UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

Filed by the Registrant ☒

Filed by a party other than the Registrant ☐

Check the appropriate box:

☐ Preliminary Proxy Statement

☐ Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

☒ Definitive Proxy Statement

☐ Definitive Additional Materials

☐ Soliciting Material Pursuant to §240.14a-12

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| ☒ | No fee required. |

| ☐ | Fee paid previously with preliminary materials |

| ☐ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

415 Kearny Street

San Francisco, California 94108

(650) 550-4810

May 2, 2022

Dear Fellow Stockholders:

We are pleased to invite you to attend the annual meeting of stockholders of Blend Labs, Inc., to be held on Tuesday, June 28, 2022 at 1:00 pm, Pacific time. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BLND2022, where you will be able to listen to the meeting live, submit questions and vote online.

The attached formal meeting notice and Proxy Statement contain details of the business to be conducted at the annual meeting.

Your vote is important. Whether or not you attend the annual meeting, it is important that your shares be represented and voted at the annual meeting. Therefore, we urge you to vote and submit your proxy promptly via the Internet, telephone or mail.

On behalf of our board of directors, we would like to express our appreciation for your continued support of and interest in Blend.

Sincerely,

Nima Ghamsari

Head of Blend, Co-Founder, and Chair

BLEND LABS, INC.

415 Kearny Street

San Francisco, California 94108

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| | | | | |

| Time and Date | 1:00 pm, Pacific time, on Tuesday, June 28, 2022 |

| |

| Place | The annual meeting will be conducted virtually via webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BLND2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting. |

| |

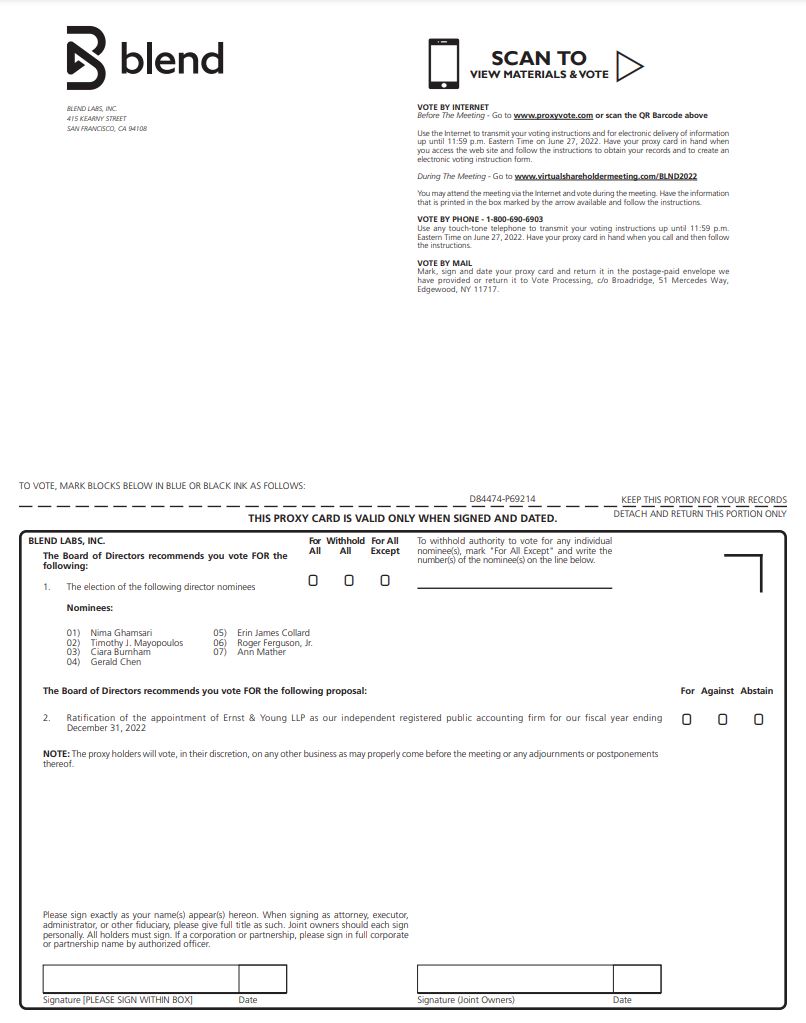

| Items of Business | •To elect seven directors to hold office until our next annual meeting of stockholders and until their respective successors are elected and qualified. •To ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. •To transact other business that may properly come before the annual meeting or any adjournments or postponements thereof. |

| |

| Record Date | April 29, 2022 Only stockholders of record as of the close of business on April 29, 2022 are entitled to notice of and to vote at the annual meeting. A list of stockholders eligible to vote at the annual meeting will be available for review during our regular business hours at our principal executive offices for the ten days prior to the meeting for any purpose related to the meeting, and will be available online during the entirety of the annual meeting. |

| |

| Availability of Proxy Materials | The Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement, notice of annual meeting, form of proxy and our annual report, is first being sent or given on or about May 2, 2022 to all stockholders entitled to vote at the annual meeting. The proxy materials and our annual report can be accessed as of May 2, 2022 by visiting www.proxyvote.com. You will be asked to enter the 16-digit control number located on your proxy card. |

| |

| Voting | Your vote is important. Whether or not you plan to attend the annual meeting, we urge you to submit your proxy or voting instructions via the Internet, telephone or mail as soon as possible. |

By order of the board of directors,

Nima Ghamsari

Head of Blend, Co-Founder, and Chair

San Francisco, California

May 2, 2022

TABLE OF CONTENTS

BLEND LABS, INC.

PROXY STATEMENT

FOR 2022 ANNUAL MEETING OF STOCKHOLDERS

To be held at 1:00 pm, Pacific time, on Tuesday, June 28, 2022

The information provided in the “question and answer” format below is for your convenience only and is merely a summary of the information contained in this Proxy Statement. You should read this entire Proxy Statement carefully.

QUESTIONS AND ANSWERS ABOUT THE PROXY MATERIALS AND OUR ANNUAL MEETING

Why am I receiving these materials?

This Proxy Statement and the form of proxy are furnished in connection with the solicitation of proxies by our board of directors for use at the 2022 annual meeting of stockholders of Blend Labs, Inc., a Delaware corporation, and any postponements, adjournments or continuations thereof. The annual meeting will be held on Tuesday, June 28, 2022 at 1:00 pm, Pacific time. The annual meeting will be conducted virtually via webcast. You will be able to attend the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BLND2022, where you will be able to listen to the meeting live, submit questions and vote online during the meeting.

The Notice of Internet Availability of Proxy Materials, (“Notice of Internet Availability”), containing instructions on how to access this Proxy Statement, the accompanying notice of annual meeting and form of proxy, and our annual report, is first being sent or given on or about May 2, 2022 to all stockholders of record as of April 29, 2022. The proxy materials and our annual report can be accessed on May 2, 2022 by visiting www.virtualshareholdermeeting.com/BLND2022. If you receive a Notice of Internet Availability, then you will not receive a printed copy of the proxy materials or our annual report in the mail unless you specifically request these materials. Instructions for requesting a printed copy of the proxy materials and our annual report are set forth in the Notice of Internet Availability.

What proposals will be voted on at the annual meeting?

The following proposals will be voted on at the annual meeting:

•the election of seven directors to hold office until our next annual meeting of stockholders and until their respective successors are elected and qualified;

•the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022; and

•any other business as may properly come before the Annual Meeting.

As of the date of this Proxy Statement, our management and board of directors were not aware of any other matters to be presented at the annual meeting.

How does the board of directors recommend that I vote on these proposals?

Our board of directors recommends that you vote your shares:

•“FOR” the election of each director nominee named in this Proxy Statement; and

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

Who is entitled to vote at the annual meeting?

