Fiscal 2022 Fourth Quarter and Full-Year Results MARCH 28, 2023

© Core & Main All Rights Reserved. Confidential and Proprietary Information. CAUTIONARY STATEMENTS 2 Cautionary Note Regarding Forward-Looking Statements This presentation and accompanying discussion may include “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements include, without limitation, all statements other than statements of historical facts contained in our accompanying Annual Report on Form 10-K for the fiscal year ended January 29, 2023, including statements relating to our intentions, beliefs, assumptions or current expectations concerning, among other things, our future results of operations and financial position, business strategy and plans and objectives of management for future operations, including, among others, statements regarding expected growth, future capital expenditures and debt service obligations, and the anticipated impact of the novel coronavirus, or COVID-19, on our business, are forward-looking statements. Some of the forward-looking statements can be identified by the use of forward-looking terms such as “believes,” “expects,” “may,” “will,” “shall,” “should,” “would,” “could,” “seeks,” “aims,” “projects,” “is optimistic,” “intends,” “plans,” “estimates,” “anticipates” or the negative versions of these words or other comparable terms. Forward-looking statements are subject to known and unknown risks and uncertainties, many of which may be outside our control. We caution you that forward-looking statements are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of the market in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this presentation. In addition, even if our results of operations, financial condition and cash flows, and the development of the market in which we operate, are consistent with the forward-looking statements contained in this presentation, those results or developments may not be indicative of results or developments in subsequent periods. A number of important factors, including, without limitation, the risks and uncertainties discussed under the captions “Risk Factors” in our Annual Report on Form 10-K for the fiscal year ended January 29, 2023 and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K, could cause actual results and outcomes to differ materially from those reflected in the forward-looking statements. Furthermore, new risks and uncertainties emerge from time to time, and it is not possible for us to predict all risks and uncertainties that could have an impact on the forward-looking statements contained in this presentation. Factors that could cause actual results and outcomes to differ from those reflected in forward-looking statements include, without limitation: declines, volatility and cyclicality in the U.S. residential and non-residential construction markets; slowdowns in municipal infrastructure spending and delays in appropriations of federal funds; our ability to competitively bid for municipal contracts; price fluctuations in our product costs; our ability to manage our inventory effectively, including during periods of supply chain disruptions; risks involved with acquisitions and other strategic transactions, including our ability to identify, acquire, close or integrate acquisition targets successfully; the fragmented and highly competitive markets in which we compete and consolidation within our industry; the development of alternatives to distributors of our products in the supply chain; our ability to hire, engage and retain key personnel, including sales representatives, qualified branch, district and region managers and senior management; our ability to identify, develop and maintain relationships with a sufficient number of qualified suppliers and the potential that our exclusive or restrictive supplier distribution rights are terminated; the availability and cost of freight; the ability of our customers to make payments on credit sales; changes in supplier rebates or other terms of our supplier agreements; our ability to identify and introduce new products and product lines effectively; the spread of, and response to public health crises and the inability to predict the ultimate impact on us; costs and potential liabilities or obligations imposed by environmental, health and safety laws and requirements; regulatory change and the costs of compliance with regulation; changes in stakeholder expectations in respect of ESG and sustainability practices; exposure to product liability, construction defect and warranty claims and other litigation and legal proceedings; potential harm to our reputation; difficulties with or interruptions of our fabrication services; safety and labor risks associated with the distribution of our products as well as work stoppages and other disruptions due to labor disputes; impairment in the carrying value of goodwill, intangible assets or other long-lived assets; interruptions in the proper functioning of our and our third-party service providers’ information technology systems, including from cybersecurity threats; risks associated with exporting our products internationally; our ability to maintain effective internal controls over financial reporting and remediate any material weaknesses; our indebtedness and the potential that we may incur additional indebtedness; the limitations and restrictions in the agreements governing our indebtedness, the Second Amended and Restated Agreement of Limited Partnership of Core & Main Holdings, LP, as amended, and the Tax Receivable Agreements (as defined in our Annual Report on Form 10-K); changes in our credit ratings and outlook; our ability to generate the significant amount of cash needed to service our indebtedness; our organizational structure, including our payment obligations under the Tax Receivable Agreements, which may be significant; our ability to sustain an active, liquid trading market for our Class A common stock; the significant influence that CD&R (as defined in our Annual Report on Form 10-K) has over us and potential conflicts between the interests of CD&R and other stockholders; and risks related to other factors described under “Risk Factors” in our Annual Report on Form 10-K. These factors are not exhaustive, and new factors may emerge or changes to the foregoing factors may occur that could impact our business. Except to the extent required by law, we undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, which speak only as of the date of this presentation. Use of Non-GAAP Financial Measures In addition to providing results that are determined in accordance with U.S. Generally Accepted Accounting Principles (“GAAP”), we present EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Net Debt Leverage, all of which are non-GAAP financial measures. These measures are not considered measures of financial performance or liquidity under GAAP and the items excluded therefrom are significant components in understanding and assessing our financial performance or liquidity. These measures should not be considered in isolation or as alternatives to GAAP measures such as net income or net income attributable to Core & Main, Inc., as applicable, cash provided by or used in operating, investing or financing activities, or other financial statement data presented in the financial statements as an indicator of our financial performance or liquidity. We use EBITDA, Adjusted EBITDA, Adjusted EBITDA margin and Net Debt Leverage to assess the operating results and effectiveness and efficiency of our business. We present these non-GAAP financial measures because we believe investors consider them to be important supplemental measures of performance, and we believe that these measures are frequently used by securities analysts, investors and other interested parties in the evaluation of companies in our industry. Non-GAAP financial measures as reported by us may not be comparable to similarly titled metrics reported by other companies and may not be calculated in the same manner. These measures have limitations as analytical tools, and you should not consider them in isolation or as substitutes for analysis of our results as reported under GAAP. Reconciliations of such non-GAAP measures to the most directly comparable GAAP measure and calculations of the non-GAAP measures are set forth in the appendix of this presentation. No reconciliation of the estimated range for Adjusted EBITDA for fiscal 2023 is included herein because we are unable to quantify certain amounts that would be required to be included in net income or net income attributable to Core & Main, Inc., as applicable, the most directly comparable GAAP measure, without unreasonable efforts due to the high variability and difficulty to predict certain items excluded from Adjusted EBITDA. Consequently, we believe such reconciliation would imply a degree of precision that would be misleading to investors. In particular, the effects of acquisition expenses cannot be reasonably predicted in light of the inherent difficulty in quantifying such items on a forward-looking basis. We expect the variability of these excluded items may have an unpredictable, and potentially significant, impact on our future GAAP results. Presentation of Financial Information The accompanying financial information presents the results of operations, financial position and cash flows of Core & Main, Inc. (“Core & Main” or the “Company”) and its subsidiaries, which includes the consolidated financial information of Holdings and its consolidated subsidiary, Core & Main LP, as the legal entity that conducts the operations of the Company. Core & Main is the primary beneficiary and general partner of Holdings and has decision making authority that significantly affects the economic performance of the entity. As a result, Core & Main consolidates the consolidated financial statements of Holdings. All intercompany balances and transactions have been eliminated in consolidation. The Company records non-controlling interests related to Partnership Interests (as defined in our Annual Report on Form 10-K) held by the Continuing Limited Partners (as defined in our Annual Report on Form 10-K) in Holdings. The Company’s fiscal year is a 52- or 53-week period ending on the Sunday nearest to January 31st. Quarters within the fiscal year include 13-week periods, unless a fiscal year includes a 53rd week, in which case the fourth quarter of the fiscal year will be a 14-week period. Each of the three months ended January 29, 2023 and January 30, 2022 included 13 weeks, and each of the fiscal years ended January 29, 2023, January 30, 2022, January 31, 2021 and February 2, 2020 included 52 weeks. The fiscal year ended February 3, 2019 included 53 weeks.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. TODAY’S PRESENTERS 3 Steve LeClair Chief Executive Officer Mark Witkowski Chief Financial Officer Robyn Bradbury VP, Finance & Investor Relations

