EXHIBIT 99.1

Centerra Gold Announces 2024 Year-End Mineral Reserves and Resources, Including an Initial Resource at Goldfield; Provides Exploration Update

All figures are in United States dollars unless otherwise stated. This news release contains forward-looking information that is subject to risk factors and assumptions as set out in the “Cautionary Note Regarding Forward-Looking Information” below.

TORONTO, Feb. 20, 2025 (GLOBE NEWSWIRE) -- Centerra Gold Inc. (“Centerra” or the “Company”) (TSX: CG) (NYSE: CGAU) announces its 2024 year-end estimates for mineral reserves and mineral resources. Proven and probable gold mineral reserves were 3.5 million ounces and proven and probable copper mineral reserves were 1,150 million pounds, as of December 31, 2024. Measured and indicated gold mineral resources were 6.8 million ounces as of December 31, 2024, which includes the initial gold mineral resource at the Goldfield Project (“Goldfield”) of 706 thousand ounces.

Centerra Year-End Gold Mineral Reserves and Mineral Resources(1)

| | 2024 | 2023 |

Property

| Tonnes

(kt) | Grade

(g/t) | Contained

Gold (koz) | Tonnes

(kt) | Grade

(g/t) | Contained

Gold (koz) |

| Total Proven and Probable Gold Mineral Reserves |

| Mount Milligan Mine | 264,512 | 0.33 | 2,826 | 250,025 | 0.35 | 2,822 |

| Öksüt Mine | 20,080 | 1.03 | 662 | 25,255 | 1.01 | 819 |

| Total | 284,591 | 0.38 | 3,488 | 275,280 | 0.41 | 3,641 |

| Total Measured and Indicated Gold Mineral Resources |

| Mount Milligan Mine | 183,971 | 0.26 | 1,566 | 259,860 | 0.27 | 2,333 |

| Öksüt Mine | 2,617 | 0.69 | 58 | 6,752 | 0.55 | 119 |

| Kemess Open Pit | 111,682 | 0.27 | 980 | 111,682 | 0.27 | 980 |

| Kemess Underground | 139,920 | 0.50 | 2,265 | 139,920 | 0.50 | 2,265 |

| Kemess East | 93,454 | 0.39 | 1,182 | 93,454 | 0.39 | 1,182 |

| Goldfield | 30,833 | 0.71 | 706 | - | - | - |

| Total | 562,476 | 0.37 | 6,759 | 611,668 | 0.35 | 6,880 |

| Inferred Gold Mineral Resources |

| Mount Milligan Mine | 27,924 | 0.44 | 395 | 7,795 | 0.34 | 84 |

| Öksüt Mine | 130 | 1.06 | 4 | 348 | 0.78 | 9 |

| Kemess Open Pit | 13,691 | 0.26 | 116 | 13,691 | 0.26 | 116 |

| Goldfield | 2,267 | 0.41 | 30 | - | - | - |

| Total | 44,012 | 0.39 | 547 | 21,833 | 0.30 | 209 |

(1) As of December 31, 2024. Refer to Tables “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Gold” and “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Other Metals”, including their respective footnotes and the “Additional Footnotes” section below.

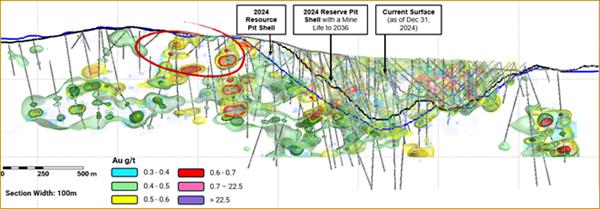

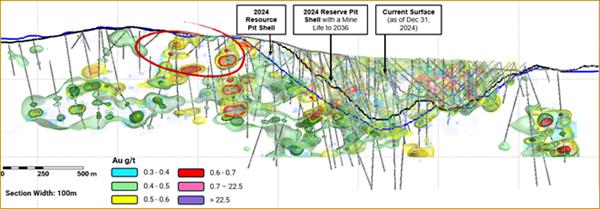

- Mount Milligan Mine (“Mount Milligan”): In 2024, the Company replaced mined mineral reserves at Mount Milligan by upgrading mineral resources. Centerra has successfully extended the life of mine at Mount Milligan to 2036 by increasing the use of mined-out areas of the open pit for potential acid generating (“PAG”) waste storage. This has increased available storage capacity in the existing tailings facility and extended the overall mine life for the current mineral reserve estimate.

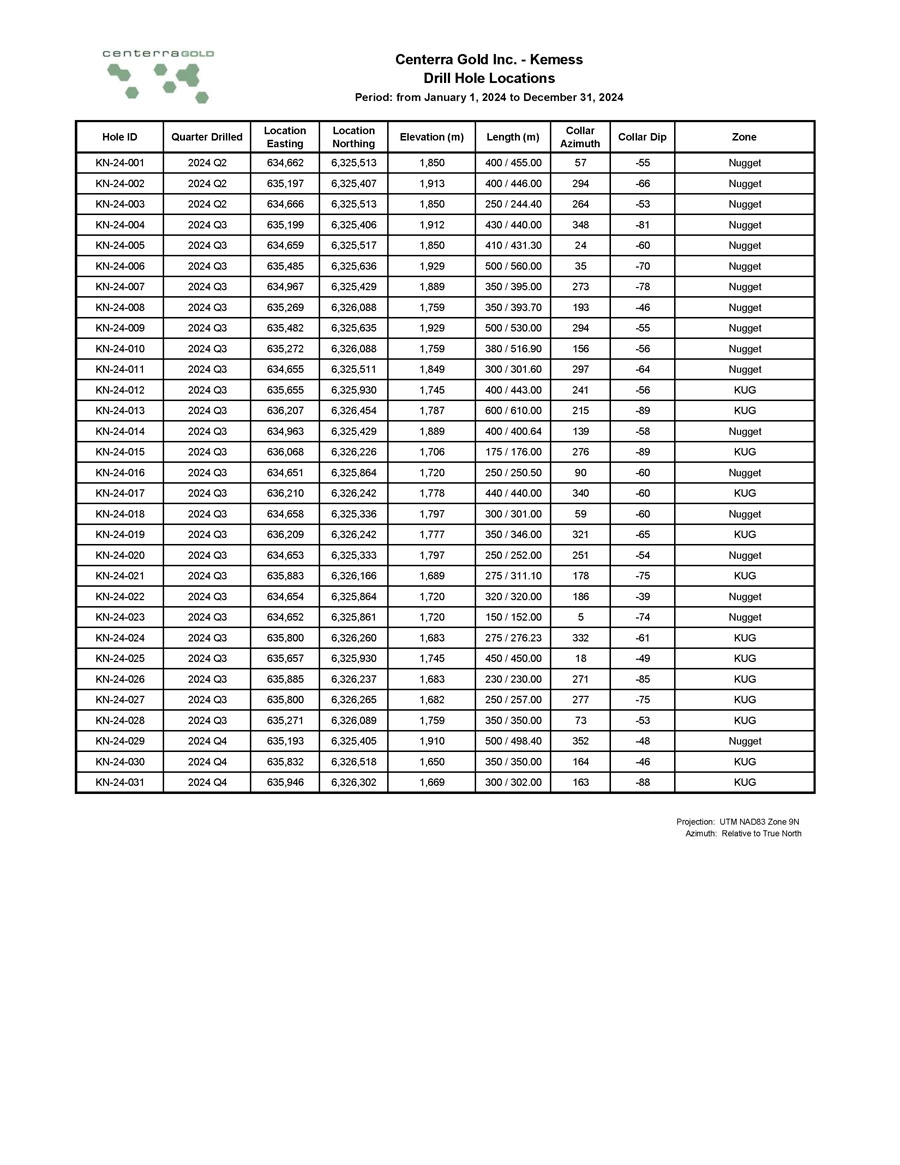

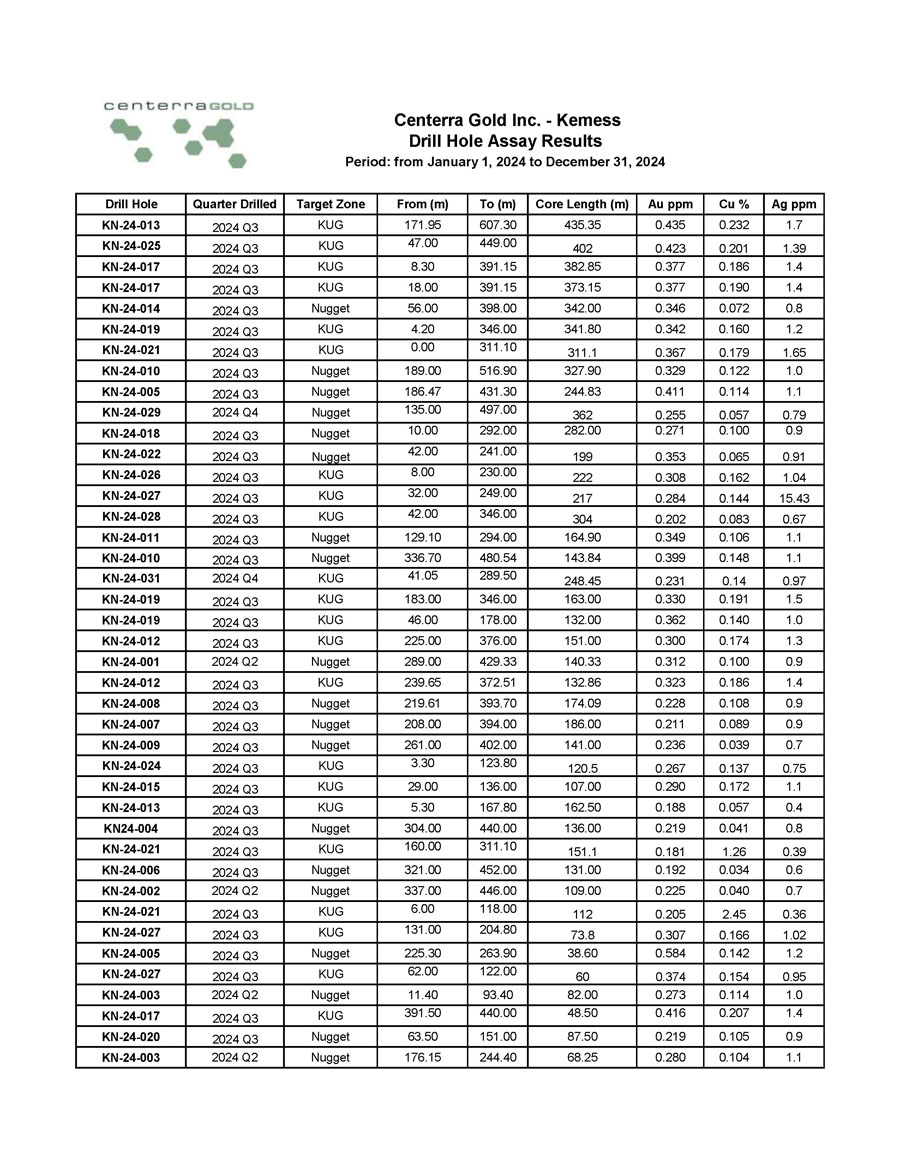

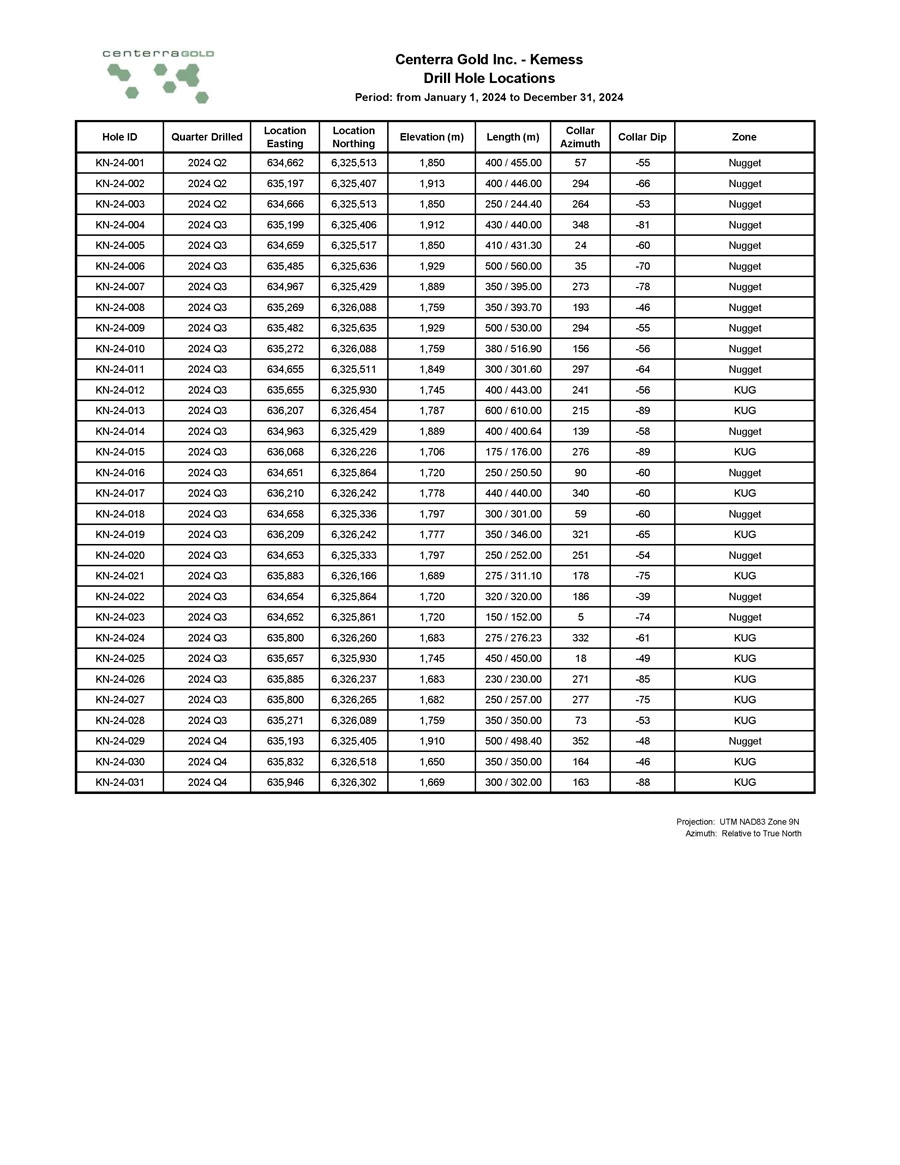

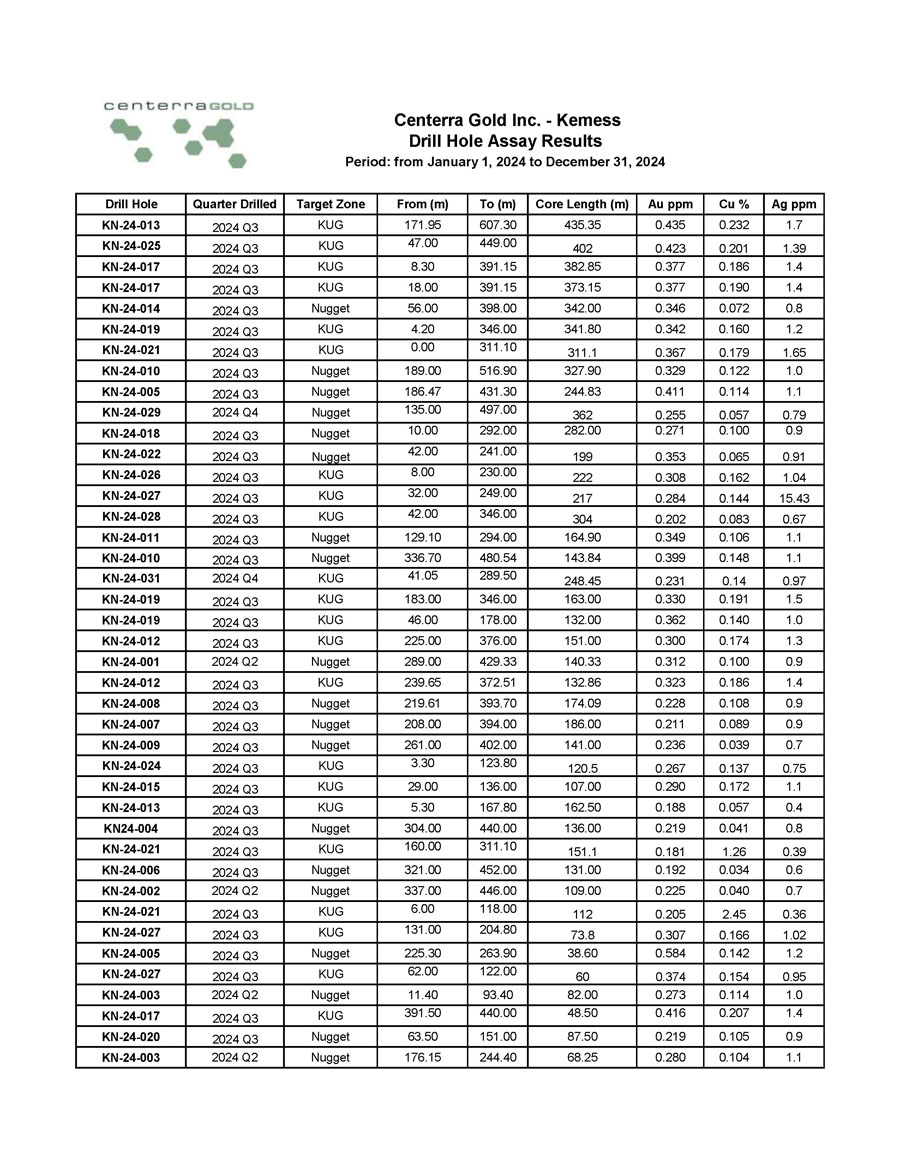

- Kemess Project (“Kemess”): The Kemess property has substantial gold and copper resources in a highly prospective district with significant infrastructure already in place, including: a 300 kilometre, 230 kilovolt power line, one of the longest privately owned power lines in British Columbia; a 50,000 tonnes per day nameplate processing plant, which would require some refurbishment and equipment replacements; site infrastructure including a camp, administration facilities, truck shop and warehouse; and tailings storage through in-pit and an existing facility, which is capable of expansion. Centerra is currently working to incorporate the results of a drilling campaign conducted in 2024 at Kemess into an updated open pit resource model. The program included over 11,400 metres of core drilling for exploration, geotechnical, and metallurgical testing purposes.

During 2024, Centerra commenced evaluation of technical concepts and engineering trade-off studies for potential restart options at Kemess. Early operating concepts include a combined open pit and conventional underground operation, which are expected to be less capital intensive and have a better cash flow profile than the previously permitted underground block cave concept. In addition to an exploration campaign in 2025 to further delineate the resources, the Company is planning on continuing to advance the technical studies that will include metallurgical testing for flowsheet optimization, mine plan optimization, materials handling infrastructure engineering, tailings design optimization, as well as initiation of environmental baseline studies. Early indications show potential for a long-life operation that takes advantage of the significant infrastructure already in place. The Company expects to provide an updated resource estimate and an accompanying update on the technical concept for Kemess in the second quarter of 2025.

- Goldfield: The initial measured and indicated gold mineral resource at Goldfield was 706 thousand ounces of gold, as of December 31, 2024, which includes both oxide and transition material, principally in the Gemfield, McMahon, and Jupiter deposits. In conjunction with exploration drilling, the Company completed metallurgical testwork resulting in run-of-mine recoveries in the mid-60% range (see “Additional Footnotes” section at the end of this release for details on recoveries), which is in line with expectations for a heap leach project and is expected to lower the capital investment required for the project. Based on the size of the resource estimate, the project does not meet Centerra’s requirements to support near-term development. The Company remains committed to maximizing the project’s potential, while exploring strategic and commercial options for Goldfield.

Centerra Year-End Copper Mineral Reserves and Mineral Resources(1)

| | 2024 | 2023 |

Property

| Tonnes

(kt) | Grade

(%Copper) | Contained Copper

(Mlbs) | Tonnes

(kt) | Grade

(% Copper) | Contained Copper

(Mlbs) |

| Proven and Probable Copper Mineral Reserves |

| Mount Milligan Mine | 264,512 | 0.20 | 1,150 | 250,025 | 0.17 | 961 |

| Total | 264,512 | 0.20 | 1,150 | 250,025 | 0.17 | 961 |

| Measured and Indicated Copper Mineral Resources |

| Mount Milligan Mine | 183,971 | 0.18 | 732 | 259,860 | 0.15 | 851 |

| Kemess Open Pit | 111,682 | 0.14 | 337 | 111,682 | 0.14 | 337 |

| Kemess Underground | 139,920 | 0.25 | 779 | 139,920 | 0.25 | 779 |

| Kemess East | 93,454 | 0.30 | 628 | 93,454 | 0.30 | 628 |

| Total | 529,027 | 0.21 | 2,476 | 604,916 | 0.19 | 2,595 |

| Inferred Copper Mineral Resources |

| Mount Milligan Mine | 27,924 | 0.12 | 74 | 7,795 | 0.14 | 24 |

| Kemess Open Pit | 13,691 | 0.16 | 48 | 13,691 | 0.16 | 48 |

| Total | 41,615 | 0.13 | 121 | 21,486 | 0.15 | 72 |

(1) As of December 31, 2024. Refer to Tables “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Gold” and “Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resource Summary – Other Metals”, including their respective footnotes and the “Additional Footnotes” section below.

Exploration Update

Exploration activities in the fourth quarter of 2024 included drilling, surface rock and soil sampling, geological mapping, and geophysical surveying, targeting gold and copy mineralization at the Company’s projects and properties in Canada, Türkiye, and the United States.

2024 Exploration Highlights

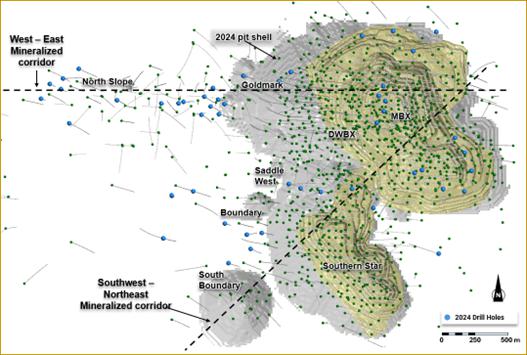

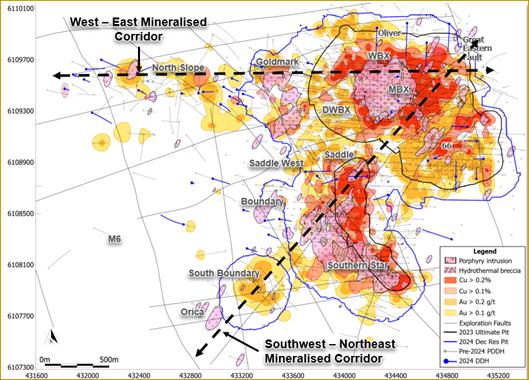

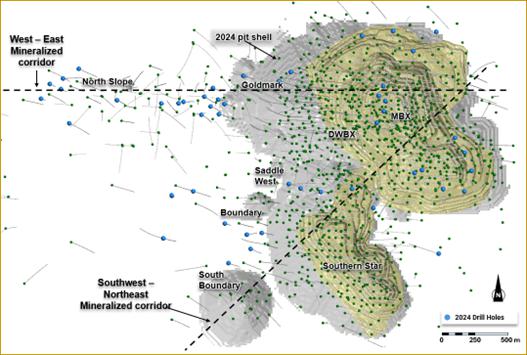

- Confirming Mount Milligan’s long-life potential, the pit expanded to the west and southwest, due to significant intersections in the Goldmark and Saddle areas. Model expansion includes the south boundary area. Remodeling considers all holes drilled west of the Mount Milligan pit and resulted in defining the South Boundary inferred resource.

- At Kemess drilling was carried out in 2024 to assess the viability of start-up scenarios and open pit resource expansion. The goal was to expand near-surface mineralization west and southwest of the Kemess underground project.

- Resource delineation drilling for near surface oxide mineralization continued at the Goldfield project. Drilling intersected low-grade mineralization with a series of 10 to 30 metres at 0.4 grams per tonne (“g/t”).

- Most of the drilling was completed before the fourth quarter 2024, except at the Oakley project, in Idaho, United States (5,818 metres), Nallihan in Türkiye (4,829 metres) and Öksüt in Türkiye (421 metres). The drilling at Öksüt started late December 2024.

- Full year 2024 drilling totalled 72.3 kilometres, including greenfield projects.

2025 Exploration Outlook

- Exploration expenditures in 2025 are expected to be $35 to $45 million, including $20 to $25 million of brownfield exploration primarily at Mount Milligan and Kemess, and $15 to $20 million of greenfield and generative exploration programs.

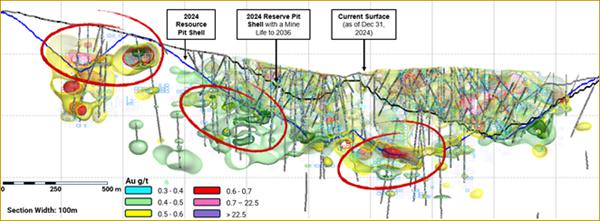

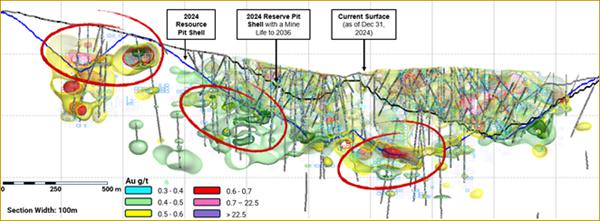

- Centerra is expected to continue to explore the western extension of the Mount Milligan deposit and perform infill drilling to upgrade the inferred resources to indicated. Approximately 25% of the 2025 exploration expenditures are allocated to drilling programs at Mount Milligan to upgrade the inferred resources between Goldmark and North Slope and to test the extension of the South Boundary mineralization. A total of 45 kilometres of drilling is planned for 2025 at Mount Milligan.

- Centerra is expected to continue to explore Kemess, where the 2024 drilling resulted in delineation of mineralization between the Kemess Main open pit and Nugget (Centra Ridge zone). The 2025 exploration program at Kemess is focused on upgrading the resources along the five-kilometre-long mineralized trend. Approximately 13% of the 2025 exploration expenditures are allocated to Kemess to drill 12.5 kilometres.

- In the United States, Centerra is expected to continue to explore for near surface oxide mineralization within the Goldfield district and at Oakley. Centerra is also expected to continue advancing exploration work at its greenfield projects, Green Springs in Nevada and Jones Creek in Utah.

- In Türkiye, Centerra is expected to commence phase 2 drilling at the Nallihan joint venture project and to continue to explore for near surface mineralization southeast of the Öksüt pit.

