UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23652

Dynamic Alternatives Fund

(Exact name of registrant as specified in charter)

Ultimus Fund Solutions, LLC

225 Pictoria Drive, Suite 450

Cincinnati, OH 45246

(Address of principal executive offices) (Zip code)

Jeffrey G. Wilkins, President and Principal Executive Officer

Dynamic Alternatives Fund

225 Pictoria Drive, Suite 450

Cincinnati, Ohio 45246

(Name and address of agent for service)

Registrant’s telephone number, including area code: 513-587-3400

Date of fiscal year end: 9/30

Date of reporting period: 9/30/2024

Item 1. Reports to Stockholders.

(a)

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| Dynamic Alternatives Fund |

| |

| |

| |

| |

| |

| Annual Report |

| |

| September 30, 2024 |

| |

| |

| |

| |

| |

| Hamilton Capital, LLC |

| |

| 5025 Arlington Centre Boulevard, Suite 300 |

| |

| Columbus, Ohio 43220 |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| |

Dynamic Alternatives Fund

Management’s Discussion of Fund Performance

(Unaudited)

Dear Investors,

We are writing to mark the second anniversary of the Dynamic Alternatives Fund and share our latest quarterly update. Your continued partnership has been instrumental in our growth, and we deeply appreciate the trust you have placed in our team.

Our assets under management reached $178 million as of September 30th, enabling us to achieve greater operational efficiency and reduce our total expense ratio. We have been pleased with our returns and consistency in recent quarters. The Fund’s performance has been particularly strong, with quarterly returns exceeding 2% in four out of the last five quarters- one of our strongest periods since inception. Notably, we have maintained this performance while recording no down months in 2024, achieving these results through genuine alpha generation rather than increased risk exposure. The Fund has maintained remarkable stability, with just 1.2% annual volatility and near-zero correlation to global equity markets (0.02 beta to MSCI ACWI).

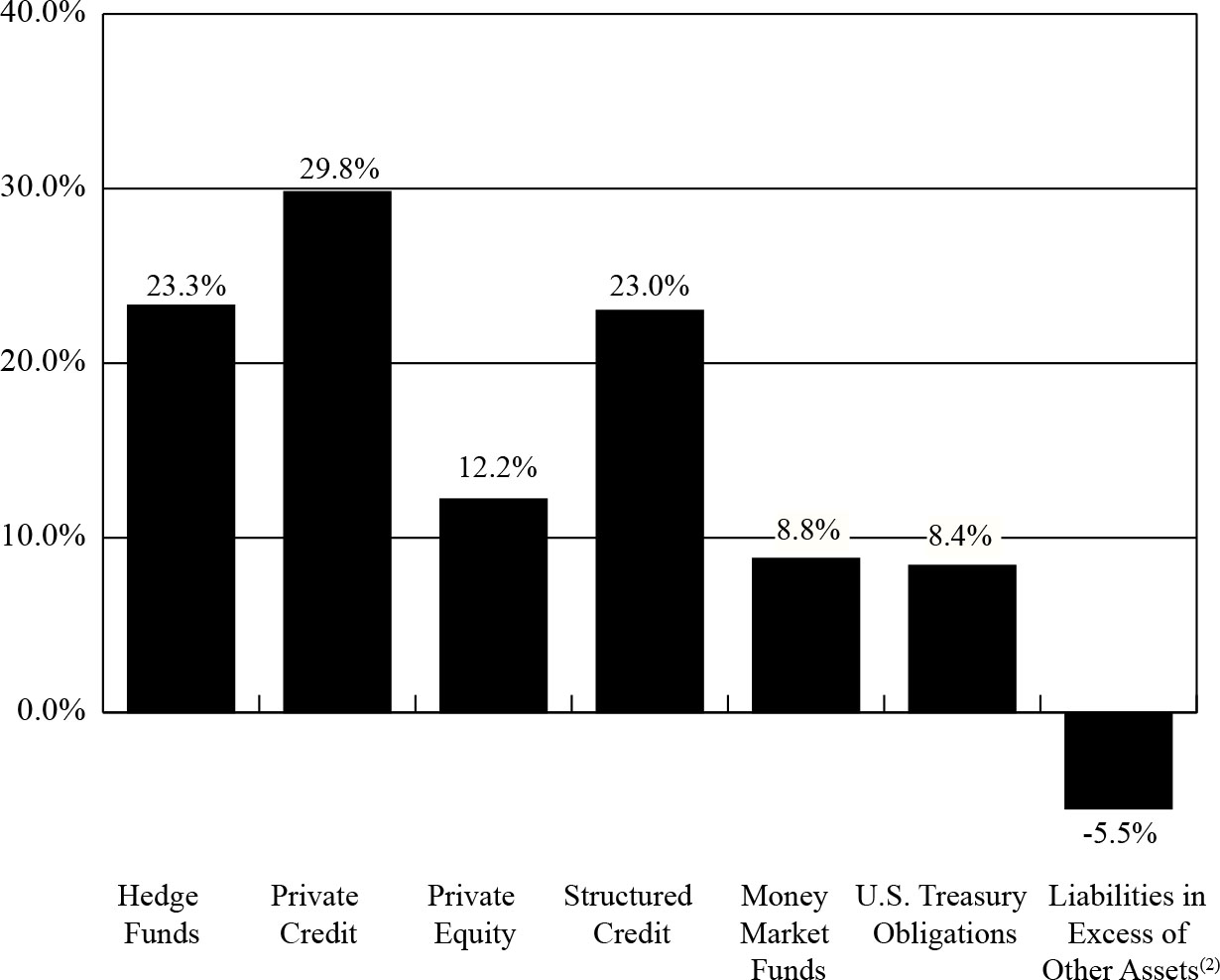

The past year brought positive returns across all investment asset classes, with Private Credit & Private Equity – comprising 40% of our portfolio – leading the way. While hedge funds delivered more modest gains, they continue to provide valuable diversification through their uncorrelated returns.

Our investment strategy continues to progress thoughtfully as we identify opportunities with increasingly attractive return profiles. Building on our successful positions in private credit and structured credit, we have identified several new investments that we believe offer even more compelling return potential:

| ● | Aircraft engine trading, where we see significant opportunities arising from current industry supply-demand dynamics |

| ● | Selected real estate investments in areas experiencing capital constraints, presenting attractive entry points |

| ● | Enhanced hedge fund allocations focused on strategies with greater upside potential while maintaining our disciplined risk management approach |

The current market environment presents particularly attractive opportunities for patient, discerning investors. We believe that our ability to identify and access these opportunities, combined with our demonstrated track record of consistent performance, positions us well to generate strong risk-adjusted returns.

Our investment team remains focused on our core objective of delivering superior risk-adjusted returns through our dynamic investment process. The addition of new investment opportunities with higher return potential reflects our commitment to enhancing portfolio outcomes while maintaining our established risk parameters.

We appreciate your continued confidence in our approach and look forward to building on our recent momentum through the remainder of 2024 and beyond.

Best regards,

| Lee J. Caleshu | | Antonio Caxide |

| Deputy Chief Investment Officer | | Chairman of the Senior Investment Council |

| | | |

| Francis Chu | | Jeffrey G. Wilkins |

| Managing Director of Portfolio Management | | Deputy Chief Investment Officer and a Managing Director |

Dynamic Alternatives Fund

Investment Results

(Unaudited)

| | | | | | | |

| | Average Annual Total Returns(1)

as of September 30, 2024 |

| | | | | | | |

| | | | | | Since | |

| | | | | | Inception | |

| | | | One year | | (10/31/22) | |

| | Dynamic Alternatives Fund | | 9.12% | | 7.63% | |

| | Bloomberg U.S. Aggregate Bond Index(2) | | 11.57% | | 6.96% | |

| | MSCI ACWI Index(3) | | 31.76% | | 23.63% | |

| | | | | | | |

The returns shown do not reflect the deduction of taxes that a shareholder would pay on Dynamic Alternatives Fund (the “Fund”) distributions or the redemption of Fund shares.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. All performance figures are presented net of fees. The Fund’s total returns reflect any fee waivers or recoupments during the applicable periods. If such fee waivers or recoupments had not occurred, the quoted performance would have been different.

Investors should carefully consider the investment objectives, risks, charges and expenses of the Fund. This and other important information about the Fund is contained in the prospectus, which can be obtained by calling (833) 617-2624. The prospectus should be read carefully before investing. The Fund is distributed by Ultimus Fund Distributors, LLC (Member FINRA).

| (1) | Return figures reflect any change in price per share and assume the reinvestment of all distributions. The Fund’s returns reflect any fee reductions during the applicable period. If such fee reductions had not occurred, the quoted performance would have been lower. |

| (2) | The Bloomberg U.S. Aggregate Bond Index (“Index”) is a broad-based flagship benchmark that measures the investment grade, U.S. dollar-denominated, fixed-rate taxable bond market. The Index includes Treasuries, government-related and corporate securities, mortgage-backed securities (agency fixed rate and hybrid adjustable rate mortgage pass throughs), asset-backed securities and commercial mortgage-backed securities (agency and non-agency). Individuals cannot invest directly in the Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

| (3) | The MSCI ACWI Index (“ACWI Index”) captures large and mid cap representation across the 23 developed markets countries and 24 emerging markets countries. The performance of the ACWI Index is expressed in terms of U.S. dollars, and does not reflect the deduction of fees or operating expenses. Individuals cannot invest directly in the ACWI Index; however, an individual can invest in exchange traded funds or other investment vehicles that attempt to track the performance of a benchmark index. |

Dynamic Alternatives Fund

Investment Results (continued)

(Unaudited)

