Exhibit 99.2

SUSTAINABLY MEETING THE CHALLENGES OF WATER SUPPLY AND COMFORT COOLING

Basis of Presentation These presentation materials (“Presentation Materials”) are provided for informational purposes only and have been prepared to assist interested parties in a proposed private placement in making their own evaluation with respect to an investment in connection with a potential business combination among Montana Technologies LLC ("Montana Technologies“ or “MT”), Power & Digital Infrastructure Acquisition II Corp . ("XPDB") and the other parties thereto and related transactions (the "Potential Business Combination") and for no other purpose . By accepting, reviewing or reading these Presentation Materials, you will be deemed to have agreed to the obligations and restrictions set out below . No Offer or Solicitation These Presentation Materials and any oral statements made in connection with these Presentation Materials do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any vote, consent or approval in any jurisdiction in connection with the Potential Business Combination or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction . These Presentation Materials do not constitute either advice or a recommendation regarding any securities . No offering of securities shall be made except by means of a prospectus meeting the requirements of the Securities Act of 1933 , as amended (the "Securities Act") or an exemption therefrom . No Representations and Warranties No representations or warranties, express, implied or statutory, are given in, or in respect of, these Presentation Materials, and no person may rely on the information contained in these Presentation Materials . Any data on past performance or modeling contained herein is not an indication as to future performance . This data is subject to change . Each recipient agrees and acknowledges that these Presentation Materials are not intended to form the basis of any investment decision by such recipient and do not constitute investment, tax or legal advice . Recipients of these Presentation Materials are not to construe its contents, or any prior or subsequent communications from or with XPDB, Montana Technologies, or their respective representatives as investment, legal or tax advice . Each recipient should seek independent third party legal, regulatory, accounting and/or tax advice regarding these Presentation Materials . In addition, these Presentation Materials do not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Montana Technologies or the Potential Business Combination . Recipients of these Presentation Materials should each make their own evaluation of Montana Technologies, and of the relevance and adequacy of the information and should make such other investigations as they deem necessary . XPDB and Montana Technologies assume no obligation to update the information in these Presentation Materials . Each recipient also acknowledges and agrees that the information contained in these Presentation Materials (i) is preliminary in nature and is subject to change, and any such changes may be material and (ii) should be considered in the context of the circumstances prevailing at the time and has not been, and will not be, updated to reflect material developments which may occur after the date of these Presentation Materials . To the fullest extent permitted by law, in no circumstances will Montana Technologies, XPDB, or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of these Presentation Materials, its contents, its omissions, reliance on the information contained within it or on opinions communicated in relation thereto or otherwise arising in connection therewith . These Presentation Materials discuss trends and markets that Montana Technologies' leadership team believes will impact the development and success of Montana Technologies based on its current understanding of the marketplace and each recipient acknowledges this information is preliminary in nature and subject to change . Industry and Market Data Industry and market data used in these Presentation Materials, including information about Montana Technologies' total addressable market, has been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes . Neither XPDB nor Montana Technologies has independently verified the data obtained from these sources and cannot assure you of the reasonableness of any assumptions used by these sources or the data's accuracy or completeness . DISCLAIMERS

Forward Looking Statements Certain statements in these Presentation Materials may be considered “forward - looking statements” as defined in the Private Securities Litigation Reform Act of 1995 and within the meaning of the federal securities laws with respect to the proposed business combination between XPDB and Montana Technologies, including statements regarding the benefits of the proposed business combination, the anticipated timing of the proposed business combination, the likelihood and ability of the parties to successfully consummate the proposed business combination, the amount of funds available in the trust account as a result of shareholder redemptions or otherwise, the impact, cost and performance of the AirJoule tm technology once commercialized, the services offered by Montana Technologies and the markets in which Montana Technologies operates, business strategies, debt levels, industry environment, potential growth opportunities, the effects of regulations and XPDB’s or Montana Technologies’ projected future results . These forward - looking statements generally are identified by the words “believe,” “predict,” “project,” “potential,” “expect,” “anticipate,” “estimate,” “intend,” “strategy,” “future,” “forecast,” “opportunity,” “plan,” “may,” “should,” “will,” “would,” “should,” “will be,” “will continue,” “will likely result,” and similar expressions (including the negative versions of such words or expressions) . Forward - looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, are subject to risks and uncertainties . Many factors could cause actual future events to differ materially from the forward - looking statements in this document, including but not limited to : (i) the risk that the proposed business combination may not be completed in a timely manner or at all, which may adversely affect the price of XPDB securities ; (ii) the risk that the proposed business combination may not be completed by XPDB’s business combination deadline and the potential failure to obtain an extension of the business combination deadline if sought by XPDB ; (iii) the failure to satisfy the conditions to the consummation of the proposed business combination, including the approval of the proposed business combination by XPDB’s stockholders, the satisfaction of the minimum aggregate transaction proceeds amount following redemptions by XPDB’s public stockholders and the receipt of certain governmental and regulatory approvals ; (iv) the failure to obtain financing to complete the proposed business combination and to support the future working capital needs of Montana Technologies ; (v) the effect of the announcement or pendency of the proposed business combination on Montana Technologies’ business relationships, performance, and business generally ; (vi) risks that the proposed business combination disrupts current plans of Montana Technologies and potential difficulties in Montana Technologies’ employee retention as a result of the proposed business combination ; (vii) the outcome of any legal proceedings that may be instituted against XPDB or Montana Technologies related to the agreement and the proposed business combination ; (viii) changes to the proposed structure of the business combination that may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the business combination ; (ix) the ability to maintain the listing of the XPDB’s securities on the NASDAQ ; (x) the price of XPDB’s securities, including volatility resulting from changes in the competitive and highly regulated industries in which Montana Technologies plans to operate, variations in performance across competitors, changes in laws and regulations affecting Montana Technologies’ business and changes in the combined capital structure ; (xi) the ability to implement business plans, forecasts, and other expectations after the completion of the proposed business combination, including the possibility of cost overruns or unanticipated expenses in development programs, and the ability to identify and realize additional opportunities ; (xii) the enforceability of Montana Technologies’ intellectual property, including its patents, and the potential infringement on the intellectual property rights of others, cyber security risks or potential breaches of data security ; and (xiii) other risks and uncertainties set forth in the section entitled “Risk Factors” and “Cautionary Note Regarding Forward - Looking Statements” in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K that are available on the website of the Securities and Exchange Commission (the “SEC”) at www . sec . gov and other documents filed, or to be filed with the SEC by XPDB, including the Registration Statement . The foregoing list of factors is not exhaustive . There may be additional risks that neither XPDB or Montana Technologies presently know or that XPDB or Montana Technologies currently believe are immaterial that could also cause actual results to differ from those contained in the forward - looking statements . You should carefully consider the foregoing factors and the other risks and uncertainties that will be described in XPDB’s definitive proxy statement contained in the Registration Statement (as defined below), including those under “Risk Factors” therein, and other documents filed by XPDB from time to time with the SEC . These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward - looking statements . Forward - looking statements speak only as of the date they are made . Readers are cautioned not to put undue reliance on forward - looking statements, and XPDB and Montana Technologies assume no obligation and, except as required by law, do not intend to update or revise these forward - looking statements, whether as a result of new information, future events, or otherwise . Neither XPDB nor Montana Technologies gives any assurance that either XPDB or Montana Technologies will achieve its expectations . DISCLAIMERS

Trademarks These Presentation Materials contain trademarks, service marks, trade names and copyrights of third parties, which are the property of their respective owners . The use or display of third parties' trademarks, service marks, trade names or products in these Presentation Materials are not intended to, and do not imply, a relationship with XPDB or Montana Technologies, an endorsement or sponsorship by or of XPDB or Montana Technologies, or a guarantee that Montana Technologies or XPDB will work or will continue to work with such third parties . Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in these Presentation Materials may appear without the TM, SM, R or C symbols, but such references are not intended to indicate, in any way, that XPDB, Montana Technologies, or the any third - party will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights . Financial Information The financial information and data contained in this Presentation is unaudited and does not conform to Regulation S - X promulgated under the Securities Act . Accordingly, such information and data may be adjusted in or may be presented differently in any proxy statement or registration statement to be filed by XPDB with the SEC . Additional Information about the Proposed Transaction and Where to Find It In connection with the proposed business combination, XPDB intends to file a registration statement on Form S - 4 (the “Registration Statement”) that is expected to include a preliminary prospectus and preliminary proxy statement of XPDB . The definitive proxy statement/final prospectus and other relevant documents will be sent to all XPDB stockholders as of a record date to be established for voting on the proposed business combination and the other matters to be voted upon at a meeting of XPDB’s stockholders to be held to approve the proposed business combination and other matters (the “Special Meeting”) . XPDB may also file other documents regarding the proposed business combination with the SEC . The definitive proxy statement/final prospectus will contain important information about the proposed business combination and the other matters to be voted upon at the Special Meeting and may contain information that an investor will consider important in making a decision regarding an investment in XPDB’s securities . Before making any voting decision, investors and security holders of XPDB and other interested parties are urged to read the Registration Statement and the proxy statement/prospectus and all other relevant documents filed or that will be filed with the SEC in connection with the proposed business combination as they become available because they will contain important information about the proposed business combination . Investors and security holders will also be able to obtain free copies of the definitive proxy statement/final prospectus and all other relevant documents filed or that will be filed with the SEC by XPDB through the website maintained by the SEC at www . sec . gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440 , Chicago, IL 60654 , or by contacting Morrow Sodali LLC, XPDB’s proxy solicitor, for help, toll - free at ( 800 ) 662 - 5200 (banks and brokers can call collect at ( 203 ) 658 - 9400 ) . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Participants in the Solicitation XPDB, Montana Technologies and certain of their respective directors and executive officers may be deemed participants in the solicitation of proxies from XPDB’s stockholders with respect to the proposed business combination . A list of the names of those directors and executive officers of XPDB and a description of their interests in XPDB is set forth in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K . Additional information regarding the interests of those persons and other persons who may be deemed participants in the proposed business combination may be obtained by reading the Registration Statement regarding the proposed business combination when it becomes available . The documents described in this paragraph are available free of charge at the SEC’s website at www . sec . gov, or by directing a request to XPDB, 321 North Clark Street, Suite 2440 , Chicago, IL 60654 . Additional information regarding the names and interests of such participants will be contained in the Registration Statement for the proposed business combination when available . DISCLAIMERS

Risk Factors For a non - exhaustive description of the risks relating to an investment in a private placement in connection with the Potential Business Combination please review "Risk Factors" at the end of this presentation . Changes and Additional Information in Connection with SEC Filings The information in these Presentation Materials has not been reviewed by the SEC and certain information may not comply in certain respects with SEC rules . As a result, the information in the Registration Statement may differ from these Presentation Materials to comply with SEC rules . The Registration Statement will include substantial additional information about Montana Technologies and XPDB not contained in these Presentation Materials . Once filed, the information in the Registration Statement will update and supersede the information presented in these Presentation Materials . INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE POTENTIAL BUSINESS COMBINATION OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN . ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE . Interests of XPDB’s Directors and Officers in the Merger In addition to the interests of XPDB’s directors and officers described in in XPDB’s Annual Reports on Form 10 - K, Quarterly Reports on Form 10 - Q and Current Reports on Form 8 - K, certain members of the board of directors and executive officers of XPDB, the Sponsor, including its directors and executive officers, and their affiliates have interests in the Potential Business Combination that are different from, or in addition to, those of XPDB stockholders generally . In particular : 1 . Patrick Eilers, the Chief Executive Officer of XPDB and a member of its board of directors, serves as an advisor to Montana Technologies 2 . XPDB will have the right to appoint two members of the initial board of directors following the Business Combination, one of whom will be Patrick Eilers 3 . TEP Montana, LLC, an affiliate of Mr . Eilers, is a minority investor in Montana Technologies with board observation rights DISCLAIMERS

Slide 6 Montana Technologies | June 2023 SUMMARY OF PROPOSED TRANSACTION TRANSACTION SUMMARY • Montana Technologies has created a transformational technology that provides significant energy efficiency gains in heating, ven tilation, and air conditioning (“HVAC”) applications while also generating potable water, all through its proprietary AirJoule tm units – Addresses two of the world’s most problematic issues: demand for energy - efficient HVAC and water stress • Power & Digital Infrastructure Acquisition II Corp. (Nasdaq: "XPDB") is a blank - check company focused on clean tech solutions, s upported by long - time energy investor, Pat Eilers (Transition Equity Partners, LLC), and professionals from global advisory firm XMS Capital P art ners, LLC, led by Ted Brombach • Montana Technologies and XPDB are combining to raise capital and continue executing on a commercialization strategy with key com mercial partners – namely BASF and CATL today – to manufacture AirJoule tm units – Montana Technologies shareholders are rolling 100% of their equity into the combined company – Transaction proceeds are being retained in the business • $500 million Pro Forma Enterprise Value at $10.00 per share (1) – Represents a highly attractive entry valuation relative to market opportunity and peer group metrics • $100 million of gross proceeds is expected to be sufficient to fund operations through commercialization, production and depl oym ent XPDB has identified Montana Technologies as a highly differentiated and scalable technology provider that is developing solutions to provide a cleaner energy future across two enormous addressable markets – HVAC and water 1. Excludes earnout provision of up to $200 million at $10.00 per share that may be earned by existing shareholders within 5 yea rs after closing based on annualized EBITDA milestones expected from completion of new production capacity.

Slide 7 Montana Technologies | June 2023 INVESTMENT HIGHLIGHTS • Transformational Technology: 5 - 10x energy reduction, air - to - water and HVAC solutions – Applications across dehumidification, atmospheric water generation and evaporative cooling help solve two of the world’s most problematic issues: demand for energy - efficient HVAC and water stress • Leading Partnerships: – Partnerships help accelerate manufacturing of materials and components as well as provide product validation and commercialization • Capital Efficient and Highly Scalable Business Model: <$50 million capex investment expected to generate ~$100 million EBITDA per line – Montana Technologies expects to self - fund future production lines through capital - efficient production • Large Addressable Market: >$100 billion air - to - water and $355 billion HVAC markets – Scaling to base case production lines would represent a de minimis proportion of the ~$455 billion market • Key Components Plan: Deliver proprietary technology for OEM assembly – MOF coated contactors to be sold in combination with air pumps, vacuum compressors and water vapor condensers • Strong Management: Team supported by some of the nation’s leading scientists in this area – Combined 140+ years of experience across commercialization, finance, operations and research

Slide 8 Montana Technologies | June 2023 • Over 30 years of experience successfully founding and leading innovative product - based companies • Founded Core Innovation, predecessor to Montana Technologies • Previously founded Jore Corporation, a power tool and accessories manufacturer that exceeded ~$55 million annual revenue • Led Jore Corporation through a successful IPO MONTANA TECHNOLOGIES EXPERIENCED TEAM WITH STRONG TRACK RECORD Matt Jore Founder, CEO Jeff Gutke CFO • Over 25 years of financial, operational and technical experience • Founder of Doxey Capital, a private investment and advisory services firm • Former Managing Director for Talara Capital and a member of the firm’s investment committee • Previously worked at Denham Capital, J.M. Huber Corporation, and Aquila Energy Capital Corporation Dan Gabig VP Business Development • Over 30 years in financial management and strategic corporate development • Financial management at Alumax Inc., a multinational aluminum manufacturer; Scios Inc./Cal Bio, a biotechnology & biopharmaceutical company; Jore Corporation, a power tool accessories manufacturer; and Core Innovation JJ JENKS VP Operations • Over 20 years of research experience • Co - inventor of AirJoule tm and the Harmonic Adsorption Recuperative Power System • Team member in the developed applications for Metal - organic framework nanomaterials • Expertise in thermal fluid sciences MANAGEMENT Pete McGrail CTO • Former staff member at Pacific Northern National Lab (“PNNL”) 39 years, attaining the position of Laboratory Fellow • Managed Applied Functional Materials group at PNNL • H as received five research grant awards from the U.S. D epartment of Energy’s (“DOE”) Advanced Research Projects Agency - Energy, more than any other researcher in the U.S.

Slide 9 Montana Technologies | June 2023 B adische Anilin und Sodafabrik ("BASF") is the world’s largest chemical producer with facilities around the world • Montana Technologies and BASF have implemented a development agreement for the production of engineered super - porous materials that are applied as a coating to AirJoule tm contactors to perform the energy and water - harvesting function • BASF has successfully produced coatings for AirJoule tm prototypes and is now scaling the processes for mass - production • M ontana Technologies is executing its ongoing development agreement for global manufacturing and supply PNNL scientists conceived Self - Regenerating Dehumidifier • Montana Technologies holds worldwide exclusive rights to Self - Regenerating Dehumidifier patents • Montana Technologies has added its own significant advancements and holds independent intellectual property that allows for heating, cooling, and ultra low cost harvesting of fresh water from air • PNNL has validated performance of AirJoule tm prototypes in the lab’s environmental test facilities MONTANA TECHNOLOGIES’ STRATEGIC GLOBAL PARTNERSHIPS CATL is one of the world’s largest Lithium - ion electric vehicle battery manufacturers • CATL and Montana Technologies have executed a 50/50 joint venture, CAMT Climate Solutions (“CAMT”), to manufacture and commercialize AirJoule tm to reduce CO2 emissions, especially in Asia • Montana Technologies completed its Series A investment led by CATL and its Series B investment led by an affiliate of Transition E quity Partners in cooperation with CATL Transition Equity Partners provides holistic support for the energy transition

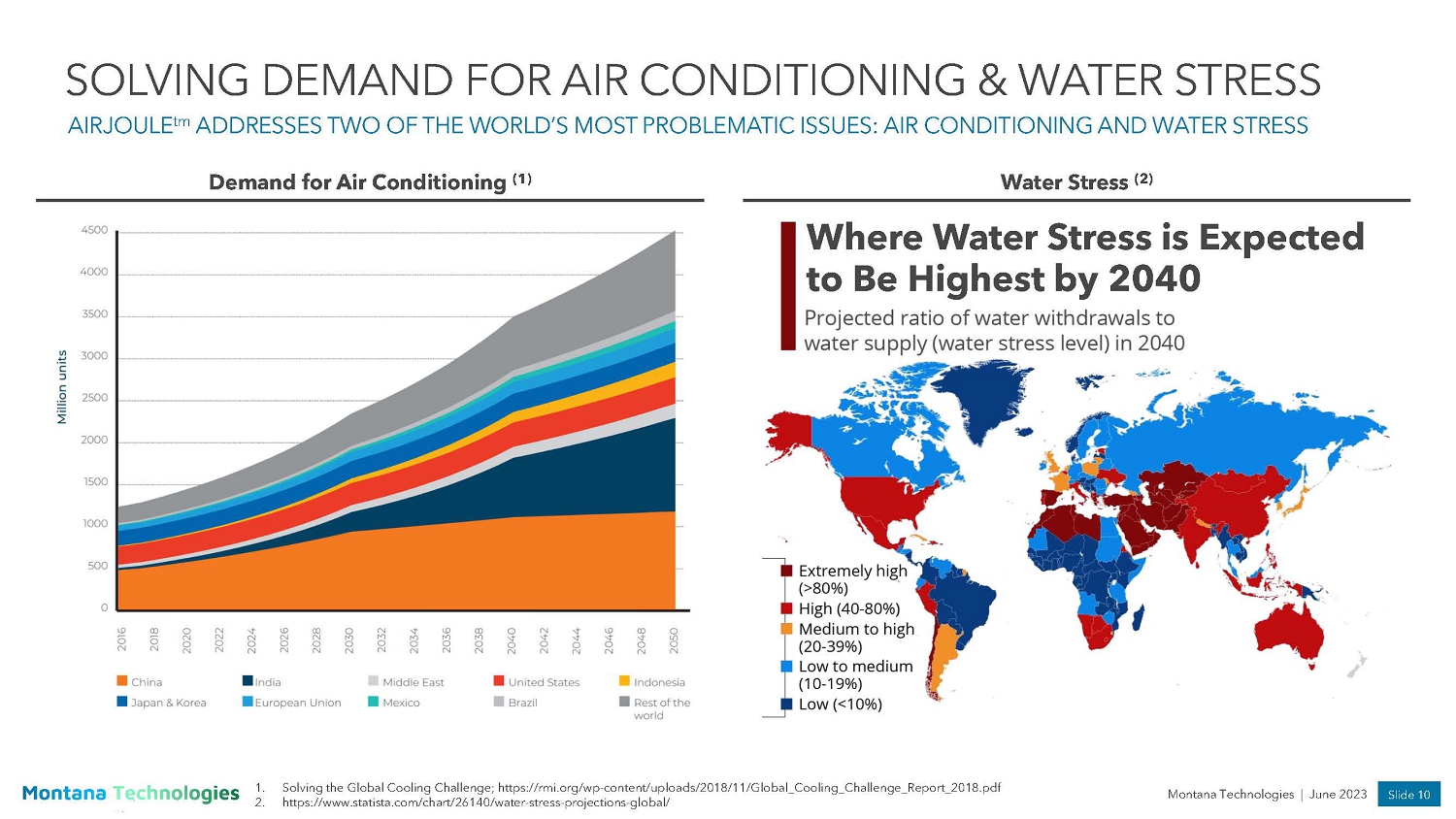

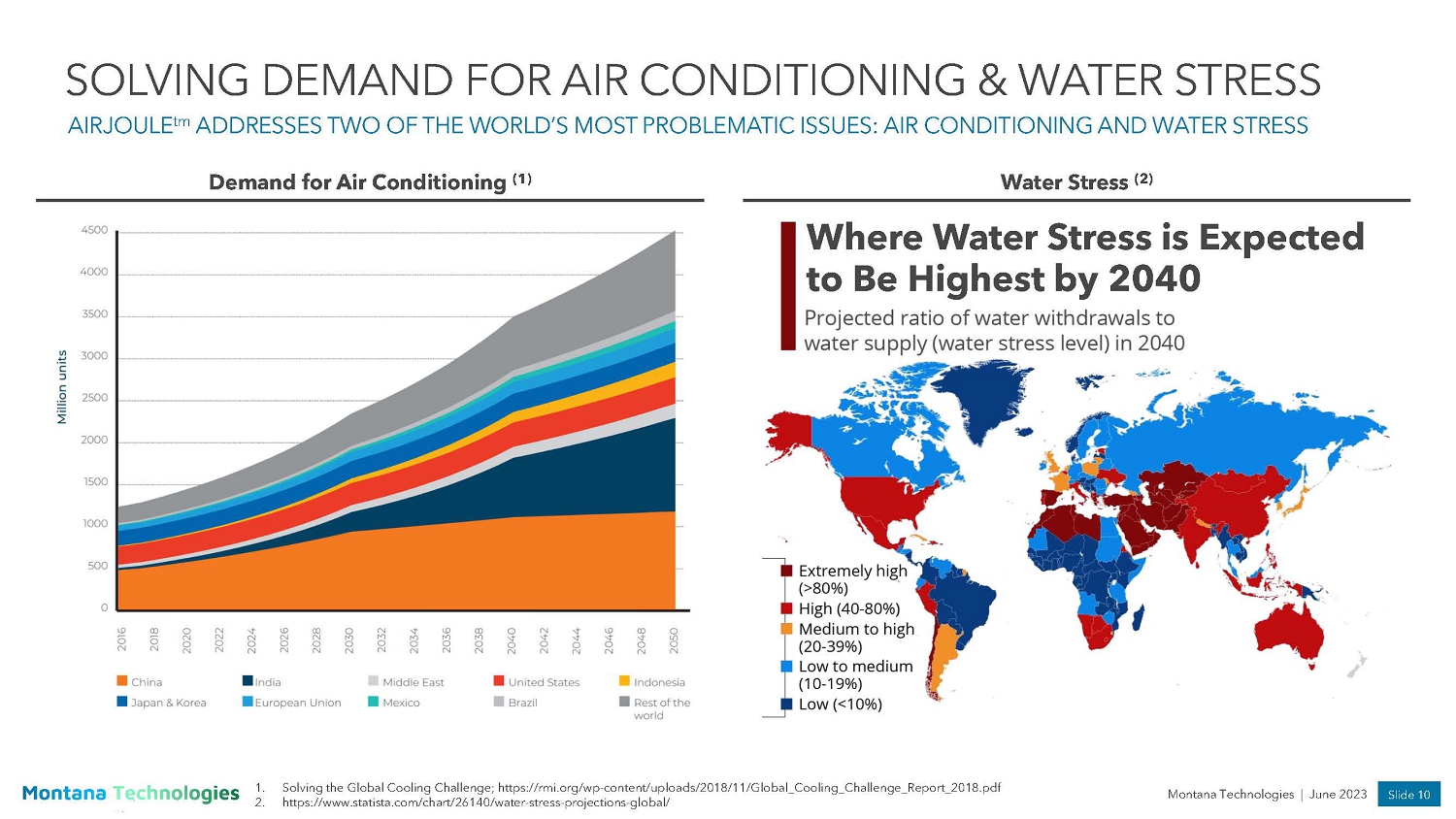

Slide 10 Montana Technologies | June 2023 Water Stress (2) Demand for Air Conditioning (1) SOLVING DEMAND FOR AIR CONDITIONING & WATER STRESS 1. Solving the Global Cooling Challenge; https://rmi.org/wp - content/uploads/2018/11/Global_Cooling_Challenge_Report_2018.pdf 2. https://www.statista.com/chart/26140/water - stress - projections - global/ AIRJOULE tm ADDRESSES TWO OF THE WORLD’S MOST PROBLEMATIC ISSUES: AIR CONDI TIONING AND WATER STRESS Where Water Stress is Expected to Be Highest by 2040

