Exhibit 99.2

Vast Investor Presentation February 2023

This presentation (together with oral statements made in connection herewith, the “Presentation”) is for informational purpos es only to assist interested parties in making their own evaluation with respect to the proposed business combination between Na bor s Energy Transition Corp. (“NETC”) and Vast Solar Pty Ltd, an Australian proprietary company limited by shares (“Vast” or the “Company”), and the related transa cti ons (the “Business Combination”). The information contained herein does not purport to be all - inclusive and none of NETC, Vast, nor any of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employ ees , advisers or agents make any representation or warranty, express or implied, as to the accuracy, completeness or reliability of the information contained in this Presentation. You should consult your own counsel and tax and financial advisors as to legal and related matters concerning t he matters described herein, and, by accepting this Presentation, you confirm that you are not relying upon the information cont ain ed herein to make any decision. The recipient shall not rely upon any statement, representation or warranty made by any other person, firm or corporation in maki ng its investment or decision to invest in Vast. To the fullest extent permitted by law, in no circumstances will NETC, Vast, or an y of their respective subsidiaries, stockholders, shareholders, affiliates, representatives, control persons, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Pr esentation, its contents, its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection there wit h. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of NETC, Vast, or the Business Combination. Please refer to the business combination agreement and other related transaction documents for the full te rms of the Business Combination. The general explanations included in this Presentation cannot address, and are not intended to address, your specific investment objectives, financial situations or financial needs. Important Information for NETC Stockholders This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or constitute a so licitation of any vote or approval. In connection with the proposed business combination, Vast will file with the Securities and Exchange Commission (the “SEC”) a registration statement on Form F - 4 (the “Registration Statement”), which will include ( i ) a preliminary prospectus of Vast relating to the offer of securities to be issued in connection with the proposed business com bination and (ii) a preliminary proxy statement of NETC to be distributed to holders of NETC’s capital stock in connection with NETC’s solicitation of proxies for vote by NETC’s shareholders with respec t t o the proposed business combination and other matters described in the Registration Statement. NETC and Vast also plan to fil e o ther documents with the SEC regarding the proposed business combination. After the Registration Statement has been declared effective by the SEC, a defin iti ve proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS AND SECURITY HOLDERS OF NETC AND VAST ARE UR GED TO READ THE REGISTRATION STATEMENT, THE PROXY STATEMENT/PROSPECTUS CONTAINED THEREIN (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERET O) AND ALL OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PRO POSED BUSINESS COMBINATION. Investors and security holders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information about NETC and Vast once such documents are filed w ith the SEC, through the website maintained by the SEC at http://www.sec.gov . In addition, the documents filed by NETC may be obtained free of charge from NETC’s website at www.nabors - etcorp.com or by written request to NETC at 515 West Greens Road, Suite 1200, Houston, TX 77067. Use of Data Certain information contained in this Presentation, including that which relates to Vast’s industry and markets in which it o per ates, relates to or is based on third party studies, publications and surveys and the Company’s own internal estimates and re sea rch. In some cases, we may not expressly refer to the sources from which this information is derived. In addition, all of the market data included in this Presentatio n i nvolves a number of assumptions, estimates and limitations, and there can be no guarantee as to the accuracy or reliability o f s uch assumptions or estimates; none of the Company, NETC, nor their representatives or affiliates assumes any responsibility for updating this Presentation based on fac ts learned following its use. Finally, while the Company believes such third - party sources and its internal research are reliable, such sources and research have not been verified by any independent source and none of NETC, the Company, nor any of their respective affiliates nor any of its or th eir control persons, officers, directors, employees or representatives make any representation or warranty with respect to the ac cu racy of such information. These and other factors could cause Vast’s future performance and actual market growth, opportunity and size and the like to differ mat eri ally from the Company’s assumptions and estimates presented herein. Forward - Looking Statements The information included herein and in any oral statements made in connection herewith include “forward - looking statements” with in the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 19 34, as amended. All statements, other than statements of present or historical fact included herein, regarding the proposed Business C ombination , NETC’s and Vast’s ability to consummate the proposed Business Combination, the benefits of the proposed Business Combinatio n a nd NETC’s and Vast’s future financial performance following the proposed Business Combination, as well as NETC’s and Vast’s strategy, future operations, financial pos ition, estimated revenues and losses, projected costs, prospects, plans and objectives of management are forward - looking stateme nts. When used herein, including any oral statements made in connection herewith, the words “could, ” “should,” “will,” “may,” “believe,” “anticipate,” “intend,” “estimate,” “expect,” “project,” the negative of such terms and o th er similar expressions are intended to identify forward - looking statements, although not all forward - looking statements contain such identifying words. These forward - looking statements are based on NETC and Vast management’s curr ent expectations and assumptions about future events and are based on currently available information as to the outcome and t imi ng of future events. Except as otherwise required by applicable law, NETC and Vast disclaim any duty to update any forward - looking statements, all of which are expressly qualified by the statements in this section, to reflect events or circumstances after the date hereof. NETC and Va st caution you that these forward - looking statements are subject to risks and uncertainties, most of which are difficult to predict and many of which are beyon d t he control of NETC and Vast. These risks include, but are not limited to, general economic, financial, legal, political and b usi ness conditions and changes in domestic and foreign markets; the inability to complete the Business Combination or the convertible debt and equity financings contemp lat ed in connection with the proposed Business Combination (the “Financing”) in a timely manner or at all (including due to the fai lure to receive required stockholder or shareholder, as applicable, approvals, or the failure of other closing conditions such as the satisfaction of the minimum cas h condition following redemptions by NETC’s public stockholders and the receipt of certain governmental and regulatory approv als ), which may adversely affect the price of NETC’s securities; the inability of the Business Combination to be completed by NETC’s business combination deadline and t he potential failure to obtain an extension of the business combination deadline if sought by NETC; the occurrence of any event, ch ange or other circumstance that could give rise to the termination of the Business Combination or the Financing; the inability to recognize the anticipated b ene fits of the proposed Business Combination; the inability to obtain or maintain the listing of Vast’s shares on a national exc han ge following the consummation of the proposed Business Combination; costs related to the proposed Business Combination; the risk that the proposed Business Combin ati on disrupts current plans and operations of Vast, business relationships of Vast or Vast’s business generally as a result of the announcement and consummation of the proposed Business Combination; Vast’s ability to manage growth; Vast’s ability to execute its business plan, including th e completion of the Port Augusta project, at all or in a timely manner and meet its projections; potential disruption in Vast ’s employee retention as a result of the proposed Business Combination; potential litigation, governmental or regulatory proceedings, investigations or inquiries invo lvi ng Vast or NETC, including in relation to the proposed Business Combination; changes in applicable laws or regulations and ge ner al economic and market conditions impacting demand for Vast’s products and services. Additional risks are set forth in the section of the Appendix titled "Summ ary Risk Factors" attached to this Presentation and will be set forth in the section titled "Risk Factors" in the proxy statement /p rospectus that will be filed with the U.S. Securities and Exchange Commission (the “SEC”) in connection with the proposed Business Combination. Should one or more of th e r isks or uncertainties described herein and in any oral statements made in connection therewith occur, or should underlying as sum ptions prove incorrect, actual results and plans could differ materially from those expressed in any forward - looking statements. Additional information concerning these and other factors that may impact NETC’s expectations can be found in NETC’s periodic filings with the SEC, inc luding NETC’s Annual Report on Form 10 - K filed with the SEC on March 28, 2022 and any subsequently filed Quarterly Reports on Form 10 - Q. NETC’s SEC filings are available publicly on the SEC’s website at www.sec.gov . Disclaimers & Disclosures (1/2) 2

Disclaimers & Disclosures (2/2) 3 Participants in the Solicitation NETC, Nabors Industries Ltd. (“Nabors”), Vast and their respective directors and executive officers may be deemed to be parti cip ants in the solicitation of proxies from the stockholders of NETC in connection with the proposed business combination. Infor mat ion about the directors and executive officers of NETC is set forth in NETC’s Annual Report on Form 10 - K for the year ended December 31, 2021, filed with th e SEC on March 28, 2022. To the extent that holdings of NETC’s securities have changed since the amounts printed in NETC’s An nua l Report on Form 10 - K for the year ended December 31, 2021, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 file d w ith the SEC. Other information regarding the participants in the proxy solicitation and a description of their direct and ind ire ct interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus and other relevant materials to be filed with the SEC when the y b ecome available. You may obtain free copies of these documents as described in the preceding paragraph. No Offer or Solicitation This Presentation shall not constitute a “solicitation” of a proxy, consent, or authorization, as defined in Section 14 of th e S ecurities Exchange Act of 1934, as amended, with respect to any securities or in respect of the proposed Business Combination . T his Presentation also does not constitute an offer, or a solicitation of an offer, to buy, sell, or exchange any securities, investment or other specific product, or a so licitation of any vote or approval, nor shall there be any sale of securities, investment or other specific product in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securit ies , other than with respect to the Financing, will be made except by means of a prospectus meeting the requirements of section 10 of the Securities Act of 1933, as amended, or an exemption therefrom. NEITHER THE SEC NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THIS PRESENTATI ON OR DETERMINED IF THIS PRESENTATION IS TRUTHFUL OR COMPLETE. In connection with the proposed Business Combniation, Vast will file with the SEC a registration statement on Form F - 4, which will include a prospectus of Vast and a proxy statement of NETC. NETC and Vast also plan to file other documents with the SEC regarding the proposed Business Combination. After the reg istration statement has been declared effective by the SEC, a definitive proxy statement/prospectus will be mailed to the stockholders of NETC. INVESTORS AND STOCKHOLDERS OF NETC ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS THERETO) AND OTHER DOCUMENTS RELATING TO THE PROPOSED BUSINESS COMBINATION THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECA USE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED BUSINESS COMBINATION. Investors and stockholders will be able to obtain free copies of the proxy statement/prospectus and other documents containing important information abo ut NETC and Vast once such documents are filed with the SEC, through the website maintained by the SEC at http://www.sec.gov . In addition, the documents filed by NETC may be obtained free of charge from NETC’s website at www.nabors - etcorp.com or by written request to NETC at 515 West Greens Road, Suite 1200, Houston, TX 77067. Trademarks and Trade Names Vast, Nabors and NETC own or have rights to various trademarks, service marks and trade names that they use in connection wit h t he operation of their respective businesses. This Presentation also contains trademarks, service marks and trade names of thi rd parties, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this Pres ent ation is not intended to, and does not imply, a relationship with the Company, Nabors or NETC, or an endorsement or sponsorsh ip by or of the Company, Nabors or NETC. Solely for convenience, the trademarks, service marks and trade names referred to in this Presentation may appear with the ®, TM or SM symbols, but such references are not intended to indicate, in any way, that the Company, Nabors or NETC will not as sert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks and trade names. Summary of Contracts Insofar as this Presentation contains summaries of existing agreements and documents, such summaries are qualified in their e nti rety by reference to the agreements and documents being summarized.

Executive Summary Vast Demonstration Plant near Forbes, Australia

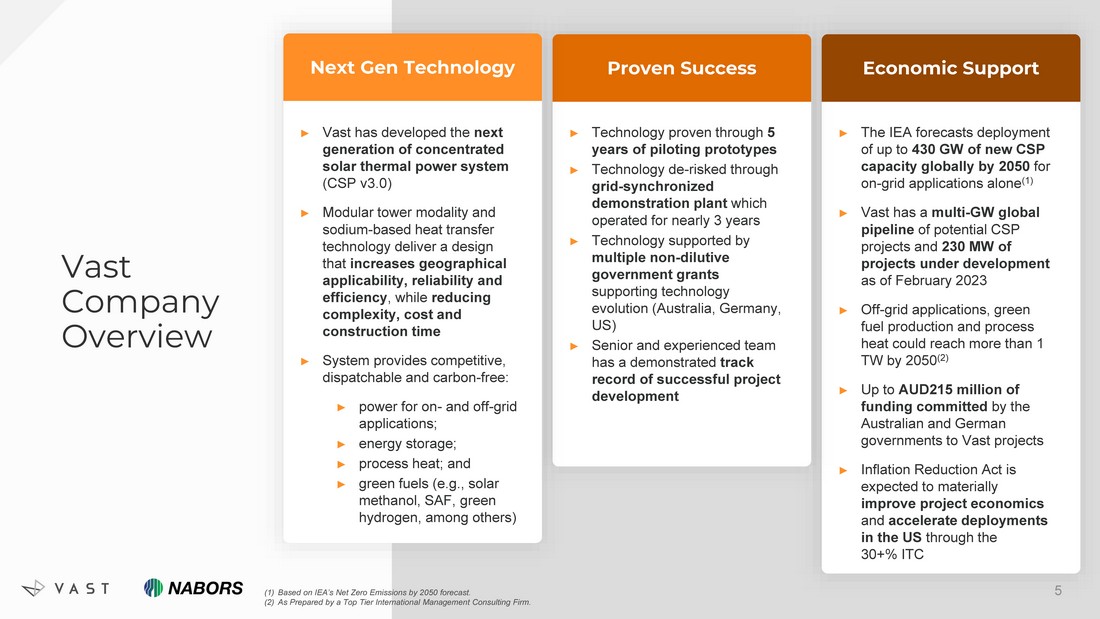

► The IEA forecasts deployment of up to 430 GW of new CSP capacity globally by 2050 for on - grid applications alone (1) ► Vast has a multi - GW global pipeline of potential CSP projects and 230 MW of projects under development as of February 2023 ► Off - grid applications, green fuel production and process heat could reach more than 1 TW by 2050 (2) ► Up to AUD215 million of funding committed by the Australian and German governments to Vast projects ► Inflation Reduction Act is expected to materially improve project economics and accelerate deployments in the US through the 30+% ITC ► Technology proven through 5 years of piloting prototypes ► Technology de - risked through grid - synchronized demonstration plant which operated for nearly 3 years ► Technology supported by multiple non - dilutive government grants supporting technology evolution (Australia, Germany, US) ► Senior and experienced team has a demonstrated track record of successful project development Proven Success ► Vast has developed the next generation of concentrated solar thermal power system (CSP v3.0) ► Modular tower modality and sodium - based heat transfer technology deliver a design that increases geographical applicability, reliability and efficiency , while reducing complexity, cost and construction time ► System provides competitive, dispatchable and carbon - free: ► power for on - and off - grid applications; ► energy storage; ► process heat; and ► green fuels (e.g., solar methanol, SAF, green hydrogen, among others) Next Gen Technology Vast Company Overview Economic Support 5 (1) Based on IEA’s Net Zero Emissions by 2050 forecast. (2) As Prepared by a Top Tier International Management Consulting Firm.

