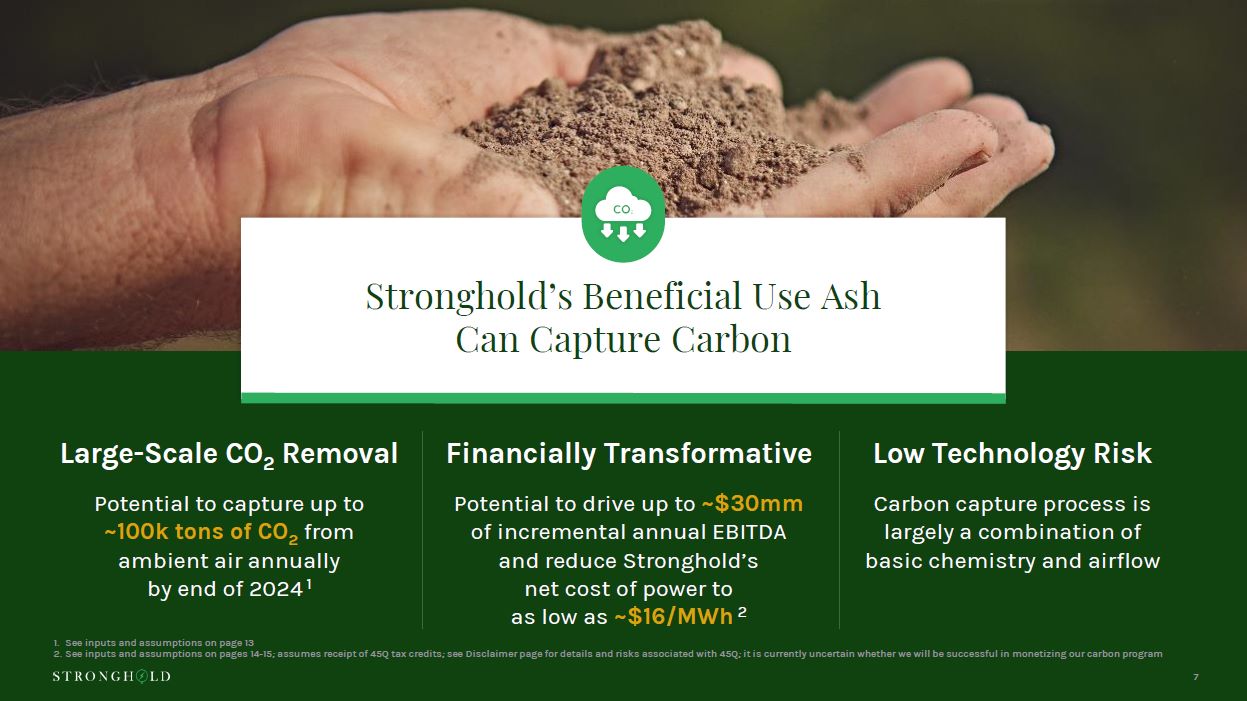

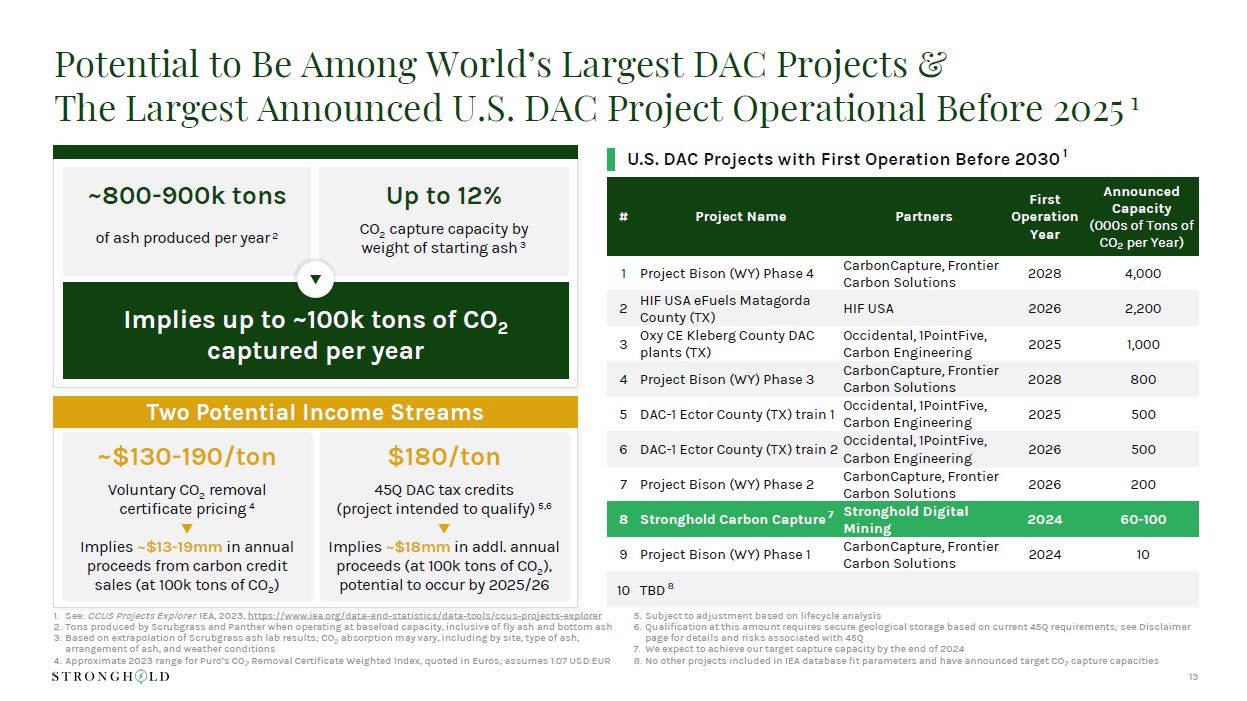

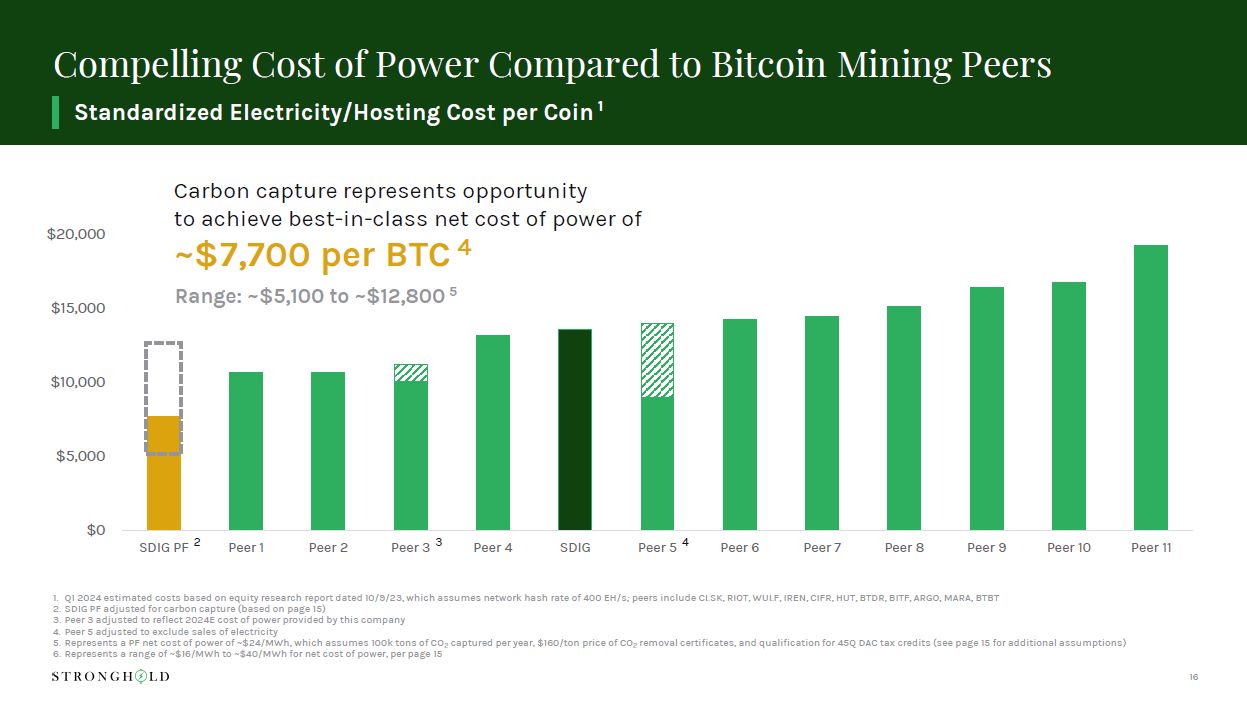

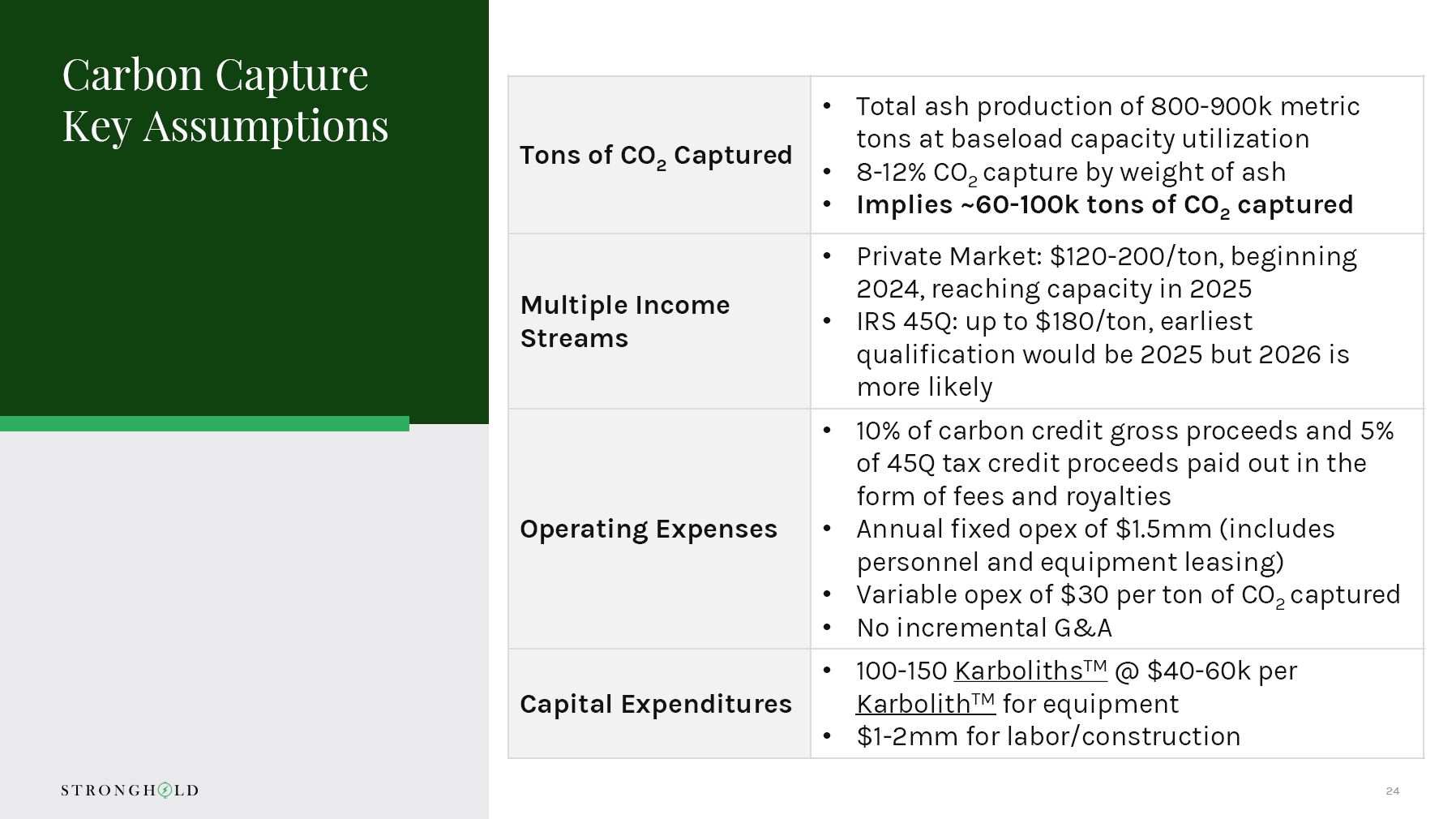

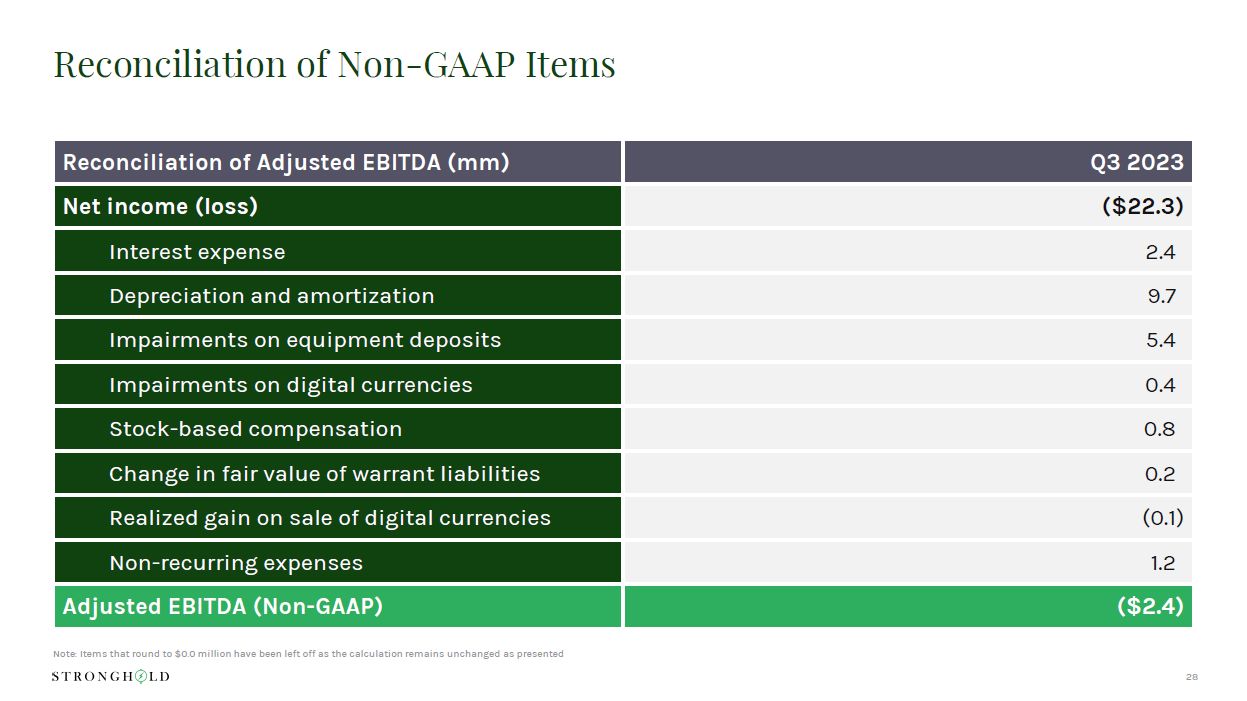

Disclaimer 2 Forward-Looking Statements The information, financial projections and other estimates contained herein contain forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, and future guidance with respect to the anticipated future performance of the Company and its potential carbon capture initiative. Such financial projection, guidance, and estimates are as to future events and are not to be viewed as facts, and reflect various assumptions of management of the Company concerning the future performance of the Company and are subject to significant business, financial, economic, operating, competitive and other risks and uncertainties and contingencies (many of which are difficult to predict and beyond the control of the Company) that could cause actual results to differ materially from the statements and information included herein. Forward-looking statements may include statements about various risks and uncertainties, including those described under the heading "Risk Factors“ in our previously filed Annual Report on Form 10-K, filed on April 3, 2023, and in our subsequently filed Quarterly Reports on Form 10-Q. In addition, such