Exhibit 99.1

2021 Annual Information Form

March 21, 2022

Table of Contents

1. | Important Information about this Document | 4 |

| | | | |

| | 1.1 | Reporting Currency | 4 |

| | 1.2 | Historic Metals Prices | 4 |

| | 1.3 | Technical Information | 4 |

| | 1.4 | Forward-Looking Information | 5 |

| | 1.5 | Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources | 8 |

| | | |

2. | About Centerra | 9 |

| | | | |

| | 2.1 | Our Properties | 9 |

| | 2.2 | Inter-Corporate Relationships | 10 |

| | 2.3 | Recent Developments | 11 |

| | | Kumtor Mine | 11 |

| | | Mount Milligan Mine | 13 |

| | | Öksüt Mine | 14 |

| | | Greenstone Gold Property | 14 |

| | | Corporate | 14 |

| | | COVID-19 Update | 15 |

| | 2.4 | Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets | 15 |

| | | Controls Relating to Corporate Structure Risk | 15 |

| | | Procedures of the Board of Directors of the Company | 17 |

| | 2.5 | Centerra’s Business | 18 |

| | | Business Objectives | 18 |

| | | Business Operations | 18 |

| | | Marketing and Distribution | 19 |

| | | Gold Doré Produced at Öksüt Mine | 20 |

| | | Copper/Gold Concentrate Produced at Mount Milligan Mine | 20 |

| | | Molybdenum Industry | 20 |

| | | 2021 and 2020 Production and Revenue | 21 |

| | | Competitive Conditions | 21 |

| | | Mineral Reserves and Resources | 21 |

| | | Sources, Pricing and Availability of Materials, Parts and Equipment | 26 |

| | | Financial and Operational Effects of Environmental Protection Requirements | 26 |

| | 2.6 | Responsible Mining | 28 |

| | | Our Approach | 28 |

| | | Governance | 29 |

| | | Our Employees | 31 |

| | | Social Performance | 32 |

| | | |

3. | Centerra’s Properties | 35 |

| | | | |

| | 3.1 | Operating Mines | 35 |

| | | Mount Milligan Mine | 35 |

| | | Öksüt Mine | 44 |

| | 3.2 | Other Properties | 52 |

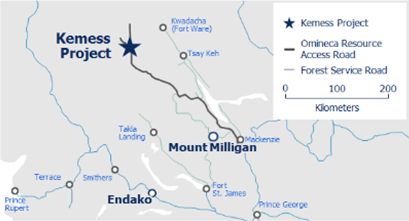

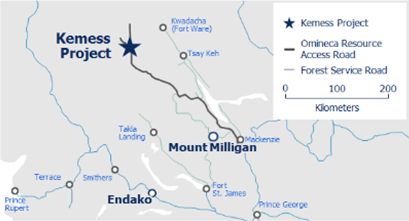

| | | Kemess Project | 53 |

| | 3.3 | Molybdenum | 55 |

| | | Endako Mine | 55 |

| | | Thompson Creek Mine | 56 |

| | | Langeloth Metallurgical Facility | 56 |

| | 3.4 | Other Properties (Exploration) | 56 |

| | | |

4. | Governance | 59 |

| | | | |

| | 4.1 | Directors and Officers | 59 |

| | | Directors | 59 |

| | | Executive Officers | 60 |

| | | Other Information About Our Directors and Officers | 61 |

| | 4.2 | Committees | 62 |

| | | Audit Committee | 63 |

| | | Audit Committee Charter | 63 |

| | | Composition of the Audit Committee | 63 |

| | | External Audit Pre-Approval Procedures | 64 |

| | | Fees Paid to External Auditors | 64 |

| | 4.3 | Interest of Management and Others in Material Transactions | 64 |

| | | |

5. | Risk Factors | 64 |

| | | | |

| | 5.1 | Strategic Risks | 64 |

| | | Country, Political & Regulatory | 64 |

| | | Disputes with the Kyrgyz Republic and Kyrgyzaltyn Relating to the Kumtor Mine | 67 |

| | | Legal and Other | 67 |

| | | Strategy and Planning | 69 |

| | | Natural Phenomena | 71 |

| | | Competition | 72 |

| | 5.2 | Financial Risks | 72 |

| | | Commodity Market | 72 |

| | | Economy, Credit and Liquidity | 73 |

| | | Insurance | 75 |

| | | Tax and Royalties | 75 |

| | | Counterparty | 75 |

| | 5.3 | Operational Risks | 75 |

| | | Health, Safety and Environment | 76 |

| | | Asset Management | 79 |

| | | Human Resources | 79 |

| | | Supply Chain | 80 |

| | | Information Technology Systems | 80 |

| | | |

6. | Investor information | 80 |

| | | | |

| | 6.1 | Description of Share Capital | 80 |

| | | Common Shares | 80 |

| | | Class A Non-Voting Shares | 81 |

| | | Preference Shares | 81 |

| | | Insurance Risk Rights Plan | 81 |

| | 6.2 | Market for Our Securities | 81 |

| | | Trading Price and Volume | 82 |

| | | Registrar and Transfer Agent | 82 |

| | 6.3 | Dividend Policy | 82 |

| | 6.4 | Material Contracts | 83 |

| | | Mount Milligan Streaming Arrangement | 83 |

| | | Kumtor Project Agreements | 83 |

| | 6.5 | Legal Proceedings and Regulatory Actions | 84 |

| | 6.6 | Interests of Experts | 84 |

| | | |

7. | Glossary of Geological and Mining Terms | 85 |

| | |

Schedule A Audit Committee Charter | 90 |

1. IMPORTANT INFORMATION ABOUT THIS DOCUMENT

| This annual information form (“AIF”) provides important information about Centerra Gold Inc. It describes our history, our markets, our operations and projects, our mineral reserves and resources, sustainability, our regulatory environment, the risks we face in our business and the market for our shares, among other things. Unless otherwise indicated, information in this AIF is provided as of December 31, 2021. | | Throughout this document, the terms we, us, our, Centerra and the Company mean Centerra Gold Inc. and its direct and indirect subsidiaries. |

1.1 Reporting Currency

All dollar amounts in this AIF are expressed in United States dollars except as otherwise indicated. References to $ or dollars are to United States dollars and references to C$ are to Canadian dollars. For reporting purposes, we prepare our financial statements in United States dollars and in conformity with accounting principles generally accepted in Canada, being International Financial Reporting Standards, as issued by the International Accounting Standards Board.

The average exchange rate in 2021 for U.S. dollars to Canadian dollars, based on the Bank of Canada exchange rate for the 12 months ending December 31, 2021 (the last business day), was one U.S. dollar per C$1.2535.

With respect to legal and regulatory claims or decisions made by certain governmental agencies or courts and described in this AIF, the amounts of the claims or decisions are reported in the U.S. dollar equivalent as at of the date of such claim or decision.

1.2 Historic Metals Prices

The price of gold, copper and molybdenum fluctuates. The following table shows the average annual price for gold, copper, and molybdenum from 2012 to 2021, and for the period up to March 1, 2022:

| | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 up to March 1, 2022 |

Average Gold Price ($/oz)(1) | 1,669 | 1,411 | 1,266 | 1,160 | 1,251 | 1,258 | 1,268 | 1,393 | 1,770 | 1,798 | 1,836 |

Average Copper Price ($/lb.)(2) | 3.61 | 3.32 | 3.11 | 2.49 | 2.21 | 2.80 | 2.96 | 2.72 | 2.80 | 4.23 | 4.47 |

Average Molybdenum Oxide Price ($/lb.)(3) | 12.74 | 10.30 | 11.38 | 6.63 | 6.50 | 8.19 | 11.93 | 11.35 | 8.68 | 15.94 | 18.98 |

| | (1) | London Bullion Market annual average daily afternoon gold price fixing. |

| | (2) | London Metal Exchange Copper Cash-Settlement. |

1.3 Technical Information

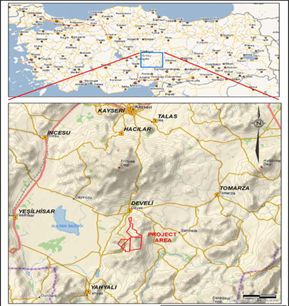

The disclosure in this AIF of a scientific or technical nature for our Mount Milligan Mine, Öksüt Mine and Kemess Project is based on technical reports prepared for these properties in accordance with National Instrument 43-101 - Standards of Disclosure for Mineral Projects (“NI 43-101”) of the Canadian Securities Administrators. The technical information has been updated with current information, where applicable. Information regarding qualified persons is as of the effective date of the relevant technical report.