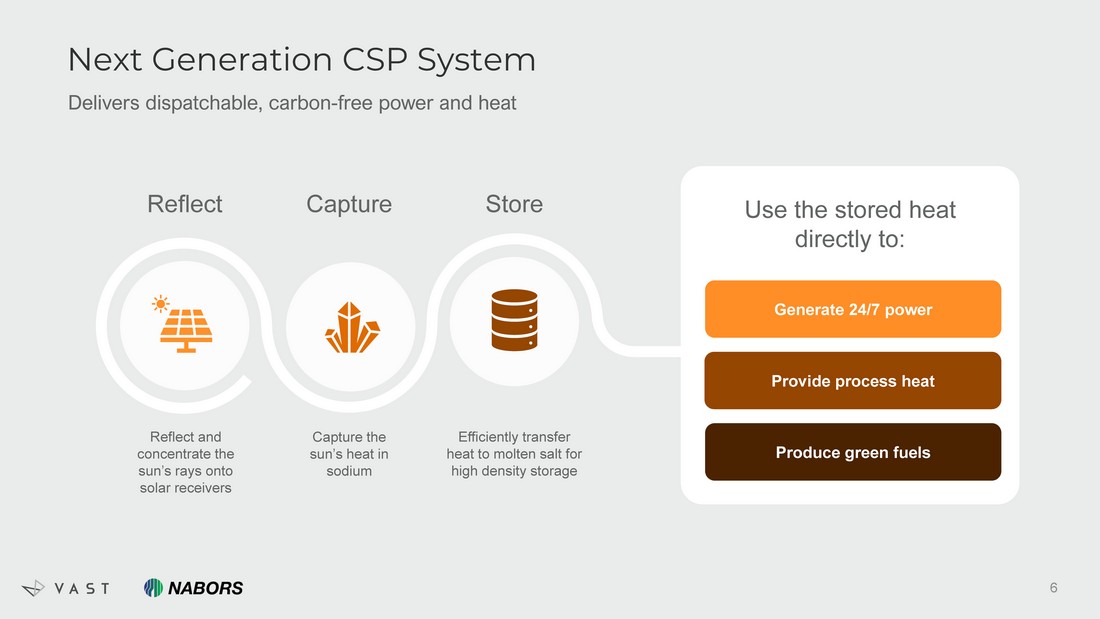

Next Generation CSP System Delivers dispatchable, carbon - free power and heat Reflect and concentrate the sun’s rays onto solar receivers Capture the sun’s heat in sodium Use the stored heat directly to: Reflect Capture Store Efficiently transfer heat to molten salt for high density storage Generate 24/7 power Provide process heat Produce green fuels 6

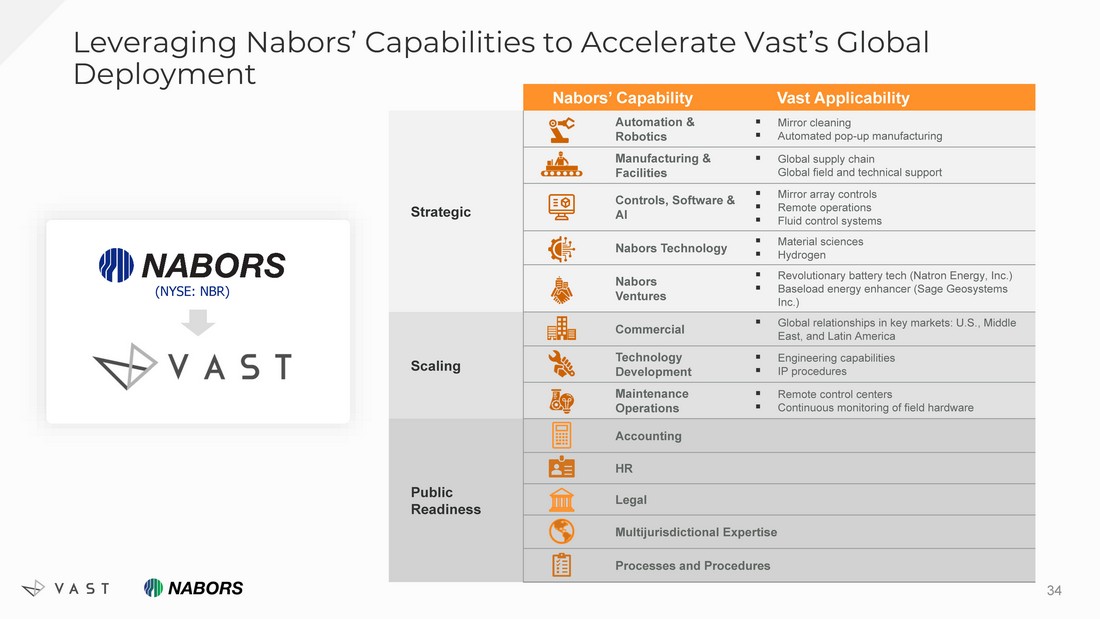

Transaction Overview 7 The Business Combination Entering Into Agreements With Nabors Transaction: ► Business combination between Nabors Energy Transition Corp. (“NETC”) and Vast ► Significant investment commitments secured from existing Vast investor and Nabors ► Represents an attractive entry point for some of the most topical energy transition macro themes: dispatchable power, storage, process heat and green fuels Challenge: ► Decarbonization limited by intermittency in traditional solar PV and wind ► Traditional storage solutions come with many compromises (cost, safety, supply chain, etc.) ► Process heat and liquid fuels are harder to decarbonize given the inherent inefficiency of turning renewable power into heat Solution: ► Vast’s CSP v3.0 technology uses thermal energy storage to deliver clean, dispatchable power and heat for utility - scale power generation, green fuels production and process heat applications ► Vast’s partnership with Nabors and NETC is expected to drive innovation and accelerate Vast’s growth trajectory, while providing mutual benefits for both parties ► Nabors is a global leader in advanced technology for the energy industry, providing oil and gas drilling contracting services valued at over $3.5 billion in enterprise value ► In connection with the transaction, NETC and Vast are expected to enter into several agreements with Nabors: ► Joint Development and Licensing Agreement to jointly develop technology to improve Vast’s CSP systems by leveraging Nabors expertise in automation, robotics, remote operations, material science, among others ► Shared Services Agreement with respect to various support functions ► In addition to the transaction, in December 2022 Vast entered into agreements with companies within Nabors’ venture platform: ► Agreement between Vast and Sage Geosystems Inc. to collaborate on future solar projects incorporating the Sage geothermal battery + storage technology, which allows for both storage and generation of energy from the earth’s heat ► Partnership agreement between Vast and Natron Energy, Inc., a provider of sodium - ion battery products, to use revolutionary Natron batteries in projects using Vast’s CSP technology ► Additional opportunities for partnership and collaboration include leveraging Nabors’ global supply chain and operational footprint as well as its advanced engineering and engineering expertise, infrastructure resources, market knowledge, technology innovation / competencies and customer / vendor relationships Nabors’ Capabilities Maintenance Operations Technology Development Commercial Nabors Ventures Nabors Technology Controls, Software & AI Manufacturing & Facilities Automation & Robotics

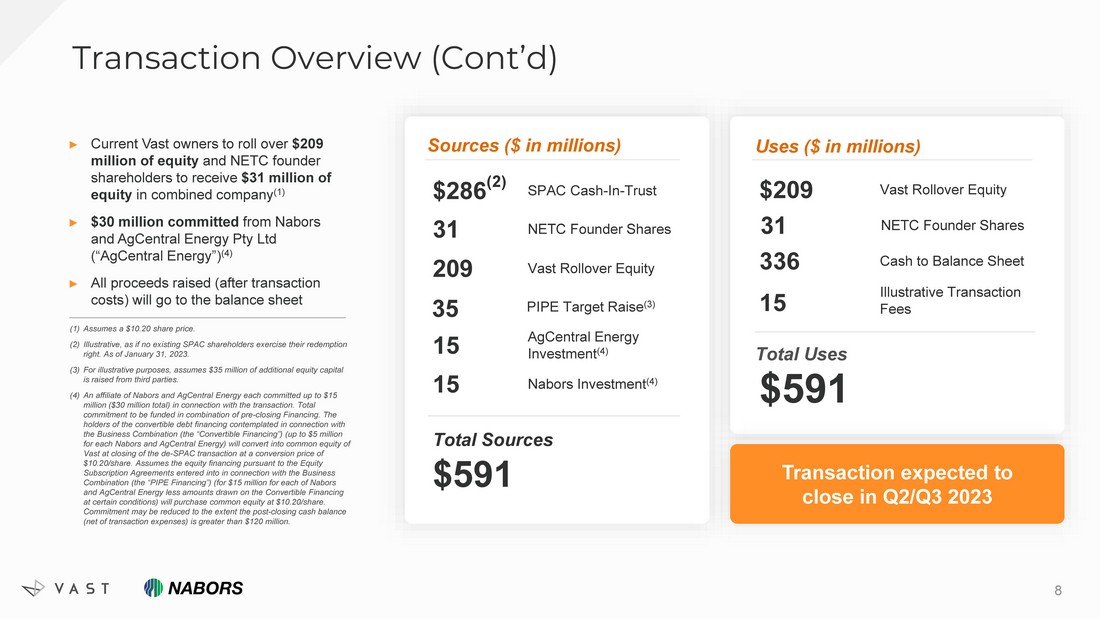

Transaction Overview (Cont’d) 8 $591 336 Cash to Balance Sheet 15 Illustrative Transaction Fees Total Uses Uses ($ in millions) $591 Total Sources Sources ($ in millions) Transaction expected to close in Q2/Q3 2023 $209 Vast Rollover Equity 31 NETC Founder Shares $286 (2) SPAC Cash - In - Trust 35 PIPE Target Raise (3) 209 Vast Rollover Equity 15 AgCentral Energy Investment (4) 15 Nabors Investment (4) 31 NETC Founder Shares (1) Assumes a $10.20 share price. (2) Illustrative, as if no existing SPAC shareholders exercise their redemption right. As of January 31, 2023. (3) For illustrative purposes, assumes $35 million of additional equity capital is raised from third parties. (4) An affiliate of Nabors and AgCentral Energy each committed up to $15 million ($30 million total) in connection with the transaction. Total commitment to be funded in combination of pre - closing Financing. The holders of the convertible debt financing contemplated in connection with the Business Combination (the “Convertible Financing”) (up to $5 million for each Nabors and AgCentral Energy) will convert into common equity of Vast at closing of the de - SPAC transaction at a conversion price of $10.20/share. Assumes the equity financing pursuant to the Equity Subscription Agreements entered into in connection with the Business Combination (the “PIPE Financing”) (for $15 million for each of Nabors and AgCentral Energy less amounts drawn on the Convertible Financing at certain conditions) will purchase common equity at $10.20/share. Commitment may be reduced to the extent the post - closing cash balance (net of transaction expenses) is greater than $120 million. ► Current Vast owners to roll over $209 million of equity and NETC founder shareholders to receive $31 million of equity in combined company (1) ► $30 million committed from Nabors and AgCentral Energy Pty Ltd (“ AgCentral Energy”) (4) ► All proceeds raised (after transaction costs) will go to the balance sheet

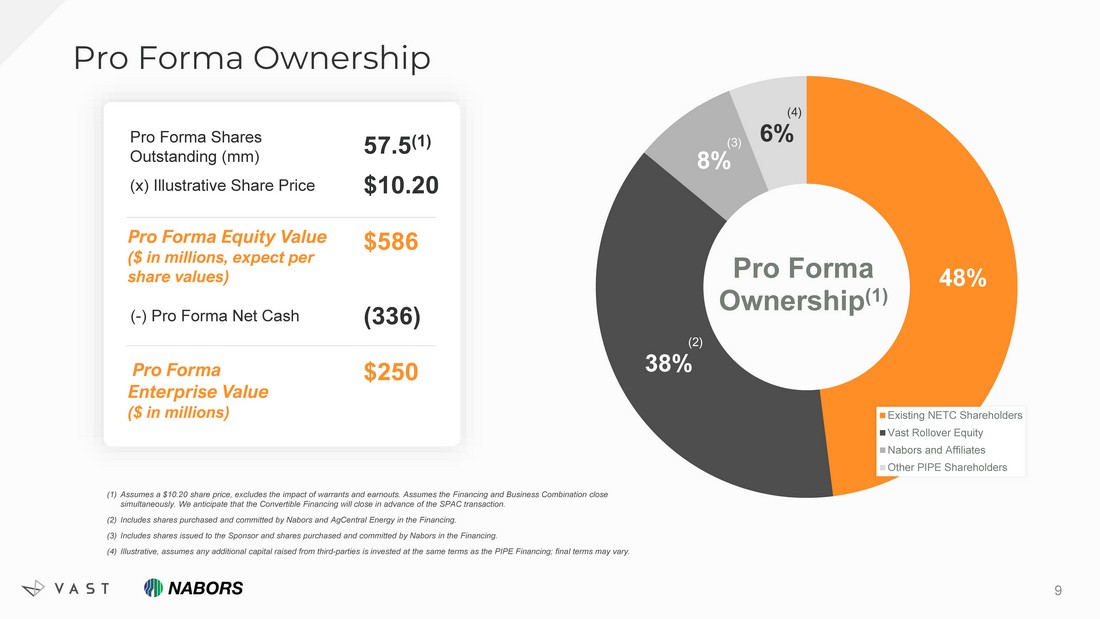

Pro Forma Ownership 48% 38% 8% 6% Pro Forma Ownership (1) Existing NETC Shareholders Vast Rollover Equity Nabors and Affiliates Other PIPE Shareholders 9 (1) Assumes a $10.20 share price, excludes the impact of warrants and earnouts. Assumes the Financing and Business Combination close simultaneously. We anticipate that the Convertible Financing will close in advance of the SPAC transaction. (2) Includes shares purchased and committed by Nabors and AgCentral Energy in the Financing. (3) Includes shares issued to the Sponsor and shares purchased and committed by Nabors in the Financing. (4) Illustrative, assumes any additional capital raised from third - parties is invested at the same terms as the PIPE Financing; fina l terms may vary. (2) (3) (4) 57.5 (1) $10.20 $586 Pro Forma Shares Outstanding (mm) (x) Illustrative Share Price Pro Forma Equity Value ($ in millions, expect per share values) $250 ( - ) Pro Forma Net Cash Pro Forma Enterprise Value ($ in millions) (336)

Key Investment Highlights 10 (1) Tracking PV Solar + Storage from BloombergNEF 2H 2022 LCOE Update. (2) Includes all patent applications, including applications for the same technology in different countries. (3) Based on IEA’s Net Zero Emissions by 2050 forecast. (4) As Prepared by Top Tier International Management Consulting Firm. ► Vast estimates a Levelized Cost of Energy (“LCOE”) of $50/MWh at scale compared with $83 - 86/MWh (1) for Tracking PV Solar + Storage ► Vast estimates a capacity factor of 40% - 50% for CSP only, up to 90% with thermal storage and CSP / PV hybrid system ► Option to be hybridized and use biofuels, fossil fuels or geothermal energy to drive the steam turbine when solar energy is i nsu fficient Potential to Deliver Low - Cost, Dispatchable Renewable Energy – the “Holy Grail” of Clean Energy ► Modular tower technology is designed to offer advantages in maintaining stable operating temperatures, reducing probability o f failure and is easier to operate and maintain relative to central tower systems ► Sodium loop offers significant advantages over conventional salt solutions including lower melting temperatures, higher therm al conductivity and greater operating temperature range ► Over 50 applications filed for patents covering the sodium heat transfer system, modular solar array and plant design with ot her components protected through trade secrets (2) Proprietary Technology that Addresses CSP’s Historical Reliability and Manufacturability Issues ► End - markets include utility - scale power, process heat (food, cement, chemicals, polymers, others), utility - scale energy storage, hydrogen and green fuels (including methanol for shipping and sustainable aviation fuel among others) ► The IEA forecasts deployment of up to 430 GW of new CSP capacity globally by 2050 for on - grid applications (3) ► Further CSP deployment for off - grid, dispatchable projects, process heat applications and as the energy input for green fuel production could reach more than a terawatt by 2050 (4) ► Vast has a multi - GW global pipeline of potential CSP projects with 230 MW of projects under development as of February 2023 Targets Large Addressable Market ► Approximately $50 million of equity capital required to complete the first commercial project and fund operating expenses ove r t he next 2 - 3 years ► Commercial viability should be established if the first two plants perform as expected and lead to additional commercial inte res t in the technology Attractive Entry Point Provides for Potential Asymmetric Risk / Reward Profile ► Partnership with Nabors should allow Vast to accelerate deployment of its pipeline through access to Nabors’ global relations hip s, improve its technology and lower costs through Nabors’ supply chain, advanced manufacturing, engineering, automation and robotics expertise as well as its extensive operational experience across the globe Partnership with Nabors Should Accelerate Deployment

