united states

securities and exchange commission

washington, d.c. 20549

form n-csr

certified shareholder report of registered management

investment companies

Investment Company Act file number 811-23652

Dynamic Alternatives Fund

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC 225 Pictoria Drive, Suite 450 Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Jeffrey G. Wilkins, President and Principal Executive Officer

Dynamic Alternatives Fund

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant's telephone number, including area code: 513-587-3400

Date of fiscal year end: 9/30

Date of reporting period: 3/31/2023

Item 1. Reports to Stockholders.

(a)

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Dynamic Alternatives Fund |

| |

| |

| |

| |

| |

| |

| |

| Semi-Annual Report |

| |

| March 31, 2023 |

| |

| |

| |

| |

| |

| |

| |

| |

| Hamilton Capital, LLC |

| |

| 5025 Arlington Centre Boulevard, Suite 300 |

| |

| Columbus, Ohio 43220 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Dynamic Alternatives Fund |

| Investment Results |

| (Unaudited) |

| Total Returns(1) |

| as of March 31, 2023 |

| |

| | Since |

| | Inception |

| | (10/31/22) |

| Dynamic Alternatives Fund | 1.56% |

| Bloomberg U.S. Aggregate Bond Index(2) | 6.27% |

| MSCI ACWI Index(3) | 11.08% |

| | |

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Dynamic Alternatives Fund (the “Fund”) distributions or the redemption of Fund shares.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All performance figures are presented net of fees. The Fund’s total returns reflect any fee waivers during the applicable period. If such fee waivers had not occurred, the quoted performance would have been lower.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (833) 617-2624. The prospectus should be read carefully before investing. The Fund is distributed by Ultimus Fund Distributors, LLC (Member FINRA).

| (1) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would have been lower. Returns for less than one year are not annualized. |

| (2) | The Bloomberg U.S. Aggregate Bond Index (“Index”) is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed rate and hybrid adjustable rate mortgage pass throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). Individuals cannot invest directly in the Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (3) | The MSCI ACWI Index (“MSCI Index”) captures large and mid cap representation across the 23 developed markets countries and 24 emerging markets countries. The performance of the MSCI Index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or operating expenses. Individuals cannot invest directly in the MSCI Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| Dynamic Alternatives Fund |

| Fund Holdings |

| (Unaudited) |

| |

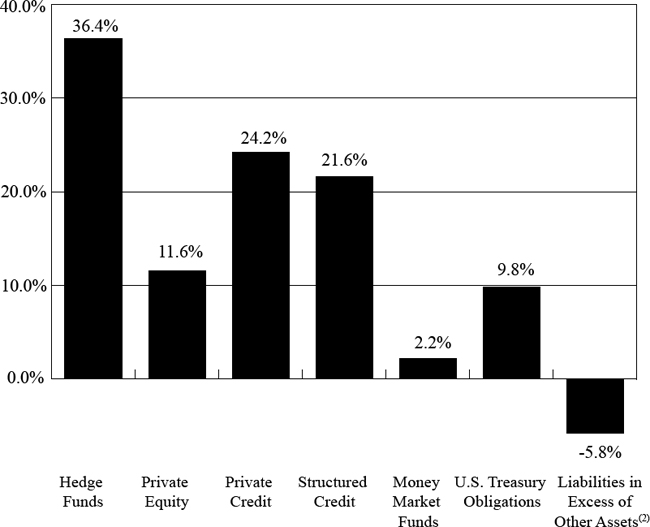

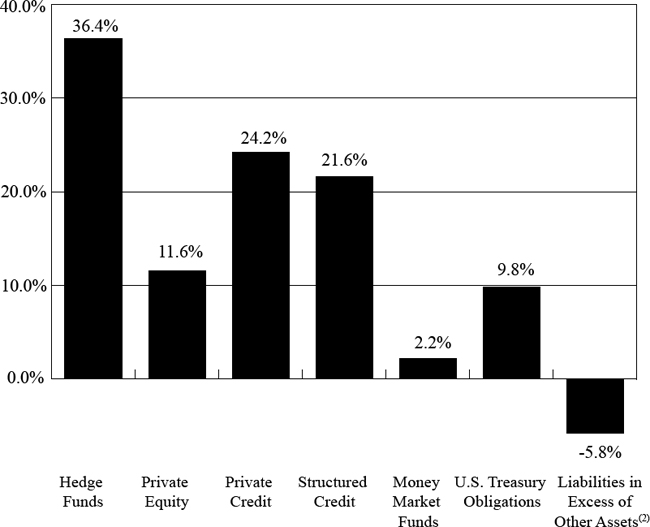

Dynamic Alternatives Fund as of March 31, 2023(1)

| (1) | As a percentage of net assets. |

| (2) | Consists of the Fund’s liabilities less any non-investment assets. |

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

| Dynamic Alternatives Fund |

| Schedule of Investments |

| March 31, 2023 (Unaudited) |

| | | | | | | | | | | | | | | | | | | Next |

| | | | | | % of | | | | | | | | | Initial | | | | Available |

| | | | | | Net | | | | | | | | | Acquisition | | Redemption | | Redemption |

| Portfolio Funds* | | Shares | | | Assets | | | Cost(1) | | | Fair Value | | | Date | | Frequency(2) | | Date |

| Hedge Funds | | | | | | | | | | | | | | | | | | | | | | |

| Centiva Offshore Fund, Ltd., Class A, Series 0621 | | | 48,235 | | | | 8.2 | % | | $ | 5,062,774 | | | $ | 5,126,032 | | | 11/1/2022 | | Quarterly | | 6/30/2023(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0323 | | | 6,000 | | | | 1.0 | % | | | 600,000 | | | | 595,346 | | | 3/1/2023 | | Quarterly | | 6/30/2023(3) |

| | | | 54,235 | | | | 9.2 | % | | | 5,662,774 | | | | 5,721,378 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Corbin Hedged Equity Fund, LP | | | | | | | 11.7 | % | | | 7,206,299 | | | | 7,339,050 | | | 11/1/2022 | | Monthly | | 4/30/2023(4) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Mission Crest Macro Fund, Ltd., Class C, Series 0123(5) | | | 5,000 | | | | 7.5 | % | | | 5,000,000 | | | | 4,719,551 | | | 1/3/2023 | | Monthly | | 4/30/2023 |

