United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

United States Securities and Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: Walmart Inc.

Name of persons relying on exemption: The Shareholder Commons, Inc.

Address of persons relying on exemption: PO Box 1268, Northampton, Massachusetts 01061

Written materials are submitted pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the terms of the Rule but is made voluntarily in the interest of public disclosure and consideration of these important issues.

Balancing Employee Financial Security and Company Financial Returns: A Rebuttal to the Walmart Board

At Walmart, the average hourly wage is not even enough to sustain a single adult with no children, even in low-cost areas of the United States. This failure to provide a living wage to people who work for a living threatens the entire economy, and thus the investment portfolios of the average diversified investor.

The Shareholder Commons urges (“TSC”) you to vote “FOR” Item 7 on the proxy (the “Proposal”), a shareholder proposal requesting that Walmart Inc. (“Walmart” or the “Company”) establish wage policies designed to provide workers with the minimum earnings necessary to meet a family’s basic needs.

TSC is a non-profit organization that addresses social and environmental issues from the perspective of shareholders who diversify their investments to optimize risk and return. More specifically, TSC addresses the conflict that often emerges between a company’s interest in maximizing its cash flows and its shareholders’ interests in optimizing overall market returns.

We support Item 7 because Company compensation practices that fail to provide a living wage are harmful to the economy and therefore to the returns of Walmart’s diversified shareholders.

Walmart is the largest employer in the United States;1 its policies thus have tremendous influence on the market as a whole. The Proposal requests that the Company pay a living wage, with the aim of protecting diversified portfolios from negative effects on the economy caused by inadequate wages and expanding income inequality:

BE IT RESOLVED, shareholders ask that the board and management exercise their discretion to establish Company wage policies that are consistent with fiduciary duties and reasonably designed to provide workers with the minimum earnings necessary to meet a family’s basic needs, because Company compensation practices that fail to provide a living wage are harmful to the economy and therefore to the returns of diversified shareholders.2

Walmart’s opposition to the proposal relies on irrelevant arguments that do not address the magnitude of the threat posed by poverty wages and expanding income inequality:

| 1. | Walmart says it “provides strong pay and benefits.” But such a statement relies on an irrelevant reference point: while its pay and benefits may allow Walmart to optimize recruiting and retention to meet its internal financial goals, it makes no acknowledgement of the fact that this Proposal addresses the portfolio costs its shareholders absorb from Company wages that fall dramatically short of a living wage. |

| 2. | Walmart says it provides “opportunities for people” to “gain the skills and experiences they need to meet their life and career (including pay) goals.” But while this may be true, it again fails to address the economic damage Walmart creates when it underpays the people to whom it provides “opportunities.” |

| 3. | Walmart says it already operates “in a way that creates substantial value for customers, associates, suppliers, communities, and other constituencies.” But the constituency this Proposal addresses is Walmart’s shareholders. Walmart’s argument does not account for the impact of its poverty wages on the diversified portfolios of most investors such as Texas teachers, Detroit fire fighters, and other working people who count on their savings and pensions for a dignified retirement. For them, the single greatest determinant of portfolio value is broad economic health, and the living wage gap may be costing the economy $4.56 trillion every year. |

_____________________________

1 Richard Volpe and Michael A. Boland, “The Economic Impacts of Walmart Supercenters,” Annual Review of Resource Economics 14, no. 1 (October 5, 2022): 43–62, https://doi.org/10.1146/annurev-resource-111820-032827.

2 The Shareholder Commons, “Living Wage & the Engagement Gap: Using a Systems Lens to Build Portfolio Value through Improved Wages,” November 2023, https://theshareholdercommons.com/case-studies/labor-and-inequality-case-study/.

| B. | Underpaying Workers Threatens Economic Prosperity and Diversified Portfolios |

Current levels of poverty wages and income inequality threaten the global economy with losses that will burden investment portfolios over the next 30 years and beyond, as we explain further in Section C. Conversely, higher wages lead to increased productivity and consumption in a virtuous macroeconomic cycle that benefits investment portfolios.

Diversified investors—including pension funds, foundations, and endowments—and other institutions working on behalf of these investors and other beneficiaries with diversified portfolios must work to bring an end to employment practices at Walmart that threaten the economy upon which their portfolios depend.