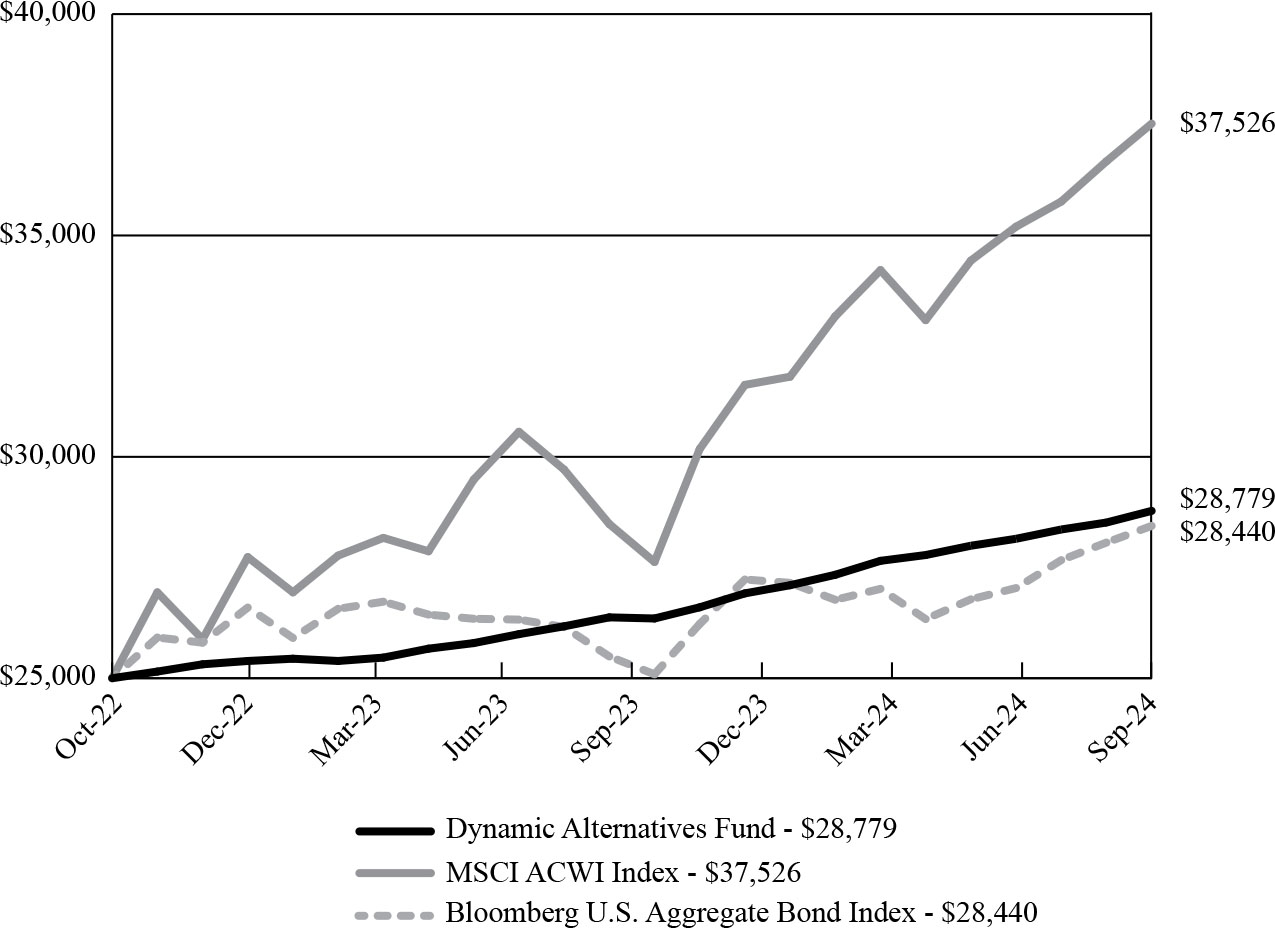

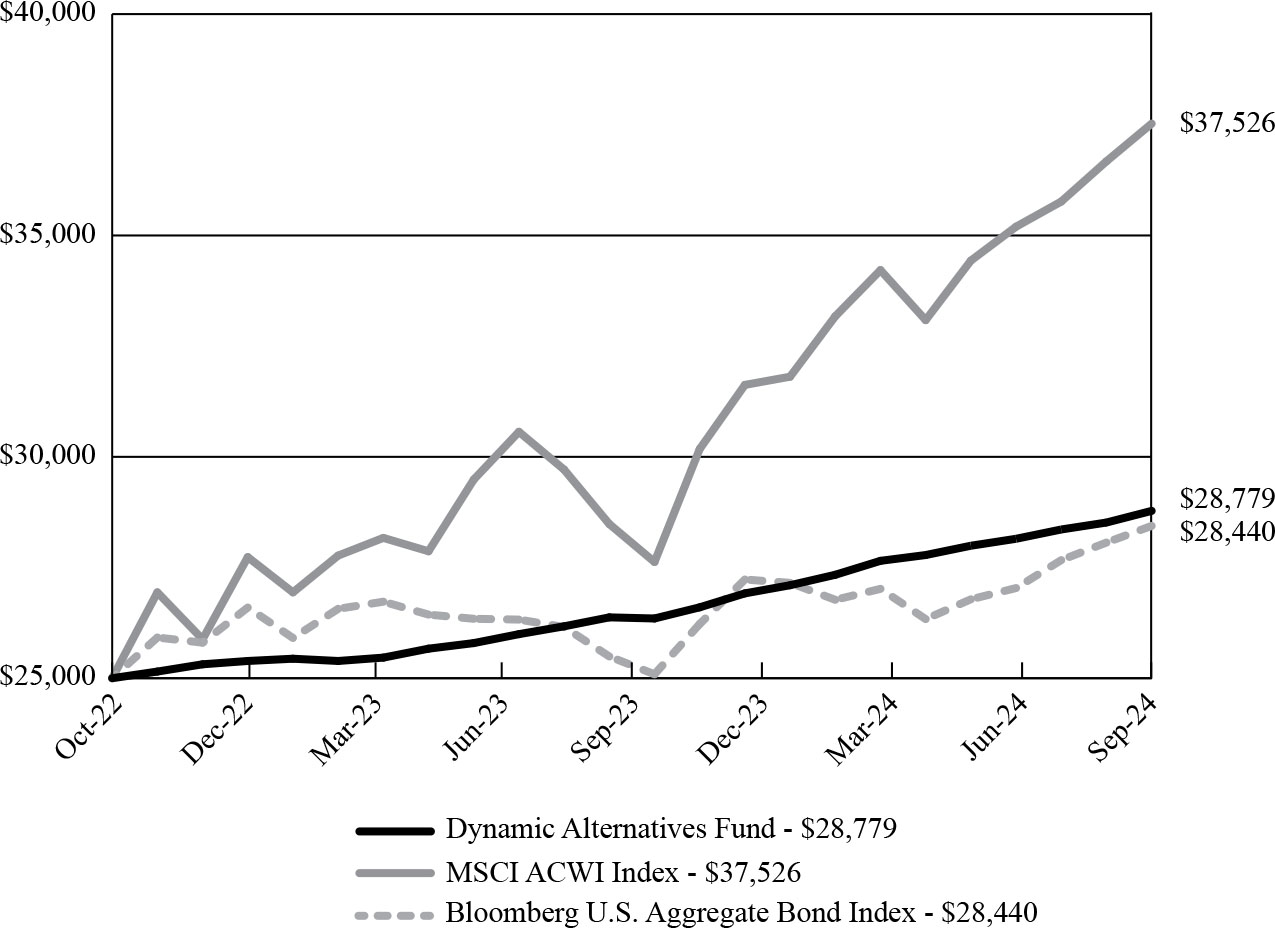

Comparison of a $25,000 Investment in the Dynamic Alternatives Fund,

Bloomberg U.S. Aggregate Bond Index and the MSCI ACWI Index

The chart above assumes an initial investment of $25,000 made on October 31, 2022 (commencement of operations) and held through September 30, 2024. THE FUND’S RETURNS REPRESENT PAST PERFORMANCE AND DO NOT GUARANTEE FUTURE RESULTS. The returns shown do not reflect deduction of taxes that a shareholder would pay on the Fund’s distributions or the redemption of the Fund’s shares. Investment returns and principal values will fluctuate so that your shares, when redeemed, may e worth more or less than their original purchase price.

Current performance may be lower or higher than the performance data quoted. For more information on the Fund, and to obtain performance data current to the most recent month-end, or to request a prospectus, please call (833) 617-2624. You should carefully consider the investment objectives, potential risks, management fees, and charges and expenses of the Fund before investing. The Fund’s prospectus contains this and other information about the Fund and should be read carefully before investing.

The Fund is distributed by Ultimus Fund Distributors, LLC, Member FINRA/SIPC.