Business Update STEVE LECLAIR

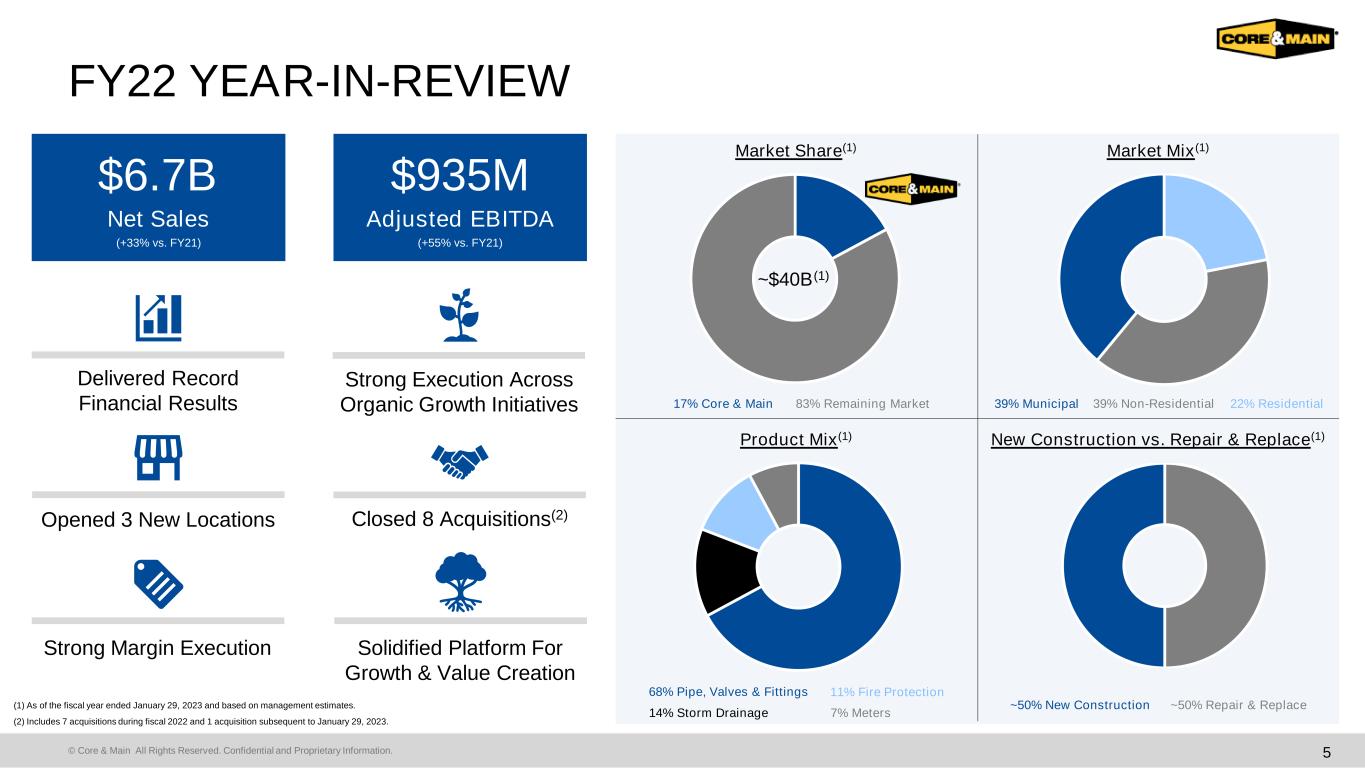

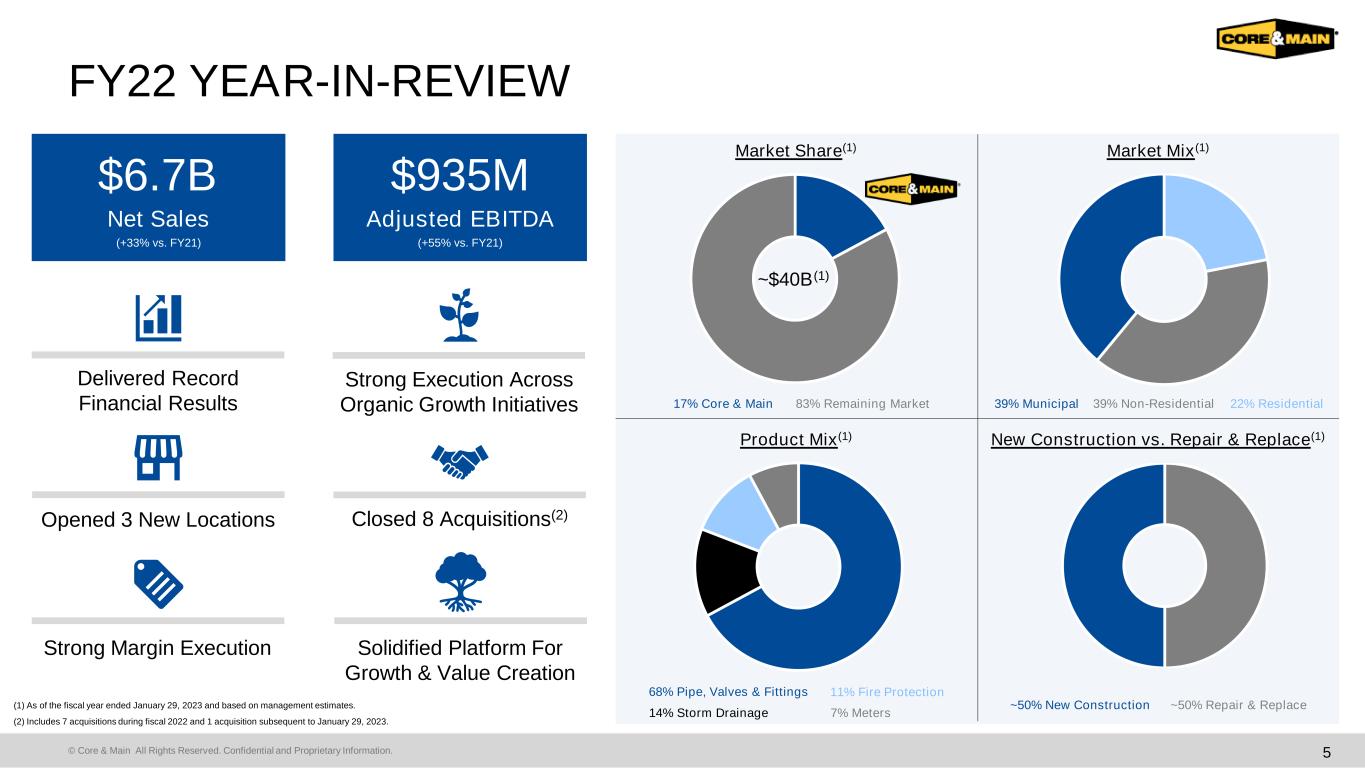

© Core & Main All Rights Reserved. Confidential and Proprietary Information. (1) As of the fiscal year ended January 29, 2023 and based on management estimates. (2) Includes 7 acquisitions during fiscal 2022 and 1 acquisition subsequent to January 29, 2023. FY22 YEAR-IN-REVIEW Delivered Record Financial Results Opened 3 New Locations Strong Execution Across Organic Growth Initiatives Market Share(1) Market Mix(1) Product Mix(1) New Construction vs. Repair & Replace(1) ~50% New Construction ~50% Repair & Replace ~$40B(1) 17% Core & Main 83% Remaining Market 39% Non-Residential39% Municipal 22% Residential 14% Storm Drainage 68% Pipe, Valves & Fittings 11% Fire Protection 7% Meters 5 Solidified Platform For Growth & Value Creation Closed 8 Acquisitions(2) Strong Margin Execution $6.7B Net Sales (+33% vs. FY21) $935M Adjusted EBITDA (+55% vs. FY21)

