January 2025

2 Disclaimers "Safe Harbor" Statement Under the Private Securities Litigation Reform Act of 1995 This presentation contains forward-looking statements made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These forward-looking statements reflect the current views of FinWise Bancorp (“FinWise,” “we,” “us,” or the “Company”) with respect to, among other things, future events and its financial performance. These statements are often, but not always, made through the use of words or phrases such as “may,” “might,” “should,” “could,” “predict,” “potential,” “believe,” “will likely result,” “expect,” “continue,” “will,” “anticipate,” “seek,” “estimate,” “intend,” “plan,” “project,” “projection,” “forecast,” “budget,” “goal,” “target,” “would,” “aim” and “outlook,” or the negative version of those words or other comparable words or phrases of a future or forward-looking nature. These forward-looking statements are based on current expectations, estimates and projections about the Company’s industry and management’s beliefs and certain assumptions made by management, many of which, by their nature, are inherently uncertain and beyond the Company’s control. The inclusion of these forward-looking statements should not be regarded as a representation by the Company or any other person that such expectations, estimates or projections will be achieved. Accordingly, the Company cautions you that any such forward-looking statements are not guarantees of future performance and are subject to risks, assumptions and uncertainties. Although the Company believes that the expectations reflected in these forward-looking statements are reasonable as of the date made, actual results may prove to be materially different from the results expressed or implied by the forward-looking statements. There are or will be important factors that could cause the Company’s actual results to differ materially from those indicated in these forward-looking statements, including, but not limited to, the following: (a) the success of the financial technology industry, as well as the continued evolution of the regulation of this industry; (b) the ability of the Company’s Strategic Program or Fintech Banking Solutions service providers to comply with regulatory regimes, and the Company’s ability to adequately oversee and monitor its Strategic Program and Fintech Banking Solutions service providers; (c) the Company’s ability to maintain and grow its relationships with its service providers; (d) changes in the laws, rules, regulations, interpretations or policies relating to financial institutions, accounting, tax, trade, monetary and fiscal matters, including the application of interest rate caps or maximums; (e) the Company’s ability to keep pace with rapid technological changes in the industry or implement new technology effectively; (f) system failure or cybersecurity breaches of the Company’s network security; (g) potential exposure to fraud, negligence, computer theft and cyber-crime and other disruptions in the Company’s computer systems relating to its development and use of new technology platforms; (h) the Company’s reliance on third-party service providers for core systems support, informational website hosting, internet services, online account opening and other processing services; (i) general economic and business conditions, either nationally or in the Company’s market areas; (j) increased national or regional competition in the financial services industry; (k) the Company’s ability to measure and manage its credit risk effectively and the potential deterioration of the business and economic conditions in the Company’s primary market areas; (l) the adequacy of the Company’s risk management framework; (m) the adequacy of the Company’s allowance for credit losses (“ACL”); (n) the financial soundness of other financial institutions; (o) new lines of business or new products and services; (p) changes in Small Business Administration (“SBA”) rules, regulations and loan products, including specifically the Section 7(a) program or changes to the status of the Bank as an SBA Preferred Lender; (q) the value of collateral securing the Company’s loans; (r) the Company’s levels of nonperforming assets; (s) losses from loan defaults; (t) the Company’s ability to protect its intellectual property and the risks it faces with respect to claims and litigation initiated against the Company; (u) the Company’s ability to implement its growth strategy; (v) the Company’s ability to launch new products or services successfully; (w) the concentration of the Company’s lending and depositor relationships through Strategic Programs in the financial technology industry generally; (x) interest-rate and liquidity risks; (y) the effectiveness of the Company’s internal control over financial reporting and its ability to remediate any future material weakness in its internal control over financial reporting; (z) dependence on our management team and changes in management composition; (aa) the sufficiency of the Company’s capital; (bb) compliance with laws and regulations, supervisory actions, the Dodd-Frank Act, capital requirements, the Bank Secrecy Act and other anti-money laundering laws, predatory lending laws, and other statutes and regulations; (cc) results of examinations of the Company by its regulators; (dd) the Company’s involvement from time to time in legal proceedings; (ee) natural disasters and adverse weather, acts of terrorism, pandemics, an outbreak of hostilities or other international or domestic calamities, and other matters beyond the Company’s control; (ff) future equity and debt issuances; (gg) that the anticipated benefits new lines of business that the Company may enter or investments or acquisitions the Company may make are not realized within the expected time frame or at all as a result of such things as the strength or weakness of the economy and competitive factors in the areas where the Company and such other businesses operate; and (hh) other factors listed from time to time in the Company’s filings with the Securities and Exchange Commission, including, without limitation, its Annual Report on Form 10-K for the year ended December 31, 2023 and subsequent reports on Form 10-Q and Form 8-K. Any forward-looking statement speaks only as of the date of this release, and the Company does not undertake any obligation to publicly update or review any forward-looking statement, whether because of new information, future developments or otherwise, except as required by law. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence. In addition, the Company cannot assess the impact of each risk and uncertainty on its business or the extent to which any risk or uncertainty, or combination of risks and uncertainties, may cause actual results to differ materially from those contained in any forward-looking statements. Market and industry data This presentation includes estimates regarding market and industry data. Certain information is based on management estimates, which have been derived from third-party sources, as well as data from our internal research. While we believe the estimated market and industry data included in this presentation are generally reliable, such information, which is derived in part from management’s estimates and beliefs, is inherently uncertain and imprecise. Non-GAAP financial measures Some of the financial measures included in this presentation are not measures of financial performance recognized by generally accepted accounting principles in the United States (“GAAP”). These non-GAAP financial measures are “tangible shareholders’ equity,” “tangible book value per share,” and “efficiency ratio.” We believe these non-GAAP financial measures provide useful information to management and investors; however, we acknowledge that our non-GAAP financial measures have limitations. As such, you should not view these measures as a substitute for results determined in accordance with GAAP. A reconciliation of such non-GAAP financial measures to the most closely related GAAP financial measures is included in the Appendix to this presentation. Trademarks “FinWise” and its logos and other trademarks referred to and included in this presentation belong to us and are protected by applicable laws. We refer to our trademarks in this presentation without the ® or the ™ or symbols for convenience. Other service marks, trademarks and trade names referred to in this presentation, if any, are the property of their respective owners, although for presentational convenience we may not use the ® or the ™ symbols to identify such trademarks.

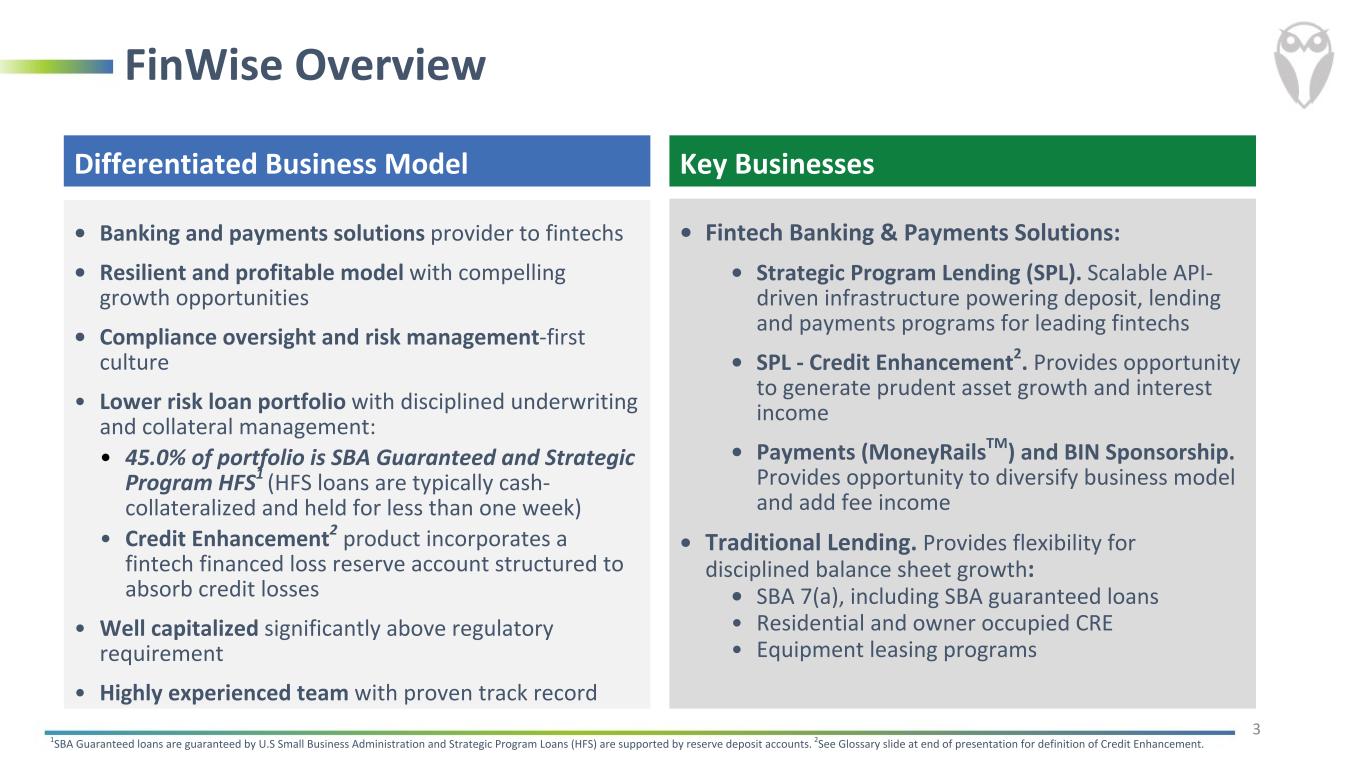

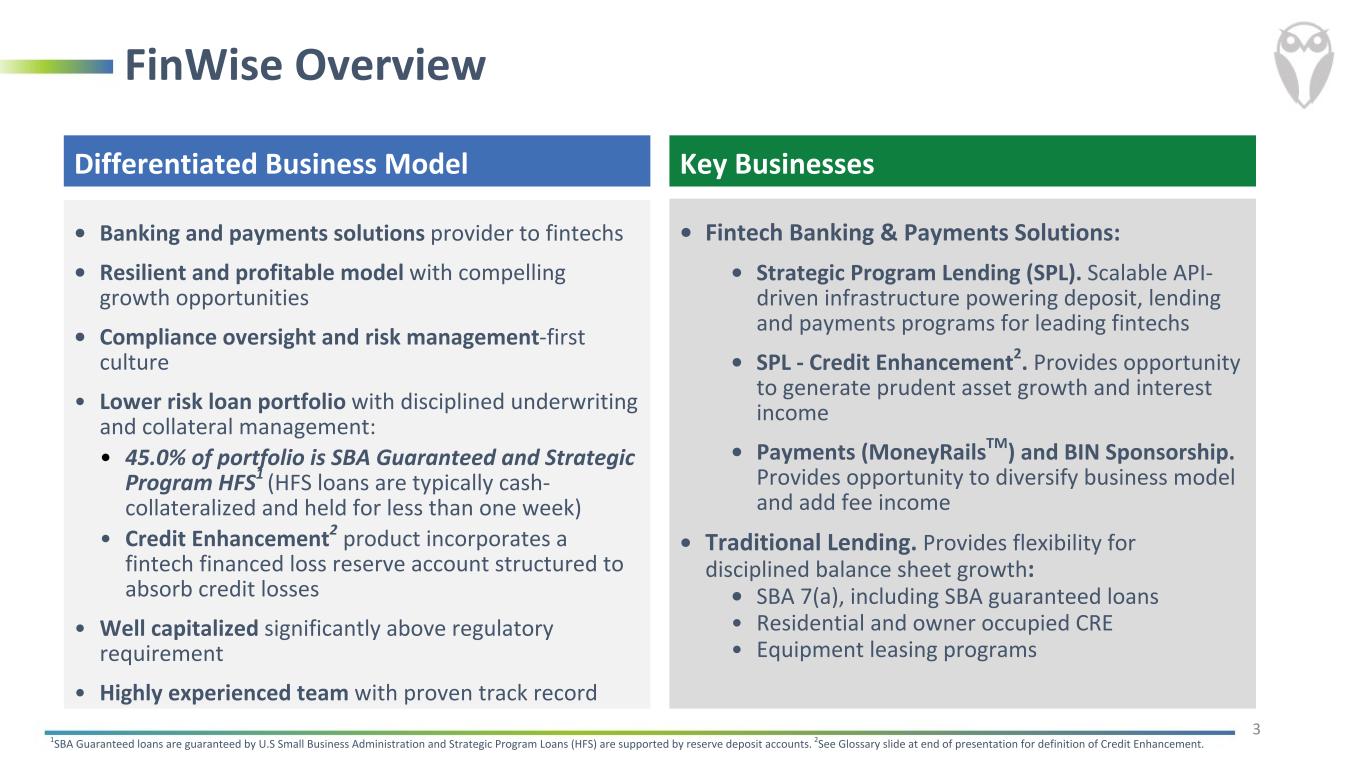

FinWise Overview Differentiated Business Model • Banking and payments solutions provider to fintechs • Resilient and profitable model with compelling growth opportunities • Compliance oversight and risk management-first culture • Lower risk loan portfolio with disciplined underwriting and collateral management: • 45.0% of portfolio is SBA Guaranteed and Strategic Program HFS1 (HFS loans are typically cash- collateralized and held for less than one week) • Credit Enhancement2 product incorporates a fintech financed loss reserve account structured to absorb credit losses • Well capitalized significantly above regulatory requirement • Highly experienced team with proven track record 1SBA Guaranteed loans are guaranteed by U.S Small Business Administration and Strategic Program Loans (HFS) are supported by reserve deposit accounts. 2See Glossary slide at end of presentation for definition of Credit Enhancement. 3 • Fintech Banking & Payments Solutions: • Strategic Program Lending (SPL). Scalable API- driven infrastructure powering deposit, lending and payments programs for leading fintechs • SPL - Credit Enhancement2. Provides opportunity to generate prudent asset growth and interest income • Payments (MoneyRailsTM) and BIN Sponsorship. Provides opportunity to diversify business model and add fee income • Traditional Lending. Provides flexibility for disciplined balance sheet growth: • SBA 7(a), including SBA guaranteed loans • Residential and owner occupied CRE • Equipment leasing programs Key Businesses

