Exhibit 99.1

INVESTOR PRESENTATION NOVEMBER 2022

This presentation is provided for informational purposes only and has been prepared to assist interested parties in making th eir own evaluation with respect to a potential business combination (the “ proposed business combination ” ) among (i) AUM Biosciences Limited ( “ Holdco ” ), (ii) AUM Biosciences Subsidiary Pte. Ltd., (iii) a to be formed Delaware merger subsidiary, (iv) AUM Biosciences Pte. Ltd. ( “ AUM ” ) and (v) Mountain Crest Acquisition Corp. V ( “ Mountain Crest ” ) and related transactions and for no other purpose. No representations or warranties, express or implied are given in, or in re spect of, this presentation. To the fullest extent permitted by law in no circumstances will AUM, Mountain Crest or any of their re spe ctive subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents b e r esponsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this presentation, its contents, its omissions, reliance on the inf ormation contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. I ndu stry and market data used in this presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. N either AUM nor Mountain Crest has independently verified the data obtained from these sources and cannot assure you of the da ta ’ s accuracy or completeness. This data is subject to change. In addition, this presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of AUM or the proposed business combination. Viewers of this presentation should each m ake their own evaluation of AUM and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. The information i n t his presentation is highly confidential. The distribution of this presentation by an authorized recipient to any other person is unauthorized. Any photocopying, disclosure, reproduction or alteration of the contents of this presentation and any forwarding of a copy of this presentation or any port ion of this presentation to any person is prohibited. The recipient of this presentation shall keep this presentation and its con te nts confidential, shall not use this presentation and its contents for any purpose other than as expressly authorized by AUM and Mountain Crest and shall be required to return or dest roy all copies of this presentation or portions thereof in its possession promptly following request for the return or destructio n of such copies. By accepting delivery of this presentation, the recipient is deemed to agree to the foregoing confidentiality requirements. This presentation contains tra dem arks, service marks, trade names and copyrights of AUM, Mountain Crest and other companies, which are the property of their r esp ective owners. Forward - looking Statements This presentation includes “ forward - looking statements ” within the meaning of the “ safe harbor ” provisions of the United States Private Securities Litigation Reform Act of 1995 . Forward - looking statements may be identified by the use of words such as “ estimate, ” “ plan, ” “ project, ” “ forecast, ” “ intend, ” “ will, ” “ expect, ” “ anticipate, ” “ believe, ” “ seek, ” “ target ” or other similar expressions that predict or indicate future events or trends or that are not statements of historical matter s. These forward - looking statements include, but are not limited to, statements regarding estimates and forecasts of financial and performance metrics, projections of market opportunity and market share. These statements are based on various assumption s, whether or not identified in this presentation, and on the current expectations of AUM ’ s and Mountain Crest ’ s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be r elied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual ev ents and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of AUM and Mountain Cre st. These forward - looking statements are subject to a number of risks and uncertainties, including changes in domestic and foreign business, market, financial, political and legal conditions; the inability of the parties to successfully or timely consummate the proposed business combination, includ ing the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that c ould adversely affect the combined company or the expected benefits of the proposed business combination or that the approval of the stockholders of Mountain Crest or AUM is n ot obtained; failure to realize the anticipated benefits of the proposed business combination; risks relating to the uncertainty of the projected financial information with respect to AUM; the effects of competition on AUM ’ s future business; the amount of redemption requests made by Mountain Crest ’ s public stockholders; the ability of Mountain Crest or the combined company to issue equity or equity - linked securities in conn ection with the proposed business combination or in the future, and those factors discussed in Mountain Crest ’ s final prospectus dated November 12 , 2021 under the heading “ Risk Factors, ” and other documents of Mountain Crest filed, with the Securities and Exchange Commission ( “ SEC ” ). If any of these risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward - looking statements. There may be additional ris ks that neither Mountain Crest nor AUM presently know or that Mountain Crest and AUM currently believe are immaterial that co uld also cause actual results to differ from those contained in the forward - looking statements. In addition, forward - looking statements reflect Mountain Crest ’ s and AUM ’ s expectations, plans or forecasts of future events and views as of the date of this presentation. Mountain Crest and AUM ant ici pate that subsequent events and developments will cause Mountain Crest ’ s and AUM ’ s assessments to change. However, while Mountain Crest and AUM may elect to update these forward - looking statements at some poin t in the future, Mountain Crest and AUM specifically disclaim any obligation to do so. These forward - looking statements should n ot be relied upon as representing Mountain Crest ’ s and AUM ’ s assessments as of any date subsequent to the date of this presentation. Accordingly, undue reliance should not be placed up on the forward - looking statements. Use of Projections This presentation contains projected financial information with respect to AUM. Such projected financial information constitu tes forward - looking information, and is for illustrative purposes only and should not be relied upon as necessarily being indicativ e of future results. The assumptions and estimates underlying such projected financial information are inherently uncertain and are subject to a wide variety of significant bus ine ss, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those c ont ained in the prospective financial information. See “ Forward - Looking Statements ” above. Actual results may differ materially from the results contemplated by the projected financial information contained in th is presentation, and the inclusion of such information in this presentation should not be regarded as a representation by any pe rson that the results reflected in such projections will be achieved. Neither the independent auditors of Mountain Crest nor the independent regist ere d public accounting firm of AUM, audited, reviewed, compiled, or performed any procedures with respect to the projections for th e purpose of their inclusion in this presentation, and accordingly, neither of them expressed an opinion or provided any other form of assurance with respect ther eto for the purpose of this presentation. Financial Information The financial information and data contained in this presentation is unaudited and does not conform to Regulation S - X. According ly, such information and data may not be included in, may be adjusted in or may be presented differently in, any proxy statem ent , registration statement, or prospectus to be filed by Mountain Crest with the SEC. All AUM historical financial information included herein is preliminary and subject to cha nge pending finalization of audits of AUM for the fiscal years ended March 31 , 2022 and 2021 in accordance with PCAOB auditing standards. Additional Information and Where to Find It In connection with the transaction described herein, Holdco and Mountain Crest will file relevant materials with the SEC, inc lud ing the Registration Statement on Form F - 4 and a proxy statement. The proxy statement and a proxy card will be mailed to stockholders of Mountain Crest as of a record d ate to be established for voting at the stockholders ’ meeting relating to the proposed transactions. Stockholders will also be able to obtain a copy of the Registration Statement on Form F - 4 and proxy statement without charge from Holdco and Mountain Crest. The Registration Statement on Form F - 4 and proxy statement, once available, may also be obtained without charge at the SEC ’ s website at www.sec.gov. INVESTORS AND SECURITY HOLDERS OF MOUNTAIN CREST ARE URGED TO READ THESE MATERIALS (INCLUDING ANY A MEN DMENTS OR SUPPLEMENTS THERETO) AND ANY OTHER RELEVANT DOCUMENTS IN CONNECTION WITH THE TRANSACTIONS THAT MOUNTAIN CREST WILL FILE WITH THE SEC WHEN THEY BECOME AVAILABLE BEC AUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT MOUNTAIN CREST, AUM AND THE TRANSACTIONS. Participants in Solicitation AUM, Mountain Crest, certain shareholders of Mountain Crest, and their respective directors, executive officers and employees an d other persons may be deemed to be participants in the solicitation of proxies from the holders of Mountain Crest common sto ck in respect of the proposed transaction. Information about Mountain Crest ’ s directors and executive officers and their ownership of Mountain Crest ’ s common stock is set forth in Mountain Crest's Registration Statement on Form S - 1 filed with the SEC. Other information regarding the interests of the participants in the proxy solicitation will be included in the proxy statement pertaining to the proposed transaction when it becomes available. These documents can be obta ine d free of charge from the sources indicated above. No Offer or Solicitation This presentation shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall ther e b e any sale of securities in any states or jurisdictions in which such offer, solicitation, or sale would be unlawful prior to re gistration or qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933 , as amended, or an exemption therefrom. Disclaimers 2

Table of Contents Transaction Details 04 Business Overview 07 Development Overview 17 3

TRANSACTION DETAILS

AUM Biosciences Vishal Doshi Chairman & Chief Executive Officer Harish Dave Chief Medical Officer Mountain Crest Acquisition Corp. V Suying Liu, Ph.D Chairman, Chief Executive Officer, and Chief Financial Officer Today ’ s Presenters 5

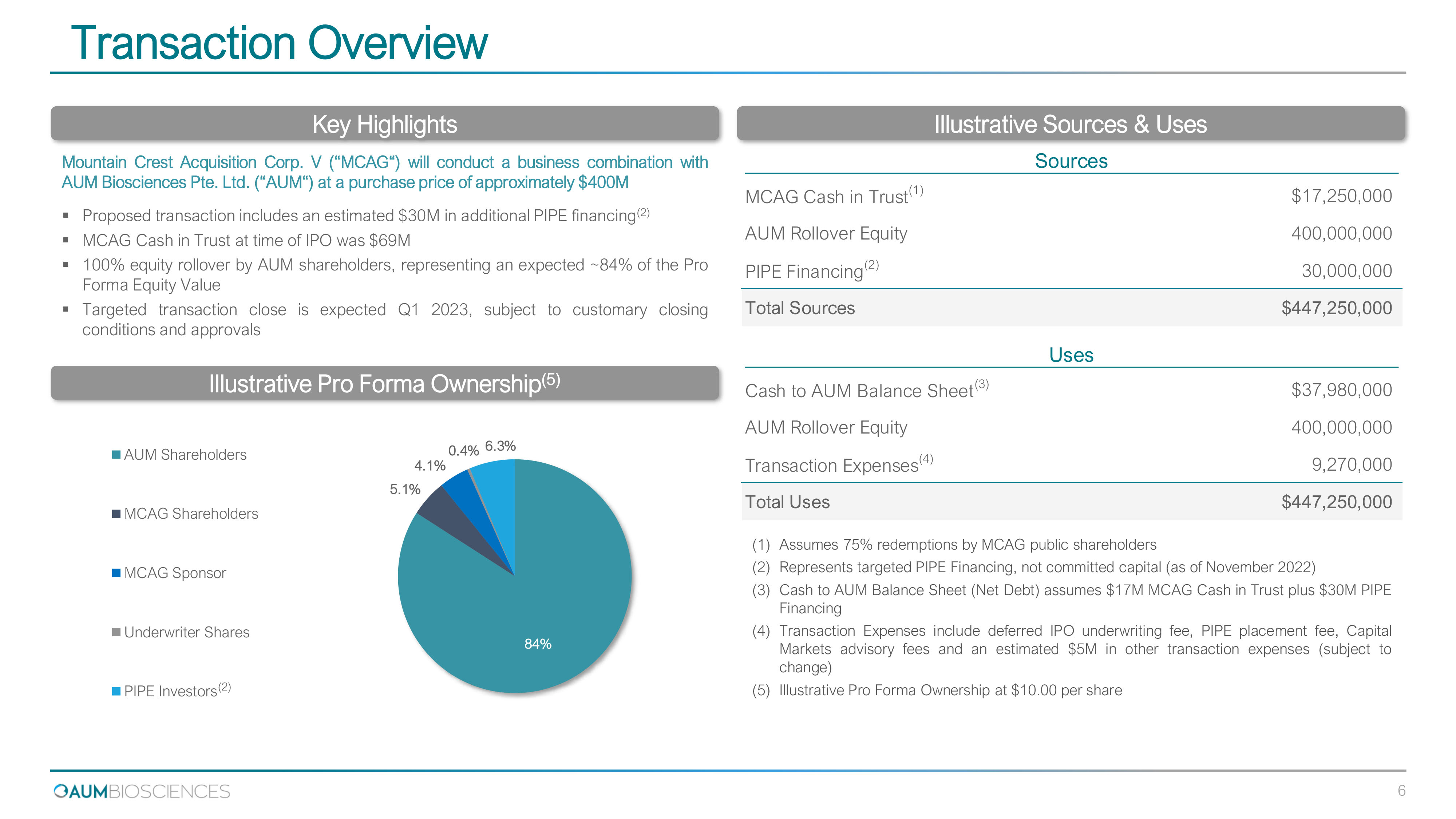

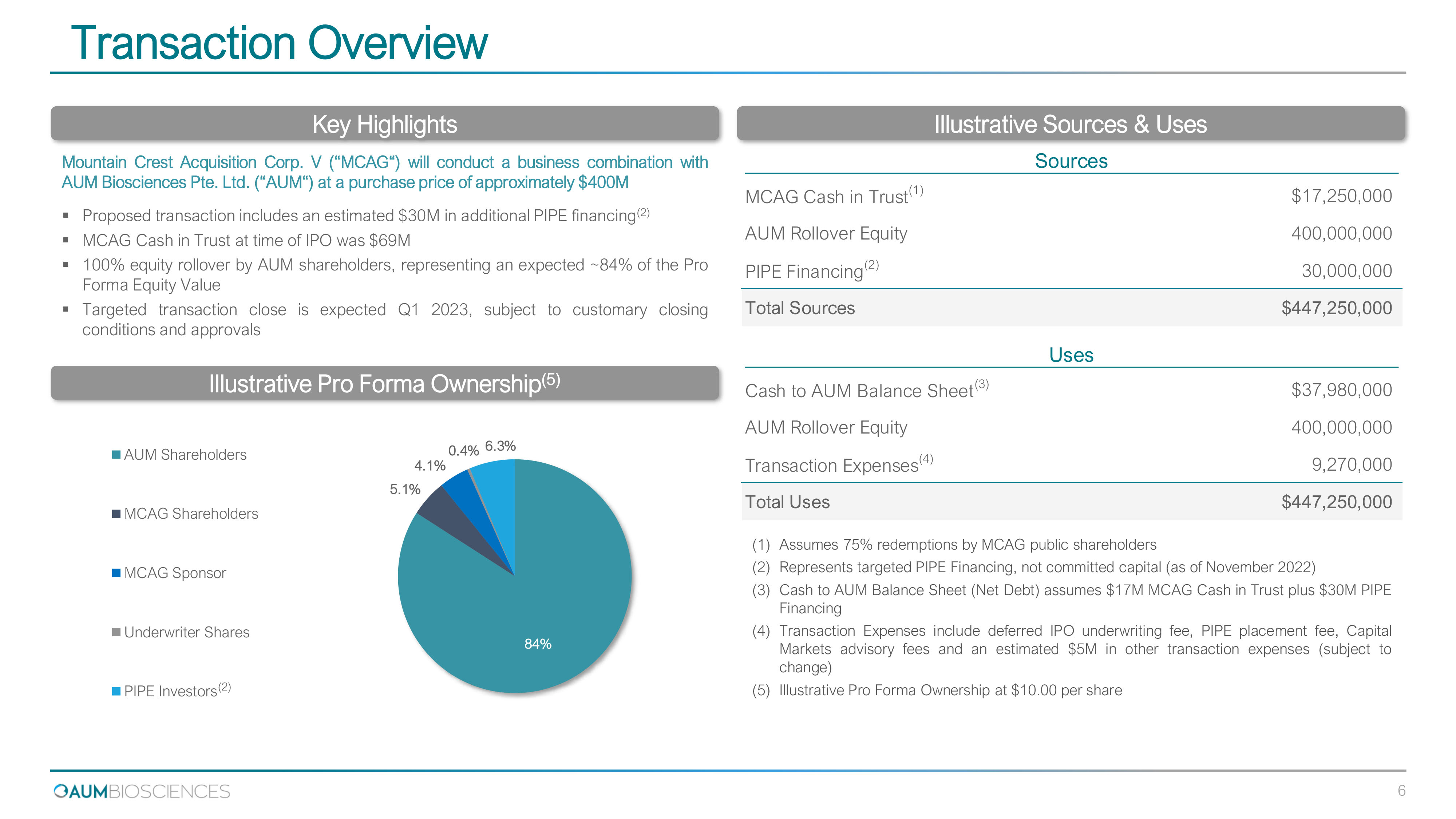

Transaction Overview Key Highlights Illustrative Pro Forma Ownership ( 5 ) Illustrative Sources & Uses Mountain Crest Acquisition Corp . V ( “ MCAG “ ) will conduct a business combination with AUM Biosciences Pte . Ltd . ( “ AUM “ ) at a purchase price of approximately $ 400 M ▪ Proposed transaction includes an estimated $ 30 M in additional PIPE financing ( 2 ) ▪ MCAG Cash in Trust at time of IPO was $ 69 M ▪ 100 % equity rollover by AUM shareholders, representing an expected ~ 84 % of the Pro Forma Equity Value ▪ Targeted transaction close is expected Q 1 2023 , subject to customary closing conditions and approvals (1) Assumes 75 % redemptions by MCAG public shareholders (2) Represents targeted PIPE Financing, not committed capital (as of November 2022 ) (3) Cash to AUM Balance Sheet (Net Debt) assumes $ 17 M MCAG Cash in Trust plus $ 30 M PIPE Financing (4) Transaction Expenses include deferred IPO underwriting fee, PIPE placement fee, Capital Markets advisory fees and an estimated $ 5 M in other transaction expenses (subject to change) (5) Illustrative Pro Forma Ownership at $ 10 . 00 per share 6 ( 2 ) 84 % 5.1 % 4.1 % 0.4 % 6.3 % AUM Shareholders MCAG Shareholders MCAG Sponsor Underwriter Shares PIPE Investors Sources MCAG Cash in Trust (1) $17,250,000 AUM Rollover Equity 400,000,000 PIPE Financing (2) 30,000,000 Total Sources $447,250,000 Uses Cash to AUM Balance Sheet (3) $37,980,000 AUM Rollover Equity 400,000,000 Transaction Expenses (4) 9,270,000 Total Uses $447,250,000

BUSINESS OVERVIEW

Investment Highlights CLINICAL STAGE DIVERSIFIED PIPELINE ▪ AUM 001 | Phase 2 ongoing* ▪ AUM 601 | Phase 2 planned ▪ AUM 302 & AUM 003 | IND enabling ▪ Multiple future candidates in R&D STRONG FUNDAMENTALS ▪ Series A – $ 27 M led by Everlife ( 2021 ) ▪ Available cash or cash equivalents of ~$ 20 M driving major milestones through 2023 * ▪ Upfront payments, development milestones & royalties generated through partnerships GLOBAL STRATEGIC PARTNERSHIPS ▪ Merck ▪ Roche ▪ Newsoara STRONG LEADERSHIP & BOARD ▪ 50 + INDs and > 150 oncology trials experience ▪ Notable exits include $ 1.9 B Sirtex sale to China Grand, $ 2.1 B exit to Novo Nordisk ▪ Experienced team facilitating Alternative Public Offerings – Mountain Crest V NON - DILUTIVE CAPITAL RAISED ▪ Eligible for R&D Rebate from Australian Tax Office of up to AUD $ 25 M ▪ SGD 10.7 M Grant from Singapore Immunology network ▪ RMB 2.0 M from Suzhou Industrial Park Administrative Committee (SIPAC) in China REVERSING CANCER RESISTANCE Precision oncology therapeutics designed to reverse cancer resistance through multi - faceted strategies 8 *includes a long - term facility of $ 15 M ( 1 ) US IND approved; FPI expected in Q 4 2022 * see slide 22

