On December 2, 2021, the SEC adopted amendments to finalize rules implementing the submission and disclosure requirements in the Holding Foreign Companies Accountable Act, or the HFCA Act. The rules apply to registrants the SEC identifies as having filed an annual report with an audit report issued by a registered public accounting firm that is located in a foreign jurisdiction and that the PCAOB is unable to inspect or investigate, or the Commission-Identified Issuers. The final amendments require Commission-Identified Issuers to submit documentation to the SEC establishing that it is not owned or controlled by a governmental entity in the public accounting firm’s foreign jurisdiction. Furthermore, on June 22, 2021, the U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act, which, if enacted into law would amend the HFCA Act and require the SEC to prohibit an issuer’s securities from trading on U.S. stock exchanges if its auditor is not subject to PCAOB inspections for two consecutive “non-inspection” years instead of three, and therefore reducing the time before our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges, and this ultimately could result in our Class A ordinary shares being delisted. On September 22, 2021, the PCAOB adopted a final rule implementing the HFCA Act, which provides a framework for the PCAOB to use when determining, as contemplated under the HFCA Act, whether the PCAOB is unable to inspect or investigate completely registered public accounting firms located in a foreign jurisdiction because of a position taken by one or more authorities in that jurisdiction. On December 16, 2021, the PCAOB issued a report on its determinations that the PCAOB is unable to inspect or investigate completely PCAOB-registered public accounting firms headquartered in mainland China and Hong Kong, because of positions taken by PRC authorities in these jurisdictions. The PCAOB included in its report a list of registered public accounting firms headquartered in mainland China and Hong Kong that the PCAOB is unable to inspect or investigate completely, including our auditor, KPMG Huazhen LLP. Our Class A ordinary shares may be delisted under the HFCA Act if the PCAOB is unable to inspect auditors who are located in China and if we fail to implement measures to enable PCAOB’ inspection of our auditor. See “Risk Factors—Related to Our Class A Ordinary Shares and this Offering—Our Class A ordinary shares may be delisted under the HFCA Act if the PCAOB is unable to inspect auditors who are located in China and if we fail to implement measures to enable PCAOB’s inspection of our auditor. The delisting of our Class A ordinary shares, or the threat of their being delisted, may materially and adversely affect the value of your investment. Additionally, the inability of the PCAOB to conduct inspections deprives our investors of the benefits of such inspections.”