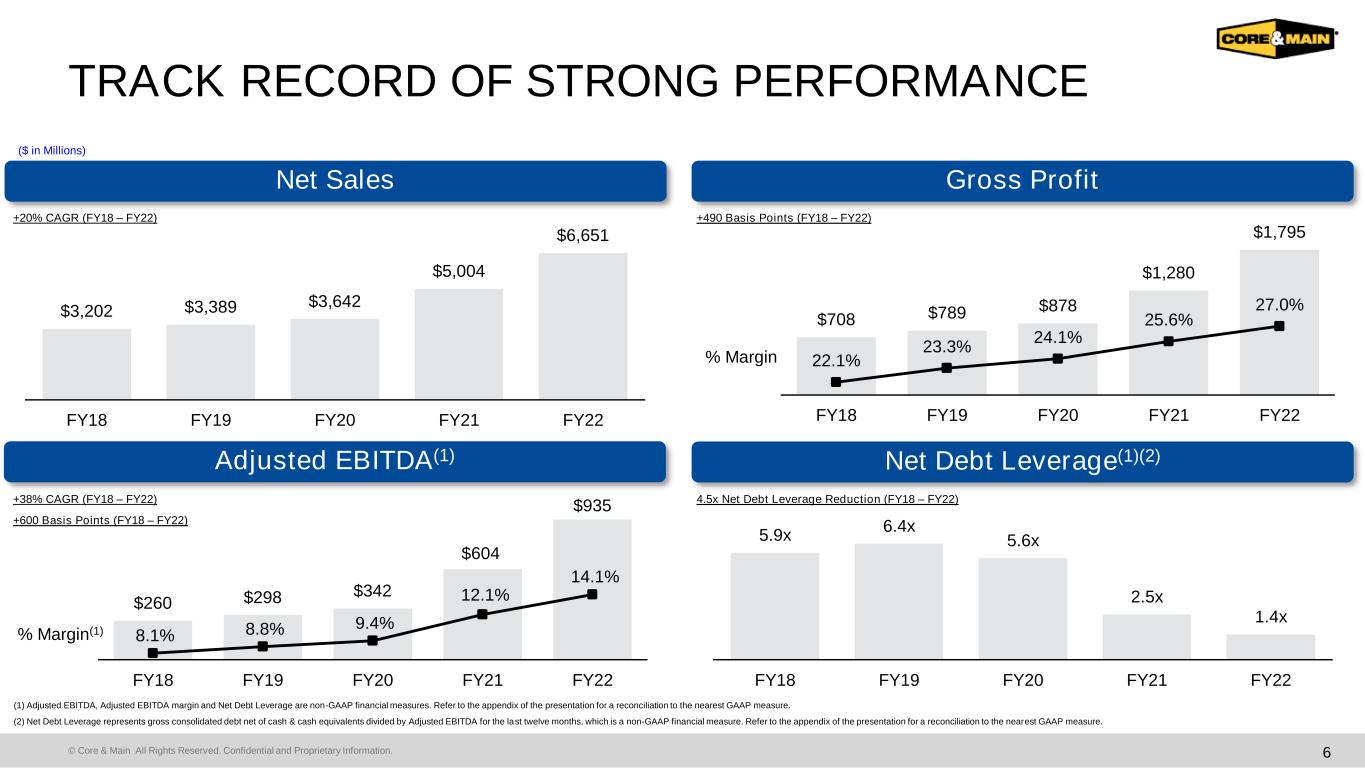

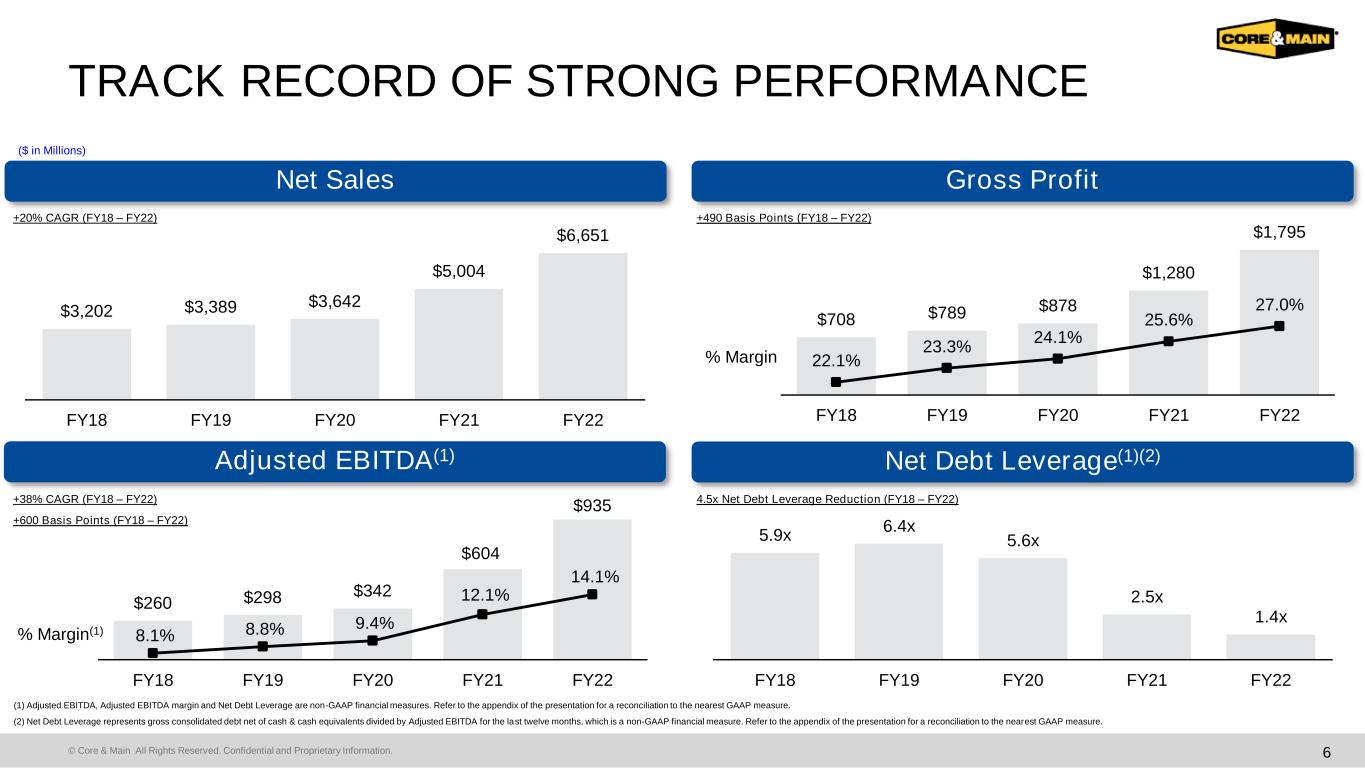

© Core & Main All Rights Reserved. Confidential and Proprietary Information. $3,202 $3,389 $3,642 $5,004 $6,651 FY18 FY19 FY20 FY21 FY22 6 TRACK RECORD OF STRONG PERFORMANCE Net Sales Gross Profit Adjusted EBITDA(1) Net Debt Leverage(1)(2) +20% CAGR (FY18 – FY22) +490 Basis Points (FY18 – FY22) +38% CAGR (FY18 – FY22) +600 Basis Points (FY18 – FY22) 4.5x Net Debt Leverage Reduction (FY18 – FY22) ($ in Millions) $708 $789 $878 $1,280 $1,795 22.1% 23.3% 24.1% 25.6% 27.0% FY18 FY19 FY20 FY21 FY22 5.9x 6.4x 5.6x 2.5x 1.4x FY18 FY19 FY20 FY21 FY22 $260 $298 $342 $604 $935 8.1% 8.8% 9.4% 12.1% 14.1% FY18 FY19 FY20 FY21 FY22 (1) Adjusted EBITDA, Adjusted EBITDA margin and Net Debt Leverage are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (2) Net Debt Leverage represents gross consolidated debt net of cash & cash equivalents divided by Adjusted EBITDA for the last twelve months, which is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. % Margin % Margin(1)

© Core & Main All Rights Reserved. Confidential and Proprietary Information. OUR VALUE CREATION TARGETS 7 Market Growth Above Market Growth Acquisitions Operating Leverage Operating Cash Flow +200 – 300 bps +200 – 500 bps 1.3x – 1.5x 55% – 65% Adj. EBITDA Conversion Low to Mid Single-Digit ▪ Attract and develop new sales talent ▪ Expand into new and underpenetrated geographies ▪ Expand into new and underrepresented product categories ▪ Accelerate new product adoption ▪ Increase share with strategic accounts ▪ Disciplined pursuit of active target pipeline to fill existing geographies and product lines ▪ Leverage M&A platform to access adjacent markets, new technologies and product innovations ▪ Enhance key talent and operational capabilities ▪ Drive immediate synergistic value from M&A with a focus on people, process & strategy ▪ Expand private label offering across our nationwide network ▪ Expand product margins through pricing analytics ▪ Maximize category management opportunity ▪ Drive SG&A productivity and cost leverage ▪ Resilient business model with counter-cyclical working capital characteristics ▪ Cash generation model provides ample liquidity to fund growth strategies while returning capital to shareholders ▪ Non-discretionary municipal repair & replacement demand expected to remain resilient for the foreseeable future ▪ Secular market tailwinds provided by the Infrastructure Investment & Jobs Act ▪ Continued growth in non- residential development as communities expand ▪ Fundamental undersupply of housing relative to household formations CONTINUE TO DELIVER ON KEY GROWTH, PROFITABILITY & CASH FLOW TARGETS

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 8 SECULAR MARKET GROWTH FUNDAMENTALS… U.S. Municipal Water Infrastructure Spending(1) Non-Residential Starts(2) (Sq. Feet Per Million of Population) Single Family Housing Starts(3) (Starts Per Million of Population) Vacant Developed Lots & Months of Supply(4) $- $30 $60 $90 $120 $150 '70 '74 '78 '82 '86 '90 '94 '98 '02 '06 '10 '14 '18 '22 ($ i n B il li o n s ) Significant Underinvestment Historical Spending Management Estimates - 1.5 3.0 4.5 6.0 7.5 '70 '74 '78 '82 '86 '90 '94 '98 '02 '06 '10 '14 '18 '22 (S q . F e e t in T h o u s a n d s ) Median - 1.5 3.0 4.5 6.0 7.5 '70 '74 '78 '82 '86 '90 '94 '98 '02 '06 '10 '14 '18 '22 (S ta rt s i n T h o u s a n d s ) (1) Source: 1970 – 2017 data provided by the U.S. Congressional Budget Office. Data from 2018 – 2022 based on management estimates. (2) Source: Dodge Data & Analytics. Represents non-residential building starts (measured in square feet) per million of U.S. population. (3) Source: U.S. Census Bureau. Represents single-family housing starts per million of U.S. population. (4) Source: Zonda. Represents vacant developed lots and months of supply for single-family housing units in select geographies across the U.S. Median - 20 40 60 80 100 0.40 0.60 0.80 1.00 1.20 1.40 Q4'08 Q4'10 Q4'12 Q4'14 Q4'16 Q4'18 Q4'20 Q4'22 M o n th s o f S u p p ly V a c a n t D e v e lo p e d L o ts (i n M il li o n s ) Vacant Developed Lots Months of Supply

