Exhibit 10.21

Certain portions of this exhibit (indicated by [***]) have been omitted as the Registrant has determined (i) the omitted information is not material and (ii) the omitted information would likely cause competitive harm to the Registrant if publicly disclosed

SYLVAMO CORPORATION

ANNUAL INCENTIVE PLAN (AIP)

Effective as of January 1, 2023

Pursuant to the Sylvamo Corporation 2021 Incentive Compensation Plan

I. Purposes of the Plan and Plan Description

The 2023 Annual Incentive Plan (the “Plan” or “AIP”), effective as of January 1, 2023, is governed by the Sylvamo Corporation 2021 Incentive Compensation Plan, as amended from time to time.

The purposes of the Plan are to: (a) provide an incentive to reward Participants for results in improving the financial performance of the Company; (b) attract and retain the best talent available; and (c) further align the interests of the Participants and the Company’s shareowners.

The Plan is an annual, cash incentive plan developed around the achievement of pre-established Performance Objectives and funded based on the Company’s achievement level against those Performance Objectives.

II. Definitions

Additional definitions, including the definitions of the performance metrics, can be found in Appendix A.

•Award Scale

“Award Scale” means the conversion of the Performance Objective Achievement to a percent of Target Award earned.

•Cause

“Cause” includes but is not limited to Misconduct or other activity detrimental to the business interest or reputation of the Company or continued unsatisfactory job performance without making reasonable efforts to improve. Examples include insubordination, protracted or repeated absence from work without permission, illegal activity, disorderly conduct, etc.

•Committee

“Committee” means the Management Development and Compensation Committee of the Company’s Board of Directors.

•Company

“Company” means Sylvamo Corporation, a Delaware corporation, together with its Subsidiaries.

•Executive Officer

“Executive Officer” means an Eligible Employee in a position designated as Senior Vice President.

•Maximum Award

“Maximum Award” means the an eligible Participants’ Target Award (as prorated, if applicable) and the sum of eligible Participants’ Target

Awards cannot not exceed 200% of the Target Award or sum of all Target Awards.

•Misconduct

“Misconduct” includes but is not limited to an act detrimental to the business interest or reputation of the Company or any act determined to be a deliberate disregard of the Company’s rules, or violation of the Eligible Employee’s Non-Competition or Non-Solicitation Agreement. The determination of whether a Participant has engaged in Misconduct shall be made by the Senior Vice President & Chief People Officer or by the Committee with regard to Executive Officers, or by the Board of Directors for a determination with regard to the CEO.

•Participant

“Participant” means a person who has been designated as a participant in the Plan, according to Section IV.

•Performance Objective Achievement

“Performance Objective Achievement” means the percentage amount assigned to a Performance Objective for a level of performance achievement.

•Performance Objectives

“Performance Objectives” mean the measures identified by the Company and approved by the Committee as set forth in Appendix A.

•Performance Reward Factor

“Performance Reward Factor” means a percentage amount determined by the Committee to be applied to the sum of eligible Participants’ Target Awards (excluding Executive Officers) multiplied by the Company’s percentage achievement of its Performance Objectives.

•Plan Year

“Plan Year” means the twelve-month period corresponding to the Company’s fiscal year (January 1 through December 31).

•Retirement Eligible

“Retirement Eligible” means an employee who is at least age 55 with 10 years of service or age 65.

•SEC

“SEC” means the Securities and Exchange Commission.

•Subsidiary

“Subsidiary” means any company that is owned (more than 50%) or controlled, directly or indirectly, by the Company.

•Target Award

“Target Award” means an amount equal to (a) for each Executive Officer, the percentage of base salary approved for such officer by the Committee or, for the Chief Executive Officer (the “CEO”), by the independent members of the Company’s Board of Directors, (b) for other Participants employed on a full-time basis, the target award amount applicable to the actual pay grade of such Participant, an illustration of which for U.S. target awards is shown in Appendix A and (c) for other Participants employed on a part-time basis, the target award amount applicable to the actual pay grade of such Participant, prorated for the percentage of time worked.