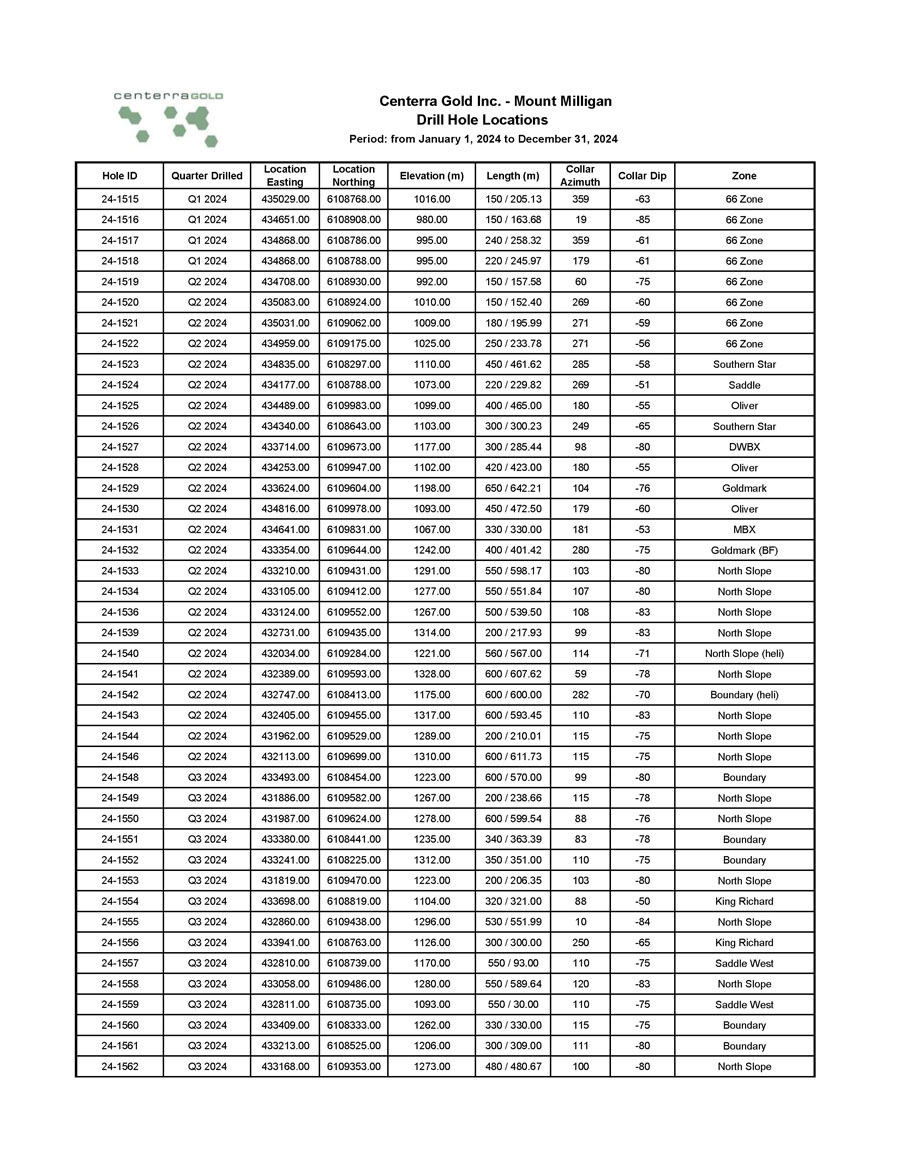

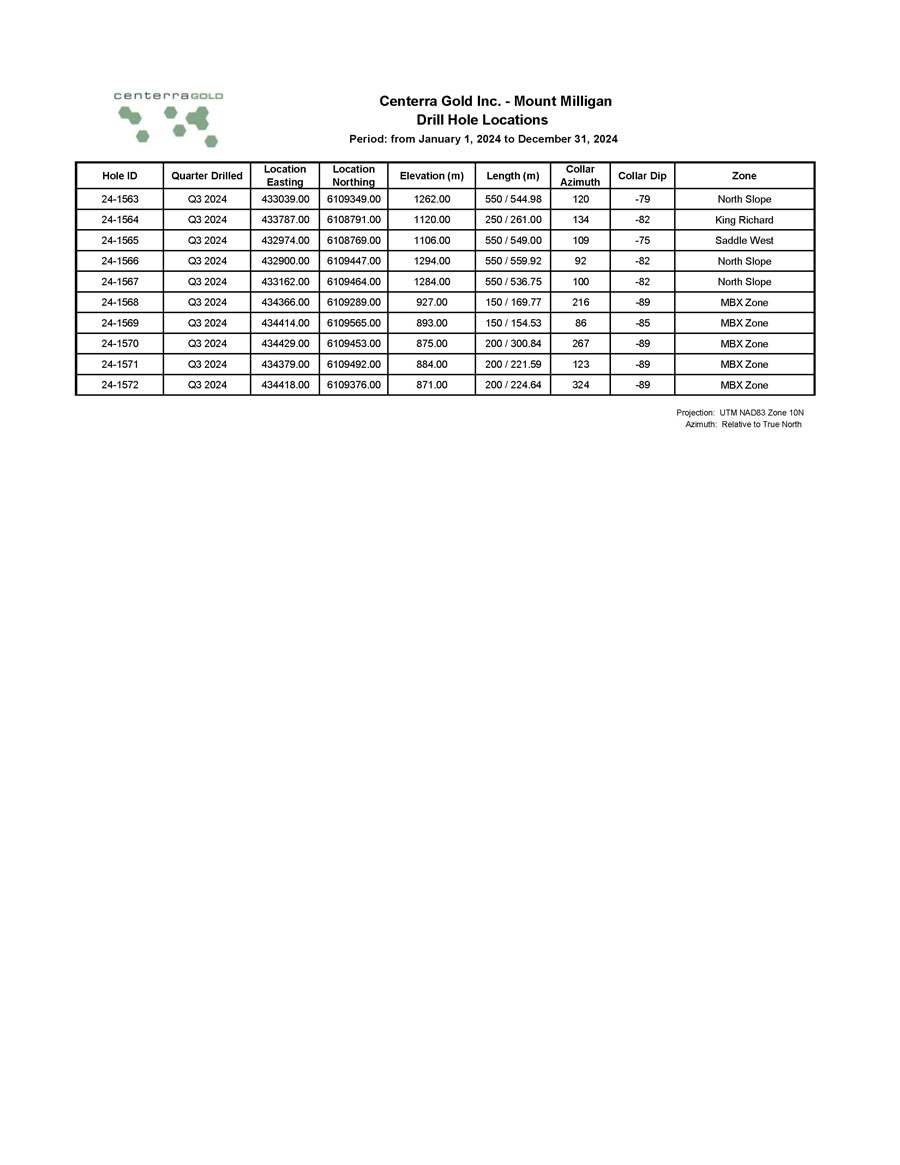

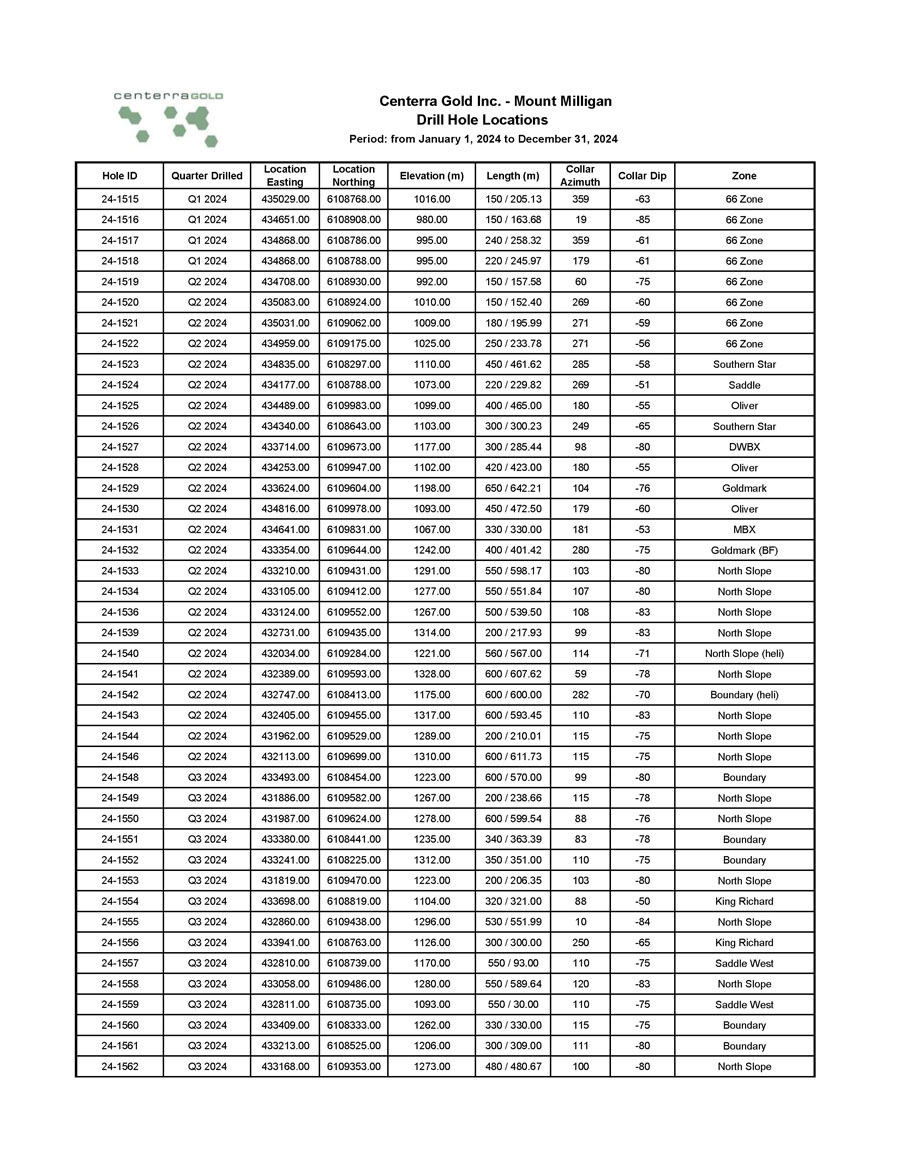

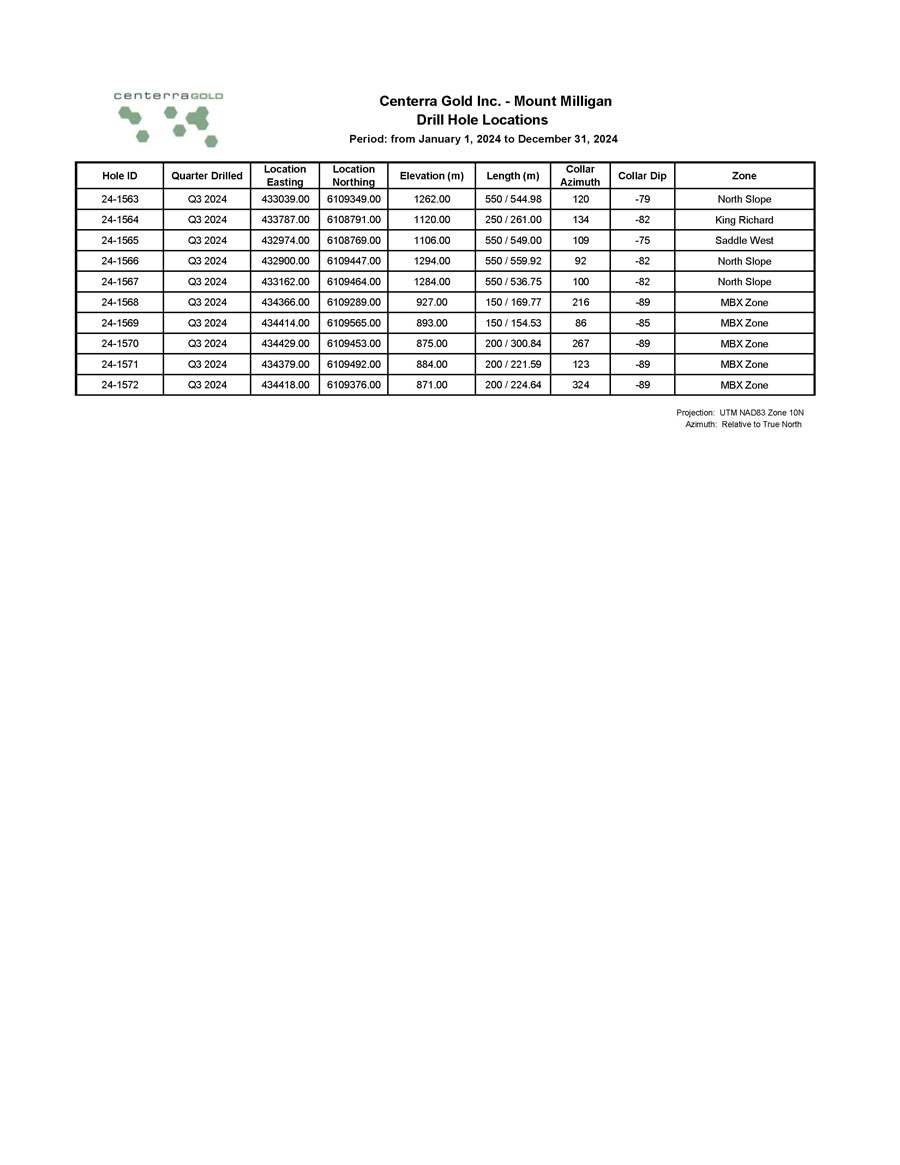

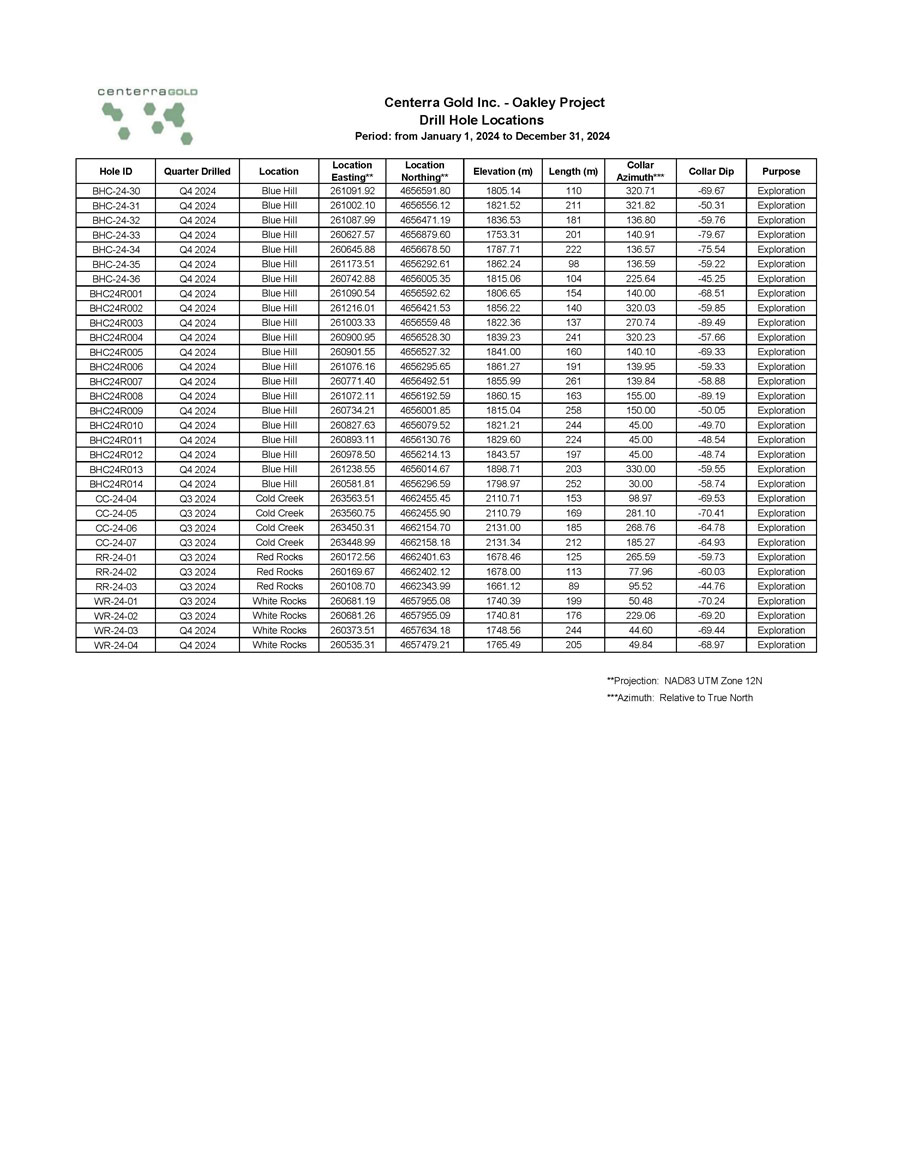

Mount Milligan

- In 2024, the Company replaced mined mineral reserves at Mount Milligan by upgrading mineral resources. Ongoing exploration drilling program at the site is aimed at expanding the mineral resource base significantly to the west and southwest.

