UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the Securities

Exchange Act of 1934

Filed by the Registrant [X]

Filed by a Party other than the Registrant [ ]

Check the appropriate box:

| [ ] | Preliminary Proxy Statement. |

| [ ] | Confidential, for use of the Commission Only (as permitted by Rule 14a-6(e)(2)). |

| [X] | Definitive Proxy Statement. |

| [ ] | Definitive Additional Materials. |

| [ ] | Soliciting Material Pursuant to § 240.14a-12. |

FS MVP Private Markets Fund

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| [ ] | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| [ ] | Fee paid previously with preliminary materials: |

| [ ] | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

FS MVP Private Markets Fund

July 2, 2024

Dear Shareholder,

FS MVP Private Markets Fund (the “Fund”) will hold a Special Meeting of Shareholders on July 22, 2024 at the offices of Faegre Drinker Biddle & Reath LLP, One Logan Square, Suite 2000, Philadelphia, PA 19103-6996 (the “Special Meeting”). The Special Meeting will be held at 12:00 p.m. Eastern Time. Formal notice of the Special Meeting appears on the next page and is followed by the Proxy Statement for the Special Meeting.

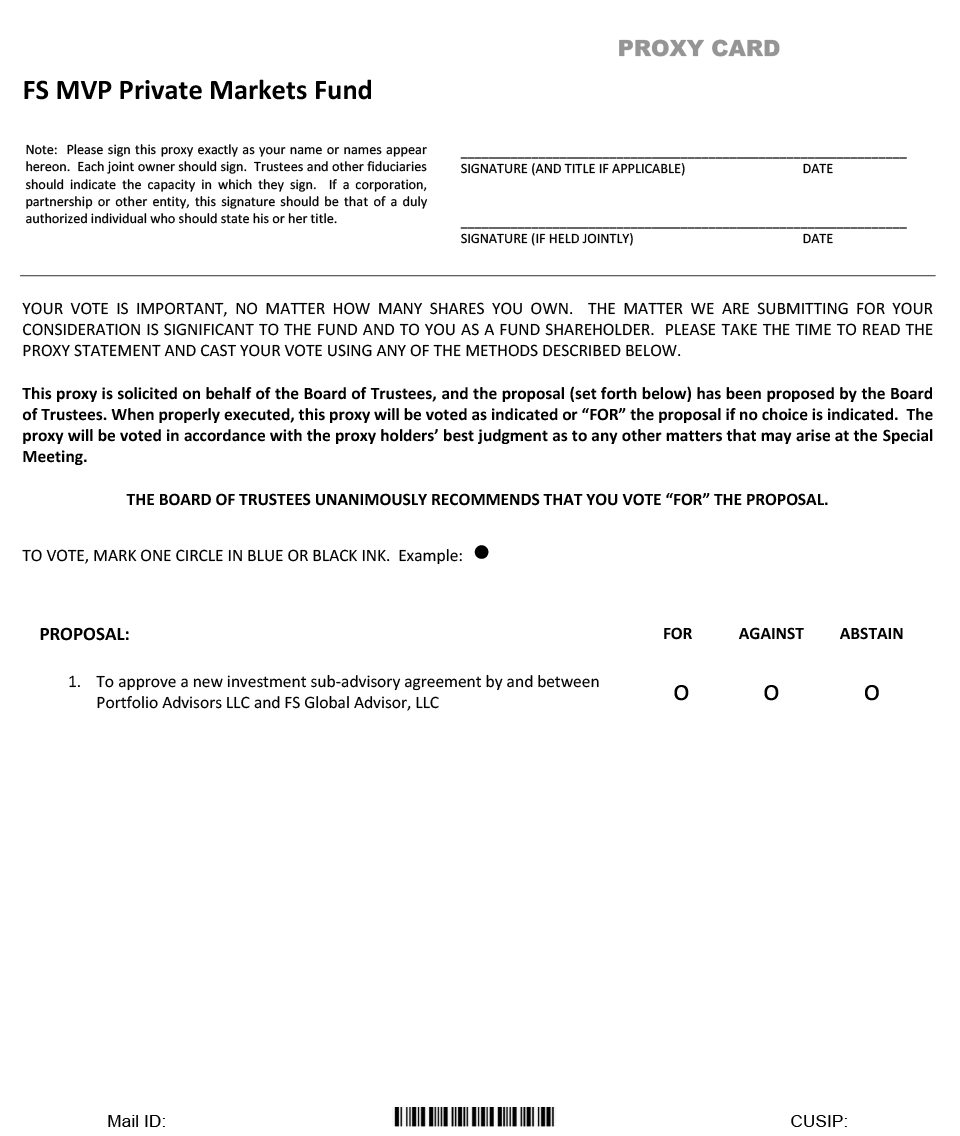

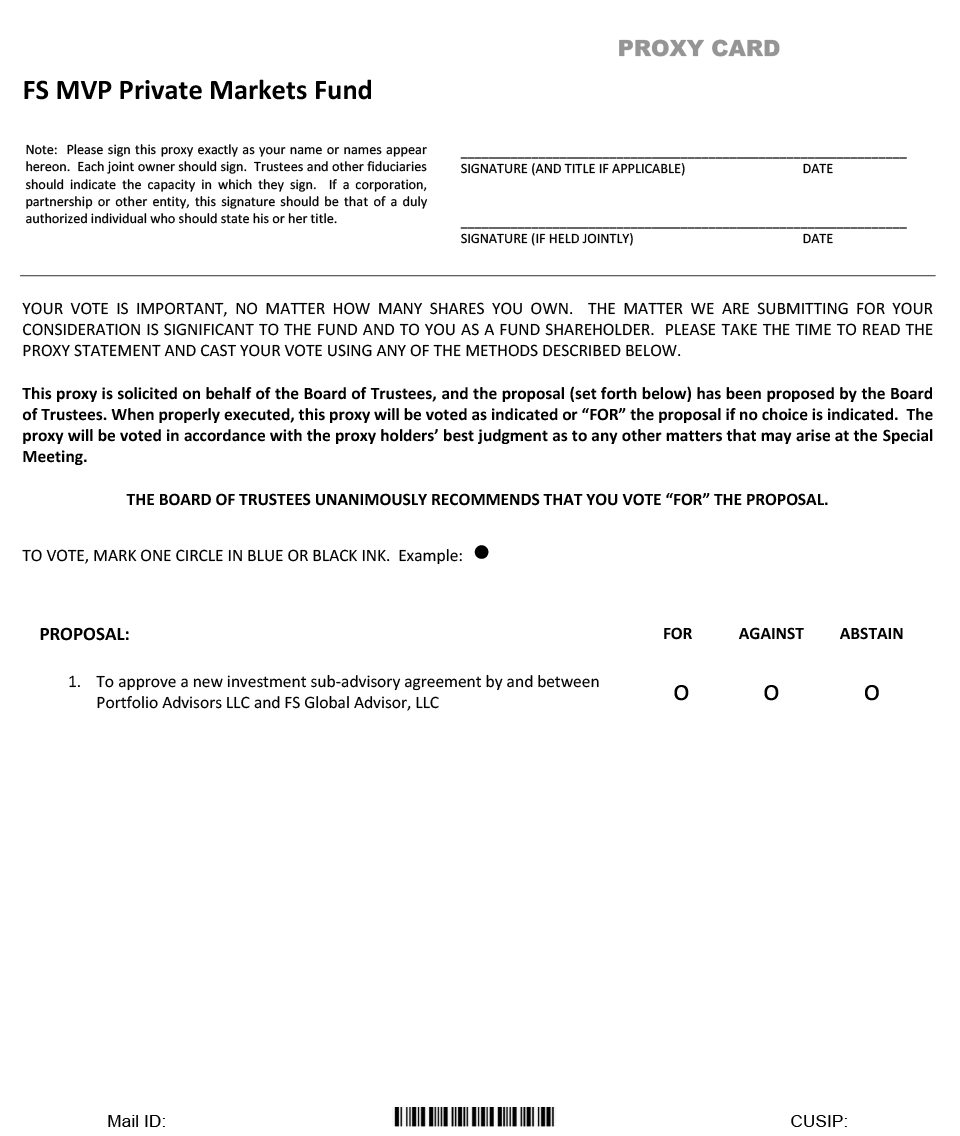

At the Special Meeting, you are being asked to approve a new investment sub-advisory agreement between Portfolio Advisors LLC (the “Investment Manager” or “PA”) and FS Global Advisor, LLC (“FSGA”) (the “Investment Sub-Advisory Agreement”). The approval of the Investment Sub-Advisory Agreement is being proposed at the request of the Investment Manager to allow FSGA to manage an allocated portion of the Fund, at the discretion of the Investment Manager. As further described in the Proxy Statement, FSGA will serve as a non-discretionary sub-adviser.

