Form 1-SA

SPECIAL FINANCIAL PERIODIC REPORT PURSUANT TO REGULATION A

For the fiscal semiannual period ended September 30, 2021

Solar Intermodal Corporation

A Delaware Corporation 85-4303385

Solar Intermodal Corporation

101 Eisenhower Parkway, Ste. 300

Roseland, NJ 07068

Phone: 201-519-5501

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS

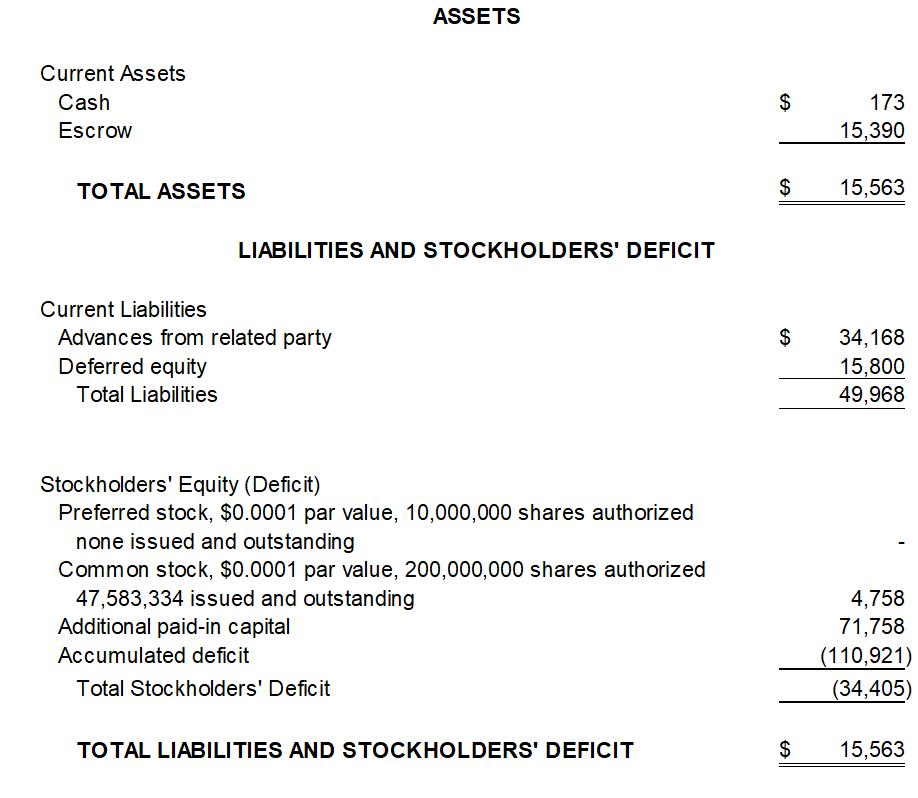

The following is a statement by the management regarding the period of March 31, 2021 through September 30, 2021. The following balance sheets were prepared by the Company.

Revenue

As of September 30, 2021 the Company had zero dollars ($0) in revenues because the Company had no sales of its products during this period.

