Shareholder Letter Q4 2024

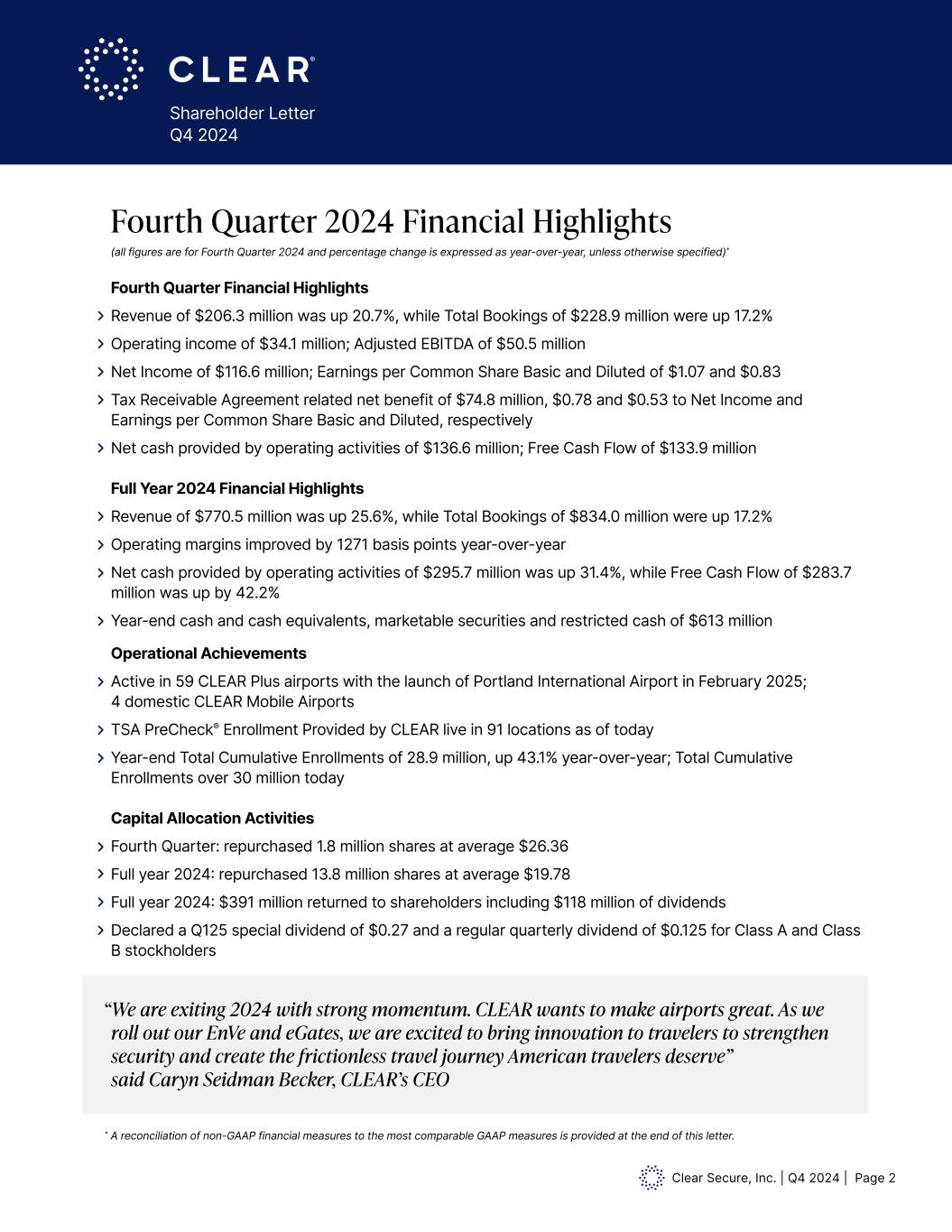

Clear Secure, Inc. | Q4 2024 | Page 2 Shareholder Letter Q4 2024 Fourth Quarter 2024 Financial Highlights (all figures are for Fourth Quarter 2024 and percentage change is expressed as year-over-year, unless otherwise specified)* Fourth Quarter Financial Highlights Revenue of $206.3 million was up 20.7%, while Total Bookings of $228.9 million were up 17.2% Operating income of $34.1 million; Adjusted EBITDA of $50.5 million Net Income of $116.6 million; Earnings per Common Share Basic and Diluted of $1.07 and $0.83 Tax Receivable Agreement related net benefit of $74.8 million, $0.78 and $0.53 to Net Income and Earnings per Common Share Basic and Diluted, respectively Net cash provided by operating activities of $136.6 million; Free Cash Flow of $133.9 million Full Year 2024 Financial Highlights Revenue of $770.5 million was up 25.6%, while Total Bookings of $834.0 million were up 17.2% Operating margins improved by 1271 basis points year-over-year Net cash provided by operating activities of $295.7 million was up 31.4%, while Free Cash Flow of $283.7 million was up by 42.2% Year-end cash and cash equivalents, marketable securities and restricted cash of $613 million Operational Achievements Active in 59 CLEAR Plus airports with the launch of Portland International Airport in February 2025; 4 domestic CLEAR Mobile Airports TSA PreCheck® Enrollment Provided by CLEAR live in 91 locations as of today Year-end Total Cumulative Enrollments of 28.9 million, up 43.1% year-over-year; Total Cumulative Enrollments over 30 million today Capital Allocation Activities Fourth Quarter: repurchased 1.8 million shares at average $26.36 Full year 2024: repurchased 13.8 million shares at average $19.78 Full year 2024: $391 million returned to shareholders including $118 million of dividends Declared a Q125 special dividend of $0.27 and a regular quarterly dividend of $0.125 for Class A and Class B stockholders * A reconciliation of non-GAAP financial measures to the most comparable GAAP measures is provided at the end of this letter. “ We are exiting 2024 with strong momentum. CLEAR wants to make airports great. As we roll out our EnVe and eGates, we are excited to bring innovation to travelers to strengthen security and create the frictionless travel journey American travelers deserve” said Caryn Seidman Becker, CLEAR’s CEO

Clear Secure, Inc. | Q4 2024 | Page 3 Shareholder Letter Q4 2024 in millions in thousands Total GAAP Revenue & Bookings Total Cumulative Enrollments 2022 2023 Revenue Total Bookings (10-K)

Clear Secure, Inc. | Q4 2024 | Page 4 Shareholder Letter Q4 2024 Total Cumulative Platform Uses Active CLEAR Plus Members in thousands in thousands

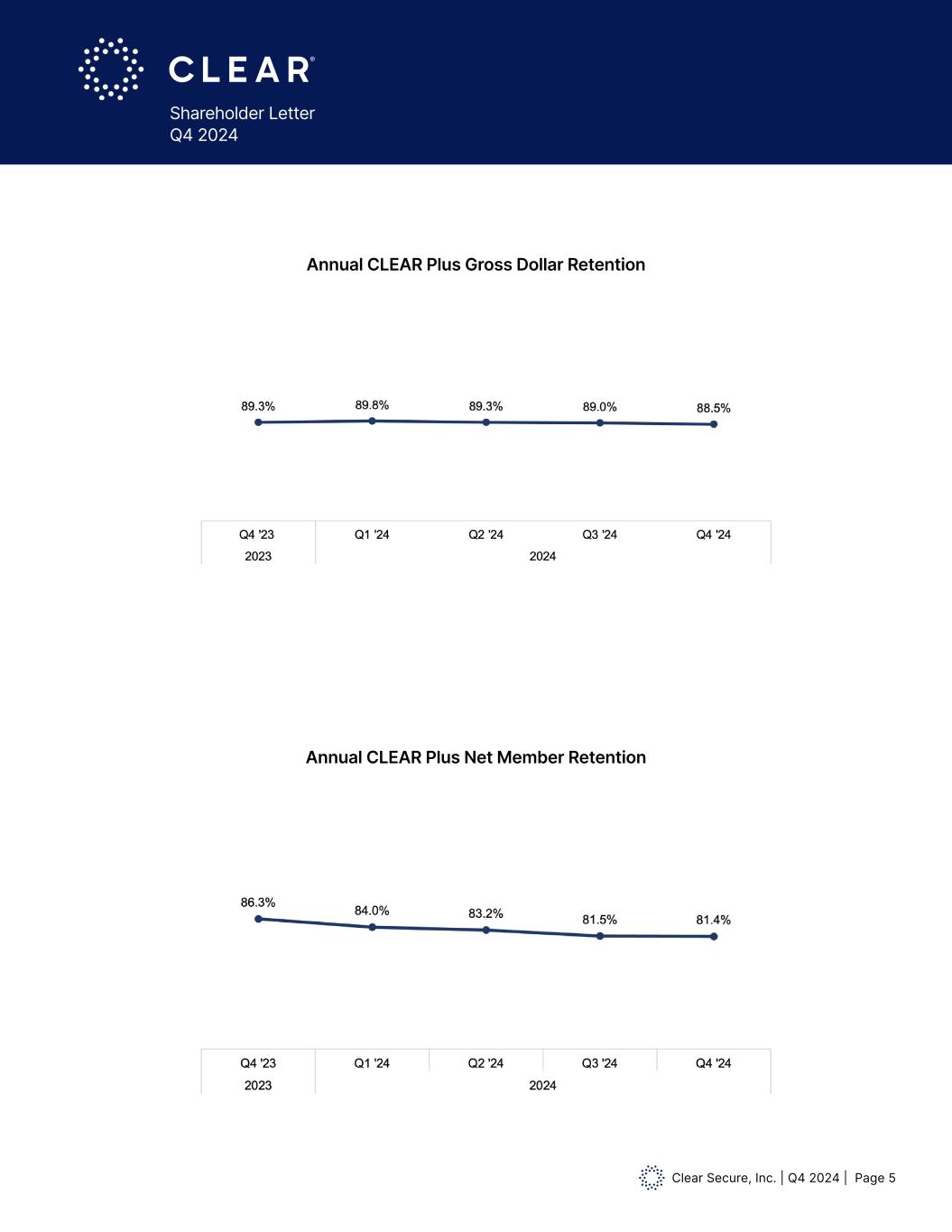

Clear Secure, Inc. | Q4 2024 | Page 5 Shareholder Letter Q4 2024 Annual CLEAR Plus Gross Dollar Retention Annual CLEAR Plus Net Member Retention

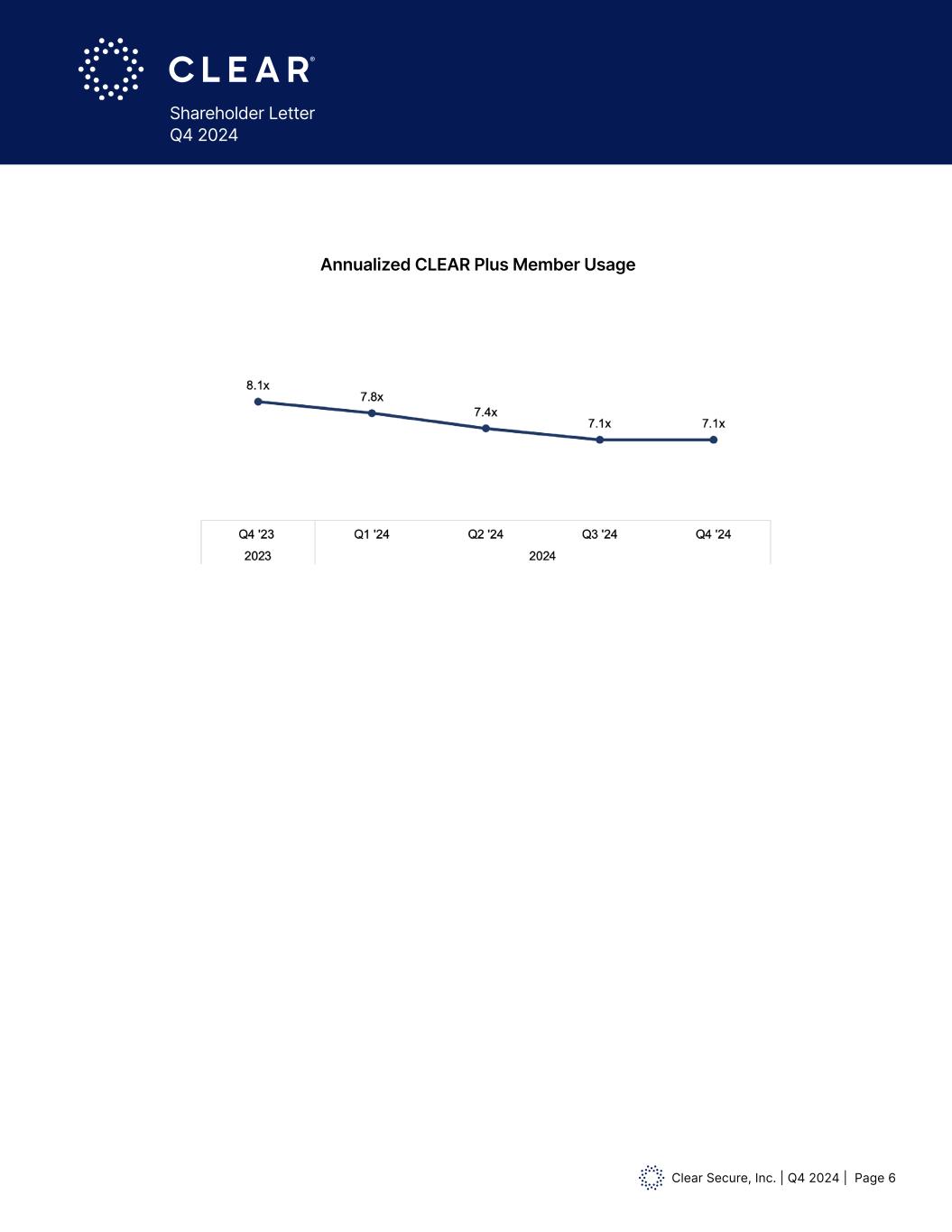

Clear Secure, Inc. | Q4 2024 | Page 6 Shareholder Letter Q4 2024 Annualized CLEAR Plus Member Usage