Vast Overview

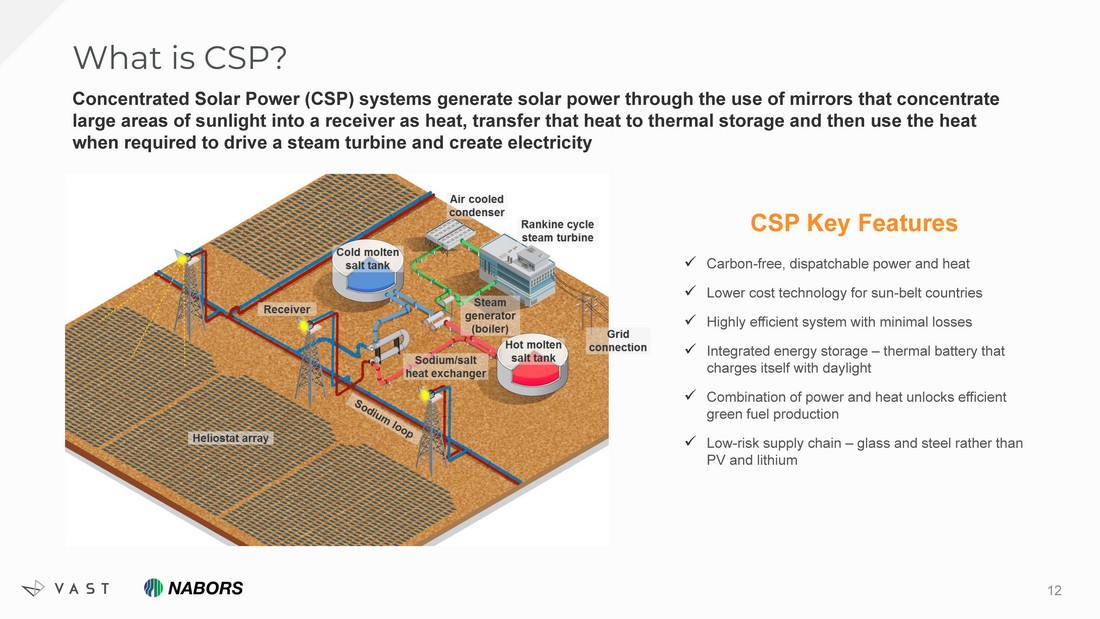

What is CSP? 12 Concentrated Solar Power (CSP) systems generate solar power through the use of mirrors that concentrate large areas of sunlight into a receiver as heat, transfer that heat to thermal storage and then use the heat when required to drive a steam turbine and create electricity CSP Key Features x Carbon - free, dispatchable power and heat x Lower cost technology for sun - belt countries x Highly efficient system with minimal losses x Integrated energy storage – thermal battery that charges itself with daylight x Combination of power and heat unlocks efficient green fuel production x Low - risk supply chain – glass and steel rather than PV and lithium

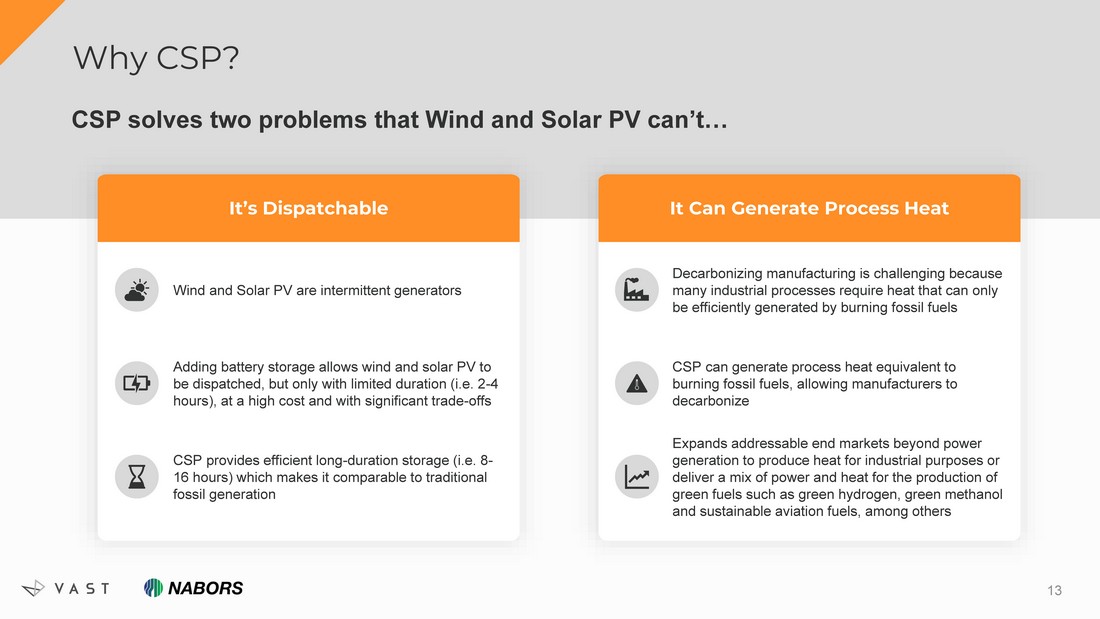

Why CSP? 13 CSP solves two problems that Wind and Solar PV can’t… It’s Dispatchable It Can Generate Process Heat Wind and Solar PV are intermittent generators Adding battery storage allows wind and solar PV to be dispatched, but only with limited duration (i.e. 2 - 4 hours), at a high cost and with significant trade - offs CSP provides efficient long - duration storage (i.e. 8 - 16 hours) which makes it comparable to traditional fossil generation Decarbonizing manufacturing is challenging because many industrial processes require heat that can only be efficiently generated by burning fossil fuels CSP can generate process heat equivalent to burning fossil fuels, allowing manufacturers to decarbonize Expands addressable end markets beyond power generation to produce heat for industrial purposes or deliver a mix of power and heat for the production of green fuels such as green hydrogen, green methanol and sustainable aviation fuels, among others

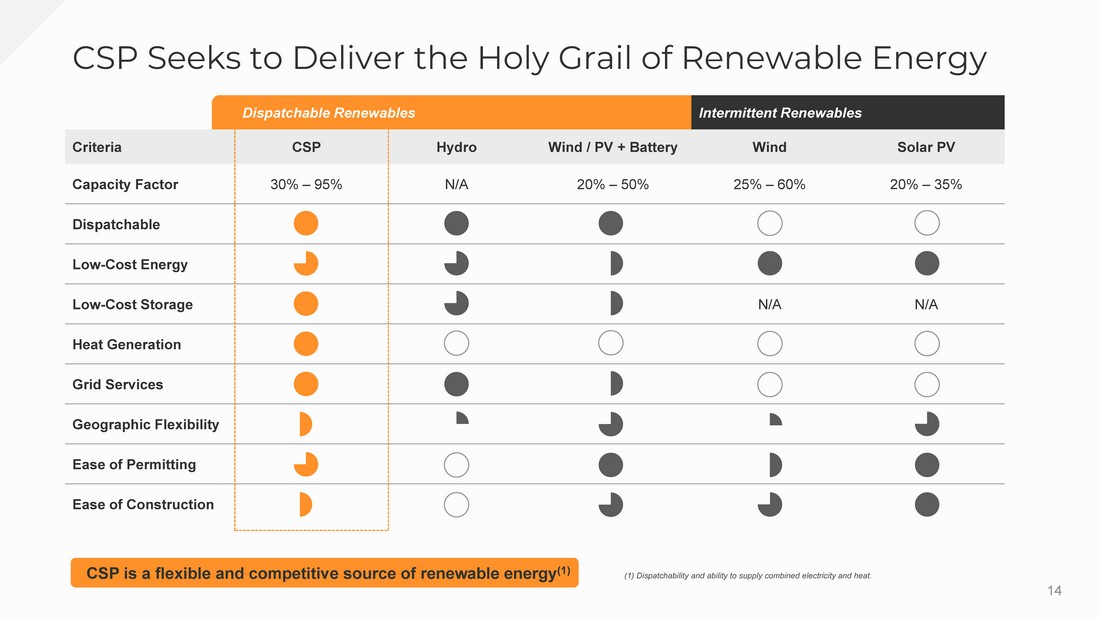

CSP Seeks to Deliver the Holy Grail of Renewable Energy Dispatchable Renewables Intermittent Renewables Criteria CSP Hydro Wind / PV + Battery Wind Solar PV Capacity Factor 30% – 95% N/A 20% – 50% 25% – 60% 20% – 35% Dispatchable Low - Cost Energy Low - Cost Storage N/A N/A Heat Generation Grid Services Geographic Flexibility Ease of Permitting Ease of Construction 14 CSP is a flexible and competitive source of renewable energy (1) (1) Dispatchability and ability to supply combined electricity and heat.

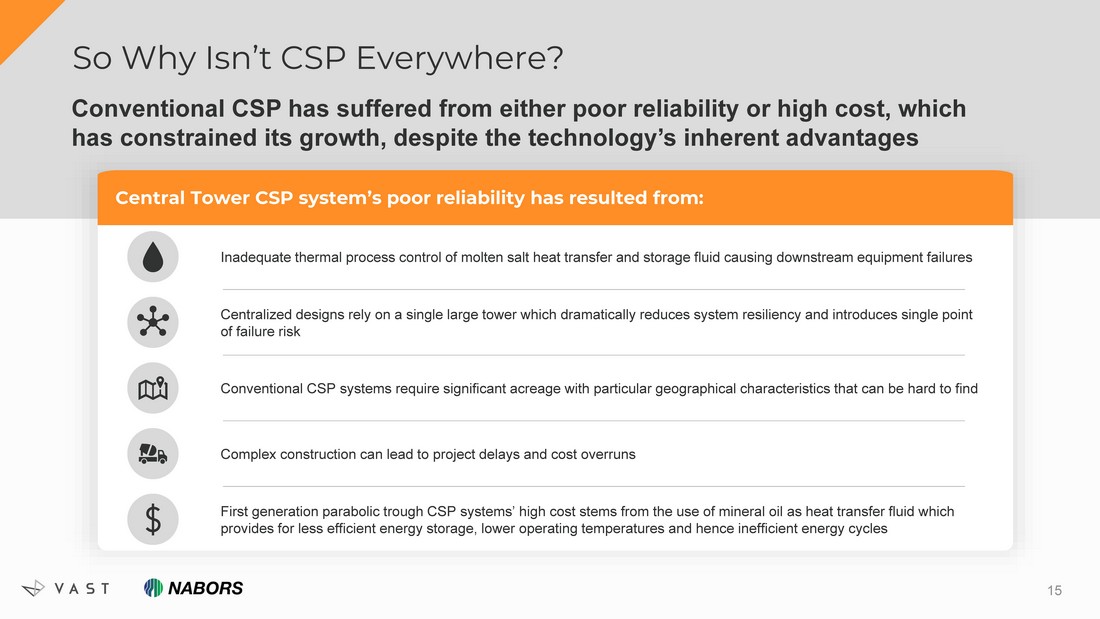

So Why Isn’t CSP Everywhere? 15 Conventional CSP has suffered from either poor reliability or high cost, which has constrained its growth, despite the technology’s inherent advantages Central Tower CSP system’s poor reliability has resulted from: Complex construction can lead to project delays and cost overruns Centralized designs rely on a single large tower which dramatically reduces system resiliency and introduces single point of failure risk Conventional CSP systems require significant acreage with particular geographical characteristics that can be hard to find Inadequate thermal process control of molten salt heat transfer and storage fluid causing downstream equipment failures First generation parabolic trough CSP systems’ high cost stems from the use of mineral oil as heat transfer fluid which provides for less efficient energy storage, lower operating temperatures and hence inefficient energy cycles

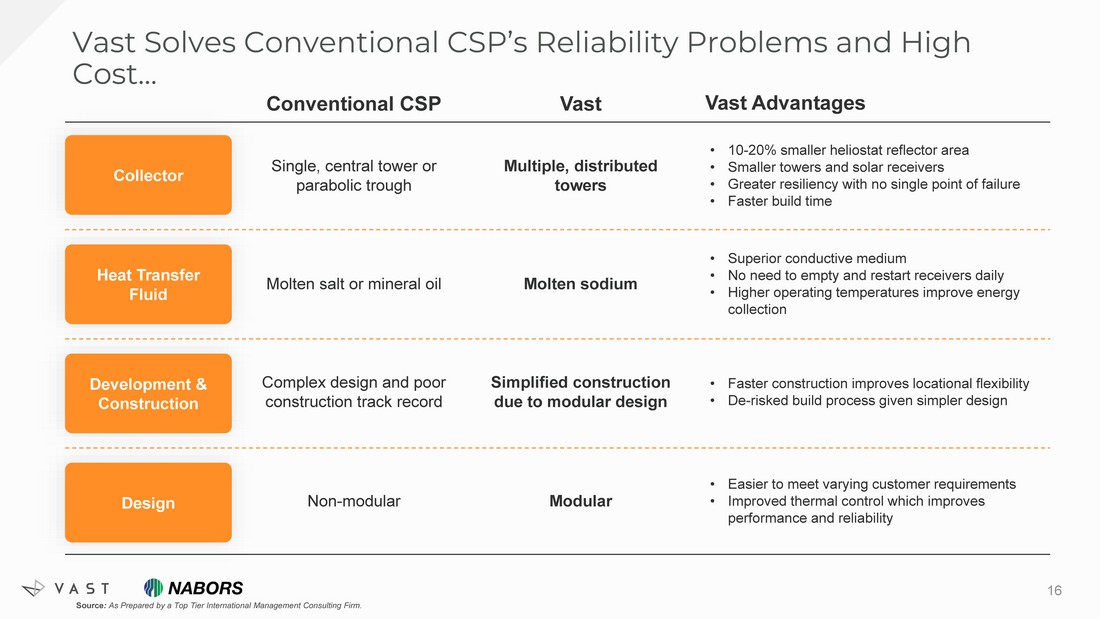

Vast Solves Conventional CSP’s Reliability Problems and High Cost… 16 Conventional CSP Single, central tower or parabolic trough Molten salt or mineral oil Complex design and poor construction track record Non - modular Vast Multiple, distributed towers Molten sodium Simplified construction due to modular design Modular Vast Advantages • 10 - 20% smaller heliostat reflector area • Smaller towers and solar receivers • Greater resiliency with no single point of failure • Faster build time • Superior conductive medium • No need to empty and restart receivers daily • Higher operating temperatures improve energy collection • Faster construction improves locational flexibility • De - risked build process given simpler design • Easier to meet varying customer requirements • Improved thermal control which improves performance and reliability Collector Heat Transfer Fluid Development & Construction Design Source : As Prepared by a Top Tier International Management Consulting Firm.