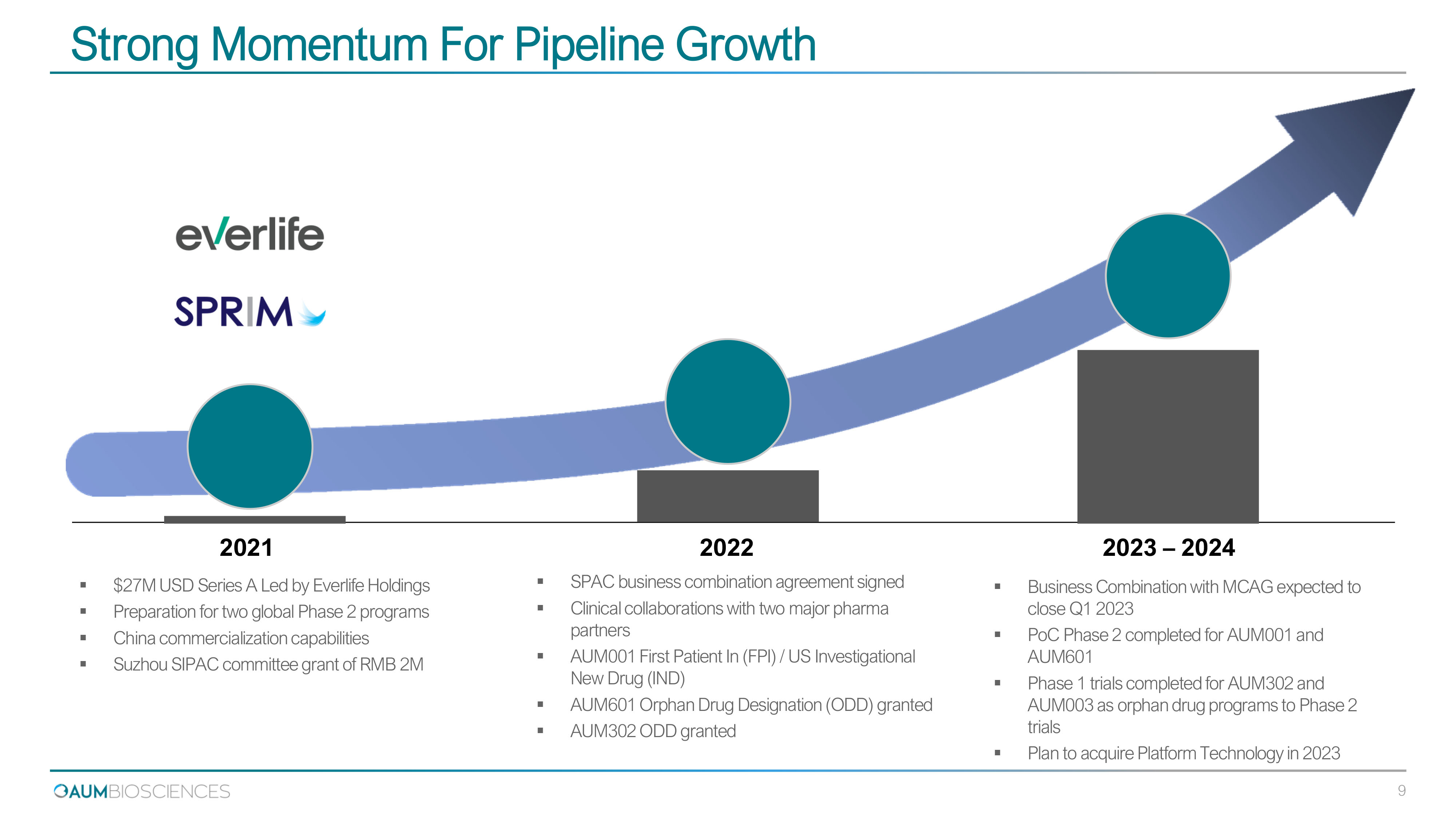

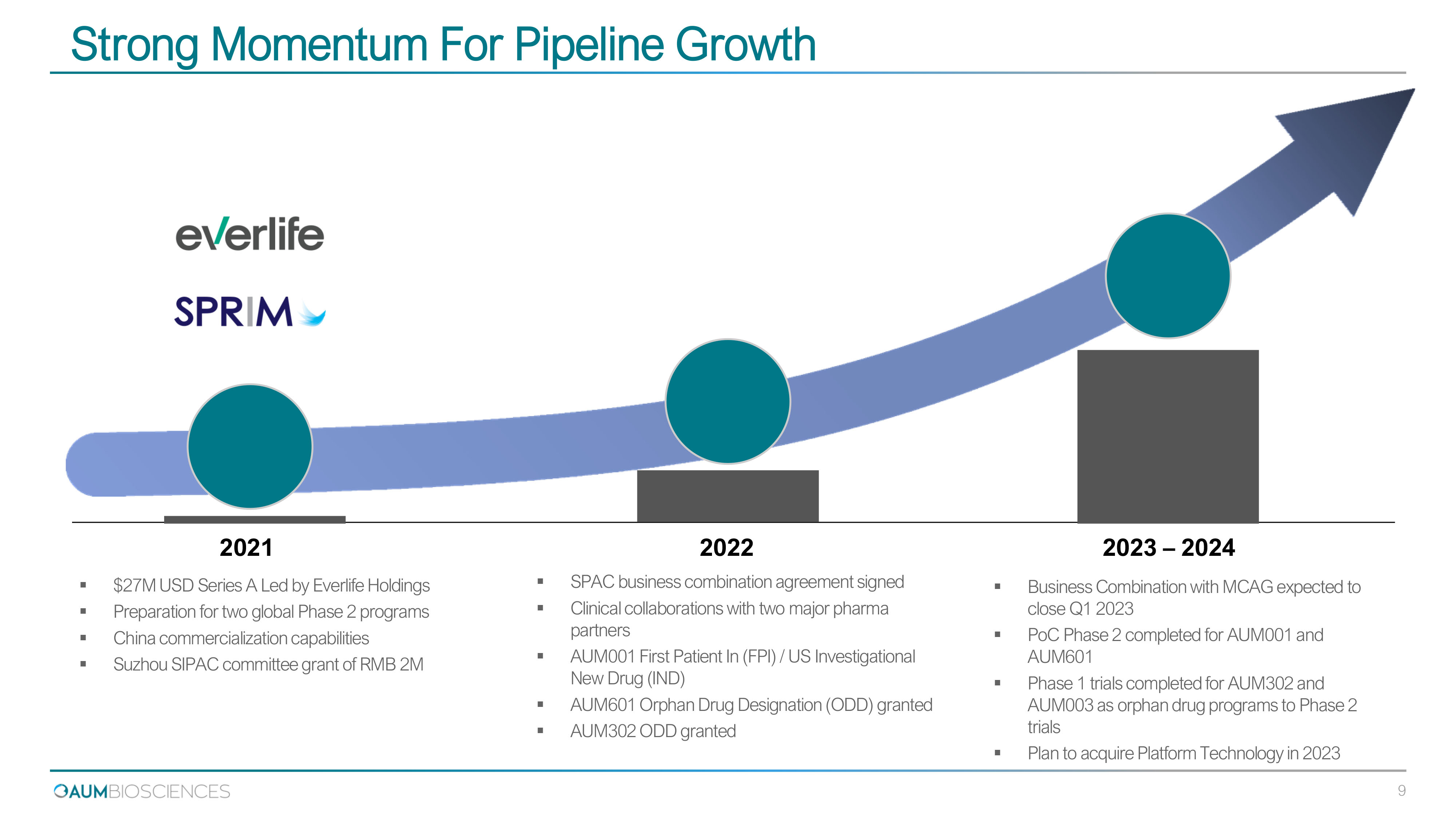

Strong Momentum For Pipeline Growth ▪ Business Combination with MCAG expected to close Q 1 2023 ▪ PoC Phase 2 completed for AUM 001 and AUM 601 ▪ Phase 1 trials completed for AUM 302 and AUM 003 as orphan drug programs to Phase 2 trials ▪ Plan to acquire Platform Technology in 2023 20 21 2023 – 202 4 ▪ $27M USD Series A Led by Everlife Holdings ▪ Preparation for two global Phase 2 programs ▪ China commercialization capabilities ▪ Suzhou SIPAC committee grant of RMB 2M 20 22 ▪ SPAC business combination agreement signed ▪ Clinical collaborations with two major pharma partners ▪ AUM 001 First Patient In (FPI) / US Investigational New Drug (IND) ▪ AUM 601 Orphan Drug Designation (ODD) granted ▪ AUM 302 ODD granted 9

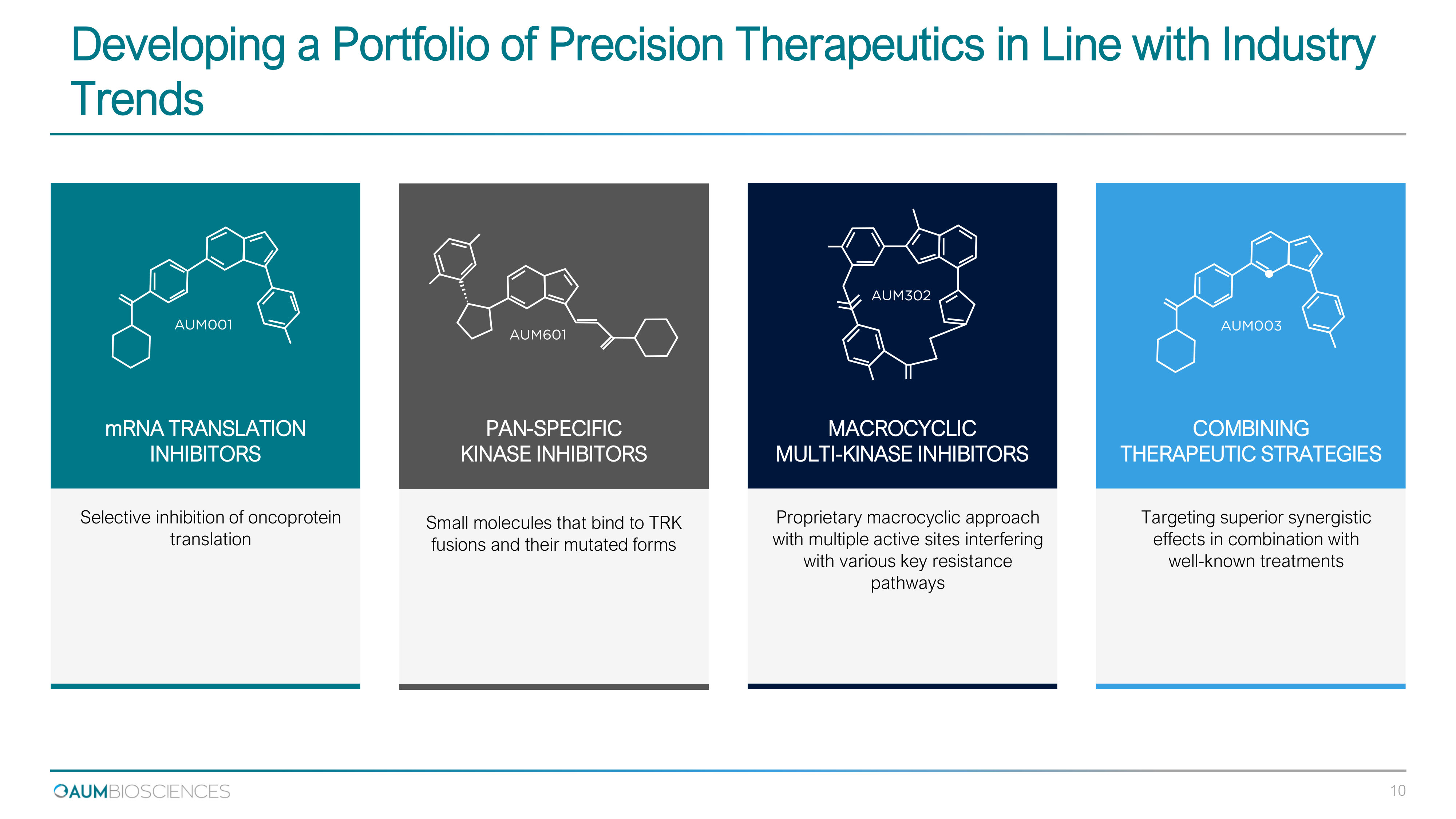

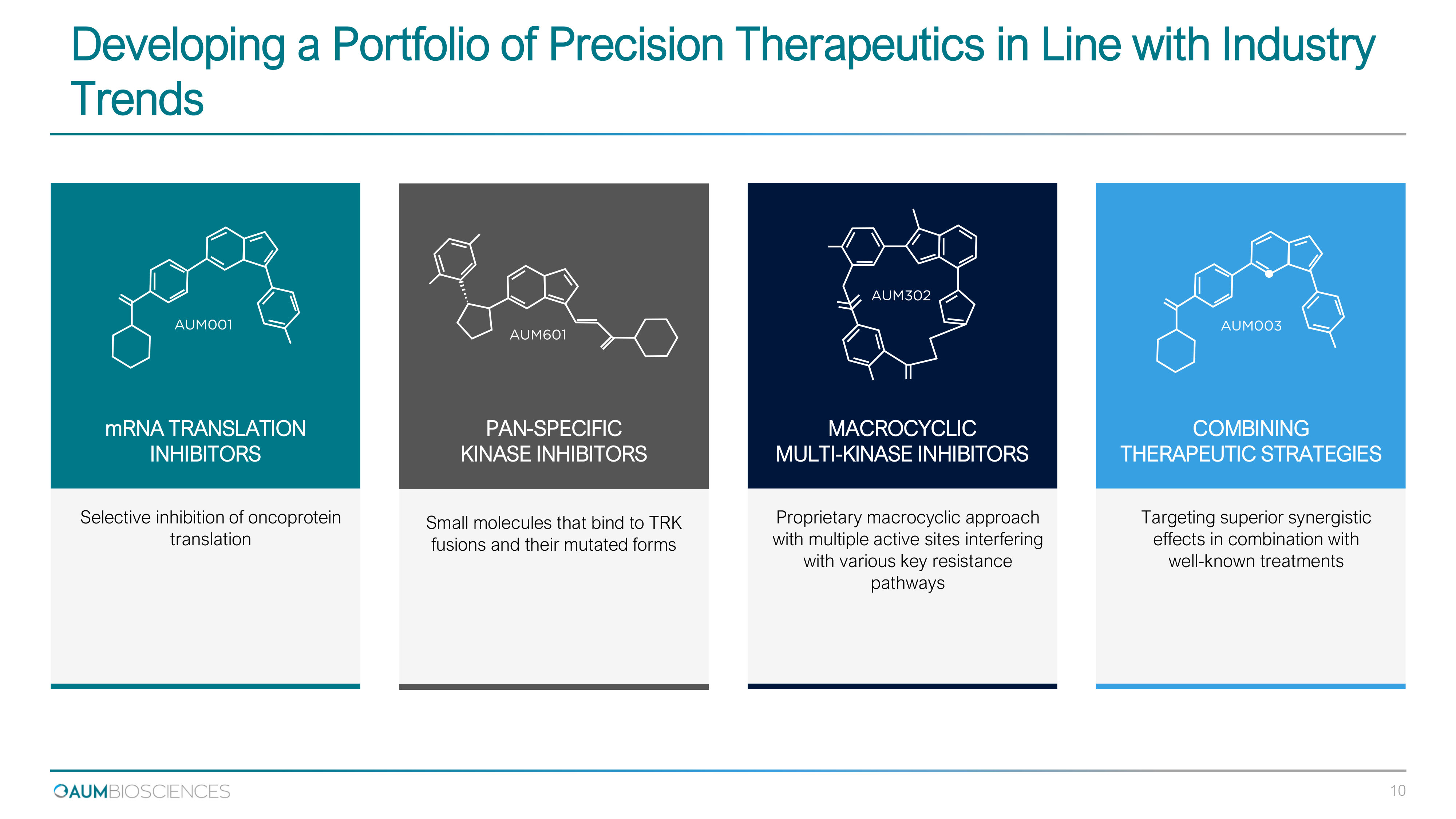

Developing a Portfolio of Precision Therapeutics in Line with Industry Trends Targeting superior synergistic effects in combination with well - known treatments Proprietary macrocyclic approach with multiple active sites interfering with various key resistance pathways Small molecules that bind to TRK fusions and their mutated forms Selective inhibition of oncoprotein translation COMBINING THERAPEUTIC STRATEGIES MACROCYCLIC MULTI - KINASE INHIBITORS PAN - SPECIFIC KINASE INHIBITORS mRNA TRANSLATION INHIBITORS 10

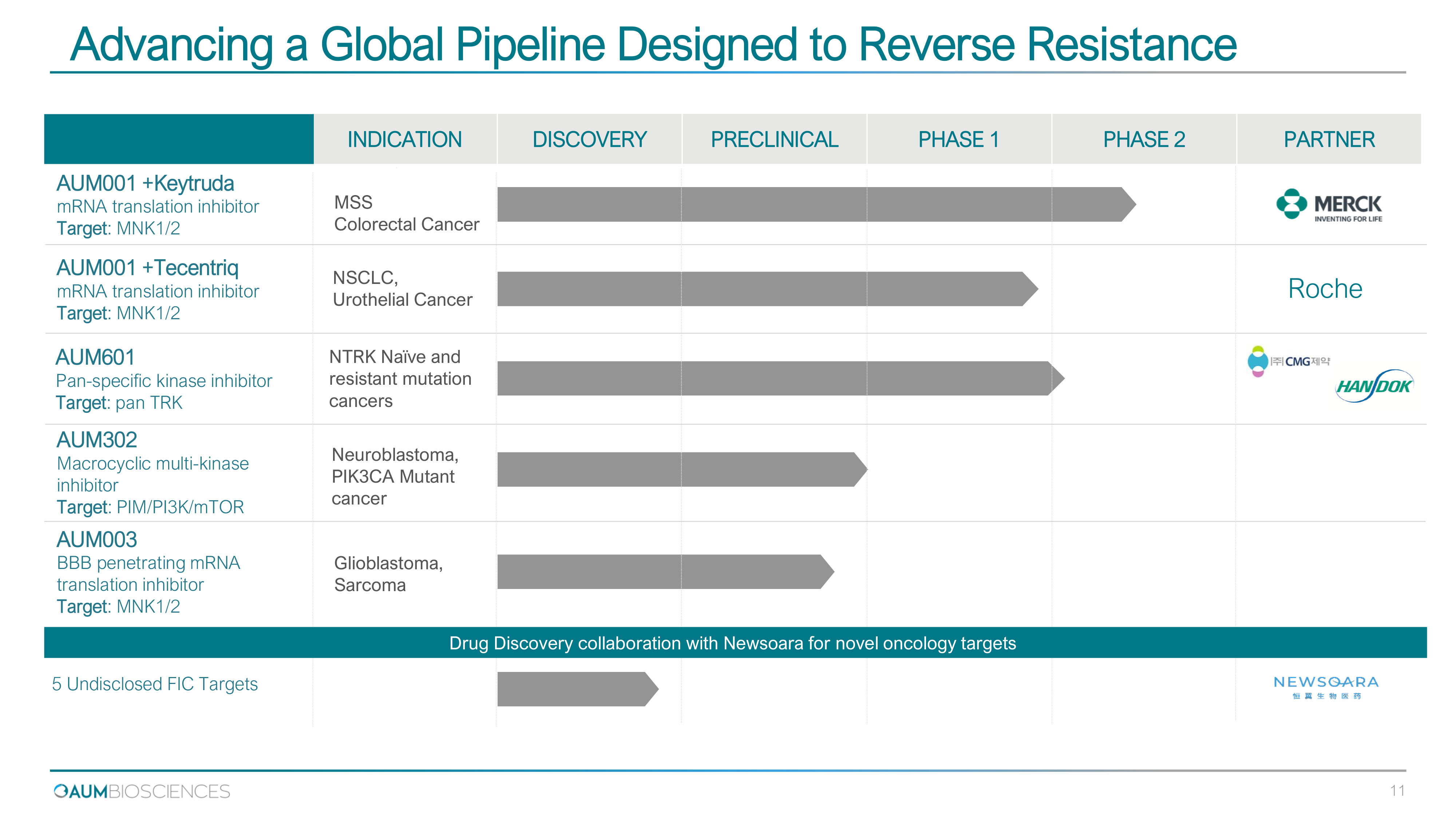

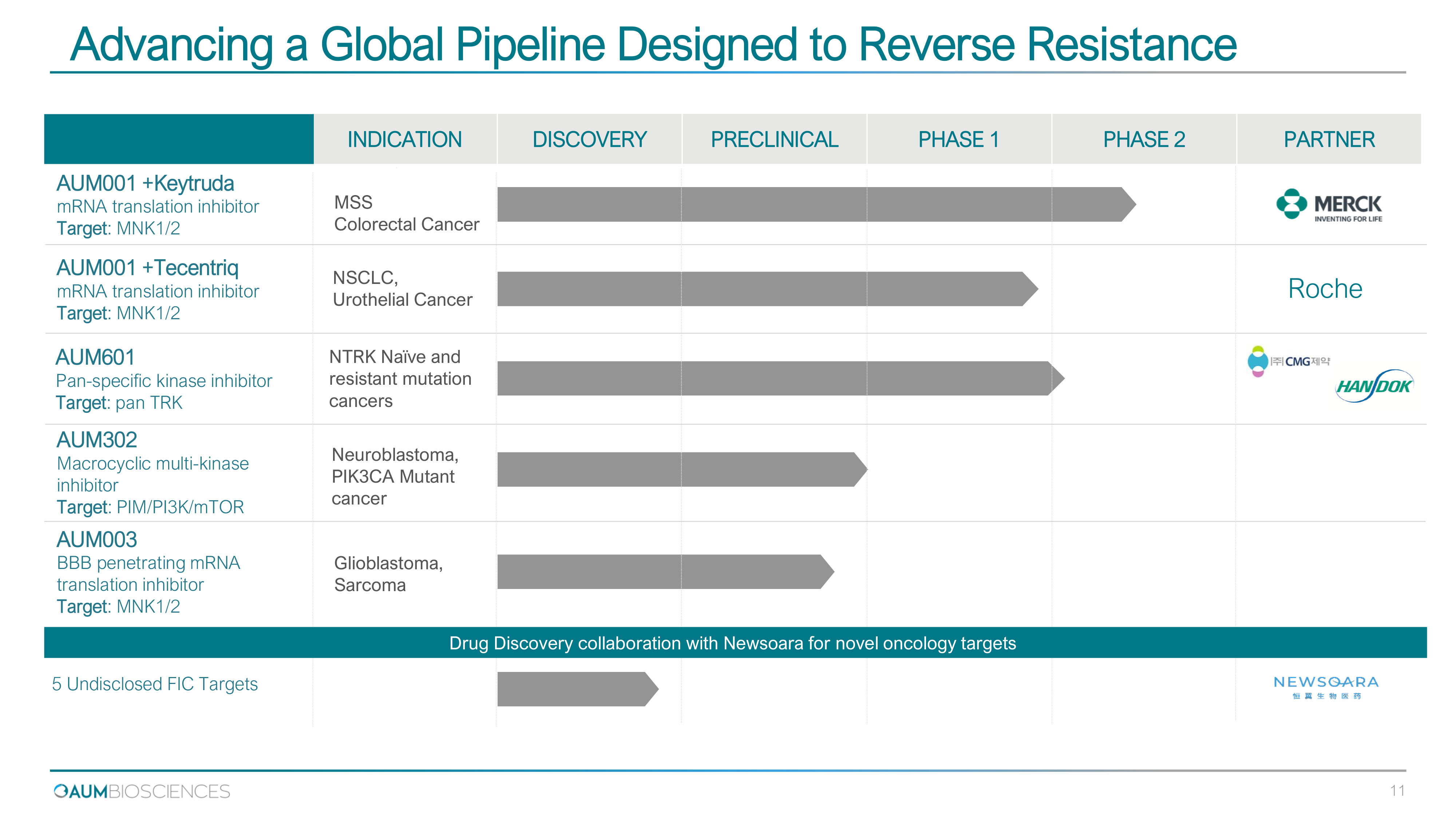

Advancing a Global Pipeline Designed to Reverse Resistance 5 Undisclosed FIC Targets INDICATION DISCOVERY PRECLINICAL PHASE 1 PHASE 2 PARTNER MSS Colorectal Cancer Glioblastoma, Sarcoma NTRK Naïve and resistant mutation cancers AUM 001 +Keytruda mRNA translation inhibitor Target : MNK 1 / 2 AUM 003 BBB penetrating mRNA translation inhibitor Target : MNK 1 / 2 AUM 601 Pan - specific kinase inhibitor Target : pan TRK Neuroblastoma, PIK3CA Mutant cancer AUM302 Macrocyclic multi - kinase inhibitor Target : PIM/PI3K/mTOR NSCLC, Urothelial Cancer AUM 001 +Tecentriq mRNA translation inhibitor Target : MNK 1 / 2 Drug Discovery collaboration with Newsoara for novel oncology targets Roche 11

Clinical and Regulatory Milestones Driving Enterprise Value AUM601: Pan - TRK Inhibitor First Patient Dosed in Phase 2 for MSS CRC AUM 001 : MNK Inhibition 2022 2023 Orphan Drug Designation * US FDA and China IND First Patient Dosed 2022 202 3 202 3 20 23 Drug Discovery Collaboration Five Potentially First in Class Targets in Discovery 2023 / 2024 Top Line Data from Module 1 AUM302: Macrocyclic Multi - kinase Inhibitor AUM 003 : BBB Penetrating MNK Inhibitor US IND & AUS CTN US FDA IND US FDA IND Orphan Drug Designation (ODD)* Anticipated First Patient Dosed 2022 2023 2023 2022 Phase 1 completion 20 2 4 2024 Phase 1 Completion * Granted 11 - Aug - 2022 for treatment of solid tumors with NTRK fusion gene 12 * Granted 08 - Nov - 2022 for treatment of Neuroblastoma