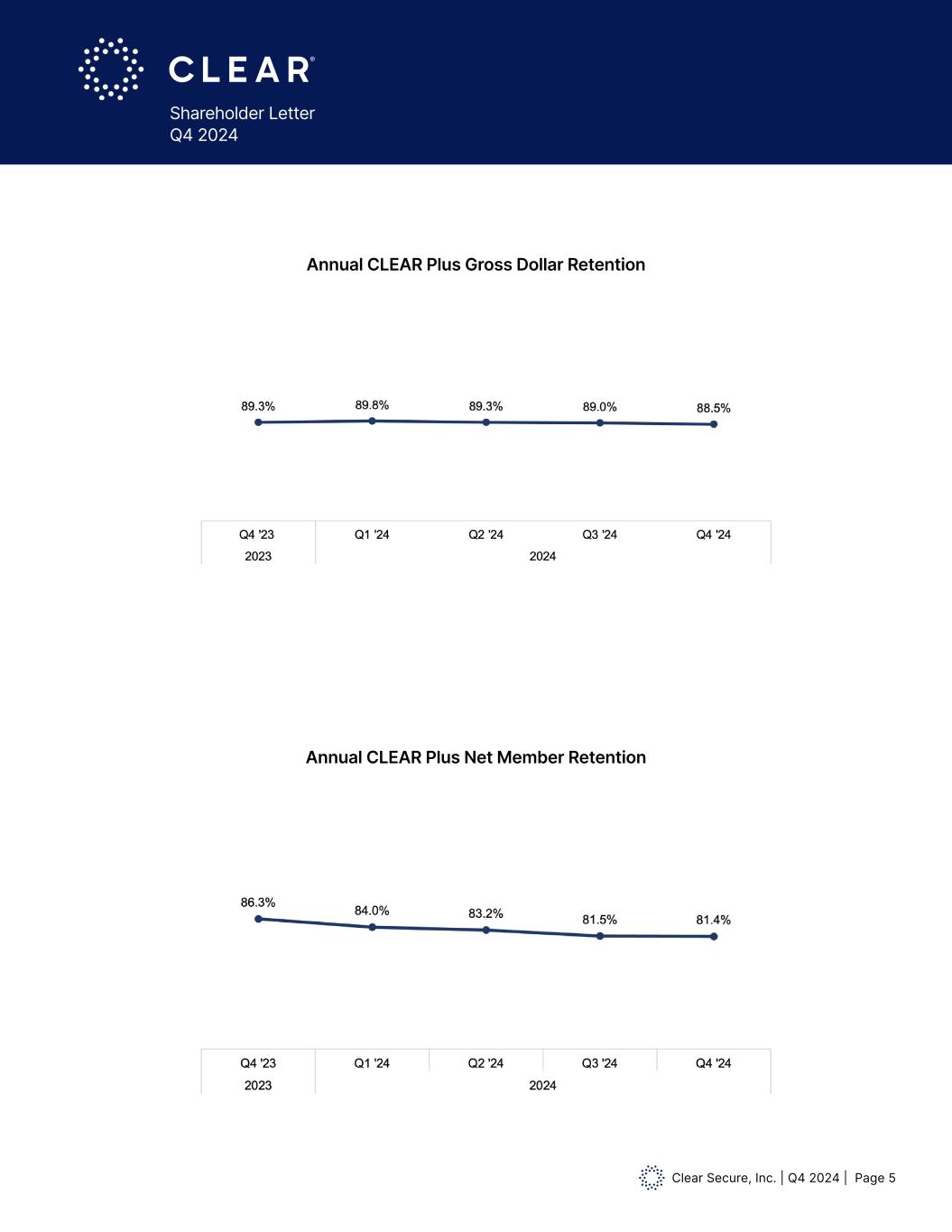

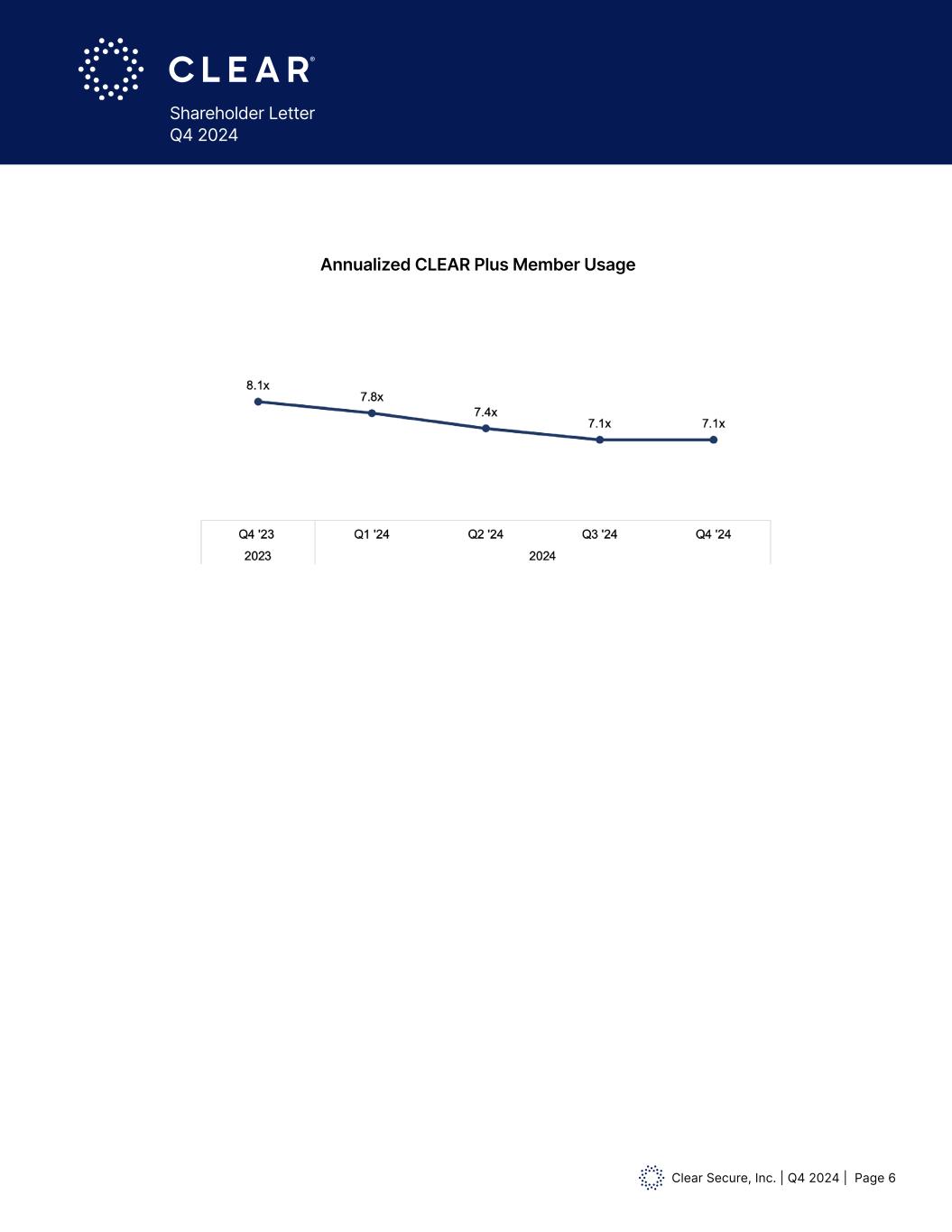

Clear Secure, Inc. | Q4 2024 | Page 7 Shareholder Letter Q4 2024 Fourth quarter 2024 Revenue of $206.3 million grew 20.7% as compared to the fourth quarter of 2023 while Total Bookings of $228.9 million grew 17.2%. These increases were driven primarily by Member growth and price increases. Fourth quarter 2024 Total Cumulative Enrollments reached 28.9 million, up 2.5 million sequentially driven by growth in CLEAR1 and CLEAR Plus enrollments. Fourth quarter 2024 Active CLEAR Plus Members reached 7.3 million, up 8.9% as compared to the fourth quarter of 2023 driven by airport, partner and organic channels in existing and new markets. Fourth quarter 2024 Total Cumulative Platform Uses reached 234.8 million, driven primarily by CLEAR Plus verifications. Fourth quarter 2024 Annualized CLEAR Plus Member Usage was 7.1x. Fourth quarter 2024 Annual CLEAR Plus Gross Dollar Retention was 88.5%, down 50 basis points sequentially. Fourth quarter 2024 Annual CLEAR Plus Net Member Retention was 81.4%, down 10 basis points sequentially. Cost of revenue share fee was $29.1 million in the fourth quarter of 2024. Excluding previously disclosed COVID-related benefits in prior periods, cost of revenue share fee as a percentage of revenue was down 76 basis points year-over-year. Cost of direct salaries and benefits was $47.8 million in the fourth quarter of 2024. Excluding previously disclosed prior-period surge staffing, severance and non-cash items, cost of direct salaries and benefits was up 24.3% year-over-year and as a percentage of revenue was up 68 basis points. Fourth quarter 2024 figures include higher base wage rates resulting from the previously disclosed shift in our field compensation structure away from commissions. Research and development expense was $18.4 million in the fourth quarter of 2024 and includes $0.7 million related to a non-cash writeoff resulting from the closure of our Israel office. Excluding the fourth quarter 2024 writeoff and previously disclosed prior-period severance and non-cash items, research and development expense was down 14.4% year-over-year and as a percentage of revenue was down 351 basis points. Sales and marketing expense was $14.6 million in the fourth quarter of 2024. Excluding previously disclosed prior-period severance and non-cash items, sales and marketing expense increased 7.8% year-over-year and as a percentage of revenue was down 84 basis points. Fourth quarter 2024 figures benefit from the previously disclosed shift in our field compensation structure away from commissions. Fourth Quarter 2024 Financial Discussion

Clear Secure, Inc. | Q4 2024 | Page 8 Shareholder Letter Q4 2024 General and administrative expense was $55.3 million in the fourth quarter of 2024. Excluding previously disclosed prior-period NextGen Identity+ expenses, severance and non-cash items, general and administrative expense was up 2.5% year-over-year and as a percentage of revenue was down 475 basis points. Stock compensation expense was $8.3 million in the fourth quarter of 2024. Excluding previously disclosed prior-period adjustments, stock compensation was down 29.7% year-over-year. Operating Income was $34.1 million in the fourth quarter of 2024 and includes a $0.7 million non- cash writeoff. Excluding the fourth quarter 2024 writeoff and previously disclosed prior period items, Operating Income was $34.8 million and as a percentage of revenue was up 944 basis points year- over-year. Other Income (Expense) includes a non-recurring, non-cash expense of $90.8 million relating to the establishment of Tax Receivable Agreement (“TRA”) liability resulting from the expected realization of certain tax benefits.1 Income tax expense includes a non-recurring, non-cash benefit of $165.5 million due to the release of a valuation allowance against certain deferred tax assets associated with the TRA liability and our corporate structure. Fourth quarter 2024 Net Income was $116.6 million, Net Income per Common Share, Basic and Diluted was $1.07 and $0.83, respectively and includes a net TRA-related benefit of $74.8 million, $0.78 and $0.53, respectively. Fourth quarter 2024 Adjusted Net Income was $126.6 million, Adjusted Net Income per Common Share, Basic and Diluted was $0.91 and $0.90, respectively. Fourth quarter 2024 net cash provided by operating activities was $136.6 million, Free Cash Flow was $133.9 million and Adjusted EBITDA was $50.5 million. Full year 2024 net cash provided by operating activities was $295.7 million and Free Cash Flow was $283.7 million. As of December 31, 2024, our cash and cash equivalents, marketable securities and restricted cash, totaled $613.0 million. As of February 21, 2025, 136,870,675 shares of common stock were outstanding including the following: Class A Common Stock 96,100,081, Class B Common Stock 677,234, Class C Common Stock 15,196,670, and Class D Common Stock 24,896,690. In the fourth quarter of 2024 we repurchased 1.8 million shares at $26.36 and in the first quarter of 2025 we repurchased 0.9 million shares at $23.08. Fourth Quarter 2024 Financial Discussion (Cont.) 1 TRA liability expense and the tax benefit result from the conclusion that TRA payments are probable based on estimated future taxable income over the term of the TRA.