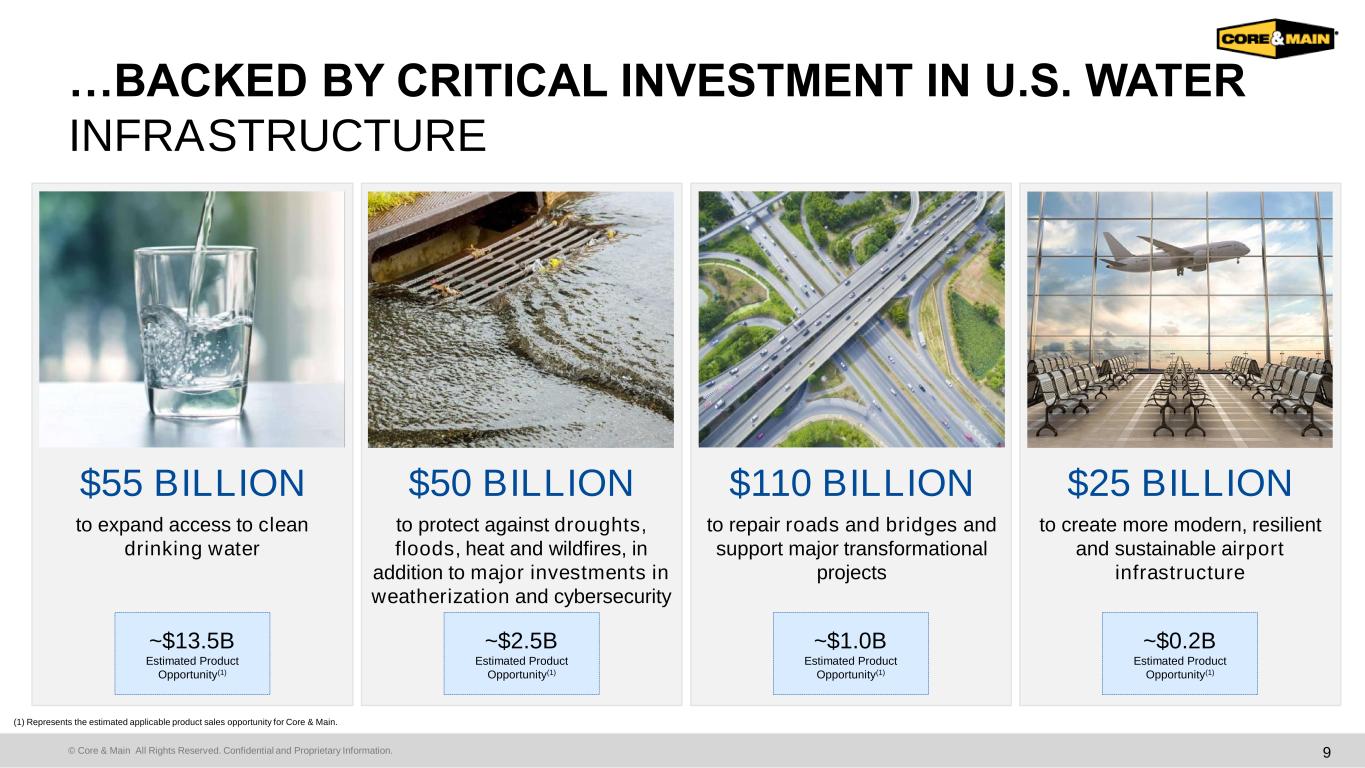

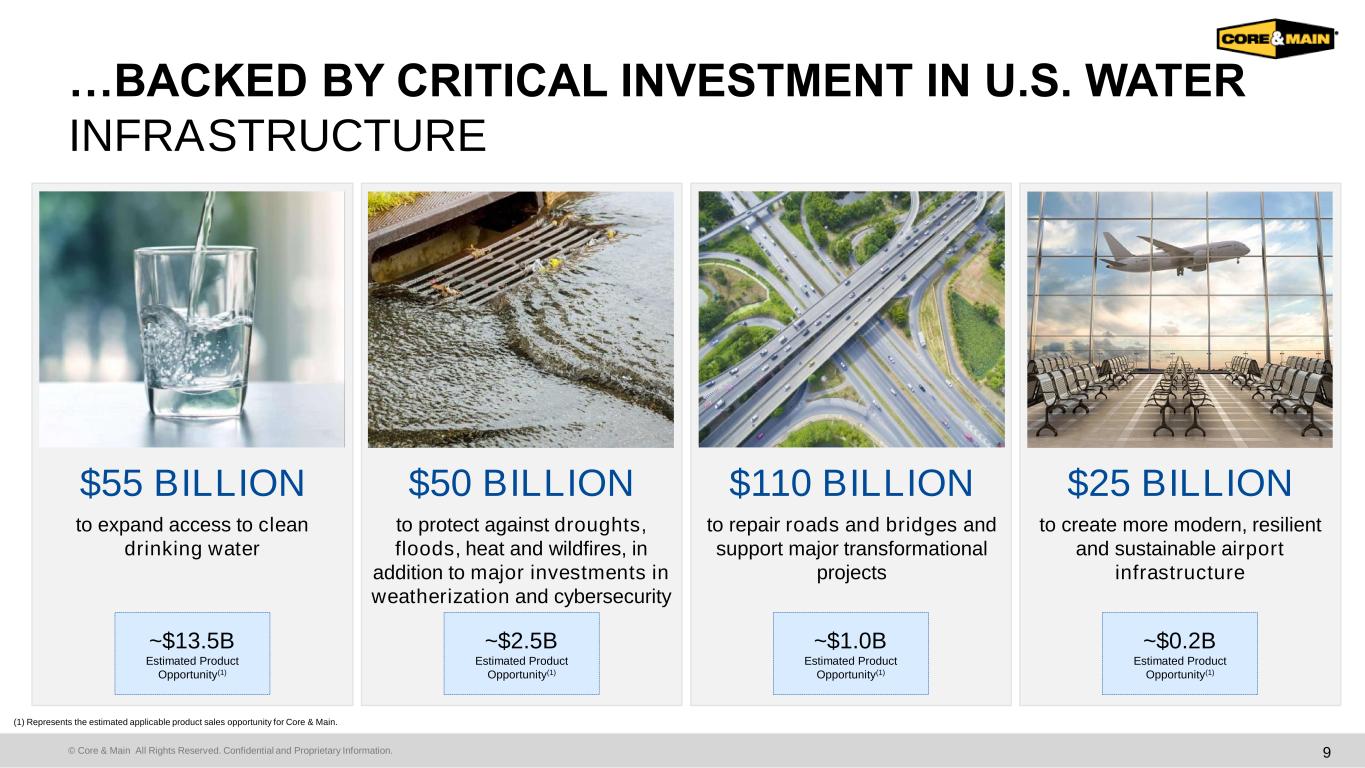

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 9 …BACKED BY CRITICAL INVESTMENT IN U.S. WATER INFRASTRUCTURE $55 BILLION to expand access to clean drinking water $50 BILLION to protect against droughts, floods, heat and wildfires, in addition to major investments in weatherization and cybersecurity $110 BILLION to repair roads and bridges and support major transformational projects $25 BILLION to create more modern, resilient and sustainable airport infrastructure ~$2.5B Estimated Product Opportunity(1) ~$13.5B Estimated Product Opportunity(1) ~$1.0B Estimated Product Opportunity(1) ~$0.2B Estimated Product Opportunity(1) (1) Represents the estimated applicable product sales opportunity for Core & Main.

