cF

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| |

☐ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| |

☒ | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2024

or

| |

☐ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

or

| |

☐ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15 (d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to .

Commission file number: 001-41208

NOVONIX LIMITED

(Exact name of Registrant as specified in its charter

NOVONIX LIMITED

(Translation of Registrant’s name into English)

Australia

(Jurisdiction of incorporation or organization)

NOVONIX LIMITED

Level 38

71 Eagle Street

Brisbane QLD 4000

Australia

(Address of principal executive offices)

NOVONIX Limited

Level 38

71 Eagle Street

Brisbane QLD 4000

Australia

(P) +61 439 310 818

Attn: Suzanne Yeates, Company Secretary

suzie@novonixgroup.com

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | | | | | |

Title of each class | | | Trading Symbol(s) | | | Name of each exchange and on which registered |

American Depositary Shares, each representing four ordinary | | | NVX | | | The Nasdaq Stock Market LLC |

Securities registered or to be registered pursuant to Section 12(g) of the Act: None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act: None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the annual report: 488,733,461 Ordinary Shares

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐ No ☒

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or (15)(d) of the Securities Exchange Act of 1934. Yes ☐ No ☒

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes ☒ No ☐

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). Yes ☒ No ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or an emerging growth company. See definition of “accelerated filer,” “large accelerated filer” and “emerging growth company” in Rule 12b-2 of the Exchange Act. (Check one):

| | | | | | |

Large Accelerated Filer ☐ | | | Accelerated Filer ☒ | | | Non-Accelerated Filer ☐ |

| | |

| | | Emerging Growth Company ☒ |

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards† provided pursuant to Section 13(a) of the Exchange Act. ☐

† The term “new or revised financial accounting standard” refers to any update issued by the Financial Accounting Standards Board to its Accounting Standards Codification after April 5, 2012.

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report. ☐

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements. ☐

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive- based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to §240.10D-1(b). ☐

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | | | |

U.S. GAAP ☐ | | | International Financial Reporting Standards as issued by the International Accounting Standards Board ☒ | | | Other ☐ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. Item 17 ☐ Item 18 ☐

If this is an annual report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes ☐ No ☒

(APPLICABLE ONLY TO ISSUERS INVOLVED IN BANKRUPTCY PROCEEDINGS DURING THE PAST FIVE YEARS)

Indicate by check mark whether the registrant has filed all documents and reports required to be filed by Sections 12, 13 or 15(d) of the Securities Exchange Act of 1934 subsequent to the distribution of securities under a plan confirmed by a court. Yes ☐ No ☐

TABLE OF CONTENTS

INTRODUCTION AND USE OF CERTAIN TERMS

We have prepared this annual report on Form 20-F using a number of conventions, which you should consider when reading the information contained herein. In this annual report, “NOVONIX,” the “Company,” the “Group”, “our company,” “we,” “us” and “our” refer to NOVONIX Limited and its consolidated subsidiaries, taken as a whole. Additionally, this annual report uses the following conventions:

•“US$,” “U.S. dollars,” “$” and “dollars” mean United States dollars;

•“A$” mean Australian dollars;

•“C$” mean Canadian dollars, unless otherwise noted;

•“ADSs” mean American depositary shares, each of which represents four of our ordinary shares, no par value;

•“ADRs” mean the American depositary receipts that may evidence the ADSs;

•“ASX” refers to the Australian Securities Exchange; and

•“Nasdaq” refers to the Nasdaq Stock Market LLC.

AUSTRALIAN DISCLOSURE REQUIREMENTS

Our ordinary shares are quoted on the ASX in addition to our listing of our ADRs on the Nasdaq. As part of our ASX listing, we are required to comply with various disclosure requirements as set out under the Australian Corporations Act 2001 and the ASX Listing Rules. Information furnished under the sub-heading "Australian Disclosure Requirements" is intended to comply with ASX Listing Rules and the Corporations Act 2001 disclosure requirements and is not intended to fulfill information required by this Annual Report on Form 20-F.

EXPLANATORY NOTE

On December 20, 2022, the Board of Directors of NOVONIX Limited (the "Board of Directors" or the "Board") approved a change of fiscal year end from June 30 to December 31 to better align the reporting of the Company’s results with its industry peers. As a result, in February 2023, we filed a transition report on Form 20-F for the six-month transition period of July 1, 2022, to December 31, 2022. Unless otherwise noted, all references to “fiscal year” in this annual report on Form 20-F refer to the fiscal year which, prior to the transition period, ended on June 30, and which, after the transition period, ended December 31. Our consolidated financial statements for the fiscal years ended December 31, 2024, 2023 and six-month period ended December 31, 2022, and year ended June 30, 2022, have been prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board. A comparison of our operating results for the years ended December 31, 2024, and 2023, has been included within Item 5. Operating and Financial Review and Prospects.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This annual report contains forward-looking statements about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this annual report, including statements regarding our future results of operations, financial condition, business strategy, and plans and objectives of management for future operations, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would,” or the negative of these words or other similar terms or expressions.

We have based these forward-looking statements largely on our current expectations and projections about future events and trends that we believe may affect our financial condition, results of operations, business strategy and financial needs. These forward-looking statements are subject to a number of known and unknown risks, uncertainties, other factors and assumptions, including the risks described in Item 3. Key Information—D. Risk Factors contained herein.

These risks are not exhaustive. Other sections of this annual report may include additional factors that could harm our business and financial performance. New risk factors may emerge from time to time, and it is not possible for our management to predict all risk factors, nor can we assess the impact of all factors on our business or the extent to which any factor, or combination of factors, may cause actual results to differ materially from those contained in, or implied by, any forward-looking statements.

You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this annual report primarily on our current expectations and projections about future events and trends that we believe may affect our business, financial condition, and operating results. We undertake no obligation to update any forward-looking statements made in this annual report to reflect events or circumstances after the date of this annual report or to reflect new information or the occurrence of unanticipated events, except as required by law. We may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future acquisitions, mergers, dispositions, joint ventures or investments.

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based on information available to us as of the date of this annual report. While we believe that information provides a reasonable basis for these statements, that information may be limited or incomplete. Our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information. These statements are inherently uncertain, and investors are cautioned not to unduly rely on these statements.

You should read this annual report and the documents that we reference in and have filed as exhibits to the annual report with the understanding that our actual future results, levels of activity, performance and achievements may be different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PART I

Item 1. Identity of Directors, Senior Management and Advisers

Not applicable.

Item 2. Offer Statistics and Expected Timetable

Not applicable.

Item 3. Key Information

B.Capitalization and Indebtedness

Not applicable.

C.Reasons for the Offer and Use of Proceeds

Not applicable.

Our business is subject to numerous risks and uncertainties that you should consider before investing in our securities. These risks are described more fully below and include, but are not limited to, risks relating to the following:

•We will need to obtain funding to finance our growth and operations, which may not be available on acceptable terms, or at all. If we are unable to raise capital when needed, we may be forced to delay, reduce or eliminate certain operations, and we may be unable to adequately control our costs.