Clear Secure, Inc. | Q4 2024 | Page 9 Shareholder Letter Q4 2024 First Quarter 2025 and Full Year 2025 Guidance We expect first quarter 2025 revenue of $207-209 million and Total Bookings of $202-204 million. For Full Year 2025, we expect strong revenue and Total Bookings growth with expanding margins. We expect Free Cash Flow of at least $310 million, inclusive of $25 million incremental year-over-year cash taxes and $9 million of EnVe related CapEx which will not recur in 2026 ($5 million of which is incremental year-over-year). On a comparable basis, this implies Free Cash Flow growth of at least 20% year-over-year. Based on the current mix of share classes and current United States corporate tax rates, we expect Full Year 2025 GAAP tax rates to range between 17-20%.

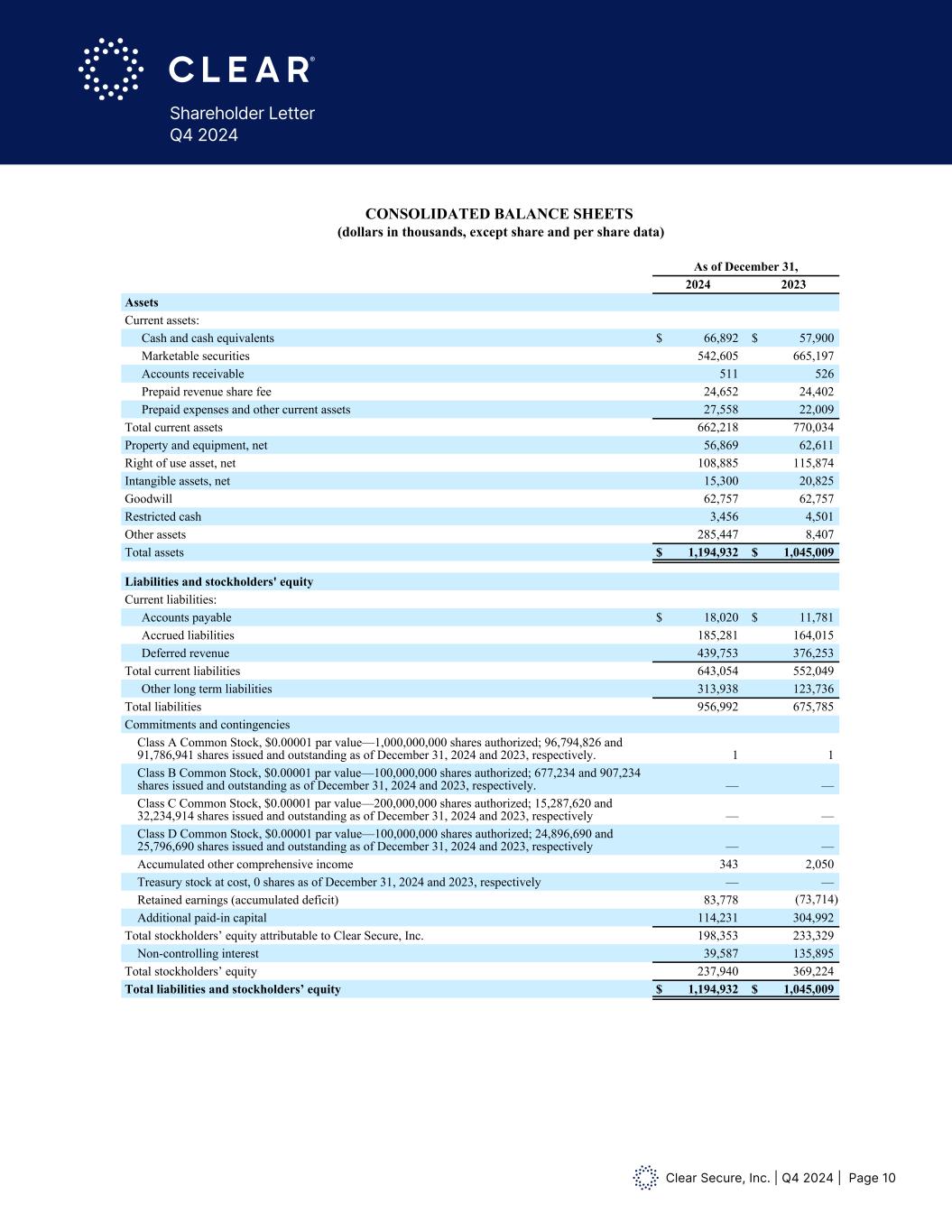

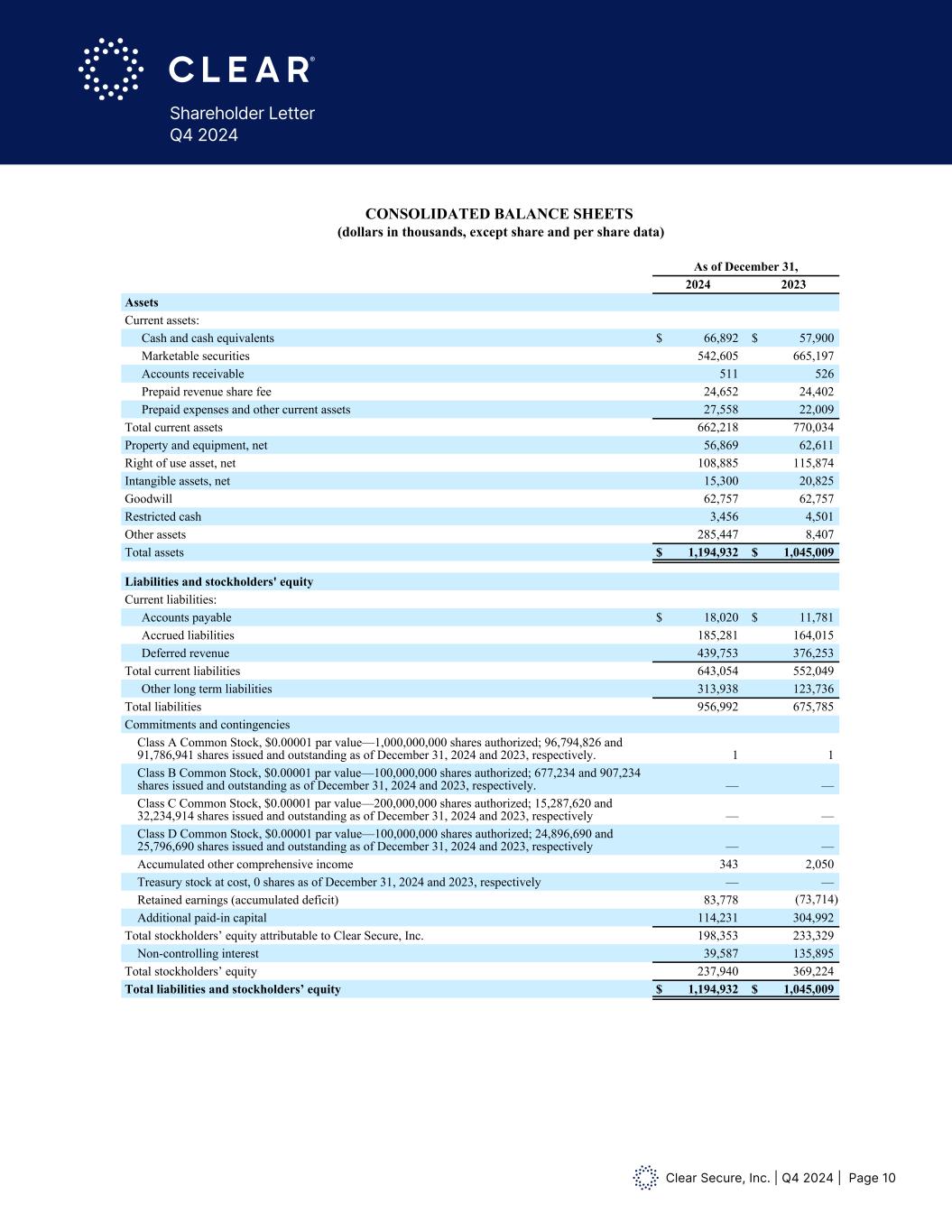

Clear Secure, Inc. | Q4 2024 | Page 10 Shareholder Letter Q4 2024 CLEAR SECURE, INC. CONSOLIDATED BALANCE SHEETS (dollars in thousands, except share and per share data) As of December 31, 2024 2023 Assets Current assets: Cash and cash equivalents $ 66,892 $ 57,900 Marketable securities 542,605 665,197 Accounts receivable 511 526 Prepaid revenue share fee 24,652 24,402 Prepaid expenses and other current assets 27,558 22,009 Total current assets 662,218 770,034 Property and equipment, net 56,869 62,611 Right of use asset, net 108,885 115,874 Intangible assets, net 15,300 20,825 Goodwill 62,757 62,757 Restricted cash 3,456 4,501 Other assets 285,447 8,407 Total assets $ 1,194,932 $ 1,045,009 Liabilities and stockholders' equity Current liabilities: Accounts payable $ 18,020 $ 11,781 Accrued liabilities 185,281 164,015 Deferred revenue 439,753 376,253 Total current liabilities 643,054 552,049 Other long term liabilities 313,938 123,736 Total liabilities 956,992 675,785 Commitments and contingencies Class A Common Stock, $0.00001 par value—1,000,000,000 shares authorized; 96,794,826 and 91,786,941 shares issued and outstanding as of December 31, 2024 and 2023, respectively. 1 1 Class B Common Stock, $0.00001 par value—100,000,000 shares authorized; 677,234 and 907,234 shares issued and outstanding as of December 31, 2024 and 2023, respectively. — — Class C Common Stock, $0.00001 par value—200,000,000 shares authorized; 15,287,620 and 32,234,914 shares issued and outstanding as of December 31, 2024 and 2023, respectively — — Class D Common Stock, $0.00001 par value—100,000,000 shares authorized; 24,896,690 and 25,796,690 shares issued and outstanding as of December 31, 2024 and 2023, respectively — — Accumulated other comprehensive income 343 2,050 Treasury stock at cost, 0 shares as of December 31, 2024 and 2023, respectively — — Retained earnings (accumulated deficit) 83,778 (73,714) Additional paid-in capital 114,231 304,992 Total stockholders’ equity attributable to Clear Secure, Inc. 198,353 233,329 Non-controlling interest 39,587 135,895 Total stockholders’ equity 237,940 369,224 Total liabilities and stockholders’ equity $ 1,194,932 $ 1,045,009