You can vote at the annual meeting if you were a holder of our common stock as of the close of business on April 29, 2022, the “record date.” Each share of Class A common stock is entitled to one vote per share. Each share of Class B common stock is entitled to forty votes per share and is convertible at any time, at the option of the holder thereof, into one share of Class A common stock. As of the close of business on April 29, 2022, there were 219,963,139 shares of our Class A common stock outstanding and 12,633,331 shares of our Class B common stock outstanding. Our Class A common stock and Class B

common stock will vote as a single class on all matters described in this Proxy Statement for which your vote is being solicited. Stockholders are not permitted to cumulate votes with respect to the election of directors.

Stockholders of Record. If your shares are registered directly in your name with our transfer agent, Computershare Trust Company, N.A., then you are considered the stockholder of record with respect to those shares, and the Notice of Internet Availability was sent directly to you by us. As a stockholder of record, you have the right to grant your voting proxy directly to the individuals listed on the proxy card or to vote on your own behalf at the annual meeting. Throughout this Proxy Statement, we refer to these holders as “stockholders of record.”

Street Name Stockholders. If your shares are held in a brokerage account or by a broker, bank, or other nominee, then you are considered the beneficial owner of shares held in street name, and the Notice of Internet Availability was forwarded to you by your broker, bank, or other nominee, which is considered the stockholder of record with respect to those shares. As a beneficial owner, you have the right to direct your broker, bank, or other nominee on how to vote the shares held in your account by following the instructions that your broker, bank, or other nominee sent to you. As a beneficial owner, you are also invited to attend the annual meeting. However, because you are not the stockholder of record, you may not vote these shares at the annual meeting unless you obtain a signed legal proxy from your broker, bank, or other nominee giving you the right to vote the shares. Throughout this Proxy Statement, we refer to these holders as “street name stockholders.”

How many votes are needed for approval of each proposal?

•Proposal No. 1: Each director is elected by a plurality of the voting power of the shares present in person (including virtually) or represented by proxy at the annual meeting and entitled to vote on the election of directors. A plurality means that the nominees with the largest number of FOR votes are elected as directors. You may (1) vote FOR the election of each of the director nominees named herein or (2) WITHHOLD authority to vote for each such director nominee. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

•Proposal No. 2: The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present in person (including virtually) or represented by proxy at the annual meeting and entitled to vote thereon. You may vote FOR or AGAINST this proposal, or you may indicate that you wish to ABSTAIN from voting on this proposal. Abstentions will be counted for purposes of determining the presence or absence of a quorum and will also count as votes against this proposal, i.e., will have the same effect as a vote AGAINST this proposal. Because this is a routine proposal, we do not expect any broker non-votes on this proposal.

What is the quorum requirement for the annual meeting?

A quorum is the minimum number of shares required to be present or represented at the annual meeting for the meeting to be properly held under our amended and restated bylaws and Delaware law. The presence, in person (including virtually) or by proxy, of a majority of the voting power of our capital stock issued and outstanding and entitled to vote as of the record date will constitute a quorum to transact business at the annual meeting. Abstentions, choosing to withhold authority to vote and broker non-votes are counted as present and entitled to vote for purposes of determining a quorum. If there is no quorum, the chairperson of the meeting may adjourn the meeting to another time or place.

How do I vote and what are the voting deadlines?

Stockholder of Record. If you are a stockholder of record, you may vote in one of the following ways:

•by Internet at www.proxyvote.com, 24 hours a day, 7 days a week, until 11:59 pm, Eastern time, on June 27, 2022 (have your Notice of Internet Availability or proxy card in hand when you visit the website);

•by toll-free telephone at 1-800-690-6903, 24 hours a day, 7 days a week, until 11:59 pm, Eastern time, on June 27, 2022 (have your Notice of Internet Availability or proxy card in hand when you call);

•by completing, signing and mailing your proxy card (if you received printed proxy materials), which must be received prior to the annual meeting; or

•by attending the annual meeting virtually by visiting www.virtualshareholdermeeting.com/BLND2022, where you may vote during the meeting (have your Notice of Internet Availability or proxy card in hand when you visit the website).

Street Name Stockholders. If you are a street name stockholder, then you will receive voting instructions from your broker, bank, or other nominee. You must follow the instructions provided by your broker, bank, or other nominee in order to instruct them on how to vote your shares. The availability of Internet and telephone voting options will depend on the voting process of your broker, bank, or other nominee. As discussed above, if you are a street name stockholder, then you may not vote your shares at the annual meeting unless you obtain a legal proxy from your broker, bank, or other nominee.

What if I do not specify how my shares are to be voted or fail to provide timely directions to my broker, bank or other nominee?

Stockholder of Record. If you are a stockholder of record and you submit a proxy, but you do not provide voting instructions, your shares will be voted:

•“FOR” the election of each director nominee named in this Proxy Statement; and

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022.

In addition, if any other matters are properly brought before the annual meeting, the persons named as proxies will be authorized to vote or otherwise act on those matters in accordance with their judgment.

Street Name Stockholders. Brokers, banks and other nominees holding shares of common stock in street name for customers are generally required to vote such shares in the manner directed by their customers. In the absence of timely directions, your broker, bank or other nominee will have discretion to vote your shares on our sole routine matter: the proposal to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Because that proposal is routine, we do not expect any broker non-votes regarding it. Your broker, bank or other nominee will not have discretion to vote on any other proposals, which are considered non-routine matters, absent direction from you. In the event that your broker, bank or other nominee votes your shares on our sole routine matter, but is not able to vote your shares on the non-routine matters, then those shares will be treated as broker non-votes with respect to the non-routine proposals. Accordingly, if you own shares through a nominee, such as a broker or bank, please be sure to instruct your nominee how to vote to ensure that your shares are counted on each of the proposals.

Can I change my vote or revoke my proxy?

Stockholder of Record. If you are a stockholder of record, you can change your vote or revoke your proxy before the annual meeting by:

•entering a new vote by Internet or telephone (subject to the applicable deadlines for each method as set forth above);

•completing and returning a later-dated proxy card, which must be received prior to the annual meeting;

•delivering a written notice of revocation to our corporate secretary at Blend Labs, Inc., 415 Kearny Street, San Francisco, California 94108, Attention: Corporate Secretary, which must be received prior to the annual meeting; or

•attending and voting at the annual meeting (although attendance at the annual meeting will not, by itself, revoke a proxy).

Street Name Stockholders. If you are a street name stockholder, then your broker, bank or other nominee can provide you with instructions on how to change or revoke your proxy.

What do I need to do to attend the annual meeting?

We will be hosting the annual meeting via webcast only. You will be able to attend the annual meeting virtually, submit your questions during the meeting and vote your shares electronically during the meeting by visiting www.virtualshareholdermeeting.com/BLND2022. To attend and participate in the annual meeting, you will need the control number included on your Notice of Internet Availability or proxy card. The annual meeting live audio webcast will begin promptly at 1:00 pm, Pacific time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 12:45 pm, Pacific time, and you should allow ample time for the check-in procedures.

How can I get help if I have trouble checking in or listening to the annual meeting online?

If you encounter difficulties accessing the virtual meeting during the check-in or meeting time, please call the technical support number that will be posted on the virtual meeting log-in page.

What is the effect of giving a proxy?

