UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number: 811-23656

FS MVP Private Markets Fund

(Exact name of registrant as specified in charter)

9 Old Kings Highway South

Darien, Connecticut 06820

(Address of principal executive offices)(Zip code)

Daniel Dwyer

Portfolio Advisors, LLC

9 Old Kings Highway South

Darien, Connecticut 06820

(Name and address of agent for service)

Copy to:

Joshua B. Deringer, Esq.

Faegre Drinker Biddle & Reath LLP

One Logan Square, Ste. 2000

Philadelphia, PA 19103-6996

Registrant's telephone number, including area code: (203) 662-3456

Date of fiscal year end: March 31

Date of reporting period: September 30, 2023

Item 1. Reports to Stockholders.

Table of Contents

| Shareholder Letter | 1 |

| Consolidated Schedule of Investments | 4 |

| Consolidated Statement of Assets and Liabilities | 9 |

| Consolidated Statement of Operations | 10 |

| Consolidated Statements of Changes in Net Assets | 11 |

| Consolidated Statement of Cash Flows | 13 |

| Consolidated Financial Highlights | 14 |

| Notes to Consolidated Financial Statements | 20 |

| Other Information | 43 |

| Privacy Policy | 44 |

| FS MVP Private Markets Fund | Shareholder Letter |

September 30, 2023 (Unaudited)

Dear Shareholder:

We thank you for your investment in FS MVP Private Markets Fund (the “Fund”). This semi-annual report covers the six-month fiscal period ended September 30, 2023 (the “period”).

While the U.S. economy continues to surprise to the upside, lingering inflation, policy uncertainty and signs of tightening financial conditions all present challenges to the forward outlook. Equity valuations soared on economic optimism for the better part of 2023 and earnings expectations for 2024 continue to imply still further acceleration in growth. The bond market, however, reflects expectations for some probability of a recession, with rate cuts priced into next year. The Fed has worked hard to close this gap, by tempering growth expectations while also pushing back against rate cut expectations. The result has been an increase in long-term interest rates to nearly 15-year highs, which now match the free cash flow of the S&P 500.

Inflection points in the economy and financial markets may result in near-term volatility. In our experience, however, such times often present attractive environments to selectively deploy capital. The changing market environment has highlighted the value of the Fund’s multi-strategy approach investing in and alongside sponsors that we believe are the “MVPs” of the U.S. middle market to drive deal flow and market insights and, ultimately, favorable economic outcomes for our shareholders.

Summary of investment activity during the period

The Fund began the period with 68 total investments and invested approximately $108 million over the ensuing 6 months across secondary, direct equity, direct credit, and primary strategies. At the period end, the Fund held 77 investments representing approximately $608 million in net asset value, comprised of 52% secondary investments, 27% direct equity investments, 11% direct credit investments, 4% primary investments, and 7% in cash equivalents.

At the end of the period, approximately 78% of the portfolio was focused on investments in the U.S. middle market driven by Portfolio Advisors’ deep sponsor relationships across more than 300 middle market sponsors. Large cap investments represented 15% of the portfolio while Growth represented 6% of the portfolio. As of September 30, 2023, the largest sector weighting was industrials, followed by information technology and health care.

| Semi-Annual Report | September 30, 2023 | 1 |

| FS MVP Private Markets Fund | Shareholder Letter |

September 30, 2023 (Unaudited)

Fund performance

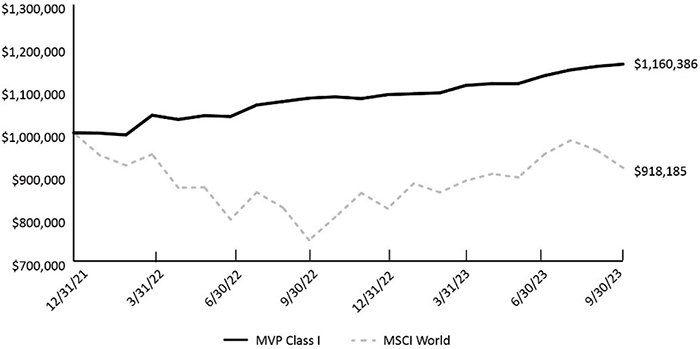

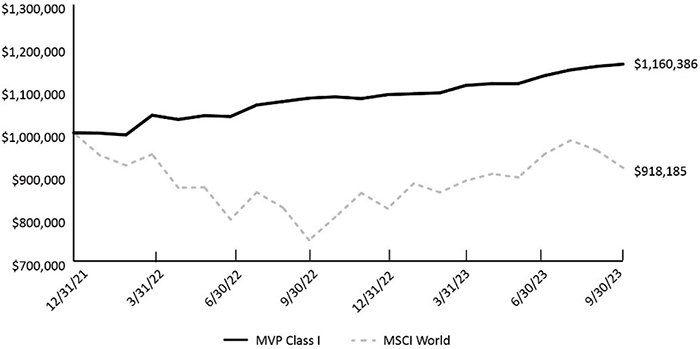

This graph compares the hypothetical $1,000,000 investment int the Fund’s Class I shares, made at inception, with similar investments in the MSCI World Index. Results include reinvestment of all dividends and capital gains. The MSCI Index does not reflect expenses, fees, or sales charges, which would reduce the index performance.

The MSCI World Index represents large and mid-cap equity performance across 23 developed markets countries, covering approximately 85% of the free float-adjusted market capitalization in each. The index is unmanaged and is not available for investment.

| Average Annual Total Returns as of September 30, 2023 |

| | 1-Year | Since Inception* |

| MVP Private Markets Fund – Class I | 8.14% | 8.45% |

| MSCI World Index | 11.27% | -4.36% |

| * | Commencement of operations for the MVP Private Markets Fund was January 3, 2022, following the reorganization of MVP Private Markets Fund L.P. with and into the Fund, which was effective as of close of business on December 31, 2021. See Note 1 in the accompanying notes to the consolidated financial statements. |

Outlook

While headwinds to private equity fundraising are expected to persist amid the higher interest rate environment, the middle market remains a bright spot as LPs shift their focus to smaller funds with more specialized and differentiated paths to driving value. U.S. middle market fundraising is up 25% year-to-date as of June 30, 2023, compared to the same period in 2022. Attractive valuations and greater opportunities for value creation within the middle market have helped offset the negative impacts of lower leverage and higher borrowing costs on returns. These trends have led mid-cap funds to outperform large-cap funds by 965 basis points (bps) over the last year, the largest gap since 2016.

| FS MVP Private Markets Fund | Shareholder Letter |

September 30, 2023 (Unaudited)

Within the secondaries market, LP-led transaction volume remains strong. H1 2023 volumes totaled $25 billion, making it the strongest H1 on record. We expect overall secondary volumes to exceed $100 billion for the third year in a row driven by:

| ● | Portfolio rebalancing: Public equity market declines in 2022 combined with strong private equity performance left many LPs overallocated to private equity (aka the denominator effect); and |

| ● | Liquidity considerations: Capital calls are generally outpacing distributions due to reduced M&A activity (exits). As a result, many LPs have turned to the secondary market to augment liquidity. |

These tailwinds are likely to continue to support a robust pipeline of LP transactions and price advantages for buyers through year end. While the improved economic outlook and strong performance of public equities in H1 modestly improved secondary LP pricing, prices remain at the second lowest level since 2017. Finally, within debt capital markets, credit conditions remain tight, but deal flow continues for higher quality borrowers. The credit team is managing default risks by maintaining strict coverage requirements and focusing only on high quality assets sourced through longstanding relationships with trusted sponsors. Our team sees increasing opportunities within the credit secondaries market where the vast growth in direct lending and year-end portfolio rebalancing is fueling sell-side demand and driving attractive pricing advantages.

We believe that the Fund’s focus on investing with disciplined, experienced sponsors positions the Fund to benefit from such opportunities as it continues to selectively deploy capital in the coming quarters.

We appreciate your support and look forward to continuing to serve you.