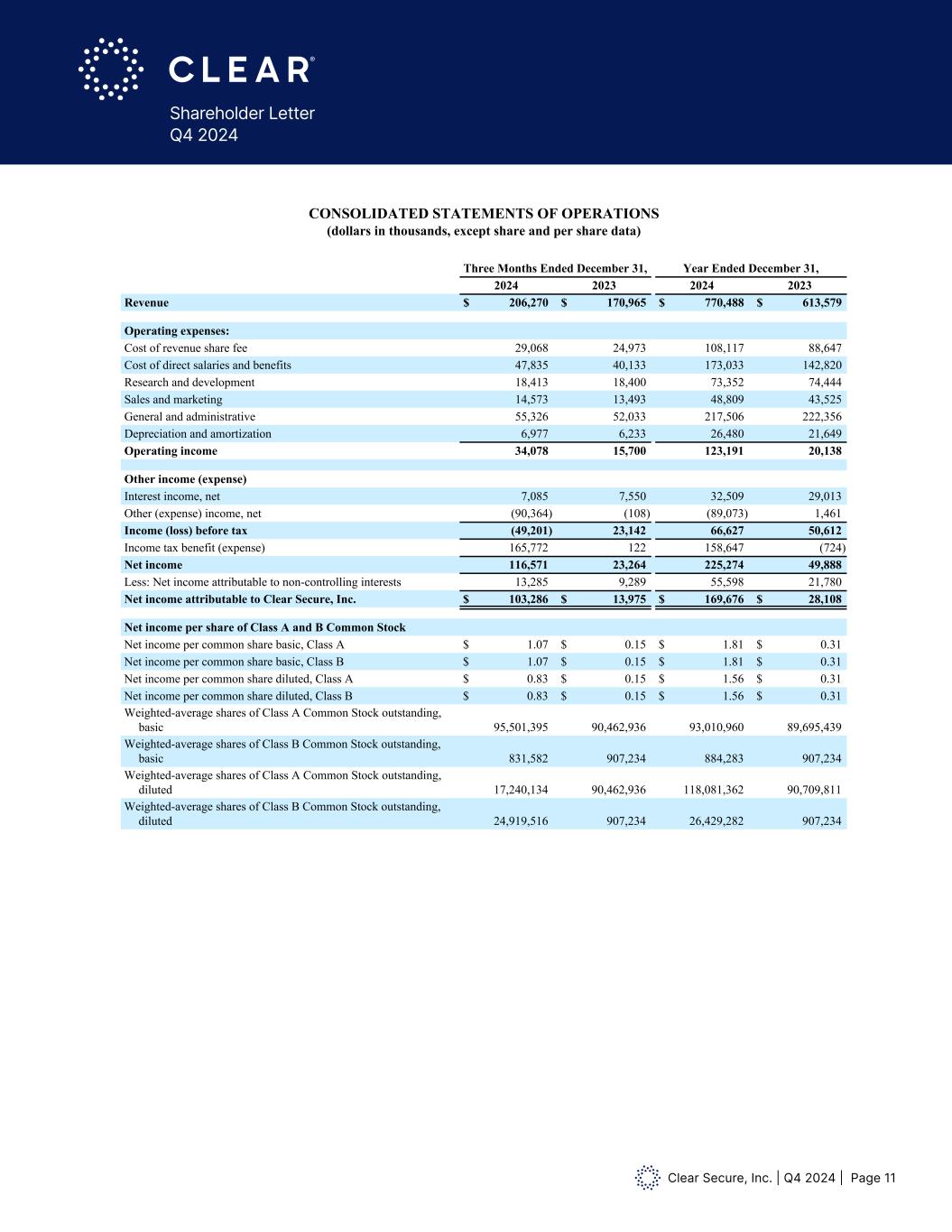

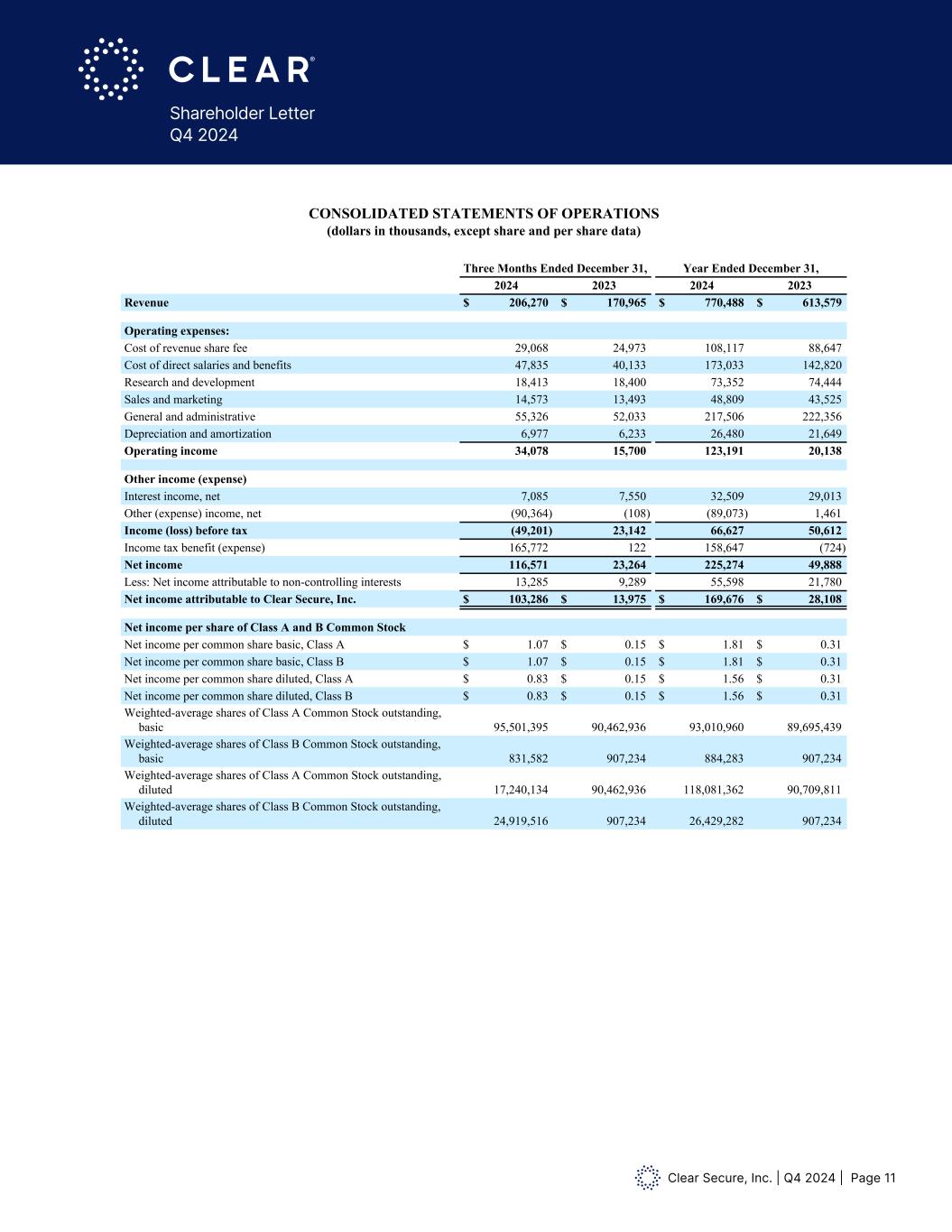

Clear Secure, Inc. | Q4 2024 | Page 11 Shareholder Letter Q4 2024 CLEAR SECURE, INC. CONSOLIDATED STATEMENTS OF OPERATIONS (dollars in thousands, except share and per share data) Revenue $ 206,270 $ 170,965 $ 770,488 $ 613,579 Operating expenses: Cost of revenue share fee 29,068 24,973 108,117 88,647 Cost of direct salaries and benefits 47,835 40,133 173,033 142,820 Research and development 18,413 18,400 73,352 74,444 Sales and marketing 14,573 13,493 48,809 43,525 General and administrative 55,326 52,033 217,506 222,356 Depreciation and amortization 6,977 6,233 26,480 21,649 Operating income 34,078 15,700 123,191 20,138 Other income (expense) Interest income, net 7,085 7,550 32,509 29,013 Other (expense) income, net (90,364) (108) (89,073) 1,461 Income (loss) before tax (49,201) 23,142 66,627 50,612 Income tax benefit (expense) 165,772 122 158,647 (724) Net income 116,571 23,264 225,274 49,888 Less: Net income attributable to non-controlling interests 13,285 9,289 55,598 21,780 Net income attributable to Clear Secure, Inc. $ 103,286 $ 13,975 $ 169,676 $ 28,108 Net income per share of Class A and B Common Stock Net income per common share basic, Class A $ 1.07 $ 0.15 $ 1.81 $ 0.31 Net income per common share basic, Class B $ 1.07 $ 0.15 $ 1.81 $ 0.31 Net income per common share diluted, Class A $ 0.83 $ 0.15 $ 1.56 $ 0.31 Net income per common share diluted, Class B $ 0.83 $ 0.15 $ 1.56 $ 0.31 Weighted-average shares of Class A Common Stock outstanding, basic 95,501,395 90,462,936 93,010,960 89,695,439 Weighted-average shares of Class B Common Stock outstanding, basic 831,582 907,234 884,283 907,234 Weighted-average shares of Class A Common Stock outstanding, diluted 17,240,134 90,462,936 118,081,362 90,709,811 Weighted-average shares of Class B Common Stock outstanding, diluted 24,919,516 907,234 26,429,282 907,234 Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023

Clear Secure, Inc. | Q4 2024 | Page 12 Shareholder Letter Q4 2024 CLEAR SECURE, INC. CONSOLIDATED STATEMENTS OF CHANGES IN CASH FLOWS (dollars in thousands) Year Ended December 31, 2024 2023 Cash flows provided by (used in) operating activities: Net income $ 225,274 $ 49,888 Adjustments to reconcile net income to net cash used in operating activities: Depreciation on property and equipment 21,749 18,215 Amortization on intangible assets 4,731 3,434 Noncash lease expense 6,607 6,468 Impairment of assets 723 4,975 Equity-based compensation 35,339 37,293 Deferred income tax expense (benefit) (165,773) (722) Amortization of revolver loan costs 202 339 Premium amortization (discount accretion) on marketable securities (7,319) (13,804) Changes in operating assets and liabilities: Accounts receivable 15 643 Prepaid expenses and other assets (6,526) (3,192) Prepaid revenue share fee (250) (6,817) Accounts payable 2,198 4,525 Accrued and other long term liabilities 120,964 33,714 Deferred revenue 63,500 92,801 Operating lease liabilities (5,757) (2,727) Net cash provided by operating activities 295,677 225,033 Cash flows provided by (used in) investing activities: Business combinations, net of cash acquired — (3,750) Purchases of marketable securities (971,097) (952,655) Proceeds from sales and maturities of marketable securities 1,098,201 973,032 Purchase of strategic investment (1,000) (6,000) Purchases of property and equipment (12,009) (25,555) Purchases of intangible assets (318) (580) Net cash provided by (used in) investing activities 113,777 (15,508) Cash flows used in financing activities: Repurchase of Class A Common Stock (272,920) (69,673) Payment of dividend (39,402) (14,483) Payment of special dividend (28,828) (68,038) Distributions to members (25,138) (42,674) Tax distribution to members (24,979) (13,929) Deferred consideration payment (1,246) — Payment of taxes on net settled stock-based awards (9,034) (6,814) Other financing activities — (396) Net cash used in financing activities (401,547) (216,007) Net increase (decrease) in cash, cash equivalents, and restricted cash 7,907 (6,482) Cash, cash equivalents, and restricted cash, beginning of period 62,401 68,884 Exchange rate effect on cash and cash equivalents, and restricted cash 40 (1) Cash, cash equivalents, and restricted cash, end of period $ 70,348 $ 62,401 Year Ended December 31, 2024 2023 Cash and cash equivalents $ 66,892 $ 57,900 Restricted cash 3,456 4,501 Total cash, cash equivalents, and restricted cash $ 70,348 $ 62,401

Clear Secure, Inc. | Q4 2024 | Page 13 Shareholder Letter Q4 2024 To evaluate performance of the business, we utilize a variety of other non-GAAP financial reporting and performance measures. These key measures include Total Bookings, Total Cumulative Enrollments, Total Cumulative Platform Uses, Annual CLEAR Plus Net Member Retention, Annual CLEAR Plus Gross Dollar Retention, Active CLEAR Plus Members, and Annual CLEAR Plus Member Usage. Total Bookings Total Bookings represent our total revenue plus the change in deferred revenue during the period. Total Bookings in any particular period reflect sales to new and renewing CLEAR Plus subscribers plus any accrued billings to partners. Management believes that Total Bookings is an important measure of the current health and growth of the business and views it as a leading indicator. Total Cumulative Enrollments We define Total Cumulative Enrollments as the number of enrollments since inception as of the end of the period. An Enrollment is defined as any Member who has registered for the CLEAR platform since inception and has a profile (including limited time free trials regardless of conversion to paid membership) net of duplicate and/or purged accounts. This includes CLEAR Plus Members who have completed enrollment with CLEAR and have ever activated a payment method, plus associated family accounts. Management views this metric as an important tool to analyze the efficacy of our growth and marketing initiatives as new Members are potentially a current and leading indicator of revenues. Total Cumulative Platform Uses We define Total Cumulative Platform Uses as the number of individual engagements across CLEAR use cases, including CLEAR Plus, our flagship app and CLEAR1, since inception as of the end of the period. Management views this metric as an important tool to analyze the level of engagement of our Member base which can be a leading indicator of future growth, retention and revenue. Active CLEAR Plus Members We define Active CLEAR Plus Members as the number of members with an active CLEAR Plus subscription as of the end of the period. This includes CLEAR Plus members who have an activated payment method, plus associated family accounts and is inclusive of members who are in a limited time free trial or in a billing grace period after a billing failure during which time we attempt to collect payment; we exclude duplicate and/or purged accounts. Management views this as an important tool to measure the growth of its CLEAR Plus product. Annual CLEAR Plus Gross Dollar Retention We define Annual CLEAR Plus Gross Dollar Retention as the net bookings collected from a Fixed Cohort of Members during the Current Period as a percentage of the net bookings collected from the same Fixed Cohort during the Prior Period. The Current Period is the 12-month period ending on the reporting Definitions of Key Performance Indicators