| Mission Crest Macro Fund, Ltd., Class C, Series 0323(5) | | | 600 | | | | 0.9 | % | | | 600,000 | | | | 575,543 | | | 3/1/2023 | | Monthly | | 4/30/2023 |

| | | | 5,600 | | | | 8.4 | % | | | 5,600,000 | | | | 5,295,094 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Pinehurst Institutional Ltd., Class B1, Series 145(5) | | | 1,465 | | | | 4.4 | % | | | 2,662,774 | | | | 2,748,315 | | | 11/1/2022 | | Quarterly | | 6/30/2023(3) |

| Pinehurst Institutional Ltd., Class B1, Series 146(5) | | | 633 | | | | 1.9 | % | | | 1,150,000 | | | | 1,186,383 | | | 12/1/2022 | | Quarterly | | 6/30/2023(3) |

| Pinehurst Institutional Ltd., Class B1, Series 147(5) | | | 265 | | | | 0.8 | % | | | 500,000 | | | | 496,001 | | | 3/1/2023 | | Quarterly | | 6/30/2023(3) |

| | | | 2,363 | | | | 7.1 | % | | | 4,312,774 | | | | 4,430,699 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments - Hedge Funds | | | | | | | 36.4 | % | | | 22,781,847 | | | | 22,786,221 | | | | | | | |

| Dynamic Alternatives Fund |

| Schedule of Investments |

| March 31, 2023 (Unaudited) (Continued) |

| | | | | | | | | | | | | | | | | | | Next |

| | | | | | % of | | | | | | | | | Initial | | | | Available |

| | | | | | Net | | | | | | | | | Acquisition | | Redemption | | Redemption |

| Portfolio Funds* | | Shares | | | Assets | | | Cost(1) | | | Fair Value | | | Date | | Frequency(2) | | Date |

| Private Equity | | | | | | | | | | | | | | | | | | | | | | |

| AMG Pantheon Fund, LLC, Class 2 | | | 340,196 | | | | 11.6 | % | | $ | 6,968,011 | | | $ | 7,249,582 | | | 11/1/2022 | | Quarterly | | 6/30/2023 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Structured Credit | | | | | | | | | | | | | | | | | | | | | | |

| Waterfall Eden Fund, Ltd., Class B, Series 1(5) | | | 5,500 | | | | 8.7 | % | | | 5,500,000 | | | | 5,431,250 | | | 3/1/2023 | | Quarterly | | 6/30/2023(3) |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments - Portfolio Funds | | | | | | | 56.7 | % | | | 35,249,858 | | | | 35,467,053 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interval Funds | | | | | | | | | | | | | | | | | | | | | | |

| Private Credit | | | | | | | | | | | | | | | | | | | | | | |

| Cliffwater Corporate Lending Fund | | | 824,629 | | | | 14.1 | % | | | 8,719,572 | | | | 8,798,791 | | | 11/1/2022 | | Quarterly | | 5/15/2023 |

| | | | | | | | | | | | | | | | | | | | | | | |

Business

Development

Companies | | | | | | | | | | | | | | | | | | | | | | |

| Private Credit | | | | | | | | | | | | | | | | | | | | | | |

| Blackstone Private Credit Fund, Class I | | | 255,555 | | | | 10.1 | % | | | 6,350,000 | | | | 6,330,099 | | | 2/1/2023 | | Quarterly | | 6/30/2023 |

| | | | | | % of | | | | | | | |

| | | | | | Net | | | | | | | |

| Open-End Mutual Funds | | Shares | | | Assets | | | Cost(1) | | | Fair Value | |

| Structured Credit | | | | | | | | | | | | | | | | |

| Axonic Strategic Income Fund, Institutional Class | | | 487,633 | | | | 6.8 | % | | $ | 4,312,774 | | | $ | 4,271,669 | |

| FPA New Income, Inc. | | | 396,436 | | | | 6.1 | % | | | 3,750,000 | | | | 3,793,896 | |

| Total Investments - Open-End Mutual Funds | | | | | | | 12.9 | % | | | 8,062,774 | | | | 8,065,565 | |

| Dynamic Alternatives Fund |

| Schedule of Investments |

| March 31, 2023 (Unaudited) (Continued) |

| | | | | | % of | | | | | | | |

| | | | | | Net | | | | | | | |

| Money Market Funds | | Shares | | | Assets | | | Cost(1) | | | Fair Value | |

| Goldman Sachs Financial Square Government Fund, Institutional Class, 4.84% (6) | | | 1,345,065 | | | | 2.2 | % | | $ | 1,345,065 | | | $ | 1,345,065 | |

| | | | | | | | | | | | | | | | | |

| | | Principal | | | | | | | | | | |

| U.S. Treasury Obligations | | Amount | | | | | | | | | | |

| United States Treasury Bill, 4.36%, 4/25/2023 (7) | | $ | 6,144,000 | | | | 9.8 | % | | | 6,126,195 | | | | 6,126,920 | |

| | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | |

| Total Investments | | | | | | | 105.8 | % | | $ | 65,853,464 | | | $ | 66,133,493 | |

| | | | | | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets | | | | | | | (5.8 | )% | | | | | | | (3,604,611 | ) |

| | | | | | | | | | | | | | | | | |

| Net Assets | | | | | | | 100.0 | % | | | | | | $ | 62,528,882 | |

| | | | | | | | | | | | | | | | | |

| * | Non-income producing security. |

| (1) | There were no unfunded capital commitments as of March 31, 2023. |

| (2) | Certain redemptions may be subject to various restrictions and limitations such as redemption penalties on investments liquidated within a certain period subsequent to investment (e.g., a soft or hard lock-up), investor-level gates and/or Portfolio Fund-level gates. Redemption notice periods range from 10 to 100 days. |

| (3) | Subject to 25% investor level quarterly gate. |

| (4) | Subject to 10% investor level monthly gate. |

| (5) | Security is being fair valued in accordance with the Fund’s valuation procedures. |