Proxies are solicited by and on behalf of our board of directors. Nima Ghamsari, our Head of Blend, Co-Founder, and Chair, Timothy J. Mayopoulos, our President and Director, Marc Greenberg, our Head of Finance and Facilities and Treasurer and Crystal Sumner, our Head of Legal, Compliance, and Risk and Corporate Secretary have been designated as proxy holders for the annual meeting by our board of directors. When proxies are properly dated, executed and returned, the shares represented by such proxies will be voted at the annual meeting in accordance with the instructions of the stockholder. If a proxy is dated, executed, and returned, but no specific instructions are given, however, the shares will be voted in accordance with the recommendations of our board of directors on the proposals as described above. If any other matters are properly brought before the annual meeting, then the proxy holders will use their own judgment to determine how to vote your shares with respect to which they hold a proxy. If you have granted a proxy and the annual meeting is postponed or adjourned, then the proxy holders can vote your shares on the new meeting date, unless you have properly revoked your proxy, as described above.

Who will count the votes?

A representative of Broadridge Financial Solutions will tabulate the votes and act as inspector of election.

How can I contact Blend’s transfer agent?

You may contact our transfer agent, Computershare Trust Company, N.A., by telephone at (800) 736-3001, or by writing Computershare Trust Company, N.A., at P.O. Box 505000, Louisville, KY, 40233-5000. You may also access instructions with respect to certain stockholder matters (e.g., change of address) via the Internet at www.computershare.com/investor.

How are proxies solicited for the annual meeting and who is paying for such solicitation?

Our board of directors is soliciting proxies for use at the annual meeting by means of the proxy materials. We will bear the entire cost of proxy solicitation, including the preparation, assembly, printing, mailing and distribution of the proxy materials. Copies of solicitation materials will also be made available upon request to brokers, banks and other nominees to forward to the beneficial owners of the shares held of record by such brokers, banks or other nominees. The original solicitation of proxies may be supplemented by solicitation by telephone, electronic communications or other means by our directors, officers or employees. No additional compensation will be paid to these individuals for any such services, although we may reimburse such individuals for their reasonable out-of-pocket expenses in connection with such solicitation.

Where can I find the voting results of the annual meeting?

We anticipate announcing preliminary voting results at the annual meeting. We will also disclose voting results on a Current Report on Form 8-K (a “Form 8-K”) that we will file with the U.S. Securities and Exchange Commission (the “SEC”) within four business days after the meeting. If final voting results are not available to us in time to timely file a Form 8-K, we will file a Form 8-K to publish preliminary results and will provide the final results in an amendment to the Form 8-K as soon as they become available.

Why did I receive a Notice of Internet Availability instead of a full set of proxy materials?

In accordance with the rules of the SEC we have elected to furnish our proxy materials, including this Proxy Statement and our annual report, primarily via the Internet. As a result, we are mailing to our stockholders a Notice of Internet Availability instead of a paper copy of the proxy materials. The Notice of Internet Availability contains instructions on how to access our proxy materials on the Internet, how to vote on the proposals, how to request printed copies of the proxy materials and our annual report, and how to request to receive all future proxy materials in printed form by mail or electronically by e-mail. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce our costs and the environmental impact of our annual meetings.

What does it mean if I receive more than one Notice of Internet Availability or more than one set of printed proxy materials?

If you receive more than one Notice of Internet Availability or more than one set of printed proxy materials, then your shares may be registered in more than one name and/or are registered in different accounts. Please follow the voting instructions on each Notice of Internet Availability or each set of printed proxy materials, as applicable, to ensure that all of your shares are voted.

I share an address with another stockholder, and we received only one copy of the Notice of Internet Availability or Proxy Statement and annual report. How may I obtain an additional copy of the Notice of Internet Availability or Proxy Statement and annual report?

We have adopted a procedure approved by the SEC called “householding,” under which we can deliver a single copy of the Notice of Internet Availability and, if applicable, the Proxy Statement and annual report, to multiple stockholders who share the same address unless we receive contrary instructions from one or more stockholders. This procedure reduces our printing and mailing costs. Stockholders who participate in householding will continue to be able to access and receive separate proxy cards. Upon written or oral request, we will deliver promptly a separate copy of the Notice of Internet Availability and, if applicable, the Proxy Statement and annual report, to any stockholder at a shared address to which we delivered a single copy of these documents. To receive a separate copy, or, if you are receiving multiple copies, to request that we only send a single copy of next year’s Notice of Internet Availability or Proxy Statement and annual report, as applicable, you may contact us as follows:

Blend Labs, Inc.

Attention: Investor Relations

415 Kearny Street

San Francisco, California 94108

Tel: (650) 550-4810

Street name stockholders may contact their broker, bank or other nominee to request information about householding.

BOARD OF DIRECTORS AND CORPORATE GOVERNANCE

Composition of the Board

Our board of directors currently consists of seven directors, four of whom are independent under the listing standards of the New York Stock Exchange (the “NYSE”). At each annual meeting of stockholders, directors will be elected for a one-year term and until their successors are duly elected and qualified.

The following table sets forth the names, ages as of March 31, 2022, and certain other information for each of our director nominees:

| | | | | | | | | | | |

| Name | Age | Position(s) | Director Since |

| Nima Ghamsari | 36 | Head of Blend, Co-Founder, and Chair | 2012 |

| Timothy J. Mayopoulos | 63 | President and Director | 2019 |

| Ciara Burnham(1)(2) | 55 | Director | 2021 |

| Gerald Chen(1)(2)(3) | 47 | Director | 2017 |

| Erin James Collard(2)(3) | 42 | Director | 2015 |

| Roger Ferguson, Jr.(1)(3) | 70 | Director | 2021 |

| Ann Mather(1) | 62 | Director | 2019 |

(1) Member of Audit Committee

(2) Member of Compensation Committee

(3) Member of Nominating and Corporate Governance Committee

Nominees for Director

Nima Ghamsari. Mr. Ghamsari is one of our co-founders and has served as Head of Blend and a member of our board of directors since May 2012. He previously worked at Palantir Technologies, a software company. Mr. Ghamsari holds a B.S. in Computer Science from Stanford University.

Mr. Ghamsari was selected to serve on our board of directors because of the perspective and experience he brings as Head of Blend and one of our co-founders. Mr. Ghamsari also has extensive experience in financial services and the banking industry, as well as expertise in technology, and sales and marketing.

Timothy J. Mayopoulos. Mr. Mayopoulos has served as our President since January 2019 and as a member of our board of directors since April 2019. Prior to joining us, Mr. Mayopoulos served as the President and Chief Executive Officer of Fannie Mae, a government-sponsored enterprise, from June 2012 to October 2018, having previously served in various other roles, including as its Executive Vice President, Chief Administrative Officer, General Counsel, and Corporate Secretary from April 2009 to June 2012. Mr. Mayopoulos also previously held senior roles at various financial institutions, including Bank of America, Deutsche Bank, Credit Suisse First Boston, and Donaldson, Lufkin & Jenrette. Mr. Mayopoulos has served on the board of directors of Science Applications International Corporation, a technology integrator, since January 2015 and LendingClub Corporation, a digital marketplace bank, since August 2016. Mr. Mayopoulos holds an A.B. in English from Cornell University and a J.D. from the New York University School of Law.

Mr. Mayopoulos was selected to serve on our board of directors because of his financial expertise and experience in financial services and the banking industry, including from serving as an executive and director at public companies, as well as his expertise in M&A, investments and integration. Mr. Mayopolous also has experience in sales and marketing, and regulatory, governmental and legal matters.

Ciara Burnham. Ms. Burnham has served as a member of the board of directors of AppHarvest, a sustainable food company, since April 2021. Ms. Burnham previously served as an advisor to Athena Technology Acquisition Corp., a special purpose acquisition company, from March 2021 through December 2021. Ms. Burnham previously served as a senior advisor, partner and member of the management committee of QED Investors, a venture capital firm, from January 2019 to December 2020, and in various positions at Evercore, an investment banking company, from 1997 to January 2019, including as Senior Managing Director and Chief Executive Officer of Evercore Trust Company, N.A. Ms. Burnham received an A.B. from Princeton University and an M.B.A from the Columbia Business School.

