Bluefin Topco, LLC and Subsidiaries

Notes to Condensed Consolidated Financial Statements

(unaudited)

1. Overview and Basis of Presentation

Organization and Description of Business

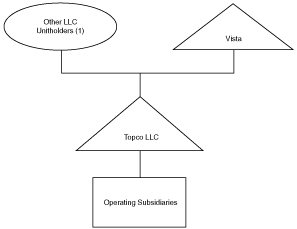

Bluefin Topco, LLC, formerly BMS Holdings, LLC, (collectively with its subsidiaries, “we”, “us”, “our”, or the “Company”) is a Delaware limited liability company, and is the sole member of Bluefin Intermediate Holdings, LLC, a Delaware limited liability company (“Bluefin Intermediate”). Bluefin Intermediate is the sole member of Bluefin Holding, LLC (“Bluefin Holding”), a Delaware limited liability company. The Company formed Bluefin Intermediate and Bluefin Holdings on August 8, 2019 to serve as the guarantor and obligor, respectively, for $234 million in debt outstanding as of June 30, 2021. Neither the Company, Bluefin Intermediate nor Bluefin Holding have operations of their own. The Company is controlled by certain affiliates of Vista Equity Partners (“Vista”), a private equity company.

The Company is comprised of the net assets and operations of the following wholly-owned subsidiaries of Bluefin Holding: Black Mountain Systems, LLC and its subsidiaries (Litheo, LLC, Mariana Systems, LLC, and Black Mountain Systems Limited) and Vertice Technologies, LLC (f/k/a AltaReturn) (“AltaReturn”) and its subsidiaries (Vertice Technologies, B.V., and Vertice Technology Services, LLC). As of January 1, 2020, Black Mountain Systems, LLC changed its name to Allvue Systems, LLC (“Allvue”) and AltaReturn was merged into Allvue.