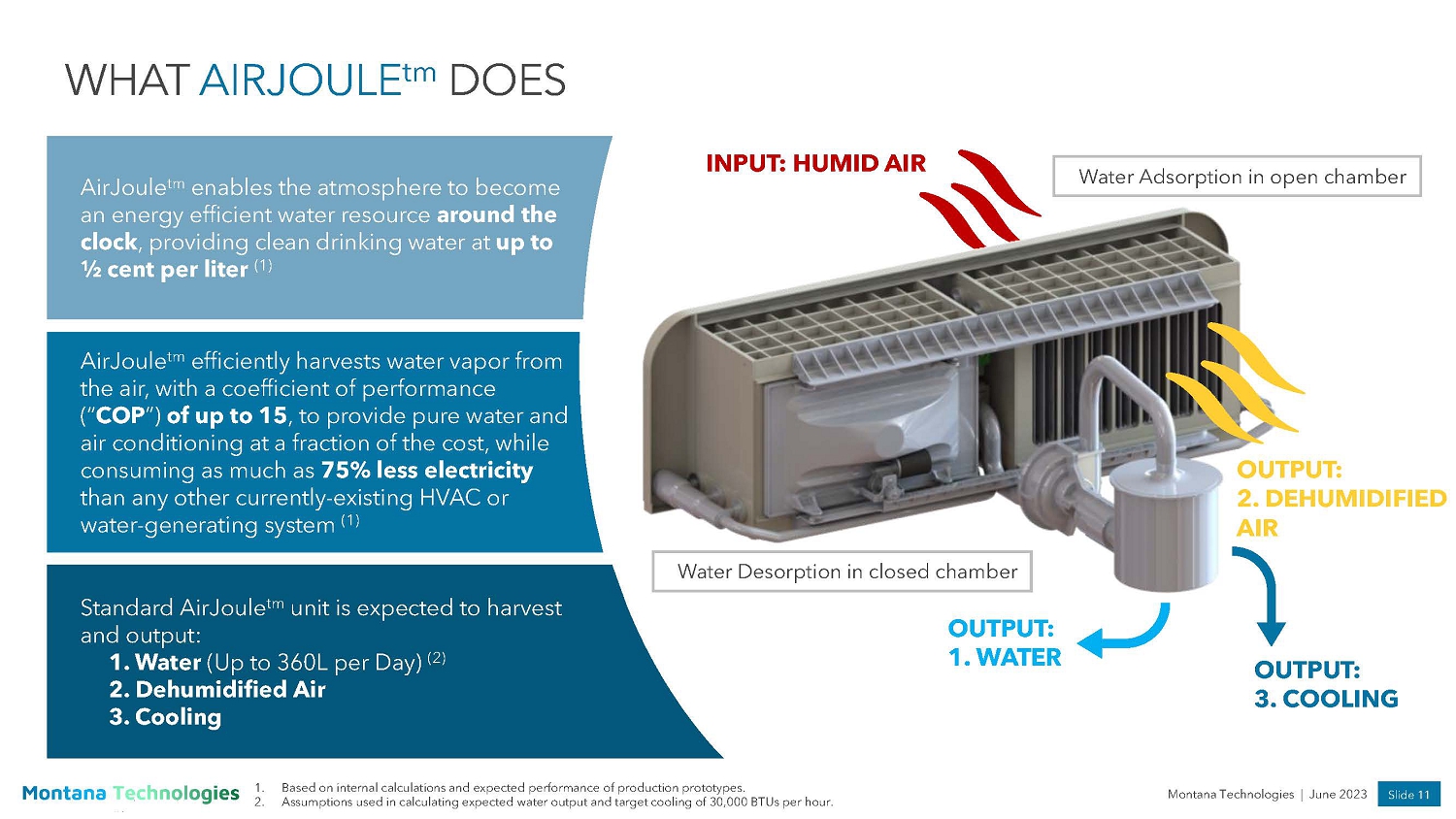

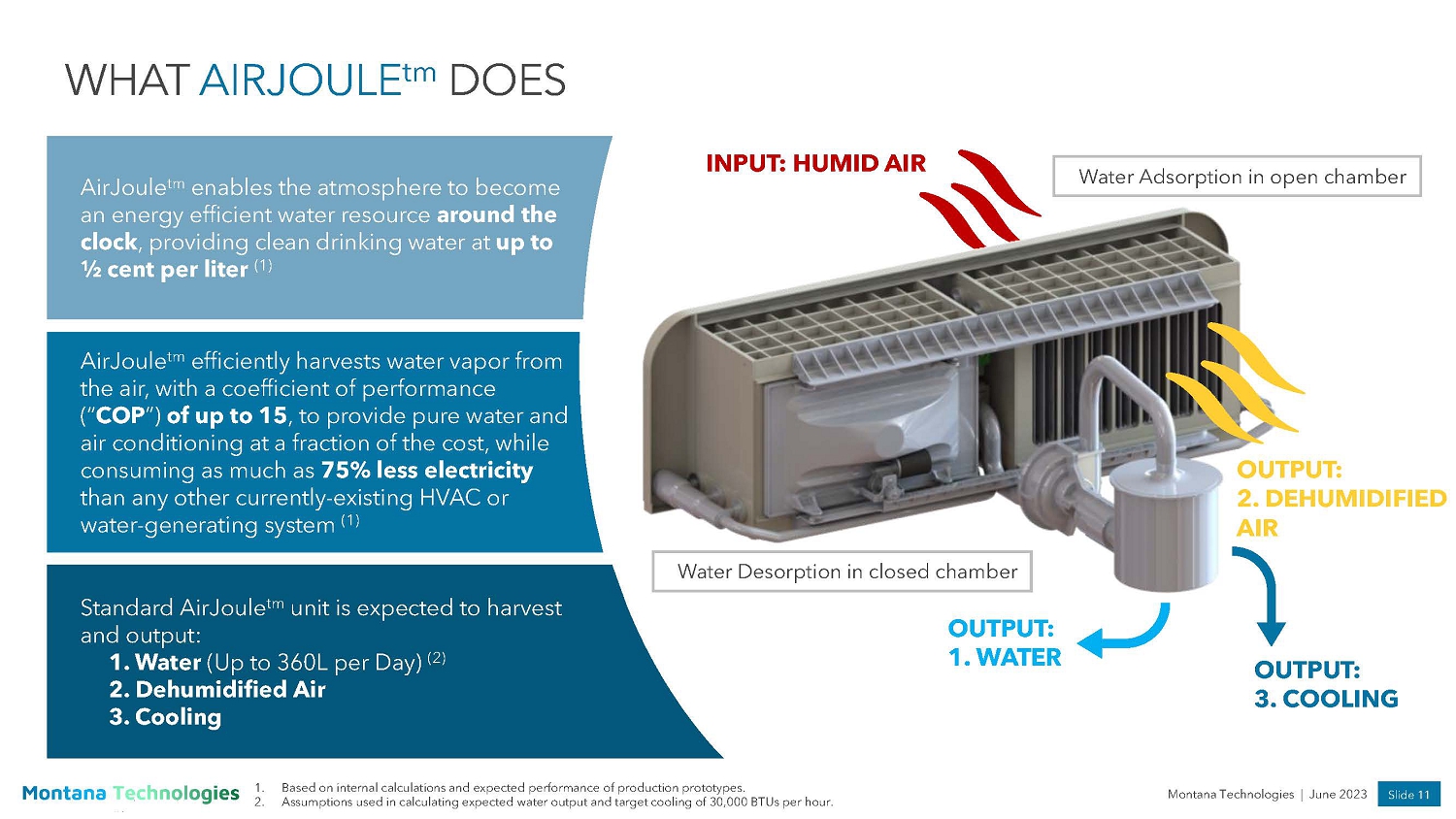

Slide 11 Montana Technologies | June 2023 AirJoule tm enables the atmosphere to become an energy efficient water resource around the clock , providing clean drinking water at up to ½ cent per liter (1) AirJoule tm efficiently harvests water vapor from the air, with a coefficient of performance (“ COP ”) of up to 15 , to provide pure water and air conditioning at a fraction of the cost, while consuming as much as 75% less electricity than any other currently - existing HVAC or water - generating system (1) Standard AirJoule tm unit is expected to harvest and output: 1. Water (Up to 360L per Day) (2) 2. Dehumidified Air 3. Cooling OUTPUT: 2. DEHUMIDIFIED AIR OUTPUT: 1. WATER OUTPUT: 3. COOLING WHAT AIRJOULE tm DOES INPUT: HUMID AIR Water Adsorption in open chamber 1. Based on internal calculations and expected performance of production prototypes. 2. Assumptions used in calculating expected water output and target cooling of 30,000 BTUs per hour. Water Desorption in closed chamber

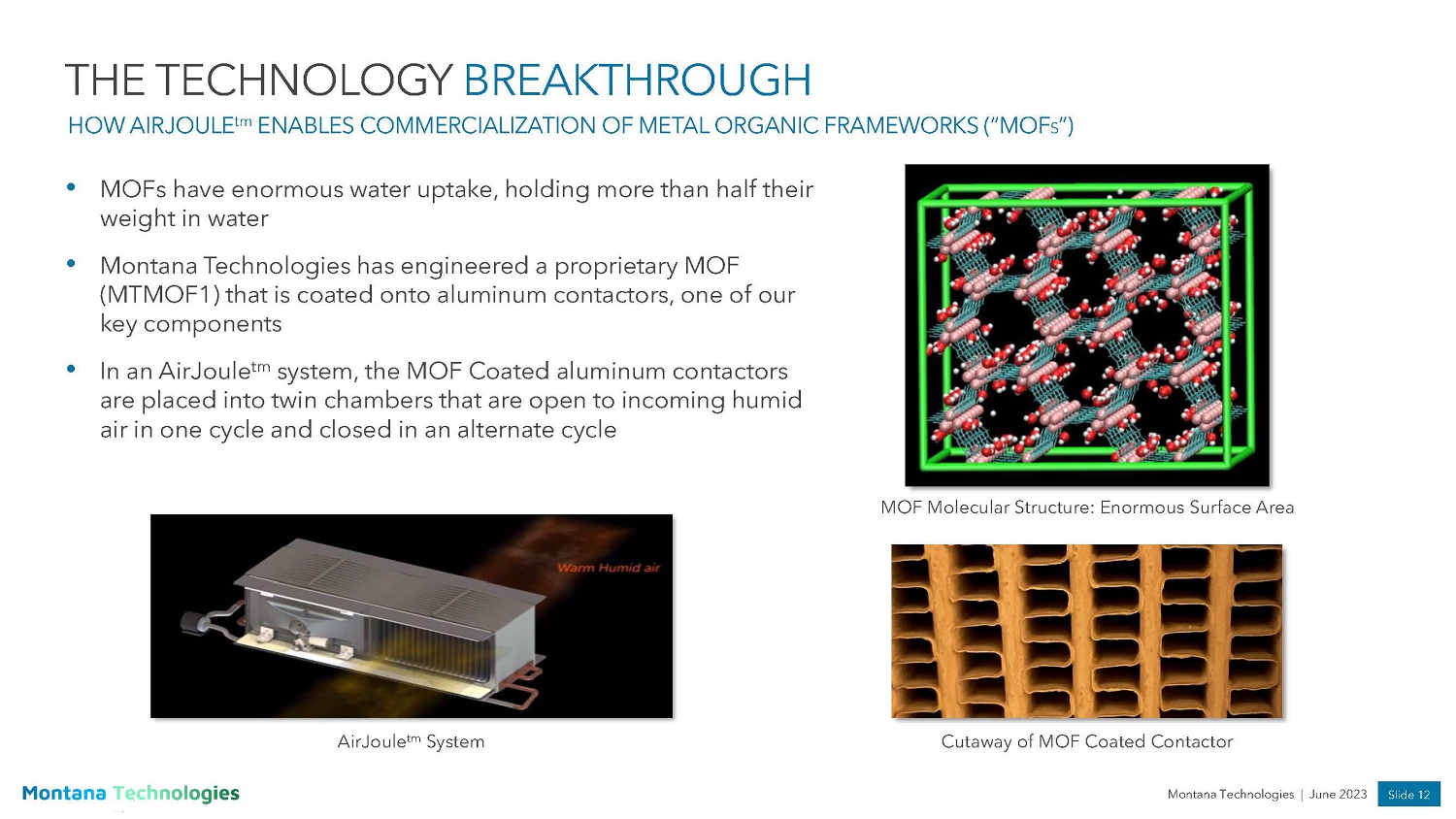

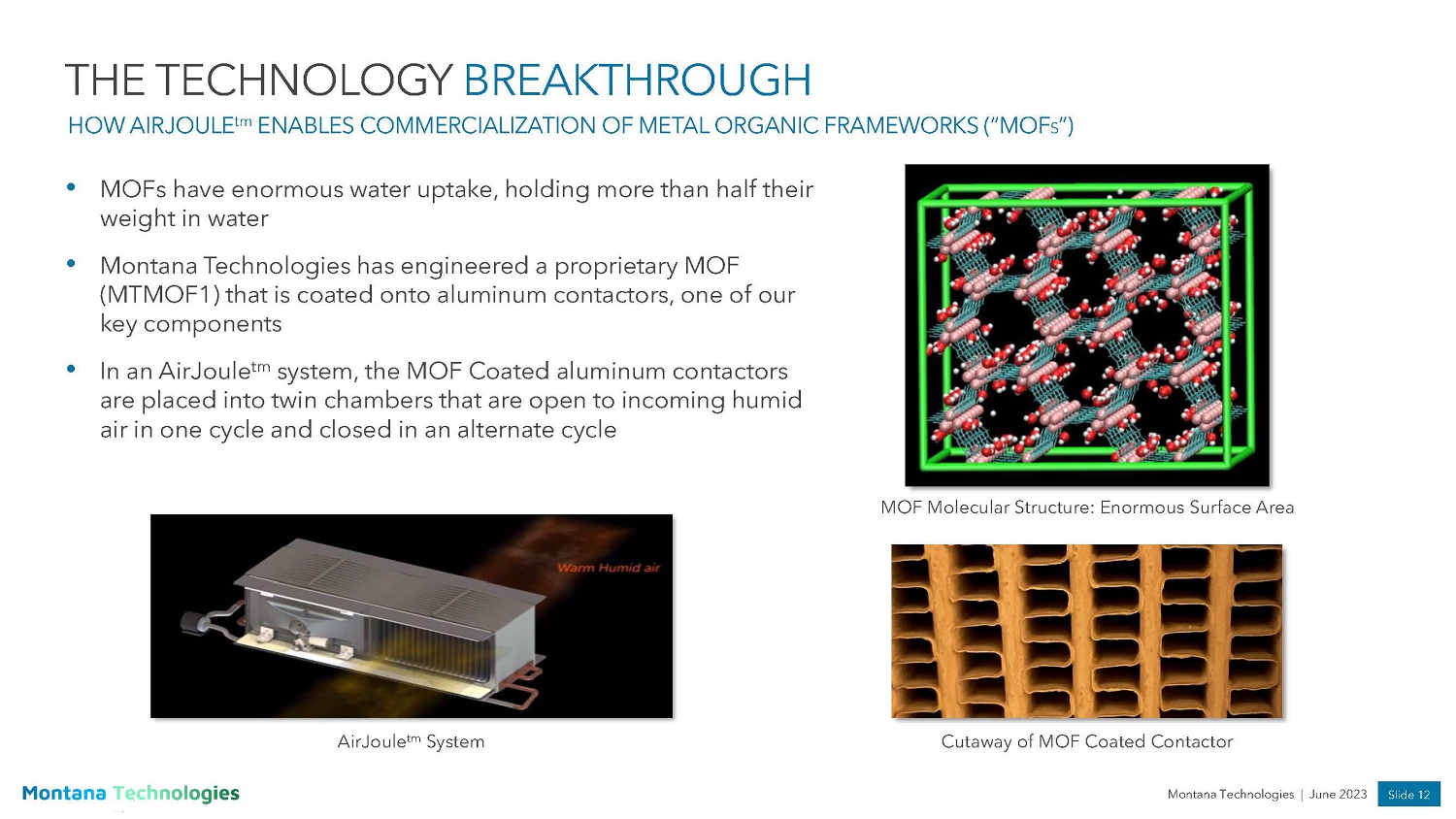

Slide 12 Montana Technologies | June 2023 THE TECHNOLOGY BREAKTHROUGH HOW AIRJOULE tm ENABLES COMMERCIALIZATION OF METAL ORGANIC FRAMEWORKS (“MOF S ”) • MOFs have enormous water uptake, holding more than half their weight in water • Montana Technologies has engineered a proprietary MOF (MTMOF1) that is coated onto aluminum contactors, one of our key components • In an AirJoule tm system, the MOF Coated aluminum contactors are placed into twin chambers that are open to incoming humid air in one cycle and closed in an alternate cycle MOF Molecular Structure: Enormous Surface Area Cutaway of MOF Coated Contactor AirJoule tm System

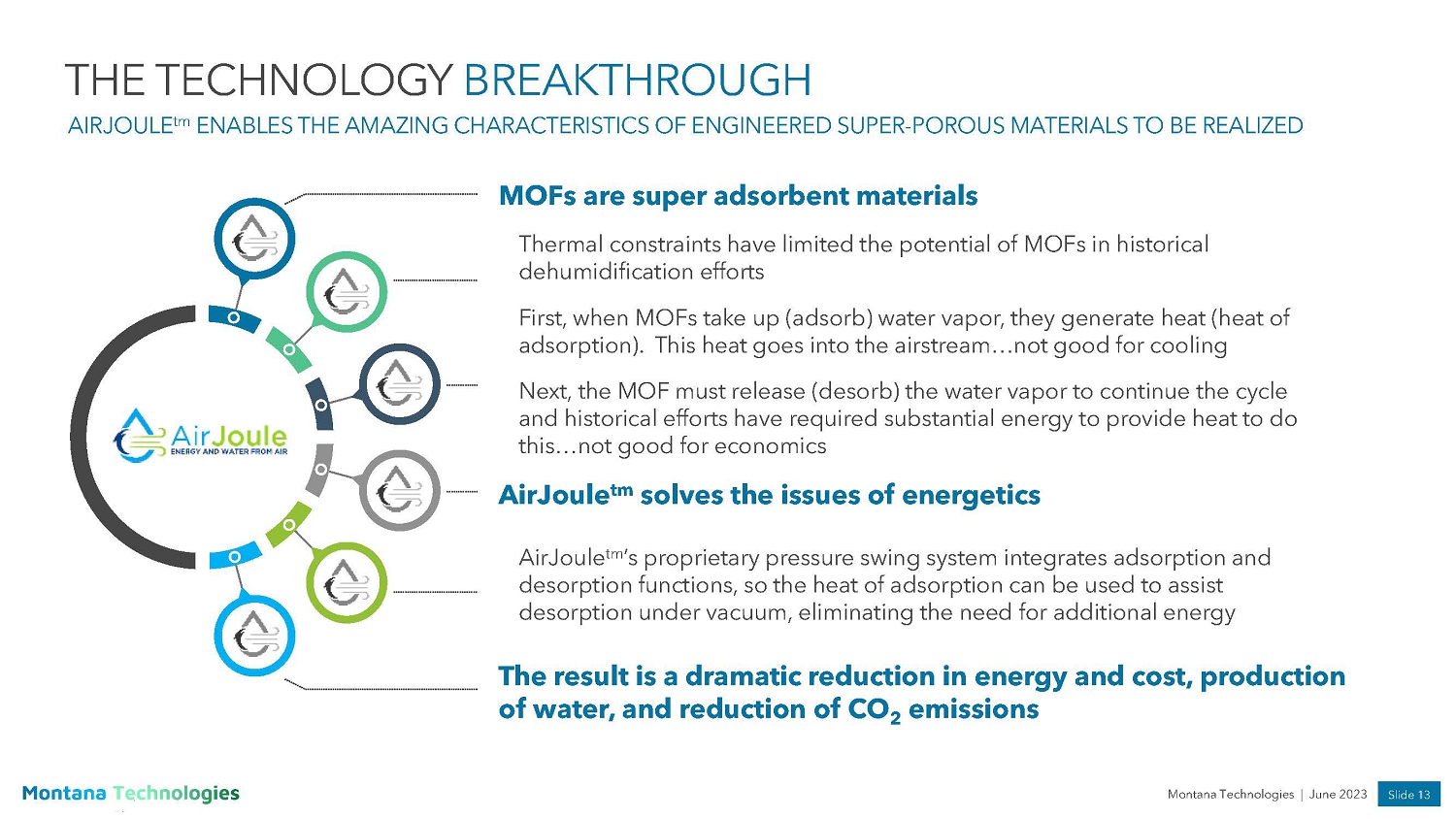

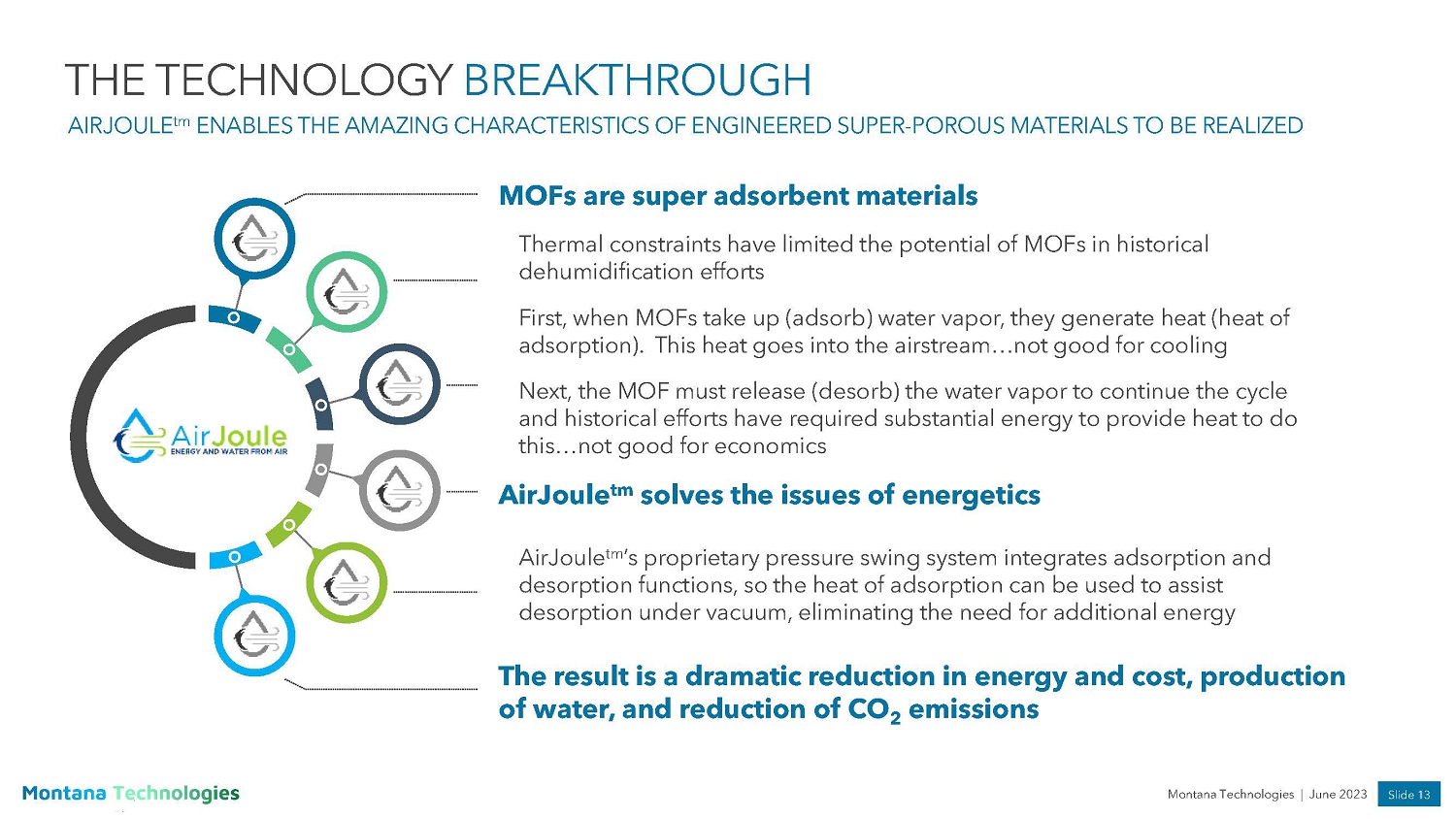

Slide 13 Montana Technologies | June 2023 THE TECHNOLOGY BREAKTHROUGH AIRJOULE tm ENABLES THE AMAZING CHARACTERISTICS OF ENGINEERED SUPER - POROUS MATERIALS TO BE REALIZED MOFs are super adsorbent materials First, when MOFs take up (adsorb) water vapor, they generate heat (heat of adsorption). This heat goes into the airstream…not good for cooling AirJoule tm ’s proprietary pressure swing system integrates adsorption and desorption functions, so the heat of adsorption can be used to assist desorption under vacuum, eliminating the need for additional energy AirJoule tm solves the issues of energetics Next, the MOF must release (desorb) the water vapor to continue the cycle and historical efforts have required substantial energy to provide heat to do this…not good for economics Thermal constraints have limited the potential of MOFs in historical dehumidification efforts The result is a dramatic reduction in energy and cost, production of water, and reduction of CO 2 emissions