Ms. Burnham was selected to serve on our board of directors because of her financial, banking, and technology expertise and experience serving on boards of public companies, as well as her M&A, investments and integration expertise.

Gerald Chen. Mr. Chen has served as a member of our board of directors since July 2017. He has been a General Partner at Greylock Partners, a venture capital firm, since June 2013. Mr. Chen has served as a member of the board of directors of Truera, a startup developing a machine learning model intelligence platform, since April 2019 and Chronosphere, a cloud native monitoring tool, since July 2019, and also serves on the board of directors of several other private companies. Mr. Chen holds a B.S. in Industrial Engineering from Stanford University and an M.B.A. from Harvard Business School.

Mr. Chen was selected to serve on our board of directors because of his extensive experience with technology companies and in the venture capital industry, including with respect to M&A, investments and integration.

Erin James Collard. Mr. Collard is one of our co-founders and has served as a member of our board of directors since August 2015. Previously, Mr. Collard served as our Chief Financial Officer from January 2013 to September 2018. He has over a decade of financial and technology experience, having served as both head trader and managing director at Clarium Capital Management LLC, an investment management and hedge fund company. Mr. Collard holds a B.A. in Economics from the University of Sheffield and an M.Sc. in Economics from the University of Warwick.

Mr. Collard was selected to serve on our board of directors because of the perspective and experience he brings as one of our co-founders. Mr. Collard also has extensive experience in financial services and the banking industry, as well as M&A, investments and integration expertise.

Roger Ferguson, Jr. Mr. Ferguson, Jr. has served as a member of our board of directors since March 2021. Mr. Ferguson, Jr. served as the President and Chief Executive Officer of TIAA, a major financial services company, from April 2008 to April 2021. Mr. Ferguson, Jr. previously served as Chairman of America Holding Corporation, Head of Financial Services, and a member of the Executive Committee of Swiss Re, a global reinsurance company, from 2006 to 2008. Prior to that, Mr. Ferguson, Jr. joined the Board of Governors of the U.S. Federal Reserve System in 1997 and served as its Vice Chairman from 1999 to 2006, and he also served as an associate and partner at McKinsey & Company from 1984 to 1997. Mr. Ferguson, Jr. has served as a member of the board of directors of Alphabet Inc. since June 2016, as a member of the board of directors of General Mills, Inc., a manufacturer and marketer of branded consumer foods, from December 2015 to September 2021, where he serves as a member of the finance committee and as chair of the corporate governance committee, as a member of the board of directors of International Flavors & Fragrances, Inc., a creator of flavors and fragrances, since April 2010, where he serves as chair of the compensation committee, and as a member of the board of directors of Corning Incorporated, a manufacturing company. Mr. Ferguson, Jr. serves on the boards of the Institute for Advanced Study, the Memorial Sloan Kettering Cancer Center, and the Conference Board. He is a fellow of the American Philosophical Society and the Academy of Arts & Sciences and is a member of the Smithsonian Institution’s Board of Regents, the Economic Club of New York, the Council on Foreign Relations, and the Group of Thirty. Mr. Ferguson, Jr. holds a B.A in Economics, a J.D., and a Ph.D. in Economics from Harvard University.

Mr. Ferguson, Jr. was selected to serve on our board of directors because of his financial expertise and extensive experience in financial services and the banking industry, including serving as an executive and director at public companies, as well as his expertise in M&A, investments and integration. Mr. Ferguson, Jr. also has experience in regulatory, governmental and legal matters.

Ann Mather. Ms. Mather has served on our board of directors since June 2019. Ms. Mather served as Executive Vice President and Chief Financial Officer of Pixar Animation Studios from September 1999 to April 2004. Ms. Mather has served as a member of the board of directors of Alphabet Inc., a global technology company, since November 2005, Netflix, Inc., a streaming media company, since June 2010, Arista Networks, Inc., a computer networking company, since July 2013, and Bumble Inc., an online dating app, since March 2020. Ms. Mather has also served as an independent trustee to the Dodge & Cox Funds board of trustees since 2011 and previously served as a member of the board of directors of Airbnb, Inc., a vacation rental online marketplace company, from August 2018 to December 2021, Shutterfly, Inc., an internet-based image publishing company, from May 2013 to September 2019, and Glu Mobile, Inc., a publisher of mobile games, from September 2005 to February 2021. Ms. Mather holds a Master of Arts from the University of Cambridge, and is an honorary fellow of Sidney Sussex College, Cambridge and a chartered accountant.

Ms. Mather was selected to serve on our board of directors because of her background serving as a finance executive at a number of technology companies and her experience serving as a director of various private and public companies. Ms. Mather also has expertise in risk and cybersecurity matters.

The table below summarizes the key qualifications, skills, and attributes most relevant to the decision to nominate candidates to serve on the Board. A mark indicates a specific area of focus or expertise on which the Board particularly relies. Not

having a mark does not mean the director nominee does not possess that qualification or skill. Our director nominees’ biographies describe each director’s background and relevant experience in more detail.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director Nominee Qualifications |

| Director | Blend Executive / Founder | Senior Public Company Executive | Public Company Board Expertise | Financial / Banking Expertise | Technology Expertise | Risk / Cyber Expertise | Sales / Marketing Expertise | Regulatory / Government / Legal Expertise | M&A / Investments / Integration Expertise |

| Ciara Burnham | | | ✔ | ✔ | ✔ | | | | ✔ |

Gerald

Chen | | | | | ✔ | | | | ✔ |

| Erin James Collard | ✔ | | | ✔ | ✔ | | ✔ | | ✔ |

| Roger Ferguson, Jr. | | ✔ | ✔ | ✔ | | | | ✔ | ✔ |

| Nima Ghamsari | ✔ | | | ✔ | ✔ | | ✔ | | |

Ann

Mather | | ✔ | ✔ | | ✔ | ✔ | | | |

| Timothy J. Mayopoulos | ✔ | ✔ | ✔ | ✔ | | ✔ | ✔ | ✔ | ✔ |

Controlled Company

Nima Ghamsari, Head of Blend, Co-Founder, and Chair controls a majority of the voting power represented by our capital stock. As a result, we are a “controlled company” within the meaning of the corporate governance rules of the NYSE. Under these corporate governance rules, a company of which more than 50% of the voting power for the election of directors is held by an individual, a group or another company is a “controlled company” and may elect not to comply with certain corporate governance requirements. We have elected not to rely on certain of the foregoing exemptions provided to controlled companies. Although we will qualify as a “controlled company” following the completion of this offering, we do not currently expect to rely on these exemptions and intend to fully comply with all corporate governance requirements under the listing standards of the NYSE. However, if we were to utilize some or all of these exemptions, we would not comply with certain of the corporate governance standards of the New York Stock Exchange. Accordingly, stockholders would not have the same protections afforded to stockholders of companies that are subject to all of the corporate governance standards of the NYSE.

Director Independence

Our Class A common stock is listed on the NYSE. As a newly-public company, we are permitted under SEC and NYSE rules, to phase in the required number of independent directors on our Audit, Compensation, and Nominating and Corporate Governance Committees. The phase-in period requires that we have one independent director on each such committee at the time of listing on the NYSE, a majority of independent directors on each such committee within 90 days of listing and fully independent committees within 12 months of listing. The phase-in period also requires that we have a majority independent board of directors within 12 months of listing. We have notified the NYSE that we are in full compliance with the NYSE’s corporate governance listing standards as applicable to us on the 90th day after its listing. We intend to be in full compliance with the NYSE listing rules within 12 months of listing.

