PROXY STATEMENT FOR SPECIAL MEETING OF

DYNAMICS SPECIAL PURPOSE CORP.

PROSPECTUS FOR 26,000,000 SHARES OF CLASS A COMMON STOCK

All of the members of the board of directors of Dynamics Special Purpose Corp., a Delaware corporation (“DYNS”), voting on the transaction approved the Business Combination Agreement, dated as of December 19, 2021 (as amended from time to time, including as amended on February 12, 2022 by Amendment No. 1 to Business Combination Agreement, the “Business Combination Agreement”), by and among DYNS, Explore Merger Sub, Inc., a Delaware corporation and wholly-owned subsidiary of DYNS (“Merger Sub”), and Senti Biosciences, Inc., a Delaware corporation (“Senti”), pursuant to which Merger Sub will merge with and into Senti, with Senti surviving as a wholly-owned subsidiary of DYNS (the “Business Combination”). In connection with the consummation of the Business Combination, DYNS will change its corporate name to “Senti Biosciences, Inc.” In this proxy statement/prospectus, when we refer to “Senti,” we mean Senti Biosciences, Inc. prior to the consummation of the Business Combination, and when we refer to “New Senti” or the “Combined Company,” we mean DYNS, under its new corporate name after the consummation of the Business Combination.

At the effective time of the Business Combination (the “Effective Time”), (i) each outstanding share of Senti common stock will be cancelled and converted into the right to receive a number of shares of Class A Common Stock equal to the Exchange Ratio (as defined in this proxy statement/prospectus), (ii) each outstanding share of Senti preferred stock will be cancelled and converted into the right to receive a number of shares of Class A Common Stock equal to (A) the aggregate number of shares of Senti common stock that would be issued upon conversion of the shares of Senti preferred stock based on the applicable conversion ratio immediately prior to the Effective Time, multiplied by (B) the Exchange Ratio, and (iii) each outstanding Senti option (whether vested or unvested) will be converted into an option to purchase a number of shares of Class A Common Stock equal to (A) the number of shares of Senti common stock subject to such option immediately prior to the Effective time, multiplied by (B) the Exchange Ratio, at an exercise price per share equal to the current exercise price per share for such option divided by the Exchange Ratio; in each case, rounded down to the nearest whole share, and rounded up to the nearest whole cent in the case of the exercise price of the Senti options. Holders of shares of Senti common stock and Senti preferred stock may also be eligible to receive up to an aggregate of 2,000,000 shares of Class A Common Stock (the “Contingency Consideration,” which would be common stock of New Senti) based on the share price of New Senti’s common stock following the Business Combination or, in some circumstances, upon a change of control of New Senti. See the section titled “Proposal 1: The Business Combination Proposal” for further information.

Based on an assumed closing date of June 8, 2022 for the Business Combination, the Exchange Ratio is approximately 0.1955 (the calculation of which is described on page 169 of this proxy statement/prospectus). Based on this Exchange Ratio, the total number of shares of Class A Common Stock expected to be issued at the Effective Time in connection with the Business Combination (not including shares that will be issuable upon exercise of outstanding stock options, and not including shares issued in connection with the PIPE Investment (as defined in this proxy statement/prospectus)) is approximately 23,112,889 shares and, assuming that (i) no additional DYNS shares are issued prior to the Effective Time, (ii) there is no exercise of any options to purchase shares of Class A Common Stock that will be outstanding immediately following the Business Combination, (iii) no shares are issued in connection with the Contingency Consideration, and (iv) no shares are issued in connection with the Incentive Plan or the ESPP (each as defined in this proxy statement/prospectus) following the Business Combination, these shares are expected to represent between approximately 39.0% and 52.3% of the issued and outstanding shares of Class A Common Stock (which would be New Senti common stock) and voting power in New Senti immediately following the closing of the PIPE Investment and the Business Combination. These percentages assume, at the low end of the range, that no redemptions from our Trust Account (as defined in this proxy statement/prospectus) occur, and, at the high end of the range, that maximum redemptions from our Trust Account occur, and also that no shares of Class A Common Stock which are subject to Non-Redemption Agreements (as defined in this proxy statement/prospectus) as at the date of this proxy statement/prospectus are redeemed. Please see the section of this proxy statement/prospectus entitled “Unaudited Pro Forma Condensed Combined Financial Information” for further information regarding what constitutes a “maximum redemptions” scenario.

Subject to the same assumptions set forth in the preceding paragraph, and also assuming that 885,377 Founder Shares (as defined in this proxy statement/prospectus) are forfeited by the Sponsor (as defined in this proxy statement/prospectus) and cancelled, with certain DYNS public stockholders concurrently being issued an equivalent number of shares of Class A Common Stock in connection with the Non-Redemption Agreements, DYNS’s public stockholders are expected to hold between 40.6% and 20.5% of the issued and outstanding common stock and voting power in New Senti. These percentages assume, at the low end of the range, that no redemptions from our Trust Account occur, and, at the high end of that range, that maximum redemptions from our Trust Account occur.