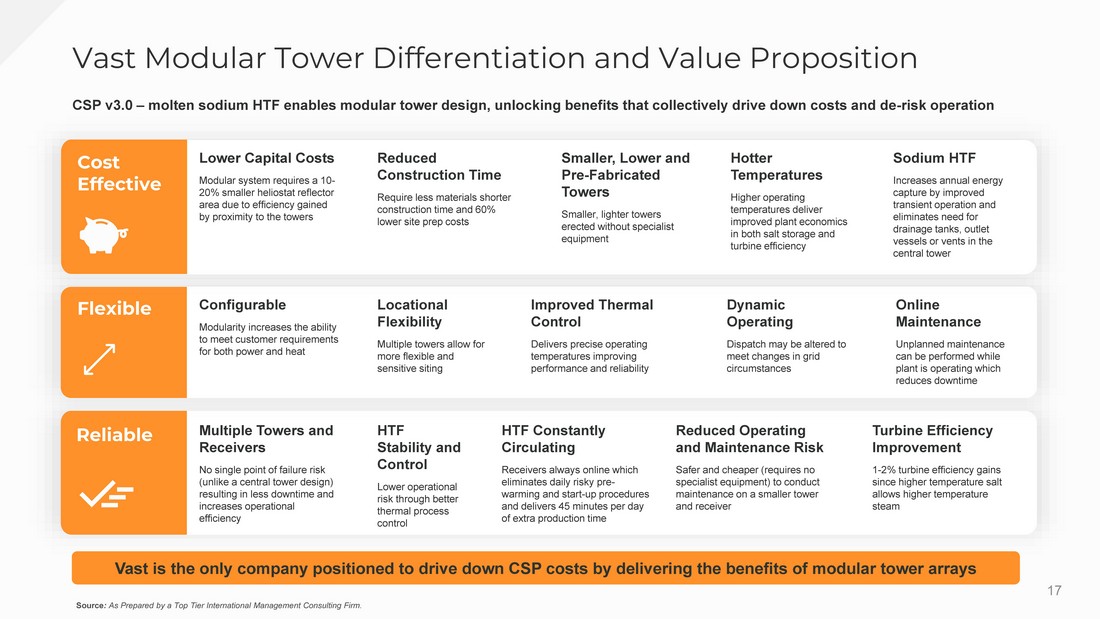

Vast Modular Tower Differentiation and Value Proposition Multiple Towers and Receivers No single point of failure risk (unlike a central tower design) resulting in less downtime and increases operational efficiency HTF Stability and Control Lower operational risk through better thermal process control HTF Constantly Circulating Receivers always online which eliminates daily risky pre - warming and start - up procedures and delivers 45 minutes per day of extra production time Reduced Operating and Maintenance Risk Safer and cheaper (requires no specialist equipment) to conduct maintenance on a smaller tower and receiver Turbine Efficiency Improvement 1 - 2% turbine efficiency gains since higher temperature salt allows higher temperature steam Improved Thermal Control Delivers precise operating temperatures improving performance and reliability Configurable Modularity increases the ability to meet customer requirements for both power and heat Dynamic Operating Dispatch may be altered to meet changes in grid circumstances Online Maintenance Unplanned maintenance can be performed while plant is operating which reduces downtime Locational Flexibility Multiple towers allow for more flexible and sensitive siting CSP v3.0 – molten sodium HTF enables modular tower design, unlocking benefits that collectively drive down costs and de - risk ope ration Vast is the only company positioned to drive down CSP costs by delivering the benefits of modular tower arrays Cost Effective Flexible Reliable Lower Capital Costs Modular system requires a 10 - 20% smaller heliostat reflector area due to efficiency gained by proximity to the towers Reduced Construction Time Require less materials shorter construction time and 60% lower site prep costs Smaller, Lower and Pre - Fabricated Towers Smaller, lighter towers erected without specialist equipment Hotter Temperatures Higher operating temperatures deliver improved plant economics in both salt storage and turbine efficiency Sodium HTF Increases annual energy capture by improved transient operation and eliminates need for drainage tanks, outlet vessels or vents in the central tower Source : As Prepared by a Top Tier International Management Consulting Firm. 17

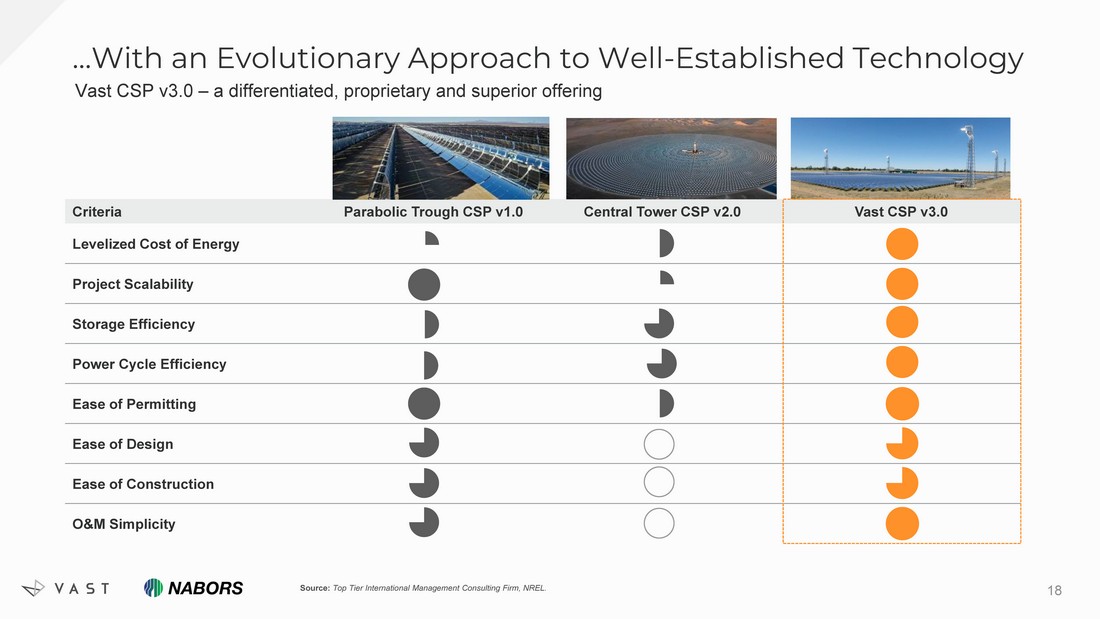

Criteria Parabolic Trough CSP v1.0 Central Tower CSP v2.0 Vast CSP v3.0 Levelized Cost of Energy Project Scalability Storage Efficiency Power Cycle Efficiency Ease of Permitting Ease of Design Ease of Construction O&M Simplicity …With an Evolutionary Approach to Well - Established Technology Vast CSP v3.0 – a differentiated, proprietary and superior offering 18 Source: Top Tier International Management Consulting Firm, NREL.

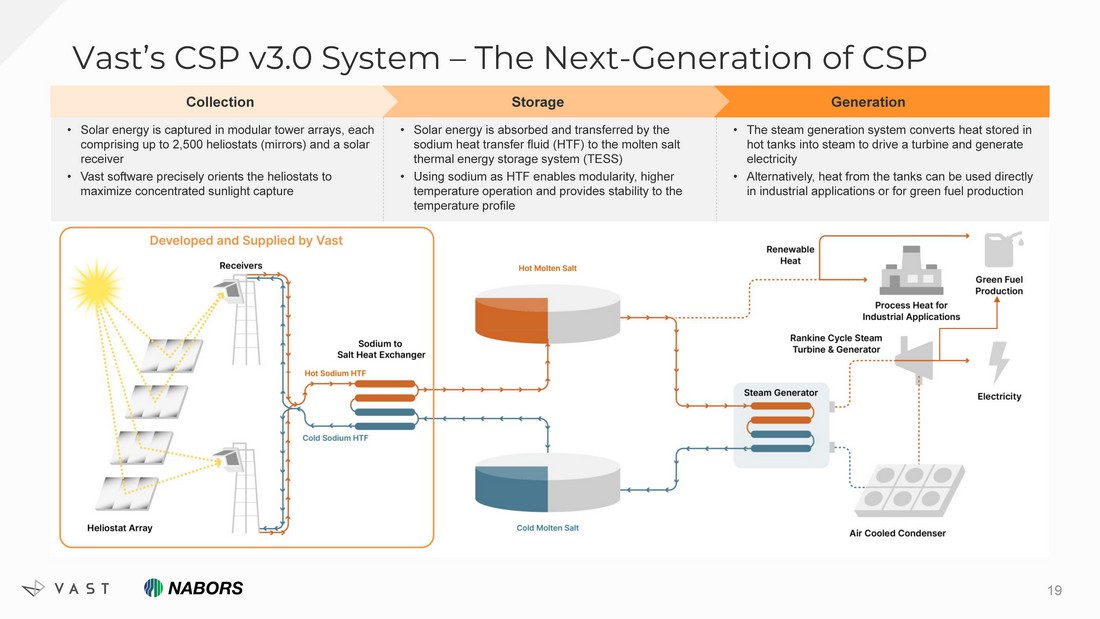

• Solar energy is captured in modular tower arrays, each comprising up to 2,500 heliostats (mirrors) and a solar receiver • Vast software precisely orients the heliostats to maximize concentrated sunlight capture • Solar energy is absorbed and transferred by the sodium heat transfer fluid (HTF) to the molten salt thermal energy storage system (TESS) • Using sodium as HTF enables modularity, higher temperature operation and provides stability to the temperature profile • The steam generation system converts heat stored in hot tanks into steam to drive a turbine and generate electricity • Alternatively, heat from the tanks can be used directly in industrial applications or for green fuel production Generation Vast’s CSP v3.0 System – The Next - Generation of CSP Collection (concentration and transient elimination) Storage (thermal battery and buffer ) 19 Storage Collection

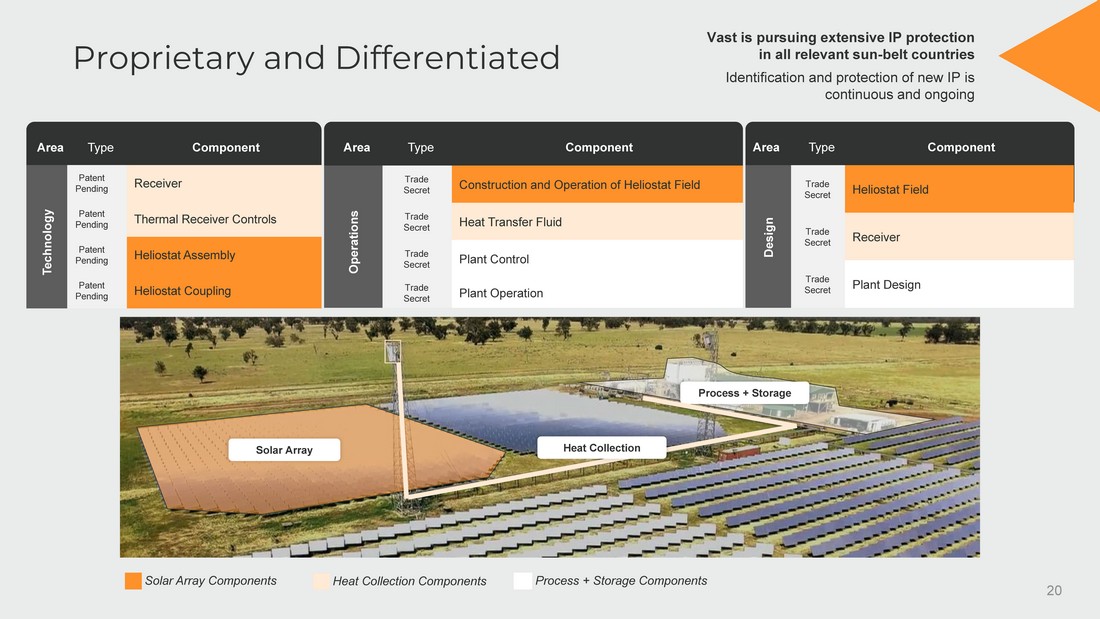

Proprietary and Differentiated Area Type Component Technology Patent Pending Receiver Patent Pending Thermal Receiver Controls Patent Pending Heliostat Assembly Patent Pending Heliostat Coupling Area Type Component Operations Trade Secret Construction and Operation of Heliostat Field Trade Secret Heat Transfer Fluid Trade Secret Plant Control Trade Secret Plant Operation Area Type Component Design Trade Secret Heliostat Field Trade Secret Receiver Trade Secret Plant Design Solar Array Process + Storage Vast is pursuing extensive IP protection in all relevant sun - belt countries Identification and protection of new IP is continuous and ongoing Heat Collection 20 Solar Array Components Heat Collection Components Process + Storage Components

Vast’s Technology is Proven Heliostat Prototyping and Testing Modular Array Prototyping and Testing Solar Receiver Prototyping and Testing Utility Scale Project Development 1.1MW Sun - to - Grid Demonstration Plant Located Near Forbes, Australia 2009 - 2010 2010 - 2011 2011 - 2014 2018 - 2019 2014 - 2020 Heliostats Solar Array Tower Solar Receiver Substation Sodium Storage Air Cooled Condenser 1MW Turbine Control Room HTF Piping Marulan 1 ▪ First heliostat generations ▪ Exploratory manufacturing techniques ▪ Optical refinement Marulan 2 ▪ Next generations of heliostats ▪ Optimal heliostat layouts ▪ Field comms and operations Back Station ▪ Water receivers ▪ Sodium receivers to unlock modularity ▪ Sodium operations Technology proven through long duration field testing at multiple sites Received International Energy Agency’s SolarPACES 2019 Technical Innovation Award Project Sold Objectives Met 50MW Solar PV ▪ Development, permitting and grid connection secured ▪ Sold shovel - ready to Genex Limited ▪ Plant now built and generating ▪ Approximately 3,500 heliostats configured into 5 modular tower arrays ▪ Co - funded with ARENA ▪ Final - form plant first synchronized with Australian national grid January 2018 ▪ Technology demonstrated, refined and validated ▪ Operability confirmed via operation for 32 months ▪ Technology scalability confirmed 21 5 years of prototyping and testing components leading to a successful grid - synchronized demonstration plant

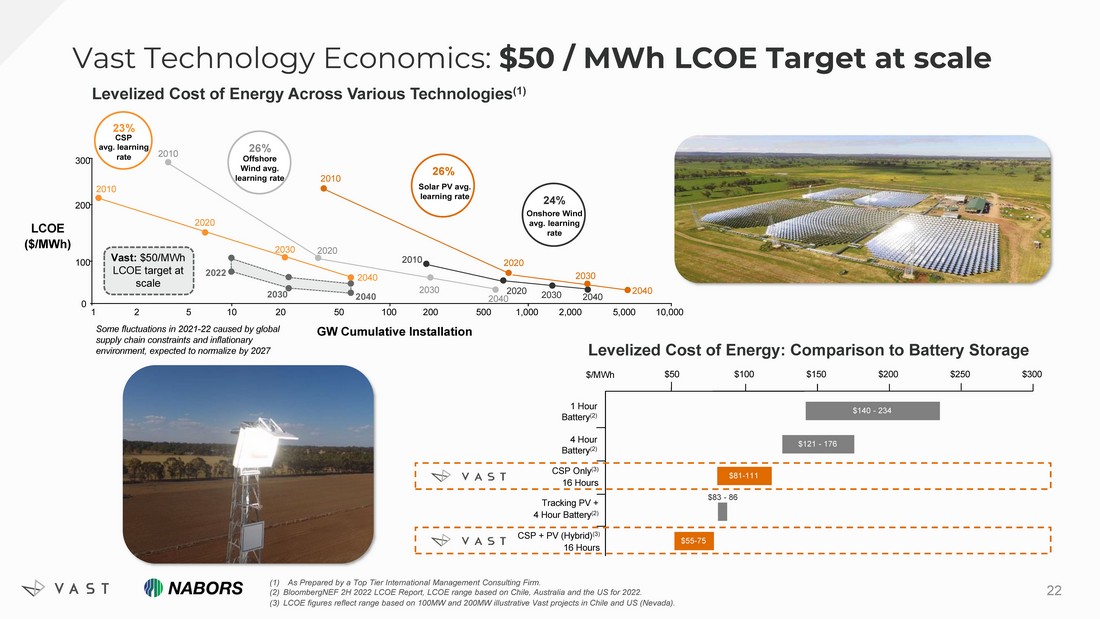

(1) As Prepared by a Top Tier International Management Consulting Firm. (2) BloombergNEF 2H 2022 LCOE Report, LCOE range based on Chile, Australia and the US for 2022. (3) LCOE figures reflect range based on 100MW and 200MW illustrative Vast projects in Chile and US (Nevada). Vast Technology Economics: $50 / MWh LCOE Target at scale 23% CSP avg. learning rate 26 % Offshore Wind avg. learning rate 26 % Solar PV avg. learning rate 24 % Onshore Wind avg. learning rate GW C umulative I nstallation 2010 2010 2010 2010 20 2 0 20 3 0 20 4 0 20 2 0 20 3 0 20 4 0 20 2 0 20 3 0 20 4 0 20 2 0 20 3 0 20 4 0 0 2 20 0 30 0 1 5 10 20 50 100 200 500 1,000 2,000 5,000 10,000 10 0 LCOE ($ /MWh ) Vast: $ 50/MWh LCOE target at scale 2022 2030 2040 1 Hour Battery (2) 4 Hour Battery (2) CSP + PV (Hybrid) (3) 16 Hours $140 - 234 $121 - 176 $55 - 75 $50 $100 $150 $200 $250 $300 $/MWh 22 Some fluctuations in 2021 - 22 caused by global supply chain constraints and inflationary environment, expected to normalize by 2027 Levelized Cost of Energy Across Various Technologies (1) Levelized Cost of Energy: Comparison to Battery Storage $81 - 111 CSP Only (3) 16 Hours Tracking PV + 4 Hour Battery (2) $83 - 86