Sincerely,

Portfolio Advisors

| Semi-Annual Report | September 30, 2023 | 3 |

| FS MVP Private Markets Fund | Consolidated Schedule of Investments |

As of September 30, 2023 (Unaudited)

| Description | | Principal | | | Acquisition Date | | Cost | | | Fair Value | |

| Direct Credit (11.97%) | | | | | | | | | | | | | | |

| Aero Operating, LLC (3M US SOFR + 6.50%, 2/6/2026)(a)(b) | | $ | 6,617,999 | | | 12/17/2021 | | $ | 6,518,666 | | | $ | 6,519,935 | |

| Beacon Oral Specialist (3M US SOFR + 6%, 12/14/2025)(a)(b) | | | 7,427,381 | | | 2/23/2022 | | | 7,349,156 | | | | 7,427,381 | |

| Beta Plus Technologies, Inc., TL (3M US SOFR + 5.75%, 3/28/2028)(a)(b) | | | 4,962,406 | | | 3/30/2023 | | | 4,412,479 | | | | 4,556,712 | |

| CMS Group Holdings, LLC (3M US SOFR + 5.5%, 11/18/2026)(a)(b) | | | 4,792,083 | | | 2/23/2022 | | | 4,673,774 | | | | 4,673,774 | |

| Erie Construction Mid-West, LLC (3M US SOFR + 4.75%, 7/30/2027)(a)(b) | | | 937,481 | | | 8/9/2022 | | | 930,254 | | | | 937,481 | |

| ETE Intermediate II, LLC RC (3M US SOFR + 6.5%, 5/26/2029)(a)(b)(c) | | | 267,857 | | | 5/26/2023 | | | 262,575 | | | | 262,575 | |

| ETE Intermediate II, LLC TL (3M US SOFR + 6.5%, 5/26/2029)(a)(b)(c) | | | 2,226,563 | | | 5/26/2023 | | | 2,162,563 | | | | 2,162,563 | |

| MDME Holdings, LLC (3M US SOFR + 6%, 8/3/2027)(a)(b)(c) | | | 4,436,878 | | | 8/3/2022 | | | 4,331,863 | | | | 4,331,863 | |

| MDME Incremental T/L (3M US SOFR + 6%, 8/3/2027)(a)(b) | | | 168,630 | | | 11/22/2022 | | | 166,053 | | | | 166,053 | |

| NAS, LLC (3M US SOFR + 6.50%, 6/3/2024)(a)(b) | | | 8,687,502 | | | 12/17/2021 | | | 8,648,484 | | | | 8,555,454 | |

| Netrix, LLC, (3M US SOFR + 8.05%, 7/31/2026)(a)(b) | | | 1,537,152 | | | 12/22/2021 | | | 1,517,628 | | | | 1,443,964 | |

| North Acquisition LLC (3M US SOFR + 6.75%, 7/27/2027)(a)(b) | | | 7,256,250 | | | 7/27/2022 | | | 7,145,119 | | | | 7,237,746 | |

| Omni Holding Company LLC, Delayed TL (3M US SOFR + 5%, 12/30/2026)(a)(b) | | | 228,426 | | | 6/24/2022 | | | 226,316 | | | | 227,417 | |

| Omni Intermediate Holdings, (3M US SOFR + 5%, 12/30/2026)(a)(b) | | | 6,130,579 | | | 12/10/2021 | | | 6,087,909 | | | | 6,103,504 | |

| Omni Intermediate Holdings, LLC TL 1L (3M US SOFR + 5%, 12/30/2026)(a)(b) | | | 1,401,991 | | | 6/24/2022 | | | 1,387,132 | | | | 1,395,800 | |

| Orthodontic Partner LLC DDTL4 (3M US SOFR + 6.25%, 10/12/2027)(a)(b) | | | 995,394 | | | 12/28/2022 | | | 989,015 | | | | 978,114 | |

| Orthodontic Partners, LLC DDTL (3M US SOFR + 6.25%, 10/12/2027)(a)(b) | | | 1,983,992 | | | 8/22/2022 | | | 1,967,729 | | | | 1,949,552 | |

| PLA Buyer, LLC (3M US SOFR + 6.9%, 6/30/2024)(a)(b) | | | 6,125,607 | | | 6/3/2022 | | | 6,117,338 | | | | 6,117,338 | |

| PLA Buyer, LLC DDTL (3M US SOFR + 6.9%, 6/30/2024)(a)(b) | | | 1,188,000 | | | 8/26/2022 | | | 1,179,786 | | | | 1,179,786 | |

See Notes to Financial Statements.

| FS MVP Private Markets Fund | Consolidated Schedule of Investments |

As of September 30, 2023 (Unaudited)

| Description (continued) | | Principal | | | Acquisition Date | | Cost | | | Fair Value | |

| PLA Revolver, LLC DDTL (3M US SOFR + 6.9%, 6/30/2024)(a)(b) | | $ | 975,000 | | | 6/3/2022 | | $ | 964,446 | | | $ | 964,446 | |

| Spectrum Vision, (3M US SOFR + 6.5%, 11/17/2024)(a)(b)(c) | | | 5,669,873 | | | 12/28/2021 | | | 5,631,507 | | | | 5,631,507 | |

| | | | | | | | | | | | | | | |

| Total Direct Credit | | | | | | | | $ | 72,669,792 | | | $ | 72,822,965 | |

| Direct Equity (29.58%) | | Acquisition Date | | Cost | | | Fair Value | |

| AEP Galaxy-A, L.P.(b)(c) | | 7/13/2023 | | | 9,455,746 | | | | 9,455,746 | |

| BA Hissho Blocker, LLC(a)(b)(d) | | 5/16/2022 | | | 5,000,000 | | | | 6,469,692 | |

| Biloxi Co-Investment Partners, L.P.(b)(c) | | 8/11/2021 | | | 3,627,986 | | | | 4,497,539 | |

| Charger Investment Partners, L.P.(b) | | 9/30/2021 | | | 5,498,221 | | | | 6,026,348 | |

| COP Lawn Services Inv, LLC(a)(b)(c)(e) | | 11/18/2022 | | | 6,020,615 | | | | 9,474,073 | |

| Cynosure Partners 2020 Co-Investment, LLC(b)(f) | | 9/30/2021 | | | 924,196 | | | | 2,775,406 | |

| Greenbriar Coinvest WPS, L.P.(b)(c) | | 2/13/2023 | | | 5,305,974 | | | | 5,248,065 | |

| IEM Parent, LP(a)(b) | | 2/1/2023 | | | 10,118,029 | | | | 15,394,942 | |

| Incline V RKD Co-Invest A, L.P.(b) | | 8/16/2022 | | | 12,070,044 | | | | 12,032,555 | |

| MDME Holdings, LLC(a)(b) | | 8/3/2022 | | | 66,624 | | | | 66,624 | |

| Medical Device Opportunities S.C.A.(b)(c) | | 6/29/2023 | | | 4,263,870 | | | | 4,058,952 | |

| MFG Partners Mellott Fund A, LLC(a)(b) | | 9/9/2021 | | | 3,000,000 | | | | 7,098,593 | |

| MiddleGround Checker Co-Invest Partners, L.P.(b) | | 2/10/2022 | | | 11,763,682 | | | | 11,458,433 | |

| MiddleGround Royal Palm Co-Invest Partners, L.P.(b) | | 2/10/2022 | | | 7,737,937 | | | | 13,700,144 | |

| MML Partnership Capital VII S.C.Sp.(b) | | 8/21/2023 | | | 10,000,000 | | | | 10,000,000 | |

| North Acquisition, LLC(b)(f) | | 7/27/2022 | | | 150,000 | | | | 230,081 | |

| OEP VIII Project Vector Co-Investment Partners, L.P.(b) | | 12/20/2021 | | | 8,000,000 | | | | 16,811,454 | |

| RCP Monte Nido Co-Investment Fund, L.P.(b) | | 8/19/2022 | | | 15,211,779 | | | | 14,973,111 | |

| Ridgemont Equity Partners Coinvest III AGP Blocker, L.P.(a)(b)(c)(g) | | 10/12/2021 | | | 4,545,455 | | | | 7,649,241 | |

| SPC Totalmed, LLC(b) | | 3/10/2023 | | | 10,000,000 | | | | 9,999,420 | |

| TPG Growth V Walkabout CI, L.P.(b)(f) | | 9/19/2023 | | | 7,500,000 | | | | 7,500,000 | |

| V-Sky Co-Investment Aggregator II, L.P.(b) | | 2/9/2023 | | | 5,007,539 | | | | 4,995,907 | |

| | | | | | | | | | | |

| Total Direct Equity | | | | $ | 145,267,697 | | | $ | 179,916,326 | |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 5 |

| FS MVP Private Markets Fund | Consolidated Schedule of Investments |

As of September 30, 2023 (Unaudited)

| Secondary Investments (57.53%) | | Acquisition Date | | Cost | | | Fair Value | |

| ABRY Partners IX, L.P.(c) | | 9/30/2021 | | $ | 13,948,860 | | | $ | 18,362,587 | |

| Accel-KKR Capital Partners CV IV Strategic Fund, L.P.(c) | | 3/22/2022 | | | 4,790,659 | | | | 4,632,373 | |

| American Securities VII(c) | | 6/30/2023 | | | 33,978,504 | | | | 37,151,951 | |

| Battery Ventures XII Side Fund, L.P.(c) | | 9/30/2021 | | | 6,442,635 | | | | 6,256,750 | |

| Battery Ventures XII, L.P.(c) | | 9/30/2021 | | | 10,098,268 | | | | 11,397,256 | |

| Berkshire Fund IX, L.P.(c)(f) | | 9/30/2021 | | | 11,679,074 | | | | 13,493,913 | |

| Berkshire Fund VIII, L.P.(c) | | 3/31/2023 | | | 6,421,175 | | | | 7,574,197 | |

| Charlesbank Equity Fund IX, L.P.(c)(f) | | 9/30/2021 | | | 8,615,121 | | | | 11,503,525 | |

| Silver Oak CCS SPV, L.P.(c) | | 12/31/2021 | | | 1,942,500 | | | | 2,789,797 | |