Dynamic Alternatives Fund

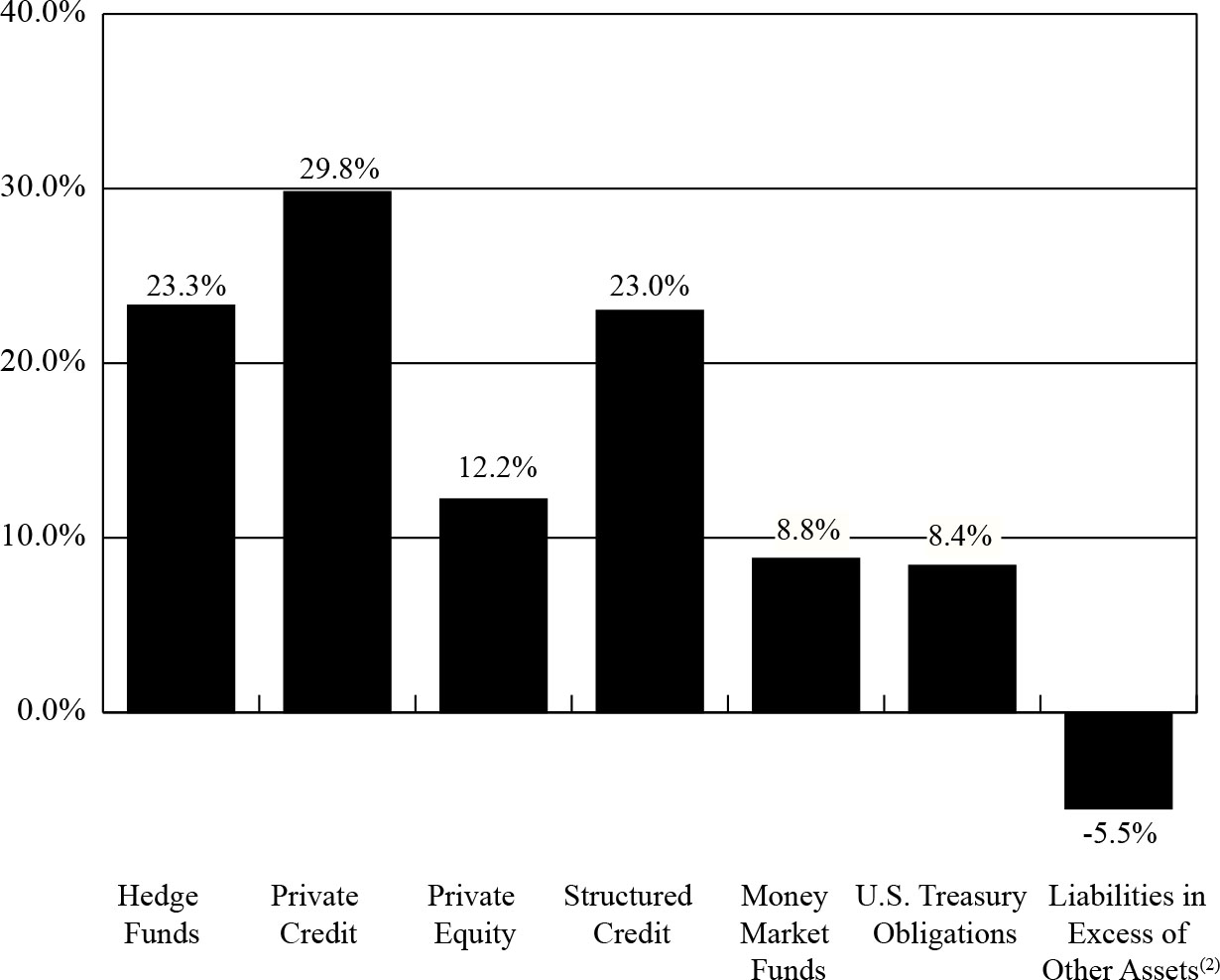

Fund Holdings

(Unaudited)

Dynamic Alternatives Fund as of September 30, 2024(1)

| (1) | As a percentage of net assets. |

| (2) | Consists of the Fund’s liabilities less any non-investment assets. |

Availability of Portfolio Schedule (Unaudited)

The Fund files its complete schedule of portfolio holdings with the Securities and Exchange Commission (“SEC”) for the first and third quarters of each fiscal year as an exhibit to its reports on Form N-PORT. The Fund’s Form N-PORT reports are available on the SEC’s website at http://www.sec.gov.

Dynamic Alternatives Fund

Schedule of Investments

September 30, 2024

| Portfolio Funds* | | Shares | | | % of

Net Assets | | | Cost(1) | | | Fair Value | | | Initial

Acquisition

Date | | Redemption

Frequency(2) | | Next Available

Redemption Date |

| Hedge Funds | | | | | | | | | | | | | | | | | | | | | | |

| Centiva Offshore Fund, Ltd., Class A, Series 0621 | | | 65,572 | | | | 4.3 | % | | $ | 6,912,774 | | | $ | 7,690,496 | | | 11/1/2022 | | Quarterly | | 12/31/2024(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0324 | | | 4,500 | | | | 0.3 | % | | | 450,000 | | | | 461,102 | | | 3/1/2024 | | Quarterly | | 12/31/2024(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0424 | | | 2,500 | | | | 0.1 | % | | | 250,000 | | | | 252,772 | | | 4/1/2024 | | Quarterly | | 12/31/2024(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0524 | | | 4,000 | | | | 0.2 | % | | | 400,000 | | | | 400,240 | | | 5/1/2024 | | Quarterly | | 12/31/2024(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0624 | | | 12,000 | | | | 0.7 | % | | | 1,200,000 | | | | 1,201,008 | | | 6/1/2024 | | Quarterly | | 12/31/2024(3) |

| Centiva Offshore Fund, Ltd., Class A, Series 0724 | | | 15,000 | | | | 0.8 | % | | | 1,500,000 | | | | 1,503,170 | | | 7/1/2024 | | Quarterly | | 12/31/2024(3) |

| | | | 103,572 | | | | 6.4 | % | | | 10,712,774 | | | | 11,508,788 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Corbin Hedged Equity Fund, LP | | | N/A | | | | 7.5 | % | | | 12,156,299 | | | | 13,400,534 | | | 11/1/2022 | | Monthly | | 10/31/2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Mission Crest Macro Fund, Ltd., Class C, Series 0123 | | | 5,000 | | | | 2.9 | % | | | 5,000,000 | | | | 5,155,531 | | | 1/3/2023 | | Monthly | | 10/31/2024 |

| Mission Crest Macro Fund, Ltd., Class C, Series 0323 | | | 600 | | | | 0.4 | % | | | 600,000 | | | | 626,762 | | | 3/1/2023 | | Monthly | | 10/31/2024 |

| Mission Crest Macro Fund, Ltd., Class C, Series 0624 | | | 1,000 | | | | 0.6 | % | | | 1,000,000 | | | | 1,020,256 | | | 6/1/2024 | | Monthly | | 10/31/2024 |

| | | | 6,600 | | | | 3.9 | % | | | 6,600,000 | | | | 6,802,549 | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Schedule of Investments

September 30, 2024 (Continued)

| Portfolio Funds* | | Shares | | | % of

Net Assets | | | Cost(1) | | | Fair Value | | | Initial

Acquisition

Date | | Redemption

Frequency(2) | | Next Available

Redemption Date |

| Pinehurst Institutional Ltd., Class B1, Series 1 | | | 2,852 | | | | 4.0 | % | | $ | 6,162,774 | | | $ | 7,196,933 | | | 11/1/2022 | | Quarterly | | 12/31/2024(3) |

| Pinehurst Institutional Ltd., Class B1, Series 152 | | | 611 | | | | 0.7 | % | | | 1,250,000 | | | | 1,317,225 | | | 1/2/2024 | | Quarterly | | 12/31/2024(3) |

| Pinehurst Institutional Ltd., Class B1, Series 153 | | | 168 | | | | 0.2 | % | | | 350,000 | | | | 362,785 | | | 2/1/2024 | | Quarterly | | 12/31/2024(3) |

| Pinehurst Institutional Ltd., Class B1, Series 154 | | | 213 | | | | 0.3 | % | | | 450,000 | | | | 459,224 | | | 3/1/2024 | | Quarterly | | 12/31/2024(3) |

| Pinehurst Institutional Ltd., Class B1, Series 155 | | | 118 | | | | 0.1 | % | | | 250,000 | | | | 253,925 | | | 4/1/2024 | | Quarterly | | 12/31/2024(3) |

| Pinehurst Institutional Ltd., Class B1, Series 156 | | | 189 | | | | 0.2 | % | | | 400,000 | | | | 407,966 | | | 5/1/2024 | | Quarterly | | 12/31/2024(3) |

| | | | 4,151 | | | | 5.5 | % | | | 8,862,774 | | | | 9,998,058 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments - Hedge Funds | | | | | | | 23.3 | % | | | 38,331,847 | | | | 41,709,929 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Structured Credit | | | | | | | | | | | | | | | | | | | | | | |

| Waterfall Eden Fund, Ltd., Class B1 | | | 4 | | | | 0.0 | %(4) | | | 4,239 | | | | 3,672 | | | 3/1/2023 | | Quarterly | | 12/31/2024(3) |

| Waterfall Eden Fund, Ltd., Class B2, Series 1 | | | 8,033 | | | | 5.2 | % | | | 8,020,761 | | | | 9,164,546 | | | 3/1/2023 | | Quarterly | | 12/31/2024(3) |

| Waterfall Eden Fund, Ltd., Class B2, Series 3 | | | 400 | | | | 0.2 | % | | | 400,000 | | | | 432,608 | | | 3/1/2024 | | Quarterly | | 12/31/2024(3) |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Schedule of Investments

September 30, 2024 (Continued)

| Portfolio Funds* | | Shares | | | % of

Net Assets | | | Cost(1) | | | Fair Value | | | Initial

Acquisition

Date | | Redemption

Frequency(2) | | Next

Available

Redemption

Date |

| Waterfall Eden Fund, Ltd., Class B2, Series 5 | | | 400 | | | | 0.2 | % | | $ | 400,000 | | | $ | 420,267 | | | 5/1/2024 | | Quarterly | | 12/31/2024(3) |

| Waterfall Eden Fund, Ltd., Class B2, Series 7 | | | 1,500 | | | | 0.9 | % | | | 1,500,000 | | | | 1,545,216 | | | 7/1/2024 | | Quarterly | | 12/31/2024(3) |

| | | | 10,337 | | | | 6.5 | % | | | 10,325,000 | | | | 11,566,309 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Private Credit | | | | | | | | | | | | | | | | | | | | | | |

| NB Credit Opportunities II Cayman LP(5) | | | N/A | | | | 2.9 | % | | | 4,878,512 | | | | 5,093,549 | | | 6/1/2023 | | N/A | | N/A |

| | | | | | | | | | | | | | | | | | | | | | | |

| Merchants Healthcare Fund 1 Onshore | | | N/A | | | | 6.0 | % | | | 10,400,000 | | | | 10,761,240 | | | 4/1/2024 | | Quarterly | | N/A |

| | | | | | | | 8.9 | % | | | 15,278,512 | | | | 15,854,789 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments - Portfolio Funds | | | | | | | 38.7 | % | | | 63,935,359 | | | | 69,131,027 | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Interval Funds | | | | | | | | | | | | | | | | | | | | | | |

| Private Credit | | | | | | | | | | | | | | | | | | | | | | |

| Cliffwater Corporate Lending Fund | | | 2,386,393 | | | | 14.6 | % | | | 25,454,571 | | | | 26,083,279 | | | 11/1/2022 | | Quarterly | | 10/14/2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Structured Credit | | | | | | | | | | | | | | | | | | | | | | |

| 1WS Credit Income Fund | | | 460,636 | | | | 5.0 | % | | | 9,000,000 | | | | 8,876,464 | | | 6/13/2024 | | Quarterly | | 10/9/2024 |

| | | | | | | | 19.6 | % | | | 34,454,571 | | | | 34,959,743 | | | | | | | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Schedule of Investments