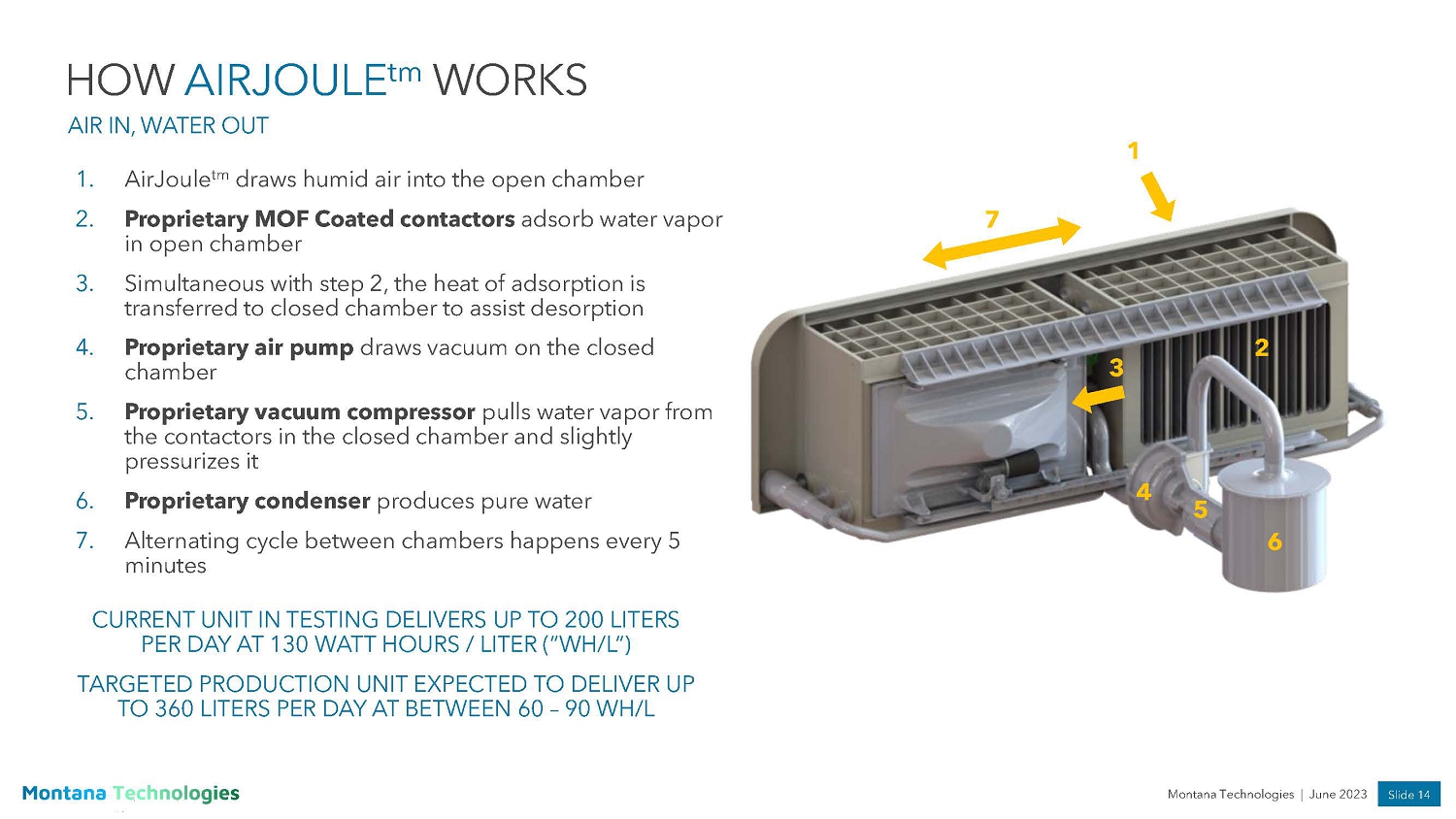

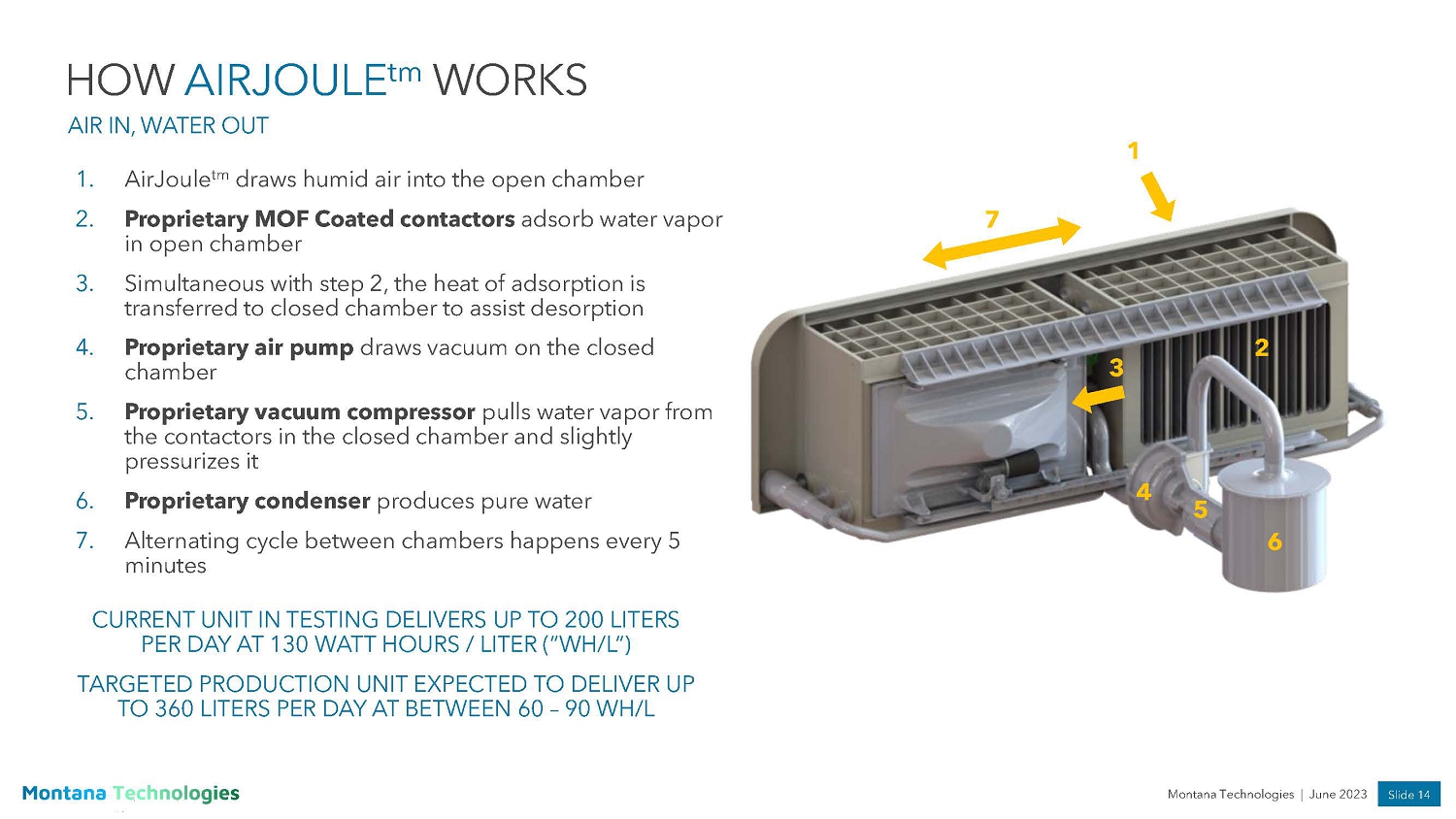

Slide 14 Montana Technologies | June 2023 1. AirJouleTM draws humid air into the open chamber 2. Proprietary MOF Coated contactors adsorb water vapor in open chamber 3. Simultaneous with step 2, the heat of adsorption is transferred to closed chamber to assist desorption 4. Proprietary air pump draws vacuum on the closed chamber 5. Proprietary vacuum compressor pulls water vapor from the contactors in the closed chamber and slightly pressurizes it 6. Proprietary condenser produces pure water 7. Alternating cycle between chambers happens every 5 minutes HOW AIRJOULE tm WORKS AIR IN, WATER OUT 1 2 3 4 5 7 6 CURRENT UNIT IN TESTING DELIVERS UP TO 200 LITERS PER DAY AT 130 WATT HOURS / LITER (“WH/L“) TARGETED PRODUCTION UNIT EXPECTED TO DELIVER UP TO 360 LITERS PER DAY AT BETWEEN 60 – 90 WH/L AirJoule tm draws humid air into the open chamber Proprietary MOF Coated contactors adsorb water vapor in open chamber Simultaneous with step 2, the heat of adsorption is transferred to closed chamber to assist desorption Proprietary air pump draws vacuum on the closed chamber Proprietary vacuum compressor pulls water vapor from the contactors in the closed chamber and slightly pressurizes it Proprietary condenser produces pure water Alternating cycle between chambers happens every 5 minutes

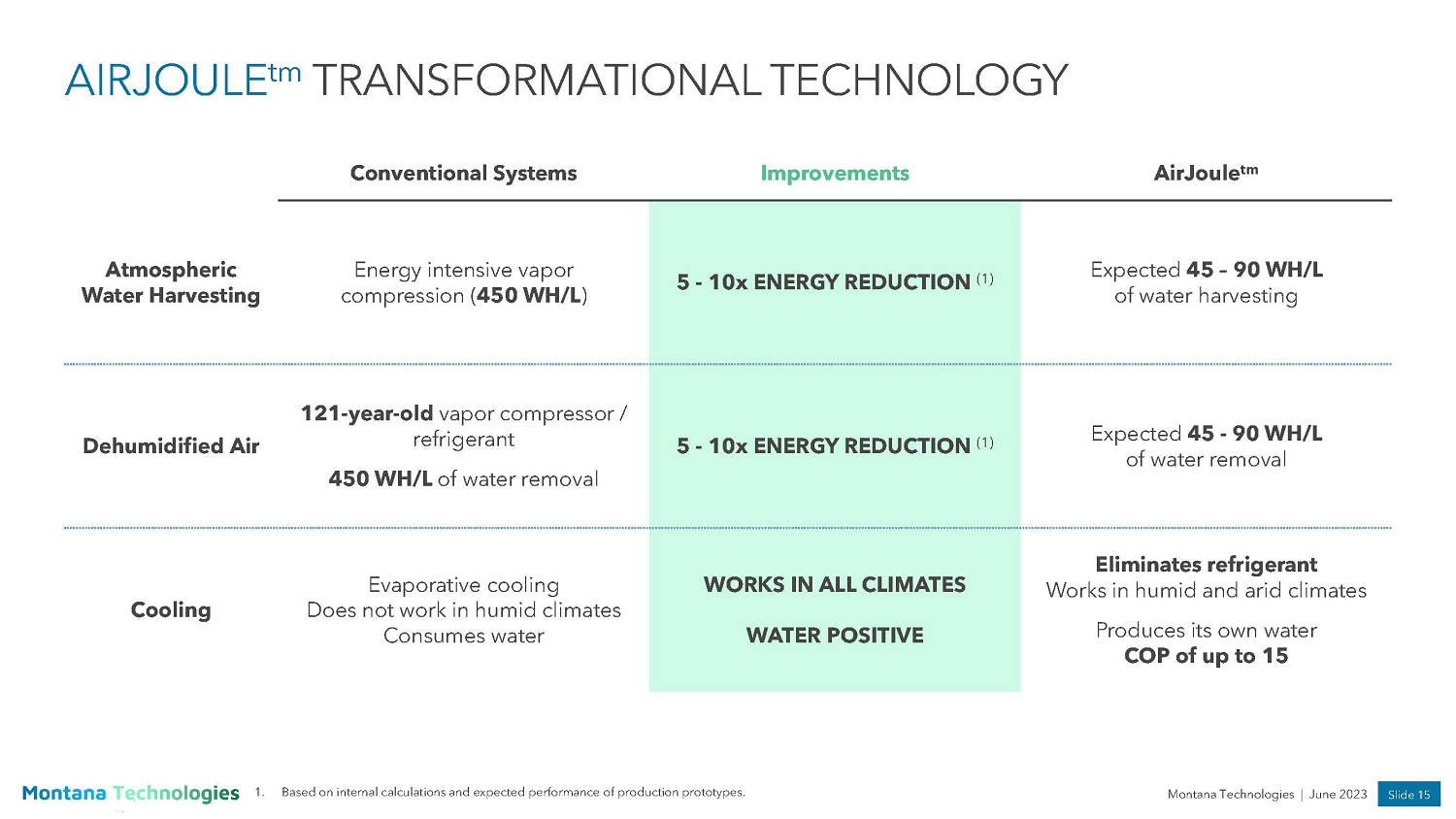

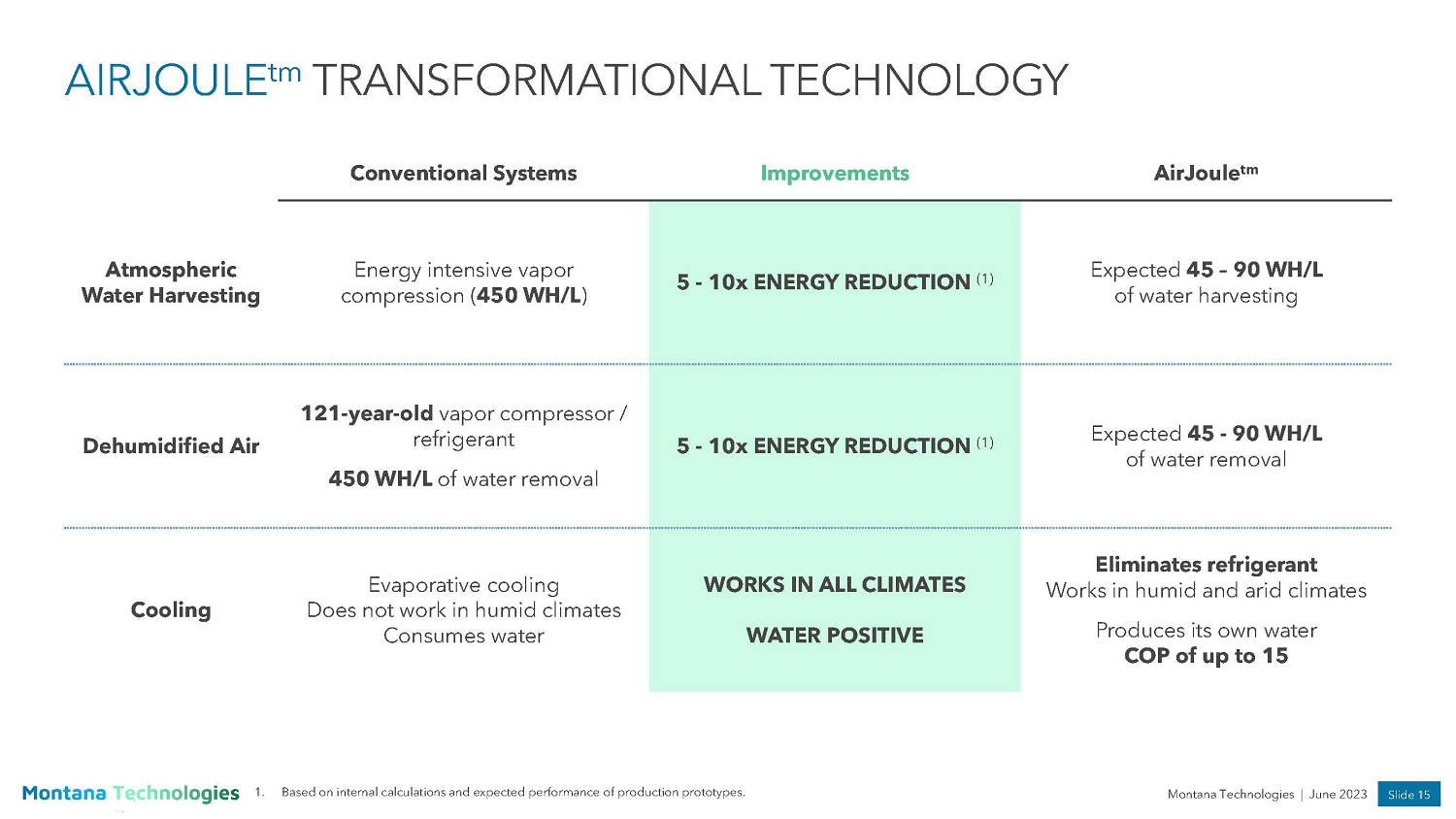

Slide 15 Montana Technologies | June 2023 AIRJOULE tm TRANSFORMATIONAL TECHNOLOGY Conventional Systems Improvements AirJoule tm Atmospheric Water Harvesting Energy intensive vapor compression ( 450 WH/L ) 5 - 10x ENERGY REDUCTION (1) Expected 45 – 90 WH/L of water harvesting Dehumidified Air 121 - year - old vapor compressor / refrigerant 450 WH/L of water removal 5 - 10x ENERGY REDUCTION (1) Expected 45 - 90 WH/L of water removal Cooling Evaporative cooling Does not work in humid climates Consumes water WORKS IN ALL CLIMATES WATER POSITIVE Eliminates refrigerant Works in humid and arid climates Produces its own water COP of up to 15 1. Based on internal calculations and expected performance of production prototypes.

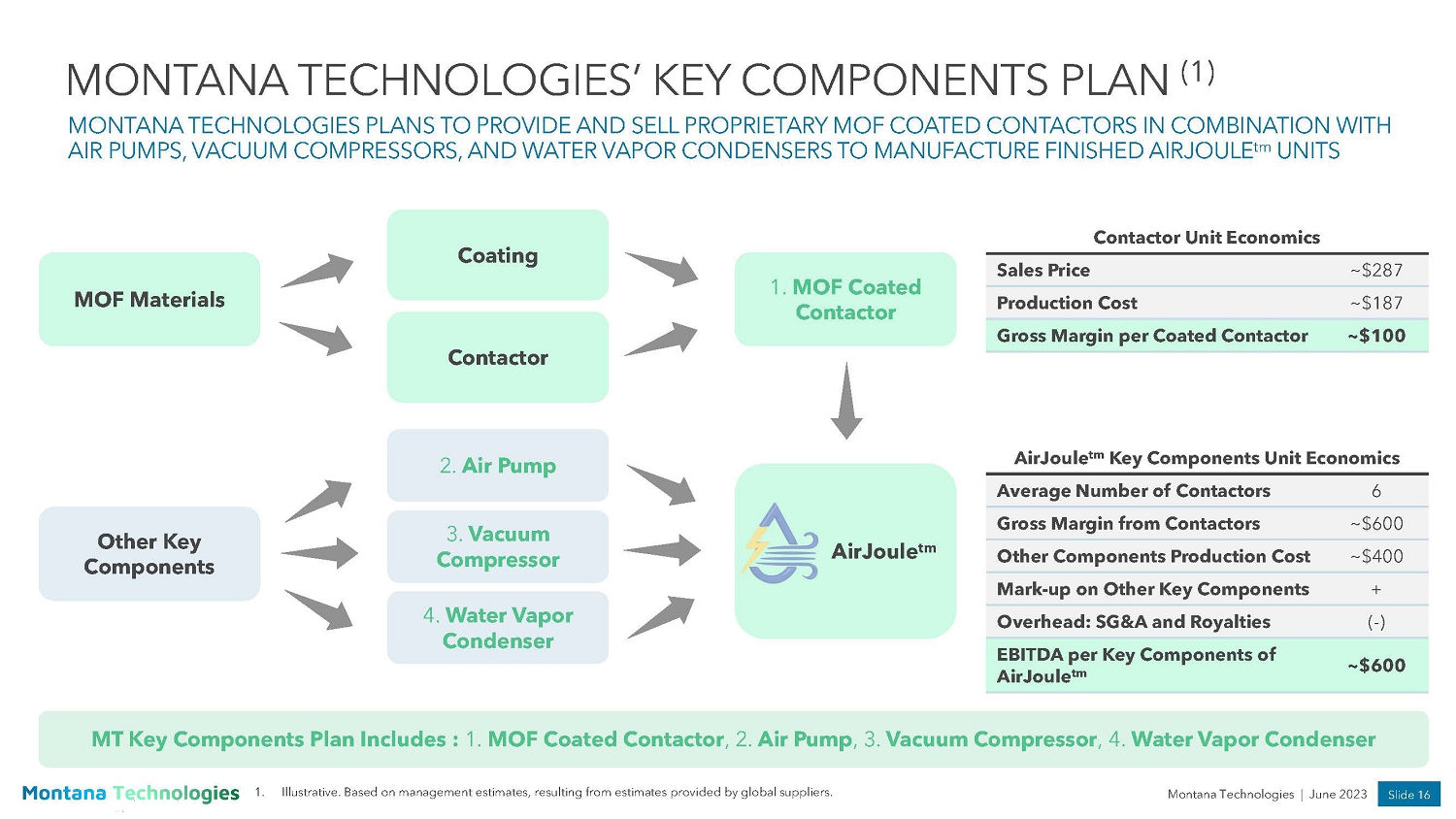

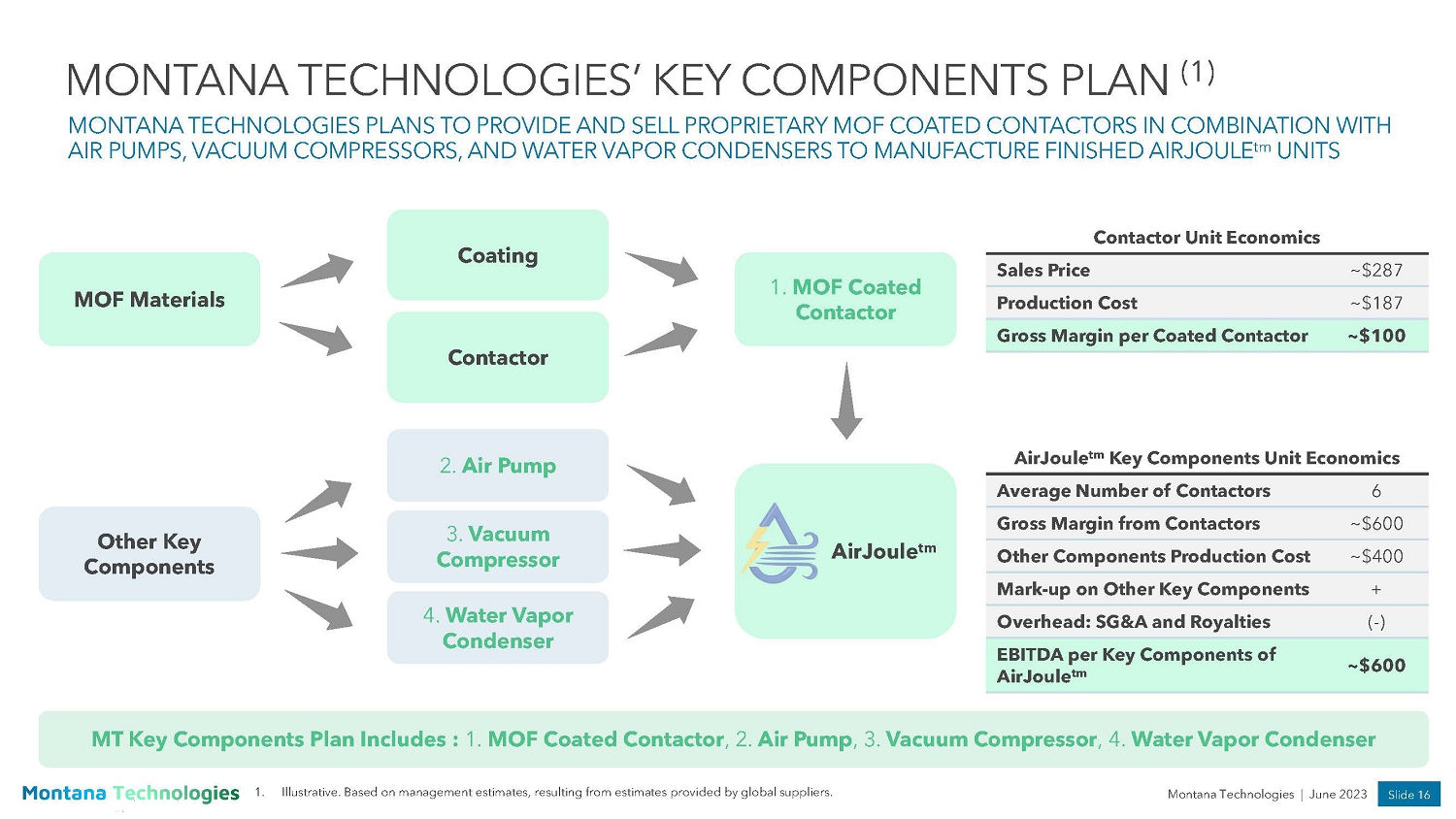

Slide 16 Montana Technologies | June 2023 MONTANA TECHNOLOGIES’ KEY COMPONENTS PLAN (1) MONTANA TECHNOLOGIES PLANS TO PROVIDE AND SELL PROPRIETARY MOF C OATED CONTACTORS IN COMBINATION WITH AIR PUMPS, VACUUM COMPRESSORS, AND WATER VAPOR CONDENSERS TO MAN UFACTURE FINISHED AIRJOULE tm UNITS MOF Materials Contactor Coating 1. MOF Coated Contactor Other Key Components 2. Air Pump 4. Water Vapor Condenser 3. Vacuum Compressor Contactor Unit Economics Sales Price ~$287 Production Cost ~$187 Gross Margin per Coated Contactor ~$100 AirJoule tm Key Components Unit Economics Average Number of Contactors 6 Gross Margin from Contactors ~$600 Other Components Production Cost ~$400 Mark - up on Other Key Components + Overhead: SG&A and Royalties ( - ) EBITDA per Key Components of AirJoule tm ~$600 AirJoule tm 1. Illustrative. Based on management estimates, resulting from estimates provided by global suppliers. MT Key Components Plan Includes : 1. MOF Coated Contactor , 2. Air Pump , 3. Vacuum Compressor , 4. Water Vapor Condenser