III. Administration of the Plan

The Plan operates at the discretion of the Committee. The Committee may exercise considerable discretion and judgment in interpreting the Plan, and

2

adopting, from time to time, rules and regulations that govern the administration of the Plan.

The Committee has delegated authority to the CEO or his designee for the day-to-day administration of the Plan, except with respect to awards made to the CEO or any other Executive Officer.

Decisions of the Committee are final, conclusive and binding on all parties, including the Company, its shareowners, and employees.

IV. Participation in the Plan

Participation in the Plan is limited to the CEO, Executive Officers and individuals who meet the definition of Eligible Employee as defined in Appendix A. Except as set forth in Section VI, a Participant must be an Eligible Employee as of September 30 of the Plan Year and on the date of the award payout in order to be eligible to receive a payout.

Employees who are eligible for participation in any other short-term, cash-based incentive compensation plan of the Company, including Mill Gainsharing Plans in the United States, with the exception of the Brazil Profit Sharing Plan, are not eligible for participation in the Plan.

An Eligible Employee who becomes eligible to participate in the Plan during the Plan Year or who moves from one eligible pay grade to another pay grade or becomes an Executive Officer or CEO will be eligible for a prorated award. An Eligible Employee who moves from an eligible position to a non-eligible position during the Plan Year will be eligible for a prorated award based on the number of months the employee was eligible during the Plan Year.

Participation in the Plan, or receipt of an award under the Plan, does not give a Participant or Eligible Employee any right to a subsequent award, or any right to continued employment by the Company for any period.

V. Performance Objectives

A.Achievement

The Company’s achievement of each Performance Objective will be evaluated by the Company as of the end of the Plan Year. The Company’s determination of its performance achievement will be presented to the Committee for its review and approval at the February meeting following the end of the Plan Year. The Company’s performance achievement under each performance metric will be evaluated by the Committee based on the Company’s financial statements. If the Committee determines that events or circumstances render the performance goals to be unsuitable, the Committee may modify such performance goals in whole or in part, as the Committee deems appropriate.

VI.Individual Participant Awards

A.Payout of Individual Awards

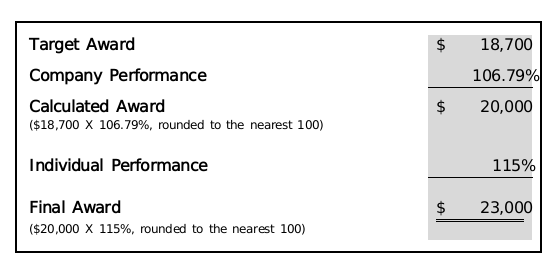

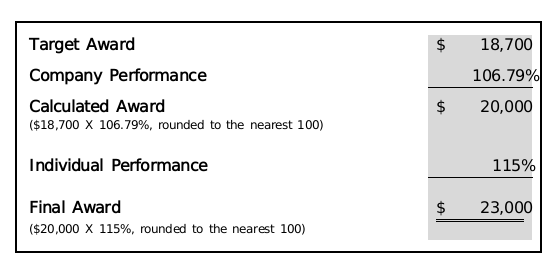

Participants each have a Target Award. A Participant’s Calculated Award is equal to the participant’s Target Award multiplied by the Company’s actual performance percentage achieved. A Participant’s Final Award is equal to the Participant’s Calculated Award adjusted by the Participant’s individual performance achievement, which may or may not include business unit, facility or mill performance, as determined by his or her manager against pre-established performance objectives or for the CEO by the Board of Directors and SVPs by the Committee. A Participant’s individual award is capped at 200% of his or her Target Award (as prorated, if applicable).

3

The following is an example of an award payout calculation for a Participant.

B.Impact of Leave of Absence for Salaried Employees

A Participant’s Target Award will not be reduced for the number of months on a leave of absence during the Plan Year. The Participant’s individual performance achievement, as determined above, against pre-established performance objectives will be considered in the Participant’s Final Award.

C.Cancellation of Award Upon Certain Events

An award not yet paid (prior to actual payment, see Note below) will be cancelled as of the date of the Participant’s termination of employment in the following events:

•Voluntary resignation before retirement eligibility; or

•Termination for Cause.