The enclosed proxy statement explains the following proposal:

| · | A proposal to approve a new investment sub-advisory agreement by and between PA and FSGA. |

Thank you for your investment in the Fund. I encourage you to exercise your rights in governing the Fund by voting on the proposal. The Board of Trustees recommends that you vote FOR the proposal. Your vote is important.

Effective as of June 30, 2023, PA is a subsidiary of Franklin Square Holdings, L.P. ("FS"), the parent company of FSGA. Effective March 1, 2024, certain portfolio management personnel responsible of PA responsible for managing the Fund's senior credit strategy became employed by FSGA. Prior to becoming employed by FSGA, such portfolio management personnel served in a non-discretionary capacity. The Fund's overall management structure has not and will not change, as the Investment Manager continues to be responsible for, among other things, managing a significant portion of the Fund's assets, making allocation decisions and overseeing FSGA. Furthermore, the Fund's portfolio management personnel are also not expected to change, and FSGA will serve as a non-discretionary sub-adviser. The Board of Trustees has therefore concluded that appointing FSGA as the investment sub-adviser will provide portfolio management consistency and would be in the best interests of the Fund and its shareholders. If the Investment Sub-Advisory Agreement is approved by shareholders, it is expected to further assist in the Fund's deployment of capital consistent with its current investment strategy as it seeks to achieve its investment objective. There will be no increase in the Fund's total fees as a result of the appointment of FSGA as the sub-adviser of the Fund.

Whether or not you expect to attend the Special Meeting, it is important that your shares be represented. Your immediate response will help reduce the need for the Fund to conduct additional proxy solicitations. Please review the proxy statement and then vote by Internet, telephone or mail as soon as possible. If you vote by mail, please sign and return the proxy card included in this package.

| | Sincerely, | |

| | | |

| | Taylor Nadauld | |

| | Chairman and Trustee | |

IMPORTANT INFORMATION

| Q. | Why am I receiving this proxy statement? |

| A. | You are receiving this proxy statement in connection with the FS MVP Private Markets Fund’s (the “Fund”) solicitation of your vote to approve a proposal to approve a new investment sub-advisory agreement between Portfolio Advisors LLC (the “Investment Manager” or “PA”) and FS Global Advisor, LLC (“FSGA”) to engage FSGA as a sub-adviser for a designated portion of the Fund’s assets, as allocated by the Investment Manager (the “Investment Sub-Advisory Agreement”). FSGA will serve as a non-discretionary sub-adviser and will have no involvement in investment decisions, any related negotiations or the finalization of any investment. All investment decisions for the Fund are made exclusively by the Investment Manager. |

At a meeting of the Board of Trustees of the Fund (the “Board”) held on May 20, 2024, based on the recommendation by the Investment Manager, the Board, including a majority of the trustees who are not “interested persons” of the Fund as that term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees”) approved the Investment Sub-Advisory Agreement, subject to approval by the Fund’s shareholders.

The Board has determined to seek shareholder approval of the Investment Sub-Advisory Agreement at a special meeting of shareholders of the Fund (the “Special Meeting”). A copy of the proposed Investment Sub-Advisory Agreement is included in this Proxy Statement as Exhibit A.

| Q. | Who is FS Global Advisor, LLC? |

| A. | FS Global Advisor, LLC, a Delaware limited liability company, is an SEC-registered investment adviser. FSGA was established in 2013 and provides investment advisory and administrative services to closed-end management investment companies and other investment funds. FSGA manages alternative investment funds. |

FSGA provides advice to various clients, including investment companies, private investment funds, institutional investors or other persons or entities. Generally, when advising private funds or separately managed accounts, FSGA provides advice on investments within a stated investment period, based upon the fund or the account’s governing agreements.

| Q. | When will the Investment Sub-Advisory Agreement take effect? |

| A. | If approved by shareholders at the Special Meeting, the Investment Sub-Advisory Agreement will become effective following the Special Meeting and will remain in effect for an initial two-year period. After the initial term, the Investment Sub-Advisory Agreement will continue in effect from year to year thereafter if approved at least annually by the Board, including a majority of the Independent Trustees. |

| Q. | Will the management fees paid by the Fund increase if the Investment Sub-Advisory Agreement is approved? |

| A. | No. PA will pay FSGA’s sub-advisory fee. There will be no increase in the Fund’s total fees, including the management fees payable to PA, as a result of the appointment of FSGA as a sub-adviser of the Fund. |

| Q. | Will the Fund pay for the shareholder meeting and related costs? |

| A. | No. These costs will be borne by PA and Franklin Square Holdings, L.P. |

| Q. | What will happen if shareholders of the Fund do not approve the Investment Sub-Advisory Agreement at the Special Meeting? |

| A. | If the shareholders do not approve the Investment Sub-Advisory Agreement at the Special Meeting, then FSGA will not serve as the sub-adviser to the Fund and the Investment Manager will consider what further actions to take, including the appointment of another investment sub-adviser. |

| Q. | How does the Board recommend that I vote? |

| A. | The current members of the Board, including all of the Independent Trustees, recommend that you vote in favor of the proposal. |

| Q. | What shareholder vote is required for the Investment Sub-Advisory Agreement to be approved? |

| A. | The Investment Sub-Advisory Agreement will be approved if it receives the affirmative vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at a shareholder meeting if the owners of more than 50% of the shares of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding shares of the Fund entitled to vote at the Special Meeting. |

| Q. | I have only a few shares — does my vote matter? |

| A. | Your vote is important. If many shareholders choose not to vote, the Fund might not receive enough votes to reach a quorum to hold the Special Meeting. If it appears that there will not be a quorum, the Fund would have to send additional mailings or otherwise solicit shareholders to try to obtain more votes. |

| Q. | What is the deadline for submitting my vote? |

| A. | We encourage you to vote as soon as possible to make sure that the Fund receives enough votes to act on the proposal. Unless you attend the Special Meeting to vote in person, your vote (cast by Internet, telephone or paper proxy card as described below) must be received by the Fund for the Special Meeting by 5:00 p.m. Eastern Time on July 19, 2024. |

| Q. | Who is eligible to vote? |

| A. | Any person who owned shares of the Fund on the “Record Date,” which was May 29, 2024 (even if that person has since sold those shares). |

| A. | You may vote in any of four ways: |

| o | Through the Internet. Please follow the instructions on your proxy card. |

| o | By telephone, with a toll-free call to the phone number indicated on the proxy card. |

| o | By mailing in your proxy card. |

| o | In person at the Special Meeting at the offices of Faegre Drinker Biddle & Reath LLP on July 22, 2024. |

We encourage you to vote via the Internet or telephone using the control number on your proxy card and following the simple instructions because these methods result in the most efficient means of transmitting your vote and reduce the need for the Fund to conduct telephone solicitations and/or follow up mailings. If you would like to change your previous vote, you may vote again using any of the methods described above.

| Q. | How should I sign the proxy card? |

| A. | You should sign your name exactly as it appears on the proxy card. Unless you have instructed us otherwise, either owner of a joint account may sign the card, but again, the owner must sign the name exactly as it appears on the card. The proxy card for accounts of which the signer is not the owner should be signed in a way that indicates the signer’s authority—for example, “Mary Smith, Custodian.” |

FS MVP Private Markets Fund

9 Old Kings Highway South

Darien, Connecticut 06820

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held July 22, 2024

FS MVP Private Markets Fund (the “Fund”) will host the Special Meeting of Shareholders on July 22, 2024 at the offices of Faegre Drinker Biddle & Reath LLP, One Logan Square, Suite 2000, Philadelphia, PA 19103-6996 (the “Special Meeting”). The Special Meeting will be held at 12:00 p.m. Eastern Time.

The purpose of the Special Meeting is to consider and act upon the following proposal and to consider and act upon such other matters as may properly come before the Special Meeting and any adjournments thereof:

| 1. | A proposal to approve a new investment sub-advisory agreement between Portfolio Advisors LLC and FS Global Advisor, LLC. |

| 2. | To transact such other business as may properly come before the Special Meeting and any adjournments thereof. |

THE BOARD OF TRUSTEES OF THE FUND UNANIMOUSLY RECOMMENDS THAT YOU VOTE IN FAVOR OF THE PROPOSAL TO APPROVE THE INVESTMENT SUB-ADVISORY AGREEMENT WITH FS Global Advisor, LLC.

THE ADDITION OF FS Global Advisor, LLC WILL NOT RESULT IN AN INCREASE IN THE TOTAL MANAGEMENT FEES PAID BY THE FUND.