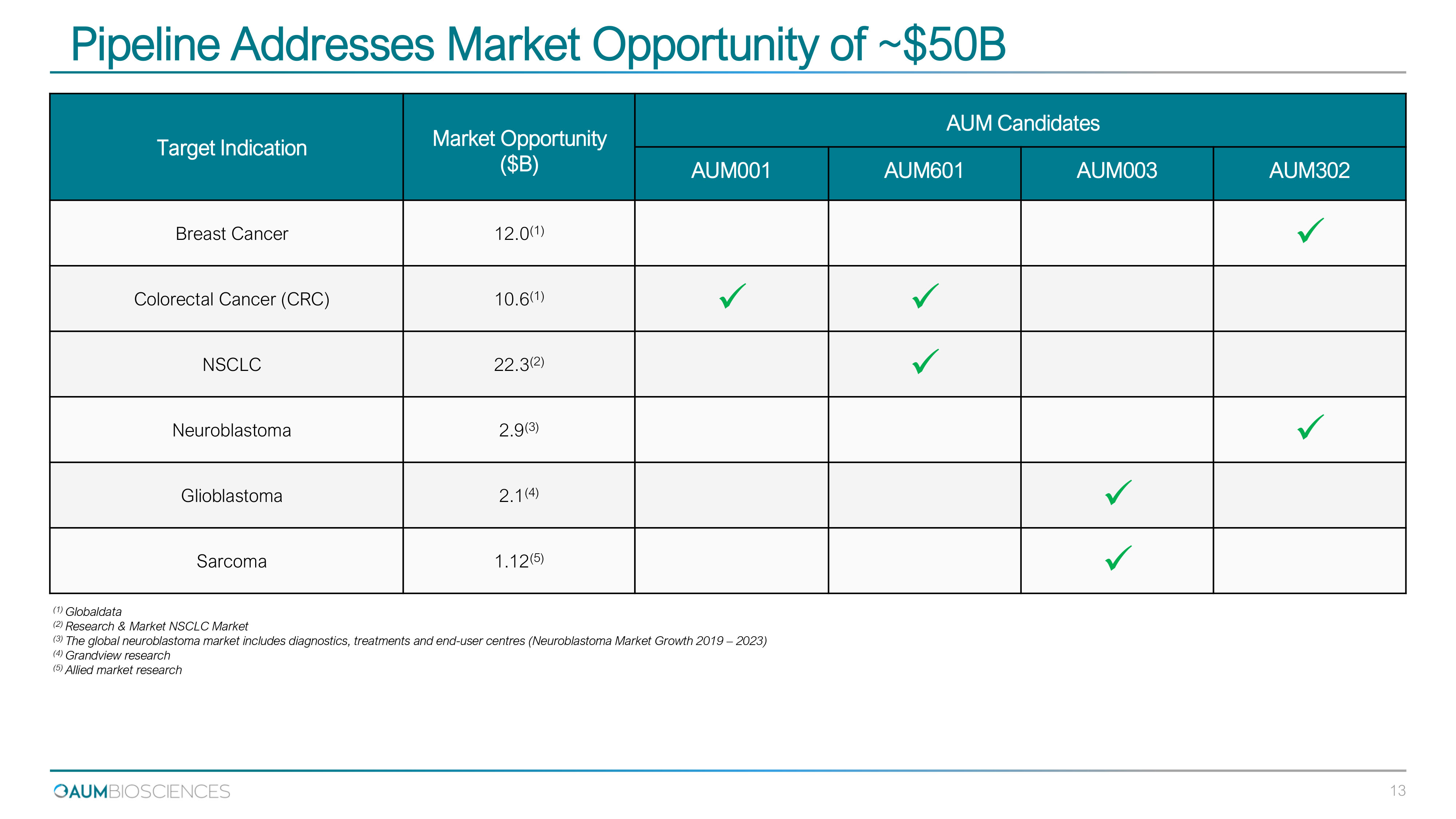

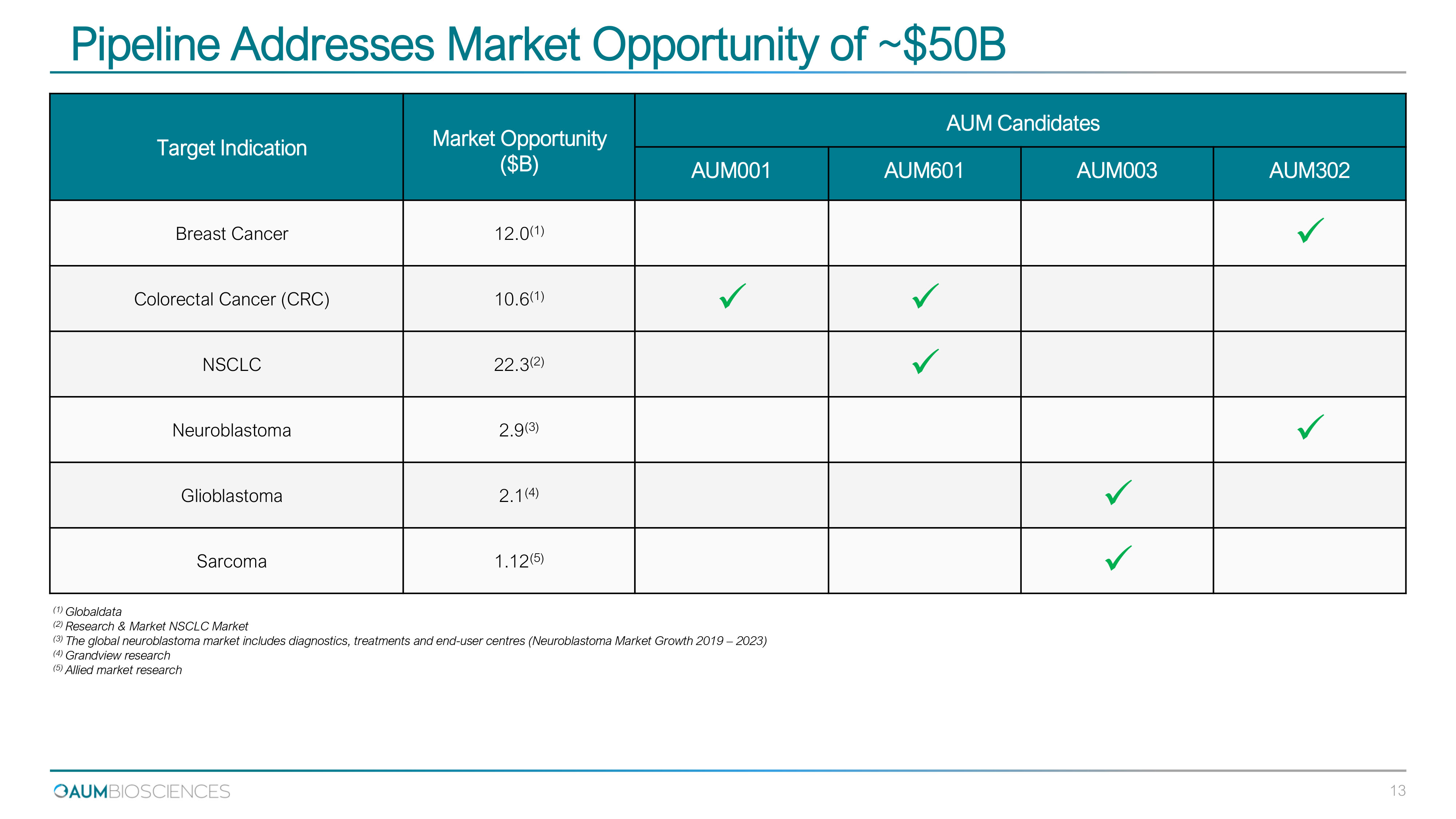

Pipeline Addresses Market Opportunity of ~$ 50 B Target Indication M ar k e t O pportunity ($ B ) AUM Candidates AUM001 AUM601 AUM003 AUM302 Breast Cancer 12.0 (1) x Colorectal Cancer (CRC) 10.6 (1) x x NSCLC 22.3 (2) x Neuroblastoma 2.9 (3) x Glioblastoma 2.1 (4) x Sarcoma 1.12 (5) x 13 ( 1 ) Globaldata ( 2 ) Research & Market NSCLC Market ( 3 ) The global neuroblastoma market includes diagnostics, treatments and end - user centres (Neuroblastoma Market Growth 2019 – 2023 ) ( 4 ) Grandview research ( 5 ) Allied market research

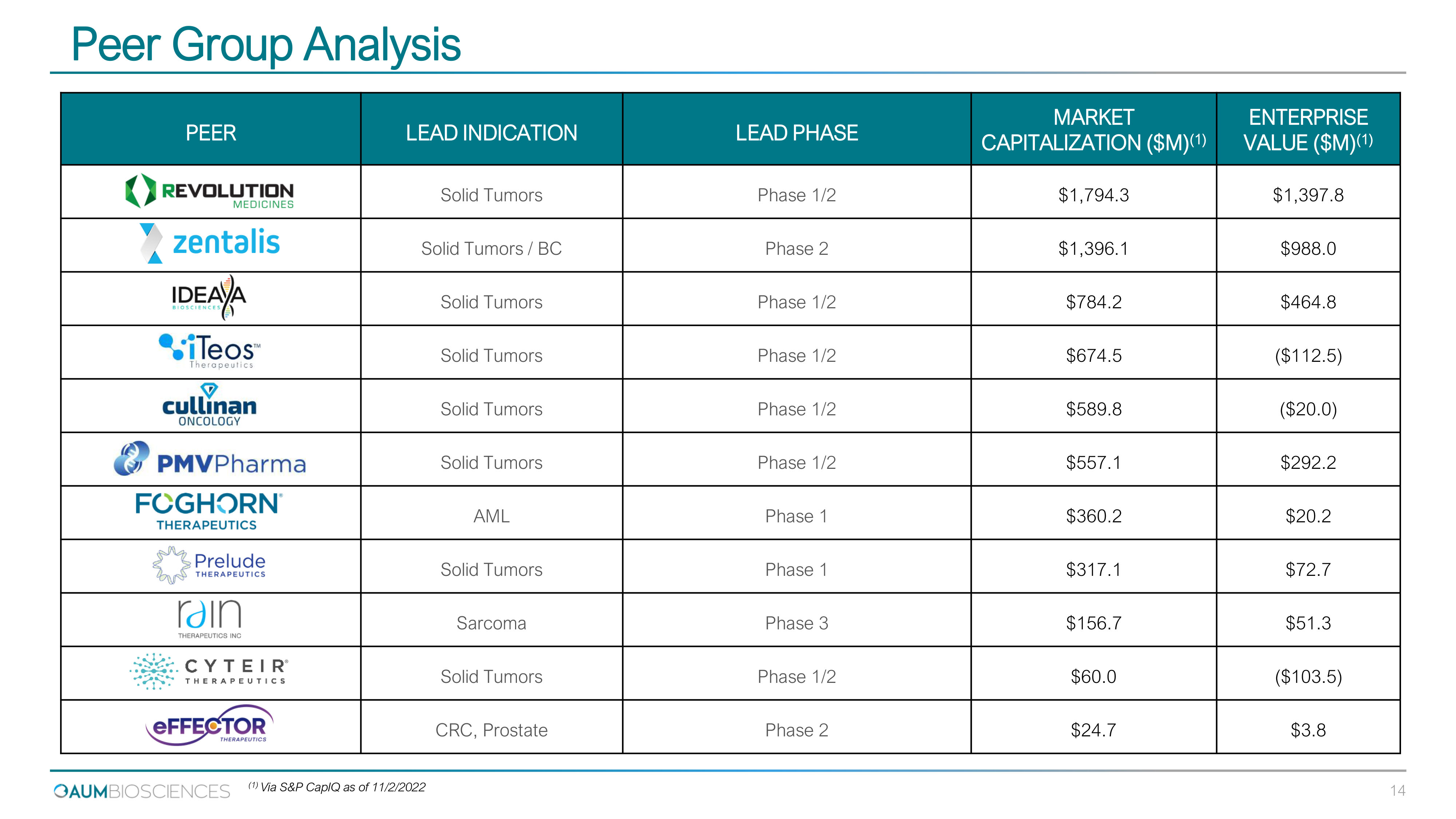

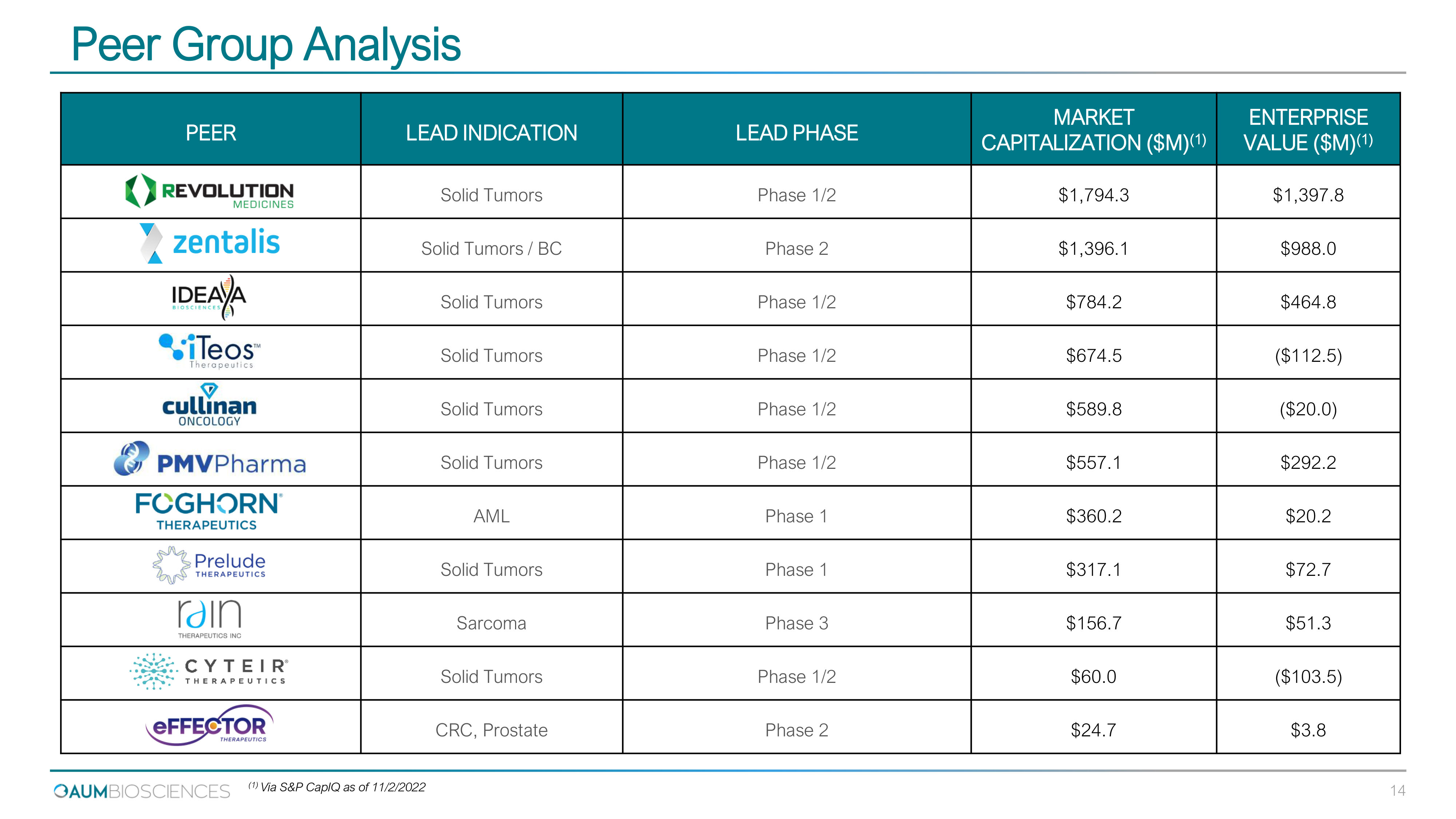

PEER LEAD INDICATION LEAD PHASE MARKET CAPITALIZATION ($M) (1) ENTERPRISE VALUE ($M) (1) Solid Tumors Phase 1/2 $1,794.3 $1,397.8 Solid Tumors / BC Phase 2 $1,396.1 $988.0 Solid Tumors Phase 1/2 $784.2 $464.8 Solid Tumors Phase 1/2 $674.5 ($112.5) Solid Tumors Phase 1/2 $589.8 ($20.0) Solid Tumors Phase 1/2 $557.1 $292.2 AML Phase 1 $360.2 $20.2 Solid Tumors Phase 1 $317.1 $72.7 Sarcoma Phase 3 $156.7 $51.3 Solid Tumors Phase 1/2 $60.0 ($103.5) CRC, Prostate Phase 2 $24.7 $3.8 Peer Group Analysis (1) Via S&P CapIQ as of 11/2/2022 14

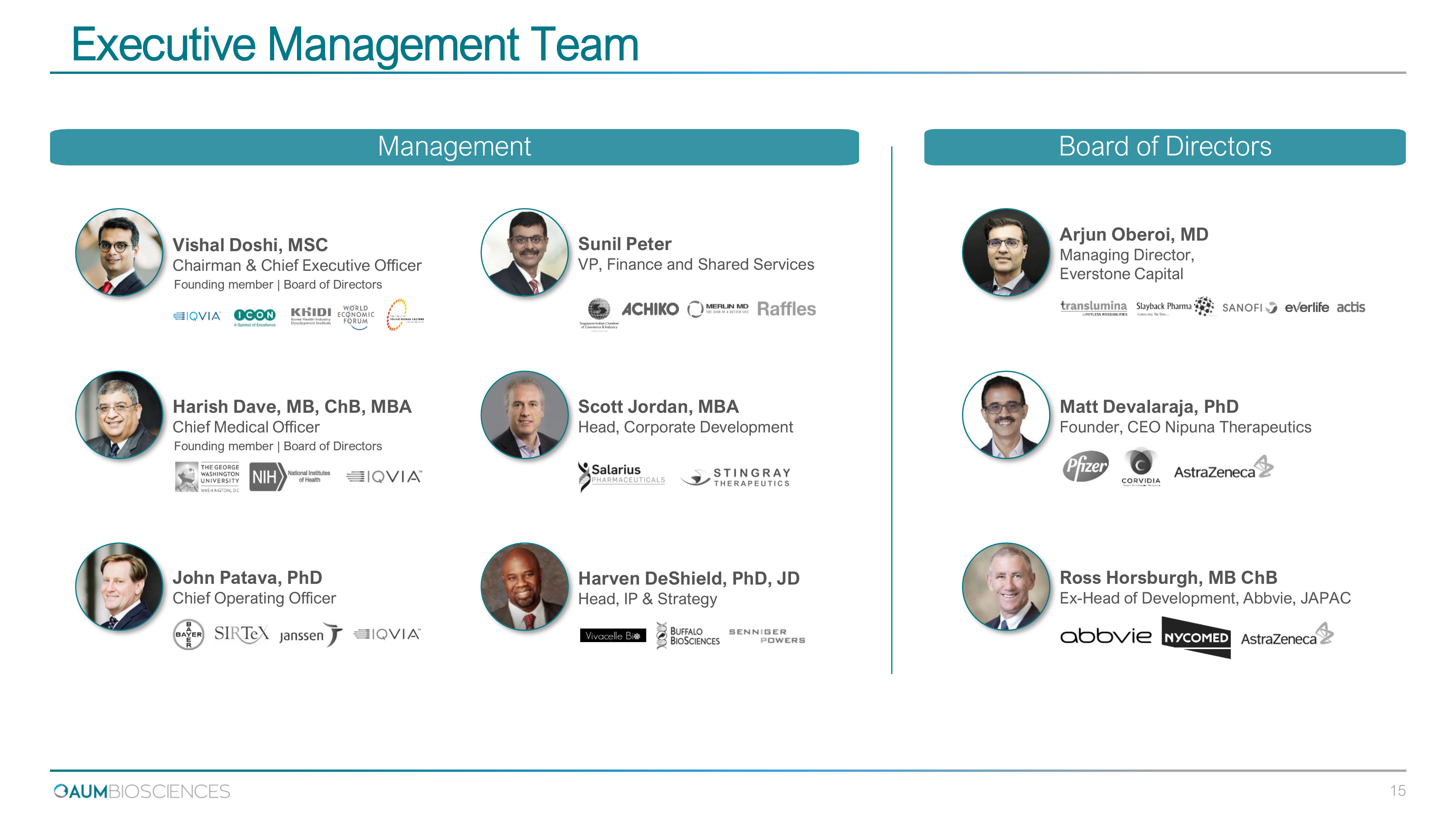

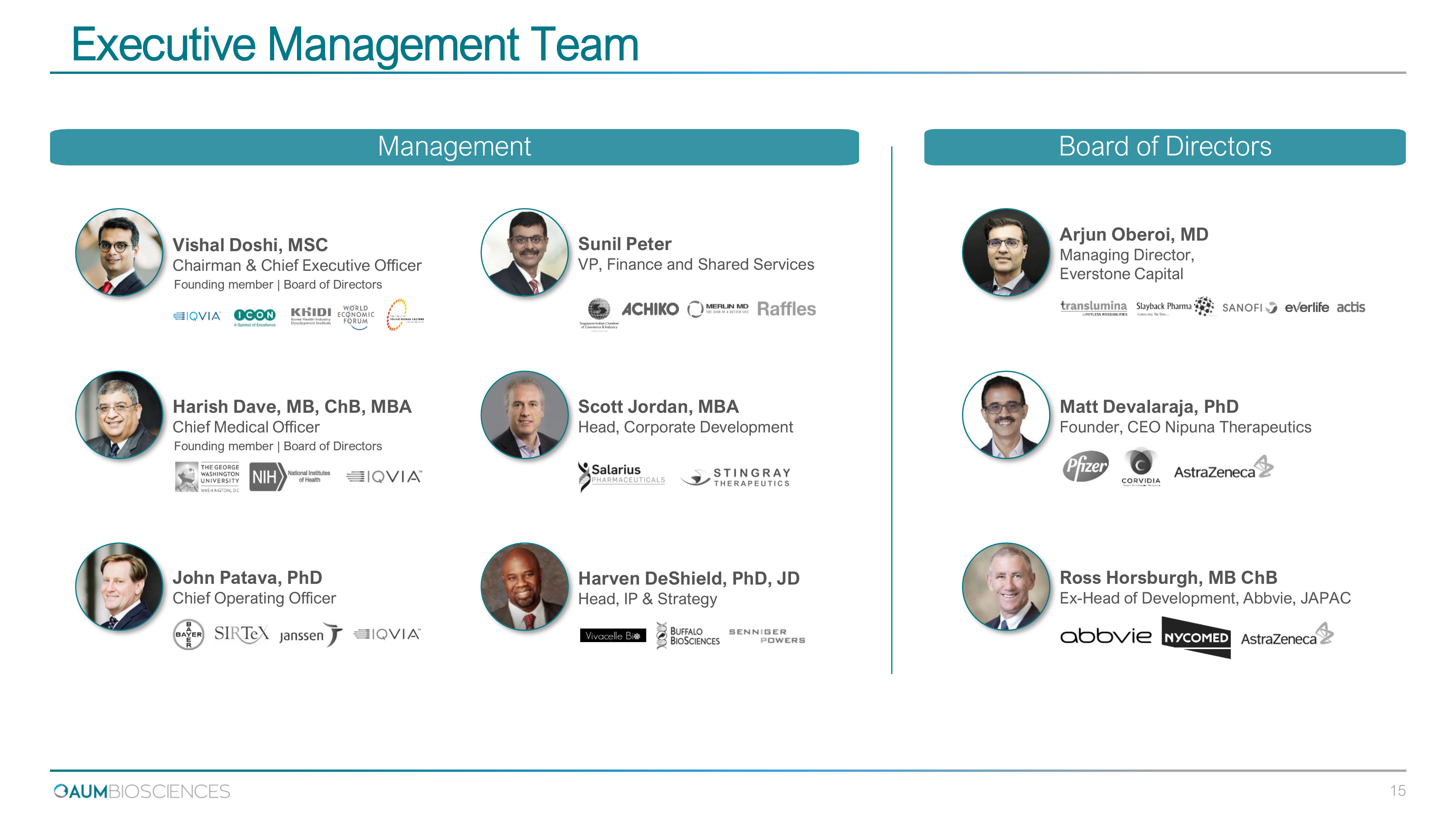

Executive Management Team 15 Board of Directors Management Arjun Oberoi, MD Managing Director, Everstone Capital Matt Devalaraja, PhD Founder, CEO Nipuna Therapeutics Ross Horsburgh, MB ChB Ex - Head of Development, Abbvie, JAPAC Sunil Peter VP, Finance and Shared Services Vishal Doshi, MSC Chairman & Ch i ef Execu t ive Officer Founding member | Board of Directors John Patava, PhD Chief Operating Officer Harish Dave, MB, ChB, MBA Chief Medical Officer Founding member | Board of Directors Harven DeShield, PhD, JD Head, IP & Strategy Scott Jordan, MBA Head, Corporate Development Management Board of Directors