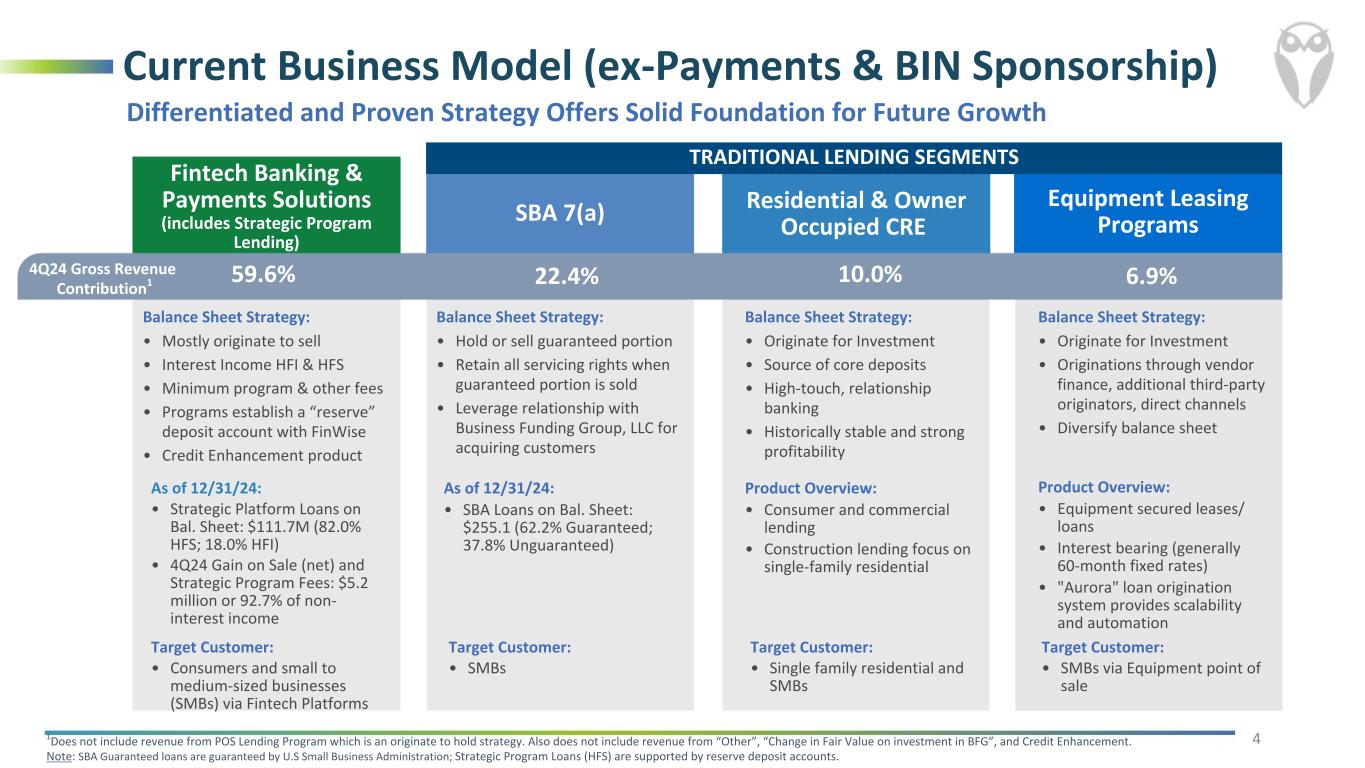

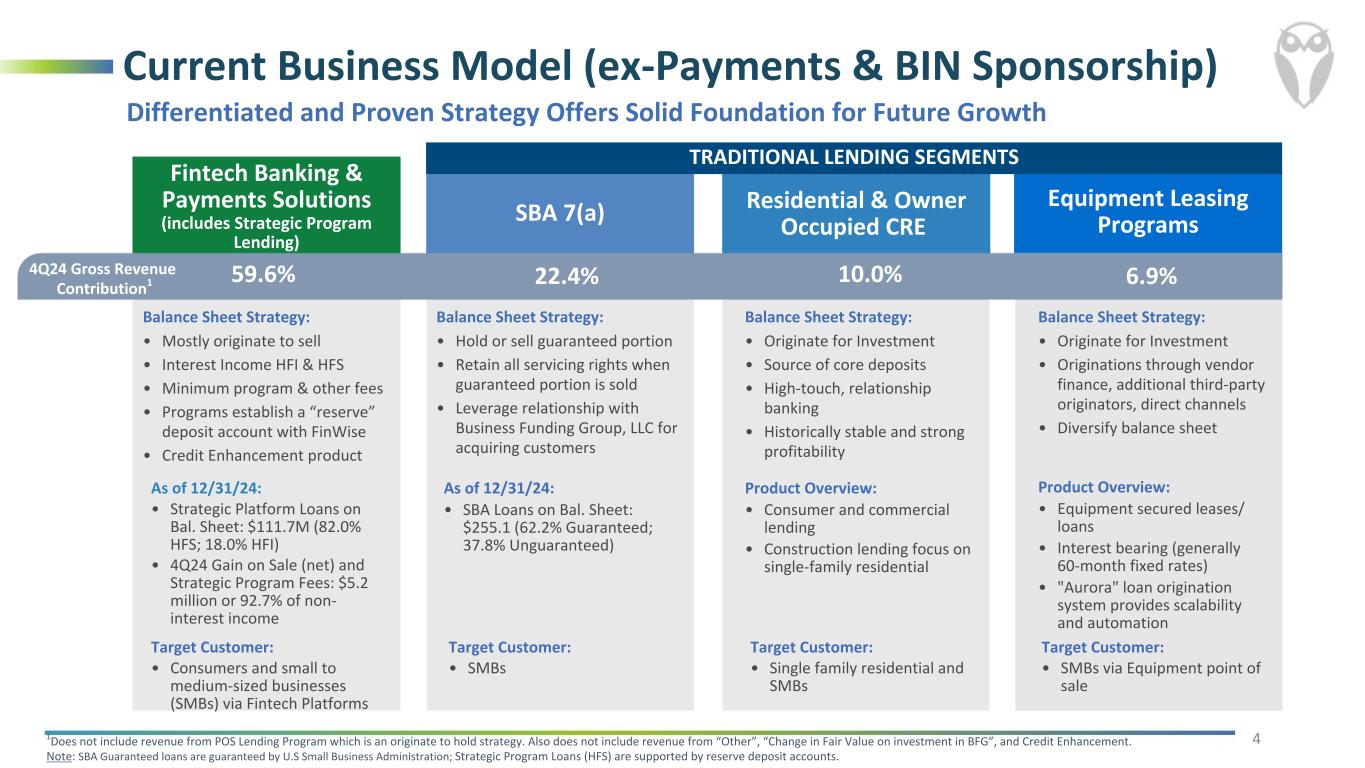

Equipment Leasing Programs Balance Sheet Strategy: • Originate for Investment • Originations through vendor finance, additional third-party originators, direct channels • Diversify balance sheet Fintech Banking & Payments Solutions (includes Strategic Program Lending) Balance Sheet Strategy: • Mostly originate to sell • Interest Income HFI & HFS • Minimum program & other fees • Programs establish a “reserve” deposit account with FinWise • Credit Enhancement product SBA 7(a) Balance Sheet Strategy: • Hold or sell guaranteed portion • Retain all servicing rights when guaranteed portion is sold • Leverage relationship with Business Funding Group, LLC for acquiring customers Residential & Owner Occupied CRE Balance Sheet Strategy: • Originate for Investment • Source of core deposits • High-touch, relationship banking • Historically stable and strong profitability Current Business Model (ex-Payments & BIN Sponsorship) 4Q24 Gross Revenue Contribution1 1Does not include revenue from POS Lending Program which is an originate to hold strategy. Also does not include revenue from “Other”, “Change in Fair Value on investment in BFG”, and Credit Enhancement. Note: SBA Guaranteed loans are guaranteed by U.S Small Business Administration; Strategic Program Loans (HFS) are supported by reserve deposit accounts. 59.6% 22.4% 10.0% 4 6.9% Differentiated and Proven Strategy Offers Solid Foundation for Future Growth As of 12/31/24: • Strategic Platform Loans on Bal. Sheet: $111.7M (82.0% HFS; 18.0% HFI) • 4Q24 Gain on Sale (net) and Strategic Program Fees: $5.2 million or 92.7% of non- interest income As of 12/31/24: • SBA Loans on Bal. Sheet: $255.1 (62.2% Guaranteed; 37.8% Unguaranteed) Product Overview: • Consumer and commercial lending • Construction lending focus on single-family residential Product Overview: • Equipment secured leases/ loans • Interest bearing (generally 60-month fixed rates) • "Aurora" loan origination system provides scalability and automation Target Customer: • Consumers and small to medium-sized businesses (SMBs) via Fintech Platforms Target Customer: • SMBs Target Customer: • Single family residential and SMBs Target Customer: • SMBs via Equipment point of sale TRADITIONAL LENDING SEGMENTS