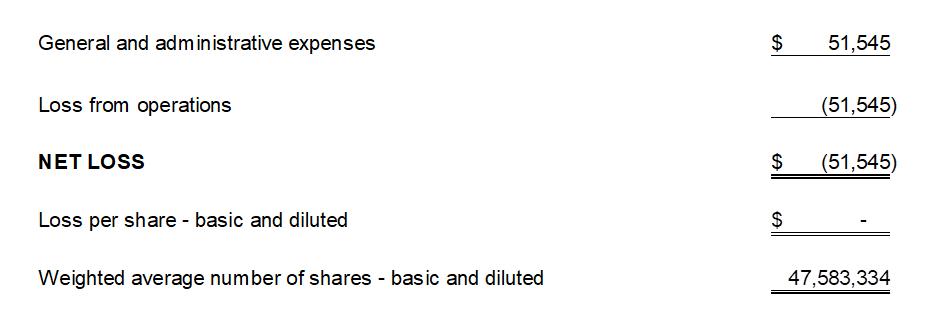

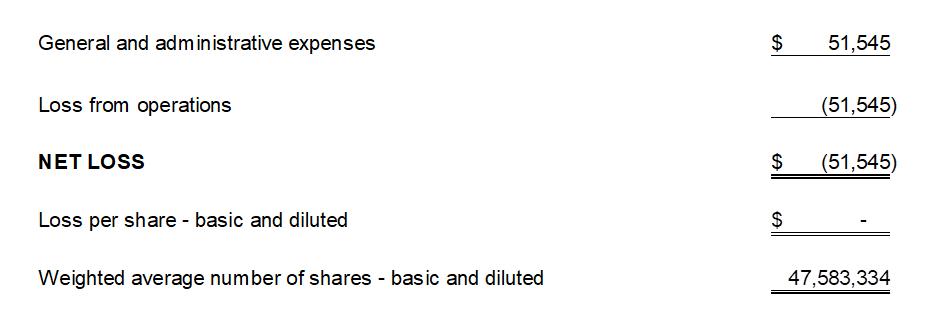

General and Administrative Expense

| | September 30, 2021 |

| General and Administrative Expenses | $51,545 |

General and administrative expenses equaled $51,545 for the period ending September 30, 2021. This is due to costs associated with executing the Regulation A offering during the period.

Loss from Operations

Losses from operations equaled $51,545 for the period. This is due to the Company’s expenses in executing a Regulation A offering during this period.

| | September 30, 2021 |

| Net Loss | ($51,545) |

Shareholders

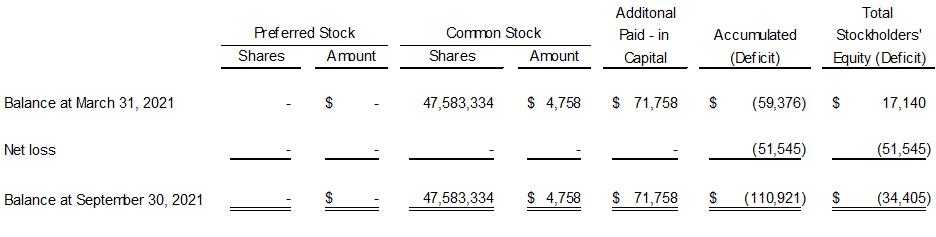

Shareholders increased to $49,968, or 57% on September 30, 2021. The increase was driven by additional advances made by Shareholders to continue funding the Company’s operating activities.

