| | | FILED PURSUANT TO RULE 424(h) |

| | | REGISTRATION FILE NO.: 333-255181-01 |

| | | |

The information in this preliminary prospectus is not complete and may be changed. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

This preliminary prospectus, dated November 1, 2021, may be amended or completed prior to time of sale.

$781,946,000 (Approximate)

3650R 2021-PF1 Commercial Mortgage Trust

(Central Index Key Number 0001890702)

as Issuing Entity

3650 REIT Commercial Mortgage Securities II LLC

(Central Index Key Number 0001856217)

as Depositor

3650 Real Estate Investment Trust 2 LLC

(Central Index Key Number 0001840727)

Citi Real Estate Funding Inc.

(Central Index Key Number 0001701238)

German American Capital Corporation

(Central Index Key Number 0001541294)

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates, Series 2021-PF1

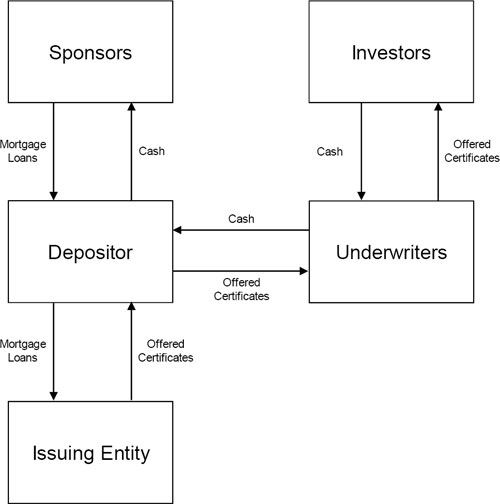

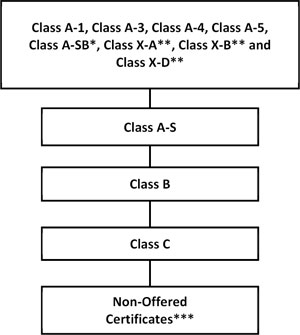

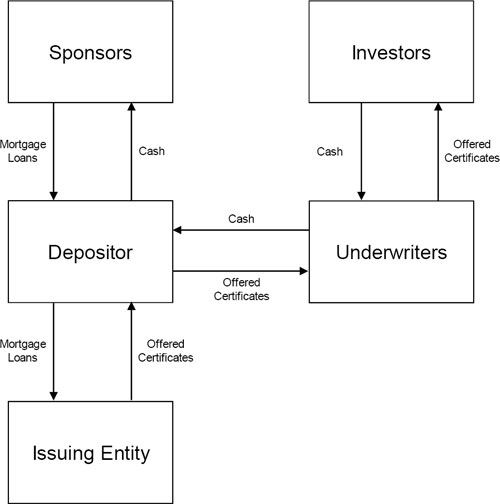

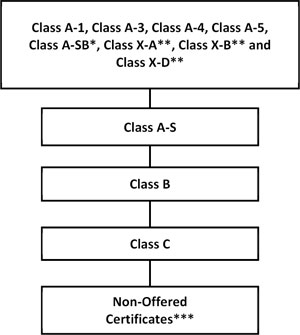

3650 REIT Commercial Mortgage Securities II LLC is offering certain classes of the Commercial Mortgage Pass-Through Certificates, Series 2021-PF1 consisting of the certificate classes identified in the table below. The certificates being offered by this prospectus (and the non-offered Class X-D, Class D, Class E, Class F-RR, Class G-RR, Class J-RR, Class NR-RR, Class Z and Class R certificates) represent the beneficial ownership interests in the issuing entity, which will be a New York common law trust named 3650R 2021-PF1 Commercial Mortgage Trust. The assets of the issuing entity will primarily consist of a pool of fixed rate commercial mortgage loans, each of which are generally the sole source of payments on the certificates. All of such commercial mortgage loans will be fixed rate mortgage loans. Credit enhancement will be provided solely by certain classes of subordinate certificates that will be subordinate to certain classes of senior certificates as described under “Description of the Certificates—Subordination; Allocation of Realized Losses”. Each class of certificates will be entitled to receive monthly distributions of interest and/or principal on the 4th business day following the 11th day of each month (or if the 11th day is not a business day, the next business day), commencing in December 2021. The rated final distribution date for the offered certificates is the distribution date in November 2054.

Class | Approximate Initial

Certificate

Balance or Notional

Amount(1) | Approximate

Initial

Pass-Through

Rate | Pass-Through

Rate

Description | Assumed Final

Distribution

Date(2) |

| Class A-1 | $ | 26,952,000 | | % | (3) | October 2026 |

| Class A-3 | $ | 141,041,000 | | % | (3) | December 2028 |

| Class A-4 | | (4) | % | (3) | (4) |

| Class A-5 | | (4) | % | (3) | (4) |

| Class A-SB | $ | 22,719,000 | | % | (3) | May 2031 |

| Class X-A | $ | 691,236,000 | (5) | % | Variable IO(6) | November 2031 |

| Class X-B | $ | 90,710,000 | (5) | % | Variable IO(6) | November 2031 |

| Class A-S | $ | 48,226,000 | | % | (3) | November 2031 |

| Class B | $ | 43,633,000 | | % | (3) | November 2031 |

| Class C | $ | 47,077,000 | | % | (3) | November 2031 |

(Footnotes to table on pages 3 and 4)

You should carefully consider the summary of risk factors and the risk factors beginning on page 57 and page 59, respectively, of this prospectus.

Neither the certificates nor the mortgage loans are insured or guaranteed by any governmental agency, instrumentality or private issuer or any other person or entity.

The certificates will represent interests in the issuing entity only. They will not represent interests in or obligations of the sponsors, depositor, any of their affiliates or any other entity.

The United States Securities and Exchange Commission and state regulators have not approved or disapproved of the offered certificates or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense. 3650 REIT Commercial Mortgage Securities II LLC will not list the offered certificates on any securities exchange or on any automated quotation system of any securities association.

The issuing entity will be relying on an exclusion or exemption from the definition of “investment company” under the Investment Company Act of 1940, as amended, contained in Section 3(c)(5) of the Investment Company Act of 1940, as amended, or Rule 3a-7 under the Investment Company Act of 1940, as amended, although there may be additional exclusions or exemptions available to the issuing entity. The issuing entity is being structured so as not to constitute a “covered fund” for purposes of the Volcker Rule under the Dodd-Frank Act (both as defined in this prospectus).

The offered certificates are offered to the public by 3650 REIT Commercial Mortgage Securities II LLC through the underwriters, Citigroup Global Markets Inc. and Deutsche Bank Securities Inc., at negotiated prices, plus, in certain cases, accrued interest, determined at the time of sale. The underwriters are not required to purchase and sell any specific dollar amount of the offered certificates. Citigroup Global Markets Inc. is acting as a co-lead manager and joint bookrunner with respect to approximately 61.15% of each class of offered certificates. Deutsche Bank Securities Inc. is acting as a co-lead manager and joint bookrunner with respect to approximately 38.85% of each class of offered certificates.

The underwriters expect to deliver the offered certificates to purchasers in book-entry form only through the facilities of The Depository Trust Company in the United States and Clearstream Banking, Luxembourg and Euroclear Bank, as operator of the Euroclear System, in Europe, against payment in New York, New York on or about November 18, 2021. 3650 REIT Commercial Mortgage Securities II LLC expects to receive from this offering approximately % of the aggregate initial certificate balance of the offered certificates, plus accrued interest from and including November 1, 2021, before deducting expenses payable by the depositor.

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum

Offering Price Per Unit(1) | Proposed Maximum

Aggregate Offering Price(1) | Amount of Registration

Fee(2) |

| Commercial Mortgage Pass-Through Certificates | $781,946,000 | 100% | $781,946,000 | $72,486.40 |

| (1) | Estimated solely for the purpose of calculating the registration fee. |

| (2) | Calculated according to Rule 457(s) of the Securities Act of 1933, as amended. |

| Citigroup | | Deutsche Bank Securities |

| Co-Lead Managers and Joint Bookrunners |

| | | |

November , 2021

Summary of Certificates

Class | Approximate Initial

Certificate Balance

or Notional

Amount(1) | Approximate

Initial Credit

Support(7) | Pass-Through

Rate

Description | Assumed

Final

Distribution

Date(2) | Initial

Approximate Pass-Through

Rate | Weighted

Average

Life (Yrs.)(8) | Expected

Principal

Window(8) |

| | | | | | | | |

| Offered Certificates | | | | | | | |

| A-1 | $ 26,952,000 | 30.000% | (3) | October 2026 | % | 2.63 | 12/21 – 10/26 |

| A-3 | $ 141,041,000 | 30.000% | (3) | December 2028 | % | 6.65 | 04/28 – 12/28 |

| A-4 | (4) | 30.000% | (3) | (4) | % | (4) | (4) |

| A-5 | (4) | 30.000% | (3) | (4) | % | (4) | (4) |

| A-SB | $ 22,719,000 | 30.000% | (3) | May 2031 | % | 6.89 | 10/26 – 05/31 |

| X-A | $ 691,236,000(5) | N/A | Variable IO(6) | November 2031 | % | N/A | N/A |

| X-B | $ 90,710,000(5) | N/A | Variable IO(6) | November 2031 | % | N/A | N/A |

| A-S | $ 48,226,000 | 24.750% | (3) | November 2031 | % | 9.93 | 10/31 – 11/31 |

| B | $ 43,633,000 | 20.000% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| C | $ 47,077,000 | 14.875% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| | | | | | | | |

| Non-Offered Certificates | | | | | | | |

| X-D | $ 40,648,000(5) | N/A | Variable IO(6) | November 2031 | % | N/A | N/A |

| D | $ 29,854,000 | 11.625% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| E | $ 10,794,000(9) | 10.450% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| F-RR | $ 14,468,000(9) | 8.875% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| G-RR | $ 26,409,000 | 6.000% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| J-RR | $ 11,482,000 | 4.750% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| NR-RR | $ 43,633,611 | 0.000% | (3) | November 2031 | % | 9.99 | 11/31 – 11/31 |

| Z(10) | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| R(11) | N/A | N/A | N/A | N/A | N/A | N/A | N/A |

| (1) | Approximate, subject to a variance of plus or minus 5%. The notional amount of each class of the Class X-A, Class X-B and Class X-D certificates (collectively the “Class X certificates”) is subject to change depending upon the final pricing of the Class A-1, Class A-3, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F-RR, Class G-RR, Class J-RR and Class NR-RR certificates (collectively, the “principal balance certificates”), as follows: (1) if as a result of such pricing the pass-through rate of any class of principal balance certificates whose certificate balance comprises such notional amount is equal to the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), the certificate balance of such class of principal balance certificates may not be part of, and reduce accordingly, such notional amount of the related Class X certificates (or, if as a result of such pricing the pass-through rate of the related Class X certificates is equal to zero, such Class X certificates may not be issued on the closing date), and/or (2) if as a result of such pricing the pass-through rate of any class of principal balance certificates that does not comprise such notional amount of the related Class X certificates is less than the weighted average of the net mortgage rates on the mortgage loans (in each case, adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months), such class of principal balance certificates may become a part of, and increase accordingly, such notional amount of the related Class X certificates. |

| (2) | The assumed final distribution dates set forth in this prospectus have been determined on the basis of the assumptions described in “Description of the Certificates—Assumed Final Distribution Date; Rated Final Distribution Date”. |

| (3) | For any distribution date, the pass-through rates on the Class A-1, Class A-3, Class A-4, Class A-5, Class A-SB, Class A-S, Class B, Class C, Class D, Class E, Class F-RR, Class G-RR, Class J-RR and Class NR-RR certificates will each be a per annum rate equal to one of the following: (i) a fixed rate, (ii) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, (iii) the lesser of a specified pass-through rate and the weighted average rate specified in clause (ii), or (iv) the weighted average rate specified in clause (ii) less a specified percentage. |

| (4) | The exact initial certificate balances of the Class A-4 and Class A-5 certificates are unknown and will be determined based on the final pricing of those classes of certificates. However, the respective approximate initial certificate balances, assumed final distribution dates, weighted average lives and expected principal windows of the Class A-4 and Class A-5 certificates are expected to be within the applicable ranges reflected in the following chart. The aggregate initial certificate balance of the Class A-4 and Class A-5 certificates is expected to be approximately $452,298,000, subject to a variance of plus or minus 5%. |