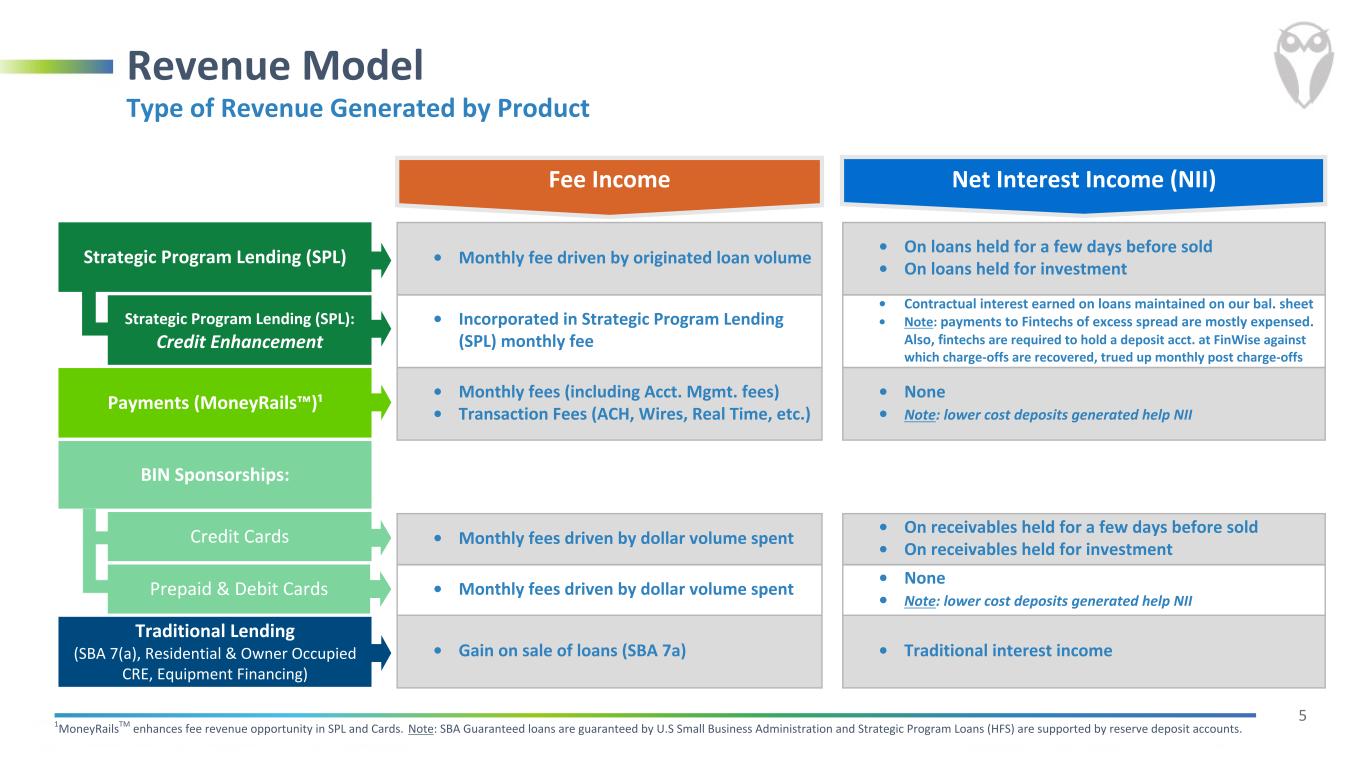

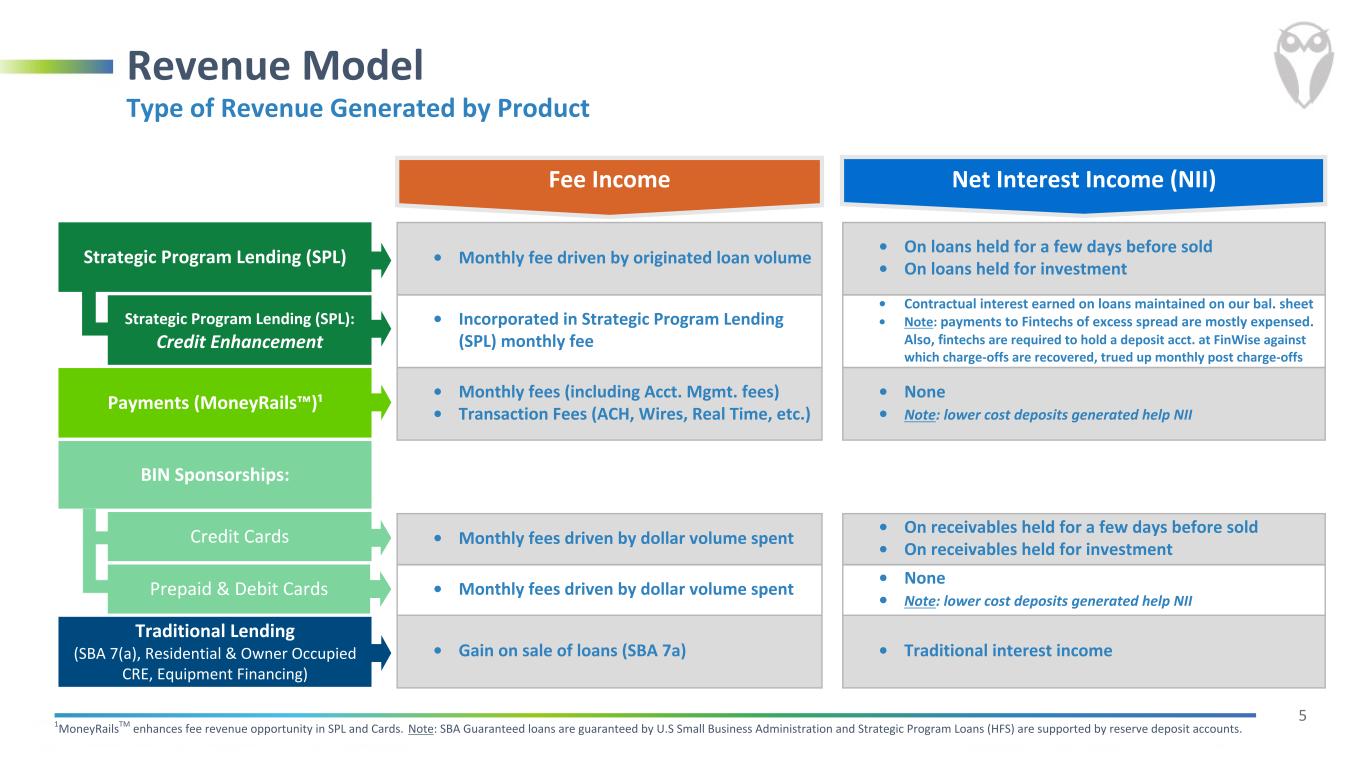

5 Interest Income • Monthly fee driven by originated loan volume • On loans held for a few days before sold • On loans held for investment • Incorporated in Strategic Program Lending (SPL) monthly fee • Contractual interest earned on loans maintained on our bal. sheet • Note: payments to Fintechs of excess spread are mostly expensed. Also, fintechs are required to hold a deposit acct. at FinWise against which charge-offs are recovered, trued up monthly post charge-offs • Monthly fees (including Acct. Mgmt. fees) • Transaction Fees (ACH, Wires, Real Time, etc.) • None • Note: lower cost deposits generated help NII • Monthly fees driven by dollar volume spent • On receivables held for a few days before sold • On receivables held for investment • Monthly fees driven by dollar volume spent • None • Note: lower cost deposits generated help NII • Gain on sale of loans (SBA 7a) • Traditional interest income 1MoneyRailsTM enhances fee revenue opportunity in SPL and Cards. Note: SBA Guaranteed loans are guaranteed by U.S Small Business Administration and Strategic Program Loans (HFS) are supported by reserve deposit accounts. Revenue Model Strategic Program Lending (SPL) Payments (MoneyRails™)¹ Credit Cards Traditional Lending (SBA 7(a), Residential & Owner Occupied CRE, Equipment Financing) Strategic Program Lending (SPL): Credit Enhancement Prepaid & Debit Cards Type of Revenue Generated by Product BIN Sponsorships: Net Interest Income (NII)Fee Income

6 Select Fintech Brands We Currently Support Note: Upstart, Elevate and Reach are not on MoneyRailsTM, but FinWise does handle Payment Processing for them. During 4Q24, we signed an agreement with a strategic lending program that we have not yet formally announced as it is still in its piloting stage but anticipate providing more details in upcoming quarters. Growth Opportunity With Existing Fintechs And As New Programs Are Onboarded

Strategic Program Lending (SPL) - Program Diversification Has Improved Note: Strategic Program Lending concentration shown since 1Q22 to highlight longer-term pattern in recent years 7

Our Culture - Strong Compliance and Risk Management 8 Consistent Investment in Personnel & Infrastructure Provides Regulatory Oversight Support to Fintechs Note: FTEs shown as of the end of each respective quarter; does not include FTEs in Governance and Operations. 38% of FTEs in IT, Compliance, Risk Mgmt., BSA functions at the end of 4Q24 Total FTEs at end of 4Q24 = 196