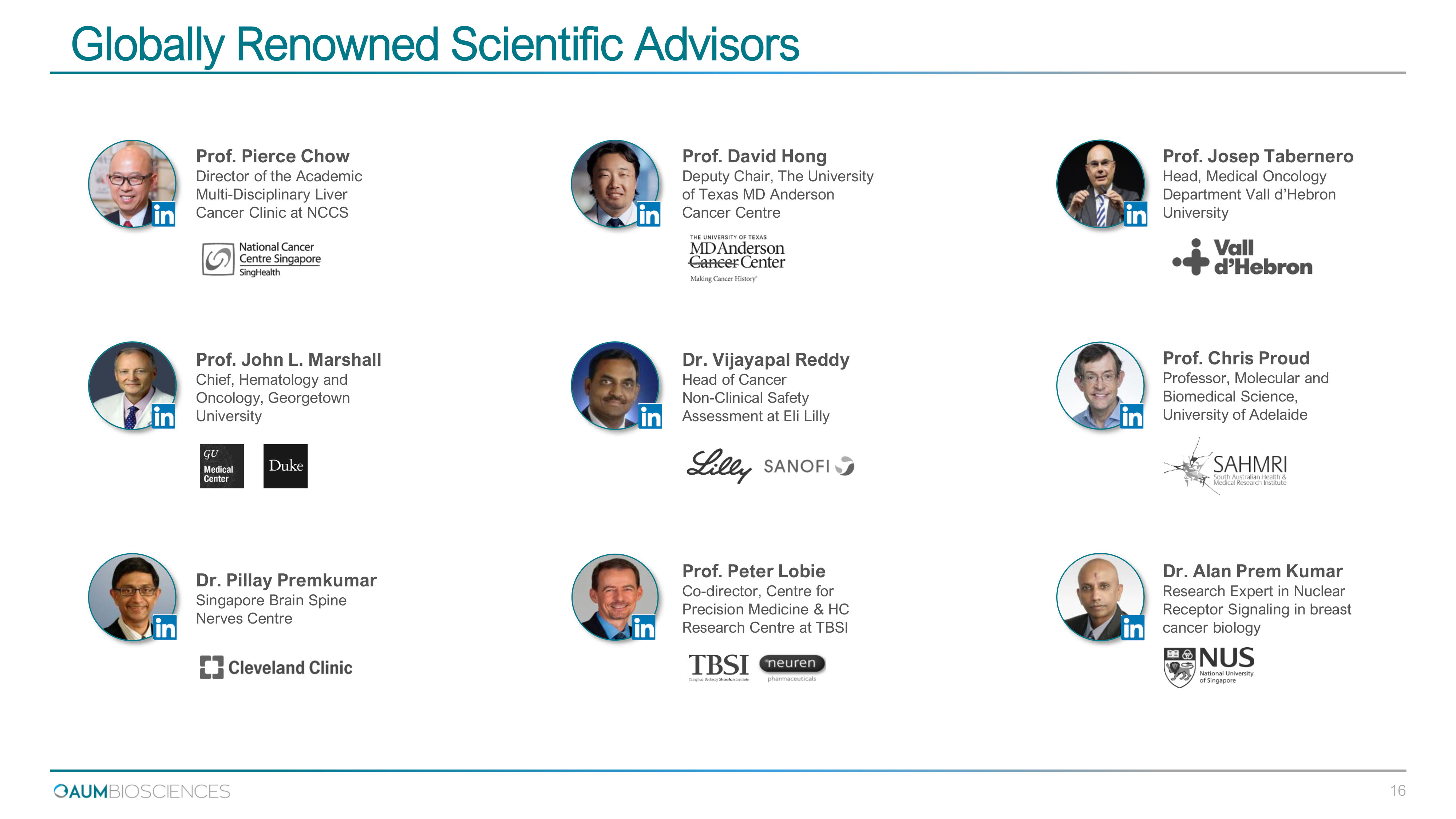

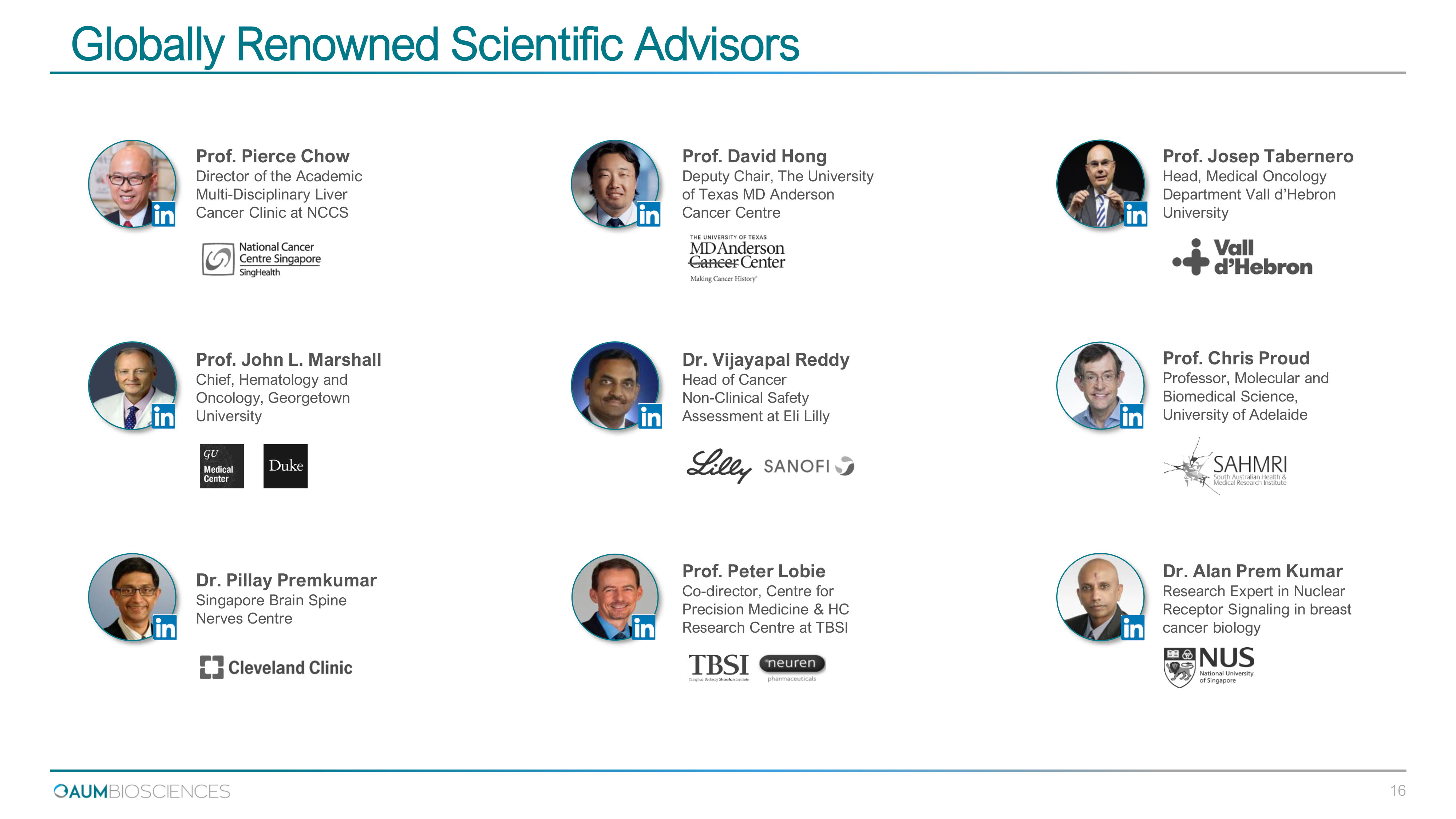

Globally Renowned Scientific Advisors 16 Prof. Pierce Chow Director of the Academic Multi - Disciplinary Liver Cancer Clinic at NCCS Prof. David Hong Deputy Chair, The University of Texas MD Anderson Cancer Centre Prof. Josep Tabernero Head, Medical Oncology Department Vall d’Hebron University Dr. Pillay Premkumar Singapore Brain Spine Nerves Centre Prof. Peter Lobie Co - director, Centre for Precision Medicine & HC Research Centre at TBSI Dr. Alan Prem Kumar Research Expert in Nuclear Receptor Signaling in breast cancer biology Dr. Vijayapal Reddy Head of Cancer Non - Clinical Safety Assessment at Eli Lilly Prof. Chris Proud Professor, Molecular and Biomedical Science, University of Adelaide Prof. John L. Marshall Chief, Hematology and Oncology, Georgetown University

DEVELOPMENT OVERVIEW

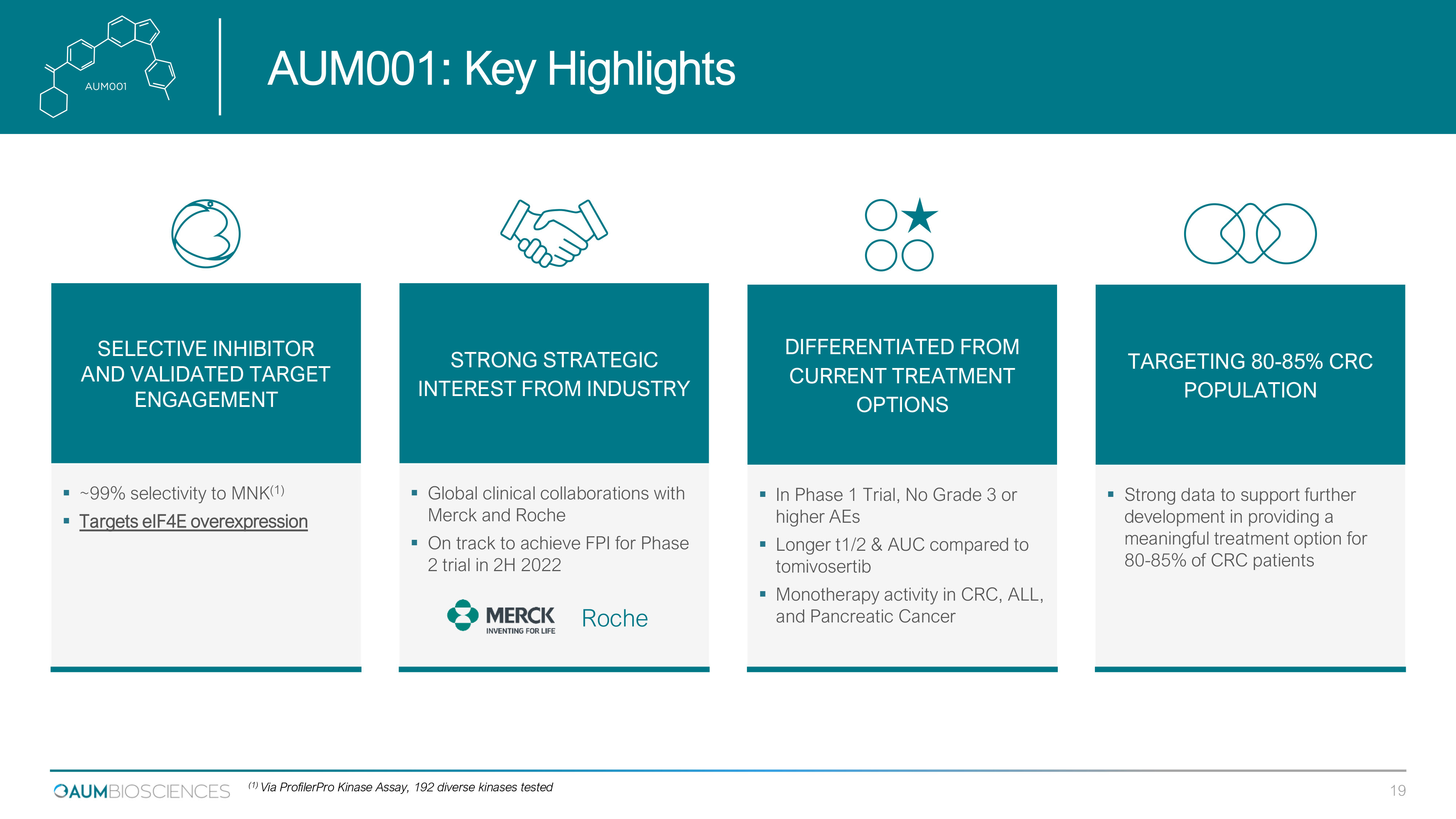

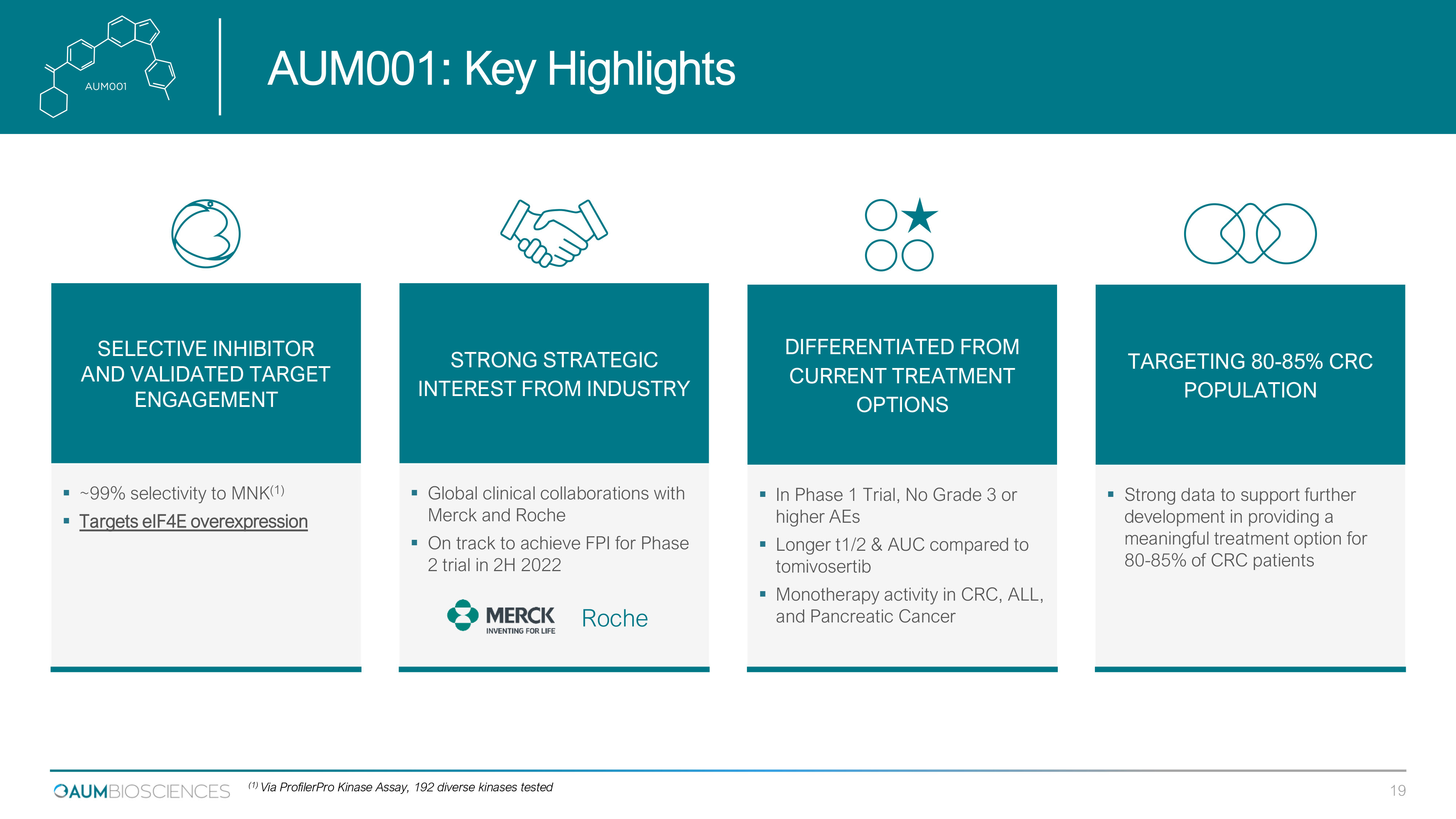

SELECTIVE INHIBITOR AND VALIDATED TARGET ENGAGEMENT ▪ ~99% selectivity to MNK (1) ▪ Targets eIF4E overexpression STRONG STRATEGIC INTEREST FROM INDUSTRY ▪ Global clinical collaborations with Merck and Roche ▪ On track to achieve FPI for Phase 2 trial in 2H 2022 Roche DIFFERENTIATED FROM CURRENT TREATMENT OPTIONS ▪ In Phase 1 Trial, No Grade 3 or higher AEs ▪ Longer t1/2 & AUC compared to tomivosertib ▪ Monotherapy activity in CRC, ALL, and Pancreatic Cancer TARGETING 80 - 85% CRC POPULATION ▪ Strong data to support further development in providing a meaningful treatment option for 80 - 85 % of CRC patients AUM 001 : Key Highlights 19 (1) Via ProfilerPro Kinase Assay, 192 diverse kinases tested