| GHO Capital Virtue, L.P.(c) | | 4/21/2022 | | | 7,771,829 | | | | 7,436,105 | |

| Hellman & Friedman Capital Partners VIII, L.P.(c) | | 9/30/2021 | | | 14,579,091 | | | | 12,412,292 | |

| HGGC Fund II, L.P.(c)(f) | | 9/30/2021 | | | 5,446,412 | | | | 8,816,470 | |

| HGGC Fund III, L.P.(c) | | 9/30/2021 | | | 7,218,029 | | | | 14,485,001 | |

| Icon Partners III, L.P.(c) | | 7/12/2021 | | | 4,265,063 | | | | 3,036,278 | |

| Icon Partners IV B, L.P(c) | | 7/12/2021 | | | 2,121,771 | | | | 2,365,196 | |

| Insight Venture Partners IX, L.P.(c) | | 9/30/2021 | | | 26,279,374 | | | | 24,910,661 | |

| Institutional Venture Partners XVI, L.P. | | 9/30/2021 | | | 2,782,159 | | | | 2,021,106 | |

| Lightyear Fund IV, L.P.(c)(f) | | 9/30/2021 | | | 7,112,348 | | | | 10,033,395 | |

| Linden Capital Partners IV, L.P.(c)(h) | | 9/1/2023 | | | 7,960,916 | | | | 11,109,945 | |

| New Mountain Partners V, L.P.(c)(f) | | 9/30/2021 | | | 12,294,480 | | | | 13,510,558 | |

| New Mountain Partners IV, L.P(c)(f) | | 9/30/2021 | | | 5,261,314 | | | | 3,351,379 | |

| Odyssey Investment Partners V, L.P.(c)(f) | | 9/30/2021 | | | 7,587,243 | | | | 7,159,096 | |

| Pantheon Viking Co-Invest, LP(c) | | 9/29/2023 | | | 8,586,192 | | | | 13,136,302 | |

| Platinum Equity Capital Partners IV, L.P.(c) | | 12/31/2021 | | | 10,310,645 | | | | 10,544,581 | |

| Quad-C Partners IX, L.P.(c)(f) | | 9/30/2021 | | | 8,321,037 | | | | 9,125,545 | |

| Silver Lake Partners V, L.P.(c)(h) | | 9/1/2023 | | | 13,596,442 | | | | 11,236,622 | |

| Stepstone Capital Partners IV, L.P.(c) | | 9/30/2021 | | | 2,167,043 | | | | 3,010,236 | |

| Thoma Bravo Fund XII, L.P.(c) | | 9/30/2021 | | | 14,071,617 | | | | 10,771,864 | |

| Thoma Bravo Fund XIII, L.P.(c) | | 9/30/2021 | | | 21,526,205 | | | | 23,960,198 | |

| Triton IV Continuation Fund SCSP(c) | | 4/25/2023 | | | 6,822,567 | | | | 7,791,371 | |

| Waud Capital Partners QP IV, L.P.(c)(f) | | 9/30/2021 | | | 10,587,453 | | | | 12,488,278 | |

| Wind Point Partners AAV, L.P.(c) | | 8/7/2021 | | | 2,999,309 | | | | 3,202,494 | |

| Wind Point Partners VIII-A, L.P.(c)(f) | | 9/30/2021 | | | 2,272,989 | | | | 8,534,171 | |

| Wind Point Partners AAV II, L.P.(c) | | 9/30/2021 | | | 2,356,725 | | | | 2,356,725 | |

| | | | | | | | | | | |

| Total Secondary Investments | | | | $ | 312,215,049 | | | $ | 349,968,218 | |

See Notes to Financial Statements.

| FS MVP Private Markets Fund | Consolidated Schedule of Investments | |

As of September 30, 2023 (Unaudited)

| Primary Investments (4.49%) | | Acquisition Date | | Cost | | | Fair Value | |

| Audax Private Equity Origins Fund I, L.P.(c) | | 10/31/2022 | | $ | 827,294 | | | $ | 549,970 | |

| Bansk Fund I-B, L.P.(c) | | 5/15/2023 | | | 6,211,176 | | | | 7,815,383 | |

| FFL Parallel Fund V, LP(c) | | 6/16/2022 | | | 6,556,893 | | | | 8,013,362 | |

| Gridiron Capital Fund V, L.P.(c) | | 4/30/2023 | | | 0 | | | | 237,525 | |

| One Equity Partners VIII-A, L.P.(c) | | 4/28/2022 | | | 9,439,549 | | | | 10,705,300 | |

| | | | | | | | | | | |

| Total Primary Investments | | | | $ | 23,034,912 | | | $ | 27,321,540 | |

| Short-Term Investments (5.89%) | | Cost | | | Fair Value | |

| Fidelity Treasury Fund, 4.70%(i) | | | 41,541 | | | | 41,541 | |

| Goldman Sachs Financial Square Government Fund, 5.01%(i) | | | 18,000,000 | | | | 18,000,000 | |

| Vanguard Federal Money Market, 5.30%(i) | | | 17,787,108 | | | | 17,787,108 | |

| | | | | | | | | |

| Total | | | 35,828,649 | | | | 35,828,649 | |

| | | | | | | | | |

| Total Short-Term Investments | | $ | 35,828,649 | | | $ | 35,828,649 | |

| | | | | | | | | |

| Total Investments (109.46%) | | $ | 589,016,099 | | | $ | 665,857,698 | |

| Liabilities In Excess of Other | | | | | | | | |

| Assets ((9.46%)) | | | | | | | (57,537,432 | ) |

| Net Assets (100.00%) | | | | | | $ | 608,320,266 | |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 7 |

| FS MVP Private Markets Fund | Consolidated Schedule of Investments |

As of September 30, 2023 (Unaudited)

Investment Abbreviations:

SOFR- Secured Overnight Financing Rate

Rates:

3M US SOFR - 3 Month SOFR as of September 30, 2023 was 5.00%

| (a) | Level 3 securities fair valued under procedures established by the Trustees, represent 19.56% of Net Assets. The total value of these securities is $118,976,130. |

| (b) | Investments have no redemption provisions, are issued in private placement transactions and are restricted as to resale. For investments that were acquired through multiple transactions, the acquisition date represents the initial acquisition date of the Fund’s investment in the position. Total fair value of restricted securities amounts to $630,029,049, which represents 103.57% of net assets as of September 30, 2023. |

| (c) | Investment has been committed to but has not been fully funded by the Fund at September 30, 2023. See Note 8 for total unfunded investment commitments. |

| (d) | The Fund owns 500,000 Class A units. |

| (e) | Investment does not allow redemptions or withdrawals except at discretion of its general partner, manager or advisor. |

| (f) | All or a portion of this security is custodied with MVP Private Markets Sub-Fund, LLC at September 30, 2023. |

| (g) | The Fund owns 4,545,455 subscriber units. |

| (h) | All or a portion of this security is custodied with MVP Private Markets Fund (S), LLC at September 30, 2023. |

| (i) | The rate shown is the annualized 7-day yield as of September 30, 2023. |

| * | All securities are domiciled in the United States. |

See Notes to Financial Statements.

| FS MVP Private Markets Fund | Consolidated Statement of Assets and Liabilities |

As of September 30, 2023 (Unaudited)

| ASSETS: | | | |

| Investments, at fair value (Cost $589,016,099) | | $ | 665,857,698 | |

| Cash | | | 12,192,365 | |

| Receivable for investments sold | | | 73,072 | |

| Interest receivable | | | 1,383,957 | |

| Prepaid expenses and other assets | | | 1,825,415 | |

| Total Assets | | | 681,332,507 | |

| | | | | |

| LIABILITIES: | | | | |

| Credit facility | | | 25,000,000 | |

| Deferred tax liability | | | 7,591,956 | |

| Current tax payable | | | 2,576,481 | |

| Payable for investments purchased | | | 31,939,324 | |

| Payable for shares repurchased | | | 476,746 | |

| Interest payable on credit facility | | | 6,451 | |

| Incentive fee payable | | | 2,729,457 | |

| Investment advisory fee payable | | | 2,255,370 | |

| Fund accounting and administration fees payable | | | 172,981 | |

| Accrued trustees' fees payable | | | 28,296 | |

| Other payables and accrued expenses | | | 235,179 | |

| Total Liabilities | | | 73,012,241 | |

| Net Assets Attributable to Common Shareholders | | $ | 608,320,266 | |

| | | | | |

| COMPOSITION OF NET ASSETS ATTRIBUTABLE TO COMMON SHARESHOLDERS: | | | | |

| Paid-in capital | | | 545,467,824 | |

| Total distributable earnings | | | 62,852,442 | |

| Net Assets Attributable to Common Shareholders | | $ | 608,320,266 | |

| | | | | |

| Class A | | | | |

| Net Assets | | $ | 38,100 | |

| Shares of Beneficial Interest Outstanding | | | 3,442 | |

| Net Asset Value | | | 11.07 | |

| Maximum offering price per share ((NAV/0.965), based on maximum sales charge of 3.50% of the offering price) | | | 11.47 | |