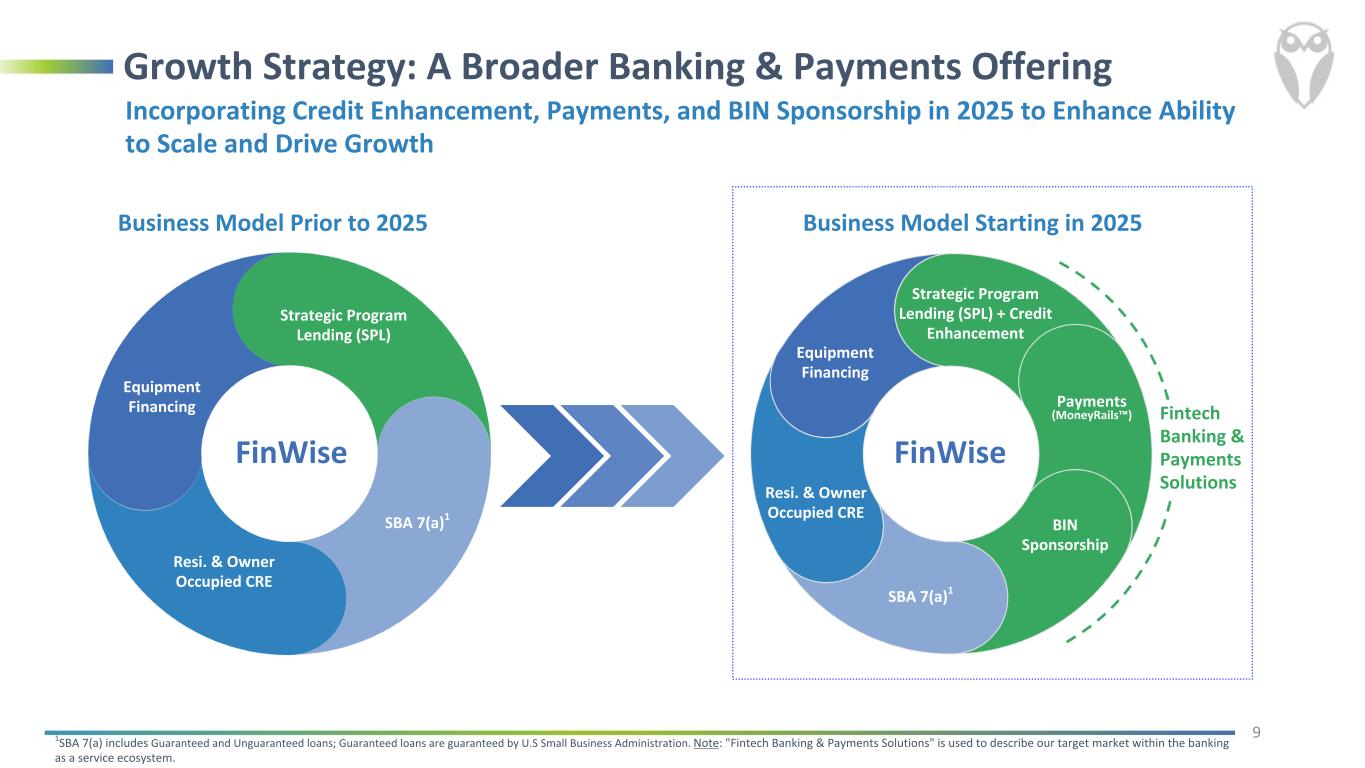

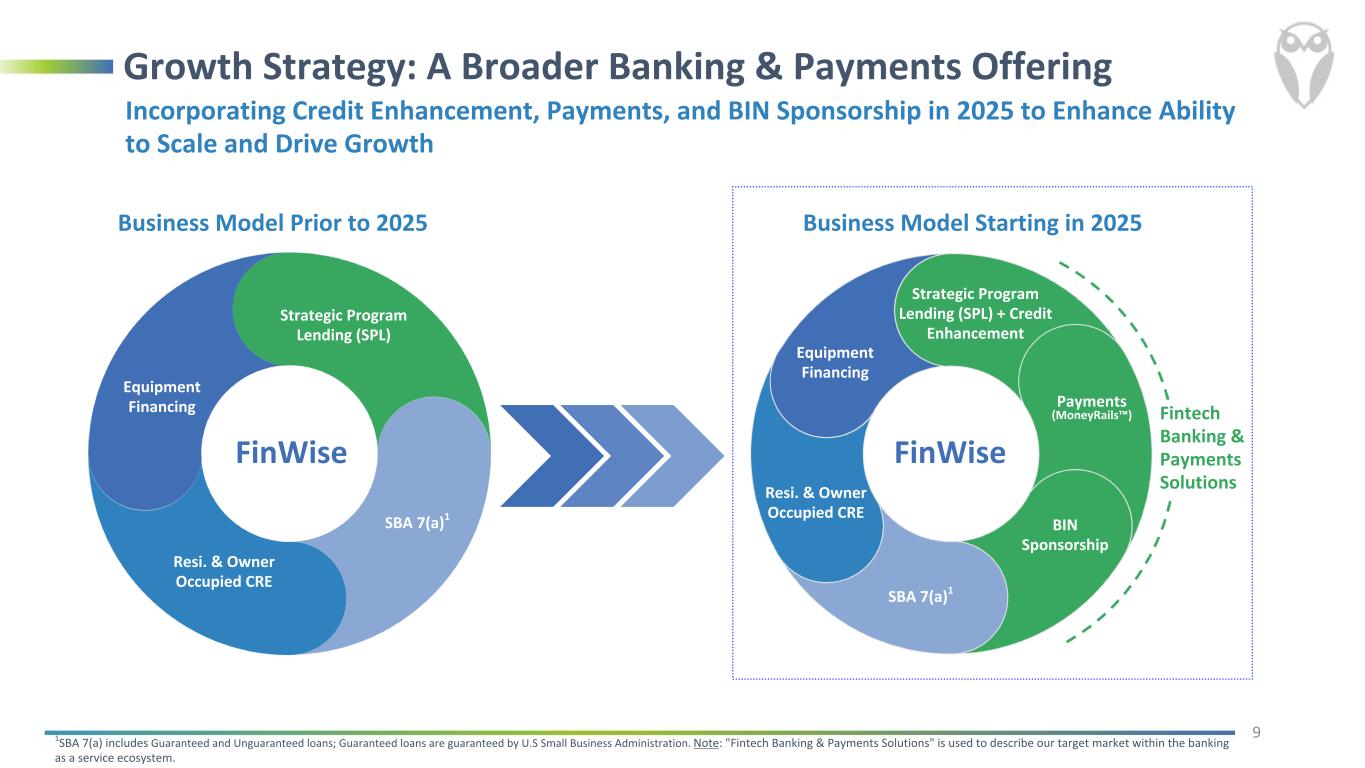

Growth Strategy: A Broader Banking & Payments Offering Business Model Prior to 2025 Business Model Starting in 2025 1SBA 7(a) includes Guaranteed and Unguaranteed loans; Guaranteed loans are guaranteed by U.S Small Business Administration. Note: "Fintech Banking & Payments Solutions" is used to describe our target market within the banking as a service ecosystem. 9 Strategic Program Lending (SPL) SBA 7(a)1 Resi. & Owner Occupied CRE Equipment Financing FinWise Fintech Banking & Payments Solutions BIN Sponsorship Strategic Program Lending (SPL) + Credit Enhancement SBA 7(a)1 Equipment Financing Resi. & Owner Occupied CRE FinWise Incorporating Credit Enhancement, Payments, and BIN Sponsorship in 2025 to Enhance Ability to Scale and Drive Growth Payments (MoneyRails™)

Sizable Addressable Market 1 Source: Matt Harris, Blake Adams, Adam Davis, and Jeff Tijsse, "Embedded Finance: What It Takes to Prosper in the New Value Chain", 2022 (Bain & Company, Inc.) 10 2021 2026 Estimated U.S. Market for Platforms and Enablers1 (Total Revenue Across Payments, Lending, Banking, Cards) Fintechs & Non-Financials Expected to Seek Bank Partners that Provide Access to Financial Products

Potential Long-term Benefits from Fintech Banking and Payments Solutions Offering Revenue Expands and diversifies potential sources of revenue Deposits Helps diversify deposit composition and reduce cost of funds through relationship-banking Credit Quality Increases percentage of Prime loans Profitability Use of outsourced solutions enhances operating leverage versus traditional models Note: "Potential Long-term Benefits" describe the Company's expectations of potential benefits to the overall FinWise business model 11

Differentiators of Fintech Banking and Payments Solutions Offering Payments (MoneyRailsTM) • Ease of Use. Brings multiple payments types under one application. Ability to see all payments through a single source • Payment Control. Allows service providers (fintechs) to embed multiple options to move money in /out of their ecosystem • Cost Effective. Business rules help optimize the payment type for users' parameters. Reduces number of bank connected systems, lowering fees and software costs • Strengthens Security. Single sign-on to manage access and real time fraud controls • Modern Payment Rails. Access to the latest payment types such as faster and real-time payments o Payment rails included: ACH, Same Day ACH (SDA), Wires, Visa Direct and/or Mastercard Send, Mastercard RPPS, The Clearing House RTP and FedNow Bank Identification Number (BIN) Sponsorship • Compliance-first Culture. Significant knowledge of compliance practices required to manage a BIN sponsorship program. Regular interactions with our regulators • Differentiated Tech Approach and Integration. Provides Bank with more control for compliance oversight and more robust solutions as service providers (fintechs) expand their operations • Focus. Limit number of processors, vendors and service providers to streamline efficiencies and oversight • Extensive Experience. Team has nearly 90 years of combined expertise in banking, payments and fintech 12 Target Customers: • Fintechs that serve needs of corporations and small businesses with existing transaction volume and a proven track record of success. • Fintechs that have the capabilities to support businesses/commercial/corporations account and payments needs, including credit, charge card, debit, prepaid program constructs. • Fintechs that are well funded, have an experienced management team, plan to drive significant activity annually and have a compliance-first mentality. • We will also support consumer programs with unique value propositions that solve financial issues.

Payments (MoneyRailsTM) Platform - The Value of a Ledger 13 Secure, Efficient API-driven Solutions for Fintechs and Commercial Customers • The Ledger provides a strong foundation with controls, standing instructions and connectors for third-party integrations • Highly secured platform with ability to stop unauthorized access to the application and the account. Transactions are immutable. • Fintechs can build their own experience using APIs without dependency on FinWise • The platform provides physical and virtual card servicing capabilities. This enables incoming/ outgoing payments and card management to be housed in a central hub

Payments (MoneyRailsTM) Benefits to Fintechs We Support 14 A Centralized, Secure Platform and Ledger that Facilitates Movement of Money

Components of Model Enable Scaling and Regulatory Oversight Our Technology:Product: Enterprise Data Warehouse -Proprietary and rigorous regulatory process -FinWise controls the data internally Lending programs, including closed and open-ended consumer and commercial • Verify borrower information • Validate loans to models and underwriting criteria, and originate API 2) Payments (MoneyRailsTM)* Payments (MoneyRailsTM) ACH, SDA, TCH RTP, FedNow, Wire, Visa Direct and Mastercard Send, Mastercard RPPS • Rules-based money movement configurations and restrictions • Verification, validation and capture of necessary oversight data API 3) BIN Sponsorship* Card Processors Credit and Charge Cards Debit cards; prepaid • Capture daily cardholder financial activity and bank-defined data sets necessary for oversight and testing of regulatory compliance API 15 1) Strategic Program Lending Credit Engine

Risk-based due diligence process involving 3rd-Party Oversight, BSA, Credit & ISO If Fintech is approved, FinWise team continues to negotiate, including defining potential product and terms Fintech is sent to Implementations Team and put into Scoping to fully define requirements of implementation Pilot Phase GO LIVE Fintech is presented at next internal Third-Party Oversight Committee (TPOC) meeting for approval Proposed term-sheet, signed Letter of Intent, product description, risk assessment submitted to Program Risk Committee (PRC), including Operations Fintech put through Implementations/ Onboarding Process Fintech and FinWise finalize all Implementations/ Onboarding Requirements Intensive Due-Diligence Process and Compliance Assessment Representative Fintech Onboarding - a Thorough Selection Process FINWISE TEAM IDENTIFIES FINTECH PROSPECT Program is "live" and active with ongoing compliance monitoring and regulatory oversight support 16

Disciplined Underwriting Process Mitigates Risk... • Credit risk is managed through combination of policy, data and pricing • Disciplined underwriting process and well collateralized portfolio has helped mitigate net charge-offs, even as credit quality normalized due to higher rate environment • Remain well-reserved with an ACL/Total Gross Loans HFI of 2.8% as of the end of 4Q24, reflecting a lower-risk portfolio vs. prior year period, including: • Significant SBA guaranteed balances as % of Total Gross Loans HFI • Decrease in Strategic Programs (SP) HFI balances as % of Total Gross Loans HFI, which carry a higher reserve rate 17 *ACL = Allowance for Credit Losses; SP = Strategic Programs; HFI = Held for Investment

...and Leads to a Diversified and Lower Risk Loan Portfolio • Combined SBA Guaranteed and Strategic Program Loans (HFS) increased to a total of 45.0% of the portfolio as of 4Q24 vs 42.7% as of FY23. Both of these products carry lower credit risk: SBA Guaranteed loans are guaranteed by the U.S Small Business Administration and Strategic Program Loans (HFS) are supported by reserve deposit accounts • SBA Unguaranteed loans declined from 25.8% of the portfolio as of FY23 to 17.3% as of 4Q24 • SBA Guaranteed balances declined modestly Y/Y, as in 4Q24 we reinitiated selling limited amounts of the guaranteed portion of SBA loans • Our new Credit Enhancement1 product incorporates a fintech financed loss reserve account structured to absorb credit losses Portfolio Characteristics: • SBA portfolio characteristics: Average FICO is 740+. Average time in business is 12+ years. Top 3 industries by Unguaranteed balances are eCommerce, Law Firms and Health Care. Our SBA loss rate is 71% lower than the SBA 7(a) industry for all originations since 2014. • CRE Non-SBA (7.6% as of 4Q24) is 96.7% Owner Occupied; SBA related CRE loans are required to be majority Owner Occupied under SBA guideline 18 *Amounts are as of the end of each respective period. Note: Commercial (Non RE) is mostly Equipment Leasing. 1Credit Enhancement activity is currently immaterial but is currently expected to become more material as we move through the year. 2Total Loans includes Held for Investment (HFI) and Held for Sale (HFS) Lower risk portfolio vs. prior year period

Deposit Composition 19 As of December 31, 2024; Total Period End Deposits: $545 Million Significant opportunity to gradually diversify deposit composition and reduce cost of funds