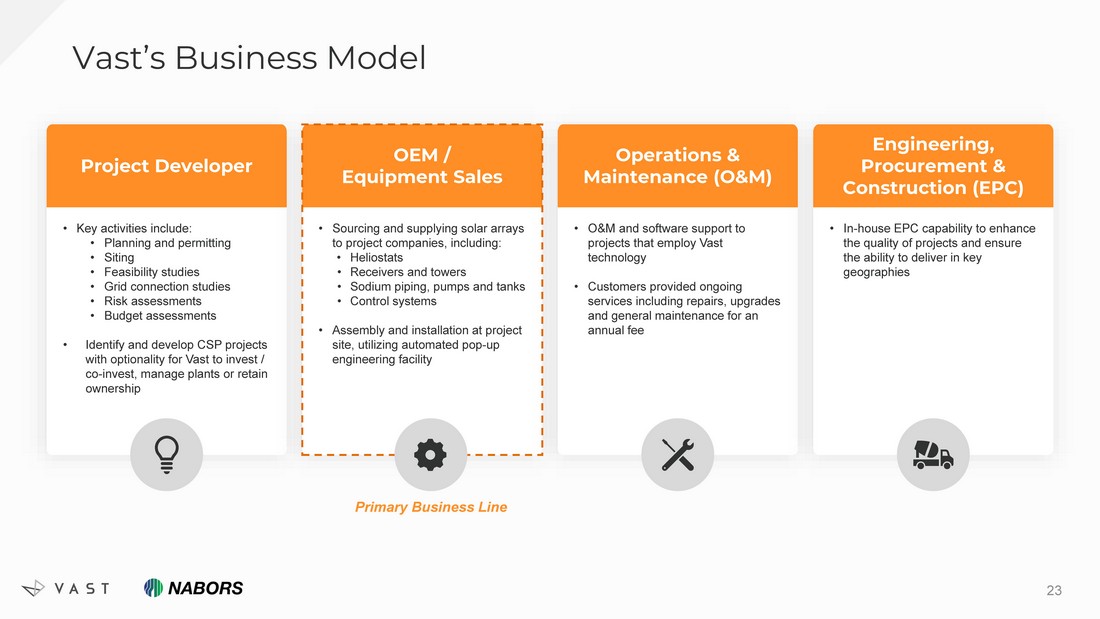

Vast’s Business Model • Key activities include: • Planning and permitting • Siting • Feasibility studies • Grid connection studies • Risk assessments • Budget assessments • Identify and develop CSP projects with optionality for Vast to invest / co - invest, manage plants or retain ownership Project Developer • Sourcing and supplying solar arrays to project companies, including: • Heliostats • Receivers and towers • Sodium piping, pumps and tanks • Control systems • Assembly and installation at project site, utilizing automated pop - up engineering facility OEM / Equipment Sales • O&M and software support to projects that employ Vast technology • Customers provided ongoing services including repairs, upgrades and general maintenance for an annual fee Operations & Maintenance (O&M) • In - house EPC capability to enhance the quality of projects and ensure the ability to deliver in key geographies Engineering, Procurement & Construction (EPC) 23 Primary Business Line

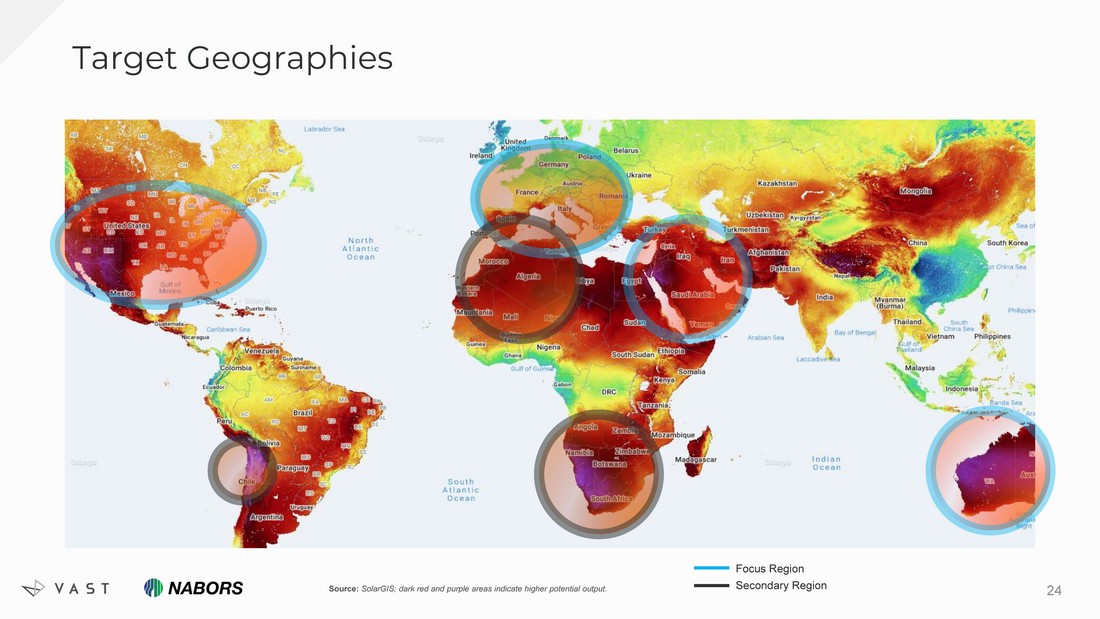

Target Geographies 24 Source: SolarGIS ; dark red and purple areas indicate higher potential output. Focus Region Secondary Region

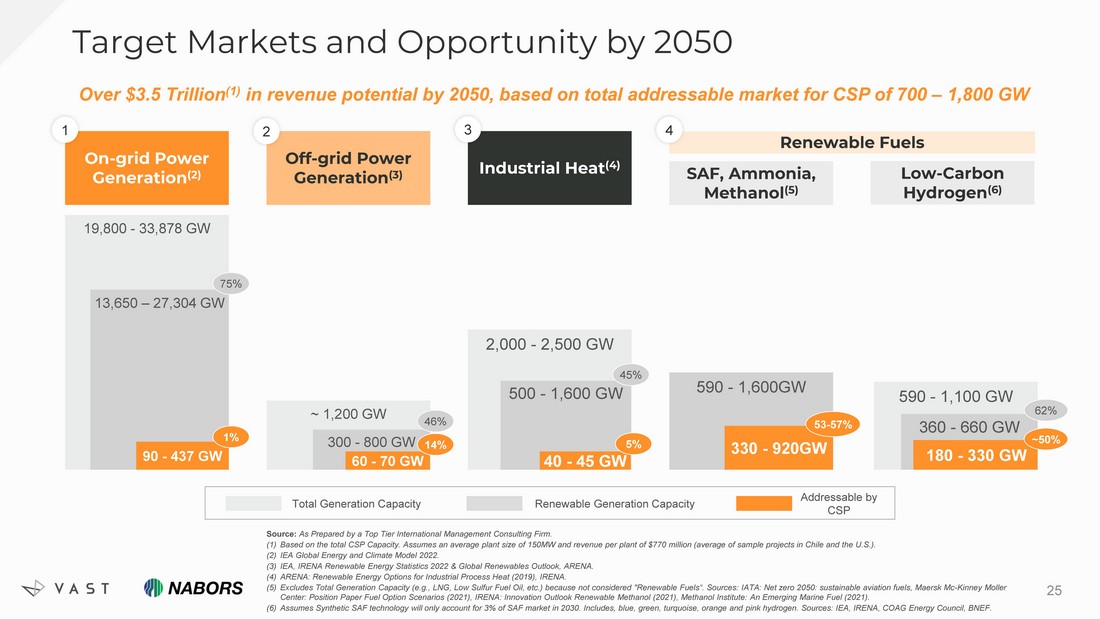

Target Markets and Opportunity by 2050 25 Source: As Prepared by a Top Tier International Management Consulting Firm. (1) Based on the total CSP Capacity. Assumes an average plant size of 150MW and revenue per plant of $770 million (average of sam ple projects in Chile and the U.S.). (2) IEA Global Energy and Climate Model 2022. (3) IEA, IRENA Renewable Energy Statistics 2022 & Global Renewables Outlook, ARENA. (4) ARENA: Renewable Energy Options for Industrial Process Heat (2019), IRENA. (5) Excludes Total Generation Capacity (e.g., LNG, Low Sulfur Fuel Oil, etc.) because not considered "Renewable Fuels“. Sources: IAT A: Net zero 2050: sustainable aviation fuels, Maersk Mc - Kinney Moller Center: Position Paper Fuel Option Scenarios (2021), IRENA: Innovation Outlook Renewable Methanol (2021), Methanol Institute: An Emerging Marine Fuel (2021). (6) Assumes Synthetic SAF technology will only account for 3% of SAF market in 2030. Includes, blue, green, turquoise, orange and pi nk hydrogen. Sources: IEA, IRENA, COAG Energy Council, BNEF. On - grid Power Generation (2) Off - grid Power Generation (3) 2 1 ~ 1,200 GW 300 - 800 GW 60 - 70 GW 19,800 - 33,878 GW 13,650 – 27,304 GW 90 - 437 GW 75% 1% 46% 14% Industrial Heat (4) 3 2,000 - 2,500 GW 500 - 1,600 GW 40 - 45 GW 45% 5% Renewable Fuels SAF, Ammonia, Methanol (5) Low - Carbon Hydrogen (6) 4 590 - 1,600GW 330 - 920GW 53 - 57% 590 - 1,100 GW 360 - 660 GW 180 - 330 GW 62% ~50% Total Generation Capacity Renewable Generation Capacity Addressable by CSP Over $3.5 Trillion (1) in revenue potential by 2050, based on total addressable market for CSP of 700 – 1,800 GW

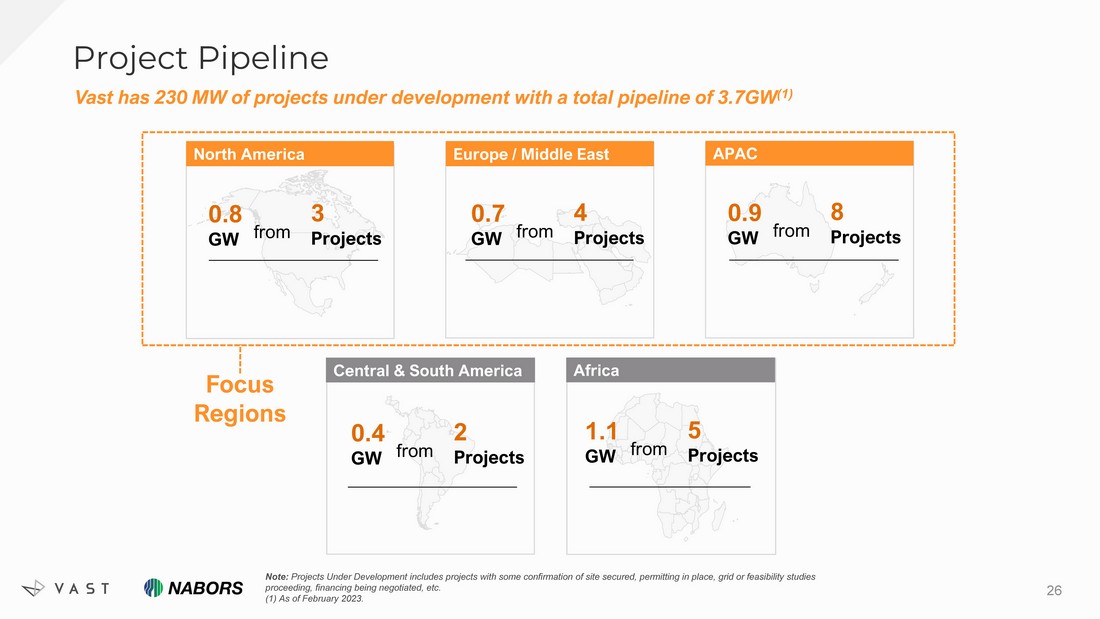

Project Pipeline North America 0.8 GW from 3 Projects Focus Regions Europe / Middle East 0.7 GW from 4 Projects Latin America Central & South America 0.4 GW from 2 Projects Africa 1.1 GW from 5 Projects APAC 0.9 GW from 8 Projects Note: Projects Under Development includes projects with some confirmation of site secured, permitting in place, grid or feasibility st udies proceeding, financing being negotiated, etc. (1) As of February 2023. 26 Vast has 230 MW of projects under development with a total pipeline of 3.7GW (1)

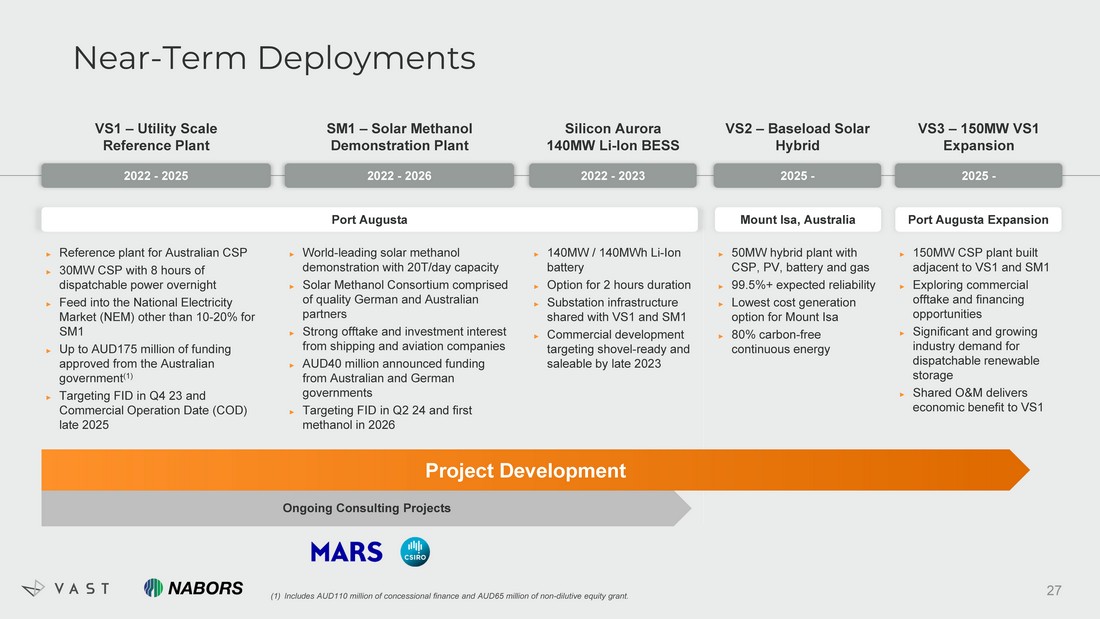

2025 - VS3 – 150MW VS1 Expansion ► 150MW CSP plant built adjacent to VS1 and SM1 ► Exploring commercial offtake and financing opportunities ► Significant and growing industry demand for dispatchable renewable storage ► Shared O&M delivers economic benefit to VS1 2025 - VS2 – Baseload Solar Hybrid ► 50MW hybrid plant with CSP, PV, battery and gas ► 99.5%+ expected reliability ► Lowest cost generation option for Mount Isa ► 80% carbon - free continuous energy 2022 - 2023 Silicon Aurora 140MW Li - Ion BESS ► 140MW / 140MWh Li - Ion battery ► Option for 2 hours duration ► Substation infrastructure shared with VS1 and SM1 ► Commercial development targeting shovel - ready and saleable by late 2023 2022 - 2026 SM1 – Solar Methanol Demonstration Plant 2022 - 2025 VS1 – Utility Scale Reference Plant Ongoing Consulting Projects Near - Term Deployments Project Development ► World - leading solar methanol demonstration with 20T/day capacity ► Solar Methanol Consortium comprised of quality German and Australian partners ► Strong offtake and investment interest from shipping and aviation companies ► AUD40 million announced funding from Australian and German governments ► Targeting FID in Q2 24 and first methanol in 2026 ► Reference plant for Australian CSP ► 30MW CSP with 8 hours of dispatchable power overnight ► Feed into the National Electricity Market (NEM) other than 10 - 20% for SM1 ► Up to AUD175 million of funding approved from the Australian government (1) ► Targeting FID in Q4 23 and Commercial Operation Date (COD) late 2025 Port Augusta Mount Isa, Australia Port Augusta Expansion 27 (1) Includes AUD110 million of concessional finance and AUD65 million of non - dilutive equity grant.

