$0.001 par value. Pursuant to the Certificate of Amendment, on September 8, 2021 the Company effected a stock split of its common stock, at a rate of 120.8-for-1 (the “Stock Split”), accompanied by a corresponding increase in the Company’s issued and outstanding shares of common stock. No fractional shares of common stock were issued upon the Stock Split. Any holder of common stock with aggregated shares totaling to fractional shares were rounded up to the nearest whole share. The accompanying consolidated financial statements and related disclosure for periods prior to the Stock Split have been retroactively restated to reflect the filing of the Certificate of Amendment, including the Stock Split.

As a result of the Stock Split, the Company had a total of 74,058,447 shares issued and outstanding as of September 8, 2021. In connection with the IPO, on September 22, 2021, the Limited Partnership distributed its shares of Sovos Brands, Inc. common stock to its limited partners, including holders of IUs, in accordance with the applicable terms of its partnership agreement.

Preferred Stock

On September 23, 2021, the Company filed an amended and restated certificate of incorporation (“Amended and Restated Charter”) with the Secretary of State of the State of Delaware, which was effective on September 23, 2021. As a result of the filing of the Amended and Restated Charter, the Company was authorized to issue 510,000,000 shares, divided into two classes as follows: (i) 500,000,000 shares are designated shares of common stock, par value $0.001 per share, and (ii) 10,000,000 shares are designated shares of preferred stock, par value $0.001 per share.

Organizational Transactions

On September 27, 2021, the Company closed its IPO of 23,334,000 shares of common stock, $0.001 par value per share, at an offering price of $12.00 per share, and received net proceeds from the IPO of approximately $263.2 million, net of $16.8 million in underwriting discounts and commissions.

Subsequent to the IPO, the underwriters exercised their option to purchase an additional 3,500,100 shares of common stock. The Company closed its sale of such additional shares on October 5, 2021, resulting in net proceeds of approximately $39.5 million, net of $2.5 million in underwriting discounts and commissions.

On August 10, 2022, the Company completed a secondary offering, in which certain of its stockholders (the “Selling Stockholders”) sold 8,500,000 shares of common stock in an underwritten public offering at an offering price of $14.00 per share, with all proceeds going to the Selling Stockholders. Subsequent to the secondary offering, the underwriters exercised their option to purchase an additional 1,275,000 shares of common stock, and the sale of such additional shares closed on August 22, 2022, with all proceeds going to the Selling Stockholders.

As a result of the IPO, secondary offering and the exercise of the underwriters’ option to purchase additional shares, the new investors in the Company own 36,609,100 shares of the common stock, or approximately 36.2% of the total 101,214,297 shares of common stock outstanding as of March 8, 2023.

Note 16. Equity-Based Compensation

Pre-IPO Equity

2017 Equity Incentive Plan

In 2017, the Sovos Brands Limited Partnership 2017 Equity Incentive Plan (“2017 Plan”), was established providing certain employees and nonemployees of the Company equity-based compensation in the form of Incentive Units (“IUs”) of the Limited Partnership, as consideration for services to the Company. The IUs, were deemed to be equity instruments subject to expense recognition under FASB ASC 718, Compensation — Stock Compensation. The estimate of fair value of the IUs granted was determined as of the grant date.

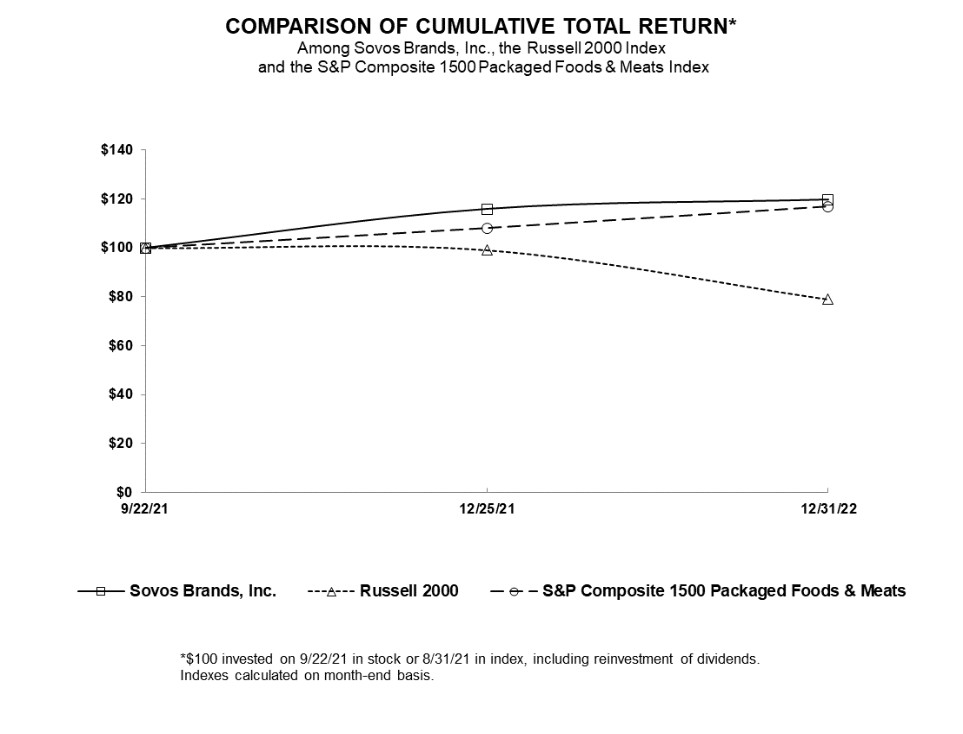

Performance Graph Data

Performance Graph Data