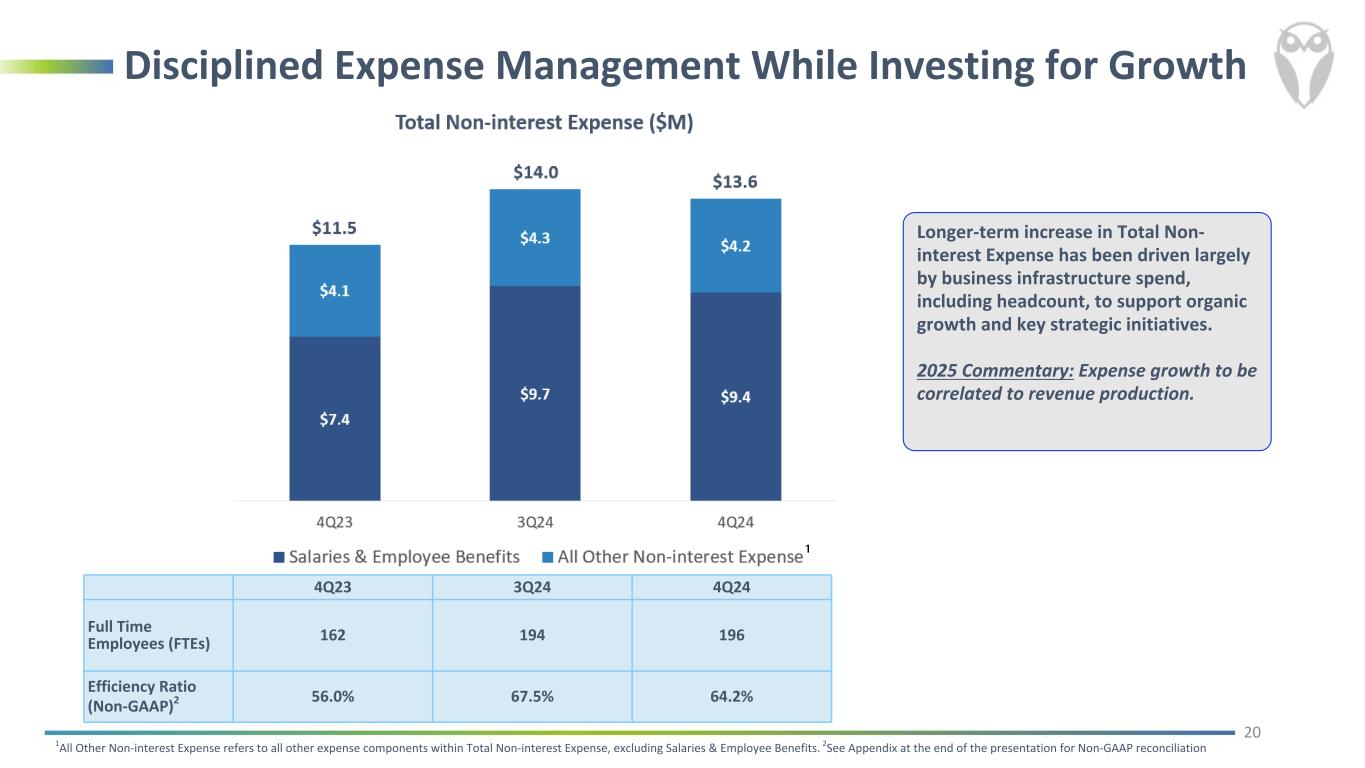

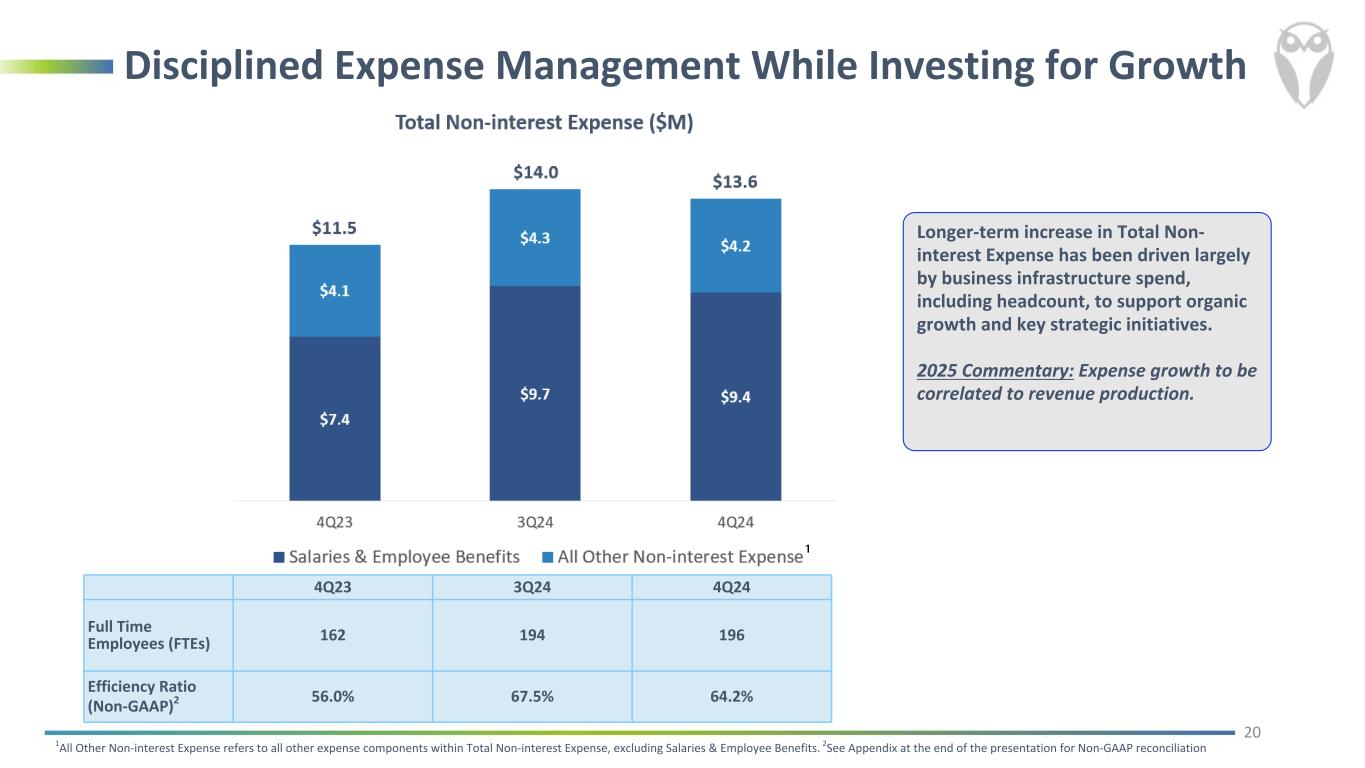

Disciplined Expense Management While Investing for Growth Longer-term increase in Total Non- interest Expense has been driven largely by business infrastructure spend, including headcount, to support organic growth and key strategic initiatives. 2025 Commentary: Expense growth to be correlated to revenue production. 20 4Q23 3Q24 4Q24 Full Time Employees (FTEs) 162 194 196 Efficiency Ratio (Non-GAAP)2 56.0% 67.5% 64.2% 1All Other Non-interest Expense refers to all other expense components within Total Non-interest Expense, excluding Salaries & Employee Benefits. 2See Appendix at the end of the presentation for Non-GAAP reconciliation

TBV Growth Has Been a Win for Shareholders Tangible Book Value Per Share (Non-GAAP)1 21 1 See Appendix at end of presentation for full description of metric and Non-GAAP reconciliation. Amounts are as of the end of each respective period 2 Bank Peers defined as: Oregon Bancorp, Inc., Quaint Oak Bancorp, Inc., University Bancorp, Inc., BayFirst Financial Corp., Fentura Financial, Inc., CF Bankshares Inc., Meridian Corporation, Coastal Financial Corporation, Capital Bancorp, Inc., FS Bancorp, Inc., Blue Ridge Bankshares, Inc., First Internet Bancorp, Nicolet Bankshares, Inc., Triumph Financial, Inc., Live Oak Bancshares, Inc., Merchants Bancorp, The Bancorp, Inc., Cross River Bank, Metropolitan Bank Holding Corp., Capital Community Bank. Fintech Peers defined as Atlanticus Holdings Corporation, Oportun Financial Corporation, LendingClub Corporation, Pathward Financial, Inc. Note: Bank level Call Report financial data used where holding company consolidated financials unavailable; 3Q 2024 financial data shown where 4Q 2024 holding company consolidated and bank level Call Report financials are unavailable; Source: S&P Capital IQ Pro Indexed Change in TBV Since FINW IPO (4Q21) vs Select Bank and Fintech Peers2

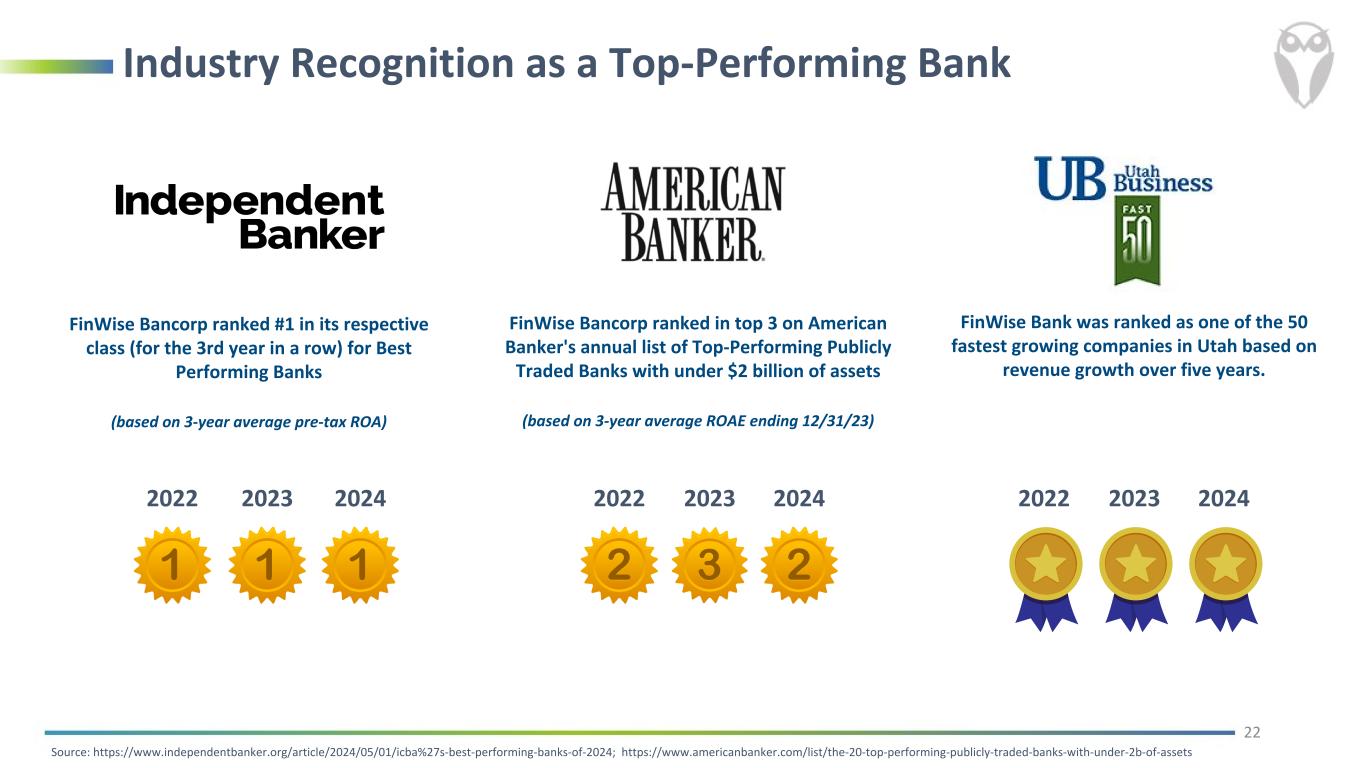

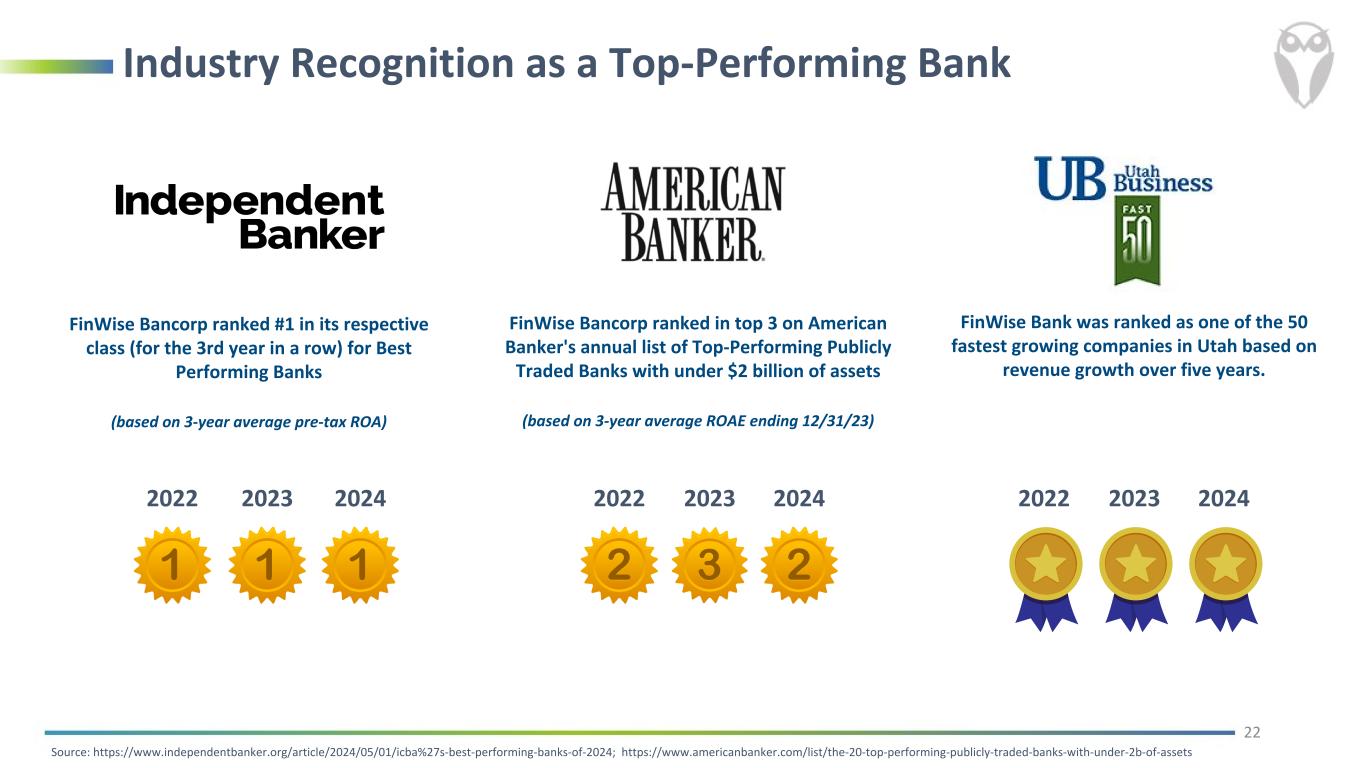

Industry Recognition as a Top-Performing Bank 22 FinWise Bancorp ranked in top 3 on American Banker's annual list of Top-Performing Publicly Traded Banks with under $2 billion of assets (based on 3-year average ROAE ending 12/31/23) 2022 2023 2022 2023 20242024 Source: https://www.independentbanker.org/article/2024/05/01/icba%27s-best-performing-banks-of-2024; https://www.americanbanker.com/list/the-20-top-performing-publicly-traded-banks-with-under-2b-of-assets FinWise Bancorp ranked #1 in its respective class (for the 3rd year in a row) for Best Performing Banks (based on 3-year average pre-tax ROA) FinWise Bank was ranked as one of the 50 fastest growing companies in Utah based on revenue growth over five years. 2022 2023 2024