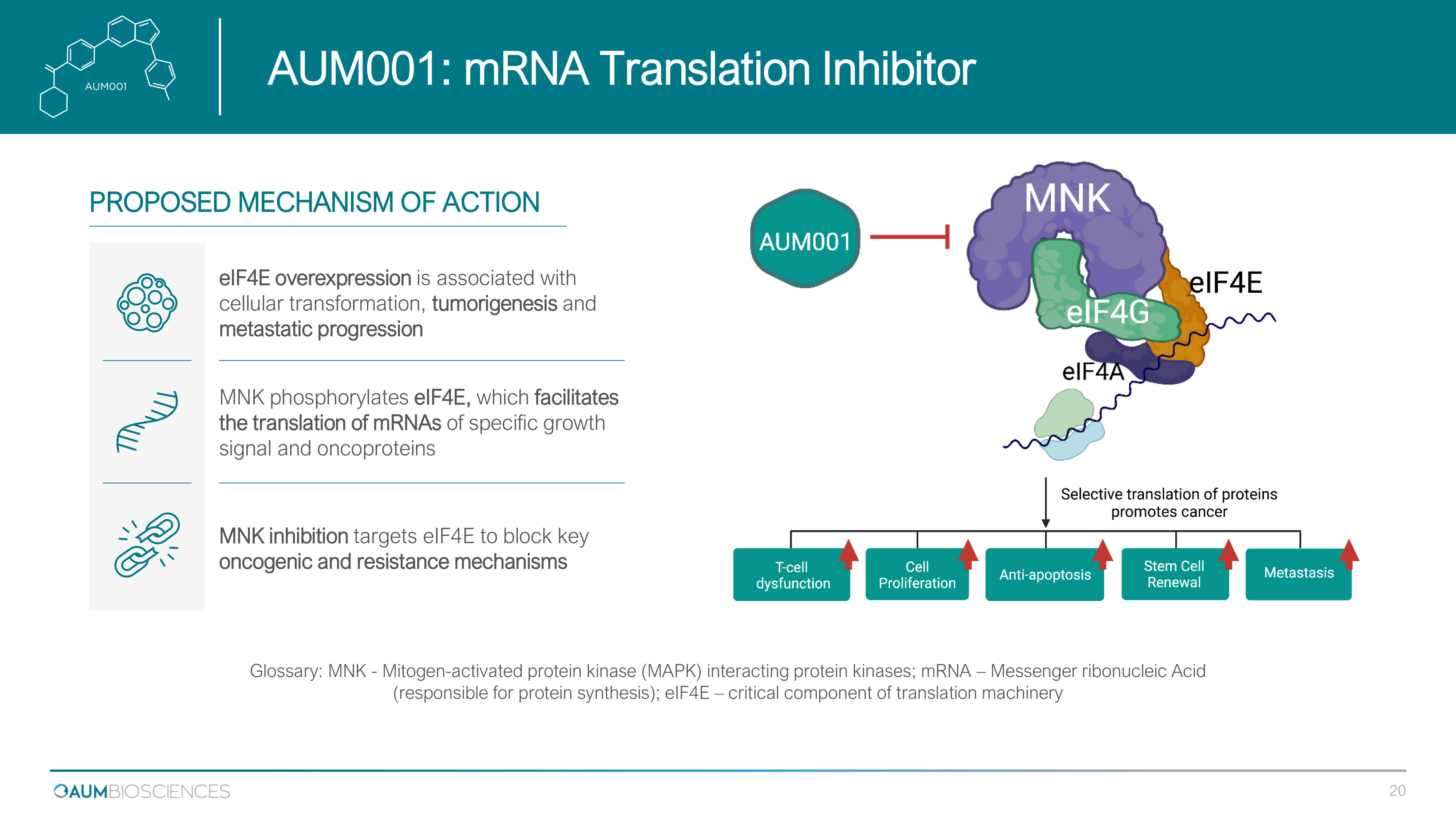

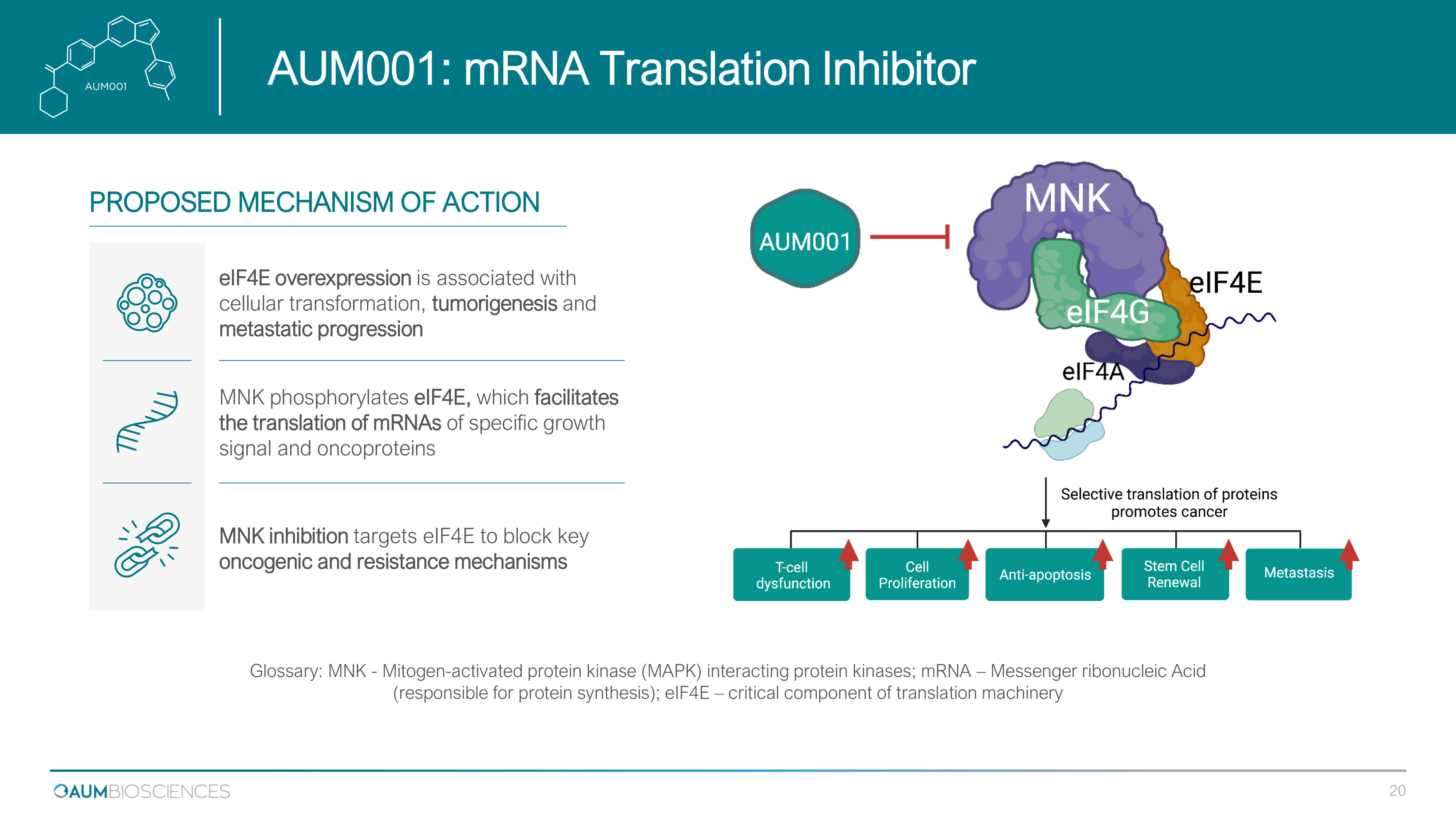

AUM 001 : mRNA Translation Inhibitor Glossary: MNK - Mitogen - activated protein kinase (MAPK) interacting protein kinases; mRNA – Messenger ribonucleic Acid (responsible for protein synthesis); eIF4E – critical component of translation machinery eIF4E overexpression is associated with cellular transformation, tumorigenesis and metastatic progression MNK phosphorylates eIF4E, which facilitates the translation of mRNAs of specific growth signal and oncoproteins MNK inhibition targets eIF 4 E to block key oncogenic and resistance mechanisms PROPOSED MECHANISM OF ACTION 20

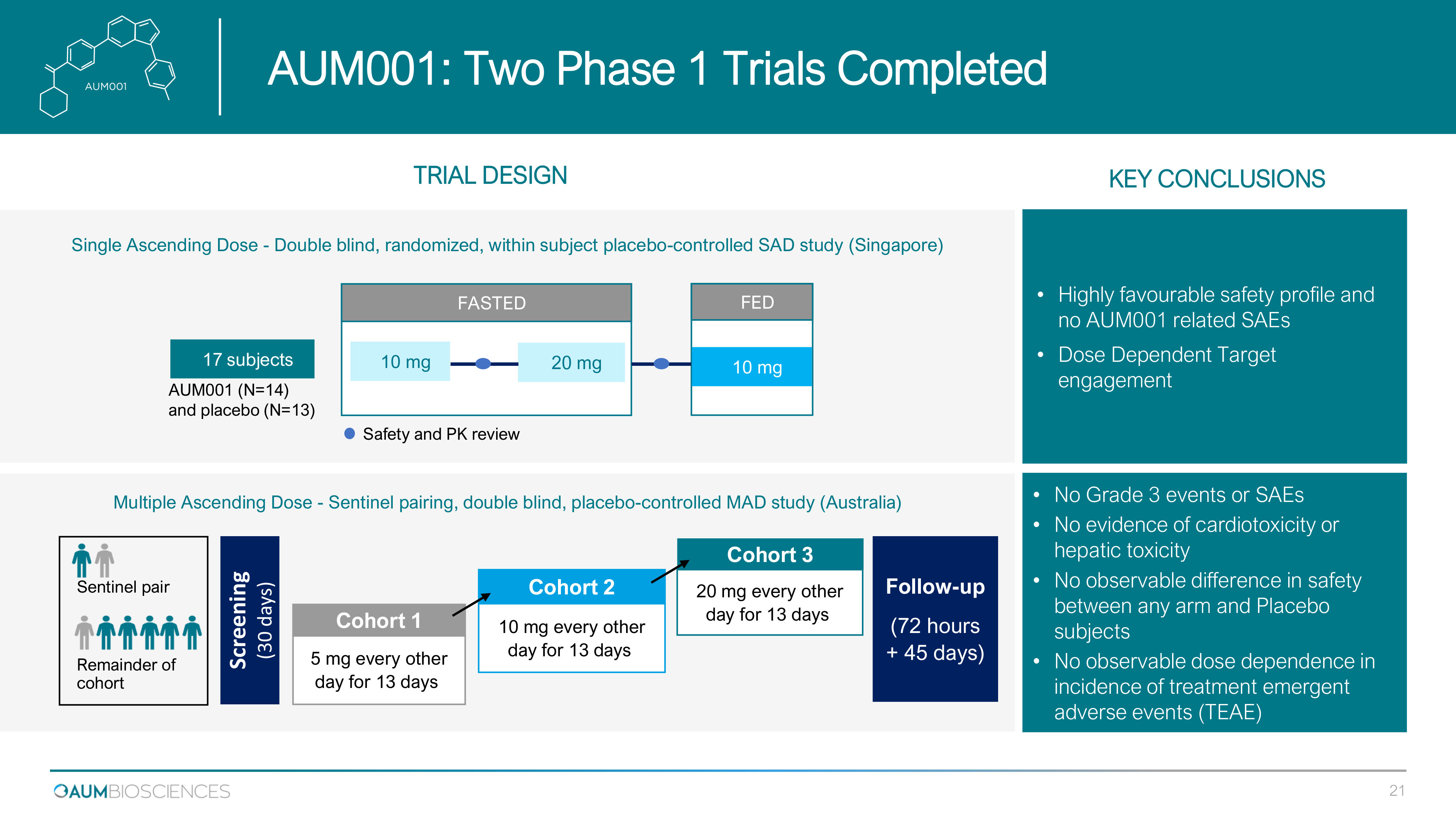

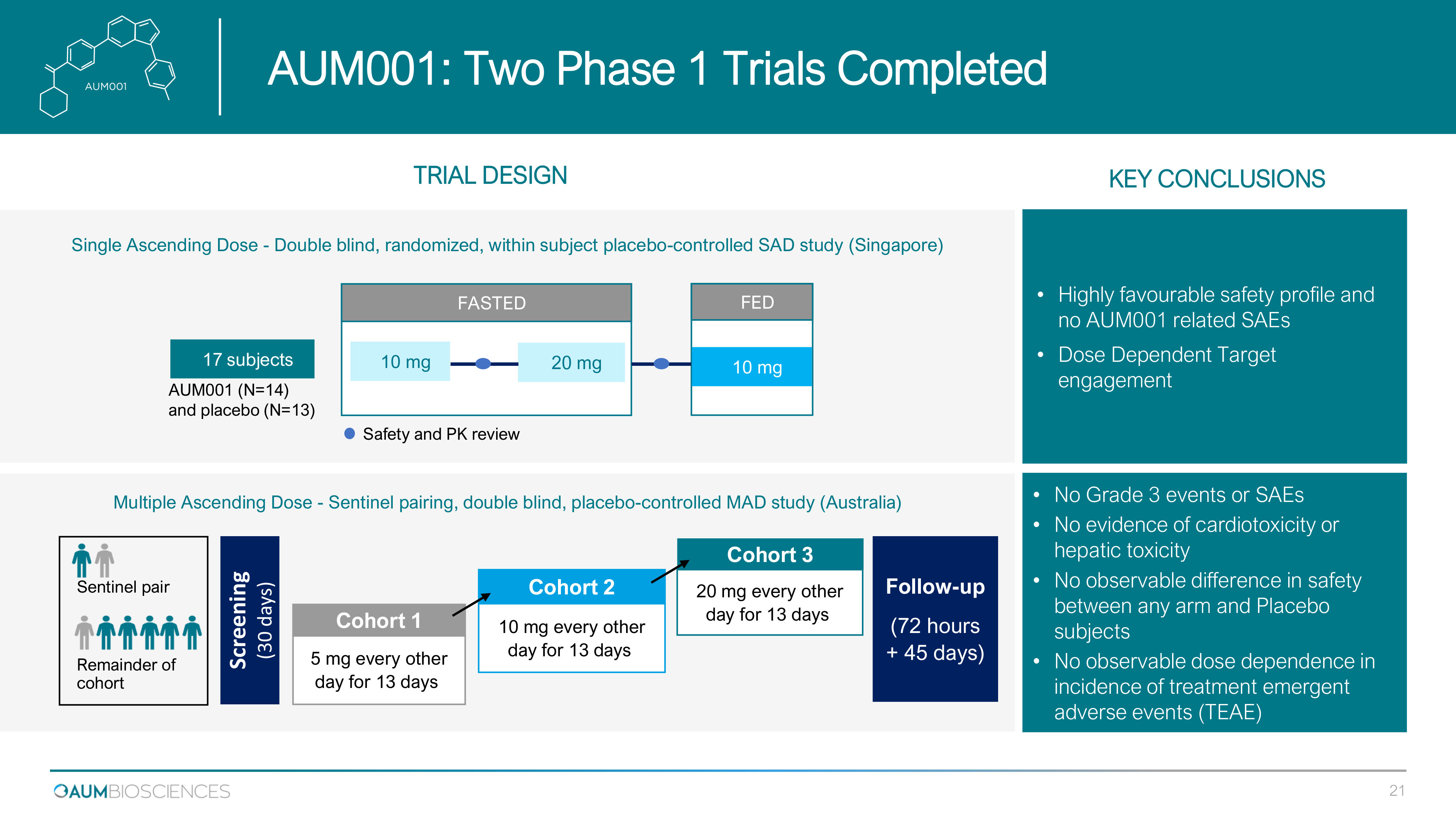

Single Ascending Dose - Double blind, randomized, within subject placebo - controlled SAD study (Singapore) 17 subjects FASTED FED Safety and PK review AUM 001 (N= 14 ) and placebo (N= 13 ) 10 mg 20 mg 10 mg TRIAL DESIGN Screening (30 days) 5 mg every other day for 13 days Cohort 1 10 mg every other day for 13 days Cohort 2 20 mg every other day for 13 days Cohort 3 Follow - up ( 72 hours + 45 days) Sentinel pair Remainder of cohort • No Grade 3 events or SAEs • No evidence of cardiotoxicity or hepatic toxicity • No observable difference in safety between any arm and Placebo subjects • No observable dose dependence in incidence of treatment emergent adverse events (TEAE) • Highly favourable safety profile and no AUM 001 related SAEs • Dose Dependent Target engagement Multiple Ascending Dose - Sentinel pairing, double blind, placebo - controlled MAD study (Australia) KEY CONCLUSIONS AUM 001 : Two Phase 1 Trials Completed 21

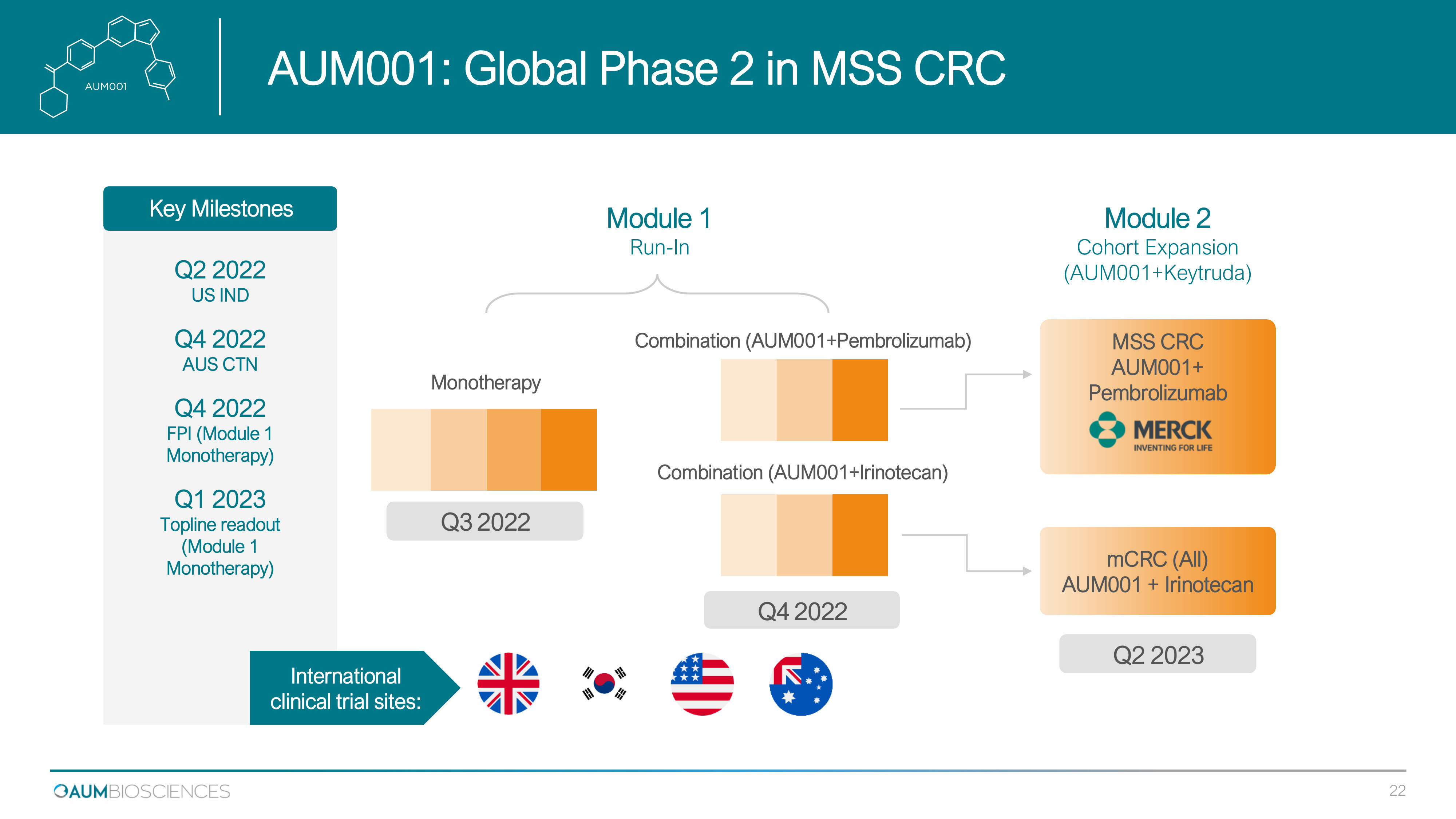

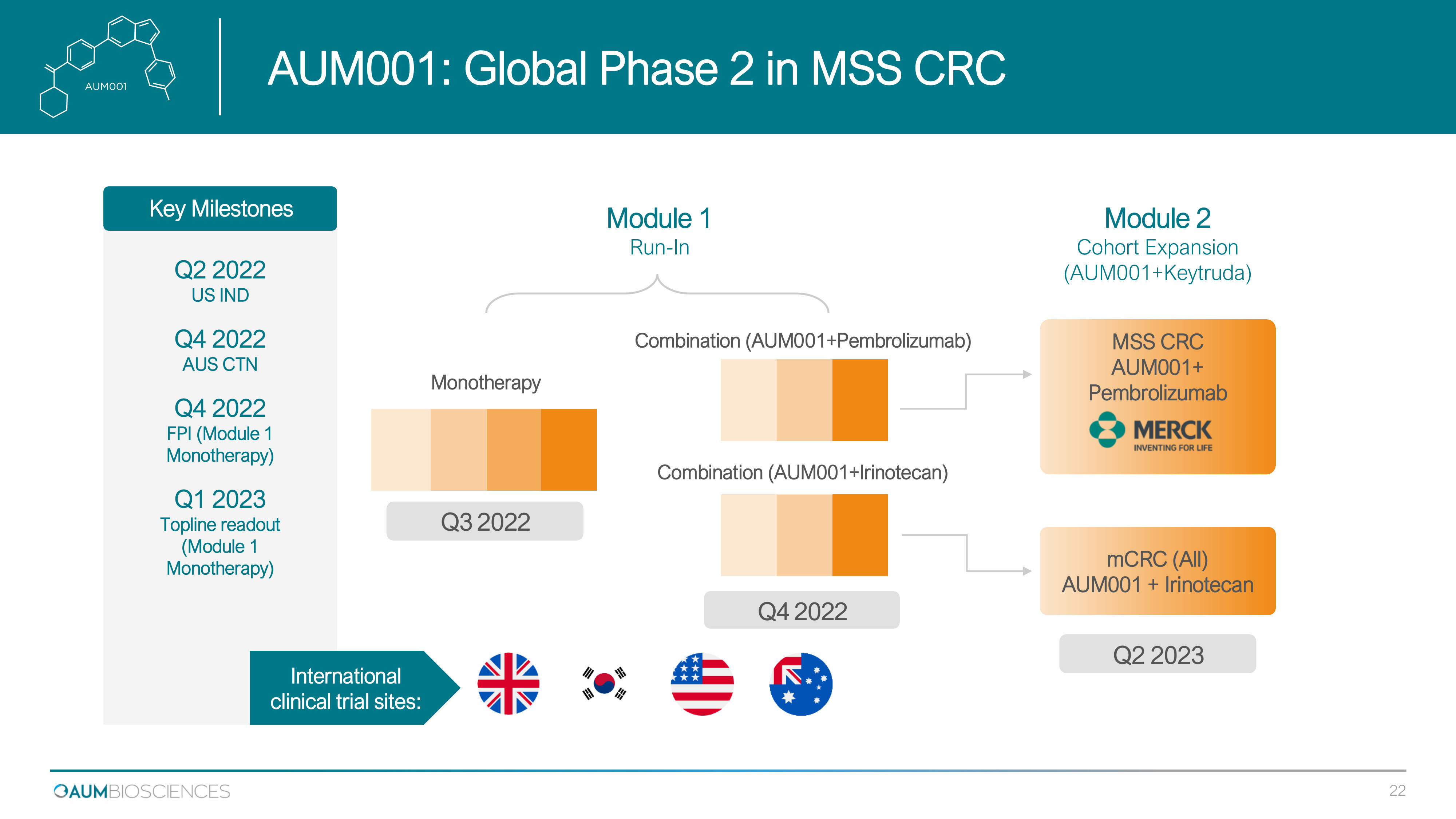

Q2 2022 US IND Q4 2022 AUS CTN Q4 2022 FPI (Module 1 Monotherapy) Q1 2023 Topline readout (Module 1 Monotherapy) AUM001+ Keytruda CRC Monotherapy 1419 + AZA R /R A M L / M D S Q 3 2022 2H 2022 Q 2 2023 Module 1 Run - In Combination (AUM001+Pembrolizumab) Combination (AUM001+Irinotecan) Q4 202 2 Module 2 Cohort Expansion (AUM 001 +Keytruda) mCRC (All) AUM 001 + Irinotecan MSS CRC AUM001+ Pembrolizumab Key Milestones International clinical trial sites: AUM 001 : Global Phase 2 in MSS CRC 22