•We face significant challenges in our attempt to develop our anode and cathode materials to produce them at volumes with acceptable performance, yields and costs. The pace of development in materials science is often not predictable. We may encounter substantial delays or operational problems in the scale-up of our anode materials production or the commercialization of our cathode materials technology.

•The systems, equipment and processes we use in the production of our anode materials are complex, and we are subject to many operational risks that could substantially increase our costs, limit the operational performance of our anode materials operations, and adversely affect our business.

•Our failure to achieve existing or target customers' product specifications for our anode materials or otherwise engage target customers successfully and convert such contacts into meaningful orders in the future would have a material adverse effect on our business.

•If we are unable to attract and retain key employees and qualified personnel, our ability to compete could be harmed.

•Labor shortages, turnover, and labor cost increases and the delay or insufficiency of the training of our employees could adversely impact our ability to scale up manufacturing of our anode materials and commercialize our cathode technology.

•If we do not satisfy the terms of our DOE grant, we may be unable to be reimbursed under or otherwise receive any or all of the funds or other benefits under the grant, may be required to return unused funds, and may be subject to claims or penalties, which would have a material adverse effect on our business.

•We may not qualify for tax credits available to U.S. producers of graphite or otherwise realize any of the benefits of such tax credits due to a change in current tax law, our inability to satisfy the requirements for realizing such benefits or factors outside our control.

•Our reliance on certain limited or sole source suppliers subjects us to a number of risks.

•The battery technology market continues to evolve and is highly competitive, and we may not be successful in competing in this industry or establishing and maintaining confidence in our long-term business prospects among current and future partners and customers.

•Our anode materials business is subject to fluctuating and potentially unfavorable market conditions for graphite.

•Our future growth and success will depend on our ability to sell effectively to large customers.

•We depend, and expect to continue to depend, on a limited number of customers for a significant percentage of our revenue.

•Our commercial relationships are subject to various risks which could adversely affect our business and future prospects.

•Our business and future growth depend substantially on the growth in demand for electric vehicles and batteries for grid energy storage.

•Our projected operating and financial results rely in large part upon assumptions and analyses we have developed. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our projected results.

•We may not be able to establish supply relationships for necessary components or may be required to pay costs for components that are more expensive than anticipated, which could delay the introduction or acquisition of additional equipment necessary to support our growth and negatively impact our business.

•We may not be able to accurately estimate the future supply and demand for our materials and equipment, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements or prices of components increase, we could incur additional costs or experience delays.

•We have a history of financial losses and expect to incur significant expenses and continuing losses in the near future.

•We have a concentration of beneficial ownership among Phillips 66, LG Energy Solution, and our executive officers, non-executive directors and their affiliates that may prevent new investors from influencing significant corporate decisions.

•Global political, economic and financial conditions (as well as the indirect effects flowing therefrom) could negatively affect our business, results of operations, and financial condition.

•Our systems and data may be subject to disruptions or other security incidents, and we may face alleged violations of laws, regulations, or other obligations relating to our employees' personal data or confidential data of our customers and other business partners that could result in liability and adversely impact our reputation and future sales.

•Our operations are subject to significant risks of safety incidents, which could result in harm to our workers, damage to our property and delays in our production that would adversely affect our business.

•From time to time, we may be involved in litigation, regulatory actions or government investigations and inquiries, which could have an adverse impact on our profitability and consolidated financial position.

•We may become subject to product liability claims, which could harm our financial condition and liquidity if we are not able to successfully defend or insure against such claims.

•From time to time we may enter into negotiations for acquisitions, dispositions, partnerships, joint ventures or investments that are not ultimately consummated or, if consummated, may not be successful.

•Our facilities or operations could be damaged or adversely affected as a result of natural disasters and other catastrophic events.

•Issues relating to the use of new and evolving technologies, such as Artificial Intelligence, in our business could adversely affect our business and operating results.

•Terrorist activity, acts of war and political instability around the world could adversely impact our business.

•We are subject to substantial regulation and unfavorable changes to, or our failure to comply with, these regulations could substantially harm our business and operating results.

•We are subject to environmental, health and safety requirements which could adversely affect our business, results of operation and reputation.

•We are subject to anti-corruption, anti-bribery, anti-money laundering, financial and economic sanctions and similar laws, and non-compliance with such laws can subject us to administrative, civil and criminal fines and penalties, collateral consequences, remedial measures and legal expenses, all of which could adversely affect our business, results of operations, financial condition and reputation.

•Our success depends upon our ability to obtain and maintain intellectual property protection for our materials and technologies.

•Termination of our collaborative research agreement with Dalhousie University to support the development of current and future technology would likely harm our business, and even if it continues, it may not help us successfully develop any new intellectual property.

•We may be subject to claims by third parties asserting misappropriation of intellectual property, or claiming ownership of what we regard as our own intellectual property.

•Our patent applications may not result in issued patents or our patent rights may be contested, circumvented, invalidated or limited in scope, any of which could have a material adverse effect on our ability to prevent others from interfering with our commercialization of our products.

•Changes in patent law could diminish the value of patents in general, thereby impairing our ability to protect our technologies and processes.

•We may be unable to obtain intellectual property rights or technology necessary to develop and commercialize our materials and equipment.

•We may become involved in lawsuits or other proceedings to protect or enforce our intellectual property, which could be expensive, time-consuming and unsuccessful and have a negative effect on the success of our business.

•An active U.S. trading market may not be sustained.

•The trading price and volume of the ADSs may be volatile, and purchasers of the ADSs could incur substantial losses.

•Future sales of our ordinary shares or the ADSs or the anticipation of future sales could reduce the market price of our ordinary shares or the ADSs.

•If securities or industry analysts do not publish research or reports about our business, or publish inaccurate or unfavorable reports about our business, the price of the ADSs and their trading volume could decline.

•We do not currently intend to pay dividends on our securities and, consequently, your ability to achieve a return on your investment will depend on appreciation in the price of the ADSs.

•The dual listing of our ordinary shares and the ADSs may negatively impact the liquidity and value of the ADSs.

•U.S. investors may have difficulty enforcing civil liabilities against our company, our directors or members of senior management and the experts named in this annual report.

•Australian takeover laws may discourage takeover offers being made for us or may discourage the acquisition of a significant position in our ordinary shares or the ADSs.

•Our Constitution and Australian laws and regulations applicable to us may differ from those which apply to a U.S. corporation.

•Holders of ADSs will not be directly holding our ordinary shares.

•Your right as a holder of ADSs to participate in any future preferential subscription rights offering or to elect to receive dividends in ordinary shares may be limited, which may cause dilution to your holdings.

•You may not be able to exercise your right to vote the ordinary shares underlying your ADSs.

•You may be subject to limitations on the transfer of your ADSs and the withdrawal of the underlying ordinary shares.

•ADS holders’ rights to pursue claims are limited by the terms of the deposit agreement.

•We and the depositary are entitled to amend the deposit agreement and to change the rights of ADS holders under the terms of such agreement and we may terminate the deposit agreement, without the prior consent of the ADS holders.

•ADS holders have limited recourse if we or the depositary fail to meet our respective obligations under the deposit agreement.