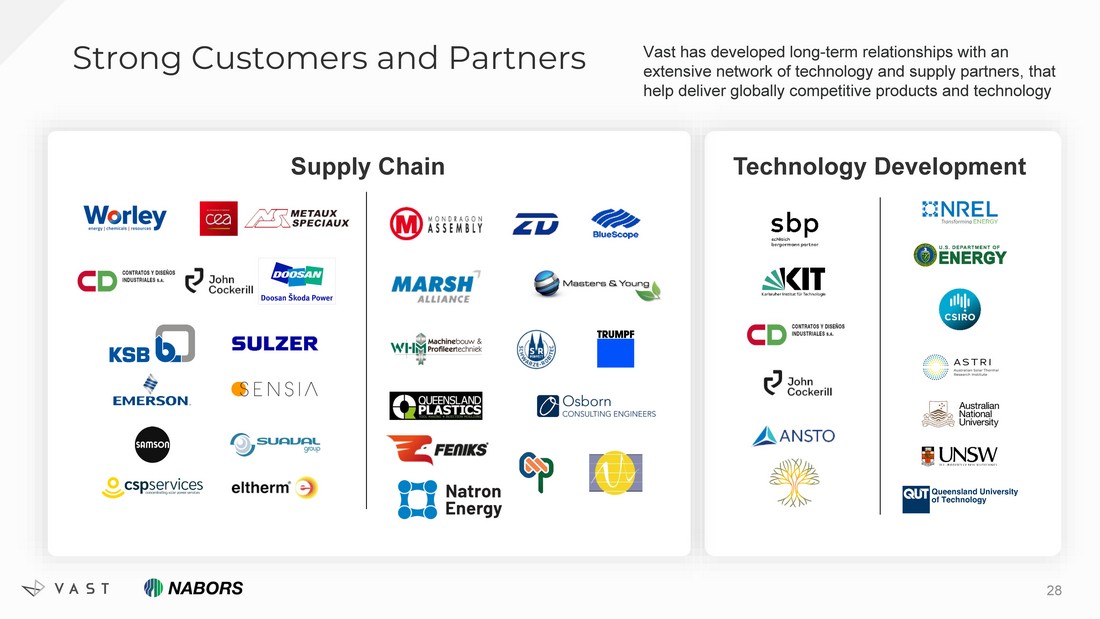

Technology Development Vast has developed long - term relationships with an extensive network of technology and supply partners, that help deliver globally competitive products and technology Supply Chain Strong Customers and Partners 28

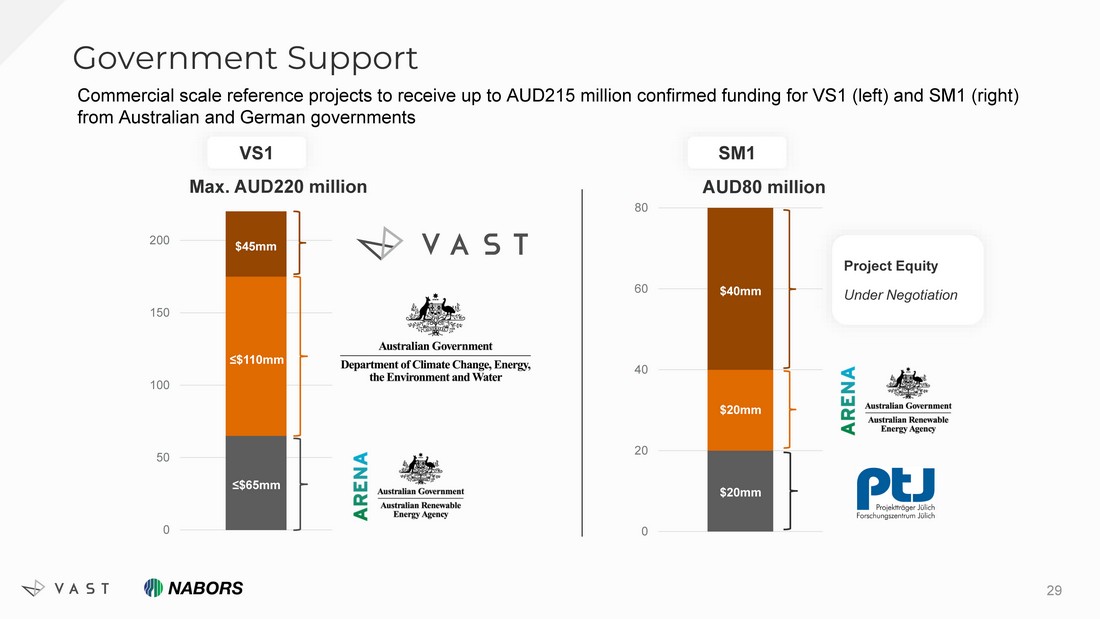

Government Support 0 20 40 60 80 0 50 100 150 200 250 $45mm ≤$110mm ≤$65mm AUD80 million $40mm $20mm $20mm Max. AUD220 million Project Equity Under Negotiation 29 Commercial scale reference projects to receive up to AUD215 million confirmed funding for VS1 (left) and SM1 (right) from Australian and German governments VS1 SM1

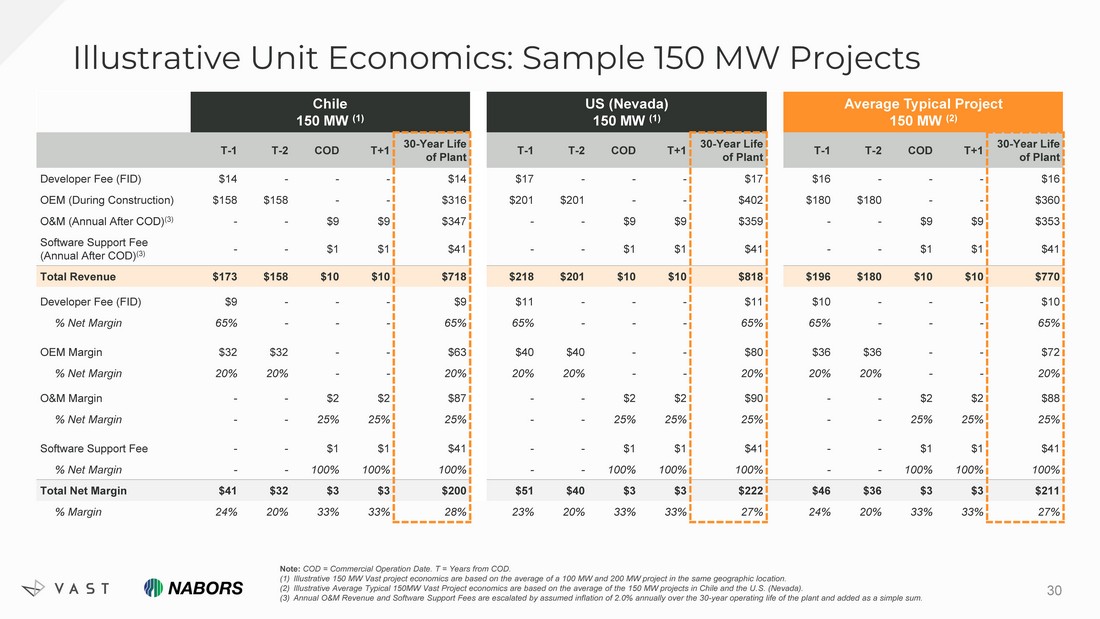

Illustrative Unit Economics: Sample 150 MW Projects Chile 150 MW (1) US (Nevada) 150 MW (1) Average Typical Project 150 MW (2) T - 1 T - 2 COD T+1 30 - Year Life of Plant T - 1 T - 2 COD T+1 30 - Year Life of Plant T - 1 T - 2 COD T+1 30 - Year Life of Plant Developer Fee (FID) $14 - - - $14 $17 - - - $17 $16 - - - $16 OEM (During Construction) $158 $158 - - $316 $201 $201 - - $402 $180 $180 - - $360 O&M (Annual After COD) (3) - - $9 $9 $347 - - $9 $9 $359 - - $9 $9 $353 Software Support Fee (Annual After COD) (3) - - $1 $1 $41 - - $1 $1 $41 - - $1 $1 $41 Total Revenue $173 $158 $10 $10 $718 $218 $201 $10 $10 $818 $196 $180 $10 $10 $770 Developer Fee (FID) $9 - - - $9 $11 - - - $11 $10 - - - $10 % Net Margin 65% - - - 65% 65% - - - 65% 65% - - - 65% OEM Margin $32 $32 - - $63 $40 $40 - - $80 $36 $36 - - $72 % Net Margin 20% 20% - - 20% 20% 20% - - 20% 20% 20% - - 20% O&M Margin - - $2 $2 $87 - - $2 $2 $90 - - $2 $2 $88 % Net Margin - - 25% 25% 25% - - 25% 25% 25% - - 25% 25% 25% Software Support Fee - - $1 $1 $41 - - $1 $1 $41 - - $1 $1 $41 % Net Margin - - 100% 100% 100% - - 100% 100% 100% - - 100% 100% 100% Total Net Margin $41 $32 $3 $3 $200 $51 $40 $3 $3 $222 $46 $36 $3 $3 $211 % Margin 24% 20% 33% 33% 28% 23% 20% 33% 33% 27% 24% 20% 33% 33% 27% Note: COD = Commercial Operation Date. T = Years from COD. (1) Illustrative 150 MW Vast project economics are based on the average of a 100 MW and 200 MW project in the same geographic loc ati on. (2) Illustrative Average Typical 150MW Vast Project economics are based on the average of the 150 MW projects in Chile and the U. S. (Nevada). (3) Annual O&M Revenue and Software Support Fees are escalated by assumed inflation of 2.0% annually over the 30 - year operating life of the plant and added as a simple sum. 30

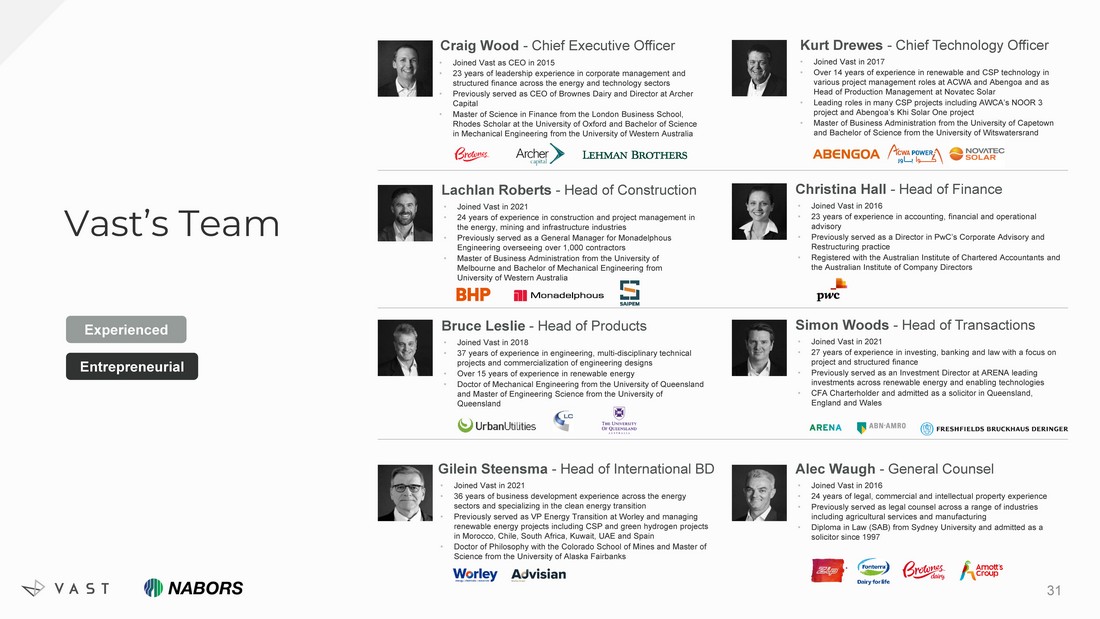

Vast’s Team Craig Wood - Chief Executive Officer • Joined Vast as CEO in 2015 • 23 years of leadership experience in corporate management and structured finance across the energy and technology sectors • Previously served as CEO of Brownes Dairy and Director at Archer Capital • Master of Science in Finance from the London Business School, Rhodes Scholar at the University of Oxford and Bachelor of Science in Mechanical Engineering from the University of Western Australia Kurt Drewes - Chief Technology Officer • Joined Vast in 2017 • Over 14 years of experience in renewable and CSP technology in various project management roles at ACWA and Abengoa and as Head of Production Management at Novatec Solar • Leading roles in many CSP projects including AWCA’s NOOR 3 project and Abengoa’s Khi Solar One project • Master of Business Administration from the University of Capetown and Bachelor of Science from the University of Witswatersrand Lachlan Roberts - Head of Construction • Joined Vast in 2021 • 24 years of experience in construction and project management in the energy, mining and infrastructure industries • Pre viously served as a General Manager for Monadelphous Engineering overseeing over 1,000 contractors • Master of Business Administration from the University of Melbourne and Bachelor of Mechanical Engineering from University of Western Australia Christina Hall - Head of Finance • Joined Vast in 2016 • 23 years of experience in accounting, financial and operational advisory • Previously served as a Director in PwC’s Corporate Advisory and Restructuring practice • Registered with the Australian Institute of Chartered Accountants and the Australian Institute of Company Directors Bruce Leslie - Head of Products • Joined Vast in 2018 • 37 years of experience in engineering, multi - disciplinary technical projects and commercialization of engineering designs • Over 15 years of experience in renewable energy • Doctor of Mechanical Engineering from the University of Queensland and Master of Engineering Science from the University of Queensland Simon Woods - Head of Transactions • Joined Vast in 2021 • 27 years of experience in investing, banking and law with a focus on project and structured finance • Previously served as an Investment Director at ARENA leading investments across renewable energy and enabling technologies • CFA C harterholder and admitted as a solicitor in Queensland, England and Wales Gilein Steensma - Head of International BD • Joined Vast in 2021 • 36 years of business development experience across the energy sectors and specializing in the clean energy transition • Previously served as VP Energy Transition at Worley and managing renewable energy projects including CSP and green hydrogen projects in Morocco, Chile, South Africa, Kuwait, UAE and Spain • Doctor of Philosophy with the Colorado School of Mines and Master of Science from the University of Alaska Fairbanks Alec Waugh - General Counsel • Joined Vast in 2016 • 24 years of legal, commercial and intellectual property experience • Previously serv ed as legal counsel across a range of industries including agricultural services and manufacturing • Diploma in Law (SAB) from Sydney University and admitted as a solicitor since 1997 Experienced Entrepreneurial 31