| Class D | | | | |

| Net Assets | | | 38,580 | |

| Shares of Beneficial Interest Outstanding | | | 3,441 | |

| Net Asset Value | | | 11.21 | |

| Maximum offering price per share ((NAV/0.965), based on maximum sales charge of 3.50% of the offering price) | | | 11.62 | |

| Class I | | | | |

| Net Assets | | | 608,243,586 | |

| Shares of Beneficial Interest | | | 54,107,929 | |

| Net Asset Value | | | 11.24 | |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 9 |

| FS MVP Private Markets Fund | Consolidated Statement of Operations |

For the Six Months Ended September 30, 2023 (Unaudited)

| INVESTMENT INCOME: | | | |

| Dividends | | $ | 1,651,349 | |

| Interest | | | 5,673,719 | |

| Lending fees | | | 131,199 | |

| Total Investment Income | | | 7,456,267 | |

| | | | | |

| EXPENSES: | | | | |

| Investment advisory fees | | | 4,019,727 | |

| Incentive fees | | | 2,750,353 | |

| Interest expense | | | 1,749,623 | |

| Legal and audit fees | | | 782,900 | |

| Fund accounting and administration fees | | | 292,635 | |

| Transfer agent fees | | | 100,211 | |

| Trustees' fees and expenses | | | 57,484 | |

| Chief Compliance Officer fees | | | 15,820 | |

| Printing expenses | | | 8,723 | |

| Custodian fees | | | 7,743 | |

| Insurance expenses | | | 3,667 | |

| Other expenses | | | 65,550 | |

| Total Expenses | | | 9,854,436 | |

| Net Investment Loss | | | (2,398,169 | ) |

| | | | | |

| NET REALIZED AND UNREALIZED GAIN/(LOSS) ON INVESTMENTS: | | | | |

| Net realized gain/(loss) on: | | | | |

| Investments | | | 9,695,788 | |

| Net realized gain on investments | | | 9,695,788 | |

| Net change in unrealized depreciation on: | | | | |

| Investments and unfunded commitments | | | 17,247,339 | |

| Net change in unrealized depreciation on investments | | | 17,247,339 | |

| Net Realized and Unrealized Gain on Investments | | | 26,943,127 | |

| Liability for taxes on realized/unrealized gain on investments | | | (941,408 | ) |

| | | | | |

| Net Increase in Net Assets from Operations | | $ | 23,603,550 | |

See Notes to Financial Statements.

| FS MVP Private Markets Fund | Consolidated Statement of Changes in Net Assets |

| | | For the Six Months Ended September 30, 2023 (Unaudited) (a) | | | For the Year Ended March 31, 2023 (a) | |

| FROM OPERATIONS: | | | | | | | | |

| Net loss | | $ | (2,398,169 | ) | | $ | (7,818,184 | ) |

| Net realized gain on investments | | | 9,695,788 | | | | 29,574,640 | |

| Net change in unrealized appreciation/depreciation on investments and unfunded commitments | | | 17,247,339 | | | | (9,207,901 | ) |

| Liability for taxes on realized/unrealized gain on investments | | | (941,408 | ) | | | – | |

| Net Increase in Net Assets from Operations | | | 23,603,550 | | | | 12,548,555 | |

| | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | |

| Class A | | | | | | | | |

| From net realized gains | | | – | | | | (1,129 | ) |

| Class D | | | | | | | | |

| From net realized gains | | | – | | | | (1,129 | ) |

| Class I | | | | | | | | |

| From net realized gains | | | – | | | | (16,083,140 | ) |

| Net Decrease in Net Assets from Distributions to Common Shareholders | | | – | | | | (16,085,398 | ) |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 11 |

| FS MVP Private Markets Fund | Consolidated Statement of Changes in Net Assets |

| | | For the Six Months Ended September 30, 2023 (Unaudited) (a) | | | For the Year Ended March 31, 2023 (a) | |

| CAPITAL SHARE TRANSACTIONS: | | | | | | | | |

| Class A | | | | | | | | |

| Proceeds from shares sold | | | 50 | | | | – | |

| Net asset value of common shares issued to shareholders from reinvestment of dividends | | | – | | | | 1,129 | |

| Class D | | | | | | | | |

| Proceeds from shares sold | | | 51 | | | | – | |

| Net asset value of common shares issued to shareholders from reinvestment of dividends | | | – | | | | 1,129 | |

| Class I | | | | | | | | |

| Proceeds from shares sold | | | 24,874,129 | | | | 95,870,285 | |

| Cost of shares repurchased | | | (1,314,680 | ) | | | – | |

| Net asset value of common shares issued to shareholders from reinvestment of dividends | | | – | | | | 14,670,991 | |

| Net Increase from Capital Share Transactions | | | 23,559,550 | | | | 110,543,534 | |

| Net Increase in Net Assets Attributable to Common Shares | | | 47,163,100 | | | | 107,006,691 | |

| | | | | | | | | |

| NET ASSETS ATTRIBUTABLE TO COMMON SHAREHOLDERS: | | | | | | | | |

| Beginning of period | | | 561,157,166 | | | | 454,150,475 | |

| End of period | | $ | 608,320,266 | | | $ | 561,157,166 | |

| | | | | | | | | |

| SHARE ACTIVITY | | | | | | | | |

| Class A | | | | | | | | |

| Shares issued in reinvestment of distributions | | | – | | | | 109 | |

| Class D | | | | | | | | |

| Shares issued in reinvestment of distributions | | | – | | | | 108 | |

| Class I | | | | | | | | |

| Shares sold | | | 2,182,740 | | | | 7,452,259 | |

| Shares issued in reinvestment of distributions | | | – | | | | 1,402,580 | |

| Shares redeemed | | | (119,092 | ) | | | – | |

See Notes to Financial Statements.

| FS MVP Private Markets Fund | Consolidated Statement of Cash Flows |

For the Six Months Ended September 30, 2023 (Unaudited)

CASH FLOWS FROM OPERATING ACTIVITIES:

| Net increase in net assets from operations | | $ | 23,603,550 | |

| Adjustments to reconcile net increase in net assets from operations to net cash provided by/(used in) operating activities: | | | | |

| Purchases of investments | | | (102,986,950 | ) |

| Proceeds from disposition of investments | | | 37,516,212 | |

| Net discounts (accreted)/premiums amortized | | | 11,005,405 | |

| Net realized (gain)/loss on: | | | | |

| Investments | | | (9,695,788 | ) |

| Net change in unrealized (appreciation)/depreciation on: | | | | |

| Investments and unfunded commitments | | | (17,247,339 | ) |

| Net purchase of short term investment | | | 32,698,191 | |

| (Increase)/Decrease in assets: | | | | |

| Interest receivable | | | (486,359 | ) |

| Prepaid expenses and other assets | | | 279,802 | |

| Increase/(Decrease) in liabilities: | | | | |

| Interest due on loan facility | | | (332,920 | ) |

| Incentive fee payable | | | 1,986,349 | |

| Deferred tax liability | | | (1,635,073 | ) |

| Current tax payable | | | 2,576,481 | |

| Organizational cost payable | | | (379,431 | ) |

| Investment advisory fee payable | | | 470,593 | |

| Fund accounting and administration payable | | | 20,606 | |

| Accrued trustees' fees payable | | | 27,484 | |

| Other payables and accrued expenses | | | 149,162 | |

| Net Cash Provided by/(Used in) Operating Activities | | | (22,430,025 | ) |

| | | | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Cost of shares repurchased | | | (837,934 | ) |

| Proceeds from shares sold - common shares | | | 25,209,230 | |

| Net Cash Provided By Financing Activities | | | 24,371,296 | |

| | | | | |

| Net Increase in Cash | | | 1,941,271 | |

| Cash, beginning balance | | $ | 10,251,094 | |

| Cash, ending balance | | $ | 12,192,365 | |

| | | | | |

| Cash paid on interest on credit facility | | $ | 2,082,543 | |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 13 |

| FS MVP Private Markets Fund – Class A | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended September 30, 2023 (Unaudited) | | | For the Year Ended March 31, 2023 | | | For the Period January 3, 2022 (Commencement of Operations) to March 31, 2022 | |

| PER COMMON SHARE OPERATING PERFORMANCE: | | | | | | |

| Net asset value - beginning of period | | $ | 10.66 | | | $ | 10.49 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.11 | ) | | | (0.26 | ) | | | (0.10 | ) |

| Net realized and unrealized gain on investments | | | 0.52 | | | | 0.77 | | | | 0.59 | |

| Total Income from Investment Operations | | | 0.41 | | | | 0.51 | | | | 0.49 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains | | | – | | | | (0.34 | ) | | | – | |

| Total Distributions to Common Shareholders | | | – | | | | (0.34 | ) | | | – | |

| | | | | | | | | | | | | |

| Net asset value per common share - end of period | | $ | 11.07 | | | $ | 10.66 | | | $ | 10.49 | |

| | | | | | | | | | | | | |

| Total Return (b) | | | 3.85 | % | | | 4.74 | % | | | 4.90 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (000s) | | $ | 38 | | | $ | 37 | | | $ | 35 | |

| Ratio of expenses to average net assets attributable to common shares | | | 4.62 | %(c)(d) | | | 3.60 | %(c)(e) | | | 3.24 | %(c) |

| Ratio of net investment loss to average net assets attributable to common shares | | | (2.08 | %)(f) | | | (2.30 | %)(f) | | | (1.86 | %)(f) |

| Portfolio turnover rate | | | 4 | %(g) | | | 3 | % | | | 0 | %(g) |

| | | | | | | | | | | | | |

| SENIOR SECURED NOTES: | | | | | | | | | | | | |

| Aggregate principal amount, end of period (000s) | | $ | 25,000 | | | $ | N/A | | | $ | N/A | |

| Asset coverage per $1,000 unit of indebtedness(h) | | $ | 25,333 | | | | N/A | | | | N/A | |

| (a) | Calculated using average common shares outstanding. |

See Notes to Financial Statements.

