Fiscal 2021 Third Quarter Financial Results DECEMBER 7, 2021

© Core & Main All Rights Reserved. Confidential and Proprietary Information. CAUTIONARY STATEMENTS 2 Cautionary Note Regarding Forward-Looking Statements This presentation and accompanying discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable terms. Forward-looking statements include, without limitation, all matters that are not historical facts. They include, without limitation, statements regarding our intentions, beliefs, assumptions or current expectations concerning, among other things, our financial position, results of operations, cash flows, prospects and growth strategies. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. Furthermore, new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Factors that could cause actual results and outcomes to differ from those reflected in forward- looking statements include, without limitation: declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; price fluctuations in our product costs, particularly with respect to the commodity-based products that we sell; the spread of, and response to, COVID-19, and the inability to predict the ultimate impact on us; general business and economic conditions; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the impact of seasonality and weather-related impacts, including natural disasters or similar extreme weather events; the fragmented and highly competitive markets in which we compete and consolidation within our industry; our ability to competitively bid for municipal contracts; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and region managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or restrictive supplier distribution rights are terminated; the availability and cost of freight and energy, such as fuel; the ability of our customers to make payments on credit sales; our ability to identify and introduce new products and product lines effectively; our ability to manage our inventory effectively, including during periods of supply chain disruptions; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficulties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products as well as work stoppages and other disruptions due to labor disputes; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; the domestic and international political environment with regard to trade relationships and tariffs, as well as difficulty sourcing products as a result of import constraints; our ability to operate our business consistently through highly dispersed locations across the United States; interruptions in the proper functioning of our IT systems, including from cybersecurity threats; risks associated with raising capital; our ability to continue our customer relationships with short-term contracts; changes in vendor rebates or other terms of our vendor agreements; risks associated with exporting our products internationally; our ability to renew or replace our existing leases on favorable terms or at all; our ability to maintain effective internal controls over financial reporting and remediate any material weaknesses; our substantial indebtedness and the potential that we may incur additional indebtedness; the limitations and restrictions in the agreements governing our indebtedness, the Second Amended and Restated Agreement of Limited Partnership of Core & Main Holdings, LP (“Holdings”) and the Tax Receivable Agreements (each as defined in our Quarterly Report on Form 10-Q for the quarterly period ended October 31, 2021). Increases in interest rates and the impact of transitioning from LIBOR as the benchmark rate in contracts; changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; the significant influence that Clayton, Dubilier & Rice, LLC (“CD&R”) has over us and potential conflicts between the interests of CD&R and other stockholders; and risks related to other factors described under “Risk Factors” in the prospectus (File No. 333-256382), dated July 22, 2021, filed with the Securities and Exchange Commission pursuant to Rule 424(b) under the Securities Act of 1933, as amended, on July 26, 2021. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, which speak only as of the date of this presentation. Use of Non-GAAP Financial Measures In addition to providing results that are determined in accordance with GAAP, we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income attributable to Core & Main, Inc., cash provided by or used in operating, investing or financing activities or other financial statement data presented in the financial statements as an indicator of our financial performance or liquidity. We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin, Adjusted Net Income and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. We present these non-GAAP financial measures because we believe that investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Reconciliations of such non-GAAP measures to the most directly comparable GAAP measure and calculations of the non-GAAP measures are set forth in the appendix of this presentation. No reconciliation of the estimated range for Adjusted EBITDA for fiscal 2021 is included herein because we are unable to quantify certain amounts that would be required to be included in net income attributable to Core & Main, Inc., the most directly comparable GAAP measure, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses and associated taxes cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP results. Presentation of Financial Information The accompanying unaudited financial information presents the results of operations, financial position and cash flows of Core & Main, Inc. (“Core & Main” or the “Company”) and its subsidiaries, which includes the consolidated financial information of Holdings and its consolidated subsidiary, Core & Main LP, as the legal entity that conducts the operations of the Company. Core & Main is the primary beneficiary and general partner of Holdings and has decision making authority that significantly affects the economic performance of the entity. As a result, Core & Main consolidates the consolidated financial statements of Holdings. All intercompany balances and transactions have been eliminated in consolidation. The Company records non-controlling interests related to Partnership Interests (as defined in the Prospectus) held by the Continuing Limited Partners (as defined in the Prospectus) in Holdings. The Company’s fiscal year is a 52 or 53 week period ending on the Sunday nearest to January 31st. Quarters within the fiscal year include 13-week periods, unless a fiscal year includes a 53rd week, in which case the fourth quarter of the fiscal year will be a 14-week period. Both the three months ended October 31, 2021 and three months ended November 1, 2020 included 13 weeks, and both the nine months ended October 31, 2021 and nine months ended November 1, 2020 included 39 weeks. The current fiscal year ending January 30, 2022 (“fiscal 2021”) will include 52 weeks.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. TODAY’S PRESENTERS 3 000 Steve LeClair Chief Executive Officer Mark Witkowski Chief Financial Officer Robyn Bradbury VP, Investor Relations and FP&A

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 4 1 Company Overview & Business Update 2 Financial Highlights 3 Q&A and Closing Remarks