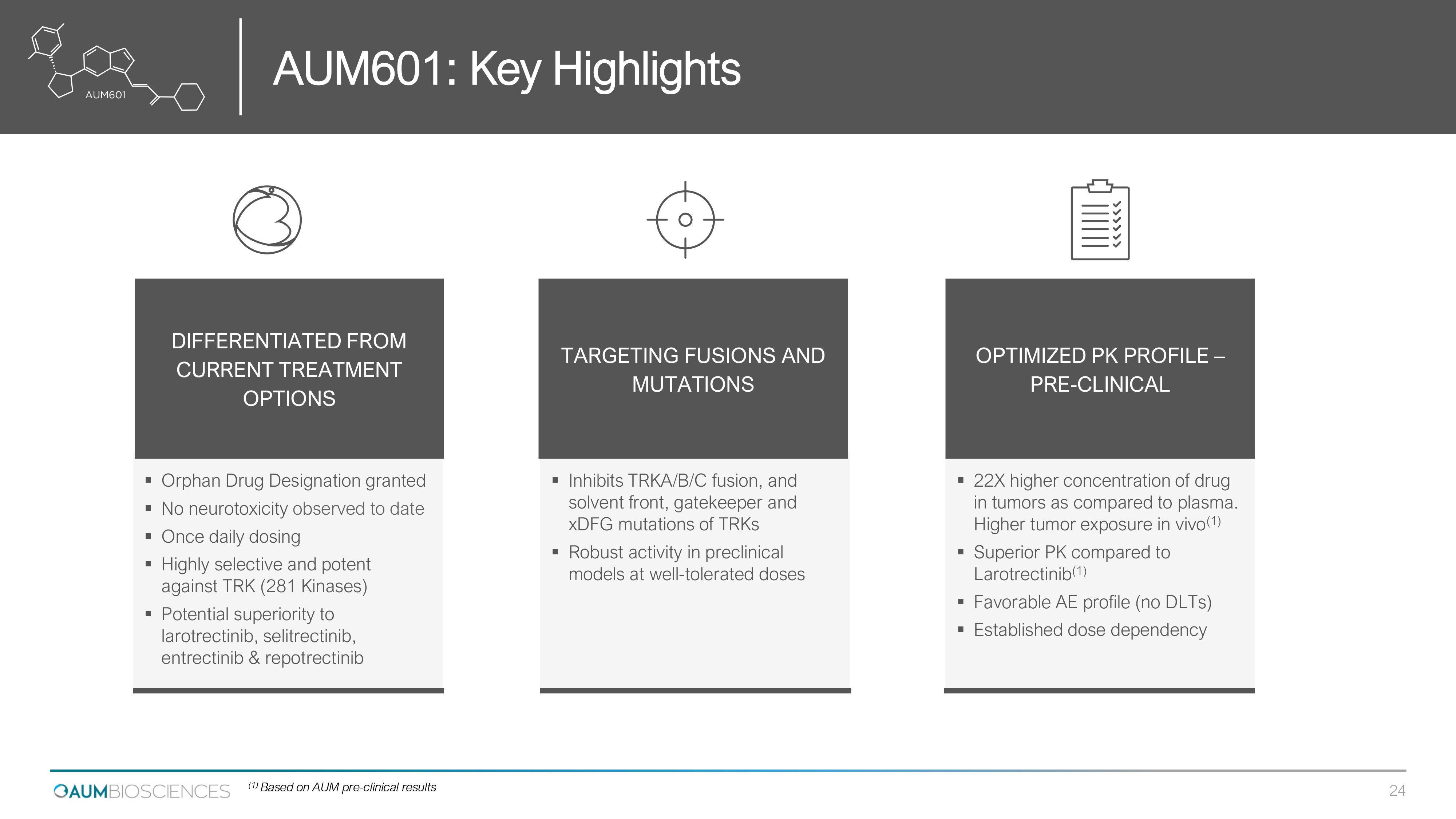

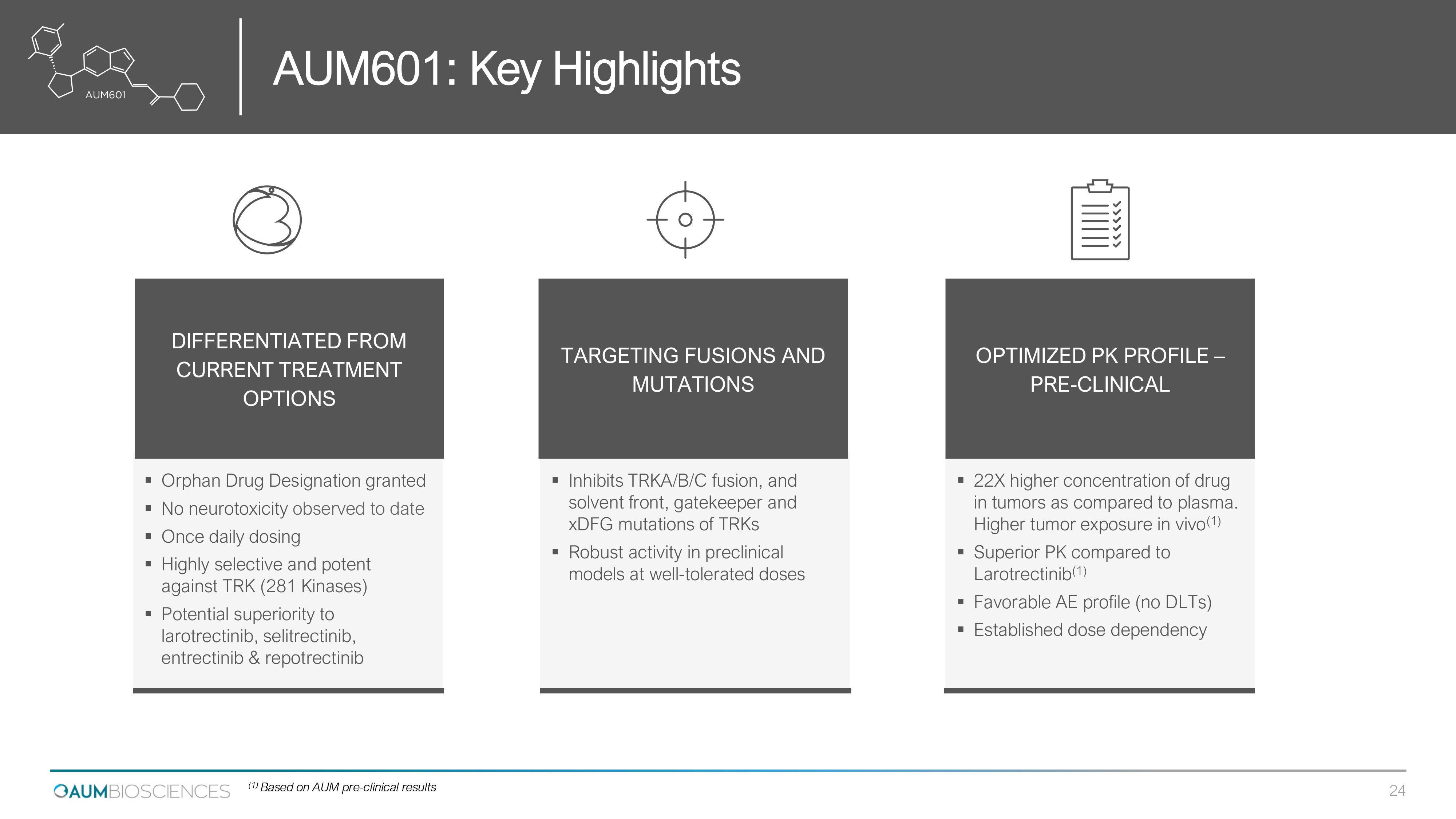

▪ Orphan Drug Designation granted ▪ No neurotoxicity observed to date ▪ Once daily dosing ▪ Highly selective and potent against TRK (281 Kinases) ▪ Potential superiority to larotrectinib, selitrectinib, entrectinib & repotrectinib ▪ Inhibits TRKA/B/C fusion, and solvent front, gatekeeper and xDFG mutations of TRKs ▪ Robust activity in preclinical models at well - tolerated doses ▪ 22 X higher concentration of drug in tumors as compared to plasma. Higher tumor exposure in vivo ( 1 ) ▪ Superior PK compared to Larotrectinib ( 1 ) ▪ Favorable AE profile (no DLTs) ▪ Established dose dependency AUM 601 : Key Highlights 24 ( 1 ) Based on AUM pre - clinical results DIFFERENTIATED FROM CURRENT TREATMENT OPTIONS TARGETING FUSIONS AND MUTATIONS OPTIMIZED PK PROFILE – PRE - CLINICAL

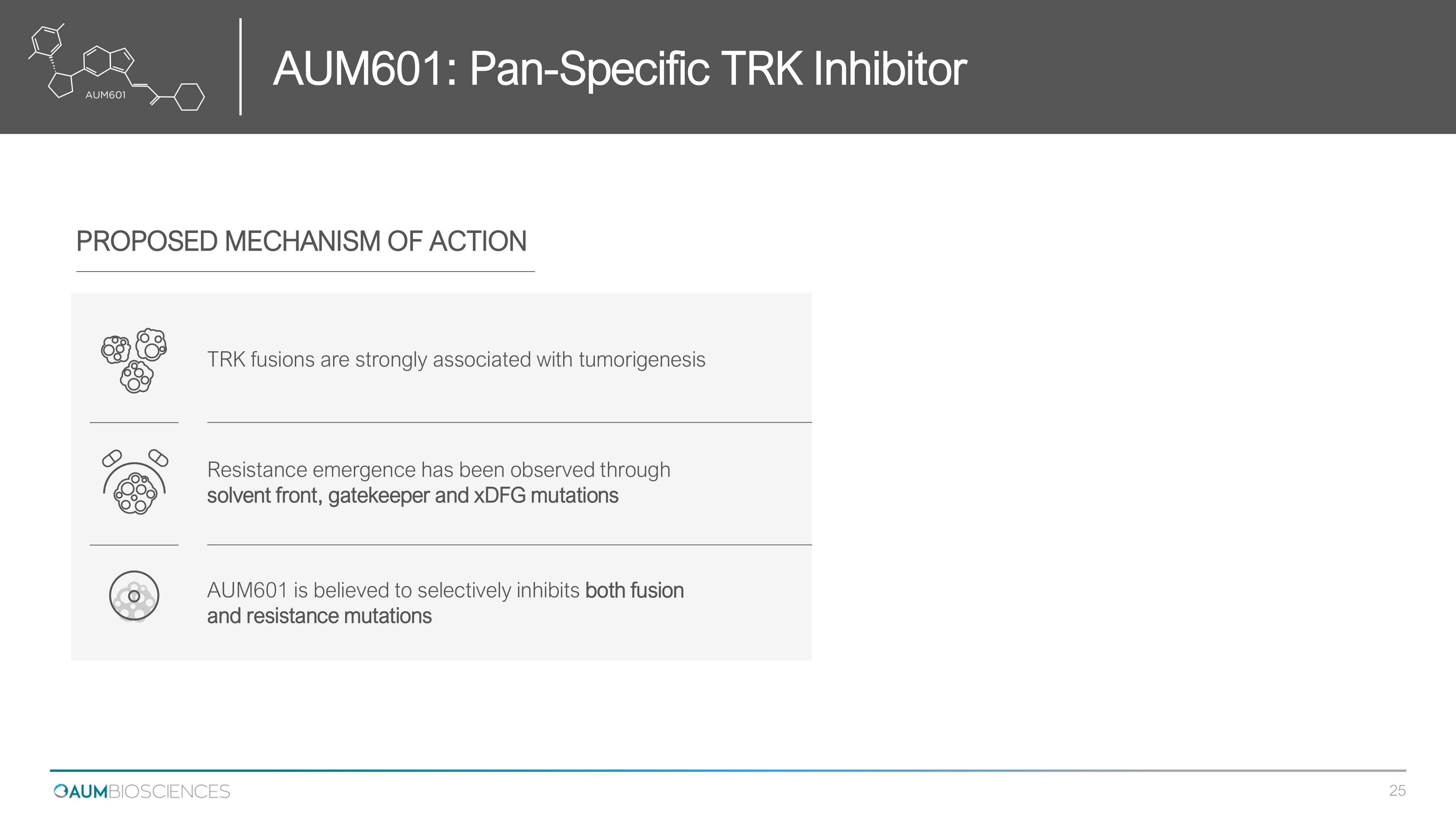

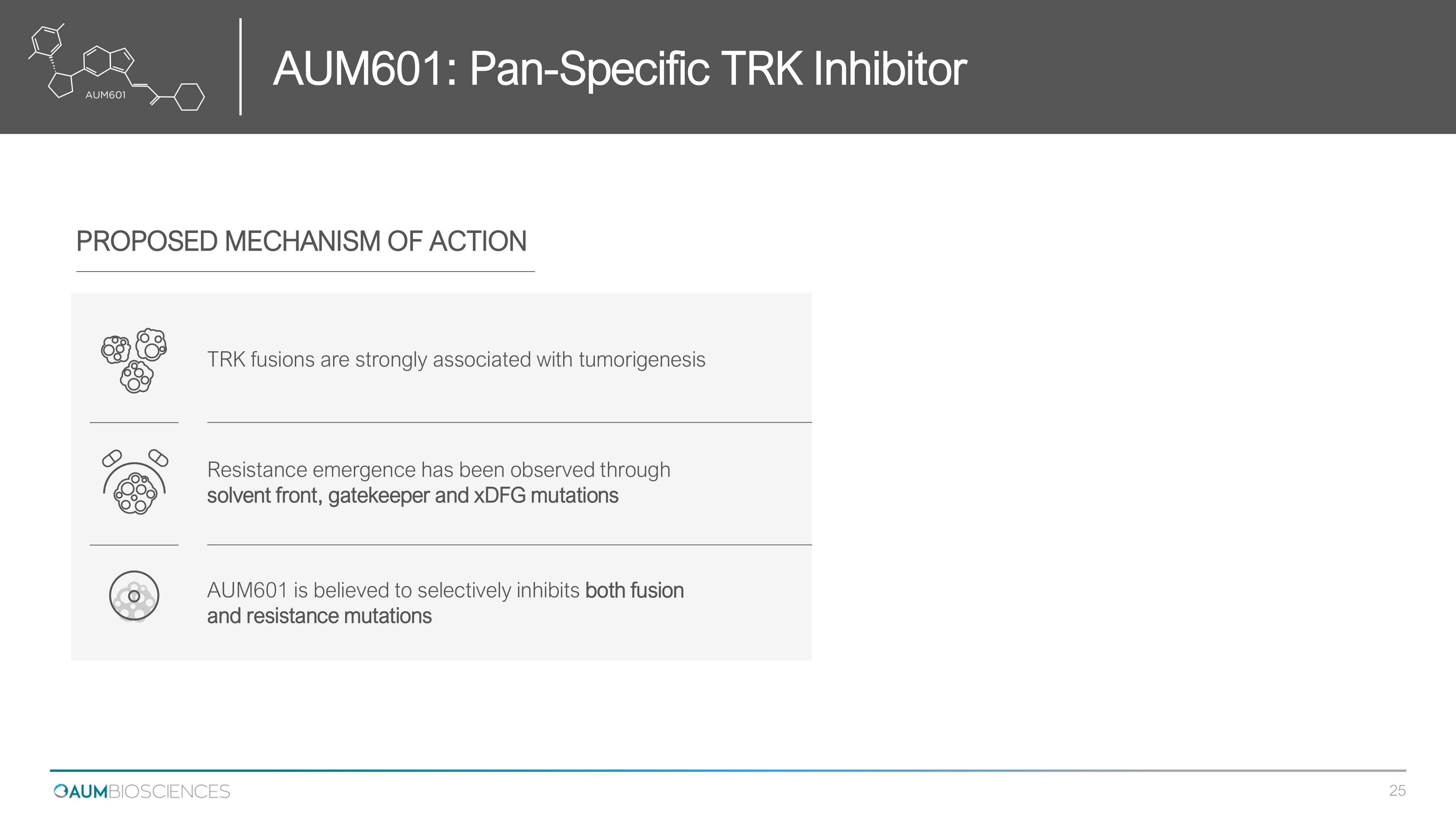

PROPOSED MECHANISM OF ACTION AUM 601 is believed to selectively inhibits both fusion and resistance mutations TRK fusions are strongly associated with tumorigenesis Resistance emergence has been observed through solvent front, gatekeeper and xDFG mutations AUM 601 : Pan - Specific TRK Inhibitor 25

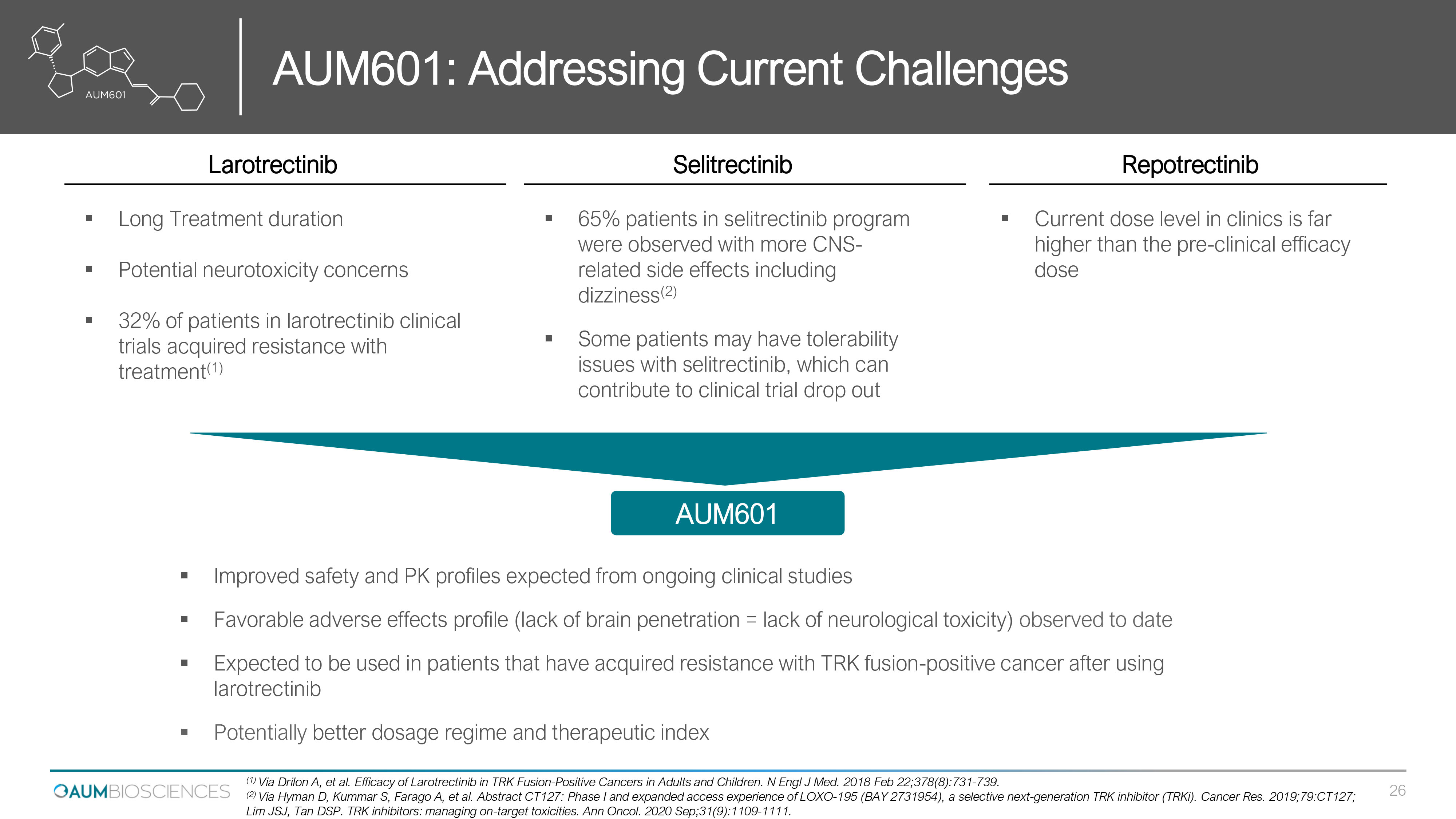

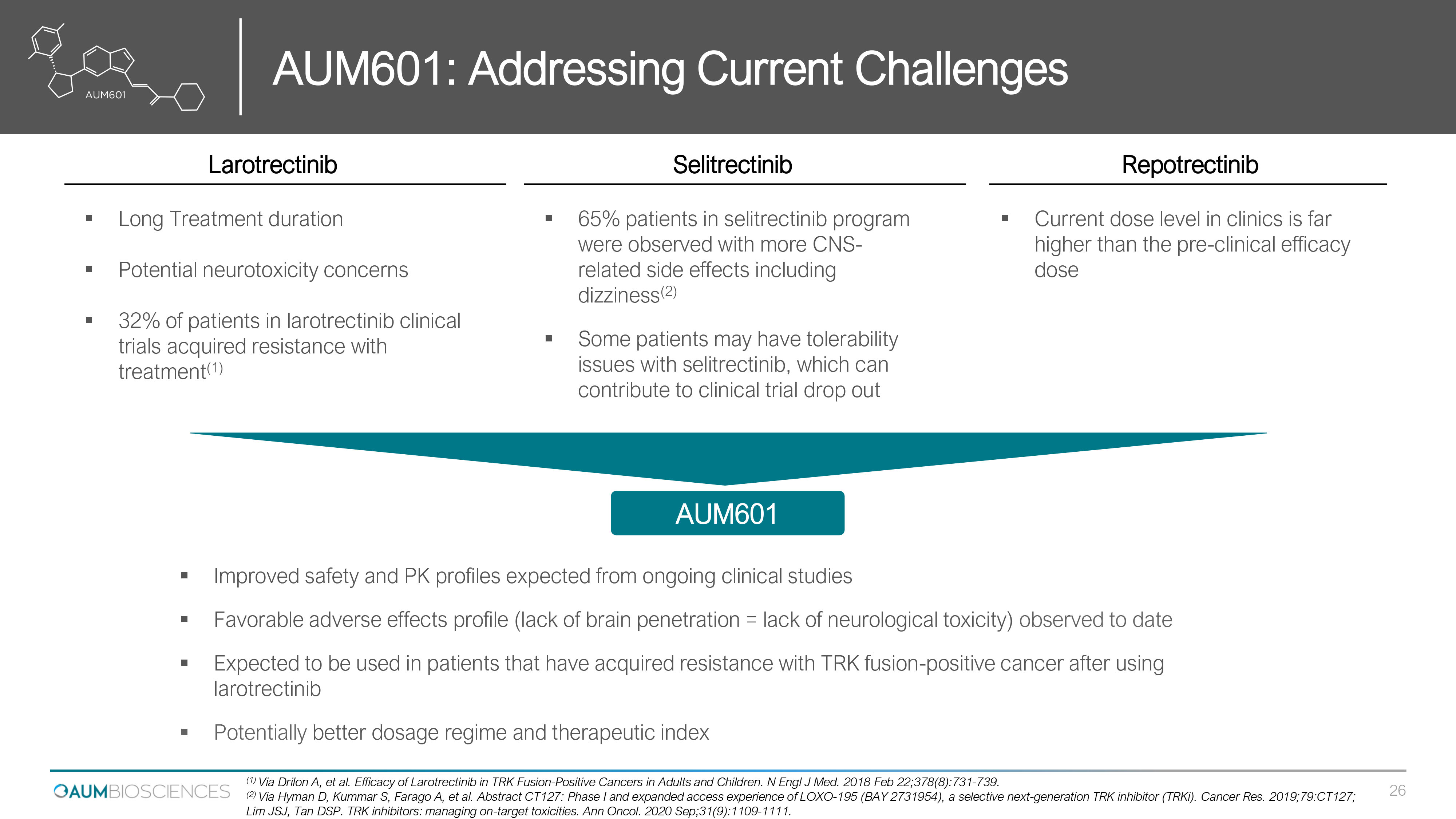

▪ Long Treatment duration ▪ Potential neurotoxicity concerns ▪ 32% of patients in l arotrectinib clinical trials acquired resistance with treatment (1) ▪ 65% patients in se litrectinib program were observed with more CNS - related side effects including dizziness (2) ▪ Some patients may have tolerability issues with selitrectinib, which can contribute to clinical trial drop out ▪ Current dose level in clinics is far higher than the pre - clinical efficacy dose Larotrectinib ▪ Improved safety and PK profiles expected from ongoing clinical studies ▪ Favorable adverse effects profile (lack of brain penetration = lack of neurological toxicity) observed to date ▪ Expected to be used in patients that have acquired resistance with TRK fusion - positive cancer after using larotrectinib ▪ Potentially better dosage regime and therapeutic index Selitrectinib Repotrectinib AUM 601 AUM 601 : Addressing Current Challenges 26 ( 1 ) Via Drilon A, et al. Efficacy of Larotrectinib in TRK Fusion - Positive Cancers in Adults and Children. N Engl J Med. 2018 Feb 22 ; 378 ( 8 ): 731 - 739 . ( 2 ) Via Hyman D, Kummar S, Farago A, et al. Abstract CT 127 : Phase I and expanded access experience of LOXO - 195 (BAY 2731954 ), a selective next - generation TRK inhibitor (TRKi). Cancer Res. 2019 ; 79 :CT 127 ; Lim JSJ, Tan DSP. TRK inhibitors: managing on - target toxicities. Ann Oncol. 2020 Sep; 31 ( 9 ): 1109 - 1111 .