| FS MVP Private Markets Fund – Class A | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment return does not reflect sales load or brokerage commissions, if any, and is not annualized. |

| (c) | Expense ratios have been annualized, except for Organizational Fees and Offering Costs which are one time expenses, and Incentive Fees which are not annualized. If Incentive Fees had been excluded, the expense ratios would have decreased by 0.42% for the six months ended September 30, 2023, 0.14% for the year ended March 31, 2023 and 0.45% for the period ended March 31, 2022. Expenses do not include expenses from underlying funds in which the Fund is invested. |

| (d) | Includes Interest expense of 0.60% of average net assets. |

| (e) | Includes Interest expense of 0.22% of average net assets. |

| (f) | Net investment loss ratio is calculated excluding Incentive Fees. If Incentive Fees were included the ratio would have been lowered by 0.42% for the six months ended September 30, 2023, 0.14% for the year ended March 31, 2023 and 0.45% for the period ended March 31, 2022. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. Ratios do not include net investment income of the funds in which the Fund invests. |

| (g) | Percentage represents the results for the period and is not annualized. |

| (h) | Calculated by subtracting the Fund's total liabilities (not including borrowings) from the Fund's total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 senior indebtedness. |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 15 |

| FS MVP Private Markets Fund – Class D | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended September 30, 2023 (Unaudited) | | | For the Year Ended March 31, 2023 | | | For the Period January 3, 2022 (Commencement of Operations) to March 31, 2022 | |

| PER COMMON SHARE OPERATING PERFORMANCE: | | | | | | |

| Net asset value - beginning of period | | $ | 10.76 | | | $ | 10.51 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.08 | ) | | | (0.19 | ) | | | (0.08 | ) |

| Net realized and unrealized gain on investments | | | 0.53 | | | | 0.78 | | | | 0.59 | |

| Total Income from Investment Operations | | | 0.45 | | | | 0.59 | | | | 0.51 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains | | | – | | | | (0.34 | ) | | | – | |

| Total Distributions to Common Shareholders | | | – | | | | (0.34 | ) | | | – | |

| | | | | | | | | | | | | |

| Net asset value per common share - end of period | | $ | 11.21 | | | $ | 10.76 | | | $ | 10.51 | |

| | | | | | | | | | | | | |

| Total Return (b) | | | 4.18 | % | | | 5.40 | % | | | 5.10 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (000s) | | $ | 39 | | | $ | 37 | | | $ | 35 | |

| Ratio of expenses to average net assets attributable to common shares | | | 3.92 | %(c)(d) | | | 2.88 | %(c)(e) | | | 2.45 | %(c) |

| Ratio of net investment loss to average net assets attributable to common shares | | | (1.38 | %)(f) | | | (1.53 | %)(f) | | | (1.06 | %)(f) |

| Portfolio turnover rate | | | 4 | %(g) | | | 3 | % | | | 0 | %(g) |

| | | | | | | | | | | | | |

| SENIOR SECURED NOTES: | | | | | | | | | | | | |

| Aggregate principal amount, end of period (000s) | | $ | 25,000 | | | $ | N/A | | | $ | N/A | |

| Asset coverage per $1,000 unit of indebtedness(h) | | $ | 25,333 | | | | N/A | | | | N/A | |

| (a) | Calculated using average common shares outstanding. |

See Notes to Financial Statements.

| FS MVP Private Markets Fund – Class D | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment return does not reflect sales load or brokerage commissions, if any, and is not annualized. |

| (c) | Expense ratios have been annualized, except for Organizational Fees and Offering Costs which are one time expenses, and Incentive Fees which are not annualized. If Incentive Fees had been excluded, the expense ratios would have decreased by 0.46% for the six months ended September 30, 2023, 0.20% for the year ended March 31, 2023 and 0.45% for the period ended March 31, 2022. Expenses do not include expenses from underlying funds in which the Fund is invested. |

| (d) | Includes Interest expense of 0.60% of average net assets. |

| (e) | Includes Interest expense of 0.22% of average net assets. |

| (f) | Net investment loss ratio is calculated excluding Incentive Fees. If Incentive Fees were included the ratio would have been lowered by 0.46% for the six months ended September 30, 2023, 0.20% for the year ended March 31, 2023 and 0.45% for the period ended March 31, 2022. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. Ratios do not include net investment income of the funds in which the Fund invests. |

| (g) | Percentage represents the results for the period and is not annualized. |

| (h) | Calculated by subtracting the Fund's total liabilities (not including borrowings) from the Fund's total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 senior indebtedness. |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 17 |

| FS MVP Private Markets Fund – Class I | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| | | For the Six Months Ended September 30, 2023 (Unaudited) | | | For the Year Ended March 31, 2023 | | | For the Period January 3, 2022 (Commencement of Operations) to March 31, 2022 | |

| PER COMMON SHARE OPERATING PERFORMANCE: | | | | | | |

| Net asset value - beginning of period | | $ | 10.78 | | | $ | 10.51 | | | $ | 10.00 | |

| INCOME/(LOSS) FROM INVESTMENT OPERATIONS: | | | | | | | | | | | | |

| Net investment loss(a) | | | (0.06 | ) | | | (0.16 | ) | | | (0.07 | ) |

| Net realized and unrealized gain on investments | | | 0.52 | | | | 0.77 | | | | 0.58 | |

| Total Income from Investment Operations | | | 0.46 | | | | 0.61 | | | | 0.51 | |

| | | | | | | | | | | | | |

| DISTRIBUTIONS TO COMMON SHAREHOLDERS: | | | | | | | | | | | | |

| From net realized gains | | | – | | | | (0.34 | ) | | | – | |

| Total Distributions to Common Shareholders | | | – | | | | (0.34 | ) | | | – | |

| | | | | | | | | | | | | |

| Net asset value per common share - end of period | | $ | 11.24 | | | $ | 10.78 | | | $ | 10.51 | |

| | | | | | | | | | | | | |

| Total Return (b) | | | 4.27 | % | | | 5.69 | % | | | 5.10 | % |

| | | | | | | | | | | | | |

| RATIOS AND SUPPLEMENTAL DATA: | | | | | | | | | | | | |

| Net assets attributable to common shares, end of period (000s) | | $ | 608,244 | | | $ | 559,754 | | | $ | 454,080 | |

| Ratio of expenses to average net assets attributable to common shares | | | 3.69 | %(c)(d) | | | 2.72 | %(c)(e) | | | 2.23 | %(c) |

| Ratio of net investment loss to average net assets attributable to common shares | | | (1.14 | %)(f) | | | (1.30 | %)(f) | | | (0.81 | %)(f) |

| Portfolio turnover rate | | | 4 | %(g) | | | 3 | % | | | 0 | %(g) |

| | | | | | | | | | | | | |

| SENIOR SECURED NOTES: | | | | | | | | | | | | |

| Aggregate principal amount, end of period (000s) | | $ | 25,000 | | | $ | N/A | | | $ | N/A | |

| Asset coverage per $1,000 unit of indebtedness(h) | | $ | 25,333 | | | | N/A | | | | N/A | |

| (a) | Calculated using average common shares outstanding. |

See Notes to Financial Statements.

| FS MVP Private Markets Fund – Class I | Consolidated Financial Highlights |

For a Share Outstanding Throughout the Periods Presented

| (b) | Total investment return is calculated assuming a purchase of common share at the opening on the first day and a sale at closing on the last day of each period reported. Dividends and distributions are assumed for purposes of this calculation to be reinvested at prices obtained under the Fund's dividend reinvestment plan. Total investment return does not reflect sales load or brokerage commissions, if any, and is not annualized. |

| (c) | Expense ratios have been annualized, except for Organizational Fees and Offering Costs which are one time expenses, and Incentive Fees which are not annualized. If Incentive Fees had been excluded, the expense ratios would have decreased by 0.46% for the six months ended September 30, 2023, 0.25% for the year ended March 31, 2023 and 0.46% for the period ended March 31, 2022. Expenses do not include expenses from underlying funds in which the Fund is invested. |

| (d) | Includes Interest expense of 0.60% of average net assets. |

| (e) | Includes Interest expense of 0.22% of average net assets. |

| (f) | Net investment loss ratio is calculated excluding Incentive Fees. If Incentive Fees were included the ratio would have been lowered by 0.47% for the six months ended September 30, 2023, 0.25% for the year ended March 31, 2023 and 0.46% for the period ended March 31, 2022. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying funds in which the Fund invests. Ratios do not include net investment income of the funds in which the Fund invests. |

| (g) | Percentage represents the results for the period and is not annualized. |

| (h) | Calculated by subtracting the Fund's total liabilities (not including borrowings) from the Fund's total assets and dividing this by the total number of senior indebtedness units, where one unit equals $1,000 senior indebtedness. |