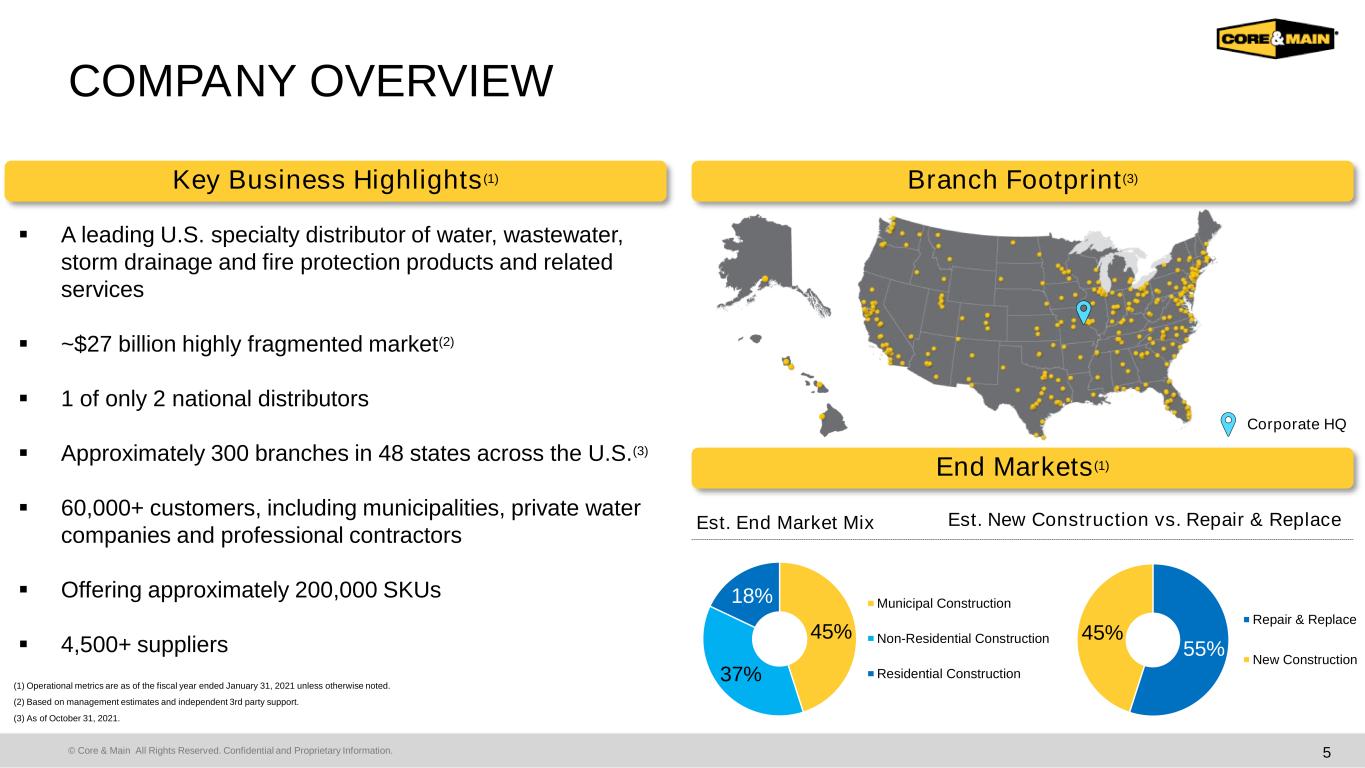

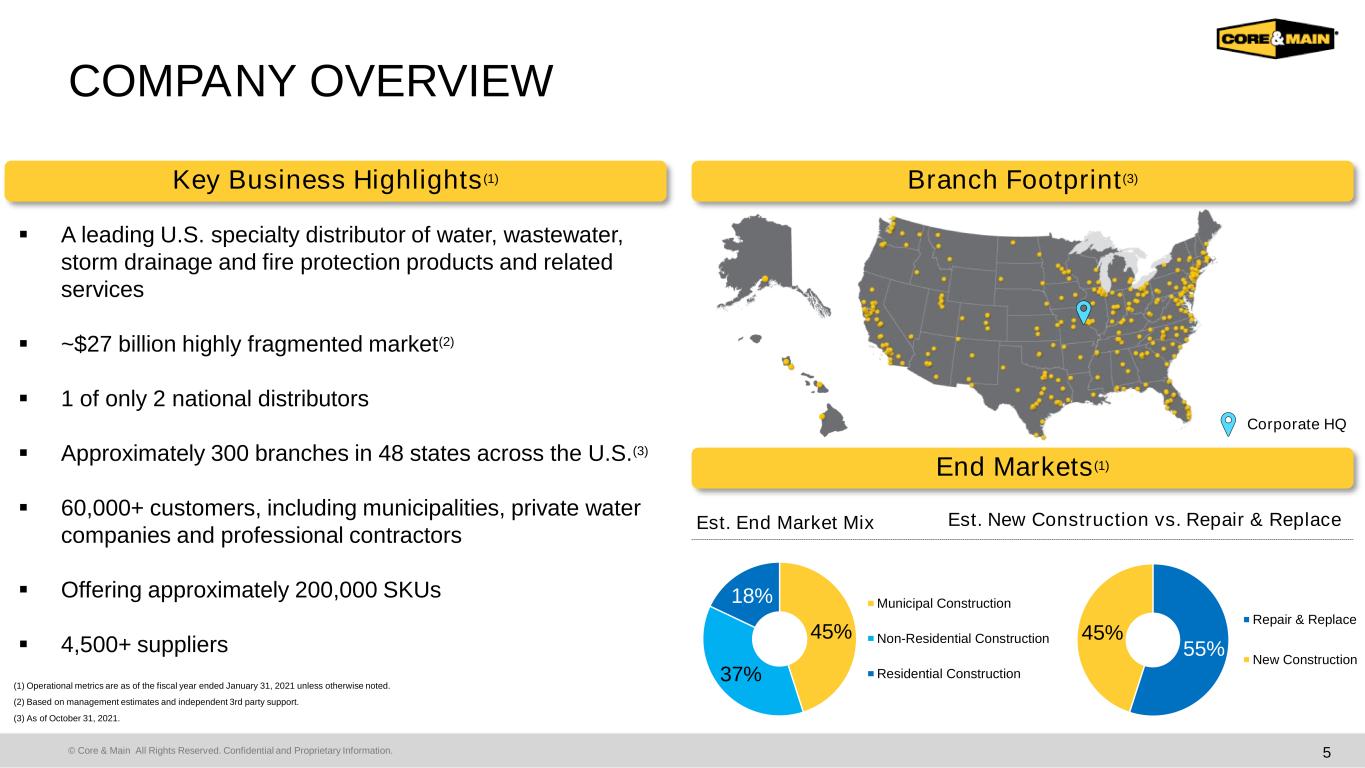

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 45% 37% 18% Municipal Construction Non-Residential Construction Residential Construction 55% 45% Repair & Replace New Construction COMPANY OVERVIEW 5 Key Business Highlights(1) Branch Footprint(3) End Markets(1) ▪ A leading U.S. specialty distributor of water, wastewater, storm drainage and fire protection products and related services ▪ ~$27 billion highly fragmented market(2) ▪ 1 of only 2 national distributors ▪ Approximately 300 branches in 48 states across the U.S.(3) ▪ 60,000+ customers, including municipalities, private water companies and professional contractors ▪ Offering approximately 200,000 SKUs ▪ 4,500+ suppliers (1) Operational metrics are as of the fiscal year ended January 31, 2021 unless otherwise noted. (2) Based on management estimates and independent 3rd party support. (3) As of October 31, 2021. Corporate HQ Est. End Market Mix Est. New Construction vs. Repair & Replace