| | ● | The technical report for the Mount Milligan Mine, with an effective date of December 31, 2019 (filed on March 26, 2020), (the “Mount Milligan Technical Report”) was prepared by John Fitzgerald, C. Paul Jago, Berge Simonian, Slobodan Jankovic, Catherine A. Taylor, and Bruno Borntraeger. Each of these persons is a qualified person for purposes of NI 43-101. None of the authors were independent of Centerra at the time of filing, except for Mr. Borntraeger, who is a Specialist Geotechnical Engineer with Knight Piésold Ltd. |

| | ● | The technical report for the Öksüt Mine, Turkey with an effective date of June 30, 2015 (filed on September 3, 2015) (the “Öksüt Technical Report”) was prepared by Gordon D. Reid, Peter Woodhouse, Malcolm Stallman, Mustafa Cihan, Pierre Landry, Tyler Hilkewich, Tommaso Roberto Raponi, Kevin D’Souza and Chris Sharpe. At the time of the filing of the Öksüt Technical Report, each of these persons was a qualified person for the purposes of NI 43-101, and none of these individuals were independent of Centerra at the time of the Öksüt Technical Report. |

| | ● | The technical report for the Kemess underground project and Kemess east project, British Columbia, Canada (the “Kemess Project”) prepared for AuRico Metals Inc. (“AuRico”) with an effective date (and filing date) of July 14, 2017 (the “Kemess Technical Report”) was prepared by Serge Chevrier, Marianne Rosted, Stephen Rice, and Don Kidd, all from AMEC Foster Wheeler, Andrew Jennings, of Conveyer Dynamics, Chad Yuhasz, Iouri Iakovlev, and Jarek Jakubec, all from SRK Consulting (Canada) Inc., Chris Struthers, of Struthers Technical Solutions, Dan Stinnette of Mine Ventilation Services, David Kratochvil, of BioteQ Environmental Technologies; Kenneth Major of KWM Consulting Inc., Rolf Schmitt, of ERM Consultants Canada, and Ross Hammett, and Alva Kuestermeyer, both from Golder Associates, Inc. Each of these persons is a qualified person for the purposes of NI 43-101. All individuals were independent of AuRico at the time of filing of the Kemess Technical Report. |

The technical reports have been filed on SEDAR at www.sedar.com. In the case of the Kemess Technical Report, this technical report was prepared for AuRico (prior to our acquisition, which closed on January 8, 2018). The Kemess Technical Report can be found under AuRico’s SEDAR profile on www.sedar.com. To the best of our knowledge, information and belief, there is no new material scientific or technical information that would make the disclosure of the mineral resources or mineral reserve on the Kemess Project inaccurate or misleading.

Scientific and technical information relating to costs (operating and capital costs) and metallurgical recovery (except as it may relate to our exploration program) in this AIF was prepared, reviewed, verified, and compiled by Centerra’s geological and technical staff under the supervision of Anna Malevich, Professional Engineer, and the Director, Process Engineering for Centerra. Ms. Malevich is a qualified person for the purposes of NI 43-101.

All exploration information and related scientific and technical information in this AIF regarding Centerra’s Mount Milligan and Kemess Project exploration programs were prepared, reviewed, verified, and compiled by Cheyenne Sica, a member of the Engineers & Geoscientists British Columbia, Exploration Manager at Centerra’s Mount Milligan Mine, who is a qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used.

All exploration information and related scientific and technical information in this AIF regarding Centerra’s Öksüt exploration program was prepared, reviewed, verified, and compiled by our geological and staff under the supervision of Mustafa Cihan, member of the Australian Institute of Geoscientist (AIG), Centerra’s Exploration Manager - Turkey at Centerra Madencilik A.Ş., one of Centerra’s Turkish subsidiaries. Mr. Cihan is a qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are done consistent with industry standards and independent certified assay labs are used.

All other scientific and technical information in this AIF, including without limitation mineral reserves and resources, mine production (historical and guidance), grades and mill throughput were prepared, reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of Slobodan (Bob) Jankovic, Professional Geoscientist, member of the Association of Professional Geoscientists of Ontario (APGO) and Centerra’s Senior Director, Technical Services. Mr. Jankovic is a qualified person for the purpose of NI 43-101.

All scientific and technical information in this AIF is prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum (“CIM”) and NI 43-101 (where relevant).

A glossary of geological and mining terms has been included at the end of this AIF for ease of reference.

1.4 Forward-Looking Information

This AIF and the documents incorporated by reference into this AIF contain statements and information about our expectations for the future. When we discuss our strategy, plans, proposed exploration and development activities and future financial and operating performance, or other things that have not yet taken place, we are making statements considered to be forward-looking information under Canadian securities laws.

Key things to understand about the forward-looking information in this AIF:

| | ● | It typically includes words and phrases about the future, such as plans, expects or does not expect, budget, forecasts, projections, anticipate or does not anticipate, believe, intend, potential, strategy, schedule, estimates, contemplates, targets, and similar expressions or statements that certain actions, events or results may, could, would, might or will be taken, occur or be achieved. |

| | ● | It is based on several material assumptions, including but not limited to those we have listed below, which may prove to be incorrect. |

| | ● | Actual results and events may be significantly different from what we currently expect, because of the risks associated with our business. We list a number of these material risks below. We recommend you also review other parts of this document, including “Risk Factors” starting on page 64, which include a more detailed discussion of the material risks that could cause our actual results to differ from current expectations. |

Forward-looking information is designed to help you understand management’s current views of our near and longer-term prospects. It may not be appropriate for other purposes. We will not necessarily update this forward-looking information unless we are required to by securities laws. Examples of forward looking information in this AIF include, without limitation: expectations as to the future business and political environment in the jurisdictions where we operate; exploration plans for 2022; expectations regarding pit wall stability at our Öksüt Mine; having adequate water inventory levels at Mount Milligan to operate at the targeted throughput level of 60,000 tonnes per calendar day; expectations regarding capital projects, including those intended to increase recovery or processing at our sites; expectations regarding future growth, results of operations and financial performance; our business prospects; the ability to deliver our Mount Milligan concentrate to port in a timely manner; no labour disruptions at our mines or in our delivery pipeline; our expectations regarding successfully obtaining additional permits for the Öksüt Mine and the plans for further mining the Keltepe and Güneytepe pits; expectations in respect of the acquisition and future development of the Goldfield Project; statements relating to reserves or resources, as they involve the implied assessment, based on certain estimates and assumptions that the resources and reserves described can be profitably mined in the future; the impact on the Company of the unlawful seizure by the Kyrgyz Government of the Kumtor Mine in May 2021; the outcome of the arbitration and other proceedings initiated by the Company in response to such seizure; the outcome or effect of the legacy environmental and tax disputes and criminal investigations relating to the Kumtor Mine; or the outcome of any future discussions or negotiations to resolve any or all of the disputes relating to the Kumtor Mine and the potential terms and conditions (including governmental, legal, and regulatory requirements and approvals in connection therewith) of any such resolution.

Material Assumptions

Forward-looking information is necessarily based upon estimates and assumptions that, while considered reasonable by Centerra, are inherently subject to significant technical, political, business, economic and competitive uncertainties and contingencies. Assumptions used in the forward-looking statements in this AIF include the following:

● There are no material disruptions in Centerra’s operations as a result of the COVID-19 pandemic, including illness in workforce, no shutdown of mining, processing and other operations, no adverse disruption on supply chains and transportation networks used to deliver products to customers. ● Centerra and our applicable subsidiaries throughout the year continue to meet the terms of our corporate credit facility to maintain compliance with the financial covenants contained therein. ● No unplanned delays in, or interruption of, scheduled production from our mines, including due to climate/weather conditions, pandemics, political or civil unrest, natural phenomena, regulatory or political disputes, equipment breakdown or other developmental and operational risks. | | ● Any sanctions imposed on Turkish entities do not have a negative effect on the costs or availability of inputs or equipment to the Öksüt Mine. ● The pit walls at our operations remain stable. ● The reserve and resource models at our operating sites reconcile as expected against production. ● The Mount Milligan Mine mill (processing facility) continues to have access to sufficient water supplies to operate year-round at the intended capacity. ● The Mount Milligan Mine tailings storage facility (“TSF”) continues to function as planned and any seepages from the TSF can be adequately managed, do not result in significant effects on the environment and do not result in significant regulatory or permitting challenges. |