Class of Certificates | Expected Range of Approximate Initial

Certificate Balance | Expected Range of Assumed

Final Distribution Date | Expected Range of Weighted Average Life (Yrs.) | Expected Range of Principal Window |

| Class A-4 | $0 – $195,000,000 | N/A – July 2031 | N/A – 9.27 | N/A / 02/30 – 07/31 |

| Class A-5 | $257,298,000 – $452,298,000 | October 2031 | 9.76 – 9.55 | 07/31 – 10/31 / 02/30 – 10/31 |

| (5) | The Class X certificates will not have certificate balances and will not be entitled to receive distributions of principal. Interest will accrue on each of the Class X certificates at its respective pass-through rate based upon its respective notional amount. The notional amount |

| | of each Class of the Class X certificates will be equal to the aggregate certificate balances of the related class(es) of certificates (the “related Class X class”) indicated below: |

Class | Related Class X Class(es) |

| Class X-A | Class A-1, Class A-3, Class A-4, Class A-5, Class A-SB and Class A-S certificates |

| Class X-B | Class B and Class C certificates |

| Class X-D | Class D and Class E certificates |

| (6) | The pass through rate of each Class of the Class X certificates for any distribution date will equal the excess, if any, of (i) the weighted average of the net mortgage rates on the mortgage loans (in each case adjusted, if necessary, to accrue on the basis of a 360-day year consisting of twelve 30-day months) as of their respective due dates in the month preceding the month in which the related distribution date occurs, over (ii) the pass through rate (or the weighted average of the pass-through rates, if applicable) of the related Class X class(es) for that distribution date. See “Description of the Certificates—Distributions—Pass-Through Rates”. |

| (7) | The approximate initial credit support percentages set forth for the certificates are approximate and, for the Class A-1, Class A-3, Class A-4, Class A-5 and Class A-SB certificates, are represented in the aggregate. |

| (8) | The weighted average life and expected principal window during which distributions of principal would be received as set forth in the foregoing table with respect to each class of certificates having a certificate balance are based on the assumptions set forth under “Yield and Maturity Considerations—Weighted Average Life” and on the assumptions that there are no prepayments, modifications or losses in respect of the mortgage loans and that there are no extensions or forbearances of maturity dates or anticipated repayment dates of the mortgage loans. |

| (9) | The initial certificate balance of each of the Class E and Class F-RR certificates is subject to change based on final pricing of all principal balance certificates and Class X certificates and the final determination of the amounts of the Class F-RR, Class G-RR, Class J-RR and Class NR-RR certificates (collectively, the “HRR certificates”) that will be retained by the retaining sponsor (or its majority-owned affiliate) as described under “Credit Risk Retention” to satisfy the U.S. risk retention requirements of 3650 Real Estate Investment Trust 2 LLC, as retaining sponsor. For more information regarding the methodology and key inputs and assumptions used to determine the sizing of the HRR certificates, see “Credit Risk Retention”. |

| (10) | The Class Z certificates will not have a certificate balance, notional amount, pass-through rate, assumed final distribution date, rating or rated final distribution date. The Class Z certificates will only entitle holders to excess interest accrued on the mortgage loans with an anticipated repayment date. See “Description of the Mortgage Pool—Certain Terms of the Mortgage Loans—ARD Loans”. |

| (11) | The Class R certificates will not have a certificate balance, notional amount, pass-through rate, assumed final distribution date, rating or rated final distribution date. The Class R certificates represent the residual interests in each real estate mortgage investment conduit created with respect to this securitization, as further described in this prospectus. The Class R certificates will not be entitled to distributions of principal or interest. |

The Class X-D, Class D, Class E, Class F-RR, Class G-RR, Class J-RR, Class NR-RR, Class Z and Class R certificates are not offered by this prospectus. Any information in this prospectus concerning such non-offered certificates is presented solely to enhance your understanding of the offered certificates.

TABLE OF CONTENTS

| Summary of Certificates | 3 |

| Important Notice Regarding the Offered Certificates | 13 |

| Important Notice About Information Presented in This Prospectus | 14 |

| Summary of Terms | 23 |

| Summary of Risk Factors | 57 |

| Risk Factors | 59 |

| Special Risks | 59 |

| Current Coronavirus Pandemic Has Adversely Affected the Global Economy and Will Likely Adversely Affect the Performance of the Mortgage Loans | 59 |

| Risks Relating to the Mortgage Loans | 62 |

| Mortgage Loans Are Non-Recourse and Are Not Insured or Guaranteed | 62 |

| Risks of Commercial and Multifamily Lending Generally | 63 |

| Performance of the Mortgage Loans Will Be Highly Dependent on the Performance of Tenants and Tenant Leases | 65 |

| General | 65 |

| A Tenant Concentration May Result in Increased Losses | 65 |

| Mortgaged Properties Leased to Multiple Tenants Also Have Risks | 66 |

| Mortgaged Properties Leased to Borrowers or Borrower Affiliated Entities Also Have Risks | 66 |

| Tenant Bankruptcy Could Result in a Rejection of the Related Lease | 67 |

| Leases That Are Not Subordinated to the Lien of the Mortgage or Do Not Contain Attornment Provisions May Have an Adverse Impact at Foreclosure | 67 |

| Early Lease Termination Options May Reduce Cash Flow | 68 |

| Mortgaged Properties Leased to Not-for-Profit Tenants Also Have Risks | 69 |

| Office Properties Have Special Risks | 69 |

| Retail Properties Have Special Risks | 70 |

| Changes in the Retail Sector, Such as Online Shopping and Other Uses of Technology, Could Affect the Business Models and Viability of Retailers | 70 |

| The Performance of the Retail Properties is Subject to Conditions Affecting the Retail Sector | 71 |

| Some Retail Properties Depend on Anchor Stores or Major Tenants to Attract Shoppers and Could be Materially Adversely Affected by the Loss of, or a Store Closure by, One or More of These Anchor Stores or Major Tenants | 71 |

| Multifamily Properties Have Special Risks | 72 |

| Mixed Use Properties Have Special Risks | 75 |

| Industrial and Logistics Properties Have Special Risks | 75 |

| Self Storage Properties Have Special Risks | 76 |

| Risks Relating to Affiliation with a Franchise or Hotel Management Company | 76 |

| Condominium Ownership May Limit Use and Improvements | 77 |

| Sale-Leaseback Transactions Have Special Risks | 78 |

| Operation of a Mortgaged Property Depends on the Property Manager’s Performance | 80 |

| Concentrations Based on Property Type, Geography, Related Borrowers and Other Factors May Disproportionately Increase Losses | 80 |

| Adverse Environmental Conditions at or Near Mortgaged Properties May Result in Losses | 82 |

| Risks Related to Redevelopment, Expansion and Renovation at Mortgaged Properties | 83 |

| Some Mortgaged Properties May Not Be Readily Convertible to Alternative Uses | 84 |

| Health Clubs May Not Be Readily Convertible to Alternative Uses | 84 |

| Parking Garages May Not Be Easily Convertible to Alternative Uses | 84 |

| Risks Related to Zoning Non-Compliance and Use Restrictions | 85 |

| Energy Efficiency and Greenhouse Gas Emission Standards Set By New York City’s Local Law 97 May Adversely Affect Future Net Operating Income at Mortgaged Real Properties Located in New York City | 87 |

| Risks Relating to Inspections of Properties | 87 |

| Risks Relating to Costs of Compliance with Applicable Laws and Regulations | 87 |

| Insurance May Not Be Available or Adequate | 87 |

| Inadequacy of Title Insurers May Adversely Affect Distributions on Your Certificates | 88 |

| Terrorism Insurance May Not Be Available for All Mortgaged Properties | 89 |

| Risks Associated with Blanket Insurance Policies or Self-Insurance | 90 |

| Condemnation of a Mortgaged Property May Adversely Affect Distributions on Certificates | 90 |

| Limited Information Causes Uncertainty | 91 |

| Historical Information | 91 |

| Ongoing Information | 91 |

| Underwritten Net Cash Flow Could Be Based On Incorrect or Flawed Assumptions | 91 |

| Frequent and Early Occurrence of Borrower Delinquencies and Defaults May Adversely Affect Your Investment | 92 |

| The Mortgage Loans Have Not Been Reviewed or Re-Underwritten by Us; Some Mortgage Loans May Not Have Complied With Another Originator’s Underwriting Criteria | 93 |

| Static Pool Data Would Not Be Indicative of the Performance of this Pool | 94 |

| Appraisals May Not Reflect Current or Future Market Value of Each Property | 94 |

| Seasoned Mortgage Loans Present Additional Risk of Repayment | 96 |

| The Performance of a Mortgage Loan and Its Related Mortgaged Property Depends in Part on Who Controls the Borrower and Mortgaged Property | 96 |

| The Borrower’s Form of Entity May Cause Special Risks | 96 |

| A Bankruptcy Proceeding May Result in Losses and Delays in Realizing on the Mortgage Loans | 99 |

| Litigation Regarding the Mortgaged Properties or Borrowers May Impair Your Distributions | 99 |

| Other Financings or Ability to Incur Other Indebtedness Entails Risk | 100 |

| CFIUS | 101 |

| Tenancies-in-Common May Hinder Recovery | 102 |

| Delaware Statutory Trusts | 102 |

| Risks Relating to Enforceability of Cross-Collateralization | 102 |

| Risks Relating to Enforceability of Yield Maintenance Charges, Prepayment Premiums or Defeasance Provisions | 103 |

| Risks Associated with One Action Rules | 103 |

| State Law Limitations on Assignments of Leases and Rents May Entail Risks | 103 |

| Various Other Laws Could Affect the Exercise of Lender’s Rights | 104 |

| Risks of Anticipated Repayment Date Loans | 104 |

| The Absence of Lockboxes Entails Risks That Could Adversely Affect Distributions on Your Certificates | 104 |

| Borrower May Be Unable to Repay Remaining Principal Balance on Maturity Date or Anticipated Repayment Date; Longer Amortization Schedules and Interest-Only Provisions Increase Risk | 105 |

| Risks Related to Ground Leases and Other Leasehold Interests | 106 |

| Energy Efficiency and Greenhouse Gas Emission Standards Set By New York City’s Local Law 97 May Adversely Affect Future Net Operating Income at Mortgaged Real Properties Located in New York City | 107 |

| Increases in Real Estate Taxes May Reduce Available Funds | 108 |

| State and Local Mortgage Recording Taxes May Apply Upon a Foreclosure or Deed in Lieu of Foreclosure and Reduce Net Proceeds | 108 |

| Risks Relating to Tax Credits | 108 |

| Risks Related to Conflicts of Interest | 109 |

| Interests and Incentives of the Originators, the Sponsors and Their Affiliates May Not Be Aligned With Your Interests | 109 |

| Interests and Incentives of the Underwriter Entities May Not Be Aligned With Your Interests | 111 |

| Potential Conflicts of Interest of the Master Servicer and the Special Servicer | 112 |

| Potential Conflicts of Interest of the Operating Advisor | 114 |

| Potential Conflicts of Interest of the Asset Representations Reviewer | 115 |

| Potential Conflicts of Interest of the Directing Holder and the Companion Loan Holders | 116 |

| Potential Conflicts of Interest in the Selection of the Underlying Mortgage Loans | 117 |

| Conflicts of Interest May Occur as a Result of the Rights of the Applicable Directing Holder To Terminate the Special Servicer of the Applicable Whole Loan | 117 |

| Other Potential Conflicts of Interest May Affect Your Investment | 118 |

| Other Risks Relating to the Certificates | 118 |

| The Certificates Are Limited Obligations | 118 |

| The Certificates May Have Limited Liquidity and the Market Value of the Certificates May Decline | 119 |

| Nationally Recognized Statistical Rating Organizations May Assign Different Ratings to the Certificates; Ratings of the Certificates Reflect Only the Views of the Applicable Rating Agencies as of the Dates Such Ratings Were Issued; Ratings May Affect ERISA Eligibility; Ratings May Be Downgraded | 119 |

| Your Yield May Be Affected by Defaults, Prepayments and Other Factors | 122 |

| General | 122 |

| The Timing of Prepayments and Repurchases May Change Your Anticipated Yield | 123 |