Selected Financial Information 23

Solid Originations and Significant Balance Sheet Growth 24 1 HFI = Held for Investment. Note: Total Loan Originations are for the quarterly period. Other amounts are as of the end of each respective period

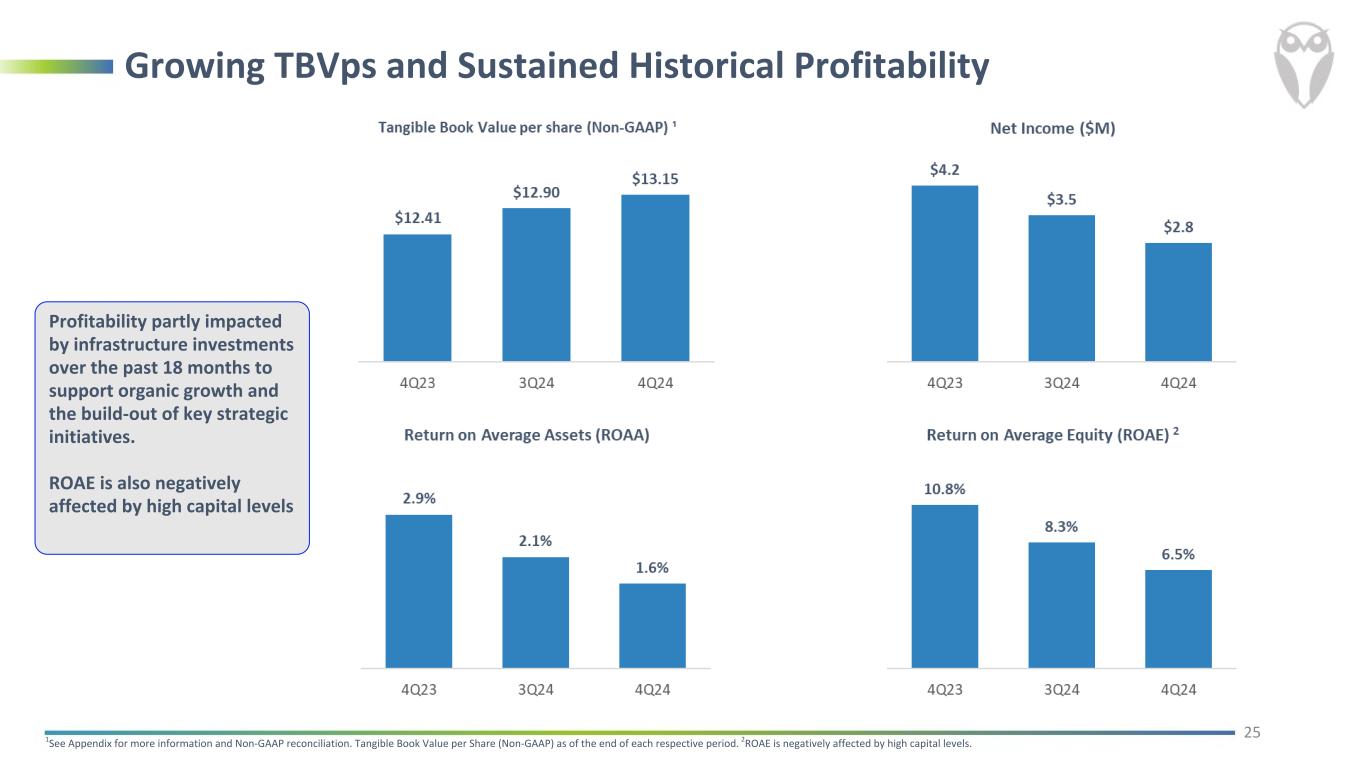

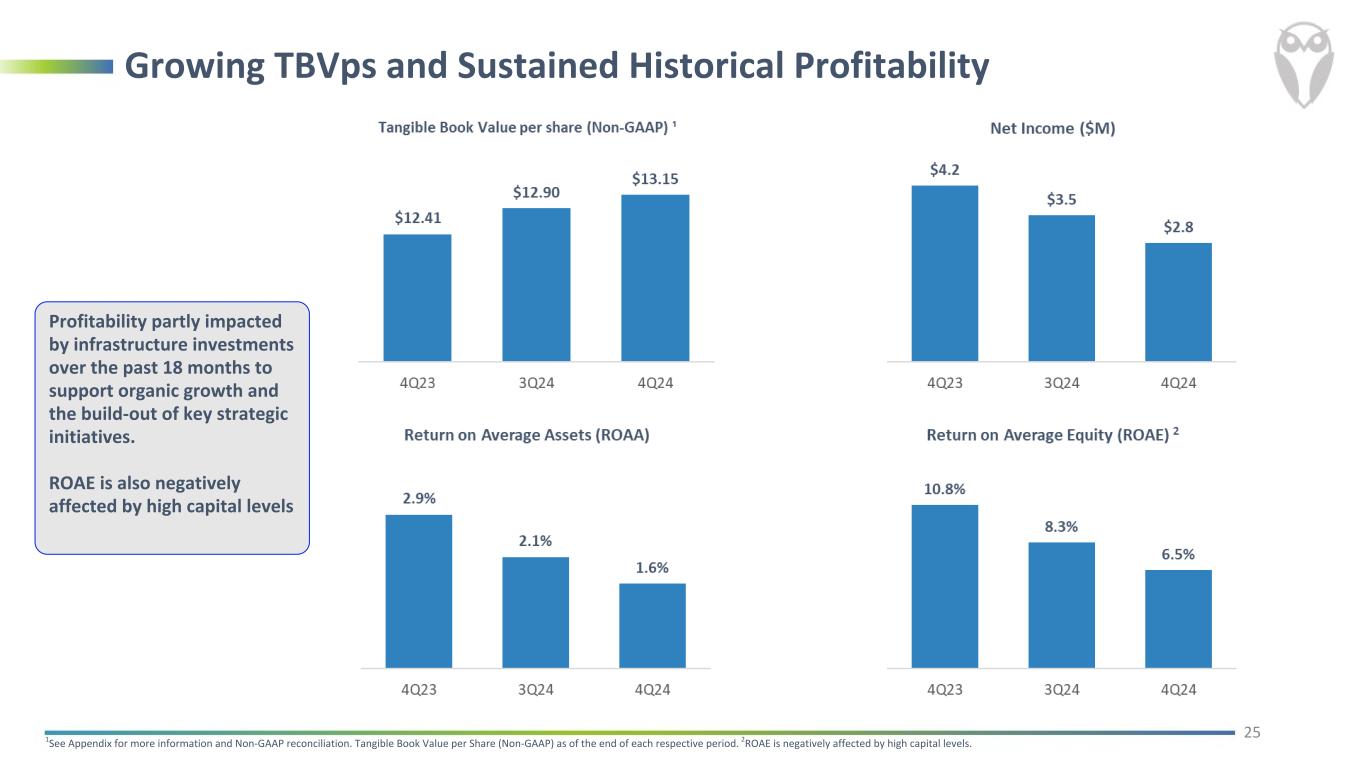

Growing TBVps and Sustained Historical Profitability 251See Appendix for more information and Non-GAAP reconciliation. Tangible Book Value per Share (Non-GAAP) as of the end of each respective period. 2ROAE is negatively affected by high capital levels. Profitability partly impacted by infrastructure investments over the past 18 months to support organic growth and the build-out of key strategic initiatives. ROAE is also negatively affected by high capital levels