● The Öksüt Mine’s local mining contractor, Çiftay İnşaat Taahhüt ve Ticaret A.Ş will continue to operate uninterrupted in accordance with its mining contract. ● Grades and recoveries at our operating properties remain consistent with the 2022 production plan to achieve the forecast gold and copper production. ● Mineral processing facilities at our operations operate as expected, including that there is no unplanned suspension of operations due to (among other things), mechanical or technical performance issues. ● There are no changes to any existing agreements or relationships with potentially impacted Indigenous groups which would materially and adversely impact our operations, and no demands are received from such groups to enter into new agreements which would materially and adversely impact our operations. ● There are no significant unfavourable changes to concentrate sales arrangements at Mount Milligan Mine and the roasting arrangements at the Langeloth facility. ● There are no adverse changes or disturbances in the transportation and logistics involved in the sale of our gold doré bars and/or concentrate produced by our mine sites, or the molybdenum products from our Langeloth facility. ● There are no adverse regulatory changes affecting any of our operations. | | ● Exchange rates, prices of key consumables, costs of power, labour, material costs, supplies and services (including transport), water usage fees, and any other cost assumptions at all operations and projects of the Company are not significantly higher than prices assumed in planning. ● Spot and realized prices for gold, copper and molybdenum will be as expected. ● Tax rates, foreign currency exchange rates, and interest rates will be as expected. ● Our non-sustaining (growth) capital, sustaining capital, decommissioning and reclamation estimates are accurate. ● Our mineral reserve and resource estimates, and the assumptions upon which they are based, are accurate. ● We are able to attract and retain qualified personnel necessary for the Company’s operations. ● No labour related disruptions occur at any of our operations. ● Our counterparties in any of our sales contracts for gold doré bars, copper/gold concentrate, or molybdenum products meet their contractual obligations to us. ● Our internal control procedures continue to satisfy all applicable laws and regulations, including those required pursuant to Section 404 of the Sarbanes-Oxley Act of 2002. |

Material Risks

The following is a list of risks that can affect our business. This is not a complete list of the potential risks that the Company faces; there may be others that we are not aware of, or risks that we feel are not material today that could become material in the future. These risks are described in greater detail in the Section of the AIF called “Risk Factors” starting on page 64.

Strategic, Legal and Planning Risks

Strategic, legal and planning risks include political risks associated with our operations in Turkey, United States and Canada; resource nationalism; reliance on cash flow from subsidiaries; the impact of changes in, or more aggressive enforcement of laws, regulations and government practices including with respect to the environment; impact of community activism on laws and regulations; increases in contributory demands or business interruption; delays or refusals to grant required permits and licenses; status of our relationships with local communities; Indigenous claims and consultation issues relating to the Company’s properties which are in proximity to Indigenous communities; the risks related to outstanding litigation affecting the Company; the impact of any sanctions imposed by Canada, the United States or other jurisdictions against various Turkish individuals and entities; potential defects of title in the Company’s properties that are not known as of the date hereof; the inability of the Company and its subsidiaries to enforce their legal rights in certain circumstances; conflicts of interest among our board members; risks related to anti-corruption legislation; Centerra’s future exploration and development activities not being successful; Centerra not being able to replace mineral reserves and resources; risks related to mineral reserves and resources being imprecise; production and cost estimates may be inaccurate; reputational risks, particularly in light of the increase in social media; inability to identify new opportunities and to grow the business; large fluctuations in our trading price that are beyond our control or ability to predict and mitigate; potential risks related to kidnapping or acts of terrorism; the impact of changes in, or to the more aggressive enforcement of, laws, regulations and government practices, including unjustified civil or criminal action against the Company, its affiliates or its current or former employees; the presence of a significant shareholder that is a state-owned company of the Kyrgyz Republic; uncertainty around the likelihood of a resolution resulting from recent negotiations with representatives of the Kyrgyz Republic and Kyrgyzaltyn JSC (“Kyrgyzaltyn”); the uncertainty of potential outcomes in the arbitration process; the inability of the Company and its subsidiaries to collect on or enforce any favorable arbitral and/or court judgement awarded against the Kyrgyz Republic or Kyrgyzaltyn; and other actions which could be taken by the Company in response to the ongoing situation involving the Kumtor Mine.

Financial Risks

We are subject to risks related to our financial position and liquidity, including sensitivity of our business to the volatility of gold, copper and other mineral prices; the use of provisionally-priced sales contracts for production at Mount Milligan; reliance on a few key customers for the gold-copper concentrate at Mount Milligan; use of commodity derivatives; sensitivity to fuel price volatility; the impact of currency fluctuations, especially in Turkey given current inflationary economic conditions; global financial conditions; access to future financing, including the impact of environmental, social and corporate governance (“ESG”) practices and reporting on the Company’s ability to obtain future financing or accessing capital; the impact of restrictive covenants in our corporate credit facility which may, among other things, restrict the Company from pursuing certain business activities; the effect of market conditions on our short-term investments; our ability to make payments, including any payments of principal and interest on our debt facilities, which depends on the cash flow of our subsidiaries; ability to obtain adequate insurance coverage; and changes to taxation laws in the jurisdictions where we operate.

Operational Risks

Mining and metals processing involve significant production and operational risks. Some of these risks are outside of our control or ability to predict and mitigate. Risks include but are not limited to the following: unanticipated ground and water conditions; shortages of water for processing activities; adjacent or adverse land or mineral ownership that results in constraints on current or future mine operations; geological risks, including earthquakes and other natural disasters; metallurgical and other processing risks; unusual or unexpected mineralogy or rock formations; ground or slope failures; pit flooding; tailings design or operational issues, including dam breaches or failures; structural cave-ins, wall failures or rock-slides; flooding or fires; other climate related risks such as wildfires; equipment failures or performance problems; periodic interruptions due to inclement or hazardous weather conditions or operating conditions and other force majeure events; lower than expected ore grades or recovery rates; accidents; changes to, or delays in, transportation routes, including cessation or disruption in rail and shipping networks whether caused by decisions of third party providers or force majeure events (including COVID-19); interruption of energy supply; labour disturbances; the availability of drilling and related equipment in the area where mining operations will be conducted; the failure of equipment or processes to operate in accordance with specifications or expectations; tailings management facilities; exposure of workforce to widespread pandemic (including COVID-19); cyanide use; regulations regarding greenhouse gas emissions and climate change; development and construction costs being over budget; predicting decommissioning and reclamation costs; attracting and retaining qualified personnel; long lead times required for equipment and supplies given the remote location of some of our operating properties, and the potential that COVID-19 could disrupt such supply chains; reliance on a limited number of suppliers for certain consumables, equipment and components; and security of critical operating systems.

1.5 Cautionary Note to U.S. Readers Concerning Estimates of Mineral Reserves and Mineral Resources

Disclosure regarding the Company’s mineral properties, including with respect to mineral reserve and mineral resource estimates included in this AIF, was prepared in accordance with NI 43-101. NI 43-101 is a rule developed by the Canadian Securities Administrators that establishes standards for all public disclosure an issuer makes of scientific and technical information concerning mineral projects. NI 43-101 differs significantly from the disclosure requirements of the Securities and Exchange Commission (the “SEC”) generally applicable to U.S. companies. Accordingly, information contained in this AIF is not comparable to similar information made public by U.S. companies reporting pursuant to SEC disclosure requirements.

2. ABOUT CENTERRA

We are a Canadian-based gold mining company focused on operating, developing, exploring, and acquiring gold properties in North America, Turkey, and other markets worldwide. Our head office is in Toronto, Ontario (Canada). We also have offices in other locations such as in Prince George, British Columbia (Canada); Ankara, Turkey; Langeloth, Pennsylvania (USA); and Challis, Idaho (USA). We have approximately 1,020 employees. We are publicly listed on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. | | Centerra Gold Inc.

