The information in this preliminary proxy statement/prospectus is not complete and may be changed. These securities may not be issued until the registration statement filed with the U.S. Securities and Exchange Commission is effective. The preliminary proxy statement/prospectus is not an offer to sell these securities and does not constitute the solicitation of offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

PRELIMINARY — SUBJECT TO COMPLETION, DATED SEPTEMBER 21, 2021

PROXY STATEMENT FOR EXTRAORDINARY GENERAL MEETING OF SHAREHOLDERS

AND SPECIAL MEETING OF PUBLIC WARRANT HOLDERS OF HORIZON ACQUISITION CORPORATION

PROSPECTUS FOR

54,448,433 SHARES OF CLASS A COMMON STOCK

18,132,811 WARRANTS TO PURCHASE SHARES OF CLASS A COMMON STOCK AND

18,132,811 SHARES OF CLASS A COMMON STOCK UNDERLYING WARRANTS

OF VIVID SEATS INC.

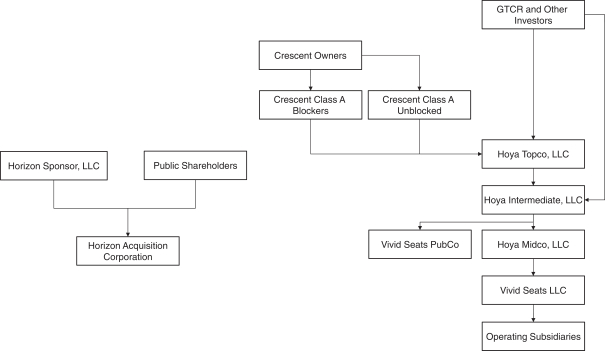

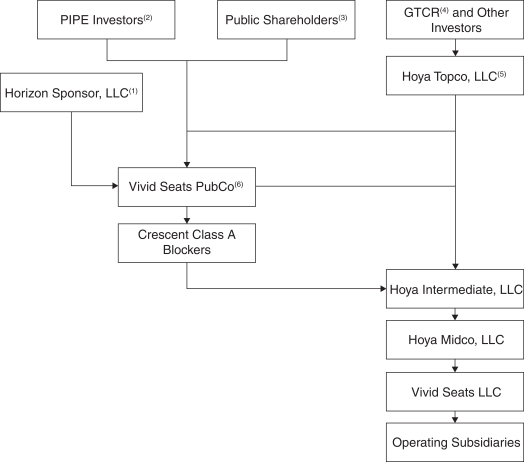

The board of directors of Horizon Acquisition Corporation, a Cayman Islands exempted company (“Horizon”), has unanimously approved the transaction agreement, dated as of April 21, 2021 (as may be amended from time to time, the “Transaction Agreement”), by and among Horizon, Horizon Sponsor, LLC, a Delaware limited liability company (“Sponsor”), Hoya Topco, LLC, a Delaware limited liability company (“Hoya Topco”), Hoya Intermediate, LLC, a Delaware limited liability company (“Hoya Intermediate”) and Vivid Seats Inc., a Delaware corporation (“Vivid Seats PubCo”), attached to this proxy statement/prospectus as Annex A, pursuant to which, among other transactions, Horizon will merge with and into Vivid Seats PubCo, upon which the separate corporate existence of Horizon will cease and Vivid Seats PubCo will become the surviving corporation (the “Merger” and, together with the other transactions contemplated by the Transaction Agreement, the “business combination”) resulting in the reorganization of the combined post-business combination company into an umbrella partnership C corporation (or “Up-C”) structure.

Immediately following the Merger and in accordance with the Transaction Agreement and the other ancillary agreements contemplated thereby, a series of transactions will occur whereby (i) certain third-party investors (including Sponsor or an affiliate thereof) will purchase an aggregate of 22,500,000 shares of Class A common stock of Vivid Seats PubCo, par value $0.0001 per share (“Vivid Seats Class A common stock”) for an aggregate purchase price of $225.0 million (the “PIPE Subscription”), (ii) Vivid Seats PubCo will purchase all of the issued and outstanding capital stock of each of CM6B Vivid Equity, Inc., CM6C Vivid Equity, Inc., CM7B VS Equity, LLC and CM7C VS Equity, LLC (collectively, the “Crescent Blockers”, and the outstanding capital stock of the Crescent Blockers, the “Crescent Blocker Shares”) from Crescent Mezzanine Partners VIB, L.P., Crescent Mezzanine Partners VIC, L.P., NPS/Crescent Strategic Partnership II, LP and Crescent Mezzanine Partners VIIB, L.P. (collectively, the “Blocker Sellers”, and such purchase, the “Blocker Purchase”) in exchange for cash (the “Blocker Purchase Price”), in an amount equal to (A) an aggregate of $107,573.05, plus interest accruing from June 30, 2017 to the date of closing of the Merger compounding semi-annually on June 30 and December 31 of each year, minus (B) the aggregate amount of estimated tax liabilities of the Blocker Sellers for the period ending on the closing date of the Merger (such tax liabilities, the “Blocker Tax Liabilities”), (iii) Vivid Seats PubCo will contribute cash to Hoya Intermediate in an amount equal to (A) all available cash of Vivid Seats PubCo following the Merger and the PIPE Subscription, minus (B) the Blocker Purchase Price, minus (C) the Blocker Tax Liabilities in exchange for Common Units of Hoya Intermediate (“Intermediate Common Units”) and warrants to purchase Intermediate Common Units (together, the “Intermediate Contribution and Issuance”), (iv) Hoya Intermediate will redeem 100% of the Intermediate Common Units held by Crescent Mezzanine Partners VI, L.P., Crescent Mezzanine Partners VII, L.P., Crescent Mezzanine Partners VII (LTL), L.P. and CBDC Universal Equity, Inc. (collectively, the “Redeemed Crescent Parties”) in exchange for cash (the “Crescent Redemption”), (v) Hoya Topco will subscribe for 118,200,000 newly issued Class B common stock of Vivid Seats PubCo, par value $0.0001 per share (“Vivid Seats Class B common stock”) and 6,000,000 warrants to purchase Vivid Seats Class B common stock (together, “Class B Issuance”) and (vi) Hoya Intermediate will contribute cash to Hoya Midco, LLC, a Delaware limited liability company (“Hoya Midco”). Immediately prior to the business combination, Hoya Intermediate expects to effectively redeem its Senior Preferred Units (as defined herein), resulting in a cash payment of $225.1 million. Upon the closing of the business combination, Vivid Seats expects to apply $488.9 million of the business combination and PIPE Subscription proceeds towards debt repayments resulting in the full repayment of its May 2020 First Lien Loan (as defined herein) and a partial repayment of its June 2017 First Lien Loan (as defined herein). As a result of the business combination, assuming no redemptions of Horizon Class A ordinary shares in connection with the business combination, Hoya Topco will hold approximately 60.6% of the issued and outstanding Intermediate Common Units and Vivid Seats PubCo will hold approximately 39.4% of the Intermediate Common Units. Following the consummation of the business combination, Vivid Seats PubCo’s assets will consist of its direct and indirect interests in Hoya Intermediate.