| Your Yield May Be Adversely Affected By Prepayments Resulting From Earnout Reserves | 125 |

| Losses and Shortfalls May Change Your Anticipated Yield | 125 |

| Risk of Early Termination | 125 |

| Subordination of the Subordinated Certificates Will Affect the Timing of Distributions and the Application of Losses on the Subordinated Certificates | 126 |

| Pro Rata Allocation of Principal Between and Among the Subordinate Companion Loans, the Related Mortgage Loan and the Related Pari Passu Companion Loans Prior to a Material Mortgage Loan Event Default | 126 |

| Your Lack of Control Over the Issuing Entity and the Mortgage Loans Can Impact Your Investment | 126 |

| You Have Limited Voting Rights | 126 |

| The Rights of the Directing Holder and the Operating Advisor Could Adversely Affect Your Investment | 127 |

| You Have Limited Rights to Replace the Master Servicer, the Special Servicer, the Trustee, the Certificate Administrator, the Operating Advisor | |

| or the Asset Representations Reviewer | 129 |

| The Rights of Companion Loan Holders and Mezzanine Debt May Adversely Affect Your Investment | 130 |

| Risks Relating to Modifications of the Mortgage Loans | 131 |

| Sponsors May Not Make Required Repurchases or Substitutions of Defective Mortgage Loans or Pay Any Loss of Value Payment Sufficient to Cover All Losses on a Defective Mortgage Loan | 132 |

| Risks Relating to Interest on Advances and Special Servicing Compensation | 133 |

| Bankruptcy of a Servicer May Adversely Affect Collections on the Mortgage Loans and the Ability to Replace the Servicer | 133 |

| The Sponsors, the Depositor and the Issuing Entity Are Subject to Bankruptcy or Insolvency Laws That May Affect the Issuing Entity’s Ownership of the Mortgage Loans | 134 |

| The Requirement of the Special Servicer to Obtain FIRREA-Compliant Appraisals May Result in an Increased Cost to the Issuing Entity | 135 |

| Tax Matters and Changes in Tax Law May Adversely Impact the Mortgage Loans or Your Investment | 135 |

| Tax Considerations Relating to Foreclosure | 135 |

| REMIC Status | 136 |

| Material Federal Tax Considerations Regarding Original Issue Discount | 136 |

| Changes to REMIC Restrictions on Loan Modifications and REMIC Rules on Partial Releases May Impact an Investment in the Certificates. | 136 |

| State and Local Taxes Could Adversely Impact Your Investment. | 137 |

| General Risk Factors | 138 |

| Combination or “Layering” of Multiple Risks May Significantly Increase Risk of Loss | 138 |

| The Certificates May Not Be a Suitable Investment for You | 138 |

| The Volatile Economy, Credit Crisis and Downturn in the Real Estate Market Adversely Affected the Value of CMBS and Similar Factors May in the Future Adversely Affect the Value of CMBS | 138 |

| Other Events May Affect the Value and Liquidity of Your Investment | 139 |

| Legal and Regulatory Provisions Affecting Investors Could Adversely Affect the Liquidity of the Offered Certificates | 139 |

| The Master Servicer, any Sub-Servicer, the Special Servicer, the Trustee, the Certificate Administrator or the Custodian May Have Difficulty Performing Under the Pooling and Servicing Agreement or a Related Sub Servicing Agreement | 143 |

| Book-Entry Securities May Delay Receipt of Payment and Reports and Limit Liquidity and Your Ability to Pledge Certificates | 143 |

| Book-Entry Registration Will Mean You Will Not Be Recognized as a Holder of Record | 143 |