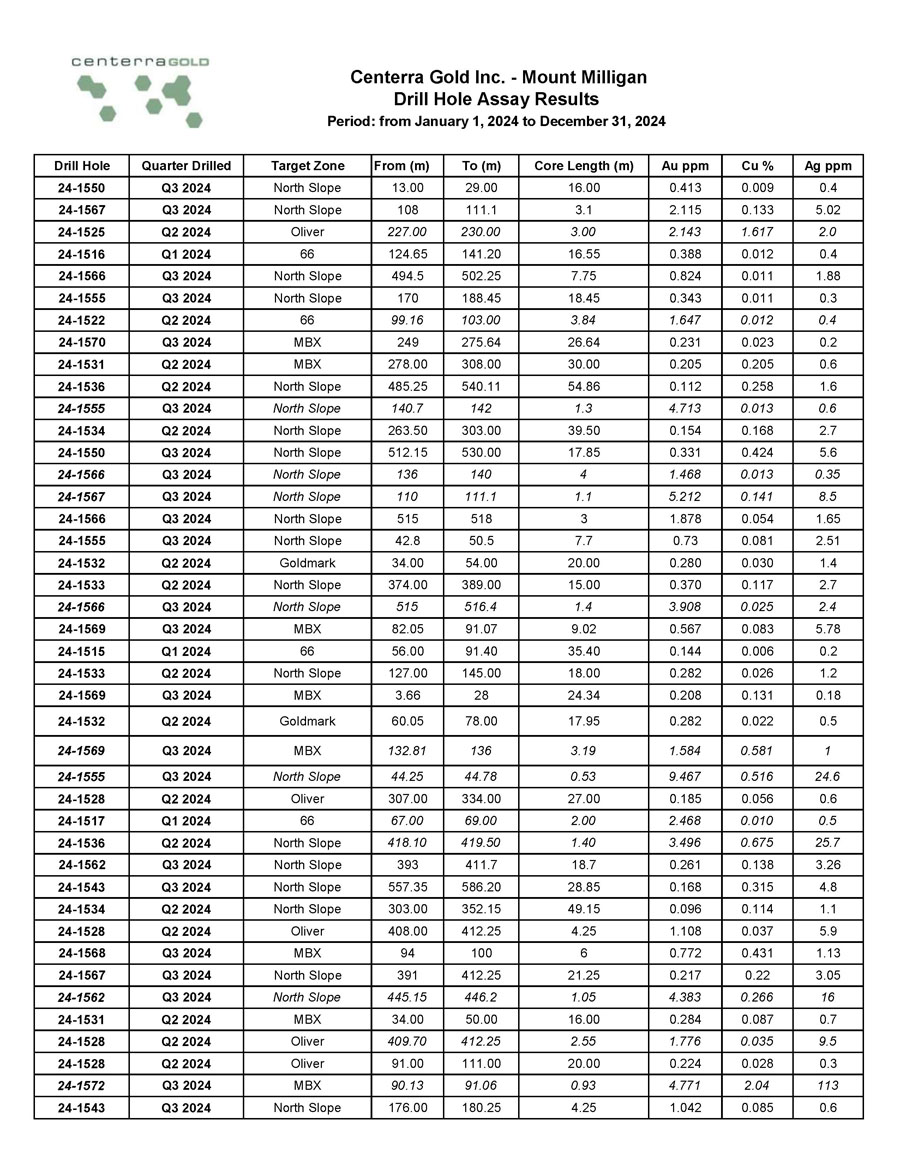

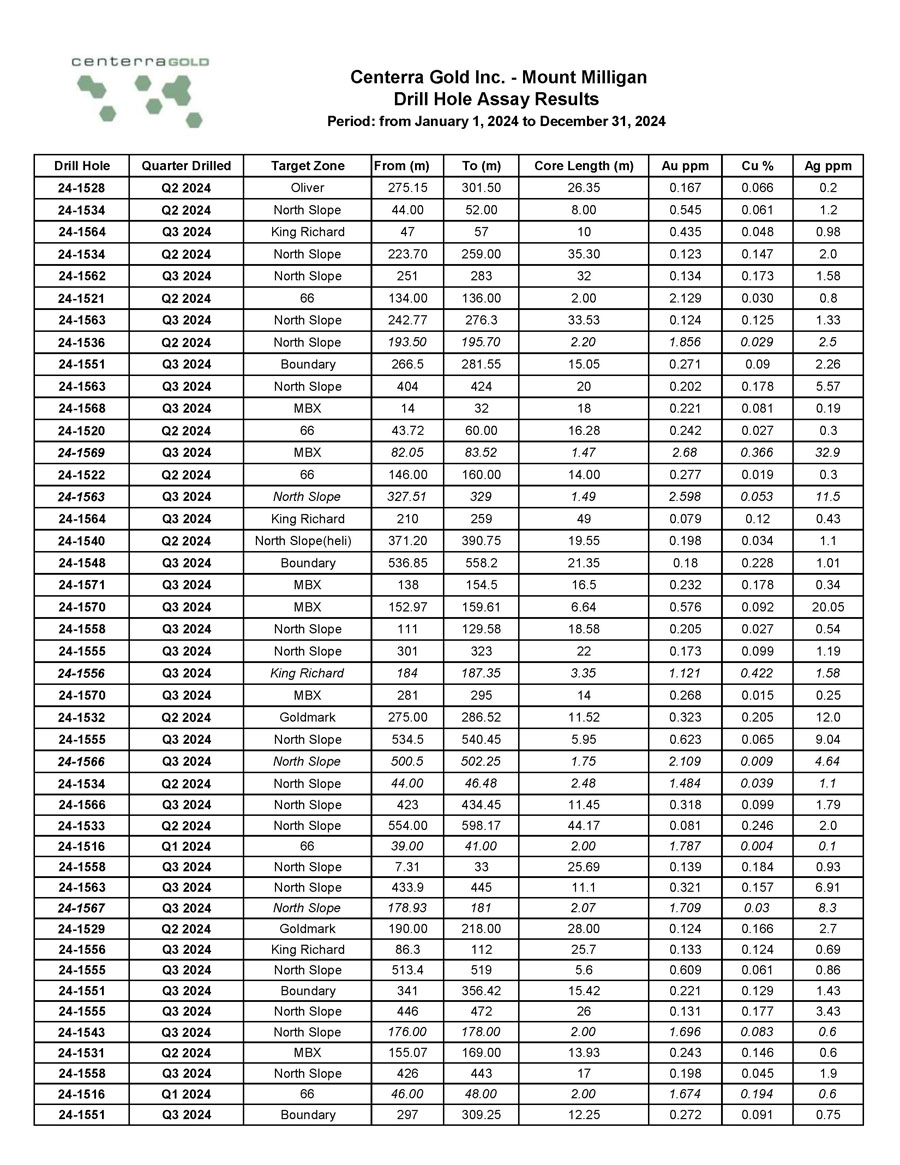

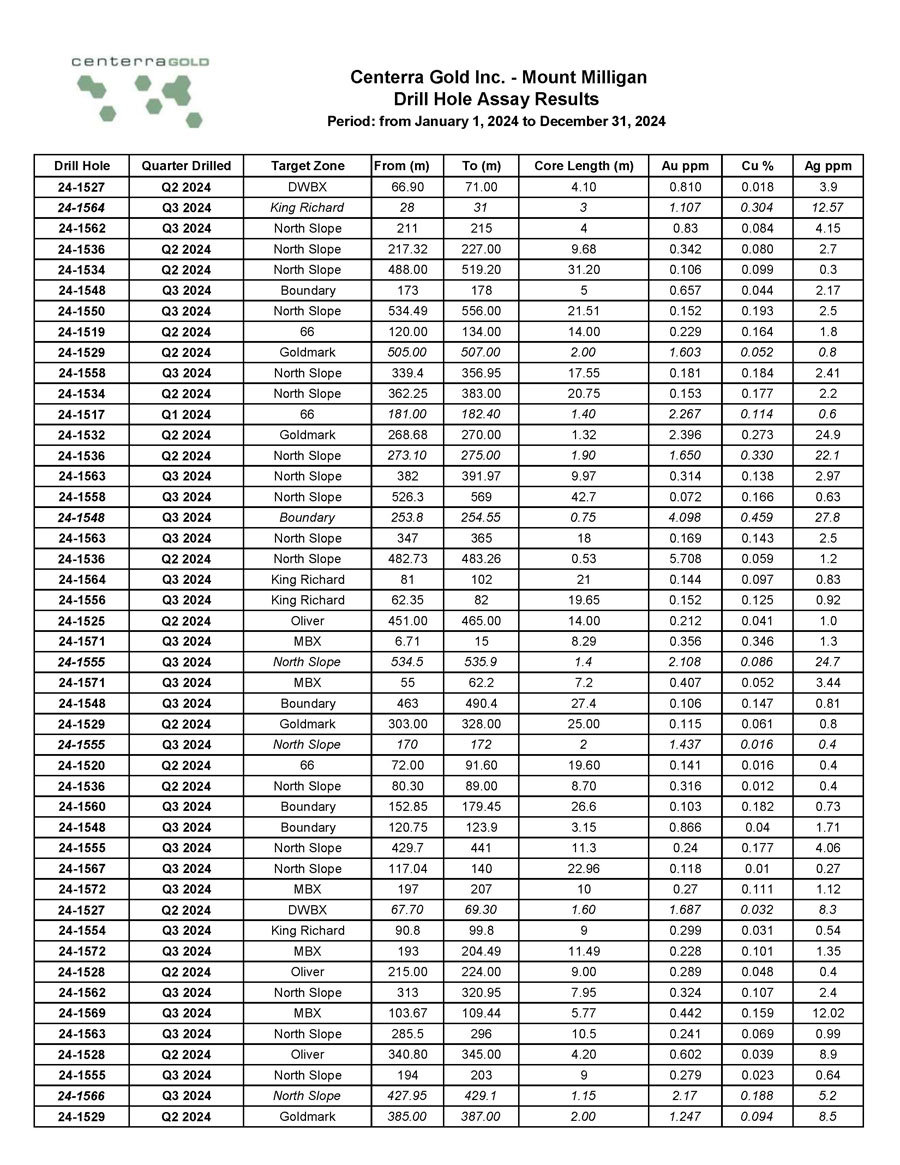

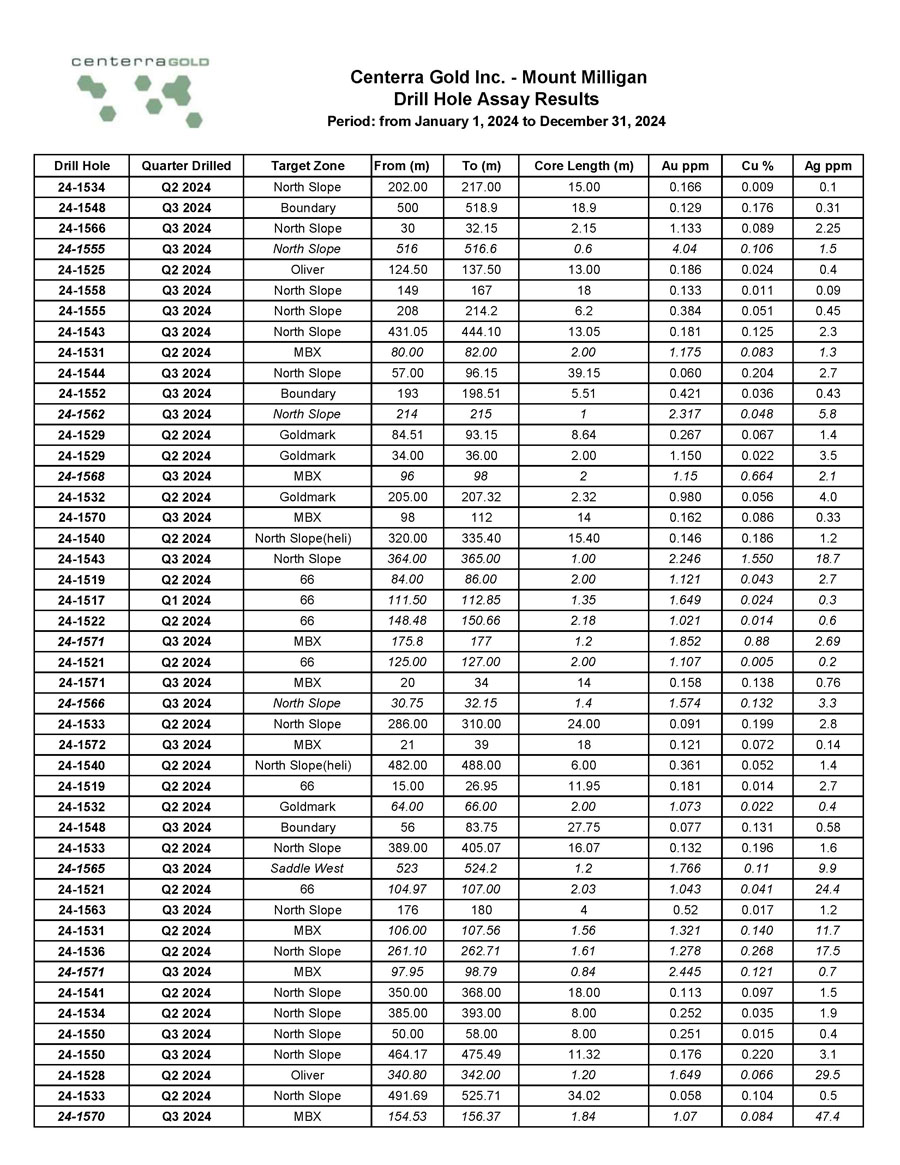

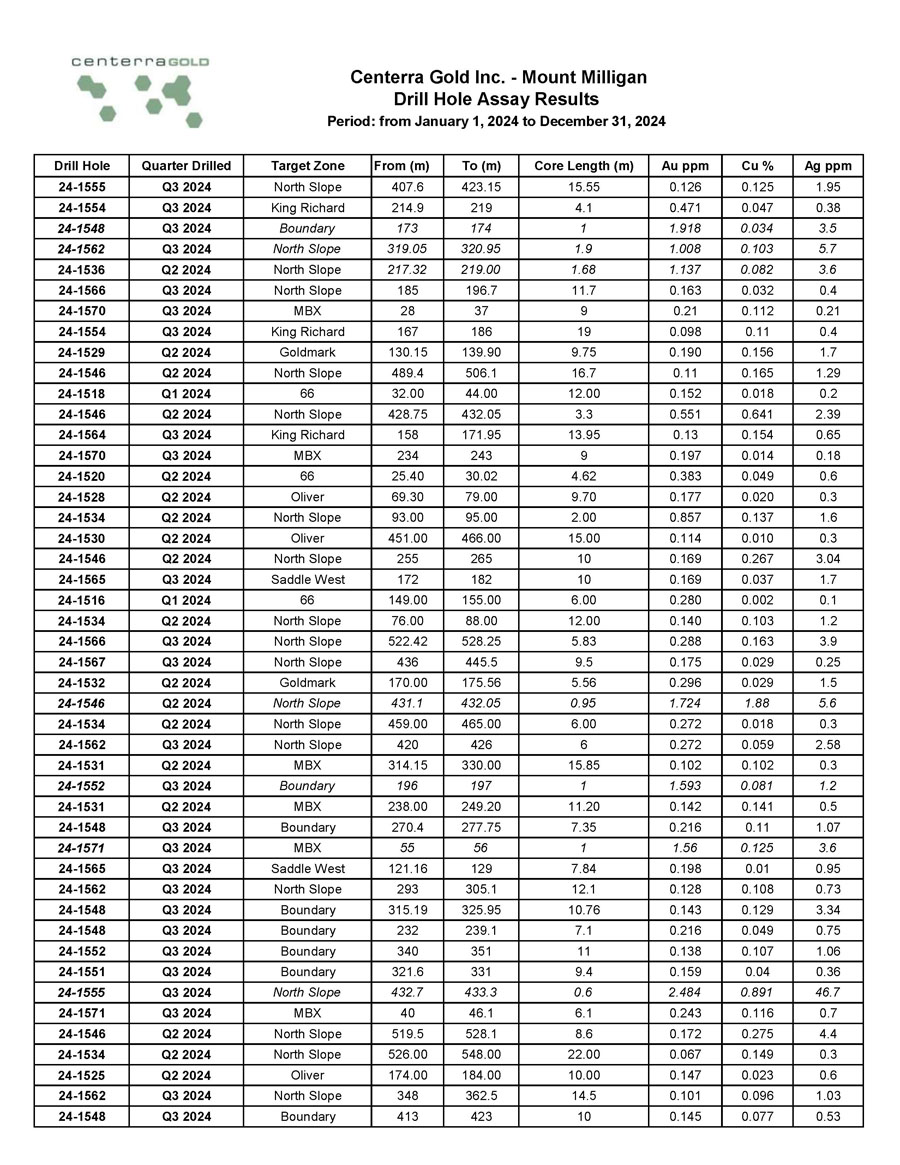

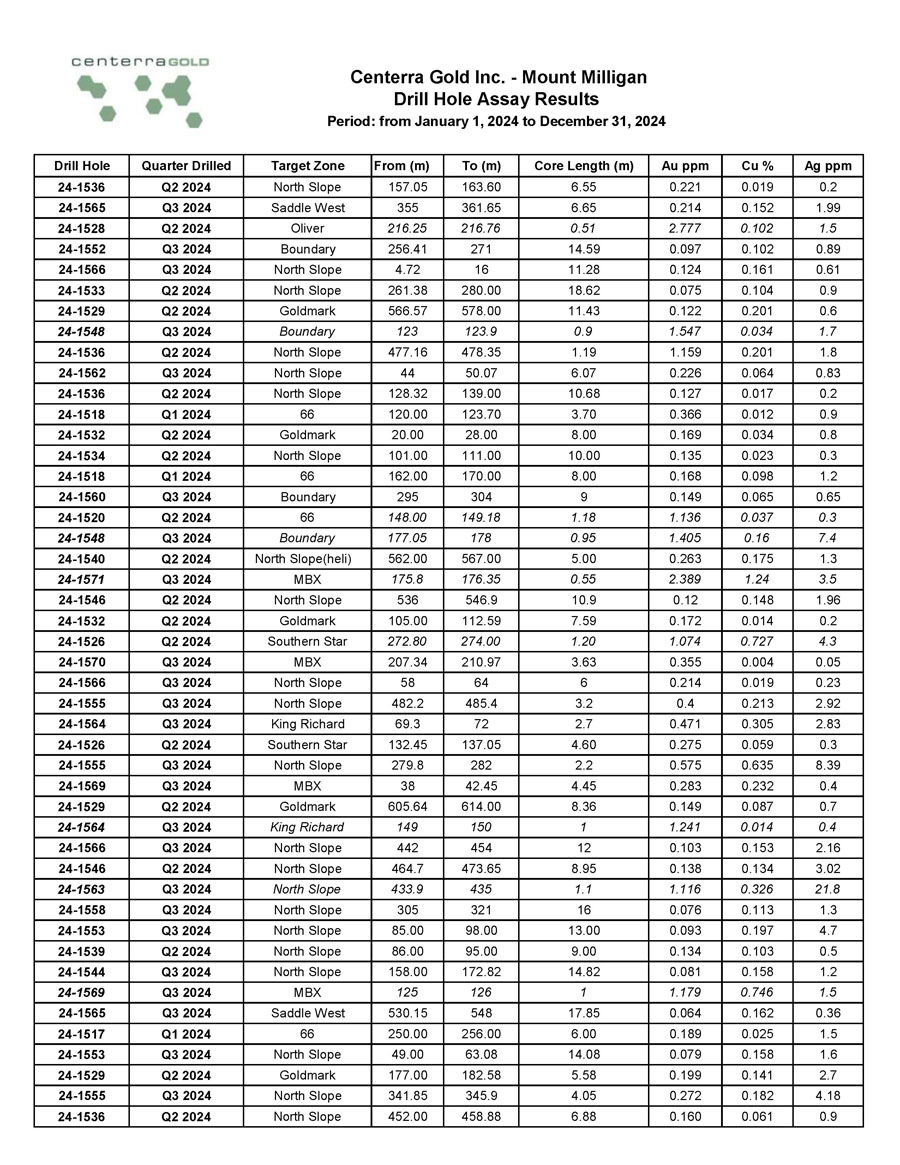

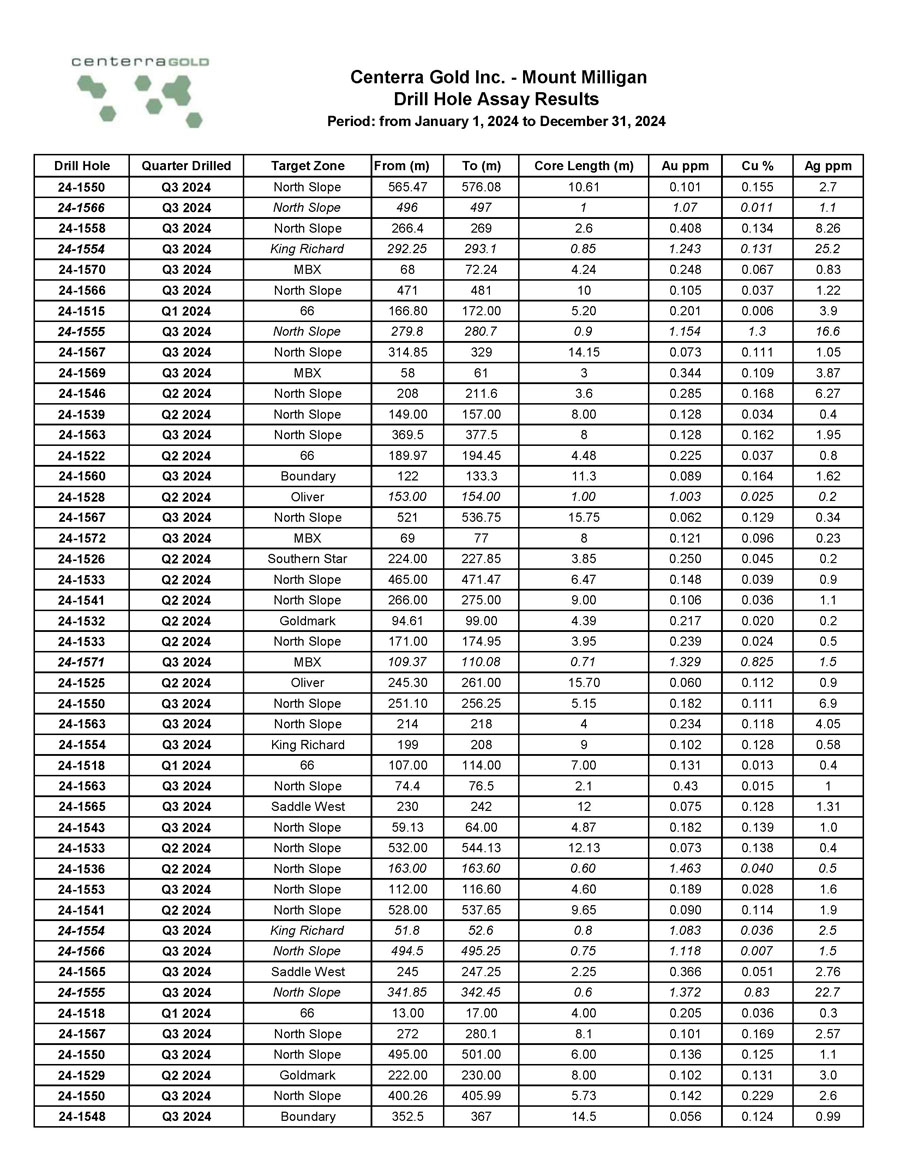

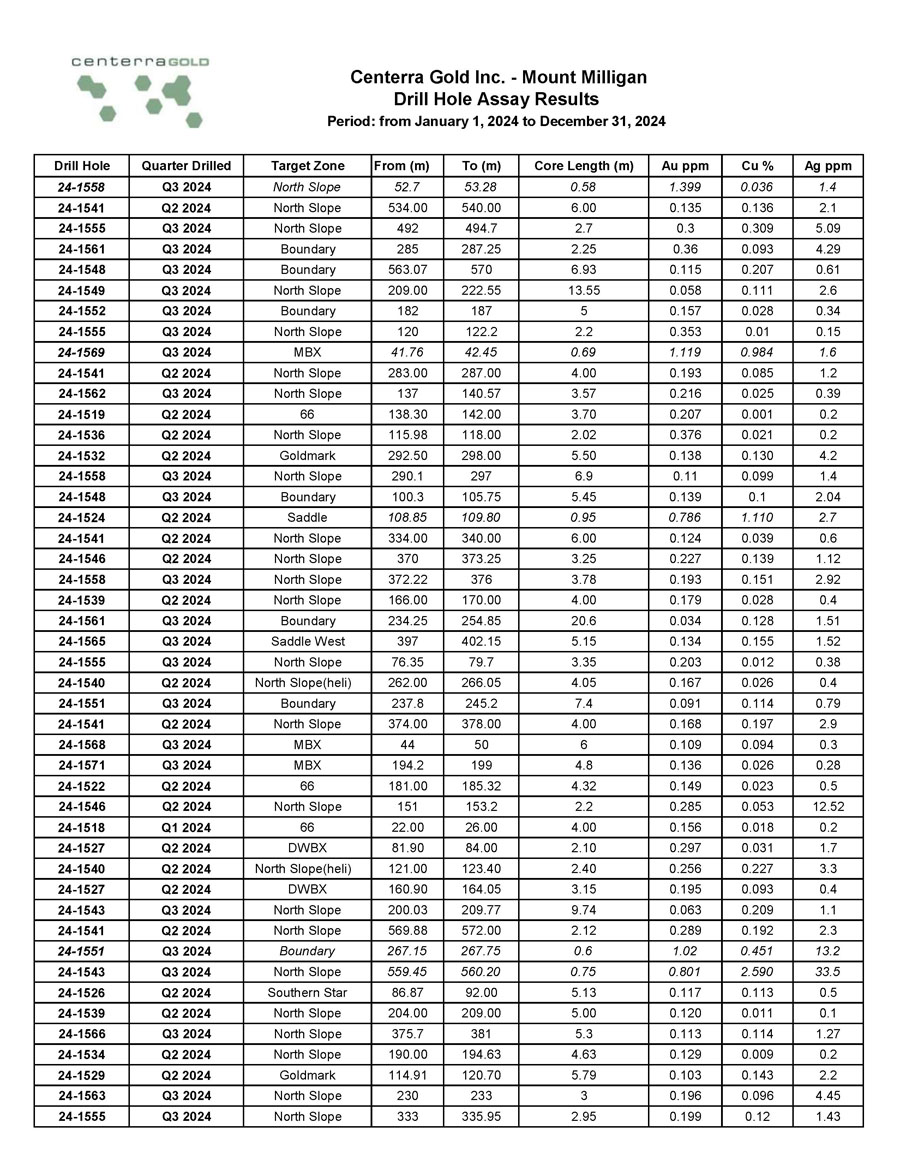

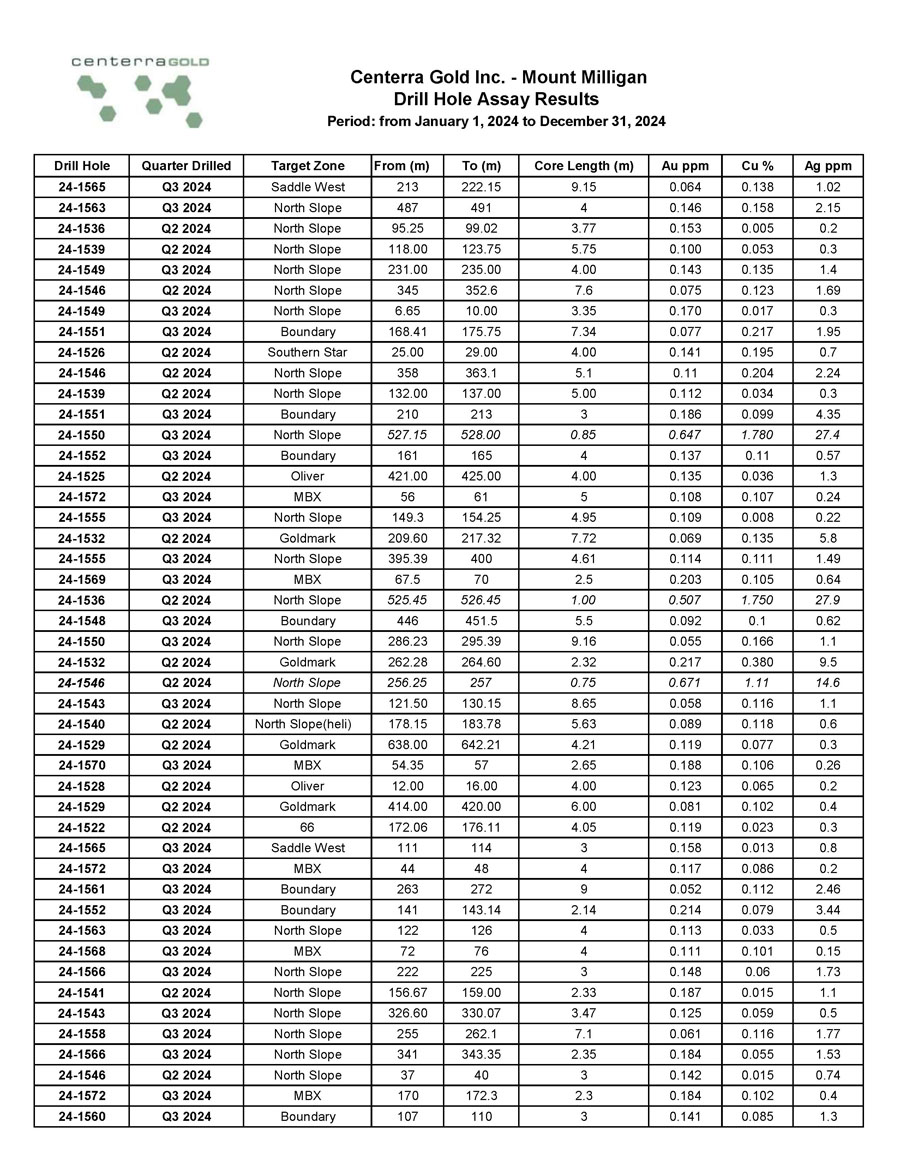

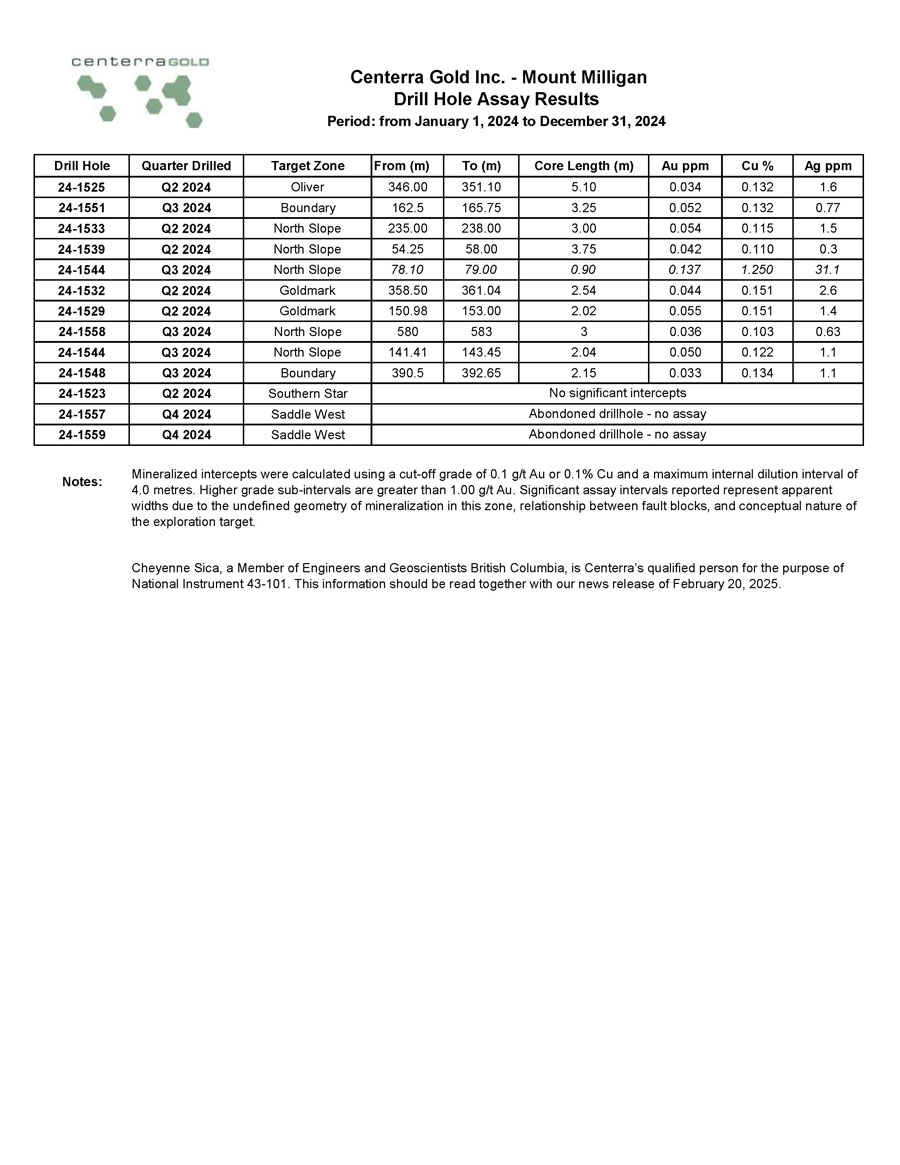

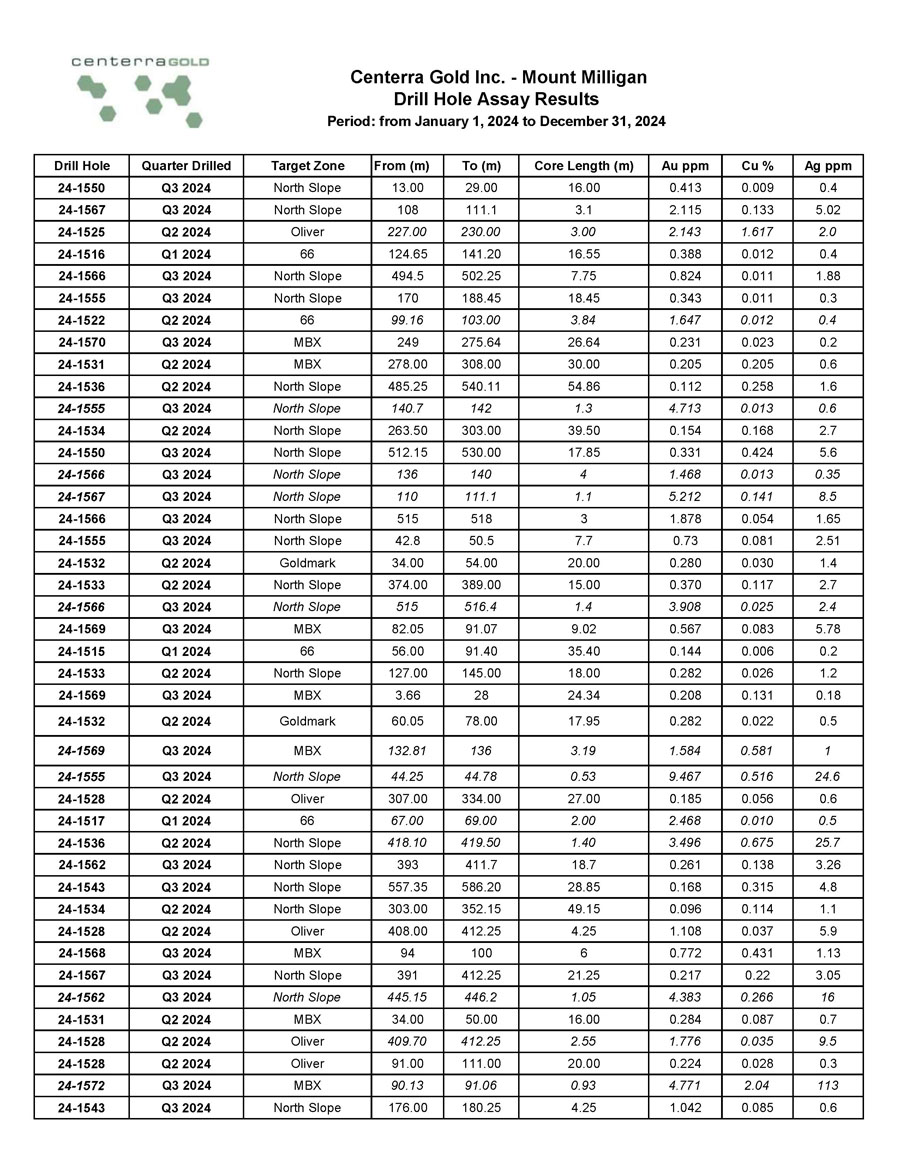

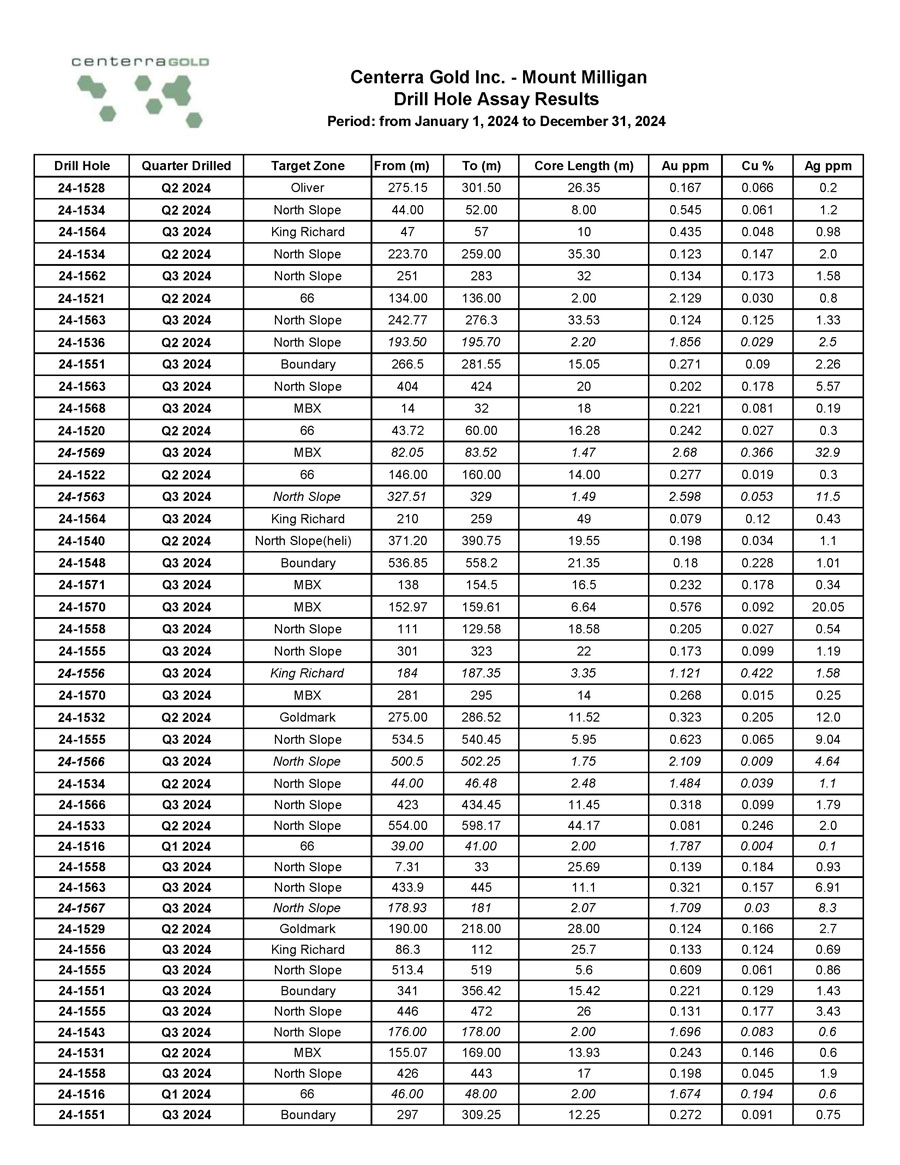

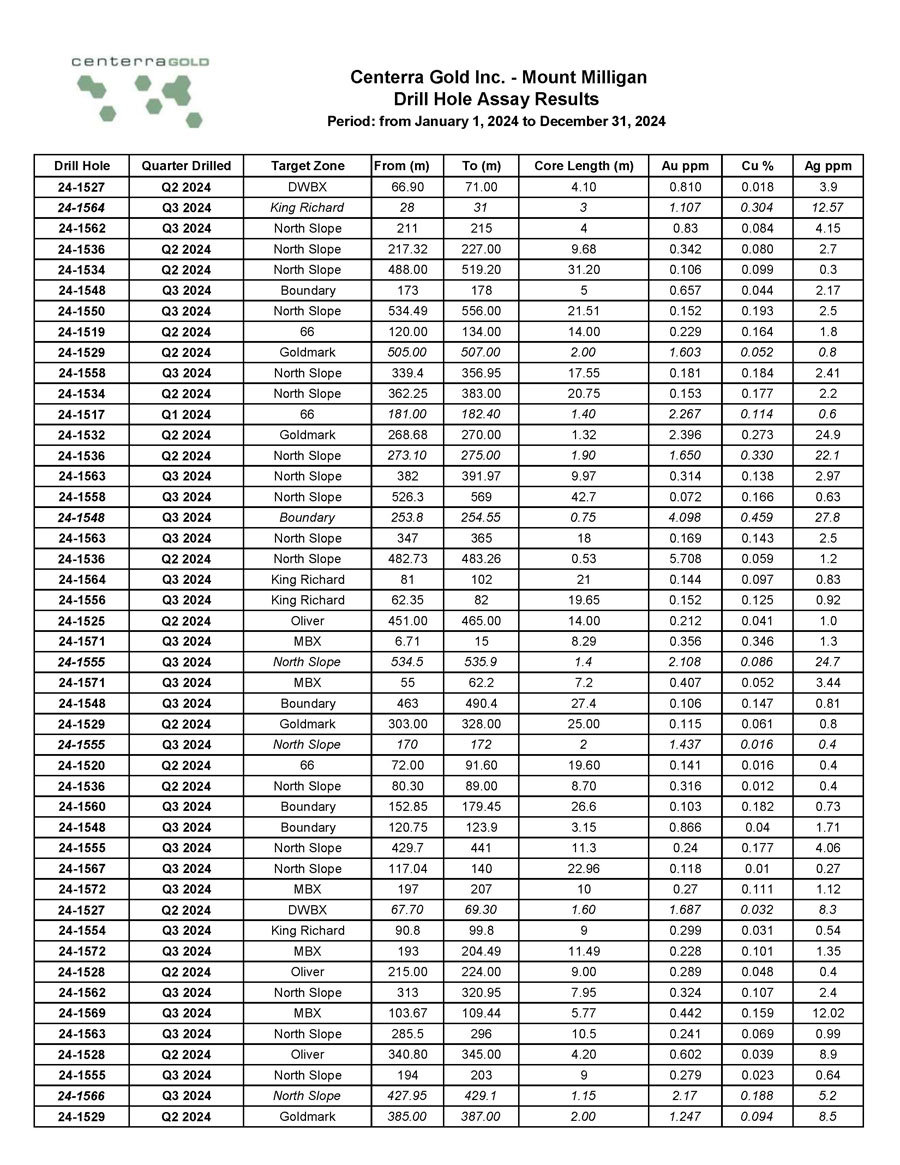

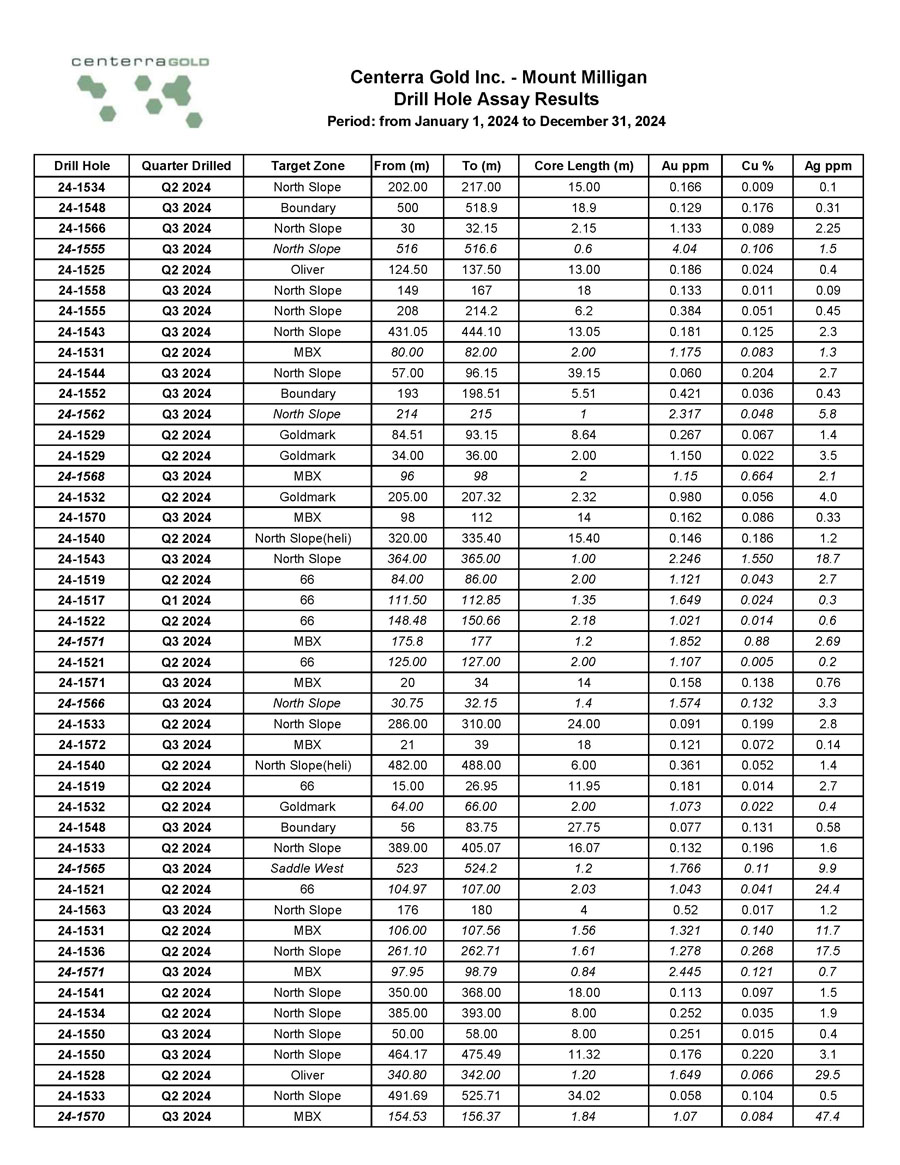

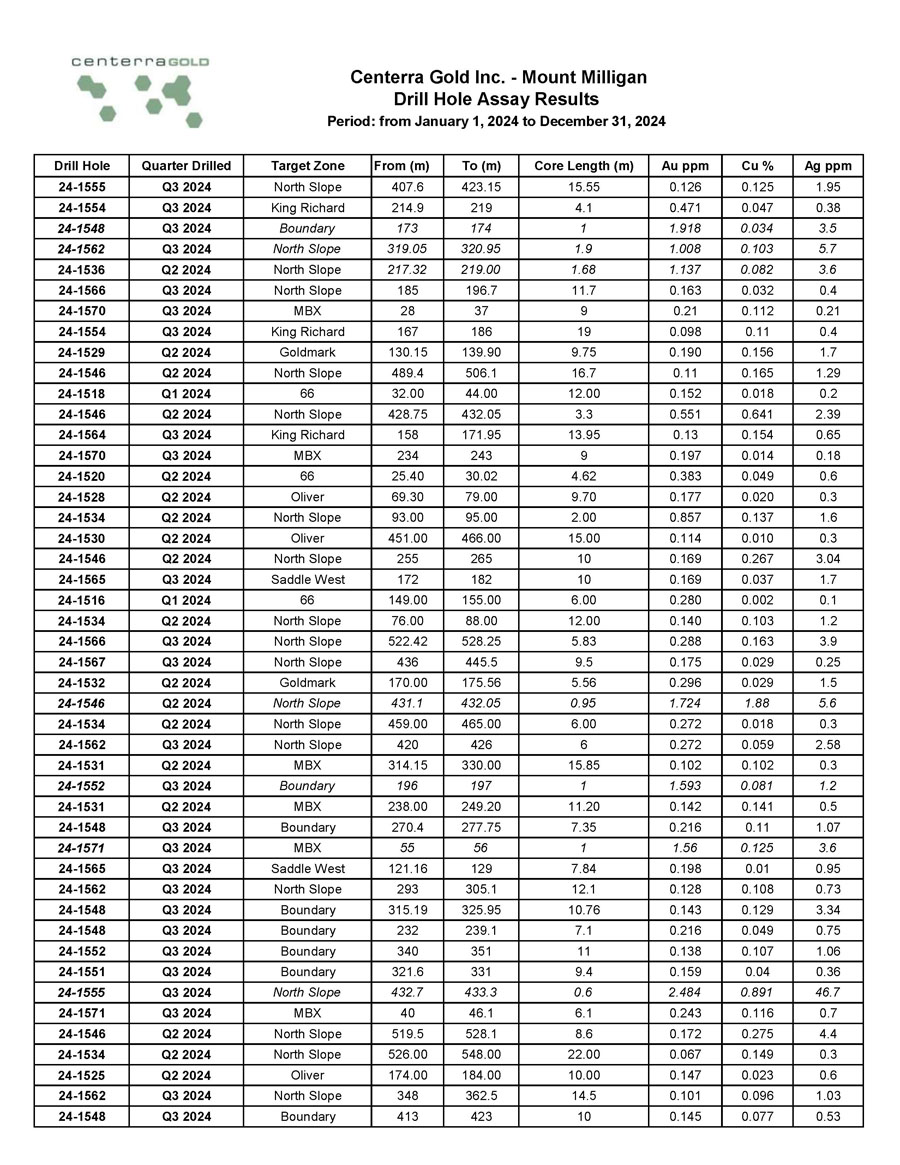

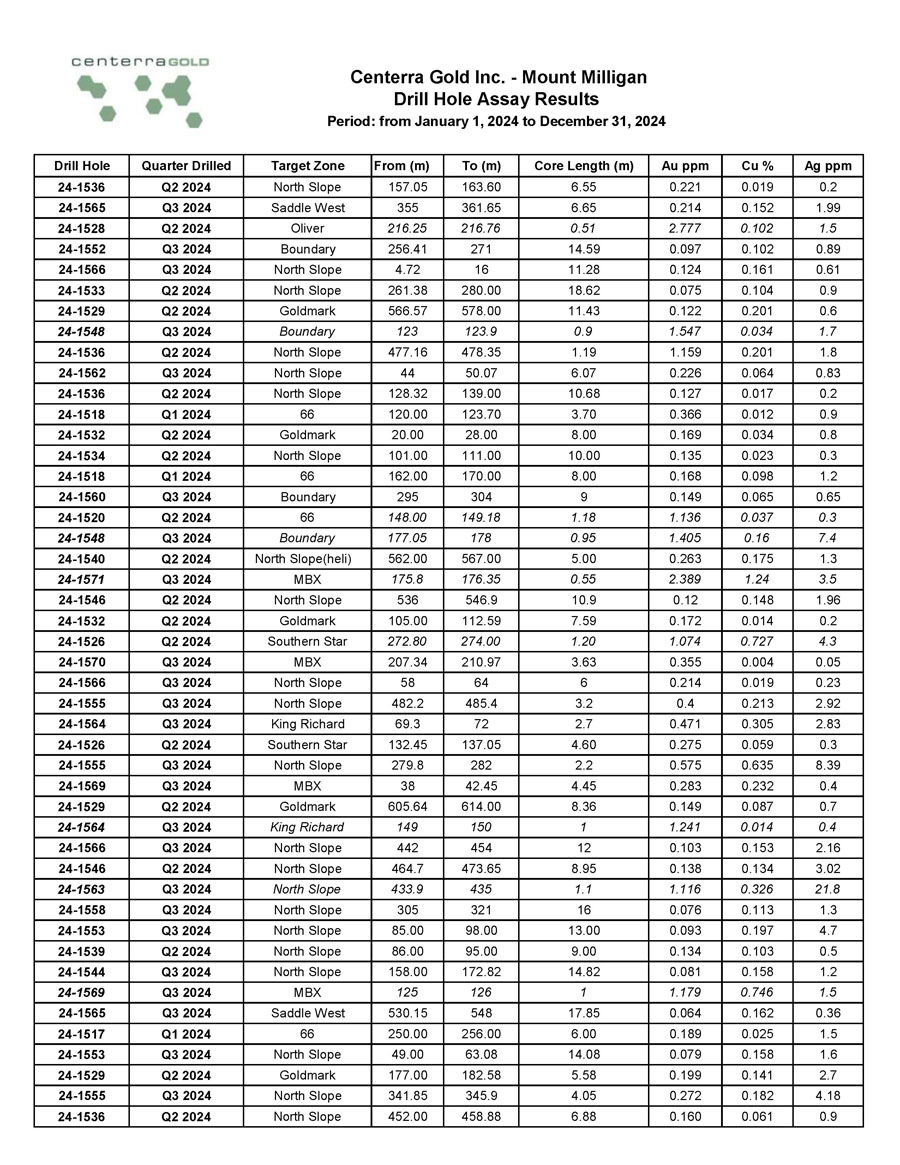

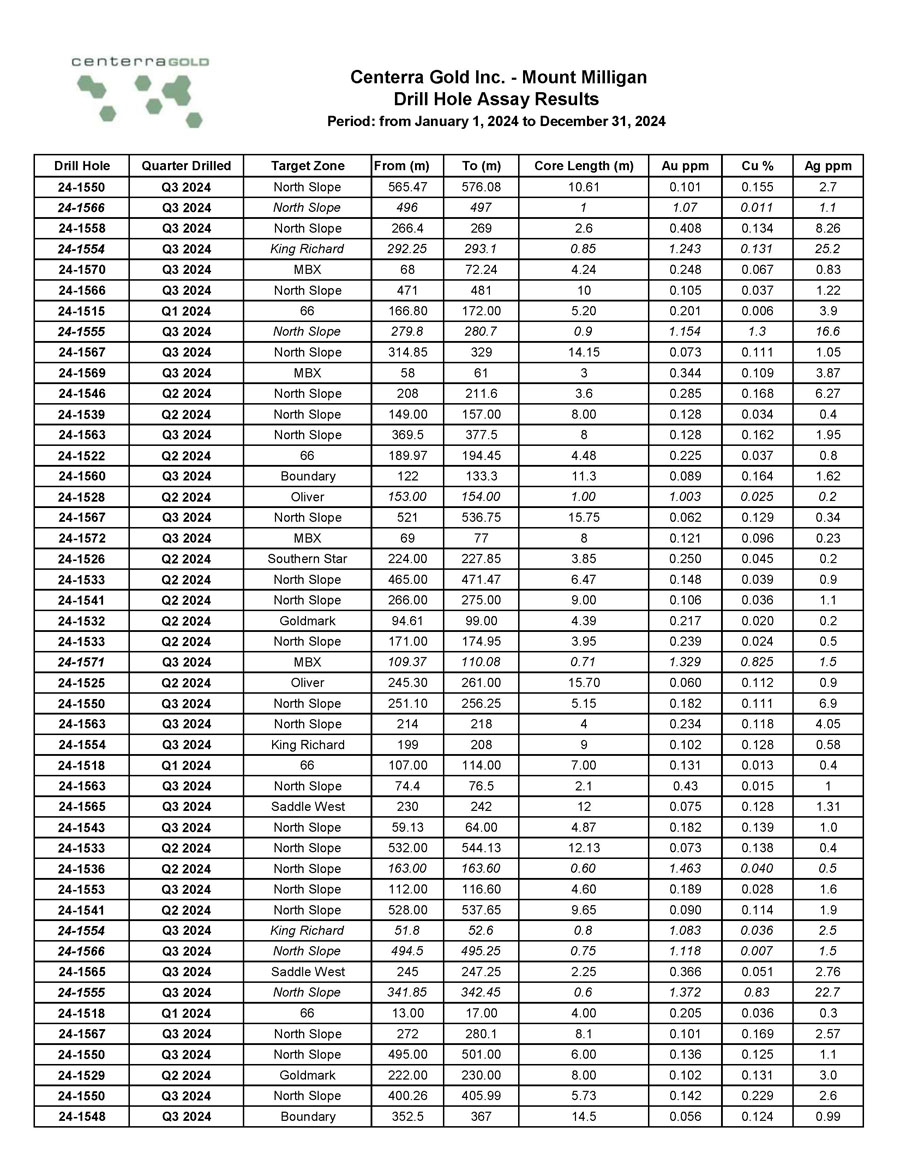

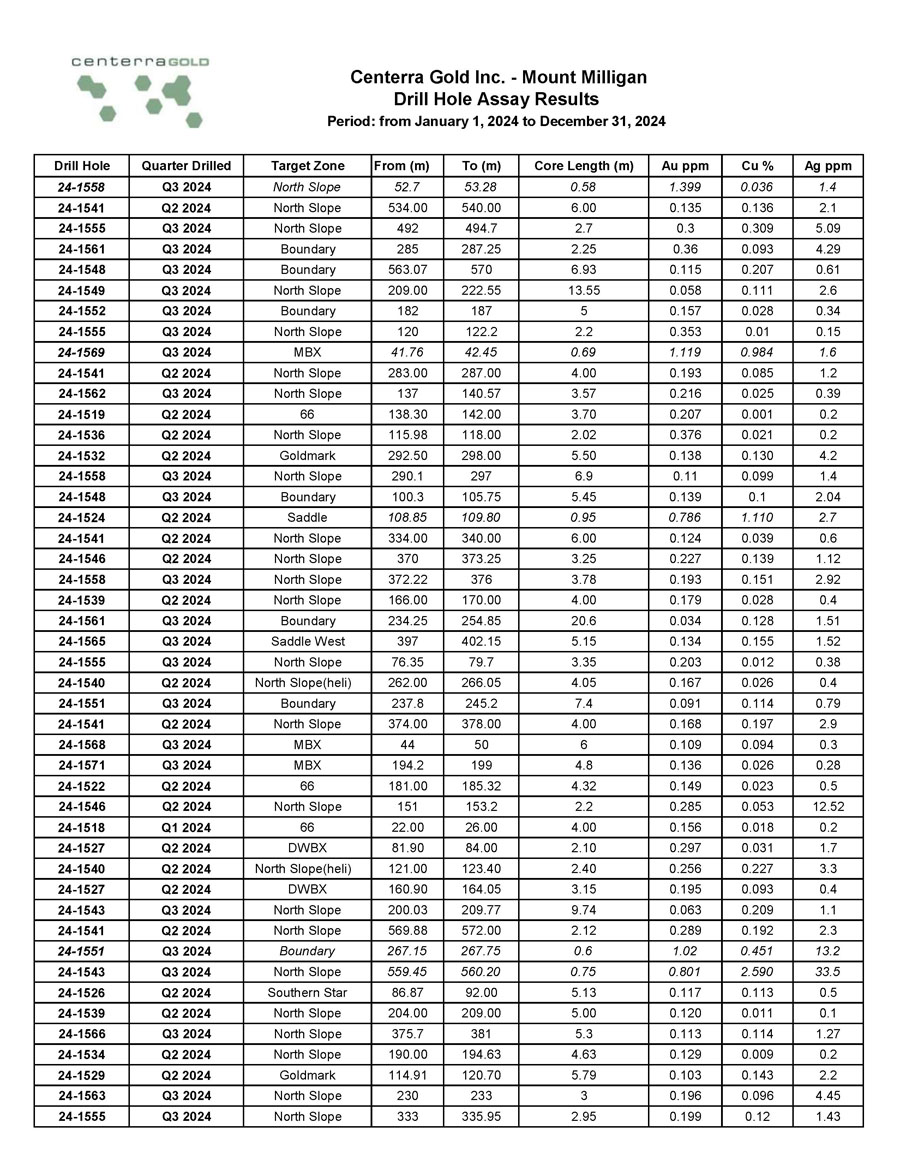

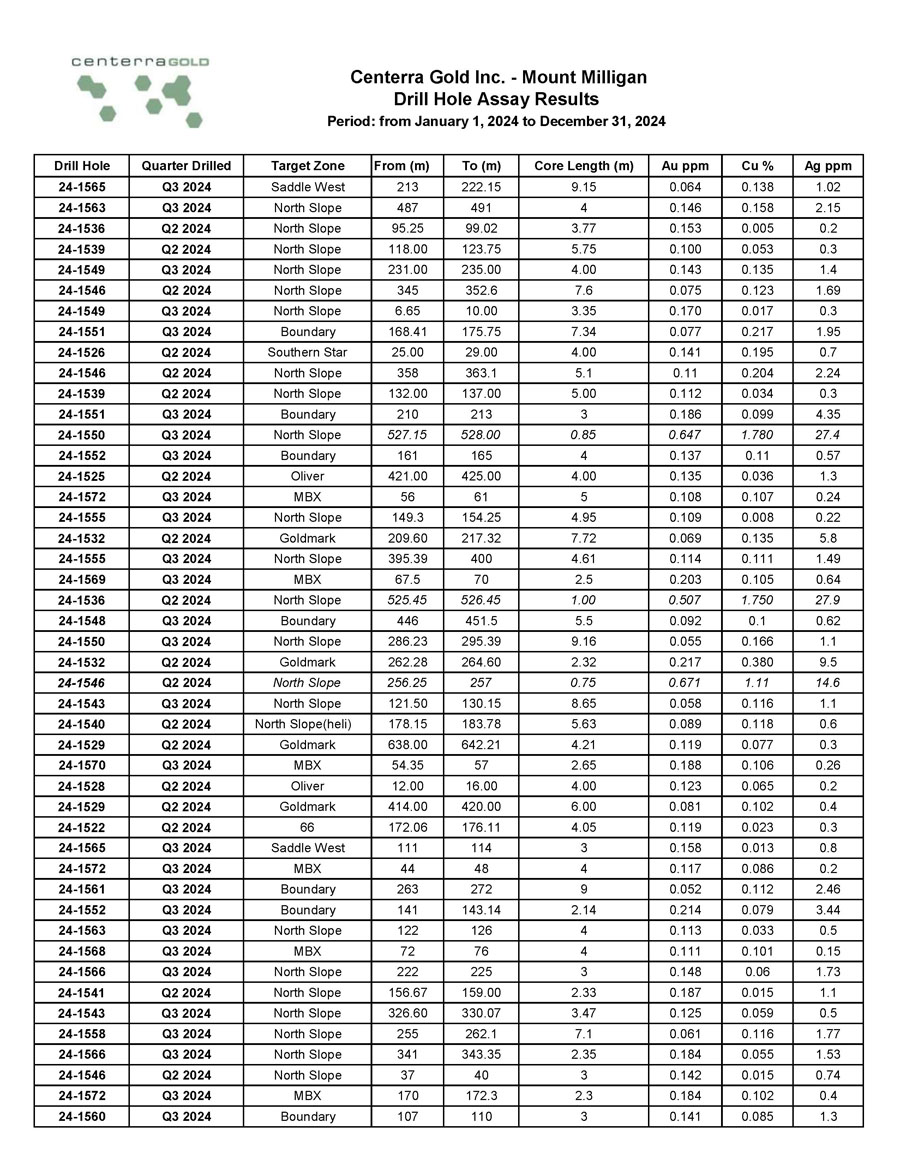

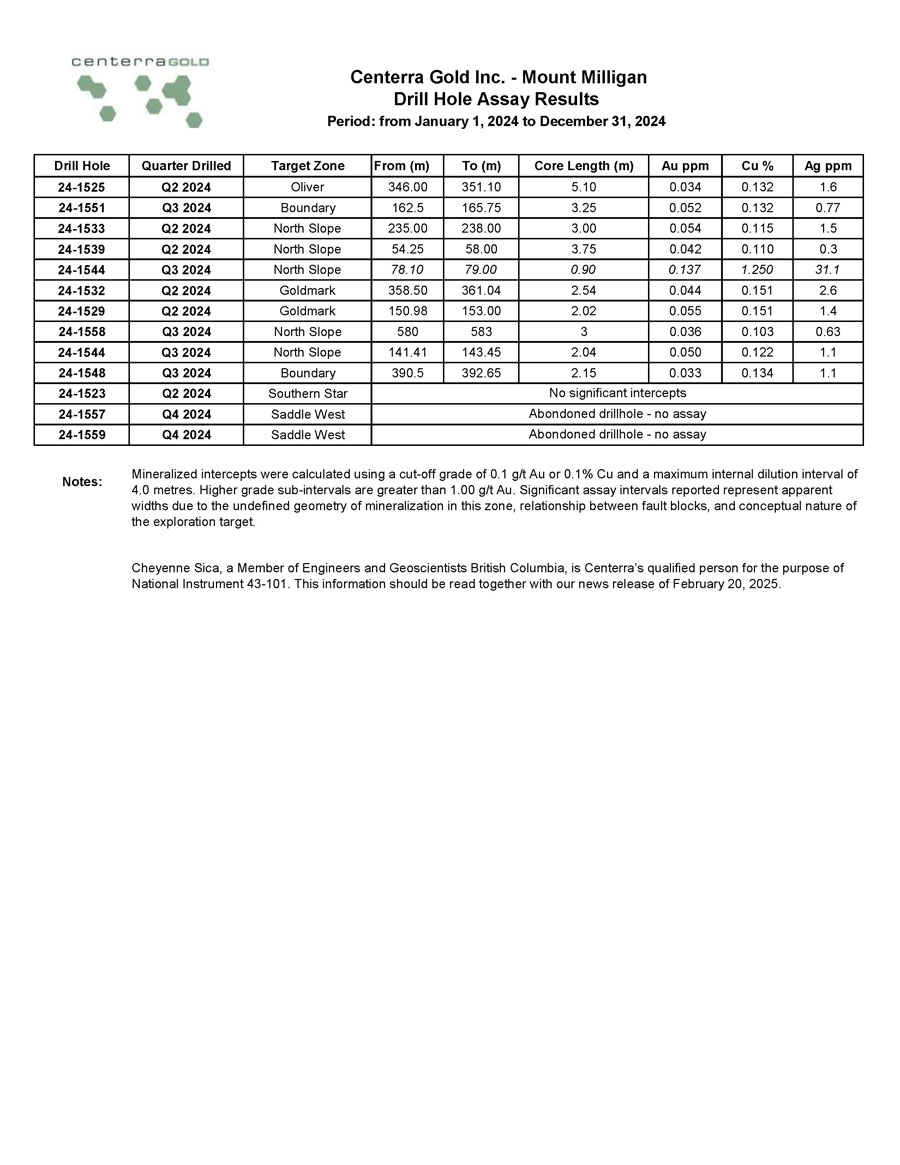

- In 2024, a total of 7,176 metres of infill drilling was completed in 25 drillholes, and 12,403 metres of brownfield exploration drilling was completed in 28 drillholes. Brownfield exploration focused on targets west of the current ultimate pit margins including the North Slope, Saddle West, and Boundary zones.

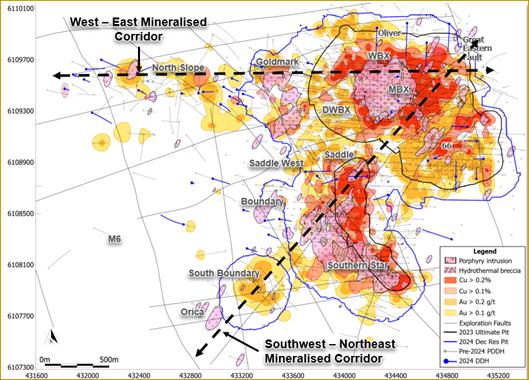

- The 2024 exploration drill results at the North Slope zone show potential for shallow as well as deep porphyry mineralization west of the ultimate pit boundary, adjacent to the Goldmark zone. Results from infill drilling in the MBX zone shows potential for resource expansion on the western pit wall margins and below the current pit boundary.

- The inclusion of all drillholes west of the Mount Milligan pit in the updated resource model resulted in the delineation of a potential satellite pit at south boundary. This area is one of the focus areas in the 2025 drilling campaign.

- Centerra continues to be encouraged by the significant mineral endowment and the potential for future resource additions at Mount Milligan. The Company is expected to invest approximately $9 to $12 million in exploration at Mount Milligan in 2025.

Mount Milligan Brownfield Drilling and Exploration

Figure 1: Plan view of Mount Milligan deposit showing 2024 resource shell.

Figure 2: Plan view of Mount Milligan deposit showing major porphyry trends.

Figure 3: East-West cross section of the Mount Milligan 2024 resource pit (looking north), showing gold and copper grade contours. The circled area is the 2025 target for infill drilling.