Under NYSE listing rules, a director will only qualify as an independent director if that listed company’s board of directors affirmatively determines that the director has no material relationship with such listed company (either directly or as a partner, stockholder or officer of an organization that has a relationship with such listed company). In addition, the NYSE listing rules require that, subject to specified exceptions, each member of our Audit, Compensation, and Nominating and Corporate Governance Committees be independent.

Audit Committee members must also satisfy the additional independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934, as amended, (the “Exchange Act”), and NYSE listing rules applicable to audit committee members. Compensation Committee members must also satisfy the additional independence criteria set forth in Rule 10C-1 under the Exchange Act and NYSE listing rules applicable to compensation committee members.

Our board of directors has undertaken a review of the independence of each of our directors. Based on information provided by each director concerning his or her background, employment and affiliations, our board of directors has determined that Messrs. Chen and Ferguson, Jr. and Mses. Burnham and Mather, representing four of our seven directors, do not have any material relationship with us (either directly or as a partner, stockholder or officer of an organization that has a relationship with us) and that each of these directors is an “independent director” as defined under the listing standards of the NYSE. Nima Ghamsari is not considered an independent director because of such person’s position as our Head of Blend and Co-Founder. Timothy J. Mayopoulos is not considered an independent director because of such person’s position as our President. Erin James Collard is not considered an independent director because of his previous employment with us.

In making these determinations, our board of directors considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances that our board of directors deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Related Party Transactions.”

There are no family relationships among any of our director nominees or executive officers.

Leadership Structure of our Board of Directors

As one of our founders, Nima Ghamsari has extensive knowledge of all aspects of our business, industry and customers, and is best positioned to identify strategic priorities, lead critical discussions and execute our business plans. We believe that Nima Ghamsari’s combined role enables strong leadership, creates clear accountability and enhances our ability to communicate our message and strategy clearly and consistently to our stockholders. Moreover, we believe that the combined role is both counterbalanced and enhanced with effective oversight by our independent directors and strong independent board committee system. We do not currently have a lead independent director. As a result of our board of directors’ committee system and majority of independent directors, our board of directors maintains effective oversight of our business operations, including independent oversight of our financial statements, executive compensation, selection of director candidates and corporate governance programs. Accordingly, we believe that our current leadership structure is appropriate and enhances the board of directors’ ability to effectively carry out its roles and responsibilities on behalf of our stockholders.

Role of Board of Directors in Risk Oversight Process

Risk is inherent with every business, and we face a number of risks, including strategic, financial, business and operational, legal and compliance and reputational. We have designed and implemented processes to manage risk in our operations. Management is responsible for the day-to-day management of risks the company faces, while our board of directors, as a whole and assisted by its committees, has responsibility for the oversight of risk management. Our board of directors reviews strategic and operational risk in the context of discussions, question and answer sessions, and reports from the management team at each regular board of directors meeting, receives reports on all significant committee activities at each regular board of directors meeting, and evaluates the risks inherent in significant transactions.

In addition, our board of directors has tasked designated standing committees with oversight of certain categories of risk management. Our Audit Committee assists our board of directors in fulfilling its oversight responsibilities with respect to risk management in the areas of internal control over financial reporting and disclosure controls and procedures, legal and regulatory compliance, and also, among other things, discusses with management and the independent auditor guidelines and policies with respect to risk assessment and risk management. Our Compensation Committee assesses risks relating to our executive compensation plans and arrangements, and whether our compensation policies and programs have the potential to encourage excessive risk taking. Our Nominating and Corporate Governance Committee assesses risks relating to our corporate governance practices, the independence of the board of directors and potential conflicts of interest.

Our board of directors believes its current leadership structure supports the risk oversight function of the board of directors.

Committees of our Board of Directors

Our board of directors has established the following standing committees of the board of directors: Audit Committee; Compensation Committee; and Nominating and Corporate Governance Committee. The composition and responsibilities of each of the committees of our board of directors is described below.

Audit Committee

The current members of our Audit Committee are Mses. Burnham and Mather and Messrs. Chen and Ferguson, Jr. Ms. Mather is the chairperson of our Audit Committee. Our board of directors has determined that each member of our Audit Committee meets the requirements for independence of audit committee members under the rules and regulations of the SEC and the listing standards of the NYSE, and also meets the financial literacy requirements of the listing standards of the NYSE. Our board of directors has determined that each of Ms. Mather is an Audit Committee Financial Expert within the meaning of Item 407(d) of Regulation S-K. Our Audit Committee is responsible for, among other things:

•selecting a qualified firm to serve as the independent registered public accounting firm to audit our financial statements;

•helping to ensure the independence and performance of the independent registered public accounting firm;

•reviewing and discussing the scope and results of the audit with the independent registered public accounting firm, and reviewing, with management and the independent registered public accounting firm, our interim and year-end results of operations;

•reviewing our financial statements and our critical accounting policies and estimates;

•overseeing and monitoring the integrity of our financial statements, accounting and financial reporting processes, and internal controls;

•overseeing the design, implementation, and performance of our internal audit function;

•overseeing our compliance with applicable legal and regulatory requirements;

•overseeing our technology security and data privacy programs;

•developing procedures for employees to submit concerns anonymously about questionable accounting or audit matters;

•overseeing our policies on risk assessment and risk management;

•overseeing compliance with our code of conduct;

•reviewing related party transactions; and

•approving or, as required, pre-approving, all audit and all permissible non-audit services to be performed by the independent registered public accounting firm.

Our Audit Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter of our Audit Committee is available on our website at investor.blend.com. During 2021, our Audit Committee held four meetings.

Compensation Committee

The current members of our Compensation Committee are Ms. Burnham and Messrs. Chen and Collard. Mr. Chen is the chairperson of our Compensation Committee. Our board of directors has determined that Mr. Chen and Ms. Burnham meet the requirements for independence for compensation committee members under the rules and regulations of the SEC and the listing standards of the NYSE. We are currently relying on the phase-in provisions of the listing standards of the NYSE. Mr. Chen and Ms. Burnham are each non-employee directors, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act. Our Compensation Committee is responsible for, among other things:

•reviewing, approving and determining, or making recommendations to our board of directors regarding, the compensation of our executive officers, including our principal executive officer;

•administering our equity compensation plans;

•reviewing, approving, and administering incentive compensation plans;

•establishing and reviewing general policies and plans relating to compensation and benefits of our employees and being responsible for our overall compensation philosophy;

•evaluating and making recommendations regarding non-employee director compensation to our full board of directors;

•assisting in the evaluation of the performance of our executive officers, including our principal executive officer; and

•periodically reviewing and discussing with our board of directors the corporate succession plans for executive officers.

The Compensation Committee has also established a sub-committee of the Compensation Committee (the “Section 16 Subcommittee”) consisting solely of independent directors and has delegated the nonexclusive authority to grant awards to any individuals eligible to receive awards under any of our former, current, and future incentive and equity-based plans in order to ensure compliance with Section 16 of the Exchange Act.

Our Compensation Committee operates under a written charter that satisfies the applicable rules and regulations of the SEC and the listing standards of the NYSE. A copy of the charter of our Compensation Committee is available on our website at investor.blend.com. During 2021, our Compensation Committee held two meetings.