•As a foreign private issuer, we are exempt from a number of rules under the U.S. securities laws that apply to public companies that are not foreign private issuers.

•As a foreign private issuer we are permitted to adopt certain home country practices in relation to corporate governance matters that differ significantly from Nasdaq corporate governance listing standards and these practices may afford less protection to shareholders than they would enjoy if we complied fully with Nasdaq corporate governance listing standards.

•We may lose our foreign private issuer status in the future, which could result in significant additional cost and expense.

•We are an “emerging growth company” under the JOBS Act and will be able to avail ourselves of reduced disclosure requirements applicable to emerging growth companies, which could make our ordinary shares and ADSs less attractive to investors.

•We have incurred and will continue to incur significant, increased costs as a result of operating as a company with ADSs that are publicly traded in the United States and will incur increased costs as a result of becoming a recipient of United States government funding and incentives, and our management will be required to devote substantial time to new compliance initiatives.

•If we fail to implement and maintain an effective system of internal controls or fail to identify and remediate our material weaknesses thereof, we may be unable to accurately report our results of operations, meet our reporting obligations or prevent fraud, and investor confidence in our Company and the market price of the ADSs may be negatively impacted.

•We currently report our financial results under IFRS, which differs in certain significant respects from U.S. generally accepted accounting principles, or U.S. GAAP.

•We are subject to risks associated with currency fluctuations, and changes in foreign currency exchange rates could impact our results of operations.

•Our ability to utilize our net operating losses to offset future taxable income may be prohibited or subject to certain limitations.

•If we are a passive foreign investment company, there could be adverse U.S. federal income tax consequences to U.S. holders.

•If a U.S. person is treated as owning at least 10% of our ordinary shares, such holder may be subject to adverse U.S. federal income tax consequences.

•Future changes to tax laws could materially adversely affect our company and reduce net returns to our shareholders.

Risks Related to Our Business

We will need to obtain funding to finance our growth and operations, which may not be available on acceptable terms, or at all. If we are unable to raise capital when needed, we may be forced to delay, reduce or eliminate certain operations, and we may be unable to adequately control our costs.

We require significant capital to develop and grow our business and expect to incur significant expenses, including those relating to acquisition of production equipment, facility expansion, research and development, property acquisition and maintenance, regulatory compliance, and sales as we scale our commercial operations and build and market our materials, equipment and service offerings. We also expect our general and administrative costs to increase as we scale our operations. Our ability to generate operating cash flow and become profitable in the future will depend not only on our ability to successfully market our materials, equipment and services, but also to control our costs, and will require us to obtain additional funding.

We have applied for, received, and intend to continue to seek government support through grants, loans and tax or other incentives from federal, state and provincial governments in the U.S. and Canada, and our ability to obtain and use funds from such programs, depends, among other things, on our ability to raise matching funding in a timely manner. For example, in the fourth quarter of 2023, we finalized our $100 million grant from the Office of Manufacturing & Energy Supply Chains ("MESC Office") of the U.S. Department of Energy ("DOE") to expand domestic production of

high-performance, synthetic graphite anode materials at our Riverside facility in Chattanooga, Tennessee. To use this grant, we must match the costs reimbursed under the grant. We also received a conditional commitment from the DOE through the Loan Programs Office ("LPO") Advanced Technology Vehicles Manufacturing ("ATVM") program for a direct loan of up to $754.8 million to be applied towards partially financing a proposed new facility in Chattanooga. We would need to raise the remainder of eligible project costs (and fund non-eligible project costs) with equity. While this conditional commitment demonstrates the DOE’s intent to finance the new facility, the DOE must complete an environmental review, and the Company must satisfy certain technical, commercial, legal, environmental, and financial conditions before the DOE can decide whether to enter into definitive financing documents and fund the loan. A binding loan agreement from the DOE is also subject to the satisfactory completion of due diligence by the DOE, satisfaction of conditions precedent specified in the term sheet, approval of the Company's Board, receipt of required governmental and third-party consents, and the negotiation and execution of binding loan documents. There can be no assurance that all of the required conditions and other actions will be satisfied or waived or that a final definitive loan agreement will be reached. For a description of the DOE grant, the LPO loan and certain tax incentives we have received and applied for, see Item 4. Information on the Company— B. Business Overview — NOVONIX Anode Materials.

The application process for financial, tax and other support from the government is highly competitive, and we cannot predict whether we will ultimately be awarded or receive any additional grants, loans, including the LPO loan, or tax or other incentives. Our ability to obtain grants, loans or tax or other incentives from government entities in the future is subject to the availability of funds under applicable government programs, our ability to raise matching funds and equity, approval of our applications to participate in such programs, achievement of milestones for funding, and ongoing compliance with various laws and regulations as described below.

As of December 31, 2024, we had $42.6 million in cash, cash equivalents and short-term investments. We require significant additional capital to achieve our plans to expand our production capacity for our anode materials to meet our existing customer commitments and anticipated customer demand. Additional capital may not be available to us on acceptable terms, or at all, and will depend among other things on our creditworthiness and the capital markets. If we raise additional funds through collaboration and licensing arrangements with third parties, we may have to relinquish some rights to our technologies or our product candidates on terms that may not be favorable to us. Any additional capital-raising efforts may divert our management from their day-to-day activities, which may adversely affect our ability to develop and commercialize our current and future product and service offerings or delay, reduce or altogether cease certain operations or future commercialization efforts. See also Item 3. Key Information — D. Risk Factors ("We have a history of financial losses and expect to incur significant expenses and continuing losses in the near future”), Item 5 Operating and Financial Review and Prospects—B. Liquidity and Capital Resources, and Item 18. Financial Statements.

We face significant challenges in our attempt to develop our anode and cathode materials to produce them at volumes with acceptable performance, yields and costs. The pace of development in materials science is often not predictable. We may encounter substantial delays or operational problems in the scale-up of our anode materials production or the commercialization of our cathode materials technology.

Developing anode and cathode materials that meet the requirements for wide adoption by our potential customers is a difficult undertaking. We are still in the development stage for certain of our materials and face significant challenges in producing our materials to required specifications and at commercial volumes. Some of the development challenges that could prevent the successful scale up of production of our materials include changes in product performance from small to large scale production, challenges in deployment of mass production equipment, and inability to produce materials cost effectively at large volumes. If we are unable to cost efficiently design, manufacture, market, and sell our materials, our margins, profitability and prospects would be materially and adversely affected. We have only recently produced anode materials with our proprietary Generation 3 continuous induction graphitization furnace ("Generation 3 furnace systems") and we have yet to produce cathode materials beyond lab and small pilot volumes. Any delay in the manufacturing scale-up of our anode materials, our ability to achieve our customers' desired product specifications or the progression of our cathode synthesis technology would negatively impact our business as it will delay revenue generation and negatively impact our customer relationships.