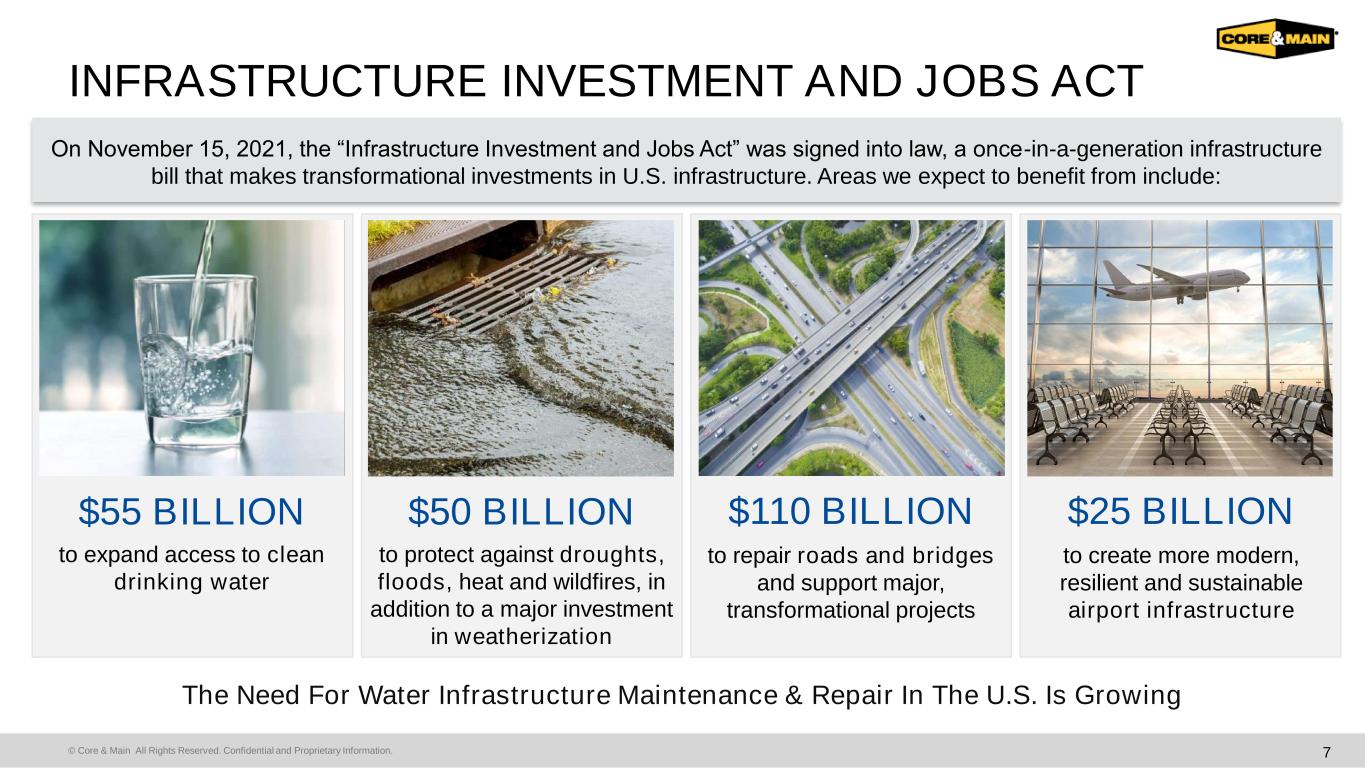

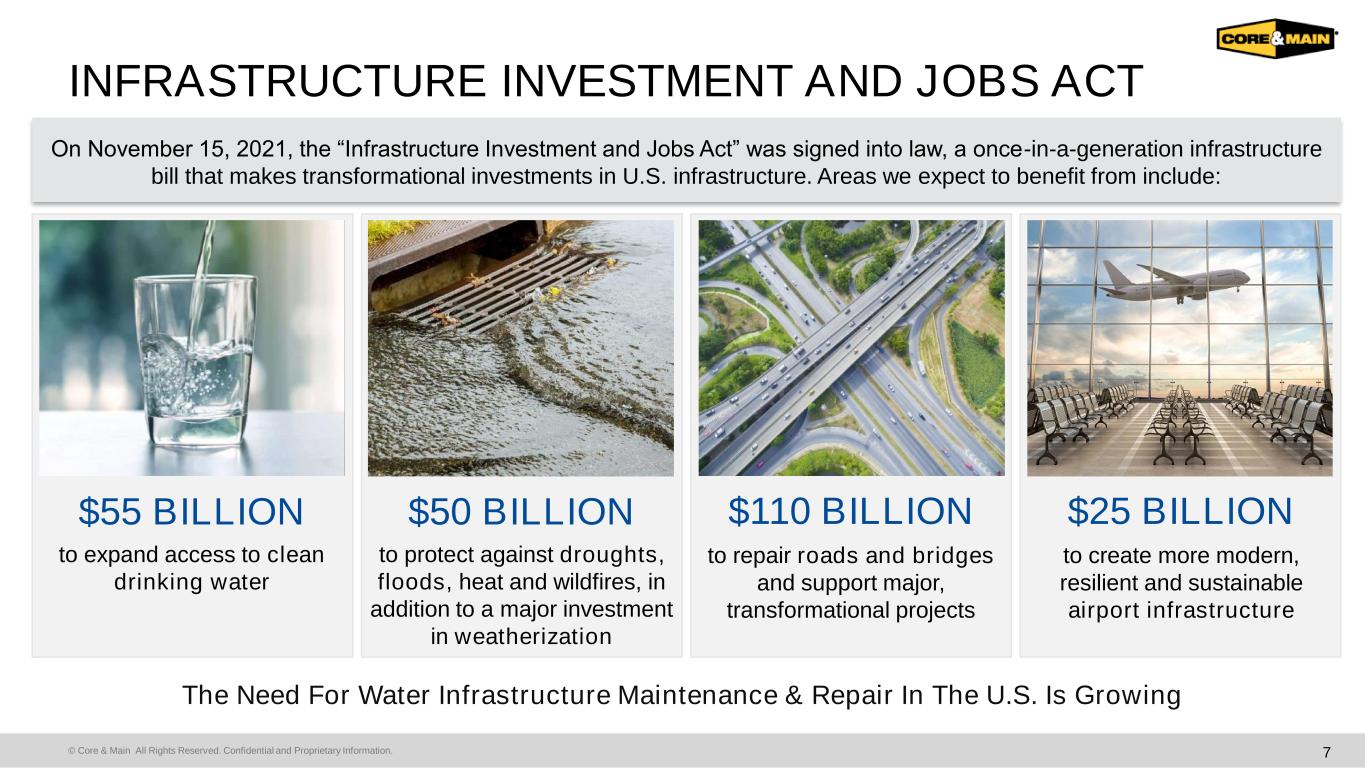

© Core & Main All Rights Reserved. Confidential and Proprietary Information. THIRD QUARTER EXECUTION HIGHLIGHTS 6 ✓ Delivered record net sales of over $1.4 billion, representing 39% growth compared with the prior year period ✓ Net income increased 406% compared with the prior year period to $109 million ✓ Adjusted EBITDA increased 83% compared with the prior year period to $189 million ✓ Continue to navigate supply chain uncertainty, heavy demand, resource constraints and price inflation ✓ Opened a new branch in Austin, TX, our 3rd greenfield location this year ✓ Closed four acquisitions during and subsequent to the third quarter – Pacific Pipe Co. (Aug. 9, 2021) – L & M Bag & Supply Co. (Aug. 30, 2021) – CES Industrial Supply, LLC (Oct. 6, 2021) – Catalone Pipe & Supply Co. (Nov. 8, 2021) ✓ Robust virtual and in-person training season underway ✓ Continued evolution of ESG strategy and goals ✓ “Infrastructure Investment and Jobs Act” signed into law on November 15, 2021

© Core & Main All Rights Reserved. Confidential and Proprietary Information. INFRASTRUCTURE INVESTMENT AND JOBS ACT 7 On November 15, 2021, the “Infrastructure Investment and Jobs Act” was signed into law, a once-in-a-generation infrastructure bill that makes transformational investments in U.S. infrastructure. Areas we expect to benefit from include: The Need For Water Infrastructure Maintenance & Repair In The U.S. Is Growing to expand access to clean drinking water to protect against droughts, floods, heat and wildfires, in addition to a major investment in weatherization to repair roads and bridges and support major, transformational projects to create more modern, resilient and sustainable airport infrastructure $50 BILLION $110 BILLION $25 BILLION $55 BILLION

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 8 1 Company Overview & Business Update 2 Financial Highlights 3 Q&A and Closing Remarks

© Core & Main All Rights Reserved. Confidential and Proprietary Information. $21 $105 Q3'20 Q3'21 $103 $189 Q3'20 Q3'21 $1,013 $1,405 Q3'20 Q3'21 THIRD QUARTER OPERATING RESULTS 9 Net Sales Gross Profit Adjusted Net Income(1) Adjusted EBITDA(1) (1) Adjusted Net Income, Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. +39% ($ in Millions) ($ in Millions) ($ in Millions)($ in Millions) % Margin(1) $244 $371 Q3'20 Q3'21 10.2% 13.5%+330 bps % Margin 24.1% 26.4%+230 bps +83% +52% +400%