Figure 4: Long section view of Mount Milligan (looking northwest), showing gold and copper grade contours. Circled areas represent target areas for the 2025 infill drill program.

Figure 5: Plan view of Mt. Milligan showing the 2025 planned drilling program. Bright red holes are phase 1 priority holes intended to be completed by the end of the first quarter 2025. Drilling started in January 2025.

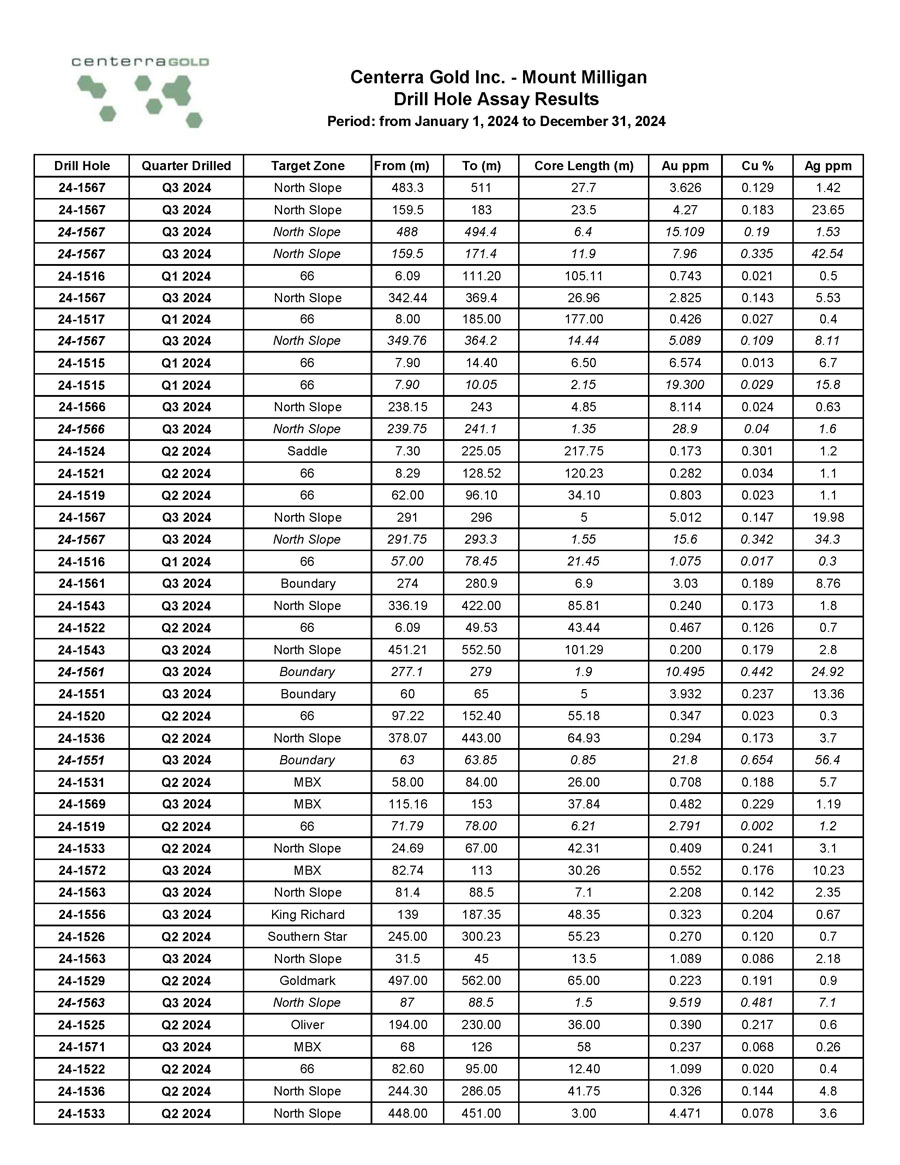

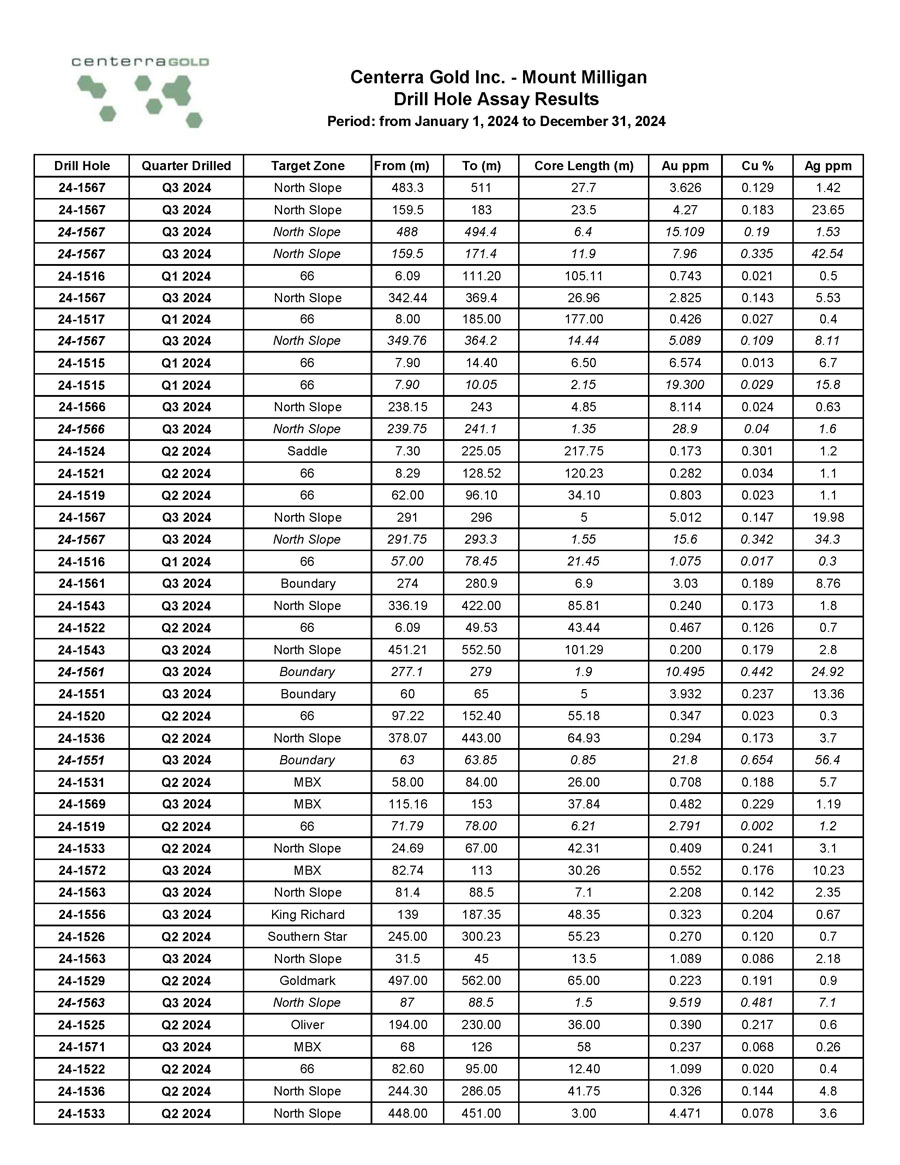

The DWBX zone is the depth extension of the WBX porphyry-style gold-copper mineralisation currently mined in the pit. Mineralization is associated with potassic alteration and early quartz veins within the DWBX stock and stock margins. Near surface and south of the DWBX is the King Richard zone. Results received to-date show the potential to extend the open pit to mine DWBX, King Richard, and DWBX Extension. Some selected significant results received during the year include:

Hole #24-1531: 26.0m @ 0.71 g/t Au, 0.188% Cu from 58m

Hole #24-1569: 37.8m @ 0.48 g/t Au, 0.229% Cu from 115m

Hole #24-1572: 30.3m @ 0.55 g/t Au, 0.176% Cu from 83m

Hole #24-1556: 48.4m @ 0.32 g/t Au, 0.204% Cu from 139m

Hole #24-1571: 58.0m @ 0.24 g/t Au, 0.068% Cu from 68m

Hole #24-1556: 83.8m @ 0.15 g/t Au, 0.127% Cu from 214m

Hole #24-1554: 73.0m @ 0.16 g/t Au, 0.168% Cu from 248m

Hole #24-1564: 18.7m @ 0.60 g/t Au, 0.161% Cu from 21m

The Goldmark zone is directly west of the current Mount Milligan pit design, situated above the high grade DWBX zone. In 2024, drilling continued to test the western extent of the Goldmark mineralisation that had been intersected in previous drill programs. Shallow porphyry-style gold and copper mineralisation is hosted at the margins of dykes and the Goldmark stock. High gold-low copper (“HGLC”) style mineralisation occurs throughout the zone. The results show potential for shallow resource additions and the extension of mineralisation west of the existing pit boundary. Significant results include:

Hole #24-1529: 65.0m @ 0.22 g/t Au, 0.191% Cu from 497m

Hole #24-1529: 19.2m @ 0.41 g/t Au, 0.038% Cu from 370m

Hole #24-1532: 20.0m @ 0.28 g/t Au, 0.030% Cu from 34m

Hole #24-1532: 11.5m @ 0.32 g/t Au, 0.205% Cu from 275m

The North Slope zone is approximately 1.5 kilometres west of the western margins of the existing pit boundary. Assays show multiple localized shallow zones of mineralisation related to the North Slope stock, with higher-grade porphyry-style gold and copper mineralization intersected near surface and at depth. Significant results include:

Hole #24-1533: 42.3m @ 0.41 g/t Au, 0.241% Cu from 25m

Hole #24-1533: 3.0m @ 4.47 g/t Au, 0.078% Cu from 448m

Hole #24-1536: 41.8m @ 0.33 g/t Au, 0.144% Cu from 244m

Hole #24-1536: 68.6m @ 0.16 g/t Au, 0.172% Cu from 305m

Hole #24-1536: 64.9m @ 0.29 g/t Au, 0.173% Cu from 378m

Hole #24-1543: 85.8m @ 0.24 g/t Au, 0.173% Cu from 336m

Hole #24-1543: 101.3m @ 0.20 g/t Au, 0.179% Cu from 451m

Hole #24-1563: 7.1m @ 2.21 g/t Au, 0.142% Cu from 81m

Hole #24-1563: 13.5m @ 1.09 g/t Au, 0.086% Cu from 32m

Hole #24-1566: 4.9m @ 8.11 g/t Au, 0.024% Cu from 238m

Hole #24-1566: 40.0m @ 0.33 g/t Au, 0.012% Cu from 136m

Hole #24-1567: 23.5m @ 4.27 g/t Au, 0.183% Cu from 160m

Hole #24-1567: 5.0m @ 5.01 g/t Au, 0.147% Cu from 291m

Hole #24-1567: 27.0m @ 2.83 g/t Au, 0.143% Cu from 342m

Hole #24-1567: 27.7m @ 3.63 g/t Au, 0.129% Cu from 483m

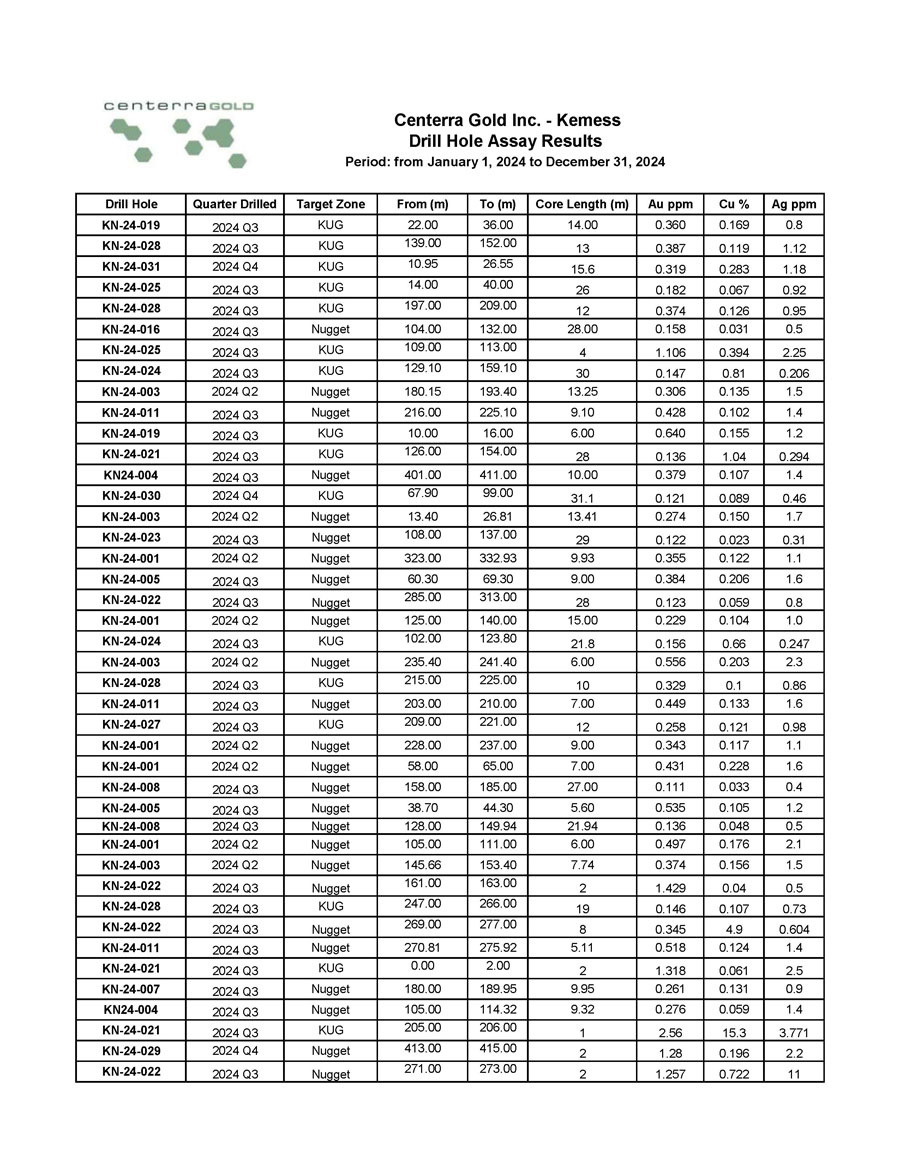

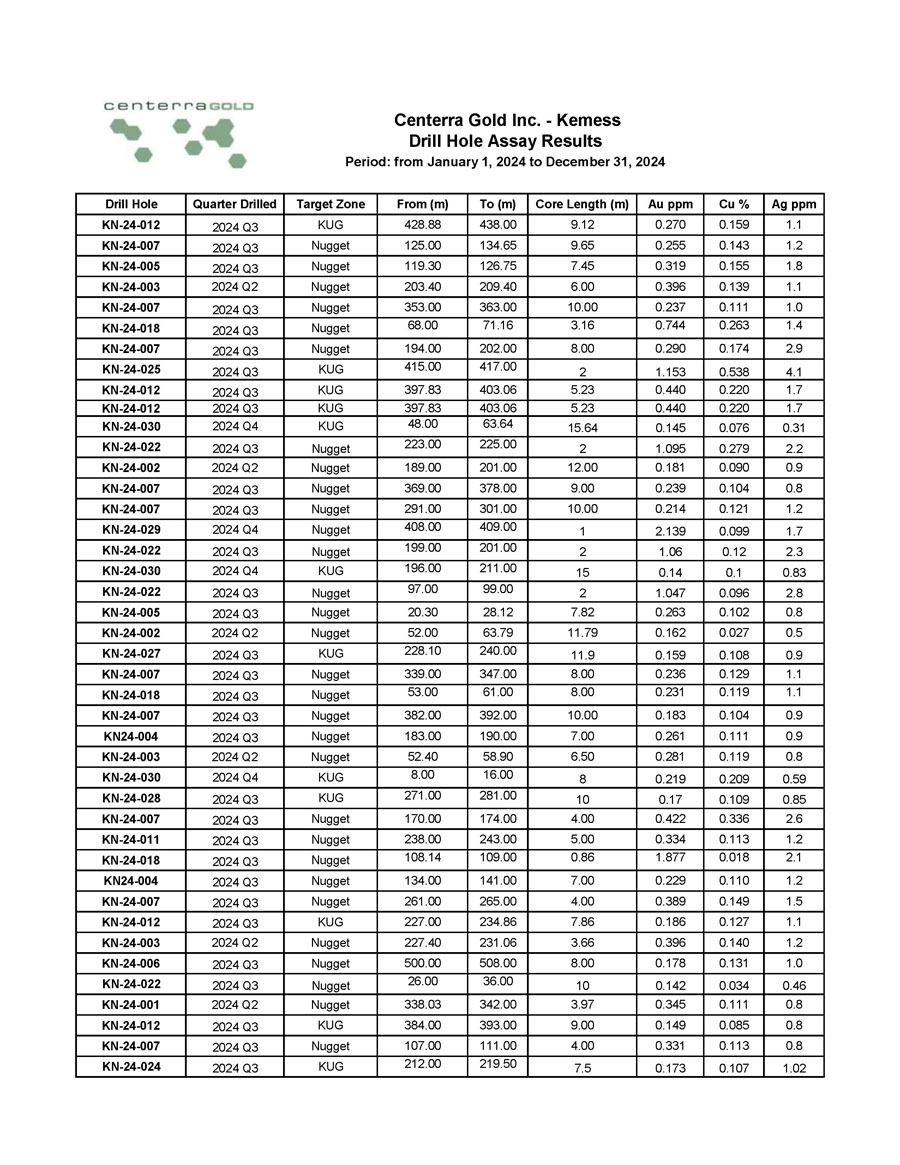

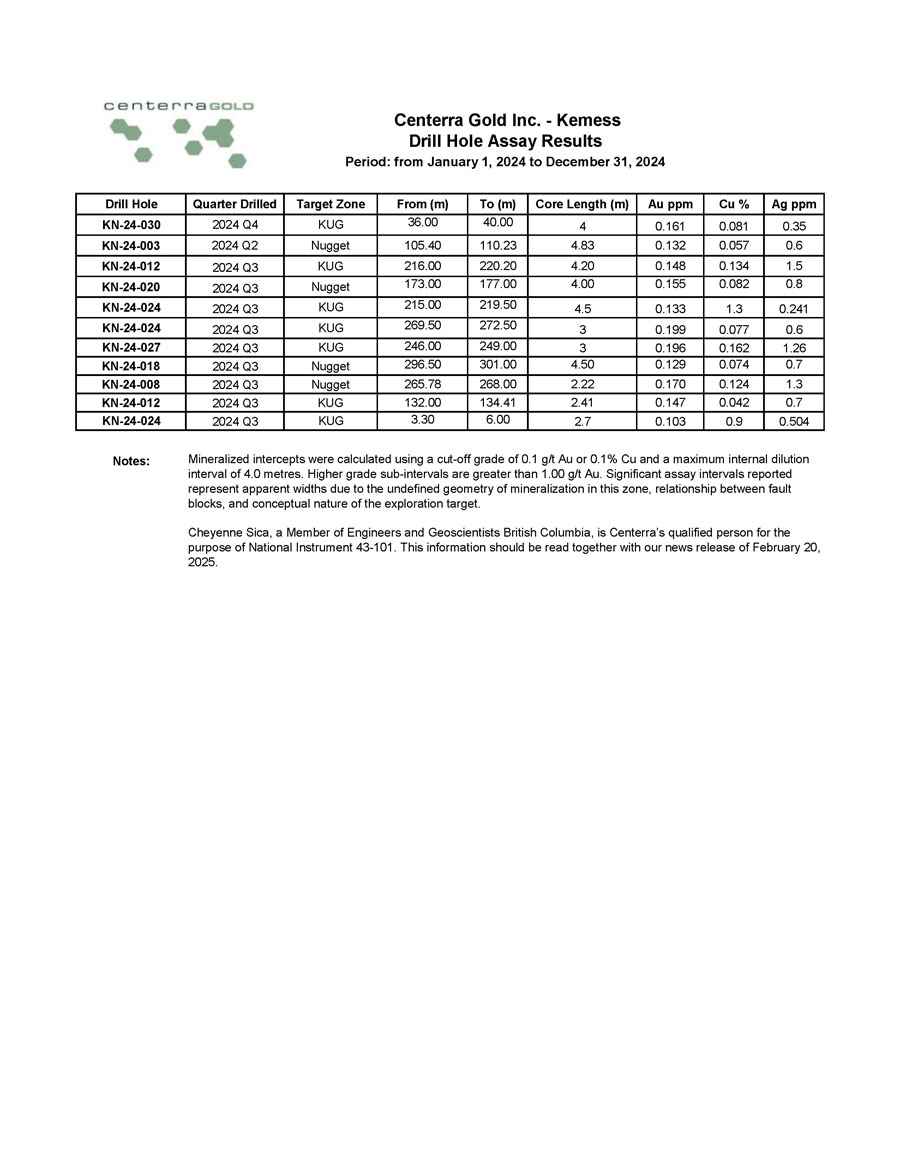

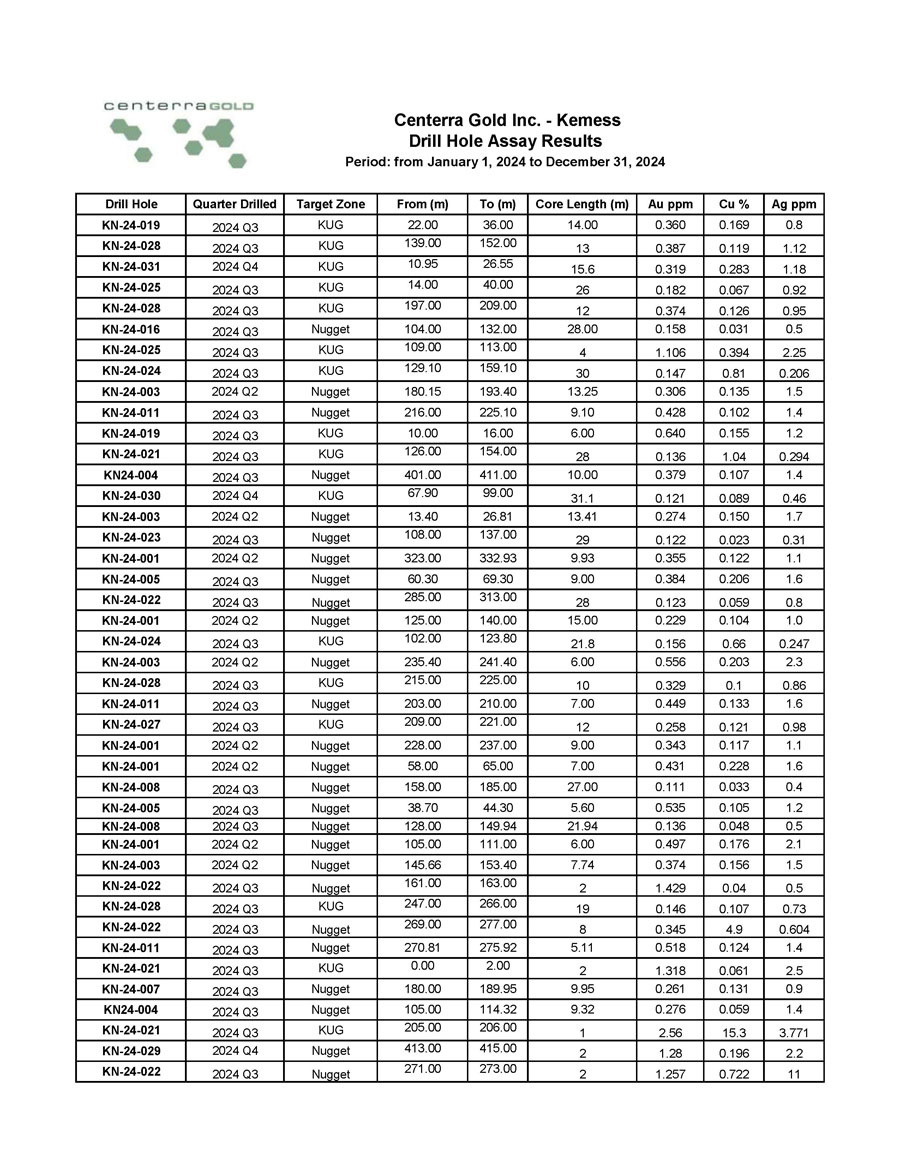

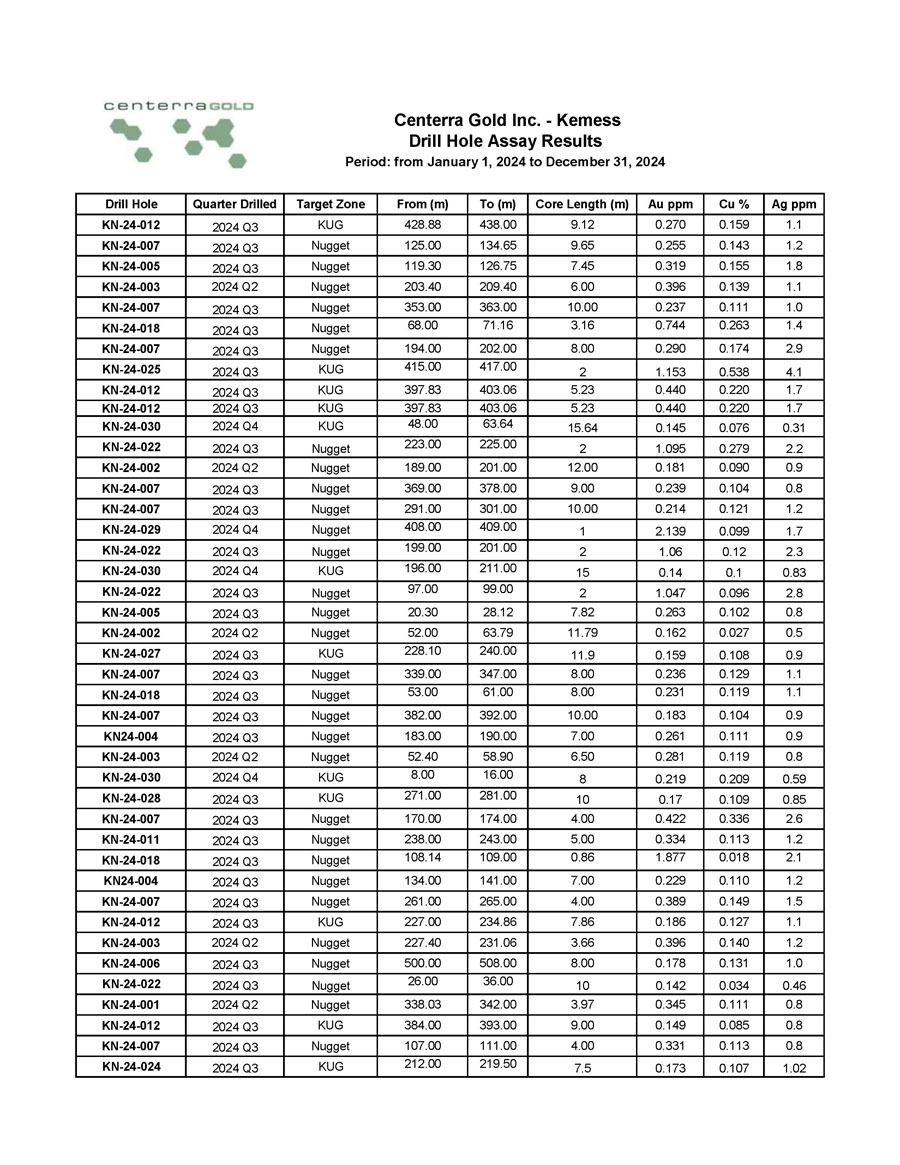

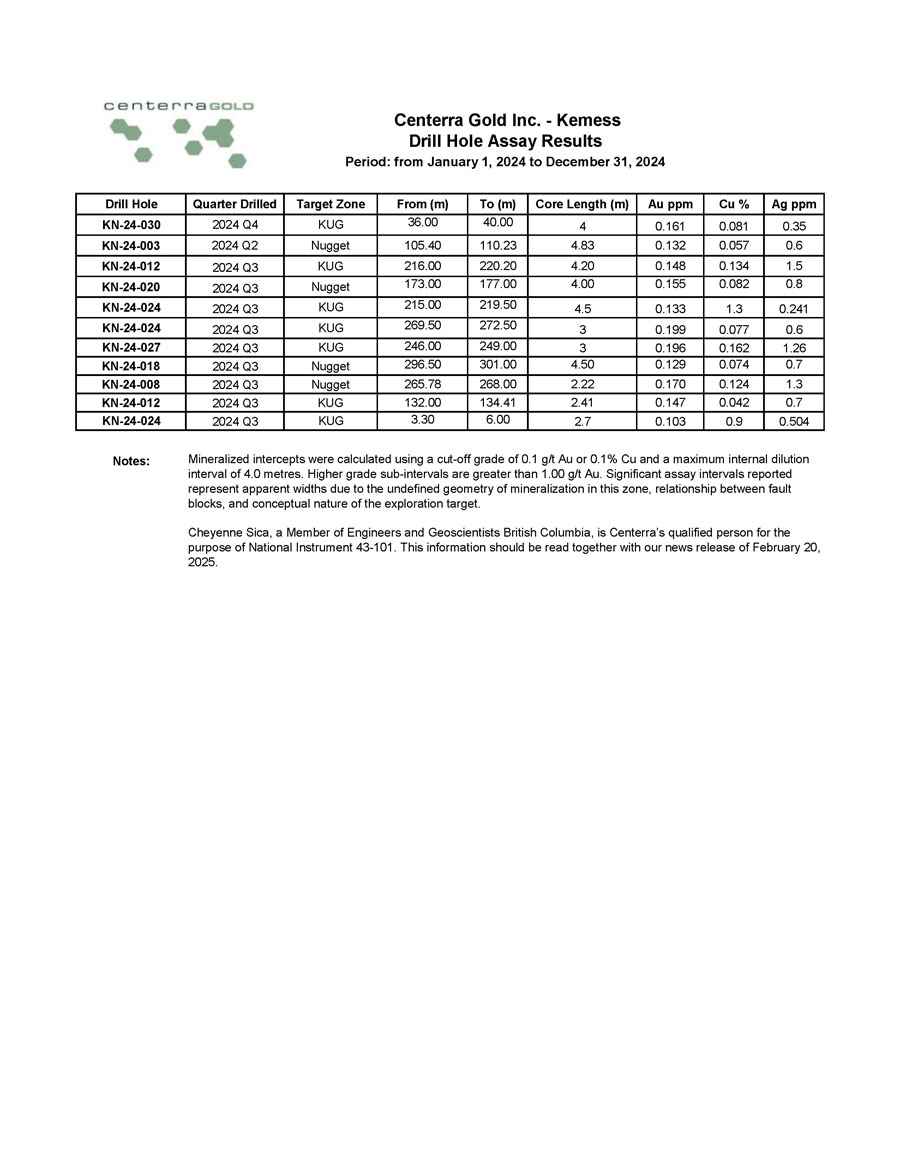

Kemess Project

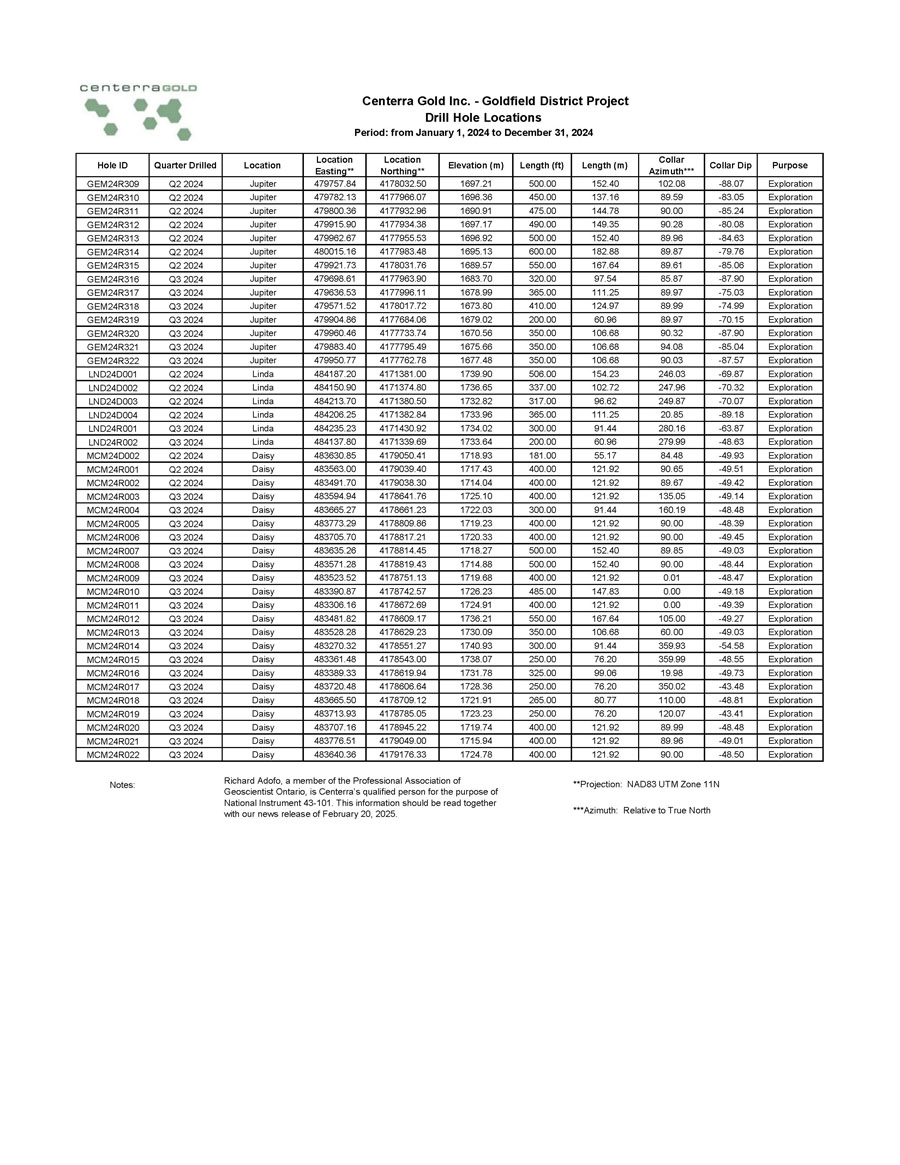

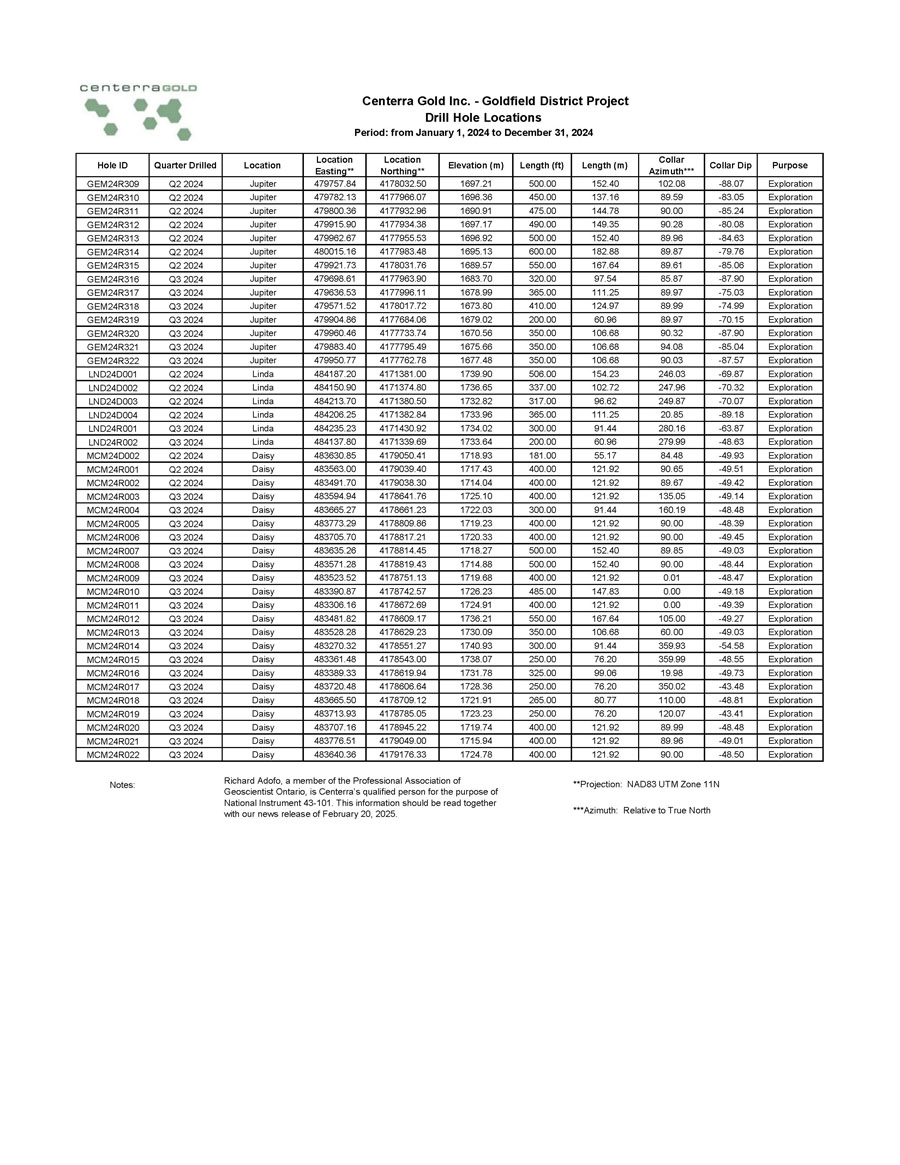

- In 2024, 11,430 metres of core drilling was completed in 31 drillholes. These drillholes are expected to be incorporated into an updated mineral resource in the second quarter of 2025.

- The 2024 drill program targeted the area between the known mineralization at Nugget and the upper portion of the Kemess Underground zones. Significant drill intersections were received, confirming that the mineralization continues approximately five kilometres along strike.

- Geologic modeling and a preliminary resource estimate show continuous mineralization between the Nugget and Kemess North zone areas, which is expected to be the focus for the 2025 drill program. The program aims to upgrade inferred resources to indicated reserves and also to test, and potentially, confirm high grade mineralization in the deep Kemess offset zone.

- Centerra is encouraged by the large mineralization at Kemess and believes that it can be a future source of gold and copper production with a long mine life.

Some of the significant 2024 results include:

Hole #KN-24-013: 435m @ 0.43g/t Au, 0.23% Cu from 172m

Hole #KN-24-013: 402m @ 0.42g/t Au, 0.20% Cu from 47m

Hole #KN-24-017: 382m @ 0.38g/t Au, 0.19% Cu from 8m

Hole #KN-24-014: 342m @ 0.35g/t Au, 0.07% Cu from 56m

Hole #KN-24-019: 341m @ 0.34g/t Au, 0.16% Cu from 4m

Hole #KN-24-021: 311m @ 0.37g/t Au, 0.18% Cu from 0m

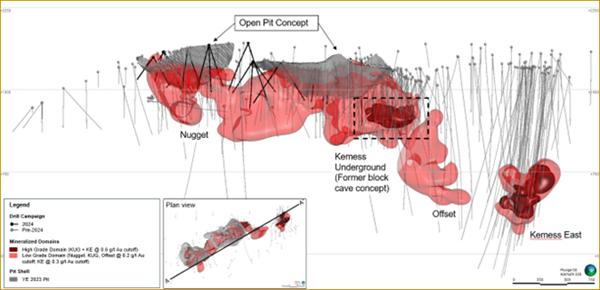

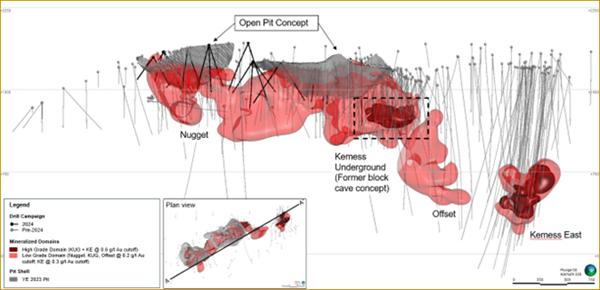

Figure 6: A long sectional view of the Kemes deposit showing a 0.2 g/t Au shell. The areas previously studied for a potential block cave mining scenario are shown within the dotted areas. The 2023 conceptual optimized pit is shown in grey.