September 30, 2024 (Continued)

| Portfolio Funds* | | Shares | | | % of

Net Assets | | | Cost(1) | | | Fair Value | | | Initial

Acquisition

Date | | Redemption

Frequency(2) | | Next

Available

Redemption

Date |

| Business Development Companies | | | | | | | | | | | | | | | | | | | | | | |

| Private Credit | | | | | | | | | | | | | | | | | | | | | | |

| Blackstone Private Credit Fund, Class I | | | 441,309 | | | | 6.3 | % | | $ | 11,000,000 | | | $ | 11,253,374 | | | 2/1/2023 | | Quarterly | | 12/31/2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Closed-End Funds | | | | | | | | | | | | | | | | | | | | | | |

| Private Equity | | | | | | | | | | | | | | | | | | | | | | |

| AMG Pantheon Fund, LLC, Class 2 | | | 428,538 | | | | 6.3 | % | | | 8,918,011 | | | | 11,296,268 | | | 11/1/2022 | | Quarterly | | 12/31/2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Stepstone Private Markets, Institutional Class | | | 191,236 | | | | 5.9 | % | | | 9,710,000 | | | | 10,512,230 | | | 12/18/2023 | | Quarterly | | 12/15/2024 |

| | | | | | | | | | | | | | | | | | | | | | | |

| Total Investments - Closed-End Funds | | | | | | | 12.2 | % | | | 18,628,011 | | | | 21,808,498 | | | | | | | |

| Open-End Mutual Funds | | Shares | | | % of

Net Assets | | | Cost(1) | | | Fair Value | |

| Structured Credit | | | | | | | | | | | | | | | | |

| Axonic Strategic Income Fund, Institutional Class | | | 1,198,352 | | | | 6.1 | % | | | 10,562,774 | | | | 10,881,034 | |

| | | | | | | | | | | | | | | | | |

| FPA New Income, Inc. | | | 951,860 | | | | 5.4 | % | | | 9,100,000 | | | | 9,528,115 | |

| | | | | | | | | | | | | | | | | |

| Total Investments - Open-End Mutual Funds | | | | | | | 11.5 | % | | | 19,662,774 | | | | 20,409,149 | |

| | | | | | | | | | | | | | | | | |

| Money Market Funds | | | | | | | | | | | | | | | | |

| Goldman Sachs Financial Square Government Fund, Institutional Class, 4.84% (6) | | | 15,776,724 | | | | 8.8 | % | | $ | 15,776,724 | | | $ | 15,776,724 | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Schedule of Investments

September 30, 2024 (Continued)

U.S. Treasury Obligations | | Principal

Amount | | | % of

Net Assets | | | Cost(1) | | | Fair Value | |

| United States Treasury Bill, 4.67%, 10/22/2024 (7) | | $ | 15,052,000 | | | | 8.4 | % | | $ | 15,011,236 | | | $ | 15,010,447 | |

| | | | | | | | | | | | | | | | | |

| Total Investments | | | | | | | 105.5 | % | | $ | 178,468,675 | | | $ | 188,348,962 | |

| | | | | | | | | | | | | | | | | |

| Liabilities in Excess of Other Assets | | | | | | | (5.5 | )% | | | | | | | (9,880,971 | ) |

| | | | | | | | | | | | | | | | | |

| Net Assets | | | | | | | 100.0 | % | | | | | | $ | 178,467,991 | |

| * | Non-income producing security. |

| (1) | There were $879,991 in unfunded commitments for NB Credit Opportunities II Cayman LP as of September 30, 2024. There were no other unfunded commitments as of September 30, 2024 for any other Portfolio Funds or securities. |

| (2) | Certain redemptions may be subject to various restrictions and limitations such as redemption penalties on investments liquidated within a certain period subsequent to investment (e.g., a soft or hard lock-up), investor-level gates and/or Portfolio Fund-level gates. Redemption notice periods range from 10 to 100 days. |

| (3) | Subject to 25% investor level quarterly gate. |

| (4) | Amount is less than 0.05%. |

| (5) | Subject to eight year hard lock-up, with three one-year extensions. |

| (6) | Rate disclosed is the seven day effective yield as of September 30, 2024. |

| (7) | The rate shown represents effective yield at time of purchase. |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Statement of Assets and Liabilities

September 30, 2024

| | | | | |

| Assets | | | | |

| Investments in securities and Portfolio Funds, at fair value (cost $178,468,675) | | $ | 188,348,962 | | |

| Cash | | | 3,060,000 | | |

| Dividends receivable | | | 511,087 | | |

| Prepaid expenses | | | 5,211 | | |

| Total assets | | | 191,925,260 | | |

| | | | | | |

| Liabilities | | | | | |

| Subscriptions received in advance | | $ | 13,036,211 | | |

| Payable to Adviser | | | 287,962 | | |

| Payable for audit and tax fees | | | 40,830 | | |

| Payable to Administrator | | | 16,170 | | |

| Other accrued expenses | | | 76,096 | | |

| Total liabilities | | | 13,457,269 | | |

| | | | | | |

| Net Assets | | $ | 178,467,991 | | |

| | | | | | |

| Net Assets Consist Of | | | | | |

| Paid-in capital | | $ | 167,376,918 | | |

| Accumulated earnings | | | 11,091,073 | | |

| Net Assets | | $ | 178,467,991 | | |

| | | | | | |

| Shares outstanding (no par value, unlimited shares authorized) | | | 16,274,264 | | |

| Net asset value and offering price per share | | $ | 10.97 | | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Statement of Operations

For the year ended September 30, 2024

| | | | | |

| Investment Income | | | | |

| Interest income | | $ | 267,891 | | |

| Dividend income | | | 5,930,774 | | |

| Total Income | | | 6,198,665 | | |

| | | | | | |

| Expenses | | | | | |

| Investment Adviser | | | 1,314,959 | | |

| Legal | | | 109,672 | | |

| Administration | | | 73,670 | | |

| Audit and tax preparation fees | | | 40,415 | | |

| Trustee | | | 35,948 | | |

| Chief Compliance Officer | | | 34,619 | | |

| Transfer agent | | | 20,840 | | |

| Printing | | | 18,151 | | |

| Custodian | | | 13,906 | | |

| Registration | | | 13,648 | | |

| Offering costs | | | 13,297 | | |

| Miscellaneous | | | 71,559 | | |

| Total expenses | | | 1,760,684 | | |

| Recoupment of prior expenses waived/reimbursed by Adviser | | | 199,442 | | |

| Net expenses | | | 1,960,126 | | |

| Net investment income | | | 4,238,539 | | |

| | | | | | |

| Realized and Change in Unrealized Gain/(Loss) from Investments | | | | | |

| Long term capital gain dividends from investment companies | | | 91,162 | | |

| Net change in unrealized appreciation/(depreciation) from investments | | | 7,171,499 | | |

| Net realized and change in unrealized gain from investments | | | 7,262,661 | | |

| Net increase in net assets resulting from operations | | $ | 11,501,200 | | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Statements of Changes in Net Assets

| | | | | | | | |

| | | For The

Year Ended

September 30,

2024 | | | For The

Period Ended

September 30,

2023(1) | | |

| Increase/(Decrease) In Net Assets Resulting From Operations | | | | | | | | | |

| Net investment income | | $ | 4,238,539 | | | $ | 977,098 | | |

| Long term capital gain dividends from investment companies | | | 91,162 | | | | 126,682 | | |

| Net change in unrealized appreciation/(depreciation) from investments | | | 7,171,499 | | | | 2,708,788 | | |

| Net increase in net assets resulting from operations | | | 11,501,200 | | | | 3,812,568 | | |

| | | | | | | | | | |

| Distributions To Shareholders From | | | | | | | | | |

| Earnings | | | (3,976,452 | ) | | | (423,901 | ) | |

| | | | | | | | | | |

| Capital Share Transactions | | | | | | | | | |

| Proceeds from issuance of shares | | | 72,490,249 | | | | 90,631,137 | | |

| Reinvestment of distributions | | | 3,909,289 | | | | 423,901 | | |

| Net increase in net assets resulting from capital share transactions | | | 76,399,538 | | | | 91,055,038 | | |

| Net increase in net assets | | | 83,924,286 | | | | 94,443,705 | | |

| Net assets at beginning of period | | | 94,543,705 | | | | 100,000 | | |

| Net assets at end of period | | $ | 178,467,991 | | | $ | 94,543,705 | | |

| | | | | | | | | | |

| Share Transactions | | | | | | | | | |

| Shares issued | | | 6,845,716 | | | | 8,995,263 | | |

| Reinvestment of distributions | | | 381,022 | | | | 42,263 | | |

| Net increase in share transactions | | | 7,226,738 | | | | 9,037,526 | | |

| (1) | For the period October 31, 2022 (commencement of operations) through September 30, 2023. |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Statement of Cash Flows

For the year ended September 30, 2024

| | | | | |

| Cash Flows From Operating Activities: | | | | |

| Net increase/(decrease) in net assets resulting from operations | | $ | 11,501,200 | | |

| | | | | | |

| Adjustments to reconcile net increase in net assets from operations to net cash used in operating activities: | | | | | |

| Net (purchase)/sales of short-term investment securities | | | (15,607,370 | ) | |

| Purchase of long-term investment securities | | | (63,156,837 | ) | |

| Decrease in subscriptions to Portfolio Funds made in advance | | | 975,000 | | |

| Increase in dividends receivable | | | (283,310 | ) | |

| Increase in prepaid expenses and other assets | | | 16,803 | | |

| Increase in payable to Adviser | | | 156,451 | | |

| Increase in payable for investments purchased | | | (5,483,280 | ) | |

| Increase in payable for audit and tax fees | | | 10,415 | | |

| Increase in payable to Administrator | | | 3,340 | | |

| Increase in other accrued expenses and expenses payable | | | 47,485 | | |

| Net change in unrealized (appreciation)/depreciation from investments | | | (7,171,499 | ) | |

| Net cash used in operating activities | | | (78,991,602 | ) | |

| | | | | | |

| Cash flows from financing activities: | | | | | |

| Proceeds from shares sold | | | 72,490,249 | | |

| Increase in subscriptions received in advance | | | 9,628,516 | | |

| Distributions paid (net of reinvestments) | | | (67,163 | ) | |

| Net cash from financing activities | | | 82,051,602 | | |

| | | | | | |

| Net change in cash | | $ | 3,060,000.00 | | |

| | | | | | |

| Cash balance beginning of year | | $ | — | | |

| Cash balance end of year | | $ | 3,060,000.00 | | |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Financial Highlights