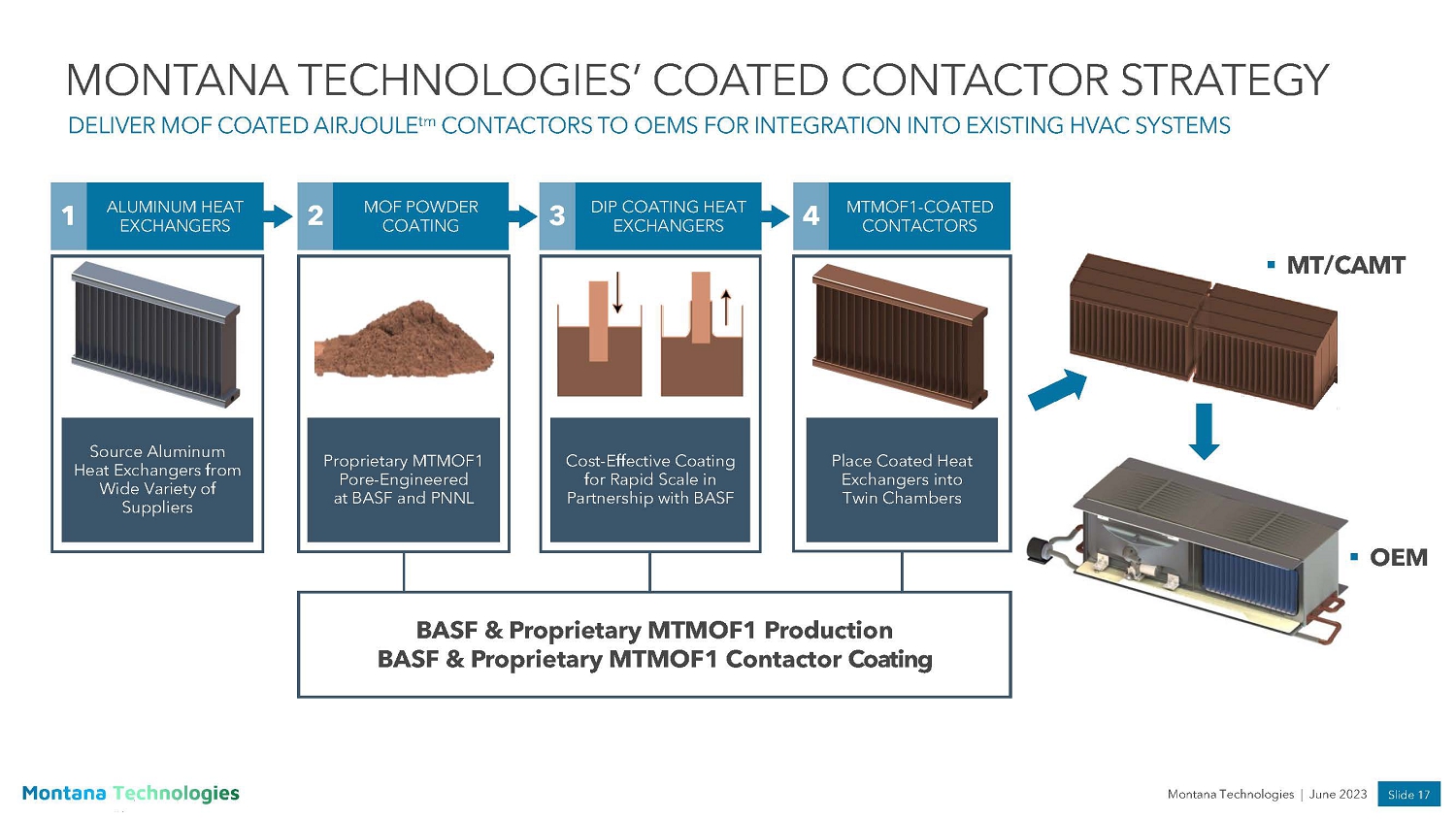

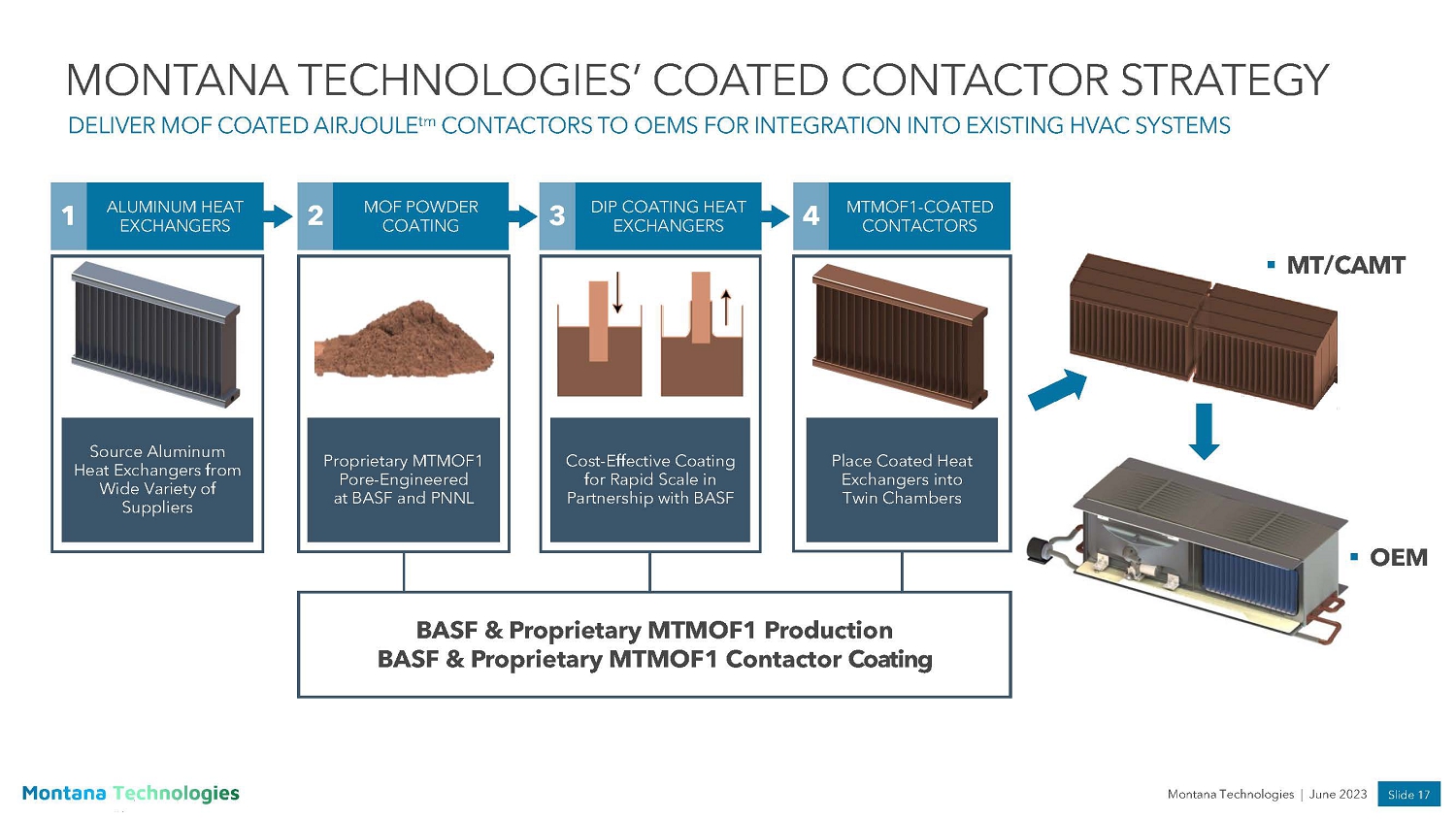

Slide 17 Montana Technologies | June 2023 MONTANA TECHNOLOGIES’ COATED CONTACTOR STRATEGY DELIVER MOF COATED AIRJOULE tm CONTACTORS TO OEMS FOR INTEGRATION INTO EXISTING HVAC SYSTEMS Source Aluminum Heat Exchangers from Wide Variety of Suppliers 1 ALUMINUM HEAT EXCHANGERS 2 MOF POWDER COATING Proprietary MTMOF1 Pore - Engineered at BASF and PNNL 3 DIP COATING HEAT EXCHANGERS Cost - Effective Coating for Rapid Scale in Partnership with BASF 4 MTMOF1 - COATED CONTACTORS Place Coated Heat Exchangers into Twin Chambers BASF & Proprietary MTMOF1 Production BASF & Proprietary MTMOF1 Contactor Coating ▪ MT/CAMT ▪ OEM

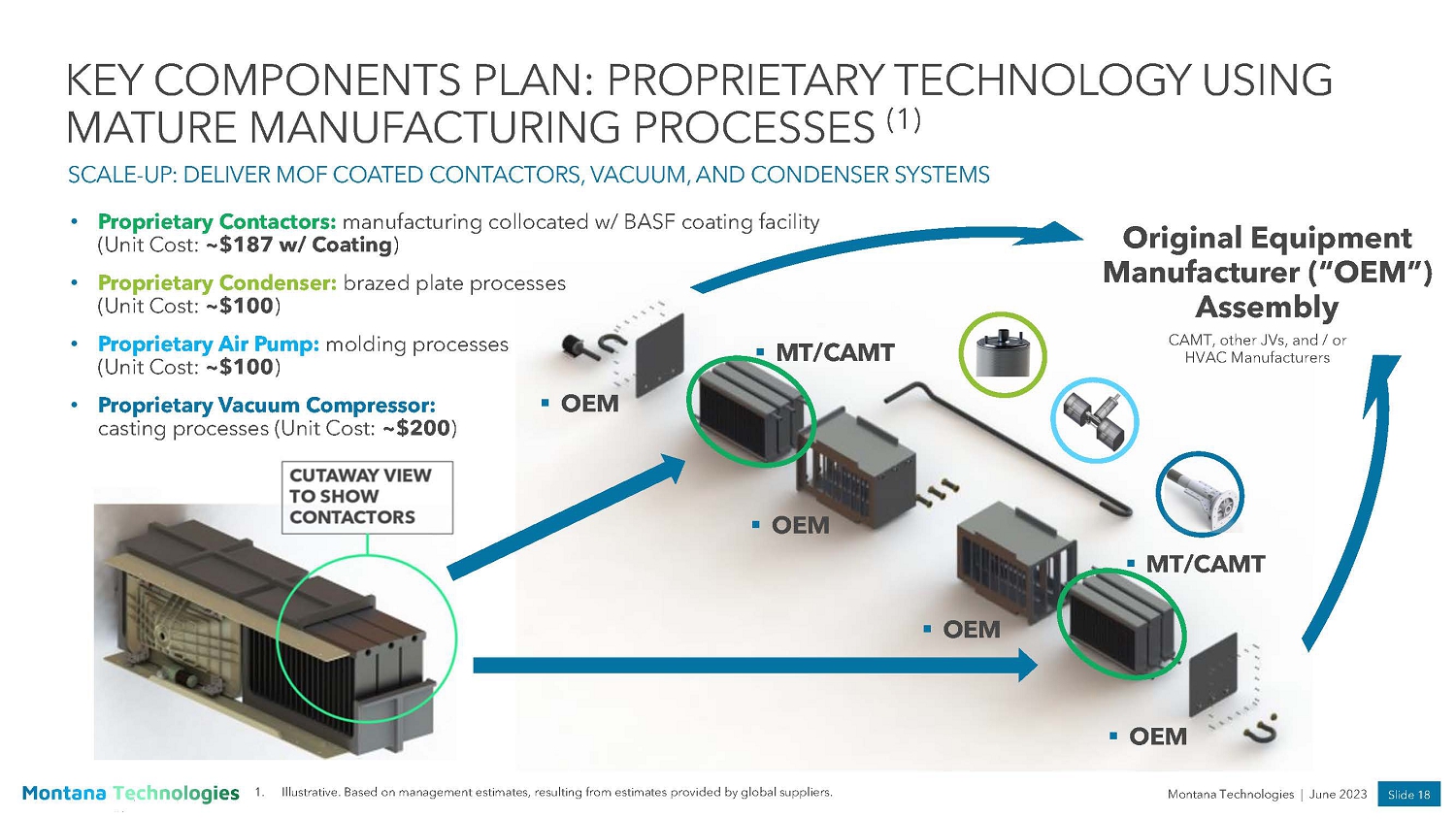

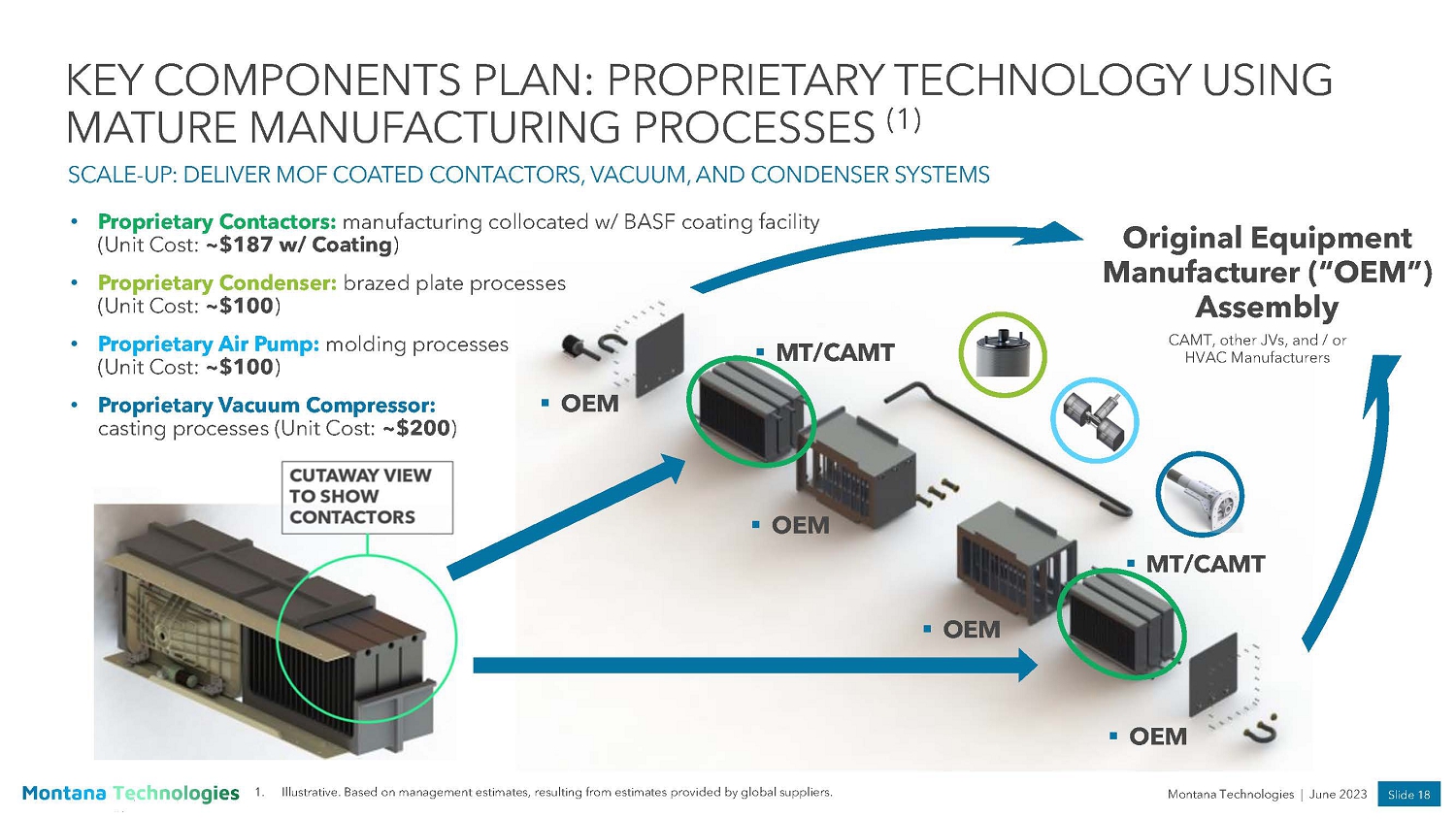

Slide 18 Montana Technologies | June 2023 KEY COMPONENTS PLAN: PROPRIETARY TECHNOLOGY USING MATURE MANUFACTURING PROCESSES (1) SCALE - UP: DELIVER MOF COATED CONTACTORS, VACUUM, AND CONDENSER S YSTEMS ▪ MT/CAMT ▪ OEM ▪ OEM ▪ OEM ▪ OEM ▪ MT/CAMT Original Equipment Manufacturer (“OEM”) Assembly • Proprietary Contactors: manufacturing collocated w/ BASF coating facility (Unit Cost: ~$187 w/ Coating ) • Proprietary Condenser: brazed plate processes (Unit Cost: ~$100 ) • Proprietary Air Pump: molding processes (Unit Cost: ~$100 ) • Proprietary Vacuum Compressor: casting processes (Unit Cost: ~$200 ) CAMT, other JVs, and / or HVAC Manufacturers 1. Illustrative. Based on management estimates, resulting from estimates provided by global suppliers.

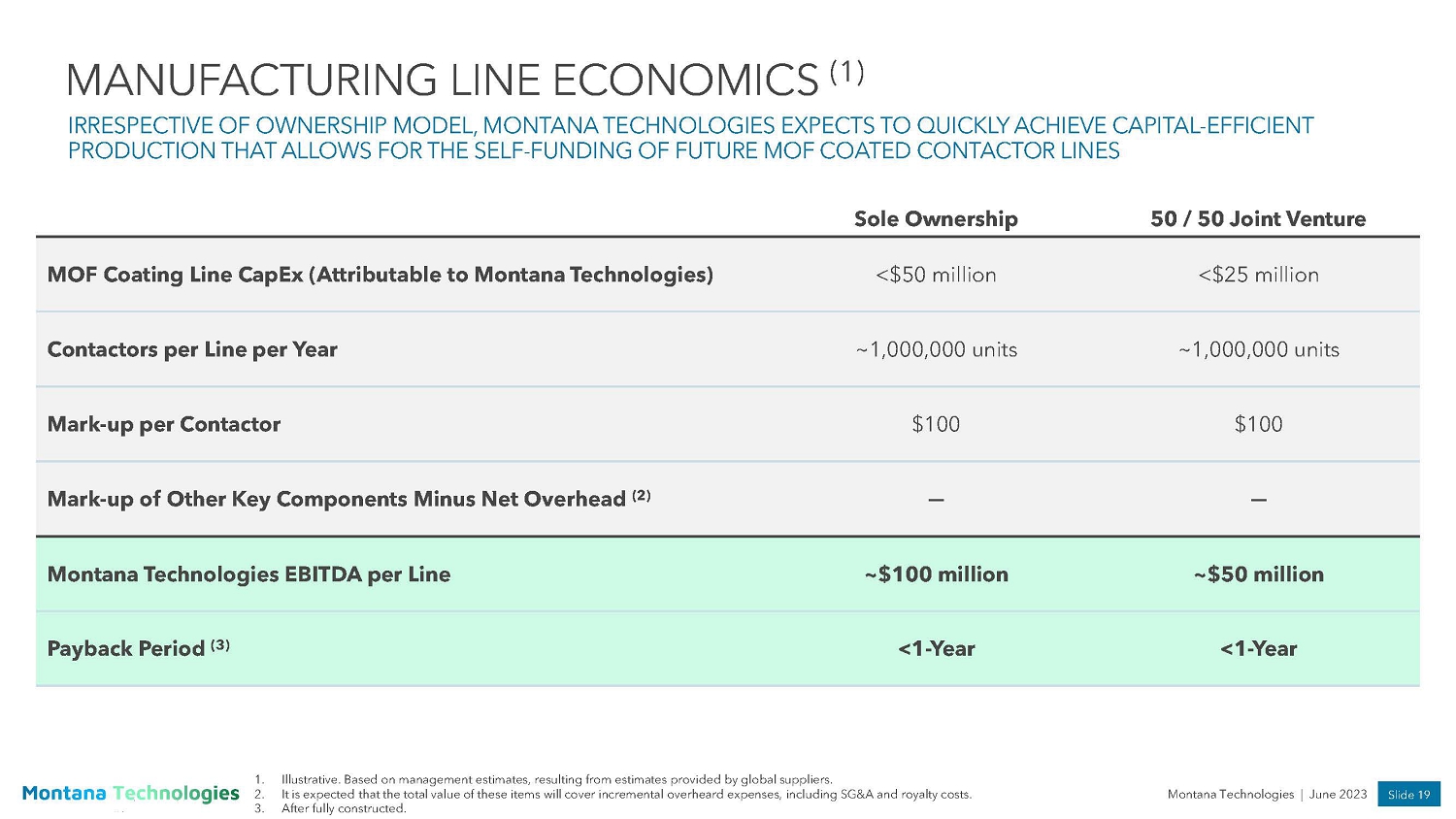

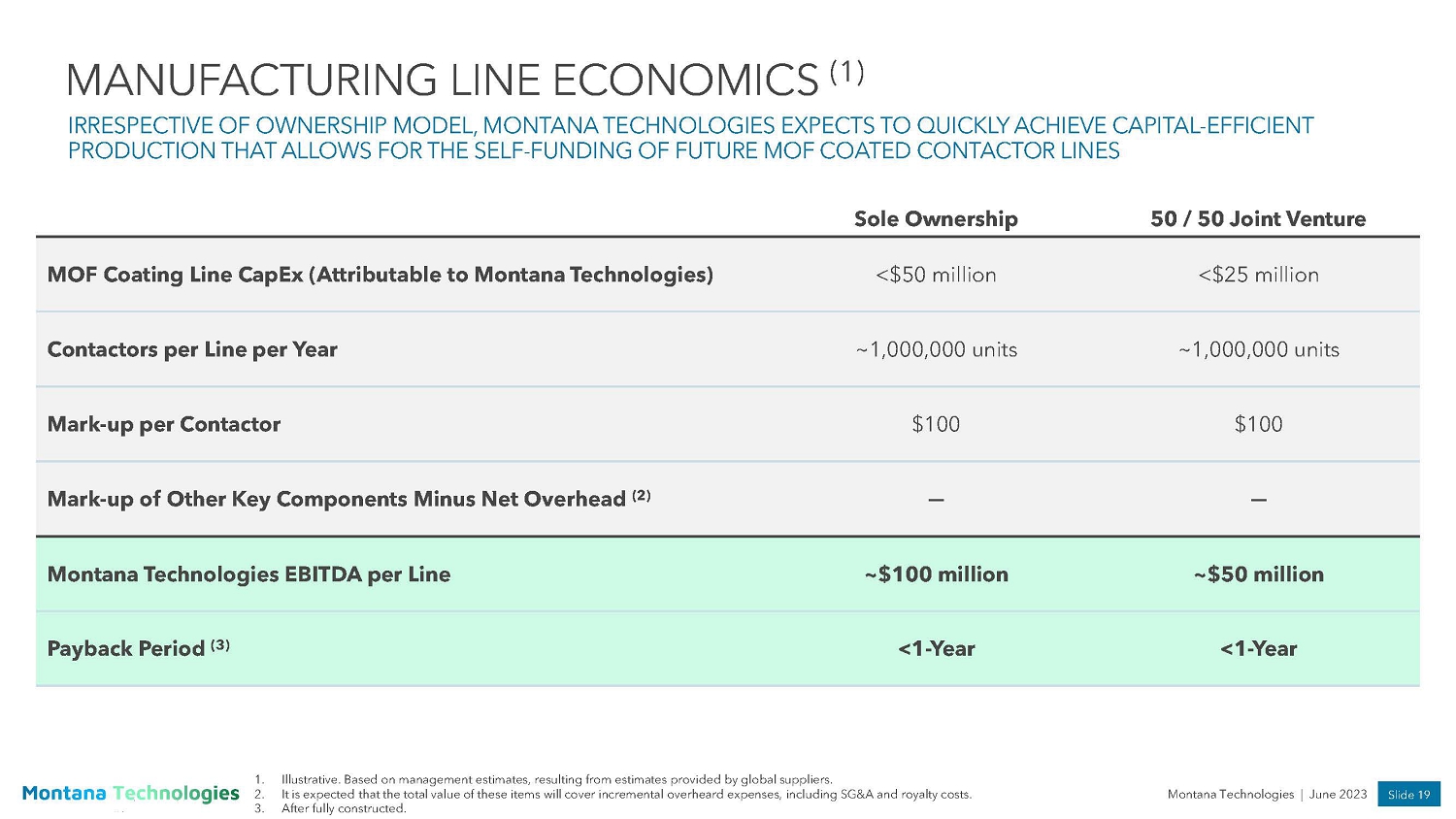

Slide 19 Montana Technologies | June 2023 MANUFACTURING LINE ECONOMICS (1) IRRESPECTIVE OF OWNERSHIP MODEL, MONTANA TECHNOLOGIES EXPECTS TO QUICKLY ACHIEVE CAPITAL - EFFICIENT PRODUCTION THAT ALLOWS FOR THE SELF - FUNDING OF FUTURE MOF COATED CONTACTOR LINES Sole Ownership 50 / 50 Joint Venture MOF Coating Line CapEx (Attributable to Montana Technologies) <$50 million <$25 million Contactors per Line per Year ~1,000,000 units ~1,000,000 units Mark - up per Contactor $100 $100 Mark - up of Other Key Components Minus Net Overhead (2) ─ ─ Montana Technologies EBITDA per Line ~$100 million ~$50 million Payback Period (3) <1 - Year <1 - Year 1. Illustrative. Based on management estimates, resulting from estimates provided by global suppliers. 2. It is expected that the total value of these items will cover incremental overheard expenses, including SG&A and royalty cost s. 3. After fully constructed.