| Description of the Mortgage Pool | 144 |

| General | 144 |

| Co-Originated or Unaffiliated Third-Party Originated Mortgage Loans | 145 |

| Certain Calculations and Definitions | 145 |

| Mortgage Pool Characteristics | 155 |

| Overview | 155 |

| Property Types | 157 |

| Office Properties | 158 |

| Retail Properties | 158 |

| Multifamily Properties | 158 |

| Mixed Use Properties | 159 |

| Industrial Properties | 160 |

| Self-Storage Properties | 160 |

| Specialty Use Concentrations | 160 |

| Mortgage Loan Concentrations | 161 |

| Geographic Concentrations | 162 |

| Mortgaged Properties With Limited Prior Operating History | 163 |

| Tenancies-in-Common; Crowd Funding; Diversified Ownership | 163 |

| Delaware Statutory Trusts | 163 |

| Condominium and Other Shared Interests | 163 |

| Fee & Leasehold Estates; Ground Leases | 165 |

| COVID Considerations | 166 |

| Environmental Considerations | 166 |

| Redevelopment, Renovation and Expansion | 168 |

| Assessment of Property Value and Condition | 168 |

| Litigation and Other Considerations | 169 |

| Loan Purpose | 170 |

| Modified and Refinanced Loans | 170 |

| Default History, Bankruptcy Issues and Other Proceedings | 171 |

| Tenant Issues | 172 |

| Tenant Concentrations | 172 |

| Lease Expirations and Terminations | 172 |

| Expirations | 172 |

| Terminations | 173 |

| Other | 177 |

| Purchase Options and Rights of First Refusal | 179 |

| Affiliated Leases | 180 |

| Insurance Considerations | 180 |

| Use Restrictions | 181 |

| Appraised Value | 182 |

| Non-Recourse Carveout Limitations | 183 |

| Real Estate and Other Tax Considerations | 184 |

| Delinquency Information | 185 |

| Certain Terms of the Mortgage Loans | 186 |

| Amortization of Principal | 186 |

| Due Dates; Mortgage Rates; Calculations of Interest | 186 |

| ARD Loans | 187 |

| Single-Purpose Entity Covenants | 187 |

| Prepayment Protections and Certain Involuntary Prepayments | 187 |

| Voluntary Prepayments | 188 |

| “Due-On-Sale” and “Due-On-Encumbrance” Provisions | 189 |

| Defeasance; Collateral Substitution | 190 |

| Partial Releases and Additions | 191 |

| Escrows | 193 |

| Mortgaged Property Accounts | 193 |

| Lockbox Accounts | 193 |

| Exceptions to Underwriting Guidelines | 194 |

| Additional Indebtedness | 194 |

| General | 194 |

| Whole Loans | 195 |

| Mezzanine Indebtedness | 195 |

| Other Secured Indebtedness | 197 |

| Preferred Equity | 197 |

| Other Unsecured Indebtedness | 198 |

| The Whole Loans | 199 |

| General | 199 |

| The Serviced Pari Passu Whole Loans | 204 |

| The Non-Serviced Pari Passu Whole Loans | 206 |

| The Non-Serviced AB Whole Loans | 209 |

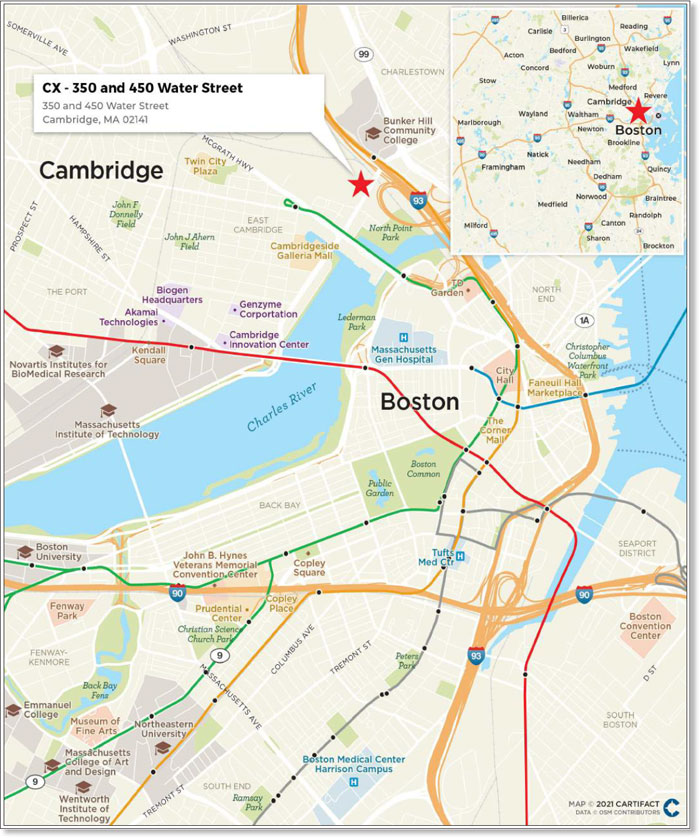

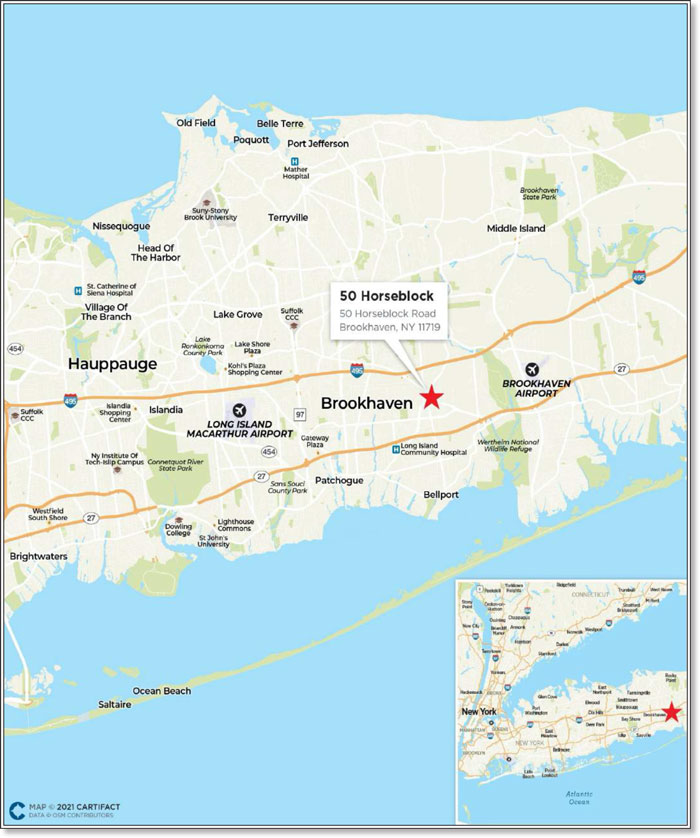

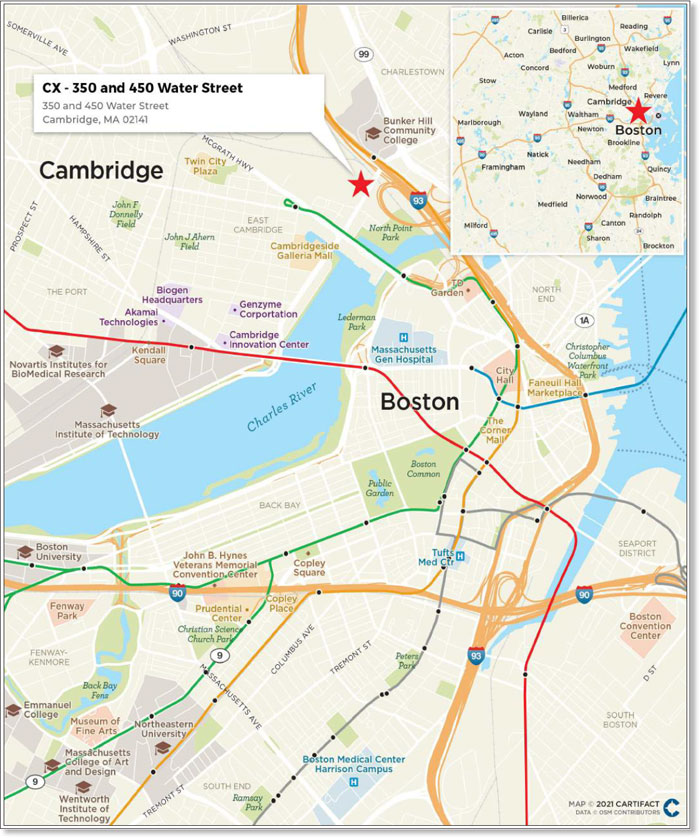

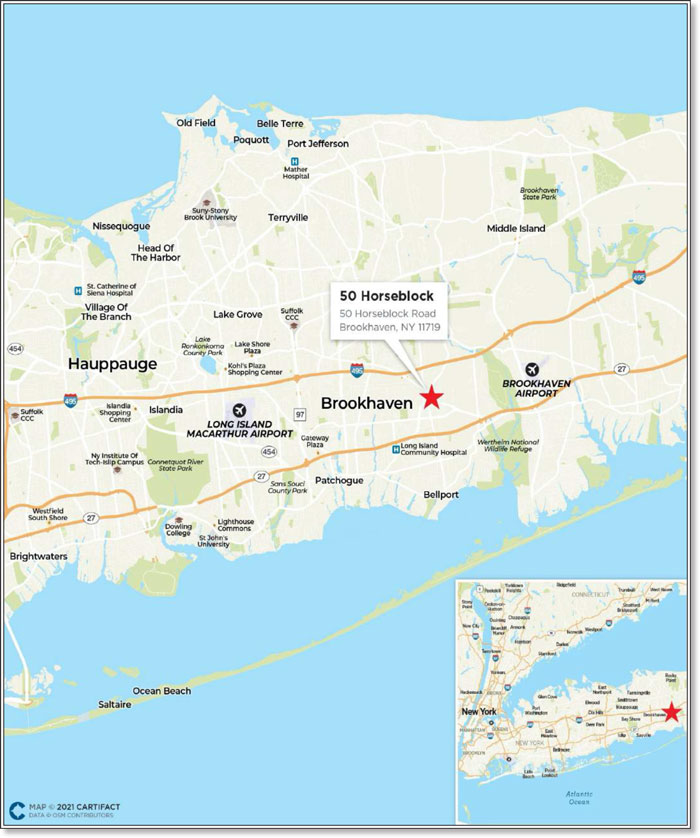

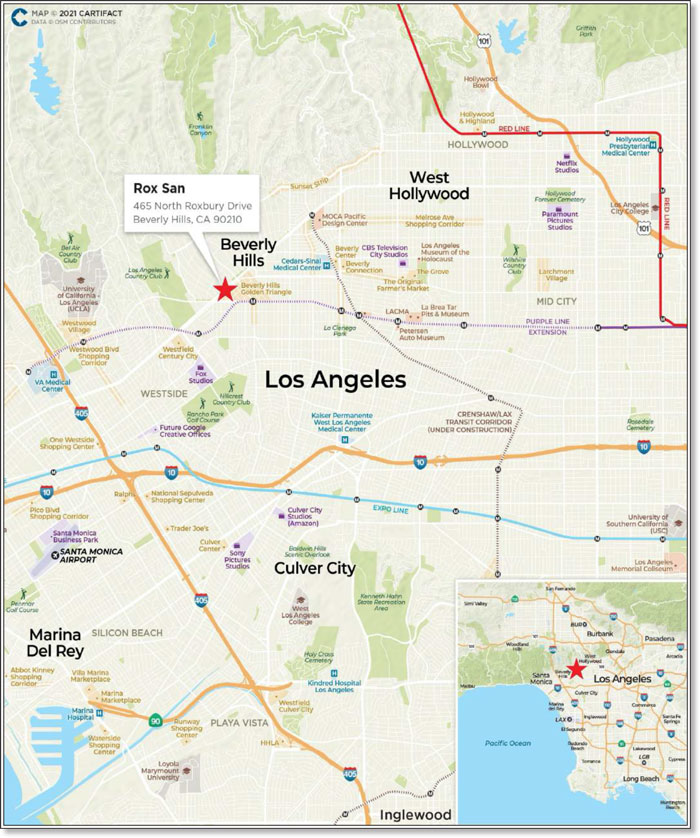

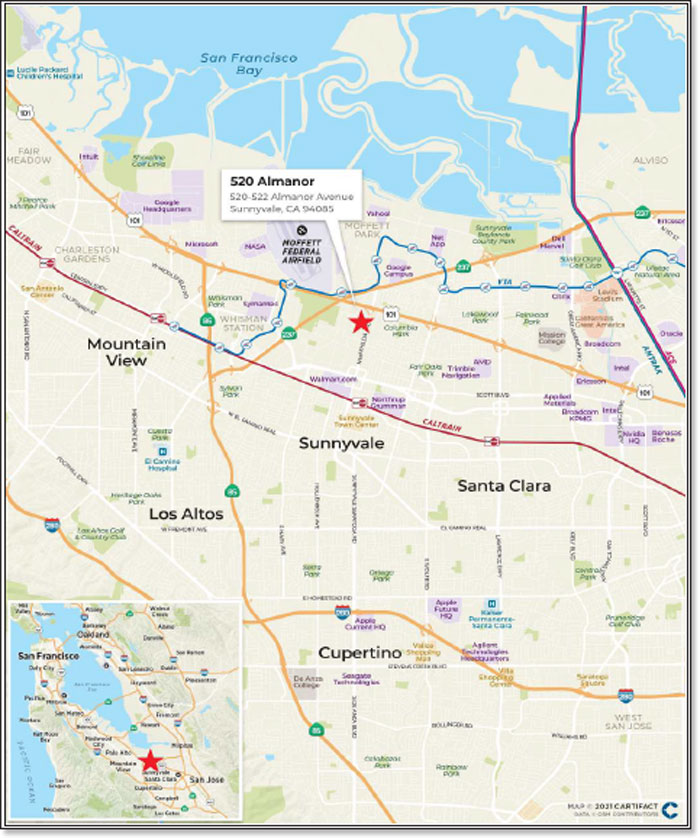

| The CX - 350 & 450 Water Street Whole Loan | 209 |

| The Westchester Whole Loan | 218 |

| The One SoHo Square Whole Loan | 222 |

| Additional Information | 227 |

| Transaction Parties | 227 |

| The Sponsors and Mortgage Loan Sellers | 227 |

| 3650 REIT | 228 |

| General | 228 |

| 3650 REIT’s Securitization Program | 228 |

| Review of 3650 REIT Mortgage Loans | 229 |

| 3650 REIT’s Underwriting Guidelines and Processes | 230 |

| Exceptions to 3650 REIT’s Disclosed Underwriting Guidelines | 234 |

| Compliance with Rule 15Ga-1 under the Exchange Act | 235 |

| Retained Interests in This Securitization | 235 |

| Certain Relationships and Related Transactions | 235 |

| Citi Real Estate Funding Inc. | 235 |

| General | 235 |

| CREFI’s Commercial Mortgage Origination and Securitization Program | 236 |

| Review of CREFI Mortgage Loans | 236 |

| CREFI’s Underwriting Guidelines and Processes | 240 |

| Exceptions to CREFI’s Disclosed Underwriting Guidelines | 243 |

| Compliance with Rule 15Ga-1 under the Exchange Act | 244 |

| Retained Interests in This Securitization | 244 |

| German American Capital Corporation | 244 |

| General | 244 |

| GACC’s Securitization Program | 244 |

| Review of GACC Mortgage Loans | 245 |

| DB Originators’ Underwriting Guidelines and Processes. | 247 |

| Exceptions to DB Originators’ Disclosed Underwriting Guidelines | 251 |

| Compliance with Rule 15Ga-1 under the Exchange Act | 252 |

| Retained Interests in This Securitization | 252 |

| The Depositor | 252 |

| The Issuing Entity | 253 |

| The Trustee and Certificate Administrator | 253 |

| The Master Servicer | 255 |

| The Special Servicer | 259 |

| The Operating Advisor and Asset Representations Reviewer | 262 |

| Credit Risk Retention | 263 |

| General | 263 |

| Qualifying CRE Loans; Required Credit Risk Retention Percentage | 264 |

| HRR Certificates | 264 |

| General | 264 |

| Material Terms of the Eligible Horizontal Residual Interest | 265 |

| Determination of Amount of Required Horizontal Credit Risk Retention | 265 |

| General | 265 |

| Swap-Priced Principal Balance Certificates | 266 |

| Swap Yield Curve | 266 |

| Credit Spread Determination | 267 |

| Discount Yield Determination | 267 |

| Determination of Class Sizes | 268 |

| Target Price Determination | 268 |

| Determination of Assumed Certificate Coupon | 269 |

| Determination of Swap-Priced Expected Price | 269 |

| Treasury Priced Interest-Only Certificates | 270 |

| Treasury Yield Curve | 270 |

| Credit Spread Determination | 270 |

| Discount Yield Determination | 271 |

| Determination of Scheduled Certificate Interest Payments | 271 |

| Determination of Interest-Only Expected Price | 271 |

| Yield-Priced Principal Balance Certificates | 271 |

| Determination of Class Sizes | 272 |

| Determination of Yield-Priced Expected Price | 272 |

| Calculation of Fair Value | 272 |

| Hedging, Transfer and Financing Restrictions | 273 |

| Operating Advisor | 274 |

| Representations and Warranties | 274 |

| Description of the Certificates | 275 |

| General | 275 |

| Distributions | 277 |

| Method, Timing and Amount | 277 |

| Available Funds | 278 |

| Priority of Distributions | 279 |

| Pass-Through Rates | 283 |

| Interest Distribution Amount | 285 |

| Principal Distribution Amount | 285 |

| Certain Calculations with Respect to Individual Mortgage Loans | 287 |

| Excess Interest | 287 |

| Application Priority of Mortgage Loan Collections or Whole Loan Collections | 288 |

| Allocation of Yield Maintenance Charges and Prepayment Premiums | 290 |

| Assumed Final Distribution Date; Rated Final Distribution Date | 291 |

| Prepayment Interest Shortfalls | 292 |

| Subordination; Allocation of Realized Losses | 294 |

| Reports to Certificateholders; Certain Available Information | 296 |

| Certificate Administrator Reports | 296 |

| Information Available Electronically | 301 |

| Voting Rights | 306 |

| Delivery, Form, Transfer and Denomination | 307 |

| Book-Entry Registration | 307 |

| Definitive Certificates | 310 |

| Certificateholder Communication | 310 |

| Access to Certificateholders’ Names and Addresses | 310 |

| Requests to Communicate | 310 |

| Description of the Mortgage Loan Purchase Agreements | 312 |

| General | 312 |

| Dispute Resolution Provisions | 321 |

| Asset Review Obligations | 321 |

| Pooling and Servicing Agreement | 322 |

| General | 322 |

| Assignment of the Mortgage Loans | 322 |

| Servicing Standard | 323 |

| Subservicing | 324 |

| Advances | 325 |

| P&I Advances | 325 |

| Servicing Advances | 326 |

| Nonrecoverable Advances | 327 |

| Recovery of Advances | 328 |

| Accounts | 329 |

| Withdrawals from the Collection Account | 331 |

| Servicing and Other Compensation and Payment of Expenses | 333 |

| General | 333 |

| Master Servicing Compensation | 338 |

| Special Servicing Compensation | 340 |

| Disclosable Special Servicer Fees | 344 |

| Certificate Administrator and Trustee Compensation | 344 |

| Operating Advisor Compensation | 345 |

| Asset Representations Reviewer Compensation | 345 |

| CREFC® Intellectual Property Royalty License Fee | 346 |

| Appraisal Reduction Amounts | 347 |

| Maintenance of Insurance | 354 |

| Modifications, Waivers and Amendments | 357 |

| Enforcement of “Due-on-Sale” and “Due-on-Encumbrance” Provisions | 360 |

| Inspections | 361 |

| Collection of Operating Information | 362 |

| Special Servicing Transfer Event | 362 |

| Asset Status Report | 364 |

| Realization Upon Mortgage Loans | 367 |

| Sale of Defaulted Loans and REO Properties | 369 |

| The Directing Holder | 372 |

| General | 372 |

| Major Decisions | 374 |

| Asset Status Report | 377 |

| Replacement of Special Servicer | 377 |

| Control Termination Event, Consultation Termination Event and Operating Advisor Consultation Event | 377 |

| Servicing Override | 379 |

| Rights of Holders of Companion Loans | 380 |

| Limitation on Liability of Directing Holder | 381 |

| The Operating Advisor | 382 |

| General | 382 |

| Duties of Operating Advisor at All Times | 382 |

| Annual Report | 384 |

| Additional Duties of the Operating Advisor During an Operating Advisor Consultation Event | 385 |