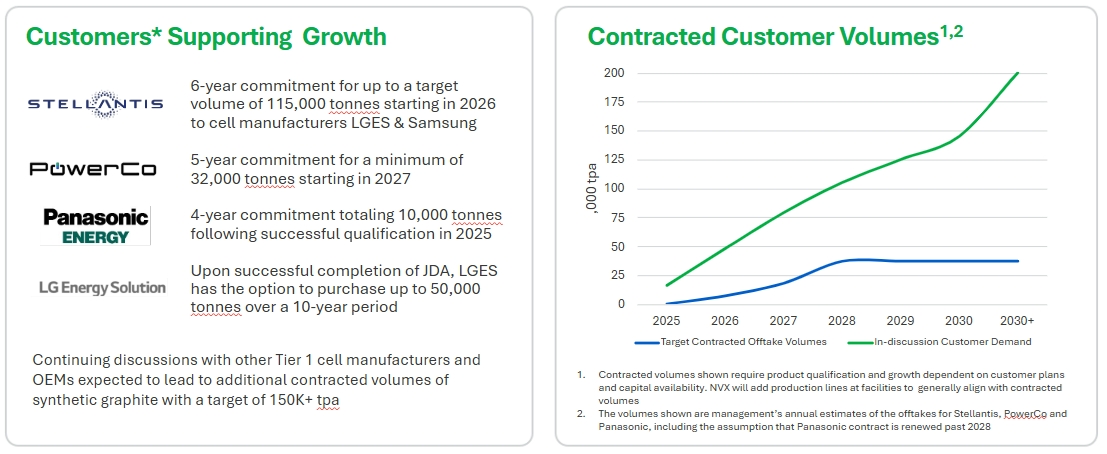

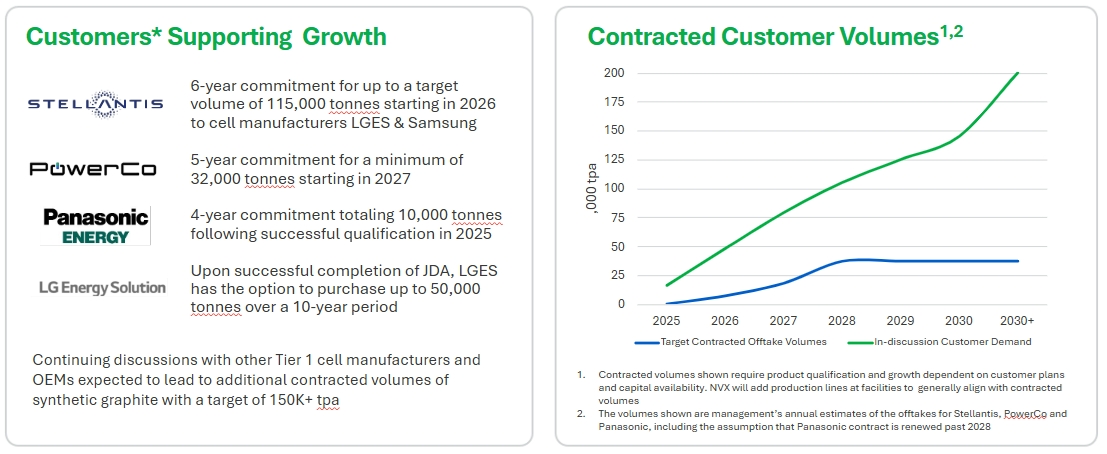

Our Riverside facility in Chattanooga Tennessee, is targeted to produce anode materials of up to 20,000 tonnes per annum (“tpa”). We utilize new proprietary furnace technology ("Generation 3 furnace systems") developed in collaboration with Harper International Corporation ("Harper"). We have installed Generation 3 furnace systems at our Riverside facility and are continuing the commissioning of those systems to meet our production targets. Our ability to produce at targeted capacity is largely dependent upon Harper manufacturing and supplying Generation 3 furnace systems on a schedule that meets our needs, our successful implementation of the same, and our ability to recruit and retain an increased number of skilled staff focused on plant design, engineering and operations. Our production timelines have recently been adjusted due to delays in receiving equipment from our vendors, ultimately affecting our installation and commissioning schedules. The targeted production capacity of our Riverside facility is planned to help us meet our volume commitments under our supply or offtake agreements with certain customers, including Panasonic Energy Co., Ltd. ("Panasonic Energy"), Stellantis NV (“Stellantis”), and PowerCo SE (“PowerCo”). In addition, we plan to build a new facility, Enterprise South, to be located in the Enterprise South Industrial Park in Chattanooga, Tennessee, to manufacture synthetic graphite primarily for use in electric vehicle ("EV") batteries.

While we have a continued, phased expansion plan of 150,000 tpa to meet expected market demand growth, our plan is contingent on the successful satisfaction of a number of factors, some of which are beyond our control. These factors include, among others, our ability to obtain funding on attractive terms to enable further expansion of our current production facilities and our ability to expand our production capacity through the construction of new production facilities, acquisition, installation and commissioning of new equipment, and business acquisitions, joint ventures and other inorganic means. Any or all of these expansion paths may involve many risks, any of which could materially harm our business, including the diversion of management’s attention from core business concerns, failure to effectively exploit acquired technologies, failure to successfully integrate acquired business or realize expected synergies or the loss of key employees from either our business or acquired businesses. If we are unable to execute on those expansion efforts for any reason, we may experience a delay in the manufacturing scale-up or the scale-up may not occur at all, which would result in the loss of customers and materially damage our business, prospects, financial condition, and operating results.

The progression of our cathode materials technology from lab to commercial scale manufacturing is contingent upon the success of our all-dry, zero-waste cathode synthesis process methodology. If production of cathode materials using this methodology, either on a pilot or commercial scale, is not successful, our business, prospects, financial condition, operating results and brand may be materially adversely affected.

The systems, equipment and processes we use in the production of our anode materials are complex, and we are subject to many operational risks that could substantially increase our costs, limit the operational performance of our anode materials operations, and adversely affect our business.

We rely heavily on complex systems, equipment and processes for our operations and the production of our synthetic graphite anode materials. We are commissioning our Generation 3 furnace systems to become qualified to operate at large-scale production. The work required to integrate our systems, equipment, and processes into the production of our anode materials is time intensive and requires us to work closely with Harper and other third-party suppliers to ensure they work properly for our proprietary battery materials technology. This work has involved and will continue to involve a significant degree of uncertainty and risk and may result in a delay in the scaling up of anode materials production or result in additional, unforeseen production costs. Any delay in the scale-up of our production would negatively impact our business as it will delay time to revenue and negatively impact our customer relationships and agreements. Even if we complete the commissioning of our systems and achieve volume production of our anode materials, if the cost, performance characteristics or other specifications of the materials fall short of our targets or our customer requirements, our sales, product pricing and margins could be adversely affected.

Our failure to achieve existing or target customers' product specifications for our anode materials or otherwise engage target customers successfully and convert such contacts into meaningful orders in the future would have a material adverse effect on our business.

Our ability to achieve our customers' desired specifications for our anode materials is critical to our meeting existing customer obligations and gaining new customers. Volume commitments under our offtake agreements with Panasonic Energy, Stellantis and PowerCo depend on our ability to produce our anode materials that meet their specific product specifications. Other potential customers, including LGES, require the successful completion of certain development work before they will enter into any binding offtake agreement. Our success, and our ability to increase revenue and operate profitably, also depends in part on our ability to identify target customers and convert such contacts into meaningful orders or expand on current customer relationships. In addition to new customers, our future success depends on whether our current customers are willing to continue using our materials and equipment as well as whether their product lines continue to incorporate our materials and equipment.