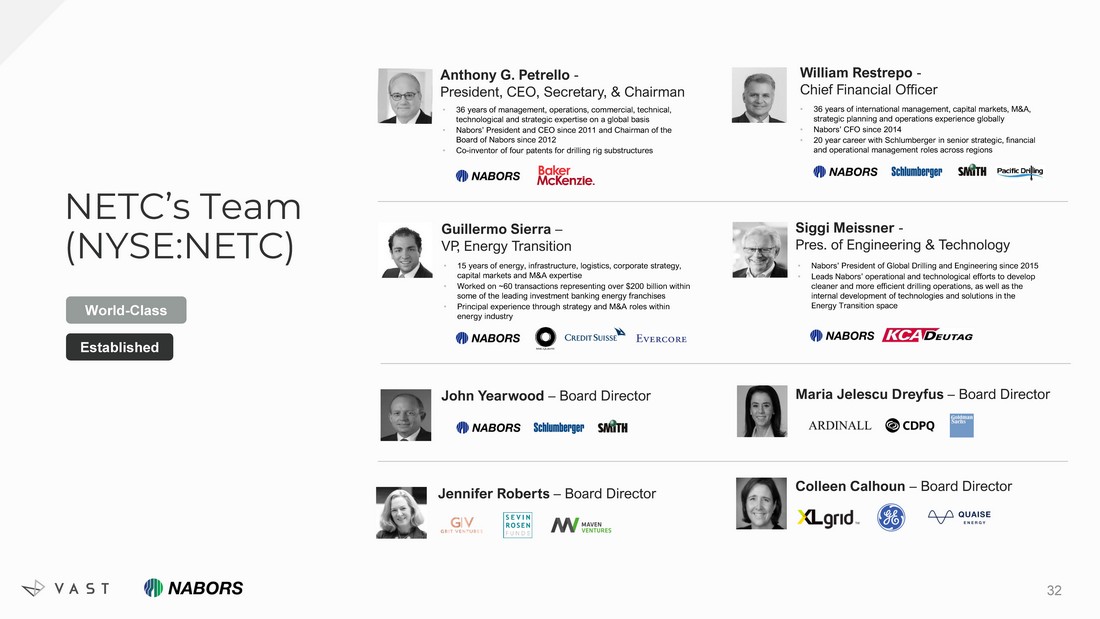

NETC’s Team (NYSE:NETC) World - Class Established Anthony G. Petrello - President, CEO, Secretary, & Chairman • 36 years of management, operations, commercial, technical, technological and strategic expertise on a global basis • Nabors’ President and CEO since 2011 and Chairman of the Board of Nabors since 2012 • C o - inventor of four patents for drilling rig substructures William Restrepo - Chief Financial Officer • 36 years of international management, capital markets, M&A, strategic planning and operations experience globally • Nabors’ CFO since 2014 • 20 year career with Schlumberger in senior strategic, financial and operational management roles across regions Guillermo Sierra – VP, Energy Transition • 15 years of energy, infrastructure, logistics, corporate strategy, capital markets and M&A expertise • Worked on ~60 transactions representing over $200 billion within some of the leading investment banking energy franchises • Principal experience through strategy and M&A roles within energy industry Siggi Meissner - Pres. of Engineering & Technology • Nabors’ President of Global Drilling and Engineering since 2015 • Leads Nabors’ operational and technological efforts to develop cleaner and more efficient drilling operations, as well as the internal development of technologies and solutions in the Energy Transition space John Yearwood – Board Director Maria Jelescu Dreyfus – Board Director Jennifer Roberts – Board Director Colleen Calhoun – Board Director 32

70%+ Active in markets comprising of global oil and gas production 15+ Located in countries, with a diversified customer base 300+ Global service assets Nabors delivers global relationships, reach and manufacturing and supply chain capabilities A Unique Sponsor Leading international franchise with significant growth opportunities 33

Leveraging Nabors’ Capabilities to Accelerate Vast’s Global Deployment 34 (NYSE: NBR) Nabors’ Capability Vast Applicability Strategic Automation & Robotics ▪ Mirror cleaning ▪ Automated pop - up manufacturing Manufacturing & Facilities ▪ Global supply chain Global field and technical support Controls, Software & AI ▪ Mirror array controls ▪ Remote operations ▪ Fluid control systems Nabors Technology ▪ Material sciences ▪ Hydrogen Nabors Ventures ▪ Revolutionary battery tech (Natron Energy, Inc.) ▪ Baseload energy enhancer (Sage Geosystems Inc.) Scaling Commercial ▪ Global relationships in key markets: U.S., Middle East, and Latin America Technology Development ▪ Engineering capabilities ▪ IP procedures Maintenance Operations ▪ Remote control centers ▪ Continuous monitoring of field hardware Public Readiness Accounting HR Legal Multijurisdictional Expertise Processes and Procedures

Appendix

Market Opportunity

On - Grid Opportunity 6.4 16.7 48.8 89.5 2020 2030 2040 Low case – IEA Stated Policies Scenario (STEPS) High case – IEA Net Zero Emissions (NZE) Global projected CSP capacity (in GW – IEA 2022) 6.4 63.7 282.6 436.5 2030 2020 2040 Global projected CSP capacity (in GW – IEA 2022) Scenario description Scenario assumes that only policies which have already been public stated, committed to and backed by funding & specific measures are implemented; this will lead to global targets for emission reductions being missed Scenario description Scenario implies the energy sector reaching net zero CO 2 emissions by 2050; this scenario also indicates achievement of UN Sustainable Development Goals and is consistent with limiting global temperature rise to 1.5ºC 2050 2050 9.2% CAGR 15.1% CAGR On - grid CSP capacity expected to grow rapidly to 2050 IEA expects CSP deployments to grow between 13x to 62x today’s deployments for on - grid applications only 37

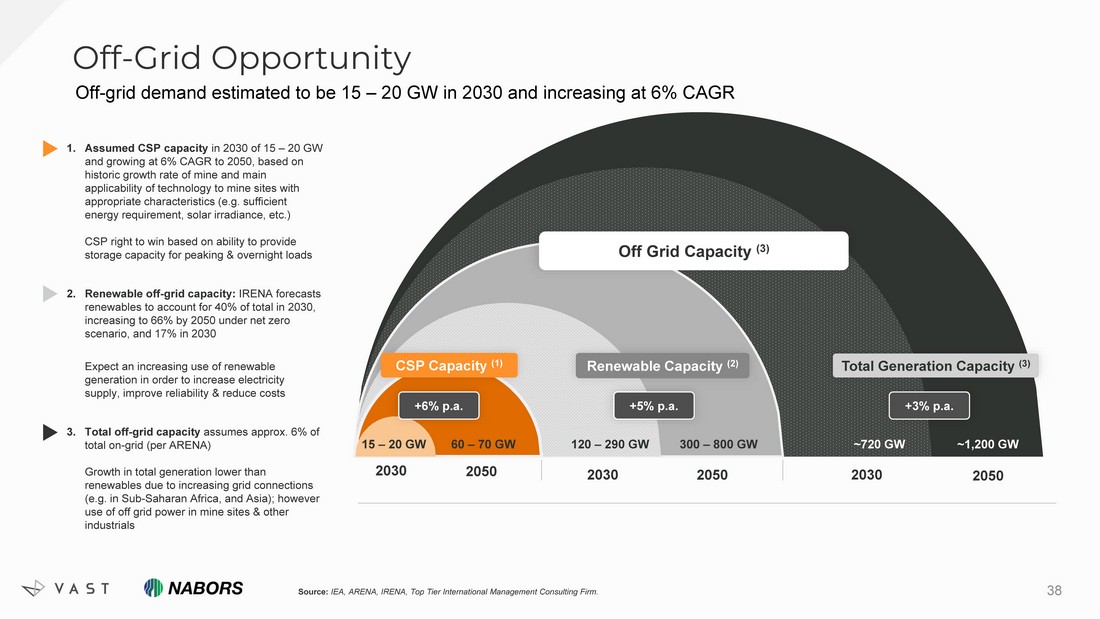

Off - Grid Opportunity 38 2030 15 – 20 GW 60 – 70 GW CSP Capacity (1) Renewable Capacity (2) Total Generation Capacity (3) 120 – 290 GW 300 – 800 GW +5% p.a. +6% p.a. ~720 GW ~1,200 GW +3% p.a. 2030 2030 2050 2050 2050 Off Grid Capacity (3) Off - grid demand estimated to be 15 – 20 GW in 2030 and increasing at 6% CAGR 1. Assumed CSP capacity in 2030 of 15 – 20 GW and growing at 6% CAGR to 2050, based on historic growth rate of mine and main applicability of technology to mine sites with appropriate characteristics (e.g. sufficient energy requirement, solar irradiance, etc.) CSP right to win based on ability to provide storage capacity for peaking & overnight loads 2. Renewable off - grid capacity: IRENA forecasts renewables to account for 40% of total in 2030, increasing to 66% by 2050 under net zero scenario, and 17% in 2030 3. Expect an increasing use of renewable generation in order to increase electricity supply, improve reliability & reduce costs 3. Total off - grid capacity assumes approx. 6% of total on - grid (per ARENA) Growth in total generation lower than renewables due to increasing grid connections (e.g. in Sub - Saharan Africa, and Asia); however use of off grid power in mine sites & other industrials Source: IEA, ARENA, IRENA, Top Tier International Management Consulting Firm.

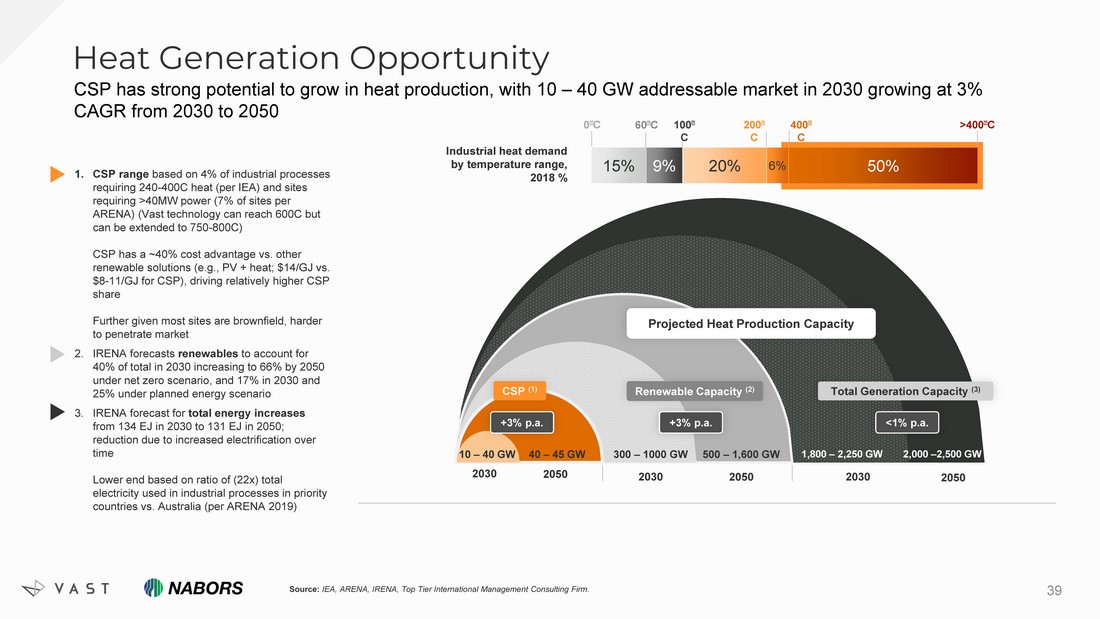

Heat Generation Opportunity 39 2030 10 – 40 GW 40 – 45 GW CSP (1) Renewable Capacity (2) Total Generation Capacity (3) 300 – 1000 GW 500 – 1,600 GW +3% p.a. +3% p.a. 1,800 – 2,250 GW 2,000 – 2,500 GW <1% p.a. 2030 2030 2050 2050 2050 Projected Heat Production Capacity CSP has strong potential to grow in heat production, with 10 – 40 GW addressable market in 2030 growing at 3% CAGR from 2030 to 2050 1. CSP range based on 4% of industrial processes requiring 240 - 400C heat (per IEA) and sites requiring >40MW power (7% of sites per ARENA) (Vast technology can reach 600C but can be extended to 750 - 800C) CSP has a ~40% cost advantage vs. other renewable solutions (e.g., PV + heat; $14/GJ vs. $8 - 11/GJ for CSP), driving relatively higher CSP share Further given most sites are brownfield, harder to penetrate market 2. IRENA forecasts renewables to account for 40% of total in 2030 increasing to 66% by 2050 under net zero scenario, and 17% in 2030 and 25% under planned energy scenario 3. IRENA forecast for total energy increases from 134 EJ in 2030 to 131 EJ in 2050; reduction due to increased electrification over time Lower end based on ratio of (22x) total electricity used in industrial processes in priority countries vs. Australia (per ARENA 2019) Industrial heat demand by temperature range, 2018 % 50% 6% 20% 9% 15% 0 C 60 C 100 C 200 C 400 C >400 C Source: IEA, ARENA, IRENA, Top Tier International Management Consulting Firm.

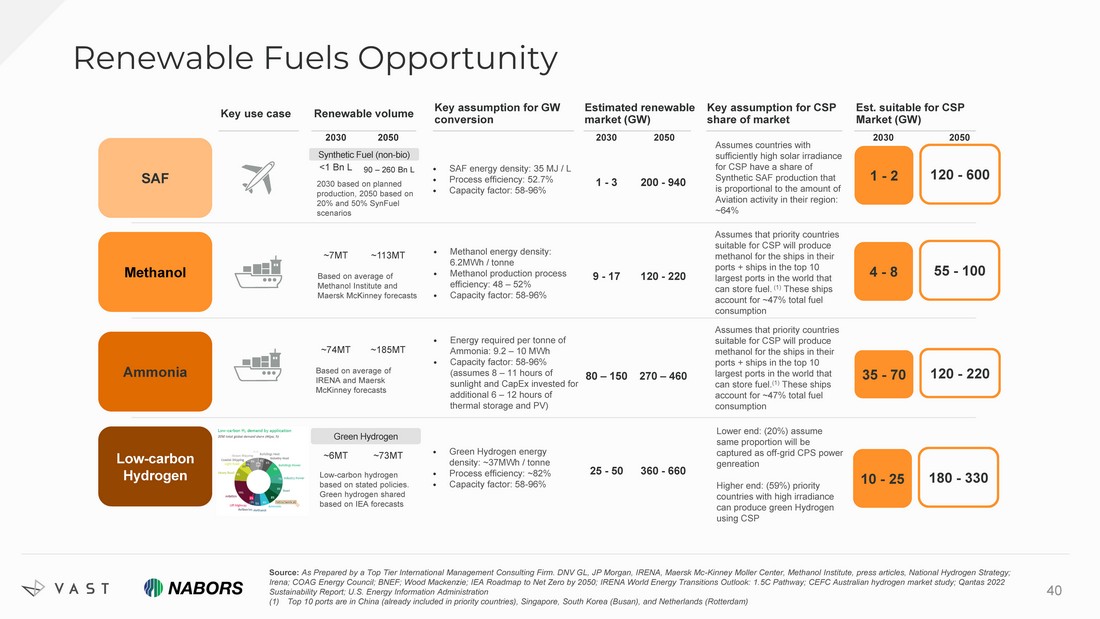

40 Source: As Prepared by a Top Tier International Management Consulting Firm. DNV GL, JP Morgan, IRENA, Maersk Mc - Kinney Moller Center, Me thanol Institute, press articles, National Hydrogen Strategy; Irena; COAG Energy Council; BNEF; Wood Mackenzie; IEA Roadmap to Net Zero by 2050; IRENA World Energy Transitions Outlook: 1. 5C Pathway; CEFC Australian hydrogen market study; Qantas 2022 Sustainability Report; U.S. Energy Information Administration (1) Top 10 ports are in China (already included in priority countries), Singapore, South Korea (Busan), and Netherlands (Rotterda m) Renewable Fuels Opportunity Methanol Low - carbon Hydrogen Key use case Renewable volume ~7MT ~113MT ~6MT ~73MT Key assumption for GW conversion • Green Hydrogen energy density: ~37MWh / tonne • Process efficiency: ~82% • Capacity factor: 58 - 96% • Methanol energy density: 6.2MWh / tonne • Methanol production process efficiency: 48 – 52% • Capacity factor: 58 - 96% Based on average of Methanol Institute and Maersk McKinney forecasts Low - carbon hydrogen based on stated policies. Green hydrogen shared based on IEA forecasts Green Hydrogen Estimated renewable market (GW) 9 - 17 120 - 220 25 - 50 360 - 660 Key assumption for CSP share of market Lower end: (20%) assume same proportion will be captured as off - grid CPS power genreation Higher end: (59%) priority countries with high irradiance can produce green Hydrogen using CSP Est. suitable for CSP Market (GW) Ammonia ~74MT ~185MT 2030 2050 • Energy required per tonne of Ammonia: 9.2 – 10 MWh • Capacity factor: 58 - 96% (assumes 8 – 11 hours of sunlight and CapEx invested for additional 6 – 12 hours of thermal storage and PV) Based on average of IRENA and Maersk McKinney forecasts 80 – 150 270 – 460 2030 2050 Assumes that priority countries suitable for CSP will produce methanol for the ships in their ports + ships in the top 10 largest ports in the world that can store fuel. (1) These ships account for ~47% total fuel consumption 2030 2050 SAF <1 Bn L 90 – 260 Bn L • SAF energy density: 35 MJ / L • Process efficiency: 52.7% • Capacity factor: 58 - 96% 2030 based on planned production, 2050 based on 20% and 50% SynFuel scenarios Synthetic Fuel (non - bio) 1 - 3 200 - 940 Assumes countries with sufficiently high solar irradiance for CSP have a share of Synthetic SAF production that is proportional to the amount of Aviation activity in their region: ~64% Assumes that priority countries suitable for CSP will produce methanol for the ships in their ports + ships in the top 10 largest ports in the world that can store fuel. (1) These ships account for ~47% total fuel consumption 1 - 2 120 - 600 4 - 8 55 - 100 35 - 70 120 - 220 10 - 25 180 - 330