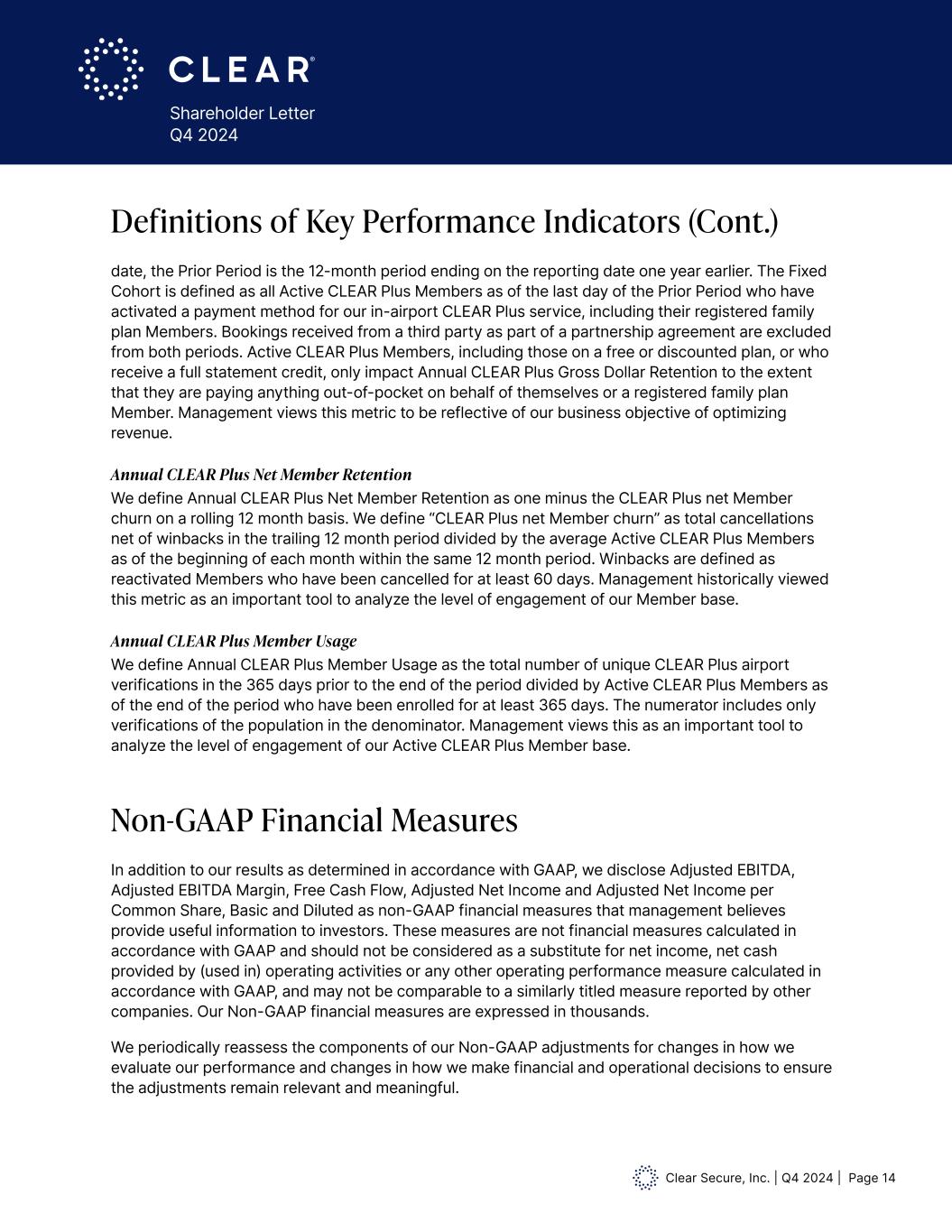

Clear Secure, Inc. | Q4 2024 | Page 14 Shareholder Letter Q4 2024 In addition to our results as determined in accordance with GAAP, we disclose Adjusted EBITDA, Adjusted EBITDA Margin, Free Cash Flow, Adjusted Net Income and Adjusted Net Income per Common Share, Basic and Diluted as non-GAAP financial measures that management believes provide useful information to investors. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for net income, net cash provided by (used in) operating activities or any other operating performance measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies. Our Non-GAAP financial measures are expressed in thousands. We periodically reassess the components of our Non-GAAP adjustments for changes in how we evaluate our performance and changes in how we make financial and operational decisions to ensure the adjustments remain relevant and meaningful. Non-GAAP Financial Measures date, the Prior Period is the 12-month period ending on the reporting date one year earlier. The Fixed Cohort is defined as all Active CLEAR Plus Members as of the last day of the Prior Period who have activated a payment method for our in-airport CLEAR Plus service, including their registered family plan Members. Bookings received from a third party as part of a partnership agreement are excluded from both periods. Active CLEAR Plus Members, including those on a free or discounted plan, or who receive a full statement credit, only impact Annual CLEAR Plus Gross Dollar Retention to the extent that they are paying anything out-of-pocket on behalf of themselves or a registered family plan Member. Management views this metric to be reflective of our business objective of optimizing revenue. Annual CLEAR Plus Net Member Retention We define Annual CLEAR Plus Net Member Retention as one minus the CLEAR Plus net Member churn on a rolling 12 month basis. We define “CLEAR Plus net Member churn” as total cancellations net of winbacks in the trailing 12 month period divided by the average Active CLEAR Plus Members as of the beginning of each month within the same 12 month period. Winbacks are defined as reactivated Members who have been cancelled for at least 60 days. Management historically viewed this metric as an important tool to analyze the level of engagement of our Member base. Annual CLEAR Plus Member Usage We define Annual CLEAR Plus Member Usage as the total number of unique CLEAR Plus airport verifications in the 365 days prior to the end of the period divided by Active CLEAR Plus Members as of the end of the period who have been enrolled for at least 365 days. The numerator includes only verifications of the population in the denominator. Management views this as an important tool to analyze the level of engagement of our Active CLEAR Plus Member base. Definitions of Key Performance Indicators (Cont.)