Shareholders of record of the Fund at the close of business on May 29, 2024 are entitled to notice of and to vote at the Special Meeting and any adjournment(s) thereof. We anticipate that the Notice of the Special Meeting of Shareholders, this proxy statement and the proxy card (collectively, the “proxy materials”) will be mailed to shareholders beginning on or about July 8, 2024.

| By Order of the Board of Trustees, | |

| | |

| Taylor Nadauld | |

| Chairman and Trustee | |

| | |

| July 2, 2024 | |

YOUR VOTE IS IMPORTANT

You can vote easily and quickly over the Internet, by toll-free telephone call, or by mail. Just follow the simple instructions that appear on your proxy card. Please help the Fund reduce the need to conduct telephone solicitation and/or follow-up mailings by voting today.

1

FS MVP Private Markets Fund

9 Old Kings Highway South

Darien, Connecticut 06820

PROXY STATEMENT

SPECIAL MEETING OF SHAREHOLDERS

To be held July 22, 2024

Introduction

This proxy statement is being provided to you on behalf of the Board of Trustees of FS MVP Private Markets Fund (the “Fund”) in connection with the solicitation of proxies to be used at a Special Meeting of Shareholders (the “Special Meeting”) of the Fund. The following table identifies the proposal set forth in this proxy statement.

| Proposal Number | Proposal Description |

| 1 | A proposal to approve a new investment sub-advisory agreement between Portfolio Advisors LLC and FS Global Advisor, LLC (“FSGA”) |

| 2 | To transact such other business as may properly come before the Special Meeting and any adjournments thereof. |

You will find this proxy statement divided into four parts:

Part 1 Provides details on the proposal to approve the new investment sub-advisory agreement with FSGA (see page 3).

Part 2 Provides information about ownership of shares of the Fund (see page 9).

Part 3 Provides information on proxy voting and the operation of the Special Meeting (see page 10).

Part 4 Provides information on other matters (see page 12).

Please read the proxy statement before voting on the proposals. Please call toll-free at (800) 628-8509 if you have any questions about the proxy statement, or if you would like additional information.

We anticipate that the Notice of the Special Meeting of Shareholders, this proxy statement and the proxy card (collectively, the “proxy materials”) will be mailed to shareholders beginning on or about July 8, 2024.

Annual and Semi-Annual Reports. The Fund’s most recent annual and semi-annual reports to shareholders are available at no cost. You may obtain a copy of a report through the Fund’s website at https://www.portad.com/mvp-fund. You may also request a report by calling toll-free at 844-663-0164.

Important Notice Regarding the Availability of Materials

for the Shareholder Meeting to be Held on July 22, 2024

The proxy statement for the Special Meeting is available at https://vote.proxyonline.com/mvpprivate/docs/2024special.pdf.

2

PART 1

DESCRIPTION OF PROPOSAL 1

APPROVAL OF INVESTMENT SUB-ADVISORY AGREEMENT

Introduction

The current investment adviser to the Fund, Portfolio Advisors LLC (“PA” or the “Investment Manager”), has recommended to the Board of Trustees (the “Board”) of the Fund the engagement of a new investment sub-adviser to manage a portion of the Fund’s assets, as allocated by the Investment Manager. FS Global Advisor, LLC (“FSGA” or the “Sub-Adviser”) will serve as a non-discretionary sub-adviser and will have no involvement in investment decisions, any related negotiations or the finalization of any investment. All investment decisions for the Fund are made exclusively by the Investment Manager. At a meeting held on May 20, 2024, the Board considered and approved a new investment sub-advisory agreement between PA and FSGA (the “Investment Sub-Advisory Agreement”), subject to the approval of shareholders. The sub-advisory fees paid to FSGA will be paid by PA and not by the Fund, and accordingly the total management fees paid by the Fund will not change as a result.

Information About FS Global Advisor, LLC

The Board is recommending that shareholders approve FSGA as a new sub-adviser for the Fund. FSGA provides investment advisory and administrative services to closed-end management investment companies and other investment funds. FSGA manages alternative investment funds.

FSGA provides advice to various clients, including investment companies, private investment funds, institutional investors or other persons or entities. Generally, when advising private funds or separately managed accounts, FSGA provides advice on investments within a stated investment period, based upon the fund or the account’s governing agreements. Effective as of June 30, 2023, PA is a subsidiary of Franklin Square Holdings, L.P. (“FS”), the parent company of FSGA.

FSGA is located at 201 Rouse Boulevard Philadelphia, Pennsylvania 19112. FSGA has been registered with the U.S. Securities and Exchange Commission (“SEC”) as an investment adviser since January of 2013 and as of December 31, 2023, FSGA had $2.09 billion in assets under management.

FSGA does not currently manage other registered funds with similar investment strategies and objectives as the Fund.

Factors Considered by the Trustees and their Recommendation

At the regular meeting of the Board held on May 20, 2024, the entire Board, including all of the Independent Trustees, discussed and approved the New Investment Sub-Advisory Agreement (the “Agreement”) between the Investment Manager and the Sub-Adviser, and determined to recommend that Shareholders approve the Agreement. In considering information relating to the approval of the Agreement, the Independent Trustees received assistance and advice from their independent legal counsel, which had provided the Independent Trustees with a written description of their responsibilities in considering the Agreement.

Independent legal counsel, on behalf of the Independent Trustees, had previously requested a variety of information from the Sub-Adviser, which the Sub-Adviser had provided to the Board in advance of the May 20th meeting. At that meeting, the Independent Trustees met in executive session with their independent legal counsel, at which no representative of either the Investment Manager or Sub-Adviser was present.

In making the decision to approve the Agreement, the Independent Trustees gave attention to all information furnished. The following discussion identifies the primary factors taken into account by the Board in approving the Agreement. The Board did not identify any one factor as dispositive, and each Board member may have attributed different weights to the factors considered.

3

The nature, extent, and quality of services to be provided to the Fund by the Sub-Adviser.

The Board considered the materials provided describing the services to be provided by the Sub-Adviser to the Fund, as well as their conversations with the Investment Manager on behalf of the Sub-Adviser. In reviewing the nature, extent, and quality of services to be provided to the Fund, the Board considered, among other things, that: the team at the Investment Manager which is currently providing advice to the Fund on the senior credit portion of the Fund’s portfolio would continue to do so as the Sub-Adviser for the Account (defined below); the team was moving their place of employment to the Sub-Adviser, an affiliate of the Investment Manager, solely for business reasons to seek to achieve better economies of scale in the management of the senior credit asset class; the Sub-Adviser would serve as a non-discretionary investment sub-adviser, with the Investment Manager maintaining responsibility for making all final investment decisions on behalf of the Fund with respect to the Account; the Investment Manager would have oversight responsibilities over the Sub-Adviser and would be paying the Sub-Adviser’s fee with no additional costs to the Fund; and there would otherwise be no changes in how the Fund is managed or administered.

Based on its consideration and review of the foregoing and other information, the Board determined that the Fund was likely to benefit from the nature, extent, and quality of services to be provided by the Sub-Adviser, as well as the Sub-Adviser’s ability to render such services based on its experience, operations, and resources.

Comparison of the fees to be charged by the Sub-Adviser.

The Board considered the Sub-Adviser’s proposed sub-advisory fee structure, noting that the Investment Manager was proposing to pay the Sub-Adviser for managing the Account and was proposing to do so at the same fee level that the Investment Manager currently receives. In addition, the Board compared these proposed fees to the fees that the Sub-Adviser charges to pooled investment vehicles that invest in senior credit, and noted that the proposed fees are generally in line with the fees of those vehicles. Accordingly, the Board determined that the fees proposed to be paid to the Sub-Adviser under the Agreement were reasonable.

Performance.

The Board took into account the fact that the team that currently manages the senior credit portion of the Fund would manage the Account at the Sub-Adviser on a non-discretionary basis. In addition, the Board reviewed the performance of the Sub-Adviser in managing senior credit pooled investment vehicles, and noted that the Sub-Adviser’s historical performance in that asset class is generally comparable with the performance of the team in managing the senior credit portion of the Fund. Accordingly, the Board determined that the Sub-Adviser is capable of providing non-discretionary investment sub-advisory services to achieve satisfactory performance for the Fund.

Profitability and Economies of Scale.

Because all of the Sub-Adviser’s fees will be paid by the Investment Manager out of the fees it charges the Fund, and that this would be a new mandate for the Sub-Adviser and thus it would be difficult for the Sub-Adviser to estimate its projected profitability, the Board did not consider the Sub-Adviser’s future profitability as a factor as part of its considerations. In that regard, the Board further took into consideration, the Sub-Adviser’s statement that it does not currently expect to derive any material indirect benefits from its relationship to the Fund.

The Board likewise did not take into account economies of scale as the Fund grows, as the Investment Manager would be paying the Sub-Adviser’s fees for the Sub-Adviser’s management of the Account at the same rate that the Fund pays the Investment Manager.