In the following sections, we describe the research establishing the relationship between poverty wages and income inequality on the one hand and long-term returns of diversified portfolios on the other, and show why shareholders can and must steward Walmart away from pay practices that threaten the economy. This system-wide perspective is necessary to protect shareholders, whose diversified portfolios are threatened by company decisions that do not account for systemic effects.

Addressing these systemic concerns means moving beyond the measurement of investment success solely at the company level, and recognizing that portfolio returns are based not only on the profits that companies deliver, but also on the economic impact they create.

| C. | Walmart’s wages are insufficient to mitigate economic damage and do not account for portfolio impact |

Walmart’s wage policies are not sufficient to mitigate the risk its diversified shareholders face to their portfolios from the economic damage that arises from an impoverished workforce and expanding income inequality.

| 1. | Walmart says it “provides strong pay and benefits,” without acknowledging the insufficiency of its wage structure to protect its shareholders |

Living wage

The living wage model reflects “the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency.”3 The living wage is abstemious, making no allowances for savings, consumption of even modest prepared foods, or home purchases, among other things. As the MIT Living Wage Calculator explains: “The living wage is the minimum income standard that, if met, draws a very fine line between the financial independence of the working poor and the need to seek out public assistance or suffer consistent and severe housing and food insecurity. In light of this fact, the living wage is perhaps better defined as a minimum subsistence wage.”4

_____________________________

3 “Living Wage Calculator,” accessed August 4, 2023, https://livingwage.mit.edu/pages/about. (Living wage is a “market-based approach that draws upon geographically specific expenditure data related to a family’s likely minimum food, childcare, health insurance, housing, transportation, and other basic necessities (e.g. clothing, personal care items, etc.) costs. The living wage draws on these cost elements and the rough effects of income and payroll taxes to determine the minimum employment earnings necessary to meet a family’s basic needs while also maintaining self-sufficiency.”)

4 Id. (Emphasis added)

Many people believe a living wage is the same as the minimum wage, but that is not the case. Indeed, in some regions, the chasm between the two is substantial. For instance, the U.S. federal minimum wage stood at $7.25 per hour in 2023, whereas the U.S. average living wage in 2022—the most recent year for which data are available—was $25.02 per hour for a family of four (two working adults, two children).5 That figure is likely to have increased in the current inflationary environment.

Walmart’s cost externalization resulting from its failure to pay a living wage

In its Opposition Statement, Walmart asserts that its “average hourly wage for Company associates in the U.S. was over $17.50 per hour.” [emphasis added] The Company does not mention that it recently reduced its lowest-paid workers’ hourly wage to $13.6 With an average hourly wage that falls well short of a living wage, and a starting hourly wage $12.02 less than a living wage, Walmart clearly underpays many of its workers, especially those at starting wages in the lowest-paid jobs.

Walmart’s stores are often located in areas where the cost of living may be lower than national averages. Noting that, we provide in the following table the current living wage for selected Walmart store locations:7

| Store Location | Living wage: 1 adult, 0 children | Living wage: 2 working adults, 2 children |

| Batesville, MS | $18.36/hour | $20.54/hour |

| Los Lunas, NM | $19.43/hour | $23.55/hour |

| Kuna, ID | $22.72/hour | $27.62/hour |

| Turlock, CA | $23.10/hour | $27.73/hour |

| Flanders, NJ | $26.58/hour | $33.65/hour |

In other words, Walmart’s starting pay is deeply inadequate no matter the employee’s location or family situation, and its average wage fails to meet the basic needs of single, childless employees even in the most economically disadvantaged areas of the country. The average Walmart associate makes far less than necessary to sustain a family of four with both adults working full time, even in locations with the lowest cost of living. Its average hourly wage isn’t even enough to sustain a single adult with no children in the lowest cost-of-living location cited above.

Corresponding to Walmart’s current failure to pay many of its employees a living wage, there is also significant wage inequality within the Company. According to the Company’s 2024 Proxy Statement, the Company’s CEO made $27 million in the previous fiscal year, or 976 times more than the Company’s median employee (up from a CEO pay ratio of 933 the previous year8).