Note: Awards will be cancelled in the situations listed above even if time and performance have been met, but the award has not yet been physically paid at the time of termination. Any dispute as to whether any of the events described in this paragraph have occurred will be resolved by the Company or the Committee in its sole discretion in accordance with Section III.

D.Proration Upon Certain Events

An award not yet paid will be prorated based upon the number of months of employment during the Plan Year in which the Participant worked 15 days or more.

Awards paid at the target amount in connection with a termination scenario during the Plan Year are not deemed an AIP award and accordingly are not paid from the Total AIP Award Pool, but instead are charged to the appropriate cost center.

4

| TERMINATION SCENARIO | LAST DAY WORKED (i.e. Date of Termination) | AMOUNT TO BE PAID | TIME OF PAYMENT | ||||||||

| For All AIP-eligible Employees | |||||||||||

| DURING PLAN YEAR | |||||||||||

•Death •Long-Term Disability | 1/1 through 12/31 | Pro rata Target Award | As soon as practical following termination | ||||||||

•Retirement eligible1 •Eligible for Termination Allowance with signed Release2 (Even IF Retirement Eligible)1 •Company’s Divestiture of Participant’s Business1 | 1/1 through 6/30 | Pro rata Target Award | As soon as practical following termination | ||||||||

| 7/1 through 12/31 | Pro rata Calculated Award based on Actual performance | At time of normal AIP payout | |||||||||

| AFTER PLAN YEAR BUT BEFORE AIP PAYOUT | |||||||||||

•Death •Long-Term Disability •Eligible for Termination Allowance with signed Release2 •Company’s Divestiture of Participant’s Business •Retirement eligible | 1/1 (of year following Plan Year) through AIP payout date | Full prior year Calculated Award based on Actual performance | At time of normal AIP payout | ||||||||

1For the CEO and Senior Vice Presidents, these termination scenarios, regardless of termination date, will result in a pro rata calculated award based on Actual performance, to be paid at the normal AIP payout.

2U.S.: Eligible for a Termination Allowance under Company Salaried Employee Severance Plan. A U.S. Participant who does not sign the Company’s Termination Agreement and Release in connection with the payment of a Termination Allowance will forfeit his or her AIP award, unless retirement eligible.

VII. Payment of Awards

A.Type of Payment

AIP awards are paid in cash unless deferred by the Participant. Alternatively, the Committee may, in its sole discretion, authorize payment of all or a portion of earned AIP awards to all or certain groups of Participants under the Company’s Incentive Compensation Plan in shares of Company stock. For Participants outside of the United States, management has discretion to pay AIP in any form permitted by local law.

B.Time of Payment

Awards may be paid in one or two installments, as determined by the Committee. Each such installment will be deemed to be a separate payment for purposes of Section 409A of the Internal Revenue Code and Treas. Reg. §1.409A-2(b)(2)(iii).

5

In the event an award is paid in one installment, it will be made no later than March 15 following the Plan Year. In the event an award is paid in more than one installment, the first such payment will be made no later than March 15 following the Plan Year and the second such payment will be made no later than December 31 following the Plan Year. In no event will an award or any portion thereof be paid in the current Plan Year. For Participants outside of the United States, management has discretion to pay AIP at such time as is permitted by local law.

C.Payment to Beneficiaries

If a Participant dies prior to receipt of an approved award under the Plan, the award will be paid in accordance with the charts under Section VI in a lump sum to the Participant’s estate as soon as practicable but in no event later than 90 days after the date of death.

D.Deferral of Payment

Any Participant who is eligible for and has elected to participate in the Company’s Deferred Compensation Savings Plan (“DCSP”) may elect to defer payment, not to exceed 85%, of any award under the Plan by filing an irrevocable AIP Deferral Election by the last business day in December of the year prior to the year in which such award would be earned. Awards or portions elected to be deferred will be credited with investment earnings or losses in accordance with provisions of, and the Participant’s elections under, the DCSP. AIP awards that are deferred will be paid in accordance with the payment terms of the DCSP.