Certain privately held entities affiliated with certain of DYNS’s officers and directors will participate in the PIPE Investment by subscribing for an aggregate of 500,000 shares of Class A Common Stock at the time the Business Combination is consummated, on the same terms and conditions as other PIPE Investors (as defined in this proxy statement/prospectus). These entities are also affiliates of our Sponsor. Immediately following the Business Combination and the PIPE Investment, subject to the same assumptions set forth in the two preceding paragraphs, the Sponsor together with its affiliates is expected to collectively hold between approximately 10.3% and 13.7% of the issued and outstanding common stock and voting power in New Senti. These percentages assume, at the low end of the range, that no redemptions from our Trust Account occur, and, at the high end of that range, that maximum redemptions from our Trust Account occur.

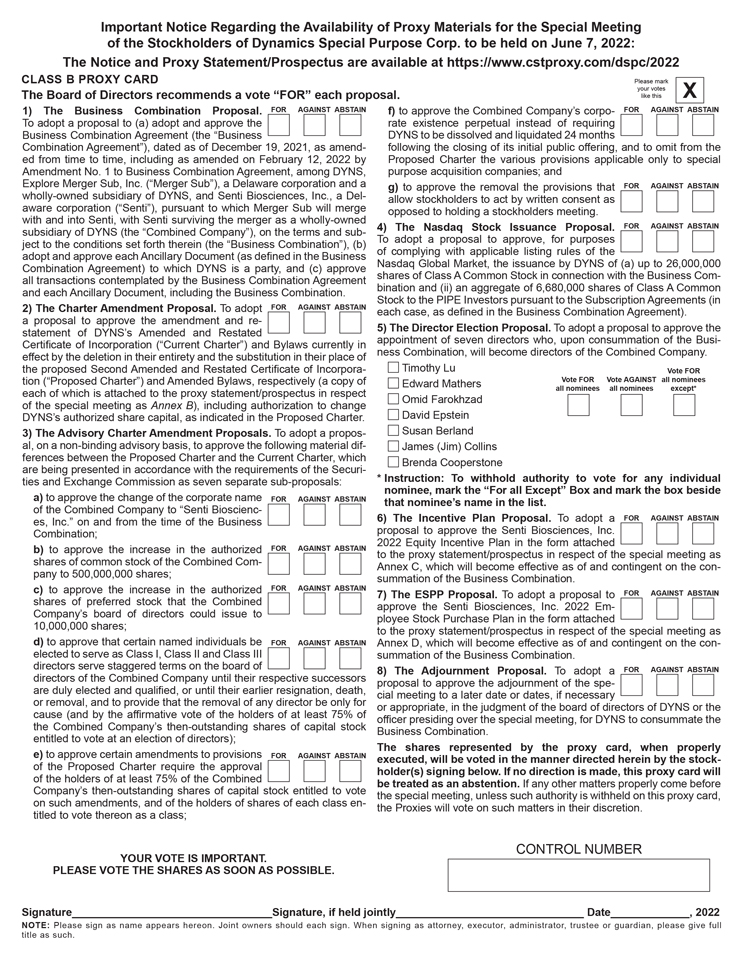

Proposals to approve the Business Combination Agreement and the other matters discussed in this proxy statement/prospectus will be presented for approval by DYNS’s stockholders at the special meeting of stockholders of DYNS (the “Special Meeting”) scheduled to be held on June 7, 2022, in virtual format.

DYNS’s Class A Common Stock is currently listed on The Nasdaq Capital Market under the symbol “DYNS.” DYNS intends to apply to list its shares of Class A Common Stock effective upon the consummation of the Business Combination on the Nasdaq Global Market (“Nasdaq”) under the proposed symbol “SNTI.” No shares will trade on Nasdaq (or on The Nasdaq Capital Market) under the symbol “DYNS” following the consummation of the Business Combination. It is a condition of the consummation of the Business Combination that the Class A Common Stock is approved for listing on Nasdaq (subject only to official notice of issuance thereof), but there can be no assurance that such listing condition will be met. If such listing condition is not met, the Business Combination will not be consummated unless the listing condition set forth in the Business Combination Agreement is waived by the parties to that agreement.

DYNS is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, and has elected to comply with certain reduced public company reporting requirements.

This proxy statement/prospectus incorporates by reference important business and financial information about DYNS from documents that are not included in or delivered with this proxy statement/prospectus. You can obtain documents incorporated by reference in this proxy statement/prospectus and other filings of DYNS with the Securities and Exchange Commission (the “SEC”) by visiting its website at www.sec.gov or requesting them in writing or by telephone from DYNS using the following details:

2875 El Camino Real

Redwood City, California, 94061

Telephone: (408) 212-0200

You will not be charged for any of these documents that you request. Stockholders requesting documents should do so by May 31, 2022 (five business days prior to the date of the Special Meeting) in order to receive them before the Special Meeting. Filings of DYNS are also available free of charge to the public on, or accessible through, DYNS’s corporate website under the heading “Documents”, at https://www.dspc.bio.

This proxy statement/prospectus provides you with detailed information about the Business Combination and other matters to be considered at the Special Meeting. We urge you to carefully read this entire document and the documents incorporated herein by reference. In particular, you should review the matters discussed under the heading “Risk Factors” beginning on page 24 of this proxy statement/prospectus.

Neither the SEC nor any state securities commission has approved or disapproved of the transactions described in this proxy statement/prospectus or the securities referenced herein, passed upon the merits or fairness of the Business Combination or related transactions, or passed upon the adequacy or accuracy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated May 13, 2022 and is first being mailed to stockholders of DYNS on or about May 13, 2022.