Risk Factors

Summary of Risk Factors 42 Risks Relating to Vast’s Business • If the demand for Vast’s CST and CSP technology does not grow as anticipated, it will negatively impact Vast’s revenue and ha rm the overall performance of the company. • If Vast is not successful in securing new contracts and / or developing the projects in its pipeline, it could negatively imp act Vast’s business operations and financial performance. • Vast expects to invest in growth for the foreseeable future, and there is a risk that Vast may fail to manage that growth eff ect ively. • If Vast is not able to appropriately manage its growth strategy, its business operations and financial results could be adver sel y affected. • A material reduction in the retail price of traditional utility - generated electricity or electricity from other sources could ha rm its business, financial condition, results of operations and prospects. • Vast will likely require a significant amount of capital to achieve its growth plans but obtaining it may be uncertain as Vas t m ay not be able to secure additional financing on favorable terms, or at all. • Vast may invest large amounts of resources in its project development and construction activities, in particular its IEP busi nes s line, without first securing project financing, which could raise its expenses and make it harder to recoup its investments. • Vast may not be able to successfully finish or operate its projects in a way that makes a profit and / or meets its customers ' r equirements. • Vast is a growth - stage company with a history of operating losses, and it will likely incur substantial additional expenses and operating losses in the future. • Vast’s revenue, expenses, and related financials may fluctuate significantly. • An increase in the cost of materials and commodities used as inputs or otherwise in Vast’s business could adversely affect it s b usiness. • The failure of Vast’s suppliers to continue to deliver necessary raw materials or other components required for Vast’s projec ts in a timely manner or at all, or Vast’s inability to obtain substitute sources of these components on a timely basis or on terms acceptable to us, could adversely affect Vast’s business. • Vast requires certain specialty materials and components that may be subject to supply chain disruptions and the inability to ob tain such materials and components on a timely basis or on terms acceptable to us, could adversely affect Vast’s business. • Certain estimates of market opportunity and forecasts of market growth may prove to be inaccurate. • Expanding Vast’s operations beyond Australia is a planned avenue for growth, but this strategy comes with additional risks th at it may not encounter domestically. These risks could have a material adverse effect on its business and financial performance. • Vast operates in a highly competitive industry, where its present or future competitors may be able to compete more effective ly than Vast does, which could have a material adverse effect on Vast’s business, revenues, growth rates, and market share. • Should it seek to dispatch during daylight hours, CSP faces competition from both rooftop and utility scale PV electricity ge ner ation in the Australian Electricity Market. The success of PV generating during daylight hours in the Australian Electricity Market depresses the price at which a CSP plant can sell electricity during the day . • CSP faces competition from existing coal - fired and other power plants that over their longer periods of operation have already a mortized their fixed project costs and now offer energy at marginal costs that are difficult for newly - built plants to match. • Securing government support such as grant funding and concessional debt financing may result in increased government oversigh t a nd regulation for Vast. • The green hydrogen and downstream derivative production industry is an emerging market and it may not receive widespread mark et acceptance. • Debt financing typically required for large and utility - scale projects such as VS1 and the other projects in Vast’s pipeline requires, for example, a third - party energy assessment and a third - party engineering report in form and substance satisfactory to the lenders. Failure to obtain such assessments and reports could result in dela ys, increased expenses or project cancellation. • Vast’s business is subject to risks associated with construction, utility interconnection, cost overruns and delays, including those r elated to obtaining government permits and other contingencies that may arise in the course of completing installations. • CSP v3.0 construction is complex and engineering, procurement and construction of VS1 and other Vast projects may require Vas t t o negotiate, engage and oversee multiple construction companies on split EPC contracts which may result in delay and cost overruns. • A portion of Vast’s activities are conducted through variable interest entities, and changes to accounting guidance, policies or interpretations thereof could cause Vast to materially change the presentation of its financial statements.

Summary of Risk Factors (cont’d) 43 Risks Relating to Vast’s Business (cont’d) • VS1 is critically important to the future of the business. The project may be delayed due to factors such as a complex grid c onn ection process, permitting delays, updated legislation forcing permits to be re - acquired, failure to attract the required financing, construction delays, cost overruns, loss / theft of a key piece of equip men t, longer than expected commissioning process and a slower than expected ramp - up of production post commissioning. A delay / failure in the delivery of VS1 could materially impact Vast’s overall growth stra teg y and substantially reduce the potential to commercialize Vast’s product offering. • VS1 involves an approximately 30X scale up relative to the JSS Pilot Plant which exposes Vast to significant risk associated wit h factors such as technology readiness, organizational capability to deliver and production ramp up. • Vast is only a 50% owner of SiliconAurora whose support is critical to ensure the success of VS1 and other projects in the pipeline. Should Vast lose control of this e nt ity / fail to appropriately manage this business with its co - investors, 1414 Degrees Pty. Ltd, it may significantly delay Vast’s projects and have material adverse outc omes for the overall prospects of the business. • Elevated interest rates could adversely affect Vast’s business, its results of operations and its financial condition. • Construction of Vast’s projects requires it to rely on the experience and resources of designers, general contractors and sub con tractors, who may experience financial or other problems during the design or construction process and their failures may delay or prevent completion of its projects which may materially adversely affect it s business, financial condition and results of operations. • Delays in the construction of Vast’s projects or significant cost overruns could present significant risks to its business an d c ould have a material adverse effect on its business, financial condition and results of operations. • A work interruption, strike or other union activities by the employees of Vast’s suppliers, contractors or subcontractors cou ld have a material adverse effect on its business, financial condition and results of operations. • It is difficult, if not impossible, to forecast Vast’s future results, and Vast has limited insight into trends that may emer ge and affect Vast’s business. • Vast may be unable to execute on its business model or develop its technology, which would have a material adverse effect on Vas t’s operating results and business, would harm Vast’s reputation and could result in substantial liabilities that exceed its resources. • Vast may be unable to raise the necessary capital to implement its business plan and strategy, and Vast may not be able to sa tis fy the conditions precedent to funding of the DOE, ARENA and the German government grants. • If Vast needs to raise additional funds, there is a risk that these funds may not be available on terms favorable to Vast or Vas t’s shareholders, or at all when needed. • Vast faces significant competition and that its competitors may develop competing technologies that are more efficient or eff ect ive than Vast’s. • There is a risk that Vast may not be able to attain the supplies and products for its projects. • If Vast is unable to enter into commercial agreements with its current suppliers or its replacement suppliers on favorable te rms , or if these suppliers experience difficulties meeting Vast’s requirements, the development and commercial progression of Vast’s projects may be delayed. Risks Related to Vast’s Technology • CST and CSP plants developed using Vast’s technology may not generate the levels of output estimated by Vast’s production mod els . • Vast may be unable to adapt its technologies and products to meet shifting customer preferences or industry regulations, and Vas t’s rivals could create products that reduce the need and / or demand for its offerings. • The development and delivery of Vast’s modular CSP v3.0 plants will require substantial funding. Vast’s projects may rely on out side sources to finance this, and such financing may not be available on favorable terms or at all. • Commercial deployment of new power generation technology, such as CSP v3.0 is difficult. • Vast may experience issues with scaling up Vast’s technology to the size required for VS1 and other large and utility - scale proj ects, which may have a material adverse effect on Vast’s business in the form of higher costs, reduced demand and delayed growth. • Vast’s business may be harmed if it fails to properly protect its intellectual property, and Vast may also be required to def end against claims or indemnify others against claims if its intellectual property infringes on the intellectual property rights of third parties. There is also a risk that Vast may not have adequate intellec tua l property rights to carry out its business, may need to defend itself against patent, copyright, trademark, trade secret or other intellectual property infringement or misappropriation claims, and may need to en for ce its intellectual property rights from unauthorized use by third parties. • Vast’s business and growth strategy relies on having continued access to sodium metal used as the primary HTF. There are a li mit ed number of suppliers of this product and any issues that impede of remove these suppliers from the market could have an outsized impact on the overall prospects of the business.

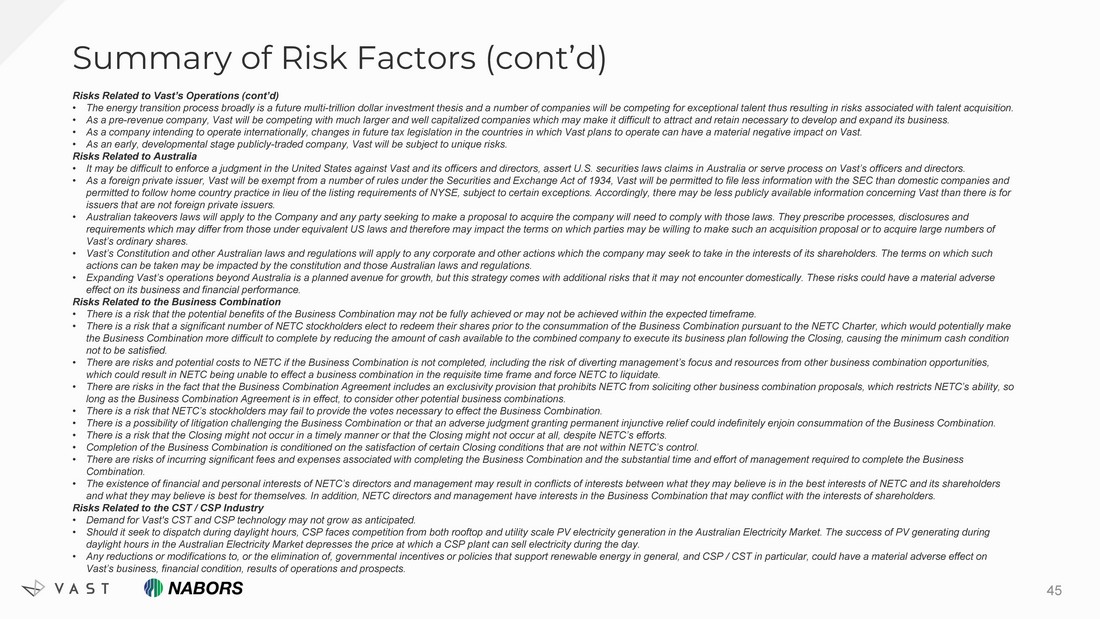

Summary of Risk Factors (cont’d) 44 Risks Related to Vast’s Technology (cont’d) • Vast will have to share information with suppliers and construction partners which may result in unauthorized disclosure or u nin tended transmission of trade secrets or know - how resulting in a loss of its competitive advantage. • The successful delivery of a plant utilizing Vast technology requires the integration of a number of small and large packages of components, technologies and processes. Failure to integrate these appropriately could result in significant underperformance of the plant, which would result in a loss of reputation in the ma rke t and a material adverse impact on the business. • Due to the relatively nascent nature of Vast’s technology and lack of familiarity of the technology with existing contractors , t here is a risk that the contractors Vast engages fail to follow CSP engineering best practices, which may result in poor performance, breakdowns, cost and schedule overruns which could materially impact the com mer cial viability of projects using its technology. • Vast intends to manufacture products that it has designed / co - designed and refined over many years that are yet to be produced in commercial quantities. This includes, but is not limited to, heliostats, sodium receivers, sodium / salt heat exchangers, and / or control system software. There is a risk that the quality of Vast’ s m anufactured products is inadequate, the ramp up of manufacturing takes longer than expected and / or costs significantly more than expected, any of which may result in poor performance of its plants, a l oss of confidence in the technology and failure to deliver on its growth strategy. • Vast has not yet integrated a molten salt TESS into its overall technology offering. Molten salt TES is a key driver of the o ver all economics of Vast’s technology and failure to integrate it appropriately at VS1 and other future projects could have a material adverse effect on the attractiveness of its technology to future investors an d c ustomers which could significantly impede its growth strategy. Risks Relating to Legal Matters and Regulations • Vast’s business, financial condition, results of operations and prospects may be materially adversely affected by the extensi ve regulation of its business. • Any reductions or modifications to, or the elimination of, governmental incentives or policies that support renewable energy in general, and CSP / CST in particular, could have a material adverse effect on Vast’s business, financial condition, results of operations and prospects. • Existing electric utility industry regulations, and changes to regulations, may present technical, regulatory and economic ba rri ers to the purchase and use of solar energy offerings that may significantly reduce demand for Vast’s solar energy offerings. Risks Related to Vast’s Operations • Vast’s business will depend on experienced and skilled personnel and substantial specialty subcontractor resources with empha sis on key offshore personnel that may be required (e.g., turbine suppliers) to verify the installation, and if Vast loses key personnel or if it is unable to attract and integrate additional skilled perso nne l, it will be more difficult for Vast to manage its business and complete projects. • Vast Solar uses sodium, a material that is highly reactive and can be dangerous when inappropriately handled, as an HTF. • Hydrogen and methanol are flammable fuels that are inherently dangerous substance. • Security and privacy breaches, loss of proprietary information, and service interruptions caused by computer malware, viruses , r ansomware, hacking, phishing attacks, and other network disruptions could have a negative impact on Vast’s business. • Adverse weather conditions and natural disasters may have a negative impact on Vast’s operations. This includes, but is not l imi ted to, short term phenomena such as volcanic eruptions and long term deviations to the weather resource relative to historical periods. • The operation and maintenance of Vast’s facilities are subject to many operational risks, the consequences of which could hav e a material adverse effect on Vast’s business, financial condition, results of operations and prospects. • CSP v3.0 requires the use of a number of complex components, equipment and interconnections, some of which have been custom d esi gned by or for Vast and have not been used in commercial projects in the past. Any failure of such components, equipment or interconnections could result in delays, impaired performance, increas ed costs and damage to Vast’s reputation. • The performance of Vast’s technology may be affected by field conditions and other factors outside of its control, which coul d r esult in harm to its business and financial results. • The equipment Vast procures and manufacture may have shorter lifetime and / or degrade faster than expected resulting in the los s of a competitive advantage, which could result in harm to its projects, reputation in the market and financial results. • Plants using Vast technology are large industrial facilities that may attract negative attention from protestors and / or loc al communities around the presence of an industrial asset, which could result in a loss of its social license to operate and lawsuits which could have an adverse impact on Vast’s financials. • Vast may fail to secure the Major Hazard Facility licenses and other relevant licenses for VS1 and other projects from releva nt federal, state and local regulators resulting in its plants being forced to remain shut down for extended periods of time resulting in a materially adverse impact to the overall production of the plant. • A major safety incident which occurs on one or more of Vast’s projects during construction, commissioning and / or operations co uld result in harm to personnel, environment and property, which could further result in the creation of material liabilities, shutdown of site for extended time periods, severely tarnish the reputation o f i ts technology and substantially reduce likelihood of winning future projects.