Nominating and Corporate Governance Committee

The current members of our Nominating and Corporate Governance Committee are Messrs. Collard, Chen and Ferguson Jr. Mr. Collard is the chairperson of our Nominating and Corporate Governance Committee. Our board of directors has determined Mr. Chen and Mr. Ferguson Jr. meet the requirements for independence for nominating and corporate governance committee members under the listing standards of the NYSE. We are currently relying on the phase-in provisions of the listing standards of the NYSE. Our Nominating and Corporate Governance Committee is responsible for, among other things:

•identifying, evaluating, and selecting, or making recommendations to our board of directors regarding, nominees for election to our board of directors;

•considering and making recommendations to our board of directors regarding the composition of our board of directors and its committees;

•evaluating the performance of our board of directors and of individual directors;

•overseeing and reviewing developments in corporate governance practices;

•evaluating the adequacy of our corporate governance practices and reporting; and

•developing and making recommendations to our board of directors regarding corporate governance guidelines and matters.

Our Nominating and Corporate Governance Committee operates under a written charter that satisfies the applicable listing standards of the NYSE. A copy of the charter of our Nominating and Corporate Governance Committee is available on our website at investor.blend.com. During 2021, our Nominating and Corporate Governance Committee held two meetings.

Attendance at Board and Stockholder Meetings

During 2021, our board of directors held 15 meetings (including regularly scheduled and special meetings), and each director attended at least 75% of the aggregate of (1) the total number of meetings of the board of directors held during the period for which he or she has been a director and (2) the total number of meetings held by all committees on which he or she served during the periods that he or she served.

Although we do not have a formal policy regarding attendance by members of our board of directors at the annual meetings of stockholders, we encourage, but do not require, directors to attend. This annual meeting will be our first annual meeting of our stockholders as a public company.

Executive Sessions of Non-Employee Directors

To encourage and enhance communication among non-employee directors, and as required under applicable NYSE rules, our corporate governance guidelines provide that the non-employee directors will meet in executive sessions without management directors or management present on a periodic basis, but no less than twice per year. In addition, if any of our non-employee directors are not independent directors, then our independent directors will also meet in executive sessions on a periodic basis, but no less than twice per year.

Hedging and Stock Trading Policies

We have established an Insider Trading Policy, which, among other things, prohibits short sales, engaging in transactions in publicly-traded options (such as puts and calls) and other derivative securities relating to our common stock. This prohibition extends to any hedging or similar transaction designed to decrease the risks associated with holding our securities.

Pledging Policy

Our Insider Trading Policy prohibits the holding of our common stock in margin accounts. In addition, we have established guidelines on the pledging of our common stock as collateral for loans, which provide that any director, “executive officer” or “Section 16 officer” (under the applicable SEC rules), or any member of the Blend Leadership Team, wishing to enter into any pledge of the Company’s stock must first submit the proposed pledging arrangements to the Audit Committee for review and pre-approval.

Compensation Committee Interlocks and Insider Participation

None of our executive officers currently serves, or in the past fiscal year has served, as a member of the board of directors or Compensation Committee (or other board of directors committee performing equivalent functions) of any entity that has one or more executive officers serving on our board of directors or Compensation Committee.

Considerations in Evaluating Director Nominees

Our Nominating and Corporate Governance Committee uses a variety of methods for identifying and evaluating potential director nominees. In its evaluation of director candidates, including the current directors eligible for re-election, our Nominating and Corporate Governance Committee will consider the current size and composition of our board of directors and the needs of our board of directors and the respective committees of our board of directors and other director qualifications. Our board of directors has established minimum qualifications for board of directors members, including, the highest personal and professional ethics and integrity, proven achievement and competence in the nominee’s field and the ability to exercise sound business judgment, skills that are complementary to those of the existing board of directors, the ability to assist and support management and make significant contributions to our success, and an understanding of the fiduciary responsibilities that are required of a member of the board of directors and the commitment of time and energy necessary to diligently carry out those responsibilities. Additionally, the Nominating and Corporate Governance Committee considers the current size and composition of the board of directors and the background, independence, area of expertise, length of service, potential conflicts of interest, other commitments and the like, including as required by applicable laws, rules, regulations or listing rules regarding board of directors composition in its consideration of candidates. Although our board of directors does not maintain a specific policy with respect to board of directors diversity, our board of directors believes that the board of directors should be a diverse body, and the Nominating and Corporate Governance Committee considers a broad range of perspectives, backgrounds and experiences.

If our Nominating and Corporate Governance Committee determines that an additional or replacement director is required, then the committee may take such measures as it considers appropriate in connection with its evaluation of a director candidate, including candidate interviews, inquiry of the person or persons making the recommendation or nomination, engagement of an outside search firm to gather additional information, or reliance on the knowledge of the members of the Nominating and Corporate Governance Committee, board of directors or management.

After completing its review and evaluation of director candidates, our Nominating and Corporate Governance Committee recommends to our full board of directors the director nominees for selection. Our Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors and our board of directors has the final authority in determining the selection of director candidates for nomination to our board of directors.

Stockholder Recommendations and Nominations to our Board of Directors

Our Nominating and Corporate Governance Committee will consider director candidates recommended by stockholders holding at least one percent (1%) of our fully diluted capitalization continuously for at least 12 months prior to the date of the submission of the recommendation, so long as such recommendations and nominations comply with our amended and restated certificate of incorporation and amended and restated bylaws, all applicable company policies and all applicable laws, rules and regulations, including those promulgated by the SEC. Our Nominating and Corporate Governance Committee will evaluate such recommendations in accordance with its charter, our bylaws and corporate governance guidelines and the director nominee criteria described above.

Eligible stockholders that want to recommend a candidate to our board of directors should direct the recommendation in writing by letter to our Legal Team at Blend Labs, Inc., 415 Kearny Street, San Francisco, California 94108, Attention: Legal Team. Such recommendation must include the candidate’s name, home and business contact information, detailed biographical data, relevant qualifications, a signed letter from the candidate confirming willingness to serve, information regarding any relationships between the candidate and us and evidence of the recommending stockholder’s ownership of our capital stock. Such recommendation must also include a statement from the recommending stockholder in support of the candidate. Our Nominating and Corporate Governance Committee has discretion to decide which individuals to recommend for nomination as directors.

Under our amended and restated bylaws, stockholders may also directly nominate persons for our board of directors. Any nomination must comply with the requirements set forth in our amended and restated bylaws and the rules and regulations of the SEC and should be sent in writing to our corporate secretary at the address above. To be timely for our 2023 annual meeting of stockholders, nominations must be received by our corporate secretary observing the deadlines discussed below under “Other Matters—Stockholder Proposals or Director Nominations for 2023 Annual Meeting.”

Communications with the Board of Directors

Stockholders and other interested parties wishing to communicate directly with our non-management directors, may do so by writing and sending the correspondence to our Head of Legal or Legal Team by mail to our principal executive offices at Blend Labs, Inc., 415 Kearny Street, San Francisco, California 94108. Our Head of Legal or Legal Team, in consultation with appropriate directors as necessary, will review all incoming communications and screen for communications that (1) are solicitations for products and services, (2) relate to matters of a personal nature not relevant for our stockholders to act on or for our board of directors to consider and (3) matters that are of a type that are improper or irrelevant to the functioning of our board of directors or our business, for example, mass mailings, job inquiries and business solicitations. If appropriate, our Head of Legal or Legal Team will route such communications to the appropriate director(s) or, if none is specified, then to the chairperson of the board of directors or the lead independent director (if one is appointed). These policies and procedures do not apply to communications to non-management directors from our officers or directors who are stockholders or stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Corporate Governance Guidelines and Code of Conduct

Our board of directors has adopted corporate governance guidelines. These guidelines address, among other items, the qualifications and responsibilities of our directors and director candidates, the structure and composition of our board of directors and corporate governance policies and standards applicable to us in general. In addition, our board of directors has adopted a code of conduct that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and other executive and senior financial officers. The full text of our corporate governance guidelines and code of conduct are available on our website at investor.blend.com. We will post amendments to our code of conduct or any waivers of our code of conduct for directors and executive officers on the same website.