| | | | | | | | |

| | | For the

Year Ended

September 30,

2024 | | | For the

Period Ended

September 30,

2023(1) | | |

| Per Share Operating Performance | | | | | | | | | |

| Net asset value, beginning of period | | $ | 10.45 | | | $ | 10.00 | | |

| | | | | | | | | | |

| Investment operations: | | | | | | | | | |

| Net investment income | | | 0.38 | | | | 0.16 | | |

| Net realized and unrealized gains/(losses) from investments | | | 0.54 | | | | 0.39 | | |

| Net change in net assets resulting from operations | | | 0.92 | | | | 0.55 | | |

| | | | | | | | | | |

| Distributions from: | | | | | | | | | |

| Net investment income | | | (0.39 | ) | | | (0.10 | ) | |

| Net realized gains | | | (0.01 | ) | | | - | | |

| | | | (0.40 | ) | | | (0.10 | ) | |

| Net asset value, end of period | | $ | 10.97 | | | $ | 10.45 | | |

| | | | | | | | | | |

| Total return(2) | | | 9.12 | % | | | 5.49 | %(3) | |

| | | | | | | | | | |

| Net assets, end of period | | $ | 178,467,991 | | | $ | 94,543,705 | | |

| | | | | | | | | | |

| Ratios To Average Net Assets | | | | | | | | | |

| Expenses after waiver/reimbursement or recoupment(4) | | | 1.47 | % | | | 1.75 | %(5) | |

| Expenses before waiver/reimbursement or recoupment(4) | | | 1.32 | % | | | 1.89 | %(5) | |

| Net investment income after waiver/reimbursement or recoupment(4) | | | 3.17 | % | | | 1.58 | %(5) | |

| Net investment income before waiver/reimbursement or recoupment(4) | | | 3.32 | % | | | 1.44 | %(5) | |

| Portfolio turnover rate | | | 0.00 | % | | | 0.00 | %(3) | |

| (1) | For the period October 31, 2022 (commencement of operations) through September 30, 2023. |

| (2) | Total return represents the rate an investor would have earned or lost on an investment in the Fund, assuming reinvestment of distributions, if any. |

| (3) | Not annualized. |

| (4) | The ratios do not reflect the Fund’s proportionate share of income and expenses of the underlying Portfolio Funds. |

| (5) | Annualized. |

See accompanying notes which are an integral part of these financial statements.

Dynamic Alternatives Fund

Notes to the Financial Statements

September 30, 2024

The Dynamic Alternatives Fund (the “Fund”) was organized on March 24, 2021 as a Delaware statutory trust that is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end management investment company. The Fund is non-diversified and operates as a “tender offer fund,” which means that it is subject to the requirements of Rule 13e-4 under the Securities Exchange Act of 1934, as amended (the “1934 Act”), with respect thereto.

The Fund commenced operations on October 31, 2022. The Fund had no operations prior to October 31, 2022 other than those relating to organizational matters, including the issuance of 10,000 shares at $10.00 per share to its initial investor, Hamilton Capital, LLC (the “Adviser”), the investment adviser to the Fund. The Fund’s registration statement permits it to offer a single class of shares of beneficial interest (“shares”). The Fund’s shares will be offered monthly, as of the first business day of each month, based on the net asset value (“NAV”) per share calculated as of the last business day of the prior month. The Fund has registered $250,000,000 of shares for sale under the registration statement. The Fund is governed by the Board of Trustees (the “Board”).

The Fund’s investment objective is to seek total return through a combination of capital appreciation and income generation. The Fund seeks to achieve its investment objective by dynamically allocating its assets among investments in private investment vehicles (“Portfolio Funds”), commonly referred to as hedge funds, private equity funds and private real estate investment funds, that are managed by unaffiliated asset managers and employ a broad range of investment strategies.

| (2) | SIGNIFICANT ACCOUNTING POLICIES |

The Fund follows accounting and reporting guidance under Financial Accounting Standards Board Accounting Standards Codification Topic 946, Financial Services – Investment Companies. The financial statements are prepared in conformity with accounting principles generally accepted in the United States of America (“GAAP”).

Estimates

The preparation of financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates.

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

Federal Income Taxes

The Fund intends to qualify as a “registered investment company” under Subchapter M of the Internal Revenue Code of 1986, as amended, and, if so qualified, will not be liable for federal income taxes to the extent earnings are distributed to shareholders on a timely basis. Therefore, no provision of federal income taxes is required.

Share Valuation

The Fund will calculate the NAV of the shares as of the close of business on the last business day of each calendar month and at such other times as the Board may determine, including in connection with the repurchase of shares (each such date, an “NAV Date”). Due to the nature of many of the securities held in the Fund’s portfolio, the valuation information necessary to calculate NAV will generally not be available until several weeks after each NAV Date. As a result, in general, the NAV will be calculated within approximately 30 calendar days after each NAV Date (based on the value of each portfolio holding as of the NAV Date).

| (3) | SECURITIES VALUATION AND FAIR VALUE MEASUREMENTS |

The Fund has adopted valuation procedures (the “Valuation Procedures”) which have been approved by the Board. Under the Valuation Procedures, the Board has delegated to the Adviser the role of serving as the Fund’s valuation designee (the “Valuation Designee”), with responsibility for determining a fair value for securities for which market quotations are not readily available, subject to Board oversight. The Board receives valuation reports from the Valuation Designee on a quarterly basis and determines if the Valuation Procedures are operating as expected and the outcomes are reliable.

Investments in Portfolio Funds are recorded on a subscription effective date basis, which is generally the first day of the calendar month in which the investment is effective. Realized gains and losses are calculated on a specific identification method when redemptions are accepted by a Portfolio Fund, which is generally on the last day of the calendar month. Interest income and expense, if any, are accrued each month. Dividends are recorded on the ex-dividend date. Distributions received from the Fund’s investments in Portfolio Funds generally are comprised of ordinary income and return of capital. For financial statement purposes, the Fund uses return of capital and income estimates to allocate the distribution received. Such estimates are based on historical information available and other industry sources. These estimates may subsequently be revised based on information received from Portfolio Funds after their tax reporting periods are concluded.

Because the Fund invests a substantial portion of its assets in Portfolio Funds, the NAV of the shares will depend on the value of the Portfolio Funds. The NAVs of Portfolio Funds are generally not available from pricing vendors, nor are they calculable

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

independently by the Fund or by the Adviser. Under the Valuation Procedures, the Adviser, as the Valuation Designee, is responsible for determining the fair value of each Portfolio Fund as of each date upon which the Fund calculates its NAV (i.e. NAV Date). The Valuation Procedures require the Adviser to consider all relevant information when assessing and determining the fair value of the Fund’s interest in each Portfolio Fund.

As a general matter, the fair value of the Fund’s interest in a Portfolio Fund will be the amount that the Fund could reasonably expect to receive from the Portfolio Fund if the Fund’s interest in the Portfolio Fund was redeemed as of the NAV Date. In accordance with the Valuation Procedures, the fair value of the Fund’s interest in a Portfolio Fund as of a NAV Date will ordinarily be the most recent NAV reported by an investment manager or third-party administrator (“Portfolio Fund Management”). In the event that the last reported NAV of a Portfolio Fund is not as of the NAV Date, the Adviser may use other information that it believes should be taken into consideration in determining the Portfolio Fund’s fair value as of the NAV Date. This may include any cash flows since the reference date of the last reported valuation by the Portfolio Fund Management, and relevant broad-based and issuer (or fund) specific valuation information relating to the assets held by the Portfolio Fund that is reasonably available at the time the Portfolio Fund values its investments.

Pursuant to the Valuation Procedures, the Adviser may conclude in certain circumstances that, after considering information reasonably available at the time the valuation is made and that the Adviser believes to be reliable, the NAV provided by Portfolio Fund Management does not represent the fair value of the Fund’s interest in the Portfolio Fund. In addition, in the absence of specific transaction activity in the interests of a particular Portfolio Fund, the Adviser could consider whether it was appropriate, in light of all relevant circumstances, to value such a position at the Portfolio Fund’s net assets as reported at the time of valuation, or whether to adjust such value to reflect a premium or discount to the reported net assets.

The Fund’s interests in Portfolio Funds may also be illiquid and may be subject to substantial restrictions on transferability. The Fund may not be able to acquire initial or additional interests in a Portfolio Fund or withdraw all or a portion of its investment from a Portfolio Fund promptly after it has made a decision to do so because of limitations set forth in that Portfolio Fund’s governing documents. See the Schedule of Investments for more information.

Generally, the fair value of the Fund’s investment in a Portfolio Fund represents the Fund’s proportionate share of that Portfolio Fund’s net assets as reported by the applicable Portfolio Fund Management. All valuations were determined by the Adviser consistent with the Fund’s Valuation Procedures and are net of management and

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

incentive fees pursuant to the Portfolio Funds’ applicable agreements. The fair value represents the amount the Fund expects to receive, gross of redemption fees or penalties, at September 30, 2024, if it were to liquidate its investments in the Portfolio Funds.

Investments in mutual funds, including money market mutual funds, business development companies and interval funds are generally priced at the closing NAV. These securities are categorized as Level 1 securities.

Fixed income securities are priced using evaluated prices supplied by approved pricing services, which may use electronic data processing techniques and/or a computerized matrix system to determine a fair value. In determining the value of a bond or other fixed income security, matrix pricing takes into consideration recent transactions, yield, liquidity, risk, credit quality, rating, coupon, maturity and type of issue, and any other factors or market data as the independent pricing service deems relevant for the security being priced and for other securities with similar characteristics. These securities will generally be categorized as Level 2 securities. If the Adviser, as “Valuation Designee” under the oversight of the Board, decides that a price provided by the pricing service does not accurately reflect the fair value of the securities or when prices are not readily available from a pricing service, securities are valued at fair value as determined by the Valuation Designee, in conformity with the Valuation Procedures adopted by and subject to review of the Board. These securities will generally be categorized as Level 3 securities.