See Notes to Financial Statements.

| Semi-Annual Report | September 30, 2023 | 19 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

1. ORGANIZATION

FS MVP Private Markets Fund, formerly MVP Private Markets Fund, (the "Fund") was organized as a Delaware statutory trust on April 7, 2021. The Fund is registered under the Investment Company Act of 1940, as amended (the "1940 Act"), as a non-diversified, closed-end management investment company. The Fund’s investment adviser is Portfolio Advisers, LLC (the "Adviser"), a subsidiary of FS Investments (formerly Franklin Square Capital Partners), a national sponsor of alternative investment funds designed for the individual investor. The Adviser is an investment adviser registered under the Investment Advisers Act of 1940, as amended (the "Advisers Act") and was organized as a limited liability company under the laws of the State of Connecticut on June 19, 1997. The Fund commenced operations on January 3, 2022 ("Commencement of Operations"). Simultaneous with the Commencement of Operations, the Predecessor Fund, through a tax-free reorganization, transferred investments, cash and other assets totaling $416,174,869 (including $45,914,879 of unrealized appreciation) into the Fund. The investments acquired by the Fund in the reorganization were valued using fair value procedures approved by the Fund's Board of Trustees (the "Board"). The Predecessor Fund maintained an investment objective, strategies and investment policies, guidelines and restrictions that are, in all material respects, equivalent to those of the Fund. At the time of the conversion, the Predecessor Fund was managed by the same Adviser and portfolio managers as the Fund.

The Fund’s investment objective is to generate long-term capital appreciation by investing in a diversified portfolio of private market investments, with a focus on investments in mid-sized companies in the United States. The Fund will seek to achieve its investment objective through a mix of investments (the "Fund Investments") that is predominantly comprised of private equity, and to a lesser extent private credit. Fund Investments are expected to primarily consist of the following:

| | ● | direct investments in the equity or debt of target companies and other private assets (i.e. assets that are not traded on a public securities exchange) ("Direct Investments"), typically together with third-party managers ("Sponsors"); |

| | ● | purchases of existing interests in private equity or private credit funds ("Portfolio Funds") and other private assets managed by Sponsors ("Secondary Investments"); |

| | ● | subscriptions for new interests in Portfolio Funds ("Primary Investments"); and |

| | ● | short-term and liquid investments, including money market funds, short term treasuries, and/or other liquid investment vehicles. |

Subject to applicable law and regulation, the Fund may gain exposure to Fund Investments indirectly through pooled vehicles or special purpose vehicles managed by the Adviser, any of its affiliates or third parties.

Under normal circumstances, the Fund intends to invest and/or make capital commitments of at least 80% of its net assets (plus the amount of any borrowings for investment purposes) in ("Private Market Assets"). For purposes of this policy, Private Market Assets include Direct Investments, Portfolio Funds, Secondary Investments, and Primary Investments.

The Board has overall responsibility for the management and supervision of the business operations of the Fund on behalf of the shareholders. A majority of Trustees of the Board are and will be persons who are not "interested persons," as defined in Section 2(a)(19) of the 1940 Act (the "Independent Trustees"). To the extent permitted by the 1940 Act and other applicable law, the Board may delegate any of its rights, powers and authority to, among others, the officers of the Fund, any committee of the Board, service providers or the Adviser.

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The Fund offers three separate classes of shares of beneficial interest ("Shares") designated as Class A Shares, Class I Shares and Class D Shares. Each class of Shares is subject to different fees and expenses. The Fund may offer additional classes of Shares in the future. The Fund has received an exemptive order from the SEC with respect to the Fund’s multi-class structure. The purchase price of the Shares at the Commencement of Operations was $10.00 per Share. Thereafter, the purchase price Shares was based on the net asset value per Share as of the date such Shares were purchased. Fractions of Shares are issued to one one-thousandth of a Share.

The minimum initial investment in the Fund for Class A Shares and Class D Shares is $50,000, and the minimum initial investment for Class I Shares is $1,000,000 except for additional purchases pursuant to the dividend reinvestment plan. However, the Fund, in its sole discretion, may accept investments below these minimums. Investors subscribing through a given broker/dealer or registered investment adviser may have shares aggregated to meet these minimums, so long as denominations are not less than $50,000 and incremental contributions are not less than $5,000.

Shares will generally be offered for purchase as of the first business day of each month, except that Shares may be offered more or less frequently as determined by the Board in its sole discretion. Investments in Class A Shares and Class D Shares of the Fund are sold subject to a sales charge of up to 3.50% of the investment. For some investors, the sales charge may be waived or reduced (in whole or in part). The full amount of sales charge may be reallowed to brokers or dealers participating in the offering.

2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The Fund meets the definition of an investment company and follows the accounting and reporting guidance as issued through the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) 946, Financial Services – Investment Companies.

The following is a summary of significant accounting policies followed by the Fund in the preparation of its financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

Consolidation of Subsidiaries: The Fund may make investments through wholly-owned subsidiaries (each a “Subsidiary” and together, the “Subsidiaries”). Such Subsidiaries will not be registered under the Investment Company Act; however, the Fund will wholly own and control any Subsidiaries. The Board has oversight responsibility for the investment activities of the Fund, including its investment in any Subsidiary, and the Fund’s role as sole shareholder owner of any Subsidiary. To the extent applicable to the investment activities of a Subsidiary, the Subsidiary will follow the same compliance policies and procedures as the Fund. The Fund would “look through” any such Subsidiary to determine compliance with its investment policies. The Fund complies with Section 8 of the Investment Company Act governing investment policies on an aggregate basis with any Subsidiary. The Fund also complies with Section 18 of the Investment Company Act governing capital structure and leverage on an aggregate basis with each Subsidiary so that the Fund treats a Subsidiary’s debt as its own for purposes of Section 18. Further, each Subsidiary complies with the provisions of Section 17 of the Investment Company Act relating to affiliated transactions and custody. Any Subsidiary would use UMB Bank, n.a. as custodian. The Fund will not create or acquire primary control of any entity which engages in investment activities in securities or other assets, other than entities wholly-owned by the Fund.

| Semi-Annual Report | September 30, 2023 | 21 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

As of September 30, 2023, there are two active Subsidiaries: MVP Private Markets Sub-Fund LLC (the “Sub-Fund”) and MVP Private Markets Fund (S) LLC, both formed in Delaware. These Subsidiaries have the same investment objective as the Fund. The Consolidated Schedule of Investments, Consolidated Statement of Assets and Liabilities, Consolidated Statement of Operations, Consolidated Statement of Changes in Net Assets, Consolidated Statement of Cash Flows and Consolidated Financial Highlights of the Fund include the accounts of the Subsidiaries. All inter-company accounts and transactions have been eliminated in the consolidation for the Fund.

As of September 30, 2023, the total value of investments held by the Sub-Fund is $108,521,817 or approximately 17.84% of the Fund's net assets.

As of September 30, 2023, the total value of investments held by MVP Private Markets Fund (S) LLC are $22,346,567 or approximately 3.67% of the Fund's net assets.

Federal Tax Information: The Fund has elected to be treated, and qualifies as a regulated investment company ("RIC") under Internal Revenue Code of 1986, as amended (the "Code"). To qualify for and maintain RIC tax treatment, the Fund must, among other things, distribute at least 90% of its net ordinary income and realized net short-term capital gains in excess of realized net long-term capital losses, if any. The Fund has adopted a tax-year end of September 30. The Fund’s tax year will be the 12-month period ending on September 30. The Fund files tax returns as prescribed by the tax laws of the jurisdictions in which it operates. In the normal course of business, the Fund is subject to examination by U.S. federal, state, local and foreign jurisdictions, where applicable. As of September 30, 2023, the tax years ended September 30, 2023 and September 30, 2022 are subject to examination by the major tax jurisdictions as the statute of limitations are the previous three tax years.

Management evaluates the tax positions taken or expected to be taken in the course of preparing the Fund’s tax returns to determine whether the tax positions will “more-likely-than-not” be sustained upon examination by the applicable tax authority. Tax positions deemed to meet the more-likely-than-not threshold that would result in a tax benefit or expense to the Fund would be recorded as a tax benefit or expense in the current year. The Fund has not recognized any tax liability for unrecognized tax benefits or expenses. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Consolidated Statement of Operations. During the six months ended September 30, 2023, the Fund did not incur any interest or penalties.