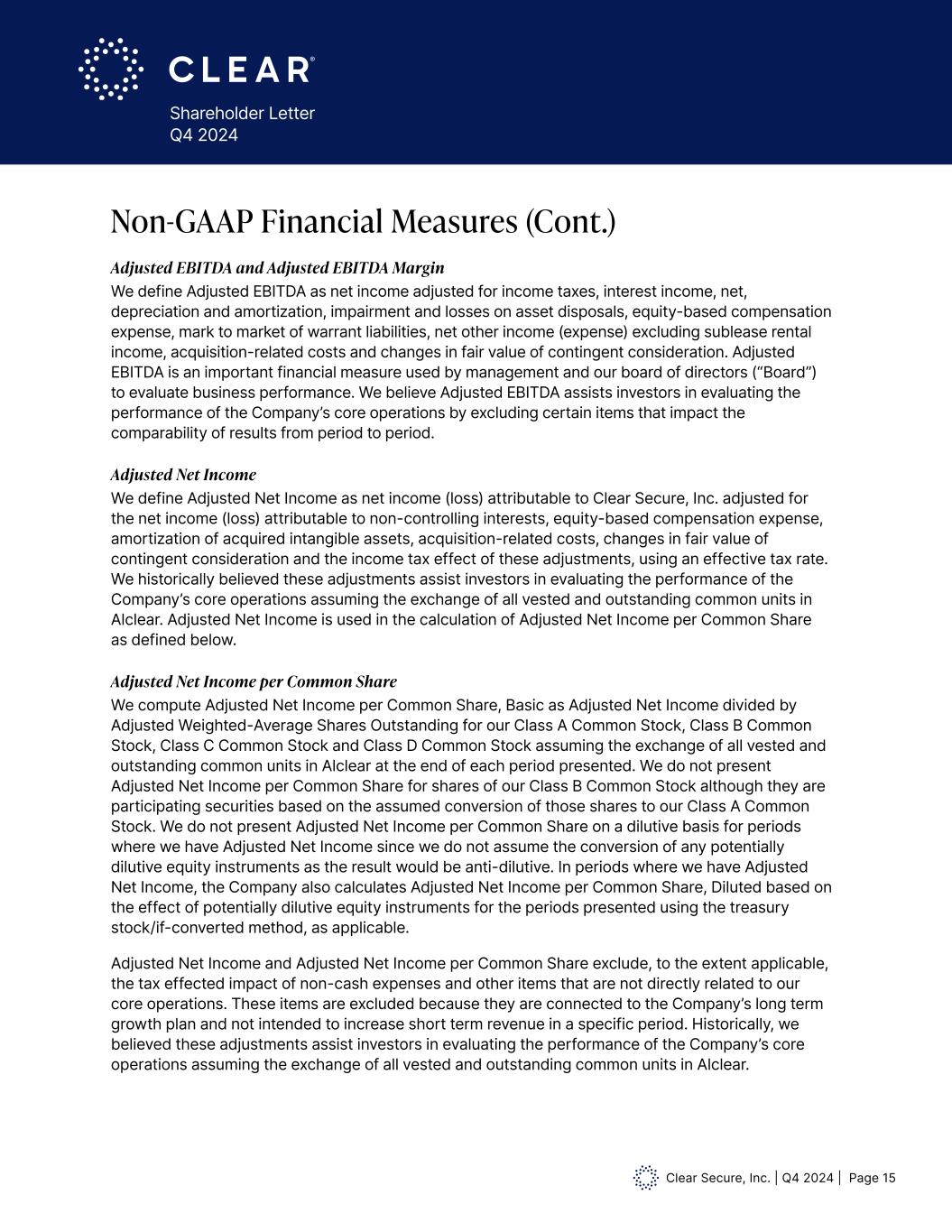

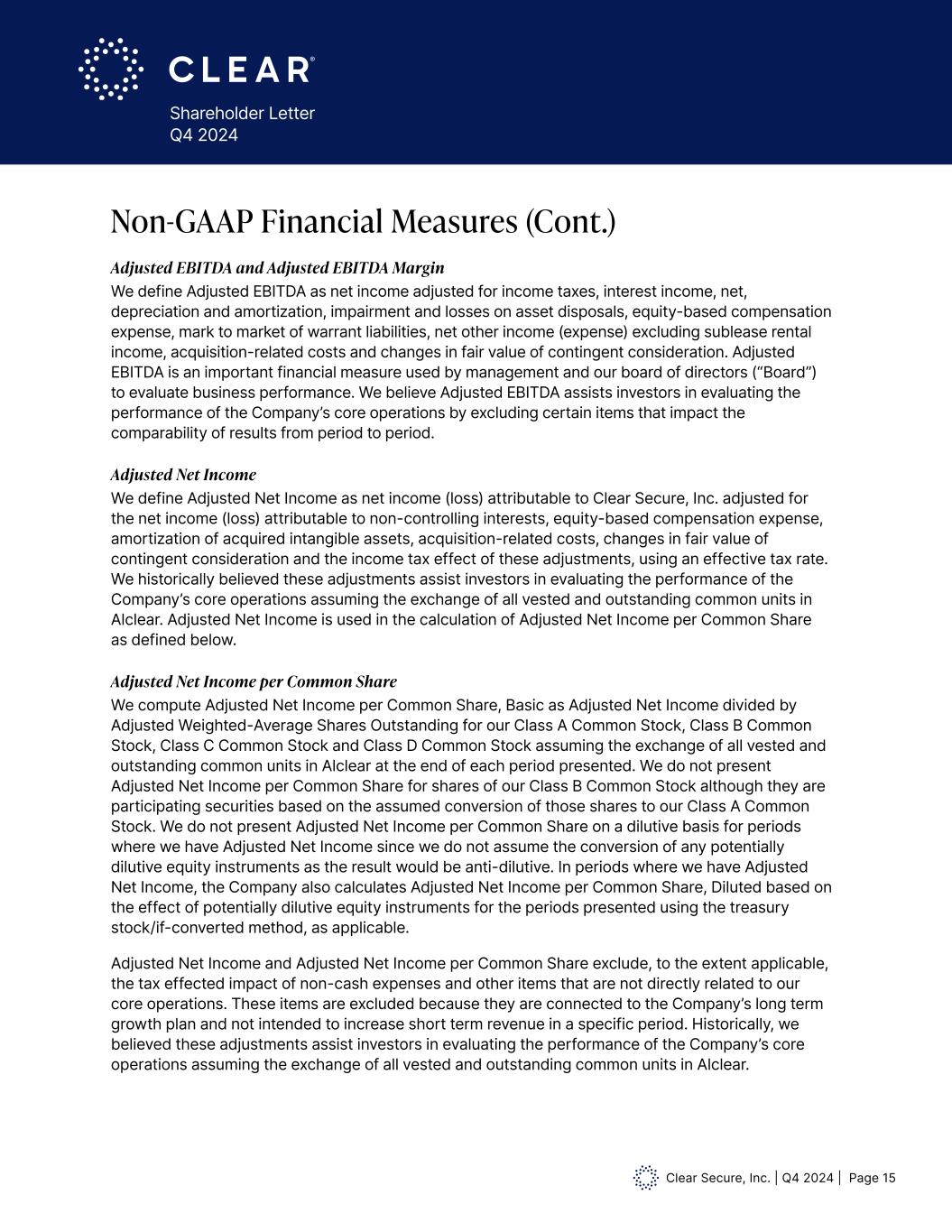

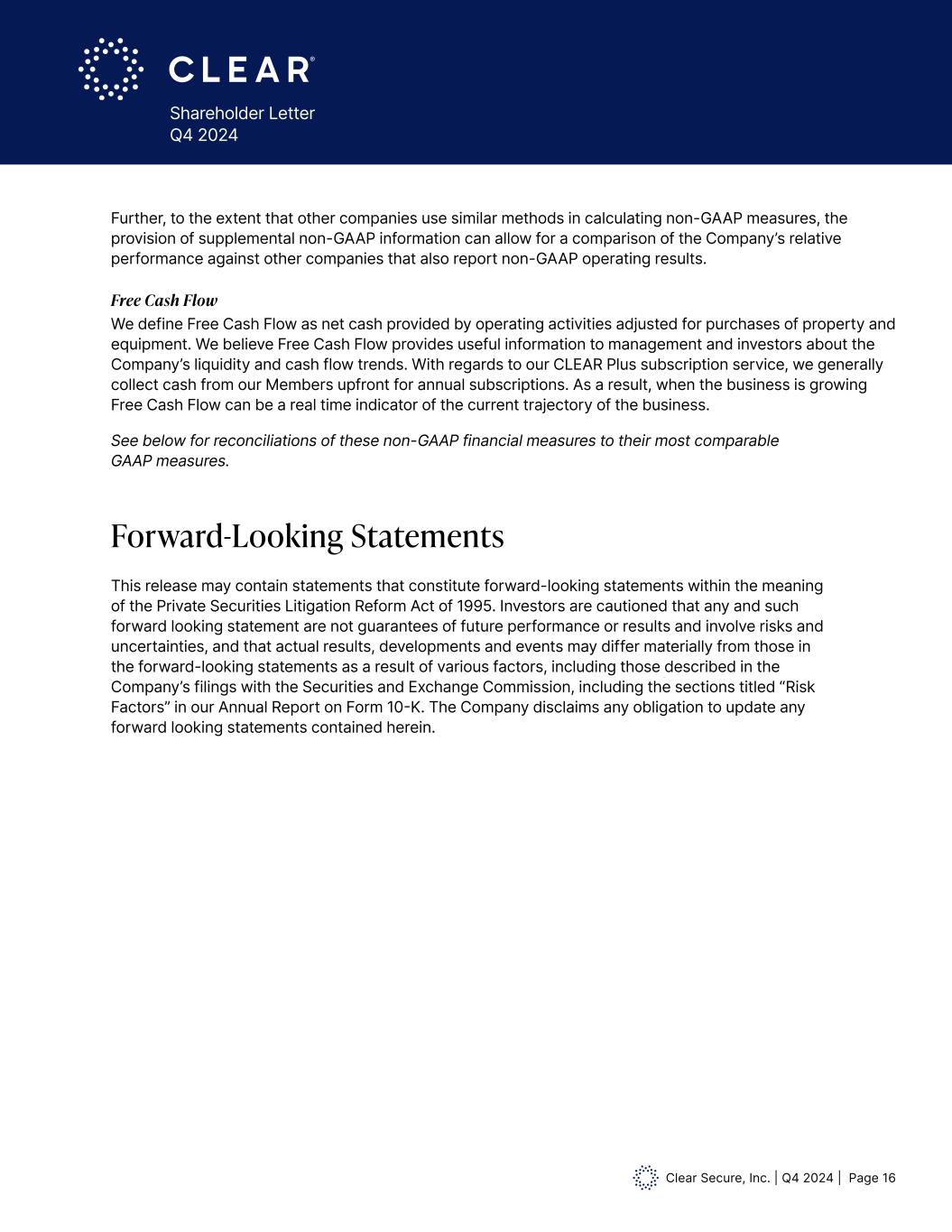

Clear Secure, Inc. | Q4 2024 | Page 15 Shareholder Letter Q4 2024 Adjusted EBITDA and Adjusted EBITDA Margin We define Adjusted EBITDA as net income adjusted for income taxes, interest income, net, depreciation and amortization, impairment and losses on asset disposals, equity-based compensation expense, mark to market of warrant liabilities, net other income (expense) excluding sublease rental income, acquisition-related costs and changes in fair value of contingent consideration. Adjusted EBITDA is an important financial measure used by management and our board of directors (“Board”) to evaluate business performance. We believe Adjusted EBITDA assists investors in evaluating the performance of the Company’s core operations by excluding certain items that impact the comparability of results from period to period. Adjusted Net Income We define Adjusted Net Income as net income (loss) attributable to Clear Secure, Inc. adjusted for the net income (loss) attributable to non-controlling interests, equity-based compensation expense, amortization of acquired intangible assets, acquisition-related costs, changes in fair value of contingent consideration and the income tax effect of these adjustments, using an effective tax rate. We historically believed these adjustments assist investors in evaluating the performance of the Company’s core operations assuming the exchange of all vested and outstanding common units in Alclear. Adjusted Net Income is used in the calculation of Adjusted Net Income per Common Share as defined below. Adjusted Net Income per Common Share We compute Adjusted Net Income per Common Share, Basic as Adjusted Net Income divided by Adjusted Weighted-Average Shares Outstanding for our Class A Common Stock, Class B Common Stock, Class C Common Stock and Class D Common Stock assuming the exchange of all vested and outstanding common units in Alclear at the end of each period presented. We do not present Adjusted Net Income per Common Share for shares of our Class B Common Stock although they are participating securities based on the assumed conversion of those shares to our Class A Common Stock. We do not present Adjusted Net Income per Common Share on a dilutive basis for periods where we have Adjusted Net Income since we do not assume the conversion of any potentially dilutive equity instruments as the result would be anti-dilutive. In periods where we have Adjusted Net Income, the Company also calculates Adjusted Net Income per Common Share, Diluted based on the effect of potentially dilutive equity instruments for the periods presented using the treasury stock/if-converted method, as applicable. Adjusted Net Income and Adjusted Net Income per Common Share exclude, to the extent applicable, the tax effected impact of non-cash expenses and other items that are not directly related to our core operations. These items are excluded because they are connected to the Company’s long term growth plan and not intended to increase short term revenue in a specific period. Historically, we believed these adjustments assist investors in evaluating the performance of the Company’s core operations assuming the exchange of all vested and outstanding common units in Alclear. Non-GAAP Financial Measures (Cont.)

Clear Secure, Inc. | Q4 2024 | Page 16 Shareholder Letter Q4 2024 This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K. The Company disclaims any obligation to update any forward looking statements contained herein. Forward-Looking Statements Further, to the extent that other companies use similar methods in calculating non-GAAP measures, the provision of supplemental non-GAAP information can allow for a comparison of the Company’s relative performance against other companies that also report non-GAAP operating results. Free Cash Flow We define Free Cash Flow as net cash provided by operating activities adjusted for purchases of property and equipment. We believe Free Cash Flow provides useful information to management and investors about the Company’s liquidity and cash flow trends. With regards to our CLEAR Plus subscription service, we generally collect cash from our Members upfront for annual subscriptions. As a result, when the business is growing Free Cash Flow can be a real time indicator of the current trajectory of the business. See below for reconciliations of these non-GAAP financial measures to their most comparable GAAP measures.

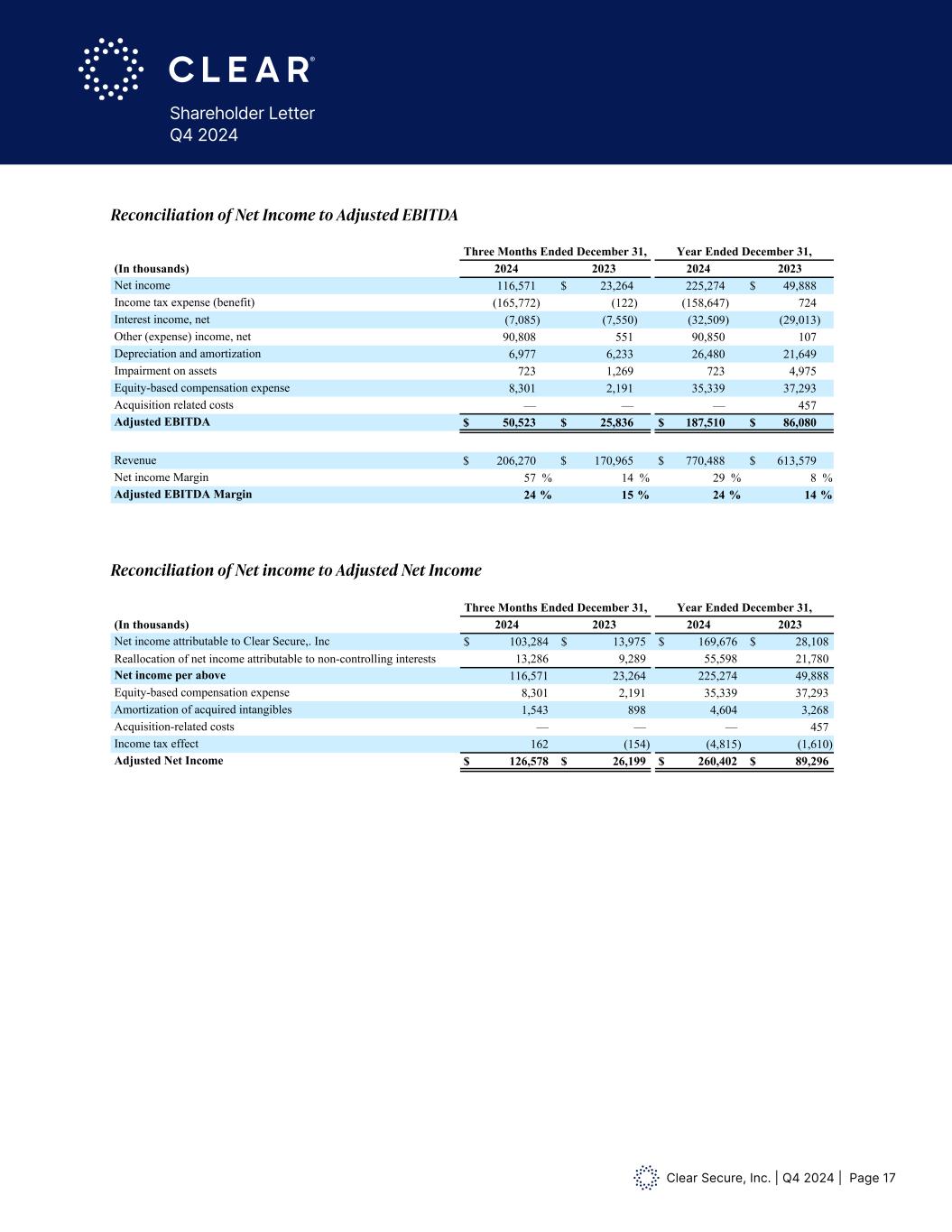

Clear Secure, Inc. | Q4 2024 | Page 17 Shareholder Letter Q4 2024 Forward Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein. Reconciliation of Net income to Adjusted EBITDA Three Months Ended December 31, Year Ended December 31, (In thousands) 2024 2023 2024 2023 Net income 116,571 $ 23,264 225,274 $ 49,888 Income tax expense (benefit) (165,772) (122) (158,647) 724 Interest income, net (7,085) (7,550) (32,509) (29,013) Other (expense) income, net 90,808 551 90,850 107 Depreciation and amortization 6,977 6,233 26,480 21,649 Impairment on assets 723 1,269 723 4,975 Equity-based compensation expense 8,301 2,191 35,339 37,293 Acquisition related costs — — — 457 Adjusted EBITDA $ 50,523 $ 25,836 $ 187,510 $ 86,080 Revenue $ 206,270 $ 170,965 $ 770,488 $ 613,579 Net income Margin 57 % 14 % 29 % 8 % Adjusted EBITDA Margin 24 % 15 % 24 % 14 % Reconciliation of Net income to Adjusted Net Income Three Months Ended December 31, Year Ended December 31, (In thousands) 2024 2023 2024 2023 Net income attributable to Clear Secure,. Inc $ 103,284 $ 13,975 $ 169,676 $ 28,108 Reallocation of net income attributable to non-controlling interests 13,286 9,289 55,598 21,780 Net income per above 116,571 23,264 225,274 49,888 Equity-based compensation expense 8,301 2,191 35,339 37,293 Amortization of acquired intangibles 1,543 898 4,604 3,268 Acquisition-related costs — — — 457 Income tax effect 163 (154) (4,815) (1,610) Adjusted Net Income $ 126,579 $ 26,199 $ 260,402 $ 89,296 Forward Looking Statements This release may contain statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Investors are cautioned that any and such forward looking statement are not guarantees of future performance or results and involve risks and uncertainties, and that actual results, developments and events may differ materially from those in the forward-looking statements as a result of various factors, including those described in the Company’s filings with the Securities and Exchange Commission, including the sections titled “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2023. The Company disclaims any obligation to update any forward looking statements contained herein. Reconciliation of Net income to Adjusted EBITDA Three Months Ended December 31, Year Ended December 31, (In thousands) 2024 2023 2024 2023 Net income 116,571 $ 23,264 225,274 $ 49,888 Income tax expense (benefit) (165,772) (122) (158,647) 724 Interest income, net (7,085) (7,550) (32,509) (29,013) Other (expense) income, net 90,808 551 90,850 107 Depreciation and amortization 6,977 6,233 26,480 21,649 Impairment on assets 723 1,269 723 4,975 Equity-based compensation expense 8,301 2,191 35,339 37,293 Acquisition related costs — — — 457 Adjusted EBITDA $ 50,523 $ 25,836 $ 187,510 $ 86,080 Revenue $ 206,270 $ 170,965 $ 770,488 $ 613,579 Net income Margin 57 % 14 % 29 % 8 % Adjusted EBITDA Margin 24 % 15 % 24 % 14 % Reconciliation of Net income to Adjusted Net Income Three Months Ended December 31, Year Ended December 31, (In thousands) 2024 2023 2024 2023 Net income attributable to Clear Secure,. Inc $ 103,284 $ 13,975 $ 169,676 $ 28,108 Reallocation of net income attributable to non-controlling interests 13,286 9,289 55,598 21,780 Net income per above 116,571 23,264 225,274 49,888 Equity-based compensation expense 8,301 2,191 35,339 37,293 Amortization of acquired intangibles 1,543 898 4,604 3,268 Acquisition-related costs — — — 457 Income tax effect 162 (154) (4,815) (1,610) Adjusted Net Income $ 126,578 $ 26,199 $ 260,402 $ 89,296 conciliati n of Net Income to A just d EBITDA Reconciliation of Net income to Adjusted Net Income