Financial Results MARK WITKOWSKI

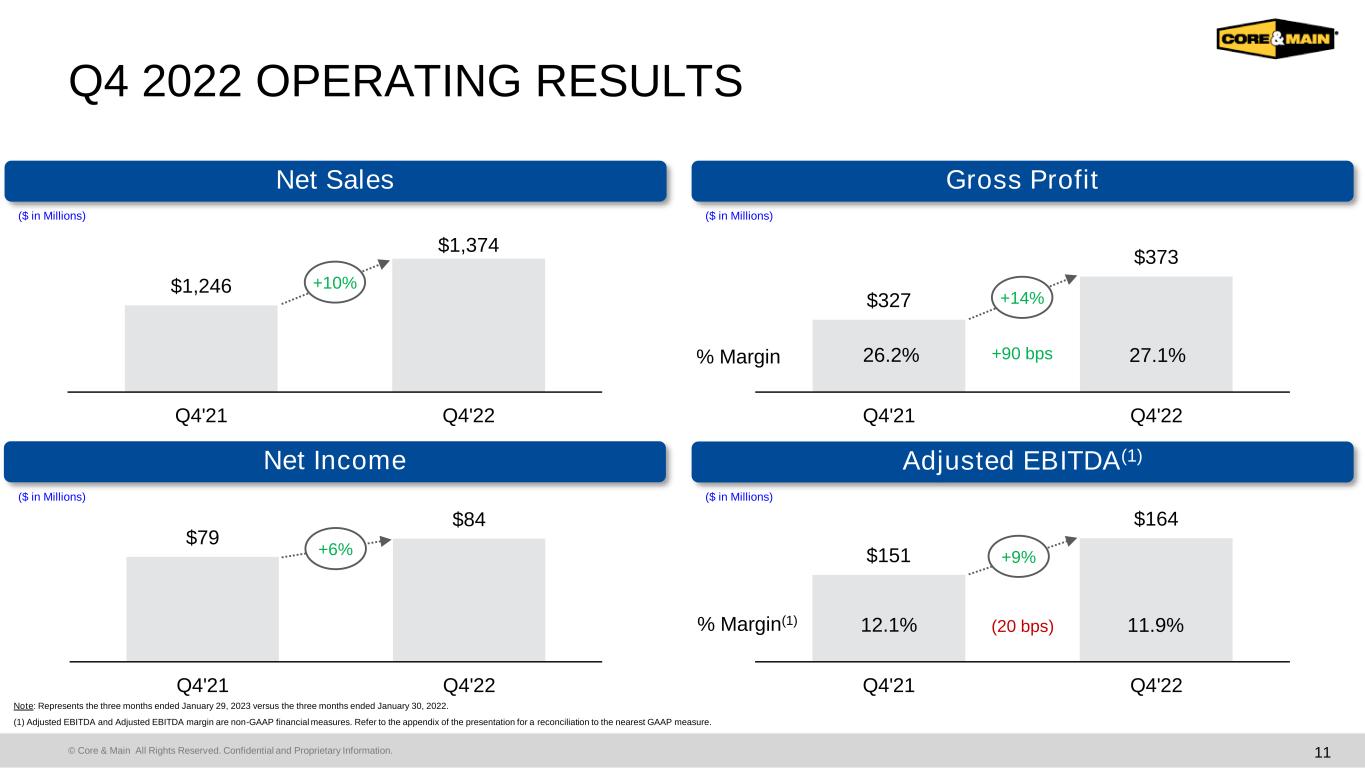

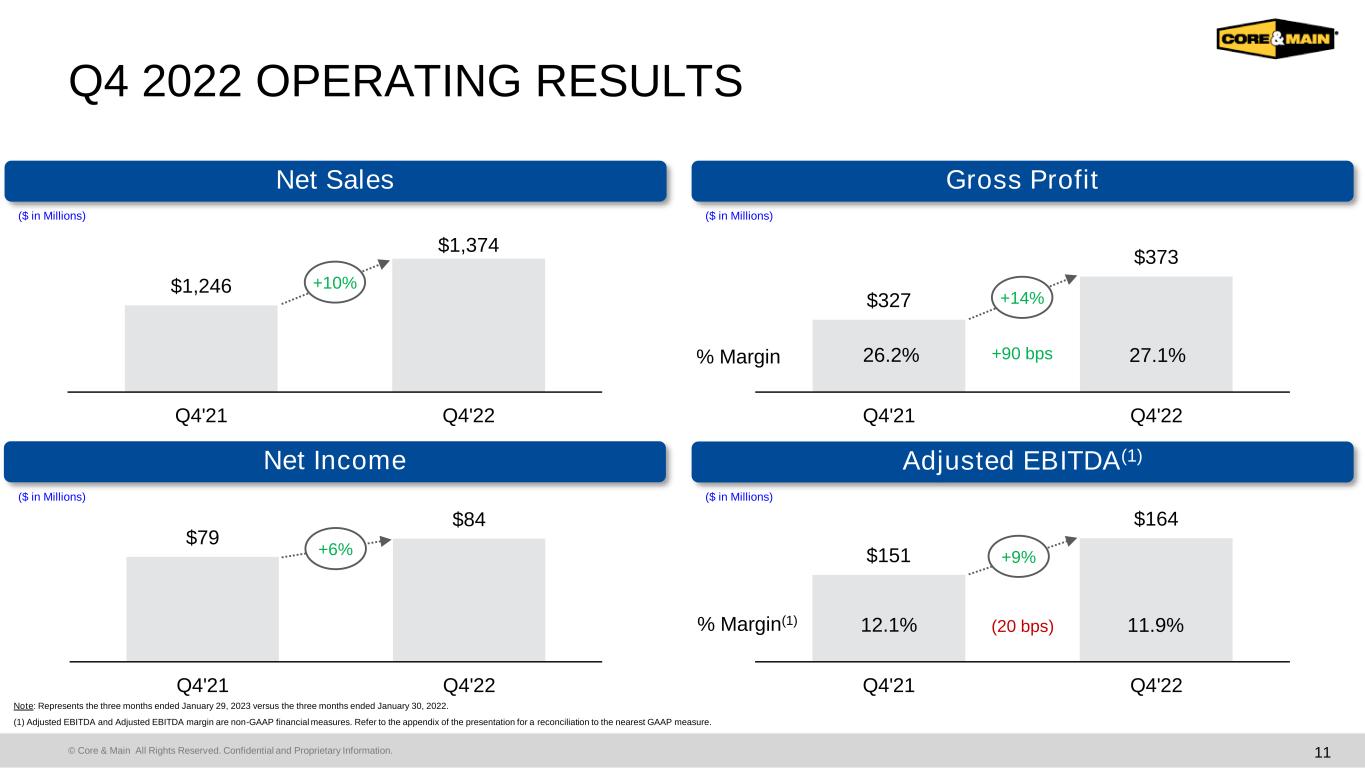

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 11 Q4 2022 OPERATING RESULTS Net Sales Gross Profit Net Income Adjusted EBITDA(1) ($ in Millions) ($ in Millions) ($ in Millions) ($ in Millions) $1,246 $1,374 Q4'21 Q4'22 $327 $373 Q4'21 Q4'22 $151 $164 Q4'21 Q4'22 $79 $84 Q4'21 Q4'22 +10% +14% +6% +9% % Margin % Margin(1) 12.1% 11.9% 26.2% 27.1%+90 bps (20 bps) Note: Represents the three months ended January 29, 2023 versus the three months ended January 30, 2022. (1) Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure.

© Core & Main All Rights Reserved. Confidential and Proprietary Information. $604 $935 FY21 FY22 $5,004 $6,651 FY21 FY22 $1,280 $1,795 FY21 FY22 $225 $581 FY21 FY22 12 FY22 OPERATING RESULTS Net Sales Gross Profit Net Income Adjusted EBITDA(1) ($ in Millions) ($ in Millions) ($ in Millions) ($ in Millions) +33% +40% +158% +55% % Margin 12.1% 14.1% 25.6% 27.0%+140 bps +200 bps% Margin(1) Note: Represents the fiscal year ended January 29, 2023 versus the fiscal year ended January 30, 2022. (1) Adjusted EBITDA and Adjusted EBITDA margin are non-GAAP financial measures. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure.