Liquidity and Capital Resources

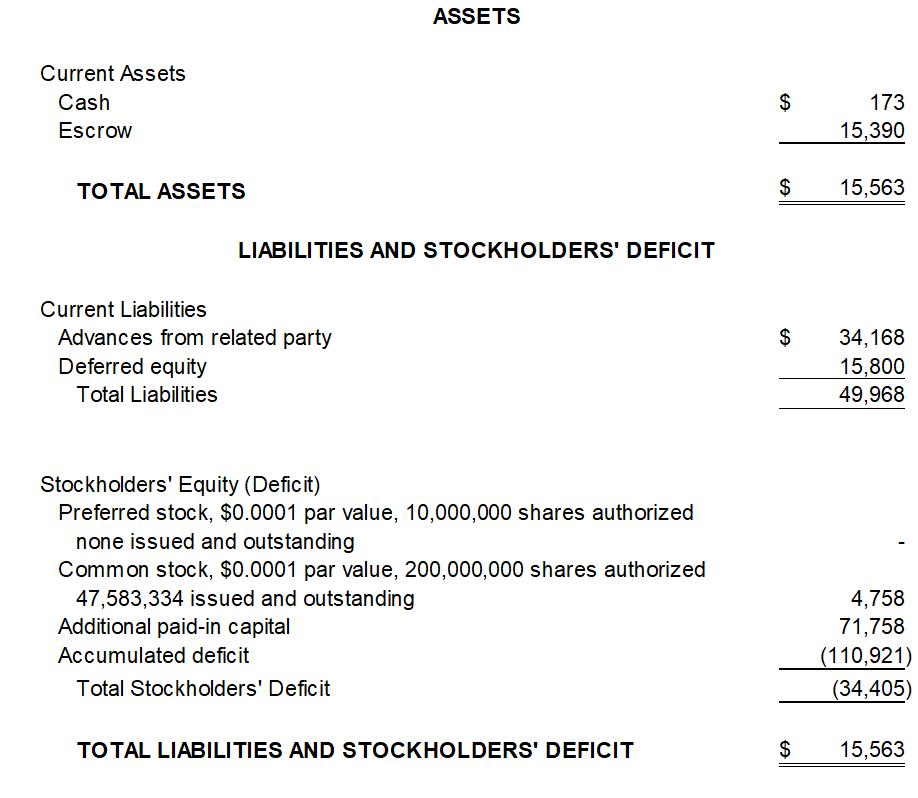

On March 31, 2021 the Company had $17,140 in Cash and Cash equivalents. As of September 30, 2021, the Company had $173 of cash and cash equivalents. As of September 30, 2021, the Company also had an accumulated deficit of approximately $110,921 and stockholder’s deficit of $34,405. The Company has financed its operations through a combination of shareholder advances and ongoing equity investments by its founder and other investors through private placements through the Regulation A offering. The Company has projected operating losses and negative cash flows for the next several months. There can be no assurance that the Company will be successful in acquiring additional funding at levels sufficient to fund its future operations beyond this period. If the Company is unable to raise additional capital in sufficient amounts or on terms acceptable to it, the Company may have to significantly reduce its operations, delay, scale back or discontinue the development of its technologies and/or discontinue operations completely.

FINANCIAL STATEMENTS (UNAUDITED)

Balance Sheet

Statement of Operations

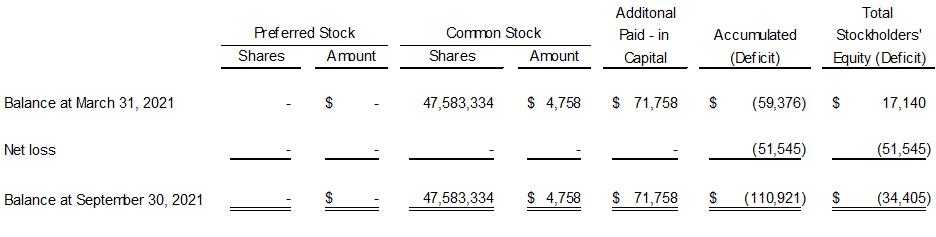

Statement of Changes in Stockholders Equity (Deficit)

Six Months Ended September 30, 2021

Statement of Cash Flows

Six Months Ended September 30, 2021

Notes to Financial Statements September 30, 2021

| 1. | Organization and Nature of Operations (continued) |

Liquidity, Going Concern and Management’s Plan (continued)

Management’s strategic plans include the following:

| · | Pursuing additional capital raising opportunities, |

| · | Continuing to explore and execute prospective partnering or distribution opportunities; and |

| · | Identifying unique market opportunities that represent potential positive short-term cash flow. |

| 2. | Summary of Significant Accounting Policies |

Business Segments

The Company uses the “management approach” to identify its reportable segments. The management approach requires companies to report segment financial information consistent with information used by management for making operating decisions and assessing performance as the basis for identifying the Company’s reportable segments. The Company has identified one single reportable operating segment. The Company manages its business on the basis of one operating and reportable segment.

Use of Estimates

Preparing financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and the disclosure of contingent assets and liabilities at the date of the financial statements and revenues and expenses during the reported period. Actual results could differ from those estimates, and those estimates may be material.

Changes in estimates are recorded in the period in which they become known. The Company bases its estimates on historical experience and other assumptions, which include both quantitative and qualitative assessments that it believes to be reasonable under the circumstances.

Fair Value of Financial Investments

The Company accounts for financial instruments under Financial Accounting Standards Board (“FASB”) ASC 820, Fair Value Measurements. ASC 820 provides a framework for measuring fair value and requires disclosures regarding fair value measurements. Fair value is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date, based on the Company’s principal or, in absence of a principal, most advantageous market for the specific asset or liability.