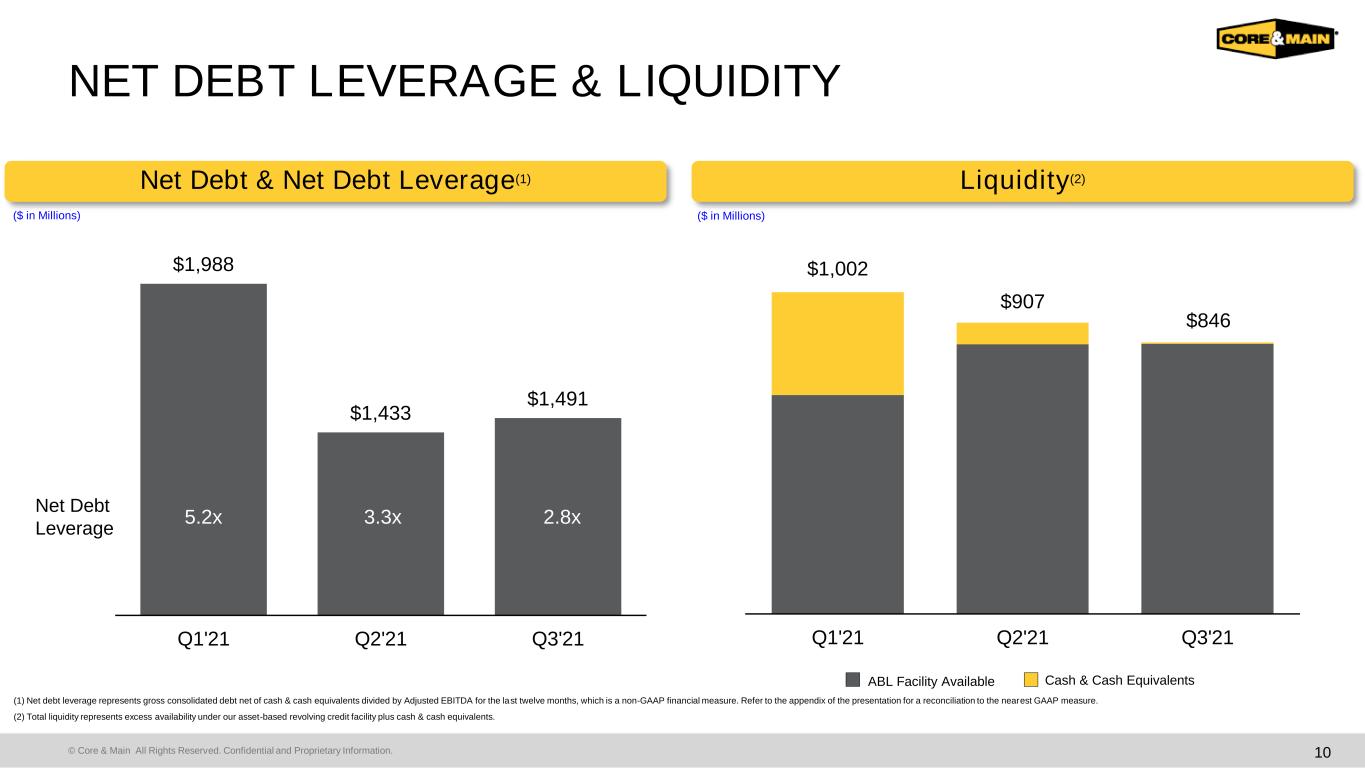

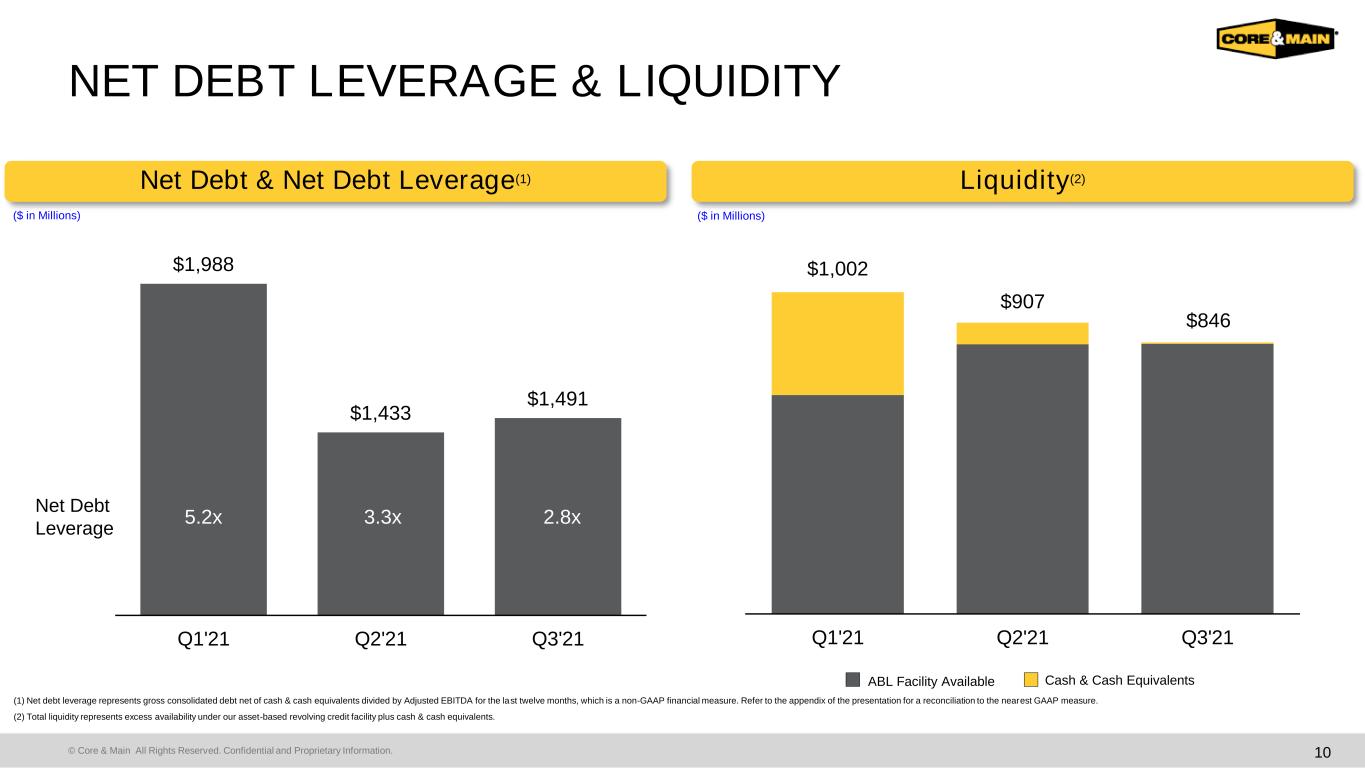

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Liquidity(2)Net Debt & Net Debt Leverage(1) NET DEBT LEVERAGE & LIQUIDITY 10 (1) Net debt leverage represents gross consolidated debt net of cash & cash equivalents divided by Adjusted EBITDA for the last twelve months, which is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (2) Total liquidity represents excess availability under our asset-based revolving credit facility plus cash & cash equivalents. Net Debt Leverage ABL Facility Available Cash & Cash Equivalents $1,988 $1,433 $1,491 Q1'21 Q2'21 Q3'21 $1,002 $907 $846 Q1'21 Q2'21 Q3'21 5.2x 3.3x 2.8x ($ in Millions) ($ in Millions)