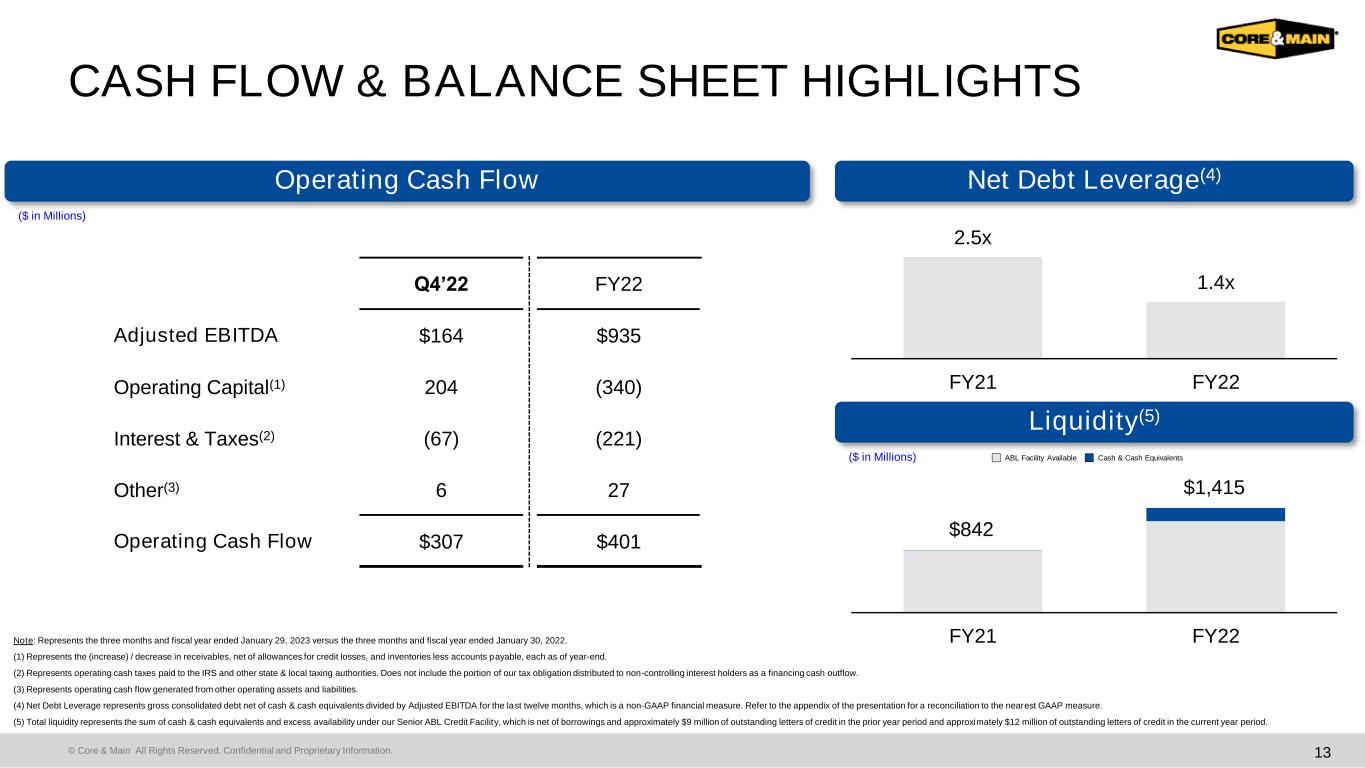

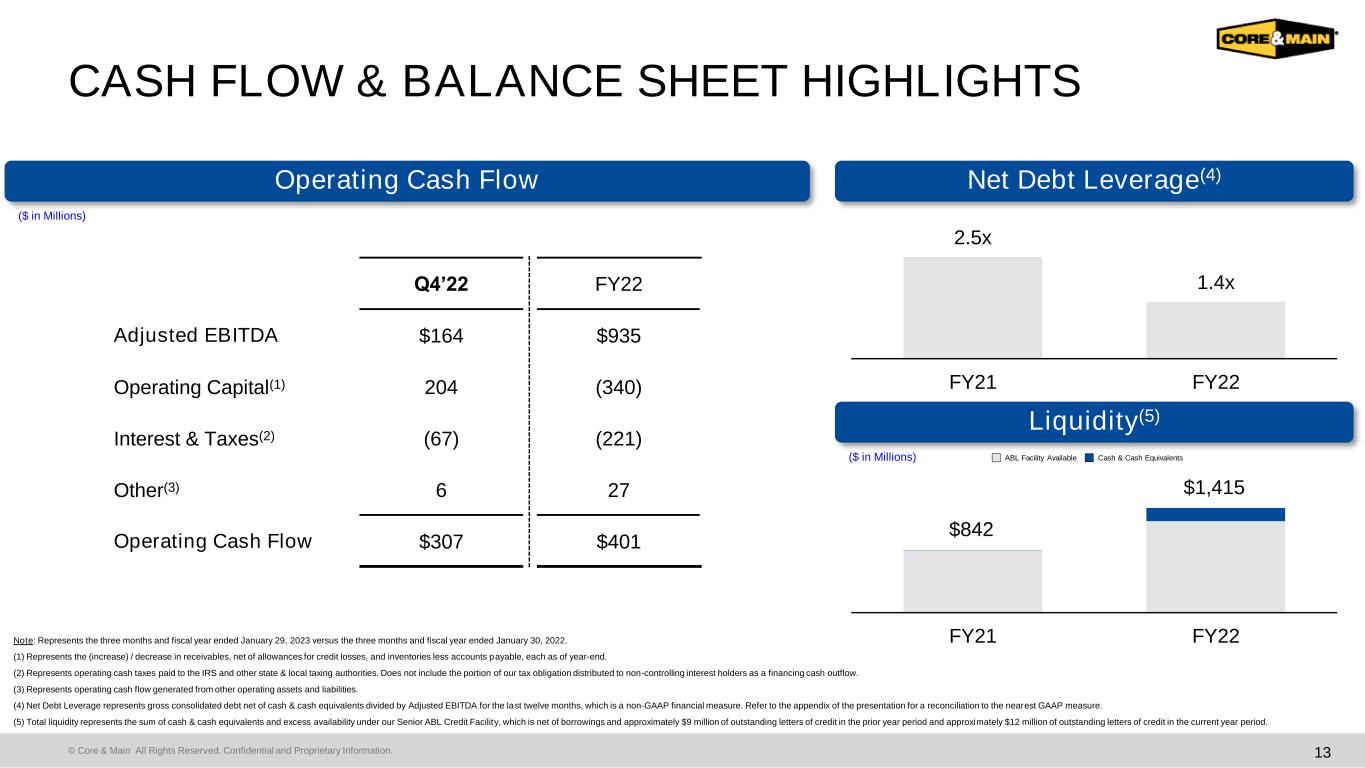

© Core & Main All Rights Reserved. Confidential and Proprietary Information. FY21 FY22 13 CASH FLOW & BALANCE SHEET HIGHLIGHTS Operating Cash Flow Net Debt Leverage(4) Liquidity(5) ($ in Millions) ($ in Millions) 2.5x 1.4x FY21 FY22 Q4’22 FY22 Adjusted EBITDA $164 $935 Operating Capital(1) 204 (340) Interest & Taxes(2) (67) (221) Other(3) 6 27 Operating Cash Flow $307 $401 Note: Represents the three months and fiscal year ended January 29, 2023 versus the three months and fiscal year ended January 30, 2022. (1) Represents the (increase) / decrease in receivables, net of allowances for credit losses, and inventories less accounts payable, each as of year-end. (2) Represents operating cash taxes paid to the IRS and other state & local taxing authorities. Does not include the portion of our tax obligation distributed to non-controlling interest holders as a financing cash outflow. (3) Represents operating cash flow generated from other operating assets and liabilities. (4) Net Debt Leverage represents gross consolidated debt net of cash & cash equivalents divided by Adjusted EBITDA for the last twelve months, which is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. (5) Total liquidity represents the sum of cash & cash equivalents and excess availability under our Senior ABL Credit Facility, which is net of borrowings and approximately $9 million of outstanding letters of credit in the prior year period and approximately $12 million of outstanding letters of credit in the current year period. $1,415 $842 ABL Facility Available Cash & Cash Equivalents

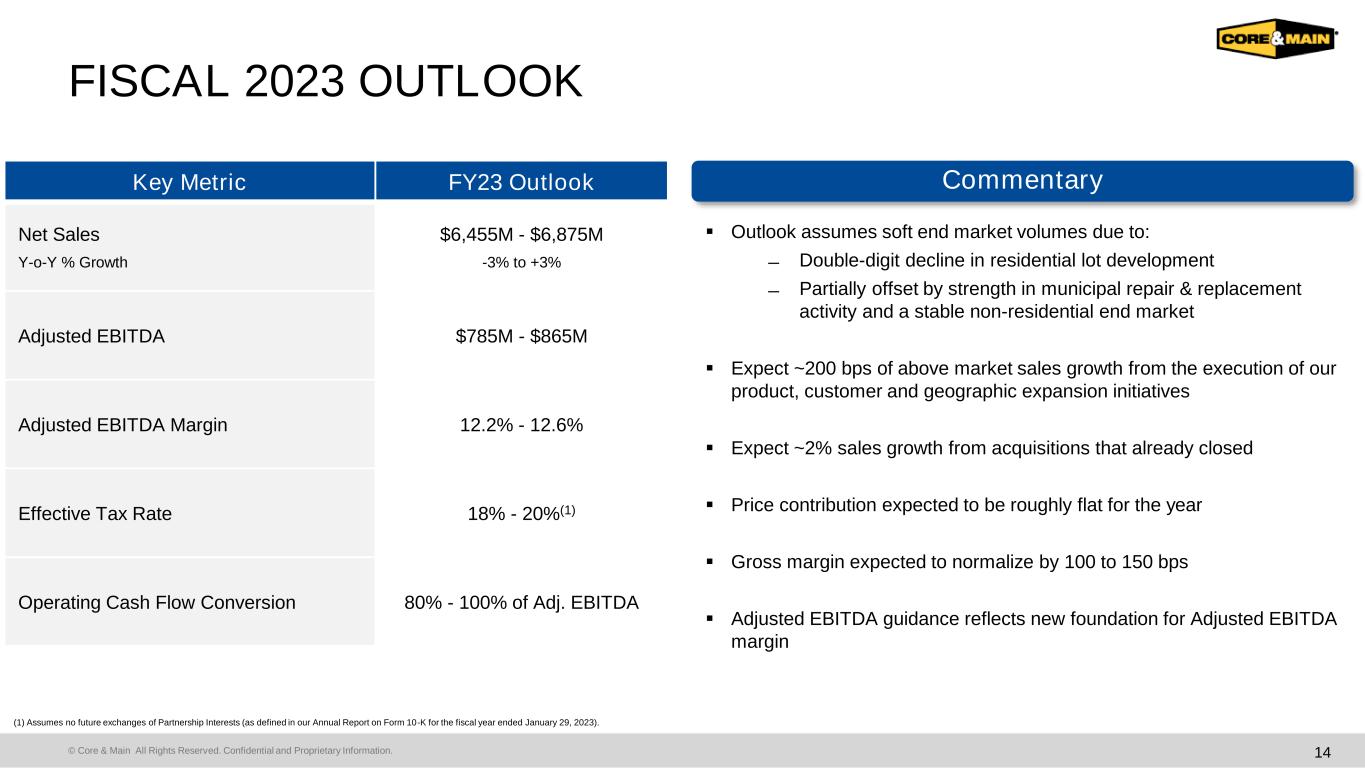

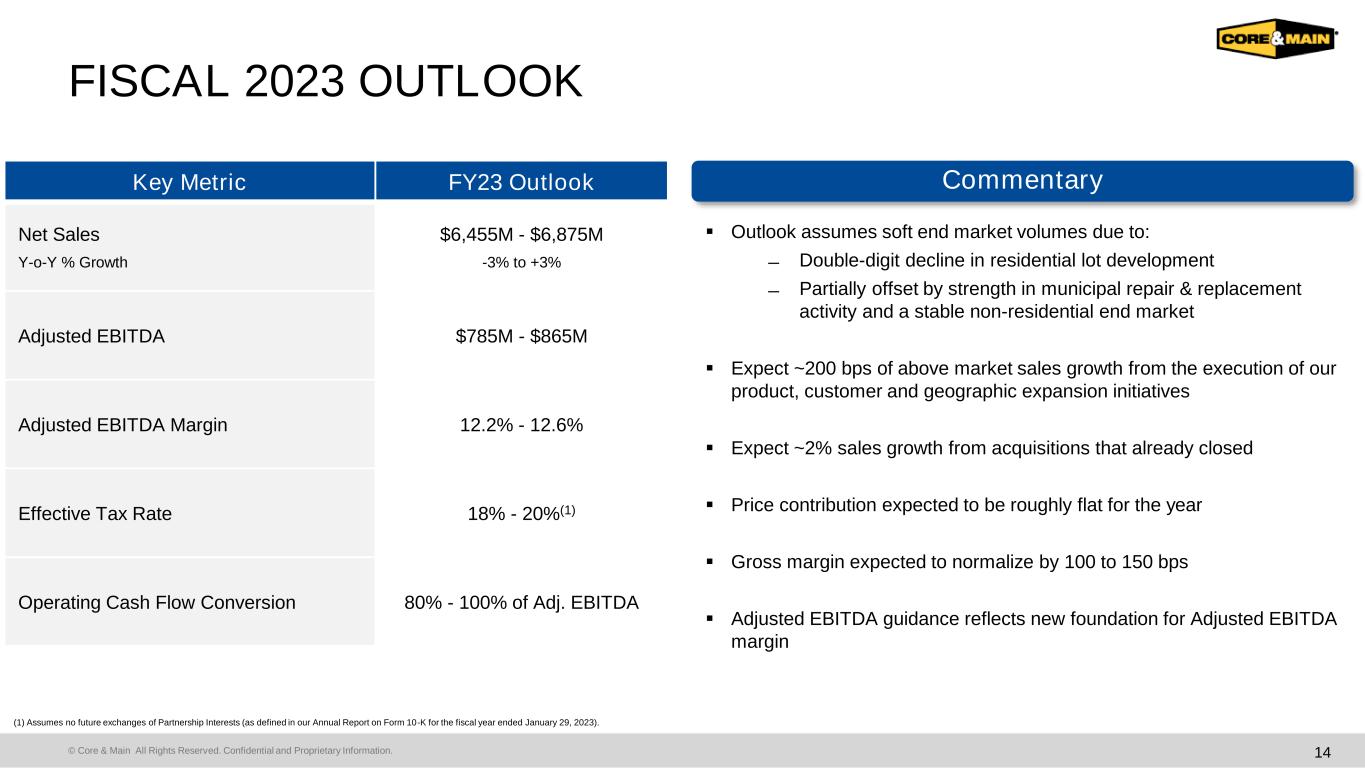

© Core & Main All Rights Reserved. Confidential and Proprietary Information. FISCAL 2023 OUTLOOK 14 CommentaryKey Metric FY23 Outlook Net Sales Y-o-Y % Growth $6,455M - $6,875M -3% to +3% Adjusted EBITDA $785M - $865M Adjusted EBITDA Margin 12.2% - 12.6% Effective Tax Rate 18% - 20%(1) Operating Cash Flow Conversion 80% - 100% of Adj. EBITDA (1) Assumes no future exchanges of Partnership Interests (as defined in our Annual Report on Form 10-K for the fiscal year ended January 29, 2023). ▪ Outlook assumes soft end market volumes due to: ̶ Double-digit decline in residential lot development ̶ Partially offset by strength in municipal repair & replacement activity and a stable non-residential end market ▪ Expect ~200 bps of above market sales growth from the execution of our product, customer and geographic expansion initiatives ▪ Expect ~2% sales growth from acquisitions that already closed ▪ Price contribution expected to be roughly flat for the year ▪ Gross margin expected to normalize by 100 to 150 bps ▪ Adjusted EBITDA guidance reflects new foundation for Adjusted EBITDA margin