| Recommendation of the Replacement of the Special Servicer | 385 |

| Eligibility of Operating Advisor | 385 |

| Other Obligations of Operating Advisor | 386 |

| Delegation of Operating Advisor’s Duties | 387 |

| Termination of the Operating Advisor With Cause | 387 |

| Rights Upon Operating Advisor Termination Event | 388 |

| Waiver of Operating Advisor Termination Event | 389 |

| Termination of the Operating Advisor Without Cause | 389 |

| Resignation of the Operating Advisor | 389 |

| Operating Advisor Compensation | 389 |

| The Asset Representations Reviewer | 390 |

| Asset Review | 390 |

| Asset Review Trigger | 390 |

| Asset Review Vote | 391 |

| Review Materials | 392 |

| Asset Review | 393 |

| Eligibility of Asset Representations Reviewer | 394 |

| Other Obligations of Asset Representations Reviewer | 395 |

| Delegation of Asset Representations Reviewer’s Duties | 395 |

| Asset Representations Reviewer Termination Events | 396 |

| Rights Upon Asset Representations Reviewer Termination Event | 397 |

| Termination of the Asset Representations Reviewer Without Cause | 397 |

| Resignation of Asset Representations Reviewer | 397 |

| Asset Representations Reviewer Compensation | 398 |

| Replacement of Special Servicer Without Cause | 398 |

| Replacement of Special Servicer After Operating Advisor Recommendation and Certificateholder Vote | 400 |

| Termination of Master Servicer and Special Servicer for Cause | 401 |

| Servicer Termination Events | 401 |

| Rights Upon Servicer Termination Event | 403 |

| Waiver of Servicer Termination Event | 404 |

| Resignation of the Master Servicer or Special Servicer | 405 |

| Resignation of Master Servicer, Trustee, Certificate Administrator, Operating Advisor or Asset Representations Reviewer Upon Prohibited Risk Retention Affiliation | 405 |

| Limitation on Liability; Indemnification | 406 |

| Enforcement of Mortgage Loan Seller’s Obligations Under the MLPA | 408 |

| Dispute Resolution Provisions | 409 |

| Certificateholder’s Rights When a Repurchase Request is Initially Delivered by a Certificateholder | 409 |

| Certificateholder’s Rights When a Repurchase Request is Delivered by Another Party to the PSA | 409 |

| Resolution of a Repurchase Request | 410 |

| Mediation and Arbitration Provisions | 412 |

| Servicing of the Non-Serviced Mortgage Loans | 413 |

| General | 413 |

| Servicing of the CX - 350 & 450 Water Street Mortgage Loan | 416 |

| Servicing of The Westchester Mortgage Loan | 417 |

| Servicing of the One SoHo Square Mortgage Loan | 417 |

| Rating Agency Confirmations | 418 |

| Evidence as to Compliance | 420 |

| Limitation on Rights of Certificateholders to Institute a Proceeding | 421 |

| Termination; Retirement of Certificates | 421 |

| Amendment | 422 |

| Resignation and Removal of the Trustee and the Certificate Administrator | 425 |

| Governing Law; Waiver of Jury Trial; and Consent to Jurisdiction | 426 |

| Certain Legal Aspects of Mortgage Loans | 426 |

| California | 426 |

| New York | 427 |

| General | 427 |

| Types of Mortgage Instruments | 427 |

| Leases and Rents | 428 |

| Personalty | 428 |

| Foreclosure | 428 |

| General | 428 |

| Foreclosure Procedures Vary from State to State | 428 |

| Judicial Foreclosure | 429 |

| Equitable and Other Limitations on Enforceability of Certain Provisions | 429 |

| Nonjudicial Foreclosure/Power of Sale | 429 |

| Public Sale | 430 |

| Rights of Redemption | 431 |

| Anti-Deficiency Legislation | 431 |

| Leasehold Considerations | 431 |

| Cooperative Shares | 432 |

| Bankruptcy Laws | 432 |

| Environmental Considerations | 438 |

| General | 438 |

| Superlien Laws | 438 |

| CERCLA | 438 |

| Certain Other Federal and State Laws | 439 |

| Additional Considerations | 439 |

| Due-on-Sale and Due-on-Encumbrance Provisions | 439 |

| Subordinate Financing | 440 |

| Default Interest and Limitations on Prepayments | 440 |

| Applicability of Usury Laws | 440 |

| Americans with Disabilities Act | 440 |

| Servicemembers Civil Relief Act | 441 |

| Anti-Money Laundering, Economic Sanctions and Bribery | 441 |

| Potential Forfeiture of Assets | 442 |

| Certain Affiliations, Relationships and Related Transactions Involving Transaction Parties | 442 |

| Pending Legal Proceedings Involving Transaction Parties | 443 |

| Use of Proceeds | 444 |

| Yield and Maturity Considerations | 444 |

| Yield Considerations | 444 |

| General | 444 |

| Rate and Timing of Principal Payments | 444 |

| Losses and Shortfalls | 445 |

| Certain Relevant Factors Affecting Loan Payments and Defaults | 446 |

| Delay in Payment of Distributions | 447 |

| Yield on the Certificates with Notional Amounts | 447 |

| Weighted Average Life | 447 |

| Pre-Tax Yield to Maturity Tables | 454 |

| Material Federal Income Tax Considerations | 458 |

| General | 458 |

| Qualification as a REMIC | 459 |

| Status of Offered Certificates | 460 |

| Taxation of Regular Interests | 461 |

| General | 461 |

| Original Issue Discount | 461 |

| Acquisition Premium | 463 |

| Market Discount | 463 |

| Premium | 464 |

| Election To Treat All Interest Under the Constant Yield Method | 464 |

| Treatment of Losses | 465 |

| Yield Maintenance Charges and Prepayment Premium | 465 |

| Sale or Exchange of Regular Interests | 466 |

| Taxes That May Be Imposed on a REMIC | 466 |

| Prohibited Transactions | 466 |

| Contributions to a REMIC After the Startup Day | 467 |

| Net Income from Foreclosure Property | 467 |

| REMIC Partnership Representative | 467 |

| Taxation of Certain Foreign Investors | 467 |

| FATCA | 468 |

| Backup Withholding | 469 |

| Information Reporting | 469 |

| 3.8% Medicare Tax on “Net Investment Income” | 469 |

| Reporting Requirements | 469 |

| Certain State and Local Tax Considerations | 470 |

| Method of Distribution (Conflicts of Interest) | 470 |

| Incorporation of Certain Information by Reference | 472 |

| Where You Can Find More Information | 473 |

| Financial Information | 473 |

| Certain ERISA Considerations | 473 |

| General | 473 |

| Plan Asset Regulations | 474 |

| Administrative Exemptions | 475 |

| Insurance Company General Accounts | 476 |

| Legal Investment | 478 |

| Legal Matters | 478 |

| Ratings | 478 |

| Index of Significant Definitions | 481 |

| ANNEX A-1 – CERTAIN CHARACTERISTICS OF THE MORTGAGE LOANS AND MORTGAGED PROPERTIES | a-1-1 |

| ANNEX a-2 – SIGNIFICANT LOAN SUMMARIES | a-2-1 |

| ANNEX a-3 – MORTGAGE POOL INFORMATION | a-3-1 |

| ANNEX b – FORM OF DISTRIBUTION DATE STATEMENT | b-1 |

| Annex c – FORM OF OPERATING ADVISOR ANNUAL REPORT | c-1 |

| Annex D-1 – MORTGAGE LOAN seller REPRESENTATIONS AND WARRANTIES | d-1-1 |

| Annex d-2 – EXCEPTIONS TO MORTGAGE LOAN seller REPRESENTATIONS AND WARRANTIES | d-2-1 |

| ANNEX E – CLASS A-SB PRINCIPAL BALANCE SCHEDULE | E-1 |

Important Notice Regarding the Offered Certificates

WE HAVE FILED WITH THE SECURITIES AND EXCHANGE COMMISSION A REGISTRATION STATEMENT UNDER THE SECURITIES ACT OF 1933, AS AMENDED, WITH RESPECT TO THE CERTIFICATES OFFERED IN THIS PROSPECTUS. HOWEVER, THIS PROSPECTUS DOES NOT CONTAIN ALL OF THE INFORMATION CONTAINED IN OUR REGISTRATION STATEMENT. FOR FURTHER INFORMATION REGARDING THE DOCUMENTS REFERRED TO IN THIS PROSPECTUS, YOU SHOULD REFER TO OUR REGISTRATION STATEMENT AND THE EXHIBITS TO IT. OUR REGISTRATION STATEMENT AND THE EXHIBITS TO IT CAN BE ACCESSED ELECTRONICALLY AT HTTP://WWW.SEC.GOV.

THIS PROSPECTUS IS NOT AN OFFER TO SELL OR A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY STATE OR OTHER JURISDICTION WHERE SUCH OFFER, SOLICITATION OR SALE IS NOT PERMITTED.

THE INFORMATION IN THIS PROSPECTUS IS PRELIMINARY AND MAY BE SUPPLEMENTED OR AMENDED PRIOR TO THE TIME OF SALE.

IN ADDITION, THE OFFERED CERTIFICATES REFERRED TO IN THIS PROSPECTUS, AND THE ASSET POOL BACKING THEM, ARE SUBJECT TO MODIFICATION OR REVISION (INCLUDING THE POSSIBILITY THAT ONE OR MORE CLASSES OF OFFERED CERTIFICATES MAY BE SPLIT, COMBINED OR ELIMINATED) AT ANY TIME PRIOR TO ISSUANCE, AND ARE OFFERED ON A “WHEN, AS AND IF ISSUED” BASIS.

THE UNDERWRITERS DESCRIBED IN THESE MATERIALS MAY FROM TIME TO TIME PERFORM INVESTMENT BANKING SERVICES FOR, OR SOLICIT INVESTMENT BANKING BUSINESS FROM, ANY COMPANY NAMED IN THESE MATERIALS. THE UNDERWRITERS AND/OR THEIR RESPECTIVE EMPLOYEES MAY FROM TIME TO TIME HAVE A LONG OR SHORT POSITION IN ANY CONTRACT OR CERTIFICATE DISCUSSED IN THESE MATERIALS.

THE INFORMATION CONTAINED IN THIS PROSPECTUS SUPERSEDES ANY PREVIOUS SUCH INFORMATION DELIVERED TO ANY PROSPECTIVE INVESTOR AND MAY BE SUPERSEDED BY INFORMATION DELIVERED TO SUCH PROSPECTIVE INVESTOR PRIOR TO THE TIME OF SALE.

THE OFFERED CERTIFICATES DO NOT REPRESENT AN INTEREST IN OR OBLIGATION OF THE DEPOSITOR, THE SPONSORS, THE MORTGAGE LOAN SELLERS, THE MASTER SERVICER, THE SPECIAL SERVICER, THE TRUSTEE, THE OPERATING ADVISOR, THE ASSET REPRESENTATIONS REVIEWER, THE CERTIFICATE ADMINISTRATOR, THE DIRECTING HOLDER, THE UNDERWRITERS OR ANY OF THEIR RESPECTIVE AFFILIATES. NEITHER THE OFFERED CERTIFICATES NOR THE MORTGAGE LOANS ARE INSURED OR GUARANTEED BY ANY GOVERNMENTAL AGENCY OR INSTRUMENTALITY OR PRIVATE INSURER.

THERE IS CURRENTLY NO SECONDARY MARKET FOR THE OFFERED CERTIFICATES. WE CANNOT ASSURE YOU THAT A SECONDARY MARKET WILL DEVELOP OR, IF A SECONDARY MARKET DOES DEVELOP, THAT IT WILL PROVIDE HOLDERS OF THE OFFERED CERTIFICATES WITH LIQUIDITY OF INVESTMENT OR THAT IT WILL CONTINUE FOR THE TERM OF THE OFFERED CERTIFICATES. THE UNDERWRITERS CURRENTLY INTEND TO MAKE A MARKET IN THE OFFERED CERTIFICATES, BUT ARE UNDER NO OBLIGATION TO DO SO AND MAY DISCONTINUE ANY MARKET-MAKING ACTIVITIES AT ANY TIME WITHOUT NOTICE. IN ADDITION, THE ABILITY OF THE UNDERWRITERS TO MAKE A MARKET IN THE OFFERED CERTIFICATES MAY BE IMPACTED BY CHANGES IN ANY REGULATORY REQUIREMENTS APPLICABLE TO THE MARKETING AND SELLING OF, AND ISSUING QUOTATIONS WITH RESPECT TO, COMMERCIAL MORTGAGED-BACKED SECURITIES. ACCORDINGLY, PURCHASERS MUST BE PREPARED TO BEAR THE RISKS OF THEIR INVESTMENTS FOR AN INDEFINITE PERIOD. SEE “RISK FACTORS—

Other Risks Relating to the Certificates—The Certificates May Have Limited Liquidity and the Market Value of the Certificates May Decline”.