| (6) | Rate disclosed is the seven day effective yield as of March 31, 2023. |

| (7) | The rate shown represents effective yield at time of purchase. |

| Dynamic Alternatives Fund |

| Statement of Assets and Liabilities |

| March 31, 2023 (Unaudited) |

| Assets | | | |

| Investments in securities and Portfolio Funds, at fair value (cost $65,853,464) | | $ | 66,133,493 | |

| Advanced subscriptions in Portfolio Funds | | | 1,200,000 | |

| Dividends receivable | | | 128,602 | |

| Prepaid offering costs | | | 93,079 | |

| Prepaid expenses | | | 2,088 | |

| Total assets | | | 67,557,262 | |

| | | | | |

| Liabilities | | | | |

| Subscriptions received in advance | | $ | 4,891,000 | |

| Payable to Adviser | | | 83,725 | |

| Payable for audit and tax fees | | | 14,073 | |

| Payable to Administrator | | | 12,830 | |

| Other accrued expenses | | | 26,752 | |

| Total liabilities | | | 5,028,380 | |

| | | | | |

| Net Assets | | $ | 62,528,882 | |

| | | | | |

| Net Assets Consist Of | | | | |

| Paid-in capital | | $ | 62,352,602 | |

| Accumulated earnings | | | 176,280 | |

| Net Assets | | $ | 62,528,882 | |

| | | | | |

| Shares outstanding (no par value, 9,990,000 additional shares registered) | | | 6,218,474 | |

| Net asset value, offering and redemption price per share | | $ | 10.06 | |

| | | | | |

See accompanying notes which are an integral part of these financial statements.

| Dynamic Alternatives Fund |

| Statement of Operations |

| For the period ended March 31, 2023(1) (Unaudited) |

| Investment Income | | | | |

| Interest income | | $ | 84,936 | |

| Dividend income | | | 473,619 | |

| Total Income | | | 558,555 | |

| | | | | |

| Expenses | | | | |

| Investment Adviser | | | 208,621 | |

| Offering costs | | | 66,485 | |

| Legal | | | 52,010 | |

| Administration | | | 23,742 | |

| Audit and tax preparation fees | | | 14,073 | |

| Trustee | | | 13,739 | |

| Organizational fees | | | 11,630 | |

| Chief Compliance Officer | | | 10,036 | |

| Transfer agent | | | 8,333 | |

| Printing | | | 4,244 | |

| Custodian | | | 4,118 | |

| Registration | | | 1,462 | |

| Miscellaneous | | | 14,048 | |

| Total expenses | | | 432,541 | |

| Fees waived by Adviser | | | (67,456 | ) |

| Net expenses | | | 365,085 | |

| Net investment income | | | 193,470 | |

| | | | | |

| Realized and Change in Unrealized Gain/(Loss) from Investments in Portfolio Funds | | | | |

| Net realized gain on sale of investments in Portfolio Funds | | | 126,682 | |

| Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | 280,029 | |

| Net realized and change in unrealized gain from investments in Portfolio Funds | | | 406,711 | |

| Net increase in net assets resulting from operations | | $ | 600,181 | |

| | | | | |

| (1) | For the period October 31, 2022 (commencement of operations) through March 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Dynamic Alternatives Fund |

| Statement of Changes in Net Assets |

| | | For The Period | |

| | | Ended | |

| | | March 31, | |

| | | 2023(1) | |

| | | (Unaudited) | |

| Increase/(Decrease) In Net Assets Resulting From Operations | | | | |

| Net investment income/(loss) | | $ | 193,470 | |

| Net realized gain on sale of investments in Portfolio Funds | | | 126,682 | |

| Net change in unrealized appreciation/(depreciation) from investments in Portfolio Funds | | | 280,029 | |

| Net increase/(decrease) in net assets resulting from operations | | | 600,181 | |

| | | | | |

| Distributions To Shareholders From Earnings | | | | |

| Institutional Shares | | | (423,901 | ) |

| | | | | |

| Capital Share Transactions | | | | |

| Proceeds from issuance of shares | | | 61,928,701 | |

| Reinvestment of distributions | | | 423,901 | |

| Payments for redemption of shares | | | — | |

| Net increase/(decrease) in net assets resulting from capital share transactions | | | 62,352,602 | |

| Net increase/(decrease) in net assets | | | 62,528,882 | |

| Net assets at beginning of period | | | — | |

| Net assets at end of period | | $ | 62,528,882 | |

| | | | | |

| Share Transactions | | | | |

| Shares issued | | | 6,176,211 | |

| Reinvestment of distributions | | | 42,263 | |

| Shares redeemed | | | — | |

| Net increase/(decrease) in share transactions | | | 6,218,474 | |

| | | | | |

| (1) | For the period October 31, 2022 (commencement of operations) through March 31, 2023. |

See accompanying notes which are an integral part of these financial statements.

| Dynamic Alternatives Fund |

| Financial Highlights |

| | | For the Period | |

| | | Ended | |

| | | March 31, 2023(1) | |

| | | (Unaudited) | |

| Per Share Operating Performance | | | | |

| Net asset value, beginning of period | | $ | 10.00 | |

| | | | | |

| Investment operations: | | | | |

| Net investment income | | | 0.06 | |

| Net realized and unrealized gains/(losses) from investments in Portfolio Funds | | | 0.10 | |

| Net change in net assets resulting from operations | | | 0.16 | |

| | | | | |

| Distributions from: | | | | |

| Net investment income | | | (0.10 | ) |

| | | | | |

| Net asset value, end of period | | $ | 10.06 | |

| | | | | |

| Total return(2) | | | 1.56 | % (3) |

| | | | | |

| Net assets, end of period | | $ | 62,528,882 | |

| | | | | |

| Ratios To Average Net Assets | | | | |

| Expenses after waiver and reimbursement(4) | | | 1.75 | % (5) |

| Expenses before waiver and reimbursement(4) | | | 2.07 | % (5) |

| Net investment income after waiver and reimbursement(4) | | | 0.93 | % (5) |

| Net investment income before waiver and reimbursement(4) | | | 0.61 | % (5) |

| Portfolio turnover rate | | | 0.00 | % (3) |

| | | | | |

| (1) | For the period October 31, 2022 (commencement of operations) through March 31, 2023. |

| (2) | Total return represents the rate an investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions, if any. |

| (4) | The ratios do not reflect the Fund’s proportionate share of income, expenses and incentive allocations of the underlying Portfolio Funds. |

See accompanying notes which are an integral part of these financial statements.

| Dynamic Alternatives Fund |

| Notes to the Financial Statements |

| March 31, 2023 (Unaudited) |

1. ORGANIZATION

The Dynamic Alternatives Fund (the “Fund”) was organized on March 24, 2021 as a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end investment management company. The Fund is non-diversified and operates as a “tender offer fund,” which means that it is subject to the requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended (the “1934 Act”), with respect thereto.