_____________________________

5 Amy Glasmeier, “NEW DATA POSTED: 2023 Living Wage Calculator,” Living Wage Calculator, February 1, 2023, https://livingwage.mit.edu/articles/103-new-data-posted-2023-living-wage-calculator.

6 Daphne Howland, “Walmart Lowers Starting Wage for Some Store Workers,” Retail Dive, September 8, 2024, https://www.retaildive.com/news/walmart-lowers-starting-wage-workers/693071/.

7 See MIT’s Living Wage Calculator at https://livingwage.mit.edu/

8 https://www.sec.gov/ix?doc=/Archives/edgar/data/0000104169/000010416923000034/wmt-20230420.htm

In its Opposition Statement, Walmart asserts that its associates who are women or people of color are “paid 1:1 (dollar for dollar)” the pay of their white and male counterparts. We do not dispute that assertion, but it is not responsive to Walmart’s contribution to expanding, economy-wide racial disparity in income: Walmart’s employees of color make up a disproportionate number of employees not earning a living wage because people of color compose more than half the Company’s U.S. workforce, yet account for only 29 percent of officer roles.9

It appears Walmart’s decision not to pay a living wage is attributable to a Company approach to compensation that does not account for economy- or portfolio-wide risk mitigation, and instead focuses on risks to its own business.

| 2. | The broad economic cost associated with poverty wages and income inequality surpasses any risk the issue poses to Walmart itself |

Walmart as a unitary economic force

Walmart is the largest employer in the United States,10 giving its wages economy-wide impact. With 1.6 million associates in the United States alone,11 more people work at Walmart than the collective populations of 11 U.S. states and the District of Columbia.12 In 2019, Walmart’s revenues were $514 billion, or about 2.4 percent of the entire United States’ GDP.13 A 2020 research article found that if Walmart were a country, it would rank in the top 25 countries in terms of GDP.14

The term “Walmart Effect” can be traced back to the 1990s.15 In 2006, business journalist Charles Fishman wrote a book titled “The Walmart Effect”16 describing the effects Walmart has on the economy. In 2013, Democratic staff of the U.S. House Committee on Education and the Workforce issued a report titled: “The Low-Wage Drag on Our Economy: Wal-Mart’s low wages and their effect on taxpayers and economic growth.”17 The report raises the issue of cost externalization of Walmart’s low wages: “While employers like Wal-Mart seek to reap significant profits through the depression of labor costs, the social costs of this low-wage strategy are externalized.”

_____________________________

9 https://corporate.walmart.com/purpose/belonging-diversity-equity-inclusion/belonging-diversity-equity-and-inclusion-report

10 Richard Volpe and Michael A. Boland, “The Economic Impacts of Walmart Supercenters,” Annual Review of Resource Economics 14, no. 1 (October 5, 2022): 43–62, https://doi.org/10.1146/annurev-resource-111820-032827.

11 https://corporate.walmart.com/askwalmart/how-many-people-work-at-walmart

12 (Alaska, Delaware, District of Columbia, Hawaii, Maine, Montana, New Hampshire, North Dakota, Rhode Island, South Dakota, Vermont, Wyoming) US Census Bureau, “State Population Totals and Components of Change: 2020-2023,” Census.gov, accessed April 26, 2024, https://www.census.gov/data/tables/time-series/demo/popest/2020s-state-total.html.

13 Bob Unglesbee, “Retailer of the Year: Walmart,” Retail Dive (blog), December 9, 2019, https://www.retaildive.com/news/retailer-walmart-dive-awards/566187/.

14 Robert W. McGee, “How Highly Would Walmart Rank If It Were a Country? A Comparison of Walmart Revenue to Nations’ GDP,” SSRN Scholarly Paper (Rochester, NY, January 22, 2020), https://doi.org/10.2139/ssrn.3524078.

15 Julie Morris, “Store shuts doors on Texas town,” USA Today, October 11, 1990.

16 Charles Fishman, The Wal-Mart Effect: How the World’s Most Powerful Company Really Works - and How It’s Transforming the American Economy (Penguin Books, 2006).

17 Democratic Staff of the U.S. House Committee on Education and the Workforce, “The Low-Wage Drag on Our Economy: Wal-Mart’s Low Wages and Their Effect on Taxpayers and Economic Growth,” May 2013, https://democrats-edworkforce.house.gov/imo/media/doc/WalMartReport-May2013.pdf.