Important Notice About Information Presented in This Prospectus

You should rely only on the information contained in this prospectus. We have not authorized anyone to provide you with information that is different from that contained in this prospectus. The information contained in this prospectus is accurate only as of the date of this prospectus.

This prospectus begins with several introductory sections describing the offered certificates and the issuing entity in abbreviated form:

| ● | Summary of Certificates, commencing on the page set forth on the table of contents of this prospectus, which sets forth important statistical information relating to the certificates; |

| ● | Summary of Terms, commencing on the page set forth on the table of contents of this prospectus, which gives a brief introduction of the key features of the certificates and a description of the mortgage loans; and |

| ● | Summary of Risk Factors and Risk Factors, commencing on the respective pages set forth on the table of contents of this prospectus, which describe risks that apply to the certificates. |

This prospectus includes cross references to sections in this prospectus where you can find further related discussions. The table of contents in this prospectus identifies the pages where these sections are located.

Certain capitalized terms are defined and used in this prospectus to assist you in understanding the terms of the offered certificates and this offering. The capitalized terms used in this prospectus are defined on the pages indicated under the caption “Index of Significant Definitions” commencing on the page set forth on the table of contents of this prospectus.

All annexes and schedules attached to this prospectus are a part of this prospectus.

In this prospectus:

| ● | the terms “depositor”, “we”, “us” and “our” refer to 3650 REIT Commercial Mortgage Securities II LLC; |

| ● | unless otherwise specified, (i) references to a mortgaged property (or portfolio of mortgaged properties) by name refer to such mortgaged property (or portfolio of mortgaged properties) so identified on Annex A-1, (ii) references to a mortgage loan by name refer to such mortgage loan secured by the related mortgaged property (or portfolio of mortgaged properties) so identified on Annex A-1, (iii) any parenthetical with a percent next to a mortgaged property name (or portfolio of mortgaged properties name) indicates the approximate percent (or approximate aggregate percent) that the outstanding principal balance of the related mortgage loan (or, if applicable, the allocated loan amount with respect to such mortgaged property) represents of the aggregate outstanding principal balance of the pool of mortgage loans as of the cut-off date for this securitization, and (iv) any parenthetical with a percent next to a mortgage loan name or a group of mortgage loans indicates the approximate percent (or approximate aggregate percent) that the outstanding principal balance of such mortgage loan or the aggregate outstanding principal balance of such group of mortgage loans, as applicable, represents of the aggregate outstanding principal balance of the pool of mortgage loans as of the cut-off date for this securitization; |

| ● | references to a “pooling and servicing agreement” (other than the 3650R 2021-PF1 pooling and servicing agreement) governing the servicing of any mortgage loan should be construed to refer to any relevant pooling and servicing agreement, trust and servicing agreement or other primary transaction agreement governing the servicing of such mortgage loan; and |

| ● | references to “lender” or “mortgage lender” with respect to a mortgage loan generally should be construed to mean, from and after the date of initial issuance of the offered certificates, the trustee on behalf of the issuing entity as the holder of record title to the mortgage loans or the master servicer or special servicer, as applicable, with respect to the obligations and rights of the lender as described under “Pooling and Servicing Agreement”. |

Until ninety days after the date of this prospectus, all dealers that buy, sell or trade the offered certificates, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriters and with respect to their unsold allotments or subscriptions.

NOTICE TO INVESTORS IN THE EUROPEAN ECONOMIC AREA

PROHIBITION ON SALES TO EEA RETAIL INVESTORS

THE OFFERED CERTIFICATES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY EEA RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA (“EEA”). FOR THESE PURPOSES, AN “EEA RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF THE FOLLOWING: (I) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR (II) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 (AS AMENDED, THE “EU Prospectus Regulation”).

CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 (AS AMENDED, THE “EU PRIIPS Regulation”) FOR OFFERING OR SELLING THE OFFERED CERTIFICATES OR OTHERWISE MAKING THEM AVAILABLE TO EEA RETAIL INVESTORS IN THE EEA HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE OFFERED CERTIFICATES OR OTHERWISE MAKING THEM AVAILABLE TO ANY EEA RETAIL INVESTOR IN THE EEA MAY BE UNLAWFUL UNDER THE EEA PRIIPS REGULATION.

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF THE EU PROSPECTUS REGULATION.

MIFID II PRODUCT GOVERNANCE

ANY PERSON OFFERING, SELLING OR RECOMMENDING THE OFFERED CERTIFICATES (A “DISTRIBUTOR”) SUBJECT TO MIFID II IS RESPONSIBLE FOR UNDERTAKING ITS OWN TARGET MARKET ASSESSMENT IN RESPECT OF THE OFFERED CERTIFICATES AND DETERMINING APPROPRIATE DISTRIBUTION CHANNELS FOR THE PURPOSES OF THE MIFID II PRODUCT GOVERNANCE RULES UNDER COMMISSION DELEGATED DIRECTIVE (EU) 2017/593 (AS AMENDED, THE “DELEGATED DIRECTIVE”). NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR (EXCEPT AS REGARDS ITSELF OR AGENTS ACTING ON ITS BEHALF, TO THE EXTENT RELEVANT) ANY UNDERWRITER MAKE ANY REPRESENTATIONS OR WARRANTIES AS TO A DISTRIBUTOR’S COMPLIANCE WITH THE DELEGATED DIRECTIVE.

NOTICE TO INVESTORS IN THE UNITED KINGDOM

PROHIBITION ON SALES TO UK RETAIL INVESTORS

THE OFFERED CERTIFICATES ARE NOT INTENDED TO BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO AND SHOULD NOT BE OFFERED, SOLD OR OTHERWISE MADE AVAILABLE TO ANY UK RETAIL INVESTOR IN THE UNITED KINGDOM (THE “UK”). FOR THESE PURPOSES, A “UK RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF THE FOLLOWING: (I) A RETAIL CLIENT AS DEFINED IN POINT (8) OF ARTICLE 2 OF COMMISSION DELEGATED

REGULATION (EU) 2017/565 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMENDED, THE “EUWA”) AND AS AMENDED; OR (II) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (AS AMENDED, THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA (SUCH RULES AND REGULATIONS AS AMENDED) TO IMPLEMENT DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED; OR (III) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED (THE “UK PROSPECTUS REGULATION”).

CONSEQUENTLY NO KEY INFORMATION DOCUMENT REQUIRED BY REGULATION (EU) NO 1286/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED (THE “UK PRIIPS REGULATION”) FOR OFFERING OR SELLING THE OFFERED CERTIFICATES OR OTHERWISE MAKING THEM AVAILABLE TO UK RETAIL INVESTORS IN THE UK HAS BEEN PREPARED AND THEREFORE OFFERING OR SELLING THE OFFERED CERTIFICATES OR OTHERWISE MAKING THEM AVAILABLE TO UK RETAIL INVESTORS IN THE UK MAY BE UNLAWFUL UNDER THE UK PRIIPS REGULATION.

THIS PROSPECTUS IS NOT A PROSPECTUS FOR THE PURPOSES OF THE UK PROSPECTUS REGULATION.

UK PRODUCT GOVERNANCE

ANY PERSON OFFERING, SELLING OR RECOMMENDING THE OFFERED CERTIFICATES (A “DISTRIBUTOR”) THAT IS SUBJECT TO THE FCA HANDBOOK PRODUCT INTERVENTION AND PRODUCT GOVERNANCE SOURCEBOOK (THE “UK MIFIR PRODUCT GOVERNANCE RULES”) THAT IS OFFERING, SELLING OR RECOMMENDING THE OFFERED CERTIFICATES IS RESPONSIBLE FOR UNDERTAKING ITS OWN TARGET MARKET ASSESSMENT IN RESPECT OF THE OFFERED CERTIFICATES AND DETERMINING APPROPRIATE DISTRIBUTION CHANNELS. NONE OF THE ISSUING ENTITY, THE DEPOSITOR OR (EXCEPT AS REGARDS ITSELF OR AGENTS ACTING ON ITS BEHALF, TO THE EXTENT RELEVANT) ANY UNDERWRITER MAKE ANY REPRESENTATIONS OR WARRANTIES AS TO A DISTRIBUTOR’S COMPLIANCE WITH THE UK MIFIR PRODUCT GOVERNANCE RULES.

UK FINANCIAL PROMOTION REGIME AND PROMOTION OF COLLECTIVE INVESTMENT SCHEMES REGIME

THE ISSUING ENTITY MAY CONSTITUTE A “COLLECTIVE INVESTMENT SCHEME” AS DEFINED BY SECTION 235 OF THE FSMA THAT IS NOT A “RECOGNISED COLLECTIVE INVESTMENT SCHEME” FOR THE PURPOSES OF THE FSMA AND THAT HAS NOT BEEN AUTHORIZED, REGULATED OR OTHERWISE RECOGNIZED OR APPROVED. AS AN UNREGULATED SCHEME, THE OFFERED CERTIFICATES CANNOT BE MARKETED IN THE UK TO THE GENERAL PUBLIC, EXCEPT IN ACCORDANCE WITH THE FSMA.

THE COMMUNICATION OF THIS PROSPECTUS (A) IF MADE BY A PERSON WHO IS NOT AN AUTHORIZED PERSON UNDER THE FSMA, IS BEING MADE ONLY TO, OR DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UK, OR (II) HAVE PROFESSIONAL EXPERIENCE IN MATTERS RELATING TO INVESTMENTS AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 19(5) OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (FINANCIAL PROMOTION) ORDER 2005 (AS AMENDED, THE “FINANCIAL PROMOTION ORDER”), OR (III) ARE PERSONS FALLING WITHIN ARTICLE 49(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE FINANCIAL PROMOTION ORDER, OR (IV) ARE PERSONS TO WHICH THIS PROSPECTUS MAY OTHERWISE LAWFULLY BE COMMUNICATED OR DIRECTED (ALL SUCH PERSONS TOGETHER BEING REFERRED TO AS “FPO PERSONS”); AND (B) IF MADE BY A PERSON WHO IS AN AUTHORIZED PERSON UNDER

THE FSMA, IS BEING MADE ONLY TO, AND DIRECTED ONLY AT, PERSONS WHO (I) ARE OUTSIDE THE UK, OR (II) HAVE PROFESSIONAL EXPERIENCE OF PARTICIPATING IN UNREGULATED SCHEMES (AS DEFINED FOR PURPOSES OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (PROMOTION OF COLLECTIVE INVESTMENT SCHEMES) (EXEMPTIONS) ORDER 2001 (AS AMENDED, THE “PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER”) AND QUALIFY AS INVESTMENT PROFESSIONALS IN ACCORDANCE WITH ARTICLE 14(5) OF THE PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER, OR (III) ARE PERSONS FALLING WITHIN ARTICLE 22(2)(A) THROUGH (D) (“HIGH NET WORTH COMPANIES, UNINCORPORATED ASSOCIATIONS, ETC.”) OF THE PROMOTION OF COLLECTIVE INVESTMENT SCHEMES EXEMPTIONS ORDER, OR (IV) ARE PERSONS TO WHOM THE ISSUING ENTITY MAY LAWFULLY BE PROMOTED IN ACCORDANCE WITH CHAPTER 4.12 OF THE FCA HANDBOOK CONDUCT OF BUSINESS SOURCEBOOK (ALL SUCH PERSONS TOGETHER WITH FPO PERSONS, “RELEVANT PERSONS”).

THIS PROSPECTUS MUST NOT BE ACTED ON OR RELIED ON BY PERSONS WHO ARE NOT RELEVANT PERSONS. ANY INVESTMENT OR INVESTMENT ACTIVITY TO WHICH THIS PROSPECTUS RELATES, INCLUDING THE OFFERED CERTIFICATES, IS AVAILABLE ONLY TO RELEVANT PERSONS AND WILL BE ENGAGED IN ONLY WITH RELEVANT PERSONS. ANY PERSONS OTHER THAN RELEVANT PERSONS SHOULD NOT ACT OR RELY ON THIS PROSPECTUS.