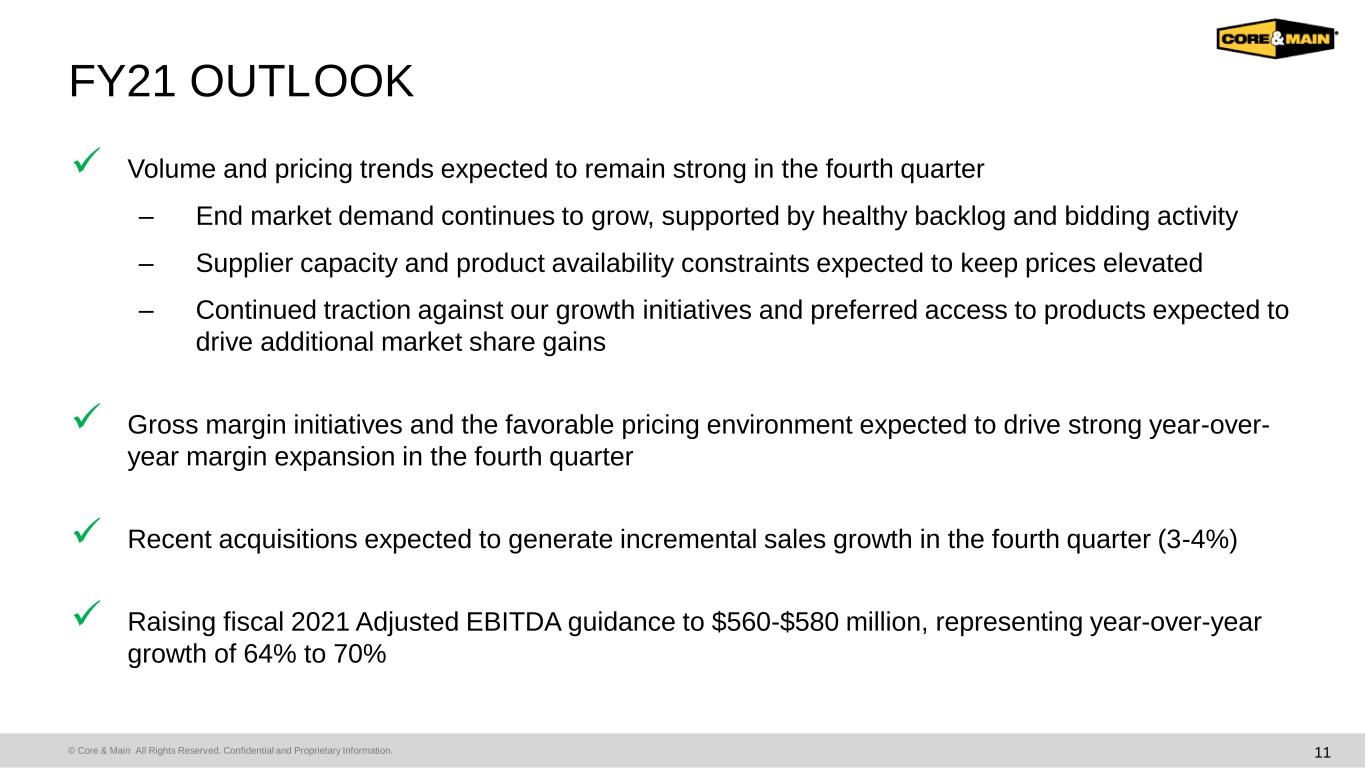

© Core & Main All Rights Reserved. Confidential and Proprietary Information. FY21 OUTLOOK 11 ✓ Volume and pricing trends expected to remain strong in the fourth quarter – End market demand continues to grow, supported by healthy backlog and bidding activity – Supplier capacity and product availability constraints expected to keep prices elevated – Continued traction against our growth initiatives and preferred access to products expected to drive additional market share gains ✓ Gross margin initiatives and the favorable pricing environment expected to drive strong year-over- year margin expansion in the fourth quarter ✓ Recent acquisitions expected to generate incremental sales growth in the fourth quarter (3-4%) ✓ Raising fiscal 2021 Adjusted EBITDA guidance to $560-$580 million, representing year-over-year growth of 64% to 70%

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 12 1 Company Overview & Business Update 2 Financial Highlights 3 Q&A and Closing Remarks

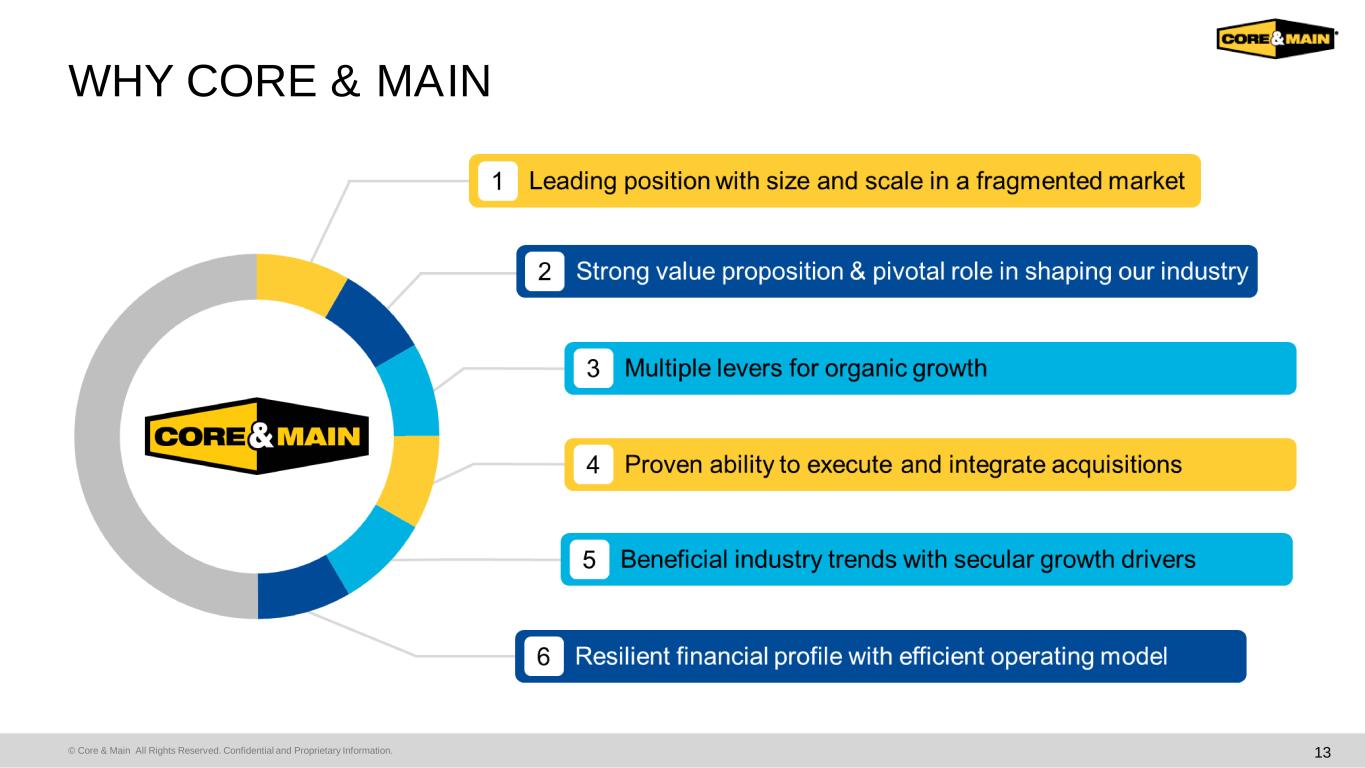

© Core & Main All Rights Reserved. Confidential and Proprietary Information. WHY CORE & MAIN 13

© Core & Main All Rights Reserved. Confidential and Proprietary Information. APPENDIX 14

© Core & Main All Rights Reserved. Confidential and Proprietary Information. PRODUCT & SERVICE OFFERING 15

© Core & Main All Rights Reserved. Confidential and Proprietary Information. MULTIPLE GROWTH DRIVERS 16 Multiple Levers To Drive Profitable Growth And Generate Shareholder Value ✓ Strong underlying market fundamentals ✓ Grow share locally ✓ Underpenetrated markets and product categories ✓ Accelerate new product adoption ✓ Consolidate existing market positions ✓ Expansion into new markets ✓ Expansion into new and underpenetrated product categories ✓ Key talent and capability enhancement Acquisitions ✓ Private label & global sourcing ✓ Product margin expansion ✓ Category management optimization ✓ SG&A productivity and leverage Margin Expansion Organic Growth