The Fund commenced operations on October 31, 2022. The Fund had no operations prior to October 31, 2022 other than those relating to organizational matters, including the issuance of 10,000 shares at $10.00 per share to its initial investor, Hamilton Capital, LLC (the “Adviser”), the investment adviser to the Fund. The Fund’s registration statement permits it to offer a single class of shares of beneficial interest (“shares”). The Fund’s shares will be offered monthly, as of the first business day of each month, based on the net asset value (“NAV”) per share calculated as of the last business day of the prior month. The Fund has registered $100,000,000 of shares for sale under the registration statement. The Fund is governed by the Board of Trustees (the “Board”).

The Fund’s investment objective is to seek total return through a combination of capital appreciation and income generation. The Fund seeks to achieve its investment objective by dynamically allocating its assets among investments in private investment vehicles (“Portfolio Funds”), commonly referred to as hedge funds, private equity funds and private real estate investment funds, that are managed by unaffiliated asset managers and employ a broad range of investment strategies.

(2) SIGNIFICANT ACCOUNTING POLICIES

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

| |

| Federal Income Taxes |

The Fund intends to qualify as a “registered investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis. Therefore, no provision of federal income taxes is required.

Share Valuation

The Fund will calculate the NAV of the shares as of the close of business on the last business day of each calendar month and at such other times as the Board may determine, including in connection with the repurchase of shares (each such date, an “NAV Date”). Due to the nature of many of the securities held in the Fund’s portfolio, the valuation information necessary to calculate NAV will generally not be available until several weeks after each NAV Date. As a result, in general, the NAV will be calculated within approximately 30 calendar days after each NAV Date (based on the value of each portfolio holding as of the NAV Date).

(3) SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS

The Fund has adopted valuation procedures the (“Valuation Procedures”) which have been approved by the Board. Under the Valuation Procedures, the Board has delegated to the Adviser the role of serving as the Fund’s valuation designee (the “Valuation Designee”), with responsibility for determining a fair value for securities for which market quotations are not readily available, subject to Board oversight. The Board receives valuation reports from the Valuation Designee on a quarterly basis and determines if the Valuation Procedures are operating as expected and the outcomes are reliable.

Investments in Portfolio Funds are recorded on a subscription effective date basis, which is generally the first day of the calendar month in which the investment is effective. Realized gains and losses are calculated on a specific identification method when redemptions are accepted by a Portfolio Fund, which is generally on the last day of the calendar month. Interest income and expense, if any, are accrued each month. Dividends are recorded on the ex-dividend date. Distributions received from the Fund’s investments in Portfolio Funds generally are comprised of ordinary income and return of capital. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution received. Such estimates are based on historical information available and other industry sources. These estimates may subsequently be revised based on information received from Portfolio Funds after their tax reporting periods are concluded.

Because the Fund invests a substantial portion of its assets in Portfolio Funds, the NAV of the shares will depend on the value of the Portfolio Funds. The NAVs of Portfolio Funds are generally not available from pricing vendors, nor are they calculable independently

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

by the Fund or by the Adviser. Under the Valuation Procedures, the Adviser, as the Valuation Designee, is responsible for determining the fair value of each Portfolio Fund as of each date upon which the Fund calculates its NAV (the “NAV Date”). The Valuation Procedures require the Adviser to consider all relevant information when assessing and determining the fair value of the Fund’s interest in each Portfolio Fund.

As a general matter, the fair value of the Fund’s interest in a Portfolio Fund will be the amount that the Fund could reasonably expect to receive from the Portfolio Fund if the Fund’s interest in the Portfolio Fund was redeemed as of the NAV Date. In accordance with the Valuation Procedures, the fair value of the Fund’s interest in a Portfolio Fund as of a NAV Date will ordinarily be the most recent NAV reported by an Investment Manager or third-party administrator (“Portfolio Fund Management”). In the event that the last reported NAV of a Portfolio Fund is not as of the NAV Date, the Adviser may use other information that it believes should be taken into consideration in determining the Portfolio Fund’s fair value as of the NAV Date. This may include any cash flows since the reference date of the last reported valuation by the Portfolio Fund Management, and relevant broad-based and issuer (or fund) specific valuation information relating to the assets held by the Portfolio Fund that is reasonably available at the time the Portfolio Fund values its investments.

Pursuant to the Valuation Procedures, the Adviser may conclude in certain circumstances that, after considering information reasonably available at the time the valuation is made and that the Adviser believes to be reliable, the NAV provided by Portfolio Fund Management does not represent the fair value of the Fund’s interest in the Portfolio Fund. In addition, in the absence of specific transaction activity in the interests of a particular Portfolio Fund, the Adviser could consider whether it was appropriate, in light of all relevant circumstances, to value such a position at the Portfolio Fund’s net assets as reported at the time of valuation, or whether to adjust such value to reflect a premium or discount to the reported net assets.

The Fund’s interests in Portfolio Funds may also be illiquid and may be subject to substantial restrictions on transferability. The Fund may not be able to acquire initial or additional interests in a Portfolio Fund or withdraw all or a portion of its investment from a Portfolio Fund promptly after it has made a decision to do so because of limitations set forth in that Portfolio Fund’s governing documents. See the Schedule of Investments for more information.