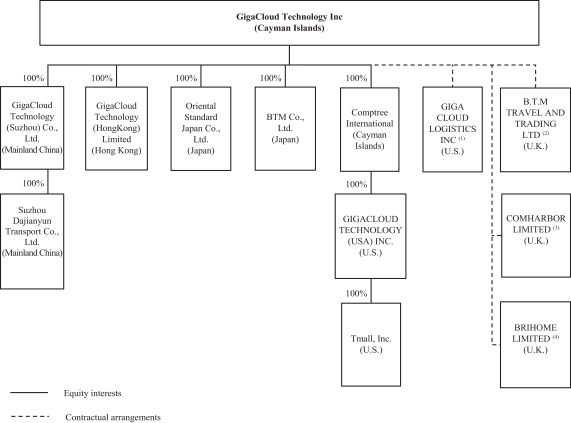

We have operations in many locations globally through our principal subsidiaries incorporated in mainland China, Hong Kong, Japan and the United States and our principal consolidated VIEs incorporated in the United States and the United Kingdom. If needed, cash can be transferred between our holding company and subsidiaries through intercompany fund advances. In 2019, GigaCloud Technology Inc, our Cayman Islands holding company (i) received a total of $4.4 million in cash from our subsidiaries and our consolidated VIEs, of which nil was from our Hong Kong Subsidiary or PRC Subsidiaries; and (ii) transferred a total of $3.3 million in cash to our subsidiaries and our consolidated VIEs, of which $1.0 million was to our Hong Kong Subsidiary and $1.4 million was to Suzhou Dajianyun Transport Co., Ltd., or Suzhou GigaCloud. In 2020, GigaCloud Technology Inc (i) received a total of $12.3 million in cash from our subsidiaries and our consolidated VIEs, of which $1.1 million was from our Hong Kong Subsidiary and nil from our PRC Subsidiaries; and (ii) transferred a total of $2.1 million in cash to our subsidiaries and our consolidated VIEs, of which $1.8 million was to our Hong Kong Subsidiary. In 2021, GigaCloud Technology Inc (i) received a total of $6.7 million in cash, of which $6.7 million was from our Hong Kong Subsidiary; and (ii) transferred a total of $18.6 million in cash to our subsidiaries, of which $18.5 million was to our Hong Kong Subsidiary and $0.1 million was to GigaCloud Trading (HongKong) Limited. In the three months ended March 31, 2022, GigaCloud Technology Inc (i) did not receive any cash transfer from our subsidiaries or consolidated VIEs; and (ii) transferred a total of $10.1 million to our subsidiaries, of which $10.0 million was to our Hong Kong Subsidiary and $0.1 million was to GigaCloud Trading (HongKong) Limited. Suzhou GigaCloud was a consolidated VIE in mainland China from 2018 to February 2021, and we acquired 100% of the equity interest in Suzhou GigaCloud in February 2021, which then became our indirect wholly-owned subsidiary. In 2019, Suzhou GigaCloud did not have any transfers, dividends or distributions with our Cayman Islands holding company or other intercompany entities. In 2020 and 2021, Suzhou GigaCloud received a total of $0.4 million and $1.5 million, respectively, in cash from our Hong Kong Subsidiary. In the three months ended March 31, 2022, Suzhou GigaCloud received a total of $0.3 million in cash from our Hong Kong Subsidiary. In 2020 and 2021, Suzhou GigaCloud transferred a total of nil and $0.5 million, respectively, in cash to our subsidiary in Japan and our consolidated VIE in the United States. In the three months ended March 31, 2022, Suzhou GigaCloud did not have any transfers, dividends or distributions with our Cayman Islands holding company or other intercompany entities. In 2019, 2020, 2021 and the three months ended March 31, 2022, GigaCloud Technology (Suzhou) Co., Ltd., our wholly-owned subsidiary in mainland China, transferred a total of $0.04 million, nil, $0.06 million and nil, respectively, in cash to our subsidiaries in mainland China. In 2019, 2020, 2021 and the three months ended March 31, 2022, GigaCloud Technology (Suzhou) Co., Ltd. received a total of $3.1 million in cash, of which $1.7 million was from our Hong Kong Subsidiary and $1.4 million was from GigaCloud Technology Inc, $4.6 million in cash from our Hong Kong Subsidiary, $15.1 million in cash, of which $15.0 million was from our Hong Kong Subsidiary and $0.1 million was from one of our PRC Subsidiaries, and $2.9 million in cash from our Hong Kong Subsidiary, respectively. As of the date of this prospectus, other than the cash transfer described hereto, there were no transfer of other assets between our Cayman Islands holding company, our subsidiaries and VIEs. Our subsidiaries and consolidated VIEs have never made any dividends or distributions to our Cayman Islands holding company, or to investors. Similarly, our Cayman Islands holding company has not declared or made any dividend or other distribution to its shareholders, including U.S. investors, in the past. If we decide to pay dividends on any of our ordinary shares in the future, as a holding company, we will be dependent on receipt of funds from our principal subsidiaries in Hong Kong, Japan and the United States and our principal consolidated VIEs in the United States and the United Kingdom. There are currently no restrictions on foreign exchange and our ability to transfer cash among our Cayman Islands holding company and our principal subsidiaries and consolidated VIEs, as applicable, in Hong Kong, Japan, the United States and the United Kingdom, or to investors. Although we did not rely on our PRC Subsidiaries in dividends or other distributions on equity in the past, in the event that our PRC Subsidiaries were to issue dividends or distribution to us out of mainland China in the future, our PRC Subsidiaries may be subject to the applicable foreign currency control. To date, there have not been any such dividends or other distributions from our PRC Subsidiaries to our subsidiaries located outside of mainland China. In addition, save as disclosed above, as of the date of this prospectus, none of our subsidiaries have ever issued any dividends or distributions to us or their respective shareholders outside of mainland China. In the PRC, the PRC government imposes controls on the convertibility of the Renminbi into foreign currencies and the remittance of currency out of the PRC which may restrict our PRC Subsidiaries’ ability to transfer cash from our PRC Subsidiaries to our other non-mainland China entities. To the extent cash is generated in our PRC Subsidiaries, and may need to be used to fund operations outside of mainland China, such funds may not be available due to limitations placed by the PRC government. Furthermore, to the extent assets (other than cash) in our business are located in mainland China or held by a mainland China entity, the assets may not be available to fund operations or for other use outside of mainland China due to interventions in or the imposition of restrictions and limitations on the ability of us and our subsidiaries to transfer assets by the PRC government. If certain PRC laws and regulations, including existing laws and regulations and those enacted or promulgated in the future were to become applicable to our Hong Kong Subsidiary in the future, and to the extent cash is generated in our Hong Kong Subsidiary and to the extent assets (other than cash) in our business are located in Hong Kong or held by a Hong Kong entity and may need to be used to fund operations outside of Hong Kong, such funds or assets may not be available due to interventions in or the imposition of restrictions and limitations on the ability of us and our subsidiaries to transfer funds or assets by the PRC government. Furthermore, there can be no assurance that the PRC government will not intervene or impose restrictions on GigaCloud Group’s ability to transfer or distribute cash within its organization, which could result in an inability or prohibition on making transfers or distributions to entities outside of mainland China and Hong Kong and adversely affect its business. Saved as the foregoing limitations imposed by the PRC government as described hereto, there are currently no limitations on our or our subsidiaries’ ability to transfer cash to investors. See “Risk Factors—Risks Related to Doing Business in China—Governmental control of currency conversion may limit our ability to utilize our revenues, transfer or distribute cash within our group effectively and affect the value of your investment.”