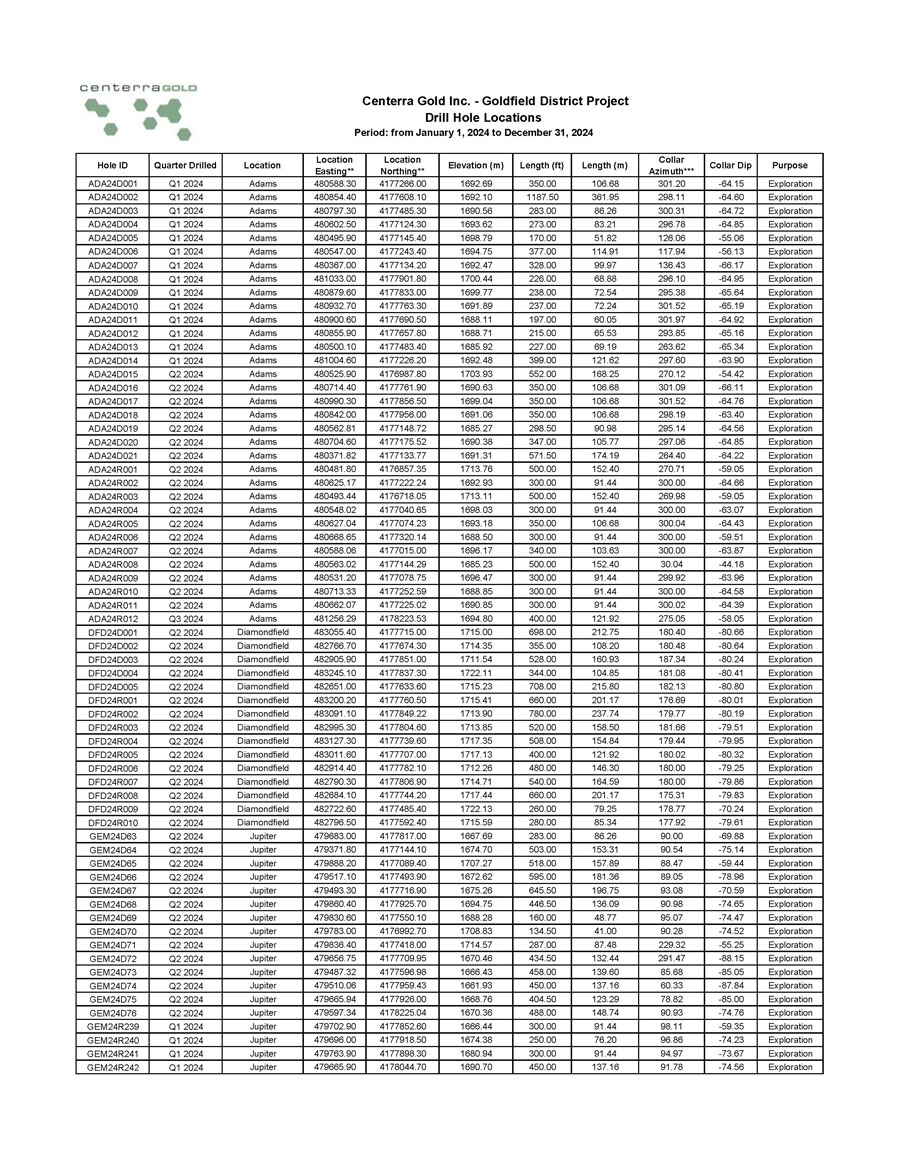

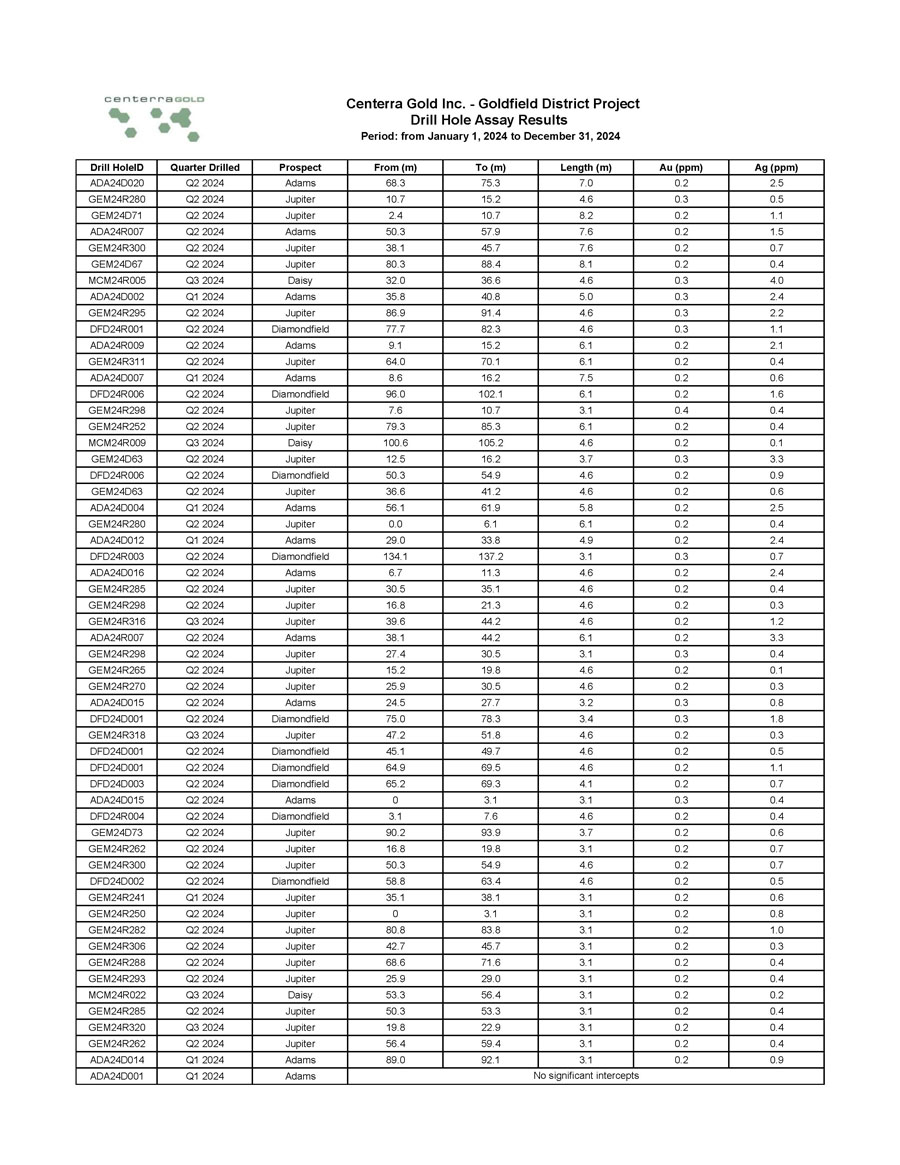

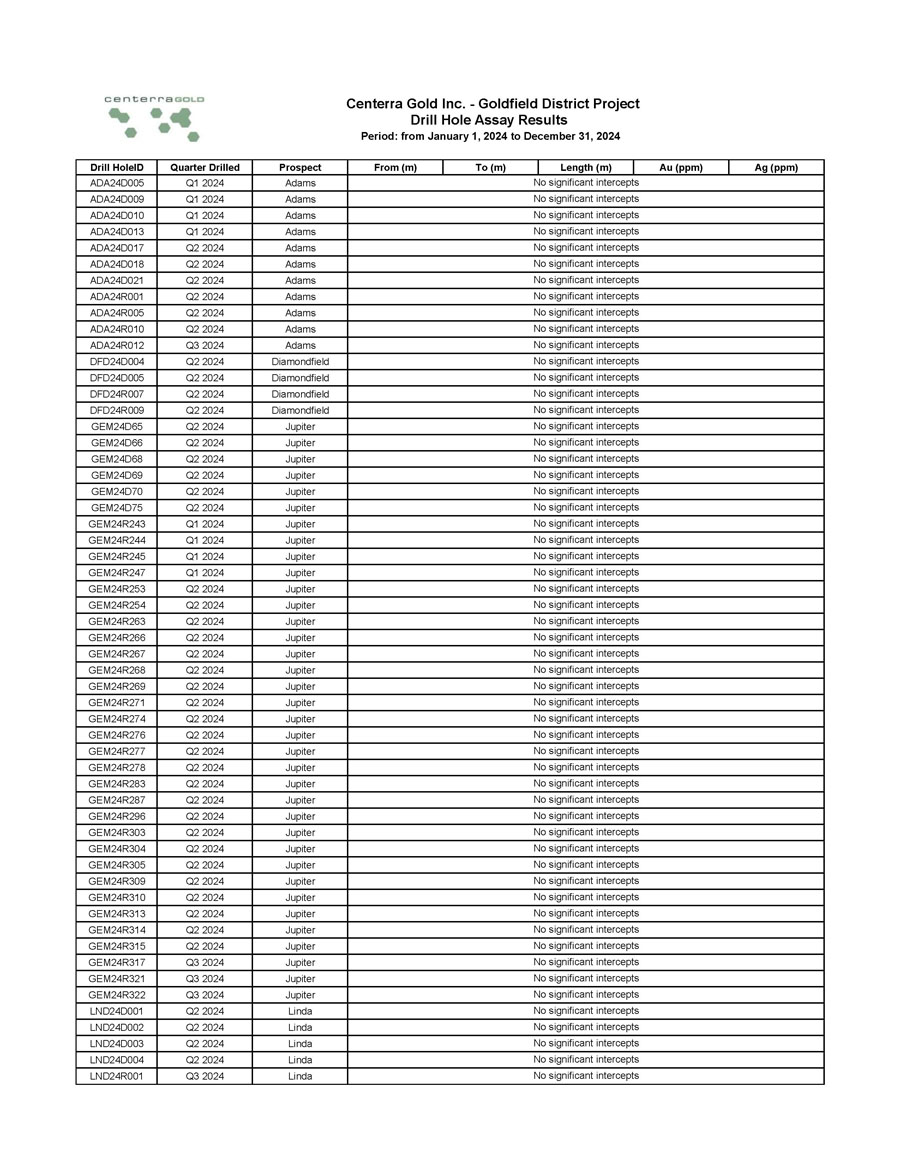

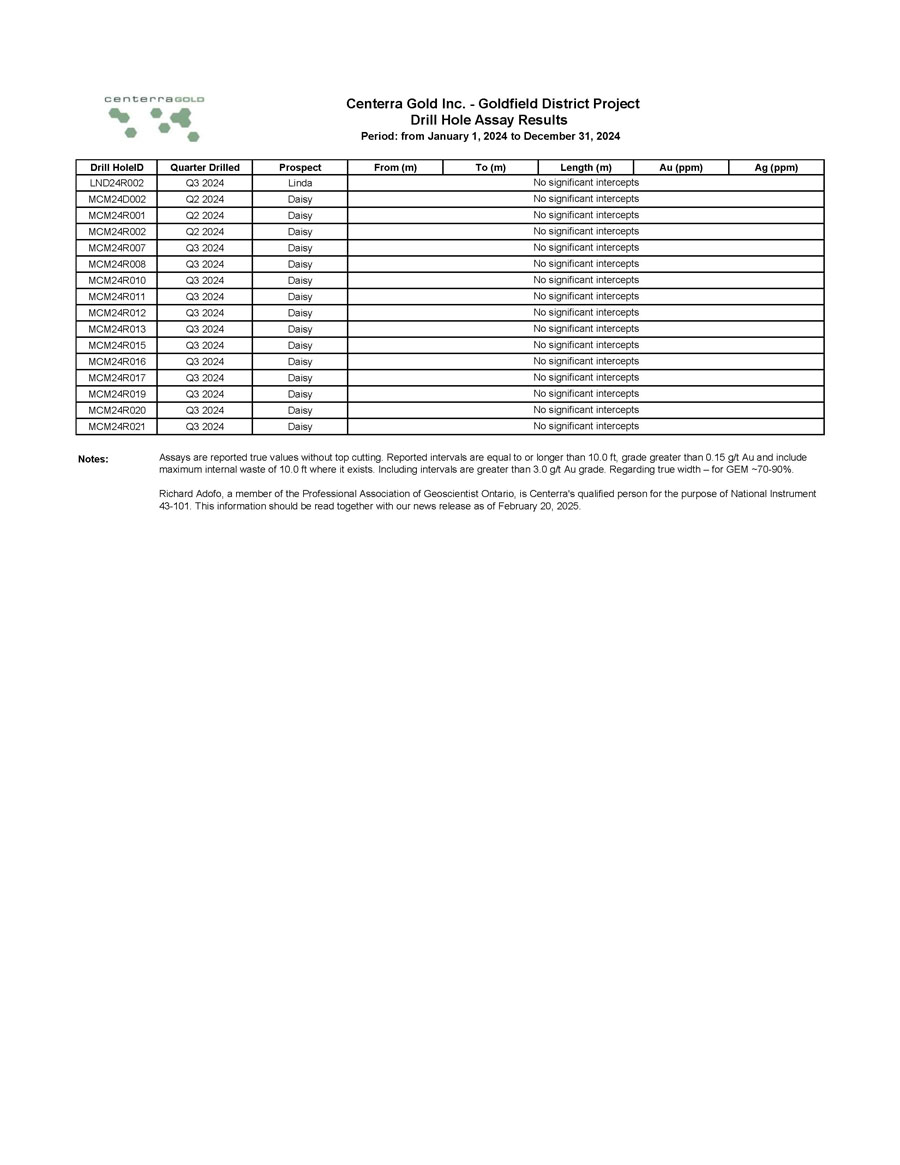

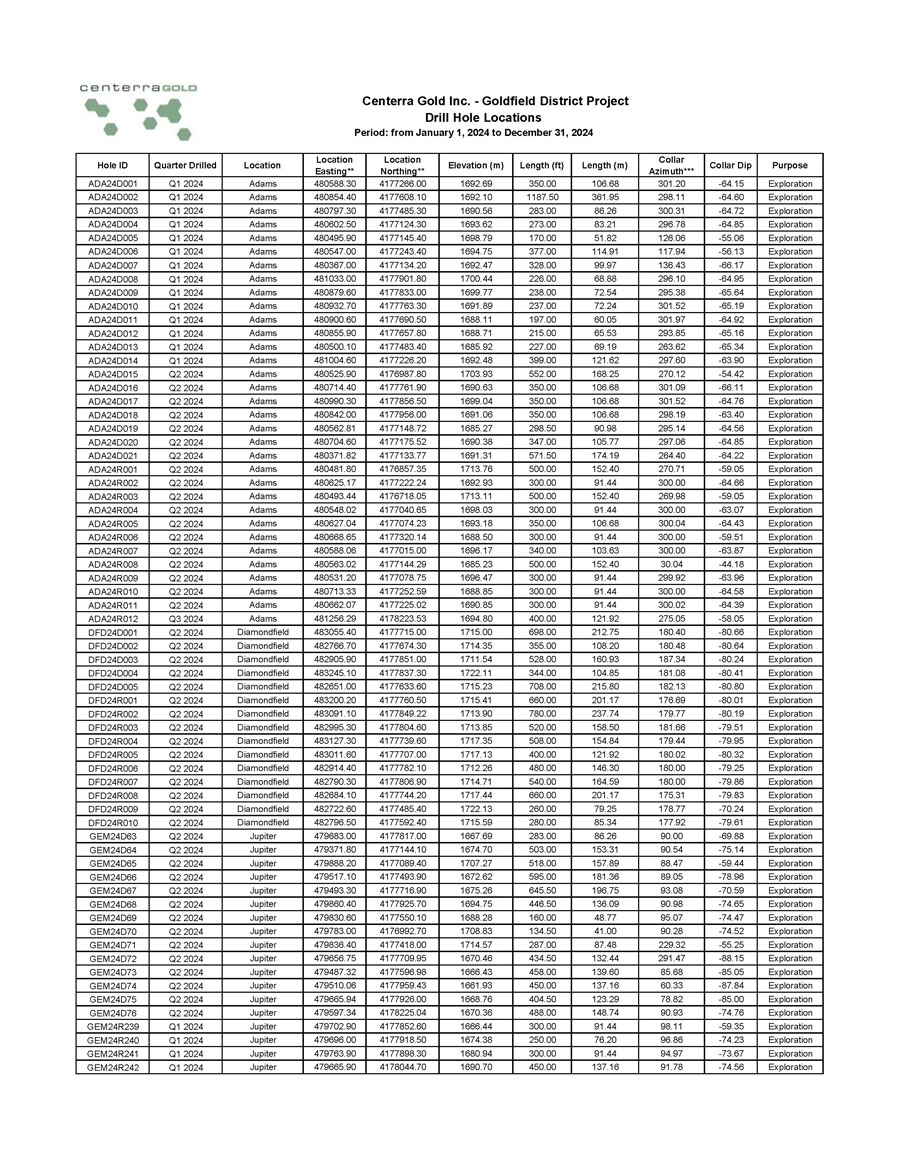

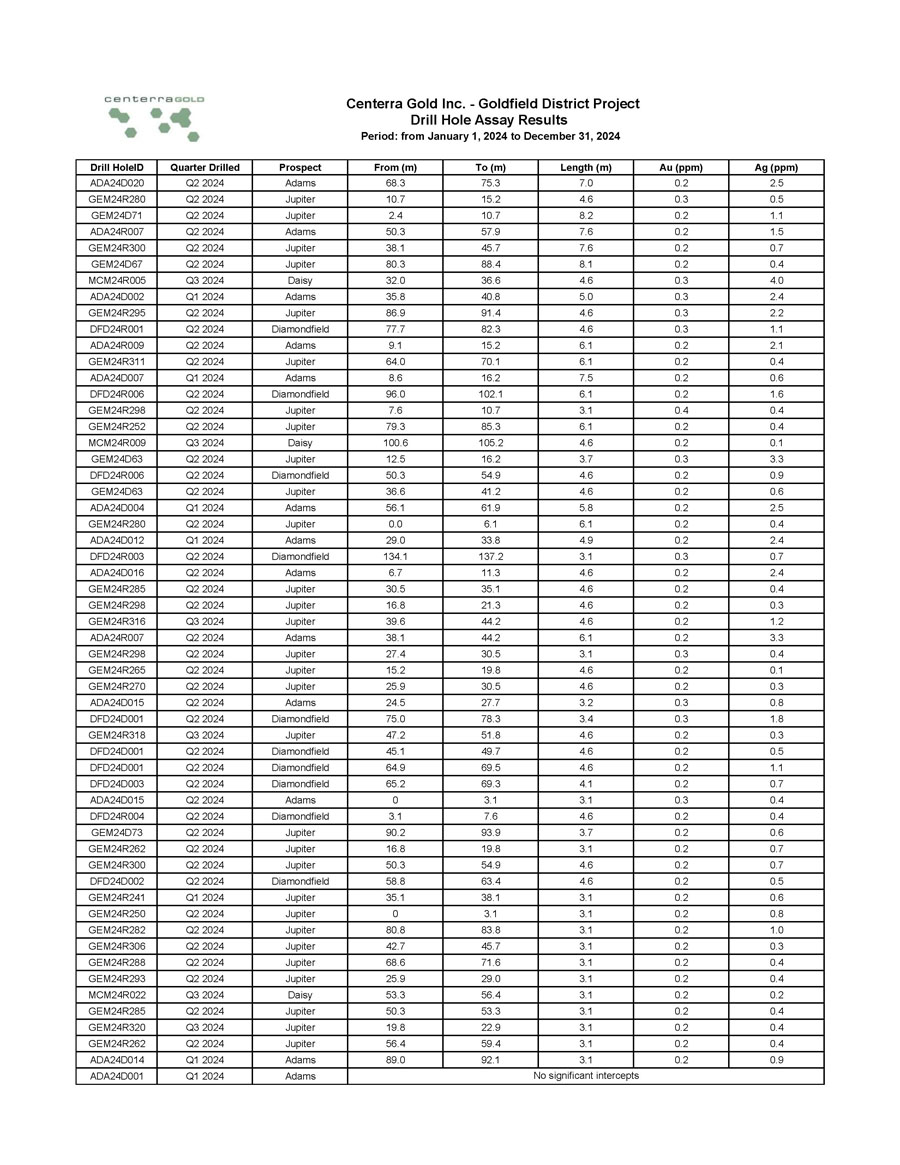

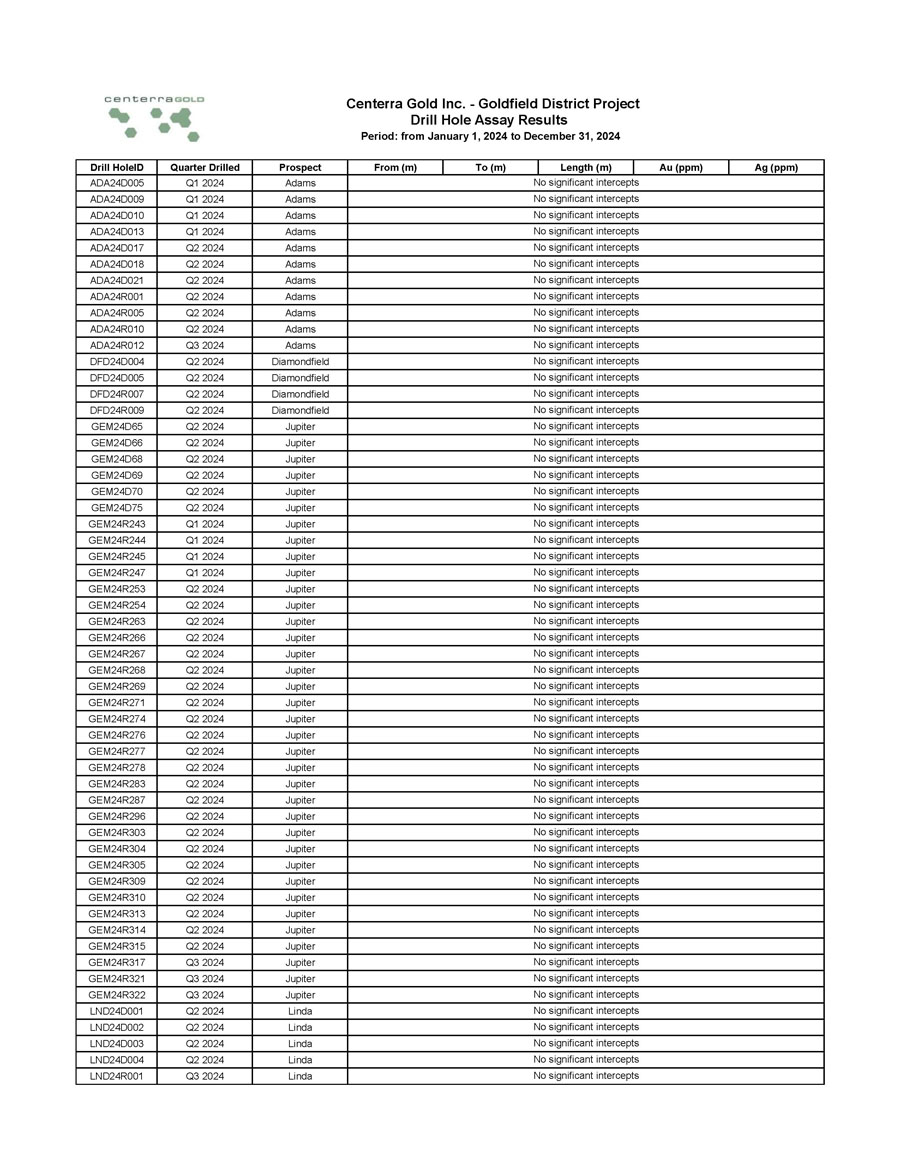

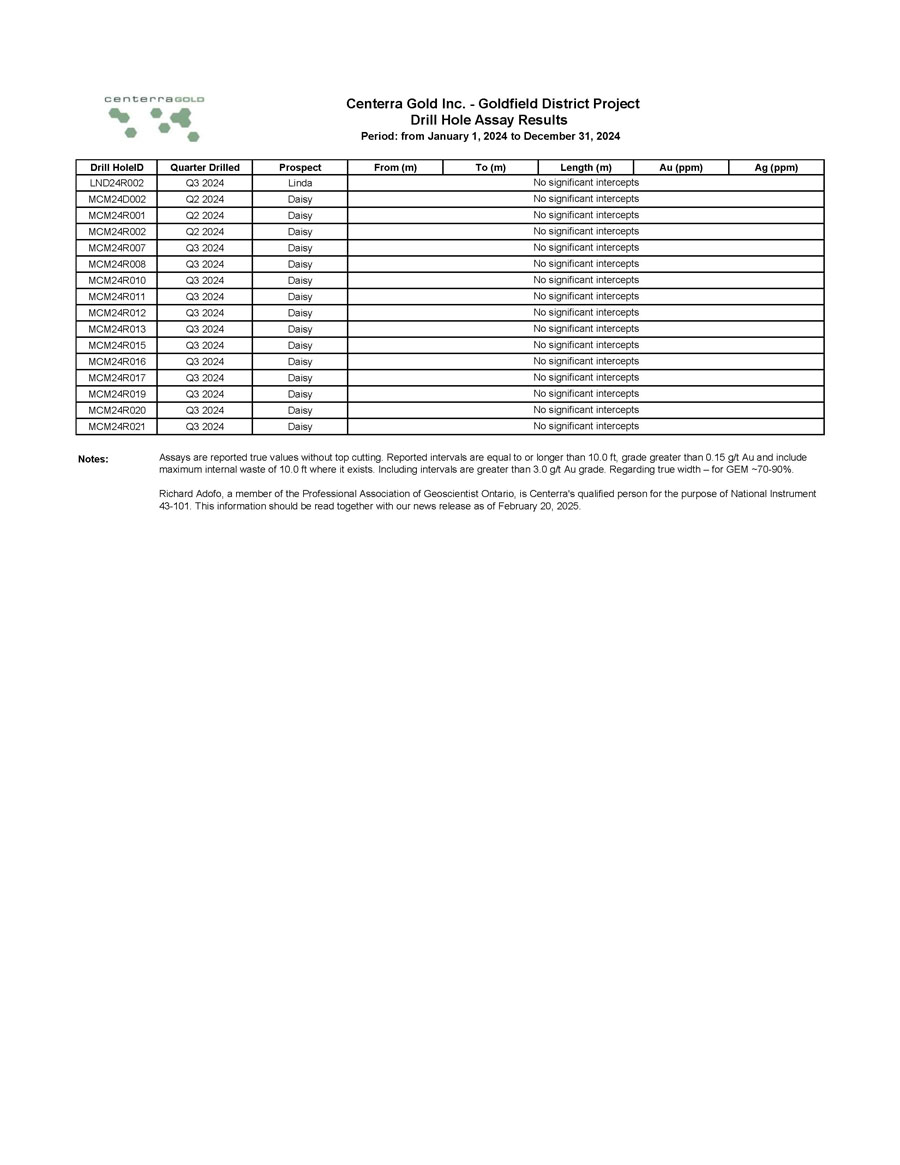

Goldfield Project (“Goldfield”)

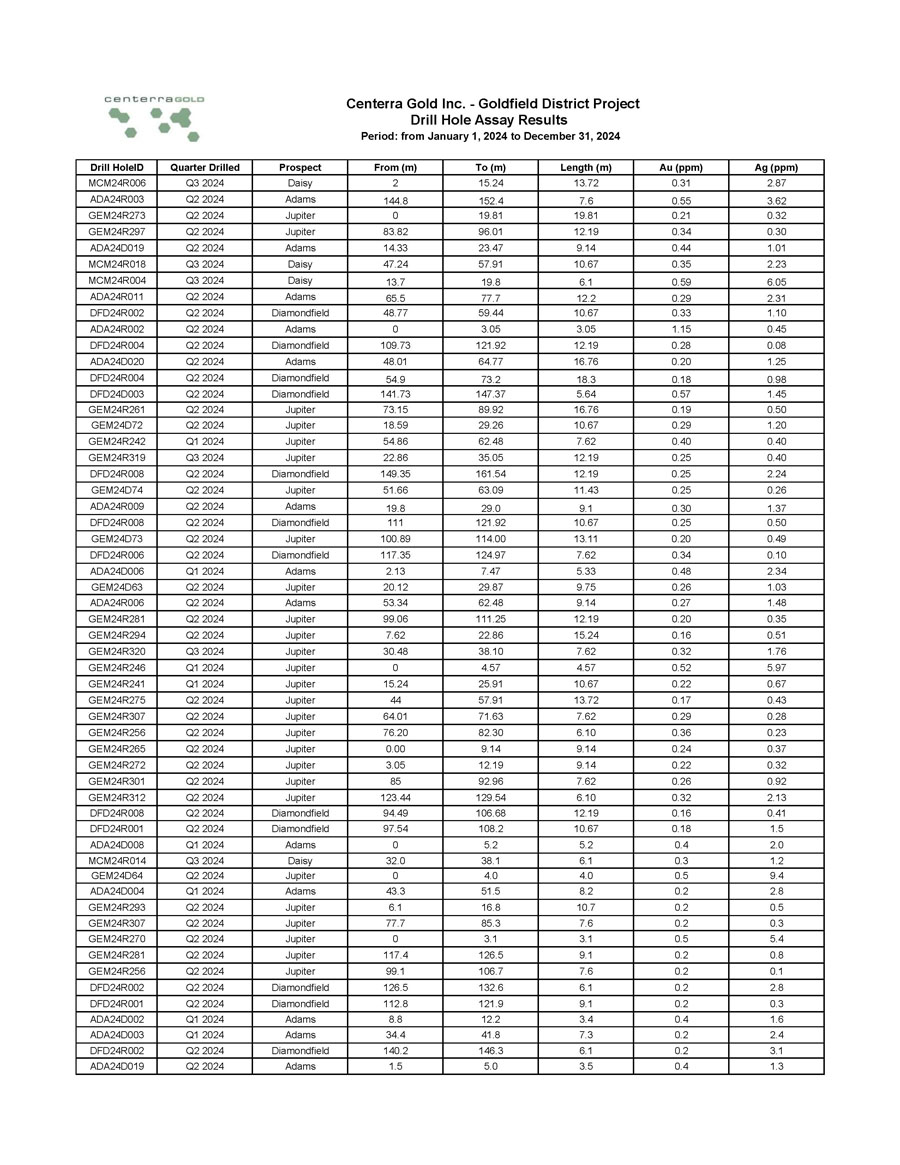

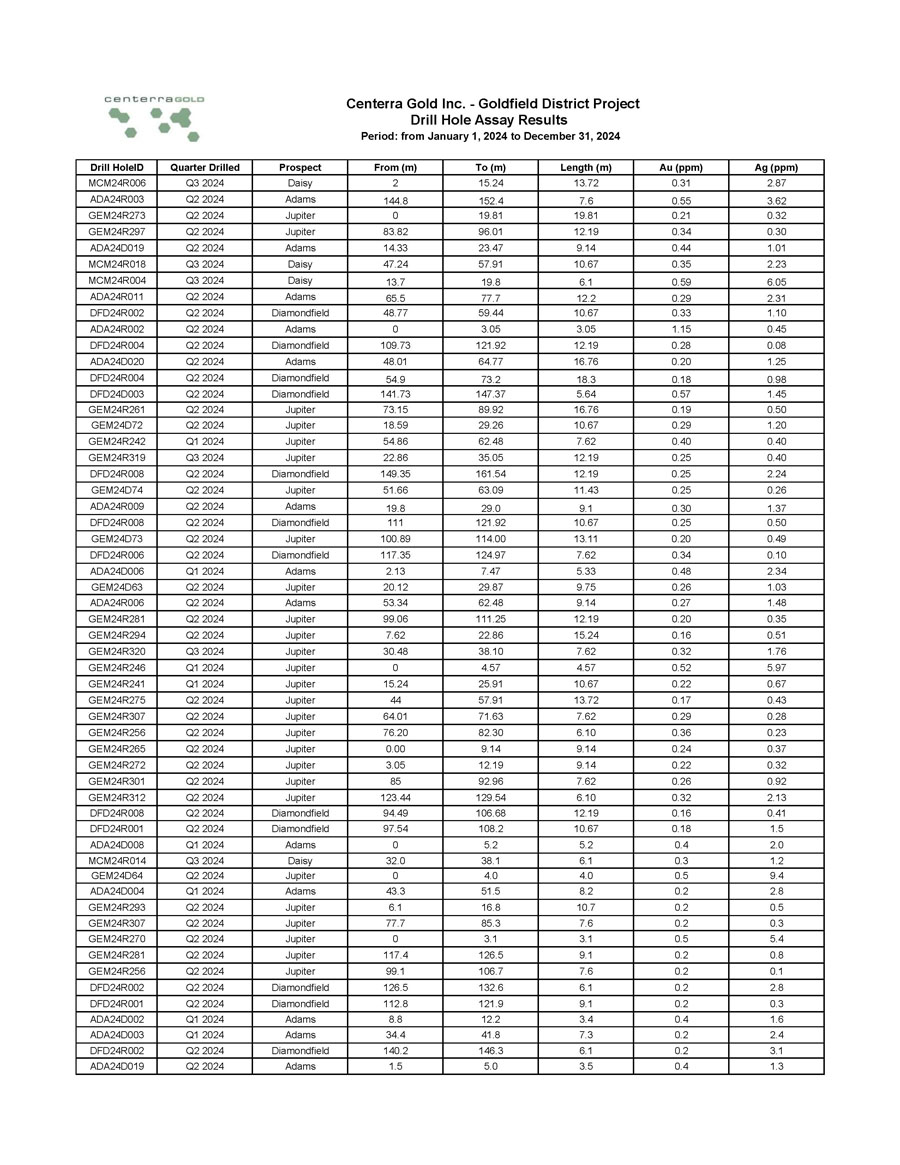

- In 2024, Centerra continued to explore within the Goldfield district, focusing on exploring near surface oxide mineralization.

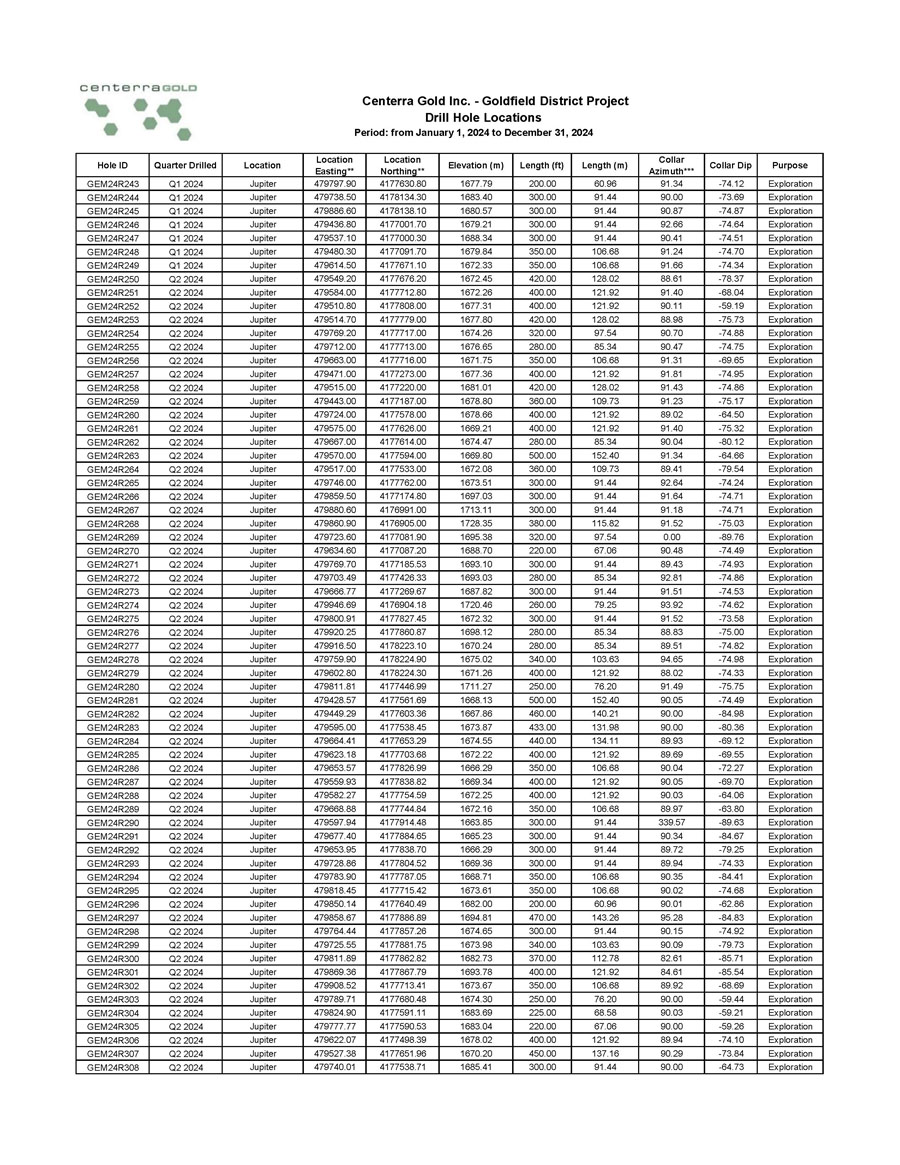

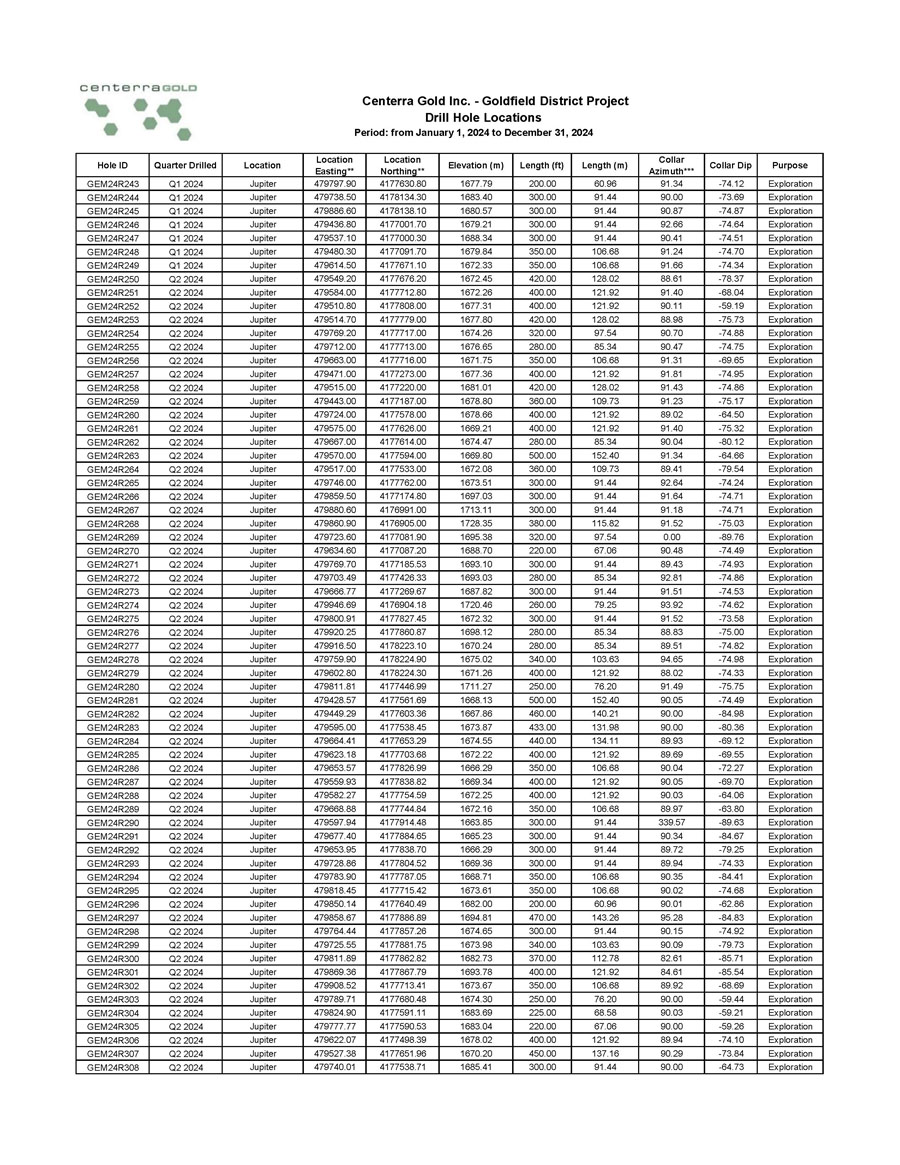

- The 2024 drill program consisted of 175 drillholes over 20,028 metres with 45 core holes totaling 5,386 metres and 130 reverse circulation drillholes totaling 14,642 metres.

- Drilling at Goldfield’s other target areas did not yield meaningful results.

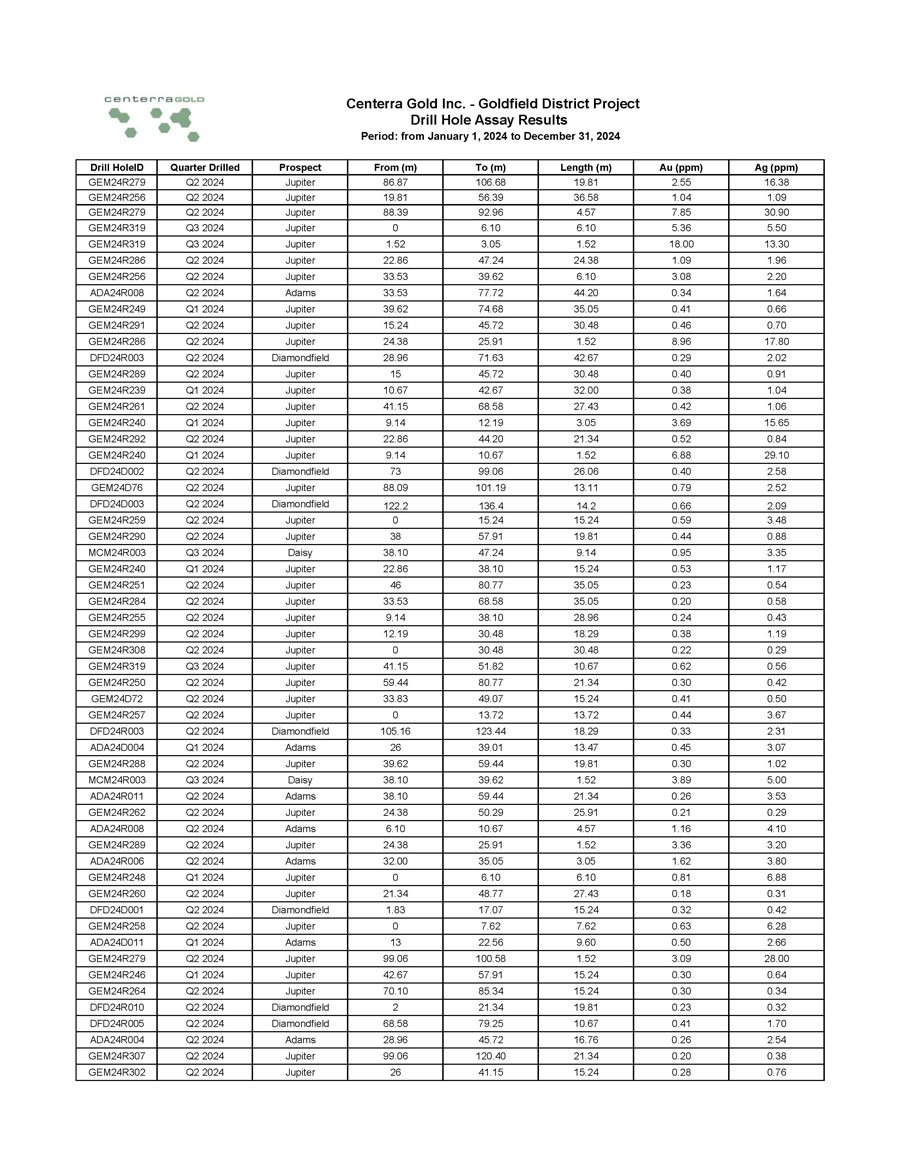

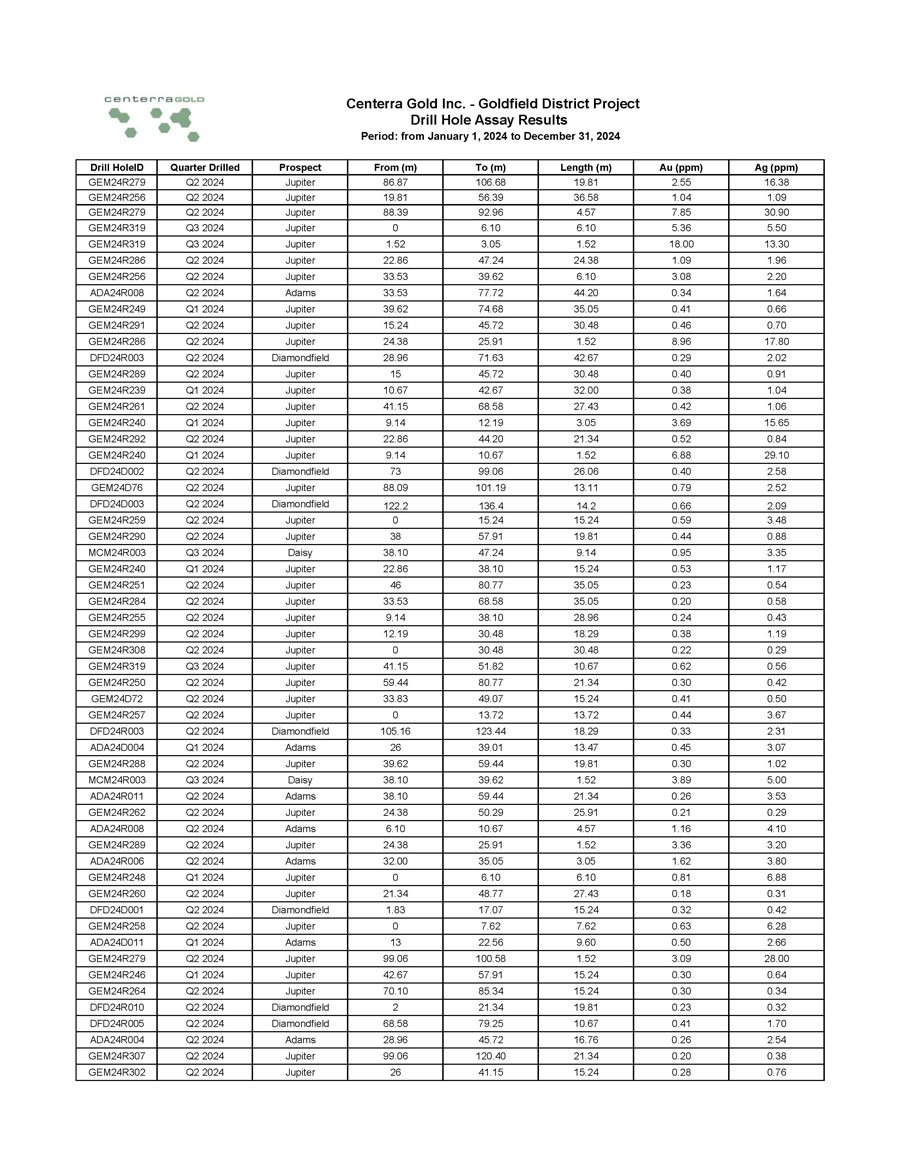

The Jupiter prospect exploration program focused on oxidized mineralization with an up-dip projection trending shallower on the eastern portion of the prospect. The Jupiter prospect is the northerly extension of the Gemfield deposit. Drilling was facilitated by land agreements and drill permits completed in late 2023. Results proved the up-dip projection of oxide mineralization in the prospect, however, the grades and thickness are uneconomic to include an appreciable amount of material into an optimized pit shell when the prevailing economic parameters were applied. A series of small satellite pits were delineated to be included in the Goldfield initial resource. Some of the significant results received for Jupiter include:

Hole #GEM24R279: 19.8m @ 2.55 g/t Au, 16.38 g/t Ag from 87m

Hole #GEM24R256: 36.6m @ 1.04 g/t Au, 1.09 g/t Ag from 20m

Hole #GEM24R319: 6.1m @ 5.36 g/t Au, 5.50 g/t Ag from 0m

Hole #GEM24R286: 24.4m @ 1.09 g/t Au, 1.96 g/t Ag from 23m

Hole #GEM24R249: 35.1m @ 0.41 g/t Au, 0.66 g/t Ag from 40m

Hole #GEM24R291: 30.5m @ 0.46 g/t Au, 0.70 g/t Ag from 15m

Hole #GEM24R289: 30.5m @ 0.40 g/t Au, 0.91 g/t Ag from 15m

Hole #GEM24R239: 32.0m @ 0.38 g/t Au, 1.04 g/t Ag from 11m

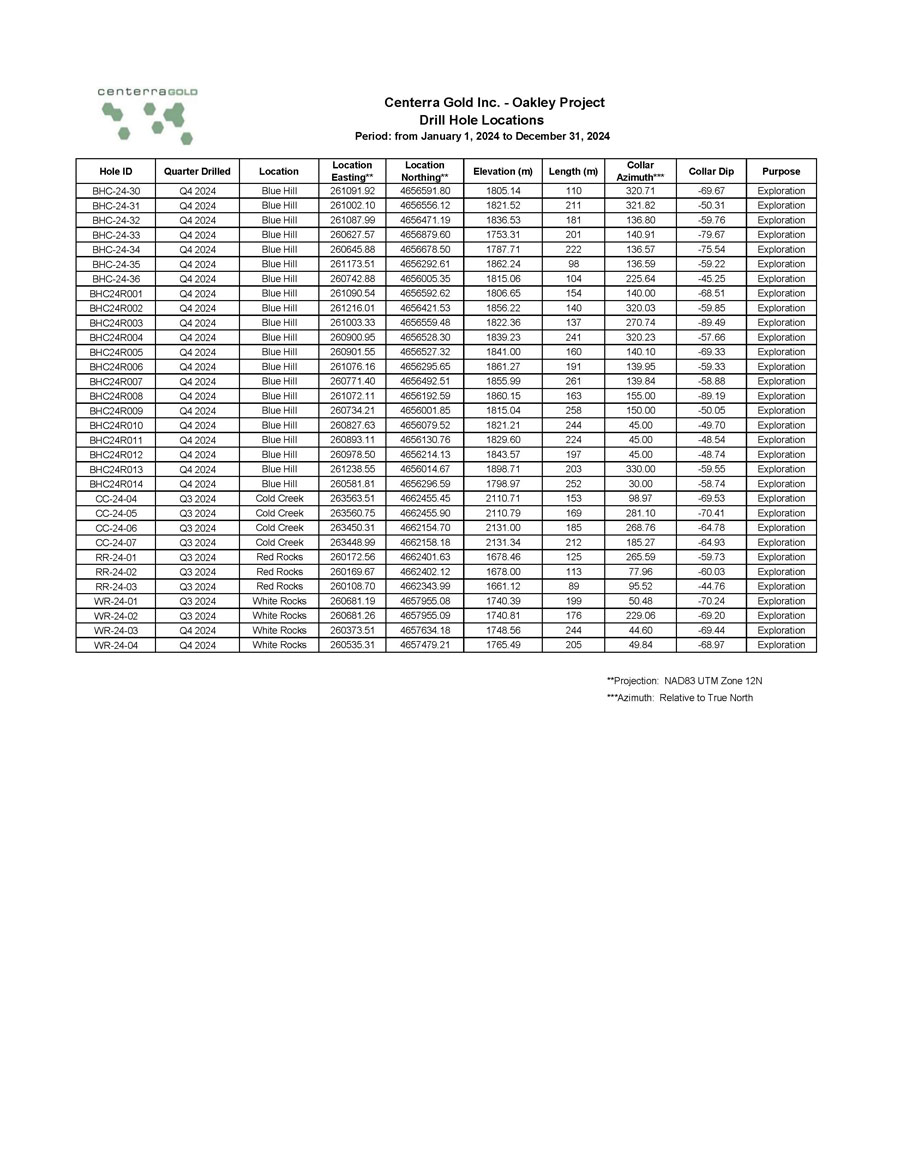

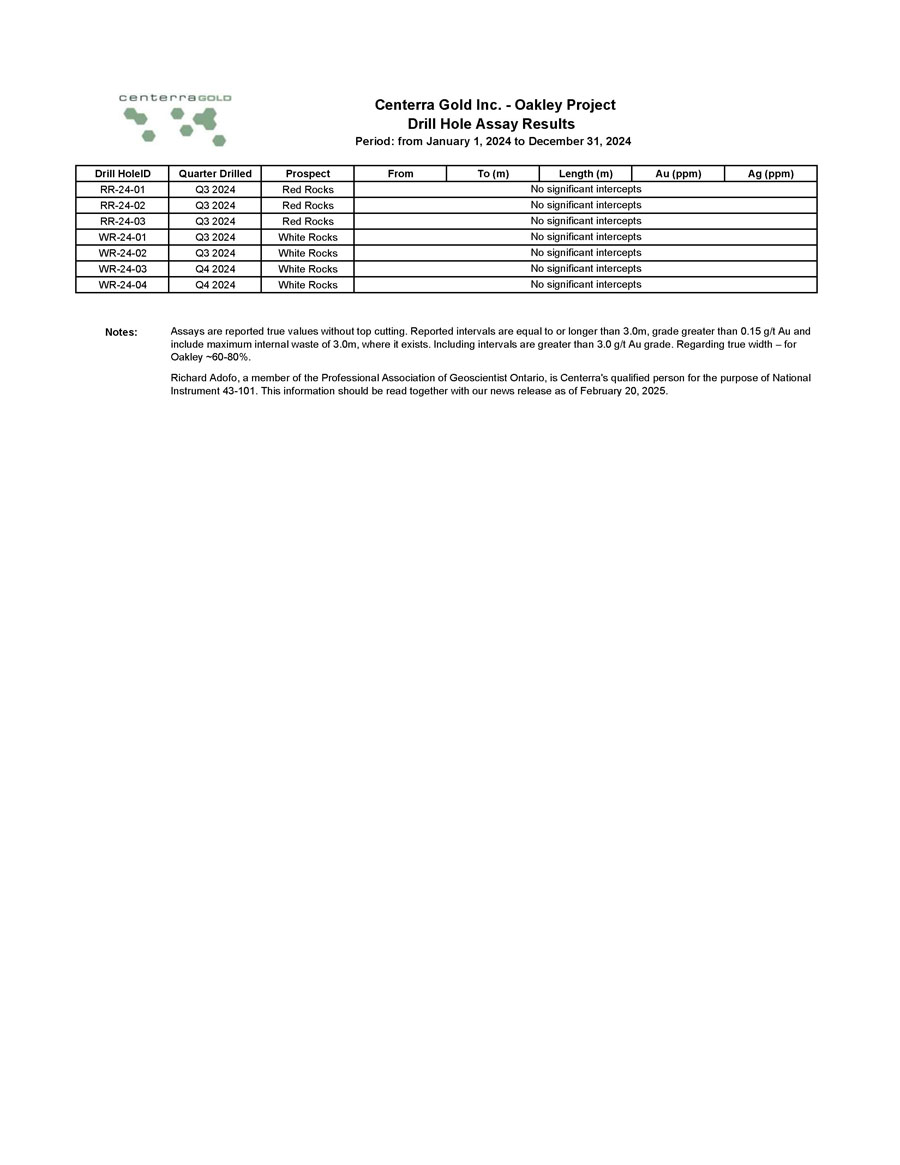

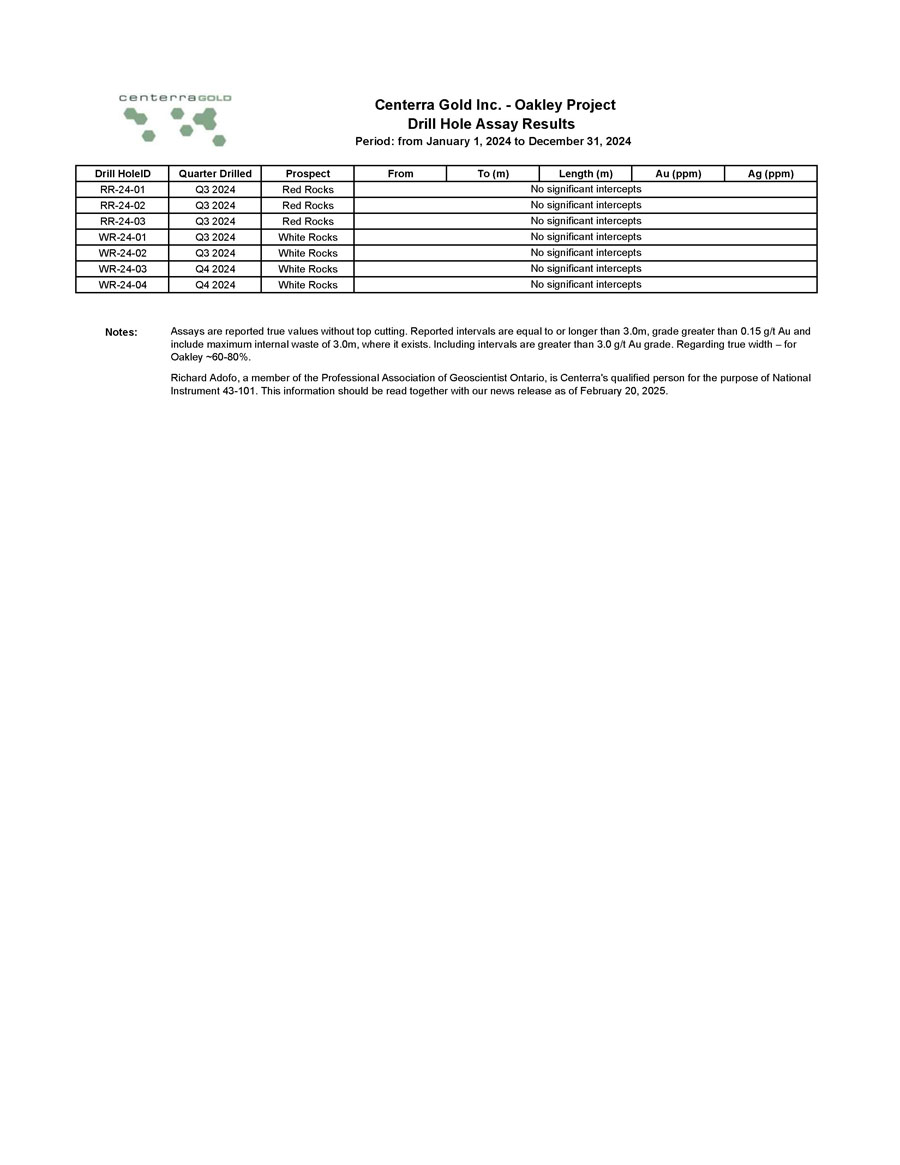

Oakley Project (“Oakley”)

- The 2024 drill program at Oakley completed 32 drillholes over 5,818 metres with 18 core holes totaling 2,995 metres and 14 reverse circulation drillholes totaling 2,823 metres.