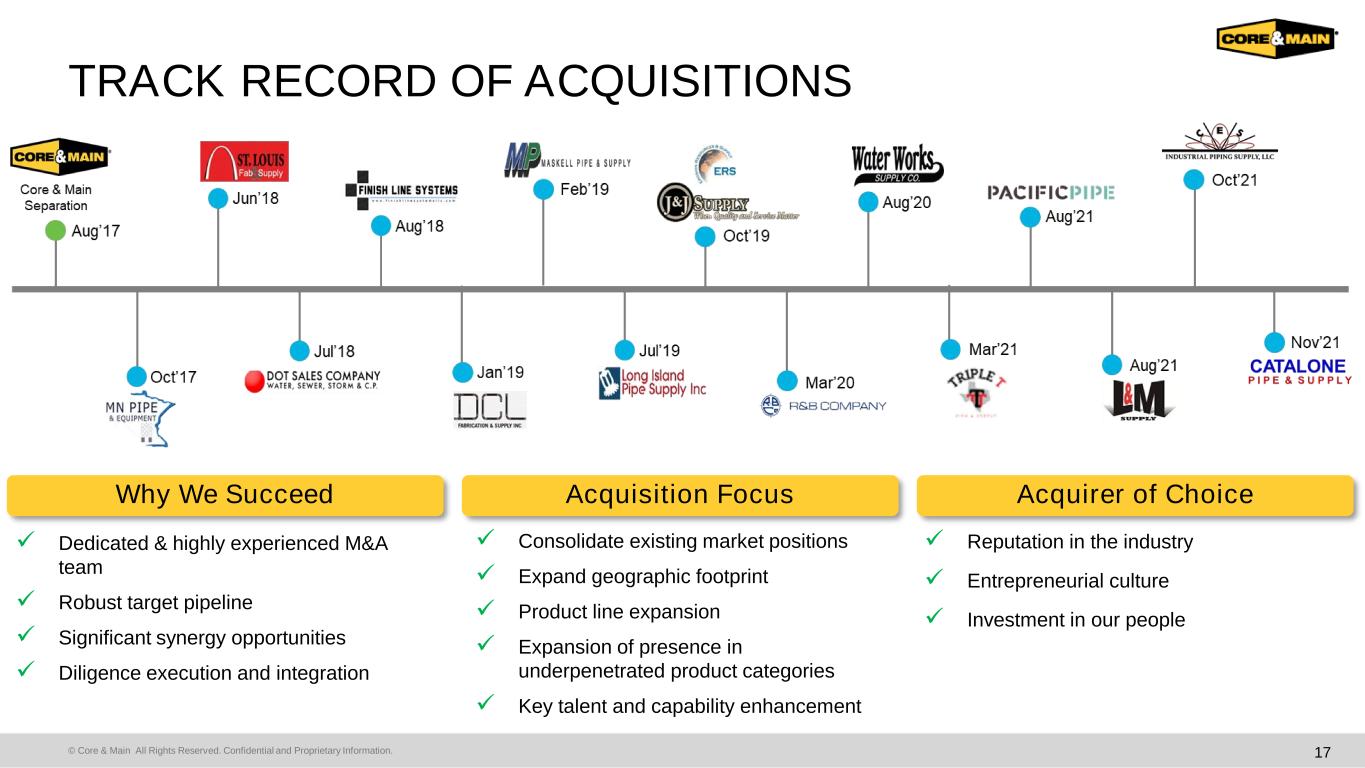

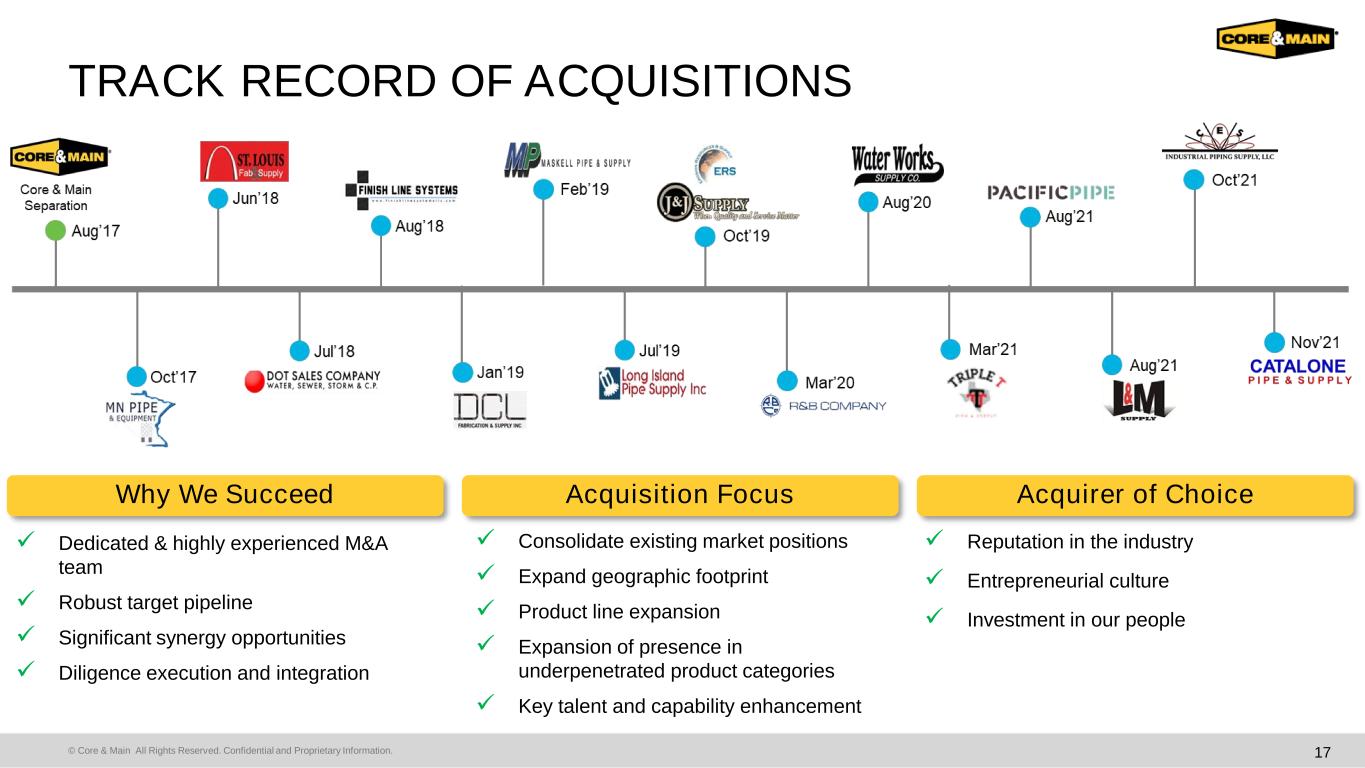

© Core & Main All Rights Reserved. Confidential and Proprietary Information. TRACK RECORD OF ACQUISITIONS 17 Organic Growth Why We Succeed Acquisition Focus Acquirer of Choice ✓ Reputation in the industry ✓ Entrepreneurial culture ✓ Investment in our people ✓ Consolidate existing market positions ✓ Expand geographic footprint ✓ Product line expansion ✓ Expansion of presence in underpenetrated product categories ✓ Key talent and capability enhancement ✓ Dedicated & highly experienced M&A team ✓ Robust target pipeline ✓ Significant synergy opportunities ✓ Diligence execution and integration