Conclusion.

Based on the totality of the information considered, the Trustees concluded that the Fund was likely to benefit from the nature, extent and quality of the Sub-Adviser’s services, and that the Sub-Adviser has the ability to provide these services based on its experience, operations and resources. After evaluation of the performance, fee information, ancillary benefits and other considerations as described above, and in light of the nature, extent and quality of services to be provided by the Sub-Adviser, the Trustees, including a majority of the Independent Trustees, approved the Agreement and determined to recommend that Shareholders approve the Agreement.

4

Based on all of the foregoing, the Trustees recommend that shareholders of the Fund vote FOR the approval of the Investment Sub-Advisory Agreement.

Terms of the Investment Sub-Advisory Agreement

A copy of the proposed Investment Sub-Advisory Agreement is attached hereto as Exhibit A. The following description is only a summary; however, all material terms of the Investment Sub-Advisory Agreement have been included in this summary. You should refer to Exhibit A for the Investment Sub-Advisory Agreement.

Sub-Advisory Services. Under the Investment Sub-Advisory Agreement, PA has engaged FSGA to assist in managing the investment and reinvestment of a portion of the assets of the Fund subject to a Senior Credit strategy (defined below) (the “Account”), subject to the terms set forth herein and subject to the supervision of PA and the Board. The Senior Credit strategy seeks attractive, risk adjusted returns with current income by primarily making direct investments in U.S. middle market companies and specifically, senior debt investments (typically, first lien, “stretch senior” and “unitranche” investments).

With respect to the Account, FSGA will, during the term and subject to the provisions of the Investment Sub-Advisory Agreement and the supervision of PA: (i) within the parameters of the Fund’s investment guidelines, advise PA on the composition and allocation of the Account, the nature and timing of the changes therein and the manner of implementing such changes; (ii) advise PA on the specific securities and other assets to be purchased, retained, or sold by the Fund; (iii) advise PA on placing orders and arranging for any investment including identifying, evaluating and, if applicable, negotiating the structure of the investments made by the Fund; (iv) assist the Investment Manager in monitoring and servicing the Fund’s investments; (v) perform due diligence on prospective portfolio companies for investment recommendations to PA; (vi) Reserved; (vii) provide such information to the Fund and the Investment Manager as the Fund or the Investment Manager deems reasonably necessary for the Fund and the Investment Manager to (A) comply with the Investment Company Act of 1940, as amended (the “1940 Act”) and the rules and regulations thereunder (including, but not limited to, quarterly certifications pursuant to Rule 17j-1 under the 1940 Act), and (B) maintain a current and/or effective private placement memorandum, prospectus and/or registration statement under the Securities Act and the 1940 Act that complies with the requirements of the Securities Act, the 1940 Act and/or the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated under each; (viii) assist PA in maintaining books and records with respect to the Fund’s securities transactions and render to the Investment Manager and the Board such periodic and special reports with respect thereto as they may reasonably request; (ix) report to the Investment Manager and to the Board and provide such information, and make appropriate persons available for the purpose of reviewing with representatives of the Investment Manager and the Board on a regular basis at reasonable times its activities, including without limitation, review of the investment strategies of the Account, the performance of the Account in relation to standard industry indices, stock market and interest rate considerations and general conditions affecting the marketplace, and the placement and execution of portfolio transactions and provide various other reports and information from time to time as reasonably requested by the Investment Manager or the Board; (x) act upon reasonable instructions from the Investment Manager or the Board which, in the reasonable determination of the Sub-Adviser, are not inconsistent with the Sub-Adviser’s fiduciary duties under this Agreement or the Fund’s investment guidelines; and (xi) provide the Investment Manager with such other research and related services as the Investment Manager may, from time to time, reasonably require for the Investment Manager to manage the Fund.

Compensation of FSGA. In consideration of FSGA’s services under the Investment Sub-Advisory Agreement, PA will pay the Sub-Adviser a sub-advisory fee at a quarterly rate of 0.3125% (1.25% on an annualized basis) of the Account’s Managed Investments at the end of each calendar quarter. “Managed Investments” means the total value of the Account’s assets (including any assets attributable to money borrowed for investment purposes), minus the sum of the Fund’s accrued liabilities on assets that are invested pursuant to the terms of this Agreement (other than money borrowed for investment purposes) (the “Sub-Advisory Fee”). The Sub-Advisory Fee is paid to the Sub-Adviser before giving effect to any repurchase of shares in the Fund effective as of that date. The Sub-Advisory Fee will be payable on a quarterly basis in arrears promptly following the time that the Investment Management Fee (as defined in the Fund’s prospectus) is paid or, if deferred or waived, would have been paid, to the Investment Manager pursuant to the Investment Management Agreement (as defined in the Fund’s prospectus).

5

Duration and Termination. The Investment Sub-Advisory Agreement will not take effect unless it has first been approved: (i) by a vote of a majority of those Trustees of the Fund who are not “interested persons” (as defined in the 1940 Act) of any party to this Agreement (“Independent Trustees”), cast at a meeting called for the purpose of voting on such approval in accordance with the provisions of Section 15 of the 1940 Act and any rule, interpretation or order of the SEC, and (ii) by vote of a majority of the Fund’s outstanding voting securities. The Investment Sub-Advisory Agreement provides that it will continue in effect for a period of more than two (2) years from the date of its execution only so long as such continuance is specifically approved at least annually by the Board provided that in such event such continuance will also be approved by the vote of a majority of the Independent Trustees cast at a meeting called for the purpose of voting on such approval in accordance with the provisions of Section 15 of the 1940 Act and any rule, interpretation or order of the SEC.

The Investment Sub-Advisory Agreement may be terminated at any time, without the payment of any penalty, (A) on 60 days’ written notice by (i) the Investment Manager, if the Board or a “majority of the outstanding voting securities” (as such term is defined in Section 2(a)(42) of the 1940 Act) of the Fund determine that the Investment Sub-Advisory Agreement should be terminated, or (ii) the Sub-Adviser. The Investment Sub-Advisory Agreement also automatically terminates in the event of (1) its “assignment” (as such term is defined for purposes of Section 15(a)(4) of the 1940 Act) or (2) the termination of the Investment Management Agreement.

Expenses. The Investment Sub-Advisory Agreement provides that FSGA will pay all expenses incurred by it in connection with the activities it undertakes to meet its obligations under the Investment Sub-Advisory Agreement. The Sub-Adviser will, at its sole expense, employ or associate itself with such persons as it reasonably believes will assist it in the execution of its duties under the Investment Sub-Advisory Agreement, including without limitation, persons employed or otherwise retained by the Sub-Adviser or made available to the Sub-Adviser by its members or affiliates.

Liability and Indemnification. Under the Investment Sub-Advisory Agreement, the Sub-Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Sub-Adviser) will not be liable for any action taken or omitted to be taken by the Sub-Adviser or such other person in connection with the performance of any of its duties or obligations under the Investment Sub-Advisory Agreement, except to the extent resulting from willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties under the Investment Sub-Advisory Agreement, except as may otherwise be provided under provisions of applicable state law which cannot be waived or modified.

The Sub-Adviser will indemnify the Investment Manager and the Fund (and their officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Investment Manager and the Fund), for any liability, losses, damages, costs and expenses, including reasonable attorneys’ fees and amounts reasonably paid in settlement (“Losses”), arising directly from, or in connection with, the Sub-Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of the performance of its obligations under the Investment Sub-Advisory Agreement.

The Investment Manager will indemnify the Sub-Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Sub-Adviser) (collectively, the “Indemnified Parties”), for any Losses, howsoever arising from, or in connection with, the Sub-Adviser’s performance of its obligations under the Investment Sub-Advisory Agreement and (ii) the Investment Manager will indemnify the Indemnified Parties for any Losses arising directly from, or in connection with, the Investment Manager’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of the performance of its obligations under the Investment Sub-Advisory Agreement or the Investment Management Agreement; provided, however, the Sub-Adviser will not be indemnified for any Losses that may be sustained as a result of the Sub-Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties under the Investment Sub-Advisory Agreement.

6

Additional Information Pertaining to FSGA

The following table sets forth the name, position and principal occupation of each director and principal executive officer of FSGA. Each individual’s address is c/o 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112.

| Name | Principal Occupation at FSGA |

| Michael Forman | Chief Executive Officer |

| Elizabeth Detwiler | Chief Compliance Officer |

| Stephen Sypherd | General Counsel |

| Philip Browne | Chief Financial Officer |

| Andrew Beckman | Managing Director, Portfolio Manager |

| William Mann | Deputy Chief Compliance Officer |

| Marc Bryant | Chief Legal Officer |

During the Fund’s fiscal year ended March 31, 2024, the Fund paid PA $8,652,317 in investment management fees. During the same period, the Fund did not pay any amount to FSGA or any affiliated person of FSGA (other than PA) for services provided to the Fund. PA will continue to serve as the Fund’s investment manager if the Investment Sub-Advisory Agreement is approved by shareholders.