The Company uses a three-tier fair value hierarchy to classify and disclose all assets and liabilities measured at fair value on a recurring basis, as well as assets and liabilities measured at fair value on a non-recurring basis, in periods subsequent to their initial measurement. The hierarchy requires the Company to use observable inputs when available, and to minimize the use of unobservable inputs, when determining fair value.

| 2. | Summary of Significant Accounting Policies (continued) |

Fair Value of Financial Investments (continued)

The three tiers are defined as follows:

| · | Level 1 —Observable inputs that reflect quoted market prices (unadjusted) for identical assets or liabilities in active markets; |

| · | Level 2—Observable inputs other than quoted prices in active markets that are observable either directly or indirectly in the marketplace for identical or similar assets and liabilities; and |

| · | Level 3—Unobservable inputs that are supported by little or no market data, which require the Company to develop its own assumptions. |

The determination of fair value and the assessment of a measurement’s placement within the hierarchy requires judgment. Level 3 valuations often involve a higher degree of judgment and complexity. Level 3 valuations may require the use of various cost, market, or income valuation methodologies applied to unobservable management estimates and assumptions. Management’s assumptions could vary depending on the asset or liability valued and the valuation method used. Such assumptions could include estimates of prices, earnings, costs, actions of market participants, market factors, or the weighting of various valuation methods. The Company may also engage external advisors to assist us in determining fair value, as appropriate.

Although the Company believes that the recorded fair value of our financial instruments is appropriate, these fair values may not be indicative of net realizable value or reflective of future fair values.

The Company’s financial instruments, including cash, is carried at historical cost. At September 30, 2021, the carrying amounts of these instruments approximated their fair values because of the short-term nature of these instruments.

ASC 825-10 “Financial Instruments” allows entities to voluntarily choose to measure certain financial assets and liabilities at fair value (“fair value option”). The fair value option may be elected on an instrument-by-instrument basis and is irrevocable unless a new election date occurs. If the fair value option is elected for an instrument, unrealized gains and losses for that instrument should be reported in earnings at each subsequent reporting date. The Company did not elect to apply the fair value option to any outstanding financial instruments.

Cash and Cash Equivalents

For purposes of the statements of cash flows, the Company considers all highly liquid instruments with a maturity of three months or less at the purchase date and money market accounts to be cash equivalents.

At September 30, 2021, the Company did not have any cash equivalents.

| 2. | Summary of Significant Accounting Policies (continued) |

Income Taxes

The Company accounts for income tax using the asset and liability method prescribed by ASC 740, “Income Taxes”. Under this method, deferred tax assets and liabilities are determined based on the difference between the financial reporting and tax bases of assets and liabilities using enacted tax rates that will be in effect in the year in which the differences are expected to reverse. The Company records a valuation allowance to offset deferred tax assets if based on the weight of available evidence, it is more-likely-than-not that some portion, or all, of the deferred tax assets will not be realized. The effect on deferred taxes of a change in tax rates is recognized as income or loss in the period that includes the enactment date.

The Company follows the accounting guidance for uncertainty in income taxes using the provisions of ASC 740 “Income Taxes”. Using that guidance, tax positions initially need to be recognized in the financial statements when it is more likely than not the position will be sustained upon examination by the tax authorities. As of September 30, 2021, the Company had no uncertain tax positions that qualify for either recognition or disclosure in the financial statements.

The Company recognizes interest and penalties related to uncertain income tax positions in other expense. No interest and penalties related to uncertain income tax positions were recorded for the period ended September 30, 2021.

As of September 30, 2021, tax year 2021 remains open for IRS audit.

Basic and Diluted Earnings (Loss) per Share

Pursuant to ASC 260-10-45, basic loss per common share is computed by dividing net loss by the weighted average number of shares of common stock outstanding for the periods presented. Diluted loss per share is computed by dividing net loss by the weighted average number of shares of common stock, common stock equivalents and potentially dilutive securities outstanding during the period. Potentially dilutive common shares may consist of common stock issuable for stock options and warrants (using the treasury stock method), convertible notes and common stock issuable. These common stock equivalents may be dilutive in the future.

The Company did not have any potentially dilutive equity securities outstanding as of September 30, 2021.

On February 19, 2021, the Company effected a 100,000:1 forward stock split. All share and per share amounts have been retroactively restated to the earliest period presented.