POTENTIAL INVESTORS IN THE UK ARE ADVISED THAT ALL, OR MOST, OF THE PROTECTIONS AFFORDED BY THE UK REGULATORY SYSTEM WILL NOT APPLY TO AN INVESTMENT IN THE OFFERED CERTIFICATES AND THAT COMPENSATION WILL NOT BE AVAILABLE UNDER THE UK FINANCIAL SERVICES COMPENSATION SCHEME.

EEA AND UK SELLING RESTRICTIONS

EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT:

(a) IT HAS NOT OFFERED, SOLD OR OTHERWISE MADE AVAILABLE AND WILL NOT OFFER, SELL OR OTHERWISE MAKE AVAILABLE ANY OFFERED CERTIFICATES TO ANY EEA RETAIL INVESTOR IN THE EUROPEAN ECONOMIC AREA. FOR THE PURPOSES OF THIS PROVISION:

(i) THE EXPRESSION “EEA RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF THE FOLLOWING:

(A) A RETAIL CLIENT AS DEFINED IN POINT (11) OF ARTICLE 4(1) OF DIRECTIVE 2014/65/EU (AS AMENDED, “MIFID II”); OR

(B) A CUSTOMER WITHIN THE MEANING OF DIRECTIVE (EU) 2016/97 (AS AMENDED), WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT AS DEFINED IN POINT (10) OF ARTICLE 4(1) OF MIFID II; OR

(C) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 (AS AMENDED); AND

(ii) THE EXPRESSION “OFFER” INCLUDES THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE OFFERED CERTIFICATES TO BE OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE OR SUBSCRIBE FOR THE OFFERED CERTIFICATES;

(b) IT HAS NOT OFFERED, SOLD OR OTHERWISE MADE AVAILABLE AND WILL NOT OFFER, SELL OR OTHERWISE MAKE AVAILABLE ANY OFFERED CERTIFICATES TO ANY UK

RETAIL INVESTOR IN THE UNITED KINGDOM (THE “UK”). FOR THE PURPOSES OF THIS PROVISION:

(i) THE EXPRESSION “UK RETAIL INVESTOR” MEANS A PERSON WHO IS ONE (OR MORE) OF THE FOLLOWING:

(A) A RETAIL CLIENT AS DEFINED IN POINT (8) OF ARTICLE 2 OF COMMISSION DELEGATED REGULATION (EU) 2017/565 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT 2018 (AS AMENDED, THE “EUWA”) AND AS AMENDED; OR

(B) A CUSTOMER WITHIN THE MEANING OF THE PROVISIONS OF THE FINANCIAL SERVICES AND MARKETS ACT 2000 (AS AMENDED, THE “FSMA”) AND ANY RULES OR REGULATIONS MADE UNDER THE FSMA (SUCH RULES AND REGULATIONS AS AMENDED) TO IMPLEMENT DIRECTIVE (EU) 2016/97, WHERE THAT CUSTOMER WOULD NOT QUALIFY AS A PROFESSIONAL CLIENT, AS DEFINED IN POINT (8) OF ARTICLE 2(1) OF REGULATION (EU) NO 600/2014 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED; OR

(C) NOT A QUALIFIED INVESTOR AS DEFINED IN ARTICLE 2 OF REGULATION (EU) 2017/1129 AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA AND AS AMENDED; AND

(ii) THE EXPRESSION “OFFER” INCLUDES THE COMMUNICATION IN ANY FORM AND BY ANY MEANS OF SUFFICIENT INFORMATION ON THE TERMS OF THE OFFER AND THE OFFERED CERTIFICATES TO BE OFFERED SO AS TO ENABLE AN INVESTOR TO DECIDE TO PURCHASE OR SUBSCRIBE FOR THE OFFERED CERTIFICATES;

(c) IT HAS ONLY COMMUNICATED OR CAUSED TO BE COMMUNICATED AND WILL ONLY COMMUNICATE OR CAUSE TO BE COMMUNICATED AN INVITATION OR INDUCEMENT TO ENGAGE IN INVESTMENT ACTIVITY (WITHIN THE MEANING OF SECTION 21 OF THE FSMA) RECEIVED BY IT IN CONNECTION WITH THE ISSUE OR SALE OF THE OFFERED CERTIFICATES IN CIRCUMSTANCES IN WHICH SECTION 21(1) OF THE FSMA DOES NOT APPLY TO THE ISSUING ENTITY OR THE DEPOSITOR; AND

(d) IT HAS COMPLIED AND WILL COMPLY WITH ALL APPLICABLE PROVISIONS OF THE FSMA WITH RESPECT TO ANYTHING DONE BY IT IN RELATION TO THE OFFERED CERTIFICATES IN, FROM OR OTHERWISE INVOLVING THE UK.

EU SECURITIZATION REGULATION AND UK SECURITIZATION REGULATION

NONE OF THE SPONSORS, THE DEPOSITOR, THE ISSUING ENTITY, THE UNDERWRITERS OR ANY OTHER PARTY TO THE TRANSACTION INTENDS TO RETAIN A MATERIAL NET ECONOMIC INTEREST IN THE SECURITIZATION TRANSACTION CONSTITUTED BY THE ISSUE OF THE CERTIFICATES, OR TAKE ANY OTHER ACTION, IN A MANNER PRESCRIBED BY (A) EUROPEAN UNION REGULATION (eu) 2017/2402 (AS AMENDED, THE “EU SECURITIZATION REGULATION”) OR (B) REGULATION (EU) 2017/2402, AS IT FORMS PART OF UK DOMESTIC LAW BY VIRTUE OF THE EUWA, AND AS AMENDED BY THE SECURITISATION (AMENDMENT) (EU EXIT) REGULATIONS 2019 (THE “UK SECURITIZATION REGULATION”). IN ADDITION, NO SUCH PARTY WILL TAKE ANY ACTION THAT MAY BE REQUIRED BY ANY PROSPECTIVE INVESTOR OR CERTIFICATEHOLDER FOR THE PURPOSES OF ITS COMPLIANCE WITH ANY REQUIREMENT OF THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION REGULATION. FURTHERMORE, THE ARRANGEMENTS DESCRIBED UNDER “CREDIT RISK RETENTION” HAVE NOT BEEN STRUCTURED WITH THE OBJECTIVE OF ENSURING COMPLIANCE BY ANY PERSON WITH ANY REQUIREMENTS OF THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION REGULATION.

CONSEQUENTLY, THE OFFERED CERTIFICATES MAY NOT BE A SUITABLE INVESTMENT FOR ANY PERSON THAT IS NOW OR MAY IN THE FUTURE BE SUBJECT TO ANY REQUIREMENT OF THE EU SECURITIZATION REGULATION OR THE UK SECURITIZATION REGULATION.

FOR ADDITIONAL INFORMATION REGARDING THE EU SECURITIZATION REGULATION AND THE UK SECURITIZATION REGULATION, SEE “RISK FACTORS—GENERAL RISK FACTORS—LEGAL AND REGULATORY PROVISIONS AFFECTING INVESTORS COULD ADVERSELY AFFECT THE LIQUIDITY OF THE OFFERED CERTIFICATES”.

PEOPLE’S REPUBLIC OF CHINA

THE OFFERED CERTIFICATES WILL NOT BE OFFERED OR SOLD IN THE PEOPLE’S REPUBLIC OF CHINA (EXCLUDING HONG KONG, MACAU AND TAIWAN, THE “PRC”) AS PART OF THE INITIAL DISTRIBUTION OF THE OFFERED CERTIFICATES BUT MAY BE AVAILABLE FOR PURCHASE BY INVESTORS RESIDENT IN THE PRC FROM OUTSIDE THE PRC.

THIS PROSPECTUS DOES NOT CONSTITUTE AN OFFER TO SELL OR THE SOLICITATION OF AN OFFER TO BUY ANY SECURITIES IN THE PRC TO ANY PERSON TO WHOM IT IS UNLAWFUL TO MAKE THE OFFER OR SOLICITATION IN THE PRC.

THE DEPOSITOR DOES NOT REPRESENT THAT THIS PROSPECTUS MAY BE LAWFULLY DISTRIBUTED, OR THAT ANY OFFERED CERTIFICATES MAY BE LAWFULLY OFFERED, IN COMPLIANCE WITH ANY APPLICABLE REGISTRATION OR OTHER REQUIREMENTS IN THE PRC, OR PURSUANT TO AN EXEMPTION AVAILABLE THEREUNDER, OR ASSUME ANY RESPONSIBILITY FOR FACILITATING ANY SUCH DISTRIBUTION OR OFFERING. IN PARTICULAR, NO ACTION HAS BEEN TAKEN BY THE DEPOSITOR WHICH WOULD PERMIT AN OFFERING OF ANY OFFERED CERTIFICATES OR THE DISTRIBUTION OF THIS PROSPECTUS IN THE PRC.

ACCORDINGLY, THE OFFERED CERTIFICATES ARE NOT BEING OFFERED OR SOLD WITHIN THE PRC BY MEANS OF THIS PROSPECTUS OR ANY OTHER DOCUMENT. NEITHER THIS PROSPECTUS NOR ANY ADVERTISEMENT OR OTHER OFFERING MATERIAL MAY BE DISTRIBUTED OR PUBLISHED IN THE PRC, EXCEPT UNDER CIRCUMSTANCES THAT WILL RESULT IN COMPLIANCE WITH ANY APPLICABLE LAWS AND REGULATIONS.

HONG KONG

NO PERSON HAS ISSUED OR DISTRIBUTED OR HAD IN ITS POSSESSION FOR THE PURPOSES OF ISSUE OR DISTRIBUTION, OR WILL ISSUE OR DISTRIBUTE OR HAVE IN ITS POSSESSION FOR THE PURPOSES OF ISSUE OR DISTRIBUTION, WHETHER IN HONG KONG OR ELSEWHERE, ANY ADVERTISEMENT, INVITATION OR DOCUMENT RELATING TO THE OFFERED CERTIFICATES, WHICH IS DIRECTED AT, OR THE CONTENTS OF WHICH ARE LIKELY TO BE ACCESSED OR READ BY, THE PUBLIC OF HONG KONG (EXCEPT IF PERMITTED TO DO SO UNDER THE SECURITIES LAWS OF HONG KONG) OTHER THAN WITH RESPECT TO OFFERED CERTIFICATES WHICH ARE OR ARE INTENDED TO BE DISPOSED OF (A) ONLY TO PERSONS OUTSIDE HONG KONG OR (B) ONLY TO “PROFESSIONAL INVESTORS” WITHIN THE MEANING OF THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) (THE “SFO”) AND ANY RULES OR REGULATIONS MADE UNDER THE SFO.

THE OFFERED CERTIFICATES (IF THEY ARE NOT A “STRUCTURED PRODUCT” AS DEFINED IN THE SECURITIES AND FUTURES ORDINANCE (CAP. 571 OF THE LAWS OF HONG KONG) HAVE NOT BEEN OFFERED OR SOLD AND WILL NOT BE OFFERED OR SOLD, BY MEANS OF ANY DOCUMENT, OTHER THAN (A) TO “PROFESSIONAL INVESTORS” AS DEFINED IN THE SFO AND ANY RULES OR REGULATIONS MADE UNDER THE SFO, OR (B) IN OTHER CIRCUMSTANCES WHICH DO NOT RESULT IN THE DOCUMENT CONSTITUTING A “PROSPECTUS” AS DEFINED IN THE COMPANIES (WINDING UP AND MISCELLANEOUS PROVISIONS) ORDINANCE (CAP. 32 OF THE LAWS OF HONG KONG) OR WHICH DO NOT CONSTITUTE AN OFFER TO THE PUBLIC WITHIN THE MEANING OF THE COMPANIES ORDINANCE (CAP. 622 OF THE LAWS OF HONG

KONG). FURTHER, THE CONTENTS OF THIS PROSPECTUS HAVE NOT BEEN REVIEWED OR APPROVED BY THE SECURITIES AND FUTURES COMMISSION OF HONG KONG OR ANY OTHER REGULATORY AUTHORITY IN HONG KONG. YOU ARE ADVISED TO EXERCISE CAUTION IN RELATION TO THE OFFERING CONTEMPLATED IN THIS PROSPECTUS.