1 University Avenue

Suite 1500

Toronto, Ontario

Canada M5J 2P1 Telephone: 416-204-1953 Website: www.centerragold.com |

2.1 Our Properties

The table below sets out our properties as of the date of this AIF. We have two producing properties: the Mount Milligan Mine in British Columbia, Canada and the Öksüt Mine in Turkey. We own a 100% interest in each of the following properties except for (i) the Endako Mine in which we own a 75% joint venture interest (the remaining 25% is held by Sojitz Moly Resources, Inc., a subsidiary of Sojitz Corporation) (the “Endako Mine Joint Venture”), and (ii) optioned interests in various exploration projects which we are still in the process of earning.

| | Property Name | Location | Metal |

Operating Mines | Mount Milligan (the “Mount Milligan Mine”) | Canada | Gold/Copper |

| | Öksüt (the “Öksüt Mine”) | Turkey | Gold |

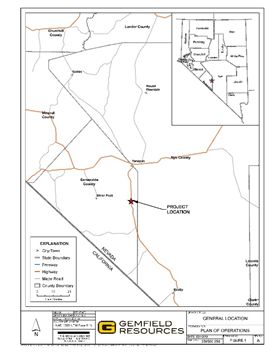

Pre-Development Projects | Goldfield District Project (the “Goldfield Project”) | United States | Gold |

| | Kemess (the “Kemess Project”) | Canada | Gold/Copper/Silver |

Exploration Projects | Berg(1) | Canada | Copper/Molybdenum |

| | Kizilkaya and Sivritepe Properties (in various stages of exploration) | Turkey | Gold |

| | Various options to earn interest on projects owned by third parties. | Turkey, Canada, United States and Finland | Gold/Copper |

Care and Maintenance/Stand-by Projects | Thompson Creek Mine (the “TC Mine”) | United States | Molybdenum |

| | Endako Mine (the “Endako Mine”) | Canada | Molybdenum |

| | 1. | Our Berg property is subject to an option agreement pursuant to which a third-party has the right to earn-in to a 70% interest in the property. |

We also own 100% of the Langeloth Metallurgical Facility which is located in Langeloth, Pennsylvania and purchases molybdenum concentrates from third parties to convert to upgraded products, which are then sold into the metallurgical and chemical markets.

Prior to May 15, 2021, the Company also owned and operated the Kumtor Mine, located in the Kyrgyz Republic, through its wholly-owned subsidiary, Kumtor Gold Company CJSC (“KGC”). Although the Company remains the rightful owner of KGC, the illegal seizure of the Kumtor Mine and the continuing actions by the Kyrgyz Republic and Kyrgyzaltyn have resulted in the Company ceasing to have control over, and benefit from, the operations of the Kumtor Mine. Since the Company does not expect to reassume control over the Kumtor Mine, which is now classified as a discontinued operation in the Company’s financial statements, the Company has not included any technical or operational information regarding the Kumtor Mine in this AIF. For historical information regarding the Kumtor Mine and its operation by the Company, please refer to the Company’s annual information form dated March 12, 2021 for the financial year ended December 31, 2020, which is filed on SEDAR at www.sedar.com. See also “Recent Developments – Kumtor Mine”.

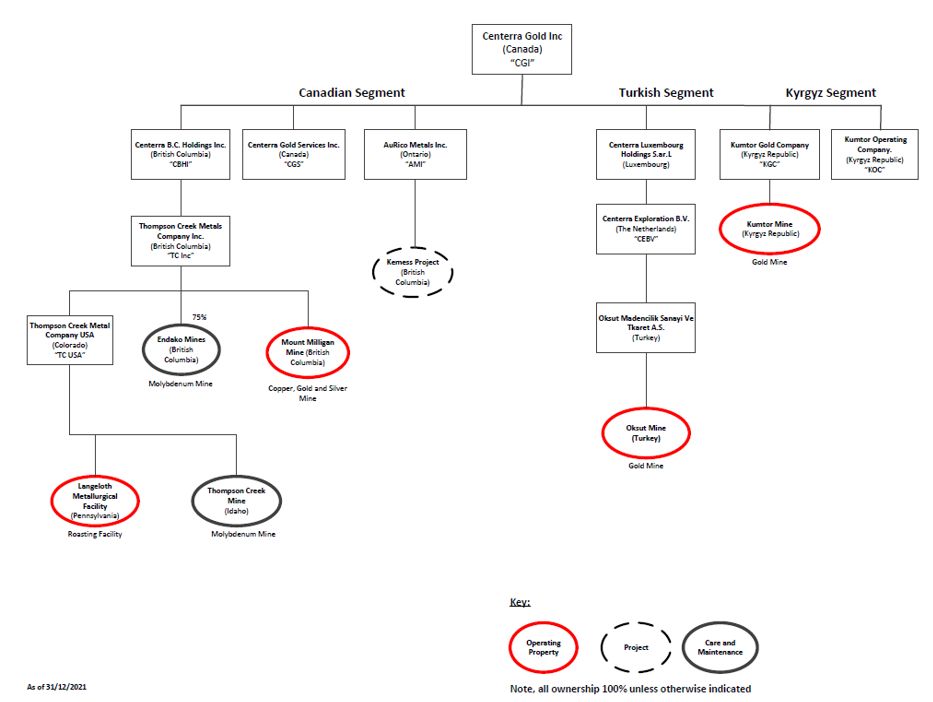

2.2 Inter-Corporate Relationships

Our principal subsidiaries, along with their jurisdiction of incorporation, continuation or organization, are set out below as at December 31, 2021. Each of our principal subsidiaries are 100% owned, unless otherwise noted.

| | 1. | Centerra was incorporated under the Canada Business Corporations Act by articles of incorporation dated November 7, 2002 under the name 4122216 Canada Limited. Centerra changed its name on December 13, 2002 to Kumtor Mountain Holdings Corporation, and on December 5, 2003 to Centerra Gold Inc. |

| | 2. | Centerra owns an indirect 75% joint venture interest in the Endako Mine. |

| | 3. | Prior to May 15, 2021, the Company also had control over the operations of its wholly-owned Kyrgyz subsidiaries, KGC and Kumtor Operating Company CJSC. Although the Company remains the sole shareholder of these two entities, the illegal seizure of the Kumtor Mine and the continuing actions by the Kyrgyz Republic and Kyrgyzaltyn have resulted in the Company ceasing to have control over, and benefit from, the operations of the Kumtor Mine and the day-to-day operations of these subsidiaries. |

| | 4. | Other subsidiaries, including those through which we hold our interest in exploration properties (including those in which we are earning an optioned interest), have not been included in the above chart because (i) their respective assets represent less than 10% of the consolidated assets of Centerra, and less than 10% of the consolidated sales and operating revenue of Centerra; and (ii) the consolidated assets and revenues of such excluded subsidiaries are less than 20% of the consolidated assets and consolidated revenue of Centerra, respectively. These subsidiaries are wholly owned, directly or indirectly, by Centerra. |

2.3 Recent Developments

The following is a summary of key developments over the past three years that have influenced the general development of our business. For further information regarding the developments, see the applicable section of this document dealing with the applicable property. As a result of the seizure of the Kumtor Mine and the continuing actions by the Kyrgyz Republic, effective as of August 10, 2021, the Company recognized a loss on the change of control and included the Kumtor Mine as a discontinued operation[1]. As such, information regarding the Kumtor Mine’s operations has not been set out in this AIF and any historical information in respect of the Kumtor Mine can be found in the Company’s prior disclosure available on SEDAR at www.sedar.com and EDGAR at www.sec.gov.

Kumtor Mine

| | ● | The Kyrgyz Parliamentary elections held in early October 2020 resulted in a period of political and social disruption in the Kyrgyz Republic, eventually leading to the cancellation of the Kyrgyz Parliamentary election results and the resignation of the then Kyrgyz Prime Minister and President. Presidential elections were held in the Kyrgyz Republic on January 10, 2021, with Mr. Sadyr Japarov being elected President. |

| | ● | Since the beginning of 2021, the Kyrgyz Republic and Kyrgyzaltyn took a number of coordinated actions that resulted in the illegal seizure of the Kumtor Mine by the Kyrgyz Republic and a loss of control of the mine by Centerra. In particular: |

| | o | In February 2021, a State Commission was formed by the Kyrgyz Republic Parliament to, among other things, review the performance of the Kumtor Mine, including alleged tax and environmental claims discussed below, and to review the results of a previous Kyrgyz Republic State Commission established in 2012. For further information relating to the legal matters arising out of the 2012 State Commission, including in respect of the comprehensive settlement resolving all of the then outstanding issues relating to the Kumtor Mine, please refer to the Company’s annual information form dated March 12, 2021 for the financial year ended December 31, 2020, which is filed on SEDAR at www.sedar.com; |

| | o | The Kyrgyz Government resurrected a number of historical tax claims and environmental claims relating to the Kumtor Mine, each of which was resolved years ago either through previous settlements or Kyrgyz court decisions. When the Company disclosed the tax claims in March 2021, the amounts claimed by the Kyrgyz Republic were estimated to be approximately $352 million, including taxes, interest and penalties. However, the Company understands that Kyrgyz officials may have subsequently increased the amounts claimed to over $1 billion. The Company denies these claims; |

| | o | A Kyrgyz court rendered a decision awarding damages against KGC of approximately $3.1 billion payable to the Kyrgyz Republic in respect of alleged damages caused by KGC’s past practice of placing waste rock on glaciers. The Company denies these claims; |