Director Compensation

In connection with our initial public offering, we adopted an outside director compensation policy for our non-employee directors. Under our outside director compensation policy, non-employee directors will receive compensation in the form of cash and equity, as described below. We also reimburse our non-employee directors for expenses incurred in connection with attending board of directors and committee meetings as well as continuing director education.

Under the outside director compensation policy, each non-employee director will be eligible to receive the compensation for board of directors services described below, beginning on January 1, 2022. We also will reimburse our non-employee directors for reasonable, customary and documented travel expenses to meetings of the board of directors.

The outside director compensation policy provides that a maximum annual limit of $800,000 of cash and equity compensation that may be paid, issued, or granted to a non-employee director in any fiscal year. For purposes of this

limitation, the value of equity awards will be based on the grant date value calculated in accordance with the Black-Scholes-Merton Option pricing model. Any cash compensation paid, or equity awards granted to a person for their services as an employee, or for their services as a consultant (other than as a non-employee director) will not count for purposes of the limitation. The maximum limit does not reflect the intended size of any potential compensation or equity awards to our non-employee directors.

Annual Retainer

Starting on January 1, 2022, each non-employee director who has not entered into a letter agreement with us that governs his or her compensation as a non-employee director is eligible to receive an annual retainer of $400,000, (the “Annual Retainer”), for services performed during the then-current calendar year. There are no per-meeting attendance fees for attending board of directors meetings. Any portion of the Annual Retainer that the non-employee director does not elect to forego in favor of receiving Retainer Options (as defined below) will be paid in cash in approximately equal monthly installments during the then-current calendar year, subject to the individual continuing to remain a non-employee director on the applicable payment date. If an individual first becomes a non-employee director after January 1 of any calendar year, such non-employee director will receive a pro-rated portion of the Annual Retainer based on the number of calendar months remaining in the calendar year in which the individual first becomes a non-employee director (with the month the individual first becomes a non-employee director counted as a remaining calendar month).

Retainer Options

Each non-employee director may elect, in accordance with the terms of the outside director compensation policy, to convert all or a portion of his or her Annual Retainer into a number of options to purchase shares of our Class A common stock, or Retainer Options. The number of shares of Class A common stock subject to each Retainer Option will be equal to the quotient of (i) 1/12th of the dollar value of the Annual Retainer that the non-employee director elected to forego over the annual period, divided by the value (based on the Retainer Option’s grant date value calculated in accordance with the Black-Scholes-Merton Option pricing model) on the Retainer Option’s grant date. If a non-employee director first becomes a member of the board of directors after January 31 of a calendar year, the number of shares subject to each Retainer Option will be calculated based on the number of Retainer Option grant dates remaining in the applicable calendar year.

Each Retainer Option will be granted on the last calendar day of each month of the applicable calendar year (or the most recent trading day prior to the last calendar day of the month if such date is not a trading day), subject to the non-employee director remaining a member of our board of directors on the applicable grant date. Each Retainer Option will have a ten-year term (subject to earlier termination as provided in the 2021 Plan), will be fully vested as of the grant date and will have an exercise price equal to 100% of our Class A common stock on the grant date.

Each non-employee director who has entered into a letter agreement with us that governs his or her compensation as a non-employee director, will not be eligible to receive compensation under the terms of the outside director compensation policy until the equity award or other compensation pursuant to such letter agreement has fully vested or been earned. For the year in which the non-employee director has earned or otherwise vested in the totality of the compensation set forth in his or her letter agreement with us, then for such calendar year the non-employee director will be entitled to receive a pro-rated amount of the Annual Retainer for such calendar year.

Director Compensation for 2021

The following table sets forth information regarding the total compensation awarded to, earned by or paid to our non-employee directors for their service on our board of directors, for the fiscal year ended December 31, 2021. Directors who are also our employees receive no additional compensation for their service as directors. During 2021, Messrs. Ghamsari and Mayopoulos were employees and executive officer of the company and therefore, did not receive compensation as directors. See “Executive Compensation” for additional information regarding Messrs. Ghamsari and Mayopoulos’s compensation.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Name | | Fees Paid or Earned in Cash ($) | | Option Awards ($)(1) | | All Other Compensation ($) | | Total ($) |

| Ciara Burnham(2) | | 33,333 | | — | | — | | 33,333 |

| Gerald Chen | | — | | — | | — | — | — |

| Erin James Collard | | — | | 656,386 | | — | | 656,386 |

| Roger Ferguson, Jr.(3) | | 100,000 | | 243,515 | | — | | 343,515 |

| Joseph Lonsdale(4) | | — | | — | | — | | — |

| Ann Mather | | — | | — | | — | | — |

1.The amount reported represents the aggregate grant-date fair value of the options awarded to the directors in 2021, calculated in accordance with ASU No. 2016 09 “Compensation—Stock Compensation (Topic 718)” (“ASC 718”). These amounts do not reflect the actual economic value that may be realized by the director.

2.Ms. Burnham joined our board of directors in December 2021.

3.Mr. Ferguson, Jr. joined our board of directors in March 2021.

4.Mr. Lonsdale resigned from our board of directors in March 2021.

The following table lists all outstanding equity awards held by non-employee directors as of December 31, 2021:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Option Awards |

| Name | | Grant

Date | | Number of Shares

Underlying

Unexercised

Option Awards(1) | | Option

Exercise

Price | | Option

Expiration

Date |

| Ciara Burnham | | — | | — | | — | | — |

| Gerald Chen | | — | | — | | — | | — |

| Erin James Collard | | 10/26/2015 | | 222,222 | (2) | $ | 0.45 | | | 10/26/2025 |

| | 4/18/2016 | | 66,666 | (2) | $ | 0.54 | | | 4/18/2026 |

| | 2/8/2017 | | 53,333 | (2) | $ | 0.54 | | | 2/8/2027 |

| | 2/14/2018 | | 100,000 | (2) | $ | 0.87 | | | 2/14/2028 |

| | 3/31/2021 | | 93,240 | (3) | $ | 8.58 | | | 3/31/2031 |

| Roger Ferguson, Jr. | | 3/31/2021 | | 34,965 | (3) | 8.58 | | 3/31/2031 |

| Joseph Lonsdale | | — | | — | | — | | — |

| Ann Mather | | 7/30/2019 | | 999,267 | (4) | $ | 0.77 | | | 7/29/2029 |

(1)Each of the outstanding equity awards listed in the table above was granted pursuant to our 2012 Plan.

(2)The shares subject to this option are fully vested and immediately exercisable.

(3)1/12th of the shares subject to this option vest monthly beginning on April 30, 2021, subject to the director’s continued role as a service provider to us. This option is subject to an early exercise provision and is immediately exercisable

(4)1/60th of the shares subject to this option vest monthly beginning on July 26, 2019, subject to Ms. Mather’s continued role as a service provider to us. This option is subject to an early exercise provision and is immediately exercisable.

Our Commitment to Social Impact

Blend’s mission is to expand access to the world’s financial resources. Our digital-first products help financial services firms deliver financial products to consumers that improve their lives. We are proud to help build an equitable ecosystem to serve people across every financial milestone of their lives, especially those in underbanked communities.