The Sub-Fund is taxed as a regular C-corporation for federal income tax purposes and as such is obligated to pay federal and state income tax. This treatment differs from most investment companies, which elect to be treated as “regulated investment companies” under the Internal Revenue Code of 1986, as amended (the “Code”) in order to avoid paying entity level income taxes. Under current law, the Sub-Fund is not eligible to elect treatment as a regulated investment company. However, the amount of taxes paid by the Sub-Fund will vary depending on the amount of capital appreciation of its investments and such taxes will reduce a Fund shareholders return from an investment in the Fund.

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

Since the Sub-Fund will be subject to taxation on the capital appreciation of its investments, the NAV of the Fund shares will also be reduced by the accrual of any deferred tax liability. As a result, the Fund's after tax performance would be impacted.

The Sub-Fund will accrue deferred income taxes for any future tax liability associated with capital appreciation of its investments. Upon the sale of an investment, the Sub-Fund may be liable for previously deferred taxes. The Sub-Fund will rely to some extent on information, which is not necessarily timely, to estimate the deferred tax liability for purposes of financial statement reporting and determining the Fund’s NAV. From time to time, the Adviser will modify the estimates or assumptions related to the Sub-Fund’s deferred tax liability as new information becomes available. The Sub-Fund will generally compute deferred income taxes based on the federal income tax rate applicable to corporations and an assumed rate attributable to state taxes.

The Fund’s income tax expense/(benefit) consists of the following:

| | | Period ended September 30, 2023 | |

| | | Current | | | Deferred | | | Total | |

| Federal | | $ | 146,960 | | | $ | 153,396 | | | $ | 300,356 | |

| State | | | 172,552 | | | | 468,500 | | | | 641,052 | |

| Total tax expense | | $ | 319,512 | | | $ | 621,896 | | | $ | 941,408 | |

Components of the Fund’s tax liability are as follows:

| | | As of September 30, 2023 | |

| Tax liability: | | | | |

| Realized gain on investment securities | | $ | 2,576,481 | |

| Net unrealized gain on investment securities | | | 7,591,956 | |

| Net Tax Liability | | $ | 10,168,437 | |

The character of distributions made during the year from net investment income or net realized gain may differ from the characterization for federal income tax purposes due to differences in the recognition of income, expense and gain or loss items for financial statement and tax purposes. Where appropriate, reclassifications between net asset accounts are made for such differences that are permanent in nature.

Cash: Cash consists of monies held at UMB Bank, n.a. (the “Custodian”). Such cash may exceed federally insured limits. The Fund has not experienced any losses in such accounts and does not believe it is exposed to any significant credit risk on such accounts. There are no restrictions on the cash held by the Fund.

Short-Term Investments: Short-term investments represent investments in high quality money market instruments and money market mutual funds, and are recorded at NAV per share which approximates fair value. Money market instruments are high quality, short-term fixed-income obligations, which generally have remaining maturities of one year or less and may include U.S. Government securities, commercial paper, certificates of deposit and bankers’ acceptances issued by domestic branches of U.S. banks that are members of the Federal Deposit Insurance Corporation, and repurchase agreements.

| Semi-Annual Report | September 30, 2023 | 23 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

Investment Transactions: Investment transactions are accounted for on a trade-date basis. The Fund accounts for realized gains and losses from its Portfolio Funds based upon the pro-rata ratio of the fair value and cost of the underlying investments at the date of redemption. Dividend and interest income and expenses are recorded on the accrual basis. Distributions from Portfolio Funds will be received as underlying investments of the Portfolio Funds are liquidated. Distributions from Portfolio Funds occur at irregular intervals, and the exact timing of distributions from the Portfolio Funds has not been communicated from the Portfolio Funds. It is estimated that distributions will occur over the life of the Investment Funds.

Foreign Currency: Investments and other assets and liabilities denominated in foreign currencies are translated into U.S. dollar amounts at the date of valuation. Purchases and sales of investments and income and expense items denominated in foreign currencies are translated into U.S. dollar amounts on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from changes in foreign exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss from investments in the Consolidated Statement of Operations. Reported net realized foreign exchange gains or losses arise from sales of foreign currencies, currency gains or losses realized between the trade and settlement dates on securities transactions and the difference between the amounts of dividends, interest and foreign withholding taxes recorded on the Fund’s books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the fair values of assets and liabilities, other than investments at period end, resulting from changes in exchange rates.

Use of Estimates: The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of increases and decreases in net assets from operations during the reporting period. Actual results could differ from those estimates.

Fair Value of Financial Instruments: The fair value of the Fund’s assets and liabilities which qualify as financial instruments approximates the carrying amounts presented in the Consolidated Statement of Assets and Liabilities. The Fund values its investments in portfolio funds at fair value in accordance with FASB ASC 820, Fair Value Measurement (“ASC 820”). See Note 3 for more information.

3. PORTFOLIO VALUATION

ASC 820 defines fair value as the value that the Fund would receive to sell an investment or pay to transfer a liability in a timely transaction with an independent buyer in the principal market, or in the absence of a principal market, the most advantageous market for the investment or liability. ASC 820 establishes a three-level hierarchy for fair value measurements based upon the transparency of inputs to the valuation of an asset or liability. Inputs may be observable or unobservable and refer broadly to the assumptions that market participants would use in pricing the asset or liability. Observable inputs reflect the assumptions market participants would use in pricing the asset or liability based on market data obtained from sources independent of the Fund. Unobservable inputs reflect the Fund’s own assumptions about the assumptions that market participants would use in valuing the asset or liability developed based on the best information available in the circumstances. Each investment is assigned a level based upon the observation of the inputs which are significant to the overall valuation.

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The three-tier hierarchy of inputs is summarized below:

| Level 1 — | unadjusted quoted prices in active markets for identical financial instruments that the reporting entity has the ability to access at the measurement date. |

| | |

| Level 2 — | inputs other than quoted prices included within Level 1 that are observable for the financial instrument, either directly or indirectly. Level 2 inputs also include quoted prices for similar assets and liabilities in active markets, and quoted prices for identical or similar assets and liabilities in markets that are not active. |

| | |

| Level 3 — | significant unobservable inputs for the financial instrument (including management’s own assumptions in determining the fair value of investments). |

Investments in Portfolio Funds are recorded at fair value, using the Investment Funds’ NAV as a “practical expedient,” in accordance with ASC 820.

The private equity Portfolio Funds generally are restricted securities that are subject to substantial holding periods and are not traded in public markets, so that the Fund may not be able to resell some of its investments for extended periods, which may be several years. The types of private equity Portfolio Funds that the Fund may make investments in include primary and secondary investments. Primary investments are investments in newly established private equity funds. Secondary investments are investments in existing private equity funds that are acquired in privately negotiated transactions.

The Fund calculates its net asset value as of the close of business on the last business day of each month, each date that a Share is offered or repurchased, as of the date of any distribution and at such other times as the Board shall determine (each, a “Determination Date”). In determining its net asset value, the Fund values its investments as of the relevant Determination Date. The net asset value of the Fund equals, unless otherwise noted, the value of the total assets of the Fund, less all of its liabilities, including accrued fees and expenses, each determined as of the relevant Determination Date. The net asset value of Class A Shares, Class I Shares and Class D Shares will be calculated separately based on the fees and expenses applicable to each class. It is expected that the net asset value of Class A Shares, Class I Shares and Class D Shares will vary over time due to the different fees and expenses applicable to each class.

The Board has approved valuation procedures for the Fund (the “Valuation Policy”), and has approved the delegation of the day-to-day work of determining fair values and pricing responsibility for the Fund to the Adviser as the Fund’s Valuation Designee, subject to the oversight of the Board. The valuation of the Fund’s investments is performed in accordance with Financial Accounting Standards Board’s Accounting Standards Codification 820 — Fair Value Measurements and Disclosures.

| Semi-Annual Report | September 30, 2023 | 25 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The Valuation Policy provides that the Fund will value its Fund Investments at fair value.

Assets and liabilities initially expressed in foreign currencies will be converted into U.S. Dollars using foreign exchange rates provided by a recognized pricing service.

Securities traded on one or more of the U.S. national securities exchanges, the Nasdaq Stock Market or any foreign stock exchange will be valued based on their respective market price, subject to adjustment based on potential restrictions on the transfer or sale of such securities.

Debt instruments for which market quotations are readily available are typically valued based on such market quotations. In validating market quotations, the Valuation Designee considers different factors such as the source and the nature of the quotation and trading volume in order to determine whether the quotation represents fair value. The Adviser makes use of reputable financial information providers in order to obtain the relevant quotations.

For debt and equity securities which are not publicly traded or for which market prices are not readily available (unquoted investments) the fair value is determined in good faith. In determining the fair values of Direct Investments, the Valuation Designee will typically apply widely recognized market and income valuation methodologies including, but not limited to, earnings and multiple analysis, discounted cash flow method and third-party valuations. In order to determine a fair value, these methods are applied to the latest information provided by the relevant Portfolio Companies or other business counterparties.