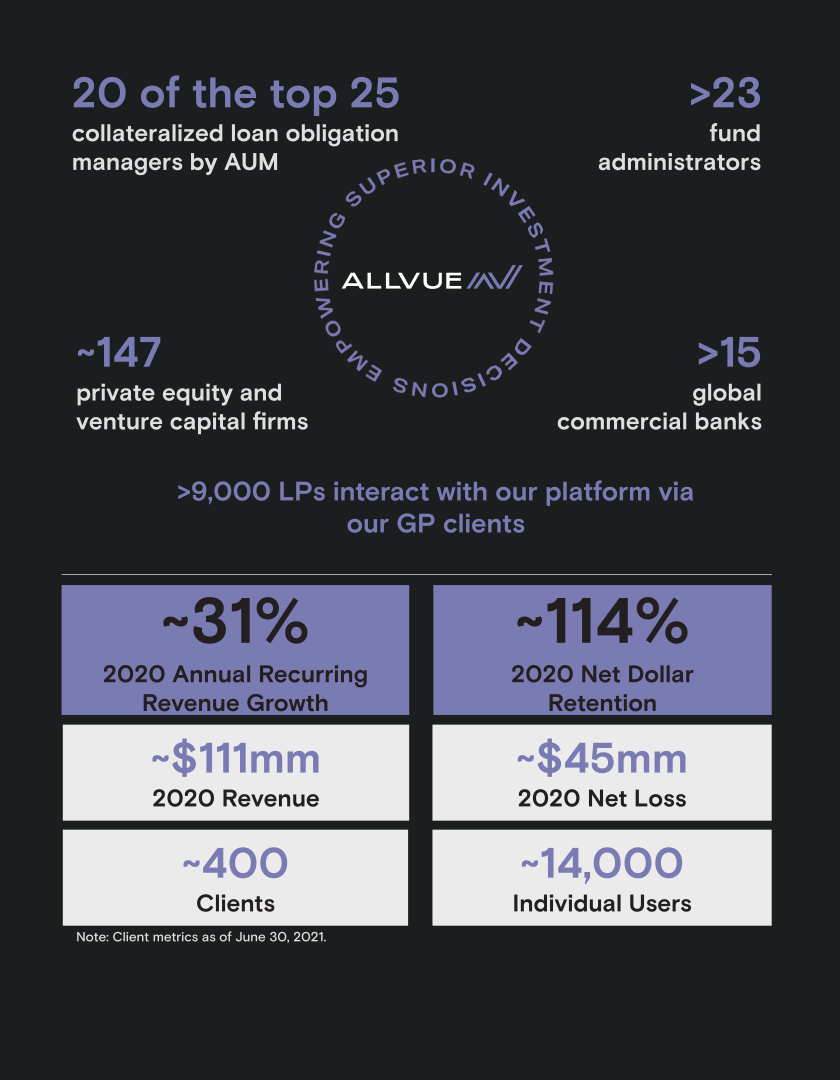

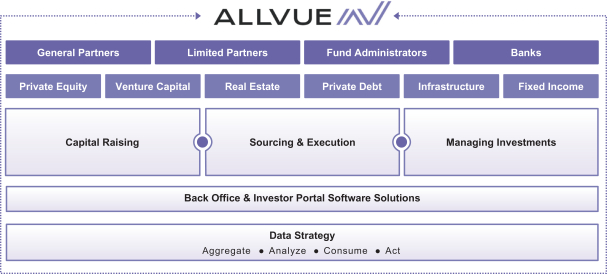

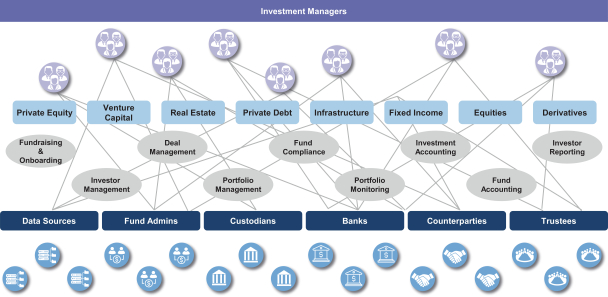

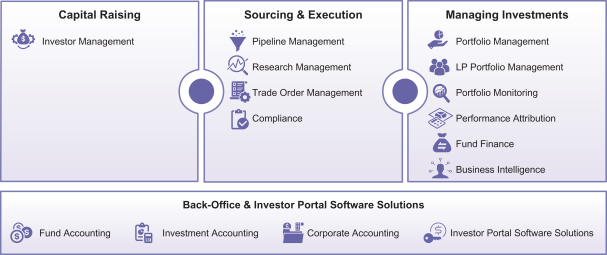

The Company operates as a leader in subscription based software solutions to alternative investment management firms. In addition to its license and cloud-based solutions, the Company provides implementation and consulting services. The Company has operations in the United States of America, United Kingdom, Ukraine, Singapore, and in the Netherlands. Revenues from foreign based clients comprise 20.5% of the Company’s consolidated revenues.

Unit Split

On September 17, 2021, the Company effected a 100-for-1 split of its common units and Management Incentive Units. All of the Company’s unit and per unit information included in the accompanying unaudited interim condensed consolidated financial statements has been adjusted to reflect this unit split.

As of June 30, 2021 and December 31, 2020, respectively, there were 69,919,064 and 69,926,900 common units issued and outstanding after giving effect to this unit split.

Unaudited Interim Condensed Consolidated Financial Information

The accompanying interim condensed consolidated balance sheet as of June 30, 2021, the interim condensed consolidated statements of operations and comprehensive loss, cash flows and members’ equity for the six months ended June 30, 2021 and 2020, and the related notes are unaudited. The condensed consolidated balance sheet as of December 31, 2020 was derived from our audited annual consolidated financial statements but does not include all disclosures required by GAAP as part of annual financial statements. Therefore, these unaudited condensed consolidated financial statements should be read in conjunction with our audited annual consolidated financial statements and notes thereto for the year ended December 31, 2020, which include a complete set of footnote disclosures, including our significant accounting policies.

These unaudited interim condensed consolidated financial statements have been prepared on the same basis as our audited annual consolidated financial statements and, in management’s opinion,

F-11