- In 2024, drilling at the Cold Hill and Blue Hill prospects focused on expanding the known gold mineralization, while drilling at Red Rock and White Rock focused on new, untested drill targets.

At the Cold Hill target, four holes encountered significant mineralization, primarily represented by silicified pebble to cobble conglomerate and silicified volcanic ash, and with minor intersections within the underlying Paleozoic limestone, represented by decalcification and silicification. These intersections continue to define the lateral extent and width of the mineralization at Cold Hill. Some of the significant results received for Cold Hill include:

Hole #CC-24-04: 20.3m @ 0.24 g/t Au, 1.47 g/t Ag from 8m

Hole #CC-24-04: 20.9m @ 0.50 g/t Au, 4.00 g/t Ag from 37m

Hole #CC-24-07: 9.9m @ 0.69 g/t Au, 1.19 g/t Ag from 192m

Hole #CC-24-07: 1.0m @ 4.54 g/t Au, 0.90 g/t Ag from 200m

Drilling at the Blue Hill prospect focused on testing the margins of the known mineralization and following up on the higher-grade intersections identified in historic drilling. Mineralization was encountered in the most southwestern drillholes in the prospect, which shows the potential for additional mineralization towards the southwest. The mineralization is associated with strong silicification of the pebble to cobble conglomerate and silicification of the volcanic ash beds. Significant intersections are listed below.

Hole #BHC24R001: 19.8m @ 0.42 g/t Au, 4.19 g/t Ag from 24m

Hole #BHC24R003: 24.4m @ 0.45 g/t Au, 4.73 g/t Ag from 84m

Hole #BHC24R005: 64.0m @ 0.31 g/t Au, 2.74 g/t Ag from 50m

Hole #BHC24R005: 28.9m @ 0.25 g/t Au, 6.88 g/t Ag from 131m

Hole #BHC24R007: 21.4m @ 0.35 g/t Au, 3.11 g/t Ag from 90m

Hole #BHC24R007: 67.0m @ 0.50 g/t Au, 5.83 g/t Ag from 162m

Öksüt Mine (“Öksüt”)

Drilling started during December 2024, with a total of 431 metres completed at the Güneytepe pit to test for potential deep porphyry mineralization. The exploration for deep porphyry deposits was initiated in 2023, based on historical drillholes confirming potassic alteration related to porphyry intrusive rocks on the Öksüt license. In 2024, a detailed alteration analysis and modelling was completed, using data from historical and recent (2023) deep holes drilled in and around the Öksüt deposit. The analysis of these drillholes pointed to the presence of a large pyrophyllite alteration zone, which is an indicator for the presence of the upper parts of a porphyry system. The porphyry system was tested in 2024 by drilling additional deep holes under the Güneytepe pit. In 2025, Centerra expects to continue to explore for near surface oxide mineralization southeast of the Öksüt pit.

A full listing of the drill results has been filed on SEDAR+ at www.sedarplus.ca, EDGAR at www.sec.gov/edgar, and is available on the Company’s website at www.centerragold.com.

| Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resources Summary – Gold(1) |

| as of December 31, 2024 (see additional footnotes below) |

| |

| Proven and Probable Gold Mineral Reserves |

| | Proven | Probable | Total Proven and Probable |

Property

| Tonnes | Grade | Contained

Gold (koz)

| Tonnes | Grade | Contained

Gold (koz)

| Tonnes | Grade | Contained

Gold (koz)

|

| (kt) | (g/t) | (kt) | (g/t) | (kt) | (g/t) |

| Mount Milligan(4) | 187,961 | 0.34 | 2,056 | 76,551 | 0.31 | 770 | 264,512 | 0.33 | 2,826 |

| Öksüt | 475 | 0.63 | 10 | 19,604 | 1.04 | 653 | 20,080 | 1.03 | 662 |

| Total | 188,436 | 0.34 | 2,065 | 96,155 | 0.46 | 1,423 | 284,591 | 0.38 | 3,488 |

| |

| Measured and Indicated Gold Mineral Resources(2) |

| | Measured | Indicated | Total Measured and Indicated |

Property

| Tonnes | Grade | Contained

Gold (koz)

| Tonnes | Grade | Contained

Gold (koz)

| Tonnes | Grade | Contained

Gold (koz)

|

| (kt) | (g/t) | (kt) | (g/t) | (kt) | (g/t) |

| Mount Milligan(4) | 91,827 | 0.25 | 743 | 92,144 | 0.28 | 824 | 183,971 | 0.26 | 1,566 |

| Öksüt | 393 | 0.55 | 7 | 2,224 | 0.72 | 51 | 2,617 | 0.69 | 58 |

| Kemess Open Pit | - | - | - | 111,682 | 0.27 | 980 | 111,682 | 0.27 | 980 |

| Kemess Underground | - | - | - | 139,920 | 0.50 | 2,265 | 139,920 | 0.50 | 2,265 |

| Kemess East | - | - | - | 93,454 | 0.39 | 1,182 | 93,454 | 0.39 | 1,182 |

| Goldfield | 9,729 | 1.08 | 339 | 21,103 | 0.54 | 368 | 30,833 | 0.71 | 706 |

| Total | 101,949 | 0.33 | 1,088 | 460,527 | 0.38 | 5,670 | 562,476 | 0.37 | 6,759 |

| |

| Inferred Gold Mineral Resources (3) | |

Property

| Tonnes | Grade | Contained

Gold (koz)

|

| (kt) | (g/t) |

| Mount Milligan (4) | 27,924 | 0.44 | 395 |

| Öksüt | 130 | 1.06 | 4 |

| Kemess Open Pit | 13,691 | 0.26 | 116 |

| Kemess Underground | - | - | - |

| Kemess East | - | - | - |

| Goldfield | 2,267 | 0.41 | 30 |

| Total | 44,012 | 0.39 | 546 |

1) Centerra’s equity interests as of this news release are as follows: Mount Milligan 100%, Öksüt 100%, Kemess Open Pit, Kemess Underground and Kemess East 100%, Goldfield 100%. Mineral reserves and resources for these properties are presented on a 100% basis. Numbers may not add up due to rounding.

2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability.

3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

4) Production at Mount Milligan is subject to a streaming agreement with RGLD Gold AG and Royal Gold, Inc. (collectively, “Royal Gold”) which entitles Royal Gold to 35% of gold sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay a reduced price per ounce of gold delivered. Mineral reserves and resources for the Mount Milligan property are presented on a 100% basis.

| Centerra Gold Inc. 2024 Year-End Mineral Reserve and Resources Summary – Other Metals(1) |

| as of December 31, 2024 (see additional footnotes below) |

| |

| | Tonnes

(kt) | Copper

Grade

(%) | Contained

Copper

(Mlbs) | Molybdenum

Grade

(%) | Contained

Molybdenum

(Mlbs) | Silver

Grade

(g/t) | Contained

Silver

(koz) |

| Proven Mineral Reserves |

| Mount Milligan(4) | 187,961 | 0.19 | 808 | - | - | - | - |

| Thompson Creek | 44,885 | - | - | 0.076 | 75 | | - |

| Probable Mineral Reserves |

| Mount Milligan(4) | 76,551 | 0.20 | 342 | - | - | - | - |

| Thompson Creek | 68,104 | - | - | 0.057 | 86 | | - |

| Total Proven and Probable Mineral Reserves |

| Mount Milligan(4) | 264,512 | 0.20 | 1,150 | - | - | - | - |

| Thompson Creek | 112,989 | - | - | 0.065 | 161 | | - |

| Total Copper and Molybdenum | 377,501 | 0.20 | 1,150 | 0.065 | 161 | - | - |

| | | | | | | | |

| Measured Mineral Resources(2) |

| Mount Milligan(4) | 91,827 | 0.19 | 384 | - | - | - | - |

| Thompson Creek | 5,009 | - | - | 0.059 | 7 | - | - |

| Endako | 47,100 | - | - | 0.050 | 48 | - | - |

| Indicated Mineral Resources(2) |

| Mount Milligan(4) | 92,144 | 0.17 | 348 | - | - | - | - |

| Kemess Open Pit | 111,682 | 0.14 | 337 | - | - | 1.19 | 4,262 |

| Kemess Underground | 139,920 | 0.25 | 779 | - | - | 1.90 | 8,544 |

| Kemess East | 93,454 | 0.30 | 628 | - | - | 1.66 | 5,000 |

| Thompson Creek | 45,178 | - | - | 0.057 | 57 | - | - |

| Endako | 122,175 | - | - | 0.040 | 118 | - | - |

| Total Measured and Indicated Mineral Resources(2) |

| Mount Milligan(4) | 183,971 | 0.18 | 732 | - | - | - | - |

| Kemess Open Pit | 111,682 | 0.14 | 337 | - | - | 1.19 | 4,262 |

| Kemess Underground | 139,920 | 0.25 | 779 | - | - | 1.90 | 8,544 |

| Kemess East | 93,454 | 0.30 | 628 | - | - | 1.66 | 5,000 |

| Total Copper and Silver | 529,027 | 0.21 | 2,476 | - | - | 1.61 | 17,806 |

| Thompson Creek | 50,187 | - | - | 0.057 | 63 | - | - |

| Endako | 169,275 | - | - | 0.043 | 166 | - | - |

| Total Molybdenum | 219,462 | - | - | 0.046 | 229 | - | - |

| Inferred Mineral Resources(3) |

| Mount Milligan(4) | 27,924 | 0.12 | 74 | - | - | - | - |

| Kemess Open Pit | 13,691 | 0.16 | 48 | - | - | 1.40 | 615 |

| Total Copper and Silver | 41,615 | 0.13 | 121 | - | - | 1.40 | 615 |

| Thompson Creek | 10,523 | - | - | 0.072 | 17 | - | - |

| Endako | 47,325 | - | - | 0.040 | 44 | - | - |

| Total Molybdenum | 57,848 | - | - | 0.046 | 61 | - | - |

1) Centerra’s equity interests as of this news release are as follows: Mount Milligan 100%, Kemess Underground and Kemess East 100%, Thompson Creek 100%, and Endako 75%. Mineral reserves and resources for these properties are presented on a 100% basis. Numbers may not add up due to rounding.

2) Mineral resources are in addition to mineral reserves. Mineral resources do not have demonstrated economic viability.

3) Inferred mineral resources have a great amount of uncertainty as to their existence and as to whether they can be mined economically. It cannot be assumed that all or part of the inferred mineral resources will ever be upgraded to a higher category.

4) Production at Mount Milligan is subject to a streaming agreement which entitles Royal Gold to 18.75% of copper sales from the Mount Milligan Mine. Under the stream arrangement, Royal Gold will pay a reduced percentage of the spot price per metric tonne of copper delivered. Mineral reserves and resources for the Mount Milligan property are presented on a 100% basis.

Additional Footnotes

General

- A conversion factor of 31.1035 grams per troy ounce of gold is used in the mineral reserve and mineral resource estimates.

Mount Milligan Mine

- The mineral reserves are reported based on a gold price of $1,800 per ounce, a copper price of $3.75 per pound and an exchange rate of 1USD:1.30CAD.

- The open pit mineral reserves are reported based on a Net Smelter Return (“NSR”) cut-off of $8.72 per tonne (C$11.33 per tonne) that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability.

- The mineral resources are reported based on a gold price of $2,000 per ounce, a copper price of $4.00 per pound, and an exchange rate of 1USD:1.30CAD.

- The open pit mineral resources are constrained by a pit shell and are reported based on a NSR cut-off of $8.72 per tonne (C$11.33 per tonne) that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges to determine economic viability.

- Further information concerning the Mount Milligan deposit, operation, as well as environmental and other risks is described in Centerra’s most recently filed Annual Information Form and in the Mount Milligan Mine Technical Report, each of which has been filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

- The resource tables above do not include the 2024 exploration drill results.

Öksüt Mine

- The mineral reserves are reported based on a gold price of $1,800 per ounce and an exchange rate of 1USD:34TL.

- The open pit mineral reserves are reported based on 0.16 grams of gold per tonne cut-off grade.

- Open pit optimization used an average life of mine (“LOM”) metallurgical recovery of 77%.

- The mineral resources are reported based on a gold price of $2,000 per ounce.

- Open pit mineral resources are constrained by a pit shell and are estimated based on 0.16 grams of gold per tonne cut-off grade.

- Further information concerning the Öksüt deposit, operation, as well as environmental and other risks is described in Centerra’s most recently filed Annual Information Form which is available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and the Technical Report on the Öksüt Project, dated September 3, 2015, which is available on SEDAR+ at www.sedarplus.ca. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

Kemess Open Pit and Underground

- The mineral resources are reported based on a gold price of $1,800 per ounce, copper price of $3.75 per pound and an exchange rate of 1USD:1.30CAD.

- The mineral resources are reported based on a NSR cut-off of C$12.92 open pit and a NSR shut-off value of C$22.92 per tonne for underground block cave mining option that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Kemess East

- The mineral resources are reported based on a gold price of $1,800 per ounce, copper price of $3.75 per pound, and an exchange rate of 1USD:1.30CAD.

- The mineral resources are reported based on a NSR shut-off of C$22.92 per tonne for underground block cave mining option that takes into consideration metallurgical recoveries, concentrate grades, transportation costs, and smelter treatment charges.

Thompson Creek Mine

- The mineral reserves have been estimated based on a molybdenum price of $16.00 per pound.

- The open pit mineral reserves are based on a 0.030% molybdenum cut-off grade.

- The mineral resources have been estimated based on a molybdenum price of $18.50 per pound.

- The open pit mineral resources are constrained by a pit shell and are estimated based on a 0.025% molybdenum cut-off grade.

- Further information concerning the Thompson Creek deposit, current and planned operations as well as environmental and other risks are described in the technical report dated September 2024 and filed on SEDAR+ at www.sedarplus.ca. Sample preparation, analytical techniques, laboratories used, and quality assurance-quality control protocols used during the exploration drilling programs are consistent with industry standards and were carried out by independent, certified assay labs.

Endako Mine

- The mineral resources are reported based on a molybdenum price of C$14.00 per pound and an exchange rate of 1USD:1.25CAD.

- The open pit mineral resources are constrained by a pit shell and are estimated based on a 0.025% molybdenum cut-off grade.

Goldfield

- The mineral resources are reported based on a gold price of $2,000 per ounce.

- The open pit mineral resources are constrained by a pit shell and are estimated based on the following cut-off grades:

Gemfield: 0.10 g/t for oxide, transition, and sulphide

Jupiter: 0.10 g/t for oxide, transition, and sulphide

Goldfield Main: 0.14 g/t for oxide, 0.21 g/t for transition, 0.24 g/t for sulphide

McMahon Ridge: 0.14 g/t for oxide, 0.21 g/t for transition, 0.24 g/t for sulphide

- ROM recoveries were assumed to be 67% for the oxide and transition zones for Gemfield and Jupiter, and 62% and 31% for the oxide and transition zones, respectively, for McMahon Ridge.

- Goldfield Main recoveries considered tertiary crushing, and were 82% for oxide, 61% for transition and 50% for sulphide mineralization.

Qualified Person – Mineral Reserves and Resources

Christopher Richings, Professional Engineer, member of the Engineers and Geoscientists British Columbia (EGBC) and Centerra’s Vice President, Technical Services, has reviewed and approved the scientific and technical information related to mineral reserves at Mount Milligan and Thompson Creek contained in this news release. Mr. Richings is a Qualified Person within the meaning of Canadian Securities Administrator’s NI 43-101 Standards of Disclosure for Mineral Projects (“NI 43-101”).

Lars Weiershäuser, PhD and PGeo., and Centerra’s Director, Geology, has reviewed and approved the scientific and technical information related to mineral resource estimates contained in this news release related to Öksüt, Kemess Open Pit, Kemess Underground, Kemess East, Thompson Creek, and Endako. Dr. Weiershäuser is a Qualified Person within the meaning of NI 43-101.

Andrey Shabunin, Professional Engineer, member of Professional Engineers of Ontario (PEO) and General Manager of Öksüt Mine, has reviewed and approved the scientific and technical information related to mineral reserves at Öksüt contained in this news release. Mr. Shabunin is a Qualified Person within the meaning of NI 43-101.

AC (Chris) Hunter, Professional Geoscientist, member of the Engineers and Geoscientists of British Columbia (EGBC) and Centerra’s Senior Geologist, has reviewed and approved the scientific and technical information related to mineral resources estimates at Mount Milligan contained in this news release. Mr. Hunter is a Qualified Person within the meaning of NI 43-101.

Karen Chiu, MSc., PGeo, and Centerra’s Corporate Geologist, has reviewed and approved the scientific and technical information related to mineral resource estimates contained in this news release related to Goldfield. Ms. Chiu is a Qualified Person within the meaning of NI 43-101.

All other scientific and technical information presented in this document were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101 and were reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO) and Centerra’s Executive Vice President and Chief Operating Officer whom is a qualified person for the purpose of NI 43-101.

All mineral reserve and resources have been estimated in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101.

Mineral reserve and mineral resource estimates are forward-looking information and are based on key assumptions and are subject to material risk factors. If any event arising from these risks occurs, the Company’s business, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares could be adversely affected. Additional risks and uncertainties not currently known to the Company, or that are currently deemed immaterial, may also materially and adversely affect the Company’s business operations, prospects, financial condition, results of operations or cash flows, and the market price of Centerra’s shares. See the section entitled “Risk That Can Affect Centerra’s Business” in the Company’s annual Management’s Discussion and Analysis (MD&A) for the year-ended December 31, 2024, available on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar and see also the discussion below under the heading “Caution Regarding Forward-looking Information”.

Qualified Person & QA/QC – Exploration

Exploration information and related scientific and technical information in this document regarding the Mount Milligan Mine were prepared, reviewed, verified, and compiled in accordance with the standards of NI 43-101 by Cheyenne Sica, Member of the Association of Professional Geoscientists Ontario and Member of Engineers and Geoscientists British Columbia, and Exploration Manager at Centerra’s Mount Milligan Mine, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance and quality control protocols used during the exploration drilling programs are done consistent with industry standards while independent certified assay labs are used.

Exploration information and related scientific and technical information in this document regarding the Öksüt Mine, the Goldfield District Project, Oakley Project, and all other exploration projects were prepared, reviewed, verified, and compiled in accordance with the standards of NI 43-101 by Richard Adofo, Member of the Professional Association of Geoscientists Ontario and Vice President, Exploration & Resource at Centerra, who is the qualified person for the purpose of NI 43-101. Sample preparation, analytical techniques, laboratories used, and quality assurance and quality control protocols used during the exploration drilling programs are done consistent with industry standards while independent certified assay labs are used.

All other scientific and technical information presented in this document were prepared in accordance with the standards of the Canadian Institute of Mining, Metallurgy and Petroleum and NI 43-101 and were reviewed, verified, and compiled by Centerra’s geological and mining staff under the supervision of W. Paul Chawrun, Professional Engineer, member of the Professional Engineers of Ontario (PEO), who is a qualified person for the purpose of NI 43-101.

About Centerra Gold

Centerra Gold Inc. is a Canadian-based gold mining company focused on operating, developing, exploring and acquiring gold and copper properties in North America, Türkiye, and other markets worldwide. Centerra operates two mines: the Mount Milligan Mine in British Columbia, Canada, and the Öksüt Mine in Türkiye. The Company also owns the Kemess Project in British Columbia, Canada, the Goldfield Project in Nevada, United States, and owns and operates the Molybdenum Business Unit in the United States and Canada. Centerra’s shares trade on the Toronto Stock Exchange (“TSX”) under the symbol CG and on the New York Stock Exchange (“NYSE”) under the symbol CGAU. The Company is based in Toronto, Ontario, Canada.

For more information:

Lisa Wilkinson

Vice President, Investor Relations & Corporate Communications

(416) 204-3780

Lisa.Wilkinson@centerragold.com

Additional information on Centerra is available on the Company’s website at www.centerragold.com, on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov/edgar.

Caution Regarding Forward-Looking Information

This news release contains or incorporates by reference “forward-looking statements” and “forward-looking information” as defined under applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact, which address events, results, outcomes or developments that the Company expects to occur are, or may be deemed to be, forward-looking statements. Such forward-looking information involves risks, uncertainties and other factors that could cause actual results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking statements are generally, but not always, identified by the use of forward-looking terminology such as “assume”, “believes”, “continue”, “encouraged”, “estimate”, “expect”, “future”, “ongoing”, “plan”, “potential”, “target” or “update”, or variations of such words and phrases and similar expressions or statements that certain actions, events or results “may”, “could”, “would” or “will” be taken, occur or be achieved or the negative connotation of such terms. Such statements include but may not be limited to: mineral reserve and mineral resource estimates; life of mine estimates and operating and capital costs; future exploration potential; timing and scope of future exploration (brownfields or greenfields); the ability of the Company to increase mineral reserves or mineral resources at any of its properties; the future success of Kemess including the results of an updated resource estimate and accompanying update on its technical concept including mining methods; the ability of the Company to achieve 50,000 tonnes per day at the Kemess processing plant; the ability of the Company to expand the existing tailings facility at Kemess; and other statements that express management’s expectations or estimates of future plans and performance, operational, geological or financial results, estimates or amounts not yet determinable and assumptions of management.

The Company cautions that forward-looking statements are necessarily based upon a number of factors and assumptions that, while considered reasonable by the Company at the time of making such statements, are inherently subject to significant business, economic, technical, legal, political and competitive uncertainties and contingencies. Known and unknown factors could cause actual results to differ materially from those projected in the forward-looking statements and undue reliance should not be placed on such statements and information.

Market price fluctuations in gold, copper, and other metals, as well as increased capital or production costs or reduced recovery rates may render ore reserves containing lower grades of mineralization uneconomic and may ultimately result in a restatement of mineral reserves. The extent to which mineral resources may ultimately be reclassified as proven or probable mineral reserves is dependent upon the demonstration of their profitable recovery. Economic and technological factors, which may change over time, always influence the evaluation of mineral reserves or mineral resources. Centerra has not adjusted mineral resource figures in consideration of these risks and, therefore, Centerra can give no assurances that any mineral resource estimate will ultimately be reclassified as proven and probable mineral reserves.

Mineral resources are not mineral reserves, and do not have demonstrated economic viability, but do have reasonable prospects for economic extraction. Measured and indicated mineral resources are sufficiently well defined to allow geological and grade continuity to be reasonably assumed and permit the application of technical and economic parameters in assessing the economic viability of the resource. Inferred mineral resources are estimated on limited information not sufficient to verify geological and grade continuity or to allow technical and economic parameters to be applied. Inferred mineral resources are too speculative geologically to have economic considerations applied to them to enable them to be categorized as mineral reserves. There is no certainty that mineral resources of any category can be upgraded to mineral reserves through continued exploration.

Centerra’s mineral reserve and mineral resource figures are estimates, and Centerra can provide no assurances that the indicated levels of gold or copper will be produced, or that Centerra will receive the metal prices assumed in determining its mineral reserves. Such estimates are expressions of judgment based on knowledge, mining experience, analysis of drilling results, and industry practices. Valid estimates made at a given time may significantly change when new information becomes available. While Centerra believes that these mineral reserve and mineral resource estimates are well established, and the best estimates of Centerra’s management, by their nature mineral reserve and mineral resource estimates are imprecise and depend, to a certain extent, upon analysis of drilling results and statistical inferences, which may ultimately prove unreliable. If Centerra’s mineral reserve or mineral reserve estimates for its properties are inaccurate or are reduced in the future, this could have an adverse impact on Centerra’s future cash flows, earnings, results, or operations and financial condition.

Centerra estimates the future mine life of its operations. Centerra can give no assurance that mine life estimates will be achieved. Failure to achieve these estimates could have an adverse impact on Centerra’s future cash flows, earnings, results of operations, and financial condition.

Additional risk factors and details with respect to risk factors that may affect the Company’s ability to achieve the expectations set forth in the forward-looking statements contained in this news release are set out in the Company’s latest 40-F/Annual Information Form and Management’s Discussion and Analysis, each under the heading “Risk Factors”, which are available on SEDAR+ (www.sedarplus.ca) or on EDGAR (www.sec.gov/edgar). The foregoing should be reviewed in conjunction with the information, risk factors and assumptions found in this news release.

The Company disclaims any intention or obligation to update or revise any forward-looking statements, whether written or oral, or whether as a result of new information, future events or otherwise, except as required by applicable law.

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/5d429e9b-0f77-4c3e-93a3-e5e3e1236b9f

https://www.globenewswire.com/NewsRoom/AttachmentNg/e8e85ba0-972a-4719-9989-96dce800f6b7

https://www.globenewswire.com/NewsRoom/AttachmentNg/2f927cb5-41ed-4049-8b1b-7bf40c8f8d3c

https://www.globenewswire.com/NewsRoom/AttachmentNg/dbd0885a-b4c3-4ff2-9733-c8647acf5ad7

https://www.globenewswire.com/NewsRoom/AttachmentNg/aaf3c0f7-8a11-49ec-a2ae-ff0893cd41e4

https://www.globenewswire.com/NewsRoom/AttachmentNg/8e68d72f-e05f-4797-b545-a93b491f9017

A PDF accompanying this announcement is available at

http://ml.globenewswire.com/Resource/Download/ad1e1cd4-3da5-4e09-92c0-75837fda9432

Zone Collar Dip Collar Azimuth Length (m) Elevation (m) Location Northing Location Easting Quarter Drilled Hole ID 66 Zone - 63 359 150 / 205.13 1016.00 6108768.00 435029.00 Q1 2024 24 - 1515 66 Zone - 85 19 150 / 163.68 980.00 6108908.00 434651.00 Q1 2024 24 - 1516 66 Zone - 61 359 240 / 258.32 995.00 6108786.00 434868.00 Q1 2024 24 - 1517 66 Zone - 61 179 220 / 245.97 995.00 6108788.00 434868.00 Q1 2024 24 - 1518 66 Zone - 75 60 150 / 157.58 992.00 6108930.00 434708.00 Q2 2024 24 - 1519 66 Zone - 60 269 150 / 152.40 1010.00 6108924.00 435083.00 Q2 2024 24 - 1520 66 Zone - 59 271 180 / 195.99 1009.00 6109062.00 435031.00 Q2 2024 24 - 1521 66 Zone - 56 271 250 / 233.78 1025.00 6109175.00 434959.00 Q2 2024 24 - 1522 Southern Star - 58 285 450 / 461.62 1110.00 6108297.00 434835.00 Q2 2024 24 - 1523 Saddle - 51 269 220 / 229.82 1073.00 6108788.00 434177.00 Q2 2024 24 - 1524 Oliver - 55 180 400 / 465.00 1099.00 6109983.00 434489.00 Q2 2024 24 - 1525 Southern Star - 65 249 300 / 300.23 1103.00 6108643.00 434340.00 Q2 2024 24 - 1526 DWBX - 80 98 300 / 285.44 1177.00 6109673.00 433714.00 Q2 2024 24 - 1527 Oliver - 55 180 420 / 423.00 1102.00 6109947.00 434253.00 Q2 2024 24 - 1528 Goldmark - 76 104 650 / 642.21 1198.00 6109604.00 433624.00 Q2 2024 24 - 1529 Oliver - 60 179 450 / 472.50 1093.00 6109978.00 434816.00 Q2 2024 24 - 1530 MBX - 53 181 330 / 330.00 1067.00 6109831.00 434641.00 Q2 2024 24 - 1531 Goldmark (BF) - 75 280 400 / 401.42 1242.00 6109644.00 433354.00 Q2 2024 24 - 1532 North Slope - 80 103 550 / 598.17 1291.00 6109431.00 433210.00 Q2 2024 24 - 1533 North Slope - 80 107 550 / 551.84 1277.00 6109412.00 433105.00 Q2 2024 24 - 1534 North Slope - 83 108 500 / 539.50 1267.00 6109552.00 433124.00 Q2 2024 24 - 1536 North Slope - 83 99 200 / 217.93 1314.00 6109435.00 432731.00 Q2 2024 24 - 1539 North Slope (heli) - 71 114 560 / 567.00 1221.00 6109284.00 432034.00 Q2 2024 24 - 1540 North Slope - 78 59 600 / 607.62 1328.00 6109593.00 432389.00 Q2 2024 24 - 1541 Boundary (heli) - 70 282 600 / 600.00 1175.00 6108413.00 432747.00 Q2 2024 24 - 1542 North Slope - 83 110 600 / 593.45 1317.00 6109455.00 432405.00 Q2 2024 24 - 1543 North Slope - 75 115 200 / 210.01 1289.00 6109529.00 431962.00 Q2 2024 24 - 1544 North Slope - 75 115 600 / 611.73 1310.00 6109699.00 432113.00 Q2 2024 24 - 1546 Boundary - 80 99 600 / 570.00 1223.00 6108454.00 433493.00 Q3 2024 24 - 1548 North Slope - 78 115 200 / 238.66 1267.00 6109582.00 431886.00 Q3 2024 24 - 1549 North Slope - 76 88 600 / 599.54 1278.00 6109624.00 431987.00 Q3 2024 24 - 1550 Boundary - 78 83 340 / 363.39 1235.00 6108441.00 433380.00 Q3 2024 24 - 1551 Boundary - 75 110 350 / 351.00 1312.00 6108225.00 433241.00 Q3 2024 24 - 1552 North Slope - 80 103 200 / 206.35 1223.00 6109470.00 431819.00 Q3 2024 24 - 1553 King Richard - 50 88 320 / 321.00 1104.00 6108819.00 433698.00 Q3 2024 24 - 1554 North Slope - 84 10 530 / 551.99 1296.00 6109438.00 432860.00 Q3 2024 24 - 1555 King Richard - 65 250 300 / 300.00 1126.00 6108763.00 433941.00 Q3 2024 24 - 1556 Saddle West - 75 110 550 / 93.00 1170.00 6108739.00 432810.00 Q3 2024 24 - 1557 North Slope - 83 120 550 / 589.64 1280.00 6109486.00 433058.00 Q3 2024 24 - 1558 Saddle West - 75 110 550 / 30.00 1093.00 6108735.00 432811.00 Q3 2024 24 - 1559 Boundary - 75 115 330 / 330.00 1262.00 6108333.00 433409.00 Q3 2024 24 - 1560 Boundary - 80 111 300 / 309.00 1206.00 6108525.00 433213.00 Q3 2024 24 - 1561 North Slope - 80 100 480 / 480.67 1273.00 6109353.00 433168.00 Q3 2024 24 - 1562 Centerra Gold Inc. - Mount Milligan Drill Hole Locations Period: from January 1, 2024 to December 31, 2024

Zone Collar Dip Collar Azimuth Length (m) Elevation (m) Location Northing Location Easting Quarter Drilled Hole ID North Slope - 79 120 550 / 544.98 1262.00 6109349.00 433039.00 Q3 2024 24 - 1563 King Richard - 82 134 250 / 261.00 1120.00 6108791.00 433787.00 Q3 2024 24 - 1564 Saddle West - 75 109 550 / 549.00 1106.00 6108769.00 432974.00 Q3 2024 24 - 1565 North Slope - 82 92 550 / 559.92 1294.00 6109447.00 432900.00 Q3 2024 24 - 1566 North Slope - 82 100 550 / 536.75 1284.00 6109464.00 433162.00 Q3 2024 24 - 1567 MBX Zone - 89 216 150 / 169.77 927.00 6109289.00 434366.00 Q3 2024 24 - 1568 MBX Zone - 85 86 150 / 154.53 893.00 6109565.00 434414.00 Q3 2024 24 - 1569 MBX Zone - 89 267 200 / 300.84 875.00 6109453.00 434429.00 Q3 2024 24 - 1570 MBX Zone - 89 123 200 / 221.59 884.00 6109492.00 434379.00 Q3 2024 24 - 1571 MBX Zone - 89 324 200 / 224.64 871.00 6109376.00 434418.00 Q3 2024 24 - 1572 Centerra Gold Inc. - Mount Milligan Drill Hole Locations Period: from January 1, 2024 to December 31, 2024 Projection: UTM NAD83 Zone 10N Azimuth: Relative to True North