Secondary Investments and Primary Investments in Portfolio Funds are generally valued based on the latest net asset value reported by the associated Sponsor taking into account the subsequent cash flow activity with respect thereto as set forth below, provided that if the Valuation Designee concludes in good faith that the latest net asset value reported by a Sponsor does not represent fair value, the Valuation Designee will make a corresponding adjustment to reflect the current fair value of such Portfolio Fund. In determining the fair value of assets held by Portfolio Funds, the Valuation Designee applies valuation methodologies as outlined above. Any cash flows since the reference date of the last net asset value for a Portfolio Fund received by the Fund from a Sponsor until the Determination Date are recognized by (i) adding the nominal amount of the investment related capital calls and (ii) deducting the nominal amount of investment related distributions from the net asset value as reported by the Sponsor.

Notwithstanding the above, Sponsors may adopt a variety of valuation bases and provide differing levels of information concerning Portfolio Funds and other investments and there will generally be no liquid markets for such investments. Consequently, there are inherent difficulties in determining the fair value that cannot be eliminated. The Valuation Designee will not be able to confirm independently the accuracy of valuations provided by the Sponsors (which are generally unaudited).

Determining the fair value of investments for which market values are not readily available is necessarily subject to incomplete information, reporting delays and many subjective judgments; accordingly, fair value determinations made by the Valuation Designee should be considered as estimates. Due to the inherent uncertainty involved in such determinations, the reported fair value of these investments may fluctuate from period to period. In addition, such fair value may differ materially from the values that may have been used had a ready market existed for such investments and may significantly differ from the value ultimately realized by the Fund.

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The Adviser and its affiliates act as investment advisers to other clients that invest in securities for which no public market price exists. Valuation determinations by the Adviser or its affiliates for other clients may result in different values than those ascribed to the same security owned by the Fund. Consequently, the fees charged to the Fund may be different than those charged to other clients, since the method of calculating the fees takes the value of all assets, including assets carried at different valuations, into consideration.

Expenses of the Fund, including the Investment Management Fee, are accrued on a monthly basis on the Determination Date and taken into account for the purpose of determining the Fund’s NAV.

Prospective investors should be aware that situations involving uncertainties as to the value of portfolio positions could have an adverse effect on the Fund’s net asset value and the Fund if the judgments of the Valuation Designee regarding appropriate valuations should prove incorrect.

The following table represents the inputs used to value the investments at fair value on the Consolidated Statement of Assets and Liabilities within the valuation hierarchy as of September 30, 2023:

Investments in

Securities at Value* | | Level 1 - Quoted

Prices | | | Level 2 - Significant

Observable Inputs | | | Level 3 - Significant

Unobservable Inputs | | | Total | |

| Direct Credit | | $ | – | | | $ | – | | | $ | 72,822,965 | | | $ | 72,822,965 | |

| Direct Equity | | | – | | | | – | | | | 46,153,165 | | | | 179,916,326 | |

| Primary Investment | | | – | | | | – | | | | – | | | | 27,321,540 | |

| Secondary Investment | | | – | | | | – | | | | – | | | | 349,968,218 | |

| Short Term Investments | | | 35,828,649 | | | | – | | | | – | | | | 35,828,649 | |

| Total | | $ | 35,828,649 | | | $ | – | | | $ | 118,976,130 | | | $ | 665,857,698 | |

Direct Equity, Primary and Secondary Investments fair valued using net asset value (or its equivalent) as a practical expedient are not included in the fair value hierarchy. As such, investments in securities with a fair value of $511,052,919 are excluded from the fair value hierarchy as of September 30, 2023.

| Semi-Annual Report | September 30, 2023 | 27 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The following is a reconciliation of investments in which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Direct Credit | | | Direct Equity | | | Secondary Investment | | | Total | |

| Balance as of March 31, 2023 | | $ | 70,094,031 | | | $ | 21,175,477 | | | $ | – | | | $ | 91,269,508 | |

| Accrued discount/ premium | | | 176,332 | | | | – | | | | – | | | | 176,332 | |

| Return of Capital | | | | | | | | | | | – | | | | – | |

| Realized Gain/(Loss) | | | 58,294 | | | | – | | | | – | | | | 58,294 | |

| Change in Unrealized Appreciation/(Depreciation) | | | 228,047 | | | | 322,129 | | | | – | | | | 550,176 | |

| Purchases | | | 5,303,341 | | | | 16,624 | | | | – | | | | 5,319,965 | |

| Sales Proceeds | | | (3,037,080 | ) | | | – | | | | – | | | | (3,037,080 | ) |

| Transfer into Level 3 | | | – | | | | 24,869,016 | | | | – | | | | 24,869,016 | |

| Transfer out of Level 3 | | | – | | | | (230,081 | ) | | | – | | | | (230,081 | ) |

| Balance as of September 30, 2023 | | $ | 72,822,965 | | | $ | 46,153,165 | | | $ | – | | | $ | 118,976,130 | |

| Net change in unrealized appreciation/(depreciation) included in the Statements of Operations attributable to Level 3 investments held at September 30, 2023 | | $ | 228,047 | | | $ | 322,129 | | | $ | – | | | $ | 550,176 | |

The following table presents additional quantitative information about valuation methodologies and inputs used for investments that are measured at fair value and categorized within Level 3 as of September 30, 2023:

| Asset Class | Fair Value at

September 30,

2023 | Valuation

Techniques | Unobservable

Input | Range of

Input | Weighted

Average

of Input | Impact to

Valuation from

an Increase

in Input |

| Direct Credit | $ 47,333,060 | Relevant ValueAnalysis | Yield toMaturity | 9.7% –16.4% | 13.0% | Decrease |

| Direct Credit | 25,489,905 | Recent transaction | N/A | N/A | N/A | N/A |

| Direct Equity | 46,153,165 | Market Comparable Companies | EBITDAMultiple | 7.1x –15.7x | 11.2x | Increase |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

The Fund’s investments in Portfolio funds, along with their corresponding unfunded commitments and other attributes, as of September 30, 2023, are briefly summarized in the table below.

| Financing Stage | | Investment

Strategy | | Fair Value | | | Unfunded

Commitments | | | Remaining

Life | | Redemption

Frequency | | Notice

Period

(In

Days) | | Redemption Restriction

Terms |

| Buyout | | Control investments in established companies | | $ | 561,762,392 | | | $ | 82,711,915 | | | Up to 10 Years | | None | | N/A | | N/A |

| Growth Capital | | Non-control investments in established companies with strong growth characteristics | | | 44,585,774 | | �� | | 977,876 | | | Up to 10 Years | | None | | N/A | | N/A |

| Special Situations/ Other | | Investments in mezzanine, distressed debt, energy/utility and turnarounds | | | 23,680,883 | | | | 3,158,003 | | | Up to 10 Years | | None | | N/A | | N/A |

| * | The information summarized in the table above represents the general terms for the specified financing stage. Individual Portfolio Funds may have terms that are more or less restrictive than those terms indicated for the asset class as a whole. In addition, most Portfolio Funds have the flexibility, as provided for in their constituent documents, to modify and waive such terms. |

Private equity is a common term for investments that typically are made in non-public companies through privately negotiated transactions. Private equity investors generally seek to acquire quality assets at attractive valuations and use operational expertise to enhance value and improve portfolio company performance. Buyout funds acquire private and public companies, as well as divisions of larger companies. Private equity specialists then seek to uncover value-enhancing opportunities in portfolio companies, unlock the value of the portfolio company and reposition it for sale at a multiple of invested equity.

The following outlines the primary investment strategies of the Portfolio Funds held by the Fund as of September 30, 2023.

Buyouts: Control investments in established, cash flow positive companies are usually classified as buyouts. Buyout investments may focus on small-, mid- or large-capitalization companies, and such investments collectively represent a substantial majority of the capital deployed in the overall private equity market. The use of debt financing, or leverage, is prevalent in buyout transactions—particularly in the large-cap segment.

Growth Capital: Investments in new and emerging companies are usually classified as venture capital. Such investments are often in technology, healthcare or other high growth industries.Companies financed by venture capital are generally not cash flow positive at the time of investment and may require several rounds of financing before the company can be sold privately or taken public. Venture capital investors may finance companies along the full path of development or focus on certain sub-stages (usually classified as seed, early and late stages) in partnership with other investors.

| Semi-Annual Report | September 30, 2023 | 29 |

| FS MVP Private Markets Fund | Notes to Consolidated Financial Statements |

September 30, 2023 (Unaudited)

Special Situations: A broad range including mezzanine, distressed debt, energy/utility investments and turnarounds.

Types of private equity investments that the Fund may make include:

Primary Investments. Primary investments (primaries) are interests or investments in newly established private equity funds. Primary investors subscribe for interests during an initial fundraising period, and their capital commitments are then used to fund investments in a number of individual operating companies during a defined investment period.

Secondary Investments. Secondary investments (secondaries) are interests in existing private equity funds that are acquired in privately negotiated transactions, typically after the end of the private equity fund’s fundraising period.