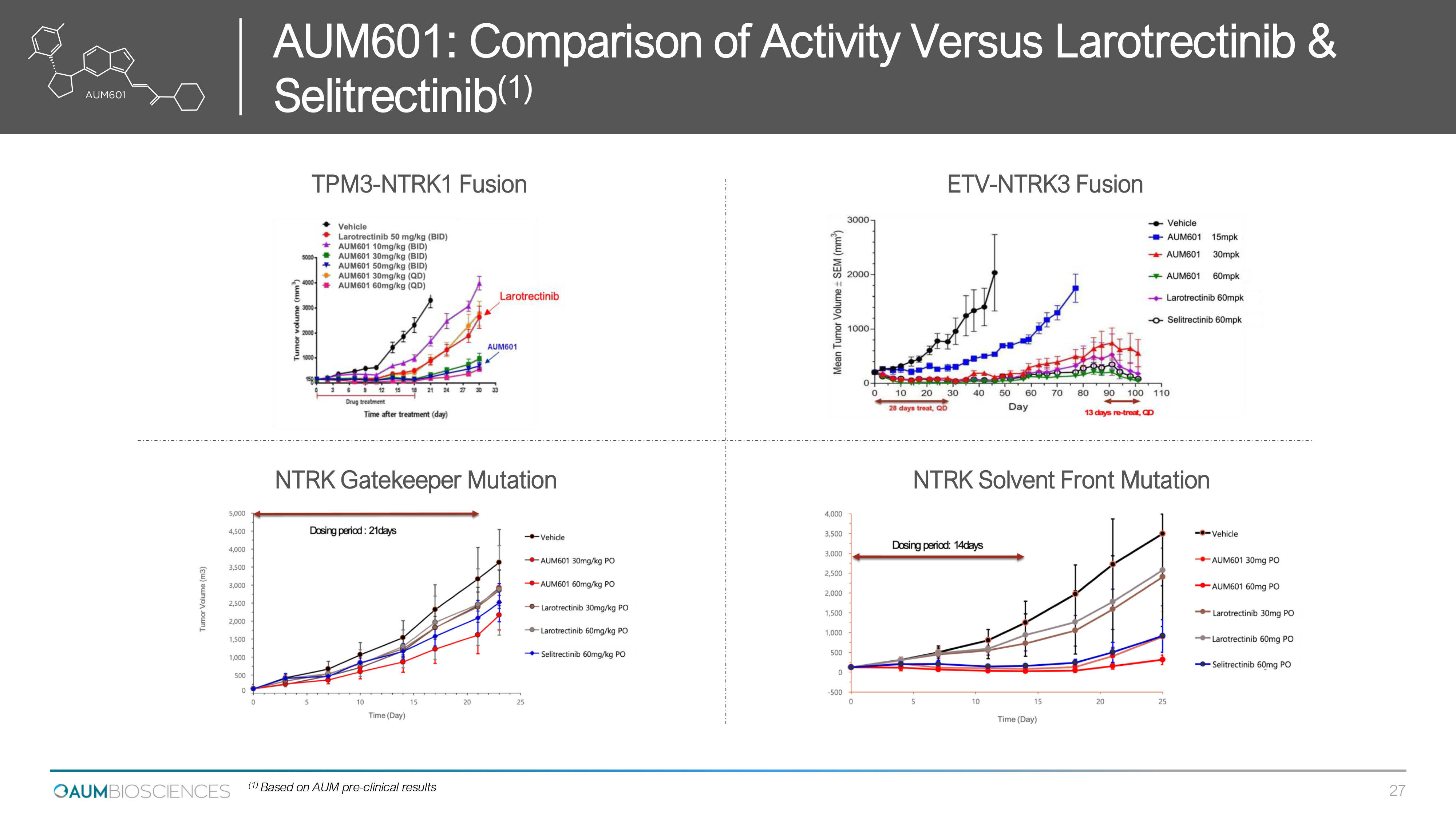

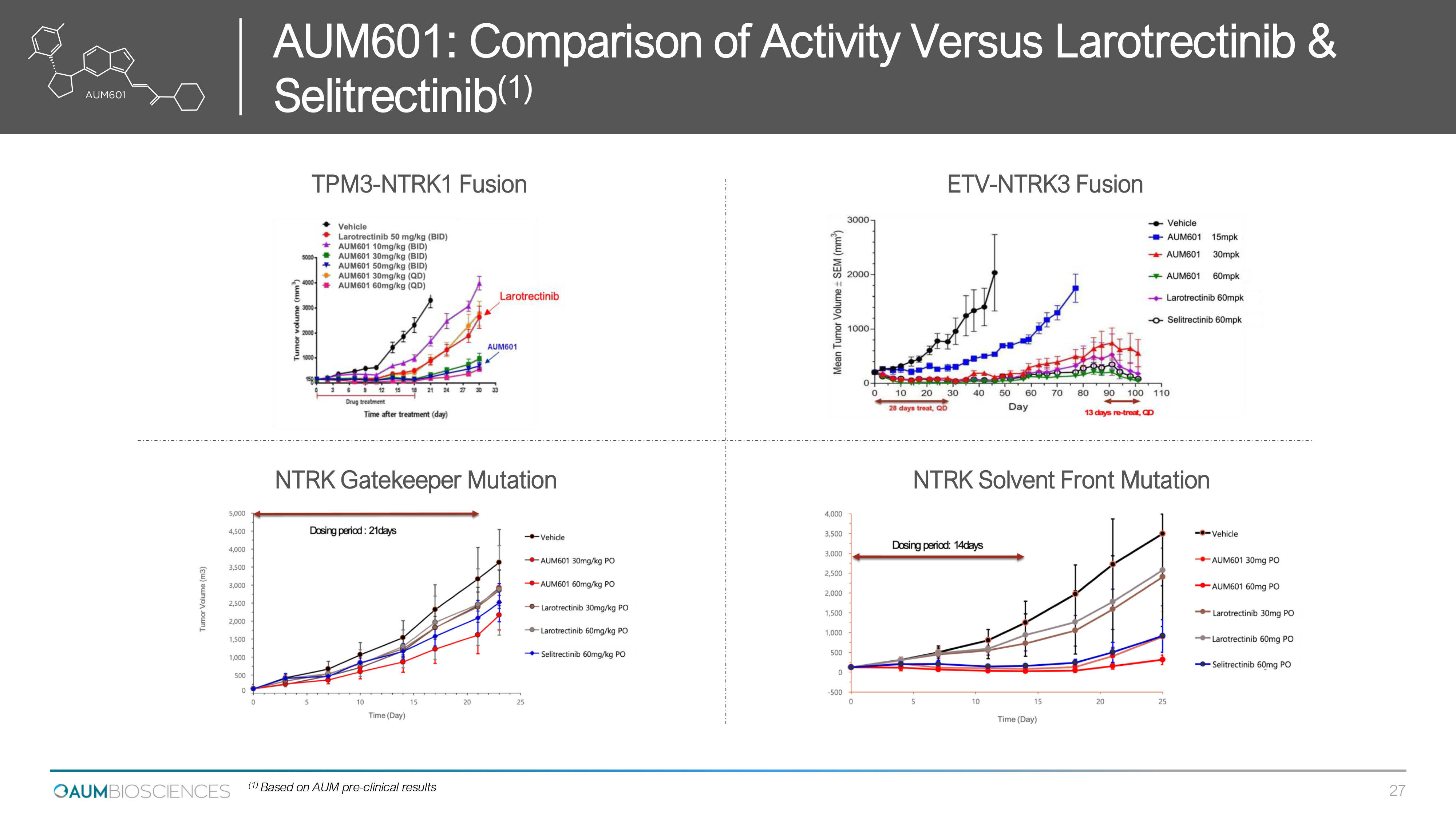

TPM 3 - NTRK 1 Fusion ETV - NTRK 3 Fusion NTRK Gatekeeper Mutation NTRK Solvent Front Mutation Comparison of Activity Versus Larotrectinib & : 601 AUM ) 1 ( Selitrectinib 27 (1) Based on AUM pre - clinical results

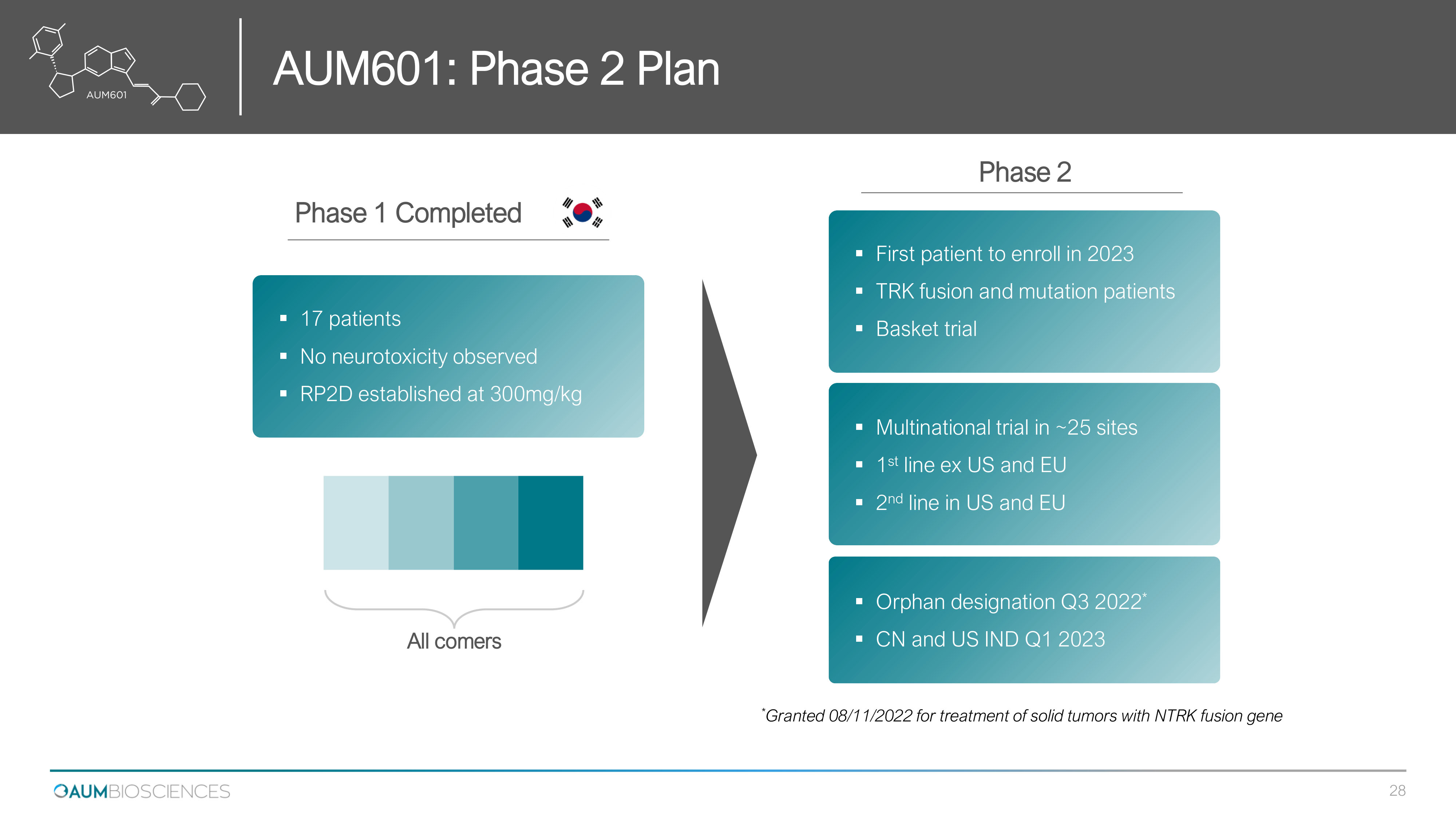

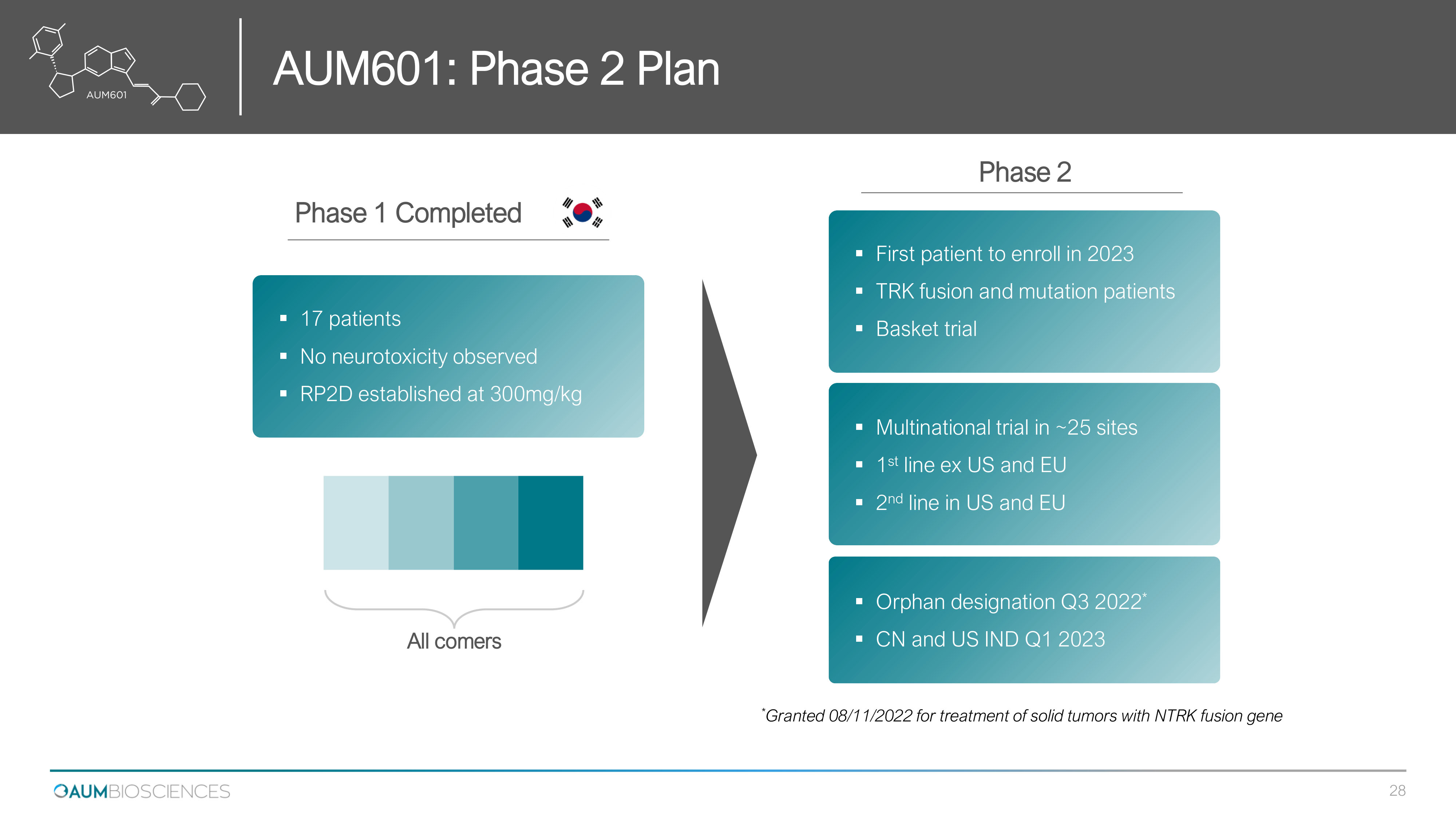

Phase 1 Completed All comers ▪ 17 patients ▪ No neurotoxicity observed ▪ RP 2 D established at 300 mg/kg Phase 2 ▪ First patient to enroll in 2023 ▪ TRK fusion and mutation patients ▪ Basket trial ▪ Multinational trial in ~ 25 sites ▪ 1 st line ex US and EU ▪ 2 nd line in US and EU ▪ Orphan designation Q 3 2022 * ▪ CN and US IND Q 1 2023 * Granted 08/11/2022 for treatment of solid tumors with NTRK fusion gene AUM 601 : Phase 2 Plan 28

POTENTIALLY DIFFERENTIATED FROM CURRENT TREATMENT OPTIONS ▪ Potential first - in - class small molecule targeting PIM, PI 3 K and mTOR ▪ US FDA Orphan Drug Designation (ODD) granted for treatment of neuroblastoma ▪ Low nanomolar IC 50 s in breast cancer ( 0.03 - 10 ) & neuroblastoma ( 0.01 - 0.8 ) ( 1 ) TARGETING SOLID TUMORS ▪ ~ 100 x Sensitivity in lung cancer compared to Alpelisib in in - vitro studies ( 1 ) ▪ ~ 80 % TGI in breast cancer ( 1 ) FIRST - TO - MARKET REGISTRATION STRATEGY ▪ Opportunity to be the FIRST multi - kinase inhibitor class of drug in Neuroblastoma ▪ Superiority to Alpelisib, if proven, may open opens a huge breast cancer opportunity ▪ Strong data supporting NSCLC development PROPRIETARY MACROCYCLIC CHEMISTRY ▪ A unique and patented macrocyclic structure combining 3 key pharmacophores PATENTED AUM 302 : Key Highlights 30 ( 1 ) Based on AUM pre - clinical results