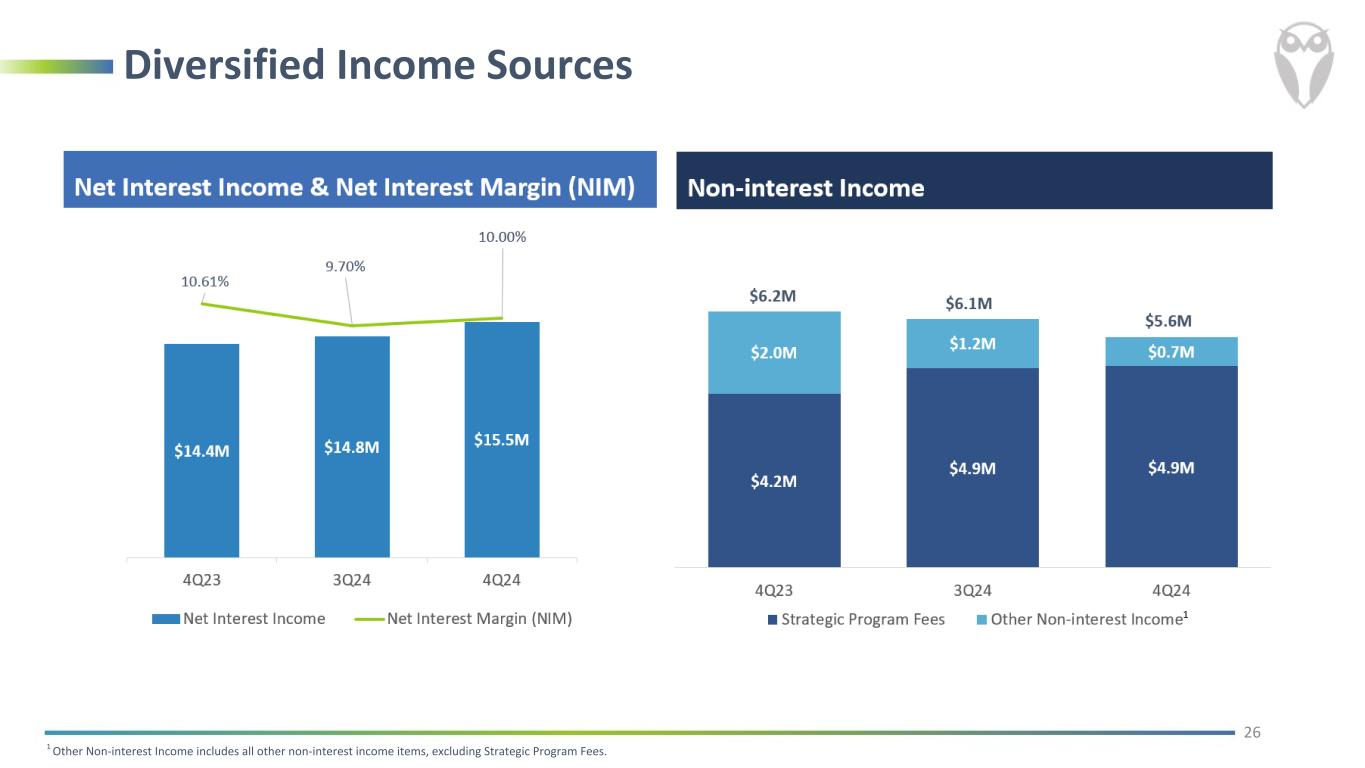

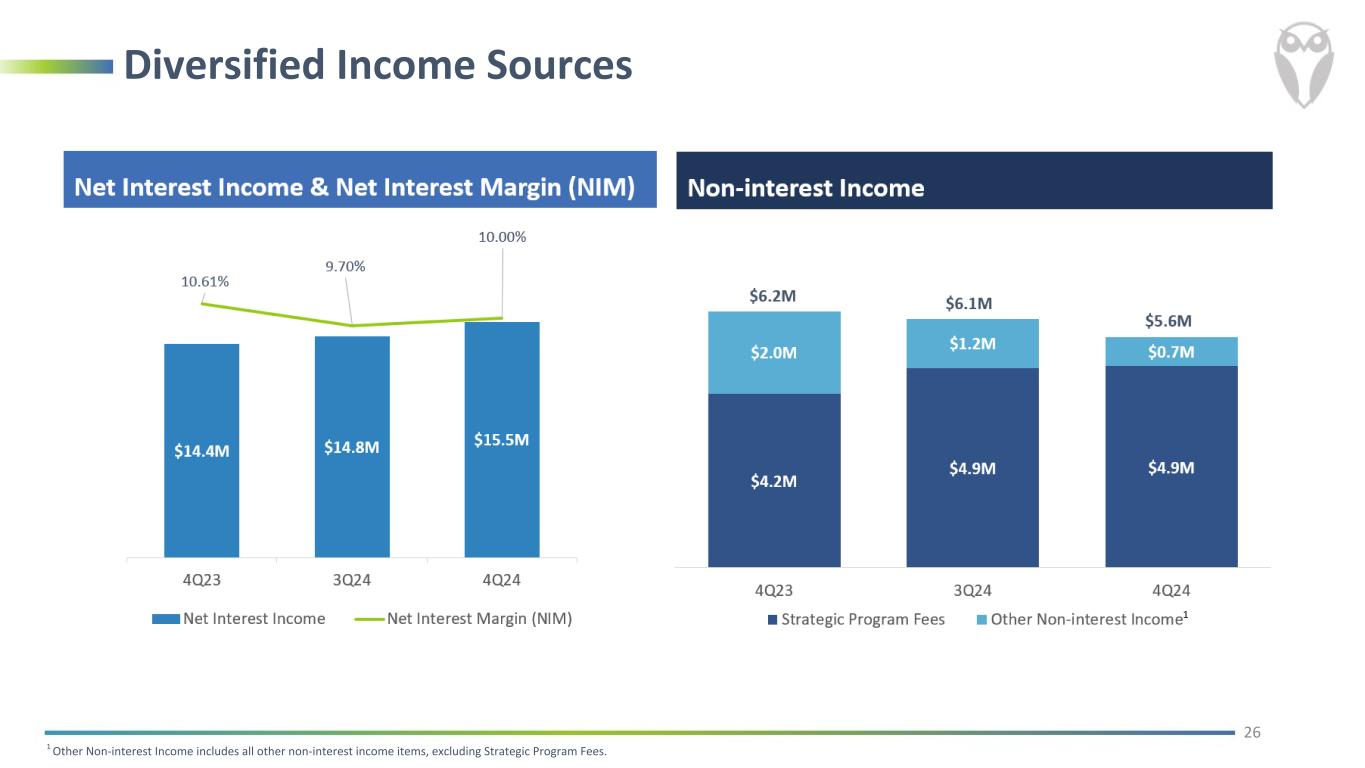

Diversified Income Sources 26 1 Other Non-interest Income includes all other non-interest income items, excluding Strategic Program Fees.

Well Capitalized Above Regulatory Requirements 27 Note: data as of the end of each respective period. The Bank's capital levels remain significantly above the well-capitalized regulatory requirement of 9%, pursuant to the Community Bank Leverage Ratio framework adopted by the Bank in 2020.

Appendix 28

Non-GAAP Reconciliations 29 (1) Tangible shareholders’ equity: This measure is not a measure recognized under GAAP and is therefore considered to be a non-GAAP financial measure. Tangible shareholders’ equity is defined as total shareholders’ equity less goodwill and other intangible assets. The most directly comparable GAAP financial measure is total shareholder’s equity to total assets. The Company had no goodwill or other intangible assets as of any of the dates indicated. The Company has not considered loan servicing rights or loan trailing fee asset as intangible assets for purposes of this calculation. As a result, tangible shareholders’ equity is the same as total shareholders’ equity as of each of the dates indicated. (2) Efficiency Ratio: This measure is not a measure recognized under United States generally accepted accounting principles, or GAAP, and is therefore considered to be a non-GAAP financial measure. The efficiency ratio is defined as total non-interest expense divided by the sum of net interest income and non-interest income. The Company believes this measure is important as an indicator of productivity because it shows the amount of revenue generated for each dollar spent. Tangible Shareholders' Equity and Tangible Book Value Per Share As of ($ in thousands, except per share amounts) December 31, 2024 September 30, 2024 December 31, 2023 Total shareholders' equity $ 173,720 $ 170,370 $ 155,056 Goodwill — — — Other intangibles — — — Less: total intangible assets — — — Tangible shareholders' equity1 $ 173,720 $ 170,370 $ 155,056 Tangible book value per share1 $ 13.15 $ 12.90 $ 12.41 Efficiency Ratio For the Three Month Period Ending ($ in thousands) December 31, 2024 September 30, 2024 December 31, 2023 Non-interest expense $ 13,564 $ 14,049 $ 11,503 Net interest income 15,529 14,763 14,367 Non-interest income 5,603 6,054 6,157 Adjusted operating revenue $ 21,132 $ 20,817 $ 20,524 Efficiency ratio2 64.2 % 67.5 % 56.0 %

Non-GAAP Reconciliations 30 As of and for the Three Months Ended As of and for the Year Ended ($ in thousands; unaudited) 12/31/2024 12/31/2024 Total Average Loans HFI Total Interest Income on Loans HFI Average Yield on Loans HFI Total Average Loans HFI Total Interest Income on Loans HFI Average Yield on Loans HFI Before adjustment for credit enhancement $ 454,474 $ 13,348 11.68 % $ 417,207 $ 51,194 12.27 % Less: credit enhancement expense (5) (8) Net of adjustment for credit enhancement expenses $ 454,474 $ 13,343 11.68 % $ 417,207 $ 51,186 12.27 % The following non-GAAP measures are presented to illustrate the impact of certain credit enhancement expenses on total interest income on loans HFI and average yield on loans HFI: Note: Total interest income on loans HFI net of credit enhancement expense and the average yield on loans HFI are non-GAAP measures that include the impact of credit enhancement expense on total interest income on loans HFI and the respective average yield on loans HFI, the most directly comparable GAAP measures.

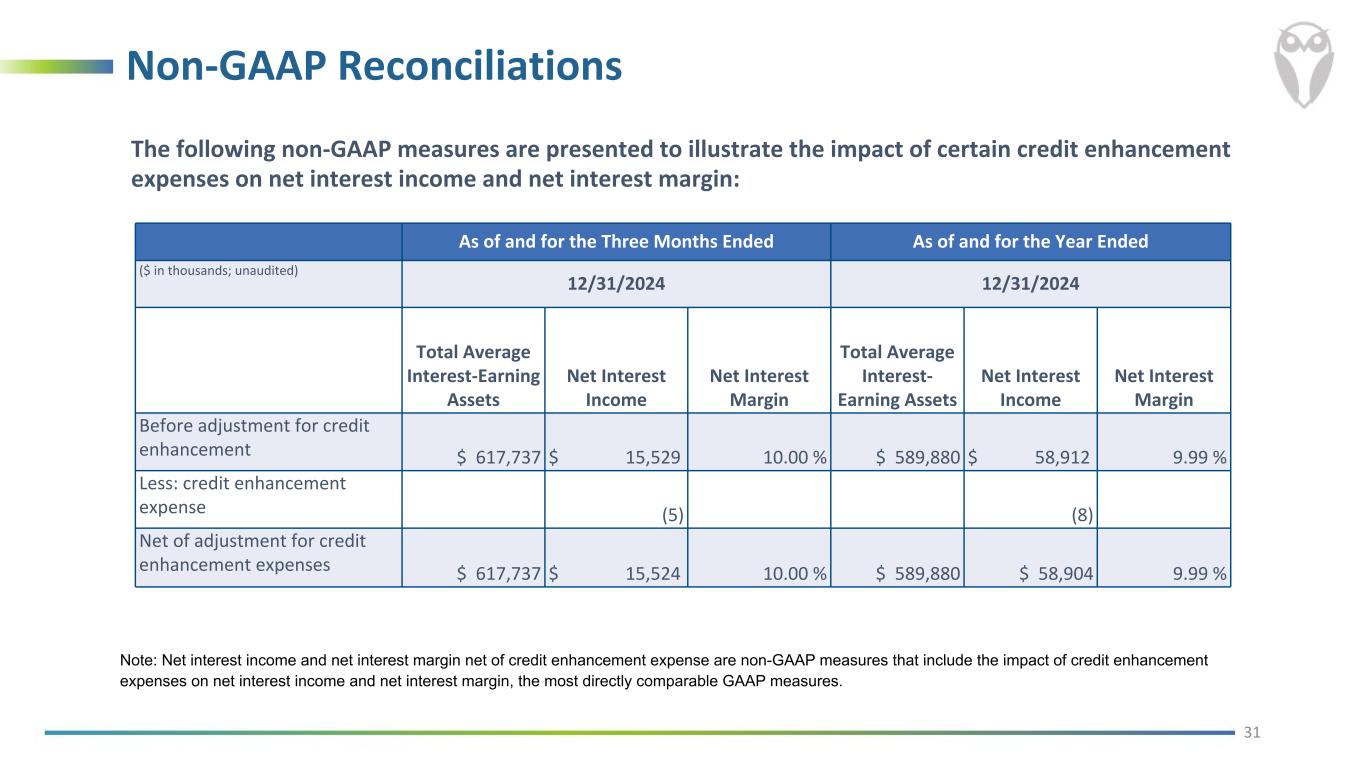

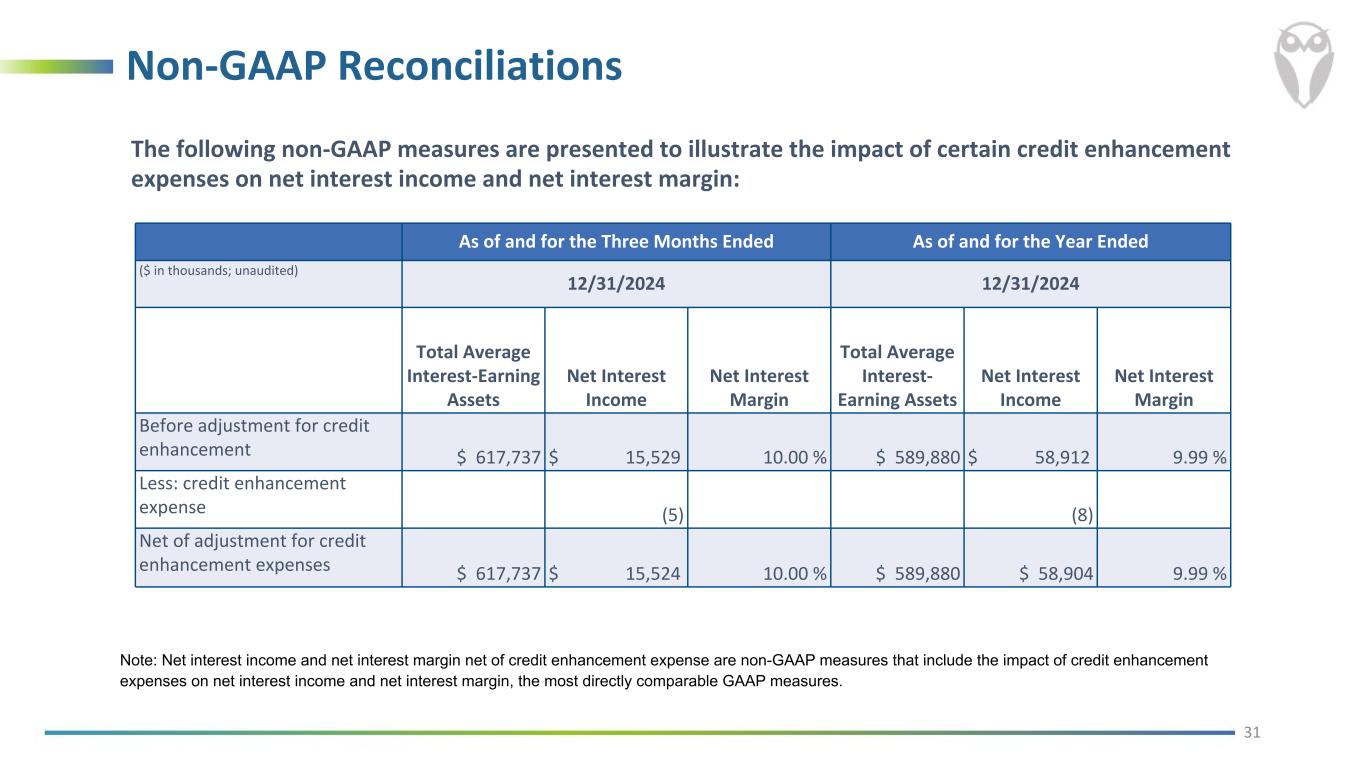

Non-GAAP Reconciliations 31 As of and for the Three Months Ended As of and for the Year Ended ($ in thousands; unaudited) 12/31/2024 12/31/2024 Total Average Interest-Earning Assets Net Interest Income Net Interest Margin Total Average Interest- Earning Assets Net Interest Income Net Interest Margin Before adjustment for credit enhancement $ 617,737 $ 15,529 10.00 % $ 589,880 $ 58,912 9.99 % Less: credit enhancement expense (5) (8) Net of adjustment for credit enhancement expenses $ 617,737 $ 15,524 10.00 % $ 589,880 $ 58,904 9.99 % The following non-GAAP measures are presented to illustrate the impact of certain credit enhancement expenses on net interest income and net interest margin: Note: Net interest income and net interest margin net of credit enhancement expense are non-GAAP measures that include the impact of credit enhancement expenses on net interest income and net interest margin, the most directly comparable GAAP measures.