© Core & Main All Rights Reserved. Confidential and Proprietary Information. CAPITAL ALLOCATION FRAMEWORK 15 Capital Allocation Framework For FY23 & Beyond Priority Uses for Capital Normalized Operating Cash Flow Target to be ~55-65% of Adjusted EBITDA Organic Growth & Operational Initiatives M&A Share Repurchases & Dividends Expect future capital expenditures to average ~0.5% of net sales Maintain a robust M&A pipeline and a disciplined approach. Expect continued M&A focused on geographic expansion, product line expansion and additional operating capabilities, while driving synergistic value creation Deploy surplus capital towards share repurchases and/or dividends

Appendix

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 17 ▪ Leading U.S. specialty distributor focused on water, wastewater, storm drainage and fire protection products, and related services ▪ Highly fragmented $40 billion addressable market(1) ▪ 1 of only 2 national distributors where scale matters ▪ ~320 branches in 48 states across the U.S. ▪ $6.7 billion of FY22 net sales and $935 million of FY22 Adjusted EBITDA(2) ▪ Balanced mix of sales across end markets, construction sectors and product lines ▪ Highly fragmented customer base of 60,000+ including municipalities, private water companies and professional contractors ▪ More than 200,000 SKUs ▪ 4,500+ suppliers, many of which have long-standing, often exclusive or restrictive, relationships with CNM Corporate HQ CORE & MAIN AT A GLANCE Key Business Highlights Branch Footprint (1) As of the fiscal year ended January 29, 2023 and based on management estimates. (2) Adjusted EBITDA is a non-GAAP financial measure. Refer to the appendix of the presentation for a reconciliation to the nearest GAAP measure. Market Share(1) Market Mix(1) ~$40B(1) 17% Core & Main 83% Remaining Market 39% Non-Residential39% Municipal 22% Residential

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 18 Leading position with size and scale in a fragmented market1 Multiple levers for organic growth3 Proven ability to execute and integrate acquisitions4 Strong value proposition & pivotal role in shaping our industry2 Beneficial industry trends with secular growth drivers6 Strong and highly experienced management team7 Differentiated service offerings enhanced by proprietary and modern technology tools5 Attractive financial profile with efficient operating model 8 OUR INVESTMENT HIGHLIGHTS

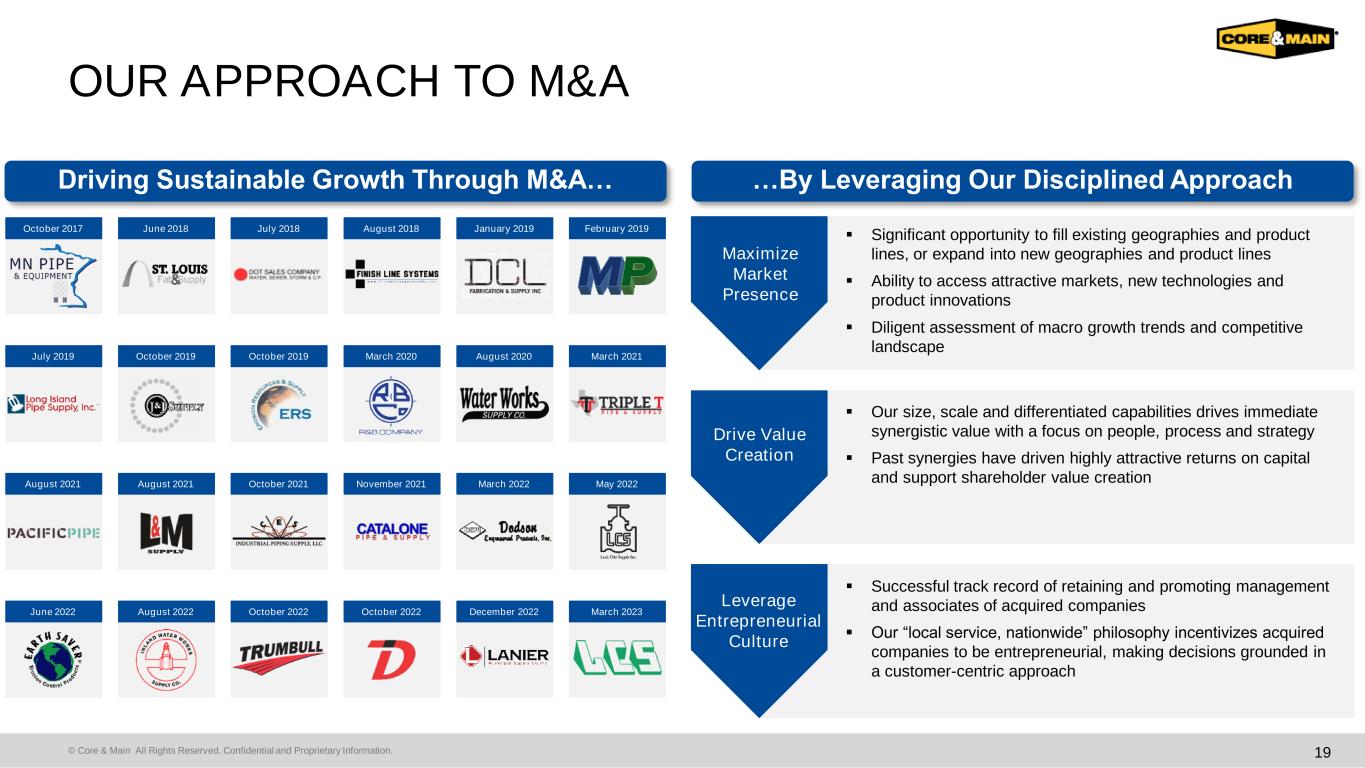

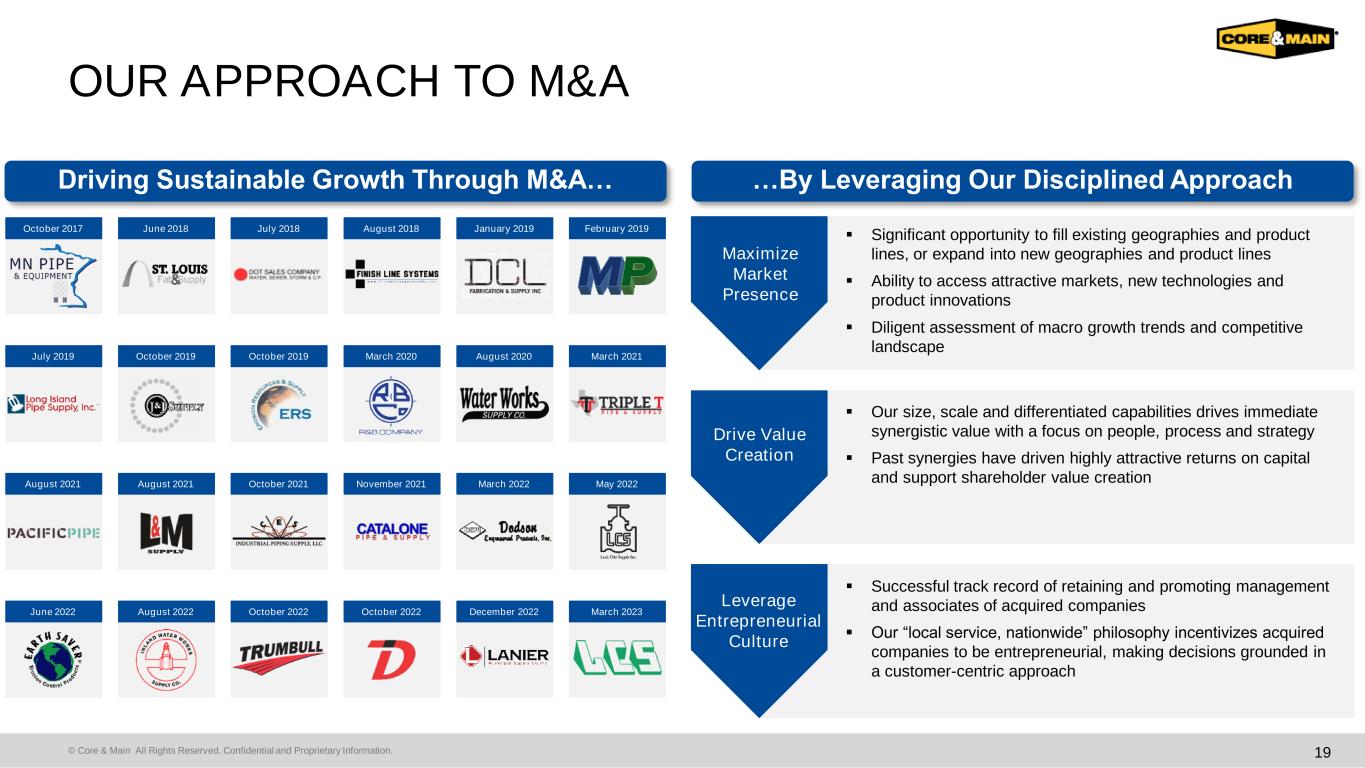

© Core & Main All Rights Reserved. Confidential and Proprietary Information. 19 OUR APPROACH TO M&A Driving Sustainable Growth Through M&A… …By Leveraging Our Disciplined Approach Maximize Market Presence Drive Value Creation Leverage Entrepreneurial Culture ▪ Significant opportunity to fill existing geographies and product lines, or expand into new geographies and product lines ▪ Ability to access attractive markets, new technologies and product innovations ▪ Diligent assessment of macro growth trends and competitive landscape October 2017 June 2018 July 2018 August 2018 January 2019 February 2019 July 2019 October 2019 October 2019 March 2020 August 2020 March 2021 August 2021 August 2021 October 2021 November 2021 March 2022 May 2022 June 2022 August 2022 October 2022 October 2022 December 2022 March 2023 ▪ Our size, scale and differentiated capabilities drives immediate synergistic value with a focus on people, process and strategy ▪ Past synergies have driven highly attractive returns on capital and support shareholder value creation ▪ Successful track record of retaining and promoting management and associates of acquired companies ▪ Our “local service, nationwide” philosophy incentivizes acquired companies to be entrepreneurial, making decisions grounded in a customer-centric approach