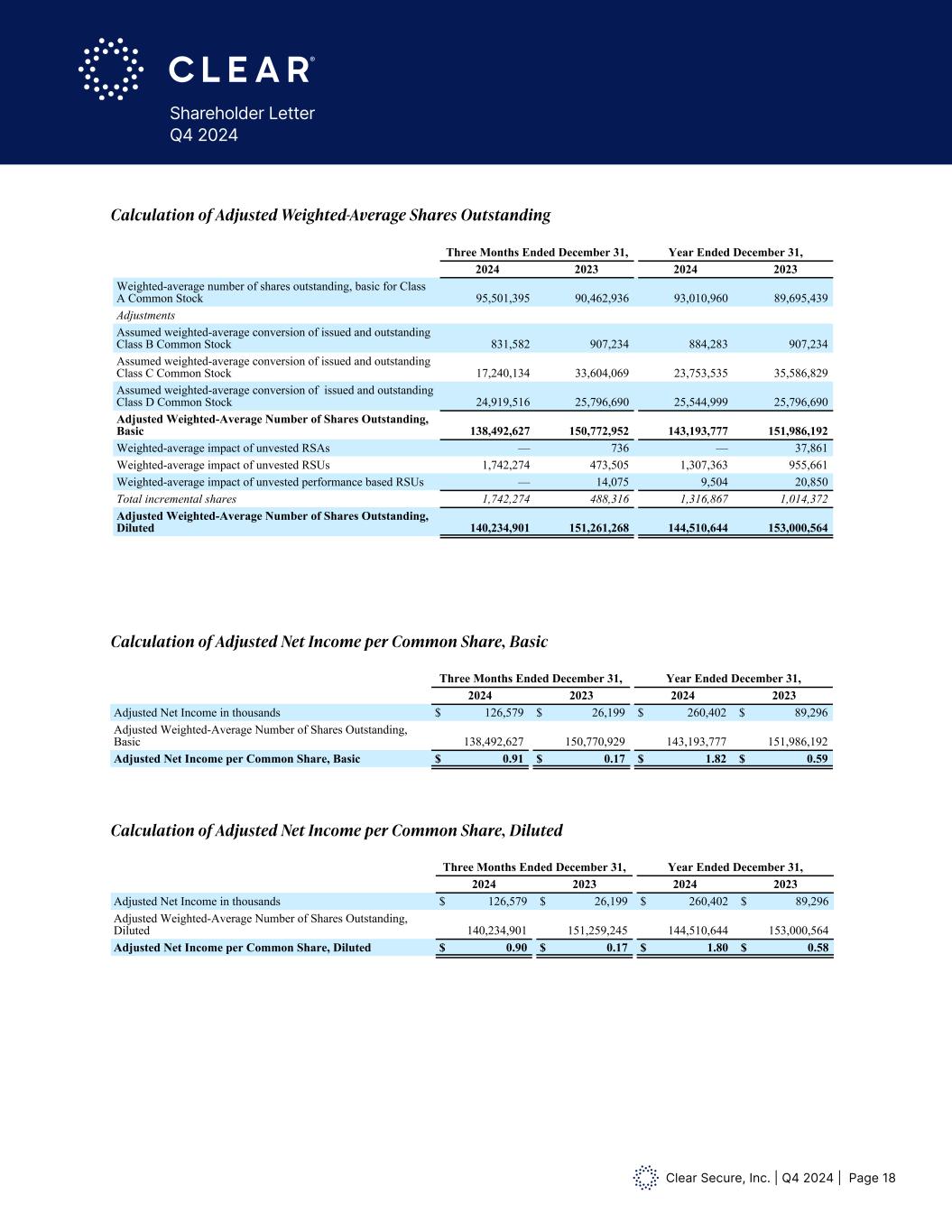

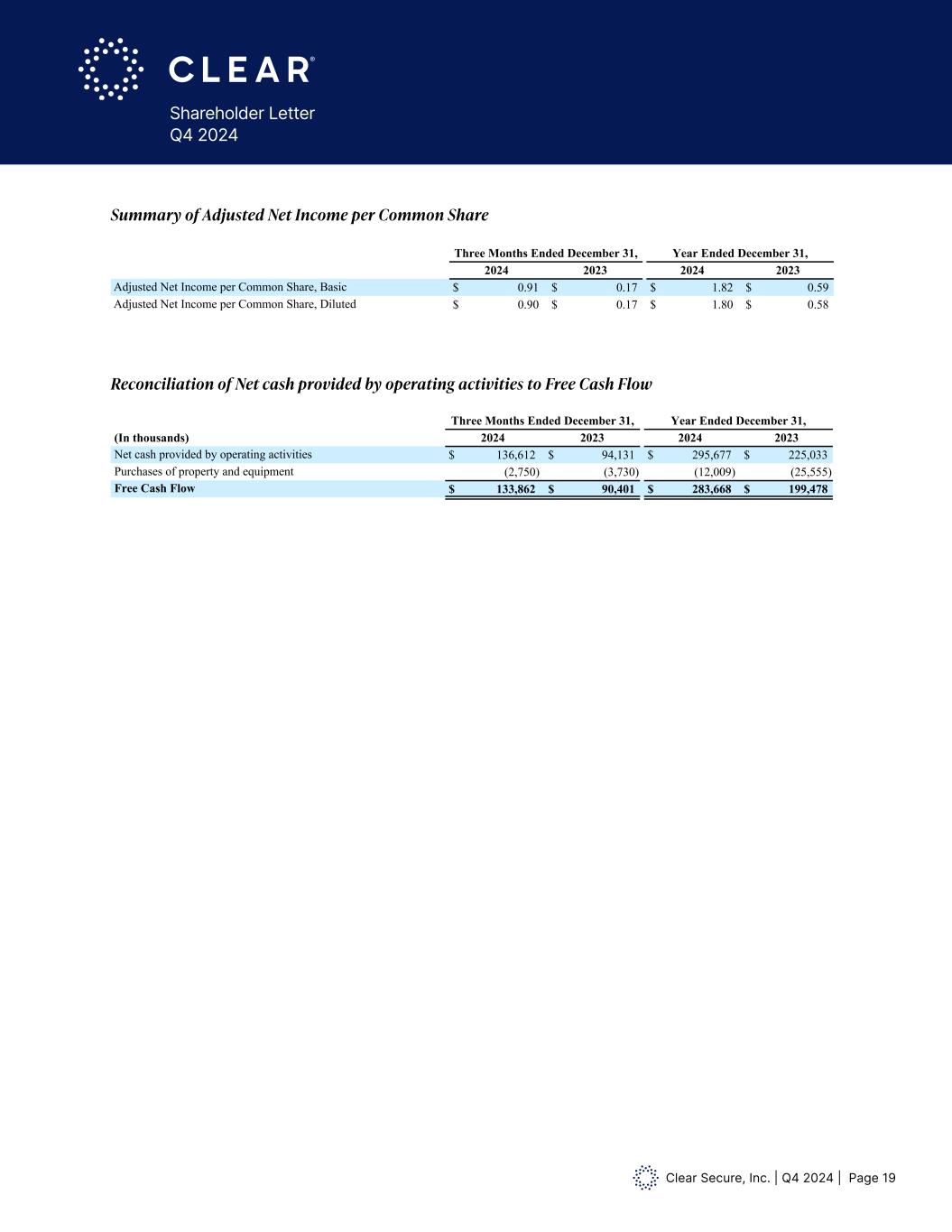

Clear Secure, Inc. | Q4 2024 | Page 18 Shareholder Letter Q4 2024 Calculation of Adjusted Weighted-Average Shares Outstandingalculation of Adjusted Weighted-Average Shares Outstanding Weighted-average number of shares outstanding, basic for Class A Common Stock 95,501,395 90,462,936 93,010,960 89,695,439 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 831,582 907,234 884,283 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 17,240,134 33,604,069 23,753,535 35,586,829 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 24,919,516 25,796,690 25,544,999 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,772,952 143,193,777 151,986,192 Weighted-average impact of unvested RSAs — 736 — 37,861 Weighted-average impact of unvested RSUs 1,742,274 473,505 1,307,363 955,661 Weighted-average impact of unvested performance based RSUs — 14,075 9,504 20,850 Total incremental shares 1,742,274 488,316 1,316,867 1,014,372 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,261,268 144,510,644 153,000,564 Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,770,929 143,193,777 151,986,192 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,259,245 144,510,644 153,000,564 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Summary of Adjusted Net Income per Common Share: Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Calculation of Adjusted Weighted-Average Shares Outstanding Weighted-average number of shares outstanding, basic for Class Co mon Stock 95,501,395 90,462,936 93,010,960 89,695,439 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 831,582 907,234 884,283 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 17,240,134 33,604,069 23,753,535 35,586,829 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 24,919,516 25,796,690 25,544,999 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Bas c 138,49 ,627 150,7 2 952 143 193 777 151, 86 192 eighted-average i pact of unvested RSAs 736 — 37 61 Weighted-average impact of unvested RSUs , , 73 505 07 3 3 955 661 Weighte -average impact of unvested perform nce based RSUs — 14,075 9,504 20,850 Total incremental shares 1,742,274 488,316 1,316,867 1,014,372 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,261,268 144,510,644 153,000,564 Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,770,929 143,193,777 151,986,192 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,259,245 144,510,644 153,000,564 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Summary of Adjusted Net Income per Common Share: Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Calculation of Adjusted Weighted-Average Shares Outstanding Weighted-average number of shares outstanding, basic for Class A Common Stock 95,501,395 90,462,936 93,010,960 89,695,439 Adju tments ssu ed eighted-average conversi f is ued and outstanding Class B Co on Stock 831 82 907 234 88 283 907 234 ssu ed eighted-average conversion of issued and outstanding Cl s C Co on Stock 17,240,134 33,604,069 2 ,75 ,535 35,5 ,829 ssumed weighted-average co rsion of i sued and outstanding Class D Common Stock 24,919,516 25,796,690 25,544,999 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,772,952 143,193,777 151,986,192 Weighted-average impact of unvested RSAs — 736 — 37,861 Weighted-average impact of unvested RSUs 1,742,274 473,505 1,307,363 955,661 Weighted-average impact of unvested performance based RSUs — 14,075 9,504 20,850 Total incremental shares 1,742,274 488,316 1,316,867 1,014,372 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,261,268 144,510,644 153,000,564 Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 djusted Weighted-Average Nu ber of Shares Outstanding, Basic 138,492,627 150,770,929 143,193,777 151,986,192 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 djusted Weighted-Average Nu ber of Shares Outstanding, Diluted 140,234,901 151,259,245 144,510,644 153,000,564 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Summary of Adjusted Net Income per Common Share: Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 lculation of Adjusted Net Income per Common Share, Basic alculation of Adjusted Net Income per Common Share, Diluted