There were no brokerage commissions paid by the Fund to affiliated brokers of FSGA for the fiscal year ended March 31, 2024.

As of the Record Date, Brooks Lindberg, Scott Higbee, Daniel Iamiceli and Daniel Dwyer, each have an indirect interest in an entity under common control with FSGA. Prior to June 30, 2023, Brooks Lindberg, Scott Higbee, Daniel Iamiceli and Daniel Dwyer, each owned shares of the Investment Manager. As of the Record Date, no Independent Trustee has had any material interest, direct or indirect, in any material transaction, proposed or otherwise, since the beginning of the Fund's fiscal year ended March 31, 2024 to which FSGA, or any parent or subsidiary of FSGA, or any parent or subsidiary of such entities, was a party.

Portfolio Management

If the Investment Sub-Advisory Agreement is approved, FSGA will serve as a non-discretionary sub-adviser and will have no involvement in investment decisions, any related negotiations or the finalization of any investment. All investment decisions for the Fund are made exclusively by the Investment Manager. Dan Cohn-Sfetcu, Matthew Campbell, Muhammad Hussain, Andrew Beckman and Nick Heilbut will serve as portfolio managers to the Fund for the assets managed by FSGA. Below is background information on the portfolio managers primarily responsible for the day-to-day management of the assets of the Fund managed by FSGA.

Dan Cohn-Sfetcu, CFA is a Managing Director on the FS Global Credit team and serves as Portfolio Manager of the Senior Credit Funds and related SMAs. Dan joined PA in 2018 and has been working in the private markets since 2002. Prior to joining PA, Mr. Cohn-Sfetcu was a Managing Director at The Carlyle Group working in the private credit division. Before that, he spent 12 years investing in middle market private equity and credit with American Capital, Richardson Capital and Brookstone Partners. He began his career in investment banking at RBC Capital Markets in Toronto and SG Cowen in New York. Mr. Cohn-Sfetcu holds a B.Com from Queen’s University and is a Chartered Financial Analyst.

Matthew Campbell is a Managing Director on the FS Global Credit team focused on senior credit investments. Mr. Campbell joined PA in 2021 and has been working in the private markets since 2006. Prior to joining PA, he was a Senior Vice President at Jefferies, and prior to that, he was responsible for illiquid and distressed investments in emerging markets at Anchorage Capital Group. Before Anchorage, he spent nine years at Goldman Sachs focused mainly on proprietary credit investments, including two years during the financial crisis as a restructuring specialist for sponsor-led loans on the firm’s own balance sheet. He holds a B.S. in Accounting from the Marriott School of Business at Brigham Young University and is fluent in Portuguese.

Muhammad Hussain is an Executive Director on the FS Global Credit team focused on senior credit investments. Mr. Hussain is responsible for identifying and underwriting private capital transactions for middle market companies and private equity sponsors in connection with leveraged buyouts, recapitalizations, mergers and acquisitions, growth financings and other corporate transactions. Mr. Hussain has over ten years of experience in the private debt markets. Prior to joining the firm, he served as a Vice President on the Private Credit team at Benefit Street Partners. Prior to that, Muhammad was an Associate at BDCA Adviser, LLC, where he focused on private debt investments in middle market companies. Muhammad began his career as an investment banker on the Leveraged Finance team at The Royal Bank of Scotland. Mr. Hussain received his dual BS in Finance and Accounting from The Leonard N. Stern School of Business at New York University.

Andrew Beckman is Head of Liquid Credit and Special Situations on the Investment Management team at FS. He serves as the Portfolio Manager for the FS Global Credit Opportunities Fund, the FS Tactical Opportunities Fund and the firm’s Bridge Street CLO business. Previously, Mr. Beckman was a Partner and Head of Corporate Credit and Special Situations at DW Partners, a $3 billion alternative credit manager. Prior to joining DW Partners, he built and managed Magnetar Capital’s event-driven credit business and served as Head of Event Credit and Head of its Credit Opportunities Fund. Prior to this, he was a Managing Director and Co-Head of Goldman Sachs’ Special Situations Multi-Strategy Investing Group. Earlier in his career, he worked at Investcorp International in its North American private equity business and at Salomon Smith Barney in the Investment Bank’s Mergers and Acquisitions Group. Mr. Beckman graduated magna cum laude from the University of Pennsylvania’s Wharton School of Business, earning a BS in Economics with a concentration in Finance and Management.

Nick Heilbut is a Managing Director for FS and serves as a Portfolio Manager and Director of Research for FS Global Credit Opportunities Fund and FS Tactical Opportunities Fund. Previously Mr. Heilbut was a Managing Director at DW Partners where he focused on investments in stressed and distressed debt. From 2012–2016, Mr. Heilbut served as the Head of Research for Magnetar’s Event Credit business and the Magnetar Credit Opportunities Fund. He was also a member of the Event Driven Investment Committee. Prior to joining Magnetar, Mr. Heilbut worked at Serengeti Asset Management where he was responsible for the firm’s investments in financial institutions, health care, media and sovereign debt. Mr. Heilbut joined Serengeti from Goldman Sachs where he was a Vice President in the firm’s Special Situations Group’s Multi Strategy Investing business, where he invested in multiple asset classes including public corporate credit and equities, private corporate credit and equities, drug royalties and distressed financial assets. Mr. Heilbut began his career as an Associate in Donaldson, Lufkin & Jenrette’s Mortgage Department. Mr. Heilbut earned a BA in History (Phi Beta Kappa) from the University of Michigan and an MBA from Columbia Business School.

Required Vote

As provided under the 1940 Act, approval of the Investment Sub-Advisory Agreement will require the vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at a shareholder meeting if the owners of more than 50% of the shares of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding shares of the Fund entitled to vote at the Special Meeting. The shareholders of the Fund will vote together as a single class.

7

FOR THE REASONS SET FORTH ABOVE, THE BOARD OF TRUSTEES OF THE FUND

UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS OF THE FUND VOTE IN FAVOR OF THE

INVESTMENT SUB-ADVISORY AGREEMENT.

8

PART 2

GENERAL INFORMATION ABOUT OWNERSHIP OF SHARES OF THE FUND

Outstanding Shares

Only Shareholders of record at the close of business on May 29, 2024, will be entitled to notice of, and to vote at, the Special Meeting. On May 29, 2024, the following shares of each class of the Fund were outstanding and entitled to vote:

| Class | Shares Outstanding and Entitled to Vote |

| Class I | 60,271,373.51 |

| Class A | 1,617,959.30 |

| Class D | 60,078.04 |

9

PART 3

INFORMATION ON PROXY VOTING AND THE SPECIAL MEETING

Who is Eligible to Vote

Shareholders of record of the Fund as of the close of business on May 29, 2024 (the “Record Date”) are entitled to vote on all of the Fund’s business at the Special Meeting and any adjournments thereof. Each whole share is entitled to one vote on each matter on which it is entitled to vote, and each fractional share is entitled to a proportionate fractional vote. Shares represented by properly executed proxies, unless revoked before or at the Special Meeting, will be voted according to the shareholder’s instructions. If you sign a proxy, but do not fill in a vote, your shares will be voted to approve the proposal. If any other business comes before the Special Meeting, your shares will be voted at the discretion of the persons named as proxies.

Proposals by Shareholders

The Fund does not intend to hold meetings of shareholders except to the extent that such meetings may be required under the 1940 Act or state law. Under the Fund’s Declaration of Trust, shareholders owning in the aggregate 10% of the outstanding shares of all classes of the Fund have the right to call a meeting of shareholders to consider the removal of one or more Trustees. Shareholders who wish to submit proposals for inclusion in the proxy statement for a subsequent shareholder meeting should submit their written proposals to the Fund at its principal office within a reasonable time before such meeting. The timely submission of a proposal does not guarantee its consideration at the meeting.

Proxies, Quorum and Voting at the Special Meeting

Shareholders may use the proxy card provided if they are unable to attend the Special Meeting in person or wish to have their shares voted by a proxy even if they do attend the Special Meeting. Any shareholder that has given a proxy to someone has the power to revoke that proxy at any time prior to its exercise by executing a superseding proxy or by submitting a notice of revocation to the secretary of the Fund. The Fund’s secretary is Daniel Dwyer, and he may be reached at the following address: 9 Old Kings Highway South, Darien, Connecticut, 06820. In addition, although mere attendance at the Special Meeting will not revoke a proxy, a shareholder present at the Special Meeting may withdraw a previously submitted proxy and vote in person.