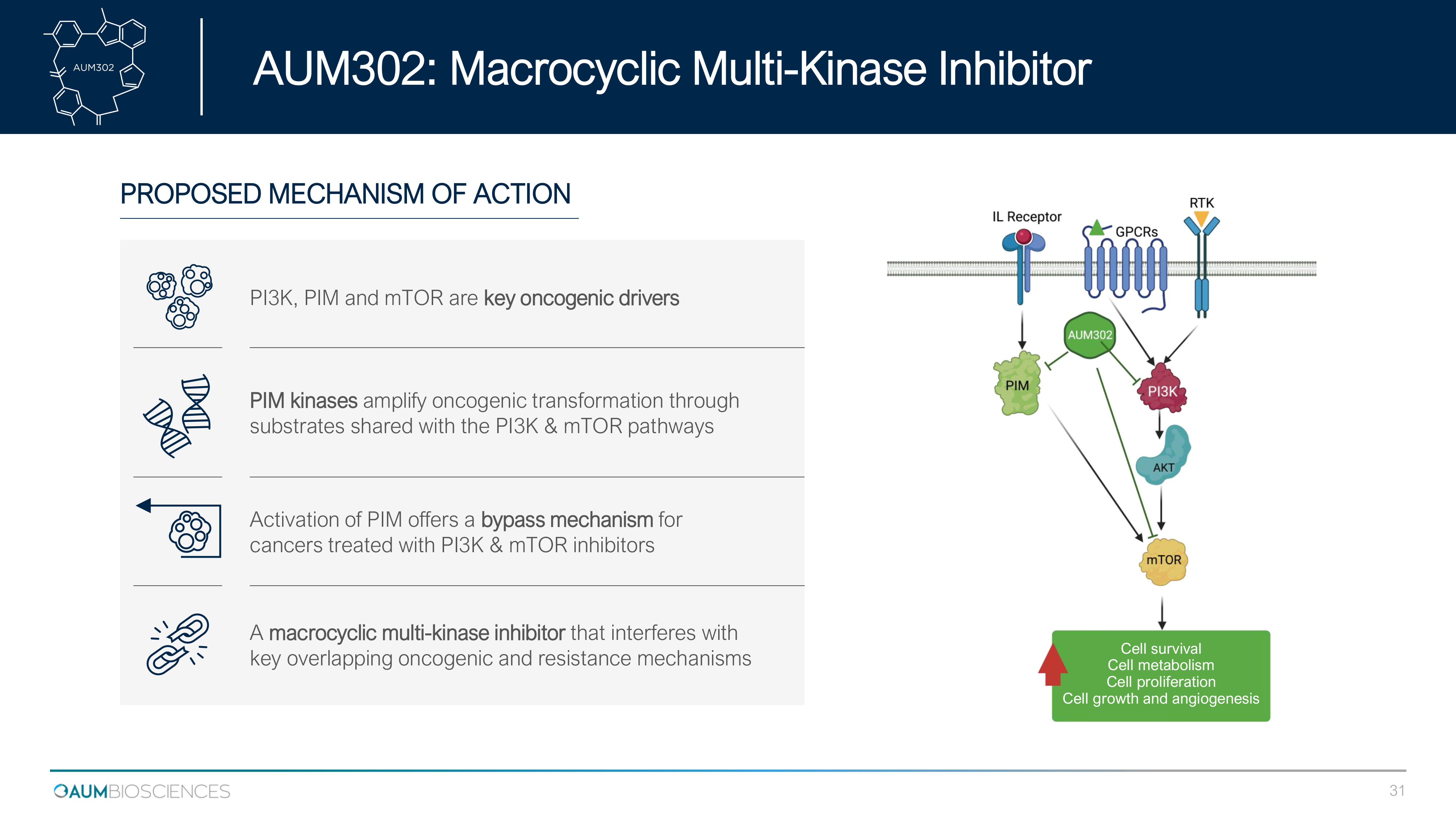

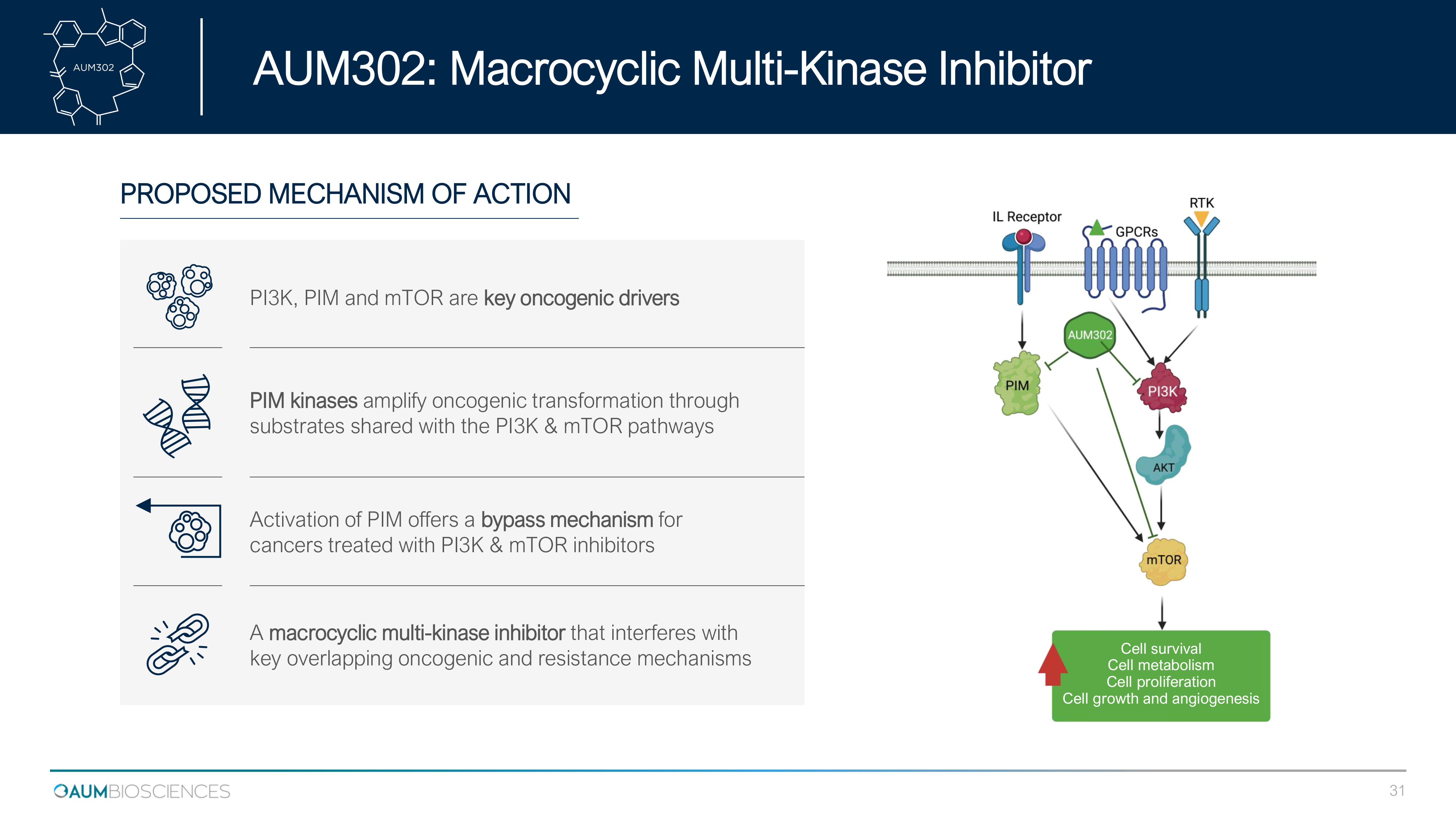

PROPOSED MECHANISM OF ACTION Activation of PIM offers a bypass mechanism for cancers treated with PI3K & mTOR inhibitors PI 3 K, PIM and mTOR are key oncogenic drivers PIM kinases amplify oncogenic transformation through substrates shared with the PI 3 K & mTOR pathways A macrocyclic multi - kinase inhibitor that interferes with key overlapping oncogenic and resistance mechanisms Cell survival Cell metabolism Cell proliferation Cell growth and angiogenesis AUM 302 : Macrocyclic Multi - Kinase Inhibitor 31

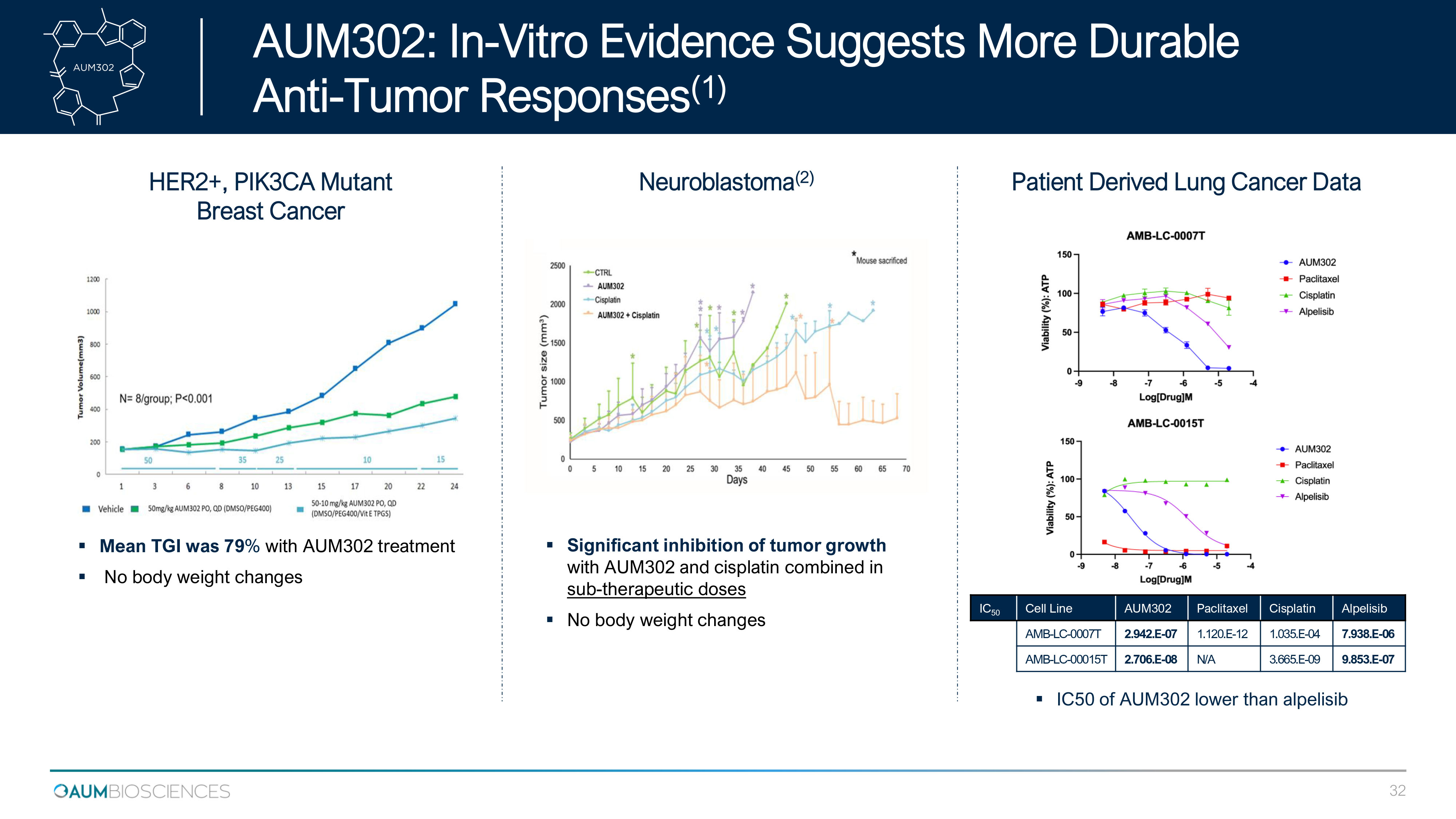

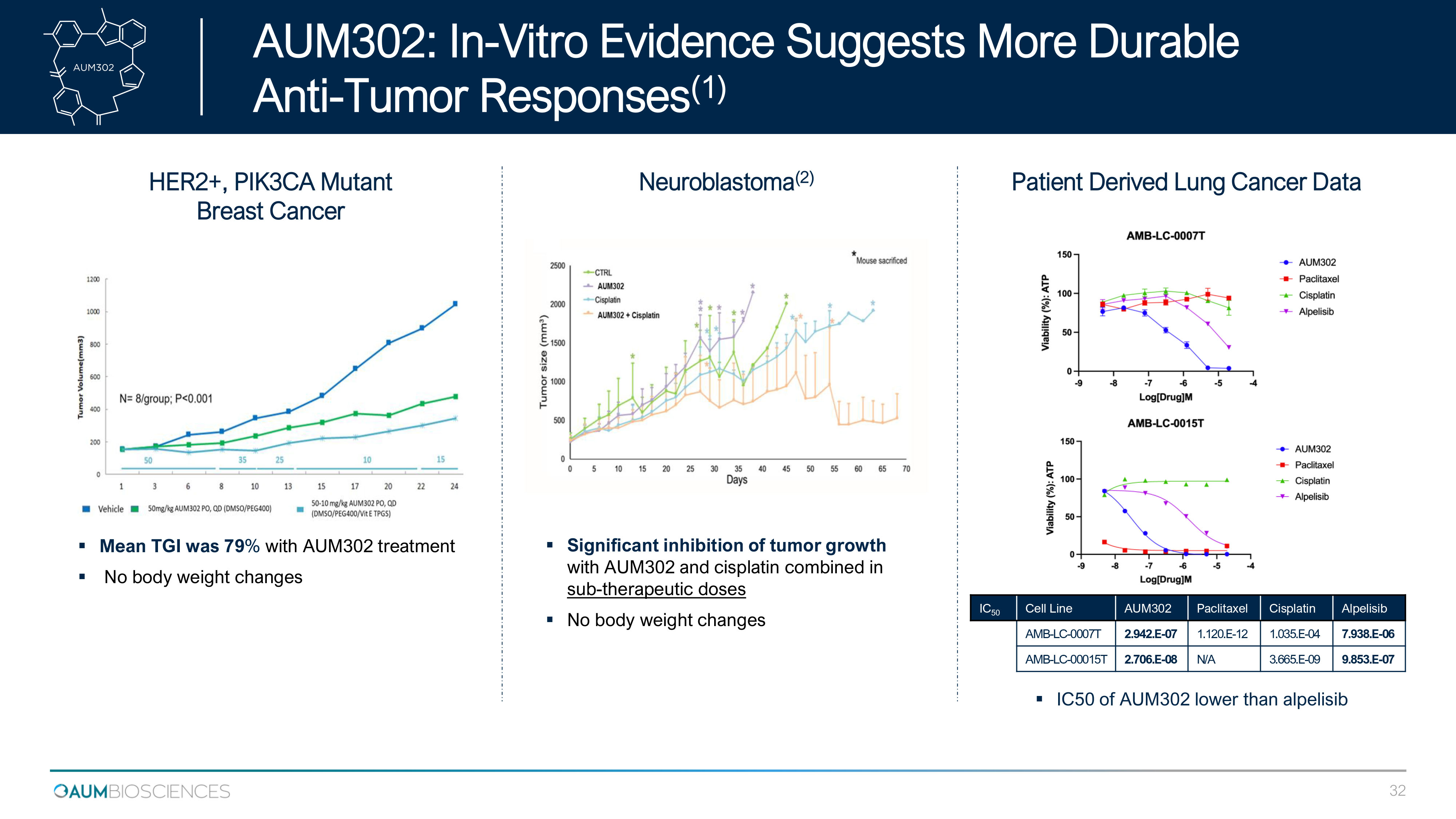

HER2+, PIK3CA Mutant Breast Cancer Neuroblastoma ( 2 ) ▪ Mean TGI was 79 % with AUM 302 treatment ▪ No body weight changes ▪ Significant inhibition of tumor growth with AUM 302 and cisplatin combined in sub - therapeutic doses ▪ No body weight changes Patient Derived Lung Cancer Data IC 50 Cell Line AUM302 Paclitaxel Cisplatin Alpelisib AMB - LC - 0007T 2.942.E - 07 1.120.E - 12 1.035.E - 04 7.938.E - 06 AMB - LC - 00015 T 2.706.E - 08 N/A 3.665.E - 09 9.853.E - 07 ▪ IC 50 of AUM 302 lower than alpelisib AUM 302 : In - Vitro Evidence Suggests More Durable ) 1 ( Tumor Responses - Anti 32

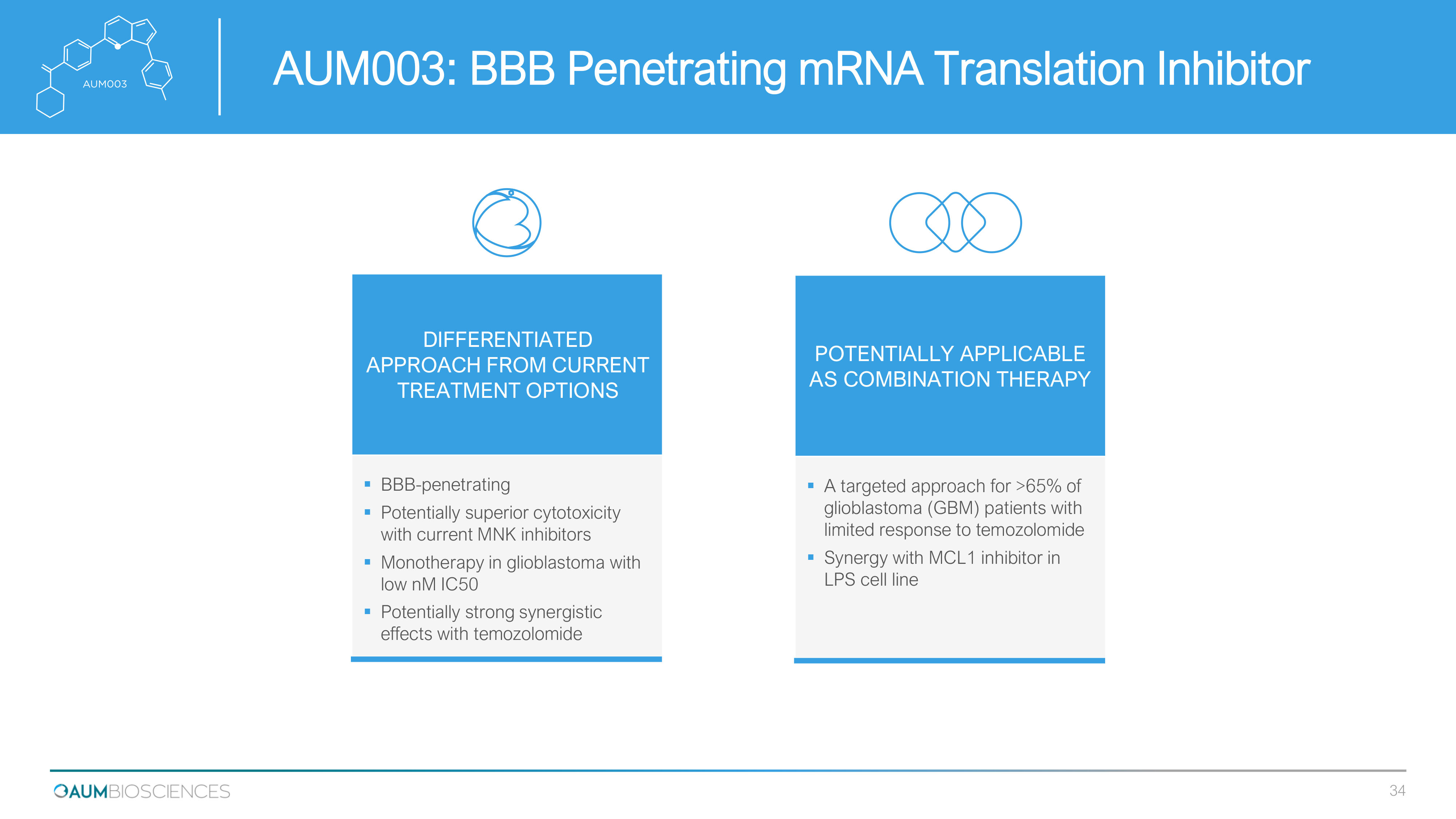

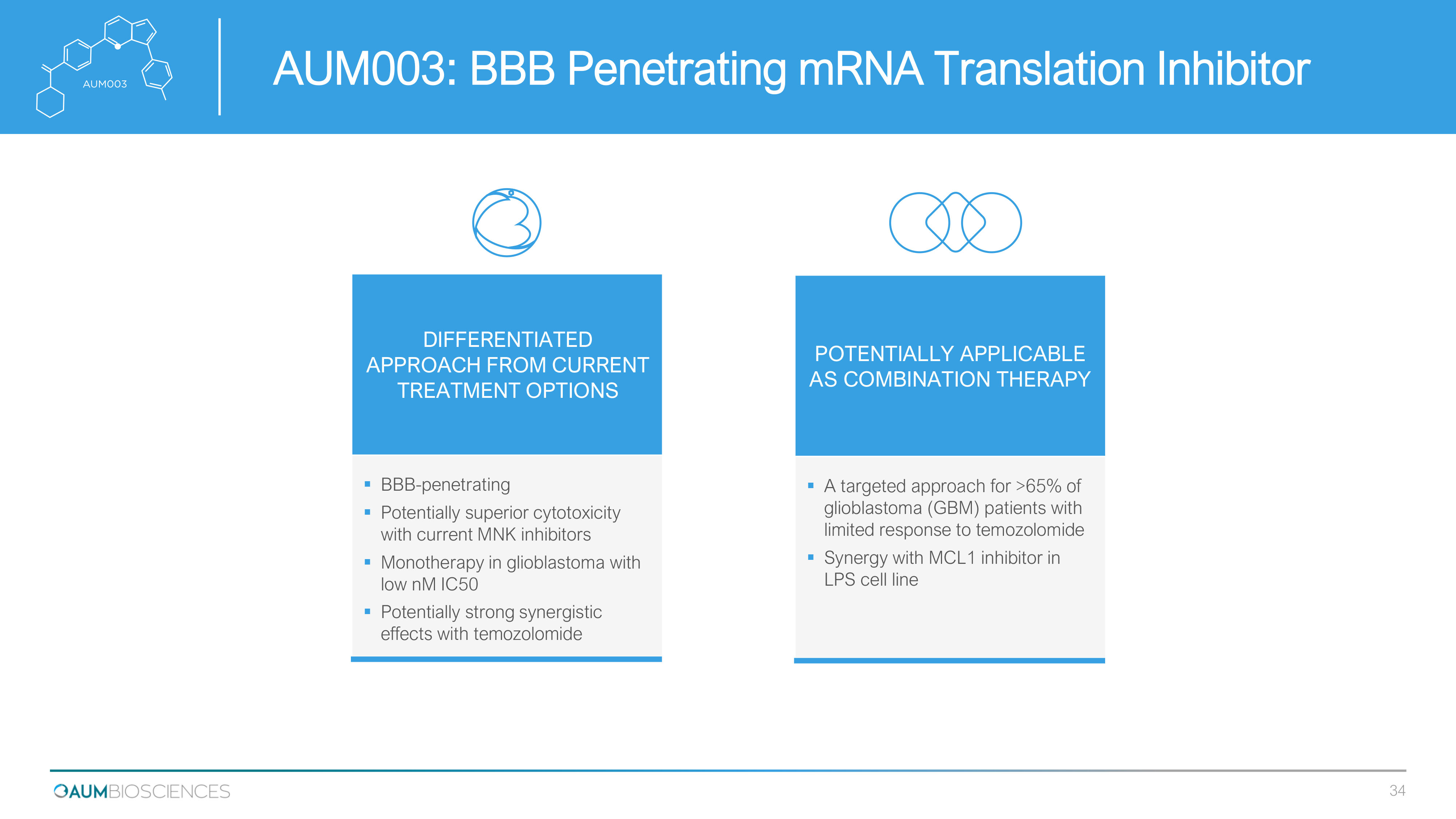

DIFFERENTIATED APPROACH FROM CURRENT TREATMENT OPTIONS ▪ BBB - penetrating ▪ Potentially superior cytotoxicity with current MNK inhibitors ▪ Monotherapy in glioblastoma with low nM IC50 ▪ Potentially strong synergistic effects with temozolomide POTENTIALLY APPLICABLE AS COMBINATION THERAPY ▪ A targeted approach for > 65 % of glioblastoma (GBM) patients with limited response to temozolomide ▪ Synergy with MCL 1 inhibitor in LPS cell line AUM 003 : BBB Penetrating mRNA Translation Inhibitor 34

T HANK YOU Mr. Vishal Doshi Founder and CEO – AUM Biosciences T: +65 6808 6034 F:+65 6808 6699 E: vishald@aumbiosciences.com www.aumbiosciences.com