For example, although our anode materials business had signed a non-binding memorandum of understanding with Samsung SDI, the MOU expired without the parties reaching an agreement. Additionally, we have a joint development agreement with LGES which requires successful completion of certain development work before any offtake of our anode materials. The satisfaction of quality standards and milestones of delivering mass production volume samples will be required for final qualification with battery manufacturers. There is no assurance that these conditions will ultimately be satisfied. However, if future production requirements, or similar production requirements with other potential customers, are not met, or the materials produced are not of acceptable quality, we may lose these customers and lose credibility with other domestic and international battery manufacturers and automotive OEMs, any of which could materially adversely affect our financial condition and results of operations.

Our research and development efforts aim to create materials and equipment that are on the cutting edge of technology, but competition in our industry is high. To secure acceptance of our materials and equipment, we must constantly develop and introduce materials and equipment that are cost-effective and with enhanced functionality and performance to meet evolving industry standards. If we are unable to meet our customers’ performance or volume requirements or industry specifications, or retain or convert target customers, our business, prospects, financial condition and operating results could be materially adversely affected.

If we are unable to attract and retain key employees and qualified personnel, our ability to compete could be harmed.

Our success depends on our ability to attract and retain our executive officers, key employees and other highly skilled personnel, and our operations may be severely disrupted if we lost their services. As we build our operations and become better known, there is an increased risk that competitors or other companies will seek to recruit and hire our key personnel. The failure to attract, integrate, train, motivate and retain such key personnel could seriously harm our business and prospects.

In addition, we are highly dependent on the services of our senior technical and management personnel, including our executive officers, who would be difficult to replace. If any key personnel were to depart, we may not be able to successfully attract and retain senior leadership necessary to grow our business. We do not currently maintain “key person” life insurance on the lives of our executives or any of our employees. This lack of insurance means that we may not receive adequate compensation for the loss of the services of these individuals.

On January 21, 2025, we announced the planned transition in our CEO role, with Dr. Chris Burns stepping down as Chief Executive Officer effective January 24, 2025. Dr. Burns will continue to support the Company in an advisory capacity, serving as Special Advisor to the Board, in order to provide continuity, support ongoing operations of the Company and ensure a smooth transition. The Board has appointed Mr. Robert Long, our Chief Financial Officer, to serve as interim CEO, effective January 24, 2025, until a permanent CEO is appointed. Mr Long will work closely with the Board to ensure a smooth transition and maintain our momentum and focus on our key strategic goals. We cannot guarantee when we will be able to appoint Dr. Burns’ permanent replacement. The change in executive management could disrupt our operations and may have a material adverse effect on our business.

Labor shortages, turnover, and labor cost increases, and the delay or insufficiency of the training of our employees could adversely impact our ability to scale up manufacturing of our anode materials and commercialize our cathode technology.

We continue to face competition for talent, wage inflation and pressure to improve benefits and workplace conditions to remain competitive. Challenging labor market conditions and the highly competitive wage pressure resulting from qualified labor shortage have made it difficult to attract and retain the best talent. A sustained labor shortage or increased turnover rates within our employee base could lead to increased costs, such as increased overtime or financial incentives to meet demand and increased wage rates to attract and retain employees, and could negatively affect our ability to scale up manufacturing for our anode and cathode materials and meet our production targets. Similarly, the complexity of our operations requires that we train our workforce effectively, and our inability to do so on a timely basis may delay or otherwise negatively affect our ability to scale up our anode materials operations, commercialize our cathode technology or otherwise negatively affect our business.

If we do not satisfy the terms of our DOE grant, we may be unable to be reimbursed under or otherwise receive any or all of the funds or other benefits under the grant, may be required to return unused funds, and may be subject to claims or penalties, which would have a material adverse effect on our business.

As a result of the DOE grant, we are required to comply with a number of laws and regulations and terms and conditions of the grant, including the preparation and furnishing of financial reports and other records. Relevant requirements include certain accounting requirements and complying with the cost allowability principles; the U.S. National Environmental Policy Act and other environmental, health and safety requirements; prevailing wage requirements; compliance with export control laws and regulations; requirements to perform work in the U.S. unless DOE grants a waiver; preferences for American-made equipment and products; requirements to substantially manufacture in the U.S. products embodying or produced through the use of a new invention developed under the grant, unless such manufacture is not commercially feasible and DOE agrees to foreign manufacture; requirements to grant liens in favor of the U.S. government on property acquired or developed with grant funds and restrictions on the sale or disposition of such property; data management requirements and restrictions on disclosing sensitive information; affirmative action and pay transparency requirements; requirements for cyber- and technology security, including employment of security officers; requirements to pre-approve participation by foreign nationals in the project; and requirements to pass-down certain of such requirements to our subrecipients and subcontractors. If we are unable to meet these requirements, we may be unable to be reimbursed under or otherwise receive any or all of the funds under the grant, may be required to return unused funds, and may be subject to claims or penalties, including the loss of our eligibility for continued participation in the grant program and other government programs. Other grants and loans for which we have applied would impose similar and potentially additional requirements and, in each case, use of such government funding subjects us to increased inspection and monitoring. We expect that the DOE’s MESC Office will, and the DOE’s Office of Inspector General may, review our compliance, and the adequacy of our practices for maintaining compliance. In the event of improper or illegal activities, or false or misleading statements in our applications or submissions to the government, we are subject to possible civil and criminal penalties, sanctions, or suspension or debarment from multiple government programs. The associated costs and risks may have a material adverse effect on our business.

We may not qualify for tax credits available to U.S. producers of graphite or otherwise realize any of the benefits of such tax credits due to a change in current tax law, our inability to satisfy the requirements for realizing such benefits or factors outside our control.

We were selected to receive a $103 million tax credit under the Qualifying Advanced Energy Project Allocation Program (the “48C program”) to support production of critical battery materials from our Chattanooga, Tennessee production facility. The 48C program incentivizes clean energy property manufacturing and recycling, industrial decarbonization, and critical materials processing, refining, and recycling, and aims to foster the creation of high-quality jobs, curb industrial emissions, and bolster U.S. domestic production of vital clean-energy products and critical materials. Realization of the full amount of this tax credit is subject to satisfaction of the requirements set forth in Section 48C of the Internal Revenue Code and operational and employment plans set out in the application to the Internal Revenue Service, including the

certification and placed-in-service requirements under the 48C program. In January 2025, we learned that we had not been selected to receive 48C tax credits for the planned Enterprise South facility. We are working with the DOE and the LPO to understand what, if any, impact this may have on the proposed LPO loan. See Item 4. Information on the Company— B. Business Overview — NOVONIX Anode Materials.

