The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

Subject to completion

Preliminary Prospectus dated July 7, 2021

10,825,000 American Depositary Shares

LinkDoc Technology Limited

Representing 43,300,000 Class A Ordinary Shares

This is an initial public offering of American depositary shares, or ADSs, representing Class A ordinary shares of LinkDoc Technology Limited. We are offering a total of 10,825,000 ADSs, each representing four Class A ordinary share, par value US$0.00008 per share. The underwriters may also purchase up to 1,623,750 additional ADSs within 30 days to cover over-allotments, if any.

Prior to this offering, there has been no public market for the ADSs or our ordinary shares. We anticipate that the initial public offering price will be between US$17.50 and US$19.50 per ADS. We intend to apply to list the ADSs representing our Class A ordinary shares on the NASDAQ Global Select Market under the symbol “LDOC”.

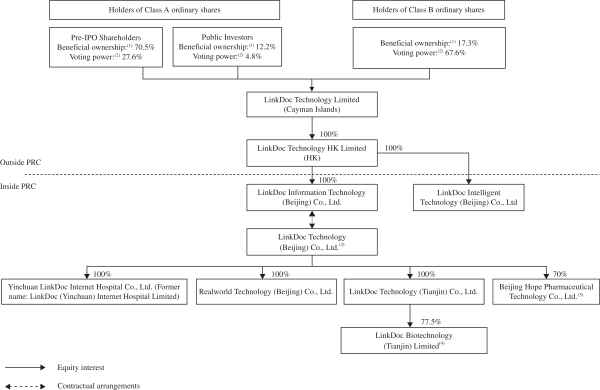

Following the completion of this offering, our issued and outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Mr. Tianze Zhang, our Chief Executive Officer and director, will beneficially own all of our issued Class B ordinary shares and will be able to exercise 67.6% of the total voting power of our issued and outstanding share capital immediately following the completion of this offering, assuming the underwriters do not exercise their option to purchase additional ADSs. Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. Each Class A ordinary share is entitled to one vote and each Class B ordinary share is entitled to 10 votes. Each Class B ordinary share is convertible into one Class A ordinary share at any time by the holder thereof, while Class A ordinary shares are not convertible into Class B ordinary shares under any circumstances. Upon any sale, transfer, assignment or disposition of any Class B ordinary share by a holder thereof to any non-affiliate to such holder, each of such Class B ordinary share will be automatically and immediately converted into one Class A ordinary share. See “Description of Share Capital.”

Upon completion of this offering, we will be a “controlled company” as defined under the Nasdaq Stock Market Rules because Mr. Tianze Zhang, as a result of his sole voting power, will be able to exercise voting rights with respect to an aggregate of 61,300,000 Class B ordinary shares, representing approximately 67.6% of the aggregate voting power of our total issued and outstanding share capital, assuming the underwriters do not exercise their over-allotment option and the automatic conversion of all preferred shares into Class A ordinary shares upon the completion of this offering (or approximately 67.1% of the aggregate voting power of our total issued and outstanding share capital if the underwriters exercise in full their over-allotment option).

We are an “emerging growth company” under applicable U.S. federal securities laws and are eligible for reduced public company reporting requirements.

A number of investors, including certain existing shareholders and their affiliates and third-party investors, have indicated their interest in subscribing for an aggregate of US$115 million of the ADSs being offered in this offering, including (i) US$25 million from Alibaba Health (Hong Kong) Technology Company Limited, our existing shareholder, (ii) US$25 million from Lake Bleu Prime Healthcare Master Fund Limited, our existing shareholder, (iii) US$10 million from Aranda Investments Pte. Ltd., an entity indirectly wholly owned by Temasek Holdings (Private) Limited and affiliated with Esta Investments Pte. Ltd., our existing shareholder, (iv) US$25 million from UBS Asset Management (Hong Kong) Limited, (v) US$20 million from Hudson Bay Master Fund Ltd, and (vi) US$10 million from Sage Partners Master Fund. The subscriptions for ADSs are at the initial public offering price and on the same terms as the other ADSs being offered in this offering. Assuming an initial public offering price of US$18.50 per ADS, the midpoint of the estimated initial public offering price range, the number of ADSs to be purchased by these investors would be at least 6,216,216 ADSs, representing approximately 57.4% of the ADSs being offered in this offering, assuming the underwriters do not exercise their option to purchase additional ADSs. However, because the indications of interest are not binding agreements or commitments to purchase, such investors may determine to purchase more, fewer or no ADSs in this offering, and we and the underwriters may determine to sell more, fewer or no ADSs to them. The underwriters will receive the same underwriting discounts and commissions on any ADSs purchased by such investors as they will on any other ADSs sold to the public in this offering.

See “Risk Factors” beginning on page 24 for factors you should consider before buying the ADSs.

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per ADS | | | Total | |

Public offering price | | US$ | | | | US$ | | |

Underwriting discounts and commissions(1) | | US$ | | | | US$ | | |

Proceeds, before expenses, to us | | US$ | | | | US$ | | |

| (1) | For a description of the compensation payable to the underwriters, see “Underwriting.” |

The underwriters have a 30-day option to purchase up to an additional 1,623,750 ADSs from us at the initial public offering price less the underwriting discount.

The underwriters expect to deliver the ADSs against payment in U.S. dollars in New York, New York on , 2021.

| | | | |

| MORGAN STANLEY | | BofA Securities | | CICC |

The date of this prospectus is , 2021.