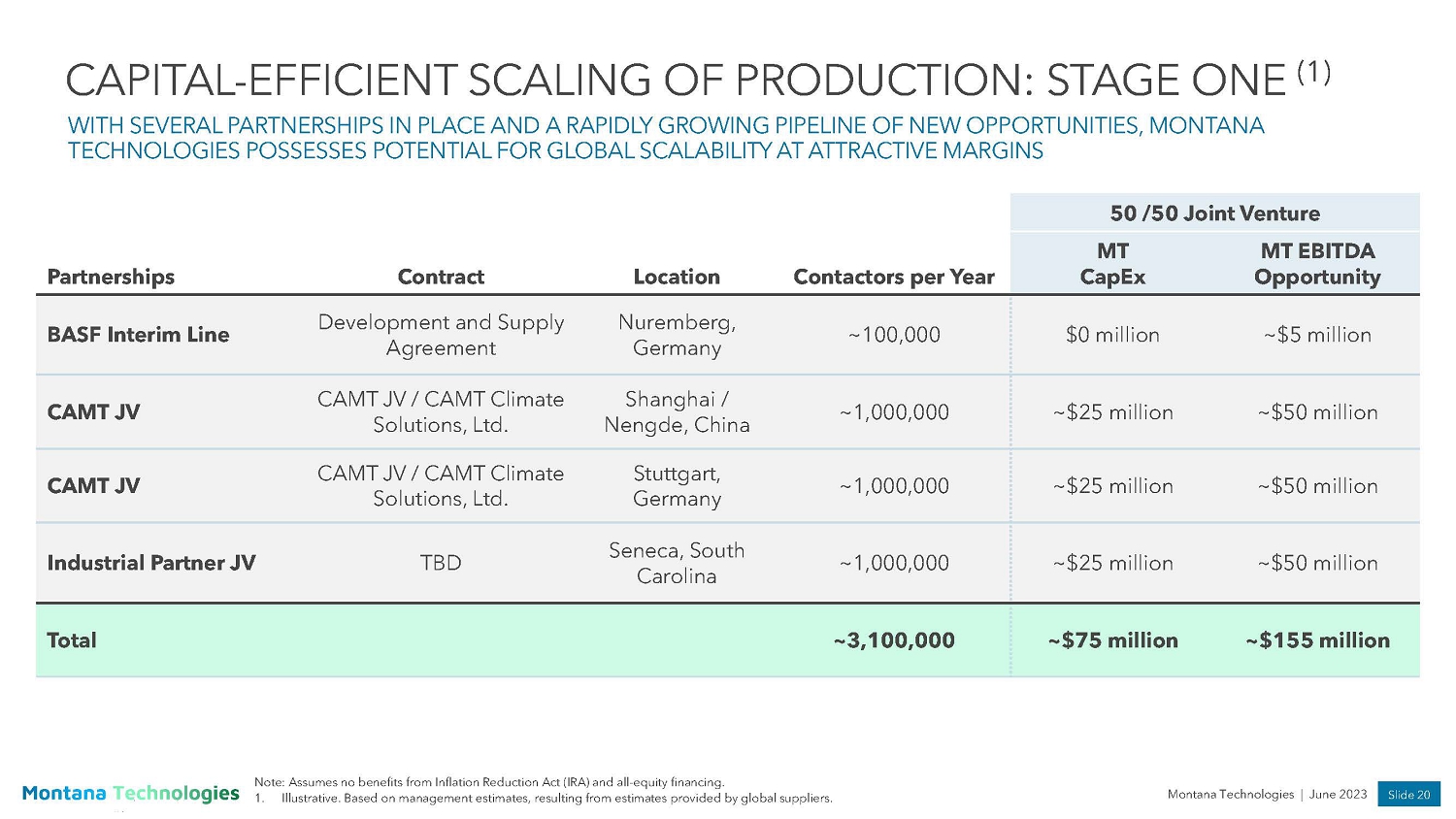

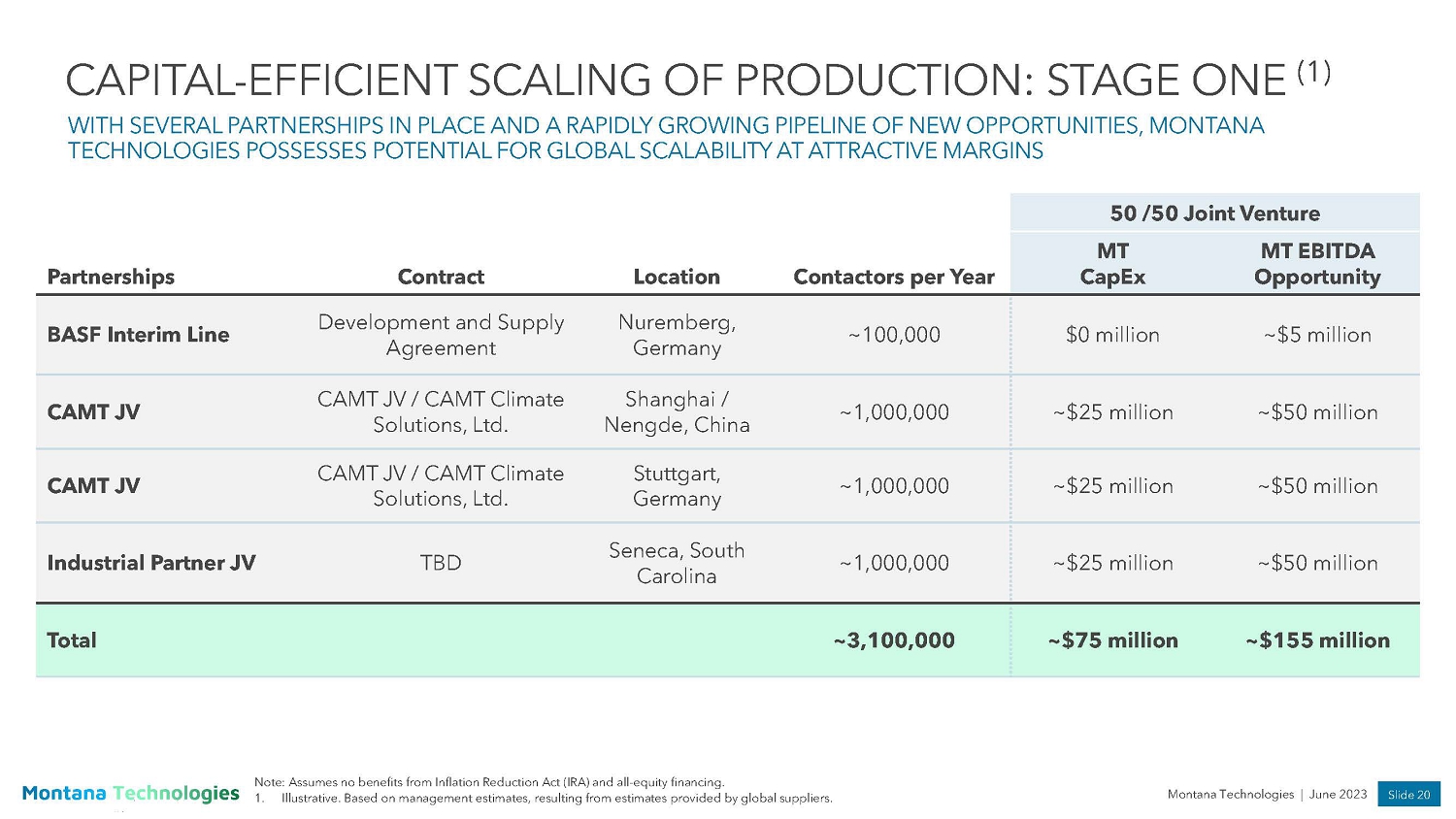

Slide 20 Montana Technologies | June 2023 CAPITAL - EFFICIENT SCALING OF PRODUCTION: STAGE ONE (1) WITH SEVERAL PARTNERSHIPS IN PLACE AND A RAPIDLY GROWING PIPELIN E OF NEW OPPORTUNITIES, MONTANA TECHNOLOGIES POSSESSES POTENTIAL FOR GLOBAL SCALABILITY AT ATTRA CTIVE MARGINS 50 /50 Joint Venture Partnerships Contract Location Contactors per Year MT CapEx MT EBITDA Opportunity BASF Interim Line Development and Supply Agreement Nuremberg, Germany ~100,000 $0 million ~$5 million CAMT JV CAMT JV / CAMT Climate Solutions, Ltd. Shanghai / Nengde, China ~1,000,000 ~$25 million ~$50 million CAMT JV CAMT JV / CAMT Climate Solutions, Ltd. Stuttgart, Germany ~1,000,000 ~$25 million ~$50 million Industrial Partner JV TBD Seneca, South Carolina ~1,000,000 ~$25 million ~$50 million Total ~3,100,000 ~$75 million ~$155 million Note: Assumes no benefits from Inflation Reduction Act (IRA) and all - equity financing. 1. Illustrative. Based on management estimates, resulting from estimates provided by global suppliers.

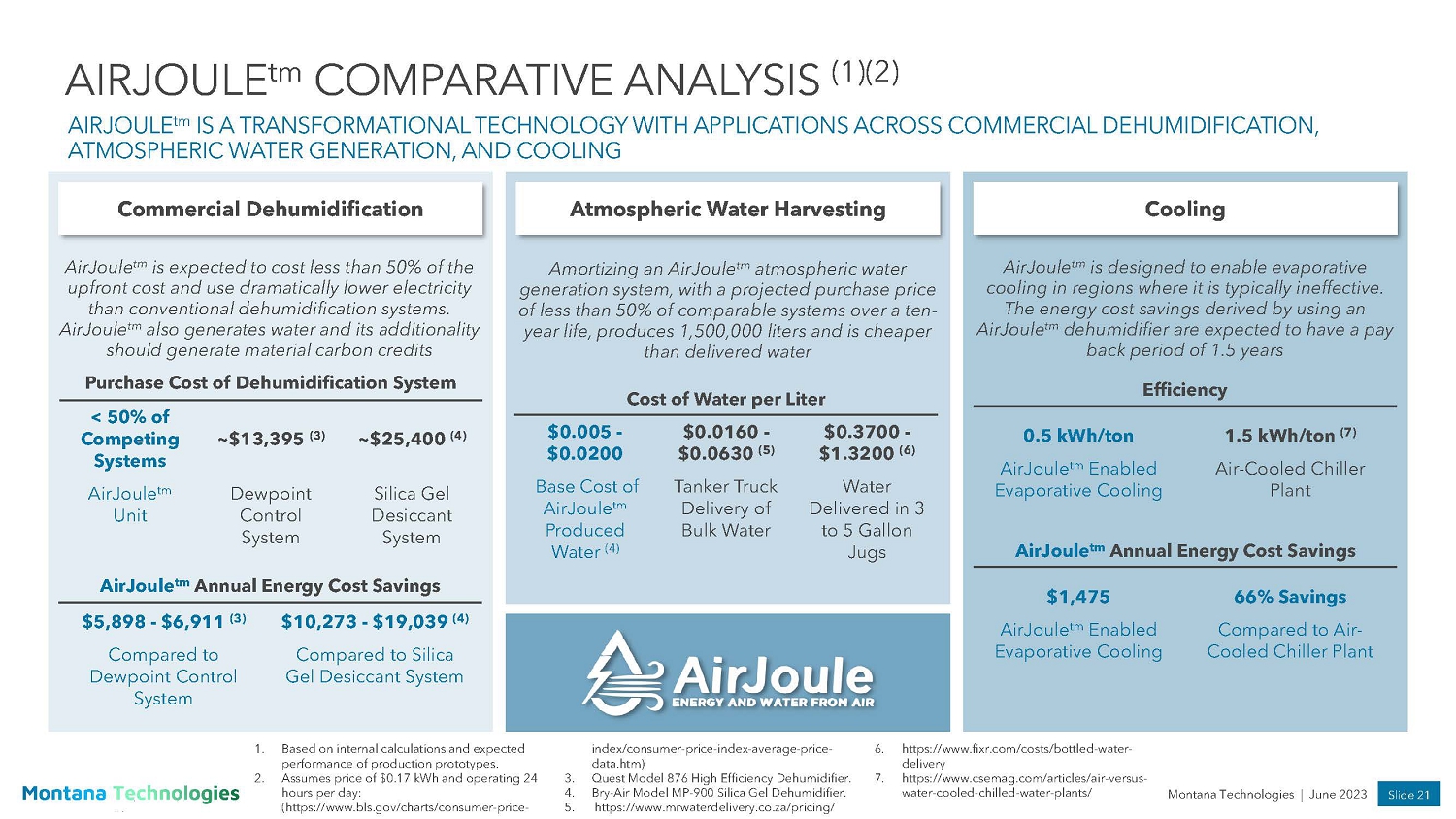

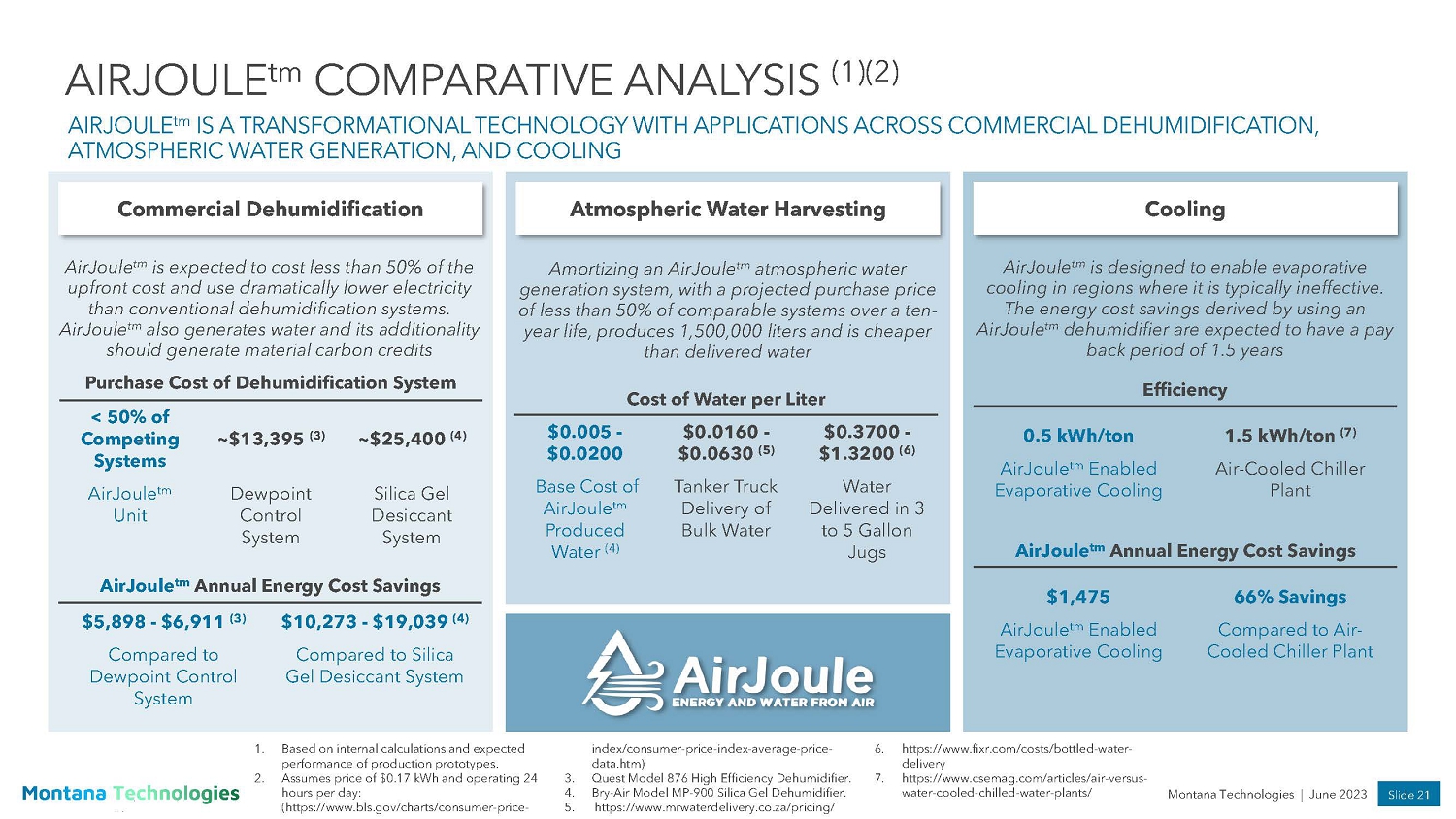

Slide 21 Montana Technologies | June 2023 Cost of Water per Liter $0.005 - $0.0200 $0.0160 - $0.0630 (5) $0.3700 - $1.3200 (6) Base Cost of AirJoule tm Produced Water (4) Tanker Truck Delivery of Bulk Water Water Delivered in 3 to 5 Gallon Jugs AIRJOULE tm COMPARATIVE ANALYSIS (1)(2) AIRJOULE tm IS A TRANSFORMATIONAL TECHNOLOGY WITH APPLICATIONS ACROSS COMME RCIAL DEHUMIDIFICATION, ATMOSPHERIC WATER GENERATION, AND COOLING Commercial Dehumidification Atmospheric Water Harvesting Cooling Purchase Cost of Dehumidification System < 50% of Competing Systems ~$13,395 (3) ~$25,400 (4) AirJoule tm Unit Dewpoint Control System Silica Gel Desiccant System AirJoule tm Annual Energy Cost Savings $5,898 - $6,911 (3) $10,273 - $19,039 (4) Compared to Dewpoint Control System Compared to Silica Gel Desiccant System AirJoule tm is expected to cost less than 50% of the upfront cost and use dramatically lower electricity than conventional dehumidification systems. AirJoule tm also generates water and its additionality should generate material carbon credits AirJoule tm is designed to enable evaporative cooling in regions where it is typically ineffective. The energy cost savings derived by using an AirJoule tm dehumidifier are expected to have a pay back period of 1.5 years AirJoule tm Annual Energy Cost Savings $1,475 66% Savings AirJoule tm Enabled Evaporative Cooling Compared to Air - Cooled Chiller Plant Efficiency 0.5 kWh/ton 1.5 kWh/ton (7) AirJoule tm Enabled Evaporative Cooling Air - Cooled Chiller Plant Amortizing an AirJoule tm atmospheric water generation system, with a projected purchase price of less than 50% of comparable systems over a ten - year life, produces 1,500,000 liters and is cheaper than delivered water 1. Based on internal calculations and expected performance of production prototypes. 2. Assumes price of $0.17 kWh and operating 24 hours per day: (https://www.bls.gov/charts/consumer - price - index/consumer - price - index - average - price - data.htm) 3. Quest Model 876 High Efficiency Dehumidifier. 4. Bry - Air Model MP - 900 Silica Gel Dehumidifier. 5. https://www.mrwaterdelivery.co.za/pricing/ 6. https://www.fixr.com/costs/bottled - water - delivery 7. https://www.csemag.com/articles/air - versus - water - cooled - chilled - water - plants/

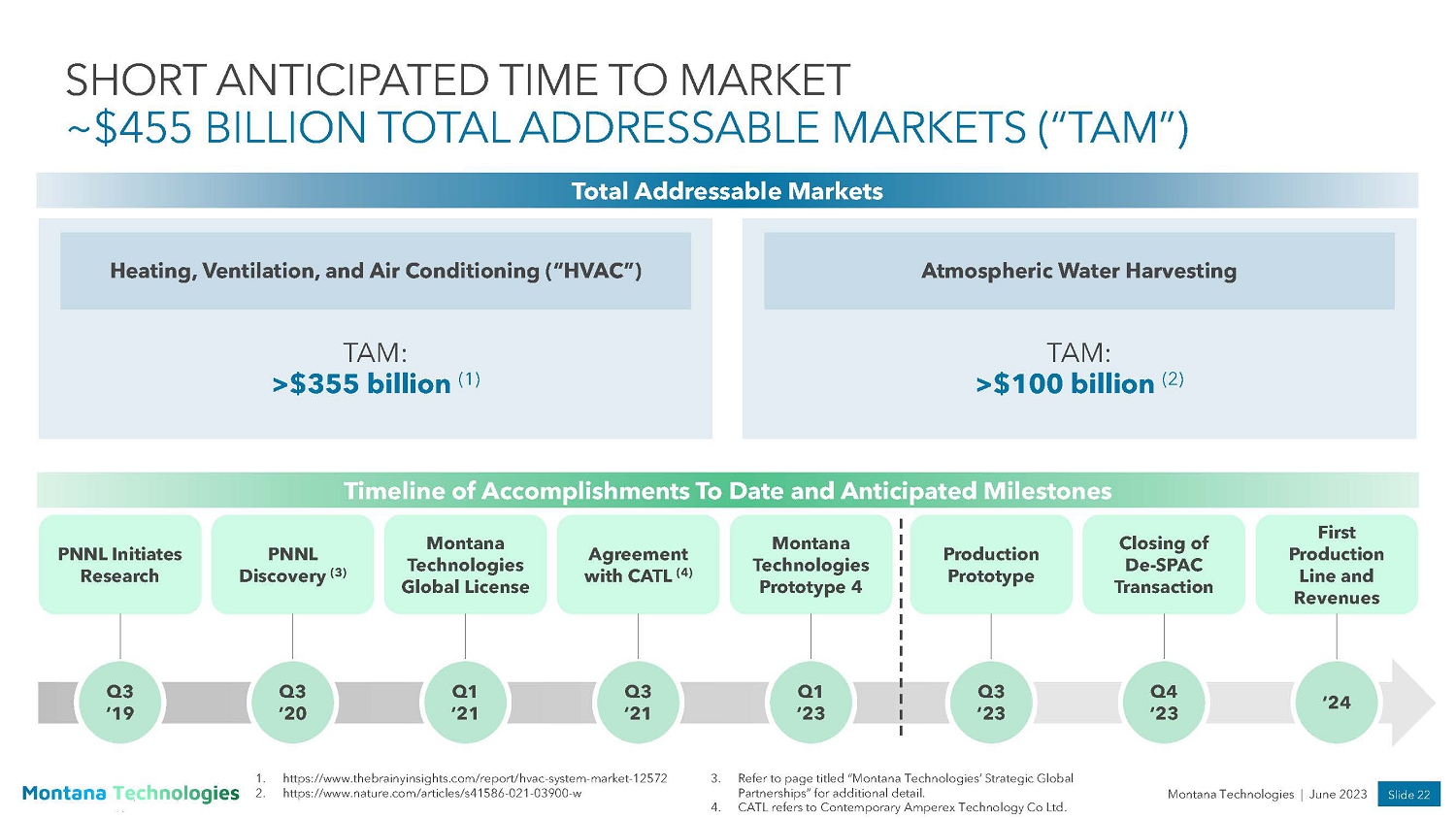

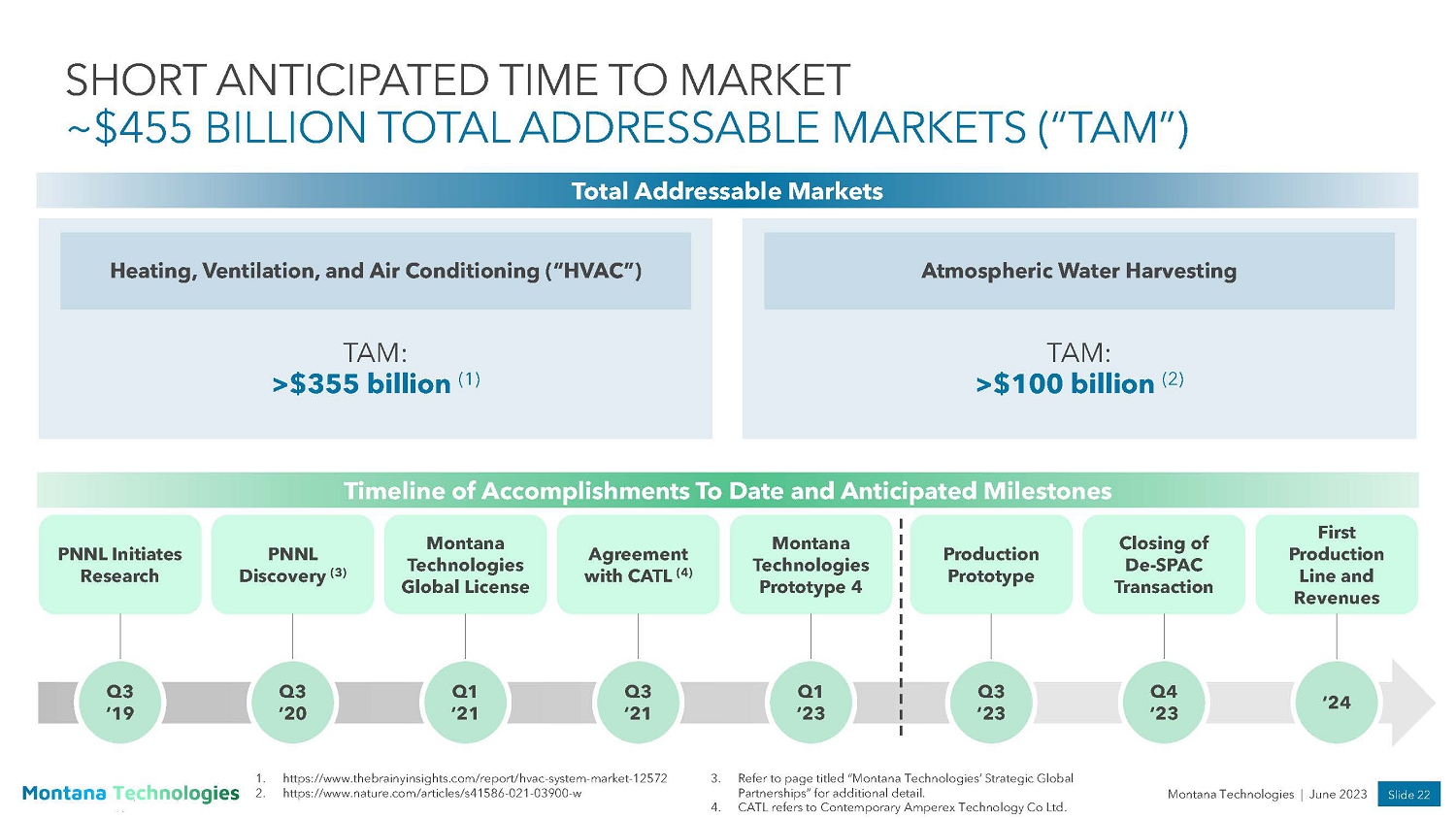

Slide 22 Montana Technologies | June 2023 TAM: >$355 billion (1) TAM: >$100 billion (2) Heating, Ventilation, and Air Conditioning (“HVAC”) Atmospheric Water Harvesting SHORT ANTICIPATED TIME TO MARKET ~$455 BILLION TOTAL ADDRESSABLE MARKETS (“TAM”) Q3 ‘19 ‘24 Q3 ‘23 Q1 ‘21 Total Addressable Markets PNNL Initiates Research PNNL Discovery (3) Montana Technologies Global License Agreement with CATL (4) Montana Technologies Prototype 4 Production Prototype Closing of De - SPAC Transaction First Production Line and Revenues Timeline of Accomplishments To Date and Anticipated Milestones Q3 ‘20 Q1 ‘23 Q4 ‘23 Q3 ‘21 1. https://www.thebrainyinsights.com/report/hvac - system - market - 12572 2. https://www.nature.com/articles/s41586 - 021 - 03900 - w 3. Refer to page titled “Montana Technologies’ Strategic Global Partnerships” for additional detail. 4. CATL refers to Contemporary Amperex Technology Co Ltd.