Under current U.S. tax law, including regulations issued by the U.S. Department of Treasury and the Internal Revenue Service, the production of graphite, including synthetic graphite, is eligible for the Advanced Manufacturing Production Tax Credit under Section 45X ("45X tax credits") of the Internal Revenue Code of 1986, as amended (the “Code”). Enterprise South remains eligible for a potential 45X tax credit, which offers 10% of eligible production costs of critical minerals, including graphite, back to producers. Although current regulations are in final form, because they were issued on October 24, 2024, they are subject to review under the Congressional Review Act, which gives the U.S. Congress the authority to overturn certain actions of federal agencies, including the U.S. Department of Treasury and Internal Revenue Service. In particular, there is a risk that the treatment of synthetic graphite may be subject to change. Further, U.S.-produced graphite indirectly benefits from the Clean Vehicle Tax Credit under Section 30D of the Code, which requires that the critical materials (and the associated constituent materials) contained in the battery cells of the clean vehicle must, to a certain applicable percentage, be extracted or processed in the U.S. or a country with whom the U.S. has a free trade agreement. The Clean Vehicle Tax Credit has been heavily criticized, and there are concerns that it may be repealed or limited, which indirectly could affect the demand for critical minerals. In addition, the critical mineral (and the associated constituent materials) cannot be extracted, processed or recycled by a foreign entity of concern (“FEOC”). That aspect of the regulations has been criticized by some members of Congress who had hoped there would be more restrictions relating to FEOCs. The regulations suggest that where a critical material is an insignificant cost and “non-traceable,” it can be excluded from tracking for FEOC purposes. Although the regulations list graphite as a traceable critical mineral, recent comments filed in response to the proposed regulations have requested that graphite be deemed a non-traceable material. The risk that final regulations deem graphite a non-traceable material may be greater as a result of Republican control of the House of Representatives and U.S. Senate.

Our ability to receive any additional tax credits, satisfy the requirements for realizing 48C and other potentially available tax credits, and fully or partially utilize, monetize or otherwise benefit from these tax credits is subject to uncertainty and factors that we may not be able to control.

Our reliance on certain limited or sole source suppliers subjects us to a number of risks.

Our anode materials business is dependent on our continued ability to source certain specialized systems, equipment, components and raw materials from a limited number of suppliers. Our ability to scale up our commercial production of synthetic graphite anode materials and meet our production targets depends on the successful and timely delivery, commissioning, operation and availability of, for example, the Generation 3 furnace systems developed in collaboration with and supplied by Harper. If the successful commissioning is delayed or the systems otherwise fail to perform as expected, we may be delayed or prevented from meeting our production targets or our obligations to customers under our offtake agreements, which would have a material adverse effect on our business, financial condition, liquidity, results of operations and prospects.

We purchase certain of our systems, equipment, components and raw materials from limited sources of supply, and disruption of these sources could negatively affect our ability to produce materials. For example, we may source specialty petroleum needle coke, a key precursor to the synthetic graphite anode material we produce, from Phillips 66 or a select few other suppliers. Even where alternative sources of equipment, materials and components are available, the quality and cost of the alternative materials, regulatory and contractual requirements to qualify materials for use in our production, the time required to establish new relationships with reliable suppliers, and the time potentially to re-qualify products with customers could result in production delays and possible loss of sales. We have in the past and may continue to experience delays in acquiring equipment due to global supply chain issues as well as our dependence on single suppliers such as Harper. Our inability or delay in obtaining the systems, equipment components or raw materials needed for our business may harm our customer relationships or require us to find alternative supply sources at increased costs,

which could have a material adverse effect on our business, financial condition, liquidity, results of operations and prospects.

The battery technology market continues to evolve and is highly competitive, and we may not be successful in competing in this industry or establishing and maintaining confidence in our long-term business prospects among current and future partners and customers.

The battery technology market in which we compete continues to evolve and is highly competitive. Certain energy storage technologies, such as lithium-ion battery technology, have been widely adopted, and current and future competitors may have greater resources than we do and may also be able to devote greater resources to the development of their current and future technologies. These competitors also may have greater access to customers and may be able to establish cooperative or strategic relationships among themselves or with third parties that may further enhance their resources and competitive positioning. In addition, lithium-ion battery manufacturers may continue to reduce cost and expand supply of conventional batteries and therefore negatively impact the ability for us to sell our materials, equipment and services at market-competitive prices and yet at sufficient margins.

Automotive original equipment manufacturers (“OEMs”) are researching and investing in energy storage development and production. We expect competition in energy storage technology and EVs to intensify due to increased demand for these vehicles and a regulatory push for EVs, continuing globalization, and consolidation in the worldwide automotive industry. Developments in alternative technologies or improvements in energy storage technology made by competitors may materially adversely affect the sales, pricing and gross margins of our business. If a competing technology is developed that has superior operational or price performance, our business will be harmed. Similarly, if we fail to accurately predict and ensure that our technology can address customers’ changing needs or emerging technological trends, or if our customers fail to achieve the benefits expected from our materials, equipment and services, our business will be harmed.

We must continue to commit significant resources to develop our technologies in order to establish a competitive position, and these commitments will be made without knowing whether such investments will result in materials, equipment and services that potential customers will accept. There is no assurance we will successfully identify new customer requirements, develop and bring our materials, equipment and services to market on a timely basis, or that products and technologies developed by others will not render our materials, equipment and services obsolete or noncompetitive, any of which would adversely affect our business and operating results.

Customers will be less likely to purchase our materials, equipment and services if they are not convinced that our business will succeed in the long term. Similarly, suppliers and other third parties will be less likely to invest time and resources in developing business relationships with us if they are not convinced that our business will succeed in the long term. Accordingly, in order to build and maintain our business, we must maintain confidence among current and future partners, customers, suppliers, analysts, ratings agencies and other parties in our long-term financial viability and business prospects. Maintaining such confidence may be particularly complicated by certain factors including those that are largely outside of our control, such as our limited operating history, size and financial resources relative to our competitors, market unfamiliarity with our materials, equipment and services, any delays in scaling manufacturing, delivery and service operations to meet demand, competition and uncertainty regarding the future of energy storage technologies and our eventual production and sales performance compared with market expectations.

Our anode materials business is subject to fluctuating and potentially unfavorable market conditions for graphite.

Graphite is not a traded commodity like many base and precious metals, and its sales prices are generally not public. Sales agreements are typically negotiated on an individual and private basis with each potential customer. In addition, there are a limited number of producers of battery-grade graphite, most of whom are producers in China and may make it difficult for new market entrants by increasing their production capacity and lowering sales prices. Factors such as foreign currency fluctuation, supply and demand, industrial disruption and actual graphite market sale prices could have an adverse impact on our ability to sell our synthetic graphite anode materials profitably. If battery manufacturers use less

graphite than expected, or if the demand for EV and energy storage grid batteries is less than anticipated, it could have a material adverse effect on the sales price, profitability and development strategy of our business.

Our future growth and success will depend on our ability to sell effectively to large customers.

