffic and new mall and shopping center development and could materially and adversely affect us and our business strategy. We may not be able to sustain or increase our current net sales if there is a decline in consumer spending.

A deterioration of economic conditions and future recessionary periods may exacerbate the other risks faced by our business, including those risks we encounter as we attempt to execute our business plans. Such risks could be exacerbated individually or collectively.

Russia’s Invasion of Ukraine may negatively impact our business.

On February 24, 2022, Russia launched an invasion of Ukraine which has resulted in increased volatility in various financial markets and across various sectors. The United States and other countries, along with certain international organizations, have imposed economic sanctions on Russia and certain Russian individuals, banking entities and corporations as a response to the invasion. The extent and duration of the military action, resulting sanctions and future market disruptions in the region are impossible to predict. Moreover, the ongoing effects of the hostilities and sanctions may not be limited to Russia and Russian companies and may spill over to and negatively impact other regional and global economic markets of the world, including Europe and the United States. The ongoing military action along with the potential for a wider or nuclear conflict could further increase financial market volatility and cause negative effects on regional and global economic markets, industries, and companies. It is not currently possible to determine the severity of any potential adverse impact of this event on the financial condition of any of the Company’s securities, or more broadly, upon the global economy.

Several of our outsourced developers are based in Pakistan and our product development could be impacted by conflict in the Middle East.

Pakistan’s economy is heavily dependent on exports and subject to high interest rates, economic volatility, inflation, currency devaluations, high unemployment rates and high level of debt and public spending. There is also the possibility of nationalization, expropriation or confiscatory taxation, security market restrictions, political changes, government regulation, a conflict with India, or diplomatic developments (including war or terrorist attacks), which could affect adversely the economy of Pakistan or the ability of the Company to continue developing its platform. As an emerging country, Pakistan’s economy is susceptible to economic, political and social instability; unanticipated economic, political or social developments could impact economic growth. Pakistan is also subject to natural disaster risk. In addition, recent political instability and protests in the Middle East have caused significant disruptions to many industries. Pakistan has recently seen elevated levels of ethnic and religious conflict, in some cases resulting in violence or acts of terrorism. Continued political and social unrest in these areas may negatively affect the Company.

| 14 |

We rely on third-party internal and outsourced software to run our critical development and information systems. As a result, any sudden loss, disruption or unexpected costs to maintain these systems could significantly increase our operational expense and disrupt the management of our business operations.

We rely on third-party software to run our critical development and information systems. We also depend on our software vendors to provide long-term software maintenance support for our information systems. Software vendors may decide to discontinue further development, integration or long-term software maintenance support for our information systems, in which case we may need to abandon one or more of our current information systems and migrate some or all of our development and information systems, thus increasing our operational expense as well as disrupting the management of our business operations.

Cyber security breaches of our systems and information technology could adversely impact our ability to operate.

We need to protect our own internal trade secrets, work product for our clients, and other business confidential information from disclosure. We face the threat to our computer systems of unauthorized access, computer hackers, computer viruses, malicious code, organized cyber-attacks and other security problems and system disruptions, including possible unauthorized access to our and our clients’ proprietary or classified information.

We rely on industry-accepted security measures and technology to maintain securely all confidential and proprietary information on our information systems. We have devoted and will continue to devote significant resources to the security of our computer systems, but they are still vulnerable to these threats. A user who circumvents security measures can misappropriate confidential or proprietary information, including information regarding us, our personnel and/or our clients, or cause interruptions or malfunctions in operations. Our industry has not been immune from organized cyber-attacks from persons seeking a ransom as a condition of releasing access to the firm’s computer systems. As a result, we can be required to expend significant resources to protect against the threat of these system disruptions and security breaches or to alleviate problems caused by these disruptions and breaches. Any of these events can damage our reputation and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Risks Related to the Common Stock and this Offering

There can be no assurance that our Common Stock will ever be approved for listing on a national securities exchange. Failure to develop or maintain an active trading market could negatively affect the value of our Common Stock and make it difficult or impossible for investors to sell their shares in a timely manner.

There is currently very limited trading of our Common Stock, and an active trading market may never develop. Our Common Stock is quoted on the OTCQB tier of the OTC Markets. The OTCQB tier of the OTC Markets is a thinly traded market and lacks the liquidity of certain other public markets with which some investors may have more experience. While we remain determined to work towards getting our securities listed on a national exchange, there can be no assurance that this will occur. As a result, we may never develop an active trading market for our securities which may limit our investors’ ability to liquidate their investments.