Generally, the fair value of the Fund’s investment in a Portfolio Fund represents the Fund’s proportionate share of that Portfolio Fund’s net assets as reported by applicable Portfolio Fund Management. All valuations were determined by the Adviser consistent with the Fund’s Valuation Procedures and are net of management and incentive fees

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

pursuant to the Portfolio Funds’ applicable agreements. The fair value represents the amount the Fund expects to receive, gross of redemption fees or penalties, at March 31, 2023, if it were to liquidate its investments in the Portfolio Funds.

Investments in mutual funds, including money market mutual funds, business development companies and interval funds are generally priced at the closing NAV. These securities are categorized as Level 1 securities.

Fixed income securities are priced using evaluated prices supplied by approved pricing services, which may use electronic data processing techniques and/or a computerized matrix system to determine a fair value. In determining the value of a bond or other fixed income security, matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, rating, coupon, maturity and type of issue, and any other factors or market data as the independent pricing service deems relevant for the security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser, as “Valuation Designee” under the oversight of the Board, decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Valuation Designee, in conformity with the Valuation Procedures adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| ● | Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly. |

| ● | Level 3 – Inputs, broadly referred to as the assumptions that market participants use to make valuation decisions, are unobservable and reflect the Adviser’s best estimate of what market participants would use in pricing the financial instrument at the measurement date. |

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

In determining fair values as of March 31, 2023, the Adviser has, as a practical expedient, estimated fair value of each Portfolio Fund using the NAV (or its equivalent) provided by the Portfolio Fund Management of each Portfolio Fund as of that date. Each investment for which fair value is measured using the Portfolio Fund’s net asset value as a practical expedient is not required to be categorized within the fair value hierarchy. Accordingly, Portfolio Funds with a fair value of $35,467,053 have not been categorized.

Investments in mutual funds and money market mutual funds are generally priced at the ending NAV provided by the service agent of the funds. The following is a summary of the inputs used to value the Fund’s investments in such instruments as of March 31, 2023:

| | | Valuation Inputs | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Interval Funds | | $ | 15,128,890 | | | $ | — | | | $ | — | | | $ | 15,128,890 | |

| Open-End Mutual Funds | | | 8,065,565 | | | | — | | | | — | | | | 8,065,565 | |

| Money Market Funds | | | 1,345,065 | | | | — | | | | — | | | | 1,345,065 | |

| U.S. Treasury Obligations | | | — | | | | 6,126,920 | | | | — | | | | 6,126,920 | |

| Total | | $ | 24,539,520 | | | $ | 6,126,920 | | | $ | — | | | $ | 30,666,440 | |

(4) FEES AND TRANSACTIONS WITH RELATED PARTIES

Investment Advisory Agreement

Under the terms of the Investment Advisory Agreement between the Fund and the Adviser, the Adviser manages the Fund’s investments subject to oversight by the Board. The Fund pays the Adviser a fee, computed and paid monthly, of 1.00% of the Fund’s month-end net assets.

The Adviser has contractually agreed under an Operating Expense Limitation Agreement (“Agreement”) to reduce the management fee and reimburse other expenses to ensure that total annual fund operating expenses (excluding brokerage commissions and other similar transactional expenses; interest (including interest incurred on borrowed funds and interest incurred in connection with bank and custody overdrafts); other borrowing costs and fees, including commitment fees; taxes; acquired fund fees and expenses; litigation and indemnification expenses; judgments; and extraordinary expenses) will not exceed 1.75% of the Fund’s average net assets. This Agreement will continue in effect until at least February 10, 2025 will renew automatically for successive periods of one year thereafter, unless written notice of termination is provided by the Adviser to the Fund not less than ten days prior to the end of the then-current term, and can only be terminated prior to that date with approval from the Board. Management fee

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

reductions and expense reimbursements by the Adviser are subject to recoupment by the Adviser for a period of up to three years from the date such fees were waived or expenses reimbursed, provided that the recoupments do not cause the total annual operating expenses (exclusive of such reductions and reimbursements) to exceed the lesser of (i) the expense limitation in effect at the time such fees were waived or expenses reimbursed, and (ii) the expense limitation in effect at the time of recoupment. For the period ended March 31, 2023, the Adviser waived fees totaling $67,456. As of March 31, 2023, the Adviser may seek recoupment of investment advisory fee waivers as follows:

| Recoverable Through | | | | |

| March 31, 2026 | | $ | 67,456 | |

Investment Managers, who operate Portfolio Funds in which the Fund invests, receive fees for their services. The fees include management and incentive fees, or allocations based upon the net asset value of the Fund’s investment in the Portfolio Fund. These fees are deducted directly from each Portfolio Fund’s assets in accordance with the governing documents of the Portfolio Fund. Generally, fees payable to an Investment Manager are estimated to range from 0.3% to 2.0% (annualized) of the average NAV of the Fund’s investment in a Portfolio Fund. In addition, certain Investment Managers charge an incentive allocation or fee which can range up to 30% of a Portfolio Fund’s net profits. The impact of these fees is reflected in the Fund’s performance but are not operational expenses of the Fund. Incentive fees may be subject to certain hurdle rates.

Master Services Agreement

Ultimus Fund Solutions, LLC (“Ultimus”) provides the Fund with administration, fund accounting and transfer agent services, including all regulatory reporting. Under the terms of a Master Services Agreement, Ultimus receives fees from the Fund for these services.

Consulting Agreement

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides compliance services, pursuant to a consulting agreement between NLCS and the Trust. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Distribution Agreement

The Fund has entered into a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”), pursuant to which the Distributor acts as principal underwriter and distributor of the Fund’s shares of beneficial interest on a best effort basis, subject to various conditions. The Distributor may retain additional broker-dealers and other financial intermediaries (each a “Selling Agent”) to assist in the distribution of shares

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

and shares are available for purchase through these Selling Agents or directly through the Distributor. Generally, shares are only offered to investors that are U.S. persons for U.S. federal income tax purposes. The Distributor is a wholly-owned subsidiary of Ultimus.

Certain officers of the Fund are also employees of the Adviser and/or Ultimus.

(5) ORGANIZATIONAL AND OFFERING COSTS

The Adviser advanced some of the Fund’s organization and initial offering costs and was subsequently reimbursed by the Fund. Costs of $159,564 incurred in connection with the offering and initial registration of the Fund have been deferred and are being amortized on a straight-line basis over the first twelve months after commencement of operations. Costs of $124,459 incurred in connection with the organization of the Fund were expensed as incurred. As of March 31, 2023, the amount of the offering costs remaining to amortize was $93,079.