_________________________

1 | For full details on the derecognition of the assets and liabilities of the Kumtor Mine, please refer to the Company’s press release on its website dated August 10, 2021 and its management’s discussion and analysis for the three and six months ended June 30, 2021, available on SEDAR at www.sedar.com and EDGAR at www.edgar.com. |

| | o | During the spring of 2021, the Kyrgyz Republic Parliament began to consider a number of laws and legislative amendments that, among other things, would fundamentally alter and breach the 2009 restated Kumtor project agreements, including the 2009 Kyrgyz law that ratified the Kumtor Project Agreements. Such amendments would not only delete provisions that ensure the primacy of the Kumtor Project Agreements over other Kyrgyz legislation but also subject Kumtor to certain Kyrgyz laws of general application, including tax laws; and |

| | o | The Kyrgyz Republic seized control of the Kumtor Mine on May 15, 2021 through a coordinated effort to take control of the Kumtor Mine site, KGC’s offices, personnel, computers and documents. The Kyrgyz Republic acted following a preliminary report of the 2021 State Commission which made a number of groundless claims against Centerra, KGC and the Kumtor Mine and under the purported authority of a new Temporary Management Law hastily passed by the Kyrgyz Republic Parliament only a few days prior to such seizure. |

| | ● | According to statements made by Kyrgyz Republic authorities during and after the events described above, the Company understands that the Kyrgyz Republic has opened a series of criminal investigations relating to the Kumtor Mine and, in particular, alleged corruption of previous agreements entered into between Centerra, its predecessor, and the Kyrgyz Government. The Company further understands that the Kyrgyz Republic has arrested or detained a significant number of former Kyrgyz politicians and government officials, including several former prime ministers, in connection with such investigations. More recently, there have been reports that the Kyrgyz Republic has reopened a series of criminal investigations in connection with the Kyrgyz Republic General Prosecutor Office’s attempt to unwind an ordinary course $200 million dividend declared and paid by KGC to its sole shareholder, Centerra, in December 2013. The Company also understands that the Kyrgyz Republic has opened a criminal investigation into alleged “cyber-sabotage” and violations of Kumtor Mine employee rights related to actions taken by Centerra to disable Kyrgyz users from accessing its IT systems around the time of the seizure of the Kumtor Mine. Such reports identify certain members of former Centerra and KGC management teams and state that those individuals were prosecuted in absentia and put on wanted lists by the State Committee for National Security of the Kyrgyz Republic. The use of the Kyrgyz criminal law and investigations as a pressure tactic in aid of economic or commercial goals is not new for the Kyrgyz Republic. The Company denies any such allegations, which should be viewed in the broader context, including the Kyrgyz Republic Government’s goal of seizing the Kumtor Mine and intimidating its political opponents. |

| | ● | Centerra, KGC and Kumtor Operating Company CJSC (“KOC”) have taken a number of measures in response to the Kyrgyz Republic’s unjustified and illegal seizure of the Kumtor Mine. In particular: |

| | o | The Company has initiated binding arbitration against the Kyrgyz Republic and Kyrgyzaltyn to enforce its rights under longstanding agreements governing the Kumtor Mine and to, among other things, hold the Kyrgyz Republic and Kyrgyzaltyn accountable for any and all losses and damages that result from its actions against KGC and the Kumtor Mine. Following the resignation of the initial arbitrator on October 27, 2021, a new arbitrator was appointed to adjudicate the arbitration dispute. The Company also filed an application requesting urgent interim measures in connection with the arbitration proceedings to, among other things, address certain critical operational and safety problems at the Kumtor Mine to preserve the status quo at the Kumtor Mine and obtain some transparency and reporting as to the mine‘s activities; |

| | o | In accordance with longstanding shareholder and investment agreements, the Company has taken steps to restrict Kyrgyzaltyn from transferring or encumbering any common shares of the Company (“Common Shares”) or exercising any voting rights or dissent rights attached to Centerra Common Shares. In addition, dividends or distributions on Centerra Common Shares that would otherwise be payable to Kyrgyzaltyn or its affiliates are waived and will be donated to the Company to the extent such dividends or distributions can be attributed reasonably to KGC (or the Kumtor Mine‘s assets or operations) or distributions from KGC; |

| | o | KGC and KOC filed for protection under Chapter 11 of the federal U.S. Bankruptcy Code in the Southern District of New York. The court-supervised process provides for, among other things, a worldwide automatic stay of all claims against KGC and KOC which the Company hopes will deter the Kyrgyz Republic from taking further precipitous action against KGC and the Kumtor Mine, including actions to enforce the meritless environmental and tax claims noted above; and |

| | o | The Company initiated proceedings in the Ontario Superior Court of Justice against Tengiz Bolturuk, a former director of the Company who resigned from the Company‘s board of directors (the “Board”) to assume control of the Kumtor Mine on behalf of the Kyrgyz Republic as external manager, for breaches of his fiduciary duties to the Company (see further information below). |

No assurances can be given that Centerra will be successful in any of the foregoing legal proceedings. There also remains the further risk that additional regulatory, tax, or civil claims will be commenced against the Company and/or its Kyrgyz subsidiaries.

| | ● | Since late 2021, the Company has been engaged in discussions and negotiations with representatives of the Government of the Kyrgyz Republic to resolve the outstanding disputes relating to the illegal seizure of control of the Kumtor Mine by the Government of the Kyrgyz Republic in May 2021. On January 3, 2022, and subsequent to the year ended December 31, 2021, Centerra publicly confirmed such negotiations and stated the framework of a resolution under discussion could involve the following principal terms: |

| | o | Centerra receiving the approximately 26.1% in Centerra Common Shares held by Kyrgyzaltyn (an instrumentality of the Kyrgyz Republic). Upon receipt, Centerra would cancel the shares surrendered by Kyrgyzaltyn; |

| | o | the Kyrgyz Republic receiving, and assuming all responsibility for, the Company’s two Kyrgyz subsidiaries and the Kumtor Mine; |

| | o | payment by Centerra of a cash amount equal to the net amount of the three dividends paid by Centerra in 2021 that Kyrgyzaltyn did not receive as a result of the seizure of the mine and certain other financial consideration associated with the settlement of intercompany balances between Centerra and its Kyrgyz subsidiaries; |

| | o | the resignation from Centerra’s Board of Kyrgyzaltyn’s two nominees; and |

| | o | full and final releases of all claims of the parties and termination of all legal proceedings involving the parties in all jurisdictions with no admissions of liability. |

Negotiations with representatives of the Government of the Kyrgyz Republic are ongoing, and there can be no assurance that any proposed resolution will be consummated or as to the final economic and other terms and conditions of any such resolution, if agreed. Any such resolution would need to be formalized in a definitive agreement and would be subject to compliance with all applicable legal and regulatory requirements and approvals, including any applicable independent valuation or shareholder or government approval requirements.

| | ● | On February 15, 2022, the Ontario Superior Court of Justice rendered a decision in the Company’s favour in its application for an order restraining Tengiz Bolturuk from breaching of his fiduciary duties as a former director of the Company. The Ontario Superior Court of Justice issued an injunction, permanently enjoining Mr. Bolturuk from disclosing or using any of the Company’s confidential information and restraining him from having any involvement, directly or indirectly, with the management, operation or control of the Kumtor Mine so long as Centerra has or asserts an interest in KGC or the Kumtor Mine, as well as awarding costs to the Company. As previously noted, Mr. Bolturuk resigned from the Company’s Board in May 2021 to assume control of the Kumtor Mine on behalf of the Kyrgyz Republic as external manager. No assurances can be given that any injunctions ordered are respected, or that any costs awards granted in connection with any resolved proceedings will be paid. |

Mount Milligan Mine

| | ● | Starting in late December 2017, the Mount Milligan Mine experienced insufficient water resources which resulted in a reduction and temporary suspension of processing operations. The reduction in processing continued until the second quarter of 2020 when water levels increased significantly following a successful water pumping plan and a robust spring runoff. |

| | ● | A new technical report for the Mount Milligan Mine was filed on March 26, 2020 with an effective date of December 31, 2019. |

| | ● | In early 2020, Thompson Creek Metals Company Inc., the owner of the Mount Milligan Mine, received a notice of civil claim from H.R.S. Resources Corp. (“HRS”), the holder of a 2% production royalty at the Mount Milligan Mine. HRS claims that since November 2016 (when the royalty became payable) the Company has incorrectly calculated amounts payable under the production royalty agreement and has therefore underpaid amounts owing to HRS. The Company disputes the claim and believes it has calculated the royalty payments in accordance with the agreement. The Company believes that the potential exposure in relation to this claim is not material. |

| | ● | In January 2022, after significant discussions and consultation with British Columbia regulators, First Nations partners and other stakeholders, the Company obtained an amendment to the Mount Milligan Mine’s environmental assessment certificate which will allow access to long-term surface water sources for the life of the project, subject to the receipt of ordinary course permits. |

