If AGC is unable to raise additional capital, it may be required to take additional measures to conserve liquidity, which could include, but not necessarily be limited to, suspending the pursuit of a business combination. AGC cannot provide any assurance that new financing will be available to it on commercially acceptable terms, if at all.

As a result of the above, in connection with the AGC’s assessment of going concern considerations in accordance with Accounting Standards Update (“ASU”) 2014-15, “Disclosures of Uncertainties about an Entity’s Ability to Continue as a Going Concern,” AGC’s management has determined that the liquidity condition and date for mandatory liquidation and dissolution raise substantial doubt about AGC’s ability to continue as a going concern through approximately one year from the date of filing. These financial statements do not include any adjustments relating to the recovery of the recorded assets or the classification of the liabilities that might be necessary should AGC be unable to continue as a going concern.

Prior to the consummation of its initial public offering, AGC’s liquidity needs have been satisfied through receipt of a $25,000 capital contribution from the Sponsor in exchange for the issuance of the founder shares to the Sponsor, and a $300,000 promissory note payable to the Sponsor.

On October 5, 2020, AGC completed its initial public offering of 50,000,000 AGC Units, which includes the full exercise by the underwriters of their over-allotment option in the amount of 5,000,000 AGC Units, at a price of $10.00 per AGC Unit, generating gross proceeds of $500,000,000. Simultaneously with the closing of its initial public offering, AGC completed the sale of 12,000,000 private placement warrants to the Sponsor at a price of $1.00 per private placement warrant generating gross proceeds of $12,000,000.

Following AGC’s initial public offering and the sale of the private placement warrants, a total of $500,000,000 was placed in AGC’s trust account, and it had $1,961,900 of cash held outside of its trust account after payment of costs related to its initial public offering, and available for working capital purposes. AGC incurred $28,244,738 in transaction costs, including $10,000,000 of underwriting fees, $17,500,000 of deferred underwriting fees and $744,738 of other costs.

As of September 30, 2021, AGC had marketable securities held in its trust account of $500,021,794 (including approximately $21,794 of unrealized gains) consisting of U.S. Treasury Bills with a maturity of 185 days or less.

For the nine months ended September 30, 2021, cash used in operating activities was $888,394. Net income of $83,708,515 was affected by an unrealized gain on marketable securities held in AGC’s trust account of $21,794, change in fair value of warrant liabilities of $49,582,029, change in fair value of forward purchase agreement liability of $41,941,059, and changes in operating assets and liabilities, which provided $6,947,973 of cash. As of September 30, 2020, AGC had no cash.

AGC intends to use substantially all of the funds held in its trust account, including any amounts representing interest earned on its trust account, which interest shall be net of taxes payable and excluding deferred underwriting commissions, to complete its initial business combination. AGC may withdraw interest from its trust account to pay taxes, if any. To the extent that its share capital or debt is used, in whole or in part, as consideration to complete an initial business combination, the remaining proceeds held in AGC’s trust account will be used as working capital to finance the operations of the target business or businesses, make other acquisitions and pursue its growth strategies.

At September 30, 2021, AGC had cash of $57,423 held outside of its trust account. AGC intends to use the funds held outside its trust account as needed primarily to identify and evaluate target businesses, perform business due diligence on prospective target businesses, travel to and from the offices, plants or similar locations of prospective target businesses or their representatives or owners, review corporate documents and material agreements of prospective target businesses, structure, negotiate and complete an initial business combination such as the Business Combination.

229

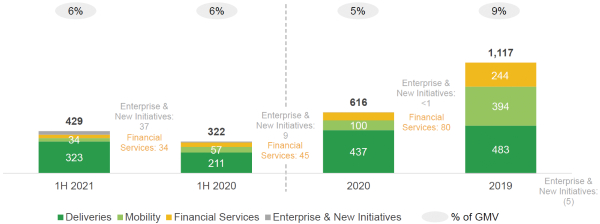

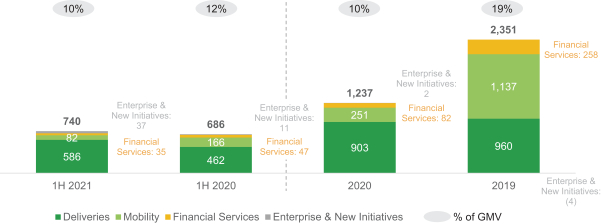

t holiday periods, during which demand for mobility offerings is typically lower. In addition, Grab’s revenue is also impacted by other holidays such as Christmas and celebration of the new year as well as the fasting month of Ramadan, which impacts demand for deliveries and mobility offerings as well as driver-partner supply. Grab’s operating results may also experience seasonal fluctuations due to weather conditions, such as flooding during the rainy season in certain markets, like Indonesia, the Philippines and Vietnam. In addition to seasonality, Grab’s operating results may fluctuate as a result of factors including Grab’s ability to attract and retain new platform users, increased competition in the markets in which Grab operates, its ability to expand Grab’s operations in new and existing markets, its ability to maintain an adequate growth rate and effectively manage that growth, its ability to keep pace with technological changes in the industries in which Grab operates, changes in governmental or other regulations affecting Grab’s business, harm to Grab’s brand or reputation, and other risks described elsewhere in this proxy statement/prospectus. In addition, with the COVID-19 pandemic, Grab has experienced a significant increase in its business revenue and volume as well as accelerated growth in its deliveries segment. Such growth stemming from the effects of the COVID-19 pandemic may not continue in the future, and Grab expects the growth rates to decline in future periods. Furthermore, Grab’s fast paced growth has made, and may in the future make, these fluctuations more pronounced and as a result, harder to predict. As such, Grab may not accurately forecast its operating results.

t holiday periods, during which demand for mobility offerings is typically lower. In addition, Grab’s revenue is also impacted by other holidays such as Christmas and celebration of the new year as well as the fasting month of Ramadan, which impacts demand for deliveries and mobility offerings as well as driver-partner supply. Grab’s operating results may also experience seasonal fluctuations due to weather conditions, such as flooding during the rainy season in certain markets, like Indonesia, the Philippines and Vietnam. In addition to seasonality, Grab’s operating results may fluctuate as a result of factors including Grab’s ability to attract and retain new platform users, increased competition in the markets in which Grab operates, its ability to expand Grab’s operations in new and existing markets, its ability to maintain an adequate growth rate and effectively manage that growth, its ability to keep pace with technological changes in the industries in which Grab operates, changes in governmental or other regulations affecting Grab’s business, harm to Grab’s brand or reputation, and other risks described elsewhere in this proxy statement/prospectus. In addition, with the COVID-19 pandemic, Grab has experienced a significant increase in its business revenue and volume as well as accelerated growth in its deliveries segment. Such growth stemming from the effects of the COVID-19 pandemic may not continue in the future, and Grab expects the growth rates to decline in future periods. Furthermore, Grab’s fast paced growth has made, and may in the future make, these fluctuations more pronounced and as a result, harder to predict. As such, Grab may not accurately forecast its operating results.