All properly executed and unrevoked proxies received in time for the Special Meeting will be voted in accordance with the instructions contained in the proxies. If no instruction is given on a properly executed proxy, the persons named as proxies will vote the shares represented thereby in favor of the proposal described herein and will use their best judgment to vote on such other business as may properly come before the Special Meeting or any adjournment thereof.

Telephonic Voting. Shareholders may call the toll-free phone number indicated on their proxy card to vote their shares. Shareholders will need to enter the control number set forth on their proxy card and then will be prompted to answer a series of simple questions. The telephonic procedures are designed to authenticate a shareholder’s identity, to allow shareholders to vote their shares and to confirm that their instructions have been properly recorded.

Internet Voting. Shareholders may submit an “electronic” proxy over the Internet in lieu of returning each executed proxy card. In order to use this voting feature, shareholders should go to the website indicated on the shareholder’s proxy card and enter the control number set forth on the proxy cards. Shareholders will be prompted to follow a simple set of instructions, which will appear on the website.

Quorum. The presence in person or by proxy of the holders of one-third of the shares of the Fund present in person or represented by proxy and entitled to vote shall constitute a quorum for the transaction of business at the Special Meeting. For purposes of determining the presence of a quorum, abstentions will be counted as present. Abstentions will have the effect of a “no” vote for purposes of obtaining the requisite approval of the proposal. If a beneficial owner does not provide voting instructions to its broker, the broker is not permitted to give a proxy with respect to such beneficial owner’s shares because the proposal is considered non-routine, and accordingly such beneficial owner's shares will not count as present for quorum purposes and will have no effect on the proposal.

10

If a quorum is not present at the Special Meeting, or if a quorum is present at the Special Meeting but sufficient votes to approve a proposal are not received, shareholders may vote to adjourn the Special Meeting in order to solicit additional proxies. Any adjournment may be held without the necessity of further notice. A shareholder vote may be taken on one or more proposals prior to such adjournment if sufficient votes for its approval have been received and it is otherwise appropriate. Such vote will be considered final regardless of whether the Special Meeting is adjourned to permit additional solicitation with respect to any other proposal.

As provided under the 1940 Act, approval of the proposal in this proxy statement concerning the approval of the Investment Sub-Advisory Agreement will require the vote of a majority of the outstanding voting securities of the Fund. In accordance with the 1940 Act, a “majority of the outstanding voting securities” of the Fund means the lesser of (a) 67% or more of the shares of the Fund present at the shareholder meeting if the owners of more than 50% of the shares of the Fund then outstanding are present in person or by proxy, or (b) more than 50% of the outstanding shares of the Fund entitled to vote at the Special Meeting.

Method of Solicitation and Expenses

Your vote is being solicited by the Board of Trustees of the Fund. The cost of soliciting proxies, including the costs related to the solicitation of shareholders and the printing, mailing and tabulation of proxies will be borne by the Portfolio Advisors LLC and Franklin Square Holdings, L.P. Such expenses are estimated to total approximately $8,884. The Fund will not bear any expenses in connection with the proposal, including any costs of soliciting shareholder approval. All such expenses will be borne by the Adviser. The Fund expects that the solicitation will be primarily by mail, but may also include electronic or other means of communication.

Ownership of the Fund

As of the Record Date, the current Trustees and officers as a group owned less than 1% of the outstanding shares of the Fund or any class of the Fund. Each person that, to the knowledge of the Fund, owned beneficially or of record 5% or more of the outstanding shares of the Fund as of the Record Date is listed in Exhibit B to this proxy statement.

Procedures for Shareholder Communications with the Board

Shareholders may send communications to the Board of Trustees of the Fund. Shareholders should send communications intended for the Board of Trustees by addressing the communication directly to the Board of Trustees (or individual Trustee(s)) and/or otherwise clearly indicating in the salutation that the communication is for the Board of Trustees (or individual Trustee(s)) and by sending the communication to the Fund’s address for the Trustee(s) at c/o Portfolio Advisors LLC, 9 Old Kings Highway South, Darien, Connecticut, 06820. Other Shareholder communications received by the Fund not directly addressed and sent to the Board of Trustees will be reviewed and generally responded to by management, and will be forwarded to the Board only at management’s discretion based on the matters contained therein.

Other Business

While the Special Meeting has been called to transact any business that may properly come before it, the only matter that the Trustees intend to present is the matter stated in the attached Notice of the Special Meeting of Shareholders. However, if any additional matters properly come before the Special Meeting, and on all matters incidental to the conduct of the Special Meeting, it is the intention of the persons named in the proxy to vote the proxy in accordance with their judgment on such matters.

July 2, 2024

11

PART 4

OTHER MATTERS

OTHER MATTERS

Proxy Statement Delivery

“Householding” is the term used to describe the practice of delivering one copy of a document to a household of shareholders instead of delivering one copy of a document to each shareholder in the household. Shareholders of the Fund who share a common address and who have not opted out of the householding process should receive a single copy of the proxy statement together with each proxy card. If you received more than one copy of the proxy statement, you may elect to household in the future; if you received a single copy of the proxy statement, you may opt out of householding in the future; and you may, in any event, obtain an additional copy of this proxy statement by calling 844-663-0164 or writing to the Fund at the following address: c/o ALPS Fund Services, Inc. 1290 Broadway, Suite 1000, Denver, CO 80203. Copies of this proxy statement and the accompanying Notice of the Special Meeting are also available at https://vote.proxyonline.com/mvpprivate/docs/2024special.pdf.

Other Service Providers

ALPS Fund Services, Inc. (“ALPS”), located at 1290 Broadway, Suite 1000, Denver, CO 80203, serves as the Fund’s administrator and provides administrative services to assist with the Fund’s operational needs. ALPS also provides accounting services to the Fund and serves as the Fund’s distribution paying agent, transfer agent and registrar. UMB Bank, n.a., located at 1010 Grand Blvd., Kansas City, MO 64106, serves as custodian for the Fund.

Fiscal Year

The fiscal year-end of the Fund is March 31.

12

EXHIBIT A

FORM OF PROPOSED INVESTMENT SUB-ADVISORY AGREEMENT

INVESTMENT SUB-ADVISORY AGREEMENT

BY AND BETWEEN

Portfolio Advisors, LLC

AND

FS Global Advisor, LLC

THIS INVESTMENT SUB-ADVISORY AGREEMENT (“Agreement”) made this ___ day of ___, 2024, by and among PORTFOLIO ADVISORS, LLC, a Connecticut limited liability company (the “Adviser”), the investment adviser to FS MVP PRIVATE MARKETS FUND, a Delaware statutory trust (the “Fund”), and FS GLOBAL ADVISOR, LLC, a Delaware limited liability company (the “Sub-Adviser”).

WHEREAS, the Adviser and the Sub-Adviser are investment advisers that are registered under the Investment Advisers Act of 1940, as amended (the “Advisers Act”), and engage in the business of providing investment management services; and

WHEREAS, the Adviser has been retained to act as the investment adviser to the Fund, a closed-end management investment company registered under the Investment Company Act of 1940, as amended (the “1940 Act”), pursuant to an Investment Management Agreement, dated June 30, 2023 (the “Advisory Agreement”); and

WHEREAS, the Advisory Agreement permits the Adviser, subject to the supervision and direction of the Fund’s board of trustees (the “Board”), to delegate certain of its duties thereunder to other investment advisers, subject to the requirements of the 1940 Act; and

WHEREAS, the Adviser desires to retain the Sub-Adviser to assist it in fulfilling certain of its obligations under the Advisory Agreement, and the Sub-Adviser is willing to render such services subject to the terms and conditions set forth in this Agreement.

NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the parties hereby agree as follows:

| 1. | Duties of the Sub-Adviser. |

(a) Retention of Sub-Adviser. The Adviser hereby engages the Sub-Adviser to assist the Adviser in managing the investment and reinvestment of a portion of the assets of the Fund subject to a Senior Credit strategy (as defined below) (the “Account”), subject to the terms set forth herein and subject to the supervision of the Adviser and the Board. The Senior Credit strategy seeks attractive, risk adjusted returns with current income by primarily making direct investments in U.S. middle market companies and specifically, senior debt investments (typically, first lien, “stretch senior” and “unitranche” investments).