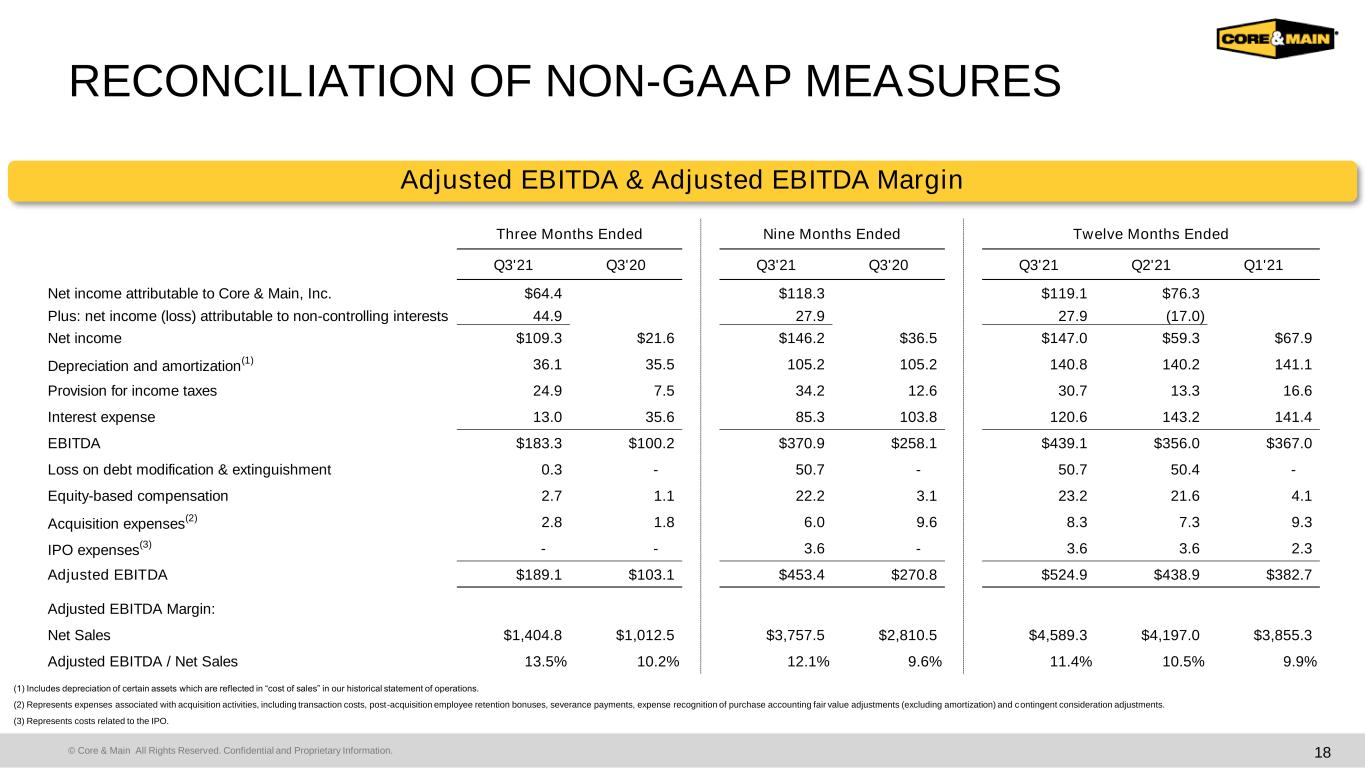

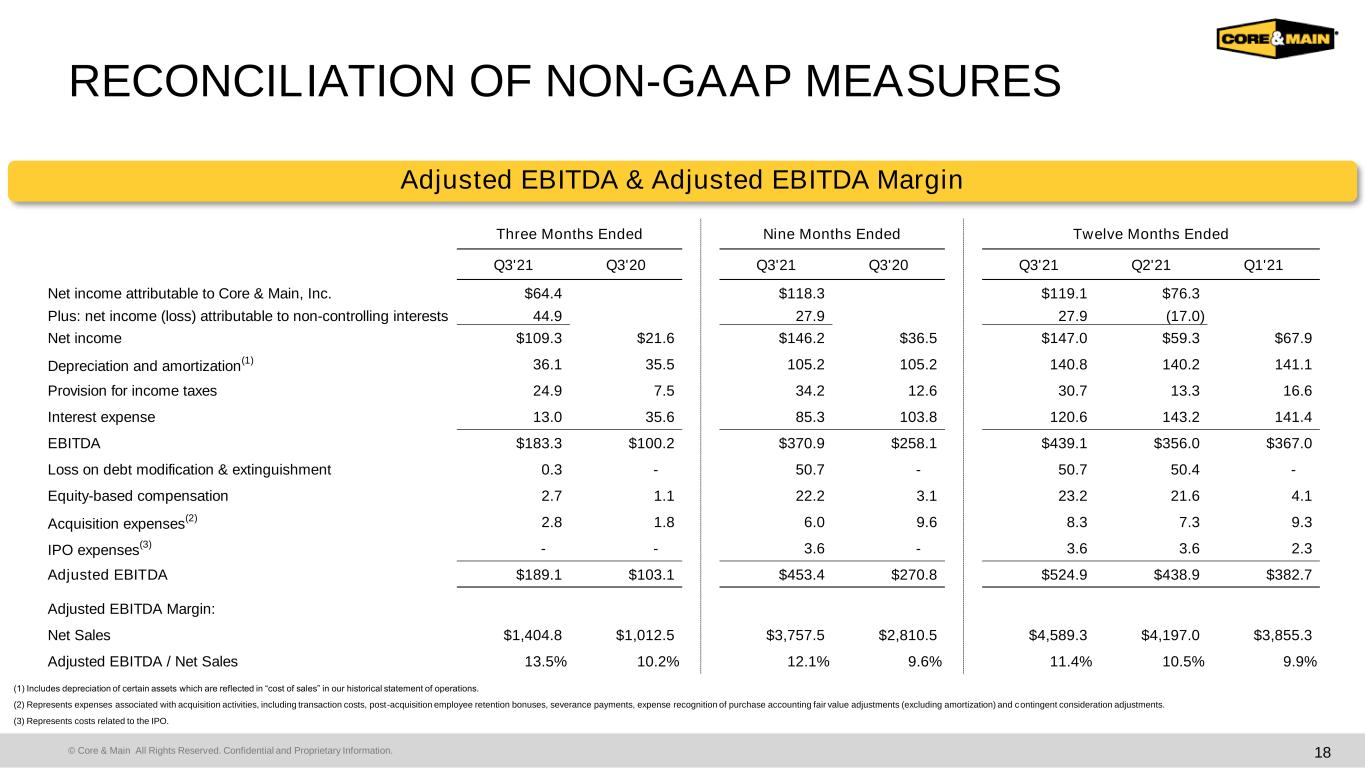

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Q3'21 Q3'20 Q3'21 Q3'20 Q3'21 Q2'21 Q1'21 Net income attributable to Core & Main, Inc. $64.4 $118.3 $119.1 $76.3 Plus: net income (loss) attributable to non-controlling interests 44.9 27.9 27.9 (17.0) Net income $109.3 $21.6 $146.2 $36.5 $147.0 $59.3 $67.9 Depreciation and amortization (1) 36.1 35.5 105.2 105.2 140.8 140.2 141.1 Provision for income taxes 24.9 7.5 34.2 12.6 30.7 13.3 16.6 Interest expense 13.0 35.6 85.3 103.8 120.6 143.2 141.4 EBITDA $183.3 $100.2 $370.9 $258.1 $439.1 $356.0 $367.0 Loss on debt modification & extinguishment 0.3 - 50.7 - 50.7 50.4 - Equity-based compensation 2.7 1.1 22.2 3.1 23.2 21.6 4.1 Acquisition expenses (2) 2.8 1.8 6.0 9.6 8.3 7.3 9.3 IPO expenses (3) - - 3.6 - 3.6 3.6 2.3 Adjusted EBITDA $189.1 $103.1 $453.4 $270.8 $524.9 $438.9 $382.7 Adjusted EBITDA Margin: Net Sales $1,404.8 $1,012.5 $3,757.5 $2,810.5 $4,589.3 $4,197.0 $3,855.3 Adjusted EBITDA / Net Sales 13.5% 10.2% 12.1% 9.6% 11.4% 10.5% 9.9% Three Months Ended Twelve Months EndedNine Months Ended RECONCILIATION OF NON-GAAP MEASURES 18 Adjusted EBITDA & Adjusted EBITDA Margin (1) Includes depreciation of certain assets which are reflected in “cost of sales” in our historical statement of operations. (2) Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments, expense recognition of purchase accounting fair value adjustments (excluding amortization) and contingent consideration adjustments. (3) Represents costs related to the IPO.