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 1.42 0.129 3.626 27.7 511 483.3 North Slope Q3 2024 24 - 1567 23.65 0.183 4.27 23.5 183 159.5 North Slope Q3 2024 24 - 1567 1.53 0.19 15.109 6.4 494.4 488 North Slope Q3 2024 24 - 1567 42.54 0.335 7.96 11.9 171.4 159.5 North Slope Q3 2024 24 - 1567 0.5 0.021 0.743 105.11 111.20 6.09 66 Q1 2024 24 - 1516 5.53 0.143 2.825 26.96 369.4 342.44 North Slope Q3 2024 24 - 1567 0.4 0.027 0.426 177.00 185.00 8.00 66 Q1 2024 24 - 1517 8.11 0.109 5.089 14.44 364.2 349.76 North Slope Q3 2024 24 - 1567 6.7 0.013 6.574 6.50 14.40 7.90 66 Q1 2024 24 - 1515 15.8 0.029 19.300 2.15 10.05 7.90 66 Q1 2024 24 - 1515 0.63 0.024 8.114 4.85 243 238.15 North Slope Q3 2024 24 - 1566 1.6 0.04 28.9 1.35 241.1 239.75 North Slope Q3 2024 24 - 1566 1.2 0.301 0.173 217.75 225.05 7.30 Saddle Q2 2024 24 - 1524 1.1 0.034 0.282 120.23 128.52 8.29 66 Q2 2024 24 - 1521 1.1 0.023 0.803 34.10 96.10 62.00 66 Q2 2024 24 - 1519 19.98 0.147 5.012 5 296 291 North Slope Q3 2024 24 - 1567 34.3 0.342 15.6 1.55 293.3 291.75 North Slope Q3 2024 24 - 1567 0.3 0.017 1.075 21.45 78.45 57.00 66 Q1 2024 24 - 1516 8.76 0.189 3.03 6.9 280.9 274 Boundary Q3 2024 24 - 1561 1.8 0.173 0.240 85.81 422.00 336.19 North Slope Q3 2024 24 - 1543 0.7 0.126 0.467 43.44 49.53 6.09 66 Q2 2024 24 - 1522 2.8 0.179 0.200 101.29 552.50 451.21 North Slope Q3 2024 24 - 1543 24.92 0.442 10.495 1.9 279 277.1 Boundary Q3 2024 24 - 1561 13.36 0.237 3.932 5 65 60 Boundary Q3 2024 24 - 1551 0.3 0.023 0.347 55.18 152.40 97.22 66 Q2 2024 24 - 1520 3.7 0.173 0.294 64.93 443.00 378.07 North Slope Q2 2024 24 - 1536 56.4 0.654 21.8 0.85 63.85 63 Boundary Q3 2024 24 - 1551 5.7 0.188 0.708 26.00 84.00 58.00 MBX Q2 2024 24 - 1531 1.19 0.229 0.482 37.84 153 115.16 MBX Q3 2024 24 - 1569 1.2 0.002 2.791 6.21 78.00 71.79 66 Q2 2024 24 - 1519 3.1 0.241 0.409 42.31 67.00 24.69 North Slope Q2 2024 24 - 1533 10.23 0.176 0.552 30.26 113 82.74 MBX Q3 2024 24 - 1572 2.35 0.142 2.208 7.1 88.5 81.4 North Slope Q3 2024 24 - 1563 0.67 0.204 0.323 48.35 187.35 139 King Richard Q3 2024 24 - 1556 0.7 0.120 0.270 55.23 300.23 245.00 Southern Star Q2 2024 24 - 1526 2.18 0.086 1.089 13.5 45 31.5 North Slope Q3 2024 24 - 1563 0.9 0.191 0.223 65.00 562.00 497.00 Goldmark Q2 2024 24 - 1529 7.1 0.481 9.519 1.5 88.5 87 North Slope Q3 2024 24 - 1563 0.6 0.217 0.390 36.00 230.00 194.00 Oliver Q2 2024 24 - 1525 0.26 0.068 0.237 58 126 68 MBX Q3 2024 24 - 1571 0.4 0.020 1.099 12.40 95.00 82.60 66 Q2 2024 24 - 1522 4.8 0.144 0.326 41.75 286.05 244.30 North Slope Q2 2024 24 - 1536 3.6 0.078 4.471 3.00 451.00 448.00 North Slope Q2 2024 24 - 1533 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 0.25 0.012 0.333 40 176 136 North Slope Q3 2024 24 - 1566 4.6 0.050 7.647 1.73 451.00 449.27 North Slope Q2 2024 24 - 1533 12.6 0.055 10.5 1.25 45 43.75 North Slope Q3 2024 24 - 1563 0.8 0.127 0.153 83.8 298 214.2 King Richard Q3 2024 24 - 1556 2.5 0.015 6.822 1.86 7.95 6.09 66 Q1 2024 24 - 1516 0.4 0.064 1.984 6.10 147.60 141.50 66 Q1 2024 24 - 1517 0.2 0.059 1.400 8.50 165.50 157.00 66 Q1 2024 24 - 1517 0.5 0.011 1.913 6.00 93.00 87.00 66 Q2 2024 24 - 1522 2.04 0.168 0.157 73 321 248 King Richard Q3 2024 24 - 1554 6.34 0.161 0.6 18.7 40 21.3 King Richard Q3 2024 24 - 1564 47.38 0.662 2.375 4.56 92.04 87.48 MBX Q3 2024 24 - 1572 2.0 0.172 0.156 68.55 374.00 305.45 North Slope Q2 2024 24 - 1536 11.23 0.087 2.795 3.8 102 98.2 North Slope Q3 2024 24 - 1567 27.2 0.716 2.182 4.84 66.84 62.00 MBX Q2 2024 24 - 1531 22.6 0.149 5.74 1.8 100 98.2 North Slope Q3 2024 24 - 1567 0.3 0.014 0.817 12.23 139.75 127.52 66 Q2 2024 24 - 1522 2.1 0.152 0.226 42.00 368.00 326.00 North Slope Q2 2024 24 - 1533 0.5 0.007 0.779 11.88 66.90 55.02 66 Q2 2024 24 - 1522 1.4 0.033 2.303 4.00 106.00 102.00 66 Q1 2024 24 - 1516 1.2 0.021 0.512 17.84 117.00 99.16 66 Q2 2024 24 - 1522 1.0 0.053 0.945 9.60 98.00 88.40 MBX Q2 2024 24 - 1531 0.73 0.116 0.24 37.78 153.78 116 King Richard Q3 2024 24 - 1564 0.4 0.086 4.505 2.00 39.00 37.00 66 Q2 2024 24 - 1522 4.0 0.055 0.320 27.89 289.10 261.21 North Slope Q3 2024 24 - 1543 4.7 0.145 0.602 14.5 189.75 175.25 MBX Q3 2024 24 - 1571 0.18 0.01 0.669 13 142 129 North Slope Q3 2024 24 - 1555 1.25 0.129 0.216 40 85 45 King Richard Q3 2024 24 - 1554 0.3 0.002 1.781 4.72 66.90 62.18 66 Q2 2024 24 - 1522 3.66 0.066 0.326 25.65 146.66 121.01 MBX Q3 2024 24 - 1570 1.92 0.2 0.192 42 348 306 Saddle West Q3 2024 24 - 1565 2.9 0.038 0.411 19.20 388.92 369.72 Goldmark Q2 2024 24 - 1529 1.7 0.104 0.326 23.91 127.91 104.00 MBX Q2 2024 24 - 1531 0.5 0.154 0.205 37.00 212.00 175.00 MBX Q2 2024 24 - 1531 3.6 0.126 4.640 1.60 90.00 88.40 MBX Q2 2024 24 - 1531 0.92 0.137 0.198 36.8 58 21.2 King Richard Q3 2024 24 - 1556 0.4 0.032 0.208 35.00 156.00 121.00 Oliver Q2 2024 24 - 1528 7.9 0.532 1.800 4.01 61.00 56.99 North Slope Q2 2024 24 - 1533 2.74 0.071 0.33 21.85 339.85 318 North Slope Q3 2024 24 - 1563 0.4 0.013 1.780 4.00 134.00 130.00 66 Q2 2024 24 - 1522 6.5 0.569 1.185 6.00 365.00 359.00 North Slope Q3 2024 24 - 1543 1.2 0.028 0.530 13.11 197.21 184.10 North Slope Q2 2024 24 - 1536 3.24 0.122 0.451 14.8 259.55 244.75 Boundary Q3 2024 24 - 1548 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 0.4 0.009 0.413 16.00 29.00 13.00 North Slope Q3 2024 24 - 1550 5.02 0.133 2.115 3.1 111.1 108 North Slope Q3 2024 24 - 1567 2.0 1.617 2.143 3.00 230.00 227.00 Oliver Q2 2024 24 - 1525 0.4 0.012 0.388 16.55 141.20 124.65 66 Q1 2024 24 - 1516 1.88 0.011 0.824 7.75 502.25 494.5 North Slope Q3 2024 24 - 1566 0.3 0.011 0.343 18.45 188.45 170 North Slope Q3 2024 24 - 1555 0.4 0.012 1.647 3.84 103.00 99.16 66 Q2 2024 24 - 1522 0.2 0.023 0.231 26.64 275.64 249 MBX Q3 2024 24 - 1570 0.6 0.205 0.205 30.00 308.00 278.00 MBX Q2 2024 24 - 1531 1.6 0.258 0.112 54.86 540.11 485.25 North Slope Q2 2024 24 - 1536 0.6 0.013 4.713 1.3 142 140.7 North Slope Q3 2024 24 - 1555 2.7 0.168 0.154 39.50 303.00 263.50 North Slope Q2 2024 24 - 1534 5.6 0.424 0.331 17.85 530.00 512.15 North Slope Q3 2024 24 - 1550 0.35 0.013 1.468 4 140 136 North Slope Q3 2024 24 - 1566 8.5 0.141 5.212 1.1 111.1 110 North Slope Q3 2024 24 - 1567 1.65 0.054 1.878 3 518 515 North Slope Q3 2024 24 - 1566 2.51 0.081 0.73 7.7 50.5 42.8 North Slope Q3 2024 24 - 1555 1.4 0.030 0.280 20.00 54.00 34.00 Goldmark Q2 2024 24 - 1532 2.7 0.117 0.370 15.00 389.00 374.00 North Slope Q2 2024 24 - 1533 2.4 0.025 3.908 1.4 516.4 515 North Slope Q3 2024 24 - 1566 5.78 0.083 0.567 9.02 91.07 82.05 MBX Q3 2024 24 - 1569 0.2 0.006 0.144 35.40 91.40 56.00 66 Q1 2024 24 - 1515 1.2 0.026 0.282 18.00 145.00 127.00 North Slope Q2 2024 24 - 1533 0.18 0.131 0.208 24.34 28 3.66 MBX Q3 2024 24 - 1569 0.5 0.022 0.282 17.95 78.00 60.05 Goldmark Q2 2024 24 - 1532 1 0.581 1.584 3.19 136 132.81 MBX Q3 2024 24 - 1569 24.6 0.516 9.467 0.53 44.78 44.25 North Slope Q3 2024 24 - 1555 0.6 0.056 0.185 27.00 334.00 307.00 Oliver Q2 2024 24 - 1528 0.5 0.010 2.468 2.00 69.00 67.00 66 Q1 2024 24 - 1517 25.7 0.675 3.496 1.40 419.50 418.10 North Slope Q2 2024 24 - 1536 3.26 0.138 0.261 18.7 411.7 393 North Slope Q3 2024 24 - 1562 4.8 0.315 0.168 28.85 586.20 557.35 North Slope Q3 2024 24 - 1543 1.1 0.114 0.096 49.15 352.15 303.00 North Slope Q2 2024 24 - 1534 5.9 0.037 1.108 4.25 412.25 408.00 Oliver Q2 2024 24 - 1528 1.13 0.431 0.772 6 100 94 MBX Q3 2024 24 - 1568 3.05 0.22 0.217 21.25 412.25 391 North Slope Q3 2024 24 - 1567 16 0.266 4.383 1.05 446.2 445.15 North Slope Q3 2024 24 - 1562 0.7 0.087 0.284 16.00 50.00 34.00 MBX Q2 2024 24 - 1531 9.5 0.035 1.776 2.55 412.25 409.70 Oliver Q2 2024 24 - 1528 0.3 0.028 0.224 20.00 111.00 91.00 Oliver Q2 2024 24 - 1528 113 2.04 4.771 0.93 91.06 90.13 MBX Q3 2024 24 - 1572 0.6 0.085 1.042 4.25 180.25 176.00 North Slope Q3 2024 24 - 1543 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 0.2 0.066 0.167 26.35 301.50 275.15 Oliver Q2 2024 24 - 1528 1.2 0.061 0.545 8.00 52.00 44.00 North Slope Q2 2024 24 - 1534 0.98 0.048 0.435 10 57 47 King Richard Q3 2024 24 - 1564 2.0 0.147 0.123 35.30 259.00 223.70 North Slope Q2 2024 24 - 1534 1.58 0.173 0.134 32 283 251 North Slope Q3 2024 24 - 1562 0.8 0.030 2.129 2.00 136.00 134.00 66 Q2 2024 24 - 1521 1.33 0.125 0.124 33.53 276.3 242.77 North Slope Q3 2024 24 - 1563 2.5 0.029 1.856 2.20 195.70 193.50 North Slope Q2 2024 24 - 1536 2.26 0.09 0.271 15.05 281.55 266.5 Boundary Q3 2024 24 - 1551 5.57 0.178 0.202 20 424 404 North Slope Q3 2024 24 - 1563 0.19 0.081 0.221 18 32 14 MBX Q3 2024 24 - 1568 0.3 0.027 0.242 16.28 60.00 43.72 66 Q2 2024 24 - 1520 32.9 0.366 2.68 1.47 83.52 82.05 MBX Q3 2024 24 - 1569 0.3 0.019 0.277 14.00 160.00 146.00 66 Q2 2024 24 - 1522 11.5 0.053 2.598 1.49 329 327.51 North Slope Q3 2024 24 - 1563 0.43 0.12 0.079 49 259 210 King Richard Q3 2024 24 - 1564 1.1 0.034 0.198 19.55 390.75 371.20 North Slope(heli) Q2 2024 24 - 1540 1.01 0.228 0.18 21.35 558.2 536.85 Boundary Q3 2024 24 - 1548 0.34 0.178 0.232 16.5 154.5 138 MBX Q3 2024 24 - 1571 20.05 0.092 0.576 6.64 159.61 152.97 MBX Q3 2024 24 - 1570 0.54 0.027 0.205 18.58 129.58 111 North Slope Q3 2024 24 - 1558 1.19 0.099 0.173 22 323 301 North Slope Q3 2024 24 - 1555 1.58 0.422 1.121 3.35 187.35 184 King Richard Q3 2024 24 - 1556 0.25 0.015 0.268 14 295 281 MBX Q3 2024 24 - 1570 12.0 0.205 0.323 11.52 286.52 275.00 Goldmark Q2 2024 24 - 1532 9.04 0.065 0.623 5.95 540.45 534.5 North Slope Q3 2024 24 - 1555 4.64 0.009 2.109 1.75 502.25 500.5 North Slope Q3 2024 24 - 1566 1.1 0.039 1.484 2.48 46.48 44.00 North Slope Q2 2024 24 - 1534 1.79 0.099 0.318 11.45 434.45 423 North Slope Q3 2024 24 - 1566 2.0 0.246 0.081 44.17 598.17 554.00 North Slope Q2 2024 24 - 1533 0.1 0.004 1.787 2.00 41.00 39.00 66 Q1 2024 24 - 1516 0.93 0.184 0.139 25.69 33 7.31 North Slope Q3 2024 24 - 1558 6.91 0.157 0.321 11.1 445 433.9 North Slope Q3 2024 24 - 1563 8.3 0.03 1.709 2.07 181 178.93 North Slope Q3 2024 24 - 1567 2.7 0.166 0.124 28.00 218.00 190.00 Goldmark Q2 2024 24 - 1529 0.69 0.124 0.133 25.7 112 86.3 King Richard Q3 2024 24 - 1556 0.86 0.061 0.609 5.6 519 513.4 North Slope Q3 2024 24 - 1555 1.43 0.129 0.221 15.42 356.42 341 Boundary Q3 2024 24 - 1551 3.43 0.177 0.131 26 472 446 North Slope Q3 2024 24 - 1555 0.6 0.083 1.696 2.00 178.00 176.00 North Slope Q3 2024 24 - 1543 0.6 0.146 0.243 13.93 169.00 155.07 MBX Q2 2024 24 - 1531 1.9 0.045 0.198 17 443 426 North Slope Q3 2024 24 - 1558 0.6 0.194 1.674 2.00 48.00 46.00 66 Q1 2024 24 - 1516 0.75 0.091 0.272 12.25 309.25 297 Boundary Q3 2024 24 - 1551 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 3.9 0.018 0.810 4.10 71.00 66.90 DWBX Q2 2024 24 - 1527 12.57 0.304 1.107 3 31 28 King Richard Q3 2024 24 - 1564 4.15 0.084 0.83 4 215 211 North Slope Q3 2024 24 - 1562 2.7 0.080 0.342 9.68 227.00 217.32 North Slope Q2 2024 24 - 1536 0.3 0.099 0.106 31.20 519.20 488.00 North Slope Q2 2024 24 - 1534 2.17 0.044 0.657 5 178 173 Boundary Q3 2024 24 - 1548 2.5 0.193 0.152 21.51 556.00 534.49 North Slope Q3 2024 24 - 1550 1.8 0.164 0.229 14.00 134.00 120.00 66 Q2 2024 24 - 1519 0.8 0.052 1.603 2.00 507.00 505.00 Goldmark Q2 2024 24 - 1529 2.41 0.184 0.181 17.55 356.95 339.4 North Slope Q3 2024 24 - 1558 2.2 0.177 0.153 20.75 383.00 362.25 North Slope Q2 2024 24 - 1534 0.6 0.114 2.267 1.40 182.40 181.00 66 Q1 2024 24 - 1517 24.9 0.273 2.396 1.32 270.00 268.68 Goldmark Q2 2024 24 - 1532 22.1 0.330 1.650 1.90 275.00 273.10 North Slope Q2 2024 24 - 1536 2.97 0.138 0.314 9.97 391.97 382 North Slope Q3 2024 24 - 1563 0.63 0.166 0.072 42.7 569 526.3 North Slope Q3 2024 24 - 1558 27.8 0.459 4.098 0.75 254.55 253.8 Boundary Q3 2024 24 - 1548 2.5 0.143 0.169 18 365 347 North Slope Q3 2024 24 - 1563 1.2 0.059 5.708 0.53 483.26 482.73 North Slope Q2 2024 24 - 1536 0.83 0.097 0.144 21 102 81 King Richard Q3 2024 24 - 1564 0.92 0.125 0.152 19.65 82 62.35 King Richard Q3 2024 24 - 1556 1.0 0.041 0.212 14.00 465.00 451.00 Oliver Q2 2024 24 - 1525 1.3 0.346 0.356 8.29 15 6.71 MBX Q3 2024 24 - 1571 24.7 0.086 2.108 1.4 535.9 534.5 North Slope Q3 2024 24 - 1555 3.44 0.052 0.407 7.2 62.2 55 MBX Q3 2024 24 - 1571 0.81 0.147 0.106 27.4 490.4 463 Boundary Q3 2024 24 - 1548 0.8 0.061 0.115 25.00 328.00 303.00 Goldmark Q2 2024 24 - 1529 0.4 0.016 1.437 2 172 170 North Slope Q3 2024 24 - 1555 0.4 0.016 0.141 19.60 91.60 72.00 66 Q2 2024 24 - 1520 0.4 0.012 0.316 8.70 89.00 80.30 North Slope Q2 2024 24 - 1536 0.73 0.182 0.103 26.6 179.45 152.85 Boundary Q3 2024 24 - 1560 1.71 0.04 0.866 3.15 123.9 120.75 Boundary Q3 2024 24 - 1548 4.06 0.177 0.24 11.3 441 429.7 North Slope Q3 2024 24 - 1555 0.27 0.01 0.118 22.96 140 117.04 North Slope Q3 2024 24 - 1567 1.12 0.111 0.27 10 207 197 MBX Q3 2024 24 - 1572 8.3 0.032 1.687 1.60 69.30 67.70 DWBX Q2 2024 24 - 1527 0.54 0.031 0.299 9 99.8 90.8 King Richard Q3 2024 24 - 1554 1.35 0.101 0.228 11.49 204.49 193 MBX Q3 2024 24 - 1572 0.4 0.048 0.289 9.00 224.00 215.00 Oliver Q2 2024 24 - 1528 2.4 0.107 0.324 7.95 320.95 313 North Slope Q3 2024 24 - 1562 12.02 0.159 0.442 5.77 109.44 103.67 MBX Q3 2024 24 - 1569 0.99 0.069 0.241 10.5 296 285.5 North Slope Q3 2024 24 - 1563 8.9 0.039 0.602 4.20 345.00 340.80 Oliver Q2 2024 24 - 1528 0.64 0.023 0.279 9 203 194 North Slope Q3 2024 24 - 1555 5.2 0.188 2.17 1.15 429.1 427.95 North Slope Q3 2024 24 - 1566 8.5 0.094 1.247 2.00 387.00 385.00 Goldmark Q2 2024 24 - 1529 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 0.1 0.009 0.166 15.00 217.00 202.00 North Slope Q2 2024 24 - 1534 0.31 0.176 0.129 18.9 518.9 500 Boundary Q3 2024 24 - 1548 2.25 0.089 1.133 2.15 32.15 30 North Slope Q3 2024 24 - 1566 1.5 0.106 4.04 0.6 516.6 516 North Slope Q3 2024 24 - 1555 0.4 0.024 0.186 13.00 137.50 124.50 Oliver Q2 2024 24 - 1525 0.09 0.011 0.133 18 167 149 North Slope Q3 2024 24 - 1558 0.45 0.051 0.384 6.2 214.2 208 North Slope Q3 2024 24 - 1555 2.3 0.125 0.181 13.05 444.10 431.05 North Slope Q3 2024 24 - 1543 1.3 0.083 1.175 2.00 82.00 80.00 MBX Q2 2024 24 - 1531 2.7 0.204 0.060 39.15 96.15 57.00 North Slope Q3 2024 24 - 1544 0.43 0.036 0.421 5.51 198.51 193 Boundary Q3 2024 24 - 1552 5.8 0.048 2.317 1 215 214 North Slope Q3 2024 24 - 1562 1.4 0.067 0.267 8.64 93.15 84.51 Goldmark Q2 2024 24 - 1529 3.5 0.022 1.150 2.00 36.00 34.00 Goldmark Q2 2024 24 - 1529 2.1 0.664 1.15 2 98 96 MBX Q3 2024 24 - 1568 4.0 0.056 0.980 2.32 207.32 205.00 Goldmark Q2 2024 24 - 1532 0.33 0.086 0.162 14 112 98 MBX Q3 2024 24 - 1570 1.2 0.186 0.146 15.40 335.40 320.00 North Slope(heli) Q2 2024 24 - 1540 18.7 1.550 2.246 1.00 365.00 364.00 North Slope Q3 2024 24 - 1543 2.7 0.043 1.121 2.00 86.00 84.00 66 Q2 2024 24 - 1519 0.3 0.024 1.649 1.35 112.85 111.50 66 Q1 2024 24 - 1517 0.6 0.014 1.021 2.18 150.66 148.48 66 Q2 2024 24 - 1522 2.69 0.88 1.852 1.2 177 175.8 MBX Q3 2024 24 - 1571 0.2 0.005 1.107 2.00 127.00 125.00 66 Q2 2024 24 - 1521 0.76 0.138 0.158 14 34 20 MBX Q3 2024 24 - 1571 3.3 0.132 1.574 1.4 32.15 30.75 North Slope Q3 2024 24 - 1566 2.8 0.199 0.091 24.00 310.00 286.00 North Slope Q2 2024 24 - 1533 0.14 0.072 0.121 18 39 21 MBX Q3 2024 24 - 1572 1.4 0.052 0.361 6.00 488.00 482.00 North Slope(heli) Q2 2024 24 - 1540 2.7 0.014 0.181 11.95 26.95 15.00 66 Q2 2024 24 - 1519 0.4 0.022 1.073 2.00 66.00 64.00 Goldmark Q2 2024 24 - 1532 0.58 0.131 0.077 27.75 83.75 56 Boundary Q3 2024 24 - 1548 1.6 0.196 0.132 16.07 405.07 389.00 North Slope Q2 2024 24 - 1533 9.9 0.11 1.766 1.2 524.2 523 Saddle West Q3 2024 24 - 1565 24.4 0.041 1.043 2.03 107.00 104.97 66 Q2 2024 24 - 1521 1.2 0.017 0.52 4 180 176 North Slope Q3 2024 24 - 1563 11.7 0.140 1.321 1.56 107.56 106.00 MBX Q2 2024 24 - 1531 17.5 0.268 1.278 1.61 262.71 261.10 North Slope Q2 2024 24 - 1536 0.7 0.121 2.445 0.84 98.79 97.95 MBX Q3 2024 24 - 1571 1.5 0.097 0.113 18.00 368.00 350.00 North Slope Q2 2024 24 - 1541 1.9 0.035 0.252 8.00 393.00 385.00 North Slope Q2 2024 24 - 1534 0.4 0.015 0.251 8.00 58.00 50.00 North Slope Q3 2024 24 - 1550 3.1 0.220 0.176 11.32 475.49 464.17 North Slope Q3 2024 24 - 1550 29.5 0.066 1.649 1.20 342.00 340.80 Oliver Q2 2024 24 - 1528 0.5 0.104 0.058 34.02 525.71 491.69 North Slope Q2 2024 24 - 1533 47.4 0.084 1.07 1.84 156.37 154.53 MBX Q3 2024 24 - 1570 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 1.95 0.125 0.126 15.55 423.15 407.6 North Slope Q3 2024 24 - 1555 0.38 0.047 0.471 4.1 219 214.9 King Richard Q3 2024 24 - 1554 3.5 0.034 1.918 1 174 173 Boundary Q3 2024 24 - 1548 5.7 0.103 1.008 1.9 320.95 319.05 North Slope Q3 2024 24 - 1562 3.6 0.082 1.137 1.68 219.00 217.32 North Slope Q2 2024 24 - 1536 0.4 0.032 0.163 11.7 196.7 185 North Slope Q3 2024 24 - 1566 0.21 0.112 0.21 9 37 28 MBX Q3 2024 24 - 1570 0.4 0.11 0.098 19 186 167 King Richard Q3 2024 24 - 1554 1.7 0.156 0.190 9.75 139.90 130.15 Goldmark Q2 2024 24 - 1529 1.29 0.165 0.11 16.7 506.1 489.4 North Slope Q2 2024 24 - 1546 0.2 0.018 0.152 12.00 44.00 32.00 66 Q1 2024 24 - 1518 2.39 0.641 0.551 3.3 432.05 428.75 North Slope Q2 2024 24 - 1546 0.65 0.154 0.13 13.95 171.95 158 King Richard Q3 2024 24 - 1564 0.18 0.014 0.197 9 243 234 MBX Q3 2024 24 - 1570 0.6 0.049 0.383 4.62 30.02 25.40 66 Q2 2024 24 - 1520 0.3 0.020 0.177 9.70 79.00 69.30 Oliver Q2 2024 24 - 1528 1.6 0.137 0.857 2.00 95.00 93.00 North Slope Q2 2024 24 - 1534 0.3 0.010 0.114 15.00 466.00 451.00 Oliver Q2 2024 24 - 1530 3.04 0.267 0.169 10 265 255 North Slope Q2 2024 24 - 1546 1.7 0.037 0.169 10 182 172 Saddle West Q3 2024 24 - 1565 0.1 0.002 0.280 6.00 155.00 149.00 66 Q1 2024 24 - 1516 1.2 0.103 0.140 12.00 88.00 76.00 North Slope Q2 2024 24 - 1534 3.9 0.163 0.288 5.83 528.25 522.42 North Slope Q3 2024 24 - 1566 0.25 0.029 0.175 9.5 445.5 436 North Slope Q3 2024 24 - 1567 1.5 0.029 0.296 5.56 175.56 170.00 Goldmark Q2 2024 24 - 1532 5.6 1.88 1.724 0.95 432.05 431.1 North Slope Q2 2024 24 - 1546 0.3 0.018 0.272 6.00 465.00 459.00 North Slope Q2 2024 24 - 1534 2.58 0.059 0.272 6 426 420 North Slope Q3 2024 24 - 1562 0.3 0.102 0.102 15.85 330.00 314.15 MBX Q2 2024 24 - 1531 1.2 0.081 1.593 1 197 196 Boundary Q3 2024 24 - 1552 0.5 0.141 0.142 11.20 249.20 238.00 MBX Q2 2024 24 - 1531 1.07 0.11 0.216 7.35 277.75 270.4 Boundary Q3 2024 24 - 1548 3.6 0.125 1.56 1 56 55 MBX Q3 2024 24 - 1571 0.95 0.01 0.198 7.84 129 121.16 Saddle West Q3 2024 24 - 1565 0.73 0.108 0.128 12.1 305.1 293 North Slope Q3 2024 24 - 1562 3.34 0.129 0.143 10.76 325.95 315.19 Boundary Q3 2024 24 - 1548 0.75 0.049 0.216 7.1 239.1 232 Boundary Q3 2024 24 - 1548 1.06 0.107 0.138 11 351 340 Boundary Q3 2024 24 - 1552 0.36 0.04 0.159 9.4 331 321.6 Boundary Q3 2024 24 - 1551 46.7 0.891 2.484 0.6 433.3 432.7 North Slope Q3 2024 24 - 1555 0.7 0.116 0.243 6.1 46.1 40 MBX Q3 2024 24 - 1571 4.4 0.275 0.172 8.6 528.1 519.5 North Slope Q2 2024 24 - 1546 0.3 0.149 0.067 22.00 548.00 526.00 North Slope Q2 2024 24 - 1534 0.6 0.023 0.147 10.00 184.00 174.00 Oliver Q2 2024 24 - 1525 1.03 0.096 0.101 14.5 362.5 348 North Slope Q3 2024 24 - 1562 0.53 0.077 0.145 10 423 413 Boundary Q3 2024 24 - 1548 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024

Ag ppm Cu % Au ppm Core Length (m) To (m) From (m) Target Zone Quarter Drilled Drill Hole 0.2 0.019 0.221 6.55 163.60 157.05 North Slope Q2 2024 24 - 1536 1.99 0.152 0.214 6.65 361.65 355 Saddle West Q3 2024 24 - 1565 1.5 0.102 2.777 0.51 216.76 216.25 Oliver Q2 2024 24 - 1528 0.89 0.102 0.097 14.59 271 256.41 Boundary Q3 2024 24 - 1552 0.61 0.161 0.124 11.28 16 4.72 North Slope Q3 2024 24 - 1566 0.9 0.104 0.075 18.62 280.00 261.38 North Slope Q2 2024 24 - 1533 0.6 0.201 0.122 11.43 578.00 566.57 Goldmark Q2 2024 24 - 1529 1.7 0.034 1.547 0.9 123.9 123 Boundary Q3 2024 24 - 1548 1.8 0.201 1.159 1.19 478.35 477.16 North Slope Q2 2024 24 - 1536 0.83 0.064 0.226 6.07 50.07 44 North Slope Q3 2024 24 - 1562 0.2 0.017 0.127 10.68 139.00 128.32 North Slope Q2 2024 24 - 1536 0.9 0.012 0.366 3.70 123.70 120.00 66 Q1 2024 24 - 1518 0.8 0.034 0.169 8.00 28.00 20.00 Goldmark Q2 2024 24 - 1532 0.3 0.023 0.135 10.00 111.00 101.00 North Slope Q2 2024 24 - 1534 1.2 0.098 0.168 8.00 170.00 162.00 66 Q1 2024 24 - 1518 0.65 0.065 0.149 9 304 295 Boundary Q3 2024 24 - 1560 0.3 0.037 1.136 1.18 149.18 148.00 66 Q2 2024 24 - 1520 7.4 0.16 1.405 0.95 178 177.05 Boundary Q3 2024 24 - 1548 1.3 0.175 0.263 5.00 567.00 562.00 North Slope(heli) Q2 2024 24 - 1540 3.5 1.24 2.389 0.55 176.35 175.8 MBX Q3 2024 24 - 1571 1.96 0.148 0.12 10.9 546.9 536 North Slope Q2 2024 24 - 1546 0.2 0.014 0.172 7.59 112.59 105.00 Goldmark Q2 2024 24 - 1532 4.3 0.727 1.074 1.20 274.00 272.80 Southern Star Q2 2024 24 - 1526 0.05 0.004 0.355 3.63 210.97 207.34 MBX Q3 2024 24 - 1570 0.23 0.019 0.214 6 64 58 North Slope Q3 2024 24 - 1566 2.92 0.213 0.4 3.2 485.4 482.2 North Slope Q3 2024 24 - 1555 2.83 0.305 0.471 2.7 72 69.3 King Richard Q3 2024 24 - 1564 0.3 0.059 0.275 4.60 137.05 132.45 Southern Star Q2 2024 24 - 1526 8.39 0.635 0.575 2.2 282 279.8 North Slope Q3 2024 24 - 1555 0.4 0.232 0.283 4.45 42.45 38 MBX Q3 2024 24 - 1569 0.7 0.087 0.149 8.36 614.00 605.64 Goldmark Q2 2024 24 - 1529 0.4 0.014 1.241 1 150 149 King Richard Q3 2024 24 - 1564 2.16 0.153 0.103 12 454 442 North Slope Q3 2024 24 - 1566 3.02 0.134 0.138 8.95 473.65 464.7 North Slope Q2 2024 24 - 1546 21.8 0.326 1.116 1.1 435 433.9 North Slope Q3 2024 24 - 1563 1.3 0.113 0.076 16 321 305 North Slope Q3 2024 24 - 1558 4.7 0.197 0.093 13.00 98.00 85.00 North Slope Q3 2024 24 - 1553 0.5 0.103 0.134 9.00 95.00 86.00 North Slope Q2 2024 24 - 1539 1.2 0.158 0.081 14.82 172.82 158.00 North Slope Q3 2024 24 - 1544 1.5 0.746 1.179 1 126 125 MBX Q3 2024 24 - 1569 0.36 0.162 0.064 17.85 548 530.15 Saddle West Q3 2024 24 - 1565 1.5 0.025 0.189 6.00 256.00 250.00 66 Q1 2024 24 - 1517 1.6 0.158 0.079 14.08 63.08 49.00 North Slope Q3 2024 24 - 1553 2.7 0.141 0.199 5.58 182.58 177.00 Goldmark Q2 2024 24 - 1529 4.18 0.182 0.272 4.05 345.9 341.85 North Slope Q3 2024 24 - 1555 0.9 0.061 0.160 6.88 458.88 452.00 North Slope Q2 2024 24 - 1536 Centerra Gold Inc. - Mount Milligan Drill Hole Assay Results Period: from January 1, 2024 to December 31, 2024