The Offering price of the Company’s Shares was not established on an independent basis; the actual value of an investment may be substantially less than what Investor pays for the securities.

The Company’s Board of Directors established the Offering price of the Company’s Shares on an arbitrary basis. The selling price of the Shares bears no relationship to the book or asset values or to any other established criteria for valuing Shares. Because the Offering price is not based upon any independent valuation, the Offering price may not be indicative of the proceeds that an Investor would receive upon liquidation. Further, the Offering price may be significantly more than the price at which the Shares would trade if they were to be listed on an exchange or actively traded by broker-dealers.

| 15 |

Investors will experience immediate and substantial dilution as a result of this Offering and may experience additional dilution in the future.

Investors will incur immediate and substantial dilution as a result of this Offering. Assuming all of the Shares of Common Stock offered by the Company herein are sold and the maximum number of bonus shares issued, the purchasers in this Offering will lose a 80.69% portion of the value of their Shares purchased. See “Dilution” in this Offering Circular for a more detailed discussion of the dilution an Investor will incur by purchasing the Company’s Common Stock in the Offering.

Management will have broad discretion as to the use of the Proceeds from this Offering and may not use the Proceeds effectively.

The Company’s management will have broad discretion in the application of the net Proceeds from this Offering and could spend the Proceeds in ways that may not improve the Company’s results of operations or enhance the value of its Common Stock. The Company’s failure to apply these funds effectively could have a material adverse effect on the business and cause the price of the Common Stock to decline.

The Company is controlled by its Chairman/Board of Directors, Chief Executive Officer, President, and additional Officers of the Company.

The Company is reliant on the Directors and Officers for key operations. Upon a successful Offering where the Maximum Offering Amount is raised, an Investor in this Offering will not own a majority of the Company’s voting stock. Investors in this Offering will not have a majority of voting Shares and therefore will not have the have the ability to control a vote of the Shareholders without consensus from the Directors, Officers, or other Common Stock Shareholders. The Board, therefore, has complete control as to the direction of the Company. There is a disproportionate reliance on the Directors and Officers for the operation of the Company, and therefore a risk that the direction of the Company may change if the Board or Officers are unable to perform their duties as Directors and Officers.

The Company’s Common Stock price may be volatile, which could result in substantial losses to Investors and litigation.

In addition to changes to market prices based on the Company’s results of operations and the factors discussed elsewhere in this “Risk Factors” section, the market price of and trading volume for the Common Stock may change for a variety of other reasons, not necessarily related to the Company’s actual operating performance. The capital markets have experienced extreme volatility that has often been unrelated to the operating performance of particular companies. These broad market fluctuations may adversely affect the trading price of the Company’s Common Stock. In addition, the average daily trading volume of the securities of small companies can be very low, which may contribute to future volatility. Factors that could cause the market price of the Common Stock to fluctuate significantly include:

| ● | the results of operating and financial performance and prospects of other companies in the same industry; | |

| ● | strategic actions by the Company or its competitors, such as acquisitions or restructurings; |

| 16 |

| ● | announcements of innovations, increased service capabilities, new or terminated customers or new, amended or terminated contracts by competitors; | |

| ● | the public’s reaction to Company press releases, other public announcements, and filings with the Securities and Exchange Commission; | |

| ● | lack of securities analyst coverage or speculation in the press or investment community about the Company or market opportunities in the social media marketing industry; | |

| ● | changes in government policies in the United States and, as the Company’s international business increases, in other foreign countries; | |

| ● | changes in earnings estimates or recommendations by securities or research analysts who track the Company’s Common Stock or failure of the Company’s actual results of operations to meet those expectations; | |

| ● | market and industry perception of the Company’s success, or lack thereof, in pursuing its growth strategy; | |

| ● | changes in accounting standards, policies, guidance, interpretations or principles; | |

| ● | any lawsuit involving the Company, its services or its products; | |

| ● | arrival and departure of key personnel; | |

| ● | sales of Common Stock by the Company, its investors or members of its management team; and | |

| ● | changes in general market, economic and political conditions in the United States and global economies or financial markets, including those resulting from natural or man-made disasters. |

Any of these factors, as well as broader market and industry factors, may result in large and sudden changes in the trading volume of the Company’s Common Stock and could seriously harm the market price of the Common Stock, regardless of the Company’s operating performance. This may prevent an Investor from being able to sell its Shares at or above the price the Investor paid for its Shares of Common Stock, if at all. In addition, following periods of volatility in the market price of a company’s securities, shareholders often institute securities class action litigation against that company. The Company’s involvement in any class action suit or other legal proceeding could divert its senior management’s attention and could adversely affect the Company’s business, financial condition, results of operations and prospects.