The valuation techniques described below maximize the use of observable inputs and minimize the use of unobservable inputs in determining fair value. The inputs or methodology used for valuing investments is not necessarily an indication of the risk associated with investing in those investments. The inputs used for valuing the Fund’s investments are summarized in the three broad levels listed below:

| ● | Level 1 – Unadjusted quoted prices in active markets for identical investments and/or registered investment companies where the value per share is determined and published and is the basis for current transactions for identical assets or liabilities at the valuation date. |

| ● | Level 2 – Quoted prices in markets that are not active or financial instruments for which all significant inputs are observable, either directly or indirectly. |

| ● | Level 3 – Inputs, broadly referred to as the assumptions that market participants use to make valuation decisions, are unobservable and reflect the Adviser’s best estimate of what market participants would use in pricing the financial instrument at the measurement date. |

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

In determining fair values as of September 30, 2024, the Adviser has, as a practical expedient, estimated fair value of each Portfolio Fund using the NAV (or its equivalent) provided by the Portfolio Fund Management of each Portfolio Fund as of that date. Each investment for which fair value is measured using the Portfolio Fund’s NAV as a practical expedient is not required to be categorized within the fair value hierarchy. Accordingly, Portfolio Funds and Closed-End Funds with a fair value of $69,131,027 and $11,296,268, respectively, have not been categorized.

Investments in mutual funds and money market mutual funds are generally priced at the closing NAV provided by the service agent of the funds. The following is a summary of the inputs used to value the Fund’s investments in such instruments as of September 30, 2024:

| | | Valuation Inputs | |

| | | Level 1 | | | Level 2 | | | Level 3 | | | Total | |

| Interval Funds | | $ | 34,959,743 | | | $ | — | | | $ | — | | | $ | 34,959,743 | |

| Business Development Companies | | | — | | | | 11,253,374 | | | | — | | | | 11,253,374 | |

| Closed-End Funds | | | 10,512,230 | | | | — | | | | — | | | | 10,512,230 | |

| Open-End Mutual Funds | | | 20,409,149 | | | | — | | | | — | | | | 20,409,149 | |

| Money Market Funds | | | 15,776,724 | | | | — | | | | — | | | | 15,776,724 | |

| U.S. Treasury Obligations | | | — | | | | 15,010,447 | | | | — | | | | 15,010,447 | |

| Total | | $ | 81,657,846 | | | $ | 26,263,821 | | | $ | — | | | $ | 107,921,667 | |

| (4) | FEES AND TRANSACTIONS WITH RELATED PARTIES |

Investment Advisory Agreement

Under the terms of the Investment Advisory Agreement between the Fund and the Adviser, the Adviser manages the Fund’s investments subject to oversight by the Board. The Fund pays the Adviser a fee, computed and paid monthly, of 1.00% of the Fund’s month-end net assets.

The Adviser has contractually agreed under an Operating Expense Limitation Agreement (“Agreement”) to reduce the management fee and reimburse other expenses to ensure that total annual fund operating expenses (excluding brokerage commissions and other similar transactional expenses; interest (including interest incurred on borrowed funds and interest incurred in connection with bank and custody overdrafts); other borrowing costs and fees, including commitment fees; taxes; acquired fund fees and expenses; litigation and indemnification expenses; judgments; and extraordinary expenses) will not exceed 1.75% of the Fund’s average net assets. This Agreement will continue in effect until at least February 1, 2026 and will renew automatically for successive

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

periods of one year thereafter, unless written notice of termination is provided by the Adviser to the Fund not less than ten days prior to the end of the then-current term, and can only be terminated prior to that date with approval from the Board. Management fee reductions and expense reimbursements by the Adviser are subject to recoupment by the Adviser for a period of up to three years from the date such fees were waived or expenses reimbursed, provided that the recoupments do not cause the total annual operating expenses (exclusive of such reductions and reimbursements) to exceed the lesser of (i) the expense limitation in effect at the time such fees were waived or expenses reimbursed, and (ii) the expense limitation in effect at the time of recoupment. For the fiscal year ended September 30, 2024, the Adviser has recouped fees totaling $199,442. The Adviser has recouped all previously waived management fees and there are no more fees eligible for recoupment.

Investment managers, who operate Portfolio Funds in which the Fund invests, receive fees for their services. The fees include management and incentive fees, or allocations based upon the NAV of the Fund’s investment in the Portfolio Fund. These fees are deducted directly from each Portfolio Fund’s assets in accordance with the governing documents of the Portfolio Fund. Generally, fees payable to an investment manager are estimated to range from 0.3% to 2.0% (annualized) of the average NAV of the Fund’s investment in a Portfolio Fund. In addition, certain investment managers charge an incentive allocation or fee which can range up to 30% of a Portfolio Fund’s net profits. The impact of these fees is reflected in the Fund’s performance but are not operational expenses of the Fund. Incentive fees may be subject to certain hurdle rates.

Master Services Agreement

Ultimus Fund Solutions, LLC (“Ultimus”) provides the Fund with administration, fund accounting and transfer agent services, including all regulatory reporting. Under the terms of a Master Services Agreement, Ultimus receives fees from the Fund for these services.

Consulting Agreement

Northern Lights Compliance Services, LLC (“NLCS”), an affiliate of Ultimus, provides compliance services, pursuant to a consulting agreement between NLCS and the Fund. Under the terms of such agreement, NLCS receives fees from the Fund, which are approved annually by the Board.

Distribution Agreement

The Fund has entered into a Distribution Agreement with Ultimus Fund Distributors, LLC (the “Distributor”), pursuant to which the Distributor acts as principal underwriter and distributor of the Fund’s shares of beneficial interest on a best effort basis, subject to various conditions. The Distributor may retain additional broker-dealers and other financial intermediaries (each a “Selling Agent”) to assist in the distribution of shares

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

and shares are available for purchase through these Selling Agents or directly through the Distributor. Generally, shares are only offered to investors that are U.S. persons for U.S. federal income tax purposes. The Distributor is a wholly-owned subsidiary of Ultimus.

Certain officers of the Fund are also employees of the Adviser and/or Ultimus.

| (5) | ORGANIZATIONAL AND OFFERING COSTS |

The Adviser advanced some of the Fund’s organization and initial offering costs and was subsequently reimbursed by the Fund. Costs of $159,564 incurred in connection with the offering and initial registration of the Fund have been deferred and were amortized on a straight-line basis over the first twelve months after commencement of operations. Costs of $124,459 incurred in connection with the organization of the Fund were expensed as incurred. During the year ended September 30, 2024, the amount of the offering costs amortized was $13,297. The amount of the offering costs remaining to amortize is $0.

| (6) | CAPITAL SHARE TRANSACTIONS |

The Fund is a closed-end tender offer fund and, to provide liquidity to shareholders, may from time to time offer to repurchase shares in accordance with written tenders by shareholders at those times, in those amounts and on such terms and conditions as the Board may determine in its sole discretion. In determining whether the Fund should offer to repurchase shares from shareholders, the Board will consider the recommendation of the Adviser. The Adviser currently expects to recommend to the Board that the Fund offer to repurchase up to 5% of the Fund’s outstanding shares at the applicable NAV per share on a quarterly basis. However, the Fund is not required to conduct repurchase offers and may be less likely to do so during the first few years following the commencement of Fund operations and during periods of exceptional market conditions. The Fund commenced its initial repurchase offer on September 27, 2024, offering to repurchase up to 5% of the Fund’s outstanding shares.

Shares of the Fund will be offered for purchase only through the Distributor, or a Selling Agent, as of the first business day of each month. Capital transactions are recorded on their effective date.

| (7) | PURCHASES AND SALES OF SECURITIES |

For the fiscal year ended September 30, 2024, the purchase and sale of investments, excluding short-term investments, were $63,156,837 and $0, respectively.

For the fiscal year ended September 30, 2024, there were no purchases or sales of long-term U.S. government obligations.

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

The beneficial ownership, either directly or indirectly, of more than 25% of the voting securities of a fund creates a presumption of control of the fund, under Section 2(a) (9) of the 1940 Act. As of September 30, 2024, there were no beneficial owners, directly or indirectly, of more than 25% of the Fund.

The Fund declares and pays dividends on investment income, if any, annually. The Fund also makes distributions of net capital gains, if any, annually.

It is the policy of the Fund to qualify or continue to qualify as a regulated investment company by complying with the provisions available to certain investment companies, as defined in applicable sections of the Internal Revenue Code, and to make distributions of net investment income and net realized capital gains sufficient to relieve it from all, or substantially all, federal income taxes.

The following information is provided on a tax basis as of September 30, 2024:

| Gross unrealized appreciation | | $ | 5,877,412 | |

| Gross unrealized depreciation | | | (124,892 | ) |

| Net unrealized appreciation | | $ | 5,752,520 | |

| Cost of investments | | $ | 182,596,442 | |

The difference between the book-basis unrealized appreciation/(depreciation) is attributable primarily to the realization for tax purposes of unrealized gains/(losses) on investments in passive foreign investment companies.

As of September 30, 2024, the following reclassifications was made on the Statement and Assets of Liabilities for the Fund:

| | | Accumulated |

| Paid-In Capital | | Earnings (Deficit) |

| $(31,386) | | $31,386 |

As of September 30, 2024, the most recent fiscal year end, the components of accumulated earnings (deficit) on a tax basis were as follows:

| Undistributed ordinary income | | $ | 5,245,895 | |

| Undistributed long term capital gains | | | 98,441 | |

| Accumulated capital and other losses | | | (5,783 | ) |

| Unrealized appreciation/(depreciation) | | | 5,752,520 | |

| Total | | $ | 11,091,073 | |

Dynamic Alternatives Fund

Notes to the Financial Statements (Continued)

The tax character of distributions for the fiscal period ended September 30, 2024 and September 30, 2023, were as follows:

| | | September 30,

2024 | | | September 30,

2023 | |

| Distributions paid from: | | | | | | | | |

| Ordinary income | | $ | 3,848,781 | | | $ | 423,901 | |

| Net Long Term Capital Gains | | | 127,671 | | | | — | |

| Total distributions paid | | $ | 3,976,452 | | | $ | 423,901 | |

Management of the Fund has reviewed tax positions taken in the tax year that remain subject to examination by all major tax jurisdictions, including federal (i.e., the interim tax period since then, as applicable). Management believes there is no tax liability resulting from unrecognized tax benefits related to uncertain tax positions taken.

| (11) | CONTINGENCIES AND COMMITMENTS |

The Fund indemnifies the Fund’s officers and the Board for certain liabilities that might arise from their performance of their duties to the Fund. Additionally, in the normal course of business the Fund enters into contracts that contain a variety of representations and warranties and which provide general indemnifications. The Fund’s maximum exposure under these arrangements is unknow, as this would involve future claims that may be made against the Fund that have not yet occurred. However, based on experience, the Fund expects the risk of loss to be remote; however, there can be no assurance that such obligations will not result in material liabilities that adversely affect the Fund.