We currently have not maintained any cash management policies that dictate the purpose, amount and procedure of fund transfers among our Cayman Islands holding company, our subsidiaries, the consolidated VIEs, or investors. Rather, the funds can be transferred in accordance with the applicable laws and regulations. See “Prospectus Summary—Cash Transfers and Dividend Distribution.” We may require additional capital resources in the future and we may seek to issue additional equity or debt securities or obtain new or expanded credit facilities, which could subject us to operating and financing covenants, including requirements to maintain certain amount of cash reserves. See “Risk Factors—Risks Related to Our Business and Industry—Our ability to raise capital in the future may be limited, and our failure to raise capital when needed could prevent us from growing.”

Neither the United States Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

| | | | | | | | |

| | | Per Class A

ordinary share | | | Total | |

Initial public offering price | | $ | | | | $ | | |

Underwriting discounts and commissions (1) | | $ | | | | $ | | |

Proceeds, before expenses, to us | | $ | | | | $ | | |

| | (1) | For additional information on underwriting compensation, see “Underwriting.” |

We have granted the underwriter a 45-day option to purchase up to an aggregate of 367,500 additional Class A ordinary shares, representing 15% of the Class A ordinary shares sold in the offering, from GigaCloud Technology Inc solely to cover over-allotments, if any, at the initial public offering price less the underwriting discounts and commissions.

Immediately prior to the completion of this offering, our outstanding share capital will consist of Class A ordinary shares and Class B ordinary shares. Mr. Larry Lei Wu, our chairman of board of directors and chief executive officer, will beneficially own all of our issued Class B ordinary shares and will be able to exercise approximately 75.4% of the total voting power of our issued and outstanding share capital immediately following the completion of this offering. Holders of Class A ordinary shares and Class B ordinary shares will have the same rights except for voting and conversion rights. Each Class A ordinary share will be entitled to one vote, and each Class B ordinary share will be entitled to ten votes. Our Class A ordinary shares and Class B ordinary shares vote together as a single class on all matters submitted to a vote of our shareholders, except as may otherwise be required by law. Each Class B ordinary share will be convertible into Class A ordinary share. Class A ordinary shares will not be convertible into Class B ordinary shares under any circumstances.

Upon the completion of this offering, we will be a “controlled company” as defined under the Nasdaq Stock Market Listing Rules because Mr. Larry Lei Wu, our chairman of board of directors and chief executive officer, will hold more than 50% of our voting power for the election of directors through TALENT BOOM GROUP LIMITED and Ji Xiang Hu Tong Holdings Limited, the entities controlled by Mr. Wu. In addition, our directors, officers and certain affiliated shareholders will own a substantial majority of our shares and will be able to exercise a substantial majority of the total voting power of our total issued and outstanding ordinary shares immediately upon the completion of this offering, assuming the underwriter does not exercise the option to purchase additional Class A ordinary shares. See “Principal Shareholders” for details.

The underwriter expects to deliver the Class A ordinary shares against payment in U.S. dollars in New York, New York on or about , 2022

Sole Book-Running Manager

PROSPECTUS DATED , 2022