(b) Responsibilities of Sub-Adviser. With respect to the Account, the Sub-Adviser shall, during the term and subject to the provisions of this Agreement and the supervision of the Adviser:

| | (i) | within the parameters of the Fund’s investment guidelines, advise the Adviser on the composition and allocation of the Account, the nature and timing of the changes therein and the manner of implementing such changes; |

| | (ii) | advise the Adviser on the specific securities and other assets to be purchased, retained, or sold by the Fund; |

| | (iii) | advise the Adviser on placing orders and arranging for any investment including identifying, evaluating and, if applicable, negotiating the structure of the investments made by the Fund; |

| | (iv) | assist the Adviser in monitoring and servicing the Fund’s investments; |

| | (v) | perform due diligence on prospective portfolio companies for investment recommendations to the Adviser; |

| | (vii) | provide such information to the Fund and the Adviser as the Fund or the Adviser deems reasonably necessary for the Fund and the Adviser to (A) comply with the 1940 Act and the rules and regulations thereunder (including, but not limited to, quarterly certifications pursuant to Rule 17j-1 under the 1940 Act), and (B) maintain a current and/or effective private placement memorandum, prospectus and/or registration statement under the Securities Act and the 1940 Act that complies with the requirements of the Securities Act, the 1940 Act and/or the Securities Exchange Act of 1934, as amended, and the rules and regulations promulgated under each; |

| | (viii) | assist the Adviser in maintaining books and records with respect to the Fund’s securities transactions and render to the Adviser and the Board such periodic and special reports with respect thereto as they may reasonably request; |

| | (ix) | report to the Adviser and to the Board and provide such information, and make appropriate persons available for the purpose of reviewing with representatives of the Adviser and the Board on a regular basis at reasonable times its activities hereunder, including without limitation, review of the general investment strategies of the Account, the performance of the Account in relation to standard industry indices, stock market and interest rate considerations and general conditions affecting the marketplace, and the placement and execution of portfolio transactions and provide various other reports and information from time to time as reasonably requested by the Adviser or the Board; |

| | (x) | act upon reasonable instructions from the Adviser or the Board which, in the reasonable determination of the Sub-Adviser, are not inconsistent with the Sub-Adviser’s fiduciary duties under this Agreement or the Fund’s investment guidelines; and |

| | (xi) | provide the Adviser with such other research and related services as the Adviser may, from time to time, reasonably require for the Adviser to manage the Fund. |

The Adviser will retain ultimate responsibility for maintaining the investment program for the Fund and responsible for the development of investment guidelines with respect thereto, including the review and modification (if necessary) of such guidelines. Except as otherwise agreed by the parties in writing, the Sub-Adviser shall be required to provide only the services expressly described in this Section 1(b), and shall have no responsibility to provide any other services to the Adviser or the Fund, including, but not limited to, administrative, management or other similar services.

(c) Acceptance of Engagement. The Sub-Adviser hereby agrees during the term hereof to render the services described herein for the compensation provided herein, subject to the limitations contained herein. The Sub-Adviser shall carry out its responsibilities under this Agreement in compliance with: (i) the Fund’s investment objectives, policies and restrictions set forth in the Fund’s registration statement and prospectus; (ii) such policies, directives, regulatory restrictions and compliance policies as the Adviser may from time to time establish or issue and communicate to the Sub-Adviser in writing; and (iii) applicable law and related regulations. The Adviser shall promptly notify the Sub-Adviser in writing of changes to (ii) above. In no event shall the Sub-Adviser be held responsible for failing to comply with changes to (ii) above unless it had previously received the written notification in the foregoing sentence.

(d) Independent Contractor Status. The Sub-Adviser shall, for all purposes herein provided, be deemed to be an independent contractor and, except as expressly provided or authorized herein, shall have no authority to act for or represent the Adviser or the Fund in any way or otherwise be deemed an agent of the Adviser or the Fund.

Except as provided below in this Section 2 or as otherwise agreed by the parties in writing, the Sub-Adviser assumes no obligation with respect to, and shall not be responsible for, the expenses of the Adviser or the Fund in fulfilling the Sub-Adviser’s obligations hereunder.

During the term of this Agreement, the Sub-Adviser shall pay all expenses incurred by it in connection with the activities it undertakes to meet its obligations hereunder. The Sub-Adviser shall, at its sole expense, employ or associate itself with such persons as it reasonably believes will assist it in the execution of its duties under this Agreement, including without limitation, persons employed or otherwise retained by the Sub-Adviser or made available to the Sub-Adviser by its members or affiliates.

(a) In consideration of the Sub-Adviser’s services hereunder, the Adviser shall pay the Sub-Adviser a sub-advisory fee at a quarterly rate of 0.3125% (1.25%, on an annualized basis) of the Account’s Managed Investments at the end of each calendar quarter. “Managed Investments” means the total value of the Account’s assets (including any assets attributable to money borrowed for investment purposes), minus the sum of the Fund’s accrued liabilities on assets that are invested pursuant to the terms of this Agreement (other than money borrowed for investment purposes) (the “Sub-Advisory Fee”). The Sub-Advisory Fee is paid to the Sub-Adviser before giving effect to any repurchase of shares in the Fund effective as of that date. The Sub-Advisory Fee shall be payable on a quarterly basis in arrears promptly following the time that the Investment Management Fee (as defined in the Advisory Agreement) is paid or, if deferred or waived, would have been paid, to the Adviser pursuant to the Advisory Agreement.

(b) In the event that this Agreement is terminated other than at the end of a Term Year, the Sub-Advisory Fee payable to the Sub-Adviser shall be appropriately prorated.

For purposes of this Agreement, a “Term Year” shall mean each annual period beginning on the Effective Date (as defined in Section 9 hereof) or anniversary thereof, and ending on the day prior to the anniversary of the Effective Date.

| 4. | Representations, Warranties and Covenants of the Sub-Adviser. |

The Sub-Adviser represents and warrants to, and covenants with, the Adviser and the Fund as follows:

(a) The Sub-Adviser shall be registered as an investment adviser under the Advisers Act as of the Effective Date (as defined below) and shall maintain such registration;

(b) The Sub-Adviser is a limited liability company duly organized and validly existing under the laws of the State of Delaware with the power to own and possess its assets and carry on its business as it is now being conducted;

(c) The execution, delivery and performance by the Sub-Adviser of this Agreement are within the Sub-Adviser’s powers and have been duly authorized by all necessary action, and no further action by or in respect of, or filing with, any governmental body, agency or official is required on the part of the Sub-Adviser for the execution, delivery and performance by the Sub-Adviser of this Agreement, and the execution, delivery and performance by the Sub-Adviser of this Agreement do not contravene or constitute a default under (i) any provision of applicable law, rule or regulation, (ii) the Sub-Adviser’s governing instruments, or (iii) any agreement, judgment, injunction, order, decree or other instrument binding upon the Sub-Adviser;

(d) Reserved.

(e) Upon written request of the Adviser or the Fund, the Sub-Adviser shall permit representatives of the Adviser or the Fund to examine the reports (or summaries of the reports) required to be made to the Sub-Adviser by Rule 17j-1(d)(1) and other records evidencing enforcement of the code of ethics;

(f) Solely with respect to information provided by and relating to the Sub-Adviser and as of the date of the applicable filing with the SEC: (A) the Fund’s registration statement on Form N-2, filed or to be filed with the SEC, does not contain and, as amended or supplemented, if applicable, will not contain any untrue statement of a material fact or omit to state a material fact required to be stated therein or necessary to make the statements therein not misleading, and (B) the Fund’s prospectus and/or private placement memorandum do not contain and, as amended or supplemented, if applicable, will not contain any untrue statement of a material fact or omit to state a material fact necessary to make the statements therein, in the light of the circumstances under which they were made, not misleading; and

(g) The Sub-Adviser shall comply in all material respects with all applicable provisions of Federal Securities Laws as defined in Rule 38a-1(e)(1) of the 1940 Act and rules and regulations of the SEC and, in addition, will conduct its activities under this Agreement in accordance with any applicable laws and regulations of any governmental authority pertaining to its investment advisory activities. The Sub-Adviser shall notify the Adviser of a change in control of the Sub-Adviser within a reasonable time before such change. The Sub-Adviser will also fully cooperate in any regulatory investigation, examination, or inspection of the Fund.

| 5. | Representations, Warranties and Covenants of the Adviser. |

The Adviser represents and warrants to, and covenants with, the Sub-Adviser as follows:

(a) The Adviser shall be registered as an investment adviser under the Advisers Act as of the Effective Date and shall maintain such registration;

(b) The Adviser is a limited liability company duly organized and validly existing under the laws of the State of Connecticut with the power to own and possess its assets and carry on its business as it is now being conducted;

(c) The execution, delivery and performance by the Adviser of this Agreement are within the Adviser’s powers and have been duly authorized by all necessary action, and no further action by or in respect of, or filing with, any governmental body, agency or official is required on the part of the Adviser for the execution, delivery and performance by the Adviser of this Agreement, and the execution, delivery and performance by the Adviser of this Agreement do not contravene or constitute a default under (i) any provision of applicable law, rule or regulation, (ii) the Adviser’s governing instruments, or (iii) any agreement, judgment, injunction, order, decree or other instrument binding upon the Adviser;

(d) The Adviser and the Fund have duly entered into the Advisory Agreement pursuant to which the Fund authorized the Adviser to enter into this Agreement;

(e) The Adviser shall comply in all material respects with all applicable provisions of Federal Securities Laws as defined in Rule 38a-1(e)(1) of the 1940 Act and rules and regulations of the SEC and, in addition, will conduct its activities under this Agreement in accordance with any applicable laws and regulations of any governmental authority pertaining to its investment advisory activities. The Adviser shall notify the Sub-Adviser of a change in control of the Adviser within a reasonable time after such change. The Adviser will also fully cooperate in any regulatory investigation, examination, or inspection of the Fund.

| 6. | Survival of Representations and Warranties; Duty to Update Information. |

(a) All representations and warranties made by the Sub-Adviser and the Adviser pursuant to Sections 4 and 5, respectively, shall survive for the duration of this Agreement and the parties hereto shall promptly notify each other in writing upon becoming aware that any of the foregoing representations and warranties are no longer true in any material respect.