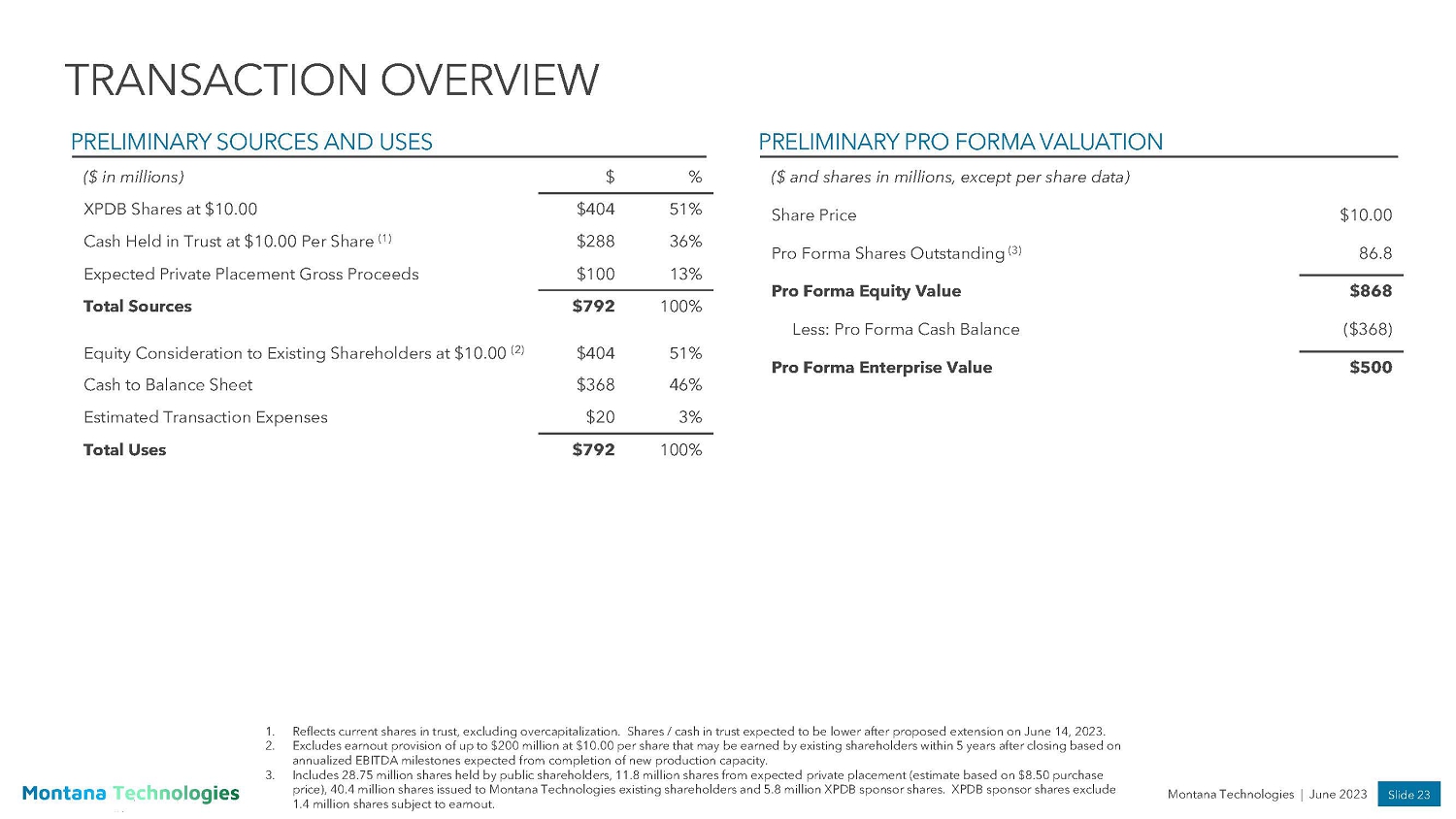

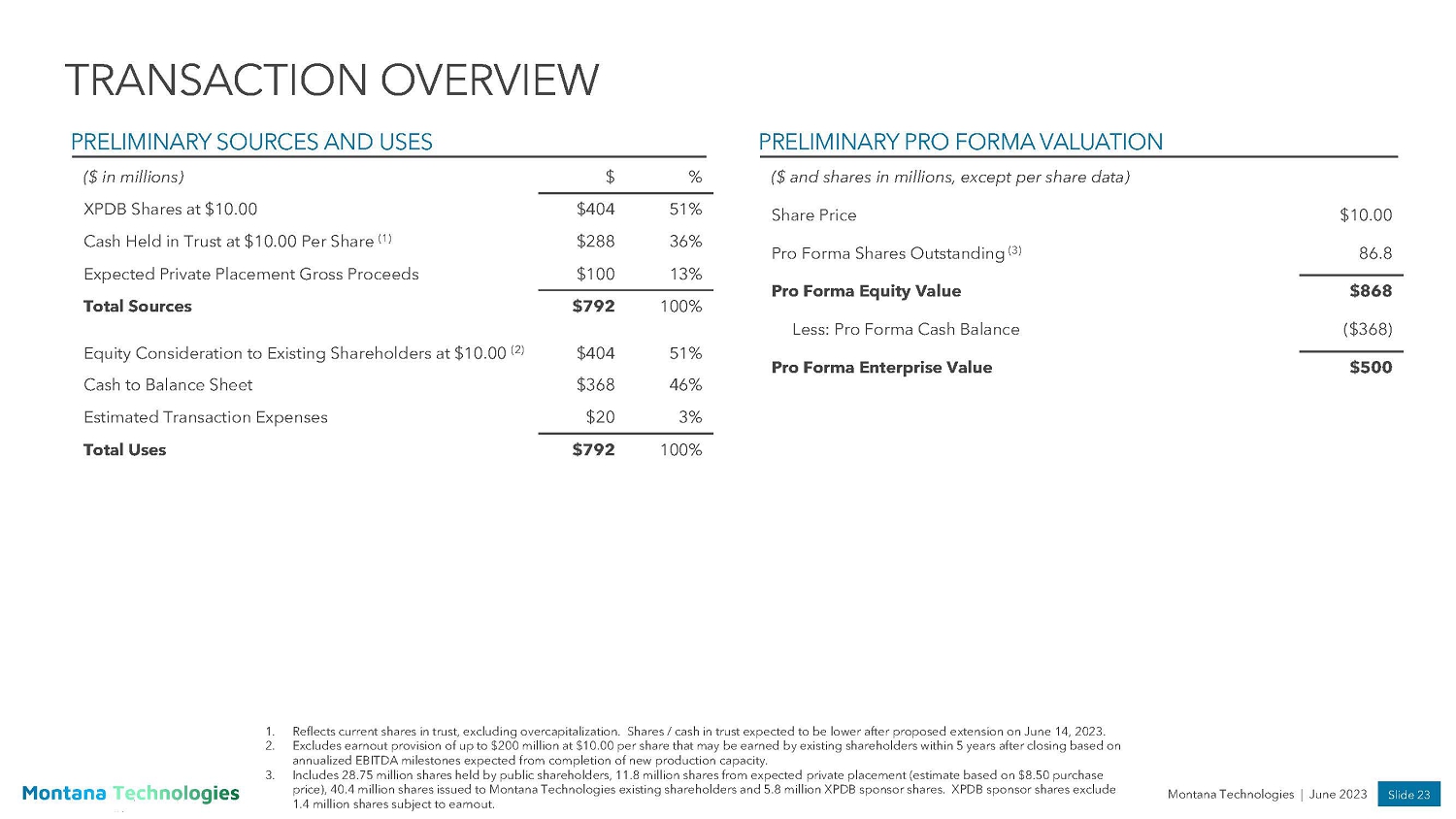

Slide 23 Montana Technologies | June 2023 TRANSACTION OVERVIEW PRELIMINARY PRO FORMA VALUATION PRELIMINARY SOURCES AND USES ($ in millions) $ % XPDB Shares at $10.00 $404 51% Cash Held in Trust at $10.00 Per Share (1) $288 36% Expected Private Placement Gross Proceeds $100 13% Total Sources $792 100% Equity Consideration to Existing Shareholders at $10.00 (2) $404 51% Cash to Balance Sheet $368 46% Estimated Transaction Expenses $20 3% Total Uses $792 100% ($ and shares in millions, except per share data) Share Price $10.00 Pro Forma Shares Outstanding (3) 86.8 Pro Forma Equity Value $868 Less: Pro Forma Cash Balance ($368) Pro Forma Enterprise Value $500 1. Reflects current shares in trust, excluding overcapitalization. Shares / cash in trust expected to be lower after proposed e xte nsion on June 14, 2023. 2. Excludes earnout provision of up to $200 million at $10.00 per share that may be earned by existing shareholders within 5 yea rs after closing based on annualized EBITDA milestones expected from completion of new production capacity. 3. Includes 28.75 million shares held by public shareholders, 11.8 million shares from expected private placement (estimate base d o n $8.50 purchase price), 40.4 million shares issued to Montana Technologies existing shareholders and 5.8 million XPDB sponsor shares. XPDB s pon sor shares exclude 1.4 million shares subject to earnout.

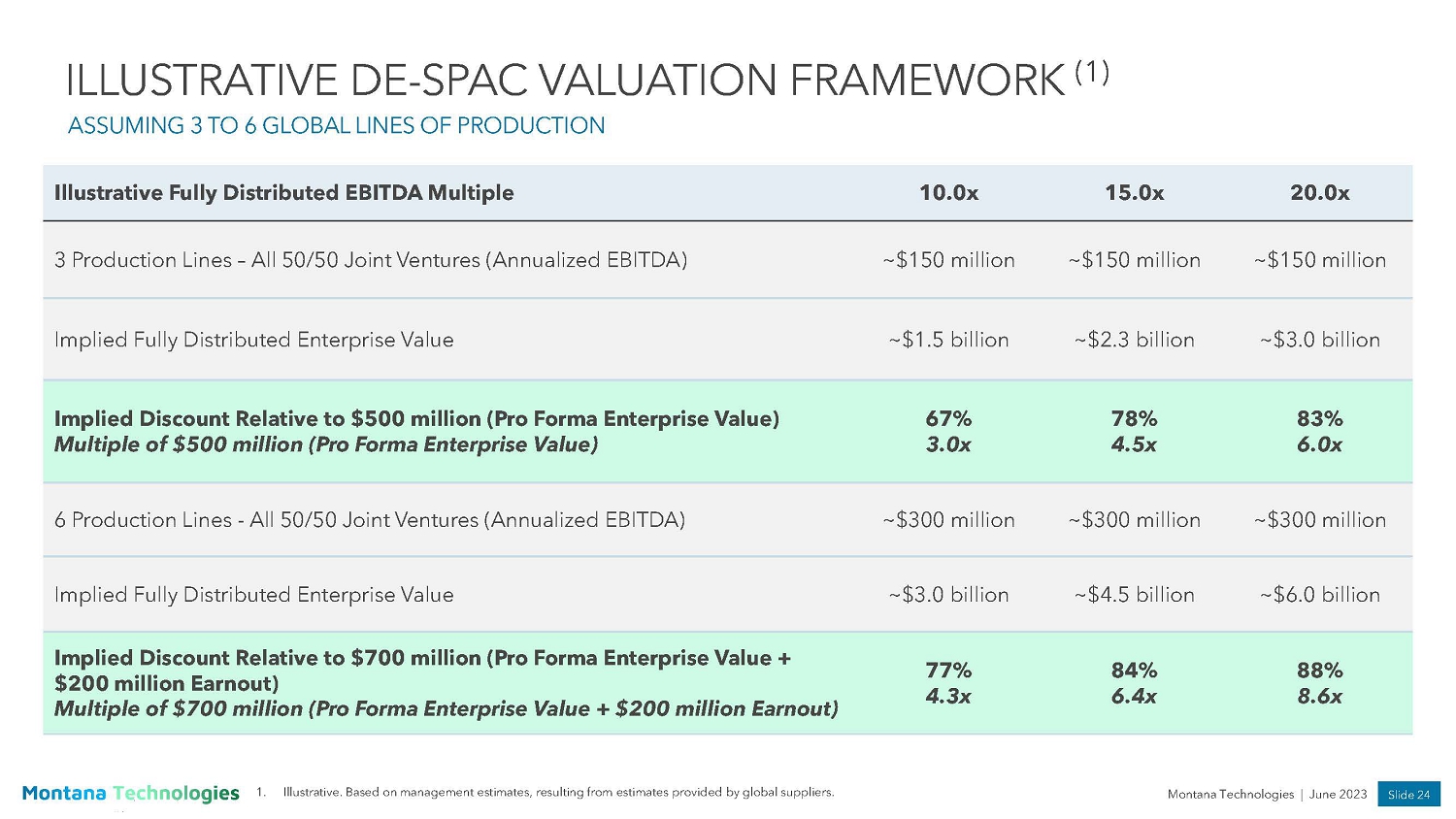

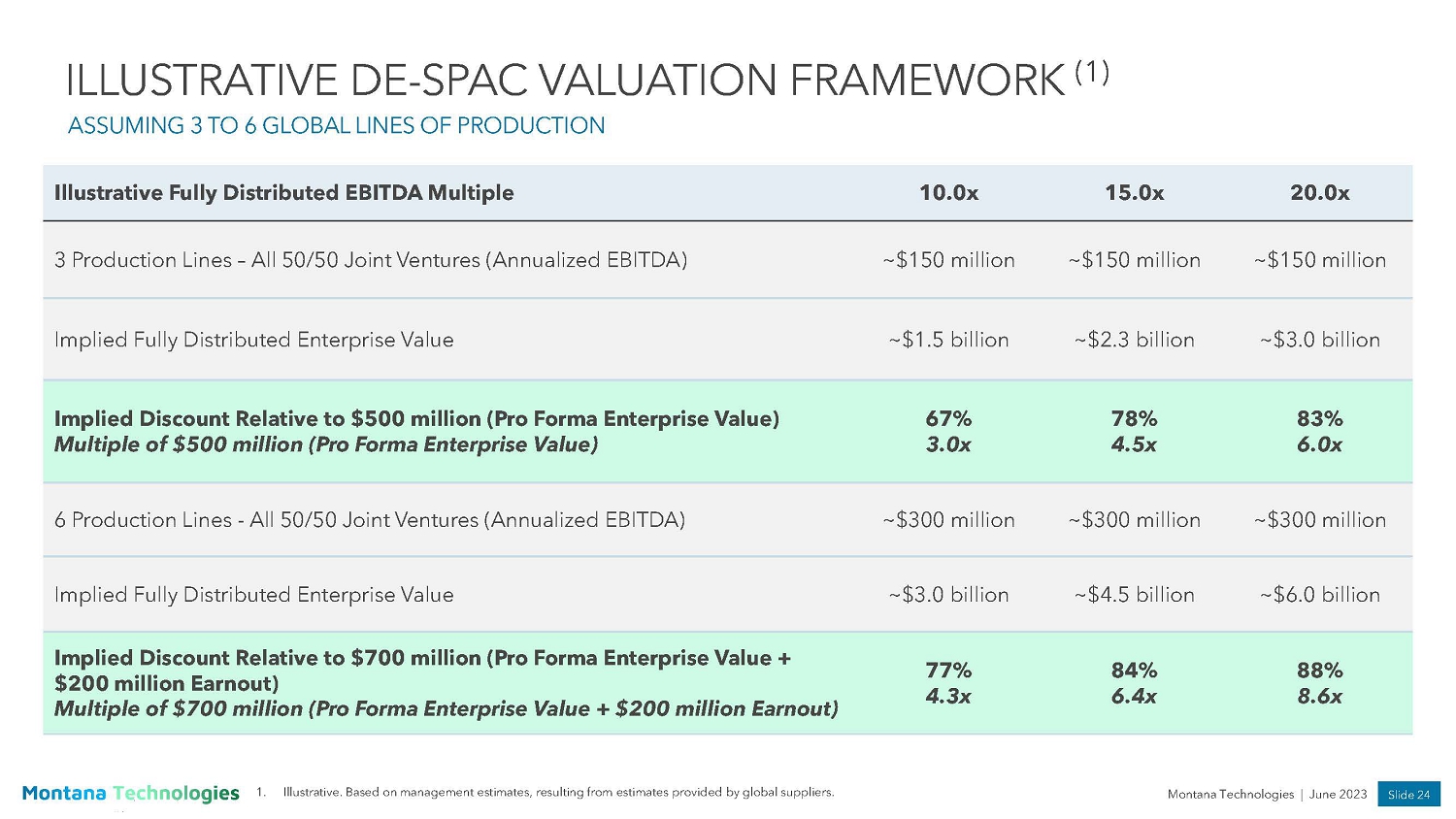

Slide 24 Montana Technologies | June 2023 ILLUSTRATIVE DE - SPAC VALUATION FRAMEWORK (1) ASSUMING 3 TO 6 GLOBAL LINES OF PRODUCTION Illustrative Fully Distributed EBITDA Multiple 10.0x 15.0x 20.0x 3 Production Lines – All 50/50 Joint Ventures (Annualized EBITDA) ~$150 million ~$150 million ~$150 million Implied Fully Distributed Enterprise Value ~$1.5 billion ~$2.3 billion ~$3.0 billion Implied Discount Relative to $500 million (Pro Forma Enterprise Value) Multiple of $500 million (Pro Forma Enterprise Value) 67% 3.0x 78% 4.5x 83% 6.0x 6 Production Lines - All 50/50 Joint Ventures (Annualized EBITDA) ~$300 million ~$300 million ~$300 million Implied Fully Distributed Enterprise Value ~$3.0 billion ~$4.5 billion ~$6.0 billion Implied Discount Relative to $700 million (Pro Forma Enterprise Value + $200 million Earnout) Multiple of $700 million (Pro Forma Enterprise Value + $200 million Earnout) 77% 4.3x 84% 6.4x 88% 8.6x 1. Illustrative. Based on management estimates, resulting from estimates provided by global suppliers.

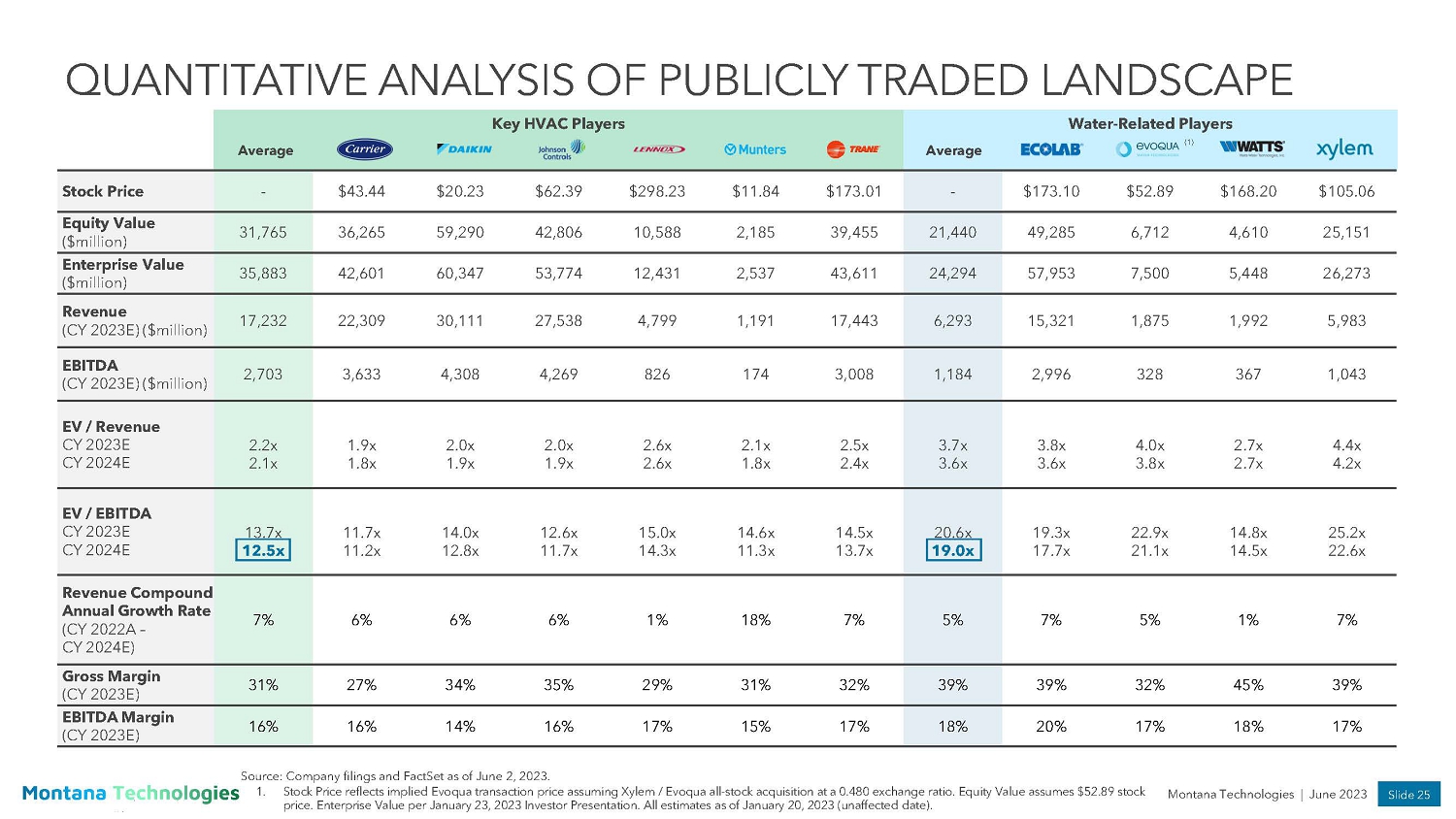

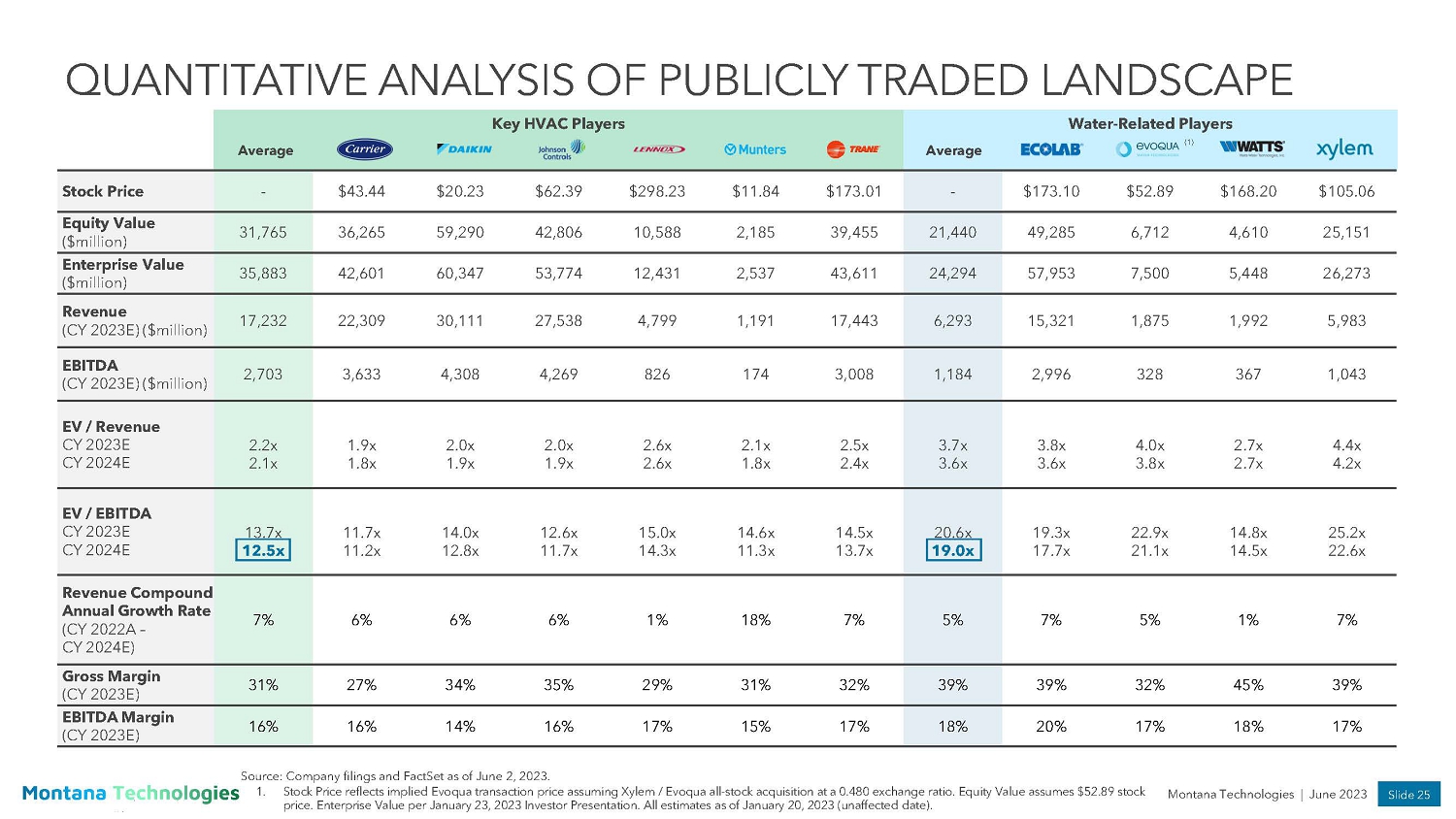

Slide 25 Montana Technologies | June 2023 Water - Related Players Key HVAC Players Stock Price - $43.44 $20.23 $62.39 $298.23 $11.84 $173.01 - $173.10 $52.89 $168.20 $105.06 Equity Value ($million) 31,765 36,265 59,290 42,806 10,588 2,185 39,455 21,440 49,285 6,712 4,610 25,151 Enterprise Value ($million) 35,883 42,601 60,347 53,774 12,431 2,537 43,611 24,294 57,953 7,500 5,448 26,273 Revenue (CY 2023E) ($million) 17,232 22,309 30,111 27,538 4,799 1,191 17,443 6,293 15,321 1,875 1,992 5,983 EBITDA (CY 2023E) ($million) 2,703 3,633 4,308 4,269 826 174 3,008 1,184 2,996 328 367 1,043 EV / Revenue CY 2023E CY 2024E 2.2x 2.1x 1.9x 1.8x 2.0x 1.9x 2.0x 1.9x 2.6x 2.6x 2.1x 1.8x 2.5x 2.4x 3.7x 3.6x 3.8x 3.6x 4.0x 3.8x 2.7x 2.7x 4.4x 4.2x EV / EBITDA CY 2023E CY 2024E 13.7x 12.5x 11.7x 11.2x 14.0x 12.8x 12.6x 11.7x 15.0x 14.3x 14.6x 11.3x 14.5x 13.7x 20.6x 19.0x 19.3x 17.7x 22.9x 21.1x 14.8x 14.5x 25.2x 22.6x Revenue Compound Annual Growth Rate (CY 2022A – CY 2024E) 7% 6% 6% 6% 1% 18% 7% 5% 7% 5% 1% 7% Gross Margin (CY 2023E) 31% 27% 34% 35% 29% 31% 32% 39% 39% 32% 45% 39% EBITDA Margin (CY 2023E) 16% 16% 14% 16% 17% 15% 17% 18% 20% 17% 18% 17% QUANTITATIVE ANALYSIS OF PUBLICLY TRADED LANDSCAPE Average Average (1) Source: Company filings and FactSet as of June 2, 2023. 1. Stock Price reflects implied Evoqua transaction price assuming Xylem / Evoqua all - stock acquisition at a 0.480 exchange ratio. E quity Value assumes $52.89 stock price. Enterprise Value per January 23, 2023 Investor Presentation. All estimates as of January 20, 2023 (unaffected date).

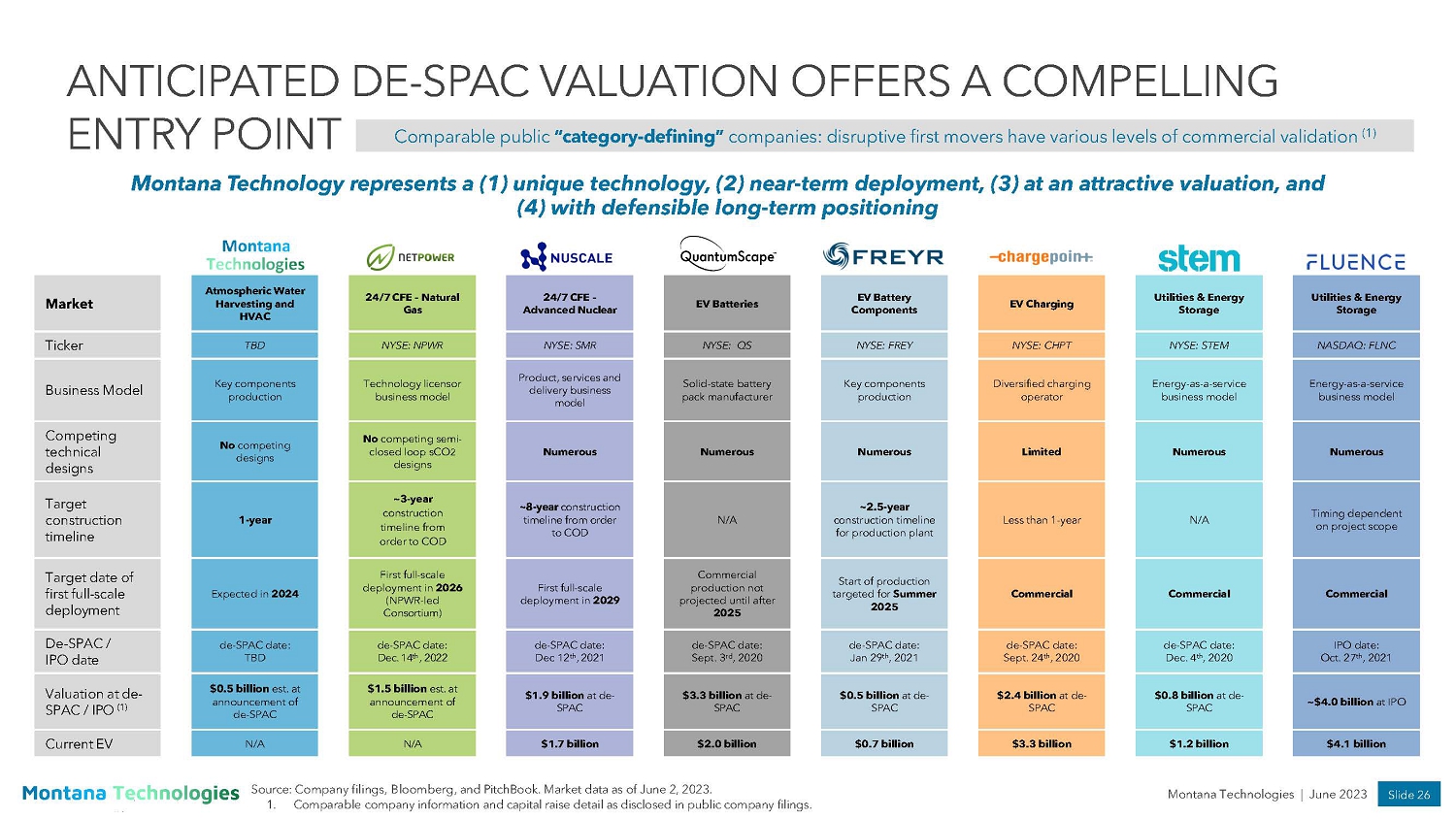

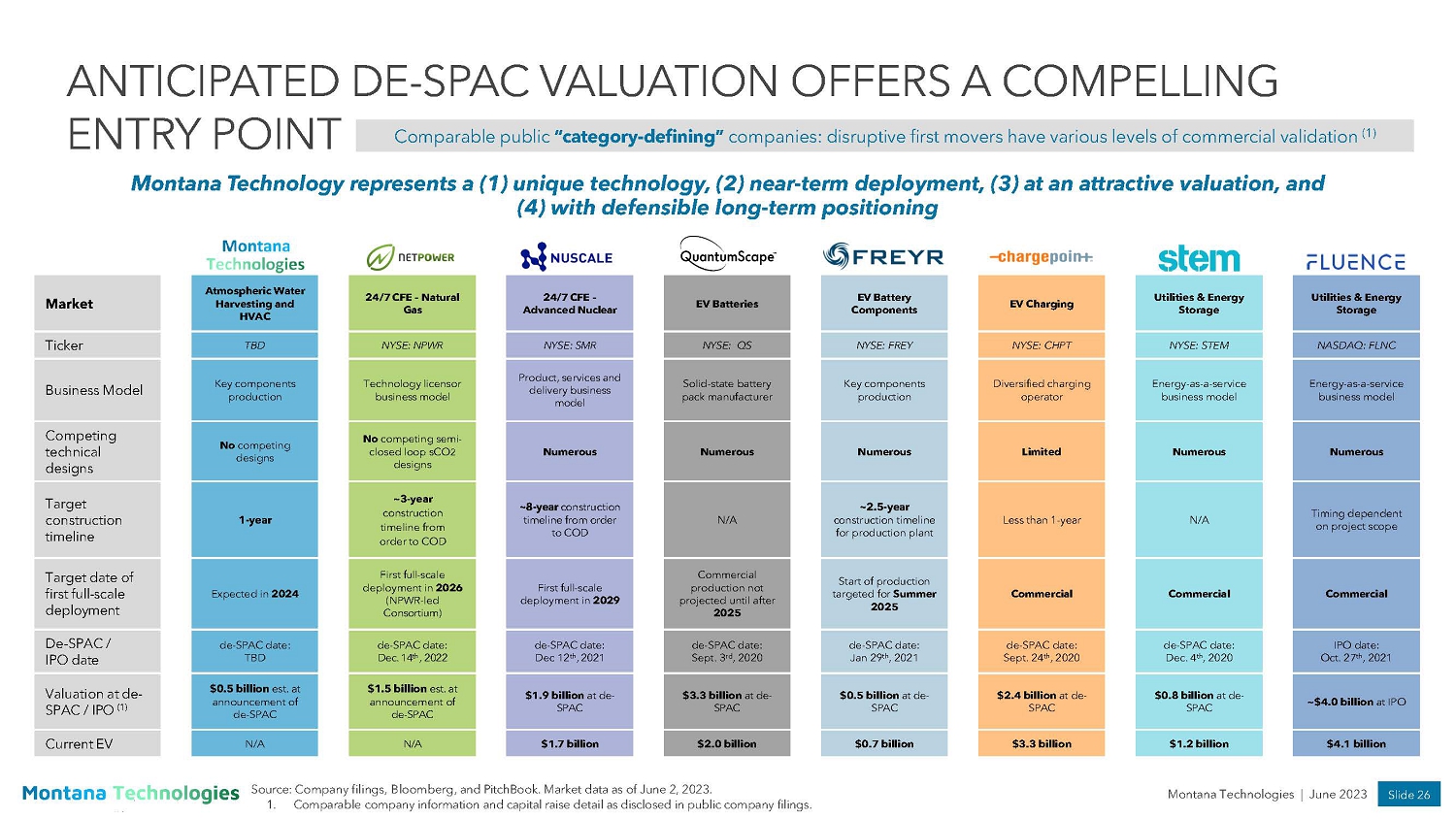

Slide 26 Montana Technologies | June 2023 Market Atmospheric Water Harvesting and HVAC 24/7 CFE – Natural Gas 24/7 CFE – Advanced Nuclear EV Batteries EV Battery Components EV Charging Utilities & Energy Storage Utilities & Energy Storage Ticker TBD NYSE: NPWR NYSE: SMR NYSE: QS NYSE: FREY NYSE: CHPT NYSE: STEM NASDAQ: FLNC Business Model Key components production Technology licensor business model Product, services and delivery business model Solid - state battery pack manufacturer Key components production Diversified charging operator Energy - as - a - service business model Energy - as - a - service business model Competing technical designs No competing designs No competing semi - closed loop sCO 2 designs Numerous Numerous Numerous Limited Numerous Numerous Target construction timeline 1 - year ~3 - year construction timeline from order to COD ~8 - year construction timeline from order to COD N/A ~2.5 - year construction timeline for production plant Less than 1 - year N/A Timing dependent on project scope Target date of first full - scale deployment Expected in 2024 First full - scale deployment in 2026 (NPWR - led Consortium) First full - scale deployment in 2029 Commercial production not projected until after 2025 Start of production targeted for Summer 2025 Commercial Commercial Commercial De - SPAC / IPO date de - SPAC date: TBD de - SPAC date: Dec. 14 th , 2022 de - SPAC date: Dec 12 th , 2021 de - SPAC date: Sept. 3 rd , 2020 de - SPAC date: Jan 29 th , 2021 de - SPAC date: Sept. 24 th , 2020 de - SPAC date: Dec. 4 th , 2020 IPO date: Oct. 27 th , 2021 Valuation at de - SPAC / IPO (1) $0.5 billion est. at announcement of de - SPAC $1.5 billion est. at announcement of de - SPAC $1.9 billion at de - SPAC $3.3 billion at de - SPAC $0.5 billion at de - SPAC $2.4 billion at de - SPAC $0.8 billion at de - SPAC ~$4.0 billion at IPO Current EV N/A N/A $1.7 billion $2.0 billion $0.7 billion $3.3 billion $1.2 billion $4.1 billion ANTICIPATED DE - SPAC VALUATION OFFERS A COMPELLING ENTRY POINT Source: Company filings, Bloomberg , and PitchBook. Market data as of June 2, 2023. 1. Comparable company information and capital raise detail as disclosed in public company filings. Montana Technology represents a (1) unique technology, (2) near - term deployment, (3) at an attractive valuation, and (4) with defensible long - term positioning Comparable public “category - defining” companies: disruptive first movers have various levels of commercial validation (1)

Slide 27 Montana Technologies | June 2023 INVESTMENT HIGHLIGHTS • Transformational Technology: 5 - 10x energy reduction, air - to - water and HVAC solutions – Applications across dehumidification, atmospheric water generation and evaporative cooling help solve two of the world’s most problematic issues: demand for energy - efficient HVAC and water stress • Leading Partnerships: – Partnerships help accelerate manufacturing of materials and components as well as provide product validation and commercialization • Capital Efficient and Highly Scalable Business Model: <$50 million capex investment expected to generate ~$100 million EBITDA per line – Montana Technologies expects to self - fund future production lines through capital - efficient production • Large Addressable Market: >$100 billion air - to - water and $355 billion HVAC markets – Scaling to base case production lines would represent a de minimis proportion of the ~$455 billion market • Key Components Plan: Deliver proprietary technology for OEM assembly – MOF coated contactors to be sold in combination with air pumps, vacuum compressors and water vapor condensers • Strong Management: Team supported by some of the nation’s leading scientists in this area – Combined 140+ years of experience across commercialization, finance, operations and research

APPENDIX Appendix

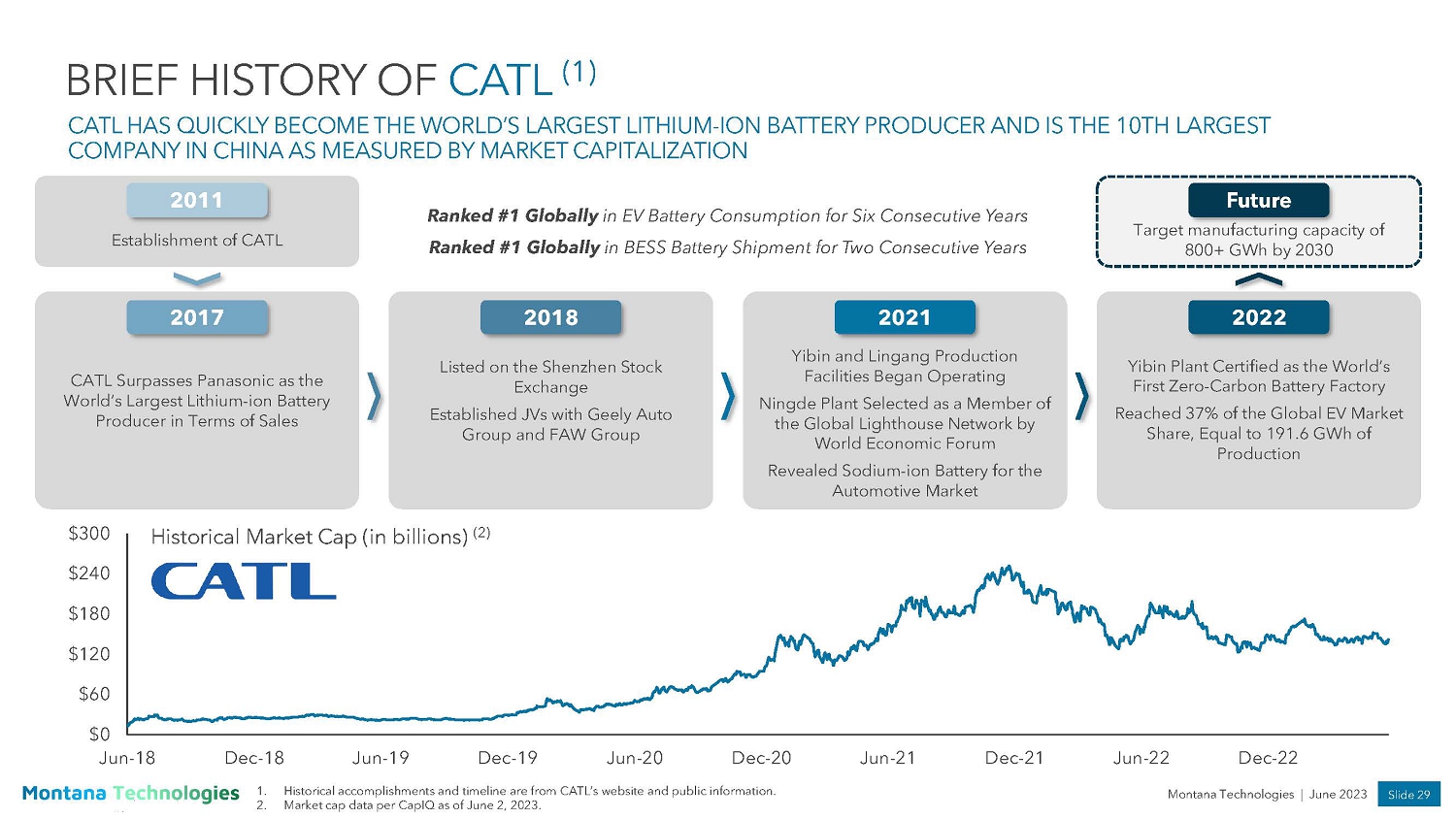

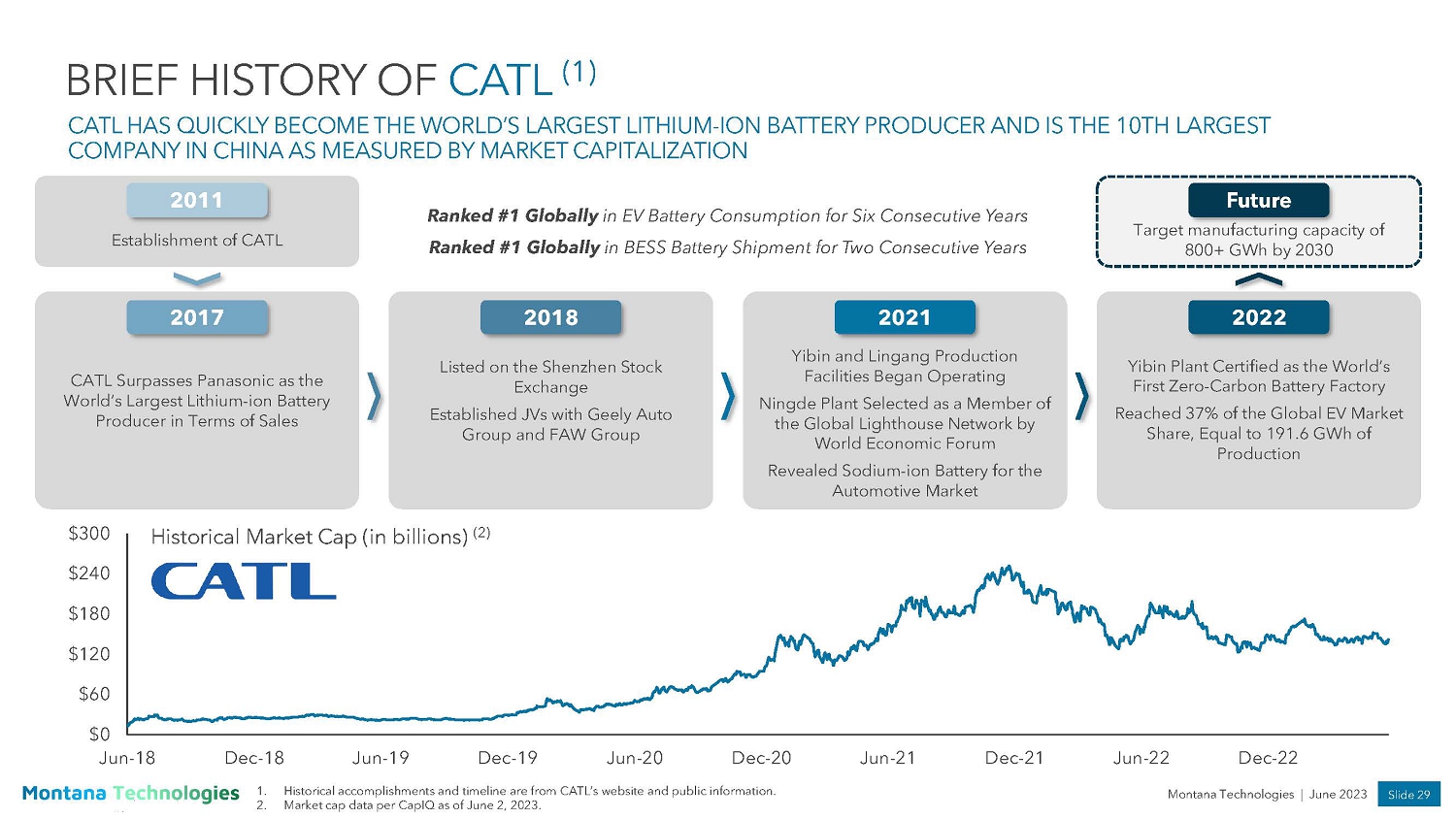

Slide 29 Montana Technologies | June 2023 BRIEF HISTORY OF CATL (1) CATL HAS QUICKLY BECOME THE WORLD’S LARGEST LITHIUM - ION BATTERY PRODUCER AND IS THE 10TH LARGEST COMPANY IN CHINA AS MEASURED BY MARKET CAPITALIZATION $0 $60 $120 $180 $240 $300 Jun-18 Dec-18 Jun-19 Dec-19 Jun-20 Dec-20 Jun-21 Dec-21 Jun-22 Dec-22 Historical Market Cap (in billions) (2) CATL Surpasses Panasonic as the World’s Largest Lithium - ion Battery Producer in Terms of Sales Yibin and Lingang Production Facilities Began Operating Ningde Plant Selected as a Member of the Global Lighthouse Network by World Economic Forum Revealed Sodium - ion Battery for the Automotive Market Establishment of CATL Listed on the Shenzhen Stock Exchange Established JVs with Geely Auto Group and FAW Group Yibin Plant Certified as the World’s First Zero - Carbon Battery Factory Reached 37% of the Global EV Market Share, Equal to 191.6 GWh of Production Target manufacturing capacity of 800+ GWh by 2030 2011 2017 2018 2021 2022 Future Ranked #1 Globally in EV Battery Consumption for Six Consecutive Years Ranked #1 Globally in BESS Battery Shipment for Two Consecutive Years 1. Historical accomplishments and timeline are from CATL’s website and public information. 2. Market cap data per CapIQ as of June 2, 2023.

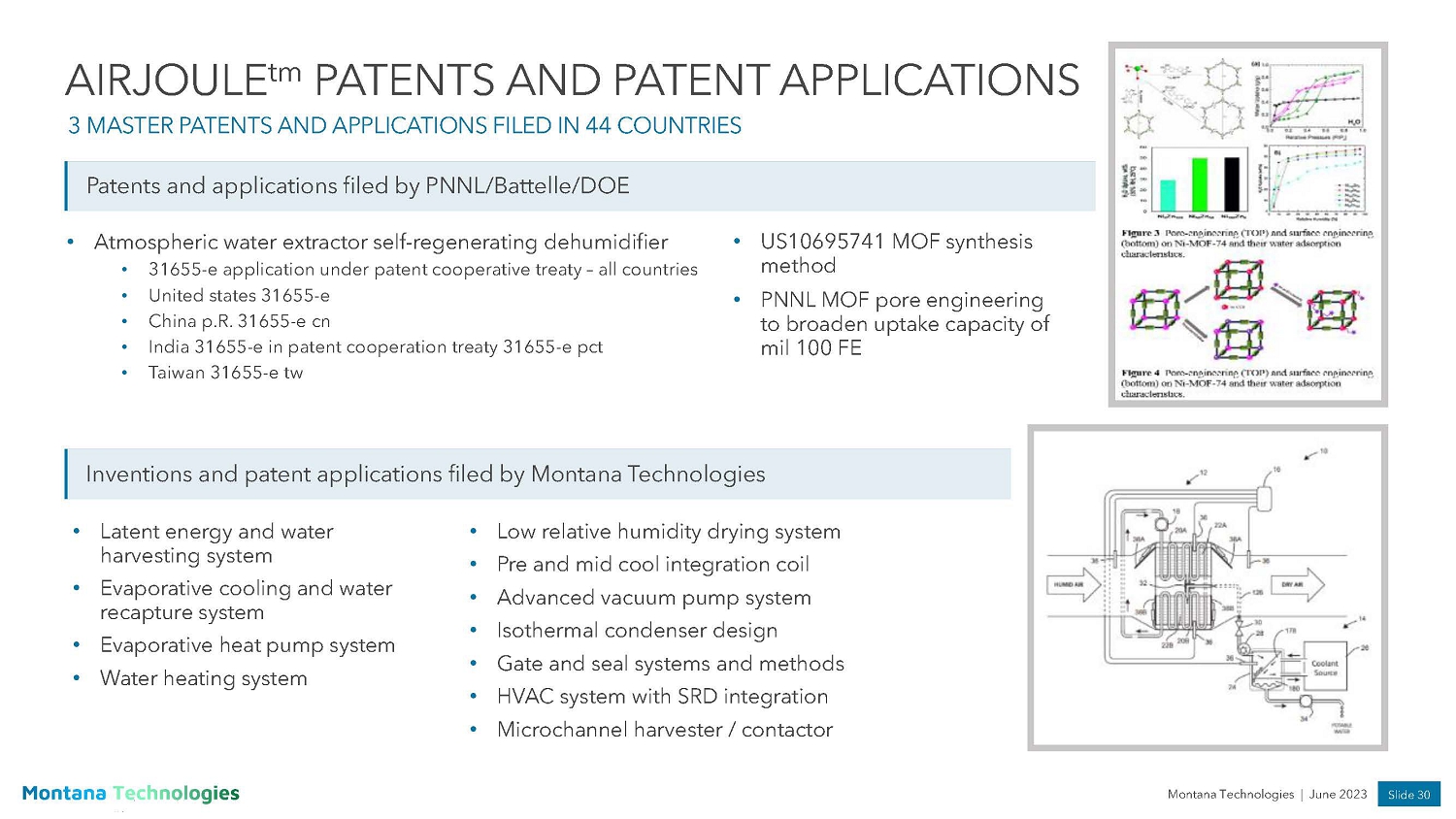

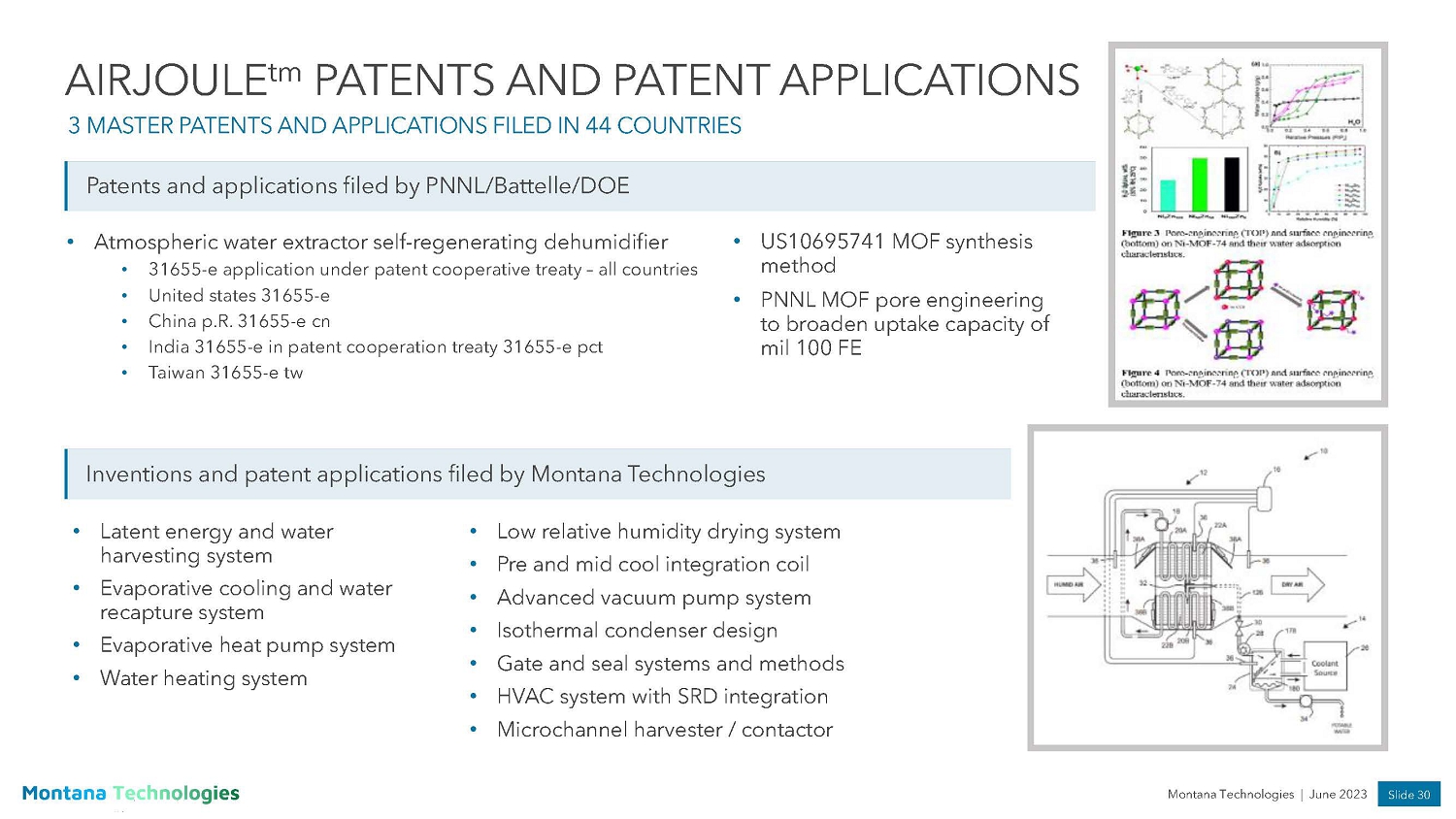

Slide 30 Montana Technologies | June 2023 • Atmospheric water extractor self - regenerating dehumidifier • 31655 - e application under patent cooperative treaty – all countries • United states 31655 - e • China p.R. 31655 - e cn • India 31655 - e in patent cooperation treaty 31655 - e pct • Taiwan 31655 - e tw AIRJOULE tm PATENTS AND PATENT APPLICATIONS 3 MASTER PATENTS AND APPLICATIONS FILED IN 44 COUNTRIES Patents and applications filed by PNNL/Battelle/DOE Inventions and patent applications filed by Montana Technologies • Latent energy and water harvesting system • Evaporative cooling and water recapture system • Evaporative heat pump system • Water heating system • Low relative humidity drying system • Pre and mid cool integration coil • Advanced vacuum pump system • Isothermal condenser design • Gate and seal systems and methods • HVAC system with SRD integration • Microchannel harvester / contactor • US10695741 MOF synthesis method • PNNL MOF pore engineering to broaden uptake capacity of mil 100 FE

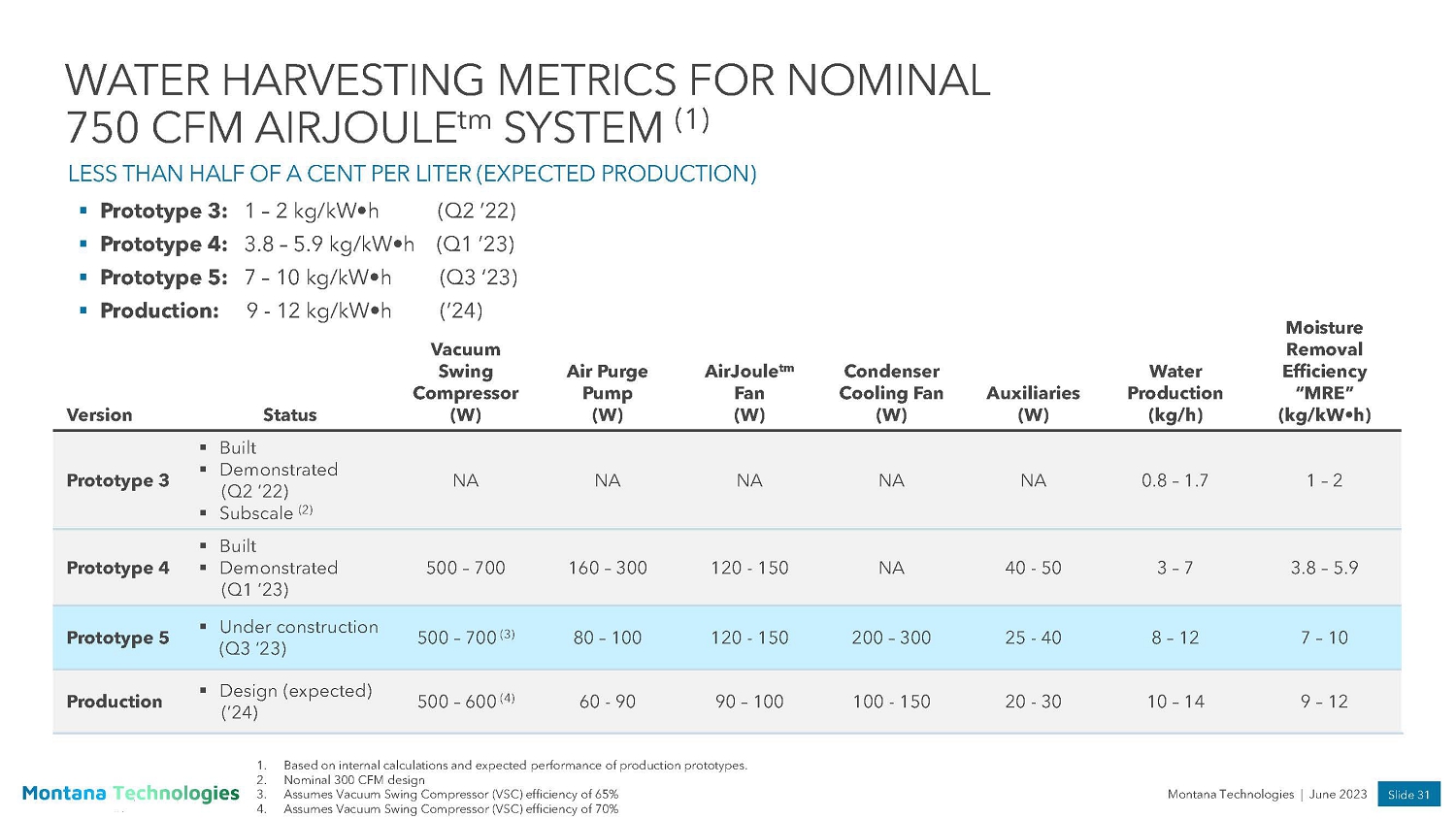

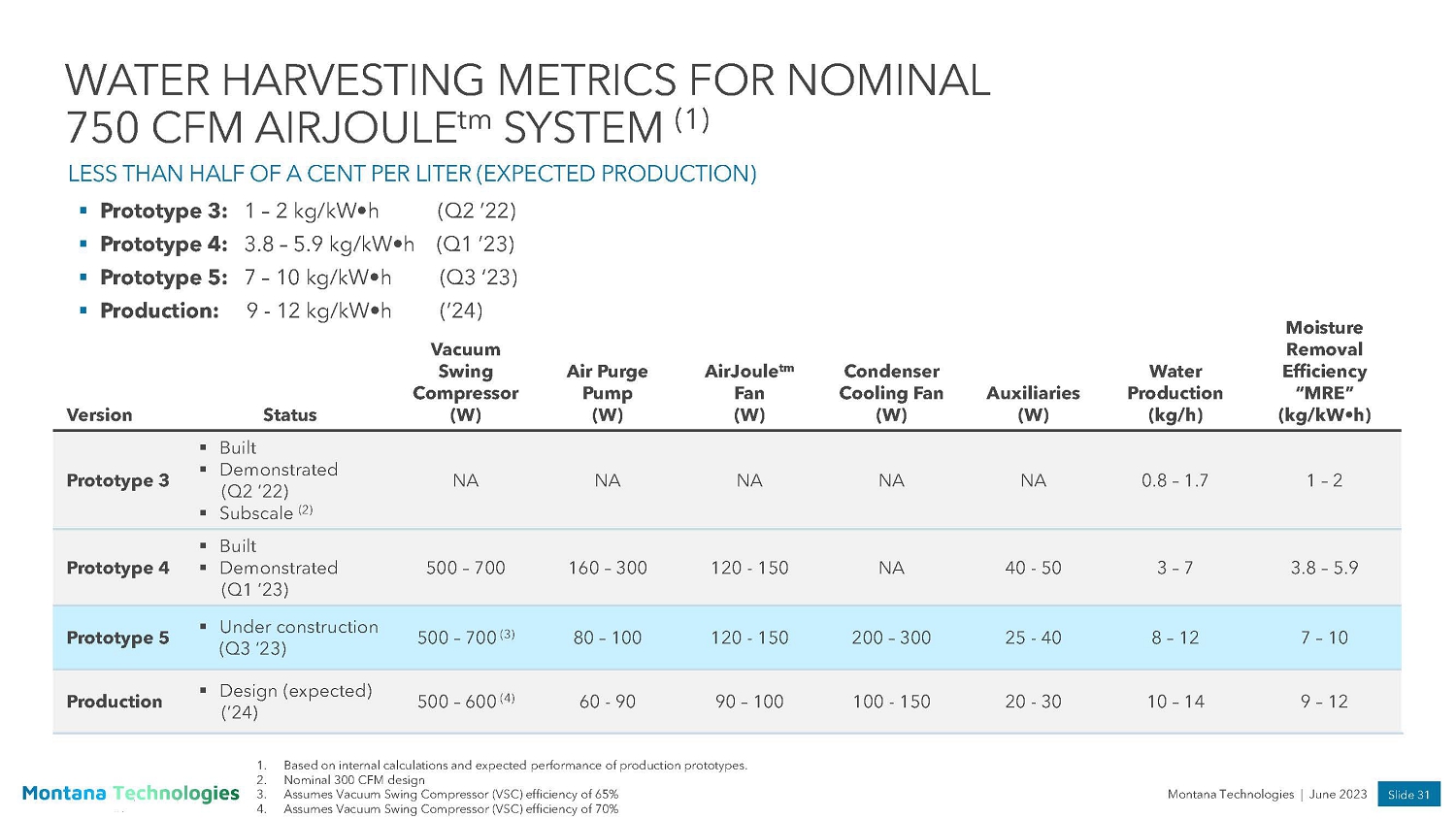

Slide 31 Montana Technologies | June 2023 WATER HARVESTING METRICS FOR NOMINAL 750 CFM AIRJOULE tm SYSTEM (1) LESS THAN HALF OF A CENT PER LITER (EXPECTED PRODUCTION) Version Status Vacuum Swing Compressor (W) Air Purge Pump (W) AirJoule tm Fan (W) Condenser Cooling Fan (W) Auxiliaries (W) Water Production (kg/h) Moisture Removal Efficiency “MRE” (kg/kW•h) Prototype 3 ▪ Built ▪ Demonstrated (Q2 ’22) ▪ Subscale (2) NA NA NA NA NA 0.8 – 1.7 1 – 2 Prototype 4 ▪ Built ▪ Demonstrated (Q1 ’23) 500 – 700 160 – 300 120 - 150 NA 40 - 50 3 – 7 3.8 – 5.9 Prototype 5 ▪ Under construction (Q3 ‘23) 500 – 700 (3) 80 – 100 120 - 150 200 – 300 25 - 40 8 – 12 7 – 10 Production ▪ Design (expected) (’24) 500 – 600 (4) 60 - 90 90 – 100 100 - 150 20 - 30 10 – 14 9 – 12 ▪ Prototype 3: 1 – 2 kg/kW •h (Q2 ’22) ▪ Prototype 4: 3.8 – 5.9 kg/kW •h (Q1 ’23) ▪ Prototype 5: 7 – 10 kg/kW •h (Q3 ‘23) ▪ Production: 9 - 12 kg/kW •h (’24) 1. Based on internal calculations and expected performance of production prototypes. 2. Nominal 300 CFM design 3. Assumes Vacuum Swing Compressor (VSC) efficiency of 65% 4. Assumes Vacuum Swing Compressor (VSC) efficiency of 70%

All references to the "company," "we," "us" or "our" refer to Montana Technologies and its consolidated subsidiaries prior to the Potential Business Combination . The risks presented below are non - exhaustive descriptions of certain of the general risks related to the business of Montana Technologies and XPDB and the Potential Business Combination, and such list is not exhaustive . The list below has been prepared solely for purposes of inclusion in these Presentation Materials and not for any other purpose . You should carefully consider these risks and uncertainties and should carry out your own diligence and consult with your own financial and legal advisors concerning the risks presented by the Potential Business Combination . Risks relating to the business of Montana Technologies, the Potential Business Combination and the business of XPDB following the consummation of the Potential Business Combination will be disclosed in future documents filed or furnished by Montana Technologies or XPDB with the SEC, including the documents filed or furnished in connection with the Potential Business Combination . The risks presented in such filings will be consistent with SEC filings typically relating to a public company, including with respect to the business and securities of Montana Technologies and XPDB and the Potential Business Combination, and may differ significantly from, and be more extensive than, those presented below . Risks Related to Our Business and Our Industry • We have no operating history . There is no assurance that we will successfully execute our proposed strategy . • We face significant barriers in our attempts to deploy our technology and may not be able to successfully develop our technology . If we cannot successfully overcome those barriers, it could adversely impact our business and operations . • Our commercialization strategy relies heavily on our relationship with BASF, CATL and other strategic investors and partners, who may have interests that diverge from ours and who may not be easily replaced if our relationships terminate, which could adversely impact our business and financial condition . • Our insurance coverage may not be adequate to protect from all business risks, adversely impacting our business and financial condition . • COVID - 19 and any future widespread public health crisis could negatively affect various aspects of our business, make it more difficult for us to meet our obligations to our customers and result in reduced demand for our products and services . • Any financial or economic crisis, or perceived threat of such a crisis, including a significant decrease in consumer confidence, may materially and adversely affect our business, financial condition, and results of operations . • Manufacturing issues not identified prior to design finalization, long - lead procurement, and/or module fabrication could potentially be realized during production or fabrication and may impact plant deployment cost and schedule, which could adversely impact our business . • Our financial results depend on successful project execution and may be adversely affected by cost overruns, failure to meet customer schedules, failure of our subcontractors to fulfill their obligations to us, or other execution issues . • Our sales and profitability may be impacted by, and we may incur liabilities as a result of, warranty claims, product defects, recalls, improper use of our products, or our failure to meet performance guarantees, customer safety standards, or treat emerging contaminants . • We will be subject to environmental, health and safety laws and regulations, and labor laws in multiple jurisdictions, which impose substantial compliance requirements on our operations . Our operating costs could be significantly increased in order to comply with new or stricter regulatory standards imposed by any governmental agency in which we operate . • We may depend on sole - source and limited - source suppliers for key components and products . If we are unable to source these components and products on a timely basis or at acceptable prices, we will not be able to deliver our products to our customers and production time and production costs could increase, which may adversely affect our business . • We may face supply chain competition, including competition from businesses in other industries, which could result in insufficient inventory and negatively affect our results of operations . • We are subject to risks associated with changing technology, product innovation, manufacturing techniques, operational flexibility and business continuity, which could place us at a competitive disadvantage . • We expect to incur research and development costs and devote resources to identifying and commercializing new products and services, which could reduce our profitability and may never result in revenue to us . • Our long - term success will depend ultimately on implementing our business strategy and operational plan, as well as our ability to generate revenues, achieve and maintain profitability and develop positive cash flows . We have a history of losses and may not be able to achieve or maintain profitability in the future . RISK FACTORS

• We lack sufficient funds to achieve our planned business objectives . Our ability to continue as a going concern is dependent on (i) continued financial support from our shareholders and other related parties, (ii) raising capital via external financing, and/or (iii) attaining profitable operations . • Our long - term success depends, in part, on our ability to negotiate and enter into sales agreements with, and deliver our products to, third party customers on commercially viable terms . There can be no assurance that we will be successful in securing such agreements . • Exchange rate fluctuations may materially affect our results of operations and financial condition . • We may seek to raise further funds through equity or debt financing, joint ventures, production sharing arrangements or other means . Any inability to access the capital or financial markets may limit our ability to fund our ongoing operations, execute our business plan or pursue investments that we may rely on for future growth . • We are engaged in, and may seek to engage in further, joint ventures with partners who may subject us to geopolitical instability, particularly related to China . • If we fail to retain our key personnel or if we fail to attract additional qualified personnel, we may not be able to achieve our anticipated level of growth and our business could suffer . • We may face significant competition from established companies with longer operating histories, customer incumbency advantages, access to and influence with governmental authorities, and more capital resources than we do . • Any failure by management to manage growth properly could have a material adverse effect on our business, operating results and financial condition . • Damage to our reputation or brand image can adversely affect our business . Risks Related to Legal, Compliance and Regulations • There are risks associated with operating in foreign countries, including those related to economic, social and/or political instability, and changes of law affecting foreign companies operating in that country . In particular, we may suffer reputational harm due to our business dealings in certain countries that have previously been associated, or perceived to have been associated, with human rights issues . Increased scrutiny and changing expectations from investors regarding environmental, social and governance considerations may result in the decrease of the trading price of our securities . • In some cases, our joint ventures with foreign - based joint venture partners may be subject to review by the Committee on Foreign Investment in the United States (“CFIUS”) . CFIUS actions, including potentially imposing restrictions or conditions on a joint venture, could adversely impact our operations . • Delays in enactment or repeals of environmental laws and regulations may make our products, services, and solutions unnecessary or less economically beneficial to our customers, adversely affecting demand for our products, services, and solutions . • The reduction, elimination, or expiration of government subsidies, economic incentives, tax incentives, renewable energy targets, and other support for our products, or other public policies could negatively impact our operations . • Our businesses require numerous permits, licenses, franchises and other approvals from various governmental agencies, and the failure to obtain or maintain any of them, or lengthy delays in obtaining them, could materially adversely affect us . • Our failure to comply with applicable anti - corruption, anti - bribery, anti - money laundering, antitrust, foreign investment, and similar laws and regulations could negatively impact our reputation and results of operations . • The requirements of being a public company in the U . S . may strain our resources and divert management's attention, and the increases in legal, accounting and compliance expenses that will result from being a public company in the U . S . may be greater than we anticipate . • As a private company, we have not been required to document and test our internal controls over financial reporting nor has our management been required to certify the effectiveness of our internal controls and our auditors have not been required to opine on the effectiveness of our internal control over financial reporting . Failure to maintain adequate financial, information technology and management processes and controls could impair our ability to comply with the financial reporting and internal controls requirements for publicly traded companies, which could lead to errors in our financial reporting and adversely affect our business . • Our business could be adversely affected by trade wars, trade tariffs, or other trade barriers . RISK FACTORS

Economic and External Risks • The occurrence of significant events against which we may not be fully insured could have a material adverse effect on our business, financial condition and results of operations . • The threat of global economic, capital markets and credit disruptions pose risks to our business . • Inflation may increase our operating costs . • Our business may be adversely affected by force majeure events outside our control, including labor unrest, civil disorder, war, subversive activities or sabotage, extreme weather conditions, fires, floods, explosions or other catastrophes, epidemics or quarantine restrictions . • The ongoing military conflict between Ukraine and Russia, and the related disruptions to the global economy and financial markets, could adversely affect our business, financial condition and results of operations . Risks Related to Intellectual Property and Technology • Our patent applications may not result in issued patents, and our issued patents may not provide adequate protection, which may have a material adverse effect on our ability to prevent others from commercially exploiting products similar to ours . • Our failure to protect our intellectual property rights may undermine our competitive position, and litigation to protect our intellectual property rights may be costly . • We may need to defend ourselves against claims that we infringe, have misappropriated, or otherwise violate the intellectual property rights of others, which may be time - consuming and would cause us to incur substantial costs . • Cyber - attacks or a failure in our information technology and data security infrastructure could adversely affect our business and operations . • We may be subject to claims by third parties of intellectual property infringement . • Third - party claims that we are infringing on intellectual property, whether successful or not, could subject us to costly and time - consuming litigation or expensive licenses, and our business could be adversely affected . • A number of foreign countries do not protect intellectual property rights to the same extent as the United States . Therefore, our intellectual property rights may not be as strong or as easily enforced outside of the United States and efforts to protect against the infringement, misappropriation or unauthorized use of our intellectual property rights, technology and other proprietary rights may be difficult and costly outside of the United States . Furthermore, legal standards relating to the validity, enforceability and scope of protection of intellectual property rights are uncertain and any changes in, or unexpected interpretations of, intellectual property laws may compromise our ability to enforce our patent rights, trade secrets and other intellectual property rights . Risks Related to Our Projections • Actual capital costs, operating costs, production and economic returns may differ significantly from those we have anticipated and future development activities may not result in profitable operations . • Our financial projections included in this presentation rely in large part upon assumptions and analyses developed by us . If these assumptions prove to be incorrect, our actual operating results may differ materially from the forecasted results . • Demand for our products may not grow or may grow at a slower rate than we anticipate . • The rapidly evolving and competitive nature of our industry makes it difficult to evaluate our future prospects . • If our estimates and assumptions we use to determine the size of our total addressable market are inaccurate, our future growth rate may be affected and the potential growth of our business may be limited . RISK FACTORS

Risks Related to the Potential Business Combination • Each of XPDB and Montana Technologies will incur significant transaction costs in connection with the Potential Business Combination, and these costs may limit Montana Technologies' ability to properly invest in its business . • The process of taking a company public by means of a business combination with a special purpose acquisition company is different from the process of taking a company public through an underwritten offering and may create risks for Montana Technologies' unaffiliated investors . • The consummation of the Potential Business Combination will be subject to a number of conditions, and if those conditions are not satisfied or waived, the Potential Business Combination agreement may be terminated in accordance with its terms and the Potential Business Combination may not be completed . • XPDB and/or Montana Technologies may waive one or more of the conditions to the Potential Business Combination, resulting in the consummation of the Potential Business Combination notwithstanding the divergence from assumptions on which the Potential Business Combination was evaluated and approved . • Upon consummation of the Potential Business Combination, the rights of the holders of XPDB shares will differ from and may be less favorable to the rights of holders of shares of XPDB Class A common stock . • Upon consummation of the Potential Business Combination, the holders of Class B common stock will have multiple votes per share, and this ownership will limit or preclude the ability of holders of Class A common stock to influence corporate matters, including the election of directors, amendments of organizational documents, and any merger, consolidation, sale of all or substantially all of the assets, or other major corporate transactions requiring shareholder approval, and that may adversely affect the trading price of our Class A common stock . • The ability to successfully effect the Potential Business Combination and Montana Technologies' ability to successfully operate the business thereafter will be largely dependent upon the efforts of certain key personnel . The loss of such key personnel could negatively impact the operations and financial results of XPDB . • There can be no assurance that, upon consummation of the Potential Business Combination, XPDB will be able to comply with the listing standards of the Nasdaq or to remain in compliance with the continued listing standards of the Nasdaq • Legal proceedings in connection with the Potential Business Combination, the outcomes of which are uncertain, could delay or prevent the completion of the Potential Business Combination . • The grant and future exercise of registration rights may adversely affect the market price of XPDB shares following the consummation of the Potential Business Combination . • Significant redemptions by XPDB's public shareholders may require XPDB to raise financing following the consummation of the Potential Business Combination and reduce the public “float” of XPDB’s shares . • If XPDB's due diligence investigation of Montana Technologies' business was inadequate and material risks are not uncovered, shareholders of XPDB following the consummation of the Potential Business Combination could lose some or all of their investment . • The Potential Business Combination may be subject to antitrust or foreign investment laws and regulations, which may adversely effect Montana Technologies' business and results of operations . • XPDB has not obtained a third - party valuation or fairness opinion in connection with the Potential Business Combination, and consequently, there is no assurance from an independent source that the consideration to be paid to Montana Technologies equity holders is fair to XPDB's shareholders from a financial point of view . • During the pre - closing period, XPDB and Montana Technologies are prohibited from entering into certain transactions that might otherwise be beneficial to them or their respective stakeholders . • Uncertainties about the Potential Business Combination during the pre - closing period may cause third parties to delay or defer decisions concerning Montana Technologies or seek to change existing arrangements . • If XPDB is not able to obtain one or more extensions of its time to complete an initial business combination, XPDB will cease all operations except for purposes of winding up, redeeming 100 % of the outstanding public shares and dissolving or liquidating . • XPDB stockholders will experience dilution as a consequence of, among other transactions, the issuance of XPDB shares as consideration in the Potential Business Combination and any private placement investment in connection therewith . Having a minority position will reduce the influence that XPDB's shareholders have on the management of XPDB after consummation of the Potential Business Combination . • XPDB and Montana Technologies may seek additional financing prior to completion of the Potential Business Combination, and may provide incentives to investors to participate in such financing or to approve consummation of the Potential Business Combination, which may dilute your ownership interest and may depress the market price of XPDB’s shares . • A new 1 % U . S . federal excise tax may be imposed in connection with redemptions of shares of XPDB Class A common stock by XPDB's existing shareholders . RISK FACTORS