The sale or availability for sale of substantial amounts of the Company’s Common Stock could adversely affect the market price of the Common Stock.

Sales of substantial amounts of Shares of the Company’s Common Stock after the completion of the Offering, or the perception that these sales could occur, could adversely affect the market price of the Common Stock and could impair the Company’s future ability to raise capital through Common Stock offerings. Following this Offering, the Company’s Officers and Directors will still beneficially own, collectively, a substantial percentage of the outstanding Common Stock. If one or more of them were to sell a substantial portion of the Shares they hold, it could cause the Company’s stock price to decline.

| 17 |

The Company is controlled by a small group of existing Shareholders, whose interests may differ from other Shareholders. The Company’s Officers and Directors will significantly influence its activities, and their interests may differ from an Investor’s interests as a Shareholder.

Following this Offering, the Company’s Officers and Directors will still beneficially own, collectively, a substantial percentage of the outstanding Common Stock. Accordingly, these Shareholders have had, and will continue to have, significant influence in determining the outcome of any corporate transaction or any other matter submitted for approval to the Company’s Shareholders, including mergers, consolidations and the sale of assets, Director elections and other significant corporate actions. They will also have significant influence in preventing or causing a change in control of the Company. In addition, without the consent of these Shareholders, the Company could be prevented from entering into transactions that could be beneficial to it. The interests of these Shareholders may differ from an Investor’s interests as a Shareholder, and they may act in a manner that advances their best interests and not necessarily those of other Shareholders.

The Company is an “emerging growth company” under the JOBS Act and it cannot be certain if the reduced disclosure requirements applicable to emerging growth companies will make the Company’s Common Stock less attractive to investors.

The Company is an “emerging growth company,” as defined in the JOBS Act, and it expects to take advantage of certain exemptions from various reporting requirements that are applicable to other public companies that are not “emerging growth companies” including, but not limited to, (i) being required to present only two years of audited financial statements and related financial disclosure, (ii) not being required to comply with the auditor attestation requirements of Section 404 of the Sarbanes-Oxley Act, (iii) extended transition periods for complying with new or revised accounting standards, (iv) reduced disclosure obligations regarding executive compensation in periodic reports and proxy statements and (v) exemptions from the requirements of holding a nonbinding advisory vote on executive compensation and stockholder approval of any golden parachute payments not previously approved. The Company has taken, and in the future may take, advantage of these exemptions until such time that it is no longer an “emerging growth company. As a result, the Company’s financial statements may not be comparable to companies that comply with public company effective dates. The Company cannot predict if investors will find its Common Stock less attractive because it relies on these exemptions. If some investors find the Company’s Common Stock less attractive as a result, there may be a less active trading market for the Common Stock and the price of the Common Stock may be more volatile.

The Company will remain an “emerging growth company” for up to five years, although it will lose that status sooner if its annual revenues exceed $1.07 billion, if it issues more than $1 billion in non-convertible debt in a three-year period, or if the market value of the Common Stock that is held by non-affiliates exceeds $700 million as of any June 30.

We are offering Bonus Shares to some investors in this offering, which effectively gives them a discount on their investment.

Certain investors in this offering who invest more than $10,000, $50,000, $100,000, or $250,000, are entitled to receive Bonus Shares as a specific percentage of the amount of their investment. The Bonus Shares effectively gives such investors in this offering a discount on their investment. Therefore, the value of shares of investors who invest less than $10,000 will be immediately diluted by investments made by investors entitled to receive the Bonus Shares, who will effectively pay a lower price per share.

The Company’s disclosure controls and procedures may not prevent or detect all errors or acts of fraud.

The Company is subject to the periodic reporting requirements of the Exchange Act, and will be required to maintain disclosure controls and procedures that are designed to reasonably assure that information required to be disclosed by the Company in reports it files or submits under the Exchange Act is recorded, processed, summarized and reported within the time periods specified by the rules and forms of the SEC, and that such information is accumulated and communicated to management to allow timely decisions regarding required disclosure.

| 18 |

As a public company, the Company is also required to maintain internal control over financial reporting and to report any material weaknesses in those internal controls. Such internal controls are designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements for external purposes in accordance with generally accepted accounting principles. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of a company’s annual or interim financial statements will not be prevented or detected on a timely basis. The Company identified three material weaknesses in its internal control over financial reporting at December 31, 2020. The material weaknesses related to (i) lack of proper segregation of duties across significant accounting cycles, (ii) lack of effective information technology security policies and control over access to key systems, and (iii) lack of precision in the design of internal control over financial reporting. Although the Company made efforts to remediate these issues, these efforts may not be sufficient to avoid similar material weaknesses in the future. Designing and implementing internal controls over financial reporting will be time consuming, costly and complicated as the Company is a small organization with limited management resources.