(b) The Sub-Adviser shall promptly notify the Fund and the Adviser in writing:

| | (i) | upon receiving notice that a governmental authority, agency or body intends to investigate it or any of its directors, officers or employees in connection with its investment activities, including any routine examination or proceeding in the ordinary course of business (any such matter, an “Investigation), to the extent that such Investigation is reasonably likely to adversely impact the Fund or the Sub-Adviser’s ability to perform its services hereunder; |

| | (ii) | of any change in the portfolio managers of the Sub-Adviser providing services to the Fund hereunder; and |

| | (iii) | of any prospective material change in approach to the Sub-Adviser’s management of and recommendations with respect to the Fund’s assets that are inconsistent in any material respect with the Fund’s investment guidelines. |

| | (iv) | of any other change in the Sub-Adviser’s business activities or circumstances that could reasonably be expected to materially adversely affect the Sub-Adviser’s ability to discharge its obligations under this Agreement; and |

| | (v) | of the execution of a definitive agreement that provides for a change in ownership of the Sub-Adviser or its affiliates constituting, or that would reasonably be expected to constitute, an “assignment” of this Agreement for purposes of the 1940 Act. |

| 7. | Liability and Indemnification. |

(a) The duties of the Sub-Adviser shall be confined to those expressly set forth herein. The Sub-Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Sub-Adviser) shall not be liable for any action taken or omitted to be taken by the Sub-Adviser or such other person in connection with the performance of any of its duties or obligations hereunder, except to the extent resulting from willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties hereunder, except as may otherwise be provided under provisions of applicable state law which cannot be waived or modified hereby. As used in this Section 7(a), the term “Sub-Adviser” shall include, without limitation, the Sub-Adviser’s affiliates and the Sub-Adviser’s and its affiliates’ respective partners, shareholders, directors, members, principals, officers, employees and other agents of the Sub-Adviser.

(b) The Sub-Adviser shall indemnify the Adviser and the Fund (and their officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Adviser and the Fund), for any liability, losses, damages, costs and expenses, including reasonable attorneys’ fees and amounts reasonably paid in settlement (“Losses”), arising directly from, or in connection with, the Sub-Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of the performance of its obligations under this Agreement.

(c) (i) Except as set forth in clause (ii), the Adviser shall indemnify the Sub-Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents, employees, controlling persons and any other person or entity affiliated with the Sub-Adviser) (collectively, the “Indemnified Parties”), for any Losses, howsoever arising from, or in connection with, the Sub-Adviser’s performance of its obligations under this Agreement and (ii) the Adviser shall indemnify the Indemnified Parties for any Losses arising directly from, or in connection with, the Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of the performance of its obligations under this Agreement or the Advisory Agreement; provided, however, that in the case of clauses (i) and (ii) the Sub-Adviser shall not be indemnified for any Losses that may be sustained as a result of the Sub-Adviser’s willful misfeasance, bad faith or gross negligence in the performance of its duties, or by reason of reckless disregard of its obligations and duties hereunder.

| 8. | Responsibility of Dual Directors, Officers and/or Employees |

If any person who is a director, officer, equityholder or employee of the Sub-Adviser or its affiliates is or becomes a director, officer, equityholder and/or employee of the Fund and acts as such in any business of the Fund, then such director, officer, equityholder and/or employee of the Sub-Adviser or its affiliates shall be deemed to be acting in such capacity solely for the Fund, and not as a director, officer, equityholder or employee of the Sub-Adviser or its affiliates or under the control or direction of the Sub-Adviser or its affiliates, even if paid by the Sub-Adviser.

| 9. | Duration and Termination of Agreement. |

(a) Term and Effectiveness. This Agreement shall become effective upon the date first above written (the “Effective Date”), provided that this Agreement shall not take effect unless it has first been approved: (i) by a vote of a majority of those Trustees of the Fund who are not “interested persons” (as defined in the 1940 Act) of any party to this Agreement (“Independent Trustees”), cast at a meeting called for the purpose of voting on such approval in accordance with the provisions of Section 15 of the 1940 Act and any rule, interpretation or order of the SEC, and (ii) by vote of a majority of the Fund’s outstanding voting securities. This Agreement shall continue in effect for a period of more than two (2) years from the date of its execution only so long as such continuance is specifically approved at least annually by the Board provided that in such event such continuance shall also be approved by the vote of a majority of the Independent Trustees cast at a meeting called for the purpose of voting on such approval in accordance with the provisions of Section 15 of the 1940 Act and any rule, interpretation or order of the SEC.

(b) Termination. This Agreement may be terminated at any time, without the payment of any penalty, upon 60 days’ written notice, by (i) the Adviser, if the Board or a “majority of the outstanding voting securities” (as such term is defined in Section 2(a)(42) of the 1940 Act) of the Fund determine that this Agreement should be terminated, or (ii) the Sub-Adviser. This Agreement shall automatically terminate in the event of (1) its “assignment” (as such term is defined for purposes of Section 15(a)(4) of the 1940 Act) or (2) the termination of the Advisory Agreement.

| 10. | Services Not Exclusive. |

Nothing in this Agreement shall prevent the Sub-Adviser or any member, manager, officer, employee, agent or other affiliate thereof from acting as investment adviser for any other person, firm or corporation, or from engaging in any other lawful activity, and shall not in any way limit or restrict the Sub-Adviser or any of its members, managers, officers, employees, agents or other affiliates from buying, selling or trading any securities for its or their own accounts or for the accounts of others for whom it or they may be acting. For the avoidance of doubt, the Adviser and the Sub-Adviser (or either of their respective affiliates) may enter into one or more agreements pursuant to which the Sub-Adviser and/or its affiliates and their personnel may be restricted in their investment management activities. The Sub-Adviser or any member, manager, officer, employee, agent or other affiliate thereof may allocate their time between advising the Fund and managing other investment activities and business activities in which they may be involved.

In connection with the Fund’s (a) public filings, (b) requests for information from state and federal regulators, (c) offering materials and marketing materials and (d) press releases (the materials listed in (a) through (d), the “Fund Materials”), the Fund may state in such materials that investment advisory services are being provided by the Sub-Adviser to the Fund under the terms of this Agreement. The Sub-Adviser hereby grants a non-exclusive, non-transferable, and non-sublicensable license to the Fund for the use of the name “FS Global Advisor,” and the related rights and trademarks owned by the Sub-Adviser and its affiliates (the “Brand”), solely as permitted in the foregoing sentence. Prior to using the Brand in any manner (including in the Fund Materials), the Adviser shall submit all proposed uses to the Sub-Adviser for prior written approval, unless the general form and scope of such use have been previously reviewed and approved by the Sub-Adviser (which approval shall not be unreasonably withheld, conditioned or delayed). The Adviser agrees to control the use of such Brand in accordance with the standards and policies as established between the Adviser and the Sub-Adviser. The Sub-Adviser reserves the right to terminate this license immediately upon written notice for any reason, including if the usage is not in compliance with the standards and policies. Notwithstanding the foregoing, the term of the license granted under this Section shall be for the term of this Agreement only, including renewals and extensions, and the right to use the Brand as provided herein shall terminate immediately upon the termination of this Agreement or the investment sub-advisory relationship between the Adviser and the Sub-Adviser. The Adviser agrees that the Sub-Adviser is the sole owner of the Brand, and any and all goodwill in the Brand arising from the Fund’s use shall inure solely to the benefit of the Sub-Adviser.

Any notice under this Agreement shall be given in writing, addressed and delivered or mailed, postage prepaid, to the other party at its principal office.

This Agreement may be amended by mutual consent of the parties, subject to the requirements of applicable law.