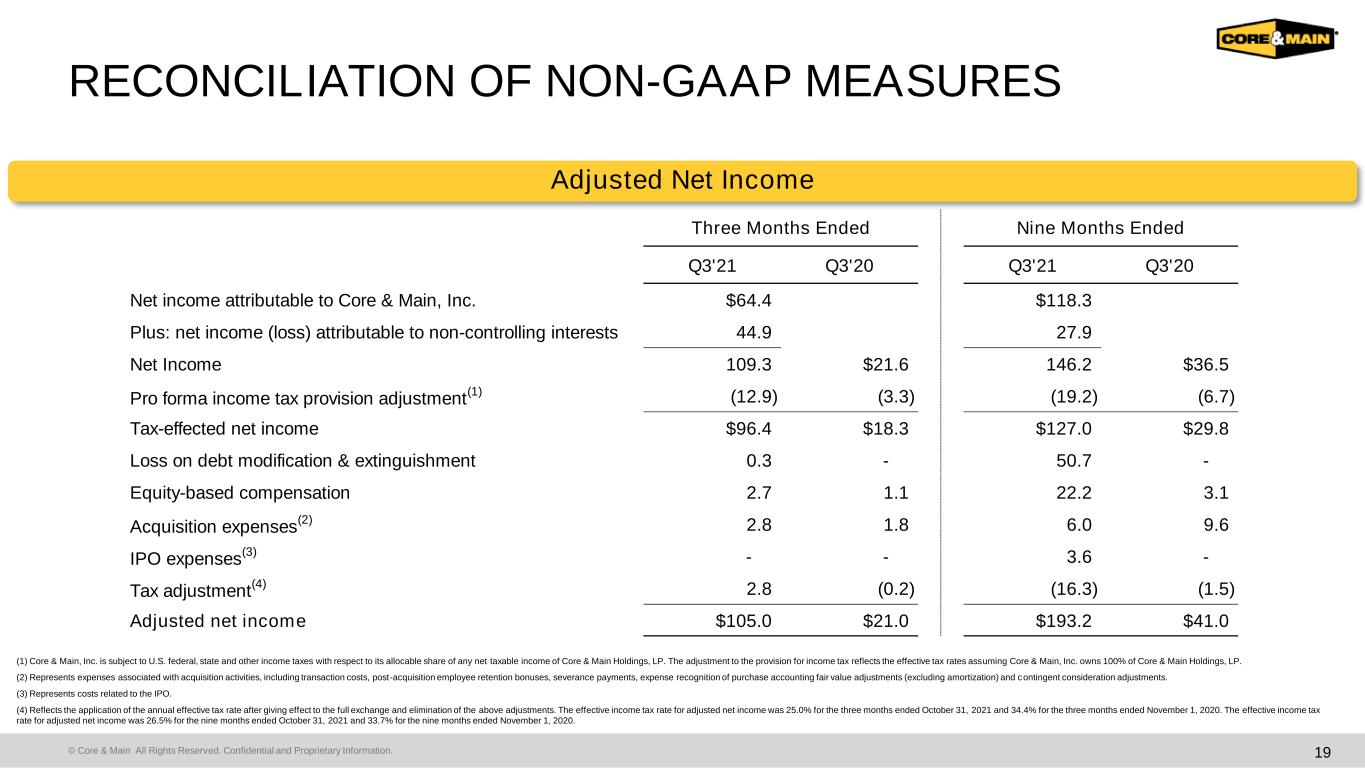

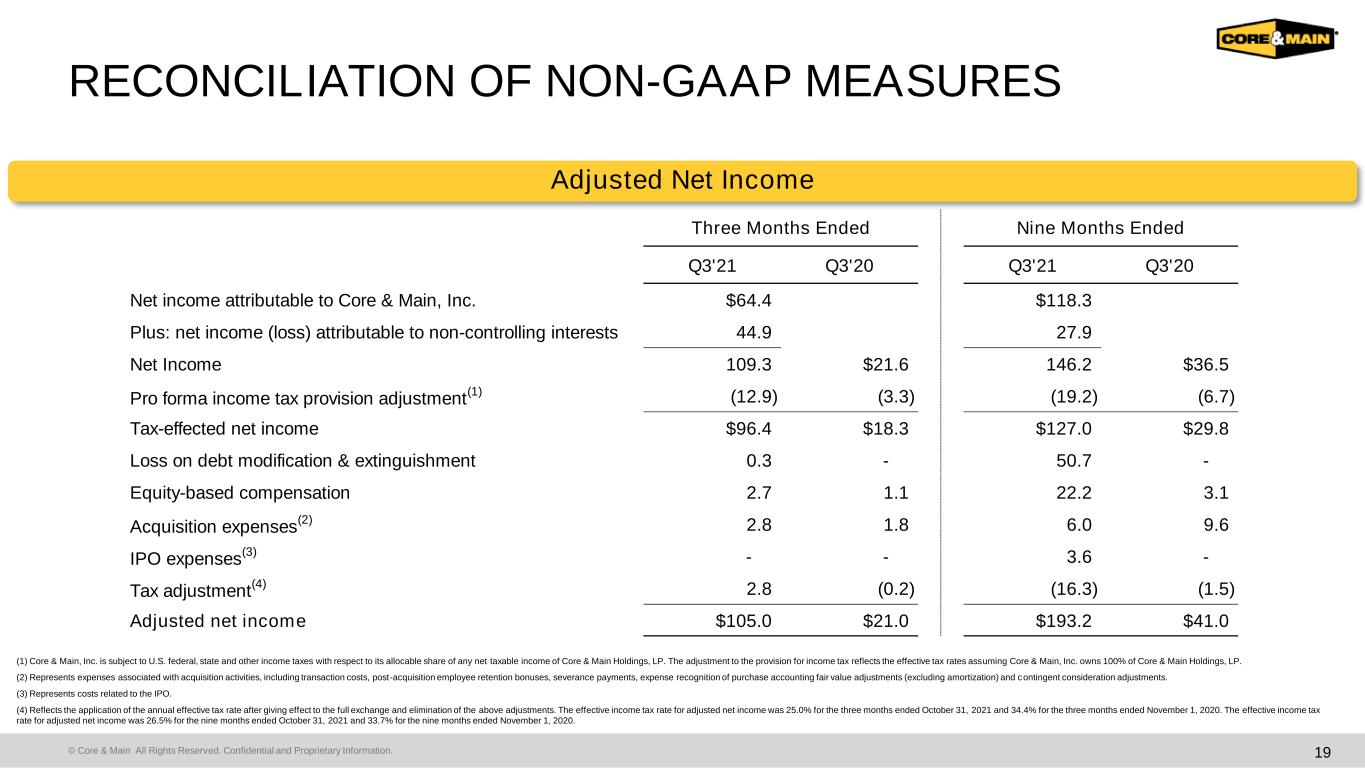

© Core & Main All Rights Reserved. Confidential and Proprietary Information. Q3'21 Q3'20 Q3'21 Q3'20 Net income attributable to Core & Main, Inc. $64.4 $118.3 Plus: net income (loss) attributable to non-controlling interests 44.9 27.9 Net Income 109.3 $21.6 146.2 $36.5 Pro forma income tax provision adjustment (1) (12.9) (3.3) (19.2) (6.7) Tax-effected net income $96.4 $18.3 $127.0 $29.8 Loss on debt modification & extinguishment 0.3 - 50.7 - Equity-based compensation 2.7 1.1 22.2 3.1 Acquisition expenses (2) 2.8 1.8 6.0 9.6 IPO expenses (3) - - 3.6 - Tax adjustment (4) 2.8 (0.2) (16.3) (1.5) Adjusted net income $105.0 $21.0 $193.2 $41.0 Three Months Ended Nine Months Ended RECONCILIATION OF NON-GAAP MEASURES 19 Adjusted Net Income (1) Core & Main, Inc. is subject to U.S. federal, state and other income taxes with respect to its allocable share of any net taxable income of Core & Main Holdings, LP. The adjustment to the provision for income tax reflects the effective tax rates assuming Core & Main, Inc. owns 100% of Core & Main Holdings, LP. (2) Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments, expense recognition of purchase accounting fair value adjustments (excluding amortization) and contingent consideration adjustments. (3) Represents costs related to the IPO. (4) Reflects the application of the annual effective tax rate after giving effect to the full exchange and elimination of the above adjustments. The effective income tax rate for adjusted net income was 25.0% for the three months ended October 31, 2021 and 34.4% for the three months ended November 1, 2020. The effective income tax rate for adjusted net income was 26.5% for the nine months ended October 31, 2021 and 33.7% for the nine months ended November 1, 2020.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 20 Net Debt Leverage Q3'21 Q2'21 Q1'21 Senior Term Loan due August 2024 - - 1,257.8 Senior Notes due September 2024 - - 300.0 Senior Notes due August 2025 - - 750.0 ABL Credit Facility due July 2026 - - - Senior Term Loan due July 2028 1,496.3 1,500.0 - Total debt $1,496.3 $1,500.0 $2,307.8 Less: cash & cash equivalents (4.9) (66.6) (320.2) Net debt $1,491.4 $1,433.4 $1,987.6 Twelve months ended Adjusted EBITDA 524.9 438.9 382.7 Net debt leverage 2.8x 3.3x 5.2x As Of