IX. Recoupment or Forfeiture of Awards

If the Company reasonably believes that a Participant has committed an act of Misconduct either during employment or within 90 days after such employment terminates, the Company may terminate the Participant’s participation in the Plan or seek recoupment of an award paid under the Plan. Recoupment may be effectuated by a notice of recapture (“Recapture Notice”) sent to such Participant within the 90-day period following the termination of employment. The Participant will be required to deliver to the Company an amount in cash equal to the gross cash payment of the award to which such Recapture Notice relates within 30 days after receiving such Recapture Notice from the Company.

The Company has sole and absolute discretion to take action or not to take action pursuant to this Section IX upon discovery of Misconduct, and its determination not to take action in any particular instance does not in any way limit its authority to terminate the participation of a Participant in the Plan and/or send a Recapture Notice in any other instance.

If any provision of this Section IX is determined to be unenforceable or invalid under any applicable law, such provision will be applied to the maximum extent permitted by applicable law, and shall automatically be deemed amended in a manner consistent with its objectives to the extent necessary to conform to any limitations required under applicable law.

X. Impact of Restatement of Financial Statements Upon Previous Awards

If any of the Company’s financial statements are required to be restated, resulting from errors, omissions, or fraud, the Committee may (in its sole discretion, but acting in good faith) direct that the Company recover all or a portion of any such award made to any, all or any class of Participants with respect to any fiscal year of the Company the financial results of which are negatively affected by such restatement. The amount to be recovered from any Participant shall be the amount by which the affected award(s) exceeded the amount that would have been payable to such Participant had the financial statements been initially filed as

6

restated, or any greater or lesser amount (including, but not limited to, the entire award) that the Committee shall determine. The Committee may determine to recover different amounts from different Participants or different classes of Participants on such bases as it shall deem appropriate. In no event shall the amount to be recovered by the Company be less than the amount required to be repaid or recovered as a matter of law. The Committee shall determine whether the Company shall effect any such recovery (i) by seeking repayment from the Participant, (ii) by reducing (subject to applicable law and the terms and conditions of the applicable plan, program or arrangement) the amount that would otherwise be payable to the Participant under any compensatory plan, program or arrangement maintained by the Company or any of its affiliates, (iii) by withholding payment of future increases in compensation (including the payment of any discretionary bonus amount) or grants of compensatory awards that would otherwise have been made in accordance with the Company’s otherwise applicable compensation practices, or (iv) by any combination of the foregoing.

XI. Modification, Suspension or Termination of Plan

The Committee may at any time suspend, terminate, modify or amend any or all of the provisions of the Plan.

XII. Governing Law

The Plan is governed by the laws of the State of Delaware. To the extent that applicable law in the local jurisdiction where a Participant resides requires modifications to the implementation of these Plan provisions, the Plan shall be implemented in accordance with such applicable law as it pertains to such resident Participants.

XIII. Tax Withholding

The Company has the right to make such provisions as it deems necessary or appropriate to satisfy any obligations it may have under law to withhold federal, state or local income or other taxes incurred by reason of payments pursuant to the Plan.

XIV. Section 409A

The Plan is intended to comply with the applicable requirements of Section 409A of the Internal Revenue Code of 1986, as amended (the “Code”), and will be limited, construed and interpreted in accordance with such intent.

XV. Non-Transferability of Award

No award under the Plan, and no rights or interests therein, will be assignable or transferable by a Participant (or legal representative).