Öksüt Mine

| | ● | On January 30, 2020, our Turkish subsidiary that owns the Öksüt Mine repaid and cancelled its Öksüt Project financing facility, which resulted in the release of $25 million in restricted cash. |

| | ● | The Öksüt Mine achieved first gold pour on January 31, 2020 and declared commercial production effective on May 31, 2020. |

| | ● | Except during a two-week period in April 2020 when Öksüt Mine operated with a skeleton staff due to COVID-19 restrictions, COVID-19 has not materially affected operations at the Öksüt Mine and operations have continued normally. The Öksüt Mine is maintaining active measures to prevent a COVID-19 outbreak at site. |

| | ● | During the third quarter of 2020, the Öksüt Mine obtained an amendment to its environmental impact assessment (“EIA”) certificate from the Minister of Environment and Urbanization. The amendment is to accommodate changes to the Öksüt Mine’s open pit mine design and pit optimization. Due to the delay in receiving the amendment from the EIA and further potential delays in obtaining the related pastureland permit, the Öksüt mine plan and design has been adjusted and required permits are anticipated to be received in 2022. |

| | ● | On March 18, 2022, the Company announced a temporary suspension of gold doré bar production at the Öksüt Mine due to mercury having been detected in the gold room of the ADR plant. The Company has taken several initial actions in response, including cleaning mercury from affected areas, taking steps to mitigate and prevent exposure, implementing the necessary safety protocols and protective equipment, and is in the process of taking the necessary regulatory reporting steps. The Company is also evaluating several potential technical solutions to remove the mercury in the gold recovery process, including a retort and scrubbing system in the ADR plant prior to the restart of production. Despite the temporary suspension, the Öksüt Mine continues to mine ore, stack ore on the leach pad, and process ore within the ADR plant into a gold-in-carbon form, which will be stockpiled until the restart of the electrowinning process. |

Greenstone Gold Property

| | ● | On January 19, 2021, the Company completed the sale of its 50% interest in the Greenstone Gold Mines Partnership (the “Partnership”) to the Orion Mine Finance Group (“Orion”) for an upfront cash payment on closing of approximately $210 million (including adjustments) and conditional consideration of up to approximately $75 million (assuming $1,500 gold price) payable in cash or refined gold upon the Partnership’s Hardrock Mine Project meeting certain construction and production milestones. As a result of the construction decision for the project, the first of such contingent payments will be due at the end of 2023. The obligations of Orion regarding payment of the conditional consideration have been guaranteed by the Partnership and secured against the Hardrock Mine Project. |

Corporate

| | ● | Effective as of December 31, 2020, we entered into a new $400 million four-year revolving credit facility plus a $200 million accordion feature with a lending syndicate led by The Bank of Nova Scotia, National Bank Financial Markets and HSBC Canada Bank and including a syndicate of international financial institutions (the “2020 Corporate Facility”). The 2020 Corporate Facility is for general corporate purposes, including working capital, investments, acquisitions and capital expenditures. The loss of control of the Kumtor Mine in 2021 has resulted in the inability for the Company to utilize the $200 million accordion feature of the 2020 Corporate Facility. |

| | ● | On April 12, 2021, we announced that the Company had received approval to list its Common Shares on the New York Stock Exchange with trading to commence on April, 15, 2021 under the symbol CGAU. |

| | ● | On February 22, 2022, Centerra announced that it had entered into an agreement to acquire Gemfield Resources LLC, owner of the Goldfield Project, from Waterton Nevada Splitter, LLC for total consideration comprised of $175 million in cash at closing and a $31.5 million deferred milestone payment. At the option of Centerra, the deferred milestone payment is payable in cash or Common Shares of the Company and becomes payable the earlier of 18 months following the closing of the transaction or the date a construction decision is confirmed with respect to the project, among other things. The Company announced the closing of its acquisition of the Goldfield Project on February 28, 2022. |

COVID-19 Update

We continue to take steps to minimize the effect of the COVID-19 pandemic on our business. The Company has established strict protocols at its mine sites to help prevent infection and reduce the potential transmission of COVID-19. A testing facility, funded by the Company, has been recently established at the Mount Milligan Mine to perform rapid testing of all employees, contractors, and other visitors to the site. Vaccination clinics have been set up for employees and contractors at the Mount Milligan Mine and the Öksüt Mine. The Company believes that these programs, in combination with a robust provincial program in British Columbia in particular, has resulted in a large percentage of employees being inoculated. While COVID-19 vaccination rates continue to rise in the communities and countries in which the Company operates its mine sites and offices, the Company continues to maintain its COVID-19 protocols.

Neither the Mount Milligan Mine nor the Öksüt Mine have been adversely impacted by COVID-19 in any significant way as employee absences due to COVID-19, or any other illnesses, have so far been successfully managed. However, the Company notes that the effects of COVID-19 on its business continue to change rapidly. Centerra continues to assess the resiliency of its supply chains, maintaining increased mine site inventories of key materials and fixed asset components. Additionally, the Company is pursuing an active sourcing strategy to identify potential alternatives for its critical supplies that can be purchased in alternative countries to reduce the risk of extended lead-times while trying to maintain an optimal cost structure. All measures enacted to date reflect the Company’s best assessment at this time but will remain flexible and will be revised as necessary or advisable and/or as recommended by public health and governmental authorities.

2.4 Other Disclosure Relating to Ontario Securities Commission Requirements for Companies Operating in Emerging Markets

Controls Relating to Corporate Structure Risk

We have implemented a system of corporate governance, internal controls over financial reporting, and disclosure controls and procedures that apply at all levels of the Company and its subsidiaries. These systems are overseen by the Company’s Board and implemented by the Company’s senior management. The relevant features of these systems include:

Control Over Subsidiaries

Centerra’s corporate structure has been designed to ensure that the Company controls or has a measure of direct oversight over the operations of its subsidiaries. All of our subsidiaries are directly or indirectly wholly-owned by the Company with the exception of shareholdings in other publicly traded and privately held companies which represent less than 10% of the consolidated assets of Centerra, and less than 10% of the consolidated sales and operating revenue of Centerra.

The directors of Centerra’s wholly-owned subsidiaries are ultimately accountable to Centerra as the shareholder appointing him or her, and to Centerra’s Board and senior management. As well, the annual budget, capital investment and exploration program in respect of the Company’s mineral properties are established by the Company and approved by the Board. Members of management of all subsidiaries are also subject to written delegation of financial authority rules (adopted by the board of directors of each subsidiary) which limit their ability to bind such company. Our internal audit group also regularly conducts examinations of Centerra’s operating sites and subsidiaries and reports directly to the Audit Committee on compliance with various matters.

We have a 75% interest in the Endako Mine Joint Venture which was formed on June 12, 1997 pursuant to the terms of the Exploration, Development and Mine Operating Agreement between Thompson Creek Metals Company Inc. (“Thompson Creek”) and Sojitz Moly Resources, Inc. (“Sojitz”), as amended (the “Endako Mine Joint Venture Agreement”). Sojitz owns the remaining 25% interest in the Endako Mine Joint Venture. Our 75% interest in the contractual joint venture is held through our wholly owned subsidiary, Thompson Creek. We appoint all officers and directors of Thompson Creek. We are the manager of the Endako Mine Joint Venture with overall management responsibility for operations. As manager, we prepare annual budgets and production plans and submit them to Sojitz for approval. Oversight is provided by a joint venture committee whose members are appointed by Thompson Creek and Sojitz.

Signing officers for subsidiary foreign bank accounts (of our wholly owned subsidiaries) are either employees of Centerra or directors of the subsidiaries. In accordance with the Company’s internal policies, all subsidiaries must notify the Company’s corporate treasury department of any changes in their local bank accounts including requests for changes to authority over the subsidiaries’ foreign bank accounts. Monetary limits are established internally by the Company as well as with the respective banking institution. Annually, authorizations over bank accounts are reviewed and revised as necessary. Changes are communicated to the banking institution by the Company and the applicable subsidiary to ensure appropriate individuals are identified as having authority over the bank accounts.