Non-GAAP Reconciliations 32 ($ in thousands; unaudited) Three Months Ended December 31, 2024 Year Ended December 31, 2024 Total non-interest expense $ 13,564 $ 52,835 Less: credit enhancement expense (5) (8) Total non-interest expense less credit enhancement expenses $ 13,559 $ 52,827 Non-interest expenses less credit enhancement expenses is a non-GAAP measure presented to illustrate the impact of credit enhancement expense on non-interest expense: Total non-interest income less credit enhancement income is a non-GAAP measure presented to illustrate the impact of credit enhancement income resulting from credit enhanced loans on non-interest income: ($ in thousands; unaudited) Three Months Ended December 31, 2024 Year Ended December 31, 2024 Total non-interest income $ 5,603 $ 22,485 Less: credit enhancement income (25) (111) Total non-interest income less credit enhancement income $ 5,578 $ 22,374 Note: Total non-interest expense less credit enhancement expense is a non-GAAP measure that illustrates the impact of credit enhancement expenses on non-interest expense, the most directly comparable GAAP measure. Total non-interest income less indemnification income is a non-GAAP measure that illustrates the impact of credit enhancement income on non-interest income. The most directly comparable GAAP measure is non-interest income.

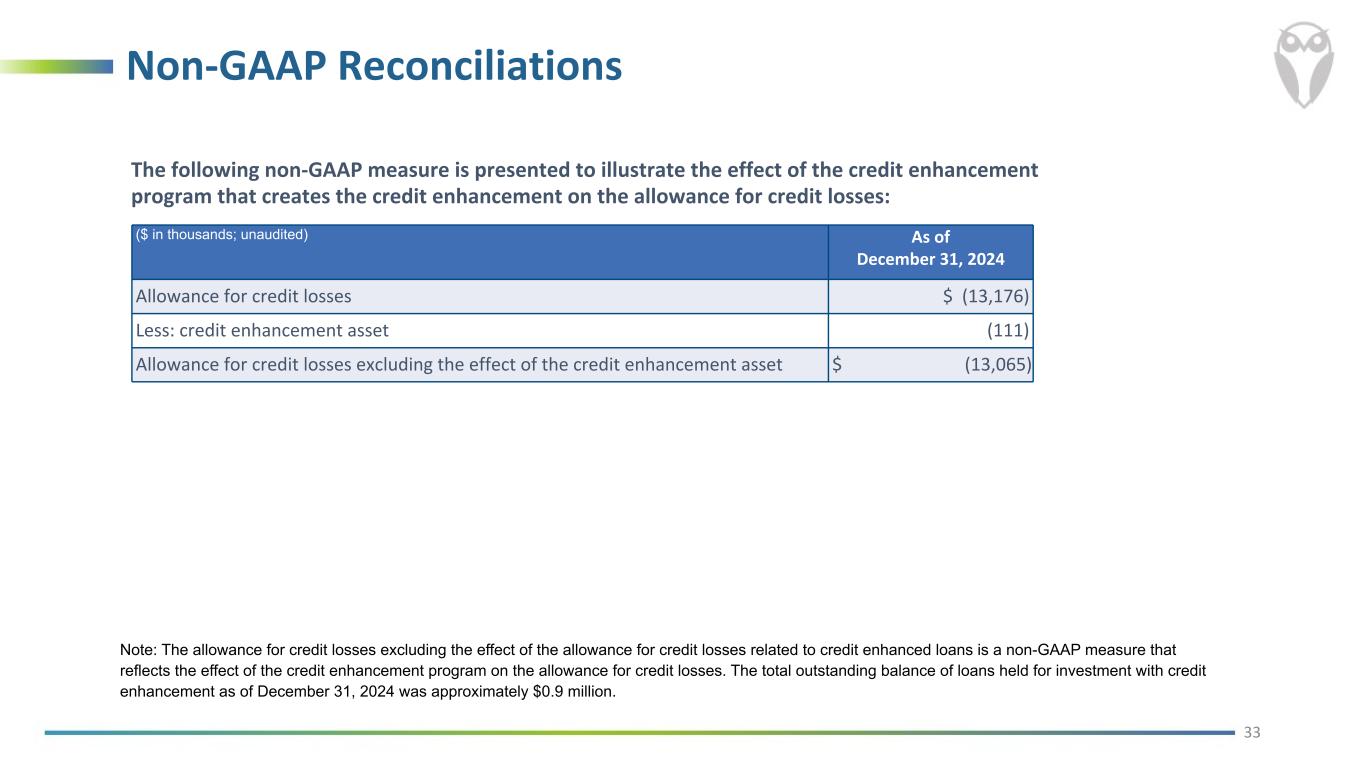

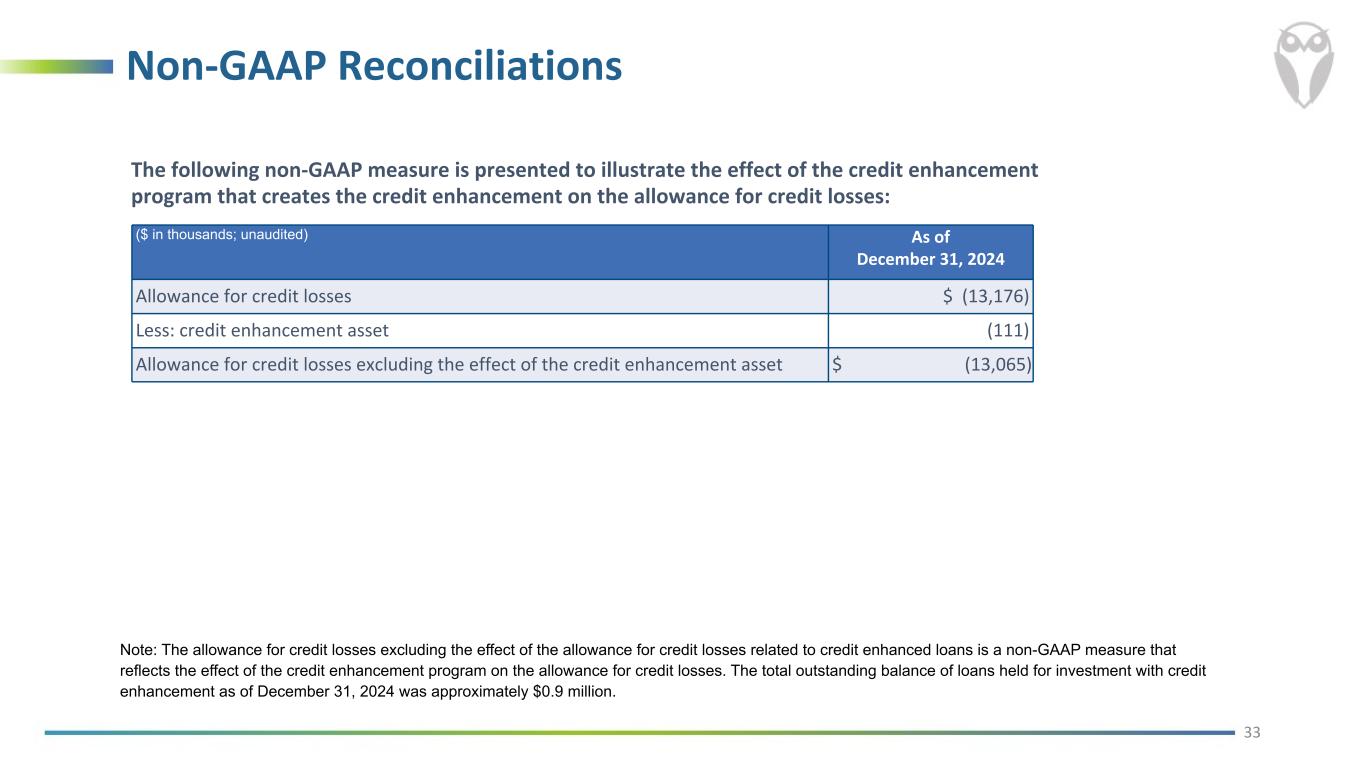

Non-GAAP Reconciliations 33 ($ in thousands; unaudited) As of December 31, 2024 Allowance for credit losses $ (13,176) Less: credit enhancement asset (111) Allowance for credit losses excluding the effect of the credit enhancement asset $ (13,065) The following non-GAAP measure is presented to illustrate the effect of the credit enhancement program that creates the credit enhancement on the allowance for credit losses: Note: The allowance for credit losses excluding the effect of the allowance for credit losses related to credit enhanced loans is a non-GAAP measure that reflects the effect of the credit enhancement program on the allowance for credit losses. The total outstanding balance of loans held for investment with credit enhancement as of December 31, 2024 was approximately $0.9 million.

Glossary of Terms Used 34 ACH (The Automated Clearing House). Electronic funds-transfer system that facilitates payments in the U.S. and internationally. The ACH is run by Nacha. API (Application Programming Interface). Set of defined rules that enable different applications to communicate with each other. It acts as an intermediary layer that processes data transfers between systems, letting companies open their application data and functionality to external third-party developers, business partners, and internal departments within their companies. Banking-as-a-Service (BaaS). Banking model in which licensed banks integrate their digital banking services directly into the products of other non-bank businesses. This allows non-bank businesses to offer their customers digital banking services such as mobile bank accounts, debit cards, loans and payment services, without needing to acquire a banking license of their own. The bank's system communicates via APIs and webhooks with that of the non-bank's business, enabling the end customer to access banking services directly through the non-bank’s website or app. BIN (Bank Identification Number) Sponsorship. BIN sponsorship allows fintech businesses to quickly gain direct access to the payment processing and card management services provided by the likes of Visa or Mastercard without going through the process of joining a major card scheme. It provides fintechs with quickest way to launch a financial product with a debit, credit or prepaid card attached. Credit Enhancement. FinWise generates interest income from existing and potential new strategic programs through contractual interest earned on loans maintained on the FinWise balance sheet. Fintech strategic programs using this product are required to hold a deposit account at FinWise against which charge-offs are recovered, and which is trued up monthly post any charge-offs. FedNow. The clearing service for financial institutions to provide immediate end-to-end payments to customers. The key difference between this service and the Fed’s previous system is that FedNow will be online 24/7, processing transactions in real time. HFI (Held for Investment). When a reporting entity holds an originated or purchased loan for which it has the intent and ability to hold for the foreseeable future or to maturity or payoff, the loan should be classified as held-for-investment. Loans held for investment are reported on the balance sheet at their amortized cost basis. HFS (Held for Sale). When a reporting entity originates or purchases a loan with the intent to sell the loan to another entity (e.g., a government sponsored enterprise). Mastercard RPPS (Remote Payment and Presentment Service). Mastercard RPPS optimizes electronic bill payment by connecting banks to billers. It offers a single, reliable connection for electronic payment providers to help with fast & secure consumer bill payments. Mastercard Send. Mastercard’s offering in the real-time personal payments arena. Senders can immediately make “push payments” to bank accounts, mobile wallets, prepaid debit cards, or targeted cash- out locations. The sender can initiate a Mastercard Send transaction with just the recipient’s debit card number. MoneyRailsTM is FinWise's Payments hub, which is a single-window platform through which companies can execute all their payments, and issue virtual cards. MoneyRails also provides the ability to safeguard funds in an array of account types: FBO and subaccounts to satisfy FinTechs’ deposit needs, as well as traditional Savings, Checking, Certificate of Deposits, etc. . Payment hubs increase fund control and visibility, reduce the risk associated with numerous fragmented payment processes, and improve overall operating efficiency. NIM: Net Interest Margin SBA 7(a) loans. Small-business loans issued by a private lender and partially backed by the U.S. Small Business Administration. SMBs. Small to medium-sized businesses. Strategic Program Lending - SPL (sometimes referred as Marketplace Lending). Lending predominately done through fintech platforms that connect borrowers with lenders. TBV: Tangible Book Value The Clearing House RTP. A real-time payments platform that all federally insured U.S. depository institutions are eligible to use for payments innovation. All RTP payments are processed by The Clearing House. When you pay your utility bill for the month using RTP, your bank sends message to network which includes the details of the payment. The Clearing House then processes the message and routes it to utility company's bank, completing the payment. Visa Direct. A type of Original Credit Transaction (OCT) that allows fast and secure payment transfers to customers using their card details. Unlike with other payment methods, where it can typically take up to 24 hours for the funds to be transferred to the customer, Visa Direct transactions normally complete near-instantly.