7

Appendix A

2023 Annual Incentive Plan (AIP)

This Appendix A is effective as of January 1, 2023 and continues

until December 31, 2023, unless otherwise terminated, suspended, modified, or amended by the Committee prior to December 31, 2023.

| Plan Provision | 2023 Definition | |||||||

| Performance Reward Factor | 5% | |||||||

| Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization or Adjusted EBITDA | EBITDA adjusted to exclude the impact of Transfer Services Agreement costs and stock based compensation. In addition, Adjusted EBITDA may also reflect, in the Committee’s discretion, adjustment for any impact of acquisitions, divestitures, and/or the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results. | |||||||

| Adjusted EBITDA Margin | Adjusted EBITDA as a percentage of revenues (net sales). For purposes of calculating Adjusted EBITDA Margin, the percentage will be rounded up or down to the nearest tenth of a percentage point. | |||||||

| Capital Spending | “Invested in Capital Projects” as reported on the Consolidated Statement of Cash Flows in the Company’s financial statements included in its periodic filings with the SEC. Investments in M&A (mergers and acquisitions) and new paper machines will be excluded from the total Capital Spending. Capital Spending may be adjusted, in the Committee’s discretion, for any impact of acquisitions, divestitures, and/or the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results. | |||||||

| Earnings Before Interest, Taxes, Depreciation and Amortization or EBITDA | (1) earnings from continuing operations before interest, income taxes, equity earnings and cumulative effect of accounting changes, and before the impact of special items and non-operating pension expense, plus (2) depreciation, amortization, and cost of timber harvested. The EBITDA metric excludes the impact of non-operating pension expense and special items, including by way of example, but without limitation, gains or losses associated with the following: (a) asset write-downs or impairment charges; (b) litigation or claim judgments or settlements; (c) the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results; (d) accruals for reorganization and restructuring programs; (e) unusual or infrequently occurring items as described in then-current generally accepted accounting principles; (f) unusual or infrequently occurring items as described in management’s discussion and analysis of the Company’s financial condition and results of operations appearing in the Company’s annual report to shareowners for the applicable year; and (g) acquisitions or divestitures. | |||||||

8

| Eligible Employee | A regular, active employee of the Company employed on a non-temporary and full-time or part-time basis whose pay grade is 7 or higher in the United States or pay grade 1 to 6 in the Corporate functions or 14 or higher outside of the United States as set forth in Section IV. | |||||||

| Free Cash Flow | EBITDA (before special items and stock based compensation) less one-time costs related to the spin-off, Capital Spending plus/minus changes in Operating Working Capital, less taxes. The dollar amount will be rounded up or down to the nearest half million. | |||||||

| Operating Working Capital | Trade Receivables plus Total Inventory less absolute Trade Accounts Payable as reported internally. Operating Working Capital may be adjusted, in the Committee’s discretion, for any impact of acquisitions, divestitures, and/or the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results. | |||||||

2023 Performance Objective: Adjusted EBITDA Margin (50%) | Performance | Award % | ||||||

| [***] | [***] | |||||||

| [***] | [***] | |||||||

| [***] | [***] | |||||||

2023 Performance Objective: Free Cash Flow (50%) | Performance | Award % | ||||||

| [***] | [***] | |||||||

| [***] | [***] | |||||||

| [***] | [***] | |||||||

9

2023 U.S. Target Awards *Target Awards for non-U.S. participants vary based on local market practice. | Pay Grade | Target Award Value* | ||||||

| [***] | $196,700 | |||||||

| [***] | $178,900 | |||||||

| [***] | $151,200 | |||||||

| [***] | $140,900 | |||||||

| [***] | $115,000 | |||||||

| [***] | $107,900 | |||||||

| [***] | $87,200 | |||||||

| [***] | $69,100 | |||||||

| [***] | $61,500 | |||||||

| [***] | $47,000 | |||||||

| [***] | $44,900 | |||||||

| [***] | $32,900 | |||||||

| [***] | $29,000 | |||||||

| [***] | $26,700 | |||||||

| [***] | $18,700 | |||||||

| [***] | $17,200 | |||||||

| [***] | $9.200 | |||||||

| [***] | $8,800 | |||||||

| [***] | $8,200 | |||||||

| [***] | $7,600 | |||||||

| [***] | $7,100 | |||||||

| [***] | $6,500 | |||||||

| [***] | $6,100 | |||||||

| [***] | $3,500 | |||||||

| [***] | $3,200 | |||||||

| [***] | $2,900 | |||||||

| [***] | $2,600 | |||||||

| [***] | $2,400 | |||||||

| [***] | $2,200 | |||||||

10