Strategic Direction

Centerra’s Board is responsible for the overall stewardship of the Company and, as such, supervises the management of the business and affairs of the Company. More specifically, the Board is responsible for reviewing the strategic business plans and corporate objectives, and approving acquisitions, dispositions, investments, capital expenditures, financings. and other transactions and matters that are material to the Company including those of its material subsidiaries.

Internal Control Over Financial Reporting

The Company prepares its consolidated financial statements and managements’ discussion and analysis (“MD&A”) on a quarterly and annual basis, using IFRS as issued by the International Accounting Standards Board, which require financial information and disclosures from its subsidiaries. The Company implements internal controls over the preparation of its financial statements and other financial disclosures to provide reasonable assurance that its financial reporting is reliable and that the quarterly and annual financial statements and MD&A are being prepared in accordance with IFRS and relevant securities laws. These internal controls include the following:

| | i. | The Company has established a monthly and quarterly reporting package relating to its subsidiaries that standardizes the information required from the subsidiaries in order to complete the consolidated financial statements and MD&A. Management of the Company has direct access to relevant financial management of its subsidiaries in order to verify and clarify all information required. |

| | ii. | All public documents and statements relating to the Company and its subsidiaries containing material information (including financial information) are reviewed by members of the in-house legal department and our internal disclosure committee comprised of the President & Chief Executive Officer (“CEO”), Chief Financial Officer (“CFO”), Chief Operating Officer and General Counsel and Director, Investor Relations before such material information is disclosed, to make sure that all material information has been considered by management of the Company and properly disclosed. Where appropriate, the disclosure committee will also convene a subset of other employees to ensure that our public documents and statements do not contain any misrepresentations, as such term is defined in applicable Canadian securities laws. |

| | iii. | As more fully described below, the Company’s Audit Committee obtains confirmation from the CEO and CFO as to the matters addressed in the quarterly and annual certifications required under National Instrument 52-109 – Certification of Disclosure in the Company’s Annual and Interim Filings (“NI 52-109”), including its review of internal controls over financial reporting and disclosure controls and procedures. |

| | iv. | The Company’s Audit Committee reviews and approves the Company’s quarterly and annual financial statements and MD&A and recommends their approval to the Board for approval prior to their publication or release. |

| | v. | The Company’s Audit Committee assesses and evaluates the adequacy of the procedures in place for the review of the Company’s public disclosure of financial information extracted or derived from the Company’s financial statements by way of reports from management and its internal and external auditors. |

| | vi. | Although not specifically a management control, the Company engages its external auditor to perform reviews of the Company’s quarterly financial statements and an audit of the annual consolidated financial statements in accordance with Canadian generally accepted auditing standards. |

Disclosure Controls and Procedures

The Company’s Audit Committee’s responsibilities include oversight of the Company’s internal control systems and disclosure controls and procedures including those systems to monitor compliance with legal, ethical and regulatory requirements.

CEO and CFO Certifications

In order for the Company’s President & CEO and CFO to be in a position to attest to the matters addressed in the quarterly and annual certifications required by NI 52-109, the Company has developed internal procedures and responsibilities throughout the organization for its regular periodic and timely reporting. These processes are designed to provide assurances that information that may constitute material information will reach the appropriate individuals who draft and/or review public documents and statements relating to the Company. Annually, we engage an external accounting firm to carry out a review of our internal controls over financial reporting.

These systems of corporate governance, internal control over financial reporting and disclosure controls and procedures are designed to ensure that, among other things, the Company has access to all material information about its subsidiaries.

Procedures of the Board of Directors of the Company

Oversight of the Company’s Risks

We have implemented an enterprise risk management program which applies to all of our operations, projects and corporate offices with a goal to ensure risk-informed decision making. The program is based on leading international risk management standards and industry best practice. It employs both a “bottom-up” and “top-down” approach to identify and address risks from all sources that threaten the achievement of our strategic and business objectives or provide opportunities to exploit. The risk management program at Centerra considers the full life of mine cycle from exploration through to closure. All aspects of the operation and our stakeholders are considered when identifying risks. As such, our risk program encompasses a broad range of risks including technical, financial, commercial, social, reputational, environmental, governance, health and safety, political and human resources related risks. Our executive team meets regularly with our Vice President, Risk and Insurance to review the risks facing the organization and each site and to review mitigation actions. The Risk Committee of the Board has oversight responsibilities for the policies, processes and systems for the identification, assessment and management of the Company’s principal strategic, financial, and operational risks. The members of the Risk Committee endeavour to include at least one member from each of the other standing committees of the Board, and the majority of members must be independent of the Company.

Fund Transfers from the Company’s Subsidiaries to Centerra

Funds are transferred by the Company’s subsidiaries to the Company by way of wire transfer for a variety of purposes, including chargeback of costs undertaken on behalf of the subsidiaries via intercompany invoices by the Company; repayment of loans related to project funding; and dividend declaration/payment by the subsidiaries. The method of transfer is dependent on the funding arrangement established between the Company and the subsidiary. In some cases, loan agreements are established with corresponding terms and conditions. In other cases, dividends are declared and paid based on the profitability and available liquidity of the applicable subsidiary.

Records Management of the Company’s Subsidiaries

The original minute books, corporate seal and corporate records of each of the Company’s subsidiaries are kept at each subsidiary’s respective registered office. All material documents are available in the local language of the subsidiary and in English.

Approval of Related Party Transactions

The Board has established a Special Committee comprised entirely of independent directors, Bruce Walter (Chair), Richard Connor, Jacques Perron, Sheryl Pressler, Paul Wright and Susan Yurkovich to, among other things, oversee, review, evaluate and consider transactions and matters involving the Government of the Kyrgyz Republic and Kyrgyzaltyn, Centerra’s largest shareholder and a corporation wholly-owned by the Government of the Kyrgyz Republic, and any other matters affecting the Kumtor Mine.

2.5 Centerra’s Business We are a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Turkey, and other markets worldwide. We have two operating properties: the Mount Milligan Mine in British Columbia, Canada and the Öksüt Mine in Turkey. The Öksüt Mine achieved its first gold pour in January 2020 and declared commercial production as of May 31, 2020. We also have pre-development projects in British Columbia, Canada (the Kemess Project) and Nevada, United States (the Goldfield Project). | | For more information You can find more information about Centerra on SEDAR at www.sedar.com and EDGAR at www.sec.gov. See our 2021 financial statements and MD&A for additional financial information. See our most recent management information circular for additional information, including how our directors and officers are compensated and any loans to them, principal holders of our securities, and securities authorized for issuance under our equity compensation plans. |

We also own a molybdenum business, which includes our Thompson Creek Mine (“TC Mine”) in Idaho, United States, and the Endako Mine (we own a 75% interest) in British Columbia, Canada. Both the TC Mine and the Endako Mine are currently on care and maintenance. We also operate the Langeloth Metallurgical Processing Facility in Pennsylvania, United States.

We have exploration interests in Canada, the United States and Turkey, which are owned (directly or indirectly) by Centerra, and properties in Canada, Finland, Turkey and the United States in which we are earning interests pursuant to option agreements with the respective property owners.

Prior to May 15, 2021, the Company also owned and operated the Kumtor Mine, located in the Kyrgyz Republic, through its wholly-owned subsidiary, KGC. Although the Company remains the rightful owner of KGC, the illegal seizure of the Kumtor Mine and the continuing actions by the Kyrgyz Republic and Kyrgyzaltyn have resulted in the Company ceasing to have control over, and benefit from, the operations of the Kumtor Mine. See “Recent Developments – Kumtor Mine”.

Business Objectives

Our vision statement is to build a team-based culture of excellence that responsibly delivers sustainable value and growth.

Centerra’s objective is to meaningfully grow its low-cost operating portfolio, while building a great place to work, with care and consideration for the environment and the communities in which the Company operates. Centerra aims to achieve this overall strategy through the following strategic imperatives:

| | ● | Creating a great place to work by attracting, retaining, and developing diverse skilled talent to create a collaborative and inclusive environment. |

| | ● | Improving the Company’s ESG performance by maintaining and enhancing value for all of Centerra’s stakeholders by embedding ESG principles across the enterprise throughout the mine life cycle and by delivering on the Company’s targets. |

| | ● | Driving growth by identifying, critically evaluating, and executing targeted growth opportunities to ensure the organization is best positioned for sustainable growth and value-creation. |

| | ● | Optimizing existing assets by leveraging the Company’s existing operations with consistent performance, focusing on activities that generate the most value. |

Business Operations

Our principal business operations of gold/copper production span the six major stages of the mining cycle, from early-stage exploration to mine closure and reclamation.