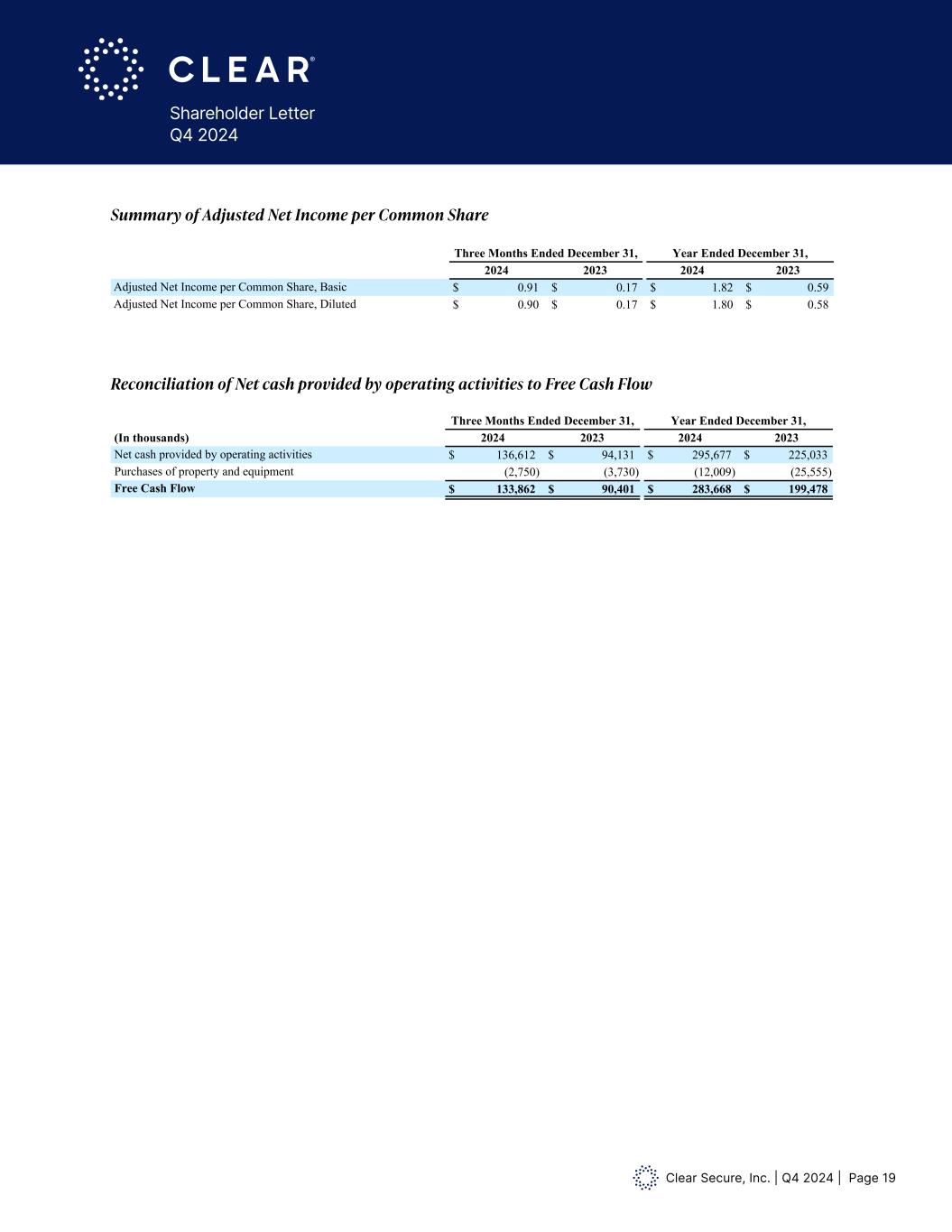

Clear Secure, Inc. | Q4 2024 | Page 19 Shareholder Letter Q4 2024 Reconciliation of Net cash provided by operating activities to Free Cash FlowReconciliation of Net cash provided by operating activities to Free Cash Flow Three Months Ended December 31, Year Ended December 31, (In thousands) 2024 2023 2024 2023 Net cash provided by operating activities $ 136,612 $ 94,131 $ 295,677 $ 225,033 Purchases of property and equipment (2,750) (3,730) (12,009) (25,555) Free Cash Flow $ 133,862 $ 90,401 $ 283,668 $ 199,478 Calculation of Adjusted Weighted-Average Shares Outstanding Weighted-average number of shares outstanding, basic for Class A Common Stock 95,501,395 90,462,936 93,010,960 89,695,439 Adjustments Assumed weighted-average conversion of issued and outstanding Class B Common Stock 831,582 907,234 884,283 907,234 Assumed weighted-average conversion of issued and outstanding Class C Common Stock 17,240,134 33,604,069 23,753,535 35,586,829 Assumed weighted-average conversion of issued and outstanding Class D Common Stock 24,919,516 25,796,690 25,544,999 25,796,690 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,772,952 143,193,777 151,986,192 Weighted-average impact of unvested RSAs — 736 — 37,861 Weighted-average impact of unvested RSUs 1,742,274 473,505 1,307,363 955,661 Weighted-average impact of unvested performance based RSUs — 14,075 9,504 20,850 Total incremental shares 1,742,274 488,316 1,316,867 1,014,372 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,261,268 144,510,644 153,000,564 Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Calculation of Adjusted Net Income per Common Share, Basic Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Basic 138,492,627 150,770,929 143,193,777 151,986,192 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Calculation of Adjusted Net Income per Common Share, Diluted Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income in thousands $ 126,579 $ 26,199 $ 260,402 $ 89,296 Adjusted Weighted-Average Number of Shares Outstanding, Diluted 140,234,901 151,259,245 144,510,644 153,000,564 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Summary of Adjusted Net Income per Common Share: Three Months Ended December 31, Year Ended December 31, 2024 2023 2024 2023 Adjusted Net Income per Common Share, Basic $ 0.91 $ 0.17 $ 1.82 $ 0.59 Adjusted Net Income per Common Share, Diluted $ 0.90 $ 0.17 $ 1.80 $ 0.58 Su mary of Adjusted Net Inco e per Common Share

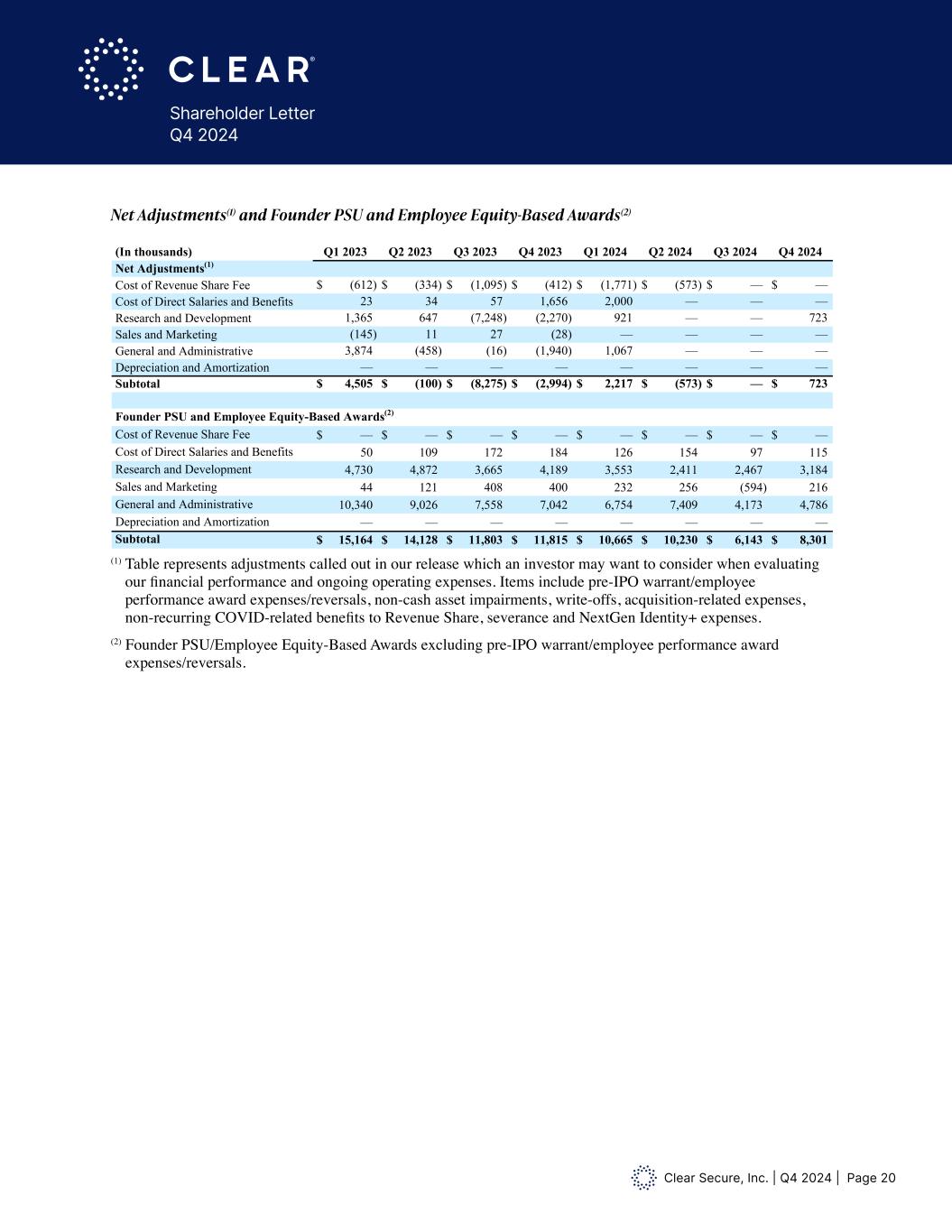

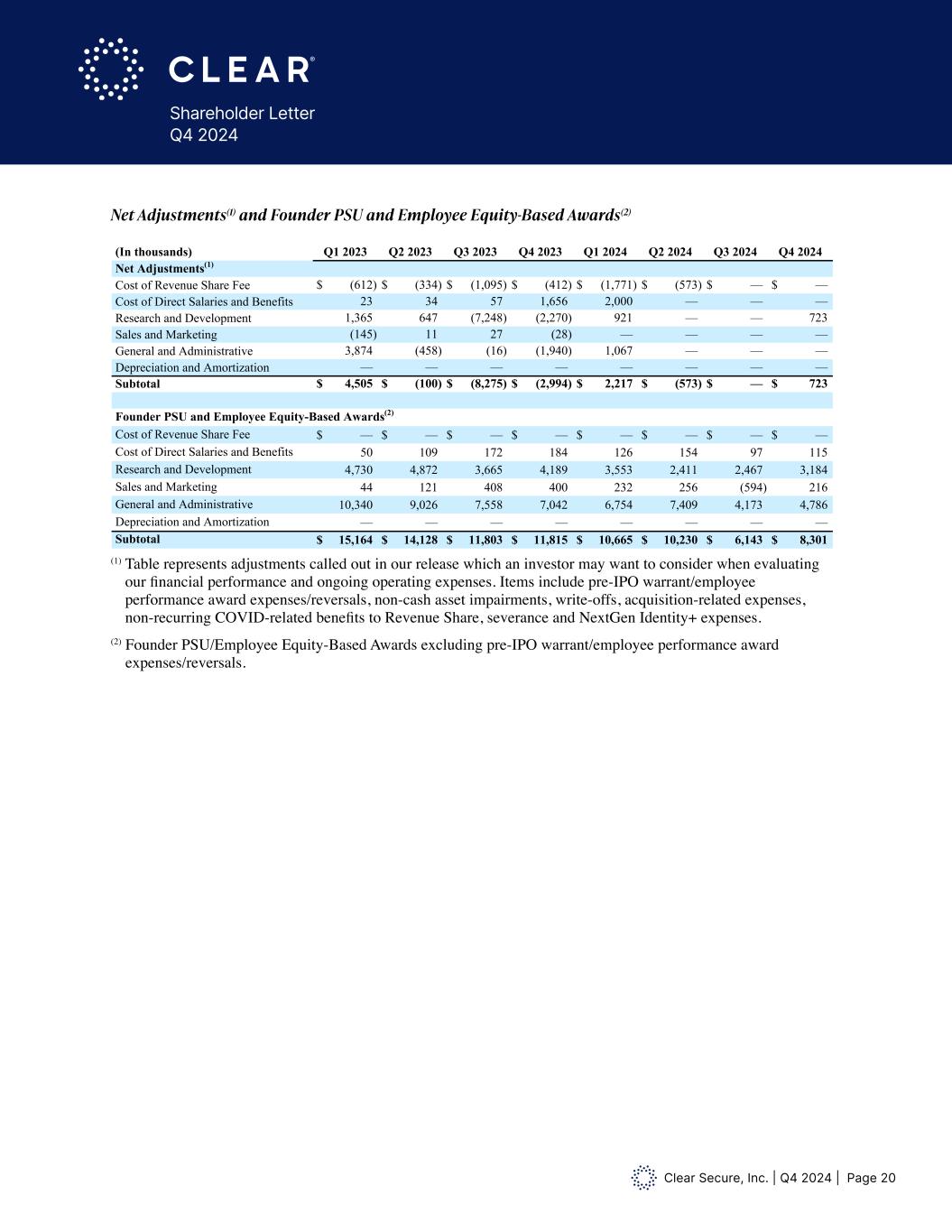

Clear Secure, Inc. | Q4 2024 | Page 20 Shareholder Letter Q4 2024 Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (1) Table represents adjustments called out in our release which an investor may want to consider when evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non-cash asset impairments, write-offs, acquisition-related expenses, non-recurring COVID-related benefits to Revenue Share, severance and NextGen Identity+ expenses. (2) Founder PSU/Employee Equity-Based Awards excluding pre-IPO warrant/employee performance award expenses/reversals. Net Adjustments(1) and Founder PSU and Employee Equity-Based Awards(2) (In thousands) Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Q3 2024 Q4 2024 Net Adjustments(1) Cost of Revenue Share Fee $ (612) $ (334) $ (1,095) $ (412) $ (1,771) $ (573) $ — $ — Cost of Direct Salaries and Benefits 23 34 57 1,656 2,000 — — — Research and Development 1,365 647 (7,248) (2,270) 921 — — 723 Sales and Marketing (145) 11 27 (28) — — — — General and Administrative 3,874 (458) (16) (1,940) 1,067 — — — Depreciation and Amortization — — — — — — — — Subtotal $ 4,505 $ (100) $ (8,275) $ (2,994) $ 2,217 $ (573) $ — $ 723 Founder PSU and Employee Equity-Based Awards(2) Cost of Revenue Share Fee $ — $ — $ — $ — $ — $ — $ — $ — Cost of Direct Salaries and Benefits 50 109 172 184 126 154 97 115 Research and Development 4,730 4,872 3,665 4,189 3,553 2,411 2,467 3,184 Sales and Marketing 44 121 408 400 232 256 (594) 216 General and Administrative 10,340 9,026 7,558 7,042 6,754 7,409 4,173 4,786 Depreciation and Amortization — — — — — — — — Subtotal $ 15,164 $ 14,128 $ 11,803 $ 11,815 $ 10,665 $ 10,230 $ 6,143 $ 8,301 (1) Table represents adjustments called out in our r lease which a investor may want to consider hen evaluating our financial performance and ongoing operating expenses. Items include pre-IPO warrant/employee performance award expenses/reversals, non- cash asset impairments, write-offs, acquisition-related expenses, non-recurring COVID-related benefits to Revenue Share, severance and NextGen Identity+ expenses. (2) Founder PSU/Employee Equity-Based Awards excluding pre-IPO warrant/employee performance award expenses/reversals.