information, financial projections, guidance and estimates were not prepared with a view to public disclosure or compliance with published guidelines of the SEC, the guidelines established by the American Institute of Certified Public Accountants or U.S. generally accepted accounting principles (“GAAP”). Accordingly, although the Company’s management believes the financial projections, guidance and estimates contained herein represent a reasonable estimate of the Company’s projected financial condition and results of operations based on assumptions that the Company’s management believes to be reasonable at the time such estimates are made and at the time the related financial projections and estimates are disclosed, there can be no assurance as to the reliability or correctness of such information, financial projections and estimates, nor should any assurances be inferred, and actual results may vary materially from those projected. Section 45Q In January 2021, the IRS issued final regulations under Section 45Q of the Internal Revenue Code, which provides a tax credit for qualified CO2 that is captured using carbon capture equipment and disposed of in secure geological storage (in the event of direct air capture that results in secure geological storage, credits are valued at $180 per ton of CO2 captured) or utilized in a manner that satisfies a series of regulatory requirements (in the event of direct air capture that results in utilization, credits are valued at $130 per ton of CO2 captured). We may benefit from Section 45Q tax credits only if we satisfy the applicable statutory and regulatory requirements, including but not limited to compliance with wage and apprenticeship requirements to receive the $180/ton tax credits, and we cannot make any assurances that we will be successful in satisfying such requirements or otherwise qualifying for or obtaining the Section 45Q tax credits currently available or that we will be able to effectively benefit from such tax credits. We are currently exploring whether our carbon capture initiatives discussed herein would be able to qualify for any 45Q tax credit. It is not entirely clear whether we will be able to meet any required statutory and regulatory requirements, and qualification for any amount of 45Q credit may not be feasible with our currently planned direct air capture initiative. Additionally, the availability of Section 45Q tax credits may be reduced, modified or eliminated as a matter of legislative or regulatory policy. Any such reduction, modification or elimination of Section 45Q tax credits, or our inability to otherwise benefit from Section 45Q tax credits, could materially reduce our ability to develop and monetize our carbon capture program. Any of these factors