Exploration | Our exploration programs are focused on increasing our mineral reserves and resources. These programs include: drilling at, or in, the immediate vicinity of our operating mine(s) to replace mined mineral reserves; drilling programs on advanced stage projects where mineralization has been identified; and grassroots exploration on projects where gold and/or copper mineralization has not been identified. Our exploration and business development teams actively pursue new project opportunities worldwide. |

Development and Construction | If our exploration programs are successful in identifying a mineral resource, the prospects for economic extraction of the resource will be analyzed through a series of technical studies. These may include metallurgical studies, scoping studies, environmental studies, mine and processing design, preliminary assessment studies, pre-feasibility studies and feasibility studies. Pre-feasibility and feasibility studies may be undertaken concurrently with permitting for the project. Once feasibility and permitting are concluded, project financing may be arranged followed by detailed engineering and construction of the mine site and processing facilities. |

Mining | Ore and waste rock are removed from deposits by open pit or underground methods – our two operating mines currently use only an open pit method. The ore is then transported to a processing facility/mill to extract gold and/or copper (depending on the mine). The waste rock is placed on an engineered waste rock dump for subsequent rehabilitation or used in the construction of the tailings management facility. |

Processing | Mined ore is processed using different methods depending on its characteristics. This may include heap leaching, crushing, milling, flotation, roasting, and CIL or CIP methods for gold and copper extraction. After having extracted the gold and/or copper, the remaining processed waste materials are placed in a tailings facility (except in the case of heap leach processing). |

Refining and Gold Sales | At our Öksüt Mine, recovered gold is processed at our ADR plant (processing facility) into doré bars which are then delivered to a refinery for further refining to market delivery standards. The Central Bank of Turkey has a right of first refusal to purchase the gold. The sales price is fixed based on the spot price of gold. If the gold is not purchased by the central bank it is sold at the spot price on the Borsa Istanbul. At our Mount Milligan Mine, we produce a copper/gold concentrate which is sold to third parties including smelters and traders for further refining. |

Closure and Reclamation | As a responsible mining company, we plan how we are going to reclaim the areas we mine before we start construction. In some cases, we reclaim at the same time as we extract to expedite the process. In other cases, it is not possible to reclaim during the extraction process and therefore, efforts are deferred until after mining is completed. After mining has permanently ceased, we reclaim or continue to reclaim (as applicable) and monitor the land. We also regularly update our final closure plans to reflect any changes in operations. Our high standards for reclamation comply with both local and international standards. |

Marketing and Distribution

Our principal products are gold, copper, and to a lesser extent, molybdenum and ferromolybdenum products. Our Öksüt Mine produces gold doré bars. Our Mount Milligan Mine produces a copper-gold concentrate, and our Langeloth Metallurgical Processing Facility provides tolling roasting services for customers and purchases molybdenum concentrates from third parties to convert to upgraded products, which are then sold into the metallurgical and chemical markets.

Gold Industry

The two principal uses of gold are bullion investment and product fabrication. A broad range of end uses is included within the fabrication category, the most significant of which is the production of jewelry. Other fabrication uses include official coins, electronics, miscellaneous industrial and decorative uses, medals, and medallions.

Copper Industry

Copper is an excellent conductor of electricity and heat and these properties result in the principal applications for copper consumption. Refined copper is used in the generation and transmission of electricity as well as industrial machinery and consumer products that have electrical and electronic applications.

Gold Doré Produced at Öksüt Mine

All gold doré produced at the Öksüt Mine is processed at refining facilities within Turkey. Under Turkish legislation, the Central Bank of the Republic of Turkey has a first right to purchase gold produced by mining operations in Turkey. The sales price is fixed based on the gold spot price. If the gold doré is not purchased by the Central Bank of the Republic of Turkey, it is sold on the Borsa Istanbul (stock exchange) at spot prices.

Copper/Gold Concentrate Produced at Mount Milligan Mine

Concentrate Sales

Copper/gold concentrate produced by the Mount Milligan Mine in Canada is sold to various smelters and off-take purchasers. We are currently party to three multi-year concentrate sales agreements for the sale of copper/gold concentrate produced at the Mount Milligan Mine. Pursuant to these agreements, we have agreed to sell an aggregate of approximately 120,000 tonnes in each of 2022 and 2023, 80,000 tonnes in 2024 and 60,000 tonnes in each of 2025, 2026 and 2027.

Pricing under these concentrate sales agreements is determined by reference to specified published reference prices during the applicable quotation periods. Payment for the concentrate is based on the price for the agreed copper and gold content of the parcels delivered, less smelting and refining charges and certain other deductions, if applicable. The copper smelting and refining charges are negotiated in good faith and agreed by the parties for each contract year based on terms generally acknowledged as industry benchmark terms. The gold refining charges are as specified in the agreements.

We intend to either extend our current multi-year agreements as the terms expire, or we may enter into additional multi-year sales agreements. To the extent that production is expected to exceed the volume committed under these agreements, we will sell the additional volume under short-term contracts or on a spot basis.

Mount Milligan Streaming Arrangement

We are subject to a streaming arrangement with RGLD Gold AG and Royal Gold Inc. (collectively, “Royal Gold”) pursuant to which Royal Gold is entitled to receive 35% of the gold produced and 18.75% of the copper production at our Mount Milligan Mine in exchange for $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered (the “Mount Milligan Streaming Arrangement”). The Mount Milligan Streaming Arrangement was first put in place in 2010 and was subsequently amended, including in connection with Centerra’s acquisition of Thompson Creek in October 2016. The streaming arrangement, as amended, required Royal Gold to make upfront payments totaling $781.5 million from 2010 to 2013 to Thompson Creek for the rights to receive future gold production. The arrangement was renegotiated by Centerra in conjunction with its acquisition of Thompson Creek. To satisfy our obligations under the Mount Milligan Streaming Arrangement, in connection with copper and gold concentrate sale from the Mount Milligan Mine, we purchase gold and copper in the market for delivery to Royal Gold based on a portion of the gold ounces and pounds of copper sold.

Molybdenum Industry

Our principal molybdenum products are molybdic oxide (also known as roasted molybdenum concentrate) and ferromolybdenum. Other products we produce include high soluble technical oxide, pure molybdenum trioxide and high purity molybdenum disulfide.

Molybdenum is an industrial metal principally used for metallurgical applications as a ferro-alloy in steels where high strength, temperature-resistant or corrosion-resistant properties are sought. The addition of molybdenum enhances the strength, toughness and wear and corrosion-resistance in steels when added as an alloy. Molybdenum is used in major industries including chemical and petro-chemical processing, oil and gas for drilling and pipelines, power generation, automotive and aerospace. Molybdenum is also widely used in non-metallurgical applications such as petroleum refining catalysts, lubricants, flame-retardants in plastics, water treatment and as a pigment.

2021 and 2020 Production and Revenue

| | 2021 | 2020 |

Total (1) | | |

Gold sold (oz) | 314,757 | 259,603 |

Payable copper sold (‘000 lbs.) | 78,017 | 80,477 |

Revenue ($ millions) | 900.1 | 721.3 |

Mount Milligan Mine (2) | | |

Payable Gold Sold (oz) | 203,103 | 154,100 |

Payable Copper Sold (‘000 lbs.) | 78,017 | 80,477 |

Gold Sales ($ millions) | 267.9 | 205.0 |

Copper Sales ($ millions) | 227.7 | 178.6 |

Öksüt Mine – Gold(3) | | |

Gold sold (oz) | 111,654 | 105,503 |

Gold Sales ($ millions) | 199.4 | 186.5 |

Langeloth – Molybdenum | | |

Molybdenum sold (‘000 lbs.) | 11,461 | 13,667 |

Molybdenum Sales ($ millions) | 184.5 | 132.3 |

| | 1. | Excludes results from the Kumtor Mine which is presented as a discontinued operation in both 2021 and 2020 due to the to the loss of control on May 15, 2021. |

| | 2. | Mount Milligan sales are presented on a 100% basis. Under the Mount Milligan Streaming Arrangement, Royal Gold is entitled to 35% of payable gold ounces and 18.75% of payable copper. Royal Gold pays $435 per ounce of gold delivered and 15% of the spot price per metric tonne of copper delivered. |

| | 3. | Reflects full year production for 2020, which includes figures before commercial production. |