(6) CAPITAL SHARE TRANSACTIONS

The Fund is a closed-end tender offer fund and, to provide liquidity to shareholders, may from time to time offer to repurchase shares in accordance with written tenders by shareholders at those times, in those amounts and on such terms and conditions as the Board may determine in its sole discretion. In determining whether the Fund should offer to repurchase shares from shareholders, the Board will consider the recommendation of the Adviser. The Adviser currently expects to recommend to the Board that the Fund offer to repurchase up to 5% of the Fund’s outstanding shares at the applicable NAV per share on a quarterly basis. However, the Fund is not required to conduct repurchase offers and may be less likely to do so during the first few years following the commencement of Fund operations and during periods of exceptional market conditions. The Fund expects to make its first repurchase offer during the quarter which is two years after November 1, 2022, the date the Fund started accepting subscriptions.

Shares of the Fund will be traded for purchase only through the Distributor, or a Selling Agent, as of the first business day of each month. Capital transactions are recorded on their effective date. To provide a limited degree of liquidity to shareholders, the Fund may from time to time offer to repurchase shares pursuant to written repurchase offers but is not obligated to do so.

(7) PURCHASES AND SALES OF SECURITIES

For the period ended March 31, 2023, the purchase and sale of investments, excluding short-term investments, were $58,382,204 and $0, respectively.

For the period ended March 31, 2023, there were no purchases or sales of long-term U.S. government obligations.

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

(8) BENEFICIAL OWNERSHIP

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a) (9) of the 1940 Act. As of March 31, 2023, there were no beneficial owners, directly or indirectly, of more than 25% of the Fund.

(9) DISTRIBUTIONS

The Fund declares and pays dividends on investment income, if any, annually. The Fund also makes distributions of net capital gains, if any, annually.

(10) FEDERAL INCOME TAXES

It is the policy of the Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The following information is provided on a tax basis as of March 31, 2023:

| Gross unrealized appreciation | | $ | 723,344 | |

| Gross unrealized depreciation | | | (443,315 | ) |

| Net unrealized appreciation | | $ | 280,029 | |

| Cost of investments | | $ | 65,853,464 | |

(11) CONTINGENCIES AND COMMITMENTS

The Fund indemnifies the Trust’s officers and Board for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote; however, there can be no assurance that such obligations will not result in material liabilities that adversely affect the Fund.

(12) SUBSEQUENT EVENTS

The Fund is required to recognize in this financial statement the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be

| Dynamic Alternatives Fund |

| Notes to the Financial Statements (Unaudited) (Continued) |

disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

| Dynamic Alternatives Fund |

| Dividend Reinvestment Plan (Unaudited) |

Shareholders will automatically participate in the Fund’s Dividend Reinvestment Plan (“DRIP”) and have all income dividends and/or capital gains distributions automatically reinvested in additional shares unless they elect in writing to receive distributions in cash in their Subscription Agreement with the Fund. Ultimus (the “Agent”) acts as the agent for participants under the DRIP. Participants in the DRIP will receive an amount of full and fractional shares equal to the amount of the distribution on that participant’s shares divided by the immediate post-distribution NAV per share.

Shareholders who elect not to participate in the DRIP will receive all distributions in cash paid by wire (or, if the shares are held in street or other nominee name, then to the nominee) by Ultimus as dividend paying agent. To the extent shareholders make an election to receive distributions in cash, the Fund may pay any or all such distributions in a combination of cash and shares. The automatic reinvestment of dividends and distributions will not relieve participants of any income taxes that may be payable (or required to be withheld) on dividends and distributions.

A shareholder may withdraw from the DRIP at any time. There will be no penalty for withdrawal from the DRIP and shareholders who have previously withdrawn from the DRIP may rejoin it at any time. Changes in elections must be in writing and should include the shareholder’s name and address as they appear on the records of the Fund. An election to withdraw from the DRIP will, until such election is changed, be deemed to be an election by a shareholder to take all subsequent distributions in cash. An election will be effective only for a distribution declared and having a record date of at least 10 days after the date on which the election is received. A shareholder whose shares are held in the name of a broker or nominee should contact such broker or nominee concerning changes in that shareholder’s election.

Questions concerning the DRIP should be directed to the Agent at P.O. Box 541150, Omaha, Nebraska 68154 or 833-617-2624.

| Dynamic Alternatives Fund |

| Approval of Advisory Agreement (Unaudited) |

In connection with an organizational meeting of the Board of Trustees (the “Board”) of the Dynamic Alternatives Fund (the “Fund”) held on November 12, 2021, followed by an additional special meeting of the Board held on May 6, 2022, the Board, including a majority of the Trustees who are not “interested persons” (the “Independent Trustees”), as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”), considered the approval of the investment advisory agreement (the “Advisory Agreement”) between Hamilton Capital, LLC (“HC” or the “Adviser”) and the Fund. In considering the approval of the Advisory Agreement, the Board received materials specifically relating to the Fund and the Advisory Agreement, including a memorandum prepared by independent legal counsel discussing the Trustees’ fiduciary obligations and the factors they should assess in considering the approval of the Advisory Agreement, detailed information provided by the Adviser regarding management fees and other expenses of the Fund, due diligence materials relating to the Adviser (including the Adviser’s responses to an information request circulated by independent legal counsel on behalf of the Independent Trustees, the Adviser’s Form ADV, select financial statements of the Adviser, and detailed pro-forma information regarding the Adviser’s expected profitability from managing the Fund) and other pertinent information.

The Board relied upon the advice of independent legal counsel and its own business judgment in determining the material factors to be considered in evaluating the Advisory Agreement and the weight to be given to each such factor. The Board’s conclusions were based on an evaluation of all of the information provided and were not the result of any one factor or group of factors. Moreover, each Trustee may have afforded different weight to the various factors in reaching conclusions with respect to the Advisory Agreement. Among the factors considered by the Board are those discussed below.