may adversely impact our business, results of operations and financial condition. Non-GAAP Measures This presentation includes financial measures that are not presented in accordance with GAAP. While management believes such non-GAAP measures are useful, it is not a measure of our financial performance under GAAP and should not be considered in isolation or as an alternative to any measure of such performance derived in accordance with GAAP. These non-GAAP measures have limitations as analytical tools and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. The reconciliations for non-GAAP figures to applicable GAAP measures are included in the Appendix. We have not reconciled non‐GAAP forward-looking measures, including Adjusted EBITDA guidance, to their corresponding GAAP measures due to the high variability and difficulty in making accurate forecasts and projections, particularly with respect to the price of Bitcoin, Bitcoin network hash rate, electricity prices, plant outages, power input costs, [and our proposed carbon capture initiative], which are difficult to predict and subject to change. Accordingly, such reconciliations of non-GAAP forward-looking measures are not available without unreasonable effort. Third-Party Information Certain information contained herein refers to or has been derived from sources prepared by third parties. While such information is believed to be reliable for the purposes used herein, none of the Company or any of its affiliates, directors, officers, employees, members, partners, shareholders or agents make any representation or warranty with respect to the accuracy or completeness of such information. Although the Company believes the sources are reliable, it has not independently verified the accuracy or completeness of data from such sources. Additionally, descriptions herein of market conditions and opportunities are presented for informational purposes only; there can be no assurance that such conditions will actually occur or result in positive returns. Recipients of this presentation should make their own investigations and evaluations of any information referenced herein. The recipient should not construe the contents of this presentation as legal, tax, accounting or investment advice or a recommendation. The recipient should consult its own counsel, tax advisors and financial advisors as to legal and related matters concerning the matters described herein. By reviewing this presentation, the recipient confirms that it is not relying upon the information contained herein to make any decision. This presentation does not purport to be all-inclusive or to contain all of the information that the recipient may require to make any decision. See Key Assumptions on page 24