As described in this proxy statement/prospectus, Horizon’s shareholders are being asked to consider and vote upon (among other things) the business combination and the other proposals set forth herein.

Horizon is also seeking approval from the holders of its outstanding public warrants, to amend certain provisions of its outstanding public warrants, as further described in this proxy statement/prospectus.

Horizon’s Class A ordinary shares, Horizon’s warrants and Horizon’s units are currently traded on The New York Stock Exchange (“NYSE”) under the ticker symbols “HZAC,” “HZAC WS” and “HZAC.U,” respectively. Vivid Seats PubCo will apply for listing, to be effective at the Closing (as defined herein), of its shares of Class A common stock and warrants on The Nasdaq Capital Market (“Nasdaq”) under the symbols “SEAT” and “SEAT WS,” respectively. Vivid Seats PubCo will not have units traded following the Closing.

It is anticipated that, upon completion of the business combination and assuming no redemptions of Horizon Class A ordinary shares in connection with the business combination, Vivid Seats PubCo’s ownership will be as follows: (1) Horizon’s public shareholders will own approximately 19.9% of Vivid Seats PubCo’s outstanding common stock (which will be in the form of shares of Vivid Seats Class A common stock); (2) the PIPE Investors (as defined herein), excluding Sponsor and certain affiliates of Sponsor, will own approximately 1.8% of Vivid Seats PubCo’s outstanding common stock (which will be in the form of shares of Vivid Seats Class A common stock); (3) Sponsor, together with certain of its affiliates, will own (i) approximately 17.7% (assuming no exercise of Vivid Seats PubCo Warrants held by Sponsor) or (ii) approximately 29.9% (assuming full exercise of Horizon $10.00 Exercise Warrants and Horizon $15.00 Exercise Warrants (each as defined herein) held by Sponsor), of Vivid Seats PubCo’s outstanding common stock (which will be in the form of shares of Vivid Seats Class A common stock); and (4) Hoya Topco will own approximately 60.6% of Vivid Seats PubCo’s outstanding common stock (which will be in the form of shares of Vivid Seats Class B common stock). The board of managers of Hoya Topco is controlled by the designees of GTCR Fund XI/B LP and GTCR Fund XI/C LP (together with GTCR Co-Invest XLLP, GTCR Golder Rauner, L.L.C., GTCR Golder Rauner II, L.L.C., GTCR Management XI LLC and GTCR LLC, our “Private Equity Owner”) and their affiliates, and consequently the Private Equity Owner will, for so long as it controls Hoya Topco, control the vote of all matters submitted to a vote of Vivid Seats PubCo shareholders through Hoya Topco’s ownership of approximately 60.6% of the voting power of Vivid Seats PubCo’s outstanding common stock following the business combination. In addition to its voting power, the Private Equity Owner, for so long as it controls Hoya Topco, will be entitled to nominate five (5) directors to the Vivid Seats PubCo Board of Directors pursuant to the Stockholders’ Agreement to be entered into by and among Vivid Seats PubCo, Sponsor and Hoya Topco at the consummation of the business combination. As a result of the voting power controlled by Hoya Topco, following the business combination, Vivid Seats PubCo will qualify as a “controlled company” within the meaning of applicable Nasdaq (as defined herein) listing rules.

Each of Horizon and Vivid Seats PubCo is an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 and has elected to comply with certain reduced public company reporting requirements.

This proxy statement/prospectus provides you with detailed information about the business combination and other matters to be considered at the extraordinary general meeting of Horizon’s shareholders and the special meeting of holders of Horizon IPO Public Warrants. Horizon and Vivid Seats PubCo encourage you to carefully read this entire document. You should also carefully consider the risk factors described in “Risk Factors” beginning on page 32.

These securities have not been approved or disapproved by the Securities and Exchange Commission or any state securities commission nor has the Securities and Exchange Commission or any state securities commission passed upon the accuracy or adequacy of this proxy statement/prospectus. Any representation to the contrary is a criminal offense.

This proxy statement/prospectus is dated , 2021 and is first being mailed to Horizon shareholders and holders of Horizon IPO Public Warrants on or about , 2021.