Nature, Extent and Quality of Services. The Trustees considered the nature, extent, and quality of services to be provided by the Adviser to the Fund under the proposed Advisory Agreement and the amount of time the Adviser and its personnel would devote to the operation of the Fund. The Trustees also considered the specific responsibilities the Adviser would undertake with respect to the day-to-day management of the Fund, as well as the qualifications and experience of the Adviser, the Fund’s portfolio managers and other key personnel of the Adviser involved in the day-to-day management of the Fund. The Board also considered the policies and procedures the Adviser had in place to ensure compliance with applicable laws are regulations, as well as the certification from the Adviser that it had adopted a Code of Ethics under Rule 17j-1 of the 1940 Act. The Board noted that the Adviser and its personnel had not been involved in any regulatory examinations or legal actions in the last two years and that the Adviser was in excellent financial condition. The Board then concluded that the Adviser had sufficient quality and depth of personnel, resources, management experience and compliance policies

| Dynamic Alternatives Fund |

| Approval of Advisory Agreement (Unaudited) |

and procedures to perform its duties under the proposed Advisory Agreement and that the nature, overall quality and extent of the management services to be provided by the Adviser to the Fund were satisfactory.

Performance. The Board considered that the Fund is newly formed and as such does not have a record of prior performance to submit at the meetings. The Board considered the Adviser’s discussion of its investment processes, as well as its staffing and resources. The Board noted that it would review at its regularly scheduled meetings information about the performance of the Fund. The Board concluded that the Adviser had the appropriate qualifications, experience and resources to perform its duties under the proposed Advisory Agreement and is qualified to manage the Fund’s assets in accordance with its investment objective and policies.

Fees and Expenses. As to the costs of the services to be provided and profits to be realized by the Adviser in connection with the proposed Advisory Agreement, the Board considered the information provided by the Adviser which compared the proposed advisory fee for the Fund and total expense ratio of the Fund to a peer group of funds with similar investment objectives and strategies, as selected by the Adviser (“Peer Group”). The Adviser noted that the number of peer funds directly comparable to the Fund was limited. The Board considered that the Adviser proposed to charge an advisory fee of 1.00% of the Fund’s average net assets. The Board also considered that HC has agreed to reimburse the Fund in order to limit the Fund’s total operating expenses, exclusive of certain transactional and other expenses, to 1.75% of the Fund’s average daily net assets. The Board considered that the proposed advisory fee and estimated total expense ratio for the Fund was within the range of advisory fees and total expense ratios reflected in the Peer Group and below the average advisory fee and total expense ratio of the Peer Group. Lastly, the Board considered the range of advisory fees charged to the Adviser’s separate accounts, noting that while such separate accounts employ alternative investments, the accounts do not have the same investment objective or strategy as the Fund. The Board noted that the proposed advisory fee for the Fund was within the range of advisory fees charged by the Adviser to its separate accounts. The Board concluded that the proposed contractual advisory fee to be paid to the Adviser was fair and reasonable and that the overall expense ratio for the Fund was acceptable in light of these factors.

Profitability. The Board reviewed the estimated profitability of the Adviser with respect to the Fund which was initially provided to the Board at its meeting on November 12, 2021, and revised and updated for purposes of the Board’s meeting on May 6, 2022. The Board noted that the Fund will initially be marketed exclusively to the Adviser’s clients and, at the November 2021 meeting, was informed that the Adviser intended to fully refund the Fund’s advisory fee to any of its clients that invest in the Fund such that the Adviser would break-even or incur a small loss with respect to its services to

| Dynamic Alternatives Fund |

| Approval of Advisory Agreement (Unaudited) |

the Fund until the Fund begins accepting large investments from outside investors, which is not expected to occur in the near future. However, due to potential tax issues around distributions from certain retirement accounts investing in the Fund by some of the Adviser’s clients, the Board was informed at the May 6, 2022 meeting that the Adviser was instead proposing to exclude any assets invested by the Adviser’s clients in the Fund from their separately managed accounts, so that these clients would be paying the Fund’s advisory fee on these assets; however, the clients will not also be paying the firm’s separately managed account investment management fee on the same assets. Following its review of detailed pro-forma information provided by the Adviser to reflect this new arrangement, the Board concluded that the estimated profitability to the Adviser for managing the Fund was reasonable.

Economies of Scale. The Board considered the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect a reasonable sharing of economies of scale for the benefit of Fund investors. The Board noted that most of the Fund’s operating expenses are fixed rather than variable and therefore, as the Fund’s size increases, each individual investor’s total expense ratio will decrease accordingly. The Board also recognized that the Fund may take some time to reach an asset level where the Adviser could realize significant economies of scale. The Board observed that economies of scale will be considered in the future as Fund asset levels grow. The Board also noted that, although the Advisory Agreement does not have advisory fee breakpoints, the Adviser has contractually agreed to limit certain expenses of the Fund so that the Fund’s annual operating expenses do not exceed 1.75% of the Fund’s average daily net assets. Based upon its review and discussion, the Board determined that, while fee breakpoints were not currently necessary for the Fund, they would continue to review whether breakpoints should be incorporated in the future. After further discussion, the Board concluded that the current fee structure was reasonable.

Conclusion. The Board, having reviewed and considered such information from the Adviser as it believed reasonably necessary to evaluate the terms of the proposed Advisory Agreement, with the Independent Trustees having met in executive session with and as assisted by the advice of independent legal counsel, and having been advised by such counsel that the Independent Trustees had appropriately considered and weighed all relevant factors, determined that approval of the Advisory Agreement for an initial two-year term was in the best interests of the Fund and its future shareholders. Accordingly, the Board, including the Independent Trustees voting separately, unanimously approved the Advisory Agreement at its November 2021 meeting, and ratified and confirmed this decision at its May 2022 meeting.

| Privacy Notice |

| |

| FACTS | WHAT DOES DYNAMIC ALTERNATIVES FUND DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: ■ Social Security number ■ Assets ■ Retirement Assets ■ Transaction History ■ Checking Account Information ■ Purchase History ■ Account Balances ■ Account Transactions ■ Wire Transfer Instructions When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons chosen to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does Dynamic