Related Parties

Parties are considered to be related to the Company if the parties, directly or indirectly, through one or more intermediaries, control, are controlled by, or are under common control with the Company. Related parties also include principal owners of the Company, its management, members of the immediate families of principal owners of the Company and its management and other parties with which the Company may deal with if one party controls or can significantly influence the management or operating policies of the other to an extent that one of the transacting parties might be prevented from fully pursuing its own separate interests.

| 2. | Summary of Significant Accounting Policies (continued) |

Recent Accounting Standards

Changes to accounting principles are established by the FASB in the form of ASU’s to the FASB’s Codification. We consider the applicability and impact of all ASU’s on our financial position, results of operations, stockholders’ equity, cash flows, or presentation thereof.

At September 30, 2021, there were no pronouncements that had an effect on the Company’s financial statements.

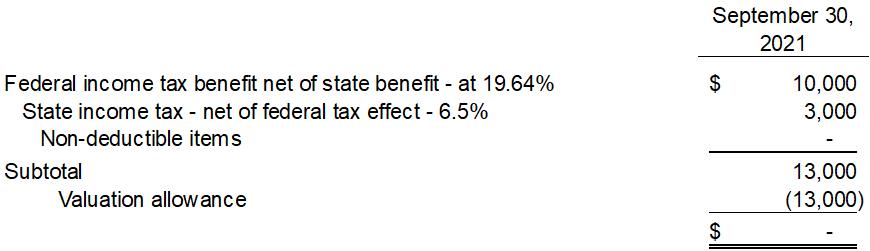

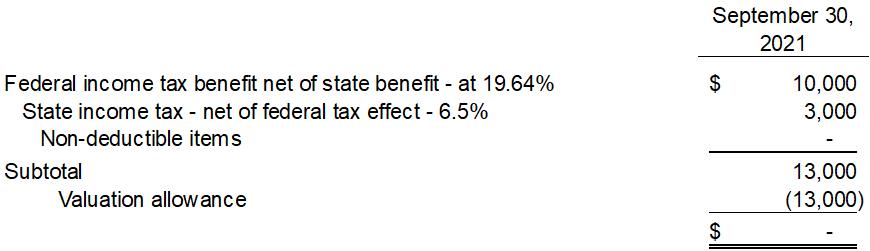

The Company's tax expense differs from the "expected" tax expense for the period (computed by applying the blended corporate tax rate of 26.14% to loss before taxes), are approximately as follows:

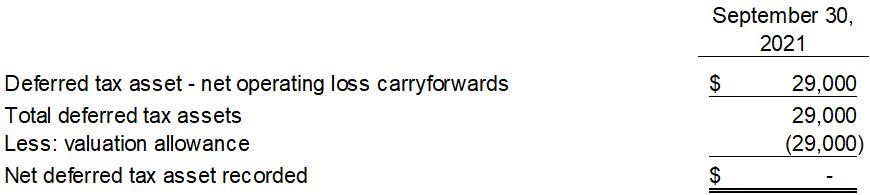

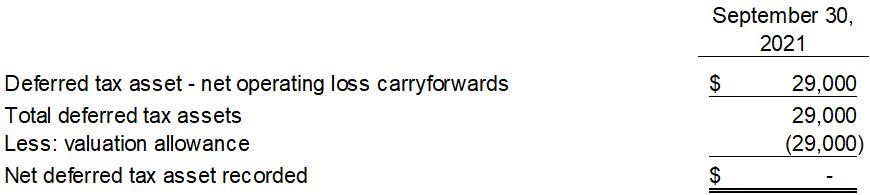

The tax effects of temporary differences that give rise to significant portions of deferred tax assets and liabilities at September 30, 2021 are approximately as follows:

Deferred tax assets and liabilities are computed by applying the federal and state income tax rates in effect to the gross amounts of temporary differences and other tax attributes, such as net operating loss carryforwards. In assessing if the deferred tax assets will be realized, the Company considers whether it is more likely than not that some or all of these deferred tax assets will be realized. The ultimate realization of deferred tax assets is dependent upon the generation of future taxable income during the period in which these deductible temporary differences reverse.

During the six months ended September 30, 2021, the valuation allowance increased by approximately $13,000. The total valuation allowance results from the Company’s estimate of its inability to recover its net deferred tax assets.

| 3. | Income Taxes (continued) |

At September 30, 2021, the Company has federal and state net operating loss (“NOL”) carryforwards, which are available to offset future taxable income, of approximately $111,000. The Company is in the process of analyzing their NOL and has not determined if the company has had any change of control issues that could limit the future use of these NOL’s. NOL carryforwards that were generated after 2017 of approximately $111,000 may only be used to offset 80% of taxable income and are carried forward indefinitely.