Our current and potential customers are primarily battery manufacturers and automotive OEMs that tend to be large enterprises. Therefore, our future success will depend on our ability to effectively sell our materials, equipment and services to such large customers. Sales to these customers involve risks that may not be present (or that are present to a lesser extent) with sales to smaller customers. These risks include, but are not limited to, (i) increased pricing power and leverage held by large customers in negotiating contractual arrangements with us, (ii) higher minimum volume requirements that we may be unable to meet, (iii) longer sales cycles and the associated risk that substantial time and resources may be spent on a potential customer that elects not to purchase our materials, equipment or services, and (iv) requirements that we meet customer standards for their suppliers, including those relating to environmental, social and governance protocols and ISO standards, that we may be unable to meet.

Purchases by large organizations are frequently subject to budget constraints, multiple approvals and unanticipated administrative, processing and other delays. Finally, large organizations typically have longer implementation cycles, require greater product functionality and scalability, require a broader range of services, demand that vendors take on a larger share of risks, require acceptance provisions that can lead to a delay in revenue recognition and expect greater payment flexibility. All of these factors can add further risk to business conducted with these potential customers.

We depend, and expect to continue to depend, on a limited number of customers for a significant percentage of our revenue.

Our Battery Technology Solutions ("BTS") business is currently our only business that is generating revenue, and BTS has generated most of its revenue from a limited number of customers. For the year ended December 31, 2024, the Company had two customers, included in the consulting services revenue stream that accounted for approximately 13% and 12% of total revenues, respectively, and one major customer, included in the hardware sales revenue stream, that accounted for 16% of total revenue. For the year ended December 31, 2023, the Company had two customers, included in consulting services revenue stream, that accounted for approximately 17% and 15% of total revenues, respectively. For the six months December 31, 2022, the Company had three major customers, included in the consulting services revenue stream, that accounted for approximately 27%, 22%, and 11% of total revenue, respectively and two major customers, included in the hardware sales revenue stream, that accounted for approximately 25% and 12% of total revenues, respectively. For the year ended June 30, 2022, the Company had two customers, included in the consulting services revenue stream that accounted for approximately 15%, and 12% of total revenues, respectively and one major customer, included in the hardware sales and consulting services revenue streams, that accounted for 11% of total revenue.

Our anode materials business is not yet generating revenue, and our plans to scale the business are dependent upon our collaborations with tier 1 customers such as Panasonic Energy, Stellantis, and PowerCo resulting in sales of our anode materials to those parties. Similarly, our joint development agreement with LG Energy Solution, Ltd. ("LG Energy Solution" or "LGES")) requires successful completion of certain development work before offtake of our anode materials. Because we rely, and will continue to rely, on a limited number of customers for significant percentages of our revenue, a decrease in demand or significant pricing pressure from any of our major customers for any reason could have a materially adverse impact on our business, financial condition, and results of operations.

In addition, a number of factors outside our control could cause the loss of, or reduction in, business or revenues from any customer, including, without limitation, pricing pressure from competitors, a change in a customer’s business strategy or financial condition, or change in market conditions. Our customers may also choose to pursue alternative technologies and develop alternative products in addition to, or in lieu of, our materials and equipment, either on their own or in collaboration with others, including our competitors. The loss of any major customer or key project, or a significant decrease in the volume of customer demand or the price at which we sell our materials and equipment to customers, could materially adversely affect our financial condition and results of operations.

In addition, our ability to satisfy our commitments to such customers is dependent, among other things, on reaching the targeted production capacities at our Riverside facility and our planned Enterprise South facility. See Item 3. Key Information — D. Risk Factors ("We face significant challenges in our attempt to develop our anode and cathode materials to produce them at volumes with acceptable performance, yields and costs. The pace of development in materials science is often not predictable. We may encounter substantial delays or operational problems in the scale-up of our anode materials production or the commercialization of our cathode materials technology.").

Our commercial relationships are subject to various risks which could adversely affect our business and future prospects.

Many of our commercial relationships are conditional, subject to supply performance, market conditions, quality assurance processes and audits of supplier processes or other agreed upon conditions. There can be no assurance that we will be able to satisfy these conditions. If we are unsuccessful in meeting the demand for high-quality materials and equipment, our business and prospects will be materially adversely affected.

In addition, our business partners may have economic, business or legal interests or goals that are inconsistent with our goals. Any disagreements with our business partners may impede our ability to maximize the benefits of any partnerships and slow the commercialization of materials and equipment. Our arrangements may require us, among other things, to pay certain costs or to make certain capital investments, for which we may not have the resources. In addition, if our business partners are unable or unwilling to meet their economic or other obligations under any business arrangements, our business and prospects will be materially adversely affected.

Our business and future growth depend substantially on the growth in demand for electric vehicles and batteries for grid energy storage.

The demand for our materials is directly related to the market demand for EVs and batteries for grid energy storage. However, the markets we have targeted may not achieve the level of growth we expect during the time frame projected. For example, the new U.S. presidential administration has indicated its agenda will focus on deregulation, particularly with respect to environmental and climate change-related regulations, which could be detrimental to companies like ours that are focused on sustainable energy. If markets fail to achieve our expected level of growth, we may have excess production capacity and may not be able to generate enough revenue to obtain profitability. If the market for EVs or batteries for grid energy storage does not develop at the rate or in the manner or to the extent that we expect, or if critical assumptions that we have made regarding the efficiency of our energy solutions are incorrect or incomplete, our business, prospects, financial condition and operating results could be harmed.

Our projected operating and financial results rely in large part upon assumptions and analyses we have developed. If these assumptions or analyses prove to be incorrect, our actual operating results may be materially different from our projected results.

Management's projected operating and financial results reflect current estimates of our future performance. Whether actual operating and financial results and business developments will be consistent with our expectations and assumptions as reflected in our projections depends on a number of factors, many of which are outside our control, including, but not limited to the factors described throughout this annual report. Unfavorable changes in any of these or other factors, most of which are beyond our control, could materially and adversely affect our business, results of operations and financial results.

We may not be able to establish supply relationships for necessary components or may be required to pay costs for components that are more expensive than anticipated, which could delay the introduction or acquisition of additional equipment necessary to support our growth and negatively impact our business.

As we expand our anode materials manufacturing capabilities, we will rely on third-party suppliers for components and materials. Any disruption or delay in the supply of components or materials by our key third-party suppliers or pricing volatility of such components or materials could temporarily disrupt research or production of our anode materials until

an alternative supplier is able to supply the required material. In such circumstances, we may experience prolonged delays, which may materially and adversely affect our results of operations, financial condition and prospects.

We may not be able to control fluctuation in the prices for materials or negotiate agreements with suppliers on terms that are beneficial to us. Our business depends on the continued supply of certain proprietary materials, components and equipment. We are exposed to multiple risks relating to the availability and pricing of such materials and components. Substantial increases in the prices for our raw materials or components would increase our operating costs and materially impact our financial condition.

Currency fluctuations, trade barriers, extreme weather, pandemics, tariffs or shortages and other general economic or political conditions may limit our ability to obtain key components for our battery cell testing equipment or significantly increase freight charges, raw material costs and other expenses associated with our business, which could further materially and adversely affect our results of operations, financial condition and prospects.

We may not be able to accurately estimate the future supply and demand for our materials and equipment, which could result in a variety of inefficiencies in our business and hinder our ability to generate revenue. If we fail to accurately predict our manufacturing requirements or prices of components increase, we could incur additional costs or experience delays.