Alternatives

Fund share? | Can you limit

this sharing? |

For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes – to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes – information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes – information about your creditworthiness | No | We don’t share |

| For non-affiliates to market to you | No | We don’t share |

| Questions? | Call 1-402-493-4603 |

| Who we are |

| Who is providing this notice? | Dynamic Alternatives Fund |

| What we do |

| How does Dynamic Alternatives Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does Dynamic Alternatives Fund collect my personal information? | We collect your personal information, for example, when you ■ Open an account ■ Provide account information ■ Give us your contact information ■ Make deposits or withdrawals from your account ■ Make a wire transfer ■ Tell us where to send the money ■ Tells us who receives the money ■ Show your government-issued ID ■ Show your driver’s license We also collect your personal information from other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ■ Sharing for affiliates’ everyday business purposes – information about your creditworthiness ■ Affiliates from using your information to market to you ■ Sharing for non-affiliates to market to you State laws and individual companies may give you additional rights to limit sharing. |

| | |

| Definitions |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ■ Dynamic Alternatives Fund does not share with our affiliates. |

| Non-affiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ■ Dynamic Alternatives Fund does not share with non-affiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ■ Dynamic Alternatives Fund does not jointly market. |

This page intentionally left blank.

PROXY VOTING

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities and information regarding how the Fund voted those proxies during the most recent twelve month period ended June 30 will be available without charge upon request by (1) calling the Fund at (833) 617-2624 and (2) from Fund documents filed with the Securities and Exchange Commission (“SEC”) on the SEC’s website at www.sec.gov.

| TRUSTEES |

| Jeffrey G. Wilkins, Chairman |

| Michael S. Jordan |

| Justin T. Klosek |

| Carrie J. Thome |

| |

| OFFICERS |

| Jeffrey G. Wilkins, President and Principal Executive Officer |

| Zachary P. Richmond, Treasurer and Principal Financial Officer |

| Lynn Bowley, Chief Compliance Officer |

| Eric Kane, Secretary |

| |

| INVESTMENT ADVISER |

| Hamilton Capital, LLC |

| 5025 Arlington Centre Boulevard, Suite 300 |

| Columbus, OH 43220 |

| |

| DISTRIBUTOR |

| Ultimus Fund Distributors, LLC |

| 4221 North 203rd Street, Suite 100 |

| Elkhorn, NE 68022 |

| |

| INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM |

| Cohen & Company, Ltd. |

| 1835 Market Street |

| Philadelphia, PA 19103 |

| |

| LEGAL COUNSEL |

| Godfrey & Kahn, S.C. |

| 833 East Michigan Street, Suite 1800 |

| Milwaukee, WI 53202 |

| |

| CUSTODIAN |

| Fifth Third Bank |

| 38 Fountain Square |

| Cincinnati, OH 45263 |

| |

| ADMINISTRATOR, FUND ACCOUNTANT |

| AND TRANSFER AGENT |

| Ultimus Fund Solutions, LLC |

| 225 Pictoria Drive, Suite 450 |

| Cincinnati, OH 45246 |

This report is intended only for the information of shareholders or those who have received the Fund’s prospectus which contains information about the Fund’s management fee and expenses. Please read the prospectus carefully before investing.

Distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC

Dynamic-SAR-23

(b) NOT APPLICABLE

Item 2. Code of Ethics.

NOT APPLICABLE – disclosed with annual report

Item 3. Audit Committee Financial Expert.

NOT APPLICABLE – disclosed with annual report

Item 4. Principal Accountant Fees and Services.

NOT APPLICABLE – disclosed with annual report

Item 5. Audit Committee of Listed Companies.

NOT APPLICABLE – applies to listed companies only

Item 6. Schedule of Investments. Schedules filed with Item 1.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

NOT APPLICABLE – disclosed with annual report

Item 8. Portfolio Managers of Closed-End Investment Companies.

| (a) | NOT APPLICABLE – disclosed with annual report |

(b) As of this reporting period end there have been no changes to any of the Portfolio Managers since the registrant’s previous from N-CSR filing.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Company and Affiliated Purchasers.

NOT APPLICABLE

Item 10. Submission of Matters to a Vote of Security Holders.

The guidelines applicable to shareholders desiring to submit recommendations for nominees to the Registrant's board of trustees are contained in the statement of additional information of the Fund with respect to the Fund(s) for which this Form N-CSR is being filed.

Item 11. Controls and Procedures.

(a) Based on their evaluation of the registrant’s disclosure controls and procedures (as defined in Rule 30a-3(c) under the Investment Company Act of 1940, as amended (the “Act”)) as of a date within 90 days of the filing date of this report, the registrant’s principal executive officer and principal financial officer have concluded that such disclosure controls and procedures are reasonably designed and are operating effectively to ensure that material information relating to the registrant is made known to them by others within those entities, particularly during the period in which this report is being prepared, and that the information required in filings on Form N-CSR is recorded, processed, summarized, and reported on a timely basis.

(b) There were no changes in the registrant’s internal control over financial reporting (as defined in Rule 30a-3(d) under the Investment Company Act of 1940) that occurred during the period covered by this report that have materially affected, or are reasonably likely to materially affect, the registrant’s internal control over financial reporting.

Item 12. Disclosure of Securities Lending Activities for Closed-End Management Investment Companies.

NOT APPLICABLE

Item 13. Exhibits.

(a) (1) NOT APPLICABLE – disclosed with annual report

(2) Certifications by the registrant’s principal executive officer and principal financial officer, pursuant to Section 302 of the Sarbanes- Oxley Act of 2002 and required by Rule 30a-2 under the Investment Company Act of 1940 are filed herewith.

(3) Not Applicable

(b) Certification pursuant to 18 U.S.C. Section 1350, as adopted pursuant to Section 906 of the Sarbanes-Oxley Act of 2002 is filed herewith.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

(Registrant) Dynamic Alternatives Fund

By: /s/ Jeffrey G. Wilkins

| Jeffrey G. Wilkins, President and Principal Executive Officer |

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.

By: /s/ Jeffrey G. Wilkins

| Jeffrey G. Wilkins, President and Principal Executive Officer |

By: /s/ Zachary P. Richmond

| Zachary P. Richmond, Treasurer and Principal Financial Officer |

| |