The Fund is required to recognize in this financial statement the effects of all subsequent events that provide additional evidence about conditions that existed as of the date of the Statement of Assets and Liabilities. For non-recognized subsequent events that must be disclosed to keep the financial statements from being misleading, the Fund is required to disclose the nature of the event as well as an estimate of its financial effect, or a statement that such an estimate cannot be made. Management has evaluated subsequent events through the issuance of these financial statements and has noted no such events.

Dynamic Alternatives Fund

Report of Independent Registered Public Accounting Firm

To the Shareholders and Board of Trustees of

Dynamic Alternatives Fund

Opinion on the Financial Statements

We have audited the accompanying statement of assets and liabilities, including the schedule of investments, of Dynamic Alternatives Fund (the “Fund”) as of September 30, 2024, the related statements of operations and cash flows for the year then ended, the statements of changes in net assets and the financial highlights for the year then ended and for the period from October 31, 2022 (commencement of operations) through September 30, 2023, and the related notes (collectively referred to as the “financial statements”). In our opinion, the financial statements present fairly, in all material respects, the financial position of the Fund as of September 30, 2024, the results of its operations, its cash flows, the changes in net assets, and the financial highlights for each of the periods indicated above, in conformity with accounting principles generally accepted in the United States of America.

Basis for Opinion

These financial statements are the responsibility of the Fund’s management. Our responsibility is to express an opinion on the Fund’s financial statements based on our audits. We are a public accounting firm registered with the Public Company Accounting Oversight Board (United States) (“PCAOB”) and are required to be independent with respect to the Fund in accordance with the U.S. federal securities laws and the applicable rules and regulations of the Securities and Exchange Commission and the PCAOB.

We conducted our audits in accordance with the standards of the PCAOB. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement whether due to error or fraud.

Our audits included performing procedures to assess the risks of material misstatement of the financial statements, whether due to error or fraud, and performing procedures that respond to those risks. Such procedures included examining, on a test basis, evidence regarding the amounts and disclosures in the financial statements. Our procedures included confirmation of securities owned as of September 30, 2024, by correspondence with the custodian and underlying fund administrators or managers. Our audits also included evaluating the accounting principles used and significant estimates made by management, as well as evaluating the overall presentation of the financial statements. We believe that our audits provide a reasonable basis for our opinion.

Dynamic Alternatives Fund

Report of Independent Registered Public Accounting Firm (Continued)

We have served as the Fund’s auditor since 2023.

COHEN & COMPANY, LTD.

Philadelphia, Pennsylvania

November 27, 2024

Dynamic Alternatives Fund

Additional Federal Income Tax Information (Unaudited)

The Form 1099-DIV you will receive will show the tax status of all distributions paid to your account in any calendar year. Shareholders are advised to consult their own tax adviser with respect to the tax consequences of their investment in the Fund. As required by the Internal Revenue Code and/or regulations, shareholders must be notified regarding the status of qualified dividend income for individuals and the dividends received deduction for corporations.

Qualified Dividend Income. For the fiscal year ended September 30, 2024, the Fund designates approximately 0% or up to the maximum amount of such dividends allowable pursuant to the Internal Revenue Code, as qualified dividend income eligible for a reduced tax rate.

Dividends Received Deduction. Corporate shareholders are generally entitled to take the dividends received deduction on the portion of the Fund’s dividend distribution that qualifies under tax law. For the fiscal year ended September 30, 2024, 0% of the Fund’s ordinary income qualifies for the corporate dividends received deduction.

For the fiscal year ended September 30, 2024, the Fund designated $127,671 long-term capital gain distributions.

Dynamic Alternatives Fund

Approval of Advisory Agreement (Unaudited)

Renewal of Advisory Agreement – Dynamic Alternatives Fund*

At a meeting held on September 5, 2024, the Board of Trustees (the “Board”) of the Dynamic Alternatives Fund (the “Fund”), including a majority of the Trustees who are not “interested persons,” as that term is defined in the Investment Company Act of 1940, as amended, discussed the renewal of the investment advisory agreement (the “Advisory Agreement”) between the Hamilton Capital, LLC (the “Adviser”) and the Fund. In considering the renewal of the Advisory Agreement, the Board received materials specifically relating to the Fund and the Advisory Agreement including a memorandum prepared by independent legal counsel discussing the Trustees’ fiduciary obligations and the factors they should assess in considering the approval of the Advisory Agreement, detailed information provided by the Adviser regarding management fees and other expenses of the Fund, due diligence materials relating to the Adviser (including the Adviser’s responses to an information request circulated by independent legal counsel on behalf of the Independent Trustees, the Adviser’s Form ADV, select financial statements of the Adviser, and information regarding the Adviser’s profitability from managing the Fund) and other pertinent information.

The Board relied upon the advice of independent legal counsel and its own business judgment in determining the material factors to be considered in evaluating the renewal of the Advisory Agreement and the weight to be given to each such factor. The Board’s conclusions were based on an evaluation of all of the information provided and were not the result of any one factor. Moreover, each Trustee may have afforded different weight to the various factors in reaching conclusions with respect to the Advisory Agreement.

Nature, Extent and Quality of Services. The Trustees considered the nature, extent, and quality of services provided by the Adviser to the Fund under the Advisory Agreement and the amount of time the Adviser and its personnel devote to the operation of the Fund. The Trustees also considered the specific responsibilities the Adviser undertakes with respect to the day-to-day management of the Fund, as well as the qualifications and experience of the Adviser, the Fund’s portfolio managers and other key personnel of the Adviser involved in the day-to-day management of the Fund. The Board also considered the resources, policies, procedures, and infrastructure of the Adviser devoted to ensuring compliance with applicable laws and regulations, as well as the Adviser’s commitment to those programs. The Board noted that there were currently no known pending regulatory actions by the Securities and Exchange Commission or other regulatory agencies involving the Adviser, or the Fund. The Board concluded that the Adviser’s key personnel had sufficient expertise necessary to continue to serve as investment adviser to the Fund, that the Adviser continues to invest in personnel and other resources to ensure the Fund receives quality services, and that the nature, overall quality and extent of the management services provided to the Fund were satisfactory and reliable.

Dynamic Alternatives Fund

Approval of Advisory Agreement (Unaudited) (Continued)

Performance. The Board considered the Fund’s performance against both its benchmark indexes (the Bloomberg U.S. Aggregate Bond Index and the MSCI All Country World Index) and in comparison to a peer group of closed-end funds with similar investment objectives and strategies, as selected by the Adviser (the “Peer Group”). The Board observed that the Fund had outperformed the Bloomberg U.S. Aggregate Bond Index over the one-year and since inception periods ended June 30, 2024 but underperformed the MSCI All Country World Index over the one-year and since inception periods ended June 30, 2024. The Board also reviewed the performance of the Fund’s allocations to private credit, private equity, hedge fund and strategic credit investments against strategy-specific benchmarks. The Board noted that the Fund’s private credit investments had outperformed the private credit benchmark over the year-to-date and since inception periods ended June 30, 2024, the Fund’s private equity investments had outperformed the private equity benchmark over the year-to-date and one-year periods ended June 30, 2024, the Fund’s hedge fund investments outperformed the hedge fund benchmark over the year-to-date and since inception periods ended June 30, 2024, and the Fund’s structured credit investments outperformed the structured credit benchmark over the year-to-date and since inception periods ended June 30, 2024. The Board also considered the Fund’s performance over the one-year period relative to the Peer Group and noted that the Fund’s returns were in line with the Peer Group average. With regard to the Peer Group, the Board noted that the funds in the Peer Group are all semi-liquid funds that calculate performance at different intervals.

After considering all of the information the Board concluded that the performance of the Fund was satisfactory under current market conditions and that the Adviser has the necessary expertise and resources in providing investment advisory services in accordance with the Fund’s investment objective and strategies. Although past performance is not a guarantee or indication of future results, the Board determined the Fund and its shareholders were likely to benefit from the Adviser’s continued management.

Fees and Expenses. The Board considered the fee rate charged by the Adviser to the Fund and the Fund’s overall net expense ratio, taking into consideration the expense limitation agreement between the Fund and the Adviser. As to the costs of the services provided and profits realized by the Adviser in connection with the Advisory Agreement, the Board considered the advisory fee for the Fund and total expense ratio of the Fund relative to the Peer Group. The Board considered that the Adviser charges an advisory fee of 1.00% of the Fund’s average net assets and that the Adviser has agreed to reimburse the Fund in order to limit the Fund’s total operating expenses, exclusive of certain transactional and other expenses, to 1.75% of the Fund’s average daily net assets. The Board considered that the advisory fee and estimated total net expense ratio for the Fund was within the range of advisory fees and total expense ratios reflected in the Peer Group and below the average advisory fee and average total expense ratio of the Peer Group. Lastly, the

Dynamic Alternatives Fund

Approval of Advisory Agreement (Unaudited) (Continued)

Board considered the range of advisory fees charged to the Adviser’s separate accounts, noting that while such separate accounts employ alternative investments, the accounts do not have the same investment objective or strategy as the Fund. The Board noted that the advisory fee for the Fund was within the range of advisory fees charged by the Adviser to its separate accounts. The Board concluded that the contractual advisory fee paid to the Adviser was fair and reasonable and that the overall expense ratio for the Fund was acceptable in light of these factors.

Economies of Scale. The Board considered the extent to which economies of scale would be realized as the Fund grows and whether fee levels reflect a reasonable sharing of economies of scale for the benefit of Fund investors. The Board noted that most of the Fund’s operating expenses are fixed rather than variable and therefore, as the Fund’s size increases, each individual investor’s total expense ratio will decrease accordingly. The Board also noted that, although the Advisory Agreement does not have advisory fee breakpoints, the Adviser has contractually agreed to limit certain expenses of the Fund so that the Fund’s annual operating expenses do not exceed 1.75% of the Fund’s average daily net assets. Based upon its review and discussion, the Board determined that, while fee breakpoints were not currently necessary for the Fund, they would continue to review whether breakpoints should be incorporated in the future. After further discussion, the Board concluded that the current fee structure was reasonable.