It is difficult to predict our future revenues and appropriately budget for our expenses, and our views as to industry trends that may emerge may prove false, which could affect our business. Currently, there is limited historical basis for making judgments on the demand for our materials or equipment, or our ability to develop, manufacture, and deliver our materials or equipment, or our profitability in the future. If we overestimate our requirements, our suppliers may have excess inventory, which indirectly would increase our costs. If we underestimate our requirements, our suppliers may have inadequate inventory, which could interrupt manufacturing of our materials or equipment and result in delays in shipments and revenues. In addition, lead times for materials that our suppliers order may vary significantly and depend on factors such as the specific supplier, contract terms and demand for each material at a given time. If we fail to order sufficient quantities of materials in a timely manner, the delivery of materials or equipment to our potential customers could be delayed, which would harm our business, financial condition and operating results.

Additionally, agreements for the purchase of certain components used in the manufacture of our materials and equipment may contain pricing provisions that are subject to adjustment based on changes in market prices of key components. Substantial increases in the prices for such components would increase our operating costs and could reduce our margins if we cannot recoup the increased costs. Any attempts to increase the announced or expected prices of our materials and equipment in response to increased costs of components could be viewed negatively by our potential customers and could adversely affect our business, prospects, financial condition or operating results.

We have a history of financial losses and expect to incur significant expenses and continuing losses in the near future.

We incurred net losses of $74.8 million, $46.2 million, $27.9 million, and $51.9 million for the years ended December 31, 2024 and 2023, six months ended December 31, 2022, and year ended June 30, 2022, respectively, and net operating cash outflows of $40.4 million $36.2 million, $18.9 million, and $29.2 million for the years ended December 31, 2024 and 2023, six months ended December 31, 2022, and year ended June 30, 2022, respectively. At December 31, 2024 and 2023, we had a cash balance of $42.6 million and $78.7 million, respectively, and net current assets of $11.1 million and $51.9 million, respectively.

We expect our expenses to increase in connection with our ongoing activities, particularly as we continue to purchase additional production equipment associated with the manufacture of synthetic graphite. For example, in July 2021, we purchased commercial land and buildings in Chattanooga, USA for $42.6 million to expand our anode materials business and concurrently entered into a loan facility with DBR Investments Co. Limited for $30.1 million with an interest rate of 4.09%. The loan was fully drawn down as at December 31, 2024. The total liability at December 31, 2024 is $27.7 million. In addition, we expect to incur significant commercialization expenses related to sales and marketing to the extent that

such sales and marketing are not the responsibility of any future customers. We may find that these efforts are more expensive than we currently anticipate or that these efforts may not result in revenues, which would further increase our losses, impact our ability to repay our debt (including our $30 million principal amount of unsecured convertible notes issued to LGES) and require future capital raises to maintain the business. These conditions give rise to a material uncertainty that may cast significant doubt (or raise substantial doubt as contemplated by PCAOB standards) as to our ability to continue as a going concern. If we were not able to continue as a going concern, or if there were continued doubt about our ability to do so, the value of your investment would be materially and adversely affected. See Item 3. Key Information — D. Risk Factors ("We have incurred and will continue to incur significant, increased costs as a result of operating as a company with ADSs that are publicly traded in the United States, and will incur increased costs as a result of becoming a recipient of United States government funding and incentives, and our management will be required to devote substantial time to new compliance initiatives.").

We have a concentration of beneficial ownership among Phillips 66, LG Energy Solution, and our executive officers, non-executive directors and their affiliates that may prevent new investors from influencing significant corporate decisions.

In September 2021, we consummated a transaction with Phillips 66 pursuant to which Phillips 66 purchased 77,962,578 ordinary shares of NOVONIX for a total purchase price of $150 million (the “Phillips 66 Transaction”). As of December 31, 2024, Phillips 66 beneficially owned approximately 13.74% of our ordinary shares (based on the number of our ordinary shares outstanding as of that date). In January 2025, Phillips 66 purchased an additional 12,771,392 ordinary shares as part of a private placement, which, after giving pro forma effect to such transaction, would have resulted in its beneficial ownership of 15.99% of our ordinary shares as of December 31, 2024. As of December 31, 2024, as the holder of our unsecured convertible notes, LGES beneficially owned approximately 4.98% of our ordinary shares, and our executive officers, non-executive directors and their affiliates beneficially owned approximately 2% as a group. Based on their beneficial ownership, such security holders will be able to exercise a significant level of influence over all matters requiring shareholder approval. This influence could have the effect of delaying or preventing a change of influence or changes in our management and will make the approval of certain transactions difficult or impossible without the support of these shareholders and their votes. In addition, pursuant to the terms of our 2021 subscription agreement, Phillips 66 has the right to nominate one director to our Board of Directors and certain rights to be notified of, and participate in, issuances of shares by the Company (other than distributions of shares to the Company’s shareholders on a pro rata basis). The interests of Phillips 66 and these shareholders may differ from our interests or those of our other shareholders, and these shareholders might not exercise their voting power in a manner favorable to our other shareholders.

Global political, economic and financial conditions (as well as the indirect effects flowing therefrom) could negatively affect our business, results of operations, and financial condition.

In recent times, global political, economic and financial conditions negatively have affected businesses across a range of industries, including the energy storage industry. In addition, there are currently political and trade tensions among a number of the world’s major economies, which have resulted in the implementation of tariff and non-tariff trade barriers, including the use of export control restrictions against certain countries and individual companies. Moreover, the new, substantial tariffs on imports to the United States from Canada announced on February 1, 2025, if they are implemented and sustained for an extended period of time, would have a significant adverse effect, including financial, on our business. The U.S. is the largest export destination for our battery testing equipment. See Item 5. Operating and Financial Review and Prospects. Implementation, prolongation or expansion of such trade barriers may result in a decrease in the growth of the global economy and the battery industry, and could cause turmoil in global markets that may result in declines in sales from which we generate our income through our materials, technologies and services. Also, any increase in the use of export control restrictions to target certain countries and companies, any expansion of the extraterritorial jurisdiction of export control laws in the jurisdiction in which we operate, or a complete or partial ban on products sales to certain companies could impact not only our ability to supply our materials, technologies and services to such customers, but also customers’ demand for our materials, technologies and services.

Any future systemic political, economic or financial crisis or market volatility, including but not limited to, interest rate fluctuation, inflation or deflation and changes in economic, fiscal and monetary policies and changes in government and election results in major economies, could cause revenue or profits for the battery industry as a whole to decline dramatically, and if the economic conditions or financial conditions of our current or target customers were to deteriorate, the demand for our materials, technologies and services may decrease. Further, in times of market instability, sufficient external financing may not be available to us on a timely basis, on commercially reasonable terms to us, or at all. If sufficient external financing is not available when we need such financing to meet our capital requirements, we may be forced to curtail our expansion, modify plans or delay the deployment of new or expanded materials, technologies and services until we obtain such financing. Thus, further escalation of trade tensions, the use of export control restrictions as a non-tariff trade barrier or any future global systemic crisis could materially and adversely affect our results of operations.