Generalized impacts of corporate cost externalization from underpaying workers

Closing the living wage gap worldwide could generate as much as an additional $4.56 trillion every year through increased productivity and spending,18 which equates to a more than 4 percent increase in annual GDP. Inadequate pay thus materially reduces the intrinsic value of the global economy, which in turn affects investment portfolios.

It has been estimated that a one percent increase in inequality leads to a decrease in GDP of 0.6-1.0 percent.19 A one percent difference in inequality could thus lead to 17-26 percent lower GDP over 30 years and correspondingly lower returns for a diversified portfolio. This means that a 32-year-old worker saving for retirement today through a defined contribution plan could expect to have a nest egg 17-26 percent smaller at age 62. A defined benefit plan facing the same deficit could be forced to lower its benefits significantly, increase employer or employee contributions, or—in the case of a public pension fund—increased tax burdens.

For a more comprehensive review of the evidence of economic damage arising from poverty wages and income inequality, please see our recently published report, “Living Wage & the Engagement Gap: Using a Systems Lens to Build Portfolio Value through Improved Wages,” available on our website at https://theshareholdercommons.com/case-studies/labor-and-inequality-case-study/.

| D. | Poverty wages and income inequality threaten the returns of Walmart’s diversified investors |

| 1. | Investors must diversify to optimize their portfolios |

It is commonly understood that investors are best served by diversifying their portfolios.20 Diversification allows investors to reap the increased returns available from risky securities while greatly reducing that risk.21 This core principle is reflected in federal law, which requires fiduciaries of federally regulated retirement plans to “diversify[] the investments of the plan.”22 Similar principles govern other investment fiduciaries.23

_____________________________

18 The Business Commission to Tackle Inequality, “Tackling Inequality: The Need and Opportunity for Business Action,” June 2022, https://tacklinginequality.org/files/introduction.pdf.

19 Orsetta Causa, Alain de Serres, and Nicolas Ruiz, “Growth and Inequality: A Close Relationship?,” OECD, 2014, https://www.oecd.org/economy/growth-and-inequality-close-relationship.htm.

20 See generally, Burton G. Malkiel, A Random Walk Down Wall Street, W. W. Norton & Company (2016).

21 Ibid.

22 29 USC Section 404(a)(1)(C).

23 See Uniform Prudent Investor Act, § 3 (“[a] trustee shall diversify the investments of the trust unless the trustee reasonably determines that, because of special circumstances, the purposes of the trust are better served without diversifying.”)

| 2. | The performance of a diversified portfolio largely depends on overall market return |

Diversification is thus required by accepted investment theory and imposed by law on investment fiduciaries. Once a portfolio is diversified, the most important factor determining return will not be how the companies in that portfolio perform relative to other companies (“alpha”), but rather how the market performs as a whole (“beta”). In other words, the financial return to such diversified investors chiefly depends on the performance of the market, not the performance of individual companies. As one work describes this, “[a]ccording to widely accepted research, alpha is about one-tenth as important as beta [and] drives some 91 percent of the average portfolio’s return.”24 As shown in the next section, the social and environmental impacts of individual companies such as Walmart can significantly affect beta.

| 3. | Costs companies impose on social and environmental systems heavily influence beta |

Over long time periods, beta is influenced chiefly by the performance of the economy itself, because the value of the investable universe is equal to the portion of the productive economy that the companies in the market represent.25 Over the long run, diversified portfolios rise and fall with GDP or other indicators of the intrinsic value of the economy. As the legendary investor Warren Buffet puts it, GDP is the “best single measure” for broad market valuations.26

But the social and environmental costs created by companies pursuing profits can burden the economy. As laid out in section B above, the economic cost estimates associated with poverty wages and income inequality are staggering. This drag on GDP directly reduces the return on a diversified portfolio over the long term.27

The acts of individual companies affect whether the economy will bear these costs: if they increase their own bottom line by underpaying workers, the profits earned for and capital returned to their shareholders may be inconsequential in comparison to the added costs the economy bears.