In August 2020, we launched the Equitable Ecosystem Initiative to drive accessibility and promote racial equity in the financial services ecosystem through community partnerships, technology investments, and regulatory engagement. We have partnered with organizations to increase opportunity for new and prospective homebuyers, with a particular focus on communities of color. We have also supported the longevity of Minority Depository Institutions (“ MDIs”), and Community Development Financial Institutions (“CDFIs”), including through the creation of a partnership with a financial services firm to drive capital to MDIs and by offering to provide Blend’s software platform to MDIs and CDFIs for free. In addition, we are committed to working closely with non-profits, industry partners, and our customers to develop enhancements to our software platform that further support more equitable outcomes for underbanked communities. To further support these efforts, in 2021 we filled a newly created role on the Global Impact, Equity, and Belonging team to focus on product equity and enablement. Through this new role, we are able to work directly with customers and partners to conduct research and discovery around the impact of new product features on both borrower experience and equitable outcomes.

We have also joined the Pledge 1% movement, a community of companies devoted to driving positive social impact. As a member of this community, we have committed 1% of our product development resources to supporting the development of features identified through our Equitable Ecosystem Initiative. We have further committed 1% of employee time to community-based volunteerism and we encourage employees to support causes of their choice by offering 24 hours of paid time off for participating in volunteer programs. In June 2021, we held our first Blend Gives Back, a company-wide day of service where employees were provided a number of virtual and in-person volunteer activities around the country focused on building housing and addressing homelessness.

PROPOSAL NO. 1:

ELECTION OF DIRECTORS

Our board of directors currently consists of seven directors. At the annual meeting, seven directors will be elected for a one-year term and until their respective successors are duly elected and qualified or until their earlier death, resignation or removal.

Nominees

Our Nominating and Corporate Governance Committee has recommended, and our board of directors has approved, Nima Ghamsari, Timothy J. Mayopoulos, Ciara Burnham Gerald Chen, Erin James Collard, Roger Ferguson, Jr., and Ann Mather as nominees for election as directors at the annual meeting. If elected, each of Messrs. Ghamsari, Mayopoulos, Chen, Collard, and Ferguson, Jr., and Mses. Burnham and Mather will serve as a director until the next annual meeting of stockholders and until his or her respective successor is elected and qualified or until his or her earlier death, resignation or removal. For more information concerning the nominees, please see the section titled “Board of Directors and Corporate Governance.”

Messrs. Ghamsari, Mayopoulos, Chen, Collard, and Ferguson, Jr., and Mses. Burnham and Mather have agreed to serve as directors if elected, and management has no reason to believe that they will be unavailable to serve. In the event a nominee is unable or declines to serve as a director at the time of the annual meeting, proxies will be voted for any nominee designated by the present board of directors to fill the vacancy.

Vote Required

Each director is elected by a plurality of the voting power of the shares present in person (including virtually) or represented by proxy at the meeting and entitled to vote on the election of directors. Because the outcome of this proposal will be determined by a plurality vote, any shares not voted FOR a particular nominee, whether as a result of choosing to WITHHOLD authority to vote or a broker non-vote, will have no effect on the outcome of the election.

Board of Directors Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE ELECTION OF EACH OF THE DIRECTOR NOMINEES NAMED ABOVE.

PROPOSAL NO. 2:

RATIFICATION OF APPOINTMENT OF

INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

Our Audit Committee has appointed Ernst & Young LLP as our independent registered public accounting firm to audit our consolidated financial statements for our fiscal year ending December 31, 2022. Ernst & Young LLP served as our independent registered public accounting firm for the fiscal year ended December 31, 2021.

At the annual meeting, we are asking our stockholders to ratify the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. Our Audit Committee is submitting the appointment of Ernst & Young LLP to our stockholders because we value our stockholders’ views on our independent registered public accounting firm and as a matter of good corporate governance. Notwithstanding the appointment of Ernst & Young LLP, and even if our stockholders ratify the appointment, our Audit Committee, in its discretion, may appoint another independent registered public accounting firm at any time during our fiscal year if our Audit Committee believes that such a change would be in the best interests of our company and our stockholders. If our stockholders do not ratify the appointment of Ernst & Young LLP, then our Audit Committee may reconsider the appointment. One or more representatives of Ernst & Young LLP are expected to be present at the annual meeting, and they will have an opportunity to make a statement and are expected to be available to respond to appropriate questions from our stockholders.

Fees Paid to the Independent Registered Public Accounting Firm

The following table presents fees billed or to be billed by Ernst & Young LLP and affiliates for professional services rendered with respect to the fiscal years ended December 31, 2021 and 2020. All of these services were approved by the Audit Committee.

| | | | | | | | | | | | | | |

| | 2021 | | 2020 |

| Audit Fees(1) | | $ | 4,270,896 | | $ | 360,607 |

| Audit-Related Fees(2) | | 3,234,557 | | — |

| Tax Fees(3) | | 187,974 | | — |

| All Other Fees(4) | | 7,105 | | — |

| Total Fees | | $ | 7,700,532 | | $ | 360,607 |

(1) “Audit Fees” consist of fees billed for professional services rendered in connection with the audit of our consolidated financial statements, reviews of our quarterly consolidated financial statements and related accounting consultations and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years.

(2) “Audit-Related Fees” consist of fees billed in connection with Form S-1 comfort letters and consent issuances related to our initial public offering.

(3) “Tax Fees” consist of fees billed for professional services for tax compliance, tax advice and tax planning.

(4) “All Other Fees” consist of fees billed in connection with our subscription to a research tool offered by Ernst and Young, LLP.

Auditor Independence

In 2021, there were no other professional services provided by Ernst & Young LLP, other than those listed above, that would have required our Audit Committee to consider their compatibility with maintaining the independence of Ernst & Young LLP.

Audit Committee Policy on Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

Our Audit Committee has established a policy governing our use of the services of our independent registered public accounting firm. Under this policy, our Audit Committee is required to pre-approve all services performed by our independent registered public accounting firm in order to ensure that the provision of such services does not impair such accounting firm’s independence. All services provided by Ernst & Young LLP for the fiscal years ended December 31, 2020 and 2021 were pre-approved by our Audit Committee (prior to adoption of our pre-approval policy). Following adoption of our pre-approval policy in July 2021, all services provided by Ernst & Young LLP will be pre-approved by our Audit Committee in accordance with the policy.

Vote Required

The ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022 requires the affirmative vote of a majority of the voting power of the shares present in person

(including virtually) or represented by proxy at the annual meeting and entitled to vote thereon. Abstentions will have the same effect as a vote AGAINST this proposal.

Board of Directors Recommendation

OUR BOARD OF DIRECTORS RECOMMENDS A VOTE “FOR” THE RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR OUR FISCAL YEAR ENDING DECEMBER 31, 2022.

REPORT OF THE AUDIT COMMITTEE

The Audit Committee is a committee of the board of directors comprised solely of independent directors as required by the NYSE listing rules and the rules and regulations of the SEC. The Audit Committee operates under a written charter adopted by the board of directors. This written charter is reviewed annually for changes, as appropriate. With respect to Blend’s financial reporting process, Blend’s management is responsible for (1) establishing and maintaining internal controls and (2) preparing Blend’s consolidated financial statements. Blend’s independent registered public accounting firm, Ernst & Young LLP, is responsible for performing an independent audit of Blend’s consolidated financial statements. It is the responsibility of the Audit Committee to oversee these activities. It is not the responsibility of the Audit Committee to prepare Blend’s financial statements. These are the fundamental responsibilities of management. In the performance of its oversight function, the Audit Committee has:

•reviewed and discussed the audited consolidated financial statements with management and Ernst & Young LLP;

•discussed with Ernst & Young LLP the matters required to be discussed by the applicable requirements of the Public Company Accounting Oversight Board (the “PCAOB”), and the SEC; and

•received the written disclosures and the letter from Ernst & Young LLP required by the applicable requirements of the PCAOB regarding the independent accountant’s communications with the Audit Committee concerning independence, and has discussed with Ernst & Young LLP its independence.