W A R N I N G

IF YOU ARE IN ANY DOUBT ABOUT ANY OF THE CONTENTS OF THIS PROSPECTUS, YOU SHOULD OBTAIN INDEPENDENT PROFESSIONAL ADVICE.

SINGAPORE

NEITHER THIS PROSPECTUS NOR ANY OTHER DOCUMENT OR MATERIAL IN CONNECTION WITH ANY OFFER OF THE OFFERED CERTIFICATES HAS BEEN OR WILL BE LODGED OR REGISTERED AS A PROSPECTUS WITH THE MONETARY AUTHORITY OF SINGAPORE (“MAS”) UNDER THE SECURITIES AND FUTURES ACT (CAP. 289) OF SINGAPORE (THE “SFA”). ACCORDINGLY, MAS ASSUMES NO RESPONSIBILITY FOR THE CONTENTS OF THIS PROSPECTUS. THIS PROSPECTUS IS NOT A PROSPECTUS AS DEFINED IN THE SFA AND STATUTORY LIABILITY UNDER THE SFA IN RELATION TO THE CONTENTS OF PROSPECTUSES WOULD NOT APPLY. PROSPECTIVE INVESTORS SHOULD CONSIDER CAREFULLY WHETHER THE INVESTMENT IS SUITABLE FOR IT.

THIS PROSPECTUS AND ANY OTHER DOCUMENTS OR MATERIALS IN CONNECTION WITH THE OFFER OR SALE, OR INVITATION FOR SUBSCRIPTION OR PURCHASE, OF THE OFFERED CERTIFICATES MAY NOT BE DIRECTLY OR INDIRECTLY ISSUED, CIRCULATED OR DISTRIBUTED, NOR MAY THE OFFERED CERTIFICATES BE OFFERED OR SOLD, OR BE MADE THE SUBJECT OF AN INVITATION FOR SUBSCRIPTION OR PURCHASE, WHETHER DIRECTLY OR INDIRECTLY, TO PERSONS IN SINGAPORE OTHER THAN TO AN INSTITUTIONAL INVESTOR (AS DEFINED IN SECTION 4A(1)(C) OF THE SFA (“INSTITUTIONAL INVESTOR”)) PURSUANT TO SECTION 304 OF THE SFA.

UNLESS SUCH OFFERED CERTIFICATES ARE OF THE SAME CLASS AS OTHER OFFERED CERTIFICATES OF THE ISSUING ENTITY THAT ARE LISTED FOR QUOTATION ON AN APPROVED EXCHANGE (AS DEFINED IN SECTION 2(1) OF THE SFA) (“APPROVED EXCHANGE”) AND IN RESPECT OF WHICH ANY OFFER, INFORMATION, STATEMENT, INTRODUCTORY DOCUMENT, SHAREHOLDERS’ CIRCULAR FOR A REVERSE TAKE-OVER DOCUMENT ISSUED FOR THE PURPOSES OF A TRUST SCHEME OR ANY OTHER SIMILAR DOCUMENT APPROVED BY AN APPROVED EXCHANGE WAS ISSUED IN CONNECTION WITH AN OFFER OR THE LISTING FOR QUOTATION OF THOSE OFFERED CERTIFICATES, ANY SUBSEQUENT OFFERS IN SINGAPORE OF OFFERED CERTIFICATES ACQUIRED PURSUANT TO AN INITIAL OFFER MADE HEREUNDER MAY ONLY BE MADE, PURSUANT TO THE REQUIREMENTS OF SECTION 304A, TO PERSONS WHO ARE INSTITUTIONAL INVESTORS.

AS THE OFFERED CERTIFICATES ARE ONLY OFFERED TO PERSONS IN SINGAPORE WHO QUALIFY AS AN INSTITUTIONAL INVESTOR, THE ISSUING ENTITY IS NOT REQUIRED TO DETERMINE THE CLASSIFICATION OF THE OFFERED CERTIFICATES PURSUANT TO SECTION 309B OF THE SFA.

NOTHING SET OUT IN THIS NOTICE SHALL BE CONSTRUED AS LEGAL ADVICE AND EACH PROSPECTIVE INVESTOR SHOULD CONSULT ITS OWN LEGAL COUNSEL. THIS NOTICE IS FURTHER SUBJECT TO THE PROVISIONS OF THE SFA AND ITS REGULATIONS AS THE SAME MAY BE AMENDED OR CONSOLIDATED FROM TIME TO TIME AND DOES NOT PURPORT TO BE EXHAUSTIVE IN ANY RESPECT.

THE REPUBLIC OF KOREA

THIS PROSPECTUS IS NOT, AND UNDER NO CIRCUMSTANCES IS THIS PROSPECTUS TO BE CONSTRUED AS, A PUBLIC OFFERING OF SECURITIES IN KOREA. NEITHER THE ISSUER NOR ANY OF ITS AGENTS MAKE ANY REPRESENTATION WITH RESPECT TO THE ELIGIBILITY OF ANY RECIPIENTS OF THIS PROSPECTUS TO ACQUIRE THE OFFERED CERTIFICATES UNDER THE LAWS OF KOREA, INCLUDING, BUT WITHOUT LIMITATION, THE FOREIGN EXCHANGE TRANSACTION LAW AND REGULATIONS THEREUNDER (THE “FETL”). THE OFFERED CERTIFICATES HAVE NOT BEEN REGISTERED WITH THE FINANCIAL SERVICES COMMISSION OF KOREA FOR PUBLIC OFFERING IN KOREA, AND NONE OF THE OFFERED CERTIFICATES MAY BE OFFERED, SOLD OR DELIVERED, DIRECTLY OR INDIRECTLY, OR OFFERED OR SOLD TO ANY PERSON FOR RE-OFFERING OR RESALE, DIRECTLY OR INDIRECTLY IN KOREA OR TO ANY RESIDENT OF KOREA EXCEPT PURSUANT TO THE FINANCIAL INVESTMENT SERVICES AND CAPITAL MARKETS ACT AND THE DECREES AND REGULATIONS THEREUNDER, THE FETL AND ANY OTHER APPLICABLE LAWS, REGULATIONS AND MINISTERIAL GUIDELINES IN KOREA. WITHOUT PREJUDICE TO THE FOREGOING, THE NUMBER OF OFFERED CERTIFICATES OFFERED IN KOREA OR TO A RESIDENT OF KOREA SHALL BE LESS THAN FIFTY AND FOR A PERIOD OF ONE YEAR FROM THE ISSUE DATE OF THE OFFERED CERTIFICATES, NONE OF THE OFFERED CERTIFICATES MAY BE DIVIDED RESULTING IN AN INCREASED NUMBER OF OFFERED CERTIFICATES. FURTHERMORE, THE OFFERED CERTIFICATES MAY NOT BE RESOLD TO KOREAN RESIDENTS UNLESS THE PURCHASER OF THE OFFERED CERTIFICATES COMPLIES WITH ALL APPLICABLE REGULATORY REQUIREMENTS (INCLUDING, BUT NOT LIMITED TO, GOVERNMENT REPORTING APPROVAL REQUIREMENTS UNDER THE FETL AND ITS SUBORDINATE DECREES AND REGULATIONS) IN CONNECTION WITH THE PURCHASE OF THE OFFERED CERTIFICATES.

JAPAN

THE OFFERED CERTIFICATES HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE FINANCIAL INSTRUMENTS AND EXCHANGE LAW OF JAPAN, AS AMENDED (THE “FIEL”), AND DISCLOSURE UNDER THE FIEL HAS NOT BEEN AND WILL NOT BE MADE WITH RESPECT TO THE OFFERED CERTIFICATES. ACCORDINGLY, EACH UNDERWRITER HAS REPRESENTED AND AGREED THAT IT HAS NOT, DIRECTLY OR INDIRECTLY, OFFERED OR SOLD AND WILL NOT, DIRECTLY OR INDIRECTLY, OFFER OR SELL ANY OFFERED CERTIFICATES IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN (WHICH TERM AS USED IN THIS PROSPECTUS MEANS ANY PERSON RESIDENT IN JAPAN, INCLUDING ANY CORPORATION OR OTHER ENTITY ORGANIZED UNDER THE LAWS OF JAPAN) OR TO OTHERS FOR REOFFERING OR RE-SALE, DIRECTLY OR INDIRECTLY, IN JAPAN OR TO, OR FOR THE BENEFIT OF, ANY RESIDENT OF JAPAN EXCEPT PURSUANT TO AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF, AND OTHERWISE IN COMPLIANCE WITH, THE FIEL AND OTHER RELEVANT LAWS, REGULATIONS AND MINISTERIAL GUIDELINES OF JAPAN.

JAPANESE RETENTION REQUIREMENT

The JAPANESE Financial Services Agency published a risk retention rule as part of the regulatory capital regulation of certain categories of Japanese investors seeking to invest in securitization transactions (the “JRR RULE”). The JRR Rule mandates an “indirect” compliance requirement, meaning that certain categories of Japanese investors will be required to apply higher risk weighting to securitization exposures they hold unless the relevant originator commits to hold a retention interest in the securities issued in the securitization transaction equal to at least 5% of the exposure of the total underlying assets in the securitization transaction (the “JAPANESE RETENTION REQUIREMENT”), or such investors determine that the underlying assets were not “inappropriately originated.” In the absence of such a determination by such investors that such underlying assets were not “inappropriately originated”, the Japanese Retention Requirement would apply to an investment by such investors in such securities.

No party to the transaction described in this Prospectus has committed to hold a risk retention interest in compliance with the Japanese Retention Requirement, and we make no representation as to whether the transaction described in this prospectus would otherwise comply with the JRR Rule.

NOTICE TO RESIDENTS OF CANADA

THE OFFERED CERTIFICATES MAY BE SOLD IN CANADA ONLY TO PURCHASERS PURCHASING, OR DEEMED TO BE PURCHASING, AS PRINCIPAL THAT ARE ACCREDITED INVESTORS, AS DEFINED IN NATIONAL INSTRUMENT 45-106 PROSPECTUS EXEMPTIONS OR SUBSECTION 73.3(1) OF THE SECURITIES ACT (ONTARIO), AND ARE PERMITTED CLIENTS, AS DEFINED IN NATIONAL INSTRUMENT 31-103 REGISTRATION REQUIREMENTS, EXEMPTIONS AND ONGOING REGISTRANT OBLIGATIONS. ANY RESALE OF THE OFFERED CERTIFICATES MUST BE MADE IN ACCORDANCE WITH AN EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE PROSPECTUS REQUIREMENTS OF APPLICABLE SECURITIES LAWS.

SECURITIES LEGISLATION IN CERTAIN PROVINCES OR TERRITORIES OF CANADA MAY PROVIDE A PURCHASER WITH REMEDIES FOR RESCISSION OR DAMAGES IF THIS PROSPECTUS (INCLUDING ANY AMENDMENT THERETO) CONTAINS A MISREPRESENTATION, PROVIDED THAT THE REMEDIES FOR RESCISSION OR DAMAGES ARE EXERCISED BY THE PURCHASER WITHIN THE TIME LIMIT PRESCRIBED BY THE SECURITIES LEGISLATION OF THE PURCHASER’S PROVINCE OR TERRITORY. THE PURCHASER SHOULD REFER TO ANY APPLICABLE PROVISIONS OF THE SECURITIES LEGISLATION OF THE PURCHASER’S PROVINCE OR TERRITORY FOR PARTICULARS OF THESE RIGHTS OR CONSULT WITH A LEGAL ADVISOR.

PURSUANT TO SECTION 3A.3 OF NATIONAL INSTRUMENT 33-105 UNDERWRITING CONFLICTS (“NI 33-105”), THE UNDERWRITERS ARE NOT REQUIRED TO COMPLY WITH THE DISCLOSURE REQUIREMENTS OF NI 33-105 REGARDING UNDERWRITER CONFLICTS OF INTEREST IN CONNECTION WITH THIS OFFERING.

MEXICO

THIS PROSPECTUS HAS NOT BEEN REVIEWED NOR APPROVED BY THE MEXICAN NATIONAL BANKING AND SECURITIES COMMISSION (COMISIÓN NACIONAL BANCARIA Y DE VALORES, OR THE “CNBV”). THIS OFFERING DOES NOT CONSTITUTE A PUBLIC OFFERING IN MEXICO AND THIS PROSPECTUS MAY NOT BE PUBLICLY DISTRIBUTED IN MEXICO.