_____________________________

24 Stephen Davis, Jon Lukomnik, and David Pitt-Watson, What They Do with Your Money, Yale University Press (2016).

25 Principles for Responsible Investment & UNEP Finance Initiative, “Universal Ownership: Why Environmental Externalities Matter to Institutional Investors,” Appendix IV, available at https://www.unepfi.org/fileadmin/documents/universal_ownership_full.pdf.

26 Warren Buffett and Carol Loomis, “Warren Buffett on the Stock Market,” Fortune Magazine (December 10, 2001), available at https://archive.fortune.com/magazines/fortune/fortune_archive/2001/12/10/314691/index.htm.

27 See supra n.25.

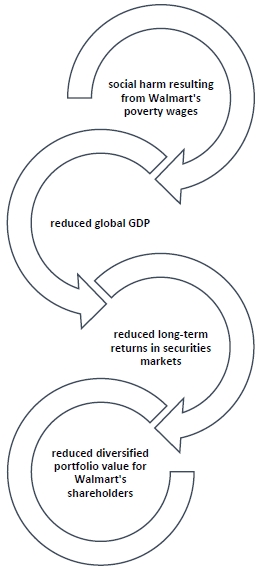

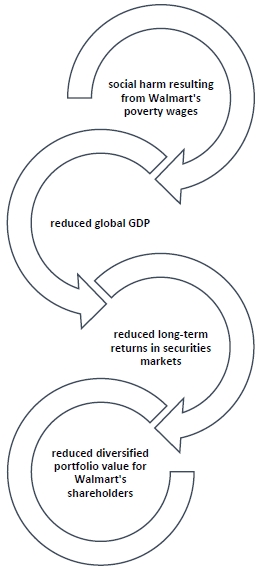

Figure 1 below illustrates how the chain of value destruction runs from Walmart’s poverty wages to its diversified shareholders’ financial returns, even if those decisions might benefit Walmart financially.

Figure 1

Walmart’s disclosures demonstrate that its compensation strategy simply fails to address the economic costs of poverty wages and income inequality. Instead, it appears the Company’s operational focus means that Walmart’s decision to deprive its workers of a living does not account for the broader impact of that decision on the economy and Walmart’s diversified shareholders.

This failure must be addressed, because a healthy economy is a far greater value driver of their portfolio value than is the enterprise value of any one company within those portfolios: systematic factors explain 75-94 percent of average portfolio return.28

_____________________________

28 Jon Lukomnik and James P. Hawley, Moving Beyond Modern Portfolio Theory: Investing that Matters (April 30, 2021) Routledge.

| E. | Why you should vote “FOR” the Proposal |

Voting “FOR” the Proposal will signal to Walmart that shareholders want the Company not to put the economy (and thus their diversified portfolios) at risk in order to improve Walmart’s financial performance.

Additionally:

| · | Walmart underpays its workers, which creates an economy-wide risk that poses a threat to diversified shareholders. |

| · | Walmart’s disclosures show it is not taking the actions that are required of corporations seeking to end practices that externalize costs onto the broader economy and diversified shareholders. |

| · | Walmart’s decision-makers—who are heavily compensated in equity—do not share the same broad market risk as Walmart’s diversified shareholders. |

Please vote “FOR” Item 7

By voting “FOR” Item 7, shareholders can urge Walmart to account directly for its poverty wages and the resulting costs to society, which in turn affect the economic health upon which diversified portfolios depend. Paying a living wage can aid the Board and management in authentically serving the needs of Walmart’s diversified shareholders and in preventing the dangerous implications—to diversified shareholders and others—of a narrow focus on internal financial return.

The Shareholder Commons urges you to vote “FOR” Item 7 on the proxy, the Shareholder Proposal requesting payment of a living wage at the Walmart Inc. Annual Meeting on June 5, 2024.

For questions regarding the Walmart Inc. Proposal submitted by Legal and General Investment Management America, Inc. and The Nathan Cummings Foundation, please contact Sara E. Murphy of The Shareholder Commons at +1.202.578.0261 or via email at sara@theshareholdercommons.com.

THE FOREGOING INFORMATION MAY BE DISSEMINATED TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES, AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY.

PROXY CARDS WILL NOT BE ACCEPTED BY FILERS NOR BY THE SHAREHOLDER COMMONS.

TO VOTE YOUR PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON YOUR PROXY CARD.

9