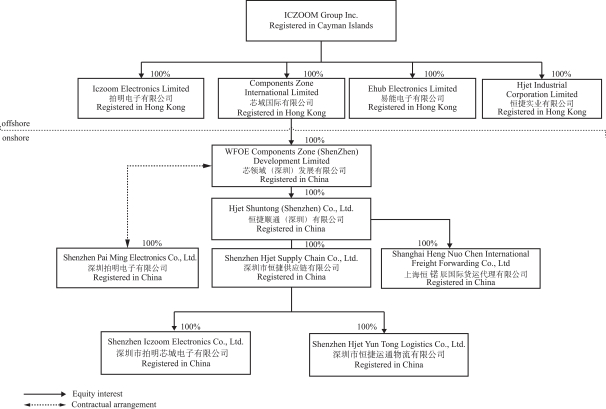

ICZOOM GROUP INC. AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 13—CONCENTRATIONS (continued)

As of June 30, 2020 and 2019, $1,417,315 and $5,547,754 of the Company’s cash and restricted cash was on deposit at financial institutions in the PRC where there currently is no rule or regulation requiring such financial institutions to maintain insurance to cover bank deposits in the event of bank failure. As of June 30, 2020 and 2019, the Company’s substantial assets were located in the PRC and the Company’s substantial revenues were derived from its subsidiaries and VIEs located in the PRC.

For the years ended June 30, 2020 and 2019, no single customer accounted for more than 10% of the Company’s total revenue. The Company’s top 10 customers aggregately accounted for 25.9% and 32.0% of the total revenue for the years ended June 30, 2020 and 2019, respectively.

As of June 30, 2020, no customer accounted for more than 10% of the total accounts receivable balance. As of June 30, 2019, one customer accounted for approximately 12.4% of the total accounts receivable balance.

As of June 30, 2020, no single supplier accounted for more than 10% of the total advance to suppliers balance. As of June 30, 2019, one supplier accounted for approximately 14.1% of the total advance to suppliers balance.

As of June 30, 2020, no single supplier accounted for more than 10% of the total accounts payable balance. As of June 30, 2019, one supplier accounted for approximately 12.5% of the total accounts payable balance.

For the year ended June 30, 2020 and 2019, no single supplier accounted for more than 10% of the Company’s total purchases.

NOTE 14—SHAREHOLDERS’ EQUITY

Ordinary shares

The Company was incorporated under the laws of the Cayman Islands on June 23, 2015. The original authorized number of ordinary shares was 100 million shares with par value of US$0.02 per share (including 60,000,000 shares of Class A shares and 40,000,000 shares of Class B shares). Holders of Class A ordinary shares and Class B ordinary shares have the same rights except for voting and conversion rights. In respect of matters requiring a shareholder vote, each Class A ordinary share will be entitled to one vote and each Class B ordinary share will be entitled to ten votes. The Class A ordinary shares are not convertible into shares of any other class. The Class B ordinary shares are convertible into Class A ordinary shares at any time after issuance at the option of the holder on a one to one basis.

On November 13, 2020, the Company amended its Memorandum of Association to reverse split the authorized number of shares at a ratio of 1-for-4 share to 25 million shares with par value of US$0.08 per share, and reverse split the issued shares from 70,610,963 shares at par value of US$0.02 per share to 17,652,743 ordinary shares with par value of $0.08 per share. The reverse split is considered part of the Reorganization of the Company, which was retroactively applied as if the transaction occurred at the beginning of the period presented (see Note 1).

As a result of this revere split, the authorized number of Class A ordinary shares have been changed from 60,000,000 shares to 15,000,000 shares, and authorized number of Class B ordinary shares have been changed from 40,000,000 shares to 10,000,000 shares. As of June 30, 2020, the Company had 17,652,743 ordinary shares issued and outstanding (including 9,993,743 shares of Class A ordinary shares and 7,659,000 shares of Class B ordinary shares). As of June 30, 2019, the Company had 17,540,868 ordinary shares issued and outstanding (including 9,881,868 shares of Class A ordinary shares and 7,659,000 shares of Class B ordinary shares).

F-33