Profitability. The Board reviewed the Adviser’s profitability analysis for the one-year period ended June 30, 2024 in connection with the advisory services provided to the Fund. The Board observed that while the Fund charges an advisory fee, clients of the Adviser did not pay additional fees at the separately managed account level on assets invested in the Fund. The Board concluded that the Adviser’s fees and the profits obtained by the Adviser from the Fund were not excessive.

Conclusion. Having requested and reviewed such information from the Adviser as the Board believed to be reasonably necessary to evaluate the terms of the Advisory Agreement and as assisted by the advice of independent counsel, the Board concluded that renewal of the Advisory Agreement was in the best interests of the Fund and its shareholders.

| * | Due to timing of the contract renewal schedule, these deliberations may or may not relate to the current performance results of the Fund. |

Dynamic Alternatives Fund

Trustees and Officers (Unaudited)

The Board of Trustees supervises the business activities of the Fund. Each Trustee serves as a trustee until termination of the Fund unless the Trustee dies, resigns, retires or is removed.

The Board is currently comprised of three Independent Trustees and one trustee who is considered an “interested person” of the Fund (the “Interested Trustee”). The business address of the Trustees is c/o Hamilton Capital, LLC, 5025 Arlington Centre Boulevard, Suite 300, Columbus, Ohio 43220.

The following tables provide information regarding the Trustees and officers of the Fund:

Name, Address and

Year of Birth | | Position(s) Held with Fund | | Term of Office and

Length of Time Served(1) | | Principal Occupation(s)

During the Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee During the past 5 Years |

| Interested Trustee |

Jeffrey G. Wilkins(2) Born: 1975 | | Interested Trustee; Chairman; President and Principal Executive Officer | | Since 2021, indefinite | | Deputy Chief Investment Officer and Managing Director, Hamilton Capital, LLC, (since August 2010). | | 1 | | None. |

| Independent Trustees |

Michael S. Jordan

Born: 1971 | | Independent Trustee | | Since 2021, indefinite | | Partner, Seyfarth Shaw LLP (since 2022); Partner, Ice Miller LLP (law firm, formerly Schottenstein, Zox & Dunn) (1997-2022); Managing Partner, Ice Miller LLP (2019-2021). | | 1 | | None. |

Carrie J. Thome Born: 1968 | | Independent Trustee | | Since 2021, indefinite | | Managing Director, NVNG Investment Advisors, LLC (since 2019); Wisconsin Alumni Research Foundation, Chief Investment Officer (2007-2019). | | 1 | | Madison Funds (15) (2017- 2022); Ultra Series Fund (14) (2017- 2022). |

Dynamic Alternatives Fund

Trustees and Officers (Unaudited) (Continued)

Name, Address and

Year of Birth | | Position(s) Held with Fund | | Term of Office and

Length of Time Served(1) | | Principal Occupation(s)

During the Past 5 Years | | Number of Portfolios in Fund Complex Overseen by Trustee | | Other Directorships Held by Trustee During the past 5 Years |

Jeremy M. Getson Born: 1971 | | Independent Trustee | | Since 2024, indefinite | | Head of Investor Relations, Northlight Capital Partners LLC (since August 2022); Partner AQR Capital Management (2004-2022) | | 1 | | None. |

| (1) | Under the Fund’s Declaration of Trust, a Trustee serves until his or her successor is elected and qualified, or until his or her removal, resignation, death, incapacity or declaration as bankrupt or retirement from the Board. While the Board has discretion to institute a retirement policy, it has not yet done so. |

| (2) | Mr. Wilkins is considered an “interested person” because of his affiliation with the Adviser. |

The following table provides information regarding the officers of the Fund. With the exception of Messrs. Wilkins and Leuby, the business address of each of the officers is c/o Ultimus Fund Solutions, LLC, 4221 North 203rd Street, Suite 100, Elkhorn, Nebraska 68022-3474. The business address of Messrs. Wilkins and Leuby is c/o Hamilton Capital, LLC, 5025 Arlington Centre Boulevard, Suite 300, Columbus, Ohio 43220.

Name, Address and

Year of Birth | | Position(s) Held with Fund | | Term of Office and

Length of Time Served(1) | | Principal Occupation(s)

During the Past 5 Years |

Jeffrey G. Wilkins Born: 1975 | | President | | Since 2021, indefinite | | Deputy Chief Investment Officer and Managing Director, Hamilton Capital, LLC (since August 2010). |

Zachary Richmond Born: 1980 | | Treasurer | | Since 2021, indefinite | | Vice President, Director of Financial Administration for Ultimus Fund Solutions, LLC (since 2019); Assistant Vice President, Associate Director of Financial Administration for Ultimus Fund Solutions, LLC (2015 – 2019). |

Dynamic Alternatives Fund

Trustees and Officers (Unaudited) (Continued)

Name, Address and

Year of Birth | | Position(s) Held with Fund | | Term of Office and

Length of Time Served(1) | | Principal Occupation(s)

During the Past 5 Years |

Dan Ellenwood Born: 1969 | | Chief Compliance Officer | | Since 2024, indefinite | | Vice President, Senior Compliance Officer, Northern Lights Compliance Services, LLC (since 2024); Chief Compliance Officer North Square Investments, LLC (2021-2023); Vice President, Fund Compliance Oversight Manager, Nuveen Investments - TIAA (2013-2021). |

Kent Barnes Born: 1968 | | Secretary | | Since 2024, indefinite | | Vice President and Senior Management Counsel, Ultimus Fund Solutions, LLC, (since 2023); Vice President, U.S. Bancorp Fund Services, LLC (2018-2023); Chief Compliance Officer, Rafferty Asset Management, LLC (2016-2018). |

William A. Leuby Born: 1957 | | Assistant Secretary | | Since 2021, indefinite | | Senior Vice President, General Counsel and Chief Compliance Officer, Hamilton Capital, LLC (since 1997). |

John Reep Born: 1978 | | Assistant Secretary | | Since 2023, indefinite | | Associate Legal Counsel, Ultimus Fund Solutions, LLC (since 2022); Associate Controller, JP Morgan Chase (2021-2022); Senior Accountant, Washington Prime Group (2019-2021); Tax Adviser, Cardinal Health (2018- 2019) |

Deryk Jones Born: 1988 | | Anti-Money Laundering Compliance Officer | | Since 2021, indefinite | | Compliance Analyst, Northern Lights Compliance Services, LLC (since 2018); prior thereto, student. |

| (1) | Under the Fund’s By-Laws, an officer holds office for one year and until their respective successors are chosen and qualified, or in each case until he or she sooner dies, resigns, is removed or becomes disqualified. Officers hold office at the pleasure of the Trustees. |

Other Information (Unaudited)

The Fund’s Statement of Additional Information (“SAI”) includes additional information about the trustees and is available on the Fund’s website at www.dynamicalternativesfund.com or you may call toll-free at (833) 617-2624 to request a free copy of the SAI or to make shareholder inquiries.

Dynamic Alternatives Fund

Dividend Reinvestment Plan (Unaudited)

Shareholders will automatically participate in the Fund’s Dividend Reinvestment Plan (“DRIP”) and have all income dividends and/or capital gains distributions automatically reinvested in additional shares unless they elect in writing to receive distributions in cash in their Subscription Agreement with the Fund. Ultimus (the “Agent”) acts as the agent for participants under the DRIP. Participants in the DRIP will receive an amount of full and fractional shares equal to the amount of the distribution on that participant’s shares divided by the immediate post-distribution NAV per share.

Shareholders who elect not to participate in the DRIP will receive all distributions in cash paid by wire (or, if the shares are held in street or other nominee name, then to the nominee) by Ultimus as dividend paying agent. To the extent shareholders make an election to receive distributions in cash, the Fund may pay any or all such distributions in a combination of cash and shares of the Fund. The automatic reinvestment of dividends and distributions will not relieve participants of any income taxes that may be payable (or required to be withheld) on dividends and distributions.

A shareholder may withdraw from the DRIP at any time. There will be no penalty for withdrawal from the DRIP and shareholders who have previously withdrawn from the DRIP may rejoin it at any time. Changes in elections must be in writing and should include the shareholder’s name and address as they appear on the records of the Fund. An election to withdraw from the DRIP will, until such election is changed, be deemed to be an election by a shareholder to take all subsequent distributions in cash. An election will be effective only for a distribution declared and having a record date of at least 10 days after the date on which the election is received. A shareholder whose shares are held in the name of a broker or nominee should contact such broker or nominee concerning changes in that shareholder’s election.

Questions concerning the DRIP should be directed to the Agent at P.O. Box 541150, Omaha, Nebraska 68154 or 833-617-2624.

PRIVACY NOTICE

| FACTS | WHAT DOES DYNAMIC ALTERNATIVES FUND DO WITH YOUR PERSONAL INFORMATION? |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| | | ■ | Social Security number |

| | | ■ | Assets |

| | | ■ | Retirement Assets |

| | | ■ | Transaction History |

| | | ■ | Checking Account Information |

| | | ■ | Purchase History |

| | | ■ | Account Balances |

| | | ■ | Account Transactions |

| | | ■ | Wire Transfer Instructions |

| | When you are no longer our customer, we continue to share your information as described in this notice. |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons chosen to share; and whether you can limit this sharing. |

| Reasons we can share your personal information | Does Dynamic

Alternatives

Fund share? | Can you limit

this sharing? |

For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

For our marketing purposes – to offer our products and services to you | No | We don’t share |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes – information about your transactions and experiences | No | We don’t share |

For our affiliates’ everyday business purposes – information about your creditworthiness | No | We don’t share |

| For non-affiliates to market to you | No | We don’t share |

| Questions? | Call 1-402-493-4603 |

| Who we are | | |

| Who is providing this notice? | Dynamic Alternatives Fund |

| What we do | | |

| How does Dynamic Alternatives Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

| How does Dynamic Alternatives Fund collect my personal information? | We collect your personal information, for example, when you |

| | ● | Open an account |