These carryforwards may be subject to an annual limitation under Section 382 and 383 of the Internal Revenue Code of 1986 (“IRC”), and similar state provisions if the Company experienced one or more ownership changes which would limit the amount of NOL and tax credit carryforwards that can be utilized to offset future taxable income and tax, respectively. In general, an ownership change, as defined by Section 382 and 383, results from transactions increasing ownership of certain stockholders or public groups in the stock of the corporation by more than 50 percentage points over a three-year period. The Company has not completed an IRC Section 382/383 analysis. If a change in ownership were to have occurred, NOL and tax credit carryforwards could be eliminated or restricted.

If eliminated, the related asset would be removed from the deferred tax asset schedule with a corresponding reduction in the valuation allowance. Due to the existence of the valuation allowance, limitations created by future ownership changes, if any, will not impact the Company’s effective tax rate.

The Company files corporate income tax returns in the United States and the State of New Jersey jurisdictions. Due to the Company’s net operating loss posture, all tax years are open and subject to income tax examination by tax authorities. The Company’s policy is to recognize interest expense and penalties related to income tax matters as tax expense. At September 30, 2021, there are no unrecognized tax benefits, and there are no significant accruals for interest related to unrecognized tax benefits or tax penalties.

The Company has two classes of stock:

Preferred Stock

| · | 10,000,000 shares authorized |

| · | Voting at 1 vote per share for Common Stock, 10 votes per Share for Preferred Stock |

Common Stock

| · | 200,000,000 shares authorized |

| · | Voting at 1 vote per share |

The ongoing COVID-19 global and national health emergency has caused significant disruption in the international and United States economies and financial markets. In March 2020, the World Health Organization declared the COVID-19 outbreak a pandemic. The spread of COVID-19 has caused illness, quarantines, cancellation of events and travel, business and school shutdowns, reduction in business activity and financial transactions, labor shortages, supply chain interruptions and overall economic and financial market instability. The COVID-19 pandemic has the potential to significantly impact the Company’s supply chain, distribution centers, or logistics and other service providers.

In addition, a severe prolonged economic downturn could result in a variety of risks to the business, including weakened demand for products and services and a decreased ability to raise additional capital when needed on acceptable terms, if at all. As the situation continues to evolve, the Company will continue to closely monitor market conditions and respond accordingly.

We have implemented adjustments to our operations designed to keep employees safe and comply with federal, state, and local guidelines, including those regarding social distancing. The extent to which COVID-19 may further impact the Company’s business, results of operations, financial condition and cash flows will depend on future developments, which are highly uncertain and cannot be predicted with confidence. In response to COVID-19, the United States government has passed legislation and taken other actions to provide financial relief to companies and other organizations affected by the pandemic.

The ultimate impact of the COVID-19 pandemic on the Company’s operations is unknown and will depend on future developments, which are highly uncertain and cannot be predicted with confidence, including the duration of the COVID-19 outbreak, new information which may emerge concerning the severity of the COVID-19 pandemic, and any additional preventative and protective actions that governments, or the Company, may direct, which may result in an extended period of continued business disruption, reduced customer traffic and reduced operations.

Any resulting financial impact cannot be reasonably estimated at this time but is anticipated to have a material adverse impact on our business, financial condition, and results of operations.

EXHIBITS

2. Articles of Incorporation

3. Shareholders Agreement

4. Subscription Agreement

8. Escrow Agreement

SIGNATURES

Pursuant to the requirements of Regulation A, the issuer certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form 1-A and has duly caused this Offering Statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the in the City of Roseland, NJ on December 28, 2021.

ISSUER COMPANY LEGAL NAME AND ADDRESS:

Solar Intermodal Corporation

101 Eisenhower Parkway, Ste. 300

Roseland, NJ 07068

This Offering Statement has been signed by the following persons in the capacities and on the dates indicated:

s/Robert Anderson

Robert Anderson, Jr., Chief Executive Officer of the Company

(Date): December 28, 2021

Location Signed: City of Roseland, NJ