© Core & Main All Rights Reserved. Confidential and Proprietary Information. PRODUCT & SERVICE OFFERING 20

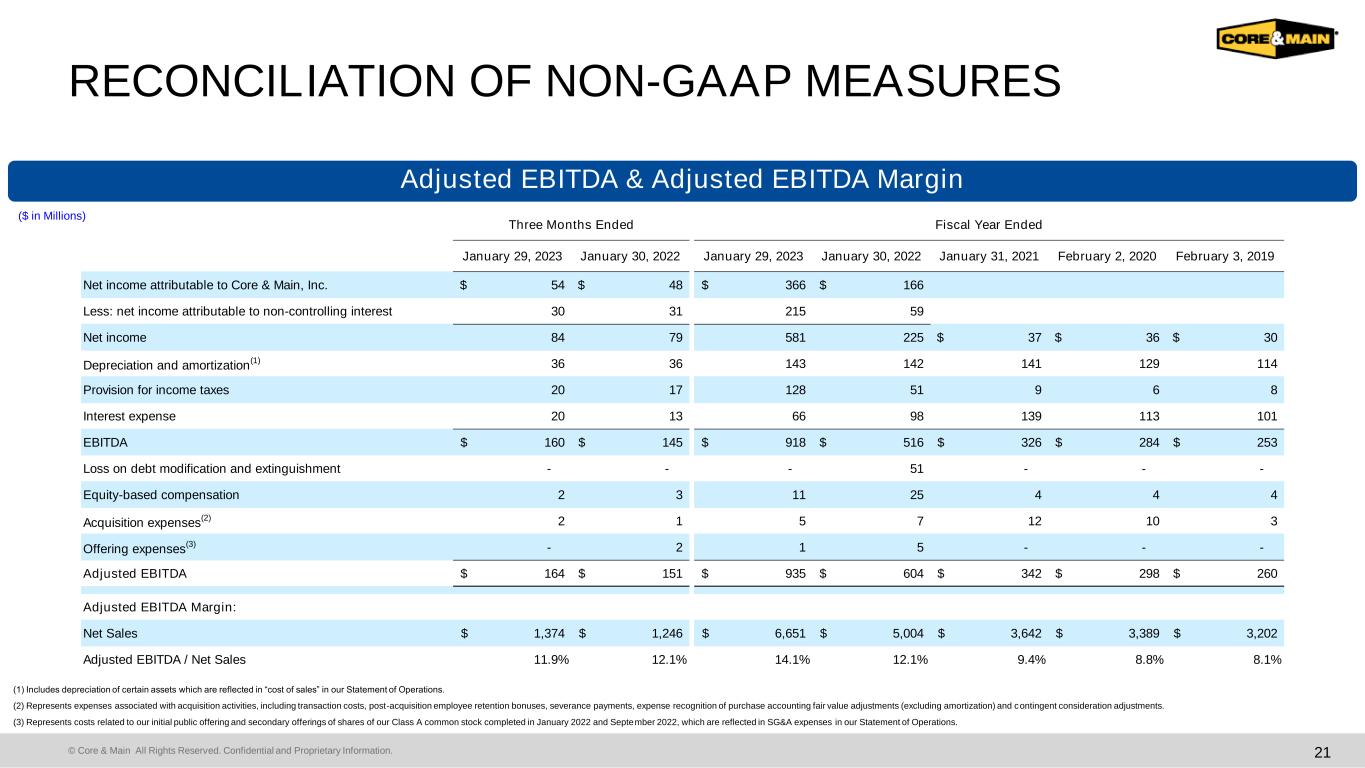

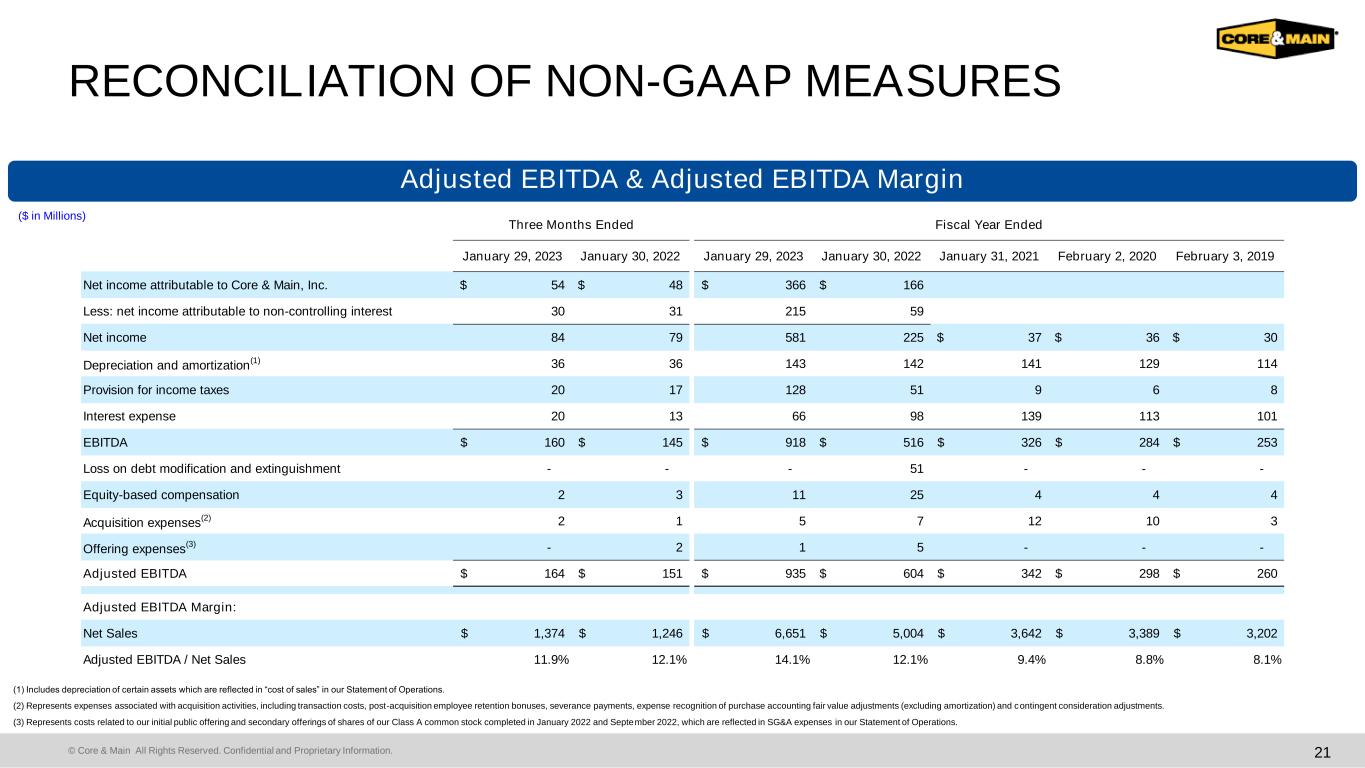

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 21 Adjusted EBITDA & Adjusted EBITDA Margin ($ in Millions) (1) Includes depreciation of certain assets which are reflected in “cost of sales” in our Statement of Operations. (2) Represents expenses associated with acquisition activities, including transaction costs, post-acquisition employee retention bonuses, severance payments, expense recognition of purchase accounting fair value adjustments (excluding amortization) and contingent consideration adjustments. (3) Represents costs related to our initial public offering and secondary offerings of shares of our Class A common stock completed in January 2022 and September 2022, which are reflected in SG&A expenses in our Statement of Operations. January 29, 2023 January 30, 2022 January 29, 2023 January 30, 2022 January 31, 2021 February 2, 2020 February 3, 2019 Net income attributable to Core & Main, Inc. 54$ 48$ 366$ 166$ Less: net income attributable to non-controlling interest 30 31 215 59 Net income 84 79 581 225 37$ 36$ 30$ Depreciation and amortization (1) 36 36 143 142 141 129 114 Provision for income taxes 20 17 128 51 9 6 8 Interest expense 20 13 66 98 139 113 101 EBITDA 160$ 145$ 918$ 516$ 326$ 284$ 253$ Loss on debt modification and extinguishment - - - 51 - - - Equity-based compensation 2 3 11 25 4 4 4 Acquisition expenses (2) 2 1 5 7 12 10 3 Offering expenses (3) - 2 1 5 - - - Adjusted EBITDA 164$ 151$ 935$ 604$ 342$ 298$ 260$ Adjusted EBITDA Margin: Net Sales 1,374$ 1,246$ 6,651$ 5,004$ 3,642$ 3,389$ 3,202$ Adjusted EBITDA / Net Sales 11.9% 12.1% 14.1% 12.1% 9.4% 8.8% 8.1% Three Months Ended Fiscal Year Ended

© Core & Main All Rights Reserved. Confidential and Proprietary Information. RECONCILIATION OF NON-GAAP MEASURES 22 Net Debt Leverage ($ in Millions) January 29, 2023 January 30, 2022 January 31, 2021 February 2, 2020 February 3, 2019 Senior Term Loan due August 2024 -$ -$ 1,261$ 1,274$ 1,062$ Senior Notes due September 2024 - - 300 300 - Senior Notes due August 2025 - - 750 500 500 Senior ABL Credit Facility due July 2026 - - - - - Senior Term Loan due July 2028 1,478 1,493 - - - Total Debt 1,478$ 1,493$ 2,311$ 2,074$ 1,562$ Less: Cash & Cash Equivalents (177) (1) (381) (181) (37) Net Debt 1,301$ 1,492$ 1,930$ 1,893$ 1,525$ Twelve Months Ended Adjusted EBITDA 935 604 342 298 260 Net Debt Leverage 1.4x 2.5x 5.6x 6.4x 5.9x Fiscal Year Ended