If the material weaknesses in the Company’s internal controls are not fully remediated or if additional material weaknesses are identified, those material weaknesses could cause the Company to fail to meet its future reporting obligations, reduce the market’s confidence in its financial statements, harm the stock price and subject the Company to sanctions or investigations by the SEC or other regulatory authorities. In addition, the Company’s Common Stock may not be able to remain quoted on OTCQB or any other securities quotation service or exchange.

For as long as the Company is an “emerging growth company,” as defined in the JOBS Act, or a non-accelerated filer, as defined in Rule 12b-2 under the Exchange Act, the Company’s auditors will not be required to attest as to its internal control over financial reporting. If the Company continues to identify material weaknesses in its internal control over financial reporting, are unable to comply with the requirements of Section 404 in a timely manner, are unable to assert that its internal control over financial reporting is effective or, once required, the Company’s independent registered public accounting firm is unable to attest that its internal control over financial reporting is effective, investors may lose confidence in the accuracy and completeness of its financial reports and the market price of the Company’s Common Stock could decrease. The Company could also become subject to stockholder or other third-party litigation as well as investigations by the securities exchange on which the Company’s securities are listed, the SEC or other regulatory authorities, which could require additional financial and management resources and could result in fines, trading suspensions or other remedies.

If equity research analysts do not publish research or reports about the Company, or if they issue unfavorable commentary or downgrade its Common Stock, the market price of its Common Stock will likely decline.

The trading market for the Company’s Common Stock will rely in part on the research and reports that equity research analysts, over whom it has no control, publish about the Company and its business. The Company may never obtain research coverage by securities and industry analysts. If no securities or industry analysts commence coverage of the Company, the market price for its Common Stock could decline. In the event the Company obtains securities or industry analyst coverage, the market price of the Common Stock could decline if one or more equity analysts downgrade the Common Stock or if those analysts issue unfavorable commentary, even if it is inaccurate, or cease publishing reports about the Company or its business.

| 19 |

MATERIAL U.S. FEDERAL INCOME TAX CONSIDERATIONS

The following discussion is a summary of certain material U.S. federal income tax consequences relevant to the purchase, ownership and disposition of the Shares, but does not purport to be a complete analysis of all potential tax consequences. The discussion is based upon the United States Internal Revenue Service (“IRS”) Code (the “Code”), current, temporary and proposed U.S. Treasury regulations issued under the Code, or collectively the Treasury Regulations, the legislative history of the Code, IRS rulings, pronouncements, interpretations and practices, and judicial decisions now in effect, all of which are subject to change at any time. Any such change may be applied retroactively in a manner that could adversely affect a Shareholder. This discussion does not address all of the U.S. federal income tax consequences that may be relevant to a holder in light of such Shareholder’s particular circumstances or to Shareholders subject to special rules, including, without limitation:

| ● | a broker-dealer or a dealer in securities or currencies; | |

| ● | an S corporation; | |

| ● | a bank, thrift or other financial institution; | |

| ● | a regulated investment company or a real estate investment trust; | |

| ● | an insurance company | |

| ● | a tax-exempt organization; | |

| ● | a person subject to the alternative minimum tax provisions of the Code; | |

| ● | a person holding the Shares as part of a hedge, straddle, conversion, integrated or other risk reduction or constructive sale transaction; | |

| ● | a partnership or other pass-through entity; | |

| ● | a person deemed to sell the Shares under the constructive sale provisions of the Code; | |

| ● | a U.S. person whose “functional currency” is not the U.S. dollar; or | |

| ● | a U.S. expatriate or former long-term resident. |

In addition, this discussion is limited to persons that purchase the Shares in this offering for cash and that hold the Shares as “capital assets” within the meaning of Section 1221 of the Code (generally, property held for investment). This discussion does not address the effect of any applicable state, local, non-U.S. or other tax laws, including gift and estate tax laws.

As used herein, “U.S. Holder” means a beneficial owner of the Shares that is, for U.S. federal income tax purposes: