related to the PIPE financing and the Amended and Restated Forward Purchase Agreements, (v) the terms of the Shareholders’ Deed, (vi) corporate governance of the combined company, including the Amended GHL Articles and (vii) the scope of the terms of the Grab Shareholder Support Agreements, Sponsor Support Agreement and Registration Rights Agreement and other ancillary documents relating to the Business Combination.

On March 14, 2021, Ropes sent Hughes Hubbard a revised draft of the Business Combination Agreement that proposed revisions to the overall suite of representations, warranties and covenants to be provided by each party under the Business Combination Agreement, including, among others, revisions to the scope of the interim operating covenants of Grab and AGC and the required level of shareholder support for the Business Combination.

Beginning on March 14, 2021, representatives of J.P. Morgan’s Equity Capital Markets Group and Morgan Stanley, as lead placement agents in connection with the PIPE financing, and Evercore and UBS, as co-placement agents in connection with the PIPE financing, began contacting a limited number of prospective PIPE investors, each of whom agreed to maintain the confidentiality of the information received pursuant to customary over-the-wall procedures, to discuss Grab, the proposed Business Combination and the PIPE financing and to determine such investors’ potential interest in participating in the PIPE financing.

Beginning on March 14, 2021, and throughout the week of April 5, 2021, representatives of AGC, J.P. Morgan’s Equity Capital Markets Group, Morgan Stanley, Evercore and UBS participated in various video-conference meetings with prospective PIPE investors.

On March 16, 2021, and March 17, 2021, Ropes and Hughes Hubbard held conference calls to discuss certain issues and other matters related to the March 14, 2021 draft of the Business Combination Agreement.

On March 17, 2021, Skadden and Ropes held a conference call to discuss matters related to the draft of the form of PIPE Subscription Agreement, and on March 19, 2021, Skadden sent a revised draft of the form of PIPE Subscription Agreement to Ropes and Cooley.

On March 19, 2021, Hughes Hubbard sent Ropes a revised draft of the Business Combination Agreement, and on March 22, 2021, Ropes and Hughes Hubbard held a conference call to discuss certain issues and other matters related to the March 19, 2021 draft of the Business Combination Agreement.

On March 23, 2021, Hughes Hubbard, Ropes, Grab and AGC held a conference call to discuss transaction structuring considerations under the Business Combination Agreement.

On March 24, 2021, the AGC Board held a board meeting to discuss, among other things, the status of its proposed business combination with Grab and the key terms and structure of the Business Combination and the related PIPE financing. The board also discussed key investment-case and valuation-related materials and analyses. All board members and representatives of Ropes were present.

On March 26, 2021, Ropes sent Hughes Hubbard a revised draft of the Business Combination Agreement which included proposed revisions, among others, relating to certain changes to the representations and warranties of Grab and AGC and revisions to the scope of the interim operating covenants of Grab and AGC, and Ropes and Hughes Hubbard held a conference call to discuss certain issues and other matters related to the March 26, 2021 draft of the Business Combination Agreement.

On March 29, 2021, Skadden and Ropes held a conference call to discuss comments from Ropes received on the same day on the draft of the form of PIPE Subscription Agreement.

On March 30, 2021, Hughes Hubbard sent Ropes a revised draft of the Business Combination Agreement, and on April 3, 2021, Ropes, Skadden and Hughes Hubbard held a conference call to discuss certain issues and

142

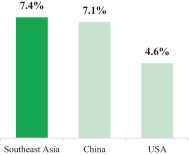

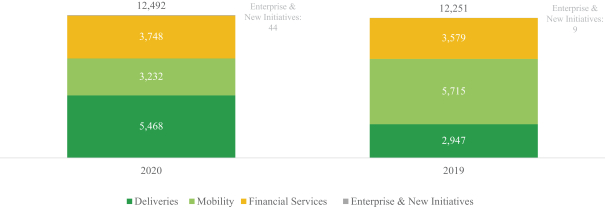

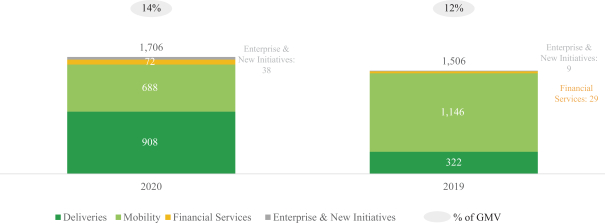

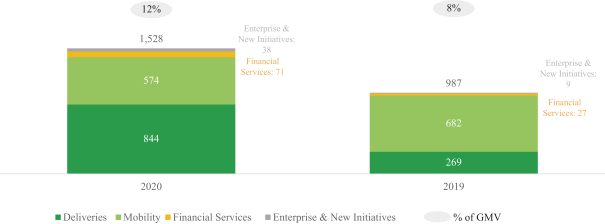

t holiday periods, during which demand for mobility offerings is typically lower. In addition, Grab’s revenue is also impacted by other holidays such as Christmas and celebration of the new year as well as the fasting month of Ramadan, which impacts demand for deliveries and mobility offerings as well as driver-partner supply. Grab’s operating results may also experience seasonal fluctuations due to weather conditions, such as flooding during the rainy season in certain markets, like Indonesia, the Philippines and Vietnam. In addition to seasonality, Grab’s operating results may fluctuate as a result of factors including Grab’s ability to attract and retain new platform users, increased competition in the markets in which Grab operates, its ability to expand Grab’s operations in new and existing markets, its ability to maintain an adequate growth rate and effectively manage that growth, its ability to keep pace with technological changes in the industries in which Grab operates, changes in governmental or other regulations affecting Grab’s business, harm to Grab’s brand or reputation, and other risks described elsewhere in this proxy statement/prospectus. In addition, with the COVID-19 pandemic, Grab has experienced a significant increase in its business revenue and volume as well as accelerated growth in its deliveries segment. Such growth stemming from the effects of the COVID-19 pandemic may not continue in the future, and Grab expects the growth rates to decline in future periods. Furthermore, Grab’s fast paced growth has made, and may in the future make, these fluctuations more pronounced and as a result, harder to predict. As such, Grab may not accurately forecast its operating results.

t holiday periods, during which demand for mobility offerings is typically lower. In addition, Grab’s revenue is also impacted by other holidays such as Christmas and celebration of the new year as well as the fasting month of Ramadan, which impacts demand for deliveries and mobility offerings as well as driver-partner supply. Grab’s operating results may also experience seasonal fluctuations due to weather conditions, such as flooding during the rainy season in certain markets, like Indonesia, the Philippines and Vietnam. In addition to seasonality, Grab’s operating results may fluctuate as a result of factors including Grab’s ability to attract and retain new platform users, increased competition in the markets in which Grab operates, its ability to expand Grab’s operations in new and existing markets, its ability to maintain an adequate growth rate and effectively manage that growth, its ability to keep pace with technological changes in the industries in which Grab operates, changes in governmental or other regulations affecting Grab’s business, harm to Grab’s brand or reputation, and other risks described elsewhere in this proxy statement/prospectus. In addition, with the COVID-19 pandemic, Grab has experienced a significant increase in its business revenue and volume as well as accelerated growth in its deliveries segment. Such growth stemming from the effects of the COVID-19 pandemic may not continue in the future, and Grab expects the growth rates to decline in future periods. Furthermore, Grab’s fast paced growth has made, and may in the future make, these fluctuations more pronounced and as a result, harder to predict. As such, Grab may not accurately forecast its operating results.